1. Introduction

Rare earth materials are strategic resources known as “industrial vitamins”. These materials are separated into light and heavy rare earth materials according to the differences in the mineral characteristics. Rare earth materials are used in the military [

1], metallurgical [

2], petrochemical [

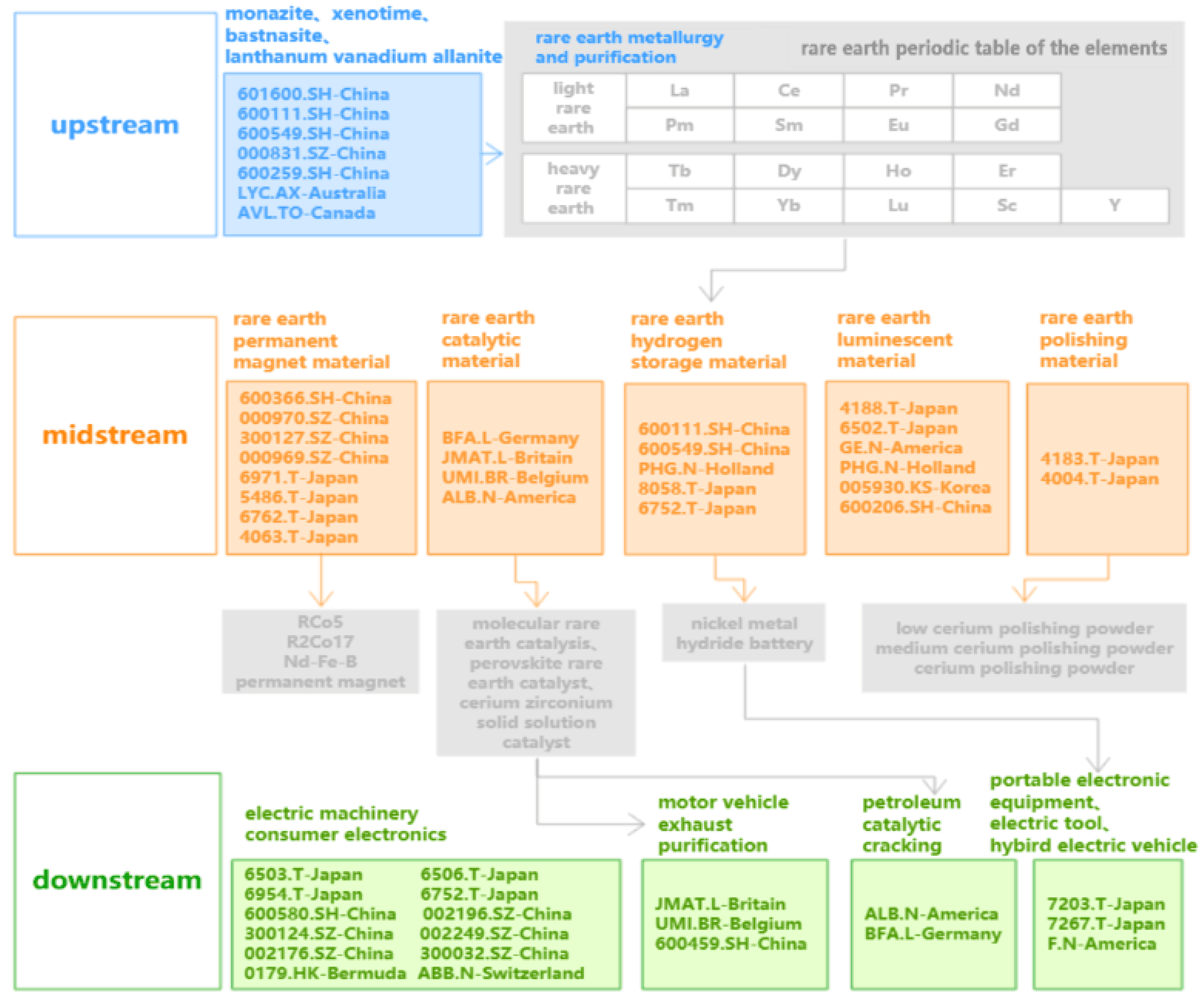

3], and other fields; consequently, the development of the rare earth industry is crucial for the evolution of modern industries. The rare earth industry chain involves a group of rare earth enterprises with certain internal connections. The upstream, midstream and downstream links of the industrial chain are responsible for the progress of the rare earth ore, rare earth smelting and separation, and deep processing and application. An exchange of relationships and mutual values occurs between all links. The upstream links provide products or services to the midstream and downstream links, and then information is fed back upstream from downstream. Changes in any link affect the development direction of the industry chain and the decisions of investors and consumers. The stock price is the “barometer” of the macro-economy. The study of the fluctuation transmission mechanism of the stock prices of listed companies upstream, midstream, and downstream of the rare earth industry chain has two functions. First, the transmission mechanism of the stock price fluctuation in the rare earth industry chain can be comprehensively analyzed. We can also identify stocks that have a key conduction effect in the rare earth industry chain. Moreover, such an analysis can provide a reference for market participants in the rare earth industry chain to prevent and control the market fluctuation risks and assist rare earth-related companies and investors in making reasonable investment decisions.

The current research on rare earth materials is mainly focused on the global rare earth resource exploitation [

4,

5,

6], China’s rare earth industrial policy [

7,

8,

9], and supply chain in the rare earth industry chain [

10,

11,

12].

The idea of the industrial chain comes from Adam Smith. Hirschman used this idea to analyze the impact of forward and backward linkages between enterprises on economic development [

13]. Porter studied the relationship between manufacturers in different links of the industrial chain from the perspectives of the value chain and cost chain [

14]. Steven further expanded the meaning of the industrial chain. He introduced the logistics chain and information chain into the industrial chain composed of manufacturers, suppliers, distributors, and consumers [

15]. It is now generally believed that the industrial chain is a notion that includes four scales, namely, the value chain, enterprise chain, supply chain, and space chain. The current research on the industrial chain is mainly divided into research based on the value chain [

16,

17] and based on the supply chain [

18,

19].

The current research on the rare earth industry chain focuses on the supply chain, with an emphasis on the analysis and prediction of the supply and demand status of rare earth materials. Wang X B used the generalized Weng model to predict the output of the three rare earth materials mainly produced in China (mixed rare earth, bastnasite, and ion-absorbed rare earth) [

20]. Ge J P constructed a dynamic computable equilibrium (DCGE) model to predict China’s rare earth production, domestic supply and exports in 2025 [

21]. Wang X B predicted China’s rare earth element production trend and the Hubbert peak, and the results showed that China’s rare earth element production will peak by 2040 and gradually decline [

22]. These studies provide a reference for the sustainable development of rare earth element markets and rare-earth-related industries in China and the world. In addition, Samsonov N Y analyzed the results of the global supply chain management methods of rare earths and rare metals in the United States, the European Union, and Russia as factors influencing the spatial distribution of international cooperation [

23].

At present, the research on the industrial chain has begun to expand to the financial field, and the correlation between stock price fluctuations is used to reflect the correlation between the industrial chains. It mainly reflected the relationship with the supply and demand chain in the industrial chain, Liu J X discussed the impact of supply chain disruption on the stock market of Japanese listed companies [

24]. Wang Y discussed the relationship between stock management and supply chain management [

25].

With the continuous development of the rare earth industry, the rare-earth-related financial market has also attracted the attention of scholars. Mainly focused on the relationship between the rare earth market and other markets. Reboredo J C used a Markov switching vector autoregressive model to analyze the price spillover between rare earth stocks and financial markets [

26]. Chen Y investigated the fluctuation spillover and dynamic correlation between international crude oil, new energy, and Chinese rare earth markets [

27]. Bouri E analyzed the dynamics of return and volatility connectedness between the rare earth stock index and indices of clean energy, consumer electronics, telecommunications, healthcare equipment, aerospace, and defense [

28]. The results indicated that extreme market scenarios considerably influence the earnings and volatility connectivity dynamics. Zheng B A studied the asymmetric connectivity and dynamic spillovers of China’s renewable energy and rare earth markets and described the risk transfer between renewable energy and rare earth market companies in the form of network connectivity [

29].

The complex network method has been widely used in trade [

30], energy [

31], finance [

32], and other fields. This method is used to analyze the overall structure, correlation mechanism, conduction path, and other relationships among a large number of variables. Granger causality test analyzes the causal relationship between variables from the perspective of prediction and is often used in biological sciences [

33], social sciences [

34], finance [

35], and other fields. B Algieri used Granger causality test to analyze the relationship between stock market volatility, speculation, and unemployment. The result negated the traditional present value model (PVM) and provided new elements for the possible determinants of stock price fluctuations. It is verified that the Granger causality test is advanced in the research of stock price fluctuation [

36]. Several scholars have combined the two methods. Specifically, the researchers used the Granger causality test method to identify the relationships among the time series and later used the complex network theory to map these relationships to the network. For example, Sun Q R constructed a price index Granger causality network to analyze the volatility transmission path of a certain price index [

37]. Huang C X ranked the influence nodes of China’s A-share market. In the rare earth stock market, the interconnections among stocks lead to the generation of a complex system [

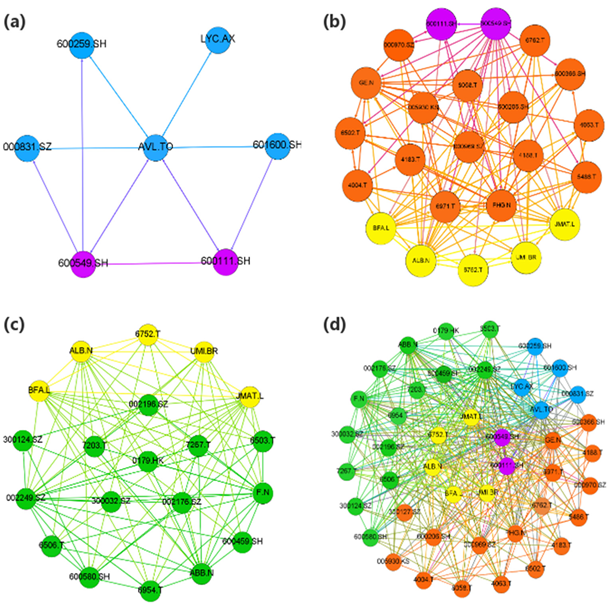

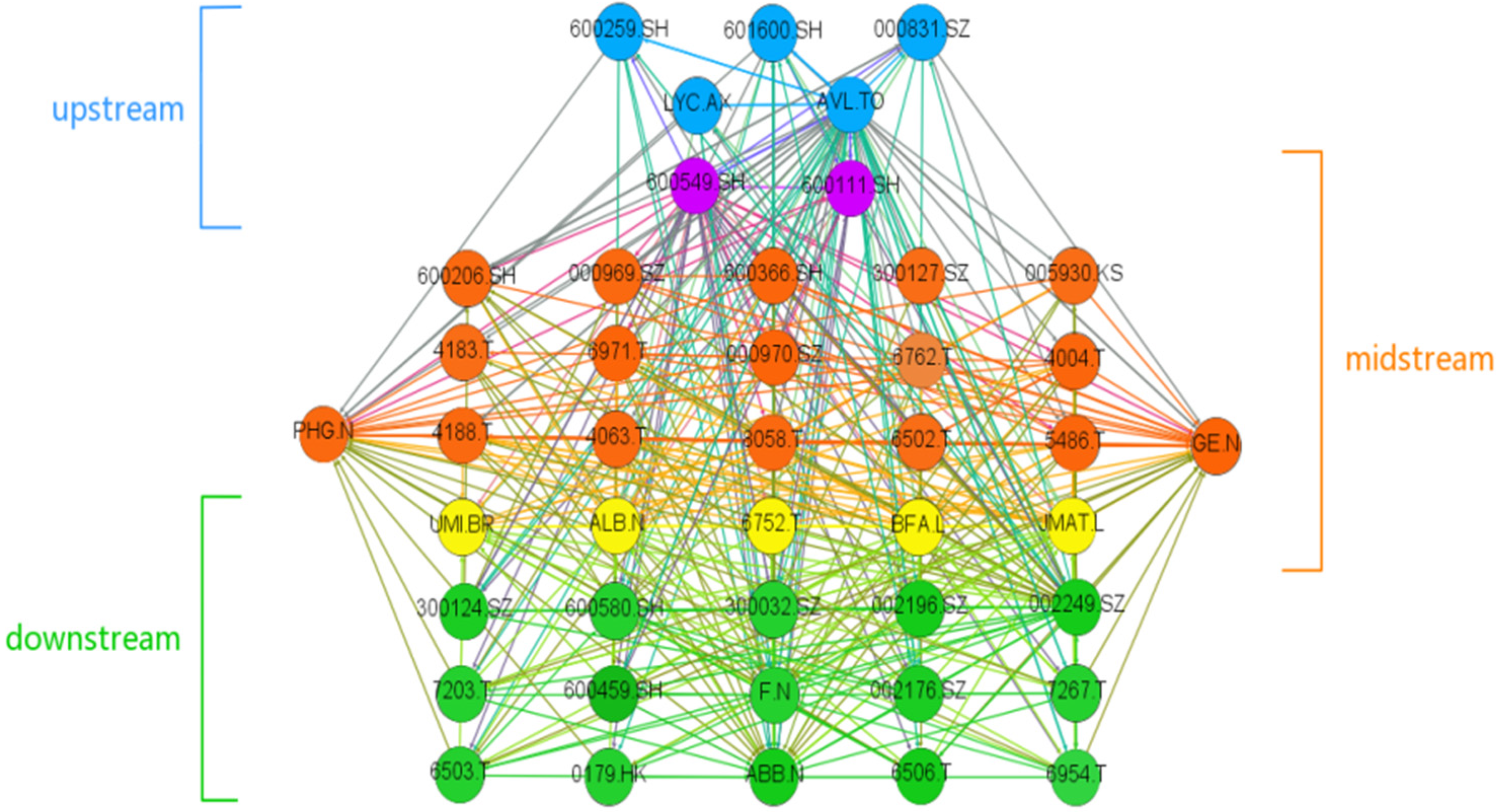

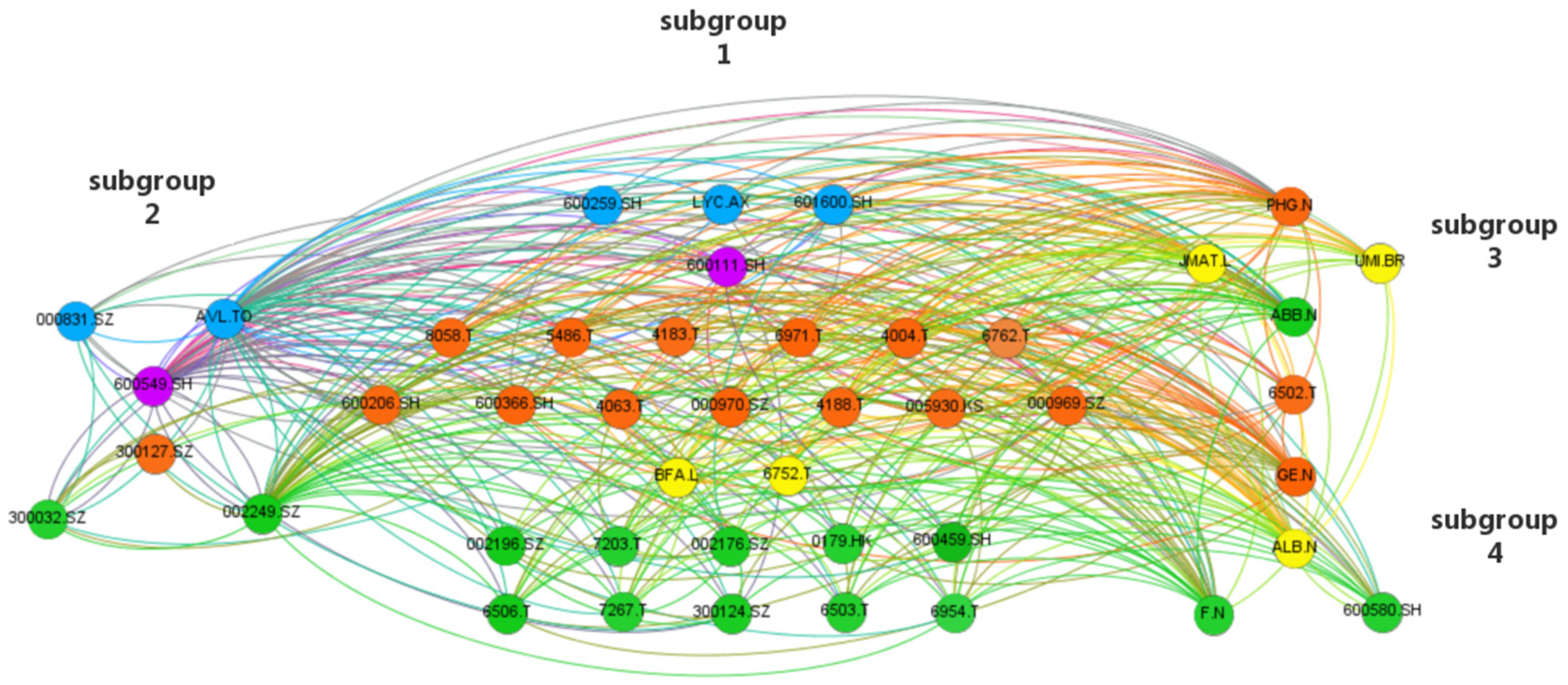

38]. Therefore, to study the fluctuation transmission mechanism among the stock prices of listed companies upstream, midstream, and downstream of the rare earth industry chain, it is necessary to use the Granger causality test to identify the relationships among the stocks. Next, we used the stocks as nodes and the Granger causality among the stocks as edges to construct a transmission network of the stock price fluctuation in the rare earth industry chain.

According to the above-mentioned studies, the current research on the rare earth industry chain and rare earth stock market is relatively separate. Most studies on the rare earth stock market focus on the spillover effects of stock price fluctuation between the rare earth stock market and other markets. The emphasis is on the mutual influence of investment in different markets rather than the investment in the rare earth market. Therefore, research on the stock market associated with the rare earth industry is limited. From the perspective of the rare earth industry chain, this paper examines the fluctuation transmission mechanism of the stock prices of listed companies upstream, midstream, and downstream of the rare earth industry chain. Using the correlation of stock price fluctuations to reflect the correlation between various links of the industrial chain. The objective is to provide a reference for market participants in the rare earth industry to prevent and control market fluctuation risks.

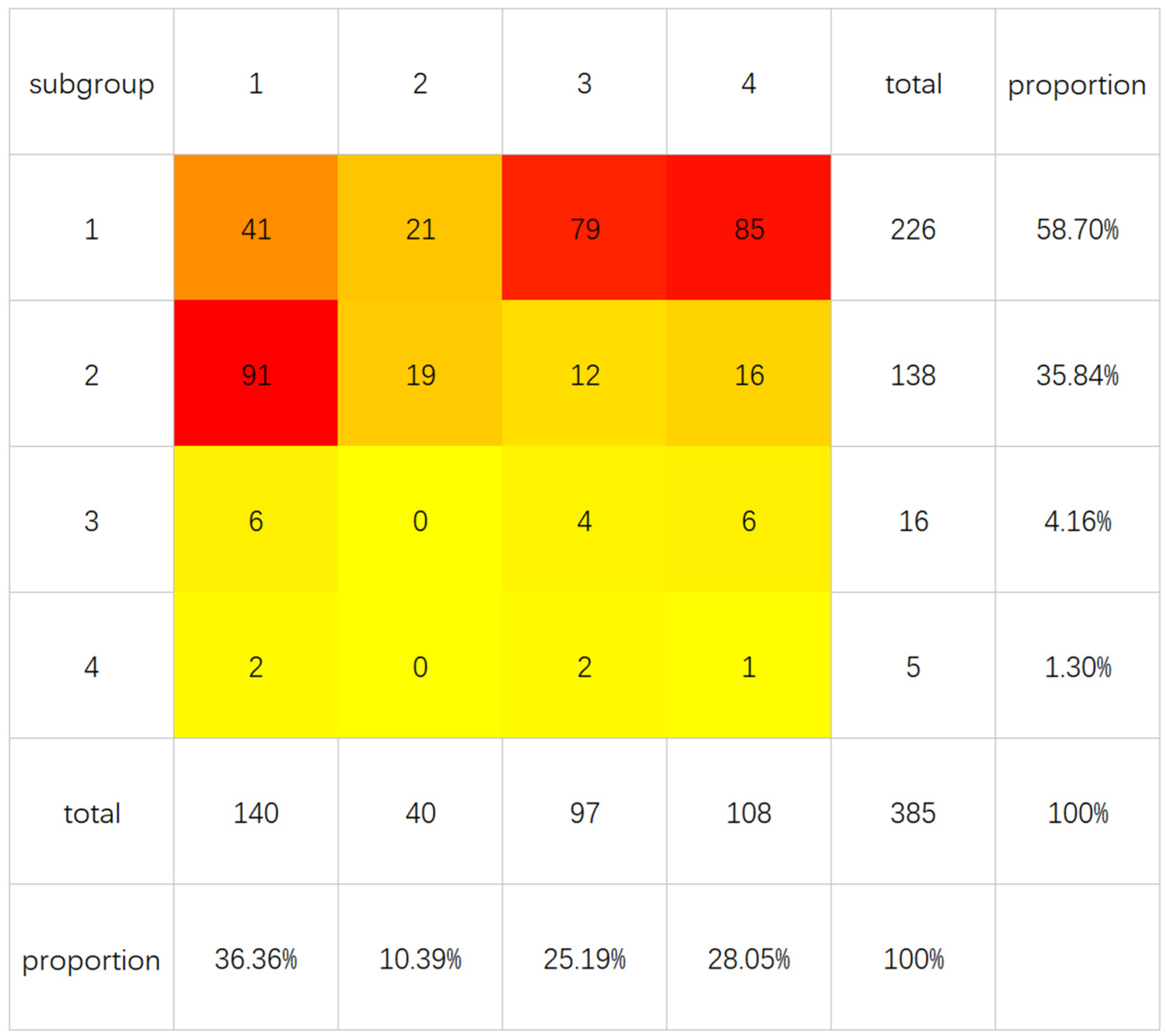

The article is organized as follows. A directional transmission network of the stock price fluctuation in the rare earth industry chain was constructed. Considering the transmission capacity of stock price fluctuation, transmission medium capacity, transmission cohesion, and transmission distance, the stocks that are in key transmission positions in the rare earth industry chain were determined. The CONCOR method and the maximum spanning tree method were used to identify the conduction path. It is hoped that the findings can help market participants in the rare earth industry chain prevent and control market fluctuation risks and provide a reference for investors to make reasonable investment decisions.