Overcapacity Risk of China’s Coal Power Industry: A Comprehensive Assessment and Driving Factors

Abstract

1. Introduction

2. Literature Review

2.1. Causes of Coal Power Overcapacity

2.2. The Judgment of Coal Power Overcapacity

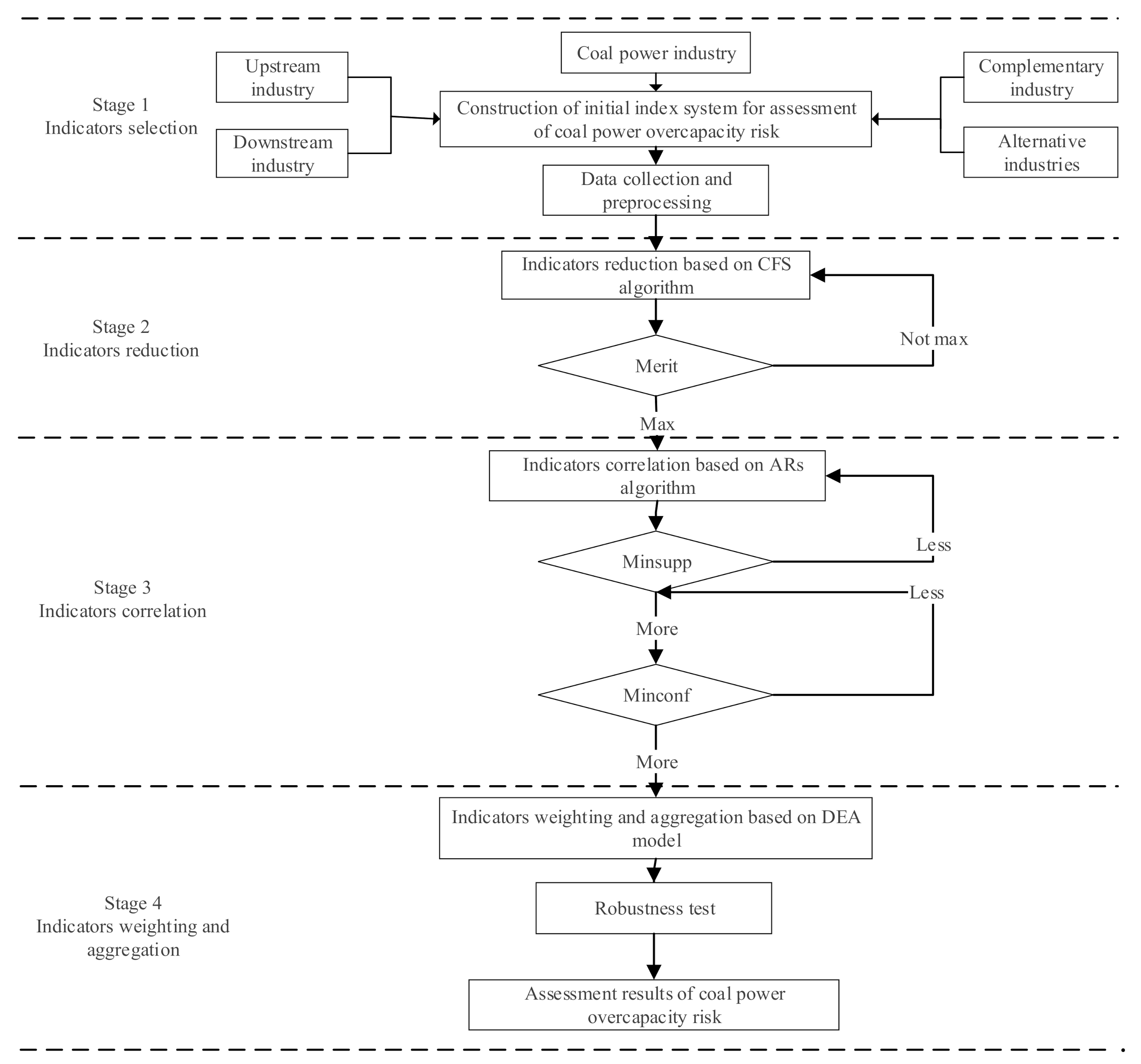

3. Risk Assessment Model Construction of Coal Power Overcapacity

3.1. Framework

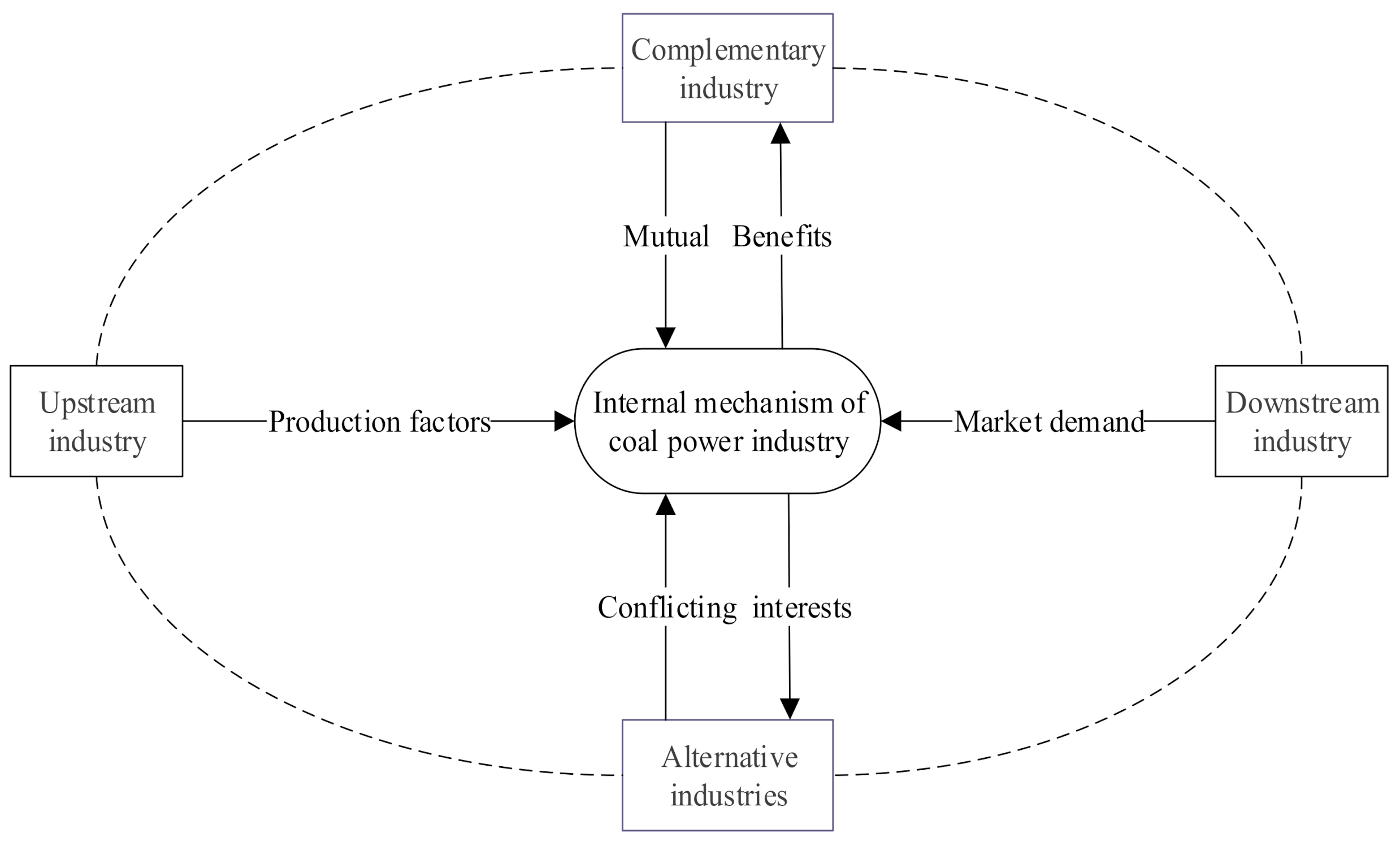

3.2. Indicators Selection

- The industry fundamentals refer to the inherent heterogeneity among industries that makes each industry flexible in coping with excess capacity in different ways. Therefore, it is an important dimension to be examined. Such fundamentals mainly include industrial concentration, marketization level, capital intensity, opening degree, and employment elasticity. These indicators have significant differences in how they influence the production and operation of each industry. High industrial concentration can reduce the blind follow-up and disorderly expansion of a large number of small and medium-sized enterprises, which helps enterprises grasp a higher share of market investment. We used the concentration ratio (CR-5) index to measure industrial concentration. The improvement of the level of marketization can make the industry allocate resources through the mechanism of survival of the fittest in competition more reasonably. Non-state-owned enterprises’ share of total industrial sales value is used to represent the marketization level. The higher the concentration of capital, the higher is the number of industry exit barriers. As a result, when market demand falls, a large number of enterprises may fail to reduce their production capacity. We use the ratio of the net value of fixed assets to total industrial sales value to measure capital intensity. Higher employment elasticity indicates that enterprises can adjust their variable costs and control their capacity according to the market changes. We measure employment elasticity by the elasticity value of employees to the sum of the inventory and accounts receivable. The level of opening up reflects the ability of enterprises to explore overseas markets. Enterprises can resolve excess capacity through export when domestic demand is insufficient. We use the ratio of the export value to total industrial sales value to represent the degree of openness.

- The matching of supply and demand is the basis for measuring industry overcapacity [30]. Supply refers to the input of production factors and is the main source of overcapacity in China. Among the various supply factors, we selected indicators from four sub-dimensions, namely fixed assets, labor, technology, and credit. At the demand level, this study used four indicators to examine the changing trend of market demand, namely the growth rate of the industrial sales output value, the turnover rate of inventory, the growth rate of inventory, and the ratio of production to sales.

- This study examines industry performance from two perspectives of economic and environmental benefits. When the industry has serious overcapacity, the overall economic benefits will decline significantly, such as price decline and deficit increase. These indicators can most intuitively reflect the degree of overcapacity. However, the negative effects of overcapacity are reflected not only in economic benefits, but also in the deterioration of environmental benefits. The real problem is that many local governments in China have relaxed their environmental protection standards and pollution control of coal power enterprises in exchange for more investment. This behavior externalizes the production cost of enterprises, intensifies over investment and repeated construction, and, finally, inhibits capacity utilization [31]. In this study, pollution emission intensity is used to represent environmental benefits.

3.3. Indicators Reduction

3.4. Indicators Correlation

3.5. Indicators Weighting and Aggregation

4. An Empirical Analysis of the Risk of Overcapacity in the Coal Power Industry

4.1. Results of the Indicators’ Reduction and Correlation

4.2. Results of Indicators’ Weighting and Aggregation

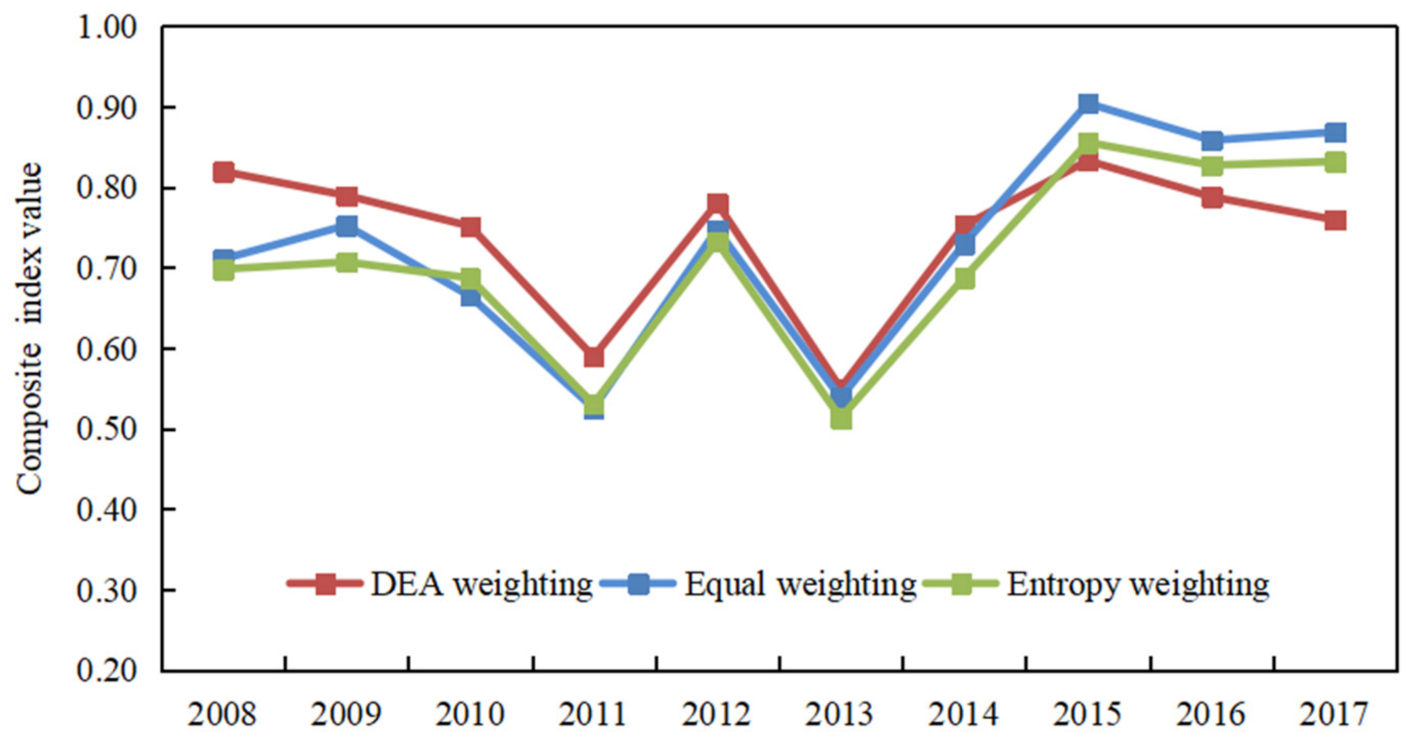

4.3. Robustness Test

4.4. Further Discussion

4.4.1. Analysis of the Causes of the Fluctuation Law of Coal Power Overcapacity Risk

- Between 2008 and 2011, the risk of coal power overcapacity keeps declining. At the same time, the contribution index curves of seven related industries show a downward trend. From 2008 to 2011, the coal power industry and its complementary and downstream industries showed good operating performance, with the input of production factors increasing steadily. On the contrary, the equipment utilization hours of the new energy power industry were at a low level, which was not a threat. These benefits jointly promote the reduction of the risk level of coal power overcapacity.

- In 2012, the risk of coal power overcapacity increased sharply, and the contribution index curves of the complementary industry and most of the downstream industries showed similar fluctuations. In reality, these industries suffered from the deterioration of operating efficiency with supply such as credit, and the number of employees declining to varying degrees. Meanwhile, the equipment utilization hours of the new energy power industry increased by 12%, which further squeezed the living space of the coal power industry. In conclusion, the change in the operating mechanism of related industries ultimately affects the coal power industry, resulting in a sharp increase in the risk of coal power overcapacity.

- In 2013, the risk of coal power overcapacity decreased significantly. Specifically, the power generation of the coal power industry resumed its growth while the equipment utilization hours of the new energy power industry showed negative growth. With the rapid growth of industrial sales value, the economic benefits of the power equipment manufacturing industry have improved significantly. At the same time, the performance of downstream industries also recovered, with the number of employees increasing by nearly 40%. These market changes will help resolve excess coal power capacity.

- Since 2014, the risk level of coal power overcapacity rose until 2015, when it reached its highest level for a decade. Then in 2016 and 2017, it dropped slightly but was still at a relatively high level. In fact, the rise in this stage was mainly due to the deterioration of the operating conditions of the coal power industry, the power equipment manufacturing industry, and the four downstream industries. Eventually, the superposition of adverse factors derived from these industries makes the risk of overcapacity to rise again.

4.4.2. The Identification of the Driving Factors of Coal Power Overcapacity

5. Conclusions and Policy Implications

5.1. Conclusions

- The comprehensive index system and model for assessing coal power overcapacity risk has remarkable advantages. First, the index system fully considers the industry correlation effect, and comprehensively covers the internal and external factors influencing coal power overcapacity. Second, the CFS-ARs-DEA integrated algorithm effectively reduces information redundancy from data features and avoids the subjectivity of index weighting and aggregation, thus helping to improve the scientificity of the risk assessment results of coal power overcapacity. This model provides an effective quantitative analysis tool for accurately identifying the risk level of industrial overcapacity and monitoring the trend of industrial overcapacity.

- The empirical evaluation result of coal power overcapacity risk reveals the fluctuation law of overcapacity risk in China’s coal power industry between 2008 and 2017. From 2008 to 2017, the risk of coal power overcapacity presents a cyclical feature of “decline-rise-decline.” In 2016 and 2017, although the risk level was slowly declining, it was still at a high level. Besides, the risk of coal power overcapacity is significantly affected by the operation of related industries. From the perspective of environmental benefits, the constraints of environmental regulations of upstream and downstream industries will aggravate the overcapacity of the coal power industry. From the perspective of industry fundamentals, the increase of the industrial concentration of the upstream industry and the complementary industry, and the increase of capital intensity of the downstream industries aggravates the overcapacity of the coal power industry. The increase of industrial concentration, marketization level, and the employment elasticity of downstream industries can effectively restrain the overcapacity of the coal power industry.

5.2. Policy Implications

- Establish and improve the monitoring and early warning mechanism of overcapacity risk in coal power industry. Government departments should systematically collect, summarize and analyze data of the whole coal power industry network, and constantly improve the statistical index system of overcapacity monitoring. It is necessary to avoid the ex-post assessment of overcapacity solely relying on the measurement of capacity utilization. Instead, a systematic analysis of the formation of overcapacity should be performed to accurately identify the potential risks. Specifically, a special information sharing platform should be established to release timely and transparent market information, so as to guide the coal power and other related enterprises to adjust their investment and production decisions. What is more, statistical departments can also rely on big data, cloud computing to dig out the causal association of data characteristics, which will help to systematically and accurately assess the state of overcapacity and potential risks.

- It is of great significance to build a mechanism to resolve overcapacity from the overall perspective of industrial network. Our empirical results show that the impact of vertical and horizontal related industries of coal power industry on its overcapacity is significant. Therefore, in order to fundamentally control the overcapacity, the government should firstly improve the marketization level of the coal power industry and its related industries, giving full play to the guiding role of the market in investment. Secondly, the government should strengthen the vertical and horizontal strategic cooperation of the whole industry network, encourage the organic integration of the coal industry and the power industry through asset pooling and mutual equity participation, and promote the merger and reorganization of coal power enterprises of different sizes to improve the industry concentration. Finally, while encouraging the development of the new energy power industry, the government must comprehensively update the development planning of the coal power industry, so as to orderly allocate power generation capacity and guide the smooth exit of backward coal power capacity.

- Government departments should control environmental regulation within the acceptable range of enterprises and establish a long-term mechanism to resolve overcapacity. As the association rules show, the increase of environmental regulation in upstream and downstream industries will aggravate the overcapacity of coal power industry. Therefore, while strengthening the industry environmental supervision, the government should ensure that the environmental regulation is reasonable and appropriate and adopt appropriate supervision measures. For example, the government can use more incentive and control measures such as environmental tax, emission trading and environmental subsidies to raise the market access threshold of high pollution and high energy consumption enterprises, and encourage enterprises to strengthen the innovation of production technology and industrial transformation. These measures are of benefit to realize the coordinated governance of environmental protection and overcapacity reduction of coal power industry.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Ethical approval and consent to participate

Consent for publication

Acknowledgments

Conflicts of Interest

References

- Yuan, J.; Li, P.; Wang, Y.; Liu, Q.; Shen, X.; Zhang, K.; Dong, L. Coal Power Overcapacity and Investment Bubble in China during 2015–2020. Energy Policy 2016, 97, 136–144. [Google Scholar] [CrossRef]

- Zhao, C.; Zhang, W.; Wang, Y.; Liu, Q.; Guo, J.; Xiong, M. The Economics of Coal Power Generation in China. Energy Policy 2017, 105, 1–9. [Google Scholar] [CrossRef]

- Zhang, H.; Zheng, Y.; Ozturk, U.A. The Impact of Subsidies on Overcapacity: A Comparison of Wind and Solar Energy Companies in China. Energy 2016, 94, 821–827. [Google Scholar] [CrossRef]

- Wang, Y.; Luo, G.; Guo, Y. Why Is There Overcapacity in China’s PV Industry in Its Early Growth Stage? Renew. Energy 2014, 72, 188–194. [Google Scholar] [CrossRef]

- Wang, D.; Wang, Y.; Song, X.; Liu, Y. Coal Overcapacity in China: Multiscale Analysis and Prediction. Energy Econ. 2018, 70, 244–257. [Google Scholar] [CrossRef]

- Feng, Y.; Wang, S.; Sha, Y.; Ding, Q.; Yuan, J. Coal Power Overcapacity in China: Province-Level Estimates and Policy Implications. Resour. Conserv. Recycl. 2018, 137, 89–100. [Google Scholar] [CrossRef]

- Ray, S.C. Nonparametric Measures of Scale Economies and Capacity Utilization: An Application to U.S. Manufacturing. Eur. J. Oper. Res. 2015, 245, 602–611. [Google Scholar] [CrossRef]

- Yang, G.; Fukuyama, H. Measuring the Chinese Regional Production Potential Using a Generalized Capacity Utilization Indicator. Omega 2018, 76, 112–127. [Google Scholar] [CrossRef]

- Wang, D.; Liu, Y.; Wang, Y.; Shi, X.; Song, X. Allocation of Coal De-capacity Quota among Provinces in China: A Bi-Level Multi-Objective Combinatorial Optimization Approach. Energy Econ. 2020, 87, 104709. [Google Scholar] [CrossRef]

- Lin, L.; Kahrl, F.; Liu, X. A Regional Analysis of Excess Capacity in China’s Power Systems. Resour. Conserv. Recycl. 2018, 129, 93–101. [Google Scholar] [CrossRef]

- Coussement, K.; Lessmann, S.; Verstraeten, G. A Comparative Analysis of Data Preparation Algorithms for Customer Churn Prediction: A Case Study in the Telecommunication Industry. Decis. Support Syst. 2017, 95, 27–36. [Google Scholar] [CrossRef]

- Pindyck, R.S. Irreversible Investment, Capacity Choice, and the Value of the Firm. Am. Econ. 1988, 969–985. [Google Scholar]

- Fusillo, M. Excess Capacity and Entry Deterrence: The Case of Ocean Liner Shipping Markets. Marit. Econ. Logist. 2003, 5, 100–115. [Google Scholar] [CrossRef]

- Nishimori, A.; Ogawa, H. Do Firms Always Choose Excess Capacity. Econ. Bull. 2004, 12, 1–7. [Google Scholar]

- Lin, Y.; Wu, H.; Xing, Y. “Wave Phenomenon” and Formation of Excess Capacity. Econ. Res. 2010, 10, 4–19. [Google Scholar]

- Qin, Q.; Jiao, Y.; Gan, X.; Liu, Y. Environmental Efficiency and Market Segmentation: An Empirical Analysis of China’s Thermal Power Industry. J. Clean Prod. 2020, 242, 118560. [Google Scholar]

- Yuan, J.; Lei, Q.; Xiong, M.; Guo, J.; Hu, Z. The Prospective of Coal Power in China: Will It Reach a Plateau in the Coming Decade? Energy Policy 2016, 98, 495–504. [Google Scholar] [CrossRef]

- Zhang, Y.; Nie, R.; Shi, R.; Zhang, M. Measuring the Capacity Utilization of the Coal Sector and Its Decoupling with Economic Growth in China’s Supply-Side Reform. Resources 2018, 129, 314–325. [Google Scholar] [CrossRef]

- Yang, G.; Fukuyama, H.; Song, Y. Estimating Capacity Utilization of Chinese Manufacturing Industries. Socio-Econ. Plan. Sci. 2019, 67, 94–110. [Google Scholar] [CrossRef]

- Han, G.; Wang, L. Capacity Utilization and the Safety Monitoring of Steel Industry in China from the Year 2000 to 2010. Reform 2012, 8, 31–41. [Google Scholar]

- Shi, R.; Fan, X.; He, Y. Comprehensive Evaluation Index System for Wind Power Utilization Levels in Wind Farms in China. Renew. Sust. Energ. Rev. 2017, 69, 461–471. [Google Scholar] [CrossRef]

- Dobos, I.; Vörösmarty, G. Green Supplier Selection and Evaluation Using DEA-Type Composite Indicators. Int. J. Prod. Econ. 2014, 157, 273–278. [Google Scholar] [CrossRef]

- Kotzee, I.; Reyers, B. Piloting a Social-Ecological Index for Measuring Flood Resilience: A Composite Index Approach. Ecol. Indic. 2016, 60, 45–53. [Google Scholar] [CrossRef]

- Neelawela, U.D.; Selvanathan, E.A.; Wagner, L.D. Global Measure of Electricity Security: A Composite Index Approach. Energy Econ. 2019, 81, 433–453. [Google Scholar] [CrossRef]

- Cigdem, O.; Demirel, H. Performance Analysis of Different Classification Algorithms Using Different Feature Selection Methods on Parkinson’s Disease Detection. J. Neurosci. Methods 2018, 3091, 81–90. [Google Scholar]

- Kushal, T.R.B.; Illindala, M.S. Correlation-Based Feature Selection for Resilience Analysis of MVDC Shipboard Power System. Int. J. Electr. Power Energy Syst. 2020, 117, 105732. [Google Scholar]

- Czibula, G.; Marian, Z.; Czibula, I.G. Software Defect Prediction Using Relational Association Rule Mining. Inf. Sci. 2014, 264, 260–278. [Google Scholar] [CrossRef]

- Carnovale, S.; Yeniyurt, S.; Rogers, D.S. Network Connectedness in Vertical and Horizontal Manufacturing Joint Venture Formations: A Power Perspective. J. Purch. Supply Manag. 2017, 23, 67–81. [Google Scholar] [CrossRef]

- Schlag, C.; Zeng, K. Horizontal Industry Relationships and Return Predictability. J. Empir. Financ. 2019, 53, 310–330. [Google Scholar]

- Sun, W.; Dong, K.; Zhao, T. Market Demand Dynamic Induced Mechanism in China’s Steel Industry. Resour. Policy 2017, 51, 13–21. [Google Scholar] [CrossRef]

- Du, W.; Li, M. Can Environmental Regulation Promote the Governance of Excess Capacity in China’s Energy Sector? the Market Exit of Zombie Enterprises. J. Clean Prod. 2019, 207, 306–316. [Google Scholar] [CrossRef]

- Guyon, I.; Elisseeff, A. An Introduction to Variable and Feature Selection. J. Mach. Learn. Res. 2003, 3, 1157–1182. [Google Scholar]

- Doshi, M.; Chaturvedi, S. Correlation based feature selection (CFS) technique to predict student Perfromance. Int. J. Comput. Vis. 2014, 6, 197–206. [Google Scholar] [CrossRef]

- Li, T.; Li, Y.; An, D.; Han, Y.; Xu, S.; Lu, Z.; Crittenden, J. Mining of the Association Rules between Industrialization Leveland Air Quality to Inform High-Quality Development in China. J. Environ. Manag. 2019, 246, 564–574. [Google Scholar] [CrossRef] [PubMed]

- Zhou, P.; Ang, B.W.; Poh, K.L. A Mathematical Programming Approach to Constructing Composite Indicators. Ecol. Econ. 2007, 62, 291–297. [Google Scholar] [CrossRef]

- Hatefi, S.M.; Torabi, S.A. A Common Weight MCDA-DEA Approach to Construct Composite Indicators. Ecol. Econ. 2010, 70, 114–120. [Google Scholar] [CrossRef]

- Nahar, J.; Kevin, T.; Tickle, S.; Chen, Y.P.P. Association Rule Mining to Detect Factors Which Contribute to Heart Disease in Males and Females. Expert Syst. Appl. 2013, 40, 1086–1093. [Google Scholar] [CrossRef]

- Dobbie, M.J.; Dail, D. Robustness and Sensitivity of Weighting and Aggregation in Constructing Composite Indices. Ecol. Indic. 2013, 29, 270–277. [Google Scholar]

- Ming, Z.; Ping, Z.; Shunkun, Y.L.H. Overall Review of the Overcapacity Situation of China’s Thermal Power Industry: Status Quo, Policy Analysis and Suggestions. Renew. Sust. Energ. Rev. 2017, 76, 768–774. [Google Scholar] [CrossRef]

- Yuan, J.; Xu, Y.; Zhang, X. China’s 2020 Clean Energy Target: Consistency, Pathways and Policy Implications. Energy Policy 2014, 65, 692–700. [Google Scholar] [CrossRef]

| Upstream, Downstream and Complementary Industries (Including 6 Industries of Coal, Steel, Non-Ferrous Metals, Building Materials, Chemical Industry and Power Equipment Manufacturing) | Coal Power Industry | Alternative Industries (New Energy Power Industry) | ||||

|---|---|---|---|---|---|---|

| Dimension | Indicator | Number | Indicator | Number | Indicator | Number |

| Industry fundamentals | Industrial Concentration | L1 | Industrial Concentration | H1 | Industrial Concentration | J1 |

| Marketization level | L2 | Opening degree | H2 | Opening degree | J2 | |

| Capital intensity | L3 | — | — | — | — | |

| Opening degree | L4 | — | — | — | — | |

| Employment elasticity | L5 | — | — | — | — | |

| Supply | Growth rate of enterprises | L6 | Growth rate of installed capacity | H3 | Growth rate of installed capacity | J3 |

| Growth rate of fixed asset investment | L7 | Growth rate of projects under construction | H4 | Growth rate of projects under construction | J4 | |

| Growth rate of reconstruction and technological transformation expenditure | L8 | Growth rate of completed electric power investment | H5 | Growth rate of completed electric power investment | J5 | |

| Growth rate of employees’ average wage | L9 | Growth rate of power generation | H6 | Growth rate of power generation | J6 | |

| Growth rate of employees | L10 | — | — | — | — | |

| Labour productivity | L11 | — | — | — | — | |

| Growth rate of financial expenses | L12 | — | — | — | — | |

| Demand | Growth rate of industrial sales value | L13 | Growth rate of the whole power consumption | H7 | Growth rate of the whole power consumption | J7 |

| Inventory turnover | L14 | — | — | — | — | |

| Growth rate of inventory | L15 | — | — | — | — | |

| Production sales ratio | L16 | — | — | — | — | |

| Performance | Growth rate of sales profit | L17 | Growth rate of total profit | H8 | Growth rate of equipment utilization hours | J8 |

| Growth rate of main business income | L18 | Growth rate of equipment utilization hours | H9 | — | — | |

| Growth rate of turnover times of working capital | L19 | Capacity utilization | H10 | — | — | |

| Deficit area | L20 | Pollution emission intensity | H11 | — | — | |

| Growth rate of loss | L21 | — | — | — | — | |

| Asset liability ratio | L22 | — | — | — | — | |

| Growth rate of accounts receivable | L23 | — | — | — | — | |

| price index | L24 | — | — | — | — | |

| Pollution emission intensity | L25 | — | — | — | — | |

| Number of initial indicators | 150 | 11 | 8 | |||

| Coal | Power Equipment | Steel | Non−Ferrous Metals | Building Materials | Chemical | Coal Power | New Energy Power | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dimension | Number | Reduction | Correlation | Reduction | Correlation | Reduction | Correlation | Reduction | Correlation | Reduction | Correlation | Reduction | Correlation | Reduction | Correlation | Reduction | Correlation | Reduction | Correlation |

| Industry fundamentals | L1 | Ret | + | Ret | − | Ret | − | H1 | Ret | Del | J1 | Ret | Del | ||||||

| L2 | Ret | − | Ret | Del | H2 | J2 | |||||||||||||

| L3 | Ret | + | Ret | Del | Ret | Del | Ret | + | |||||||||||

| L4 | |||||||||||||||||||

| L5 | Ret | Del | Ret | Del | Ret | − | |||||||||||||

| Supply | L6 | H3 | J3 | Ret | − | ||||||||||||||

| L7 | Ret | + | Ret | Del | Ret | − | H4 | Ret | + | J4 | Ret | + | |||||||

| L8 | Ret | − | Ret | − | H5 | J5 | |||||||||||||

| L9 | H6 | Ret | − | J6 | |||||||||||||||

| L10 | Ret | + | Ret | − | Ret | − | Ret | − | Ret | − | Ret | − | |||||||

| L11 | |||||||||||||||||||

| L12 | Ret | − | Ret | − | Ret | − | |||||||||||||

| Demand | L13 | Ret | − | Ret | Del | Ret | − | Ret | Del | H7 | J7 | ||||||||

| L14 | Ret | − | H8 | ||||||||||||||||

| L15 | Ret | + | Ret | + | |||||||||||||||

| L16 | Ret | − | Ret | − | |||||||||||||||

| Industry performance | L17 | H9 | Ret | − | J8 | Ret | + | ||||||||||||

| L18 | Ret | − | H10 | ||||||||||||||||

| L19 | Ret | − | Ret | − | Ret | − | H11 | Ret | − | ||||||||||

| L20 | Ret | + | Ret | + | |||||||||||||||

| L21 | |||||||||||||||||||

| L22 | Ret | Del | |||||||||||||||||

| L23 | Ret | Del | Ret | + | Ret | + | |||||||||||||

| L24 | Ret | + | Ret | Del | |||||||||||||||

| L25 | Ret | − | Ret | Del | Ret | Del | Ret | − | |||||||||||

| Number of retained | 7 | 7 | 6 | 6 | 6 | 6 | 4 | 3 | |||||||||||

| Indicators | Support | Confidence | Rank | Influencing Direction | Indicators | Support | Confidence | Rank | Influencing Direction |

|---|---|---|---|---|---|---|---|---|---|

| Capacity utilization of CP | 1 | 1 | 1 | − | Growth rate of inventory of NF | 0.67 | 1 | 4 | + |

| Growth rate of power generation of CP | 0.89 | 1 | 2 | − | Growth rate of turnover times of working capital of NF | 0.67 | 1 | 4 | − |

| Growth rate of employees of PE | 0.89 | 1 | 2 | − | Growth rate of employees of BM | 0.67 | 1 | 4 | − |

| Growth rate of installed capacity of NE | 0.78 | 1 | 3 | − | Growth rate of accounts receivable of BM | 0.67 | 1 | 4 | + |

| Growth rate of main business income of CO | 0.78 | 1 | 3 | − | Growth rate of turnover times of working capital of CH | 0.67 | 1 | 4 | − |

| Marketization level of ST | 0.78 | 1 | 3 | − | Growth rate of reconstruction and technological transformation expenditure of PE | 0.56 | 1 | 5 | − |

| Growth rate of financial expenses of ST | 0.78 | 1 | 3 | − | Deficit area of PE | 0.56 | 1 | 5 | + |

| Growth rate of employees of NF | 0.78 | 1 | 3 | − | Growth rate of employees of CO | 0.56 | 1 | 5 | + |

| Production sales ratio of BM | 0.78 | 1 | 3 | − | Growth rate of inventory of CO | 0.56 | 1 | 5 | + |

| Growth rate of financial expenses of BM | 0.78 | 1 | 3 | − | Price index of CO | 0.56 | 1 | 5 | + |

| Pollution emission intensity of CH | 0.78 | 1 | 3 | − | Pollution emission intensity of CO | 0.56 | 1 | 5 | − |

| Growth rate of projects under construction of CP | 0.67 | 1 | 4 | + | Capital intensity of ST | 0.56 | 1 | 5 | + |

| Growth rate of total profit of CP | 0.67 | 1 | 4 | − | Growth rate of employees of ST | 0.56 | 1 | 5 | − |

| Growth rate of projects under construction of NE | 0.67 | 1 | 4 | + | Inventory turnover of ST | 0.56 | 1 | 5 | − |

| Growth rate of equipment utilization hours of NE | 0.67 | 1 | 4 | + | Growth rate of turnover times of working capital of ST | 0.56 | 1 | 5 | − |

| Industrial concentration of PE | 0.67 | 1 | 4 | − | Growth rate of fixed asset investment of NF | 0.56 | 1 | 5 | − |

| Production sales ratio of PE | 0.67 | 1 | 4 | − | Growth rate of industrial sales value of BM | 0.56 | 1 | 5 | − |

| Growth rate of financial expenses of PE | 0.67 | 1 | 4 | − | Growth rate of reconstruction and technological transformation expenditure of BM | 0.56 | 1 | 5 | − |

| Growth rate of industrial sales value of PE | 0.67 | 1 | 4 | − | Capital intensity of CH | 0.56 | 1 | 5 | + |

| Industrial concentration of CO | 0.67 | 1 | 4 | + | Employment elasticity of CH | 0.56 | 1 | 5 | − |

| Growth rate of fixed asset investment of CO | 0.67 | 1 | 4 | + | Growth rate of employees of CH | 0.56 | 1 | 5 | − |

| Industrial concentration of NF | 0.67 | 1 | 4 | − | Deficit area of CH | 0.56 | 1 | 5 | + |

| Growth rate of accounts receivable of NF | 0.67 | 1 | 4 | + |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, D.; Xue, X.; Wang, Y. Overcapacity Risk of China’s Coal Power Industry: A Comprehensive Assessment and Driving Factors. Sustainability 2021, 13, 1426. https://doi.org/10.3390/su13031426

Wang D, Xue X, Wang Y. Overcapacity Risk of China’s Coal Power Industry: A Comprehensive Assessment and Driving Factors. Sustainability. 2021; 13(3):1426. https://doi.org/10.3390/su13031426

Chicago/Turabian StyleWang, Delu, Xun Xue, and Yadong Wang. 2021. "Overcapacity Risk of China’s Coal Power Industry: A Comprehensive Assessment and Driving Factors" Sustainability 13, no. 3: 1426. https://doi.org/10.3390/su13031426

APA StyleWang, D., Xue, X., & Wang, Y. (2021). Overcapacity Risk of China’s Coal Power Industry: A Comprehensive Assessment and Driving Factors. Sustainability, 13(3), 1426. https://doi.org/10.3390/su13031426