Abstract

Due to insufficient research on the relationships in the supply chain (SC) of agri-food products, and especially organic food products, the main goal of this study was to examine the perceptions of organic food producers about the importance of collaboration and trust to their performance in the organic food SC. An analysis of previous research has concluded that the important categories of relationship quality (RQ) are the following: appropriate inter-organisational collaboration, effective communication, mutual exchange of information, resource sharing (physical, financial, human, and organisational), willingness to share risks, transparency between partners, relationship quality and commitment, and the presence of trust between partners in the SC. An empirical study based on in-depth interviews was conducted on a sample of six organic food producers in Croatia. The results indicated that the producers’ perceptions of the impact of collaboration and trust on overall performance differs depending on the length of the collaboration with retailers, the types of products, and the percentage of overall sales they sell through retailers. The results of this research can serve as an information base for all stakeholders in the SCs of organic products by encouraging them to participate in activities that will strengthen trust and collaboration as a prerequisite for increasing SC organic food performance.

1. Introduction

In the last ten years, both in the world and in Croatia, there has been an increased interest in organic production, and this is the result of several factors. The most important of these are []: the large area of uncultivated land suitable for organic production, low pollution of the ecological system, increased consumer concern for health, and the growing importance of renewable sources in the global environment.

At the global and European level, there is a growing trend of areas under organic production. Since 2000, there has been an increase in areas under organic production of greater than 500%. According to the FiBL survey [], there has been a steady increase in the area covered by organic production in the world, which has grown to 71.5 million hectares. Organic agriculture is developing rapidly, and available statistics show that organic farming is practiced by 2.8 million producers in 186 countries [].

Although the interest in organic agriculture is growing, there is limited research focused on organic food producers [,,,]. Small organic food producers are often very inefficient, and they are interested in different possibilities within distribution channels, such as networking and better collaboration within the SC.

Agri-food supply chains (AFSCs) differ significantly from other SCs due to the specifics of agricultural production, its dependence on natural conditions, the seasonal nature of production, specific product characteristics (e.g., short shelf life and perishability of products), etc. The authors of [,] state that AFSCs are characterized by: (1) business relationships that typically confront profit sharing within the SC (the so-called profit–rebate relationship); (2) treatment of farmers as substitutable (and usable) input suppliers, who often operate in a limited market or under short-term contracts and therefore assume greater risk; and (3) profits from the sale of finished food products that are unevenly distributed along the SC because processors and retailers usually earn a significantly higher share compared to organic food producers.

Dani [] points out that the AFSC has two main goals: (1) to meet consumer demands and (2) to manage the chain effectively and become and remain economically viable. In addition, Dani [] believes that the AFSC can be discussed in two ways, as: (1) processor-oriented commodity chains and as (2) consumer-oriented value chains. The quality and safety of agri-food products are just some of the aspects that consumers care about more today than before, and which are also necessary prerequisites especially for AFSCs [].

Sustainable food production and distribution is one of the most important problems in developed and developing countries. Market regulation, the emergence of global companies, and changing patterns of consumer behaviour when buying and consuming food (e.g., demand for off-season products) are just some of the factors that significantly affect AFSCs. The agri-food activity also has a direct impact on the environment, playing a very important role in the sustainable management of natural resources and in the adaptation and mitigation of the effects of climate change []. Food supply chains (FSCs) from the primary farmer to the final consumer create a direct impact on the environment through the way food is produced, processed, transported, stored, and prepared, generating significant amounts of food waste and food losses. AFSCs need to become not only efficient and affordable, but also more sustainable and resilient. The long-term sustainability of this system requires the joint and integrated collaboration of all stakeholders in the FSC to include economic, technological, organisational, social, and environmental aspects in the strategic planning and design of sustainable AFSCs.

According to the definition given by Seuring and Müller [], sustainable supply chain management (SSCM) can be defined as ‘management of material, information, and capital flows as well as collaboration between companies along the SC, while achieving objectives from all levels of sustainable development, i.e., economic, environmental, and social’.

One of the most frequently cited definitions of sustainability is the triple bottom line (TBL) model, introduced by Elkington [], which divides sustainability into three basic points: (a) economic prosperity; (b) environmental quality; and (c) social equality. All three basic points and their interactions must be considered when designing sustainable AFSCs. The economic, environmental, and social requirements of stakeholders in the SSCM of agri-food products depend on the quality of collaboration and involve individual stakeholders in SSCM projects, e.g., retailers often play a central role in FSCs by linking primary production and processing with consumers [] and dictate market conditions that include elements of sustainability (such as quality standards, environmental management systems, etc.).

According to Dania et al. [], 10 key behavioural factors have been identified that enable an effective collaboration system for sustainable AFSCM, namely: joint efforts, division of activities, value of collaboration, adjustment, trust, commitment, fair distribution of power, continuous improvement, coordination, and stability.

Indicators of how the current characteristics of the agri-food system should change were presented by Ambler-Edwards et al. [], citing some of the new sustainability requirements for all actors in AFSC at the following levels, including quality of SC relationships. This includes better horizontal collaborative relationships, better vertical collaboration, long-term supply contracts in which power is balanced, partnerships with other sectors/industries, and connecting the entire chain from the farm to the consumer while collaborating with all stakeholders of the chain.

A case study on the Parmigiano Reggiano cheese SC presented the results of in-depth research where the role of the SC, deriving by cooperation, is relevant to increase the sustainability and resilience of the production chain and of the entire eco-social local system, even in economically fragile areas [].

In essence, collaboration is a key approach to achieve a balance between all sustainability goals, by mitigating the individualistic and opportunistic behaviour of stakeholders in the SC. Effective and quality collaboration for sustainable AFSCs can make it easier for farmers to access resources, opportunities, and benefits equal to those of the other stakeholders in the SC [,,].

Precisely because of the above, AFSCs should be viewed as ‘value chain systems’ in which the raw material (from an agro-industrial source) is converted into final consumption as it moves through the chain and increases in value. AFSC members strive to improve the functioning of the chain, from the perspective of quality, competitiveness, pricing, requirements for the absolute safety of agri-food products, and regarding mutual relations between chain members (trust, communication, knowledge exchange, loyalty, etc.).

Despite the need to increase the efficiency of the distribution of organic food products in Croatia, so far, no research has been identified in international and domestic literature that has researched the quality of the relationship between producers and retailers in the organic food sector. The only research in Croatia that has dealt with the perceptions of producers about the impact of the quality of relations on the performance of SCs is that of Mesić et al. [] carried out for the SC performance of the traditional food sector. In this paper, the key problems identified are the use of unfair trading practices (exploitative contracts, high rebates), receivables, non-compliance with payment deadlines, low wholesale prices, high costs of logistics, and poor collaboration and integration between chain members. A similar situation is still present in many countries of central and eastern Europe []. Considering the growth of the importance of the organic food sector in the world and in Croatia, the objective of this paper is to examine the perceptions of organic food producers about the importance of collaboration and trust on their performance in the organic food SC, and to give recommendations for the improvement of relationship quality (RQ) with retailer within this SC.

Empirical research will be used to answer the following research questions: ‘How do organic food producers perceive the most important factors of collaboration with retailers in the organic food SC?’; ‘How developed is trust among organic food producers and retailers in the organic food SC?’; and ‘How do collaboration and trust between organic food producers and retailers influence overall organic food SC performance?’

The remainder of the paper is structured as follows: The next section addresses relationship quality and collaboration in the AFSC, trust, and overall supply chain performance, followed by a short description of the organic food market and main distribution channels, with a special focus on the Croatian market. Thereafter, the main findings of the qualitative empirical research conducted on a sample of organic food producers in Croatia are discussed, followed by a discussion of the research results. The paper concludes with a section on the managerial implications, limitations, and future research directions.

2. Literature Review

One of the goals of the SC is that companies do not view each other individually, but as members of a competitive network in which multiple companies are involved in value creation []. This goal can only be achieved through the collaboration of all members in the SC, because the network has a competitive environment that brings benefits to all stakeholders and strengthens the SC []. Collaboration is a process in which several people or business entities come together (integrate) to perform a job or activity, sharing tasks and roles, helping each other, and coordinating efforts, to achieve a common goal. This implies collaboration that includes partnership, joint leadership, risk sharing, co-decision (i.e., a closer and more intensive relationship), equality, and engagement. Mentzer et al. [] under collaboration in SC defines ‘a business process in which collaborating partners work together to achieve common goals that are mutually beneficial to partner companies’.

One of the preconditions for the successful functioning of SCs is quality business relations and collaboration between members of the SC [,,]. The impact of the relationship between the members of the chain on the performance of the SC has often been investigated [,,,,], and the research of these authors confirmed that the performance of the SC is significantly improved if there is a high level of trust and attachment among the partners in the SC.

One factor that often proved as having an important influence on SC performance is SC RQ [,,,]. RQ represents a degree to which SC members are involved in an active, long-term relationship [], which, based on their past experiences of success or failure, answers to their mutual needs and expectations []. In the literature, RQ is conceptualised as a latent variable of different components mostly derived from social psychology, such as trust, commitment, and satisfaction [,,,,].

Due to the specificity of AFSCs and the significant differences in relation to non-AFSCs, ‘collaboration’ and ‘trust’ are crucial for a better flow of products and information, as well as for competitiveness and performance of the individual chain members and for the entire chains—thus providing improved contact methods and joint solutions for the growing issues related to food quality and safety, and other difficult-to-detect attributes of food products [].

2.1. Collaboration

Based on the analysis of previous research, we can conclude that the important categories of RQ in AFSCs are: appropriate inter-organisational collaboration [,,,,,], effective communication [,,,], mutual exchange of information [,,,], resource sharing (physical, financial, human, and organisational) [,,,], willingness to share risks [], transparency between partners [,], relationship quality and commitment [,,], and the presence of trust between partners in the SC [,,,,,]. Accordingly, the most important variables of RQ in the AFSC, used in our research, will be further explained.

2.1.1. Inter-Organisational Collaboration

Since collaboration is based on relationships, either at the interpersonal or organisational level in the context of SCM, there is also intra-organisational or internal collaboration, which refers to collaboration within organisations, and interorganisational collaboration, which refers to the collaboration of all members in the SC []. Internal collaboration refers to the organisation’s culture of collaboration (for example, the existence of elements of trust and commitment). External downstream collaboration includes customer relationship management, while external upstream collaboration includes supplier management. There can be different levels of relationships within a SC, and collaboration in the context of inter-organisational relations is very important, because when it comes to developing the RQ between companies or SC stakeholders, it is crucial to achieve prerequisites for successful collaboration.

2.1.2. Quality of Communication

Another important category of collaboration and one of the prerequisites for trust is communication between business partners. Effective and efficient communication is a prerequisite for quality collaboration []. Through continuous and honest communication, SC problems can be avoided, and solutions can be more easily found, which greatly simplifies and improves collaboration among SC members [].

2.1.3. Information, Risk, Knowledge, and Resource Sharing

Information sharing is a key feature in the collaborative category, as information sharing not only reduces uncertainty among business partners, but leads to better efficiency, flexibility, and faster response of the entire SC []. Except for the poor availability and high prices of the products, the imbalance between supply and demand, and high operating costs, the lack of information flow between the chain actors in organic food SCs is one of main hindrances to the growth of the organic market [].

A good collaborative relationship requires not only trust and commitment, but also a willingness to share exposure to risk to achieve the mutually agreed long-term goals []. Sinha et al. [] also state that one of the main contributors towards SC risk is a lack of trust. Therefore, incentives need to be put forward clearly and knowledge about risks needs to be assessed and managed properly.

Resource sharing is also one of the subcategories of collaboration and differs from information sharing in its physical nature. While the latter refers to the sharing of data and information, the sharing of resources between partners in the SC implies the sharing of physical, financial, human, and organisational resources []. However, companies not only share information and resources with each other, but if they work together, they share knowledge [] and risks. As a result, uncertainty among SC members is alleviated.

Transparency between SC partners improves communication within the SC and increases information exchange, which can lead to successful collaboration and can improve overall supply []. Transparency is particularly important in the case of pricing [], which can significantly affect trust between partners and the loyalty of suppliers.

2.1.4. Relationship Quality and Commitment

Quality collaboration between different stakeholders in the food value chain is extremely important and depends on many factors. Wilding and Humphries [] list ten attributes that encourage SC collaboration: reliability, long-term focus, communication, stability, win-win, trust, willingness to compensate, personal relationship, creativity, and C3 (cooperation, collaboration, and coordination). Bezuidenhout et al. [] believe that a lack of attributes, such as reliability, trust, good personal relationships, and communication, causes fragmentation, opportunism, and a desire for excessive control of individuals in the chain. Aji [], in her research, points out four key variables for relationship building: satisfaction, trust, and two dimensions of commitment—commitment to continuity and commitment to support. Schulze et al. [], in a study of RQ in the German pork sector, also argue that RQ must be conceived as a construct that encompasses satisfaction, trust, and commitment.

Collaboration is vital for the empowerment of small farmers, especially those in communities with low socio-economic status. As key stakeholders in the AFSC, farmers typically have limitations in business skills, aspirations, and systemic thinking; thus, they often focus heavily on their business rather than creating an integrated collaborative system. Conflicts and misunderstandings can be minimized by understanding and managing the factors, i.e., the preconditions of quality collaboration, in partnership in the AFSC.

Commitment reflects the organisation’s faith and dedication to maintaining and improving relationships with partners to work together to create value in the long run. Similar to trust, it is one of the most critical behavioural factors for successful collaboration in an AFSC []. Trust and commitment lead to the creation of loyalty in relation to a business partner.

2.1.5. Long-Term Orientation

Long-term, sustainable partnerships require a long-term orientation and high level of collaboration between all parties in the SC, and are characterized by high levels of trust, commitment, transparency, and integrity. As satisfaction increases, there are always expectations of relational continuity and the tendency of both parties to stay in longer-term relationships [,]. Satisfaction with past outcomes indicates that there is equity in the relational exchange. Equitable outcomes provide confidence that either party is not being taken advantage of in their relationship and that both parties have concern about the other’s welfare []. Where there are high levels of confidence, trust is established. Furthermore, when trust is established, both parties are more committed to their relationships [,,,,].

2.1.6. Power, Dependency, and Opportunism

In addition to the previously mentioned and described factors that enhance collaboration among partners in the SC, there are also those that can negatively affect the development of collaboration and ultimately the success of AFSCs, such as excessive use of power, dependency, and opportunism.

Power and dependency are regarded as a fundamental issue in the SC. The power factor defines the ability of a person or organisation to influence the behaviour, decisions, and actions of others. Power grows from organisations that have valuable resources or control over resource allocation []. The more powerful an organisation is, the more it will be able to influence the types of information shared, the recipients, and the sharing mechanism in collaborative activities. However, the power function should not be used to exploit weaknesses, but as support and assistance in finding solutions and better ways to solve partnership problems, increasing mutual benefits, and competitive strategies [].

Opportunism is a risky situation in which companies and individuals seek to take advantage of a situation. In inter-organisational relations, opportunism occurs when one or more parties exploit the vulnerabilities of other parties in search of their own unilateral gain at the substantial expense of the other parties and/or the entire relationship []. Hobbs [] states that the risk of opportunism increases in certain situations in SCs, where the bargaining power of the chains is not evenly distributed. For example, when there are only a few buyers of products from many suppliers, as for most agricultural products in rural areas. Farming companies in the fresh produce SC usually have little bargaining power []. Therefore, there is a high risk that customers will act opportunistically. Some examples of opportunistic customer behaviour (e.g., retailer) are as follows: the retailer controls all information and does not share it with producers, does not treat the supplier fairly and honestly (i.e., as an equal partner in the SC), does not care about the welfare of the supplier or their interests and well-being, etc. The lower the opportunism of the SC partners, the greater the trust in the entire SC network, i.e., the greater the trust in the SC.

2.2. Trust

Trust is a central component of AFSCM and only in this way can the FSC be successful. Trust is an important strategic condition and one of the main factors that can improve or limit (in case of distrust) successful collaboration in the agri-food chain. In the agricultural sector, trust is more important for small and medium-sized enterprises (SMEs), which characterize the existence of personal relationships between business partners [,].

There is no single definition of trust and different authors distinguish different forms of trust in business relationships. Trust is considered to exist if ‘one side believes the other is fair or well-intentioned’ []. ‘Trust can be viewed as the opposite of opportunism in business relationships. We therefore define trust as the belief that a business partner can rely on fulfilling its obligations in a situation involving risks and vulnerabilities’ [].

In operational terms, ‘trust’ refers to the belief that the other party is sincere and honest and under no circumstances will intentionally do anything that would damage the relationship. Quality collaboration, trust, and commitment are important prerequisites for food quality as some of the important indicators of the success of the AFSC [].

For trust among business partners to develop successfully, certain preconditions of trust must be met. Different literature has identified different preconditions of trust within the AFSC. Batt [] identifies perceived honesty, credibility of information, reliability of promises, relationship satisfaction, compatibility of goals, and relationship investment as factors that create trust in the fresh product chain. Puspitawati et al. [] list eight precursors of trust in AFSC: communication, price transparency, price satisfaction, price quality ratio, joint problem solving, partner reputation, dependence, and relationship flexibility. Numerous authors agree that the most important determinants of trust in the AFSC are the quality of communication achieved by communication frequency and information quality, along with a positive collaborative experience [,,].

The higher the level of trust between the partners, the more likely it is for long-term collaboration to develop. After a high level of trust, quality collaboration, good communication, and strong personal relationships develop between the partners, the parties begin to engage in activities such as joint product development, co-investment, or innovation capacity development [].

2.3. Overall Performance

Collaboration and trust can help improve the efficiency of the AFSC. SC performance refers to the overall performance of a chain, and depends on the performance achieved at each stage of the SC []. Therefore, it is important to improve not only the performance of individual members in the SC, but of all members in the SC. The findings of one study [] showed the positive effects of collaborative relationships on SC performance, including financial, innovational, operational, environmental, social, and economic performances. In practice, there are many performance indicators that mainly depend on the specific characteristics of the SC, which is why there is no single definition of performance indicators. Measuring process performance is extremely important in an AFSC. Competitive advantage is among the main strategic goals of the AFSC and can be generated and consolidated not only through the exchange of resources and information, but also through other indicators, such as cost, delivery and delivery speed, quality, and flexibility []. In this paper, performance is observed through the following variables: improvement of business processes (coordination and optimization), operational efficiency (e.g., optimal use of resources in the SC), optimization of inventories, reliability and speed of delivery, demand planning, reduction of total costs for both parties (e.g., logistics), flexibility in delivery quantity, delivery time, fast resolution of complaints (implying responding to them), customer and end consumer satisfaction, making higher profits, achieving better competitive advantage in the market, offering low prices and prices even lower than competitors, declining opportunistic behaviour (more mutual respect, work for the benefit of both parties), increased product quality, increased communication between buyer and seller, achieving mutual benefits in business, reducing risk for both parties, reducing/optimizing inventory, and introducing and/or improving online retail.

3. Case Study: Organic Food Market in Croatia

3.1. Level of Development of the Organic Food Market

Like the rest of the world and Europe, Croatia is raising awareness and concern for human health and the preservation of the planet Earth. With the raising of awareness, the area under organic agricultural production also increases. According to the Croatian Ministry of Agriculture [], the area under organic production in Croatia is constantly increasing. Table 1 shows the areas of used agricultural land, the areas under organic production, and the share (in percent) of areas under organic production in the total used agricultural areas of Croatia for the period from 2013 to 2020, and strong growth in organic production is evident.

Table 1.

Areas of used agricultural land and areas under organic production in Croatia for the period from 2013 to 2020.

Of the 15.6 hectares of organic agricultural land in Europe, 8 million hectares, or 7.7%, accounts for EU agricultural land []. Table 1 shows that in 2019, the share of areas under organic production in the total agricultural land in Croatia was 7.18%, which is almost identical to the EU average. However, Croatia is still in a distant 26th place when measured by area of organic agricultural land. Half of Europe’s organic agricultural land is located in four countries. The country with the largest area of organic agricultural land is Spain (2.2 million ha, which is more than 14% of the total European organic agricultural land), followed by France, Italy, and Germany [].

The basis for a stronger development of organic agriculture in Croatia is the adoption of the Law on Organic Production of Agricultural and Food Products in 2001. Until the enactment of this Act in Croatia, organic agriculture was practiced by ecological associations and enthusiasts []. Organic food producers have recognized the potential of the market and their number is growing exponentially. Due to climatic and relief differences, clean soil and natural benefits, Croatia has the potential for the development of organic agriculture; however, its more serious further development is slowed down by numerous barriers. The fragmentation of agricultural areas, the low share of areas under organic production, unsettled property and legal relations, unsustainable production, insufficient connection or collaboration (often ignorance) of domestic producers of organic food products, inability to reach market infrastructure, and lack of strategy and long-term planning for organic agriculture (i.e., the state’s commitment to organic agriculture) are unfavourable factors in the development of organic agriculture.

In Croatia, most farms engaged in organic production are small family farms (OPG), which also face several challenges. Although Croatian organic farms are small, mostly about five hectares and even smaller [,], and cannot meet some world market standards, Croatia is a country that has recorded a significant increase in areas under organic production in the last 10 years.

According to the data from the Register of Entities in Organic Agriculture published by the Ministry of Agriculture [], the number of entities bearing the organic food certificate in Croatia in 2019 was 5548, and the latest data indicate a further increase to 5937. Although the number of organic producers in Croatia has been growing significantly in the last 5 years, as far as processors are concerned, Croatia lags far behind other European countries. Table 2 shows the trends in the number of organic producers and processors in Croatia for the period from 2013 to 2020.

Table 2.

Number of organic agricultural entities in Croatia from 2013 to 2020.

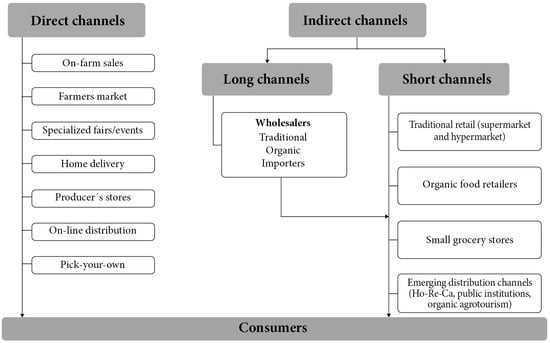

3.2. Distribution Channels of the Organic Food Market

Distribution channels for organic food products in Croatia are mainly related to the terms ‘local market’, ‘alternative market’, ‘direct sales’, and ‘short supply chains’ because most organic products in Croatia are still sold through direct channels, and a smaller percentage of domestic producers distribute their products through retail []. The results of the Hamzaoui-Essoussi and Zahaf [] study showed that small communities tend to support local organic food producers for three reasons: (1) low availability of organic food in supermarkets in small communities, (2) higher consumer confidence in local farmers than in retailers, and (3) direct marketing and distribution of food products from the local supplier to the consumer. Combining sales in short chains with organic farming practices is associated with higher farmer income, and economic performance depends not only on factors at farmer and farm-level (especially skills and labour organisation), but also at chain and territorial levels (e.g., degree of local competition and profit margin allotted to the intermediary) []. Retailers need to be aware of the different needs of consumers in small communities compared to large cities. For example, price does not significantly affect the customer’s purchase decision, but customers’ trust in the manufacturer is more important.

The main distribution channels for organic products on the European market are indirect, i.e., supermarket chains followed by specialized stores.

Digital technologies, such as big data and the Internet of Things (IoT), are widely considered as promising new tools for both increasing productivity and competitiveness in the agri-food sector and ensuring a more sustainable use of resources. Knowledge and insights derived from ever-increasing volumes and a variety of digital data may help to optimize farm production processes, improve risk management, predict market trends, and enhance strategic decision-making capabilities []. The digitization of the agri-food sector is a strategic priority in the political agenda of European institutions, and new technologies together with digitalisation are transforming agriculture and offering new opportunities to improve policy. The opportunity to improve the competitiveness and efficiency of the sector offered by new technologies comes together with its potential to face new economic and environmental challenges [].

With the development of technology and the internet, more and more businesses are doing business through online channels, which makes their products easily available to consumers almost around the world. Consumers on the other hand, with the faster lifestyle and need to save as much time as possible, have embraced this new online channel for shopping to meet their needs. The online channel has experienced exponential growth especially during the COVID-19 pandemic due to the prohibition or limitation of the business of traditional retail channels, fear of citizens of a pandemic, and many people with self-isolation measures and quarantines for which it was the only way to buy products. Due to the occurrence of the COVID-19 pandemic, the e-commerce industry has experienced rapid development [], and agricultural producers have also adjusted to intensively use this distribution channel for the sales of their products. Very often, e-commerce is especially used in organic food purchase, especially in western European countries. The various alternatives that allow consumers to purchase organic products online now include the websites of major food retailing chains, which compete with smaller companies that operate exclusively on the internet. The internet has also become a powerful relational marketing tool that acts as an instrument of social interaction, making it possible not only to attract consumers but also to secure consumer loyalty. Consequently, a mechanism to boost the home market consumption of organic products can be found in technology [].

Only a few Croatian organic food producers can compete in retail chains with foreign organic producers. The reason for this is the low ability of farmers to operate independently in the market. In addition, distribution within the organic food sector is quite inefficient. Although there is interest in expanding the organic food market, there is a lack of studies that address the distribution channels of organic food in developing countries, such as Croatia [].

Prior research has shown that usage of distribution channels for organic food products depends on different stages of development of the organic market in individual countries (e.g., emerging markets or mature markets), and organic producers also market their products through different channels [,,]. Additionally, due to the specifics of organic production and the small production quantities, depending on the number of stakeholders involved and the type of product (fresh or processed), distribution channels may look different. Figure 1 shows an overview of the usual distribution channels for organic food products in Croatia. Organic food producers in Croatia mostly use direct distribution channels (on-farm sales, specialized fairs, and home delivery) because they produce small quantities and mostly produce fresh organic products []. In terms of indirect distribution, specialised stores are the dominant form of retail, especially when it comes to organic products, followed by wholesale. Domestic supply generally cannot meet demand and domestic retail chains selling organic products offer a variety of imported products. A small number of organic producers sell their products through small grocery stores and emerging distribution channels, such as hotels, restaurants, and cafes (Ho-Re-Ca).

Figure 1.

Distribution channels in Croatian organic food market. Source: own interpretation.

4. Empirical Research

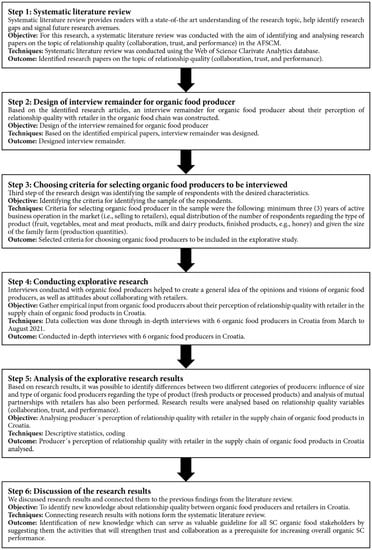

4.1. Methodology

Figure 2 shows a detailed elaboration of our research design (i.e., steps of research design, objective, techniques used, and outcome). In this study, we used in-depth interviews that provided better access to the thoughts, attitudes, and motivational ideas of organic food producers (according to []). Respondents were informed that the data provided during the in-depth interview would be used exclusively for scientific purposes, and that the individual data on organic food producers would not be used, but only aggregate data, which would guarantee the anonymity of the research.

Figure 2.

Research design.

First, a sample of respondents with the desired characteristics was found. Criteria for selecting the organic food producers in the sample were the following: minimum three (3) years of active business operation in the market (i.e., selling to retailers), equal distribution of the number of respondents regarding the type of product (fruit, vegetables, meat and meat products, milk and dairy products, and finished products, e.g., honey) and the size of the family farm (production quantities). This study was an exploratory field study in the Croatian organic food market. Using a semi-structured interview questionnaire (Appendix A), data collection was performed through in-depth interviews with six organic food producers in Croatia from March to August 2021.

Interviews conducted with organic food producers helped to create a general idea of the perceptions and visions of organic food producers, as well as attitudes about collaborating with retailers. It was also possible to identify differences between two different categories of producers and the influence of the size and type of organic food producers regarding the type of product (fresh products or processed products). An analysis of mutual partnerships with retailers was also performed.

The interview questions covered several topics [,] and the interview reminder consisted of 4 parts. In the first part, the respondents were asked about the structural characteristics of their production unit and their motives for engaging in organic production. The second part consisted of questions about the market and distribution of products (where they sell products and through which distribution channels). The third part focused on the relationship between producers and retailers of organic food products, with an emphasis on collaboration, trust, and performance. The last part was of an open type and referred to proposals for market development. Within the third part, organic food producers were asked about: inter-organisational collaboration, quality of communication with buyers (retailer), information, risk and resource sharing, relationship quality and commitment, long-term orientation (common plans and interests), power, dependency, opportunism, trust in the buyer, and overall SC performance.

The questions were deliberately expanded to allow respondents as much freedom as possible in their answers. However, in this paper, we focus on the third and fourth part of the interview reminder, which contains topics important for this discussion and textual evidence from the interview. The research findings were taken from the respondents themselves, which provides much more information and helps the goal of the research. All interviews were first recorded to increase data accuracy [] and later transcribed to allow detailed analysis [,].

Intra-case analysis involved writing a summary of each individual case to identify important facts, with a special focus on the main category of perceiving differently the main indicators of collaboration quality and relations with retailers. Following this process, a coding scheme was developed to assist in cross-case analysis [,] that included identifying similarities and differences in the attitudes of Category 1 and Category 2 respondents [], which is shown in Appendix B. The respondents were divided into two categories according to the intensity of their collaboration with the retailers. Category 1 consisted of two organic food producers who sell more than 50% of their products through retailers, while Category 2 consisted of four organic food producers whose dominant sales channel is direct selling at fairs and home delivery (approximately 80%) while the remaining 20% of sales is accomplished through the retail channel. Both Category 1 and Category 2 producers perceived differently the main indicators of quality collaboration and their relations with the retailers due to the size of the producer (i.e., its production capacities), different product characteristics (fresh products or processed products), and collaboration with the different retailers regarding their size and specialization. The gender structure of the sample was 50.0% men and 50.0% women. The age structure of the sample slightly shifts to older respondents. Furthermore, half of the respondents had completed secondary school and other half of the respondents completed high school or had a university degree. Five producers were registered as family farms, while one producer was registered as craft. Most producers (66.7%) stated that employees were family members and themselves. The key motives for organic production were primarily personal beliefs of producers (n = 3), followed by self-employment (n = 2), and health reasons (n = 1).

4.2. Results

The analysis of the results follows, with the inclusion of presentations of the key primary research evidence that was used in drawing conclusions. The main text discusses the research findings and provides some textual evidence supporting the statements from the interview reminder, and Table A1 contains additional abbreviated textual evidence for each of the two categories of respondents on the similarities and differences in their responses. A review of the literature, as well as the coding scheme, also facilitated in reporting the research findings.

4.2.1. Research Results of Inter-Organisational Collaboration

Category 1 producers mostly achieved formal/contractual collaboration with the specialized organic food retailers and with large retailers, such as retail chains, and to a lesser extent with small retailers. Contracts with the specialized retailers defined the quantities in advance, while contracts with large retailers were undefined in terms of quantities and deliveries were based on weekly supply and demand, rendering such sales unsafe for the producers. In addition, retailers required strict and controlled product quality. On the other hand, collaboration with small retailers was often informal and based on agreement and mutual trust, which is also typical of the smaller Category 2 producers. They mostly did business with small retailers because they could not provide the required quantities for the large ones. In spite of the flexibility, it was difficult for them to plan quantities because orders lacked continuity. Both categories of producers deemed that each side was oriented towards achieving its own goals, that there was no joint business planning, and that retailers mostly sought earnings. In both cases, positive past collaboration significantly affected the acquisition of trust in the relationship.

4.2.2. Research Results of Quality of Communication

Category 1 producers considered that they had quality, open, and frequent communication, especially with the specialized retailers that had departments in charge of informing their suppliers (e.g., about changes in legislation, standardization, etc.). Although they mostly communicate indirectly (online, etc.), they pointed out that it was very important for them to communicate ‘face to face’ with the retailers as often as possible. Category 2 producers mainly communicated informally with their buyers and also considered communication to be of high quality and very open. Both categories of organic food producers stated that communication with the retailers had a positive impact on the performance of their collaboration. Both groups of organic food producers affirmed that the first contacts with the retail distribution channel were mainly established at specialized eco-fairs, and that the frequency of communication depended significantly on the type of the product (fresh or processed).

4.2.3. Research Results of Information, Risk, Knowledge, and Resource Sharing

Category 1 producers generally exchanged information with the retailers about the quantities and quality of their products. With the specialized retailers, this information was timely, specific, and more accurate than with the other retailers, and it was consequently described as high quality, open, and honest. They even had an understanding regarding possible changes in the quantities of production in case of unforeseen circumstances. Specialized retailers also informed their suppliers about changes in legislation, in demand, etc. Sometimes they intervened with financial aid, for example in the form of an advanced payment so that the producer could prepare the product, and occasionally they engaged in joint promotions.

Category 2 producers pointed out that they had a more personalized relationship with small retailers and that there was a better interaction with the small retailers in terms of information about the demand for their products. In this way, long-lasting trust was created. However, retailers did not provide them with financial assistance and joint promotions. Unfortunately, both groups of producers were consistent in the conclusion that retailers were not interested in participating in the development of new products and found it difficult to accept them, and that there was no sharing of resources, such as warehousing, transport, etc., nor of production risks. In addition, retailers did not inform the organic food producers about the creation of and changes in retail prices, and there was no sharing of information about business performance.

Collaborative integration between actors in organic SCs is an opportunity to exchange information, expand knowledge, and solve problems together. Farmers must deepen their knowledge and skills regarding production technology, market conditions (e.g., new forms of sales and distribution channels, promotional activities), and formal and legal procedures as well as strengthen their competitive advantage over other market participants []. Networking with the various actors in the organic food sector is recommended, especially with retailers.

4.2.4. Research Results of Relationship Quality and Commitment

Category 1 producers believed that specialized retailers were reliable and secure customers and were mostly satisfied with the quality of the relationship. Although they did not participate in production planning, specialized retailers showed understanding for the producers’ problems regarding agricultural production. If problems arose, the retailer was ready to help and resolve them promptly. The producers expressed loyalty and commitment to the retailers, as working with them enabled them to develop professionally. Even if they had offers from alternative buyers, they would continue selling to their retailer (buyer).

Category 2 producers emphasised that their collaboration with the retailers, who were mostly trustworthy, was improving steadily. They were mainly committed to a quality relationship and collaboration with their retailers. Both categories of organic food producers solved problems and disagreements with the buyers quickly and often informally. Disagreements between retailers and producers were mostly rare, but both groups reported much less intensive collaborations with the large retailers.

4.2.5. Research Results of Long-Term Orientation

Category 1 producers stressed continuous efforts on improving long-term collaborations with their retailers and agreed that both parties invested significant efforts in developing quality long-term relationships and often discussed their mutual expectations. They also worked together on planning future demand. However, Category 2 organic food producers did not work continuously on improving long-term collaboration and generally did not discuss mutual expectations with their retailers. Both categories of producers did not collaborate with their retailers on joint production planning and the development of new products. All expected to continue and further develop their existing collaborations, but they were also open to collaborating with other, alternative retailers.

4.2.6. Research Results of Power, Dependence, and Opportunism

Both categories of organic food producers believed that, with the large retailers, the amount of production could affect their bargaining power. However, they also pointed out that as production increased, they became increasingly dependent on the retail chains. They also agreed that retailers had more bargaining power in the SC, although still not full power. All organic food producers stated that there were alternative buyers on the food market for them. The first category believed that product quality also had a significant impact on their bargaining power (especially with regard to processed products). Additionally, they felt that smaller customers did not dominate as much, that they were more flexible, and that they sometimes took products that they had not ordered. However, they ultimately said that ‘it turns out that retailers impose conditions’ because the producers must comply with what the retailer requires (quantity, method and time of delivery, etc.) i.e., through contracts. Both categories of organic food producers agreed that the retailers did not always follow only their own interests but respected the traditions and beliefs of the organic food producer.

4.2.7. Research Results of Trust

Category 1 organic food producers had great trust in the retailers, due to the high integrity in the SC and to their long-term collaboration as the basis of the trust. They believed in the sincerity of the retailers’ advice and expertise, as well as in the information and data they provided. They believed that the retailers generally kept their promises and treated them fairly and justly; hence, in the case of uncertain circumstances, they would remain loyal to the retailers. Furthermore, in terms of trust, they would recommend collaborating with their retailer to other suppliers. Nevertheless, the second group of organic food producers did not have complete confidence in their retailers. They believed in the expertise and the advice that the retailers shared with them, but they did not fully trust the information. Trust was also based on long-term collaboration and good reputation in the market, i.e., with the consumers. Customers were generally honest and kept their promises, but relationship problems could undermine customer loyalty. Since they felt that their retailers generally treated them fairly and justly, they would recommend their buyers to other suppliers.

4.2.8. Research Results of Overall Performance

Regarding the impact of collaboration and trust on business performance, Category 1 producers believed that collaboration and trust had a significant effect on improving communication, reducing business risk, and optimizing the use of resources and inventories in the SC as well as demand planning, the speed of resolving complaints, forming prices lower than the competition’s, introducing and/or improving online business, and reducing opportunistic behaviour of retailers. They also believed that the quality of collaboration and trust in the retailer influenced them to increase profits, improve product quality, and achieve a better competitive advantage. Collaboration and trust did not significantly affect their operational performance, such as reliability and speed of delivery and lead time.

In Category 2, completely opposite perceptions of organic food producers were identified, as collaboration and trust significantly affected the reliability and speed of delivery and lead time. However, they did not significantly influence the optimization of the use of resources, SC optimization, demand planning and complaint resolution, lower-than-competition pricing, increasing profits, introduction and/or improvement of e-business, the quality of communication, the reduction of business risks, or the reduction of opportunistic behaviour by the retailers. In short, collaboration and trust did not affect the improvement of product quality in the slightest.

In addition, the findings of the study showed the positive effects of collaborative relationships on supply chain performance, including financial, innovation, operational, environmental, social, and economic performances [].

4.2.9. Suggestions for Market Development

All producers also perceived the problems in the market of organic agri-food products and gave the following recommendations for the development of that market. As one of the bigger problems, they pointed out the poor information about organic products for consumers, who often do not notice the difference between domestic, peasant, and organic production. They believe that more effort should be put into promotion, in which the competent institutions should be involved. The representation of domestic products in stores needs to be strengthened, and retailers should reduce margins so that organic products are more affordable for consumers. They believe that the control of organic producers should be strengthened, due to the unfair competition of producers who present themselves as such. The association of organic food producers, the construction of joint distribution centres with the necessary infrastructure, and the organisation of special stands for organic producers in the markets were some of the other proposals. They also believe that producers should be more oriented towards processing, as this would allow them to be present on store shelves and to achieve greater added value for their products.

5. Discussion

The results show that inter-organisational collaboration with retailers is of greater importance for Category 1 producers because they sell about 50% of their products through retail channels. Organic food producers recognize the importance of working with the retailers to make sales easier. Contracts with the specialized retailers that define conditions enable better production planning and better development of trust in the retailer. A study [] found that some producers use contracts for making an investment or promoting a product, which is important to ensure their brand image among the customers. Additionally, Australian vegetable growers prefer contractual relationships to ensure stable prices. This finding is in line with another study [] where the authors found that contracts are a highly preferable option for vegetable producers in bringing down the price risks.

The sale of products to large retailers is not safe for organic food producers because the contracts are not pre-quantified, which affects the uncertainty of production for the organic producers and can cause surpluses or shortages. In general, there is no lasting and secure collaboration and there is a great deal of uncertainty. According to [], the higher the uncertainty in the chain, the lesser the trust will be. As collaborative advantages among the chain partners and their willingness to collaborate increases, trust builds up. Uncertainty occurs with smaller organic food producers (Category 2) who mainly collaborate with smaller retailers, because this collaboration is not safe nor concretely and clearly defined. The agreements are based on the ordered quantities, on which the rebates or sales prices also depend. Smaller stores mostly work with smaller organic food producers, and they find it difficult to commit to buying certain quantities of products regularly. On the other hand, it is the flexibility in order quantities here that is a favourable feature. Collaboration with small retailers in both cases is mainly based on trust and verbal agreements. In this way, organic food producers and retailers communicate more often, relationships are more flexible, and it is easier to adapt to market changes, which is in line with the findings of [].

Category 2 organic food producers still prefer to sell products directly because they have little bargaining power compared to large retailers. In addition, since their production is small, it is more profitable and safer for them to sell directly to final consumers, where there is no delay in payment. This research showed that the producers are not dependent on retailers because they sell small quantities (about 20% of total production), which does not affect their profits significantly. This is contrary to the research of Sun et al. []. According to their findings [], due to the significantly higher number of suppliers compared to buyers of organic products, suppliers must rely on retailers or distributors in many ways to secure their profits. Given that countries differ significantly in the level of organic food consumption and production, especially in relation to the share of conventional production, Orsini et al. [] conducted a study in eight EU countries and divided organic food markets into mature and new markets. The organic market is developed in Germany, France, Great Britain, Italy, and Spain, while Hungary, the Czech Republic, and Estonia have new organic markets. The Croatian organic food market is also one of the new markets in terms of its characteristics. Findings of FiBL [] and the research by Orsini et al. [] show that most organic food in Europe’s mature markets is sold through supermarkets, while a smaller number of organic food farmers sell their products directly to consumers or through ‘alternative’ chains, such as specialized organic food shops, box schemes, markets, etc. These data were not specified for specific products and depending on the type of product the distribution channel can differ significantly. The results from Orsini et al. [] do not confirm a clear distinction between mature and emerging markets, as shown in previous studies [,]. However, our study confirmed that the Croatian market belongs to the new market category, and is still underdeveloped in terms of demand, where organic food is still mostly sold through direct distribution channels, although this can sometimes be influenced by the type of product (fresh or processed) and not only the phase of development of the organic food market []. The problem with distribution through retailers, in relation to direct sales, is both strict standardization and quality requirements, especially for fresh products (size, colour, etc.), which is difficult to achieve in agricultural production, especially organic. Product quality is an important aspect of contractual collaboration in the Indonesian supermarket channels []. Our study showed that, due to the standardization requirements and often undefined contracts, organic food producers often have surpluses that they try to place on the market through direct sales channels.

The results also show that organic food producers are generally satisfied with their communication with the retailers. Orders or quantities depend on the type of product and the season, which significantly affects the frequency of communication; communication is more frequent in the season, but often sporadic as there is no continuity in orders. In selling fresh products, the communication is dynamic (‘you have to be always ready’), and ‘just in time’ delivery is expected; hence, communication by phone or by e-mail takes place on a daily basis. Processed products require less active communication due to their longer shelf life. Producers communicate with the retailers mainly about orders, deliveries, and collecting goods. Moreover, the findings of [] indicate that the communication between the retailers and the suppliers of organic food products is somewhat limited to short-term activities concerning the role and terms of the products in their focal assortment. The same authors believe that the farmers’ mistrust towards the retailers suggests that some form of communication is necessary for the creation of trust; however, they point out that the frequency and the form of communication are less important than its quality. In our study some of the smaller producers believed that they were ‘still learning to communicate’ with retailers. Informal collaboration also results in informal communication that is high quality and open but does not significantly affect its success. The research results from Fischer [] indicate that trust in SC partners can be improved significantly by effective communication and by positive past collaboration. We believe that quality communication can only be achieved if relevant information, knowledge, resources, and risks are shared, especially from the point of view of small farmers who are at a disadvantage compared to the retailers. According to Sun et al. [], retailers are usually in a dominant position in AFSCs, and when they attach importance to sharing information the suppliers will perceive it as fair.

The results of this study indicate problems in the exchange of information between organic farmers and retailers. The exchange of information depends a great deal on the type of retailers with which the organic food producers collaborate. Retailers do not exchange information about production processes because retailers are less informed and have less knowledge about it than producers; thus, there is a sharing of knowledge about market factors but not about organic production. Poor knowledge sharing is not unique to organic chains but is found in other food chains as well []. Findings of Anastasiadis et al. [] point to the problematic flow of information within the SC resulting in minimal trust among stakeholders. However, our study showed that although organic food producers are not completely satisfied with the exchange of information, given the type and quantity, they still believe that the information received from retailers is mostly accurate and timely. Consequently, the exchange of information did not significantly affect the trust in retailers because trust is mostly built on previous experience of quality and fair collaboration. Producers bear the risks of production, payments, and infrastructure investments, and retailers are not willing to share these risks with them. They receive no support in terms of infrastructure, as retailers do not provide logistic infrastructure (e.g., transport, cooler storage, and warehouse space). The development of infrastructure (warehouses, cold stores, packaging plants, processing plants, etc.) is crucial for better long-term collaboration. In their studies, Lu et al. [] and Uddin [] argued that mutual investment can activate the buyer–seller relationship, enhance business transactions, and improve SC efficiency and performance. Additionally, retailers do not exchange information about the retail prices and margins that they define, and the latter may vary from 10 to 40%. They very rarely work on joint promotion, although producers point out that the best promotion for them is word of mouth, which is achieved through direct sales and direct contact with consumers. According to research by Callado and Jack [], customer satisfaction, not financial sustainability, is the driver of collaboration between SC partners and one of the important indicators of SC success. Alternatively, while retailers share information on sales and demand for the products, they do not inform the producers on customer needs and satisfaction. This is unfortunate, as it is very important for the organic SC to achieve greater communication with consumers due to the development of the organic market. Collaborative integration between actors in organic SCs is an opportunity for exchanging information, expanding knowledge, and solving problems together. Farmers have to deepen their knowledge and skills regarding production technology, market conditions (e.g., new forms of sales and distribution channels and promotional activities), and formal and legal procedures, and strengthen their competitive advantage over other market participants []. Networking with the various actors in the organic food sector is recommended, especially with the retailers.

Our research results indicate that both categories of organic food producers are mainly satisfied with the quality of the relationship that they accomplish with the retailers who mostly fulfil their expectations. They are very committed to a quality relationship and collaboration with their retailers. Producers have been improving their collaboration with the retailers who are more aware and for whom the offer of organic products is important. These are mostly small or specialized retailers who are much more flexible, and their relationships are more based on interpersonal trust. It is necessary to enhance quantity planning so that producers do not encounter problems with surpluses or shortages of production. On the other hand, collaboration and relationships with large retailers are not guaranteed nor permanent and are mostly purely business relationships and not friendships. Organic food producers are not completely satisfied with the prices that their products attain; however, price satisfaction does not seem to have the strongest impact, which is consistent with the findings of [].

Both categories of organic food producers deem that their buyers have a good reputation in the market, which can significantly affect their performance and recognition of their product with consumers. When farmers believe that a buyer will be more successful in the long run, they consider the quality of the relationship more favourable []. In addition, the results of a study by Mesić et al. [] confirm the positive and significant influence of reputation on SC performance. Retailers, apart from the specialized ones, do not know enough about the specifics of organic production, nor do they promote the advantages of organic products enough. All organic producers agree that trust, reliability, and safety depend hugely on the quality of the product. After years of collaboration and continuity in quality, personal trust (xinyong) develops close relationships (guanxi) between the actors. The findings of a study by Lobo et al. [] suggest that xinyong is the key mediator between guanxi and the supplier’s loyalty to the buyer and financial performance. Satisfaction has a positive effect on the farmers’ commitment. The positive impact of satisfaction on commitment supports a study by Sahara and Gyau []. Farmers feel satisfied when their buyers provide favourable economic rewards (e.g., offer satisfactory prices), when the farmers’ expectation of what they should receive has been met, and when their buyers quickly respond to their complaints.

The results of this study show that larger Category 1 producers are investing more effort into developing long-term collaborations. For them, this sales channel is important because they sell about 50% of their products through retailers. However, Category 2 producers are smaller and they collaborate less with retailers. It could be concluded that they are still developing relationships with their retailers. Insufficient production is currently the biggest obstacle to product placement through retail channels and, consequently, the development of long-term collaboration. It would be important for organic producers to develop collaboration with specialized retailers where consumers of organic products gravitate. For small producers, sales through retailers would be more important outside their area, i.e., all over Croatia, because direct sales are a simpler and more acceptable distribution channel for reaching the nearby consumers.

Organic food producers believe that long-term collaboration also tends to be hindered by the retailers’ high margins, which make their products inaccessibly expensive in stores. Therefore, they consider trust as the basis for the development of long-term collaboration. Recent research, as well as this study, has confirmed that trust is important in developing long-term collaboration between farmers and retailers and an important driver of integration and collaboration within food SCs, which is contrary to previous research [,,,]. For example, Dapiran and Hogarth-Scott [], in their study of food retail in the UK and Australia, argue that collaboration and trust are not the same; Hogarth-Scott [] believes that power is the functional equivalent of trust, producing the same outcome, and collaboration is the result.

According to research by Sun et al. [], suppliers perceive high levels of distributive fairness if they sell their products at satisfying prices. The procurement prices offered by the retailers and the prices at which they sell the products to the consumers are the key factors for distributing the common incomes of the AFSCs and are also connected to the suppliers’ profits. The results of this research have revealed that procedural fairness has a strong positive effect on trust and commitment. The greater the level of trust among the chain actors, the higher the probability for the development of long-term collaboration []. As the satisfaction of farmers increases so does trust, which leads to long-term commitment to the relationship []. Willingness to collaborate affects trust and vice versa []. Trust fosters long-term relationships [], reduces opportunistic behaviour [], and increases the competitiveness and the performance of SCs.

Dependence on the retailer is more pronounced with larger producers, which is associated with higher production volumes and higher product placement through retailers, as well as with the quality and type of products (fresh or processed). High-level dependence might lead to uncertainties and opportunistic behaviours, resulting in conflicts that may negatively affect the overall collaboration and performance []. Producers who have high-quality products, especially processed products (e.g., olive or pumpkin oil), also have greater bargaining power, especially with regard to negotiating prices. The fact is that small farmers who are highly disorganized and lack support in infrastructure have a weak bargaining power [,]. However, the findings show that low bargaining power is not a problem for them at present as they do not depend on the retailers who are only an additional sales channel. For them, direct sales are more acceptable because they can dictate the prices of their products.

Retailers, on the other hand, form prices that are often much higher than those that the producers can achieve by direct sales. The growing bargaining power in the retailer sector seems to have a major influence in setting the product prices and distribution of margins within the chain []. The use of power can reduce the quality of the relationship, which then affects the operational efficiency of the supplier []. On the other hand, in their study, Kottila and Rönni [] found that neither power imbalance nor difference of values form insuperable obstacles to the establishment of collaborative relationships in organic food chains and that quality communication is necessary for the creation of trust.

Trust is a crucial element in the AFSC due to the characteristics of food products, some of which may only be analysed after consumption, such as experience characteristics, and some may not be examined at all, such as credence characteristics []. The results of this study show that organic food producers trust their retailers quite entirely. Their trust is based on good past collaboration and good reputation of the retailer. Furthermore, trust and loyalty are more pronounced in relation to larger organic food producers and specialized organic food retailers. Organic food producers believe in the expertise, honest advice, and information that the retailers share with them. However, they believe that personal trust has not yet developed between them (xinyong), which is associated with honesty, credibility, reputation, and integrity of an individual based on a gentleman’s word []. The results of this study showed that, in addition to giving organic food producers better bargaining power, they also influence the development of trust between producers and retailers. In other words, a product that shows good potential in the market involves a minor economic risk for the retailer. This enables the development of trust in the product and more generally in the producers supplying the product [].

Literature shows diverse antecedents or determinants of trust in AFSCs [,,,] and the importance of developing trust for AFSC performance. However, some previous research indicates a lack of trust among stakeholders in organic SCs, e.g., due to problematic information flow within the SC [], lack of trust caused by lack of quality communication which particularly affects the personal and process dimension of trust [], low perceptions of organic food producers’ trust in retailers who rely more on the contractual relationship than on trust as a prerequisite for good collaboration [], etc. However, this research confirmed that a number of preconditions for the development of trust have been met between organic farmers and retailers, such as relationship satisfaction, contractual relationship with specialized retailers, quality of communication achieved through frequent communication, joint problem solving, partner reputation, flexibility in the relationship, reliability, goodwill, commitment, and positive past collaboration. On the other hand, the following preconditions for the development of trust and quality collaboration have not been fully met: credibility of information, reliability of promises, goal compatibility and investments, price transparency, price satisfaction, and personal trust.

Due to the specifics of AFSCs and the characteristics that distinguish them from other SCs, it is difficult to measure their performance []. Performance indicators of AFSCs are grouped into four main categories that contain financial and non-financial performance indicators [,,]: efficiency, flexibility, responsiveness, and food quality. Each of these main categories contains several different performance indicators. Efficiency measures the optimal use of resources in the SC and aims to maximize the added value of the process and minimize costs. Flexibility is the ability to adapt to a changing environment, and can be measured, for example, through flexibility in delivery or customer satisfaction. Responsiveness is the speed at which the SC delivers products to the customer. Food quality and food safety are special characteristics of food SCs that imply the quality of products and processes. The results of this study show that collaboration with the retailers affects the financial performance of the larger Category 1 producers, which is reflected in higher profits and competitiveness based on the ability to sell at lower prices than the competition and a partial reduction in costs. The results of the study by Naspetti et al. [] also show that in organic SCs, greater trust results in greater collaboration, which in turn will result in greater non-financial and financial impacts whereby the effect of trust on financial performance is not direct but mediated by higher collaboration. Effective collaboration with specialised retailers has contributed to the professionalism of larger organic food producers, especially in terms of standardization and food quality. This is in contrast to the findings of Naspetti et al. [], which indicate that there is no evidence that collaboration actually improves product quality and safety in organic food SCs. Contractual collaboration with the retailers contributes to production expansion, better production planning, and affects the expansion of family farms and employment. In their research, Bandara et al. [] found that RQ and collaboration performance are positively related to the supplier’s operating results. However, the problem occurs with large retailers who offer more European and well-known brands that are more recognizable to the consumers, which results in the Croatian products often being ‘lost’ on the shelves. In addition, sales to large retailers are not safe for the producers because the contracts are not defined in advance in terms of quantity and time, which affects the certainty of production and sales for the producers.

Given that the volume of sales through the retailers for smaller organic food producers is significantly lower (maximum 20% of total sales), collaboration and trust cannot significantly affect their financial and non-financial performance indicators. They mainly sell to small retailers and often depend on their monthly or seasonal sales dynamics. Reliability and speed of delivery are based on the flexibility of producers and trust in retailers. In the research conducted by Lobo et al. [], the authors confirmed that collaboration with the customer based on informal relationships and personal trust can significantly affect the loyalty and financial performance of suppliers. Collaboration with small retailers at the local and regional levels is considered successful, especially regarding fresh products (short SC). However, this sales channel is not crucial for them as it does not significantly affect their revenues and their competitiveness. They are more oriented towards direct sales where they achieve better interaction and communication with the end consumers, higher prices for their products, and ultimately higher profits. Collaboration with the retailers could affect performance, if they had larger quantities of products and thus could expand in the market (they could go beyond the local and regional market). In addition, small producers often do not have developed sales skills due to their production-orientation, which means that selling through retailers can significantly facilitate their marketing and promotion and allow them more time for what they specialise in, i.e., production.

6. Managerial Implications, Limitations, and Future Research Directions

Given that this is the first time a study was conducted about the organic food producers perceptions of relationship quality with retailers in the organic food SC in Croatia, this research represents an important contribution to business practice. The results of this research can serve as an informative basis for all members of the SC by encouraging them to reach proactively to improve collaboration and trust, which can lead to overall performance improvements in the organic food SCs.