The U-Shaped Relationship between Intellectual Capital and Technological Innovation: A Perspective on Enterprise Ownership and the Moderating Effect of CSR

Abstract

:1. Introduction

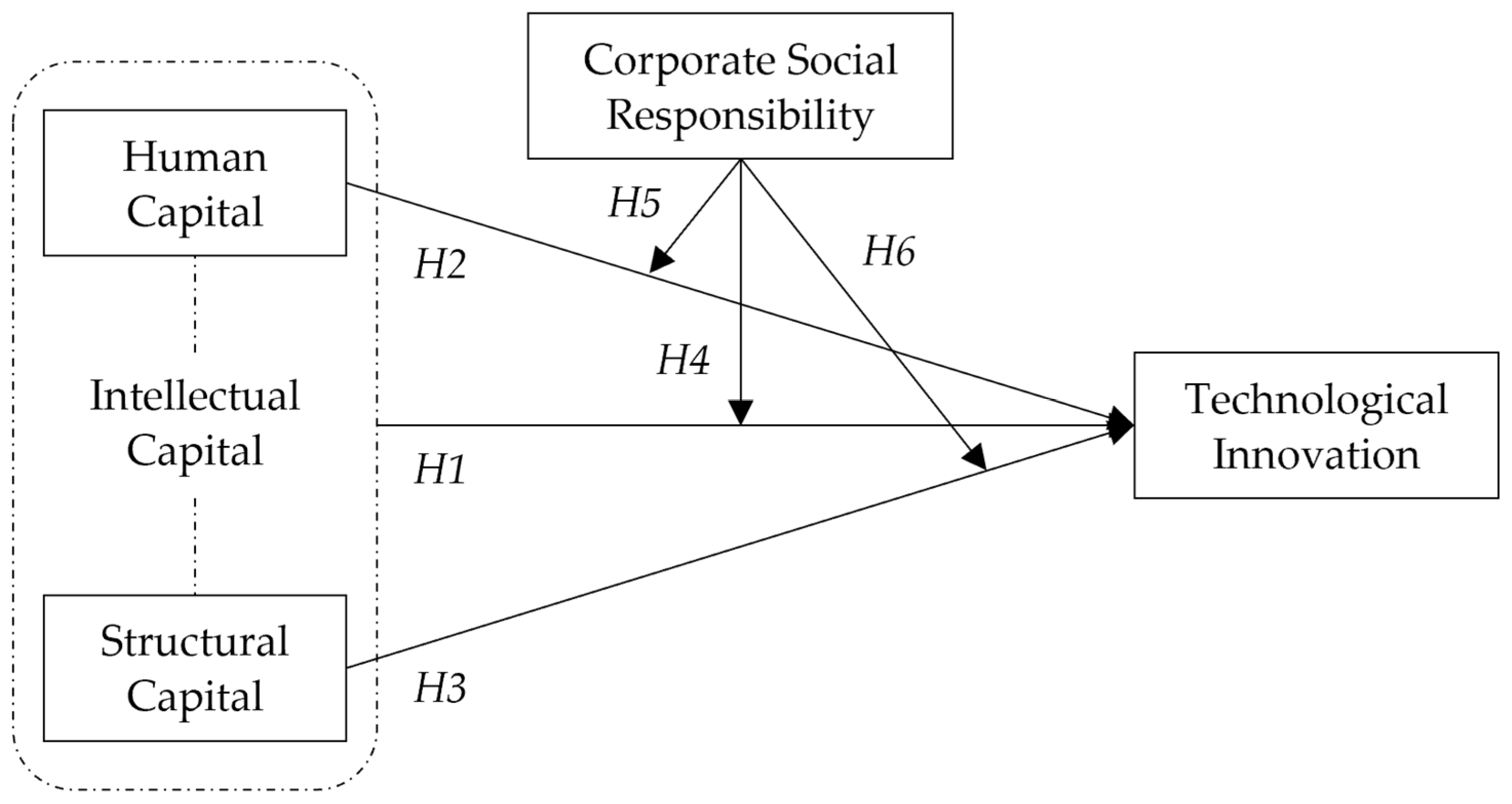

2. Theoretical Basis and Research Hypothesis

2.1. The Effect of Intellectual Capital on Technological Innovation

2.2. Intellectual Capital, Corporate Social Responsibility, and Technological Innovation

3. Research Design

3.1. Selection of Samples and Acquisition of Data

3.2. Variable Definitions

3.2.1. Dependent Variable

3.2.2. Independent Variables

3.2.3. Moderating Variable

3.2.4. Control Variables

3.3. Model Construction

4. Data Analysis

4.1. Descriptive Statistics

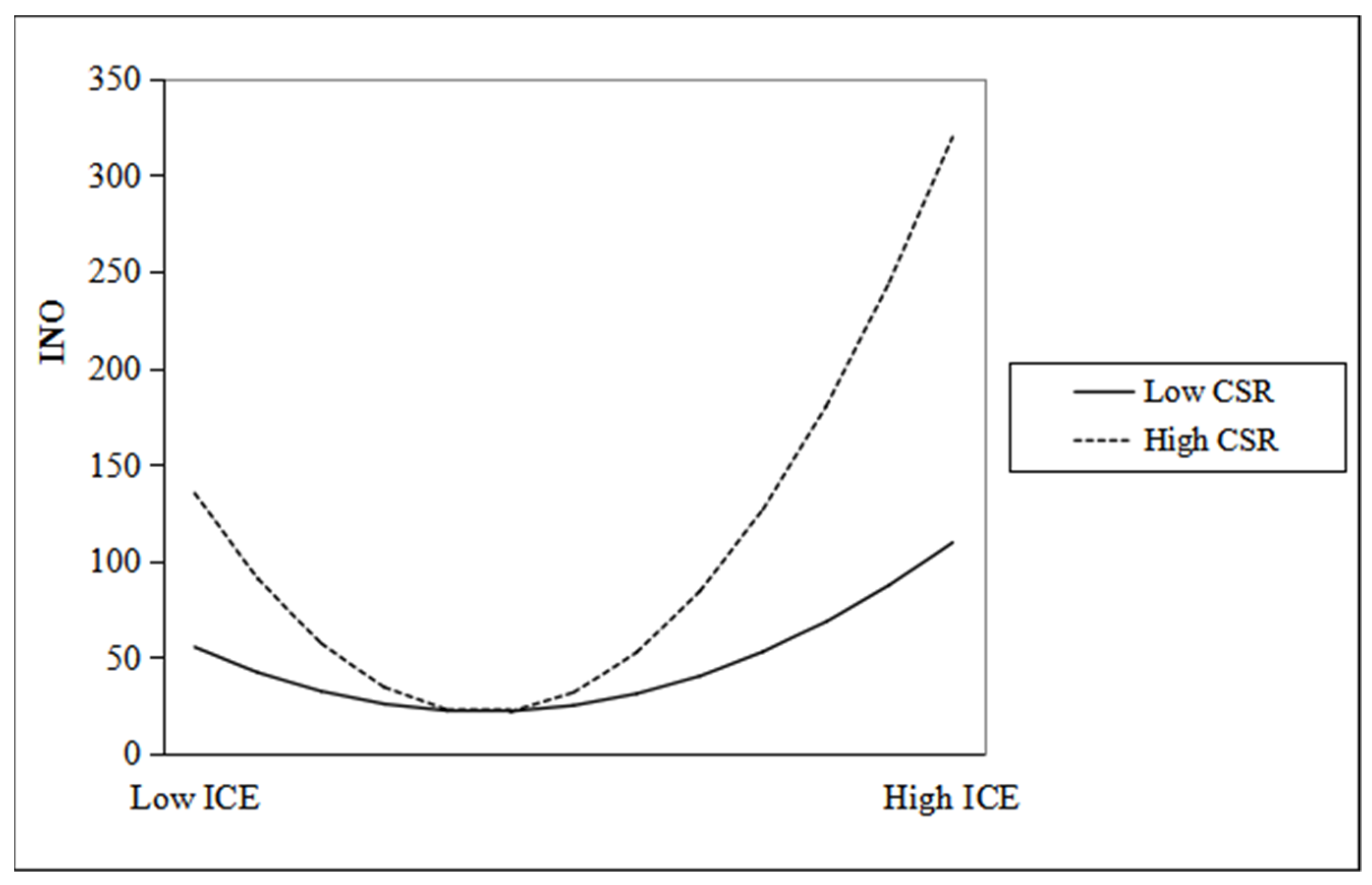

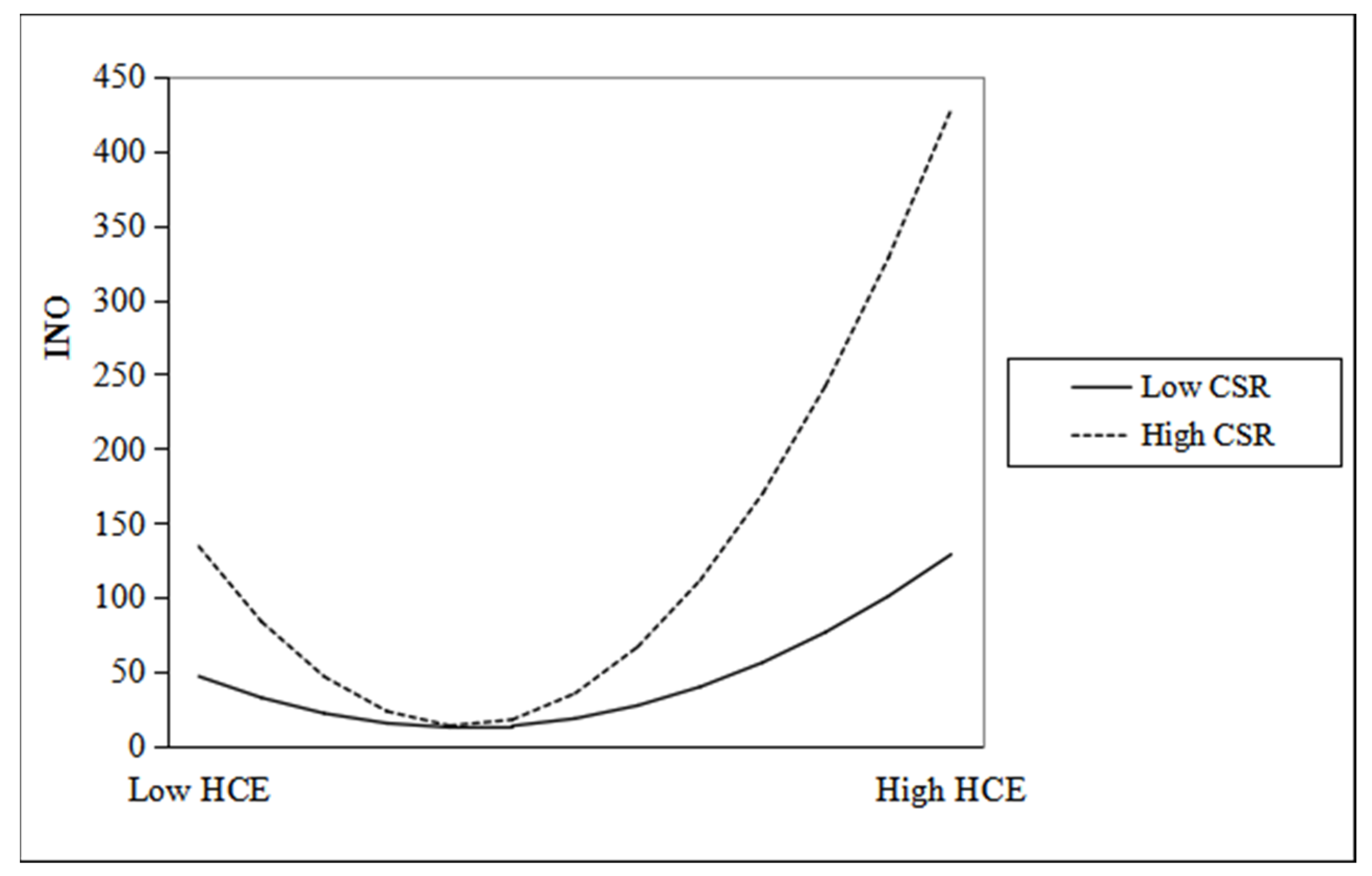

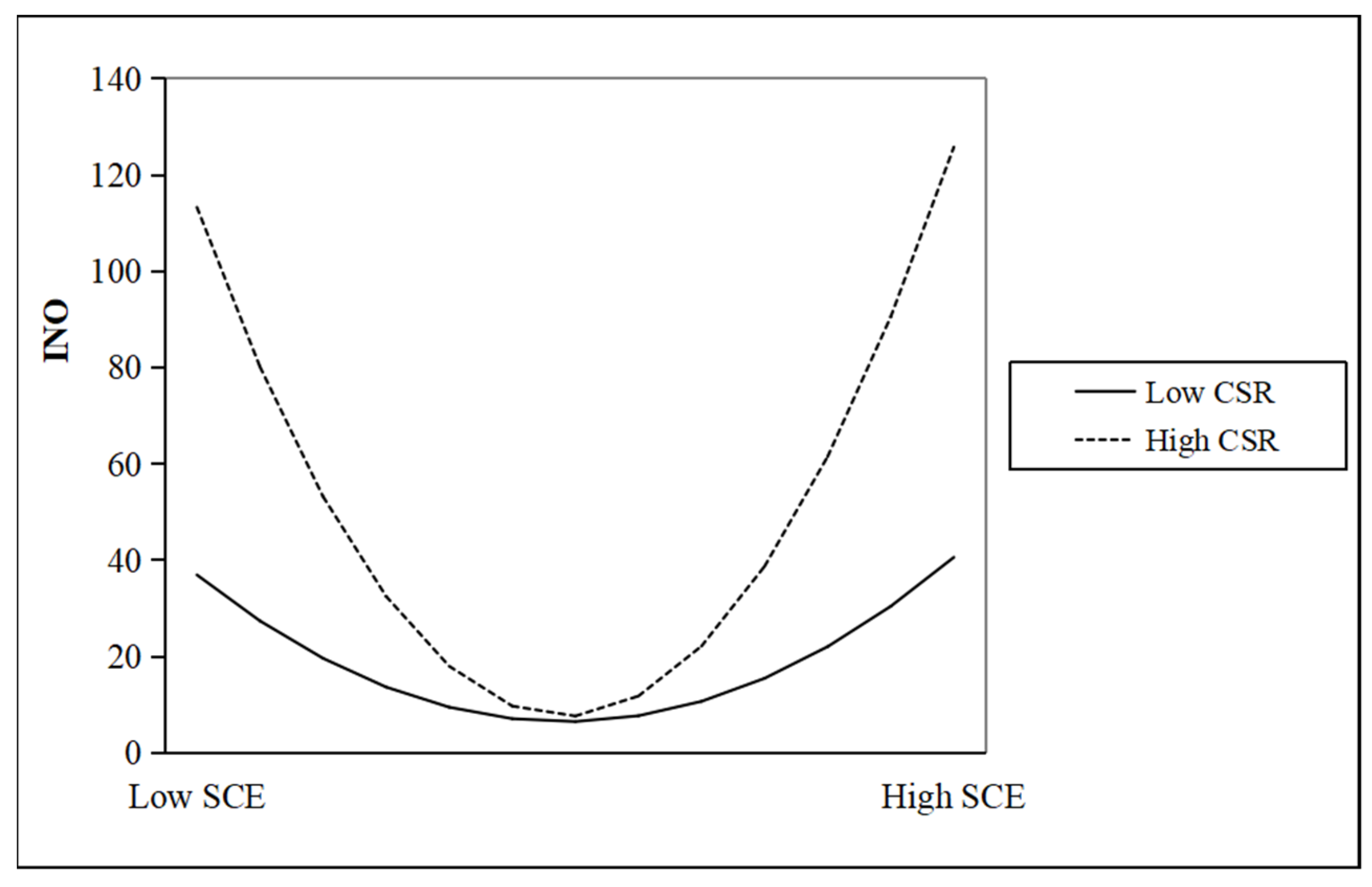

4.2. Regression Analysis

4.3. Further Analysis

4.4. Robustness Tests

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bayraktaroglu, A.E.; Calisir, F.; Baskak, M. Intellectual capital and firm performance: An extended VAIC model. J. Intellect. Cap. 2019, 20, 406–425. [Google Scholar] [CrossRef]

- Hormiga, E.; García-Almeida, D.J. Accumulated knowledge and innovation as antecedents of reputation in new ventures. J. Small Bus. Enterp. Dev. 2016, 23, 428–452. [Google Scholar] [CrossRef]

- Zhang, J.A.; Edgar, F.; Geare, A.; O’Kane, C. The interactive effects of entrepreneurial orientation and capability-based HRM on firm performance: The mediating role of innovation ambidexterity. Ind. Mark. Manag. 2016, 59, 131–143. [Google Scholar] [CrossRef]

- Subramaniam, M.; Youndt, M.A. The Influence of Intellectual Capital on the Types of Innovative Capabilities. Acad. Manag. J. 2005, 48, 450–463. [Google Scholar] [CrossRef] [Green Version]

- Pulic, A. VAIC™—An accounting tool for IC management. Int. J. Technol. Manag. 2000, 20, 702–714. [Google Scholar] [CrossRef]

- Fait, M.; Cillo, V.; Papa, A.; Meissner, D.; Scorrano, P. The roots of “volunteer” employees’ engagement: The silent role of intellectual capital in knowledge-sharing intentions. J. Intellect. Cap. 2021. ahead-of-print. [Google Scholar] [CrossRef]

- Al Qershi, N.; Mokhtar, S.S.M.; Abas, Z. The influence of structural capital on the relationship between CRM implementation and the performance of manufacturing SMEs. Int. J. Syst. Assur. Eng. Manag. 2021. [Google Scholar] [CrossRef]

- Harrison, S.; Sullivan, P.H. Profiting from intellectual capital. J. Intellect. Cap. 2000, 1, 33–46. [Google Scholar] [CrossRef]

- Hayton, J.C. Competing in the new economy: The effect of intellectual capital on corporate entrepreneurship in high-technology new ventures. R&D Manag. 2005, 35, 137–155. [Google Scholar] [CrossRef]

- Chahal, H.; Bakshi, P. Examining intellectual capital and competitive advantage relationship. Int. J. Bank Mark. 2015, 33, 376–399. [Google Scholar] [CrossRef]

- Cao, Y.; Xiong, S.; Hu, H. A study of the relationship between intellectual capital and innovation performance based on the life cycle of enterprises. Sci. Res. Manag. 2016, 37, 69–78. [Google Scholar] [CrossRef]

- Zha, C.; Chen, W.; Tang, C.; Shen, X. Empirical Study on Relationship among Intellectual Capital, Learning from Failure and Low-cost Innovation. Technol. Econ. 2015, 34, 35–43. [Google Scholar] [CrossRef]

- Bejinaru, R. Knowledge strategies aiming to improve the intellectual capital of universities. Manag. Mark. Chall. Knowl. Soc. 2017, 12, 500–523. [Google Scholar] [CrossRef] [Green Version]

- Bratianu, C.; Bejinaru, R. Knowledge strategies for increasing IC of universities. In Proceedings of the 9th European Conference on Intellectual Capital (ECIC 2017), Lisbon, Portugal, 6–7 April 2017; pp. 34–41. [Google Scholar]

- Zhan, G.; Li, Z. A research on the effect of internationalization drain of intellectual capital on technological innovation. Sci. Res. Manag. 2018, 39, 96–102. [Google Scholar] [CrossRef]

- Li, Z.; Ruan, D.; Zhang, T. Value Creation Mechanism of Corporate Social Responsibility: A Study Based on Internal Control. Account. Res. 2020, 112–124. [Google Scholar] [CrossRef]

- Luo, X.; Du, S. Exploring the relationship between corporate social responsibility and firm innovation. Mark. Lett. 2015, 26, 703–714. [Google Scholar] [CrossRef]

- Cabello, C.; Kekäle, T. Managing intellectual capital in small ITC companies. Bus. Strategy Ser. 2008, 9, 163–167. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate Social Responsibility: A Theory of the Firm Perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Stewart, T.A. Your company’s most valuable asset: Intellectual capital. Fortune 1994, 130, 68–73. [Google Scholar]

- Riahi-Belkaoui, A. Intellectual capital and firm performance of US multinational firms. J. Intellect. Cap. 2003, 4, 215–226. [Google Scholar] [CrossRef]

- Ujwary-Gil, A. The business model and intellectual capital in the value creation of firms. Balt. J. Manag. 2017, 12, 368–386. [Google Scholar] [CrossRef]

- Gallego, C.; Mejía, G.M.; Calderó, G. Strategic design: Origins and contributions to intellectual capital in organizations. J. Intellect. Cap. 2020, 21, 873–891. [Google Scholar] [CrossRef]

- Ali, B.J.; Anwar, G. Intellectual capital: A modern model to measure the value creation in a business. Int. J. Eng. Bus. Manag. 2021, 5, 31–43. [Google Scholar] [CrossRef]

- Leiter, A.M.; Parolini, A.; Winner, H. Environmental regulation and investment: Evidence from European industry data. Ecol. Econ. 2011, 70, 759–770. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, N. Knowledge sharing, innovation and firm performance. Expert Syst. Appl. 2012, 39, 8899–8908. [Google Scholar] [CrossRef]

- Chen, V.Z.; Li, J.; Shapiro, D.M.; Zhang, X. Ownership structure and innovation: An emerging market perspective. Asia Pac. J. Manag. 2014, 31, 1–24. [Google Scholar] [CrossRef]

- Niu, J.; Li, S.; Yang, Y.; Dong, C. Management Compensation, Governance Mode and Innovation Performance. J. Manag. Sci. 2019, 32, 77–93. [Google Scholar] [CrossRef]

- Grajkowska, A. Valuing intellectual capital of innovative start-ups. J. Intellect. Cap. 2011, 12, 179–201. [Google Scholar] [CrossRef]

- Wu, W.; Zhang, T. The Asymmetric Influence of Non-R&D Subsidies and R&D Subsidies on Innovation Output of New Ventures. J. Manag. World 2021, 37, 137–160. [Google Scholar] [CrossRef]

- Hervas-Oliver, J.; Sempere-Ripoll, F.; Boronat-Moll, C.; Rojas, R. Technological innovation without R&D: Unfolding the extra gains of management innovations on technological performance. Technol. Anal. Strateg. 2015, 27, 19–38. [Google Scholar] [CrossRef]

- Kang, Q.; Liu, Q.; Qi, R. The Sarbanes-Oxley act and corporate investment: A structural assessment. J. Financ. Econ. 2010, 96, 291–305. [Google Scholar] [CrossRef] [Green Version]

- Jie, X. Value Creation Mechanism of Corporate Social Responsibility. Chin. J. Manag. 2014, 11, 1671–1679. [Google Scholar] [CrossRef]

- Gangi, F.; Salerno, D.; Meles, A.; Daniele, L.M. Do Corporate Social Responsibility and Corporate Governance Influence Intellectual Capital Efficiency? Sustainability 2019, 11, 1899. [Google Scholar] [CrossRef] [Green Version]

- Cegarra-Navarro, J.; Kassaneh, T.C.; Caro, E.M.; Martínez, A.M.; Bolisani, E. Technology Assimilation and Embarrassment in SMEs: The Mediating Effect on the Relationship of Green Skills and Organizational Reputation. IEEE Trans. Eng. Manag. 2021, 1–9. [Google Scholar] [CrossRef]

- Yuan, J.; Hou, Q.; Cheng, C. The curse effect of enterprise political resources: An examination based on political affiliation and enterprise technological innovation. Manag. World 2015, 139–155. [Google Scholar] [CrossRef]

- Bellamy, M.A.; Ghosh, S.; Hora, M. The influence of supply network structure on firm innovation. J. Oper. Manag. 2014, 32, 357–373. [Google Scholar] [CrossRef]

- Li, W.; Jia, X.; Liao, Y.; Liu, Y. An Empirical Research of the Influence of Corporate Social Responsibility (CSR) on Firm’s Technological Innovation Performance with the Integration of Multiple Perspectives. Chin. J. Manag. 2018, 15, 237–245. [Google Scholar] [CrossRef]

- Marzo, G. A theoretical analysis of the value added intellectual coefficient (VAIC). J. Manag. Gov. 2021. [Google Scholar] [CrossRef]

- Singla, H.K. Does VAIC affect the profitability and value of real estate and infrastructure firms in India? A panel data investigation. J. Intellect. Cap. 2020, 21, 309–331. [Google Scholar] [CrossRef]

- Chen, M.C.; Cheng, S.J.; Hwang, Y. An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. J. Intellect. Cap. 2005, 6, 159–176. [Google Scholar] [CrossRef]

- Ghosh, S.K.; Maji, S.G. Empirical Validity of Value Added Intellectual Coefficient Model in Indian Knowledge-based Sector. Glob. Bus. Rev. 2015, 16, 947–962. [Google Scholar] [CrossRef]

- Nazari, J.A.; Herremans, I.M. Extended VAIC model: Measuring intellectual capital components. J. Intellect. Cap. 2007, 8, 595–609. [Google Scholar] [CrossRef]

- Iazzolino, G.; Laise, D. Value added intellectual coefficient (VAIC). J. Intellect. Cap. 2013, 14, 547–563. [Google Scholar] [CrossRef]

- Li, L.; Zhang, D. Analysis of Influence Factors on Value Creation Efficiency of Intellectual Capital in High-Tech Enterprise. J. Quant. Tech. Econ. 2017, 34, 55–71. [Google Scholar] [CrossRef]

- Ployhart, R.E.; Weekley, J.A.; Ramsey, J. The Consequences of Human Resource Stocks and Flows: A Longitudinal Examination of Unit Service Orientation and Unit Effectiveness. Acad. Manag. J. 2009, 52, 996–1015. [Google Scholar] [CrossRef]

- Madsen, T.L.; Mosakowski, E.; Zaheer, S. The dynamics of knowledge flows: Human capital mobility, knowledge retention and change. J. Knowl. Manag. 2002, 6, 164–176. [Google Scholar] [CrossRef]

- Hatch, N.W.; Dyer, J.H. Human capital and learning as a source of sustainable competitive advantage. Strateg. Manag. J. 2004, 25, 1155–1178. [Google Scholar] [CrossRef]

| Types | Names | Symbols | Definition |

|---|---|---|---|

| Dependent Variable | Technological Innovation | INO | The number of patent applications for listed companies is added by 1 and taken as a logarithm |

| Independent Variables | Intellectual Capital | ICE | ICE = HCE + SCE |

| Human Capital | HCE | HCE = VA/HC; VA = Salary Expense + Interest Expense + Pre-Tax Profit; HC = Salary Expense | |

| Structural Capital | SCE | SCE = SC/VA; SC = VA − HC | |

| Moderator Variable | Corporate Social Responsibility | CSR | Hexun CSR score |

| Control Variables | Company Size | Size | Take the total assets of the listed company to the logarithm |

| Financial Leverage | Lev | Total liabilities/Total assets | |

| Growth Ability | Growth | Changes in operating income for the period /Operating income in the previous period | |

| Profitability | Roa | Net profit/Total assets | |

| Nature of Ownership | State | State = 0 or 1, private take 0, state-owned take 1 | |

| Percentage of Independent Directors | Indir | Number of independent directors /Total number of directors | |

| Cash Flow Sufficiency | Cfo | Net operating cash flow/Total assets | |

| Top 10 Shareholders’ Shareholding | Top10 | The sum of the shareholding ratio of the top 10 shareholders | |

| Proportion of Fixed Assets | Ppe | Fixed assets/Total assets | |

| Company Age | Age | Year of observation minus year of company establishment |

| Variables | Max | Min | Mean | Median | SD |

|---|---|---|---|---|---|

| INO | 9.909 | 0.000 | 2.639 | 2.773 | 1.811 |

| ICE | 279.535 | −62.712 | 3.124 | 2.457 | 5.531 |

| HCE | 278.538 | −63.727 | 2.472 | 1.947 | 4.428 |

| SCE | 277.612 | −0.100 | 0.652 | 0.509 | 3.356 |

| CSR | 90.010 | −9.990 | 22.693 | 21.740 | 12.566 |

| Size | 28.636 | 17.813 | 22.298 | 22.124 | 1.324 |

| Lev | 0.987 | 0.008 | 0.421 | 0.410 | 0.227 |

| Growth | 429.036 | −0.982 | 0.344 | 0.111 | 4.234 |

| Roa | 0.964 | −1.859 | 0.044 | 0.040 | 0.074 |

| State | 1.000 | 0.000 | 0.315 | 0.000 | 0.464 |

| Indir | 0.800 | 0.200 | 0.377 | 0.364 | 0.056 |

| Cfo | 0.876 | −0.742 | 0.049 | 0.048 | 0.073 |

| Top10 | 98.588 | 1.310 | 58.804 | 59.741 | 14.816 |

| Ppe | 0.954 | 0.000 | 0.210 | 0.174 | 0.163 |

| Age | 61.000 | 4.000 | 18.161 | 18.000 | 5.510 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|

| INO | 2.442 | 2.581 | 2.743 | 2.75 | 2.663 | 2.611 |

| ICE | 3.374 | 3.39 | 3.275 | 3.256 | 2.829 | 2.816 |

| HCE | 2.748 | 2.562 | 2.604 | 2.691 | 2.178 | 2.208 |

| SCE | 0.626 | 0.828 | 0.671 | 0.565 | 0.65 | 0.608 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| INO | INO | INO | INO | |

| ICE | −0.156 *** (−14.14) | −0.044 *** (−3.13) | ||

| ICE2 | 0.110 *** (10.60) | 0.024 * (1.81) | ||

| HCE | −0.152 *** (−14.88) | −0.060 *** (−4.43) | ||

| HCE2 | 0.081 *** (9.04) | −0.039 (−1.59) | ||

| SCE | −0.035 ** (−2.44) | −0.002 (−0.14) | ||

| SCE2 | 0.039 *** (2.70) | 0.008 (0.51) | ||

| CSR | 0.073 *** (8.36) | 0.076 *** (8.41) | ||

| ICE × CSR | −0.187 *** (−13.16) | |||

| ICE2 × CSR | 0.124 *** (9.64) | |||

| HCE × CSR | −0.152 *** (−11.16) | |||

| HCE2 × CSR | 0.159 *** (6.22) | |||

| SCE × CSR | −0.128 *** (−4.46) | |||

| SCE2 × CSR | 0.125 *** (4.55) | |||

| Size | 0.496 *** (64.37) | 0.498 *** (64.61) | 0.500 *** (63.97) | 0.501 *** (64.21) |

| Lev | 0.021 *** (2.68) | 0.023 *** (2.94) | 0.018 ** (2.30) | 0.019 ** (2.50) |

| Growth | −0.028 *** (−4.55) | −0.028 *** (−4.54) | −0.028 *** (−4.58) | −0.028 *** (−4.57) |

| Roa | 0.049 *** (6.17) | 0.066 *** (7.69) | 0.022 ** (2.56) | 0.033 *** (3.53) |

| State | −0.012 * (−1.71) | −0.012 * (−1.75) | −0.018 ** (−2.57) | −0.019 *** (−2.75) |

| Indir | −0.003 (−0.50) | −0.003 (−0.55) | −0.001 (−0.21) | −0.002 (−0.26) |

| Cfo | 0.018 *** (2.71) | 0.015 ** (2.23) | 0.026 *** (3.77) | 0.024 *** (3.52) |

| Top10 | −0.039 *** (−5.96) | −0.040 *** (−6.16) | −0.037 *** (−5.73) | −0.038 *** (−5.86) |

| Ppe | −0.137 *** (−18.20) | −0.137 *** (−18.26) | −0.143 *** (−18.98) | −0.144 *** (−19.17) |

| Age | −0.069 *** (−10.21) | −0.068 *** (−10.11) | −0.067 *** (−9.98) | −0.066 *** (−9.87) |

| Year | YES | YES | YES | YES |

| Ind | YES | YES | YES | YES |

| n | 15,757 | 15,757 | 15,757 | 15,757 |

| R2 | 0.4191 | 0.4205 | 0.4255 | 0.4275 |

| F | 333.66 | 316.91 | 314.67 | 286.18 |

| Variables | State-Owned Enterprises | Private Enterprises | ||||||

|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| ICE | −0.175 *** (−7.59) | −0.136 *** (−3.51) | −0.144 *** (−11.49) | −0.02 (−1.33) | ||||

| ICE2 | 0.150 *** (6.66) | 0.101 *** (3.08) | 0.085 *** (7.39) | 0.051 ** (2.00) | ||||

| HCE | −0.148 *** (−7.76) | −0.062 * (−1.87) | −0.153 *** (−12.03) | −0.094 *** (−3.91) | ||||

| HCE2 | 0.092 *** (5.26) | −0.636 *** (−5.14) | 0.079 *** (7.18) | −0.195 *** (−2.92) | ||||

| SCE | −0.038 (−1.16) | −0.022 (−0.45) | −0.075 *** (−3.75) | −0.022 (−1.00) | ||||

| SCE2 | 0.045 (1.35) | 0.024 (0.53) | 0.076 *** (3.81) | −0.044 (−1.56) | ||||

| CSR | 0.034 ** (2.36) | 0.082 *** (4.74) | 0.098 *** (8.78) | 0.096 *** (7.74) | ||||

| ICE × CSR | −0.081 *** (−2.67) | −0.246 *** (−14.50) | ||||||

| ICE2 × CSR | 0.082 *** (4.06) | 0.117 *** (4.61) | ||||||

| HCE × CSR | −0.193 *** (−5.13) | −0.170 *** (−7.69) | ||||||

| HCE2 × CSR | 0.749 *** (5.76) | 0.362 *** (5.19) | ||||||

| SCE × CSR | −0.242 * (−1.83) | −0.111 *** (−5.34) | ||||||

| SCE2 × CSR | 0.248 * (1.93) | 0.142 *** (4.83) | ||||||

| Size | 0.560 *** (44.48) | 0.561 *** (44.56) | 0.560 *** (43.46) | 0.566 *** (43.92) | 0.407 *** (43.96) | 0.409 *** (44.20) | 0.414 *** (44.33) | 0.417 *** (44.66) |

| Lev | −0.029 ** (−2.30) | −0.027 ** (−2.13) | −0.029 ** (−2.31) | −0.025 ** (−1.98) | 0.040 *** (4.14) | 0.042 ** (4.30) | 0.037 *** (3.80) | 0.038 ** (3.96) |

| Growth | −0.035 *** (−3.71) | −0.034 *** (−3.68) | −0.035 *** (−3.71) | −0.034 *** (−3.70) | −0.024 *** (−3.04) | −0.024 *** (−3.05) | −0.024 *** (−3.00) | −0.023 *** (−3.00) |

| Roa | 0.020 * (1.73) | 0.034 *** (2.72) | 0.021 * (1.68) | 0.031 ** (2.33) | 0.062 *** (5.83) | 0.077 *** (6.73) | 0.025 ** (2.17) | 0.044 *** (3.42) |

| Indir | 0.003 (0.29) | 0.003 (0.30) | 0.005 (0.47) | 0.003 (0.33) | −0.014 * (−1.82) | −0.015 * (−1.84) | −0.013 * (−1.69) | −0.013 * (−1.71) |

| Cfo | −0.008 (−0.77) | −0.01 (−0.97) | −0.009 (−0.83) | −0.007 (−0.66) | 0.032 *** (3.70) | 0.029 *** (3.25) | 0.044 *** (5.02) | 0.040 *** (4.48) |

| Top10 | −0.041 *** (−3.78) | −0.042 *** (−3.87) | −0.043 *** (−3.88) | −0.044 *** (−4.04) | −0.056 *** (−6.84) | −0.057 *** (−6.94) | −0.053 *** (−6.52) | −0.053 *** (−6.53) |

| Ppe | −0.202 *** (−16.36) | −0.203 *** (−16.42) | −0.203 *** (−16.36) | −0.204 *** (−16.50) | −0.088 *** (−9.71) | −0.089 *** (−9.80) | −0.099 *** (−10.92) | −0.099 *** (−10.97) |

| Age | −0.037 *** (−3.55) | −0.036 *** (−3.49) | −0.036 *** (−3.48) | −0.036 *** (−3.46) | −0.079 *** (−9.32) | −0.079 *** (−9.26) | −0.077 *** (−9.14) | −0.076 *** (−9.07) |

| Year | YES | YES | YES | YES | YES | YES | YES | YES |

| Ind | YES | YES | YES | YES | YES | YES | YES | YES |

| n | 4959 | 4959 | 4959 | 4959 | 10,798 | 10,798 | 10,798 | 10,798 |

| R2 | 0.574 | 0.575 | 0.5756 | 0.5792 | 0.3372 | 0.3393 | 0.3501 | 0.3525 |

| F | 207.46 | 195.95 | 190.79 | 173.63 | 165.93 | 157.91 | 161.04 | 146.39 |

| Variables | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| INO’ | INO’ | INO’ | INO’ | |

| ICE | −0.137 *** (−12.00) | −0.037 *** (−2.60) | ||

| ICE2 | 0.099 *** (9.22) | 0.022 (1.59) | ||

| HCE | −0.136 *** (−12.95) | −0.056 *** (−4.00) | ||

| HCE2 | 0.075 *** (8.07) | −0.029 (−1.15) | ||

| SCE | −0.023 (−1.50) | 0.007 (0.45) | ||

| SCE2 | 0.029 * (1.90) | −0.001 (−0.02) | ||

| CSR | 0.077 *** (8.56) | 0.080 *** (8.57) | ||

| ICE × CSR | −0.164 *** (−11.21) | |||

| ICE2 × CSR | 0.111 *** (8.32) | |||

| HCE × CSR | −0.132 *** (−9.40) | |||

| HCE2 × CSR | 0.137 *** (5.20) | |||

| SCE × CSR | −0.117 *** (−3.96) | |||

| SCE2 × CSR | 0.115 *** (4.06) | |||

| Size | 0.514 *** (64.72) | 0.516 *** (64.94) | 0.515 *** (63.83) | 0.516 *** (64.04) |

| Lev | 0.003 (0.34) | 0.005 (0.60) | 0.001 (0.06) | 0.002 (0.27) |

| Growth | −0.027 *** (−4.36) | −0.027 *** (−4.35) | −0.027 *** (−4.34) | −0.027 *** (−4.34) |

| Roa | 0.041 *** (4.97) | 0.058 *** (6.51) | 0.012 (1.37) | 0.024 ** (2.52) |

| State | 0.007 (0.92) | 0.006 (0.89) | 0.001 (0.13) | −0.001 (−0.02) |

| Indir | 0.002 (0.33) | 0.002 (0.29) | 0.004 (0.60) | 0.003 (0.56) |

| Cfo | 0.015 ** (2.09) | 0.011 (1.63) | 0.020 *** (2.83) | 0.018 ** (2.55) |

| Top10 | −0.062 *** (−9.28) | −0.063 *** (−9.47) | −0.061 *** (−9.20) | −0.062 *** (−9.34) |

| Ppe | −0.142 *** (−18.27) | −0.142 *** (−18.32) | −0.146 *** (−18.77) | −0.147 *** (−18.92) |

| Age | −0.063 *** (−9.02) | −0.062 *** (−8.92) | −0.061 *** (−8.83) | −0.061 *** (−8.73) |

| Year | YES | YES | YES | YES |

| Ind | YES | YES | YES | YES |

| n | 15,757 | 15,757 | 15,757 | 15,757 |

| R2 | 0.3829 | 0.3842 | 0.3881 | 0.3898 |

| F | 286.94 | 272.48 | 269.47 | 244.88 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Z.; Wang, X.; Chun, D. The U-Shaped Relationship between Intellectual Capital and Technological Innovation: A Perspective on Enterprise Ownership and the Moderating Effect of CSR. Sustainability 2021, 13, 12872. https://doi.org/10.3390/su132212872

Zhang Z, Wang X, Chun D. The U-Shaped Relationship between Intellectual Capital and Technological Innovation: A Perspective on Enterprise Ownership and the Moderating Effect of CSR. Sustainability. 2021; 13(22):12872. https://doi.org/10.3390/su132212872

Chicago/Turabian StyleZhang, Zhenyang, Xinyuan Wang, and Dongphil Chun. 2021. "The U-Shaped Relationship between Intellectual Capital and Technological Innovation: A Perspective on Enterprise Ownership and the Moderating Effect of CSR" Sustainability 13, no. 22: 12872. https://doi.org/10.3390/su132212872

APA StyleZhang, Z., Wang, X., & Chun, D. (2021). The U-Shaped Relationship between Intellectual Capital and Technological Innovation: A Perspective on Enterprise Ownership and the Moderating Effect of CSR. Sustainability, 13(22), 12872. https://doi.org/10.3390/su132212872