Abstract

Green investment and technology innovations are generally considered as an effective factor to mitigate CO2 emissions as these enhance cleaner production and energy efficacy. Thus, this study investigated the influence of green investment, technology innovations, and economic growth on CO2 emissions in selected Asian countries for the period 2001 to 2019. The Cross-Section dependency (CSD) signified the cross-section dependence in the panel countries, whereas CIPS and CADF testing affirmed the stationarity of all variables at the first difference. Consequently, the Westerlund cointegration method recognized a long-term association among variables. The outcomes of Panel Fully Modified OLS and Panel Dynamic OLS results indicated that green investment and technology innovations are helpful in mitigating CO2 emissions in selected Asian countries. In addition, the Environmental Kuznets Curve (EKC) postulate is validated for the given time period and indicated inverted U-shaped linkages between the economic growth and CO2 emission. The outcomes of the remaining variables, including population growth, energy consumption, FDI inflow, and trade, are estimated to have an augmenting influence on CO2 emission. Our results regarding the FDI–CO2 emissions nexus support the presence of the pollution-haven hypothesis. Moreover, the estimated results from PFMOLS and PDOLS are validated by Granger Causality, and AMG and CCEMG tests. The study suggests the adoption of renewable sources as energy input and the promotion of innovations for energy efficiencies to reduce CO2 emissions in Asian economies.

1. Introduction

Global warming is seen as a serious threat to the global environment, according to growing sentiment across nations throughout the world. Most individuals believe that human emissions of hazardous gases such as carbon dioxide (CO2) are the primary reason for the rise in global temperatures that are hurting humans and the natural environment [1,2]. Thus, it is necessary to identify the factors that are helpful in mitigating CO2 emissions and their adverse impact on the natural environment. As the detrimental effects of environmental harm, such as climate change and global warming, became more apparent on a worldwide scale, governments began to seek a common approach, and several discussions on environmental sustainability were organized on both national and international forums. Owing to rising pollution, global temperatures have risen 1.9 degrees Fahrenheit as of 1880, sea levels have risen 178 mm in the last hundred years, and carbon dioxide (CO2) emissions have risen to 413 parts per million, the most in 650,000 years.

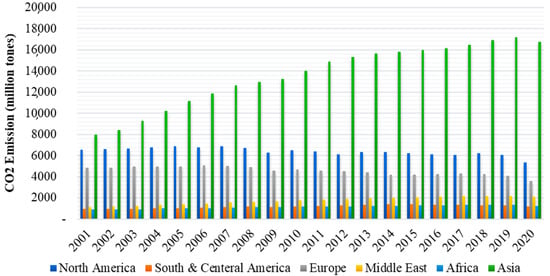

Concerning such environmental damages, actions such as the Paris Agreement (2016) compel all countries to reduce emissions to some extent, while also contemplating methods and policies to assist humanity in the adaptation to changes in climate. Consequently, the causal factors of emissions, particularly carbon emissions, have piqued the interest of scholars, with evidence pointing to population increase [1], energy utilization [1,2], human resources [3], urban growth [4], trade openness [5], financial sector growth [6]), natural resource rent [7], and research and development [8] as the crucial factors of carbon emission, among others. Carbon emissions reductions are advantageous because they have addressed an urgent worldwide challenge of reducing environmental deterioration, which has an impact on human growth and well-being. Constraining economic activity, in contrast, is unsustainable in the long-term. As a result, it begs the question of whether policymakers could combine growth strategies with low-carbon plans to assure that society’s growth is optimum, effective, and long-term. Figure 1 below shows the Asian region as the top emitter in the world for the last two decades, recording 16778 million metric tons CO2 emissions in 2020, whereas North America and Europe remain the second and third largest emitting regions, respectively.

Figure 1.

Major CO2 emitting regions. Source: Author’s calculations based on BP World Energy Statistics Data.

Among other remedial measures, innovation is thought to be the most effective technique for reducing CO2 emissions, conserving energy usage, and promoting economic growth [9]. Despite economic activities driving the demand for the utilization of power sources, which increases CO2 emissions, innovative activities drive energy combustion efficiency, improve market efficiency, and reduce market imperfections chain. The production line, improvements in fuel supply, the deployment of end-to-end pipeline technology, as well as other technical developments to manufacture sustainable product units and cycling have been proven to promote global market efficiencies and reduce carbon emissions [10].

Moreover, the beneficial influence of renewable energy on ecosystems is frequently acknowledged within those works of literature on the Environment Kuznets Curve (EKC) hypothesis [11]. Countries concentrate on environmental protection in the adaptation and mitigation strategies of climatic changes, with renewable energy playing a key part. Investment in renewable energy (green investment) is more effective than in non-renewable energy since it increases the production capacity of energy sources and the dependence of the manufacturing sector on clean energy, which reduces both manufacturing emissions and energy usage. However, in developing countries, particularly in transformation, the overall rise in energy consumption will grow by 50 percent in the coming 25 years and increase in the industrial sector where it will rise from 1.8 to 3.1 percent (United Nations Industrial Development, 2020). Further, the industry may cut energy intensity by 26%, resulting in an 8% reduction in world energy consumption as well as a 12.4% reduction in carbon emissions (International Energy Agency, 2020). In agreement with the dependency of the industrial sector on energy consumption, green investment in the manufacturing sector not only helps to alleviate energy supply shortages in developing nations, but it also helps to boost economic growth and reduce carbon emissions. Although the industrial sector is a key driver of the economy and hugely dependent on energy consumption, the influence of green investment on CO2 emissions has been largely ignored by prior researchers.

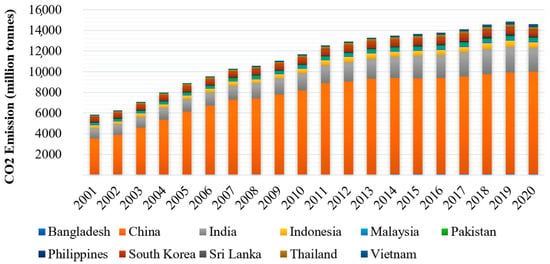

Countries are constantly confronted with dual challenges of supporting economic growth while also combating environmental issues, and this is obviously valid in the context of Asian countries. In 2019, Asian economies as a whole expanded at an average pace of 5% GDP growth, then after a decline to −0.2% in 2020 due to the COVID-19 pandemic, the region is expected to see 7.3% and 5.3% GDP growth, respectively, in 2021 and 2022 (Asian Development Bank, 2020). However, securing its recognition as the world’s fastest-growing economic region, fossil fuel consumption accounts for almost 85% of Asian’s regional energy needs. This has led to concerns that the increasing growth exhibited by these economies, backed by increased levels of energy usage, may be leading to greenhouse gas emissions and climate disruption [6,12,13]. The share of Asian countries to globally emitted CO2 is 52%, out of a total 16,778 million tons of carbon emission, with 9899.3 million tons emitted by China and almost 2302.2 million tons of CO2 emissions added by India in 2020 (BP Statistical Review of World Energy, 2020), putting the Asian region in first place globally in terms of greenhouse gas emission. Figure 2 shows the share of major Asian countries in CO2 emissions for the last two decades, revealing China and India constantly rank first and second as the largest emitters of CO2 in the region. respectively.

Figure 2.

CO2 emissions in selected Asian countries. Source: Author’s calculations based on BP World Energy Statistics Data.

Among Asian countries, the present study focused on eleven countries: China, Bangladesh, Indonesia, India, South Korea, Malaysia, Pakistan, Philippines, Sri Lanka, Thailand, and Vietnam. From these countries, China and India are two of the world’s leading emitters of greenhouse gases and leading trading economies. In 2019, China accounted for almost 28.6% of the global manufacturing output, securing its position at number one, and similarly, India, South Korea, and Indonesia are respectively at 5th, 6th, and 10th in the largest producers of global manufacturing output with 3.1%, 3.0%, and 1.6% shares, correspondingly, according to United Nations Statistics. Likewise, China, India, and Pakistan are among the top five most-populated countries of the world. Thus, as a result of rising economic growth, industrialization, population growth, and urbanization, the energy requirements in these regions are also rapidly increasing, and these achievements are also reliant on primary energy usage, mostly fossil fuels, which are seen to be highly polluting and less efficient. Given the foregoing, the apparent solution to this dilemma in Asian countries is to incorporate advanced technologies and transfer from fossil-based resources to renewable resources. Moving to a low-carbon economy not only resolves power management and social health concerns, but also innovates the country’s industrial base, assuring long-term economic prospects, while also assisting in the achievement of the Paris Agreement’s ambitious objective of curbing carbon emissions by 60–65 percent by 2030.

The current study employed the most recent available data of eleven Asian economies for the period of 2001 to 2019 to examine the influence of green investment, technology innovations, and economic growth on CO2 emissions. Besides accounting for the most recent statistics, our study contributes to the existing literature is three ways. First, it determines the consequences of CO2 emissions from green investment (investment in renewable energy) using a supply-side channel of renewable energy, whereas the previous research has mostly concentrated on the relationship between renewable energy usage and CO2 emissions for Asian nations. Therefore, this is likely to provide new insight to examine the impact of green investment (supply-side channel of renewable energy) on CO2 emissions of selected countries. Secondly, as the Industrial Revolution era resulted in the significant influence of technology innovations on both enhancing economic growth as well as abating environmental damages, we also determined the impact of technological innovation on CO2 emissions in selected countries. Very few studies have already examined the influence of technological innovation on environmental quality in Asian economies; however, they mostly used R&D activities, energy efficiency levels, and eco-innovations as proxies for technology innovations. Conversely, we used the total amount of patent applications to measure technological innovations, as patent applications are seen to be a more-precise proxy for technological innovations and account for the overall technological development of an economy, not only in the energy sector. Lastly, our study provides a systematic theoretical foundation for integrating the explanatory variables in the model for empirical estimation and also used the most consistent and modern econometric techniques for panel data estimation.

2. Empirical Evidence

2.1. Green Investment and CO2 Emission

Pollution is often seen as a danger to the environment. Yet, it is also considered a threat to the manufacturing sector’s productivity. Instead of seeing pollution as wastage of resources, [14] argued that it should be viewed as inefficiencies in the manufacturing process. As a result, any expenditure that helps to improve the efficacy of the manufacturing procedure qualifies as a green investment. Such investments (green) go beyond energy conservation and renewable resources to incorporate recycling and waste management, industrial pollution reduction, water cleanliness, biodiversity preservation, and climatic change adaptation and mitigation [15]. The amount of literature available on the influence of green investment, particularly investment in renewable energy sources on CO2 emissions, is limited. Although, there are several relevant studies that highlight the significance of green investment in promoting green growth and CO2 reduction by using other indicators. For example, [16] utilized public expenditure in energy as a measure of energy innovation in OECD nations. The empirical outcomes have shown that energy improvements had a negative effect on CO2 emissions, enhancing environmental quality. In another study, [17] evaluated the validation of the EKC postulate by analyzing renewable energy utilization and public expenditure on energy R&D and found that using renewable energy significantly diminishes carbon emissions. The research results also showed that increasing government spending on energy R&D promotes environmental quality by reducing carbon dioxide emissions.

Ref. [18] investigated green investment’s impact on CO2 emissions in OECD nations. The author pointed out that investing in green energy, such as renewable energy, improves energy efficiency while simultaneously reducing environmental damage by decreasing carbon emissions. Ref. [19] examined the correlation between private investments and carbon dioxide emissions employing FDI inflows as an indicator of private investment in South Asian Countries. They discovered that private investment is associated with CO2 emission, and that after a certain level of investment, CO2 emissions begin to decline, resulting in an inverted-U connection between both the indicators. Ref. [20] employed an ARDL cointegration approach to inspect the factors of CO2 emissions for the French economy. They utilized R&D as a tool for assessing government energy investment. Their findings showed that government investment in energy promotes the development of energy-efficient technologies, which enhances the quality of the environment via decreasing carbon dioxide emissions. Ref. [21] inspected the EKC theory for OECD nations from 1995 to 2016, taking into account the critical impact of energy investments, i.e., public expenditure on energy generation. They proved the validation of the EKC concept. According to findings, public spending in the energy industry is favorably associated with environmental quality.

The impact of encouraging green initiatives and the green investments in attaining Sustainable Development Goals (SDGs) was examined by [22]. The study advocated the adoption of green investments, green- bonds, and carbon- market tools in order to fulfill the SDGs and encourage green growth. Ref. [23] emphasized the significance of green finance in supporting green development models and argued that financial entities should also be allowed to implement carbon pricing. Ref. [24] on the other hand, stress stimulating private investment for environmentally sustainable growth. Increasing private investment will reduce global carbon emissions and accelerate the switch towards a low-carbon economy. The authors highlighted the significance of financial needs for clean energy promotion and moving towards a low-carbon economy. Ref. [25] focused on the importance of financial technologies, particularly green financial technology acquisition. The authors argued that the expansion of financial technology and green funding is the only way to accomplish the SDGs and the Paris Agreement. Furthermore, [26] highlight the role of public–private partnership investments in ensuring a low-carbon economy. Investment in public–private partnerships is more effective in nations with good governance and administration, as well as more market experience and market regulation. Given the above background of green investment and CO2 emissions, the first hypothesis of this study is;

Hypothesis 1 (H1).

An increase in green investment (renewable energy investment) would significantly reduce the CO2 emissions in selected Asian countries.

2.2. Technology Innovations and CO2 Emission

Innovation is one of the most powerful weapons for reducing CO2e emissions, conserving energy, and promoting economic growth, among other factors. Economic activities frequently increase CO2 growth by increasing energy demand and consumption, while energy efficiency driven by innovation may have a significant influence on enhancing market efficiency and reducing market imperfections [26]. As a result, technological improvements to produce sustainable product cycles, components, and manufacturing technology, as well as the deployment of end-to-end pipeline innovation and petroleum improvements, have proved to be helpful for enhancing global market productivity [27].

The present literature on CO2 emissions and innovation focused on R&D spending in general, eco-innovation development, and environmental technology, which is typical, does not reveal the overall technology innovations in an economy. For example, [28] analyzed the influence of R&D activities and the patent applications on carbon dioxide emissions in the United Kingdom, Italy, Germany, and France from 2004 to 2012. They found that patents and R&D spending have only a minor influence on CO2 emissions. Their research findings revealed that the only way to successfully reduce fossil fuels energy-related emissions is to promote technology innovations. Ref. [15] explored the effect of energy investment patterns on carbon dioxide mitigation and discovered that public–private energy expenditure results in higher CO2 emissions. Ref. [29] noted that local R&D assists in the reduction of CO2 emissions using a panel dataset.

Ref. [30] employed quantile regression and indicated that the number of patent entitlements is significantly inversely related to CO2 emissions in OECD countries. Ref. [31] asserted that technical innovation can clearly reduce CO2 emissions by boosting energy efficiency. Ref. [32] concluded that energy consumption assists in the reduction of CO2 emissions through technology innovations. While developing new goods, economic innovation, also recognized as green technology innovation, promotes environmental protection. Ref. [33] examined the link among environment patent applications and CO2 emissions in EU-27 nations from 1992 to 2014 and concluded that the quantity of environmental patent applications significantly reduces CO2 emissions. Ref. [34] examined the effect of technology innovation in the energy industry on carbon dioxide emissions in Chinese provinces from 2009 to 2016. Their estimated outcomes indicated that technological advancement in energy industries has a large and beneficial influence on CO2 emission reductions, and that energy efficiency may decrease CO2 emissions considerably. Based on empirical findings, they recommended that the government enhance spending in energy research and improve energy effectiveness to decrease the overall carbon dioxide emissions. Ref. [27] examined the link between innovation and carbon dioxide emissions in OECD countries. They discovered that an increase in economic growth has a positive influence on CO2 emissions, while innovation has a negative effect on CO2 emission. They also stated that innovation is crucial in reducing carbon emissions. Their research shows that in order to reduce carbon emissions, the implementation of innovative concepts is required by governments.

Ref. [31] used cointegration and quantile regression methods to observe the influence of technological innovations and clean energy usage on the environment–energy–growth relationship in thirty countries. According to their results, technological advancements have a large and adverse influence on carbon dioxide emission. They emphasized that countries with large CO2 emissions should invest more in new technology to reduce CO2 emissions. Furthermore, [35] revealed that renewable energy patents comprising storing, solar, bioenergy, maritime, and wind had an adverse influence on CO2 emissions in China with the support of an energy usage structure using the panel threshold approach. Using the ordinary least-squares approach, [36] examined the effect of innovation on CO2 and found an inverse linkage among innovations and CO2 emissions. Ref. [37] evaluated the influence of inter and intra technology development transfers on CO2 emissions in China and revealed that energy and environment technology have a large positive influence on the reduction of CO2 emissions. This implies that governments must devote extra resources to energy efficiency technology research, new energy innovation, and carbon mitigation applications. Hence, the second hypothesis of the study is:

Hypothesis 2 (H2).

Increases in technology innovations in an economy are expected to decrease CO2 emissions in selected countries.

2.3. Growth and CO2 Emission

Individuals are significantly affected by the negative externalities of environmental deterioration. As a result, increased economic growth leads to increased CO2 emissions, putting the environment and biodiversity at risk. Because of the contradictory and paradoxical connections between growth, energy usage, and CO2 emissions, policymakers find it challenging to achieve long-term sustainable growth.

In terms of the environmental consequences of economic growth, previous research has traditionally focused on the economic growth–environmental sustainability nexus using the EKC hypothesis as a theoretical basis. The EKC hypothesis suggests that an increase in economic growth is likely to increase CO2 emissions as well, then after reaching a certain point of economic growth, the further upsurge in economic growth leads to a decrease in CO2 emissions [38]. However, the most recent existing research on the growth–CO2 emissions nexus under the EKC theory revealed conflicting outcomes. For example, the EKC hypothesis was validated by [39] for Pakistan, [40] for ASEAN states, [32] for BRICS economies, and [8] for OECD countries. On the other hand, the EKC theory has been invalidated by [41] for China, [42] have invalidated it for BRICS economies, and [43] for 26 European countries.

Additionally, Ref. [44] determined that economic growth had a substantial and enhancing effect on CO2 emissions in GCC nations. According to [45], the economic growth and rapid urbanization activities in China increased carbon emissions. EKC had not been verified for BRICS and Turkey (BRICST), according to [46], as energy structure and energy intensity are the primary factors for carbon dioxide emission. Ref. [47] explored the long-term association among CO2 emissions, clean energy, and the economic growth for Turkey from 1974 to 2014 by applying the cointegration method. The author revealed the confirmation of long-term linkages among economic growth, clean energy, and carbon dioxide emissions. However, most of the research looked at the environment and growth link solely through the lens of the EKC concept, ignoring the importance of other factors. As a result, the conflicting empirical outcomes of the EKC hypothesis revealed that the link between CO2 emissions and growth differs among economies as they undergo different growth pathways and adopt diverse policies that might impact carbon dioxide emission. For instance, Ref. [48] have shown that increased usage of energy and increasing economic expansion are linked to increased CO2 emissions in Sub-Saharan Africa, whereas [49] claim that investment influences the connection among CO2 emissions and growth. The study further explained that economic structures differ because advanced economies have a better level of skill in human resources, whereas emerging nations prefer to industrialize, resulting in larger carbon emissions. Certain studies look at the influence of renewable energy on CO2 emissions and conclude that, on average, a rise in the usage of renewable energy is linked to lower CO2 emissions due to the clean manufacturing of this technology [50]. Finally, other studies have observed a connection between carbon dioxide emissions and economic growth with financial institutions [51], energy composition [52], and the quality of institutions [53]. Given the EKC hypothesis, the third hypothesis of our study is:

Hypothesis 3 (H3).

There exists an inverted U-shape association between economic growth and CO2 emissions in selected Asian countries.

3. Methodological Framework

3.1. Specification of Model

Following [4], the traditional factors of production for total output in an economy could be described by the Cobb Douglas production function as:

where the term Y denotes the total output, is the technology factor, is the amount of capital, and indicates the labor input, while signify constants. In Equation (1), the technology factor can be substituted with technology innovation (TIN).

As it is generally assumed that environment-polluting emissions, particularly CO2 emissions (COE), stem from the different production/output actions, in accordance with [45], the carbon emissions function can be incorporated as:

Placing the value in Equation (3) we obtain:

Consequently, we deduce that not all types of capital products are CO2 emitters throughout production. Rather, fossil fuels such as coal, oil, and gas are typically associated with CO2 emissions, whereas renewables such as hydropower, biomass, wind, and solar reduce the proportion of CO2 [54]. Therefore, the capital goods produced are divided into two types, the goods produced through fossil fuel sources of energy and termed , and the goods produced through renewable energy sources and termed . The total amount of capital in equation form can be written as:

Replacing with and in Equation (5) we obtain the following equation:

As a result, we substituted the fossil fuel capital ( with energy consumption (ENC) as an emitting capital as conducted by [55] for Vietnam. Similarly, renewable energy is indicated as a significant factor in reducing CO2 by several studies, thus renewable energy capital ( in Equation (6) is substituted with green investment (GIN), that is, investment in renewable energy, parallel to the study of [56], and the new equation can be rewritten as:

Then, because labor activities represent economic actions, we replaced the labor component by economic growth (GDP) to examine the EKC hypothesis validity, comparable to the research of [44]. We obtain a new function:

Equation (8) indicates that energy consumption, green investment, technology innovations, and economic growth are the crucial influencers of CO2 emissions. Considering the potential impact of other variables in increasing/decreasing CO2 emissions and in agreement with previous studies, we included FDI inflow, population growth, and trade in the model listed below.

All the variables in Equation (9) are transformed to the logarithm form to obtain smooth outcomes, and the final model to estimate can be rewritten as:

where COE is the CO2 emissions (metric ton), GIN is green investment measured by public investment in renewable energy, TIN denotes a technology innovation proxy by the total number of patent applications, and GDP is an economic growth factor proxy by the growth rate in gross domestic products per capita. According to [57,58,59]), renewable energy is a significant factor to mitigate CO2 emission, hence investment in renewable energy resources are likely to reduce CO2 emissions as it increases the renewable energy supply. Similarly, [56] explained that the adoption of modern technology and production methods are beneficial in lowering production-based CO2 emissions, thus technology innovations in a country are expected to have an adverse influence on CO2 emissions. Finally, in agreement with the previous literature [60,61] FDI, POP, and TRD are control variables denoting foreign direct investment inflows, the population growth rate, and trade openness, respectively.

3.2. Estimation Methods

3.2.1. Cross-Sectional Dependence (CSD)

Cross-sectional dependence (CSD) is an issue that emerges when macroeconomic shocks have comparable effects on cross-sections inside a panel, so these cross-sections may be termed cross-section dependent and thus cause misleading outcomes if the CSD issue is not handled [54]. Cross-sectional dependence concerns might arise in Asian nations as a result of interlinkages such as international treaties, trade agreements, and financial and socio-economic integration. The CSD (CD) test developed by [62,63] has been used to overcome this methodological problem with panel data as suggested in Equation (11).

where CD indicates CSD, N is the number of cross-sections, T shows the estimation time, and indicates the cross-sectional error correlation among i and j. To confirm the cross-sectional dependence, we applied the LM test denoted in Equation (12), where the null hypothesis is cross-sections are independent.

where i denotes the cross-sections in the panel and t shows the time.

3.2.2. Unit-Root Tests

If the results of the heterogeneity testing confirm the existence of CSD between the countries considered, the conventional unit-root tests are, in turn, inappropriate due to systematic bias in evaluating stationarity. The second-generation tests of the unit root are the right approach in this context [27]. As a result, we used Cross-section Augmented Dickey–Fuller (CADF) and Cross-section Im–Pesaran–Shin (CIPS) testing to check the unit-root of in each time series. The unit root equation is:

where represents the regressors, is the intercept, shows the time period, Δ denotes the difference operative, and signifies the error term.

3.2.3. Westerlund Cointegration Method

After the confirmation of the stationary level of the data series, the second-generation panel-cointegration technique is used, as suggested by [54]. By accounting for cross-section dependence concerns, this methodology offers consistent and reliable estimations of the cointegration characteristics as opposed to the commonly utilized first-generation panel-cointegration approaches.

where refers to the residual of the model, i signifies the cross-sections, and t denotes the time, with the null hypothesis suggesting no cointegration between the variables.

3.2.4. Long-Run Estimation Methods

Then, to estimate the long-term coefficients of the model, the Panel Dynamic Ordinary Least Square (PDOLS) and Panel Fully Modified Ordinary Least Square (PFMOLS) techniques are employed. The reason for adopting both methods is because some researchers believe that the PDOLS approach not only assists in the estimation of robust results, but also performs more effectively and provides improved sample characteristics for small panel samples [2]. In addition, FMOLS and DOLS methods also overcome the problem of heterogeneity and heterogeneous cointegrated [54]. Some researchers, on the other hand, suggest that the PFMOLS technique is preferable to the PDOLS method as it resolves multiple data problems such as simultaneity and autocorrelation while also giving reliable results in smaller panel samples [10]. As a consequence, in order to prevent any contradiction in the outcomes, we rely on more than one econometric method in order to report more consistent outcomes. For panel data, the general expression for the CO2 function is:

Equation (16) is advocated by [64] to compute coefficients through the PFMOLS method:

where is the arithmetic mean of Z and is equal to where indicates the covariance. In addition, is introduced to resolve the issue of specious serial correlation.

Furthermore, Pedroni represented Equation (17) by including lead, and lag aspects for PDOLS estimators.

To estimate the coefficients of , the general equation is:

where and is .

3.2.5. Augmented Mean Group (AMG) and Common Correlated Effect Mean Group (CCEMG)

This study will also employ two additional techniques, AMG and CCEMG, to verify the reliability of the outcomes acquired by PFMOLS and PDOLS. Problems such as cross-section dependency, heterogeneity, cointegration breakdowns, and non-stationarity are all addressed in both of these techniques [65]. The cross-sectional average of both dependent and explanatory variables is used by CCEMG and AMG.

3.3. Description and Source of Data

This study conducts an analysis to investigate the influence of green investment, technological innovation, and economic growth on carbon emissions in eleven selected Asian countries (China, Bangladesh, Indonesia, Malaysia, Philippine, Pakistan, India, Sri Lanka, South Korea, Thailand, and Vietnam) considering the data availability of all variables for the period 2001 to 2019. The data for CO2 emissions (COE) and fossil fuel-based energy consumption (ENC) were collected from the Statistical Review of World Energy (2020). The data for GDP, technology innovation (TIN), population (POP), and trade openness (TRD) were collected from the World Bank database. The study used public investment in renewable energy as a proxy for green investment (GIN) and these data have been collected from the International Renewable Energy Agency (IRENA).

4. Results and Discussion

4.1. Preliminary Results

This section represents the empirical outcomes of the study by employing different econometric techniques including CD tests, panel cointegration, FMOLS, PDOLS, Granger Causality, AMG, and CCEMG tests. We rely on more than one econometric in order to report efficient and consistent outcomes. Table 1 represents the outcomes of the CSD test and confirms the existence of CSD among the selected Asian countries. The outcomes of the CSD test further suggest that all variables are statistically significant at the 1% level.

Table 1.

CSD test results.

The confirmation of the presence of CSD among the panels suggests that traditional approaches to test the unit-root are not valid. Thus, we applied a second-generation unit-root test, CIPS, and CADF to confirm the integration order of the data series. Results given in Table 2 revealed the stationarity of all variables at the first difference confirmed by both CIPS and CADF. The confirmation of having the same integration order (first difference) of all variables allows us to apply the cointegration method to confirm the long-term relationship among variables. Consequently, the Westerlund panel cointegration method is applied to confirm the long-run association among variables. The cointegration results presented in Table 3 confirm the long-term relationship among variables, where p-values rejected the null hypothesis of no long-term relationship among variables.

Table 2.

Stationarity results.

Table 3.

Westerlund cointegration results.

4.2. Long-Run Results

After confirmation of the long-term relationship among the variables, we applied PFMOLS and PDOLS tests to attain long-term coefficients of the variables. PFMOLS and PDOLS results provided in Table 4 revealed that a 1% increase in technology innovations (TIN) was estimated to reduce CO2 emissions by 0.14635% and 0.28375%, respectively, by PFMOLS and PDOLS estimates. From this result, it seems that an increase in technology innovation stimulates firms to expand more in innovation, which in turn supports the adoption of environmentally friendly technology in the manufacturing process. To put it another way, firms with affluence of information, understanding, and expertise are more inclined to seek out and invent new and energy efficient technologies to decrease CO2 emissions, but developing competitive eco-friendly techniques or products requires skills as well as continued engagement in R&D. Our findings regarding the influence on technology innovations on CO2 emissions are in line with several empirical studies, see for example [32,33].

Table 4.

PFMOLS and PDOLS results.

Green investment (GIN) was found to abate CO2 emissions by 0.21937% and 0.19482%, respectively, by PFMOLS and PDOLS as a result of a 1% enhancement. This advocates that investment in renewable energy is adversely associated with CO2 emissions in selected Asian economies, and the region needs to expend renewable energy resources in order to lower CO2 emissions linked to energy consumption. A similar effect of green investment on CO2 emissions was found by [20,56]. The select countries in the region have huge potential for developing renewable energy. Indonesia, for example, has substantial biomass, geothermal, and hydropower energy, while other Asian nations also have access to hydropower, solar, and wind energy. Between 2015 and 2030, renewable energy generation in the region is expected to increase five-fold according to an IRENA report. The smart approach to take is to improve the energy infrastructure by shifting to renewable energy and increasing its generation through clean technology and investment. According to the ASEAN Plan of Action for Energy Cooperation (APAEC) 2016–2025, among the Asian region, Southeast Asian countries have planned to raise renewable energy to 23% of its energy supply by 2025.

One of the primary driving causes for the increase in CO2 emissions has been recognized as economic growth. All of the selected countries are in diverse phases of economic development, with immense potential for further economic expansion and raising the living standard through enhanced energy usage. Economic growth enhancement was found to intensify CO2 emissions in sample countries by 0.44813% and 0.51772% according to PFMOLS and PDOLS estimates, respectively. However, we found an adverse influence of the GDP square on CO2 emissions by both long-term estimates. Economic expansion has negative environmental consequences, implying that these countries have still yet to promote ecological welfare over economic benefits. Furthermore, the observed findings support the EKC inverted U-shaped curve hypothesis. As a consequence, it is reasonable to infer that, on average, the select Asian economies are moving toward a sustainable path, in which increased economic growth leads to increased CO2 emissions up to a certain point, owing to the rapid industrialization. However, continued economic expansion may improve the environment by adopting energy-efficient technologies, increasing the renewable energy supply, and making significant innovation resulting in a decline in CO2 emission.

Energy consumption (ENC) is significantly and positively linked with CO2 emissions, where a 1% increase in ENC was found to augment CO2 emissions by 0.38182% and 0.41633%, respectively, shown by PFMOLS and PDOLS estimates. This positive influence of energy consumption on CO2 emissions is consistent with several empirical studies, such as [10,66,67]. One of the key factors contributing to CO2 emissions is fossil-based energy usage, and the Asian region’s heavy reliance on carbon-based energy is a major challenge to its transformation from carbon-intensive to a lower-carbon region. The Asian region comprising emerging countries has rising energy requirements to sustain their economic growth. Consequently, in the Asian region, a carbon-based energy infrastructure with a fossil energy domination is prevalent, owing to the abundant and relatively inexpensive fossil energy inputs. According to International Energy Agency (IEA) (2019) estimates, Indonesia is the world’s fourth biggest coal generator, accounting for 7 percent of global production, whereas Malaysia and Thailand are the eighth and ninth biggest importers. In terms of environmental effects, the usage of fossil fuel-dominated energy in previous decades has probably not been the best choice for Asian countries. However, alternative decarbonized resources, such as wind energy, are available to countries such as Malaysia, Vietnam, the Philippines, and Indonesia to decrease CO2 emissions and replace energy sources. The influence of energy substitution and choice might be insightful for the region.

Foreign direct investment (FDI) inflow also amplified CO2 emissions in selected economies. We noted that a 1% surge in FDI inflows increases the CO2 emissions by 0.18277% and 0.21761%, respectively, by both PFMOLS and PDOLS. In addition, the FDI–CO2 emissions nexus results indicates the “pollution haven” concept in the selected countries, which indicates that multinational companies, specifically those involved in high-polluting activities, would relocate their production activities to nations with more relaxed environmental laws, therefore expanding CO2 emissions [55,60]. The possible reason for the positive influence of FDI on CO2 emissions is that Asian economies have received a large amount of FDI from the last two decades since the region has begun transformation towards industrialization. The adverse influence of FDI on environment quality is not sufficiently considered by Asian countries and FDI inflows have become the source of obsolete and emission-intensive technology transfer which is significantly increasing CO2 emissions.

Population growth (POP) is also estimated to be a major contributor to CO2 emissions of the sample countries, where a 1% increase in population growth of selected Asian countries induced 0.37761% and 0.29397% CO2 emissions, respectively, estimated by PFMOLS and PDOLS. Population growth has been recognized as the main driver of increased CO2 emissions, as it increases energy demand [68]. Much research supports the positive link between population and CO2 emissions [68,69,70], and this is definitely true in the context of Asian countries due to their large share in the world’s total population The population’s role as an augmenting factor of CO2 may be seen from a variety of angles. For example, higher usage of resources, such as electricity, fossil fuels, transportation, and other goods and services, results in increased CO2 emissions as a surge in population. The population as a decisive factor in the rise of CO2 emissions is influenced not only by its size, but also through its affluence. However, some researchers such as [71] believe that the magnitude of the population effect on CO2 emissions also varies depending on the income level of the country.

An increase in trade activities has a significant influence on promoting CO2 emissions. For selected Asian economies, a 1% increase in trade (TRD) was found to enhance CO2 emissions by 0.14376% and 0.16861% as revealed by PFMOLS and PDOLS outcomes, respectively. Trade openness enhances CO2 emissions in Asia because many Asian countries are largely dependent on foreign trade, where the rising share of foreign trade has intensified the use of production resources and large energy consumption. Meanwhile, enhancing the living conditions and development in these countries correspondingly surges CO2 emissions. A similar relationship between trade openness and CO2 emissions has been found by [70]. Additionally, in the case of Italy, [57]) explained that trade openness is a significant growth-promoting factor, which consequently enhances CO2 emissions in a country with an increasing trade volume.

4.3. Robustness Tests

Table 5 and Table 6 show the outcomes of the Granger Causality test, and the CCEMG and AMG tests, respectively. The Granger Causality test results represented in Table 5 suggest the unidirectional causality from technology innovations to CO2 emissions, economic growth to CO2 emissions, population to CO2 emissions, and FDI inflows to CO2 emissions. However, there is a bidirectional casualty between green investment and CO2 emissions, energy consumption and CO2 emissions, and trade and CO2 emissions. Similarly, CCEMG and AMG results given in Table 6 are similar to those attained through PFMOL and PDOLS given in Table 4, and confirm the consistency of our outcomes. The CCEMG and AMG outcomes additionally revealed the significance of the overall model as the value of the Wald test was highly significant. Similarly, the Root Mean Square Error (RMSE) for both tests was similar, although the RMSE value for CCEMG is greater than the AMG model. However, [10] explained that both CCEMG and AMG tests perform similarly in terms of RMSE, having a unit root issue, cross-section dependence, and cointegration or not.

Table 5.

Granger causality results.

Table 6.

AMG and CCEMG results.

5. Conclusions and Policy Suggestions

Environmental concerns of achieving long-term economic growth have serious consequences on human wellbeing, specifically in countries on the track of development. The overutilization of resources in these economies to improve the economic condition of the masses is causing severe harm to environmental sustainability, such as increasing the level of CO2 emissions over time. To address these issues, technology innovations and a shift towards renewable energy as the means of production appears to be an assured way to curb these rising global threats. Thus, our study explored the influence of green investment, technology innovations, and economic growth on CO2 emissions in the context of eleven selected Asian economies for the period 2001 to 2019. The study applied the CSD test to examine the cross-section dependency, CIPS and CADF tests to ascertain the stationarity level of the variables, the Westerlund cointegration test for confirmation of the long-term nexus among variables, and finally, PFMOLS and PDOLS to attain long-term coefficients of independent variables. First, the CSD test confirmed the presence of cross-section dependence, and similarly, the stationarity at the first difference was confirmed by CIPS and CADF tests for all variables, while the Westerlund cointegration method indicated the existence of long-term relationships between variables. The outcomes of PFMOLS and PDOLS indicated the negative and significant influence of green investment and technology innovations, as well as a positive significant influence of energy consumption (fossil fuel based), population growth, trade, and FDI inflow on CO2 emissions in the sample countries. The results regarding economic growth indicate an inverted U-shape relationship between economic growth and CO2 emissions, confirming the EKC concept, as GDP was found to have a positive influence while the square term of GDP was found to adversely affect CO2 emissions. Similarly, the FDI–CO2 emissions nexus validated the presence of the “pollution-haven” hypothesis in selected Asian countries. The outcomes of our study were proven to be valid and robust by applying the Granger Causality test, as well as AMG and CCEMG tests.

Based on the empirical findings, our study recommends suggestions to lower CO2 emissions. The governments in selected countries may continue to deepen their ties with developed countries that are at the forefront of technology innovations, meanwhile expanding their reliance on and investment in renewable energy resources and technological innovations. Governments should proactively encourage low-carbon technology innovations that are critical to Asia’s transition to a low-carbon region. Furthermore, we emphasize the optimistic influence of sustainable development in reducing carbon emissions, considering CO2 emissions in economic growth from the perception of long-term development rather than short-term actions, and fully realize Asia’s low-carbon transition in the economic development process. Besides, in order to mitigate the negative impacts of trade openness and FDI inflows on environment quality, more industries with eco-friendly production techniques must be targeted, since this would encourage knowledge transfer from clean technology to various sectors of the economy.

The prime limitation of this study is that it employed the data of only 11 Asian countries due to the data availability of the considered variables. Future possible research can be conducted by including a sample of other regions or panel-groups such as developed and developing countries for more interesting and comparative findings. Furthermore, we used PFMOLS and PDOLS to estimate the coefficient, and non-linear and threshold analyses can be conducted to check the possible non-linearity in the sample. Similarly, future researchers can incorporate other indicators in the model such as financial innovations, research and development expenditures in renewable energy, global value chain, and urbanization, which can possibly reduce CO2 emissions.

Author Contributions

Data curation, S.U.; formal analysis, S.U.; methodology, K.A.; validation, K.A.; visualization, S.U.; writing—original draft, R.L.; writing—review and editing, S.U. and K.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China, grant number 72073082. The APC was paid by Shandong University, Weihai, China.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets used and analyzed during the current study are available from the corresponding author on reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahmed, Z.; Wang, Z.; Ali, S. Investigating the non-linear relationship between urbanization and CO2 emissions: An empirical analysis. Air Qual. Atmos. Health 2019, 12, 945–953. [Google Scholar] [CrossRef]

- Khan, Z.; Sisi, Z.; Siqun, Y. Environmental regulations an option: Asymmetry effect of environmental regulations on carbon emissions using non-linear ARDL. Energy Sour. Part A Recov. Utilizat. Environ. Effects 2019, 41, 137–155. [Google Scholar] [CrossRef]

- Khan, M. CO2 emissions and sustainable economic development: New evidence on the role of human capital. Sustain. Dev. 2020, 28, 1279–1288. [Google Scholar] [CrossRef]

- Ahmad, M.; Jiang, P.; Majeed, A.; Umar, M.; Khan, Z.; Muhammad, S. The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: An advanced panel data estimation. Res. Policy 2020, 69, 101817. [Google Scholar] [CrossRef]

- Dou, Y.; Zhao, J.; Malik, M.N.; Dong, K. Assessing the impact of trade openness on CO2 emissions: Evidence from China-Japan-ROK FTA countries. J. Environ. Manag. 2020, 296, 113241. [Google Scholar] [CrossRef]

- Khan, S.; Khan, M.K.; Muhammad, B. Impact of financial development and energy consumption on environmental degradation in 184 countries using a dynamic panel model. Environ. Sci. Pollut. Res. 2021, 28, 9542–9557. [Google Scholar] [CrossRef] [PubMed]

- Tufail, M.; Song, L.; Adebayo, T.S.; Kirikkaleli, D.; Khan, S. Do fiscal decentralization and natural resources rent curb carbon emissions? Evidence from developed countries. Environ. Sci. Pollut. Res. 2021, 28, 49179–49190. [Google Scholar] [CrossRef]

- Petrović, P.; Lobanov, M.M. The impact of R&D expenditures on CO2 emissions: Evidence from sixteen OECD countries. J. Clean. Prod. 2020, 248, 119187. [Google Scholar]

- Wang, Z.; Zhu, Y. Do energy technology innovations contribute to CO2 emissions abatement? A spatial perspective. Sci. Total Environ. 2020, 726, 138574. [Google Scholar] [CrossRef] [PubMed]

- Ahmad, M.; Khan, Z.; Rahman, Z.U.; Khattak, S.I.; Khan, Z.U. Can innovation shocks determine CO2 emissions (CO2e) in the OECD economies? A new perspective. Econ. Innov. New Technol. 2021, 30, 89–109. [Google Scholar] [CrossRef]

- Sinha, A.; Shahbaz, M. Estimation of environmental Kuznets curve for CO2 emission: Role of renewable energy generation in India. Renew. Energy 2018, 119, 703–711. [Google Scholar] [CrossRef] [Green Version]

- Nathaniel, S.; Khan, S.A.R. The nexus between urbanization, renewable energy, trade, and ecological footprint in ASEAN countries. J. Clean. Prod. 2020, 272, 122709. [Google Scholar] [CrossRef]

- Nathaniel, S.P. Environmental degradation in ASEAN: Assessing the criticality of natural resources abundance, economic growth and human capital. Environ. Sci. Pollut. Res. 2021, 28, 21766–21778. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Shahbaz, M.; Raghutla, C.; Song, M.; Zameer, H.; Jiao, Z. Public-private partnerships investment in energy as new determinant of CO2 emissions: The role of technological innovations in China. Energy Econ. 2020, 86, 104664. [Google Scholar] [CrossRef] [Green Version]

- Álvarez-Herránz, A.; Balsalobre, D.; Cantos, J.M.; Shahbaz, M. Energy innovations-GHG emissions nexus: Fresh empirical evidence from OECD countries. Energy Policy 2017, 101, 90–100. [Google Scholar] [CrossRef]

- Alam, M.S.; Apergis, N.; Paramati, S.R.; Fang, J. The impacts of R&D investment and stock markets on clean-energy consumption and CO2 emissions in OECD economies. Int. J. Financ. Econ. 2020, 26, 4979–4992. [Google Scholar]

- Ganda, F. The influence of green energy investments on environmental quality in OECD countries. Environ. Qual. Manag. 2018, 28, 17–29. [Google Scholar] [CrossRef]

- Waqih, M.A.U.; Bhutto, N.A.; Ghumro, N.H.; Kumar, S.; Salam, M.A. Rising environmental degradation and impact of foreign direct investment: An empirical evidence from SAARC region. J. Environ. Manag. 2019, 243, 472–480. [Google Scholar] [CrossRef] [PubMed]

- Shahbaz, M.; Nasir, M.A.; Roubaud, D. Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Econ. 2018, 74, 843–857. [Google Scholar] [CrossRef] [Green Version]

- Balsalobre-Lorente, D.; Shahbaz, M.; Jabbour, C.J.C.; Driha, O.M. The role of energy innovation and corruption in carbon emissions: Evidence based on the EKC hypothesis. In Energy and Environmental Strategies in the Era of Globalization; Springer: New York, NY, USA, 2019; pp. 271–304. [Google Scholar]

- Sachs, J.D.; Woo, W.T.; Yoshino, N.; Taghizadeh-Hesary, F. Importance of green finance for achieving sustainable development goals and energy security. Handb. Green Financ. Energy Secur. Sustain. Dev. 2019, 10, 1–10. [Google Scholar]

- Dikau, S.; Volz, U. Central bank mandates, sustainability objectives and the promotion of green finance. Ecol. Econ. 2021, 184, 107022. [Google Scholar] [CrossRef]

- Azhgaliyeva, D.; Kapoor, A.; Liu, Y. Green bonds for financing renewable energy and energy efficiency in South-East Asia: A review of policies. J. Sustain. Financ. Invest. 2020, 10, 113–140. [Google Scholar] [CrossRef]

- Zahan, I.; Chuanmin, S. Towards a green economic policy framework in China: Role of green investment in fostering clean energy consumption and environmental sustainability. Environ. Sci. Pollut. Res. 2021, 28, 43618–43628. [Google Scholar] [CrossRef] [PubMed]

- Ahmad, M.; Raza, M.Y. Role of public-private partnerships investment in energy and technological innovations in driving climate change: Evidence from Brazil. Environ. Sci. Pollut. Res. 2020, 27, 30638–30648. [Google Scholar] [CrossRef]

- Mensah, C.N.; Long, X.; Boamah, K.B.; Bediako, I.A.; Dauda, L.; Salman, M. The effect of innovation on CO2 emissions of OCED countries from 1990 to 2014. Environ. Sci. Pollut. Res. 2018, 25, 29678–29698. [Google Scholar] [CrossRef] [PubMed]

- Cho, J.H.; Sohn, S.Y. A novel decomposition analysis of green patent applications for the evaluation of R&D efforts to reduce CO2 emissions from fossil fuel energy consumption. J. Clean. Prod. 2018, 193, 290–299. [Google Scholar]

- Luan, B.; Huang, J.; Zou, H. Domestic R&D, technology acquisition, technology assimilation and China's industrial carbon intensity: Evidence from a dynamic panel threshold model. Sci. Total Environ. 2019, 693, 133436. [Google Scholar]

- Cheng, C.; Ren, X.; Dong, K.; Dong, X.; Wang, Z. How does technological innovation mitigate CO2 emissions in OECD countries? Heterogeneous analysis using panel quantile regression. J. Environ. Manag. 2021, 280, 111818. [Google Scholar] [CrossRef]

- Chen, Y.; Lee, C.-C. Does technological innovation reduce CO2 emissions? Cross-country evidence. J. Clean. Prod. 2020, 263, 121550. [Google Scholar] [CrossRef]

- Petak, S.I.; Ahmad, M.; Khan, Z.U.; Khan, A. Exploring the impact of innovation, renewable energy consumption, and income on CO2 emissions: New evidence from the BRICS economies. Environ. Sci. Pollut. Res. 2020, 27, 13866–13881. [Google Scholar]

- Töbelmann, D.; Wendler, T. The impact of environmental innovation on carbon dioxide emissions. J. Clean. Prod. 2020, 244, 118787. [Google Scholar] [CrossRef]

- Jiang, Z.; Lyu, P.; Ye, L.; wenqian Zhou, Y. Green innovation transformation, economic sustainability and energy consumption during China’s new normal stage. J. Clean. Prod. 2020, 273, 123044. [Google Scholar] [CrossRef]

- Xu, L.; Fan, M.; Yang, L.; Shao, S. Heterogeneous green innovations and carbon emission performance: Evidence at China’s city level. Energy Econ. 2021, 99, 105269. [Google Scholar] [CrossRef]

- Fernández, Y.F.; López, M.F.; Blanco, B.O. Innovation for sustainability: The impact of R&D spending on CO2 emissions. J. Clean. Prod. 2018, 172, 3459–3467. [Google Scholar]

- Liu, C.; Ma, C.; Xie, R. Structural, innovation and efficiency effects of environmental regulation: Evidence from China’s carbon emissions trading pilot. Environ. Resour. Econ. 2020, 75, 741–768. [Google Scholar] [CrossRef]

- Kaika, D.; Zervas, E. The Environmental Kuznets Curve (EKC) theory—Part A: Concept, causes and the CO2 emissions case. Energy Policy 2013, 62, 1392–1402. [Google Scholar] [CrossRef]

- Hassan, S.T.; Xia, E.; Khan, N.H.; Shah, S.M.A. Economic growth, natural resources, and ecological footprints: Evidence from Pakistan. Environ. Sci. Pollut. Res. 2019, 26, 2929–2938. [Google Scholar] [CrossRef]

- Chontanawat, J. Relationship between energy consumption, CO2 emission and economic growth in ASEAN: Cointegration and causality model. Energy Rep. 2020, 6, 660–665. [Google Scholar] [CrossRef]

- Yilanci, V.; Pata, U.K. Investigating the EKC hypothesis for China: The role of economic complexity on ecological footprint. Environ. Sci. Pollut. Res. 2020, 27, 32683–32694. [Google Scholar] [CrossRef] [PubMed]

- Aydin, M.; Turan, Y.E. The influence of financial openness, trade openness, and energy intensity on ecological footprint: Revisiting the environmental Kuznets curve hypothesis for BRICS countries. Environ. Sci. Pollut. Res. 2020, 27, 43233–43245. [Google Scholar] [CrossRef]

- Aydin, C.; Esen, Ö.; Aydin, R. Is the ecological footprint related to the Kuznets curve a real process or rationalizing the ecological consequences of the affluence? Evidence from PSTR approach. Ecol. Indic. 2019, 98, 543–555. [Google Scholar] [CrossRef]

- Ansari, M.A.; Ahmad, M.R.; Siddique, S.; Mansoor, K. An environment Kuznets curve for ecological footprint: Evidence from GCC countries. Carbon Manag. 2020, 11, 355–368. [Google Scholar] [CrossRef]

- Ahmed, Z.; Asghar, M.M.; Malik, M.N.; Nawaz, K. Moving towards a sustainable environment: The dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Res. Policy 2020, 67, 101677. [Google Scholar] [CrossRef]

- Dogan, E.; Ulucak, R.; Kocak, E.; Isik, C. The use of ecological footprint in estimating the environmental Kuznets curve hypothesis for BRICST by considering cross-section dependence and heterogeneity. Sci. Total Environ. 2020, 723, 138063. [Google Scholar] [CrossRef] [PubMed]

- Pata, U.K. Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. J. Clean. Prod. 2018, 187, 770–779. [Google Scholar] [CrossRef]

- Esso, L.J.; Keho, Y. Energy consumption, economic growth and carbon emissions: Cointegration and causality evidence from selected African countries. Energy 2016, 114, 492–497. [Google Scholar] [CrossRef]

- Valadkhani, A.; Nguyen, J.; Bowden, M. Pathways to reduce CO2 emissions as countries proceed through stages of economic development. Energy Policy 2019, 129, 268–278. [Google Scholar] [CrossRef]

- Maji, I.K.; Sulaiman, C.; Abdul-Rahim, A. Renewable energy consumption and economic growth nexus: A fresh evidence from West Africa. Energy Rep. 2019, 5, 384–392. [Google Scholar] [CrossRef]

- Nasir, M.A.; Huynh, T.L.D.; Tram, H.T.X. Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. J. Environ. Manag. 2019, 242, 131–141. [Google Scholar]

- Islam, R.; Ghani, A.B.A. Link among energy consumption, carbon dioxide emission, economic growth, population, poverty, and forest area: Evidence from ASEAN country. Int. J. Soc. Econ. 2018, 45, 275–285. [Google Scholar] [CrossRef]

- Wawrzyniak, D.; Doryń, W. Does the quality of institutions modify the economic growth-carbon dioxide emissions nexus? Evidence from a group of emerging and developing countries. Econ. Res. 2020, 33, 124–144. [Google Scholar] [CrossRef] [Green Version]

- Weimin, Z.; Chishti, M.Z.; Rehman, A.; Ahmad, M. A pathway toward future sustainability: Assessing the influence of innovation shocks on CO2 emissions in developing economies. Environ. Dev. Sustain. 2021, 1–24. [Google Scholar] [CrossRef]

- Ullah, S.; Nadeem, M.; Ali, K.; Abbas, Q. Fossil fuel, industrial growth and inward FDI impact on CO2 emissions in Vietnam: Testing the EKC hypothesis. Manag. Environ. Qual. Int. J. 2021. [Google Scholar] [CrossRef]

- Chunling, L.; Memon, J.A.; Thanh, T.L.; Ali, M.; Kirikkaleli, D. The Impact of Public-Private Partnership Investment in Energy and Technological Innovation on Ecological Footprint: The Case of Pakistan. Sustainability 2021, 13, 10085. [Google Scholar] [CrossRef]

- Ali, M.; Kirikkaleli, D. The asymmetric effect of renewable energy and trade on consumption-based CO2 emissions: The case of Italy. Integr. Environ. Assess. Manag. 2021. [Google Scholar] [CrossRef] [PubMed]

- Khan, H.; Khan, I.; Binh, T.T. The heterogeneity of renewable energy consumption, carbon emission and financial development in the globe: A panel quantile regression approach. Energy Rep. 2020, 6, 859–867. [Google Scholar] [CrossRef]

- Khan, M.W.A.; Panigrahi, S.K.; Almuniri, K.S.N.; Soomro, M.I.; Mirjat, N.H.; Alqaydi, E.S. Investigating the dynamic impact of CO2 emissions and economic growth on renewable energy production: Evidence from FMOLS and DOLS tests. Processes 2019, 7, 496. [Google Scholar] [CrossRef] [Green Version]

- Shabir, M.; Ali, M.; Hashmi, S.H.; Bakhsh, S. Heterogeneous effects of economic policy uncertainty and foreign direct investment on environmental quality: Cross-country evidence. Environ. Sci. Pollut. Res. 2021, 1–16. [Google Scholar] [CrossRef]

- Yang, B.; Ali, M.; Nazir, M.R.; Ullah, W.; Qayyum, M. Financial instability and CO2 emissions: Cross-country evidence. Air Qual. Atmos. Health 2020, 13, 459–468. [Google Scholar] [CrossRef]

- Breusch, T.S.; Pagan, A.R. The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef] [Green Version]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Liddle, B. Consumption-based accounting and the trade-carbon emissions nexus in Asia: A heterogeneous, common factor panel analysis. Sustainability 2018, 10, 3627. [Google Scholar] [CrossRef] [Green Version]

- Vo, D.H.; Le, Q.T.-T. CO2 emissions, energy consumption, and economic growth: New evidence in the ASEAN countries. J. Risk Financ. Manag. 2019, 12, 145. [Google Scholar] [CrossRef] [Green Version]

- Khochiani, R.; Nademi, Y. Energy consumption, CO2 emissions, and economic growth in the United States, China, and India: A wavelet coherence approach. Energy Environ. 2020, 31, 886–902. [Google Scholar] [CrossRef]

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- Ahmed, Z.; Zafar, M.W.; Ali, S. Linking urbanization, human capital, and the ecological footprint in G7 countries: An empirical analysis. Sustain. Cities Soc. 2020, 55, 102064. [Google Scholar] [CrossRef]

- Ali, K.; Bakhsh, S.; Ullah, S.; Ullah, A.; Ullah, S. Industrial growth and CO2 emissions in Vietnam: The key role of financial development and fossil fuel consumption. Environ. Sci. Pollut. Res. 2021, 28, 7515–7527. [Google Scholar] [CrossRef]

- Dodson, J.C.; Dérer, P.; Cafaro, P.; Götmark, F. Population growth and climate change: Addressing the overlooked threat multiplier. Sci. Total Environ. 2020, 748, 141346. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).