1. Introduction

Currently, the agro-food system feeds the worldwide population composed of 7.7 billion people, and it will have to provide additional food for another 2 billion by 2050 [

1]. This means an increasing demand of 60% by 2050, resulting in increasing pressure on the scarce resources required for food production such as water, land and energy [

2,

3]. Moreover, in a world where some 850 million people live with chronic hunger [

3], reducing the amount of Food Loss and Waste (FLW) is widely seen as a way to increase the efficacy of the agro-food system and improve food security [

4,

5]. FLW is the decrease in quantity or quality of food resulting from decisions and actions of all the actors of the Food Supply Chain (FSC) [

4]. Specifically, Food Loss (FL) occurs at the production, post-harvest, and processing stages in the FSC. Food Waste (FW) takes place at the retail and consumption level [

6]. Every year, about a third of the food produced for human consumption is lost or wasted, with the associated cost estimated to be equal to USD750 billion [

5,

7]. Furthermore, the environmental impact is far more significant, considering that FLW alone generates about 8% of the total Greenhouse Gas (GHG) emissions [

8].

The growing attention on this issue is reflected in the 2030 Agenda, adopted by the United Nations (UN) Member states in 2015, which provides 17 different Sustainable Development Goals (SDGs). Among them, the SDG 12, related to the responsible production and consumption, includes the target 12.3 that calls for halving per capita global FLW by 2030 [

4,

5]. Furthermore, as recognized also by the European Commission (EC), all actions connected to food have a direct or an indirect link with the SDGs, because it affects health of people, societies, and the planet [

9,

10]. Thus, hitting the target of halving FLW means also to help the achievement of the SDG 1 (ending poverty), of the SDG 2 (zero hunger), related to food security and improved nutrition, and other targets regarding environmental sustainability (e.g., SDG 6, SDG 13) [

4,

9,

11].

In this context, the Food & Drink (F&D) industry can play a role in reducing FLW through its prevention, reuse and recycle, and promoting more sustainable production and consumption patterns [

5,

12]. In industrialized countries, where more than 40% of the whole FLW occurs at the final stages of the FSC [

7], the adoption of different key processes, such as the implementations of the requirement of the ISO 22000 Standard, concerning the development of food safety management system, could contribute in tackling this issue [

13]. Among these drivers, the adoption of primary packaging innovations assumes particular importance for manufacturers since it can help to prevent the generation of FW [

14,

15,

16].

It is well known the role of packaging in the FSC that is relative to the maintenance of food quality, integrity and safety; it supports also the food delivery, facilitating transport and storage, with direct economic benefits, and contributes to enhance its shelf-life [

15,

17,

18,

19]. A deficient packaging material is considered, on the contrary, one of the main causes of the generation of FLW [

20]. Thus, it is very crucial to adopt innovations in food packaging to tackle this issue, minimizing the FLW amount. It is possible to distinguish two typologies of innovation in packaging: health and ecological ones. The paper focuses mainly on the active and intelligent packaging, for the health innovation, and on the compostable packaging for the eco-innovation.

The active and intelligent packaging allow to maintain food quality and to extend food shelf-life and to monitor the freshness of foods [

21,

22,

23], respectively, as established by the Regulation 1933/2004/EC and 450/2009/EC [

21,

24]. The active packaging is in particular designed to deliberately incorporate components that may release substances into the packaged food or the surrounding environment or absorb some substances from food or the environment [

15,

16,

25,

26,

27,

28,

29,

30]. The key function of the intelligent packaging, instead, is to record the environmental conditions both inside and outside the packaging through the use of internal (inside the package) or external (outside the package) sensors or indicators [

27,

31]. The recent European Directive on waste (2018/851), that introduces the waste hierarchy, points out the importance of preventing FLW as the first strategy to be adopted by all the actors of the FSC. Thus, these health innovations are considered a way to avoid FLW [

32].

The compostable packaging, on the other hand, could be considered an alternative option whenever the prevention of FLW is not feasible, as stressed by the waste hierarchy [

12,

32,

33]. This latter promotes the FLW reuse as raw materials for the production of biopolymers for eco-innovations in packaging [

34,

35]. Indeed, in a Circular Economy (CE) perspective, FL from production processes and FW from consumers can be reused as direct or indirect source of inputs for other processes, minimizing resource scarcity and overexploitation [

36,

37,

38]. Then, compostable packaging could be completely biodegradable, bio-based, and its chemical, physical, and mechanical properties are comparable to petroleum-derived plastics [

34,

35,

39,

40,

41,

42,

43]. Compostability is the ability of a material to turn into compost within 3 months through the industrial composting process, according to the EN 13432 standard [

39]. During past years, the F&D industry has shown great interest in these innovations, since they can represent a suitable solution to enhance resources efficiency and to lower emissions that would have been generated in extracting and processing non-renewable raw materials [

39,

40,

41].

Both health and eco-innovation in the F&D packaging are already on the market, presenting very interesting characteristics, although they are not so common among manufacturers. Indeed, looking at the Summary Innovation index during the period of 2010–2017, and at the EU-28 level, even if the innovation performance has improved in the F&D industry, often the intellectual property rights do not cover the results of the innovative activities in some countries [

44]. Thus, this evidence could represent a barrier to invest in innovations above all for micro, small and medium-sized enterprises (SMEs), which often cannot rely on internal sources of knowledge [

45,

46,

47]. This means that companies must be “open” to collaborate with universities, research institutes, agencies, as well as suppliers and related industries (including chemicals and packaging sectors) [

46,

48].

A further important aspect that affects both consumers and producers is the absence of dangerousness of materials in contact with food. Plastics, coatings, paper and board appear to be a significant source of hazardous substances; even printing inks and adhesives are characterized by dangerous elements [

49]. In this contest a large introduction of eco and health packaging in the food sector represents a powerful tool to ensure more sustainable production and healthier consumption.

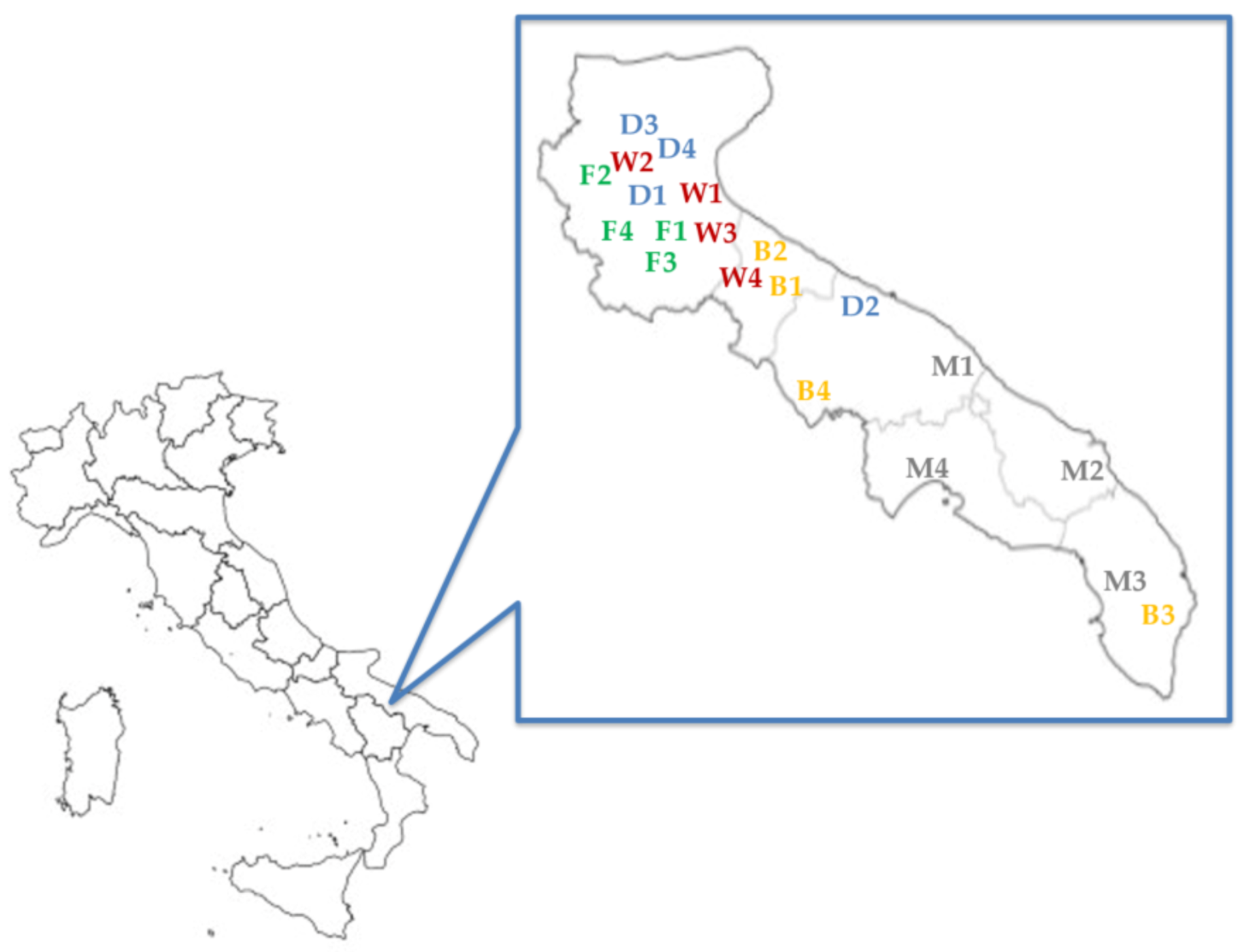

In the light of these premises, the present paper aims at analyzing whether the Italian micro and SMEs are willing to invest in F&D packaging innovations, such as active, intelligent and compostable packaging, in order to contribute to reducing FLW. Specifically, the study focuses on 20 micro and SMEs, located in Apulia that represents the Italian region with the highest number of the agro-food companies [

50,

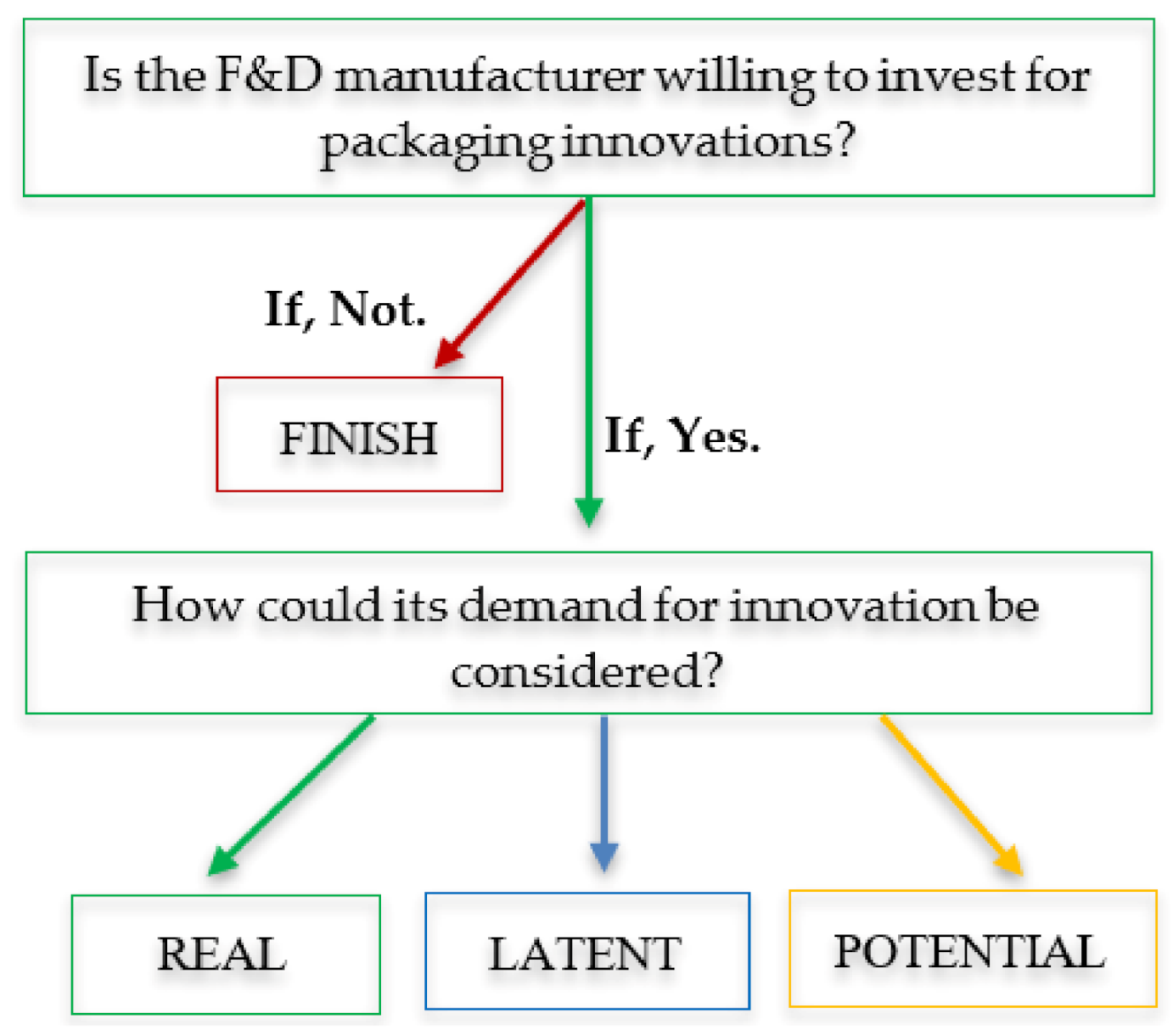

51]. The methodology used is the multiple case study able to highlight similarities and differences among the micro and SMEs’ preferences related to packaging innovations. Finally, the theoretical model proposed by Muscio et al., (2010) [

52] is used to verify if the eventual manufactures’ willingness to invest could be considered as real.

To the best of our knowledge, there are many studies on the correlation between the reduction of FLW and the use of health and eco-innovations in packaging. Nevertheless, most of them are mainly focused on the technological aspect of packages, on the evaluation of the consumer’s acceptance, as well as on their environmental sustainability assessment (see

Section 2). Thus, there is a gap in the literature review due to the lack of a complete economic analysis related to determining the manufacturers’ willingness to invest for both health and eco-innovation innovations. Furthermore, there are no studies conducted on this topic with focus in the Italian market, specifically, on the Apulia region. Consequently, this paper could be considered the first attempt to identify the main drivers and barriers in the micro and SMEs’ willingness to implement F&D packaging innovations into the market for reducing FLW. This element, as well as the theoretical framework developed, represents the novelty and originality of this research that could contribute to providing useful insights for addressing the agro-food system towards a more sustainable pathway, in compliance with the pandemic crisis we are living in.

This research, identifying the most promising innovations in food packaging, could contribute to make companies more aware of the technology supplier in the field of health and eco innovation and to be competitive in the global market by differentiating the product through innovative packaging. Moreover, a better understanding of the adoption of eco and health innovations can be of great interest not only to the research but also to the policymakers who are deputies to promote the environmental sustainability and human health.

2. Literature Review

Based on the main literature review, it has been possible to highlight what scholars on this topic have done. There are many studies on the correlation between the reduction of FLW and the use of active, intelligent and sustainable packaging. Nevertheless, most of them are principally focused on the technological aspect of packages, on the evaluation of the consumer’s acceptance, as well as on their environmental sustainability assessment. Consequently, a few are addressed to evaluate the manufacturer’s willingness to invest towards these technological solutions aimed to reduce FLW. In this section, the authors reported some main references as examples of the different studies’ approaches.

About the technological approach, Poyatos-Racionero et al., (2018) conducted an analysis of intelligent packaging, specifically different optical systems, for monitoring freshness of fruits, vegetables, fish products and meat, since they are more prone to be wasted. They stressed that these dynamic systems are able to inform about the real state of food, reducing FW, while maintaining food safety. Furthermore, they observed that technological advances in this field could promote a greater adoption of intelligent packaging by F&D industries [

53]. Moreover, Bhargava et al., (2020) highlighted the possibility to use FW for producing bioactive compounds in active and intelligent biodegradable packaging films. These are economical, safe, non-toxic, sensitive, easy to be manufactured and commercialized for fresh food products in order to evaluate the visual quality in a simple way [

54]. In this context, Firouz et al., (2021) underlined that these emerging technologies present some important barriers to be considered, such as the production costs, the complexity of these technologies as well as the consumers’ acceptance. Thus, it is very important to analyze in depth these concerns to extend the applications in the food industry [

55]. Jõgi and Bhat (2020), instead, focused on an overview of bioplastics, including production methods and possibilities of industrial food waste valorization for bioplastic production for the F&D packaging applications. They observed that the most important limit, concerning the production and usage of these products, is their cost-effectiveness. Them to reduce this issue, cheap and abundant raw materials, such as food wastes and by-products can efficiently be explored [

56].

About the consumers’ acceptance approach, Aday and Yener (2015) and Challaghan and Kerry (2016) showed that consumers prefer intelligent packages more than active ones because they want to monitor food quality and the remaining time for eating it [

57,

58]. Wilson et al., (2018) highlighted that consumers mostly prefer active packaging without the use of sachets/labels due to the fear to be swallowed [

59]. Furthermore, a general lack of consumers’ knowledge as regards such innovations is stressed by Aday and Yener (2013) and Barska and Wyrwa (2016) [

57,

60]. Thus, they pointed out the need to increase the consumers’ acceptance of these technologies by media communications strategies and information campaigns. Koenig-Lewis et al., (2014), alternatively, focused their attention on the evaluation of consumer’ emotional and rational evaluation of sustainable packaging. Results showed that the consumer’s willingness to purchase was more significantly influenced by general environmental concern rather than the rational evaluation of the benefits. Then, the authors suggested that marketers should emphasize the positive emotions evoked by using ecological packaging to advertise [

61]. Brennan et al., (2020) presented a systematized literature review of consumer food waste in households, packaging technologies to reduce food waste, and consumer perceptions of packaging. Specifically, they stressed that there is little research on the role of consumers’ perceptions in reducing food waste by using packaging innovations. This could turn into a reduced consumers’ willingness to purchase and to pay a premium price for these technologies [

62].

Regarding the environmental sustainability assessment of these packaging innovations, Dilkes-Hoffman et al., (2018) carried out a study on the quantification of the GHG trade-offs associated with the use of a biodegradable packaging. They revealed that to effectively cut these emissions it’s important to consider also the food packaging design (e.g., high barrier properties) and not only the bio-based raw material. Thus, the key design aspect should be the reduction of food waste [

63]. In the same direction, Kakadellis and Harris (2020) highlighted that, although it is difficult currently to identify what biopolymer for biodegradable plastics is the best solution for reducing food waste, it is critical to focus on food packaging performance in food waste minimization. This means to emphasize the environmental footprint associated with food production and food waste, and to highlight the importance of including the food itself in food packaging LCAs [

64]. Additionally, an interesting study is provided by Zhang et al., (2021) showed that the carbon footprint of the nano-packaging system could be reduced thanks to the decrease of FW deriving from the extension of the shell life of the food product. The results are expected to provide food manufacturers with the groundwork to make more informed decisions on nano-packaging applications [

65].

Finally, concerning the manufacturers’ willingness to invest, Simms et al., (2020) stressed that the literature on eco-innovation adoption has often overlooked the food processing sector. Thus, they examined the barriers inhibiting the adoption of waste reducing eco-innovations in the food processing sector. They found different barriers to the adoption of waste reducing technologies in the food processing sector, such as the influence of technologies on the product’s characteristics, its retailing, and a perceived lack of consumer demand. The study suggests useful information for policy makers and innovation managers to increase the adoption and diffusion of these technologies in the food processing sector [

66]. Fonseca et al., (2018) conducted an online survey among 99 Portuguese companies to evaluate their willingness to move from a linear to a CE. Then, results showed that CE activities are still relatively modest and additional government actions are required to promote it, as well as a stronger support from all the actors of the FSC [

36]. Finally, Keränen et al., (2020) studied the changes to existing industry value networks that can facilitate the diffusion of sustainable innovation in food packaging. They considered the transformation and distribution of agro-food waste into a new bioplastic packaging. Their results stressed the importance of opportunity recognition, but also the role of new actors, resources, activities, and relationships in restructuring this, network [

67].

Thus, there is a gap in the literature review due to the lack of a complete economic analysis related to determining the manufacturers’ willingness to invest for both health and eco-innovation innovations. Furthermore, there are no studies conducted on this topic with focus in the Italian market, specifically, on the Apulia region.

4. Results

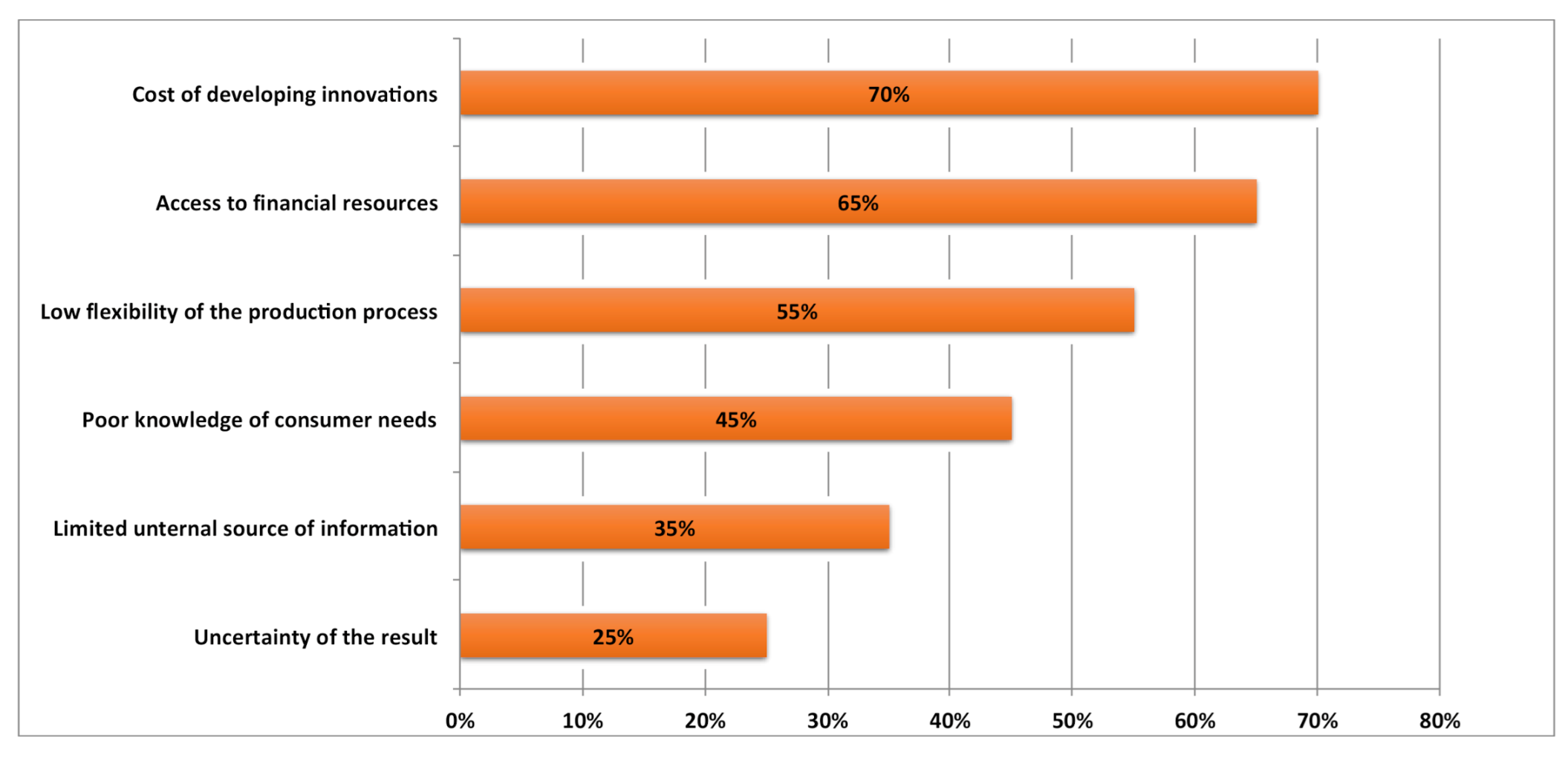

The descriptive analysis revealed that most of these companies are small (40%), followed by medium (35%) and micro-sized companies (25%). Specifically, 60% are family businesses and 30% are farms. The distribution of sales is mainly oriented on the national (41%) and regional market (33%). Moreover, the average percentage of graduates, with respect to the total number of employees, seems to be very low (22%). Finally, companies show a limited Research and Development (R&D) effort: 30% of companies’ investments in R&D during the last three years accounted for 0% of sales (see for more details

Appendix A—

Table A2). Despite the 85% of these companies started product innovation strategies over the past three years, R&D was found as one of the most widespread points of weakness (25%). Moreover, the access to financial resources was found as one of the most constraining factors in developing innovations (65%), as shown in

Figure 3. About 70% of the F&D manufacturers considered the collaboration with suppliers in generating innovations important, while 65% declared to be willing to cooperate with universities and research institutes to develop innovations.

In terms of the role of packaging in containing and protecting F&D products, plastics seems to be the most used material (80%), followed by glass (40%), and paper and cardboard (35%). Multi-layer films as well as aluminum are instead the less common packaging materials, with a percentage of 20% and 10% respectively.

Moreover, all these companies considered the role of packaging in reducing FLW as well as minimizing the environmental impact of the packages important. In this context, most of the F&D manufacturers (65%) introduced packaging innovations to reduce FLW such as resealable packaging, adopted by 20% of these companies, smaller package size and with improved barrier properties, selected by 30% of these manufacturers. At the same time, 80% of the entrepreneurs developed packaging innovations to contribute to improving the environmental wellbeing. Specifically, they introduced reusable packaging (30%), 100% recyclable (45%), compact (35%) and flexible (5%).

In analyzing the manufacturers awareness about their packaging innovation’ needs, most of the companies expressed the necessity to continue improving the packaging features (80%), as indicated in

Figure 4.

With regard to the manufacturers’ knowledge about the existing technological options to achieve their needs, results showed that all the companies were aware about compostable packaging. Conversely, 40% of the manufacturers and 25% were not aware about intelligent and active packaging, respectively. However, after providing them neutral information about these technologies, 75% of them declared to be willing to invest for one typology or even for all the proposed innovations (

Figure 5).

4.1. Demand for Active and Intelligent Packaging

By testing the demand for packaging innovation using the theoretical model, the following results were observed: 12 companies were willing to invest in active packaging. Moreover, all these F&D manufacturers considered active packaging important to enhance food safety and its shelf-life. They also, except for the Case M2, evaluated this technology important to obtain competitive advantage. However, only two companies (Cases M1, M4) could be considered able to translate their needs in a packaging innovation, as shown in

Table 3.

On the contrary, ten companies declared to be willing to invest for intelligent packaging. They considered this technological solution important in reducing food waste and improving food safety. Moreover, they considered this technology important to obtain competitive advantage, except for Cases D2 and M4.

However, results showed that only one of these companies (Cases D2) could be considered to have a real demand for intelligent packaging, as exposed in

Table 4.

4.2. Demand for Compostable Packaging

12 companies were willing to invest for compostable packaging. The results show that only two manufacturers (Cases B2, M1) were willing to invest for plant-based compostable packaging such as plants that are rich in carbohydrates (e.g., corn, sugar cane) or plants that are not eligible for food or feed production. The other 10 companies (Cases B1, B3, B4, D3, F1, F2, F3, F4, M2, W1) preferred the use of FLW.

Moreover, all the 12 companies considered this technology important to reduce the environmental impact of the packages, with the exception of Cases F1 and F2, and to obtain competitive advantage.

Finally, results show that six companies could have a Real demand for compostable packaging, as shown in

Table 5.

According to the adaptation of the authors to the theoretical model proposed by Muscio et al., (2010) [

52] six companies were considered dependent on an external source of knowledge (e.g., University, Research institutes, suppliers) to develop the packaging innovation. This is due to the lack on the market of compostable packaging made by FLW.

5. Discussion

According to the results of this analysis, most of the Italian manufacturers could be interested in the adoption of health and eco-innovations in packaging to reduce FLW.

This study, applied to 20 micro and SMEs located in Southern Italy, showed that manufacturers are aware about the important role of packages to avoid FLW as a tool to improve the environmental wellbeing as well as to obtain competitive advantage.

In this regard, companies already started to introduce improvement in the packaging features with a particular attention to its design. Specifically, companies introduced 100% recyclable packaging, compact and flexible packages. Moreover, they opted for resealable packaging, smaller packages size and with improved barrier properties. In line with these results, Williams et al., (2020) pointed out that the most important packaging factors that affect household waste are size and label (display of the information about product safety and storage) [

74]. Indeed, according to Wohner et al., (2019), packaging must contain the right amount of food, provide information and convenience features for the consumers, such as easy to use, resealability and easy to empty [

75].

Furthermore, F&D manufacturers expressed the need to continue improving the packaging features. Most of the companies (45%) highlighted the necessity to “reduce the environmental impact of the packaging”; 20% of the manufacturers to “extend the shelf-life of packaged foods or drinks”; and 15% to “provide information about food’s freshness and safety”. The remaining part (20%) did not express any specific packaging innovation needs.

Moreover, companies were also aware about the technological opportunities to meet their needs, most of them about compostable packaging. Conversely, 40% of the manufacturers and 25% were not aware about intelligent and active packaging, respectively. However, after providing them neutral information about these technologies, 75% of the interviewed declared to be willing to invest in at least one packaging innovation. The technological solutions most preferred by the companies were both active and compostable packaging (60%). Intelligent packaging was the least preferred technology, selected by 50% of the firms.

Finally, this study showed that only the F&D manufacturers who have presented a real demand for innovation are effectively prompt to invest in this field. In testing the demand for packaging innovation, through the theoretical model proposed by Muscio et al., (2010), most of the manufacturers (68%) expressed only a potential demand for innovation, since they did not show to have a clear understanding of the packaging needed to be improved. Latent demand for innovation (6%) was mostly found for active and intelligent packaging. In this case, companies showed to be aware about their packaging innovation need but they did not have a clear technological solution in mind to address this need. Furthermore, 26% of the F&D manufacturers expressed a Real demand for packaging innovations, 67% accounting for compostable packaging.

With respect to this latter, most of the companies (83%) showed a particular emphasis on recovering FLW for the production of biopolymers for eco-innovations in packaging. However, despite the vast evidence provided in literature regarding the concrete possibility to produce compostable packaging using FLW, their presence on the market is scant. For this reason, companies were considered dependent on an external source of knowledge (e.g., University, Research institutes, suppliers) to develop packaging innovation. Moreover, the lack of high-skilled stuff as well as low investments rate in R&D are considered barriers for the internal development of innovations, as also pointed out by Avermaete et al., (2004) and Muscio et al., (2016) [

47,

48]. In contrast with Simms et al., (2020), the manufacturers didn’t highlight the lack of consumer demand as a barrier to innovate [

66]. Finally, as confirmed by Fonseca et al., (2018) and Keränen et al., (2020) there is the need to improve the collaboration among all the actors of the FSC in order to switch from a liner economy to a circular economy [

36,

67].

6. Conclusions

This study provides useful information for both producers and policy-makers in the agro-food sector about their willingness to invest for health and eco-innovations. Given the presence of very few existing studies on this topic, these results surely fill the gap in scientific literature, contributing to improve the research in this field. Specifically, the paper provided a complete analysis about the key drivers and barriers affecting the micro and SMEs’ willingness to invest for both health and eco-innovation innovations. The main results show that most of the interviewed manufacturers are willing to invest in at least one packaging innovation, choosing mainly between the active packaging and the compostable one.

Additionally, the overall results of the study have several practical implications. The study highlights that many companies do not have a clear understanding of their needs regarding packaging innovations; this finding underlines the importance of the definition and emersion of potential and latent demand for innovation and of the role of bridging institutions (TTOs, technology poles, etc.) and collaborations between research institutions and industries. The results could lead to market implications such as the production costs, the complexity of these technologies as well as the consumers’ acceptance. Finally, the study involves policy implications through the use of packaging as a tool to promote environmental sustainability, responsible production and consumption.

The limits of this study are related to the sample size, the geographic settings, as well as the economic activities. Specifically, the main limitation is linked to the few number of enterprises involved in the survey (20). Thus, this research could be taken as a reference for broader application at the national level and in other food markets. This could highlight differences due to resource endowments and firms’ internal capabilities, as well as policy, structural or cultural issues.

Suggestions for further research could be the evaluation of consumers and producer’s perception of hazards related to packaging in particular materials in direct contact with food, also focusing on the European regulation concerning the risk management related to the potential toxicity of some materials. Such a study would make it possible to investigate the level of knowledge and the actual need for information to ensure food safety and consumers’ health.