Supply Chain Integration, Interfirm Value Co-Creation and Firm Performance Nexus in Ghanaian SMEs: Mediating Roles of Stakeholder Pressure and Innovation Capability

Abstract

1. Introduction

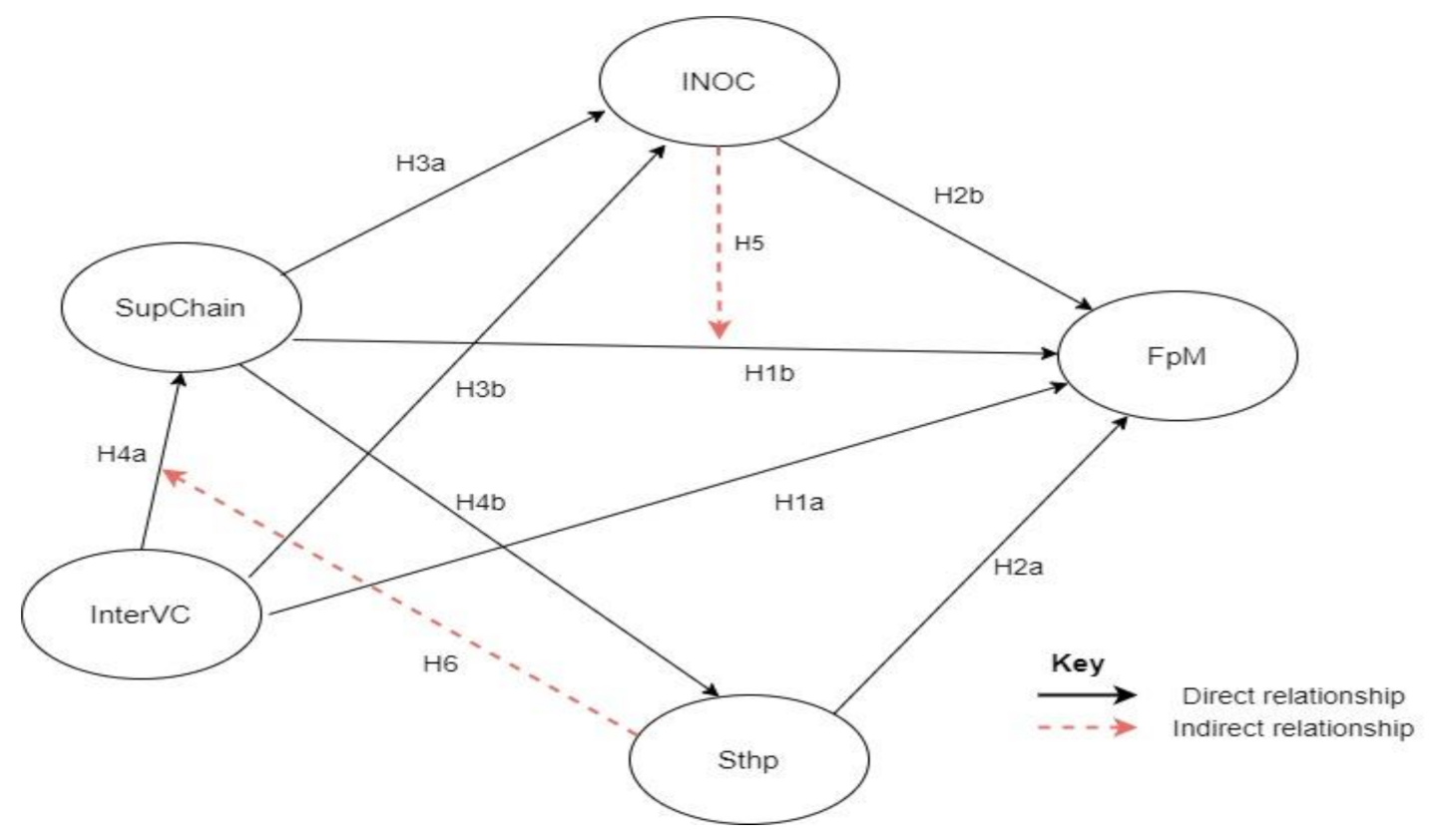

2. Literature Review and Hypothesis Development

2.1. Supply Chain Integration

2.2. Interfirm Value Co-Creation

2.3. Firm Performance

2.4. Stakeholders Pressure

2.5. Innovation Capability

2.6. Hypothesis Development

3. Research Methods

3.1. Data Source and Sampling Procedure

3.2. Measurement of Constructs

3.3. Theoretical Model Specification

4. Statistical Analysis

4.1. Descriptive Analysis

4.2. Reliability and Validity Tests

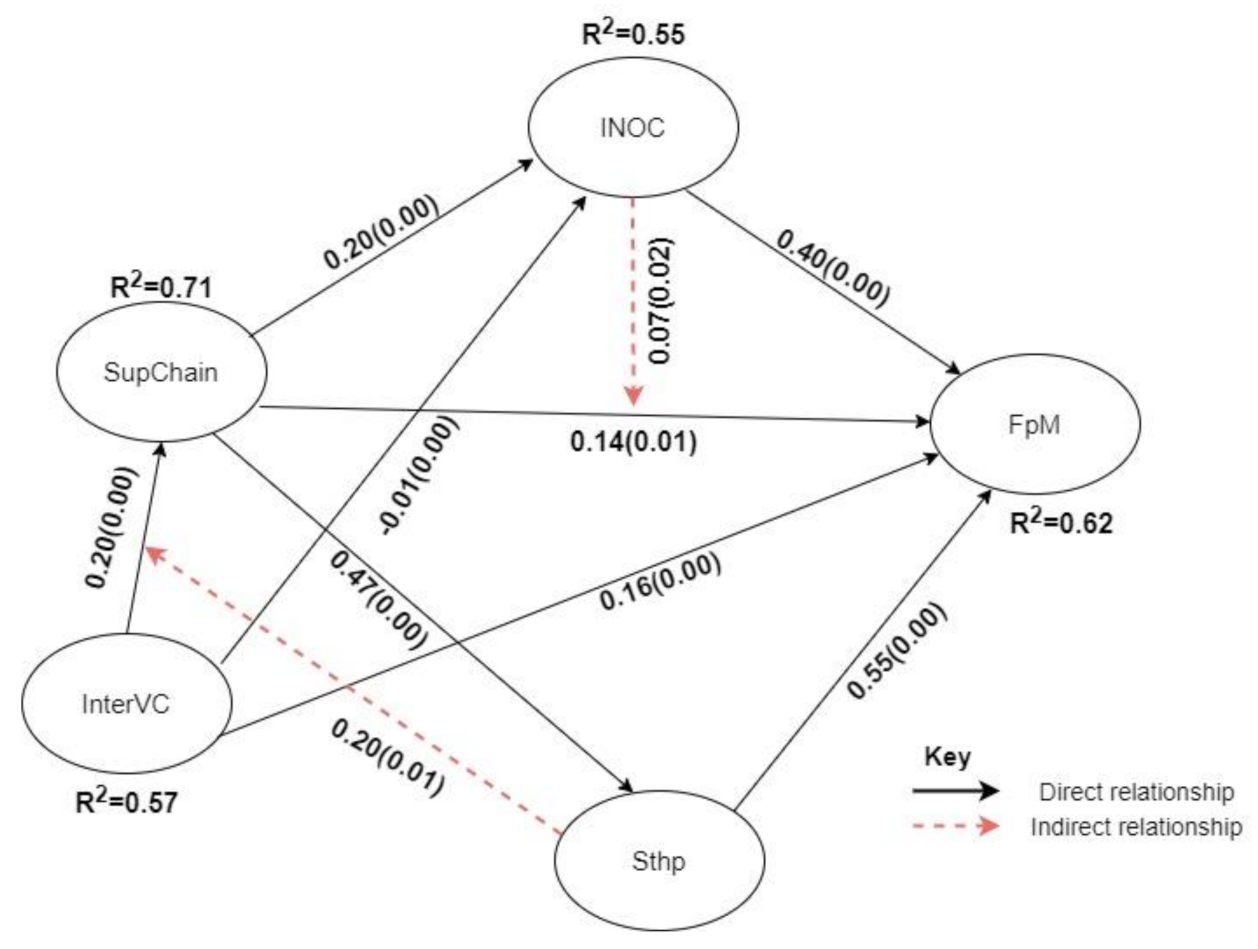

4.3. Hypothesis Testing

5. Discussion

6. Conclusions

7. Limitations

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Kim, M.K.; Park, J.H. Factors influencing innovation capability of small and medium-sized enterprises in Korean manufacturing sector: Facilitators, barriers and moderators. Int. J. Technol. Manag. 2018, 76, 214. [Google Scholar] [CrossRef]

- Munir, M.; Jajja, M.S.S.; Chatha, K.A.; Farooq, S. Supply chain risk management and operational performance: The enabling role of supply chain integration. Int. J. Prod. Econ. 2020, 227, 107667. [Google Scholar] [CrossRef]

- Yang, Q.; Geng, R.; Feng, T. Does the configuration of macro- and micro-institutional environments affect the effectiveness of green supply chain integration? Bus. Strat. Environ. 2020, 29, 1695–1713. [Google Scholar] [CrossRef]

- Phan, T.T.H.; Doan, X.T.; Nguyen, T.T.T. The impact of supply chain practices on performance through supply chain integration in textile and garment industry of Vietnam. Uncertain. Supply Chain Manag. 2020, 8, 175–186. [Google Scholar] [CrossRef]

- Coffie, C.P.K.; Hongjiang, Z.; Mensah, I.A.; Kiconco, R.; Simon, A.E.O. Determinants of FinTech payment services diffusion by SMEs in Sub-Saharan Africa: Evidence from Ghana. Inf. Technol. Dev. 2020, 1–22. [Google Scholar] [CrossRef]

- Donbesuur, F.; Ampong, G.O.A.; Owusu-Yirenkyi, D.; Chu, I. Technological innovation, organizational innovation and international performance of SMEs: The moderating role of domestic institutional environment. Technol. Forecast. Soc. Chang. 2020, 161, 120252. [Google Scholar] [CrossRef]

- Hein, A.; Weking, J.; Schreieck, M.; Wiesche, M.; Böhm, M.; Krcmar, H. Value co-creation practices in business-to-business platform ecosystems. Electron. Mark. 2019, 29, 503–518. [Google Scholar] [CrossRef]

- Ranjan, K.R.; Read, S. Value co-creation: Concept and measurement. J. Acad. Mark. Sci. 2016, 44, 290–315. [Google Scholar] [CrossRef]

- Mendoza-Silva, A. Innovation capability: A sociometric approach. Soc. Netw. 2021, 64, 72–82. [Google Scholar] [CrossRef]

- Shafi, M. Sustainable development of micro firms: Examining the effects of cooperation on handicraft firm’s performance through innovation capability. Int. J. Emerg. Mark. 2020. [Google Scholar] [CrossRef]

- Le, P.B.; Lei, H. Determinants of innovation capability: The roles of transformational leadership, knowledge sharing and perceived organizational support. J. Knowl. Manag. 2019, 23, 527–547. [Google Scholar] [CrossRef]

- Rajapathirana, R.J.; Hui, Y. Relationship between innovation capability, innovation type, and firm performance. J. Innov. Knowl. 2018, 3, 44–55. [Google Scholar] [CrossRef]

- Donkor, J.; Donkor, G.N.A.; Kankam-Kwarteng, C.; Aidoo, E. Innovative capability, strategic goals and financial performance of SMEs in Ghana. Asia Pac. J. Innov. Entrep. 2018, 12, 238–254. [Google Scholar] [CrossRef]

- Konadu, R.; Owusu-Agyei, S.; Lartey, T.A.; Danso, A.; Adomako, S.; Amankwah-Amoah, J. CEOs’ reputation, quality management and environmental innovation: The roles of stakeholder pressure and resource commitment. Bus. Strat. Environ. 2020, 29, 2310–2323. [Google Scholar] [CrossRef]

- Schoenherr, T.; Swink, M. Revisiting the arcs of integration: Cross-validations and extensions. J. Oper. Manag. 2012, 30, 99–115. [Google Scholar] [CrossRef]

- Beheshti, H.M.; Oghazi, P.; Mostaghel, R.; Hultman, M. Supply chain integration and firm performance: An empirical study of Swedish manufacturing firms. Compet. Rev. 2014, 24, 20–31. [Google Scholar] [CrossRef]

- Huo, B.; Qi, Y.; Wang, Z.; Zhao, X. The impact of supply chain integration on firm performance. Supply Chain Manag. Int. J. 2014, 19, 369–384. [Google Scholar] [CrossRef]

- Zhao, G.; Feng, T.; Wang, D. Is more supply chain integration always beneficial to financial performance? Ind. Mark. Manag. 2015, 45, 162–172. [Google Scholar] [CrossRef]

- Deshpande, A.R. Supply Chain Management Dimensions, Supply Chain Performance and Organizational Performance: An Integrated Framework. Int. J. Bus. Manag. 2012, 7, 2. [Google Scholar] [CrossRef]

- Fawcett, S.E.; Jones, S.L.; Fawcett, A.M. Supply chain trust: The catalyst for collaborative innovation. Bus. Horiz. 2012, 55, 163–178. [Google Scholar] [CrossRef]

- Seebacher, G.; Winkler, H. A capability approach to evaluate supply chain flexibility. Int. J. Prod. Econ. 2015, 167, 177–186. [Google Scholar] [CrossRef]

- Notland, J.S. Blockchain Enabled Trust & Transparency in Supply Chains. Master’s Thesis, NTNU Norwegian University of Science and Technology, Trondheim, Norway, February 2016; p. 37. [Google Scholar] [CrossRef]

- Braun, E.L.; Pereira, G.M.; Sellitto, M.A.; Borchardt, M. Value co-creation in maintenance services: Case study in the mechanical industry. Bus. Process Manag. J. 2017, 23, 984–999. [Google Scholar] [CrossRef]

- Frempong, J.; Chai, J.; Ampaw, E.M.; Amofah, D.O.; Ansong, K.W. The relationship among customer operant resources, online value co-creation and electronic-word-of-mouth in solid waste management marketing. J. Clean. Prod. 2020, 248, 119228. [Google Scholar] [CrossRef]

- Chakraborty, S.; Bhattacharya, S.; Dobrzykowski, D.D. Impact of Supply Chain Collaboration on Value Co-creation and Firm Performance: A Healthcare Service Sector Perspective. Procedia Econ. Financ. 2014, 11, 676–694. [Google Scholar] [CrossRef]

- Lusch, R.F.; Nambisam, S. Service Innovation on JSTOR MIS Q. no. 1. March 2015, Volume 339, pp. 155–176. Available online: https://www.jstor.org/stable/26628345?seq=1 (accessed on 23 January 2021).

- Mensah, I. Stakeholder pressure and hotel environmental performance in Accra, Ghana. Manag. Environ. Qual. Int. J. 2014, 25, 227–243. [Google Scholar] [CrossRef]

- Yu, J.; Lo, C.W.-H.; Li, P.H.Y. Organizational Visibility, Stakeholder Environmental Pressure and Corporate Environmental Responsiveness in China. Bus. Strat. Environ. 2016, 26, 371–384. [Google Scholar] [CrossRef]

- Sir, L.Y. Identifying Factors to Indicate the Business Performance of Small Scale Industries: Evidence from Sri Lanka|Global Journal of Management And Business Research. Glob. J. Manag. Bus. 2012, 12, 21. Available online: https://www.journalofbusiness.org/index.php/GJMBR/article/view/874 (accessed on 23 January 2021).

- Zhu, Q.; Cordeiro, J.; Sarkis, J. Institutional pressures, dynamic capabilities and environmental management systems: Investigating the ISO 9000—Environmental management system implementation linkage. J. Environ. Manag. 2013, 114, 232–242. [Google Scholar] [CrossRef] [PubMed]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman Publishing: Boston, MA, USA, 1984; Volume 1. [Google Scholar]

- Maas, S.; Schuster, T.; Hartmann, E. Stakeholder Pressures, Environmental Practice Adoption and Economic Performance in the German Third-party Logistics Industry—A Contingency Perspective. J. Bus. Econ. 2017, 88, 167–201. [Google Scholar] [CrossRef]

- Ahinful, G.S.; Tauringana, V.; Essuman, D.; Boakye, J.D.; Sha’Ven, W.B. Stakeholders pressure, SMEs characteristics and environmental management in Ghana. J. Small Bus. Entrep. 2019, 1–28. [Google Scholar] [CrossRef]

- Betts, T.K.; Wiengarten, F.; Tadisina, S.K. Exploring the impact of stakeholder pressure on environmental management strategies at the plant level: What does industry have to do with it? J. Clean. Prod. 2015, 92, 282–294. [Google Scholar] [CrossRef]

- Rahi, S. Research Design and Methods: A Systematic Review of Research Paradigms, Sampling Issues and Instruments Development. Int. J. Econ. Manag. Sci. 2017, 6. [Google Scholar] [CrossRef]

- Lugosi, P.; Janta, H.; Watson, P. Investigative management and consumer research on the internet. Int. J. Contemp. Hosp. Manag. 2012, 24, 838–854. [Google Scholar] [CrossRef]

- Bollen, K.A. A New Incremental Fit Index for General Structural Equation Models. Sociol. Methods Res. 1989, 17, 303–316. [Google Scholar] [CrossRef]

- Chang, H.H.; Hung, C.-J.; Wong, K.H.; Lee, C.-H. Using the balanced scorecard on supply chain integration performance—A case study of service businesses. Serv. Bus. 2012, 7, 539–561. [Google Scholar] [CrossRef]

| Constructs | Elements | Measures | References |

|---|---|---|---|

| Inter-firm value co-creation | Approaches | 4 questions | [7,8,26] |

| Measure | 7 questions | ||

| Innovation capability | Information system | 1 question | [9,12,13] |

| New machines | 1 question | ||

| New methods | 1 question | ||

| New processes | 1 question | ||

| Supply chain integration | System coupling | 2 questions | [2,4,15] |

| Joint decision | 4 questions | ||

| Information sharing | 4 questions | ||

| Collaborations | 2 questions | ||

| Stakeholders pressure | Internal | 2 questions | [27,30,32] |

| External | 10 questions | ||

| Firm performance | Financial | 3 questions | [25,36] |

| Non-financial | 5 questions |

| Model | Predictors | Mediator | Criterion |

|---|---|---|---|

| 1 | InterVC -------------------------------------------------------------> | FpM | |

| 2 | SupC -------------------------------------------------------------> | FpM | |

| 3 | InterVC -------------------------------------------------------------> | SupC | |

| 4 | ShP -------------------------------------------------------------> | SupC | |

| 5 | InC -------------------------------------------------------------> | SupC | |

| 6 | ShP -------------------------------------------------------------> | FpM | |

| 7 | SupC ------------------------------------------------------------> | InC | |

| 8 | InterVC -------------------------------------------------------------> | InC | |

| 9 | SupC -----------------------------------InC--------------------> | FpM | |

| 10 | SupC ------------------------------------ShP-------------------> | InterVC | |

| Variables | Frequency | Percentage | |

|---|---|---|---|

| Gender | Male | 364 | 77.0% |

| Female | 109 | 23.0% | |

| Age | 18–25 years | 33 | 7.0% |

| 26–30 years | 227 | 48% | |

| 31–35 years | 130 | 27.5% | |

| 36–40 years | 40 | 8.5% | |

| 41 years or over | 43 | 9.1% | |

| Education | Basic | 4 | 0.8% |

| Secondary | 25 | 5.3% | |

| Tertiary | 444 | 93.9% | |

| Nature of Business | Service | 331 | 70.0% |

| Manufacturing | 50 | 10.6% | |

| Service and manufacturing | 93 | 19.4% | |

| Location | Urban | 362 | 76.5% |

| Rural | 111 | 23.5% | |

| Employees | 10–50 | 341 | 72.1% |

| 51–100 | 43 | 7.2% | |

| 101 or more | 98 | 20.7% |

| Variables | Cronbach’s Alpha | Composite Reliability |

|---|---|---|

| InterVC | 0.738 | 0.823 |

| InC | 0.701 | 0.811 |

| SupC | 0.924 | 0.945 |

| ShP | 0.847 | 0.873 |

| FpM | 0.893 | 0.901 |

| InterVC | InC | SupC | ShP | FpM | |

|---|---|---|---|---|---|

| AP1 | 0.831 | 0.203 | −0.075 | −0.088 | 0.049 |

| AP2 | 0.840 | 0.050 | −0.070 | 0.311 | 0.052 |

| AP3 | 0.803 | −0.004 | −0.009 | 0.228 | 0.516 |

| MS2 | 0.795 | −0.169 | −0.384 | −0.034 | 0.153 |

| MS5 | 0.796 | −0.279 | −0.364 | 0.223 | 0.047 |

| MS6 | 0.769 | −0.361 | −0.322 | 0.184 | 0.069 |

| MS7 | 0.735 | −0.396 | −0.044 | 0.118 | 0.069 |

| IN2 | 0.225 | 0.725 | 0.264 | 0.480 | 0.226 |

| IN3 | 0.074 | 0.784 | 0.087 | 0.254 | 0.244 |

| IN4 | 0.043 | 0.787 | 0.195 | −0.086 | 0.326 |

| SCI | 0.441 | 0.292 | 0.736 | −0.406 | 0.360 |

| SC2 | 0.583 | 0.350 | 0.838 | 0.031 | 0.027 |

| DS2 | 0.670 | 0.236 | 0.788 | −0.144 | −0.233 |

| DS3 | 0.750 | 0.172 | 0.766 | −0.105 | 0.060 |

| DS4 | 0.629 | 0.283 | 0.811 | 0.075 | 0.029 |

| IS1 | 0.616 | 0.366 | 0.806 | 0.033 | 0.183 |

| IS2 | 0.716 | 0.307 | 0.836 | −0.286 | −0.178 |

| IS4 | 0.690 | 0.171 | 0.813 | −0.214 | −0.287 |

| CL1 | 0.589 | 0.316 | 0.874 | −0.175 | 0.318 |

| CL2 | 0.701 | 0.340 | 0.875 | −0.331 | −0.052 |

| SPI1 | 0.599 | −0.255 | −0.161 | 0.767 | 0.034 |

| SPI2 | 0.412 | 0.040 | .095 | 0.722 | −0.418 |

| SPE2 | 0.650 | −0.144 | .009 | 0.780 | −0.213 |

| SPE3 | 0.576 | −0.252 | −0.002 | 0.803 | 0.002 |

| SPE4 | 0.549 | 0.164 | 0.131 | 0.828 | −0.209 |

| SPE6 | 0.516 | 0.261 | −0.019 | 0.786 | −0.195 |

| FP1 | 0.612 | −0.408 | 0.306 | −0.262 | 0.797 |

| FP2 | 0.629 | −0.361 | 0.383 | −0.196 | 0.863 |

| NF1 | 0.698 | −0.229 | 0.369 | −0.054 | .736 |

| NF2 | 0.633 | −0.151 | 0.320 | −0.181 | 0.804 |

| NF4 | 0.698 | −0.215 | 0.200 | 0.227 | 0.787 |

| Average variance extracted | 0.72 | 0.64 | 0.69 | 0.77 | 0.59 |

| Hypothesis | Relationships | Coefficients | p Values | Effect | Results |

|---|---|---|---|---|---|

| H1a | InerVC FpM FpM | 0.161 | 0.003 a | Direct | Supported |

| H1b | SupC FpM FpM | 0.140 | 0.005 a | Direct | Supported |

| H2a | InterVC SupC SupC | 0.204 | 0.000 a | Direct | Supported |

| H2b | ShP SupC SupC | 0.470 | 0.000 a | Direct | Supported |

| H3a | InC SupC SupC | 0.197 | 0.000 a | Direct | Supported |

| H3b | ShP FpM FpM | 0.551 | 0.000 a | Direct | Supported |

| H4a | InC pM pM | 0.039 | 0.004 a | Direct | Supported |

| H4b | InTerVC InC InC | −0.007 | 0.000 a | Direct | Supported |

| H5 | —SupC Inc FpM FpM | 0.066 | 0.020 b | Indirect | Supported |

| H6 | SupC—ShP InterVC InterVC | 0.020 | 0.007 a | Indirect | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, H.; Otchere, S.K.; Coffie, C.P.K.; Mensah, I.A.; Baku, R.K. Supply Chain Integration, Interfirm Value Co-Creation and Firm Performance Nexus in Ghanaian SMEs: Mediating Roles of Stakeholder Pressure and Innovation Capability. Sustainability 2021, 13, 2351. https://doi.org/10.3390/su13042351

Tian H, Otchere SK, Coffie CPK, Mensah IA, Baku RK. Supply Chain Integration, Interfirm Value Co-Creation and Firm Performance Nexus in Ghanaian SMEs: Mediating Roles of Stakeholder Pressure and Innovation Capability. Sustainability. 2021; 13(4):2351. https://doi.org/10.3390/su13042351

Chicago/Turabian StyleTian, Hongyun, Samuel Kofi Otchere, Cephas P. K. Coffie, Isaac Adjei Mensah, and Raphael Kwame Baku. 2021. "Supply Chain Integration, Interfirm Value Co-Creation and Firm Performance Nexus in Ghanaian SMEs: Mediating Roles of Stakeholder Pressure and Innovation Capability" Sustainability 13, no. 4: 2351. https://doi.org/10.3390/su13042351

APA StyleTian, H., Otchere, S. K., Coffie, C. P. K., Mensah, I. A., & Baku, R. K. (2021). Supply Chain Integration, Interfirm Value Co-Creation and Firm Performance Nexus in Ghanaian SMEs: Mediating Roles of Stakeholder Pressure and Innovation Capability. Sustainability, 13(4), 2351. https://doi.org/10.3390/su13042351