Decision-Making Rules and the Influence of Memory Data

Abstract

:1. Introduction

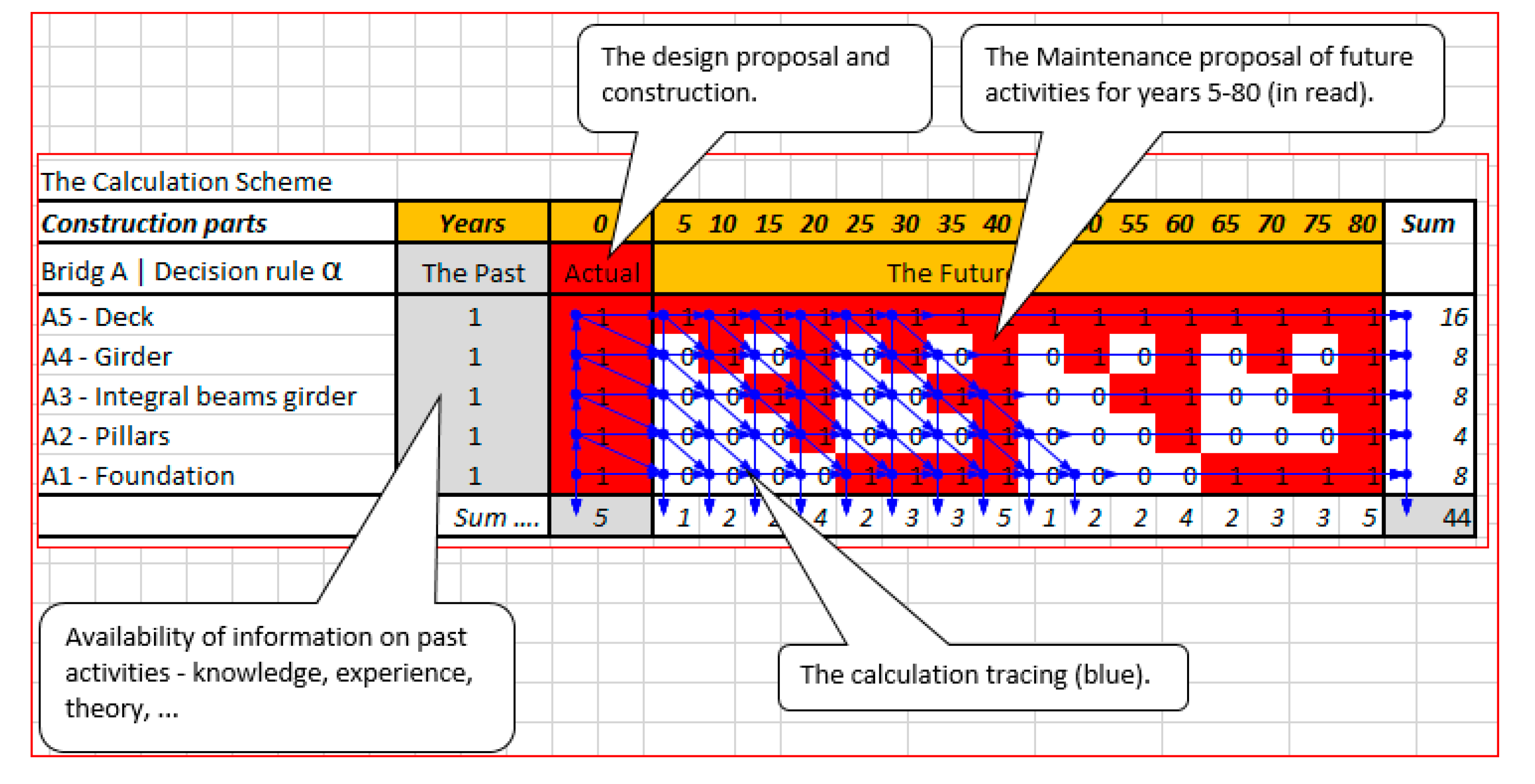

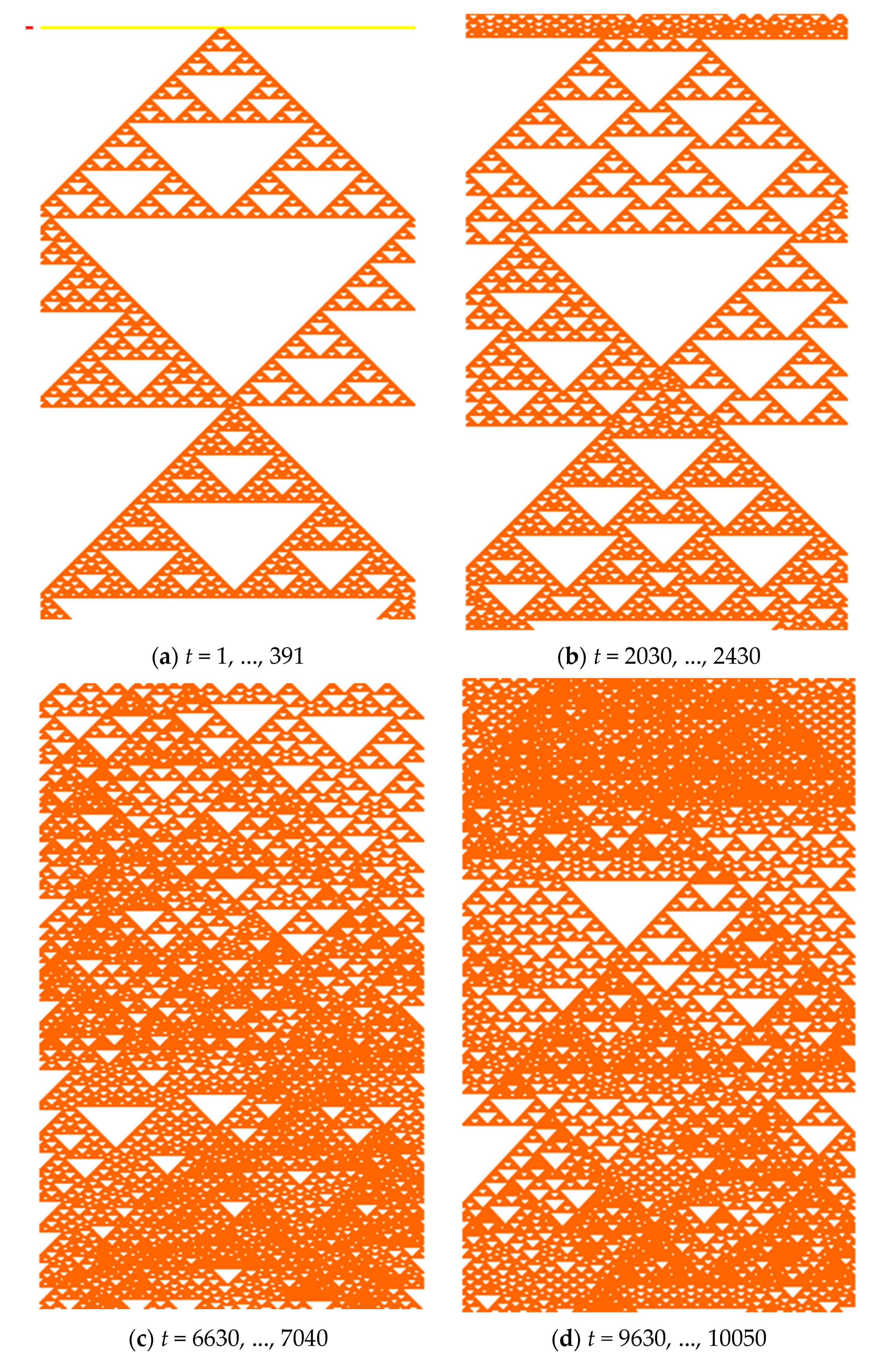

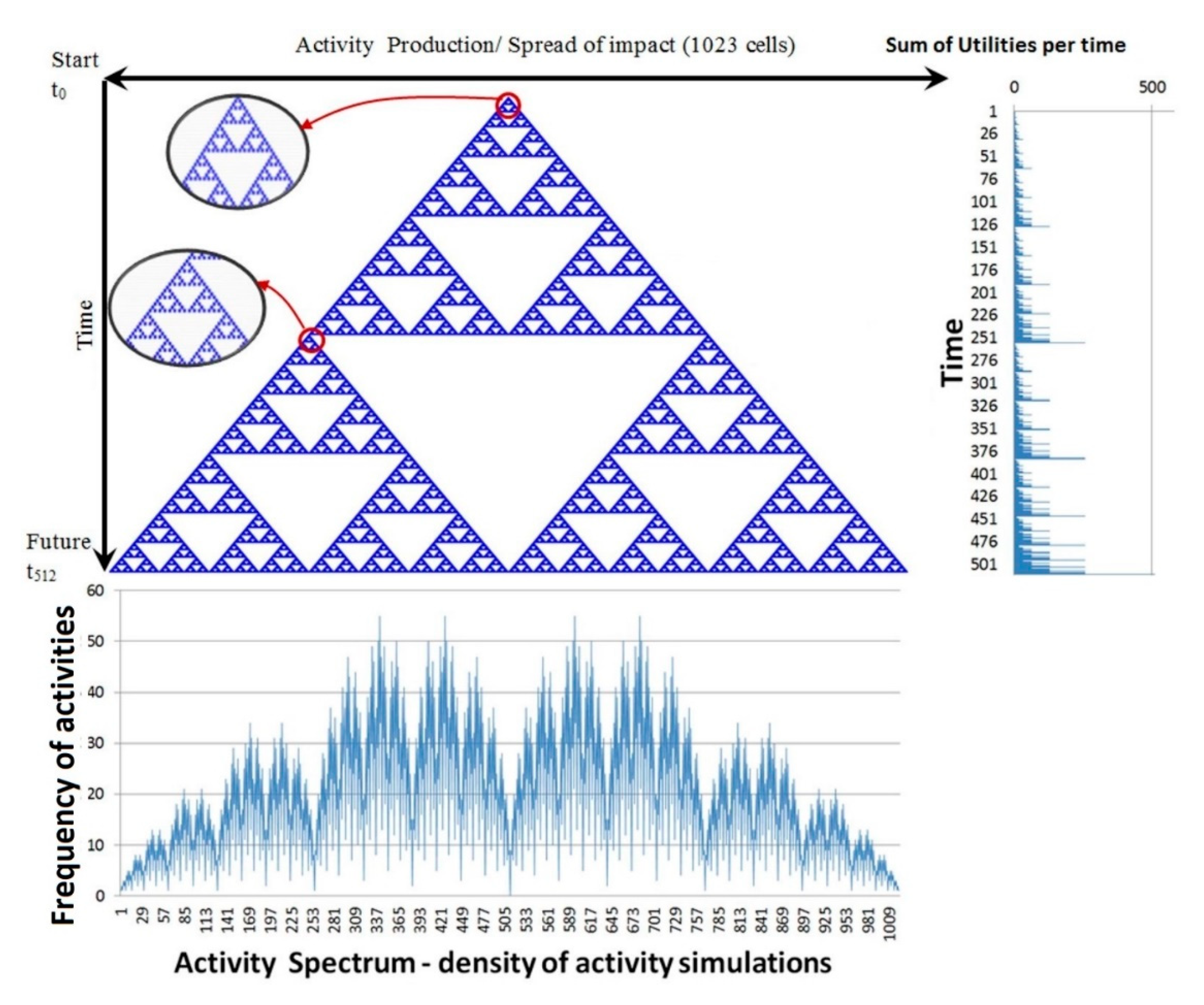

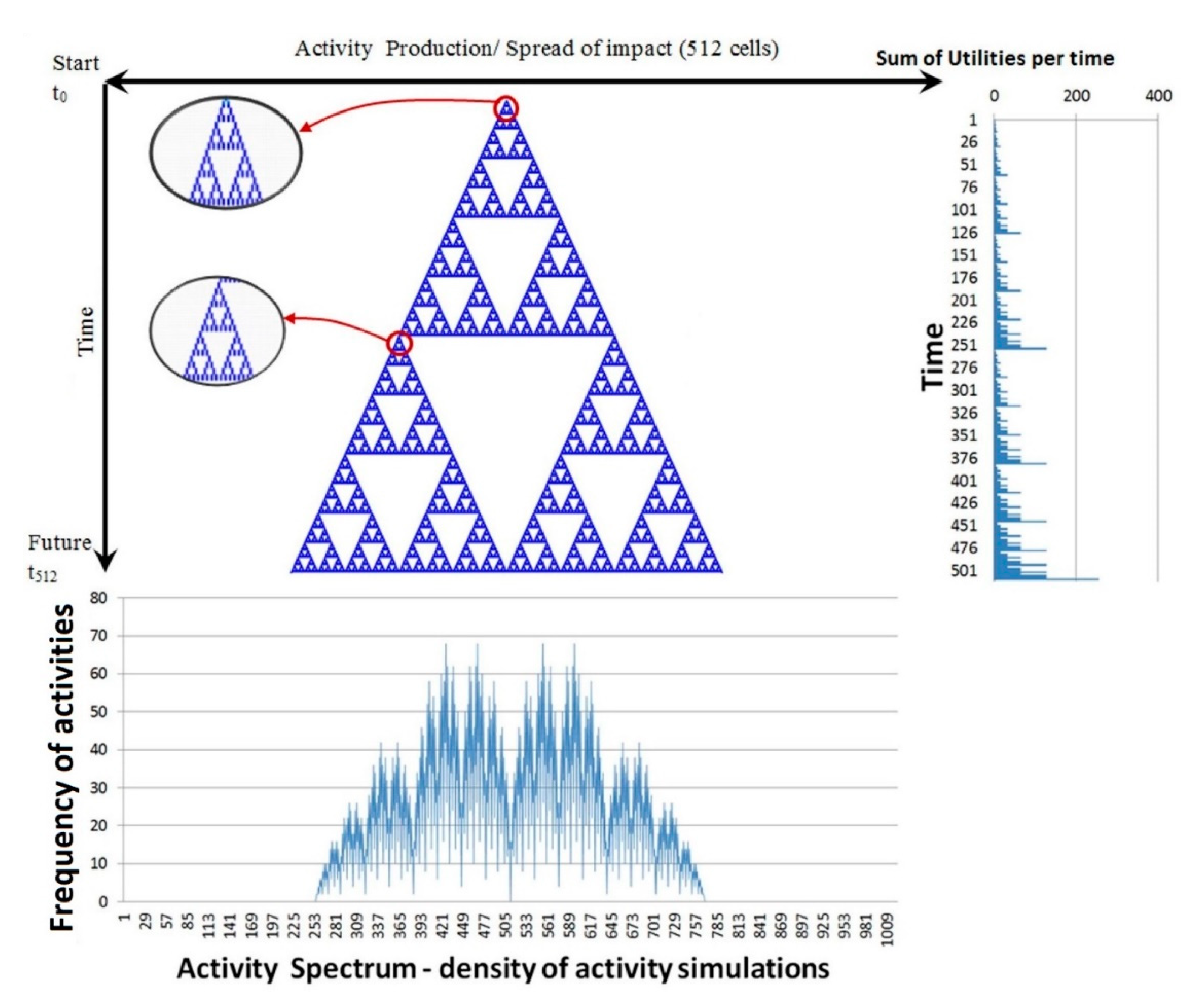

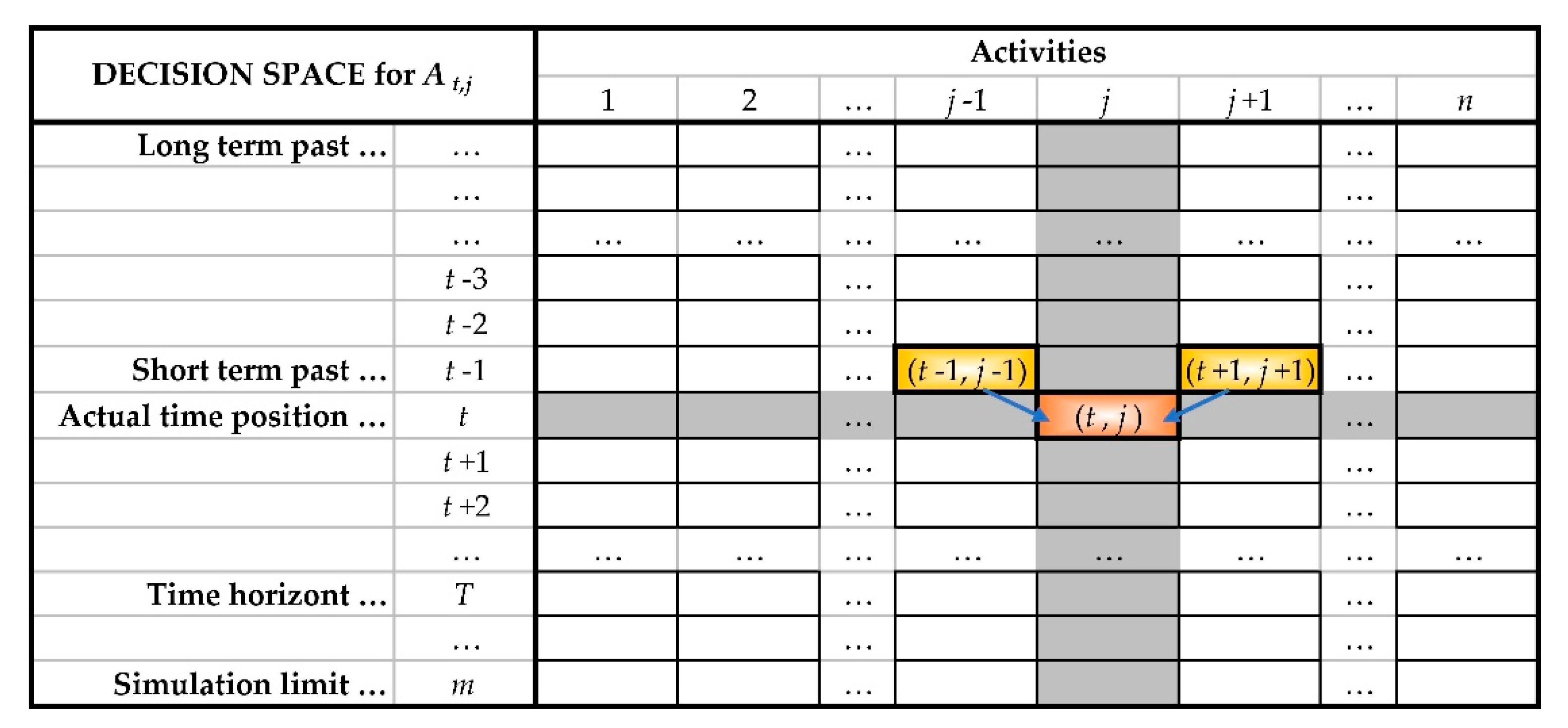

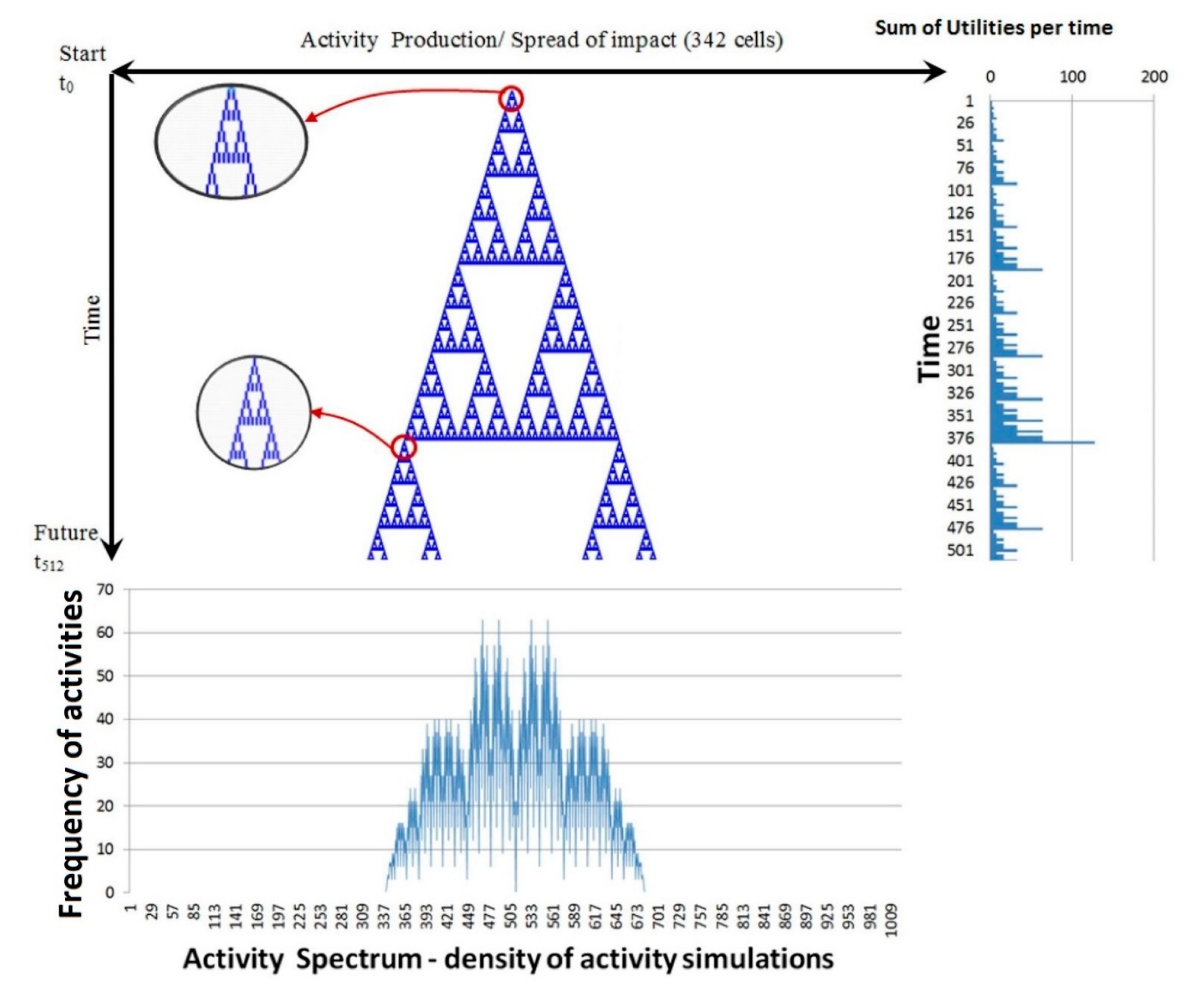

- Space for decision making (i.e., formation): Most of the arguments for fractal dynamic modelling are included in Section 2.2. Figure 1 shows the long-term application of a decision rule in the dynamic decision space SA = (A, t), where A is a set of activities At, j located in time t and their affiliation j to SA for tracking opportunities as (0;1) or (N;Y), or expressed as colors. The choice or activity is determined by professional regulation (standards, laws, guideline, etc.);

- Decision making: Opportunities in SA are calculated using decision rules Dopportunities = {(Drules, Mdata)|SA}. A look at the calculation of opportunities is offered in Section 3. It deals with a basic decision rule grounded on a general, verbally formulated logical requirement. Comparing memory Mdata dependence is the topic of the paper. This problem is treated as the productivity of the Drule in Section 3 as well as Figure 2 and Figure 3;

- Decision evaluation: Utility is the final step addressed in the article. Section 4 addresses the need for valuation opportunities. More implementation is offered in Section 5. Both the space for decision making and the decision making itself create an introduction to practical application in the Appendix A example. The evaluation of the utility is also listed in the illustrative example as an evaluation of the frequency of maintenance and renewal interventions. The extensive construction of utility functions is, however, a separate problem in the design of decision rules.

2. Materials and Methods

2.1. The Decision Process—Decision Rule Horizon and Decision Rule Memory

2.2. Research Question

- To what extent does the construction of the decision rules influence the decision space? This question reflects the considerations posed by [36];

- How intensively might the data memory influence the decision space?

2.3. Research Hypotheses

- Decision rules change the operational decision space for the decision maker depending on the time horizon of the memory used, e.g., (t − 1), (t − 2);

- The spread of activities in time is conditioned by the chosen DR.Comment: Industries and companies typically request stable regulation rules (in terms of regulatory, economic, ecological, or political rules, etc.), mostly without calculating the expected opportunities and their usefulness;

- The DR simulation utility characterizes the decision criterion both for (a) a schedule of opportunities and (b) individual activities over time.

3. Analysis

- (a)

- The total space S□ for the involved activities in the project:S□ = 1023 activities × 512 time horizon = 523,776 potential interactions;

- (b)

- Total application space after Dα activation:S∆ = 1023/2 × 512 = 261,888 potential interactions;

- (c)

- Total space after Dα simulation:S▲ = 19,171 proposed interactions according to Dα.

3.1. The Influence of Data Memory (i.e., Data History) on Decision Rules

3.2. Comparison of Decision Rule Productivity

3.3. Productivity Efficiency of Decision Rules α, β, and γ

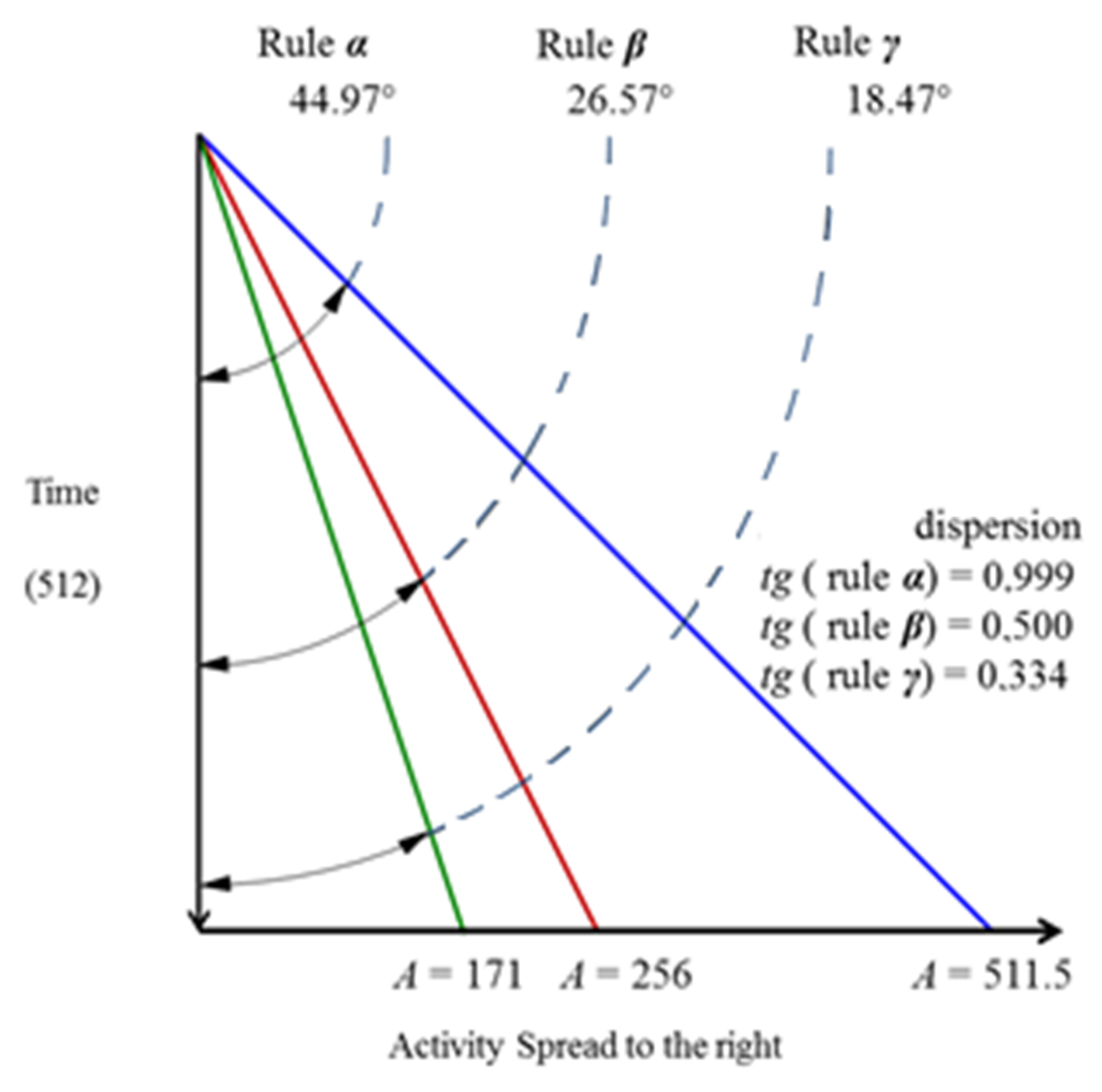

- The inclusion of a backward (historical data) time (t − 1) into the decision criterion Dα (t − 1) in Figure 2 leads to a decrease in opportunities to 50.0% of the influenced space (261,888 units), compared to space available (523,776 units). The reduction of 131,072 of 523,776 units is 25% for decisions on the basis of two time periods (t − 2), as well as the reduction on the basis of data (t − 3) to 16.72% (523,773 units to 87,552) for Dγ on the basis of data (t − 3); details are in Table 4 and Figure 2, Figure 4 and Figure 5. The inclusion of one or more backward time steps into the decision criterion leads to narrowing the influenced implementation area (S▲(t − 1) in Table 4, column (e) 19,683 as 100%) to 13,123; this is 68.4% for (t − 2), and 43.1% for (t − 3). Further comparisons are given in Table 4;

- The spread of the impact of decision rules of activities Aj slows down at a rate of tangent α; (indicator) is given as tg(Dα) = 0.999 to tg (Dβ) = 0.500 and tg(Dγ) = 0.334.

4. Discussion

- Does a decision process really act in a homogeneous decision space?The decision space is not homogenous for the rules modelling real-life situations, which were examined in this paper as decision rules (α, β, and γ). A time range of productive periods for Dαβγ exists, as do a range of unproductive time arrangements, which exhibit a lack of utility [48];

- Does the lack of homogeneity of the decision space affect the environment for implementing decisions?The decision space creates bubbles that cover substantial areas of the decision space. These bubbles indicate the absence of productive activity. Moreover, the decision space affects the utility (productivity) of subsequent time periods and parallel-running activities in the long term. To some extent, these are affected activities Aj, which can cause a long-term negative domino effect, that is, the productive space at various subsequent time steps is a sensitive structure of opportunities. The knowledge about decision consequences, which helps to choose an appropriate action in an appropriate time step, helps to generate a higher utility [49];

- To what extent is the decision in the decision layers (t − 1), (t − 2), (t − 3), etc., affected by decisions in previous layers (i.e., the decision history)?

- To what extent is the decision in the decision layers (t − 1), (t − 2), (t − 3), etc., able to influence decisions in future layers?

5. Conclusions

- A long-term life of activities included in the created decision-making space;

- The “thickening” opportunities over time;

- The existence of bubbles without application opportunities and their displacement during the lifecycle of the decision rule;

- Creating application cycles of opportunities.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

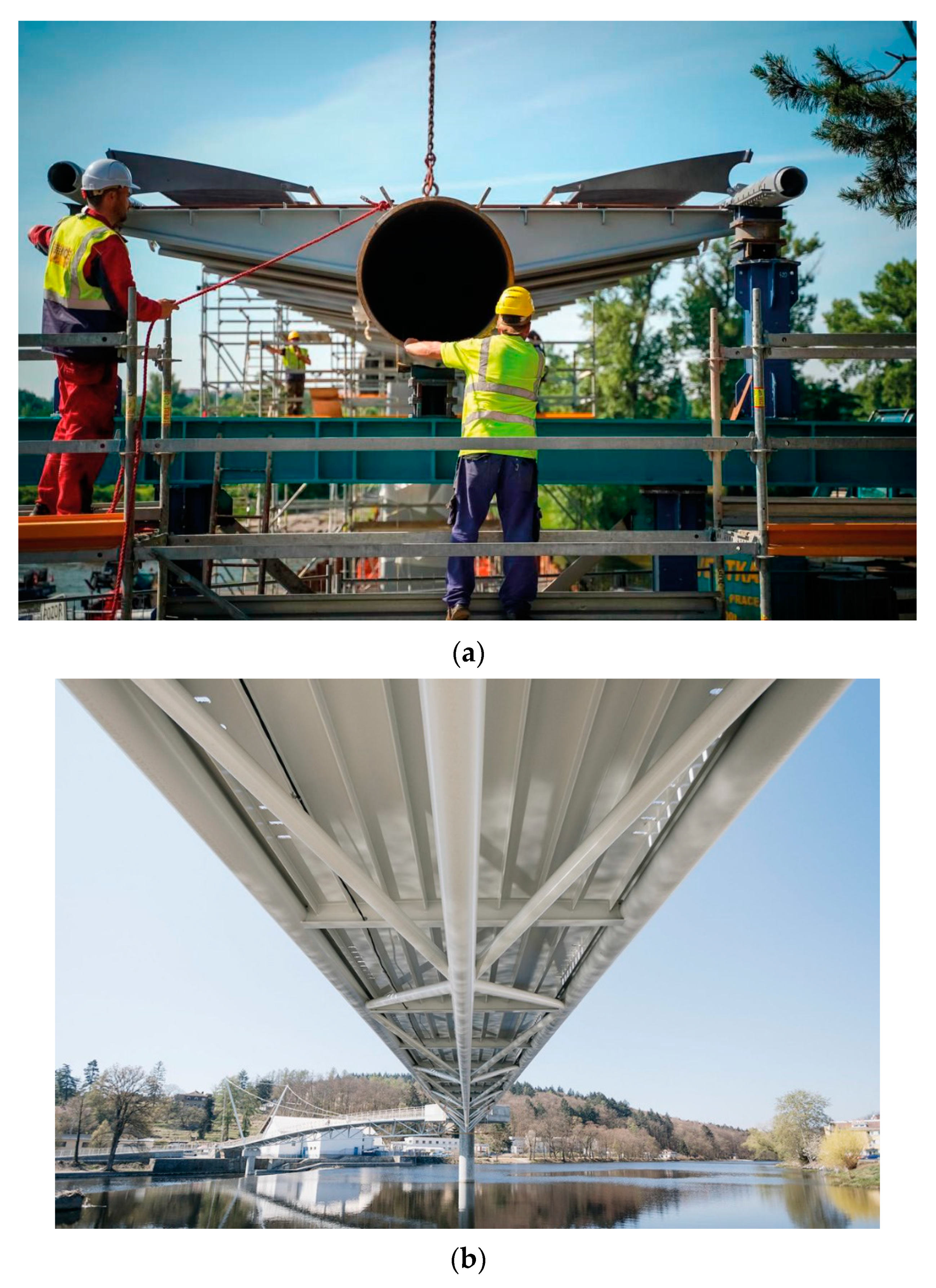

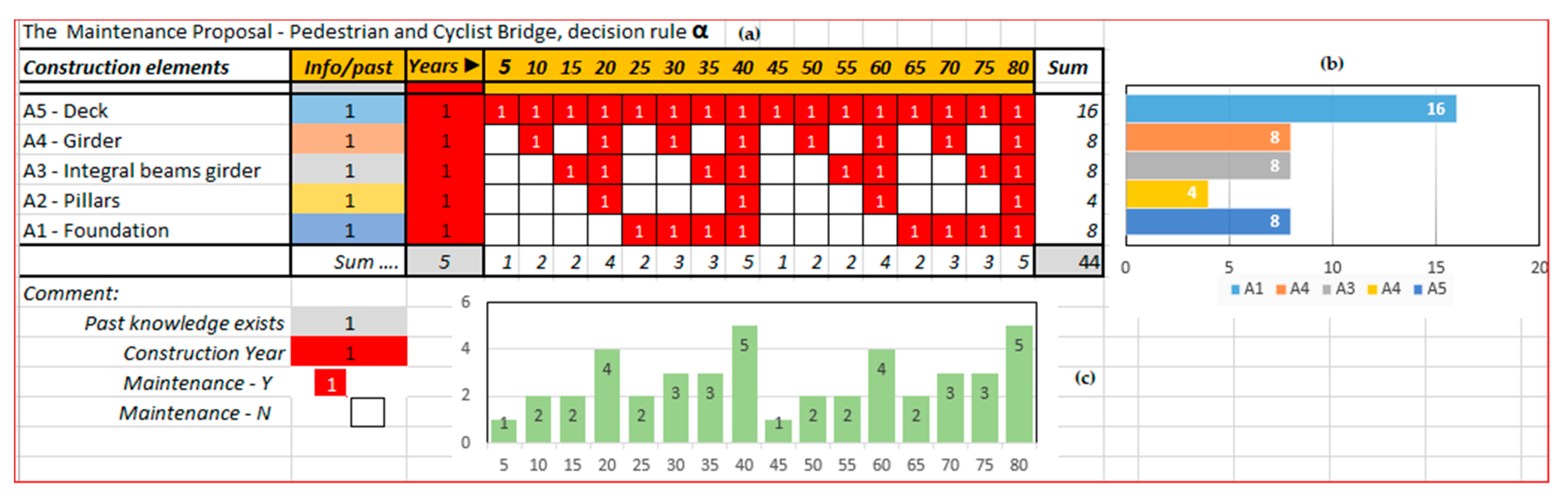

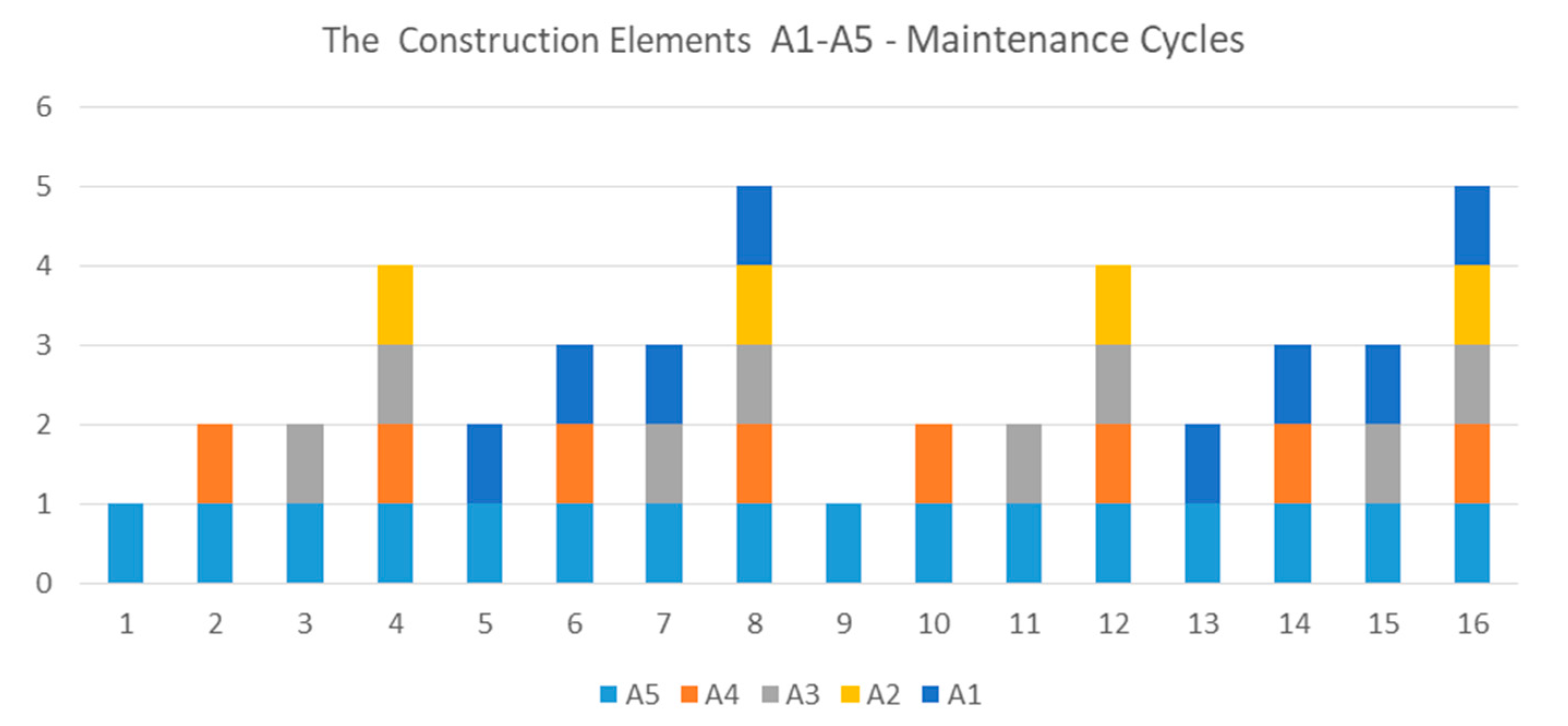

Appendix A

| Activity | Cycle | Density * | Density ** |

|---|---|---|---|

| Maintenance | Years | LC 80: % | Σ 44: % |

| (a) | (b) | (c) | (e) |

| A5—Deck | 5 | 20.00% | 36.36% |

| A4—Girder | 10 | 10.00% | 18.18% |

| A3—Integral beams girder | 20 | 10.00% | 18.18% |

| A2—Pillars | 20 | 5.00% | 9.09% |

| A1—Foundation | 25 | 10.00% | 18.18% |

References

- Forrester, J. World Dynamics; Wright-Allen Press: Cambridge, MA, USA, 1971. [Google Scholar]

- Lorenz, E.N. Deterministic nonperiodic flow. J. Atmos. Sci. 1962, 20, 130–141. [Google Scholar] [CrossRef] [Green Version]

- Miao, J. Economic Dynamics in Discrete Time; MIT Press: Cambridge, MA, USA, 2014; p. 710. ISBN 978-0-262-02761-8. [Google Scholar]

- Nguyen, M.H.; Nguyen, V.Q. Dynamic Timing Decisions under Uncertainty: Essays on Invention, Innovation and Exploration in Resource Economics; Springer: Heidelberg/Berlin, Germany, 2013; p. 198. ISBN 978-3-540-57649-5. [Google Scholar]

- Trees of Life. Philosophy of Biology, 1st ed.; Griffiths, P.E., Ed.; Kluwer Academic Publishers: Dordrecht, The Netherlands, 1992; pp. 1–13. ISBN 978-94-015-8038-0. [Google Scholar]

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Kuda, F.; Teichmann, M.; Proske, Z.; Szeligova, N. Modern approaches of facility management in the management and maintenance of underground services. In Proceedings of the 17th International Multidisciplinary Scientific Geoconference, SGEM 2017, Albena, Bulgaria, 29 June–5 July 2017; Volume 17, pp. 279–288. [Google Scholar] [CrossRef]

- Schumpeter, J. Business Cycles: A Theoretical, Historical, and Statistical Analysis of the Capitalist Process; McGraw-Hill Book Company, Inc.: New York, NY, USA, 1939. [Google Scholar]

- Anderson, B.A. Economics and The Public Welfare; BoD—Books on Demand: Princeton, NJ, USA, 1949; p. 620. ISBN 9783846046814. [Google Scholar]

- Taarasov, V.E. On history of mathematical economics: Application of fractional calculus. Mathematics 2019, 6, 509. [Google Scholar] [CrossRef] [Green Version]

- Patten, S.N. The Theory of Dynamic Economics; University of Philadelphia: Pennsylvania, PA, USA, 1892; p. 153. [Google Scholar]

- Harrod, F.R. An essay in dynamic theory. Econ. J. 1939, 49, 14–33. [Google Scholar] [CrossRef]

- Hicks, J.R. Methods of Dynamic Economics; Oxford University Press: Manhattan, NY, USA, 1985; ISBN 978-0-19-877287-3. [Google Scholar]

- Forrester, J. Industrial Dynamics; Pegasus Communications: Waltham, MA, USA, 1961. [Google Scholar]

- Forrester, J. Urban Dynamics; Pegasus Communications: Waltham, MA, USA, 1969. [Google Scholar]

- Mandelbrot, B.B. The Fractal Geometry of Nature; Henry Holt and Company: New York, NY, USA, 1982; p. 468. [Google Scholar]

- Mandelbrot, B.B.; Hudson, R.L. Misbehaviour of Markets; Basic Books: New York, NY, USA, 2004. [Google Scholar]

- Mandelbrot, B.B.; Taleb, N. Focus on the Exceptions that Prove the Rule. Financial Times. 24 March 2006. Available online: http://steveambler.uqam.ca/6080/articles/mandelbrot.taleb.2006.pdf. (accessed on 26 January 2021).

- Jammer, M. Concepts of Space: The History of Theories of Space in Physics; Dover Publications: Cambridge, MA, USA, 1969. [Google Scholar]

- Neumann, J.; Morgenstern, O. Theory of Games and Economic Behaviour; Princeton University Press: Princeton, TX, USA, 1944; p. 625. [Google Scholar]

- Britannica, The Editors of Encyclopaedia. “Cellular automata”. Encyclopedia Britannica. 30 May 2014. Available online: https://www.britannica.com/science/cellular-automata (accessed on 26 January 2021).

- Wolfram, S. Cellular Automata and Compaxity: Collected Papers. In Proceedings of the International Conference of the Center for Nonlinear Studies, Los Alamos, New Mexico, 8 March 2018; p. 19. [Google Scholar]

- Gardner, M. The fantastic combinations of John Conway’s new solitaire game life. Sci. Am. 1970, 223, 120–123. [Google Scholar] [CrossRef]

- Granger, C.W. The Typical Spectral Shape of an Economic Variable; Technical Report; Department of Statistics, Stanford University: Stanford, CA, USA, 1964. [Google Scholar]

- Wolfram, S.A. New Kind of Science; Wolfram Media Inc.: Champaign, IL, USA, 2002. [Google Scholar]

- Raiffa, H.; Schlaifer, R. Applied Statistical Decision Theory; Harvard University: Cambridge, MA, USA, 1961; p. 356. [Google Scholar]

- Ball, P. Cellular memory hints at the origin of intelligence. Nature 2008, 451, 385. [Google Scholar] [CrossRef] [PubMed]

- Batty, M.; Torrens, P.M. Modelling and prediction in a complex world. Futures 2005, 10, 745–766. [Google Scholar] [CrossRef]

- Saenz, G.D.; Smith, S.M. Testing judgments of learning in new contexts to reduce confidence. J. Appl. Res. Mem. Cogn. 2018, 12, 540–551. [Google Scholar] [CrossRef]

- Beran, V.; Dlask, P. Rational expectation in facility management. In Proceedings of the CESB 2010 Prague—Central Europe towards Sustainable Building from Theory to Practice, Prague, Austria, 30 June–2 July 2010; pp. 1–4, ISBN 978-802473624-2. [Google Scholar]

- Burton, H.K. Dynamic Economics; Harvard, University Press: Cambridge, MA, USA, 1936; e-Book 9780674188679. [Google Scholar]

- ISO. ISO 27001. Information Technology, Security Techniques, Information Security Management Systems Requirements. ISO/IEC 27001; ISO: Geneva, Switzerland, 2005. [Google Scholar]

- ISO. Environmental Management Systems. ISO 14001:2015; ISO: Vernier, Geneva, Switzerland, 2019; Available online: https://www.iso.org/files/live/sites/isoorg/files/store/en/PUB100371.pdf (accessed on 26 January 2021).

- Batty, M. Fifty years of urban modeling: Macro-statics to micro-dynamics. In The Dynamics of Complex Urban Systems; Albeverio, S., Andrey, D., Giordano, P., Vancheri, A., Eds.; Physica-Verlag HD: Berlin, Germany, 2008; pp. 1–20. [Google Scholar]

- Kristoufek, L.; Lunacková, P. Long-term memory in electricity prices: Czech market evidence. J. Econ. Financ. 2013, 63, 407–424. [Google Scholar]

- Aumann, R.J. Subjectivity and correlation in randomized strategies. J. Math. Econ. 1974, 1, 67–96. [Google Scholar] [CrossRef]

- Nation, J.B.; Trofimova, I.; Rand, J.D.; Sulis, W. Formal Descriptions of Developing Systems. In NATO Science Series II: Mathematics, Physics and Chemistry; Nation, J.B., Trofimova, I., Rand, J.D., Sulis, W., Eds.; Springer Science & Business Media: Manoa, HI, USA, 2012; Volume 121, pp. 47–48, 306. [Google Scholar]

- OECD. Guidelines for Collecting and Reporting Data on Research and Experimental Development; OECD: Paris, France, 2015. [Google Scholar]

- Box, G.E.P.; Draper, N.R. Empirical Model-Building and Response Surfaces; Wiley & Sons: New York, NY, USA, 1987. [Google Scholar]

- Kahneman, D.; Tversky, A. Choices, Values, and Frames; Cambridge University Press: Cambridge, UK; Russell Sage Foundation: New York, NY, USA, 2000; p. 840. [Google Scholar]

- Cyert, M.; DeGroot, R. Bayesian Analysis and Uncertainty in Economic Theory; Springer Science & Business Media: Pittsburgh, PA, USA, 2012; p. 206. ISBN 978-94-010-7922-8. [Google Scholar]

- Kahneman, D.; Slovic, S.P.; Tversky, A. Judgment under Uncertainty: Heuristics and Biases; Cambridge University Press: Cambridge, UK, 1982; p. 555. ISBN 0 521 28414 7. [Google Scholar]

- Kuda, F.; Teichmann, M. Maintenance of infrastructural constructions with use of modern technologies. J. Heat. Vent. Install. 2017, 26, 18–21. Available online: https://www.researchgate.net/publication/316474681_Maintenance_of_infrastructural_constructions_with_use_of_modern_technologies (accessed on 26 January 2021).

- Omar, G.R.S. Analysis of Delays in Construction Tasks. Ph.D. Thesis, Czech Technical University of Prague, Prague, Czech Republic, 2012. [Google Scholar]

- Dlask, P.; Beran, V. Long-term infrastructure investment: A new approach to the economics of location. E M Ekon. Manag. 2016, 19, 40–56. [Google Scholar] [CrossRef]

- Flyvbjerg, B.; Bruzelius, N.; Rothengatter, W. Megaprojects and Risk—An Anatomy of Ambition; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Grimscheid, G.; Thorsten, B. Projektrisiko-Management in der Bauwirtschaft; Bauwerk Verlag: Berlin, Germany, 2008. (In German) [Google Scholar]

- Beran, V.; Teichmann, M.; Kuda, F.; Zdarilova, R. Dynamics of regional development in regional and municipal economy. Sustainability 2020, 12, 9234. [Google Scholar] [CrossRef]

- Beran, V. Decision-making for long memory data in technical-economic design, fractals and decision area bubbles. Appl. Math. 2003, 48, 455–467. [Google Scholar] [CrossRef] [Green Version]

- Flyvbjerg, B.; Steward, A. Olympic Proportions: Cost and Cost Overrun at the Olympics 1960–2012; Said Business School: Oxford, UK, 2012. [Google Scholar]

- Segelod, E. Project Cost Overrun: Causes, Consequences, and Investment Decisions; Cambridge University Press: Cambridge, UK, 2018; ISBN 978-1-107-17304-0. [Google Scholar]

- Madsen, J.B. The anatomy of growth in the OECD since 1870. J. Monet. Econ. 2010, 57, 753–767. [Google Scholar] [CrossRef]

- World Bank Group. Global Economic Prospects; International Bank for Reconstruction and Development/The World Bank: Washington, DC, USA, 2020; ISBN 978-1-4648-1580-5. [Google Scholar]

- World Bank Group. Purchasing Power Parities and the Size of World Economies. Results from the 2017 International Comparison Program; International Bank for Reconstruction and Development/The World Bank: Washington, DC, USA, 2020; ISBN 978-1-4648-1531-7. [Google Scholar]

- Antuchevičiene, J.; Kou, G.; Maliene, V.; Vaidogas, E.R. Mathematical models for dealing with risk in engineering. Math. Probl. Eng. 2016, 1–3. [Google Scholar] [CrossRef] [Green Version]

- Flemming, C.; Netzker, M.; Schöttle, A. Probabilistische Berücksichtigung von Kosten- und Mengenrisiken in der Angebotskalkulation. Bautechnik 2011, 88, 94–101. (In German) [Google Scholar] [CrossRef]

- Wilson, A. Catastrophe Theory and Bifurcation: Applications to Urban and Regional Systems; Routledge: Abingdon, UK, 1981; p. 331. ISBN 978-0-415-68782-9. [Google Scholar]

- Piketty, T. Capital in the Twenty-First Century; Harvard University Press: Cambridge, UK, 2017. [Google Scholar]

- Piketty, T. Capital and Ideology; The Belknap Press of Harvard University Press: Cambridge, MA, USA, 2020. [Google Scholar]

| Decision Rule Dα for At,j | Memory Data (t − 1) | Decision on t about | Remarks | ||

|---|---|---|---|---|---|

| (j − 1) | j | (j + 1) | At,j | ||

| ut,j ⇔ IF((At−1,j−1 = At−1,j+1) then 0 else 1) | 0 | ~ | 0 | 0 | Due to the negative result for At−1,j−1 and At−1,j+1 (*) in t − 1, the rule Dα, states that the action is not recommended. |

| 1 | ~ | 1 | 0 | Due to the full capacity for At−1,j−1 and At−1,j+1 (*) in t − 1, the action is not recommended | |

| 0 | ~ | 1 | 1 | Due to the positive outcome in t−1 and the free capacity (**), the action is recommended | |

| 1 | ~ | 0 | 1 | Due to the positive outcome in t − 1 and the free capacity (**), the action is recommended | |

| Decision Rule Dβ for At,j | Memory Data (t − 2) | Decision on t about | Remarks | ||

|---|---|---|---|---|---|

| (j − 1) | j | (j + 1) | At,j | ||

| ut,j ⇔ IF((At−2,j−1 = At−2,j+1) then ut,j = 0 else ut,j = 1) | 0 | ~ | 0 | 0 | Due to the lack of previous experience (*), the action is not recommended. |

| 1 | ~ | 1 | 0 | Due to the fully exhausted capacity in the previous period (*), the action is not recommended. | |

| 0 | ~ | 1 | 1 | Due to the one positive outcome in t − 2 and the free capacity (**), the action is recommended | |

| 1 | ~ | 0 | 1 | Due to the positive outcome in t − 2 and the free capacity (**), the action is recommended | |

| Decision Rule Dγ for At,j | Memory Data (t − 3) | Decision on t about | Remarks | ||

|---|---|---|---|---|---|

| (j − 1) | j | (j + 1) | At,j | ||

| ut,j ⇔ IF((At−3,j−1 = At−3,j+1) then ut,j = 0 else ut,j = 1) | 0 | ~ | 0 | 0 | Due to the lack of previous experience (*), the action is not recommended. |

| 1 | ~ | 1 | 0 | Due to the fully exhausted capacity in the previous period (*), the action is not recommended. | |

| 0 | ~ | 1 | 1 | Due to the one positive outcome in t − 3 and the free capacity (**), the action is recommended | |

| 1 | ~ | 0 | 1 | Due to the positive outcome in t − 3 and the free capacity (**), the action is recommended. | |

| D Rule and Data Memory | Decision Rule Formula for 512 Periods of Simulations | Max Spread of Aj in t = 512 | for Dαβγ | Space Used S▲ | Of S□ Used SΔ as % | Of S∆ Used S▲ as % | |

|---|---|---|---|---|---|---|---|

| - | (a) | (b) | (c) | (d) | (e) | (f) = e/c | (g) = e/d |

| Dα: (t − 1) | ut,j ⇔ IF((At−1,j−1 = At−1,j+1) then ut,j = 0 ⇒ white else ut,j = 1 ⇒ blue) | 1023 | 523,776 | 261,888 | 19,683 | 3.76% | 7.52% |

| Dβ: (t − 2) | ut,j ⇔ IF((At−2,j−1 = At−2,j+1) then ut,j = 0 ⇒ white else ut,j = 1 ⇒ blue) | 512 | 523,776 | 131,072 | 13,123 | 2.51% | 10.01% |

| Dγ: (t − 3) | ut,j ⇔ IF((At−3,j−1 = At−3,j+1) then ut,j = 0 ⇒ white else ut,j = 1 ⇒ blue) | 342 | 523,776 | 87,552 | 8493 | 1.62% | 9.70% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Beran, V.; Teichmann, M.; Kuda, F. Decision-Making Rules and the Influence of Memory Data. Sustainability 2021, 13, 1396. https://doi.org/10.3390/su13031396

Beran V, Teichmann M, Kuda F. Decision-Making Rules and the Influence of Memory Data. Sustainability. 2021; 13(3):1396. https://doi.org/10.3390/su13031396

Chicago/Turabian StyleBeran, Vaclav, Marek Teichmann, and Frantisek Kuda. 2021. "Decision-Making Rules and the Influence of Memory Data" Sustainability 13, no. 3: 1396. https://doi.org/10.3390/su13031396

APA StyleBeran, V., Teichmann, M., & Kuda, F. (2021). Decision-Making Rules and the Influence of Memory Data. Sustainability, 13(3), 1396. https://doi.org/10.3390/su13031396