Promoting Customer Loyalty and Satisfaction in Financial Institutions through Technology Integration: The Roles of Service Quality, Awareness, and Perceptions

Abstract

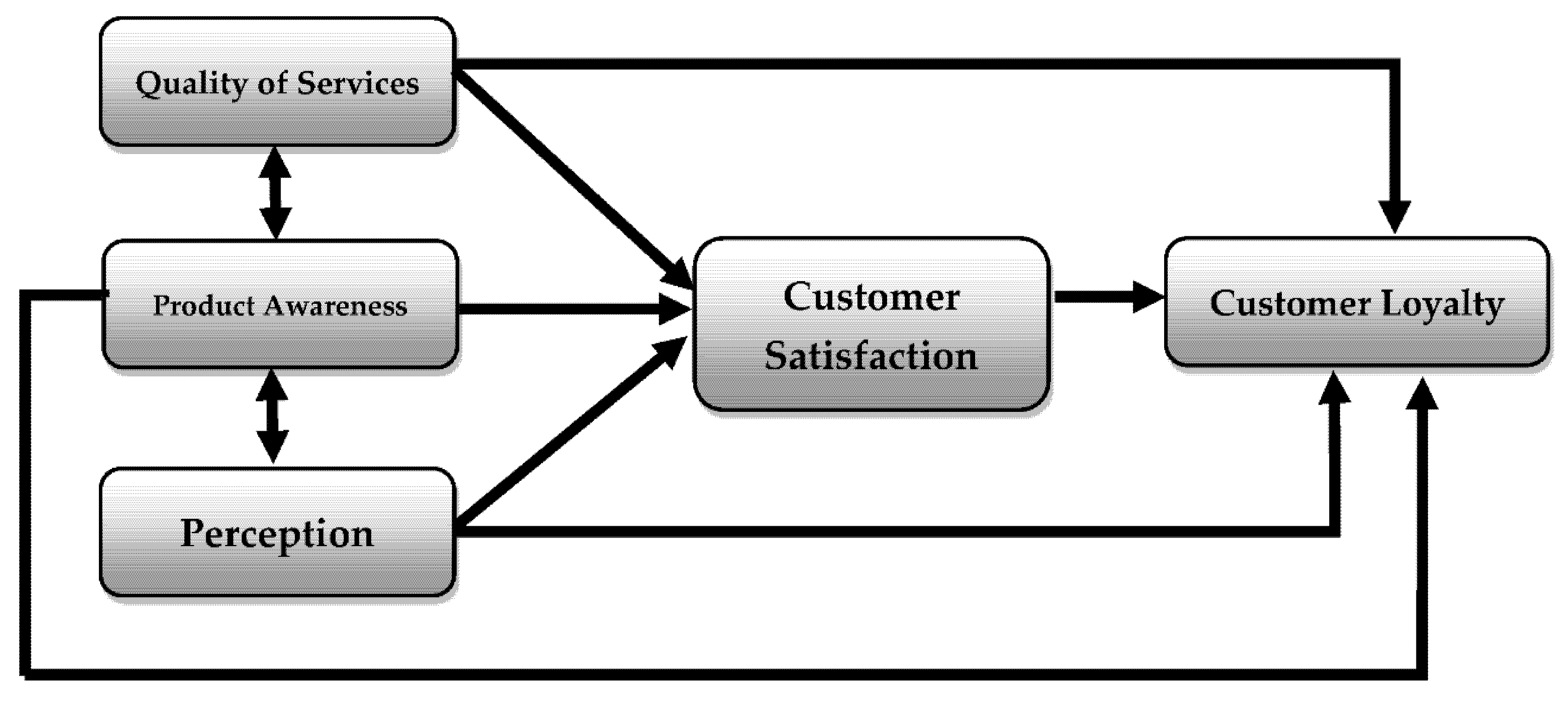

:1. Introduction

2. Literature Review

2.1. Customer Satisfaction Theory and Banking in Pakistan

2.2. Quality of Services and Customers Satisfaction

2.3. Product Awareness and Customer Loyalty

2.4. Perception and Customer Satisfaction

2.5. Loyalty and Customer Satisfaction

2.6. Mediating Role of Customer Satisfaction

3. Research Methodology

3.1. Population and Sampling

3.2. Measurement Scales and Sections of the Questionnaire

3.2.1. Quality of Services

3.2.2. Product Awareness

3.2.3. Perceptions

3.2.4. Customer Satisfaction

3.2.5. Customer Loyalty

4. Results and Discussions

5. Conclusions

Implications, Limitation and Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Thaker, H.M.T.; Sakaran, K.C.; Nanairan, N.M.; Thaker, M.A.M.T.; Hussain, H.I. Drivers of loyalty among non-Muslims towards Islamic banking in Malaysia. Int. J. Islamic Middle East. Financ. Manag. 2020, 13, 281–302. [Google Scholar] [CrossRef]

- Ullah, F.; Khan, S.I.; Qadir, Z.; Qayyum, S. Uav assisted spatiotemporal analysis and management of bushfires: A case study of the 2020 victorian bushfires. Fire 2021, 4, 40. [Google Scholar] [CrossRef]

- Zaman, M.R. Usury (Riba) and the place of bank interest in Islamic banking and finance. Int. J. Bank. Financ. 2020, 6, 1–15. [Google Scholar] [CrossRef]

- Munawar, H.S.; Hammad, A.; Ullah, F.; Ali, T.H. After the flood: A novel application of image processing and machine learning for post-flood disaster management. In Proceedings of the 2nd International Conference on Sustainable Development in Civil Engineering (ICSDC 2019), Jamshoro, Pakistan, 5–7 December 2019; pp. 5–7. [Google Scholar]

- Chaouch, N. Factors determining users’ and non-users’ choice of Islamic banks in Tunisia. Int. J. Islamic Mark. Branding 2016, 1, 321–340. [Google Scholar] [CrossRef]

- Inam, H.; Ullah, F.; Qayyum, S.; Kouzani, A.Z.; Mahmud, M.A.P. Towards smart healthcare: Uav-based optimized path planning for delivering COVID-19 self-testing kits using cutting edge technologies. Sustainability 2021, 13, 10426. [Google Scholar] [CrossRef]

- Qadir, Z.; Munir, A.; Ashfaq, T.; Khan, M.A.; Le, K. A prototype of an energy-efficient MAGLEV train: A step towards cleaner train transport. Clean. Eng. Technol. 2021, 4, 100217. [Google Scholar] [CrossRef]

- Hassan, M.K.; Aliyu, S.; Huda, M.; Rashid, M. A survey on Islamic finance and accounting standards. Borsa Istanb. Rev. 2019, 19, S1–S13. [Google Scholar] [CrossRef]

- Ullah, F.; Qayyum, S.; Heravi, A. Application of Deep Learning on UAV-Based Aerial Images for Flood Detection. Smart Cities 2021, 4, 1220–1243. [Google Scholar] [CrossRef]

- Khokhar, I.; ul Hassan, M.; Khan, M.N.; Amin, M.F.B.; Center, I.B. Investigating the Efficiency of GCC Banking Sector: An Empirical Comparison of Islamic and Conventional Banks. Int. J. Financ. Res. 2020, 11, 220–235. [Google Scholar] [CrossRef]

- Ullah, F.; Qayyum, S.; Khan, S.I.; Mojtahedi, M. Uavs in disaster management: Application of integrated aerial imagery and convolutional neural network for flood detection. Sustainability 2021, 13, 7547. [Google Scholar] [CrossRef]

- Tarazi, A.; Abedifar, P. Special issue on Islamic banking: Stability and governance. Glob. Financ. J. 2020, 100540. [Google Scholar] [CrossRef]

- Khan, S.I.; Ullah, F.; Kouzani, A.Z.; Parvez Mahmud, M.A. Effects of COVID-19 on the Australian economy: Insights into the mobility and unemployment rates in education and tourism sectors. Sustainability 2021, 13, 11300. [Google Scholar] [CrossRef]

- Qoyum, A.; Al Hashfi, R.U.; Zusryn, A.S.; Kusuma, H.; Qizam, I. Does an islamic-sri portfolio really matter? Empirical application of valuation models in indonesia. Borsa Istanb. Rev. 2020, 21, 105–124. [Google Scholar] [CrossRef]

- Maqsood, A. Isotropic surround suppression based linear target detection using hough transform. Int. J. Adv. Appl. Sci. 2017, 53322317. [Google Scholar]

- Zafar, M.B.; Sulaiman, A.A. Measuring corporate social responsibility in Islamic banking: What matters? Int. J. Islamic Middle East. Financ. Manag. 2020, 13, 357–388. [Google Scholar] [CrossRef]

- Zhang, J.; Li, H.; Mo, D.; Chang, L. Mining Multispectral Aerial Images for Automatic Detection of Strategic Bridge Locations for Disaster Relief Missions. In Trends and Applications in Knowledge Discovery and Data Mining; Springer: Cham, Switzerland, 2019; pp. 189–200. [Google Scholar] [CrossRef]

- Sufian, F. The efficiency of Islamic banking industry in Malaysia: Foreign vs. domestic banks. Humanomics 2007, 23, 174–192. [Google Scholar] [CrossRef]

- Munawar, H.S. Flood Disaster Management: Risks, Technologies, and Future Directions, Machine Vision Inspection Systems: Image Processing, Concepts. Methodol. Appl. 2020, 1, 115–146. [Google Scholar]

- Alkhan, A.M.; Hassan, M.K. Does Islamic Microfinance Serve Maqāsid Al-Shari’a? Borsa Istanb. Rev. 2020, 21, 57–68. [Google Scholar] [CrossRef]

- Khan, S.I.; Qadir, Z.; Kiani, Y.S.; Kouzani, A.Z.; Parvez Mahmud, M.A. Insights into the mobility pattern of australians during COVID-19. Sustainability 2021, 13, 9611. [Google Scholar] [CrossRef]

- Ahmad, F.; Seyyed, F.J.; Ashfaq, H. Managing a Shariah-Compliant Capital Protected Fund through Turbulent Times. Asian J. Manag. Cases 2020, 17, S32–S41. [Google Scholar] [CrossRef]

- Taap, M.A.; Chong, S.C.; Kumar, M.; Fong, T.K. Measuring service quality of conventional and Islamic banks: A comparative analysis. Int. J. Qual. Reliab. Manag. 2011, 28, 822–840. [Google Scholar] [CrossRef]

- Islam, J.U.; Rahman, Z. Awareness and willingness towards Islamic banking among Muslims: An Indian perspective. Int. J. Islamic Middle East. Financ. Manag. 2017, 10, 92–101. [Google Scholar] [CrossRef]

- Othman, N.A.; Gaffar, V.; Setiyorini, H.P.D. Comparative analysis of Islamic quality standard hotels in Malaysia and Indonesia. Int. J. Islamic Mark. Branding 2017, 2, 232–246. [Google Scholar] [CrossRef]

- Mohd Suki, N.; Abang Salleh, A.S. Does Halal image strengthen consumer intention to patronize Halal stores? Some insights from Malaysia. J. Islamic Mark. 2016, 7, 120–132. [Google Scholar] [CrossRef]

- Cham, T. Determinants of Islamic banking growth: An empirical analysis. Int. J. Islamic Middle East. Financ. Manag. 2018, 11, 18–39. [Google Scholar] [CrossRef] [Green Version]

- Dillman, D.A. Mail and Internet Surveys: The Tailored Design Method—2007 Update with New Internet, Visual, and Mixed-Mode Guide; John Wiley & Sons: Hoboken, NJ, USA, 2011. [Google Scholar]

- Tan, Y.; Floros, C. Risk, competition and efficiency in banking: Evidence from China. Glob. Financ. J. 2018, 35, 223–236. [Google Scholar] [CrossRef]

- Reza Jalilvand, M.; Shahin, A.; Nasrolahi Vosta, L. Examining the relationship between branding and customers’ attitudes toward banking services: Empirical evidence from Iran. Int. J. Islamic Middle East. Financ. Manag. 2014, 7, 214–227. [Google Scholar] [CrossRef]

- Moriuchi, E.; Takahashi, I. Satisfaction trust and loyalty of repeat online consumer within the Japanese online supermarket trade. Australas. Mark. J. (AMJ) 2016, 24, 146–156. [Google Scholar] [CrossRef]

- Liang, L.-W.; Chang, H.-Y.; Shao, H.-L. Does sustainability make banks more cost efficient? Glob. Financ. J. 2018, 38, 13–23. [Google Scholar] [CrossRef]

- Priem, R. An Exploratory Study on the Impact of the COVID-19 Confinement on the Financial Behavior of Individual Investors. Econ. Manag. Financ. Mark. 2021, 16, 9–40. [Google Scholar] [CrossRef]

- Shaukat, M.A.; Shaukat, H.R.; Qadir, Z.; Kouzani, A.Z.; Mahmud, M.A.P. Cluster Analysis and Model Comparison Using Smart Meter Data. Sensors 2021, 21, 3157. [Google Scholar] [CrossRef]

- Sharma, R.W. IndiGo Airlines Brand Crisis: Assault on Passenger Goes Viral. Asian J. Manag. Cases 2020, 0972820120918968. [Google Scholar] [CrossRef]

- Akbar, S.; Zulfiqar Ali Shah, S.; Kalmadi, S. An investigation of user perceptions of Islamic banking practices in the United Kingdom. Int. J. Islamic Middle East. Financ. Manag. 2012, 5, 353–370. [Google Scholar] [CrossRef]

- Rashid, A.; Jabeen, S. Analyzing performance determinants: Conventional versus Islamic banks in Pakistan. Borsa Istanb. Rev. 2016, 16, 92–107. [Google Scholar] [CrossRef] [Green Version]

- Fang, E.S. Three decades of “repackaging” Islamic finance in international markets. J. Islamic Mark. 2016, 7, 37–58. [Google Scholar] [CrossRef]

- Hassan, M.T.; Ahmed, M.; Imran, M.; Naeem, A.; Waheed, M.; Ahmed, S. Customer Perception Regarding Car Loans in Islamic and Conventional Banking. Int. J. Learn. Dev. 2012, 2, 174–185. [Google Scholar] [CrossRef] [Green Version]

- Arbore, A.; Busacca, B. Customer satisfaction and dissatisfaction in retail banking: Exploring the asymmetric impact of attribute performances. J. Retail. Consum. Serv. 2009, 16, 271–280. [Google Scholar] [CrossRef]

- Ullah, F.; Speasgozar, S.M.E.; Siddiqui, S.Q. An Investigation of Real Estate Technology Utilization in Technologically Advanced Marketplace. In Proceedings of the 9th International International Civil Engineering Congress (ICEC-2017) “Striving Towards Resilient Built Environment”, Karachi, Pakistan, 22–23 December 2017; pp. 173–183. [Google Scholar]

- Krishnamurthy, R.; SivaKumar, M.A.K.; Sellamuthu, P. Influence of service quality on customer satisfaction: Application of SERVQUAL model. Int. J. Bus. Manag. 2010, 5, 117. [Google Scholar] [CrossRef] [Green Version]

- Faed, A. Handling e-complaints in customer complaint management system using FMEA as a qualitative system. In Proceedings of the 2010 6th International Conference on Advanced Information Management and Service (IMS), Seoul, Korea, 30 November–2 December 2010; pp. 205–209. [Google Scholar]

- Munawar, H.S. Image and Video Processing for Defect Detection in Key Infrastructure. In Machine Vision Inspection Systems; Wiley: Hoboken, NJ, USA, 2020; pp. 159–177. [Google Scholar] [CrossRef]

- Ullah, F.; Al-Turjman, F.; Qayyum, S.; Inam, H.; Imran, M. Advertising through UAVs: Optimized path system for delivering smart real-estate advertisement materials. Int. J. Intell. Syst. 2021, 36, 3429–3463. [Google Scholar] [CrossRef]

- Ullah, F.; Sepasgozar, S.M.; Shirowzhan, S.; Davis, S. Modelling users’ perception of the online real estate platforms in a digitally disruptive environment: An integrated KANO-SISQual approach. Telemat. Inform. 2021, 63, 101660. [Google Scholar] [CrossRef]

- Ullah, F.; Sepasgozar, S.M.; Thaheem, M.J.; Al-Turjman, F. Barriers to the digitalisation and innovation of Australian Smart Real Estate: A managerial perspective on the technology non-adoption. Environ. Technol. Innov. 2021, 22, 101527. [Google Scholar] [CrossRef]

- Ullah, F.; Sepasgozar, S.M.; Thaheem, M.J.; Wang, C.C.; Imran, M. It’s all about perceptions: A DEMATEL approach to exploring user perceptions of real estate online platforms. Ain Shams Eng. J. 2021, in press. [Google Scholar] [CrossRef]

- Md Husin, M.; Ismail, N.; Ab Rahman, A. The roles of mass media, word of mouth and subjective norm in family takaful purchase intention. J. Islamic Mark. 2016, 7, 59–73. [Google Scholar] [CrossRef]

- Ullah, F.; Qayyum, S.; Thaheem, M.J.; Al-Turjman, F.; Sepasgozar, S.M. Risk management in sustainable smart cities governance: A TOE framework. Technol. Forecast. Soc. Chang. 2021, 167, 120743. [Google Scholar] [CrossRef]

- Sundström, M.; Hjelm-Lidholm, S. Re-positioning customer loyalty in a fast moving consumer goods market. Australas. Mark. J. (AMJ) 2020, 28, 30–34. [Google Scholar] [CrossRef]

- Anderson, R.E.; Srinivasan, S.S. E-satisfaction and e-loyalty: A contingency framework. Psychol. Mark. 2003, 20, 123–138. [Google Scholar] [CrossRef]

- Cohen, S.; Macek, J. Cyber-Physical Process Monitoring Systems, Real-Time Big Data Analytics, and Industrial Artificial Intelligence in Sustainable Smart Manufacturing. Econ. Manag. Financ. Mark. 2021, 16, 55–67. [Google Scholar]

- Ullah, F.; Thaheem, M.J.; Umar, M. Public-private partnerships in Pakistan: A nascent evolution. In Public-Private Partnerships in Transitional Nations: Policy, Governance and Praxis; Mouraviev, N., Kakabadse, N., Eds.; Cambridge Scholars Publishing: Cambridge, UK, 2017; Volume 1, pp. 127–150. [Google Scholar]

- Maqsoom, A.; Aslam, B.; Gul, M.E.; Ullah, F.; Kouzani, A.Z.; Mahmud, M.; Nawaz, A. Using Multivariate Regression and ANN Models to Predict Properties of Concrete Cured under Hot Weather: A Case of Rawalpindi Pakistan. Sustainability 2021, 13, 10164. [Google Scholar] [CrossRef]

- Aslam, B.; Maqsoom, A.; Khalid, N.; Ullah, F.; Sepasgozar, S. Urban overheating assessment through prediction of surface temperatures: A case study of karachi, Pakistan. ISPRS Int. J. Geo-Inf. 2021, 10, 539. [Google Scholar] [CrossRef]

- Ullah, F.; Thaheem, M.J.; Sepasgozar, S.M.; Forcada, N. System Dynamics Model to Determine Concession Period of PPP Infrastructure Projects: Overarching Effects of Critical Success Factors. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2018, 10, 04518022. [Google Scholar] [CrossRef]

- Ali, Q.; Thaheem, M.J.; Ullah, F.; Sepasgozar, S.M. The Performance Gap in Energy-Efficient Office Buildings: How the Occupants Can Help? Energies 2020, 13, 1480. [Google Scholar] [CrossRef] [Green Version]

- Naveed, T.; Akhtar, I.; Cheema, K.U.R. The impact of innovation on customer satisfaction and brand loyalty: A study of the students of Faisalabad. Int. J. Manag. Organ. Stud. 2012, 2, 62–68. [Google Scholar]

- Akhtar, M.F.; Ali, K.; Sadaqat, S. Liquidity risk management: A comparative study between conventional and Islamic banks of Pakistan. Interdiscip. J. Res. Bus. 2011, 1, 35–44. [Google Scholar]

- Hussain, R. The mediating role of customer satisfaction: Evidence from the airline industry. Asia Pac. J. Mark. Logist. 2016, 28, 234–255. [Google Scholar] [CrossRef]

- Chandrashekaran, M.; Rotte, K.; Tax, S.S.; Grewal, R. Satisfaction strength and customer loyalty. J. Mark. Res. 2007, 44, 153–163. [Google Scholar] [CrossRef]

- Terpstra, M.; Kuijlen, T.; Sijtsma, K. How to develop a customer satisfaction scale with optimal construct validity. Qual. Quant. 2014, 48, 2719–2737. [Google Scholar] [CrossRef]

- Chou, P.F.; Lu, C.S. Assessing service quality, switching costs and customer loyalty in home-delivery services in Taiwan. Transp. Rev. 2009, 29, 741–758. [Google Scholar] [CrossRef]

- Lam, R.; Burton, S. SME banking loyalty (and disloyalty): A qualitative study in Hong Kong. Int. J. Bank Mark. 2006, 24, 37–52. [Google Scholar] [CrossRef] [Green Version]

- Lin, G.T.; Sun, C.-C. Factors influencing satisfaction and loyalty in online shopping: An integrated model. Online Inf. Rev. 2009, 33, 458–475. [Google Scholar] [CrossRef] [Green Version]

- Carrillat, F.A.; Jaramillo, F.; Mulki, J.P. Examining the impact of service quality: A meta-analysis of empirical evidence. J. Mark. Theory Pract. 2009, 17, 95–110. [Google Scholar] [CrossRef]

- Ullah, F.; Thaheem, M.J.; Siddiqui, S.Q.; Khurshid, M.B. Influence of Six Sigma on project success in construction industry of Pakistan. TQM J. 2017, 29, 276–309. [Google Scholar] [CrossRef]

- Mosahab, R.; Mahamad, O.; Ramayah, T. Service quality, customer satisfaction and loyalty: A test of mediation. Int. Bus. Res. 2010, 3, 72. [Google Scholar] [CrossRef] [Green Version]

- Ross, S.D. A conceptual framework for understanding spectator-based brand equity. J. Sport Manag. 2006, 20, 22–38. [Google Scholar] [CrossRef]

- Khan, N.A. Marketing a Taboo Product: Tackling the Consumer Mind-set in Pakistan. Asian J. Manag. Cases 2018, 15, 147–160. [Google Scholar] [CrossRef]

- Ullah, F.; Sepasgozar, S.M.; Wang, C. A systematic review of smart real estate technology: Drivers of, and barriers to, the use of digital disruptive technologies and online platforms. Sustainability 2018, 10, 3142. [Google Scholar] [CrossRef] [Green Version]

- Ullah, F.; Samad Sepasgozar, P.; Ali, T.H. Real estate stakeholders technology acceptance model (RESTAM): User-focused big9 disruptive technologies for smart real estate management. In Proceedings of the 2nd International Conference on Sustainable Development in Civil Engineering (ICSDC 2019); Jamshoro, Pakistan, 5–7 December 2019, pp. 25–27.

- Meilhan, D. Customer Value Co-Creation Behavior in the Online Platform Economy. J. Self-Gov. Manag. Econ. 2019, 7, 19–24. [Google Scholar] [CrossRef] [Green Version]

- Mirica, C.O. The Behavioral Economics of Decision Making: Explaining Consumer Choice in Terms of Neural Events. Econ. Manag. Financ. Mark. 2019, 14, 16–20. [Google Scholar] [CrossRef] [Green Version]

- Drugău-Constantin, A. Is Consumer Cognition Reducible to Neurophysiological Functioning? Econ. Manag. Financ. Mark. 2019, 14, 9–14. [Google Scholar] [CrossRef] [Green Version]

- Popescu, G.H.; Ciurlău, F.C. Making Decisions in Collaborative Consumption: Digital Trust and Reputation Systems in the Sharing Economy. J. Self-Gov. Manag. Econ. 2019, 7, 7–12. [Google Scholar] [CrossRef] [Green Version]

- Aggarwal, R.; Qadir, Z.; Khan, S.I.; Kouzani, A.Z.; Mahmud, M.A.P. A gabor filter-based protocol for automated image-based building detection. Buildings 2021, 11, 302. [Google Scholar] [CrossRef]

- Qadir, Z.; Khan, S.I.; Khalaji, E.; Al-Turjman, F.; Mahmud, M.A.P.; Kouzani, A.Z.; Le, K. Predicting the energy output of hybrid PV–wind renewable energy system using feature selection technique for smart grids. Energy Rep. 2021, in press. [CrossRef]

- Awan, A.A.; Maqsood, A.; Khalid, U. Reinventing Radiology in Modern Era. IJ Wirel. Microw. Technol. 2020, 4, 34–38. [Google Scholar]

- Munawar, H.S.; Mojtahedi, M.; Hammad, A.W.; Kouzani, A.; Mahmud, M.P. Disruptive technologies as a solution for disaster risk management: A review. Sci. Total. Environ. 2021, 151351. [Google Scholar] [CrossRef]

- Hammad, A.W.A.; Waller, S.T. A review on flood management technologies related to image processing and machine learning. Autom. Constr. 2021, 132, 103916. [Google Scholar] [CrossRef]

- Munawar, H.S. Applications of leaky-wave antennas: A review. Int. J. Wirel. Microw. Technol. (IJWMT) 2020, 10, 56–62. [Google Scholar] [CrossRef]

- Liaquat, M.U.; Rahman, A.; Qadir, Z.; Kouzani, A.Z.; Mahmud, M.A.P. Sound localization for ad-hoc microphone arrays. Energies 2021, 14, 3446. [Google Scholar] [CrossRef]

- Munawar, H.S.; Qayyum, S.; Ullah, F.; Sepasgozar, S. Big Data and Its Applications in Smart Real Estate and the Disaster Management Life Cycle: A Systematic Analysis. Big Data Cogn. Comput. 2020, 4, 4. [Google Scholar] [CrossRef] [Green Version]

- Khalid, U.; Maqsood, A. Modern day detection of mines; using the vehicle based detection robot. IACST 2017. [Google Scholar]

- Khan, S.I.; Qadir, Z.; Nayak, S.R.; Budati, A.K.; Verma, K.D.; Prakash, D. UAVs path planning architecture for effective medical emergency response in future networks. Phys. Commun. 2021, 47, 101337. [Google Scholar] [CrossRef]

- Liaquat, M.U.; Rahman, A.; Qadir, Z.; Kouzani, A.Z.; Mahmud, M.A.P. Localization of sound sources: A systematic review. Energies 2021, 14, 3910. [Google Scholar] [CrossRef]

- Hammad, A.W.A.; Haddad, A.; Soares, C.A.P.; Waller, S.T. Image-based crack detection methods: A review. Infrastructures 2021, 6, 115. [Google Scholar] [CrossRef]

- Munawar, H.S.; Maqsood, A.; Mustansar, Z. Isotropic surround suppression and Hough transform based target recognition from aerial images. Int. J. Adv. Appl. Sci. 2017, 4, 37–42. [Google Scholar] [CrossRef]

- Khan, S.I.; Anum, N.; Qadir, Z.; Kouzani, A.Z.; Parvez Mahmud, M.A. Post-flood risk management and resilience building practices: A case study. Appl. Sci. 2021, 11, 4823. [Google Scholar] [CrossRef]

- Hammad, A.W.A.; Waller, S.T.; Thaheem, M.J.; Shrestha, A. An integrated approach for post-disaster flood management via the use of cutting-edge technologies and UAVs: A review. Sustainability 2021, 13, 7925. [Google Scholar] [CrossRef]

- Ullah, F.; Khan, S.I.; Qadir, Z.; Qayyum, S. Uav based spatiotemporal analysis of the 2019–2020 new south wales bushfires. Sustainability 2021, 13, 10207. [Google Scholar] [CrossRef]

- Khan, S.I.; Qadir, Z.; Kouzani, A.Z.; Mahmud, M.A.P. Insight into the impact of COVID-19 on Australian transportation sector: An economic and community-based perspective. Sustainability 2021, 13, 1276. [Google Scholar] [CrossRef]

- Qadir, Z.; Ullah, F.; Al-Turjman, F. Addressing disasters in smart cities through UAVs path planning and 5G communications: A systematic review. Comput. Commun. 2021, 168, 114–135. [Google Scholar] [CrossRef]

- Akram, J.; Javed, A.; Khan, S.; Akram, A.; Ahmad, W. Swarm intelligence based localization in wireless sensor networks. In Proceedings of the 36th Annual ACM Symposium on Applied Computing, Virtual, 22–26 March 2021; pp. 1906–1914. [Google Scholar] [CrossRef]

- Munawar, H.S. An Overview of Reconfigurable Antennas for Wireless Body Area Networks and Possible Future Prospects. Int. J. Wirel. Microw. Technol. 2020, 10, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Munawar, H.S. Reconfigurable Origami Antennas: A Review of the Existing Technology and its Future Prospects. Int. J. Wirel. Microw. Technol. 2020, 10, 34–38. [Google Scholar] [CrossRef]

- Khalid, U.; Maqsood, A. Fire detection through Image Processing: A brief overview. Int. Conf. Cult. Technol. 2017, 203–208. [Google Scholar]

- Khalid, U.; Jilani, R.; Maqsood, A. Version Management by Time Based Approach in Modern Era. Int. J. Educ. Manag. Eng. 2017, 7, 13–20. [Google Scholar] [CrossRef] [Green Version]

- Ali Awan, A.; Khalid, U.; Munawar, S.; Maqsood, A. Revolutionizing Telemedicine by Instilling H.265. Int. J. Image Graph. Signal Process. 2017, 9, 20–27. [Google Scholar] [CrossRef] [Green Version]

- Barbu, C.M.; Florea, D.L.; Dabija, D.C.; Barbu, M.C.R. Customer experience in fintech. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1415–1433. [Google Scholar] [CrossRef]

- Zeyad, M.; Ab Wahab, N. Factors affecting customer loyalty in Islamic banking: Evidence from Malaysian Banks. Int. J. Bus. Soc. Sci. 2013, 4, 264–273. [Google Scholar]

- Jayawardhena, C. Measurement of service quality in internet banking: The development of an instrument. J. Mark. Manag. 2004, 20, 185–207. [Google Scholar] [CrossRef]

- Washburn, J.H.; Plank, R.E. Measuring brand equity: An evaluation of a consumer-based brand equity scale. J. Mark. Theory Pract. 2002, 10, 46–62. [Google Scholar] [CrossRef]

| City | Population (Million) | Method of Data Collection |

|---|---|---|

| Karachi | 21.2 | Online |

| Lahore | 11.13 | Online |

| Islamabad | 2.01 | In person |

| Faisalabad | 7.87 | Online |

| Gujranwala | 5.01 | Online |

| Rawalpindi | 5.41 | In person |

| Peshawar | 4.27 | Online |

| Multan | 4.75 | Online |

| Chakwal | 1.50 | In person |

| Quetta | 2.28 | Online |

| Variable | Mean | S.D | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|---|

| Gender | 1.19 | 0.39 | |||||

| Age | 2.36 | 0.73 | |||||

| Religion | 1.01 | 0.11 | |||||

| Education Level | 4.61 | 0.67 | |||||

| Occupation | 2.40 | 0.86 | |||||

| Monthly Income | 2.09 | 0.91 | |||||

| Quality of Services | 1.67 | 0.55 | (0.81) | ||||

| Product Awareness | 2.09 | 0.75 | 0.34 ** | (0.86) | |||

| Perceptions | 1.96 | 0.61 | 0.42 ** | 0.31 ** | (0.89) | ||

| Customer Satisfaction | 2.03 | 0.59 | 0.44 ** | 0.47 ** | 0.64 ** | (0.86) | |

| Customer Loyalty | 2.06 | 0.71 | 0.44 ** | 0.52 ** | 0.36 ** | 0.47 ** | (0.76) |

| Predictor | Customer Satisfaction | Customer Loyalty | ||||

|---|---|---|---|---|---|---|

| β | R2 | Δ R2 | β | R2 | Δ R2 | |

| Step 1: | ||||||

| Quality of Service | 0.15 * | 0.32 ** | ||||

| Product Awareness | 0.21 ** | 0.38 ** | ||||

| Perceptions | 0.48 ** | 0.15 | ||||

| Step2: | ||||||

| Customer Satisfaction | 0.57 ** | 0.22 | 0.22 ** | |||

| Step3: | ||||||

| Quality of services | 0.29 * | |||||

| Product Awareness | 0.33 ** | |||||

| Perceptions | 0.04 | |||||

| Customer Satisfaction | 0.23 * | 0.38 | 0.16 ** | |||

| Relation | Category | Count | % Share |

|---|---|---|---|

| Quality of service → Satisfaction | Influencer | 29 | 61.70 |

| Product perception → Satisfaction | Influencer | 26 | 55.32 |

| Product awareness → Satisfaction | Influencer | 24 | 51.06 |

| Satisfaction ↔ Loyalty | Mutually dependent | 44 | 93.62 |

| Satisfaction → Product awareness and Loyalty | Mediator | 28 | 59.57 |

| Satisfaction → Quality of service and Loyalty | Partial Mediator | 12 | 25.53 |

| Satisfaction → Product perception and Loyalty | Mediator | 11 | 23.40 |

| Satisfaction → Product perception and Loyalty | Does not Mediate | 22 | 46.81 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Iqbal, K.; Munawar, H.S.; Inam, H.; Qayyum, S. Promoting Customer Loyalty and Satisfaction in Financial Institutions through Technology Integration: The Roles of Service Quality, Awareness, and Perceptions. Sustainability 2021, 13, 12951. https://doi.org/10.3390/su132312951

Iqbal K, Munawar HS, Inam H, Qayyum S. Promoting Customer Loyalty and Satisfaction in Financial Institutions through Technology Integration: The Roles of Service Quality, Awareness, and Perceptions. Sustainability. 2021; 13(23):12951. https://doi.org/10.3390/su132312951

Chicago/Turabian StyleIqbal, Kamran, Hafiz Suliman Munawar, Hina Inam, and Siddra Qayyum. 2021. "Promoting Customer Loyalty and Satisfaction in Financial Institutions through Technology Integration: The Roles of Service Quality, Awareness, and Perceptions" Sustainability 13, no. 23: 12951. https://doi.org/10.3390/su132312951

APA StyleIqbal, K., Munawar, H. S., Inam, H., & Qayyum, S. (2021). Promoting Customer Loyalty and Satisfaction in Financial Institutions through Technology Integration: The Roles of Service Quality, Awareness, and Perceptions. Sustainability, 13(23), 12951. https://doi.org/10.3390/su132312951