Abstract

With the rapid development of high quality industries, it is particularly important to study the sustainable competitiveness of manufacturing and its driving factors. The aim of this paper is to build the whole competitiveness index to analyze the recent development trends of manufacturing in G20 participating countries from 2008 to 2018. Meanwhile, based on the diamond theory, this paper adopted a panel regression model to conduct an empirical analysis on various factors that affect the sustainable competitiveness of manufacturing. These results showed the following: (1) Transport services have the most significant effect on manufacturing in developing countries. (2) Intellectual property only has a positive and significant effect on manufacturing in developed countries. (3) Information technology plays a significant role in all countries, but it is more effective in developed countries. Finally, this paper puts forward some suggestions for the sustainable development of manufacturing.

1. Introduction

With the continuous development of the Internet of Things [1] and the progress of information technology [2], all countries in the world are actively taking action to emphasize the importance of manufacturing in the national economy. The number of countries beginning to attach importance to the sustainable development of manufacturing is rising. As a result, measuring the driving factors of manufacturing competitiveness has become an urgent task. The analysis of manufacturing competitiveness and its driving factors can not only effectively identify new problems and phenomena in the development of manufacturing, but also promote the world’s major economies to participate in the sustainable development of manufacturing. This study attempts to help readers understand this field, that is, to ensure the sustainable development of manufacturing by looking for the driving factors of manufacturing competitiveness.

Manufacturing competitiveness is derived from the concept of industrial competitiveness. The earliest research on the industrial competitiveness can be traced back to the 1980s. According to Michael Porter [3], industrial competitiveness is the ability of a country to create a good business environment in a certain industry, such that the domestic industry can obtain competitive advantage. After that, scholars have conducted extensive research on industrial competitiveness, such as concept, influencing factors, and measurement [4,5,6].

In recent years, manufacturing competitiveness has become a research hotspot. (1) Some scholars have studied the evaluation system. For example, Huang et al. established the equipment manufacturing competitiveness evaluation system [7]. Han et al. used factor analysis to calculate the index of manufacturing competitiveness in the Yellow River Basin of China [8]. Jin et al. measured and analyzed the structural characteristics and competitiveness of the manufacturing industry in the Shandong Province of China [9]. To study the competitiveness of telecom equipment products in the Indian market, Zhang et al. conducted quantitative analysis by using the market share index and the trade competition index and revealed the comparative advantage index [10]. To evaluate the international competitiveness more accurately, Zhang. J et al. conducted a comprehensive evaluation of the high-tech industry based on comparative advantage and competitive advantage [11]. To study the influence of electronic information manufacturing competitiveness, Chen et al. conducted a qualitative analysis of its comparative advantage and competitive advantage [12]. (2) Some scholars have studied the influencing factors based on the diamond theory. For example, Shi et al. proposed a path to enhance the manufacturing competitiveness of China [13]. From the perspective of the diamond theory and the entropy method, Qin et al. evaluated and analyzed China’s equipment manufacturing [14]. Liang et al. built an evaluation index system of regional manufacturing competitiveness [15]. (3) Some scholars have looked for significant influencing factors through regression analysis. For example, Ming et al. used a regression model to empirically analyze factors that affect equipment manufacturing competitiveness [16]. Liu et al. studied the impact of independent innovation, collaborative innovation, and non-innovation on manufacturing competitiveness [17]. Ren et al. used the panel data of transnational industries to test the impact of manufacturing competitiveness [18]. Li et al. used a variety of econometric models to test export manufacturing competitiveness [19].

Most of the current research on this topic involves independent analysis, e.g., driving factors, evaluation systems, and regression analysis. The existing research lacks a systematic analysis of manufacturing competitiveness and its driving factors. To address this knowledge gap, this study applies the entropy method to first provide the weight of the individual index. We then use a panel model to find the driving factors of manufacturing competitiveness, from the perspective of developed countries and developing countries. Our research provides a systematic method to ensure its sustainable development.

The main objective of the current study is to evaluate the manufacturing competitiveness of G20 countries using the comprehensive competitiveness index and to analyze the effect of factors on manufacturing competitiveness, from the perspective of developed countries and developing countries.

The rest of the paper is organized as follows: Section 2 presents the literature review; Section 3 puts forward the methodology, including the evaluation index, the research theory, and the research method. Section 4 describes the experiment results, including the data collected, data test results, regression results, and classification test results. Section 5 is the discussion. Limitations and conclusion are presented in the Section 6.

2. Literature Review

2.1. The Concept of Industrial Competitiveness

Industrial competitiveness is derived from the concept of international competitiveness. Michael Porter believes that competitiveness provides products to the market more effectively and enables self-development [20]. There are also many indexes for evaluating industrial competitiveness, such as the revealed comparative advantage index (RCA) [21], the international market share (MS) [22], the trade competitive advantage index (TCA) [22], and the Michaely index (MI). For example, according to the classification standard of Aiginger [23,24], Zhou et al. [25] measured industrial competitiveness based on the RCA. Li et al. [26] constructed comprehensive international competitiveness from the aspects of RCA and TCA. According to Lall’s [27] classification of products with different technological content, Jin et al. [28] used the RCA to measure industrial competitiveness. Nevertheless, there is no integrated indicator to quantity the level of industrial competitiveness. As such, Li et al. [29] and Chen et al. [30] weighted each index using the entropy method to systematically measure the industrial competitiveness, respectively.

To comprehensively evaluate the manufacturing competitiveness of various countries, we used the entropy method to build an evaluation system of manufacturing competitiveness, based on the existing indexes.

2.2. Related Theories of Industrial Competitiveness

One of the theoretical bases of industrial competitiveness is international trade theory. Early scholars believed that industrial competitiveness was composed of resource endowment advantage and relative competitive advantage. For example, in the theory of absolute advantage, Adam Smith thinks that international trade is explained by the absolute cost between countries. If the cost of a country in the production of a commodity is absolutely lower than that of other countries, the country has the absolute advantage of the product [31]. As per the theory of comparative advantage, Ricardo believes that the basis of international trade is the relative difference in production technology and the resulting relative cost. Each country should concentrate on producing and exporting its products with “comparative advantage” [32]. Heckler and Orin believe that the relative differences of factor endowments among countries are the basis of international trade; different factors of production are needed to produce goods [33].

Another theoretical basis of industrial competitiveness is Michael Porter’s diamond model. Porter believes that industrial competitiveness is the ability of a nation’s international competitiveness in a certain industry. It can create a good business environment and enable its enterprises to gain competitive advantage [3]. Porter mainly explains the advantages of national competitiveness from the aspects of resource elements, market demand, supporting industries, and industrial strategy. Under the background of the development and change of the age, the connotation and manifestation of national competitiveness are constantly changing. With the emergence and development of globalization, the differences in resource elements and scientific and technological strength between countries are increasingly obvious. All countries compete with others through their technology. From the perspective of economics, Porter’s theory is more suitable for the study of industrial competitiveness.

This paper studies manufacturing competitiveness and its driving factors. By finding the relevant factors that affect manufacturing, countries can promote its sustainable development. Therefore, Porter’s theory is more consistent with the theoretical basis of our article.

2.3. Motivation of Manufacturing Competitiveness

Manufacturing competitiveness to a large extent is mainly due to the improvement of manufacturing competitive advantage. Scholars have studied this in finance, transportation, information technology, and innovative technology. (1) In terms of finance, Qi et al. found that financial services can make manufacturing enterprises obtain the financing convenience and financial support of production activities, which can significantly improve their technical complexity [34]. Yang et al. found that the development of manufacturing will be significantly affected by the financial capital market [35]. Li et al. found that the impact of manufacturing on finance is related to economic development [36]. Svalleryd et al. believe that the financial market can affect a country’s industrial development [37]. (2) In terms of transport, Shao et al. analyzed the correlation between port throughput and the scale of manufacturing. They found that the rapid development of manufacturing can drive the growth of coastal port transport [38]. Karimi et al. studied the production and transport scheduling problem [39]. Tian et al. studied the relationship between the quality of transportation infrastructure and the export of machinery manufacturing [40]. Ismail et al. found that the construction of transport infrastructure can promote the import and export of manufacturing in Asia [41]. (3) In terms of information technology, Han et al. found that information technology can significantly drive the improvement of the manufacturing industry in the global value chain [42]. Frishammar et al. found that informatization has a significant impact on China’s industrial technology innovation efficiency [43]. Zhang et al. confirmed that there is a positive relationship between informatization and innovation performance [44]. Dewan et al. pointed out that, with the improvement of enterprise information technology capabilities, information investment can significantly improve the level of enterprise profits [45]. (4) In terms of innovative technology, Kleynhans verified the role of technology spillover in promoting industrial competitiveness through regression analysis [46]. Lee et al. believe that manufacturing should focus on innovation. This can not only improve manufacturing competitiveness, but also promote the sustainable development of traditional manufacturing [47]. Lee et al. found that the innovation effect dominates the productivity of the Korean manufacturing industry [48].

These studies have rich theoretical and practical value for analyzing and understanding manufacturing competitiveness. However, most of the existing studies ignore the common influence of these factors. We use the diamond model and entropy model to select the influencing factors and comprehensively evaluate the driving factors of manufacturing competitiveness in this paper.

3. Methodology

3.1. Evaluation Index

3.1.1. Existing Indexes

The commonly used method for trade evaluation is the comparative advantage analysis method based on industrial import and export data, which mainly include the RCA, MS, TCA, and MI. These indexes have various forms and reflect the trade competitiveness of the industry from different aspects.

- (1)

- RCA

The RCA represents the status of a product in the global export pattern by comparing it with the average export level of similar products in the world, as shown in Equation (1):

where i = 1, 2, …, m, m is the number of countries, t = 1, 2, …,T, T is the number of years, is the export volume of manufactured products of the ith country in the tth year, is the total export volume of manufactured products of the ith country in the tth year, is the global export volume of manufactured products in the tth year, and is the total export volume of the global trade products in the tth year.

- (2)

- MS

The MS reflects the international competitiveness of a national product, as shown in Equation (2).

- (3)

- TCA

TCA is a powerful tool for the analysis of international competitiveness of an industry, which can reflect whether domestic industry has a competitive advantage over the same industry trade of other countries in the world market. TCA is shown in Equation (3).

is the import value of manufactured products in the tth year of country i.

- (4)

- MI

MI is an important index reflecting the annual average change degree of a certain product in a country, as shown in Equation (4).

is the total import value of tradable products of country i in year t.

3.1.2. Whole International Competitiveness Index (WIC)

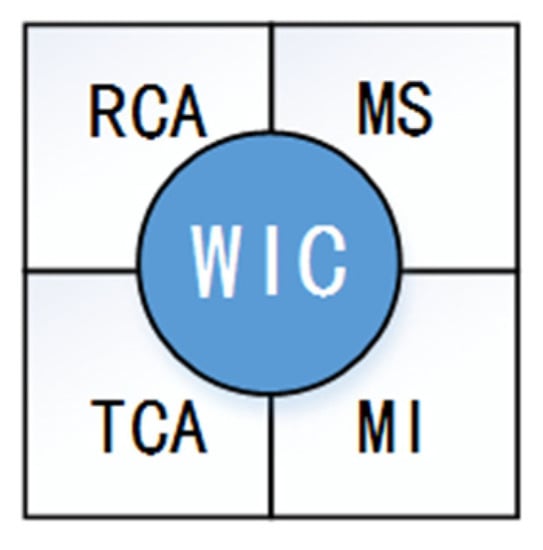

The above-mentioned RCA, MS, TCA, and MI have different focuses on the evaluation of industrial competitiveness. However, all of them have limitations (it is worth noting that using the entropy method to build the whole evaluation index method has been recognized by a large number of scholars [49,50,51]). Therefore, a whole international competitiveness index (WIC) was constructed to analyze the current situation of manufacturing competitiveness in various countries. The concept of WIC is shown in Figure 1. Based on this, this paper puts forward:

Figure 1.

The concept of the whole international competitiveness index (WIC).

Hypothesis 1 (H1):

The WIC can more comprehensively reflect manufacturing competitiveness.

For the treatment of index standardization, this paper uses a range change method to obtain the standardization matrix and carries out normalization, and the formula is as follows:

where i = 1, 2, …, m, m is the number of countries, j = 1, 2, …, n, n is the number of evaluation indexes, and represents the jth index value of the ith country.

Secondly, the weight of each index is calculated as follows:

where , .

Thus, the whole index of manufacturing competitiveness can be obtained, which is repeated t times (t = 1, 2, …, T), along with the whole index value of the tth year of the ith country .

3.2. Research Theory

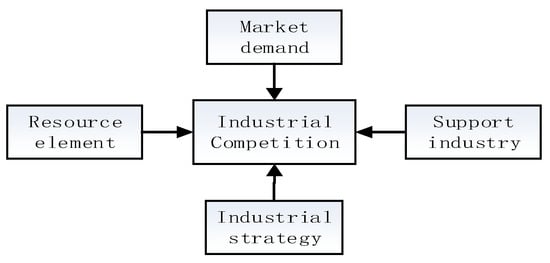

The diamond theory put forward by Porter [52,53,54] is used to analyze how a national industry forms its whole advantages and judge whether it has strong competitiveness. Many scholars have used it to study industrial competitiveness. For example, Fan et al. used it to explain the determinants of manufacturing competitiveness in Marchaco County [55]; Nyambane et al. used it to analyze the urban rail transit equipment manufacturing in Machakos [56]; Men et al. used it to analyze the competitive advantages and disadvantages of Soviet-style furniture in Ming Dynasty [57]. It can mainly divide the influencing factors of industrial competitiveness into four levels: the resource factor [58], market demand [59], the supportive industry [60], and the industrial strategy [61]. The basic idea of the diamond model is shown in Figure 2.

Figure 2.

The basic idea of the diamond model.

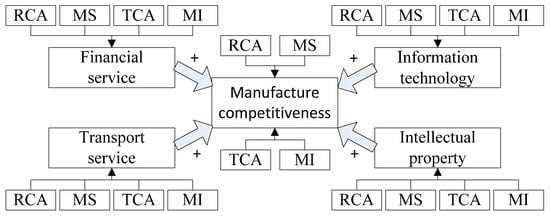

In this study, different factors of service in different countries were classified and mapped to the four factors, respectively. The basic idea of our research is shown in Figure 3.

Figure 3.

The basic idea of our research.

- (1)

- The resource factor: Financial services can effectively reflect the situation of economic resources. A national financial strength indicates the adequacy of national funds. When the financial level is higher, the country has high economic strength. It can effectively invest capital in manufacturing, i.e., product development, the construction of supporting facilities, etc. See Section 2.3 for a review of related research. Thus, we put forward the following hypothesis:

Hypothesis 2 (H2):

Financial service has a positive impact on manufacturing competitiveness.

- (2)

- Market demand: Transport services can be measured to reflect the consumption situation. Enterprises in different regions need to carry out cross-regional transportation to purchase manufacturing products. They can transport manufacturing goods produced in different regions to markets in different regions for sales, so as to promote the development of manufacturing from the perspective of market demand. See Section 2.3 for a review of related research. Thus, we put forward the following hypothesis:

Hypothesis 3 (H3):

Transport service has a positive impact on manufacturing competitiveness.

- (3)

- The supportive industry: Information technology can support the sustainable development of the manufacturing. The manufacturing system is relatively complex, requiring a large amount of information technology to design, operate, and maintain. The more developed a national information technology, the better its manufacturing. See Section 2.3 for a review of related research. Thus, we put forward the following hypothesis:

Hypothesis 4 (H4):

Information technology has a positive impact on manufacturing competitiveness.

- (4)

- Industrial strategy: Intellectual property can effectively reflect the national strategy. A national manufacture has a large number of independent core technologies, which can determine its position as a manufacturing power. Therefore, the manufacturing competitiveness of various countries can be understood in terms of the competition in core technologies, and intellectual property rights are the most representative. See Section 2.3 for a review of related research. Thus, we put forward the following hypothesis:

Hypothesis 5 (H5):

Intellectual property has a positive impact on manufacturing competitiveness.

3.3. Research Methods

Due to the numerous influencing factors discussed in this paper, the panel regression model was adopted for analysis. The reason for this is that the application space of the model shrinks when the research variables increase in the theoretical assumptions of many cutting-edge models, while the panel regression model has good operability in dealing with multiple variables, which has been confirmed by many scholars [62,63,64].

Based on different indexes, the following five-panel regression models are constructed here to empirically test the impact of each influencing factor on manufacturing competitiveness:

The model 1 as shown in Equation (7).

where is the RCA of manufacturing competitiveness of the ith country in the tth year, is the RCA of financial service competitiveness of the ith country in the tth year, is the RCA of transport service competitiveness of the ith country in the tth year, is the RCA of information technology competitiveness of the ith country in the tth year, and is the RCA of intellectual property competitiveness of the ith country in the tth year.

The model 2 as shown in Equation (8).

where is the MS of manufacturing competitiveness of the ith country in the tth year, is the MS of financial service competitiveness of the ith country in the tth year, is the MS of transport service competitiveness of the ith country in the tth year, is the MS of information technology competitiveness of the ith country in the tth year, and is the MS of intellectual property competitiveness of the ith country in the tth year.

The model 3 as shown in Equation (9).

where is the TCA of manufacturing competitiveness of the ith country in the tth year, is the TCA of financial service competitiveness of the ith country in the tth year, is the TCA of transport service competitiveness of the ith country in the tth year, is the TCA of information technology competitiveness of the ith country in the tth year, and is the TCA of intellectual property competitiveness of the ith country in the tth year.

The model 4 as shown in Equation (10).

where is the MI of manufacturing competitiveness of the ith country in the tth year, is the MI of financial service competitiveness of the ith country in the tth year, is the MI of transport service competitiveness of the ith country in the tth year, is the MI of information technology competitiveness of the ith country in the tth year, and is the MI of intellectual property competitiveness of the ith country in the tth year.

The ED model as shown in Equation (11).

where is the WIC of manufacturing competitiveness of the ith country in the tth year, is the WIC of financial service competitiveness of the ith country in the tth year, is the WIC of transport service competitiveness of the ith country in the tth year, is the WIC of information technology competitiveness of the ith country in the tth year, and is the WIC of intellectual property competitiveness of the ith country in the tth year.

4. Experimental Results

4.1. Data Collection

The G20 group is an organization that promotes the development of the industrialized market, and its participants play an important role in promoting economic stability and sustained growth. Therefore, G20 participating countries were selected as the research object of this paper. However, the European Union is a multi-national coalition. Saudi Arabia and Turkey depend on oil resources and tourism resources, respectively. They should not be regarded as research countries. Only 17 of the G20 group are considered in this paper (Table 1). Meanwhile, data regarding the above countries from 2008 to 2018 were selected. The data in this paper are from WTO.

Table 1.

Name and serial number of G20 participating countries.

4.2. Data Test

Table 2 shows the correlation test results of all variable data. The correlation between each variable is small, so the multi-linearity can be reduced.

Table 2.

Correlation test.

To guarantee the robustness of regression results, we deal with the LLC, ADF, the PP unit root test, and the Pedroni co-integration test. As shown in Table 3 and Table 4, all models passed the test, which indicates that there is a long-term equilibrium and stable relationship among the variables in the model.

Table 3.

Unit root test.

Table 4.

Co-integration test.

To select the appropriate regression methods, we used the F test, the Breusch–Pagan (BP) test, and the Hausman test. These results are shown in Table 5. It can be seen that under the assumption of homology variance, all models in the F test and BP test rejected the hypothesis of mixed regression. In the Hausman test, M1, M3, and M5 rejected the original set, indicating that the random effect model should be selected for regression analysis. The fixed effect model should be selected for regression analysis in both M2 and M4.

Table 5.

Model selection.

4.3. Regression Result

Table 6 shows the regression results of M1-M5. Due to the different focus of different models, the impact of various factors on manufacturing competitiveness is inconsistent in different scenarios.

Table 6.

Regression results.

In M1, X12 and X14 have a positive impact on Y1, while the impact of X13 on Y1 is negative. This shows that knowledge service plays an important role in the world. Market demand still plays a very important role. In addition, information technology requires innovation and it is costly. Therefore, in the world, the proportion of information technology service relative to manufacturing is low, and the proportion does not match.

In M2, the impact of X22 and X24 on Y2 is significant. The reason is that these services exported by various countries are highly consistent with those exported by the world. The international market has a strong demand for manufacturing products, and the relevant supporting industrial services exported by various countries are used to guarantee the normal transaction of manufacturing.

In M3, the effect of X31 is not significant, while others are positive. This shows that the regulation of products or services cannot be separated from a reasonable allocation of financial services. In addition, each national market has a strong demand for manufacturing, and the relevant supporting industrial services are used to ensure the normal transaction of domestic manufacturing.

In M4, the effects of all variables are not significant. The reason is that the total export and import of each country are inconsistent with the proportion of import and export of products or services, which makes it impossible to effectively identify factors that affect manufacturing competitiveness.

In M5, X53 and X54 have a significant effect, which indicates that market demand and the supporting industry have important effects on manufacturing competitiveness. The market demand for products stimulates enterprises to respond quickly to the demand, promotes their production efficiency, and expands the scale of production. Additionally, countries put forward intelligent manufacturing strategies to promote the integration of new generations of information technology and manufacturing. The more perfect the information technology service is, the better the development of manufacturing will be. In addition, although resource factors and industrial strategies are not significant, they play a role in promoting manufacturing competitiveness. This indicates that the effective coordination of resource allocation among countries makes it difficult for manufacturing to fluctuate greatly. Furthermore, all countries put forward their own industrial strategic planning and intellectual property protection, and their strength is relatively balanced.

In conclusion, information technology and transport services have a significant impact on manufacturing competitiveness. Information technology, to some extent, is an emerging industry, and therefore cannot effectively demonstrate a logical relationship with manufacturing. They may even be negatively correlated. However, through the comprehensive consideration of M5, it can be shown that there is a positive and significant relationship between information technology and manufacturing, which, like a transport service, plays a positive role in manufacturing competitiveness. In addition, it has been found that, when countries emphasize intellectual property rights, intellectual property has a significant impact on manufacturing, but through a comprehensively considered M5 model. Since specific national conditions are different, and manufacturing classifications are various, the relationship between intellectual property services and manufacturing competitiveness is not clear. At the same time, we find that the impact of financial services on the manufacturing industry can be ignored.

The M5 results show that the research on manufacturing competitiveness should mainly focus on the whole situation of domestic and international industries. The concept is shown in Figure 4. Therefore, M5 takes into account the international and domestic market situation, which can show that the WIC value is more convincing than other indicators. This is consistent with H1.

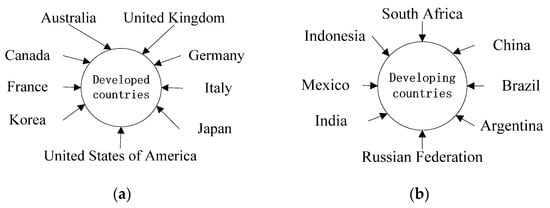

Figure 4.

Country category (a) Developed countries category; (b) Developing countries category.

4.4. Classification Test

To further analyze the development of manufacturing competitiveness, we further distinguish research objects according to developed countries and developing countries (Figure 4). In this way, we can judge whether the factors that affect manufacturing competitiveness have changed given different degrees of development. The regression method used is consistent with the previous one. Table 7 shows the regression results of country category.

Table 7.

Regression results of country category.

The results show that information technology and especially intellectual property have a significant positive impact on manufacturing competitiveness in developed countries. Developed countries have complete information networks that inject new vitality and power into the development of manufacturing. Information technology can promote the globalization of manufacturing. At the same time, guided by the 5G technology revolution, a new generation of information technology, such as the Internet of Things, will promote the sustainable development of manufacturing. In addition, developed countries with intellectual property rights will turn their technological advantages into market advantages and occupy a larger international market scale. In this way, they can always be in a favorable competitive position in the international market and provide a good environment for the sustainable development of manufacturing.

In developing countries, information technology and especially transport services have a significant positive impact on manufacturing competitiveness. Manufacturing in developing countries is mainly labor-intensive and resource-intensive and has become the “processing factory” of developed countries. Thus, it is closely related to transport services. The transport service is the foundation and forerunner of manufacturing. Developing countries need cross-regional transportation to sell processed products. Further, the sustainable development of manufacturing promotes the development scale of the transportation service industry. As the scale of transport development increases, the capacity of the transport supply is constantly enhanced, and the trade volume of manufacturing also increases. In addition, with globalization and the development of information technology, developing countries have begun to focus on the integration of industrial informatization. However, compared with developed countries, the impact of information technology on manufacturing is still limited.

5. Discussion

5.1. Theoretical Implications

Manufacturing competitiveness is a hot topic. Previous studies have been based on a single method, such as the evaluation system and the regression test. However, there is a lack of systematic research. Existing research lacks systematic analysis of manufacturing competitiveness and its driving factors.

Thus, one of the key points of this paper is to systematically discuss how factors can significantly influence the manufacturing industry. It enriches the literature on the manufacturing competitiveness and provides a comprehensive examination of factors affecting the manufacturing from the perspective of the national development level, based on four types of factors.

In the process of studying manufacturing competitiveness, we combine the entropy model with the diamond model to build a new theoretical framework to systematically study driving factors, such as financial services, transport services, information technology, and intellectual property, on manufacturing competitiveness. Thus, we can comprehensively consider the development of manufacturing competitiveness and avoid the problems of existing indexes, such as RCA, TCA, MC, and MI, which have different focuses on the evaluation of competitiveness. The panel regression model can lead to a deeper understanding of the driving factors of manufacturing competitiveness and of which factors have an important impact on manufacturing. This can then lead to reasonable suggestions for the sustainable development of manufacturing in various countries.

5.2. Practical Implications

Under the background of globalization, G20 participating countries have their own interests in the development of manufacturing. Therefore, on the basis of proving H3–H5, countries should actively carry out the construction of manufacturing ecology. It can stimulate the development of manufacturing industry more sustainability. Promoting the construction of regional and multi-lateral manufacturing development ensures the sustainable competitiveness of manufacturing.

Intellectual property has a significant positive impact on the manufacturing competitiveness in developed countries. Developed countries should attach importance to intellectual property protection and strengthen intellectual property management. Firstly, technological innovation needs to be driven through institutional innovation. Developed countries should fully integrate the resources of local governments and scientific research institutions, and systematically improve the national innovation capacity of manufacturing. Secondly, they should increase research input in the field of manufacturing. Through the integration of resources and platform, enterprises can realize technological innovation and accelerate technological transformation. Thirdly, they should construct scientific and effective innovation incentives. Finally, they should pay attention to the development of high-tech talent. Relying on scientific research institutions, universities, and advanced manufacturing enterprises, they should systematically promote the integrated development of high-end technical personnel and management personnel.

The market demand has a positive significant impact on manufacturing competitiveness in developing countries. Transportation services can significantly improve the level of manufacturing when transportation service investment reaches a certain scale, in terms of, e.g., personnel, capital, and time investment. For example, reducing the cost of transport services and improving the efficiency of transport services can promote the sustainable development of manufacturing and enhance competitiveness.

All countries have a significant impact on information technology. According to their own industrial characteristics and environment, countries should promote the development of information technology. The development of manufacturing depends on it. Manufacturing is not an isolated industry category. It is a compound cross industry with strong diffusion and a large industrial chain span. To improve their manufacturing competitiveness, countries need to rely on the development of information technology to improve the value content of manufacturing products. Therefore, all countries should actively promote the development of the Internet, artificial intelligence, and new-generation information technologies. This can promote the sustainable development of manufacturing competitiveness.

6. Conclusions

Based on the entropy diamond theory, this paper uses a panel regression model to analyze manufacturing competitiveness and its driving factors. The results show the following: Firstly, in M5–M7, the information technology industry, as a supporting industry, has a significant positive impact on manufacturing competitiveness. This reflects the rapid development of information technology. Both developed and developing countries are using information technology to enhance their manufacturing competitiveness. Secondly, compared with M5, market demand has a more significant impact on manufacturing competitiveness in M6. This shows that developing countries, as the “processing factories” of the world’s manufacturing, can significantly improve the level of manufacturing through transport services, so as to promote the sustainable development of manufacturing and enhance their international competitiveness. Thirdly, the industrial strategy passed the significance test in M7, but failed in M5. Although the manufacturing of different countries is uneven in strength, there is substantial development space. Developed countries monopolize core technology, which hinders the sustainable development of developing countries in the core of manufacturing. Finally, the regression coefficients of resource elements did not pass the significance test. Thus, even with the support of financial services, manufacturing cannot effectively improve their competitiveness. The reason for this is likely to be a lack of government policy supporting services.

At present, the study of manufacturing in this paper is only a preliminary exploration. There are still many areas that need to be improved. The current indexes of manufacturing competitiveness lack a unified caliber, which has an impact on the evaluation of manufacturing competitiveness and the judgment of their driving factors. With a continuous deepening of the research, the current results need to be updated. Furthermore, only the whole manufacturing competitiveness has been studied at present. To find sustainable development strategies, a subdivision of manufacturing must be carried out.

Author Contributions

Methodology: Z.D.; software: B.W.; validation: Z.D., B.W., and T.W.; formal analysis: Z.D. and Y.S.; resources: T.W.; writing—original draft preparation: Z.D. and B.W.; writing—review and editing: Z.D. and Y.S.; supervision, Y.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by National Natural Science Foundation Project under grant number 71571072; National Social Science Foundation Project under grant number 18BGL236; Guangdong Province Key Research and Development Project under grant number 2020B0101050001.

Data Availability Statement

The data in this paper are from WTO. https://www.wto.org.

Acknowledgments

The authors thank the editor and anonymous reviewers for their numerous constructive comments and encouragement that have improved our paper greatly.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Kleanthis, T.; Danai, C.; Vachtsevanou, A.S. Cyber-physical microservices: An IoT-based framework for manufacturing systems. Industrial Cyber-Physical Systems (ICPS). In Proceedings of the 2018 IEEE Industrial Cyber-Physical Systems (ICPS), St. Petersburg, Russia, 15–18 May 2018; pp. 232–239. [Google Scholar]

- Qin, S.B. Information technology strategy implementation based on differentiated competition on manufacturing enterprises in China. In Proceedings of the 2011 2nd International Conference on Artificial Intelligence, Management Science and Electronic Commerce (AIMSEC), Dengleng, China, 8–10 August 2011; pp. 2155–2158. [Google Scholar]

- Wood, J.C.; Wood, M.C. Michael Porter; Routledge: Abingdon, UK, 2010. [Google Scholar]

- Fabio, M.; Francesco, R. The impact of technology and structural change on export performance in nine developing countries. Econ. Quant. Methods 2002, 33, 527–547. [Google Scholar]

- Gordon, I. Internationalisation and urban competition. Urban Stud. 2014, 36, 1001–1016. [Google Scholar]

- Jaider, V.J.; Antonio, G.G.; Ignacio, F.L. Does external knowledge sourcing matter for innovation? Evidence from the Spanish manufacturing industry. Ind. Corp. Chang. 2009, 18, 637–670. [Google Scholar]

- Huang, C.P. Comparative Study on International Competitiveness of Power Plant Equipment Manufacturing Enterprises in China; Harbin University of Science and Technology: Harbin, China, 2009. [Google Scholar]

- Han, H.Y.; Ren, B.P. The High-quality development and competitiveness of manufacturing industry of the Yellow River Basin. Econ. Probl. 2020, 8, 1–9. [Google Scholar]

- Jin, F.; Su, Q.; Liang, Y.L. Analysis on the competitiveness of manufacture segmentation in Shandong Province. Econ. Manag. Rev. 2020, 3, 152–164. [Google Scholar]

- Zhang, H.J. International competitiveness of China’s telecommunication equipment: An analysis based on Indian market. Price Theory Pract. 2010, 10, 73–74. [Google Scholar]

- Zhang, J.; Jiang, Y.X. An analysis on the international competitiveness of high tech industry in China from the perspective of trade in value-added. Sci. Technol. Manag. Res. 2019, 18, 116–122. [Google Scholar]

- Chen, Z.C. International Competitiveness of China’s Electronic Information Manufacturing Industry; Jiangxi University of Finance and Economics: Nanchang, China, 2010. [Google Scholar]

- Shi, Y.F. Promote China’s national competitiveness by developing manufacturing-An analysis based on Porter diamond model. Tax. Econ. 2020, 4, 20–26. [Google Scholar]

- Qin, L.J.; Zhang, N.; Yang, X.J. Evaluation of international competitiveness of China’s electronic and communication equipment manufacturing industry. Dev. Innov. Mech. Electr. Prod. 2011, 4, 1–3. [Google Scholar]

- Liang, S.G.; Ma, Z.D.; Zhang, Y.H.; Li, S.D. Evaluation of regional manufacturing quality competitiveness based on diamond model. Stat. Decis. Mak. 2020, 51, 109. [Google Scholar]

- Ming, X.; Hu, L.J.; Wang, Y.M. Competitiveness evaluation of regional equipment manufacturing industry based on cluster analysis. Macroecon. Res. 2020, 6, 114–121. [Google Scholar]

- Liu, L.J.; Wang, X.Q. Relationship between Innovation Path, Technology Density and Manufacturing International Competitiveness-Based on Empirical Research in 17 Industries. Forum on Sci. Technol. China 2020, 10, 114–121, 141. [Google Scholar]

- Ren, T.L.; Qi, J.Y. Productive service input and international competitiveness of manufacturing industry-based on wiod data. Discuss. Mod. Econ. 2020, 5, 52–61. [Google Scholar]

- Li, C.; Zhao, J.; Liu, C.Y. Two way FDI synergy and export competitiveness upgrading of manufacturing industry: Theoretical mechanism and China’s experience. Ind. Econ. Res. 2020, 2, 16–31. [Google Scholar]

- Jin, B. Competitiveness Economics; Guangdong Economy Press: Guangdong, China, 2003. [Google Scholar]

- Yeats, A.J. On the appropriate interpretation of the revealed comparative advantage index: Implications of a methodology based on industry sector analysis. Weltwirtschaftliches Archiv. 1985, 121, 61–73. [Google Scholar]

- Zhou, Z.J.; Feng, F. The Present situation of China’s international competitiveness advantages of service trade. In Proceedings of the 3rd Annual International Conference on Management, Economics and Social Development (ICMESD 2017), Guangzhou, China, 26–28 May 2017. [Google Scholar]

- Zhou, S.L. Comparison of manufacturing competitiveness of technology intensive products between China, Japan and South Korea. Asia Pac. Econ. 2008, 4, 67–73. [Google Scholar]

- Aiginger, K. The use of unit values for discriminating between price and quality competition. Camb. J. Econ. 1997, 5, 571–592. [Google Scholar]

- Aiginger, K. A framework for evaluation the dynamiccompetitiveness of countries. Struct. Chang. Econ. Dyn. 1998, 2, 159–188. [Google Scholar]

- Li, G.; Liu, C.J. An empirical analysis of the international competitiveness of China’s industries in the past decade of WTO. Financ. Trade Econ. 2012, 8, 88–96. [Google Scholar]

- Lall, S. Competitiveness indices and developing countries: An economic evaluation of the global competitivenessreport. World Dev. 2001, 9, 1501–1525. [Google Scholar]

- Jin, B.; Li, P.F.; Liao, J.H. The current situation and evolution trend of international competitiveness of China’s industries-Based on the analysis of export commodities. China Ind. Econ. 2013, 5, 5–17. [Google Scholar]

- Chen, M.Y.; Lin, W.M.; Dai, Y.W. Comparative study on international competitiveness of Chinese wood processing industry based on entropy weight method. China For. Econ. 2018, 150, 34–37. [Google Scholar]

- Gai, X. The Design and Evaluation of Ship Navigation Display and Control System Based on Cognitive Load. Ph.D. Thesis, Harbin Engineering University, Harbin, China, 2015. [Google Scholar]

- Newman, M. The Wealth of Nations; Grove Press: New York, NY, USA, 2004. [Google Scholar]

- Ricardo, D. On the principles of political economy and taxation. Hist. Econ. Thought J. 1996, 1, 62–74. [Google Scholar]

- Betty, O. Interregional Trade and International Trade; Harvard University Press: Cambridge, UK, 2001. [Google Scholar]

- QI, J.Y.; Xiang, G.L. Opening up of financial service sector, external financial dependence and the export sophistication of manufacturing Sector-an empirical analysis based on different policies of services trade restrictiveness. J. Univ. Int. Bus. Econ. 2020, 6, 78–91. [Google Scholar]

- Yang, B.F.; Zhu, S.J. Financial markets and regional industrial evolution. Geogr. Res. 2020, 10, 2345–2360. [Google Scholar]

- Li, Z.R. Impact of Trade openness, transformation and upgrading of manufacture on financial openness. Inq. Econ. Probl. 2020, 5, 149–159. [Google Scholar]

- Svaleryd, H.; Vlachos, J. Markets for risk and openness to trade: How are they related. J. Int. Econ. 2002, 57, 369–395. [Google Scholar] [CrossRef]

- Shao, L.H.; Li, N.H.; Tang, Q.; Song, L.Y.; Wang, X.C. The influence of offshore and backflow of manufacture on port development in China. Transp. Syst. Eng. Inf. 2020, 6, 47–56. [Google Scholar]

- Karimi, N.; Davoudpour, H. A branch and bound method for solving multi-factory supply chain scheduling with batch delivery. Expert Syst. Appl. 2015, 42, 238–245. [Google Scholar] [CrossRef]

- Tian, H.; Wang, J. Research on quality of transport infrastructure along “The Belt and Road Initiatives” and China’s machinery manufacturing export—Empirical analysis based on the random effects model. J. Ind. Technol. Econ. 2020, 39, 63–72. [Google Scholar]

- Ismail, N.W.; Mahyideen, J.M. The Impact of Infrastructure on Trade and Economic Growth in Selected Economies in Asia; Social Science Electronic Publishing: Rochester, NY, USA, 2015. [Google Scholar]

- Han, X.F.; Hui, N.; Song, W.F. Can information improve the technology innovation efficiency of Chinese industrial sectors. China Ind. Econ. 2014, 12, 70–82. [Google Scholar]

- Frishammar, J.; SvenÅke, H. Managing external information in manufacturing firms. J. Prod. Innov. Manag. 2010, 22, 251–266. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, J.J. Information density, information technology capability and global value chain climbing of manufacture. Int. Trade Probl. 2020, 6, 111–126. [Google Scholar]

- Dewan, S.; Ren, F. Information technology and firm boundaries: Impact on firm risk and return performance. Inf. Syst. Res. 2011, 22, 369–388. [Google Scholar] [CrossRef]

- Kleynhans, E. Factors determining industrial competitiveness and the role of spillovers. J. Appl. Bus. Res. 2016, 32, 527–540. [Google Scholar] [CrossRef]

- Lee, Z.Y.; Chu, M.T.; Chen, S.S.; Tsai, C.H. Identifying comprehensive key criteria of sustainable development for traditional manufacturing in Taiwan. Sustainability 2018, 10, 3275. [Google Scholar] [CrossRef]

- Lee, H.S.; Choi, Y. Environmental performance evaluation of the Korean manufacture based on sequential DEA. Sustainability 2019, 11, 874. [Google Scholar]

- Thanh, T.; Vu, H.; Tian, G. Evaluating the international competitiveness of vietnam wood processing industry by combining the variation coefficient and the entropy method. Forests 2019, 10, 703. [Google Scholar]

- Sun, Y.; Tong, L.; Liu, D. An empirical study of the measurement of spatial-temporal patterns and obstacles in the green development of northeast China. Sustainability 2020, 12, 10190. [Google Scholar] [CrossRef]

- Guo, H.; Xu, S.; Pan, C. Measurement of the spatial complexity and its influencing factors of agricultural green development in China. Sustainability 2020, 12, 9259. [Google Scholar] [CrossRef]

- Wu, C.R.; Lin, C.T.; Chen, H.C. Integrated environmental assessment of the location selection with fuzzy analytical network process. Qual. Quant. 2009, 43, 351–380. [Google Scholar] [CrossRef]

- Fang, K.; Zhou, Y.; Wang, S. Assessing national renewable energy competitiveness of the G20: A revised Porter’s diamond model. Renew. Sustain. Energy Rev. 2018, 93, 719–731. [Google Scholar] [CrossRef]

- Sun, H.; Fan, Z.; Zhou, Y. Empirical research on competitiveness factors: Analysis of real estate industry of Beijing and Tianjin. Engineering 2010, 17, 240–251. [Google Scholar] [CrossRef]

- Fan, K.K.; Feng, T.T. Discussion on sustainable development strategies of the traditional handicraft industry based on su-style furniture in the ming dynasty. Sustainability 2019, 11, 2008. [Google Scholar] [CrossRef]

- Nyambane, E.N. Determinants of Machakos County Manufacturing Sector Competitiveness and Applicability of Porter’s Diamond Model. Ph.D. Thesis, Master of Business Administration University of Nairobi, Nairobi, Kenya, 2013. [Google Scholar]

- Men, G.; Liu, Y. The diamond model analysis of Chinese city rail transportation equipment manufacture cluster. In Proceedings of the 2012 3rd International Conference on E-Business and E-Government, Washington, DC, USA, 3 May 2012. [Google Scholar]

- Sabina, S.; Luz, M.M.; Pilar, P.T.; José, M.M. Defining and measuring different dimensions of financial resources for business eco-innovation and the influence of the firms’ capabilities. J. Clean. Prod. 2018, 204, 258–269. [Google Scholar]

- Anders, J.; Pejryd, L.; Christiernin, L.G. Consideration of Market Demand Volatility Risks, when Making Manufacturing System Investments. Procedia Cirp 2016, 40, 307–311. [Google Scholar]

- Johanna, K.; Andreas, K. Potentials of It-Supported Assistive Systems: Comparison of Two User Studies in The Manufacturing Industry. IFAC-PapersOnLine 2019, 52, 1866–1871. [Google Scholar]

- Lin, C.L. The analysis of sustainable development strategies for industrial tourism based on IOA-NRM approach. J. Clean. Prod. 2019, 241, 118281. [Google Scholar] [CrossRef]

- Geisser, S. A predictive approach to the random effect model. Biometrika 1974, 61, 101–107. [Google Scholar] [CrossRef]

- Abrahamson, N.A.; Youngs, R.R. A stable algorithm for regression analyses using the random effect model. Bull. Seismol. Soc. Am. 1992, 82, 505–510. [Google Scholar]

- Shiwei, Z.; Fengming, G. Change in gender wage gap in urban labor market:an analysis based on fixed-effect model. Econ. Rev. 2010, 4, 66–72. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).