A Study on the Impact of Unconventional (and Conventional) Drilling on Housing Prices in Central Oklahoma

Abstract

:1. Introduction

Literature Review

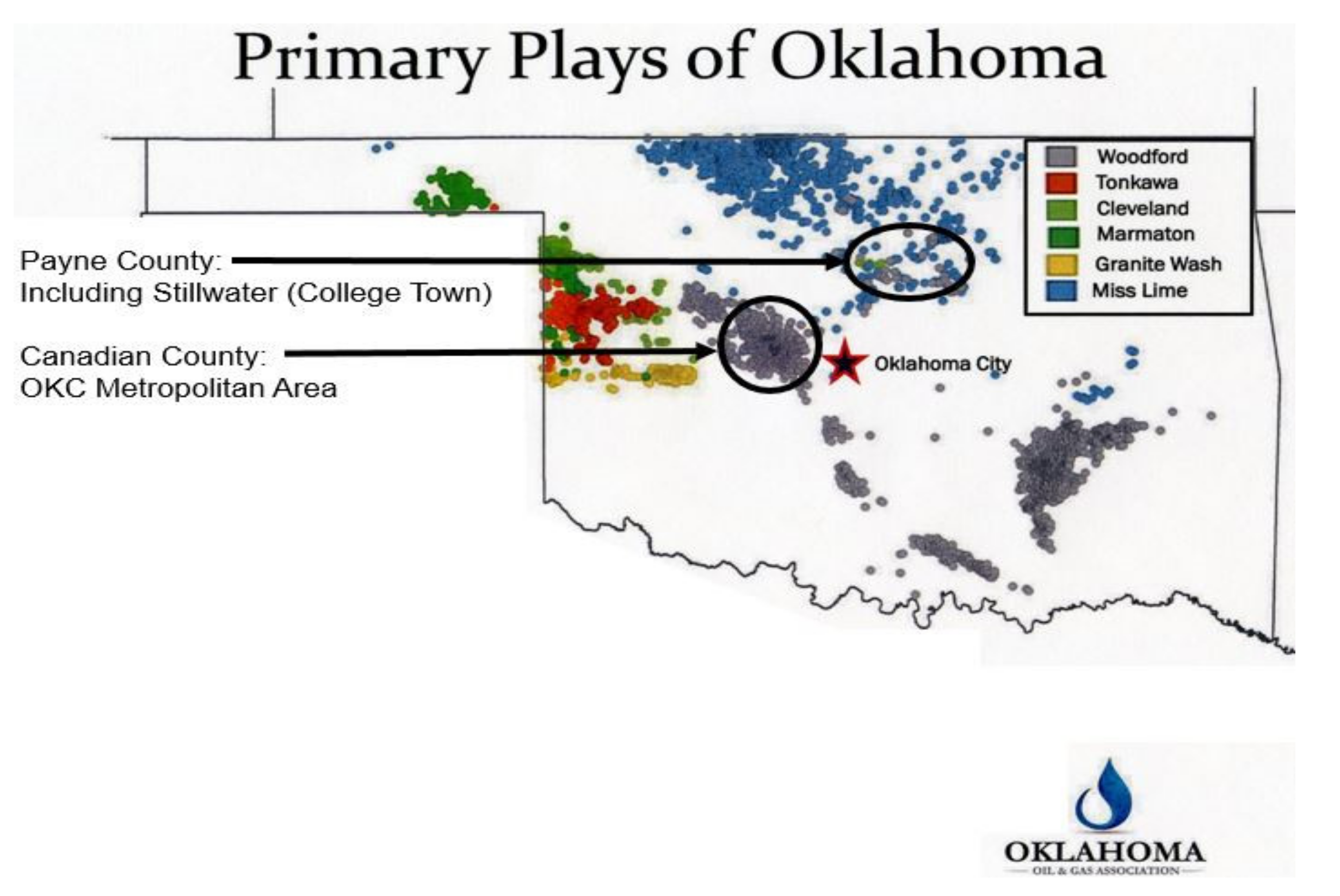

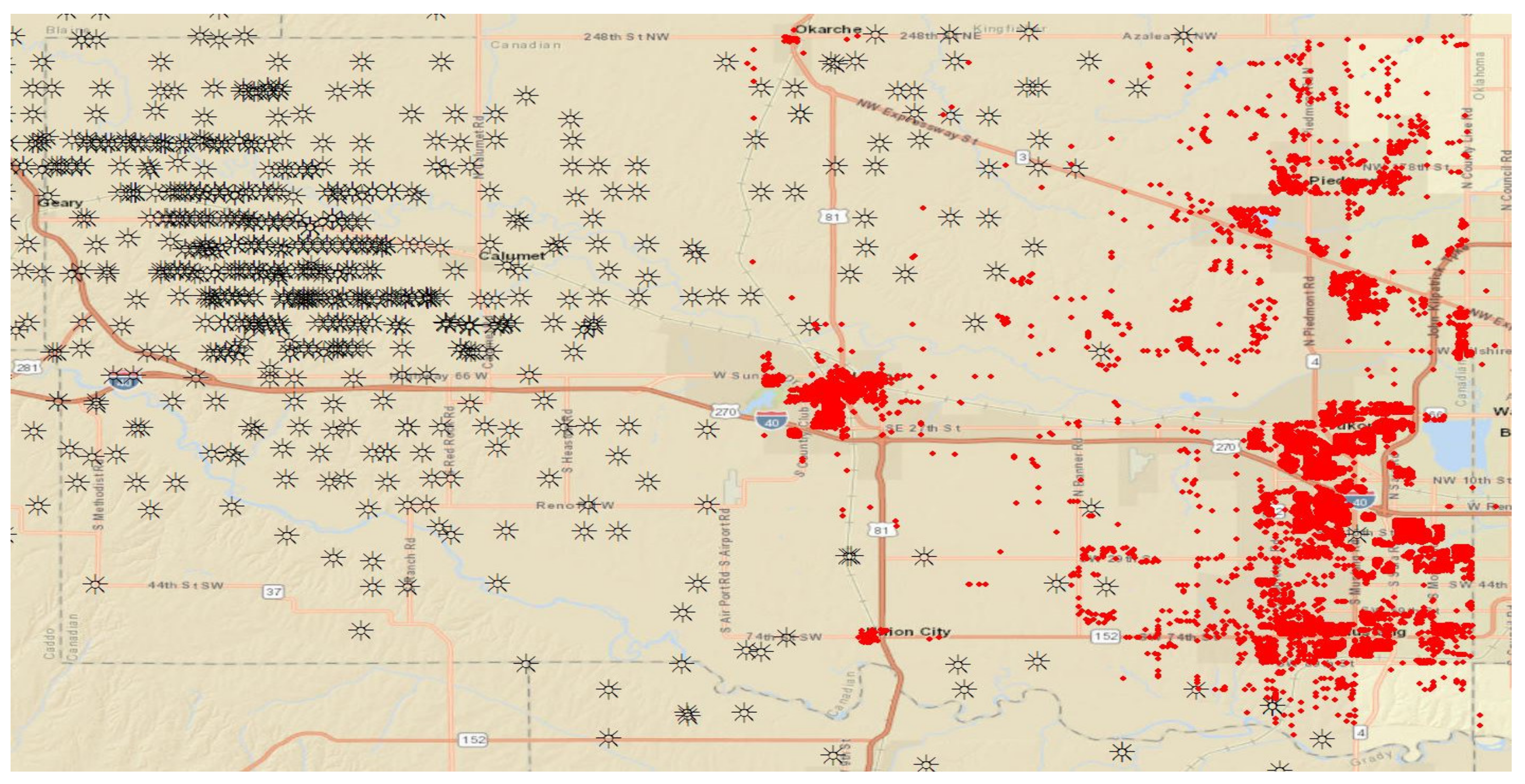

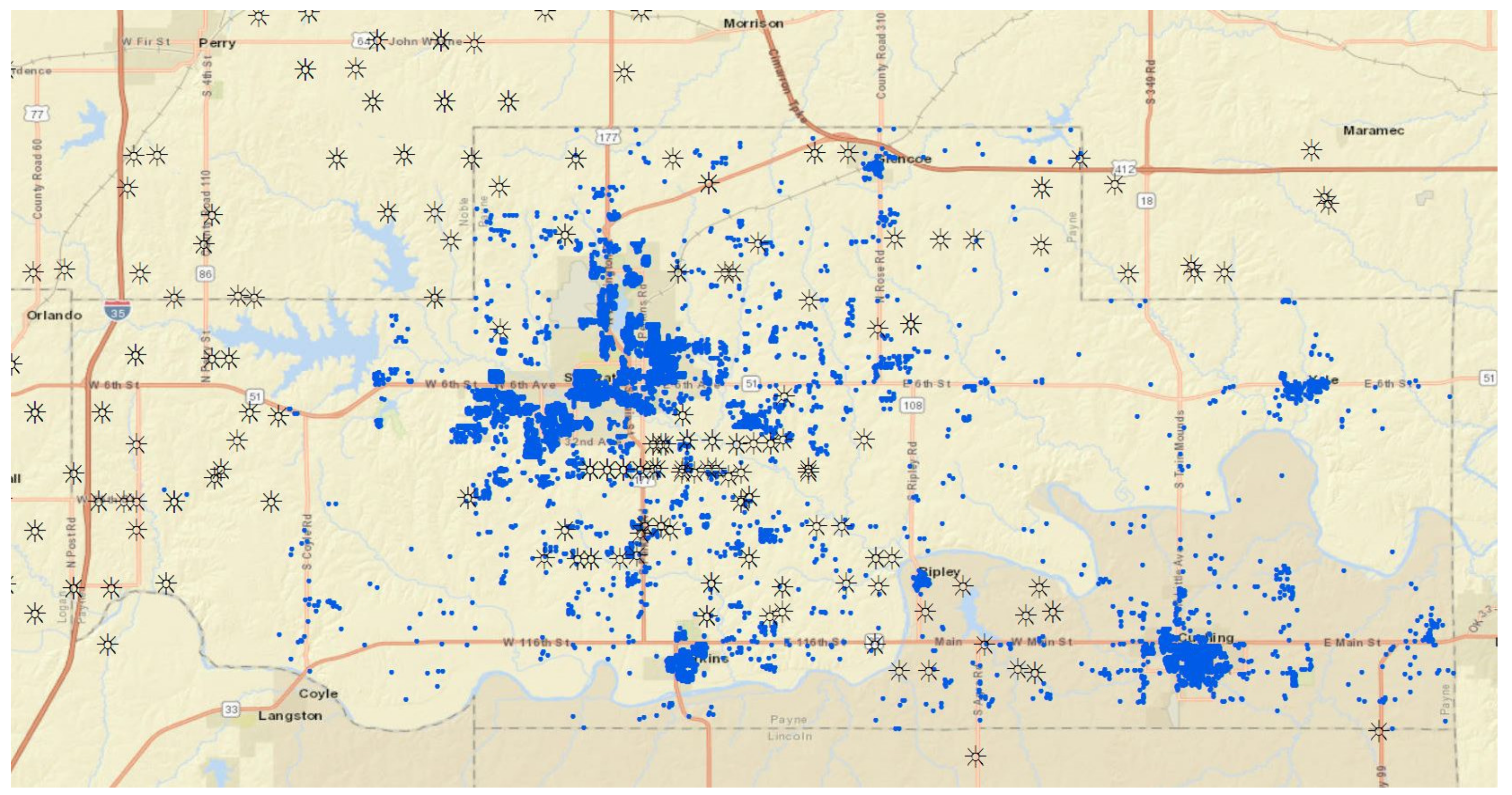

2. Study Region: Canadian County and Payne County in Oklahoma

3. Methodology

3.1. Hedonic Price Model

3.2. Empirical Estimation Strategy: Benchmark Model

3.3. Additional Estimation: Semiparametric Estimation

4. Data

4.1. House Transaction Data

4.2. Drilling and the Other Geographical Data

5. Results and Discussion

5.1. Baseline Regression: Housing Characteristics and Locational Components

5.2. Baseline Regression: The Impact of Unconventional Drilling Wells

5.3. Baseline Regression: Conventional Drilling Well Impact and Additional Estimation

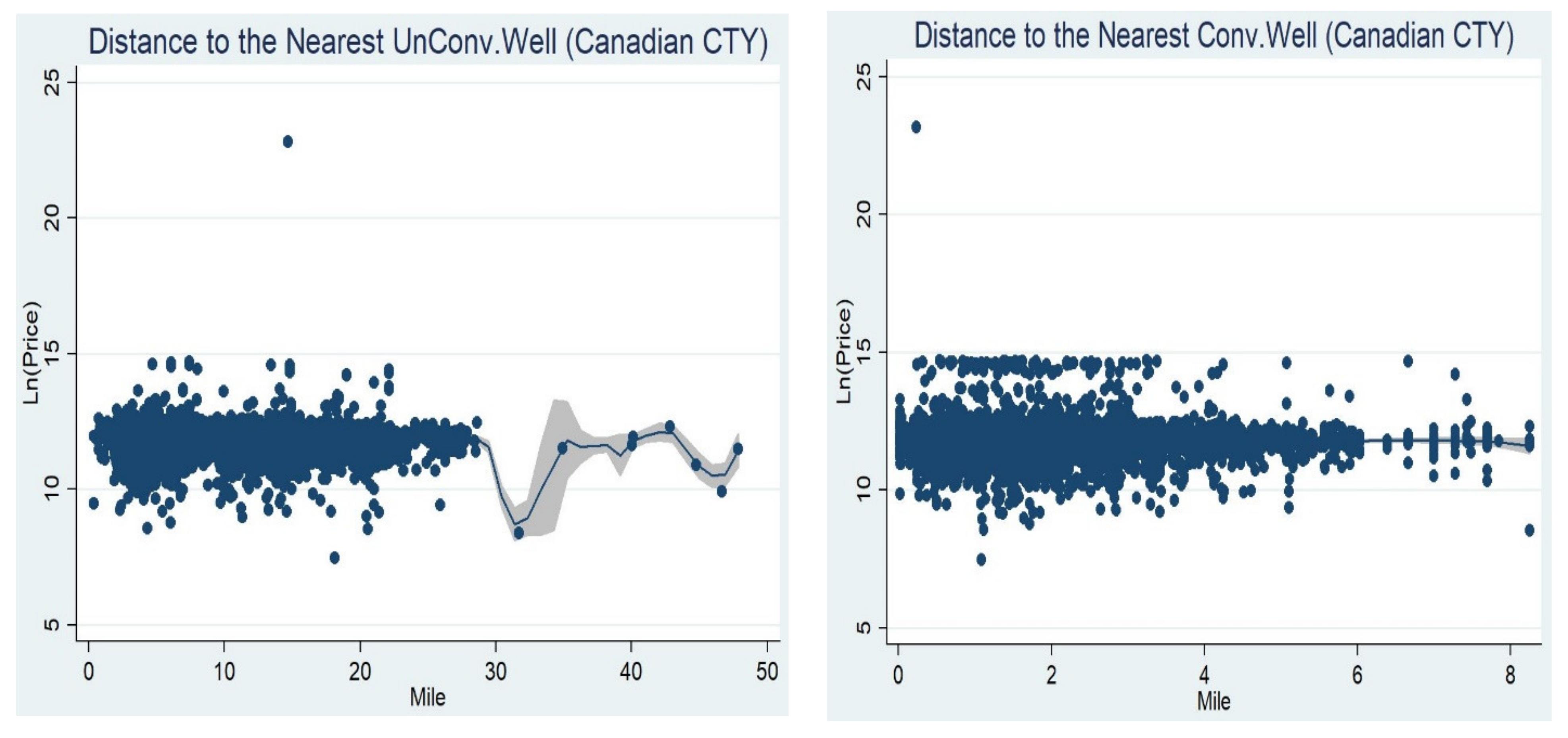

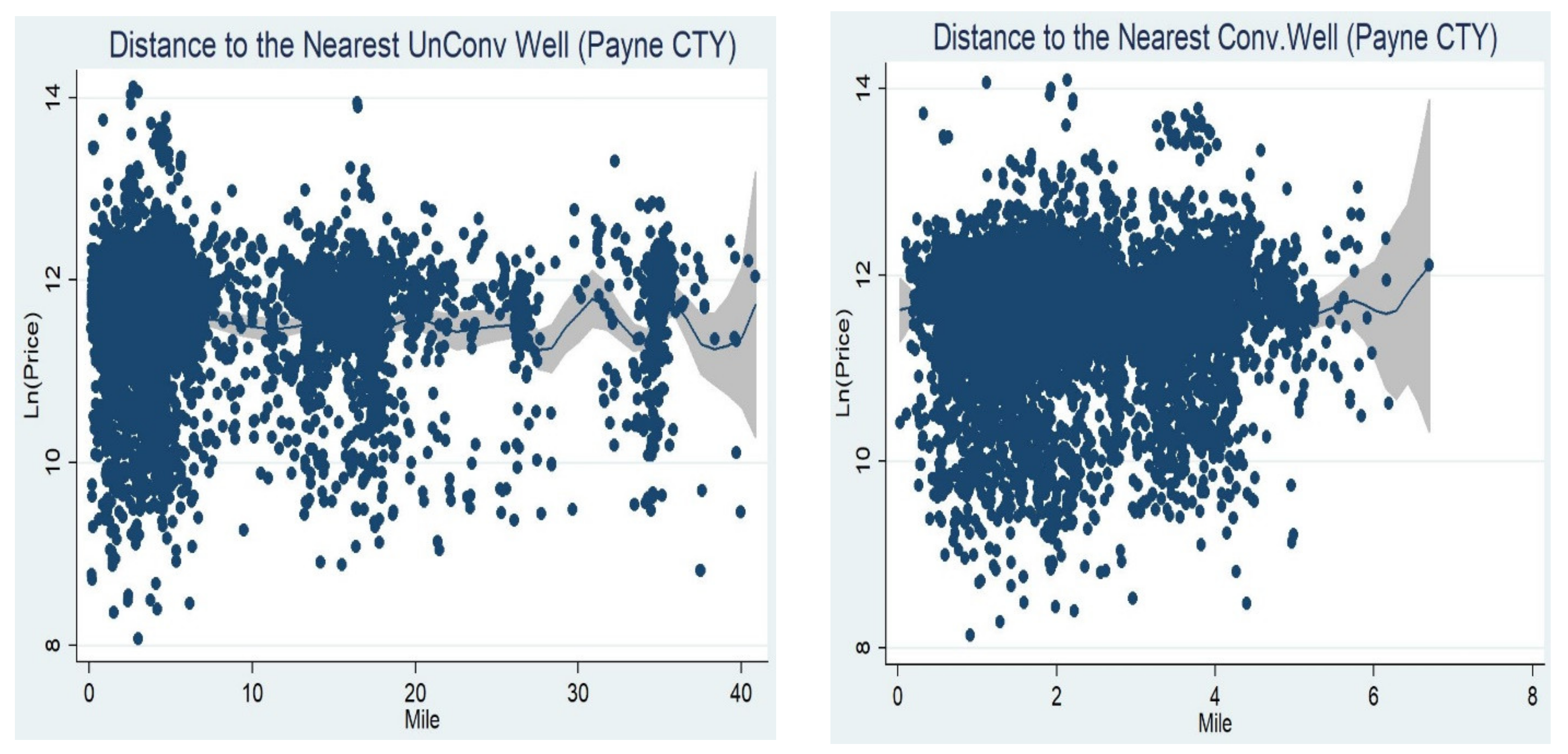

5.4. Semiparametric Estimation Results

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Weber, J.G. The effects of a natural gas boom on employment and income in Colorado, Texas, and Wyoming. Energy Econ. 2012, 34, 1580–1588. [Google Scholar] [CrossRef]

- Weber, J.G. A decade of natural gas development: The makings of a resource curse. Resour. Energy Econ. 2014, 37, 168–183. [Google Scholar] [CrossRef]

- Munasib, A.; Rickman, D. Regional economic impacts of the shale gas and tight oil Boom: A synthetic control analysis. Reg. Sci. Urban Econ. 2015, 50, 1–17. [Google Scholar] [CrossRef] [Green Version]

- Paredes, D.; Komarek, T.; Loveridge, S. Income and employment effects of shale gas extraction windfalls: Evidence from the Marcellus region. Energy Econ. 2015, 47, 112–120. [Google Scholar] [CrossRef]

- Komarek, T.M. Labor market dynamics and the unconventional natural gas boom evidence from the Marcellus region. Resour. Energy Econ. 2016, 45, 1–17. [Google Scholar] [CrossRef]

- Maniloff, P.; Mastromonaco, R. The local employment impacts of fracking: A national study. Resour. Energy Econ. 2017, 49, 62–85. [Google Scholar] [CrossRef]

- Whitacre, B.; Johnston, D.; Shideler, D.; Lansford, N. The Influence of Oil and Gas Employment on Local Retail Spending: Evidence from Oklahoma Panel Data. Ann. Reg. Sci. 2020, 64, 133–157. [Google Scholar] [CrossRef]

- Rickman, D.; Wang, H.; Winters, J.V. Is shale development drilling holes in the human capital pipeline. Energy Econ. 2017, 62, 283–290. [Google Scholar] [CrossRef] [Green Version]

- Maguire, K.; Winters, J.V. Energy boom and gloom? Local effects of oil and natural gas drilling on subjective well-being. Growth Change 2017, 48, 590–610. [Google Scholar] [CrossRef] [Green Version]

- Del Giudice, V.; De Paola, P.; Manganelli, B.; Forte, F. The Monetary Valuation of Environmental Externalities through the Analysis of Real Estate Prices. Sustainability 2017, 9, 229. [Google Scholar] [CrossRef] [Green Version]

- Muehlenbachs, L.; Spiller, E.; Timmins, C. The housing market impacts of shale gas development. Am. Econ. Rev. 2015, 105, 3633–3659. [Google Scholar] [CrossRef] [Green Version]

- Delgado, M.S.; Guilfoos, T.; Boslett, A. The cost of unconventional gas extraction: A hedonic analysis. Resour. Energy Econ. 2016, 46, 1–22. [Google Scholar] [CrossRef]

- Wrenn, D.H.; Klaiber, H.A.; Jaenicke, E.C. Unconventional shale gas development, risk perceptions, and averting behavior: Evidence from bottled water purchases. J. Assoc. Environ. Resour. Econ. 2016, 3, 779–817. [Google Scholar] [CrossRef]

- Gopalakrishnan, S.; Klaiber, H.A. Is the shale energy boom a bust for nearby residents? Evidence from housing values in Pennsylvania. Am. J. Agric. Econ. 2014, 96, 43–66. [Google Scholar] [CrossRef]

- Balthrop, A.; Hawley, Z. I can hear my neighbors fracking: The effect of natural gas production on housing values in Tarrant county, TX. Energy Econ. 2017, 61, 351–362. [Google Scholar] [CrossRef]

- Gibbons, S. Gone with the wind: Valuing the visual impacts of wind turbines through house prices. J. Environ. Econ. Manag. 2015, 72, 177–196. [Google Scholar] [CrossRef] [Green Version]

- Dröes, M.I.; Koster, H.R.A. Renewable energy and negative externalities: The effect of wind turbines on house prices. J. Urban Econ. 2016, 96, 121–141. [Google Scholar] [CrossRef] [Green Version]

- Oklahoma Geological Survey. Available online: http://www.ou.edu/content/ogs/data/oil-gas.html (accessed on 2 November 2021).

- Harvorsen, R.; Pollakowski, H.O. Choice of functional form for hedonic price equations. J. Urban Econ. 1981, 10, 37–49. [Google Scholar] [CrossRef]

- Ekeland, I.; Heckman, J.J.; Nesheim, L. Identification and estimation of hedonic models. J. Polit. Econ. 2004, 112, 60–109. [Google Scholar] [CrossRef] [Green Version]

- Robinson, P. Root n-consistent semiparametric regression. Econometrica 1988, 56, 931–954. [Google Scholar] [CrossRef] [Green Version]

- Anglin, P.M.; Gencay, R. Semiparametric estimation of a hedonic price function. J. Appl. Econ. 1996, 11, 633–648. [Google Scholar] [CrossRef]

- Oklahoma Corporation Commission. Available online: http://www.occeweb.com/og/ogdatafiles2.htm (accessed on 2 November 2021).

- Oklahoma Department of Transportation. Available online: http://www.okladot.state.ok.us/hqdiv/p-r-div/maps/shp-files (accessed on 2 November 2021).

- Oklahoma Water Resource Board. Available online: https://www.owrb.ok.gov/maps/index.php (accessed on 2 November 2021).

- Salvo, F.; Tavano, D.; De Ruggiero, M. Hedonic price of the built-up area appraisal in the Market Comparison Approach. In New Metropolitan Perspectives NMP 2020. Smart Innovation, Systems and Technologies; Bevilacqua, C., Calabrò, F., Della Spina, L., Eds.; Springer: Cham, Switzerland, 2021; Volume 178. [Google Scholar]

- Brown, J.; Fitzgerald, T.; Weber, J. Capturing Rents from Natural Resource Abundance: Private Royalties from U.S. Onshore Oil & Gas Production. Resour. Energy Econ. 2016, 46, 23–38. [Google Scholar]

| Year | Canadian County | Payne County | ||

|---|---|---|---|---|

| Wells | House Transactions | Wells | House Transactions | |

| 2001 | 0 | 1 | 0 | 222 |

| 2002 | 0 | 3 | 0 | 285 |

| 2003 | 0 | 0 | 0 | 293 |

| 2004 | 0 | 4 | 0 | 424 |

| 2005 | 0 | 2 | 0 | 451 |

| 2006 | 0 | 5 | 0 | 480 |

| 2007 | 1 | 5 | 0 | 493 |

| 2008 | 20 | 1747 | 0 | 509 |

| 2009 | 37 | 1830 | 0 | 529 |

| 2010 | 59 | 1579 | 2 | 508 |

| 2011 | 77 | 1559 | 1 | 510 |

| 2012 | 132 | 1813 | 14 | 728 |

| 2013 | 135 | 2104 | 22 | 888 |

| 2014 | 85 | 2324 | 77 | 1012 |

| 2015 | 82 | 2344 | 40 | 1093 |

| 2016 | 45 | 2437 | 17 | 1305 |

| Total | 673 | 17,757 | 173 | 9730 |

| Variable | Canadian County | Payne County | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Obs | Mean | Std. Dev. | Min | Max | Obs | Mean | Std. Dev. | Min | Max | |

| Public Water | 17,757 | 0.93 | 0.26 | 0 | 1 | 9730 | 0.81 | 0.39 | 0 | 1 |

| Distance to the Nearest Road | 17,757 | 417.23 | 409.14 | 0.00 | 4152.35 | 9730 | 383.73 | 440.22 | 3.79 | 3157.57 |

| Distance to the Nearest Highway | 17,757 | 1155.47 | 1233.68 | 0.03 | 10,652.10 | 9730 | 1136.68 | 1132.32 | 14.12 | 7172.08 |

| Distance to the Nearest Unconventional Drill Site | 17,748 | 12.63 | 6.24 | 0.26 | 47.87 | 7940 | 8.30 | 8.60 | 0.09 | 40.87 |

| Count in Ring I (Unconventional Drilling) | 17,757 | 0.00 | 0.02 | 0 | 1 | 9730 | 0.04 | 0.32 | 0 | 8 |

| Count in Ring II (Unconventional Drilling) | 17,757 | 0.00 | 0.02 | 0 | 1 | 9730 | 0.04 | 0.33 | 0 | 6 |

| Count in Ring III (Unconventional) | 17,757 | 0.00 | 0.02 | 0 | 1 | 9730 | 0.09 | 0.57 | 0 | 10 |

| Distance to the Nearest Conventional Drill Site | 17,757 | 1.85 | 1.20 | 0.01 | 8.25 | 9730 | 2.21 | 1.12 | 0.03 | 6.98 |

| Count in Ring I (Conventional Drilling) | 17,757 | 0.16 | 0.44 | 0 | 5 | 9730 | 0.07 | 0.41 | 0 | 10 |

| Count in Ring II (Conventional Drilling) | 17,757 | 0.15 | 0.42 | 0 | 5 | 9730 | 0.10 | 0.37 | 0 | 6 |

| Count in Ring III (Conventional Drilling) | 17,757 | 0.21 | 0.52 | 0 | 6 | 9730 | 0.14 | 0.44 | 0 | 6 |

| Sale Price | 17,757 | 159,960.7 | 169,233.5 | 500 | 4,700,000 | 9730 | 125,332.3 | 126,248.7 | 25.00 | 6,100,000 |

| Age of Bldg | 17,757 | 25.88 | 29.44 | 0 | 2010 | 8628 | 34.78 | 28.31 | 0 | 120 |

| # of Bath | 17,603 | 1.95 | 0.55 | 0 | 6 | 9727 | 1.71 | 0.93 | 0 | 8 |

| # of Beds | 17,562 | 3.10 | 0.75 | 0 | 38 | 8603 | 3.04 | 0.94 | 0 | 12 |

| Area | 17,757 | 1754.66 | 664.64 | 72 | 8585 | 8618 | 2162.29 | 1036.99 | 0 | 11,011.16 |

| Ln (Sale Price) | Canadian County | Payne County | ||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Distance to nearest | 0.001 | - | - | - | −0.003 | - | ||

| drilling site | (0.002) | - | - | - | (0.003) | - | ||

| Ring Boundary I | - | −0.591 | - | - | - | 0.008 | - | |

| (0–3500 ft) | - | (0.551) | - | - | - | (0.032) | - | |

| Ring Boundary II | - | - | 0.203 | - | - | 0.021 | - | |

| (3501–5000 ft) | - | - | (0.163) | - | - | (0.034) | - | |

| Ring Boundary III | - | - | - | −0.269 * | - | −0.009 | ||

| (5001–6500 ft) | - | - | - | (0.150) | - | (0.017) | ||

| Bedrooms | 0.034 *** | 0.035 *** | 0.034 *** | 0.028 ** | 0.041 ** | 0.033 ** | 0.033 ** | 0.033 ** |

| (0.012) | (0.012) | (0.012) | (0.012) | (0.016) | (0.015) | (0.015) | (0.015) | |

| Bathrooms | 0.166 *** | 0.166 *** | 0.166 *** | 0.159 *** | 0.157 *** | 0.132 *** | 0.132 *** | 0.132 *** |

| (0.040) | (0.040) | (0.040) | (0.038) | (0.020) | (0.020) | (0.020) | (0.020) | |

| Age of Building | −0.006 ** | −0.006 ** | −0.006 ** | −0.006 ** | −0.004 *** | −0.004 *** | −0.003 *** | −0.004 *** |

| (0.003) | (0.003) | (0.003) | (0.003) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Area | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Public Water Supply | 0.032 ** | 0.032 ** | 0.032 ** | 0.024 ** | 0.026 | 0.057 | 0.058 | 0.053 |

| (0.014) | (0.013) | (0.013) | (0.012) | (0.053) | (0.048) | (0.047) | (0.047) | |

| Distance to Biggest City | 0.007 | 0.003 | 0.006 | 0.006 | 0.044 *** | 0.051 *** | 0.051 *** | 0.051 *** |

| (OKC or Stillwater) | (0.014) | (0.014) | (0.014) | (0.013) | (0.011) | (0.010) | (0.010) | (0.010) |

| Distance to | 0.000 | 0.000 | 0.000 | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 |

| biggest city_sq | (0.000) | (0.000) | (0.000) | (0.000) | (0.001) | (0.001) | (0.001) | (0.001) |

| D_Nearest Highway | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| D_Highway_sq | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| D_nearest_road | 0.000 * | 0.000 * | 0.000 * | 0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| D_road_sq | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Year FE | Y | Y | Y | Y | Y | Y | Y | Y |

| Community FE | Y | Y | Y | Y | Y | Y | Y | Y |

| R-sq | 0.596 | 0.596 | 0.596 | 0.602 | 0.442 | 0.457 | 0.457 | 0.457 |

| adj. R-sq | 0.595 | 0.595 | 0.595 | 0.601 | 0.439 | 0.454 | 0.454 | 0.454 |

| N | 16,848 | 16,850 | 16,850 | 16,785 | 6730 | 8227 | 8227 | 8227 |

| Ln (Sale Price) | Canadian County | Payne County | ||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Distance to nearest | −0.006 ** | - | - | - | 0.039 *** | - | - | - |

| drilling site | (0.003) | - | - | - | (0.008) | - | - | - |

| Ring Boundary I | - | 0.008 | - | - | - | 0.004 | - | - |

| (0–3500 ft) | - | (0.007) | - | - | - | (0.036) | - | - |

| Ring Boundary II | - | - | 0.009 | - | - | - | −0.070 *** | - |

| (3501–5000 ft) | - | - | (0.007) | - | - | - | (0.027) | - |

| Ring Boundary III | - | - | - | −0.001 | - | - | - | −0.001 |

| (5001–6500 ft) | - | - | - | (0.005) | - | - | - | (0.020) |

| Bedrooms | 0.037 *** | 0.037 *** | 0.029 ** | 0.029 ** | 0.031 ** | 0.033 ** | 0.032 ** | 0.033 ** |

| (0.012) | (0.012) | (0.012) | (0.012) | (0.015) | (0.015) | (0.015) | (0.015) | |

| Bathrooms | 0.168 *** | 0.168 *** | 0.160 *** | 0.160 *** | 0.136 *** | 0.132 *** | 0.133 *** | 0.132 *** |

| (0.042) | (0.042) | (0.040) | (0.040) | (0.020) | (0.020) | (0.020) | (0.020) | |

| Age of Building | −0.007 ** | −0.007 ** | −0.006 ** | −0.006 ** | −0.003 *** | −0.004 *** | −0.003 *** | −0.004 *** |

| (0.003) | (0.003) | (0.003) | (0.003) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Area | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Public Water Supply | 0.036 *** | 0.036 *** | 0.029 ** | 0.029 ** | 0.062 | 0.055 | 0.062 | 0.055 |

| (0.014) | (0.014) | (0.012) | (0.012) | (0.048) | (0.048) | (0.048) | (0.048) | |

| Distance to Biggest City | 0.007 | 0.007 | 0.010 | 0.010 | 0.045 *** | 0.051 *** | 0.052 *** | 0.051 *** |

| (OKC or Stillwater) | (0.014) | (0.014) | (0.013) | (0.013) | (0.011) | (0.010) | (0.010) | (0.010) |

| Distance to | 0.000 | 0.000 | −0.000 | −0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Biggest City_sq | (0.000) | (0.000) | (0.000) | (0.000) | (0.001) | (0.001) | (0.001) | (0.001) |

| D_Nearest Highway | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| D_Highway_sq | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| D_nearest_road | 0.000 | 0.000 | 0.000 | 0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| D_road_sq | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Year FE | Y | Y | Y | Y | Y | Y | Y | Y |

| Community FE | Y | Y | Y | Y | Y | Y | Y | Y |

| R-sq | 0.590 | 0.590 | 0.598 | 0.597 | 0.458 | 0.457 | 0.457 | 0.457 |

| adj. R-sq | 0.590 | 0.589 | 0.597 | 0.597 | 0.455 | 0.454 | 0.454 | 0.454 |

| N | 17,241 | 17,241 | 17,145 | 17,145 | 8227 | 8227 | 8227 | 8227 |

| Ln (Sale Price) | Canadian County | Payne County | ||

|---|---|---|---|---|

| Unconventional Drilling Well | Conventional Drilling Well | Unconventional Drilling Well | Conventional Drilling Well | |

| Bedrooms | 0.034 *** | 0.035 *** | 0.034 ** | 0.032 ** |

| (0.012) | (0.012) | (0.016) | (0.015) | |

| Bathrooms | 0.160 *** | 0.166 *** | 0.161 *** | 0.136 *** |

| (0.037) | (0.040) | (0.020) | (0.020) | |

| Age of Building | −0.006 ** | −0.006 ** | −0.003 *** | −0.003 *** |

| (0.003) | (0.003) | (0.000) | (0.000) | |

| Area | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| Public Water Supply | 0.037 *** | 0.033 ** | 0.033 | 0.058 |

| (0.014) | (0.013) | (0.054) | (0.048) | |

| Distance to Biggest City | 0.018 | 0.006 | 0.055 *** | 0.055 *** |

| (OKC or Stillwater) | (0.013) | (0.014) | (0.012) | (0.011) |

| Distance to Biggest City_sq | −0.000 | 0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.001) | (0.001) | |

| D_Nearest Highway | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| D_Highway_sq | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| D_nearest_road | 0.000 | 0.000 | −0.000 | 0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| D_road_sq | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| Year FE | Y | Y | Y | Y |

| Community FE | Y | Y | Y | Y |

| R-sq | 0.563 | 0.596 | 0.381 | 0.418 |

| adj. R-sq | 0.562 | 0.595 | 0.377 | 0.415 |

| N | 16,846 | 16,852 | 6728 | 8225 |

| Critical value (95%): 1.96 Critical value (90%): 1.645 | ||||

| Hardle–Mammen Test Statistics | 1.824 | 0.787 | 3.792 | 8.900 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, K.; Whitacre, B. A Study on the Impact of Unconventional (and Conventional) Drilling on Housing Prices in Central Oklahoma. Sustainability 2021, 13, 13880. https://doi.org/10.3390/su132413880

Lee K, Whitacre B. A Study on the Impact of Unconventional (and Conventional) Drilling on Housing Prices in Central Oklahoma. Sustainability. 2021; 13(24):13880. https://doi.org/10.3390/su132413880

Chicago/Turabian StyleLee, Kangil, and Brian Whitacre. 2021. "A Study on the Impact of Unconventional (and Conventional) Drilling on Housing Prices in Central Oklahoma" Sustainability 13, no. 24: 13880. https://doi.org/10.3390/su132413880

APA StyleLee, K., & Whitacre, B. (2021). A Study on the Impact of Unconventional (and Conventional) Drilling on Housing Prices in Central Oklahoma. Sustainability, 13(24), 13880. https://doi.org/10.3390/su132413880