Our discussion of relevant literature is divided into four sections. We first present a nuanced definition of CSP. We then focus on technological feasibility and institutional compliance. Finally, we outline the proposed methodology and the factors selected for the original framework.

2.1. Corporate Sustainability Performance

CSP is defined as the activities a firm engages in in quest of sustainability at the economic, social, and environmental levels. The definition includes the firm’s relationships with relevant stakeholders and operating strategies [

22]. The business sector has profoundly engaged with the concept of CSP as an incentive rather than a requirement. This has resulted in a paradigm shift in how companies conceptualize and generate value [

23,

24]. Indeed, CSP is considered as the process of meeting and managing stakeholders’ demands and preferences on behalf of the organization, while maintaining profitability and preserving human capital and environmental resources for the near and distant future [

25,

26]. It means it is closely linked with the concept of the TBL [

4,

9]

Elkington [

27] presented the idea of the “triple bottom line” (TBL), which refers to the notion of sustainable performance as represented by a triple line with varying interfaces between social, economic, and environmental dimensions. Since then, the TBL approach has been adopted by many studies to measure corporate sustainability performance [

28,

29]. The TBL evaluates performance in three ways: traditional profit or economic measures, an assessment of its environmental responsibilities, and people’s concerns about a firm’s social responsibility as evidenced by its operations [

30]. The TBL comprises fundamental pillars for determining a firm’s sustainability [

30,

31]. Sustainability is the capacity to preserve long-term welfare that enables enterprises to meet current requirements without jeopardizing future generations’ ability to meet their own.

Although CSP is often considered synonymous with the TBL concept, several researchers have claimed that assessments of CSP based on only three criteria may be insufficient [

9,

12,

13]. For example, Bhupendra and Sangle [

13] pointed out the importance of adopting advanced technology to eliminate the waste and emissions generated by production processes. Furthermore, Annunziata et al. (2018) argued that the adoption of advanced technology in the manufacturing process was associated with higher sustainability performance. It seems that technological incorporation could assist in improving the efficiency of CSP. Additionally, Xia et al. [

9] noted the influence of pressure from governments and industry associations exerted to meet regulations. We therefore aimed to expand the notion of CSP by incorporating these two factors.

2.3. Institutional Compliance

The practices of firms are affected by the expectations of external parties such as institutions and stakeholders [

37]. These external parties can have a substantial impact on the decision processes and behaviors of firms. Stakeholders have particular demands that must be met by the company, and the pressure generated by these demands can serve as an incentive for firms to adopt environmentally-friendly business practices. Prior studies have categorized stakeholders as either primary or secondary ones [

17,

38]. Primary stakeholders are entities capable of influencing important aspects of the company, while secondary stakeholders have less influence on company survival. Government and industry or trade associations are considered primary stakeholders because these bodies have the power to establish regulations and standards.

As a primary stakeholder, the government has power over corporate management through regulations and legal requirements of compliance [

16,

39,

40]. Acquah et al. [

41] argued that changes in prevailing laws and requirements for legal compliance at both regional and national levels have a substantial influence on firms’ operations. Qi et al. [

37] specified that technical requirements, environmental taxes, and emission license procedures obligate businesses to devote resources to pollution mitigation. Promoting socially-responsible behavior is the most apparent motivation driving institutional stakeholders; disciplinary procedures and fines are the most common consequence of non-compliance. These elements affect a firm’s operating costs, thereby aiding in the advancement of its manufacturing processes.

An important secondary stakeholder is industry associations, who also gauge the environmental performance of their members [

17,

38]. Shubam et al. [

40] argued that industry associations enforce industry standards and smear nonconforming organizations for high-pollution industries. Baah et al. [

17] affirmed that a firm’s inability to comply with industry-association demands or standards will significantly deteriorate the firm’s reputation and legitimacy. This strengthens firm performance in environmental and social aspects, leading to stronger relationships among stakeholders, organizational credibility, healthy company image, satisfaction of stakeholders, and commitment to meeting stakeholder needs.

2.5. Proposed Factors for Original Framework

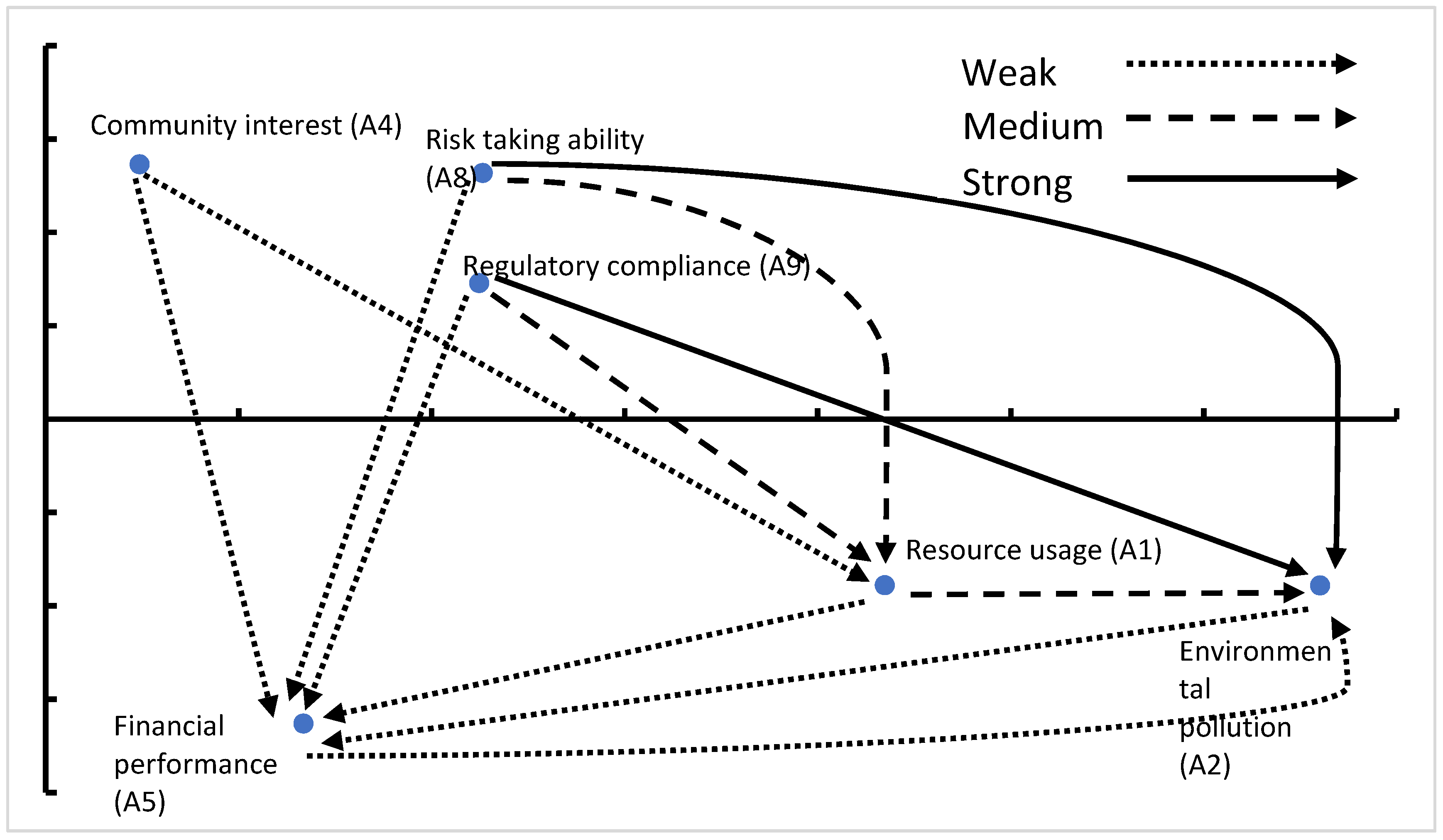

Based on a review of relevant literature, we considered the following five dimensions of CSP: environmental impact, social sustainability, economic gain, technological feasibility, and institutional compliance. Each of these were divided into two sub-dimensions. Environmental impact comprises resource usage (A1) and environmental pollution (A2). Social sustainability is achieved through human resources development (A3) and community interest (A4). Economic gain can be measured by either financial performance (A5) or market performance (A6). Technological feasibility is determined by the adoption of technology (A7) and the ability to take risks (A8). Institutional compliance can be divided into regulatory compliance (A9), that is, compliance with government regulations, and compliance with industry associations (A10). Within these ten sub-dimensions, we found 44 factors of CSP. These are specified in

Table 1. We introduce each in the following.

The optimization of resource usage (A1) is considered critical to CSP. A Firm’s efforts to limit hazardous chemicals and components (C1) can mitigate negative environmental impacts [

43]. Using waste as inputs (C2) also offers advantages [

43]. Renewable energy resources (C3) are a promising avenue towards greater sustainable environmental [

23,

44]. Increasing the efficiency of the consumption of raw material (C4) helps firms build superior corporate resources and capabilities [

23].

Environmental pollution (A2) includes waste (C5) and greenhouse gas emissions (C6) [

11]. Reducing emissions and streamlining the disposal of waste are important aspects of controlling environmental pollution [

23,

45]. Other environmental impacts include noise pollution from manufacturing processes (C7), the mining of limestone (C8), and negative effects of company operations which lead to complaints from residents (C9) [

46].

Human resources development (A3) emphasizes the critical nature of social resource management, which is at the heart of CSP [

3]. Human resources development is focused on talent attraction and retention (C12), which is relevant to sustainability because talented employees contribute to innovative development [

3,

18]. Training develops dedicated staff, while reward systems positively affect behavior and increase commitment [

3]. Managing employees’ satisfaction (C10) regarding their jobs and the organization they work for as well as offering employees long-term benefits (C14) also help firms to retain the best talent [

23]. Employing a skill-building orientation (C13) [

22] and increasing gender diversity in the workplace (C11) [

11] also lead to higher social sustainability performance.

Community interest (A4) can be generated by developing mission statements, establishing social networks, and committing to the protection of community rights [

3]. A firm’s mission determines its strategic priorities and differentiates it from competitors. A clear socio-oriented mission statement (C16) reflects the firm’s concern for society [

3]. However, a mission statement alone is not adequate to attain CSP; a firm’s commitment to protect the rights of the local community (C20) and their contributions to charity (C17) reflect that the firm is recognizing and acting on the needs of the local community [

43]. In order to attain social sustainability, firms should develop economic activity in their neighborhoods and create additional job possibilities (C18) [

47]. This aids in fostering a mutually beneficial relationship (C19) with society.

Financial performance (A5) refers to the financial aspects of a firm which enhance its position compared to its competitors [

48]. It encompasses profit growth (C23) [

49,

50] and return on assets (C26) [

49]. Profitability can also be measured by the return on equity (C21) provided by shareholders [

23,

51]. Artiach et al. [

25] argued that only firms that offer a large profit margin to shareholders have a high CSP. Return on investment (C22) reflects the efficiency of investment; this is therefore an indicator of superior financial performance [

51]. When industry becomes saturated in one country, a company may consider exporting its products (C24) [

46]. The ratio between debts and assets (C25) represents the proportion of financed assets where a larger ratio implies a higher level of leverage and financial risks [

8]. While acceptable financial leverage can help companies remain viable, excessive financial leverage increases their financial vulnerability.

While financial performance demonstrates an organization’s capacity to manage its financial activities, market performance (A6) demonstrates a corporation’s capability to escalate its sales volume as well as its share of market [

52]. The firm’s market share (C27) reflects its competitiveness [

49,

52]: the higher the share of market, the higher the firm’s economic gain. Sales growth (C28) indicates the performance of current sales compared to a previous period [

23,

52].

Technological adoption (A7) reflects a firm’s intention to incorporate advanced technology to its production processes [

13]. Businesses that adopt innovative technology can simultaneously reduce their dependence on conventional energy sources and improve their sustainability performance. Sustainability requires revolutionary, cleaner technologies capable of displacing traditional products and services [

53]. Fu et al. [

14] argued that firm readiness to adopt clean production processes (C31) may significantly decrease waste as well as carbon emissions. Recycling technology (C30) enables the recycling of industrial waste to serve as inputs [

13]. Technology adoption is only possible with adequate training (C33), which further serves to secure employee readiness to innovate (C32) [

54].

Risk-taking ability (A8) determines a firm’s performance in volatile future markets [

13]. The development of long-term solutions is not merely about dramatic improvements to goods, operations, and services; it involves preparation for future transformation, which is eased by the proactiveness of top management [

22]. A shift to sustainability begins with a succinct conceptualization and the formulation of an appropriate organizational strategy [

24]. Hence, firms must have a clear view of what technologies will be beneficial (C35) in order to secure the resources necessary to execute future technologies. Firms are more likely to pursue technology if they believe it will improve their competitive edge [

13]. Thus, if technology has the potential to differentiate the firm from competitors (C36), management will be encouraged to take greater risks. Top management risk-taking ability (C34) leads the opinions and perceptions of employees downstream [

13]. Managers must make additional efforts to lessen their reliance on dwindling natural resources [

55]. Therefore, in order to protect investment and share the risk associated with the adoption of sophisticated sustainable technologies, firms can explore partnerships with high-tech corporations (C37) [

36].

Firms are embedded in complex relationships with internal and external stakeholders. These stakeholders are crucial to the firm’s performance because they have the ability to influence the firm’s long-term strategic goals; hence, incorporating stakeholder demands directly and clearly is vital [

56]. One of the most influential stakeholders is government, which demands regulatory compliance (A9). Many firms have adopted an informed and strategic stance to regulations to ensure that environmental measures are likely to result in competitive advantages [

57]. Moreover, Danso et al. [

57] claimed that benefits may accrue as a result of reactive actions such as regulatory government policies or as a result of high proactive efforts. Chatzitheodorou et al. [

16] and Zhao et al. [

58] argued that government exerts significant influence on firms regarding sustainability issues. Government formulates both legislative (C38) and national (C39) standards [

59]. Wagner [

52] argued that strict environmental legislation will cause extra expense for firms that do not comply. Indeed, national and regional legislation have increased their authority and ability to interrupt firm operation through sanctions and penalties if firms do not comply with the legislation. Under the close control of the government (C41), implementing company sustainability practices should be regarded as a collaborative initiative to lessen regulatory pressure [

59].

Secondary stakeholders such as industry associations (A10) can push firms to comply with industry standards. Shubham et al. [

40] pointed out that industry associations in high-pollution industries pressure their members by self-regulating the industry and denigrating noncomplying groups (C44). Industry associations establish their own environmental standard so as to preserve their mutual legitimacy [

40,

60,

61,

62,

63,

64]. To retain memberships, firms must meet association requirements (C42) for social and environmental responsibility. With targeted environmental and social responsibility initiatives, the industry association also encourages (C43) organizations within its sector to adopt more sustainable practices. By the existence of industry associations, all firms within the industry are urged to become more ecologically and socially responsible.