Abstract

This paper aims to determine the interaction of commercial energy distribution, including the installed capacity of hydroelectric energy, hydroelectric energy generation, the installed capacity of thermal energy, thermal energy generation, the installed capacity of nuclear energy, and nuclear energy generation, with economic progress in Pakistan over the 1970–2019 period. Both linear and non-linear autoregressive distributed lag models were used to ascertain the symmetric and asymmetric short- and long-run effects. The findings from the linear autoregressive distributed lag model analysis revealed evidence that increases in the installed capacity of nuclear energy, alongside higher levels of hydroelectric energy generation and thermal energy generation, have positively affected economic growth in the short run, while a greater installed capacity of nuclear energy has positively affected economic growth in the long run. The findings from the non-linear autoregressive distributed lag model analysis showed that negative shocks to installed capacities related to hydroelectric, thermal, and nuclear energy reduced economic growth, while positive shocks to hydroelectric energy generation and the installed capacity of nuclear energy boosted economic growth in the short run. Furthermore, in the long run, negative shocks to the installed capacities of hydroelectric and thermal energy reduced economic growth, negative shocks to the installed capacity of nuclear energy enhanced economic growth, and positive shocks to hydroelectric energy generation and the installed capacity of nuclear energy have stimulated economic growth in Pakistan.

1. Introduction

Pakistan can effectively handle the country’s energy crisis by improving energy production and grid transmission capabilities. Oil scarcity has a knock-on impact on the economy. Because of the recent energy restructure, the energy industry is now suffering a supply shortfall and is seeking solutions to increase production while cutting costs. Pakistan’s reliance on fuel mix imports, such as energy, local coal, and re-gasified liquefied natural gas, has reduced in recent years. Pakistan’s whole energy balance is shifting away from dependence on natural gas. The shift in the energy balance might be attributed to a reduction in natural gas reserves and liquefied gas primer [1]. Pakistan’s power sector is in a slump and has experienced a number of challenges in recent years. The cyclical debt, the unstable financial situation of energy providers, a strong reliance on gas and oil, the diminishing availability of natural gas, the reduced usage of inexpensive hydel and coal resources, and the undeveloped potential to produce electricity all present little or no substantial restraint on energy shortages. In addition to changing global petroleum prices, Pakistan’s rising reliance on thermal energy production has a negative impact on energy production costs and may aggravate the country’s energy constraint [2,3,4].

To gain a better understanding of how energy affects human activities and development, it is necessary to examine each country’s energy use. With an increasing global population and changes in residents’ material lifestyle, energy resources are rapidly decreasing. Furthermore, the surge in global energy consumption has had a significant influence on the planet’s temperature and ecosystems. Because they are used to generate energy, fossil fuels are a significant source of pollution. The rise in oil production and use indicates that energy will be one of the world’s most significant issues in the future. Sustainable and renewable energy sources are required to meet this demand, while also addressing unfavorable environmental challenges. Renewable energies, such as solar and wind, will bridge the energy gap without emitting greenhouse gases or adversely hurting the environment [5,6,7,8]. Massive population increase has led to deforestation, and Pakistan is the Asian country with the most serious deforestation issues. Economic expansion and power consumption play a major role in boosting productivity and contributing to environmental devastation. Pakistan has a high energy demand, and conventional oil is utilized to fulfill the country’s ever-increasing energy need. The use of traditional energy sources emits carbon dioxide, which contributes to environmental damage [9,10].

In recent years, maintaining an efficient economy and a clean environment have been two sides of the same coin. We may create a better environment while still ensuring economic progress, or we can seek growth while reducing the use of non-renewable resources. There is also a link between a sustainable environment and economic development, because growth is tied to resource utilization. Understanding the relationship between energy usage and economic growth is an important goal in environmental policy formulation [11,12,13]. Some feel that global warming is a real hazard, and that, as a result, fast economic progress will be hampered. Furthermore, the world’s dependence on economically, monetarily, and politically dependent nations, energy-rich oil, and the peak oil hypothesis contribute to local energy supply and resource scarcity issues. This is backed by resource use and renewable energy, as well as evidence demonstrating a causal relationship with development [14,15,16].

Many investigates and analyses have been conducted which demonstrate the link between energy use and CO2 emissions, urbanization, energy consumption, financial development, renewable energy, trade, health expenditures, and natural resources [17,18,19,20,21,22,23,24], but this study makes a unique contribution to the previous literature by investigating the impact of commercial energy distribution, including hydroelectric, thermal, and nuclear energy, on economic progress in Pakistan by utilizing annual data for the period of 1970–2019. Linear (ARDL) and non-linear (NARDL) techniques have been employed with the help of long- and short-run analysis to investigate the interactions among the variables. The study is important for a developing country, such as Pakistan, that relies mainly on fossil fuel energy and thus risks significant environmental deterioration in its race for achieving economic growth. The research question focuses on investigating the existence of a positive or negative relationship between the clean energy sources and economic growth in Pakistan.

2. Eco-Energy: Related Literature

Over the last two decades, several researchers have investigated the correlation between energy demand and macroeconomic issues. Numerous studies have been conducted to investigate the underlying causes of energy consumption with a random effects model, focusing on a range of factors, such as industrial expansion, economic advancement, employment, and population. Energy is recognized as one of the most important instruments for social and economic progress, acting as the lifeblood of an economy. Not only is energy crucial to the market, but it is also important to its supply. Moreover, it is a geopolitical resource that has an impact on conflict outcomes, which itself boosts and impedes economic progress, and which pollutes and cleans the environment. In the era of globalization, the rapidly increasing oil supply and each nation’s dependency on energy demonstrate that energy will be a serious concern for the globe in the next century [25,26,27]. The high intensity of carbon pollution as a result of rapid economic development and increased fossil fuel consumption is important to researchers and policymakers. If we were to reduce greenhouse gas emissions via energy consumption methods, economic production would be adversely affected, since energy supply is a critical contributor to productivity [28,29,30].

The causal relationship between oil, environmental emissions, and economic growth is now being studied, focusing on a variety of procedures, methodologies, factors, and countries. However, the analytical results of this research are discordant. Some researchers believe that a two-way causal connection exists between energy consumption and economic development, whereas others believe that the relationship between energy and economic growth is unique, and vice versa. From an environmental and economic standpoint, the relationship between these variables is a highly fascinating concept [31]. National firms are establishing operations in their host countries to increase their energy consumption in the manufacturing sector. The expansion of economic practices leads to increased energy consumption, which may have a detrimental impact on environmental quality. Furthermore, the phenomena related to globalization have resulted in the transfer of new technology and experience, which not only decreases traditional energy usage but also often lowers energy demand. Foreign enterprises use new technologies to reduce fuel consumption in order to establish companies that can take advantage of current investment opportunities. New developments have also led to the introduction of ground-breaking manufacturing processes that reduced energy consumption [32,33,34].

In recent years, both theoretical and analytical research have focused on the relationship between energy use and economic advancement. Economic development and capital accumulation are important sources of energy. Increasing economic activity needs additional resources in order to further develop goods and services. Because of the economy’s heterogeneity, the path of this relationship is not always clear. This matter has lately received a lot of attention in case studies on oil-rich countries. As energy consumers and exporters, their markets face challenges not just in supporting sustainable industrial growth, but also in manufacturing. They also face fluctuations in their product prices. One of the most often discussed subjects is the utilization of energy. Because of its importance, it should be examined from a variety of perspectives, examining changes in global structures, assessing the energy potential of a variety of nations, and assessing their national economic and policy priorities [35,36,37,38]. There is a close correlation between economic growth and energy use. Most countries have now shifted from low income to middle income in their stages of development. Energy consumption in such nations is rising as the growth paradigm evolves. Because industrialized nations rely on fossil fuels for the bulk of their energy usage, and energy assistance in distant places is unneeded, these governments confront a twofold energy dilemma: can they provide vital energy supplies while also ensuring energy efficiency [39,40,41]?

Renewable energy is a critical component of long-term success. The world’s population has increased dramatically in recent years, and so the need for energy generation from non-stop conventional sources has increased. As a result, the future of sustainable growth is jeopardized by environmental issues and rising oil prices. Green technology, on the other hand, is designed to improve energy efficiency by augmenting natural capital and reacting to climate change and global warming. Renewable energy is an essential component for achieving long-term economic prosperity. Energy is the most important component of the production procedure; it is the cornerstone of the manufacturing industry. The acceleration of economic growth would increase energy consumption since neither would go ahead at the same time without the use of energy [42,43,44]. Growing demand for electricity promotes economic growth, yet energy usage often contributes to greenhouse gas emissions. Over the last decade, much attention has been paid to global warming and climate change, as well as the connection between air pollution, resource consumption, and economic growth. Many nations are attempting to minimize greenhouse gas emissions. The world’s biggest energy consumer has addressed the need for greenhouse gas reductions and proposed more sustainable policy actions to create a renewable roadmap for economic development [45,46,47].

Energy can also help with economic growth. Energy is a significant driver of economic growth since it is required for many industrial activities. On the other hand, more economic growth would result in an increased demand for goods and services, notably for more oil [48]. The environmental implications of growing oil consumption have resulted in climate change and global warming. Climate change and the acceleration of global warming do not benefit the natural world or human life on Earth. Governments and legislators in high-polluting nations want to reduce energy usage by increasing energy production and creation, and they want to look into the link between energy growth and global warming mitigation [49]. Furthermore, energy is required for domestic cooking, power storage, transportation, lighting, and routine duties, such as fuel and technology cleaning. The industrial sector demands greater resources in order to create economic activity and employ power for mass production. The role of energy is to fulfill the supply–demand connection of the market economy and to establish economic comparability in export commodities with greater returns and revenue. Directly used sources of energy include fossil fuels, such as gasoline, coal, and natural gas. Removing greenhouse pollutants would improve air quality and mitigate the consequences of global warming, and would promote the use of green energy [50,51,52].

3. Material and Methods

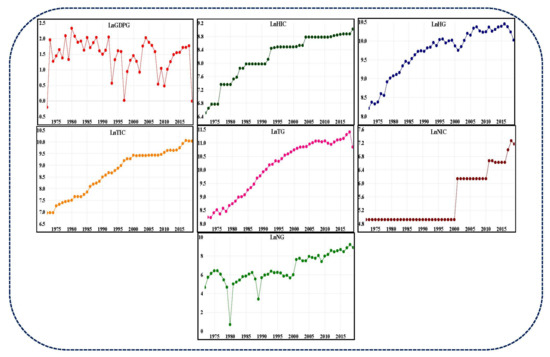

This assessment has used annual time series data from 1970–2019, collected from two main sources, WDI (World Development Indicators) (https://data.worldbank.org/country/pakistan (accessed on 10 August 2021) and the Economy Survey of Pakistan (http://www.finance.gov.pk/survey_1920.html (accessed on 10 August 2021), in order to analyze interactions between the variables. The main research variables are GDP growth, the installed capacity of hydroelectric energy, hydroelectric energy generation, the installed capacity of thermal energy, thermal energy generation, the installed capacity of nuclear energy, and nuclear energy generation. The tendencies of each variable are clearly seen in Figure 1.

Figure 1.

Plot of the analysis variables.

3.1. The Specifications of the Model

We used the subsequent model to show the interaction between GDP growth, the installed capacity of hydroelectric energy, hydroelectric energy generation, the installed capacity of thermal energy, thermal energy generation, the installed capacity of nuclear energy, and nuclear energy generation, and stated this as:

The testing technique can be introduced, and Equation (1) may be expanded as follows:

In addition, the logarithmic expression of Equation (2) might be structured as follows:

Equation (3) presents the logarithmic demonstration of the variables, including economic progress, the installed capacity of hydroelectric energy, hydroelectric energy generation, the installed capacity of thermal energy, thermal energy generation, the installed capacity of nuclear energy, and nuclear energy generation in Pakistan; designates error term, t is the measurement of time, and to represent the long-run model’s exponents.

3.2. Linear (ARDL) and Non-Linear (NARDL) Techniques

Moreover, in order to correct the association among variables in long- and short-run periods, we used the ARDL model, following Pesaran et al. [53] and Pesaran and Shin (1998) [54], the latter of whom further extended the technique. The ARDL technique has many benefits compared to other one-time integer approaches. The model has no compulsory assumptions, which other integrated procedures do, while all factors in the study must be used in the same sequence. That is, the ARDL procedure is used irrespective of the separation in the order of the simple return scheme in I(2), while the cointegration series is in I(0) or I(1). The linear ARDL technique is also more suitable when working with limited data. The model’s sample size is highly adjustable. For short- and long-term use, the version of the ARDL approach that it is best to use is the UECM model. Here, the long- and short-term trends are defined separately. The general classification of the relationships between variables is as follows:

The long-run link description for variables can be seen as:

In addition, the representation of short-term interactions for the variables may be written as follows:

Equation (6) shows the short-term analysis of variables. Furthermore, it is better suited for use with small samples than for most traditional recursion progressions compared to the short- and long-run dynamic relationships that are assessed using the asymmetric (NARDL) techniques. Pesaran et al. [53] projected that F-tests would take into consideration the widespread implications of adding long-term variables in order to validate long-term estimates.

In addition, drawing on the study of Shin et al. [55], an asymmetric technique (NARDL) can also be used, which represents the decomposition of the installed capacity of hydroelectric energy, hydroelectric energy generation, the installed capacity of thermal energy, thermal energy generation, the installed capacity of nuclear energy, and nuclear energy generation with consistent positive ((; ), (; ), and (; )) and negative ((; ), (; ), and (; )) processes, and can be stated as:

The NARDL model requirements can be defined for positive and negative shocks with Equations (7)–(18). Equation (4) can then be written as an asymmetric model:

The asymmetric (NARDL) technique is described in Equation (19). In addition, the Wald estimation is often used for analyzing short-run asymmetries and long-run asymmetries as follows: [≠ ≠ ≠ ]. The ECM (error correction model) description can be stated as:

The nonlinear ARDL model often calculates the multiplier impact of the study variables’ asymmetric form, and the following are listed:

where e = 1, 2, 3…. and [ as , and ].

The multiplier effect is a long term equilibrium alteration when calculating the unit shocks of HIC, HG, TIC, TG, NIC, and NG.

4. Results and Discussion

4.1. Study Summary Statistics and Correlation Outcomes

The summary statistics for each variable are shown in Table 1. It can be seen that all of the variables apart from LnNIC are negatively skewered. Moreover, the kurtosis outcomes show that all of the variables are platykurtic as well. Furthermore, the statistical significance of the Jarque–Bera statistics affirms the normal distributions of these variables. Table 2 shows the results of the correlation analysis for the variables used in this study. It can be seen that all of the explanatory variables are correlated with the dependent variable.

Table 1.

Summary statistics.

Table 2.

Correlation among study variables.

4.2. Stationarity Test for the Variables

Firstly, we used the two stationary tests for unit root testing, namely the ADF [56] and the P-P [57] tests. The analysis first examines the unit root features of the investigative variables. Therefore, the inclusion order is very crucial in the decision of the regression estimator, which is used to estimate long-term coefficients, for the increased confidence in the variables. However, the consequence of using these two unit root analytical techniques is that procedural disruption of the data is not taken into account. However, systemic defects are very critical to consider, since preventing this key issue leads to partial forecasts of the resort assets. The test results are revealed in Table 3. The estimates from both tests reveal a mixed order of integration among the variables at level and at first difference. Hence, the choice of using the ARDL and NARDL models in this study is justified. Besides, the confirmation of the stationarity of the variables nullifies the probability of estimating spurious regression outcomes.

Table 3.

Outcomes of unit root testing.

4.3. Symmetric and Asymmetric Bounds Testing for the Presence of Cointegration

The symmetric and asymmetric long-run connections between variables was analyzed using bounds testing. The following Table 4 shows the results of a symmetrical and asymmetrical cointegration test with F-statistical values 8.493856 and 5.290013 signifying levels of 10%, 5%, 2.5%, and 1%, with a lower and a higher bound signifying a cointegrated verdict.

Table 4.

Symmetric and asymmetric bounds test for the presence of cointegration results.

4.4. Cointegration Technique for the Variables

The interface between the variables of interest is described as critical after the assurance of the order of incorporation into the testing parameters. This research mostly utilizes the simplified moment’s procedure to approximate the connections between the sample variables. This process requires the integration of the testing variables if the predicted statistical values are higher than those below, and over the critical values. The reliability and the results are interpreted in Table 5. Variable intervention may be evaluated with the process of cointegration used by Johansen [58].

Table 5.

Outcomes of cointegration technique.

4.5. Symmetric (ARDL) Model Results

The results of the linear autoregressive distributed lag technique with long- and short-run analyses are shown in Table 6.

Table 6.

Symmetric short- and long-run examination outcomes.

In the Table 6, the outcomes of Panel A show that, in the short-run, economic growth had a positive relationship with hydroelectric energy generation, the installed capacity of thermal energy, and the installed capacity of nuclear energy, with probability values of 0.282, 0.561, and 0.024, respectively. The results also show that the installed capacity of hydroelectric energy, thermal energy generation, and nuclear energy generation had the opposite link to economic growth in Pakistan. Moving on to Panel B, the symmetric long-run analysis shows that hydroelectric energy generation, the installed capacity of thermal energy, and the installed capacity of nuclear energy were positively associated with economic progress, with coefficients of 0.681, 0.357, and 0.404 and probability values of 0.275, 0.562, and 0.024, respectively. Similarly, the installed capacity of hydroelectric energy, thermal energy generation, and nuclear energy generation were negatively associated with economic growth in Pakistan. Increased global rivalry between the emerging and industrialized world in the near future, will bring countries closer not only socially, but politically and economically.

The competition between developed and developing countries is becoming fiercer. It is well known that this growth is accompanied with a significant increase in energy consumption as a result of economic development. The environmental implications of increasing oil consumption have resulted in climate change and global warming. Global warming and the intensification of climate change do not benefit the natural world or human life on Earth. Governments and officials in high-polluting economies want to reduce energy demand by increasing energy innovation and production in order to minimize global warming and investigate the relationship between energy usages. Many longitudinal studies on energy development linkages have been carried out [59,60,61]. The ongoing movement from conventional to alternative energy is happening. As traditional energy generation and consumption, as well as increased conventional energy use, have negative environmental consequences, the demand for renewable energies is growing more pressing. Furthermore, there was data that revealed a short-term, two-way relationship between conventional energy usage and GDP growth. Based on these results, renewables are a potential choice for energy and climate change protection, while removing fossil fuels supports a clean energy economy [62,63,64].

The connection between growth in energy consumption and its effect on environmental deterioration, as well as its inherent influence on greenhouse gas emissions, has been thoroughly studied. Economic progress has a significant impact on standards of living, but also a negative environmental impact. Economic growth could simultaneously increase the consumption of energy. Some experts are concerned in this respect with the causal connection between these factors. However, economic development can also lead to emissions of greenhouse gases, which led some investigators to incorporate environmental predictors in the correlation analysis outlined above [65,66,67]. The ecosystem is highly interconnected with sustainable development. Given the energy supply and environmental issues, such as globalization, air contamination, industrial pollution, ozone degradation, and loss of forests, as well as environmental quality pressures from energy transmission to the economy, it is clear that if a society does not take heed, sustainable development cannot be achieved by using energy. Furthermore, the relationship between energy efficiency and environmental impact is strong because of the increase in efficiency which leads to the reduced use of resources and pollution. Furthermore, as more or less all energy supplies have certain environmental effects, environmental constraints and the resulting negative impacts on sustainable growth can be at least partly resolved with energy quality improvements [68,69,70].

Furthermore, Pakistan is a growing country with a manufacturing sector that is heavily reliant on energy. The connection between energy use and fiscal success has been investigated in the most current results that utilize national or integrated information. However, the presence of the aviation sector at the industrial levels does not support the energy development connotation, since energy utilization might be stringent in specific industries. Every year, Pakistan’s energy consumption rises. In order to close the supply–demand gap, Pakistan’s government must take urgent action to make use of key energy sources, such as solar and wind energy. In the current conditions of modern development, energy is not only the backbone of economic growth, but also an essential strategic reserve for a country, such as Pakistan, which confronts the relentless danger of energy shortages [71,72]. As the use of renewable energy grows, more researchers at the national, regional, and global levels are examining the fundamental elements of green energy generation to minimize pollution. Many recent studies have shown that renewable energy has a good environmental impact [73,74]. The outcomes of the Panel C show that the value of R2 and adj-R2 are 0.488 and 0.363, respectively. Likewise, the values for the F-statistic and DW are 3.921 and 2.028, respectively.

4.6. Asymmetric (NARDL) Model Outcomes

The results of the non-linear (NARDL) technique with long-and short-run examination are shown in Table 7.

Table 7.

Outcomes of asymmetric short- and long-run examination.

Table 7 shows the results of the asymmetric (NARDL) technique analysis, with Panel D showing the results of the short-run interactions between variables. The results show that the positive and negative shocks caused by the changes to the installed capacity of hydroelectric energy has both adversative and productive relationships to economic growth, with probability values of 0.752 and 0.000. The positive and negative shocks of hydroelectric energy generation have both constructive and adverse associations with economic progress, with probability values of 0.027 and 0.515. Similarly, the positive and negative shocks caused by changes to the installed capacity of thermal energy had an adverse and constructive association to economic growth, with p-values of 0.647 and 0.011. The positive and negative shocks of thermal energy generation had both a detrimental and beneficial association with economic progress, with p-values of 0.621 and 0.176. Furthermore, the positive and negative shocks caused by changes to the installed capacity of nuclear energy had both a positive and adversative connection with economic progress, with p-values of 0.026 and 0.021. The positive and negative shocks of nuclear energy generation had an adversative connection, with probability values of 0.571 and 0.156, respectively.

Proceeding to the Panel E, findings from the long-term exploration reveal that the positive and negative shocks caused by changes in the installed capacity of hydroelectric energy had an adversative and productive connection, with coefficients of −0.171 and 415.565 and p-values of 0.752 and 0.000. The positive and negative shocks of hydroelectric energy generation had both a constructive and undesirable association with economic growth, with coefficients of 1.417 and −0.783 and p-values of 0.027 and 0.511. Similarly, the positive and negative shocks caused by changes in the installed capacity of thermal energy had both an adverse and constructive connection, with coefficients of −0.335 and 50.374 and p-values of 0.641 and 0.008. The positive and negative shocks of thermal energy generation had a negative and positive relationship with economic progress, with coefficients of −0.421 and 1.590 and p-values of 0.625 and 0.177. Furthermore, the positive and negative shocks caused by changes in the installed capacity of nuclear energy had both a constructive and adverse relationship with economic progress, with coefficients of 0.922 and −12.445 and p-values of 0.026 and 0.014. The positive and negative shocks of nuclear energy generation had an adversative linkage to economic progress, with coefficients of −0.037 and −0.105 and p-values of 0.166 and 0.000, respectively.

The impact on income indicates that globalization, which decreased quality of the atmosphere by increasing greenhouse gases, raised the amount of production and exchange within an economy. Improvements in technology mean that countries will achieve energy-saving innovations faster because of development. To increase the environmental standards by reducing carbon dioxide, use energy-efficient technology. This effect reveals that the move to green capitalism, by shifting the economic system, influences the capital–labor ratio. The economy is also likely to shift from production to manufacturing and services. Interestingly, these sectoral shifts are likely to have distinct environmental effects. The transition to manufacturing from farming has deteriorated the sustainability of the atmosphere with increased carbon emissions. On the contrary, by reducing emissions of pollutants, the transition from farming to services improves the standard of temperature [75,76,77]. Because of several factors, such as increasing industrialization, increasing world population, shifting living conditions, and rising energy demand, the threat of global warming has risen in the past few decades. Decision makers may also be recommending energy-saving technology since energy use has a major influence on environmental pollution and appropriate strategies are therefore needed to address the impact of carbon emissions. Moreover, if globalization exacerbates environmental destruction, lawmakers could develop enabling strategies for globalization [78,79].

Economic development and the use of resources are, moreover, the primary sources of energy transfer and are seen as the main culprits of environmental degradation. Economic growth strategies must therefore be moderate to reduce the mechanism of environmental deterioration, and policymakers view the environmental pollution process as a major challenge for the economy and for growth. The reality is that industrialization, urbanization, and development in trade depend to a significant degree on the consumption of fossil fuels, such as oil and coal, and this is due to recent rapid economic development. Oil and coal were used for mining activities, electricity production, and transport. High energy use is, on the one hand, a key factor in fast economic growth, industrialization, and development. In turn, the intake of oil causes emissions of carbon [80,81,82]. The global mean temperature has increased in recent years, natural disasters and swelling weather have repeatedly occurred, air contamination is extremely severe, and environmental questions are becoming a key problem for civilization as a whole. Air pollution has become extremely dangerous, threatening human health and limiting the sustained growth of the global economy and civilization with the development of industrialization and urbanization across countries [83].

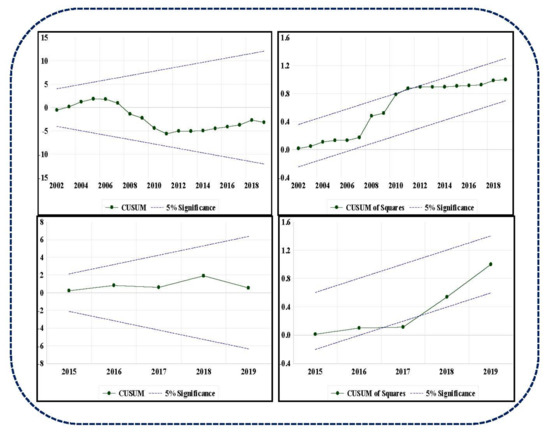

Energy is essential for economic growth. Furthermore, the rise in productivity continues to raise energy demand owing to the increase in energy use. There is a strong correlation between a country’s energy use and its total economic development. A country’s development and socio-economic advancement may therefore be gauged by looking at its per capita energy intake (PEI). Pakistan, similar to other developing nations, is seeing an increase in energy consumption due to the country’s growing population. Because of its high dependency on oil and gas, decreased power levels, circulatory debt, energy safety and challenges, and low governance, Pakistan is in the face of an acute energy shortage. Oil crisis management requires policies that reduce debt to a minimum and discourage financing investment [84,85]. Various nations around the globe have worked tirelessly to curb global emissions and to prevent dangerous climate change effects. Since fossil fuel is being used, much attention has been paid to greenhouse gas pollution resulting from combustion. In order to reduce greenhouse gas emissions while also generating cheaper and more efficient energy, the challenge is to increase the sector of energy procurement. If fossil fuel oil cannot yet be replaced, every effort must be made to discover an alternative source of energy. Nuclear and renewable energy may provide solutions to energy conservation and climate change [86,87,88]. The ultimate global task is to achieve environmental sustainability, and development is moving at a rapid pace in this field. Pollution is on the rise, and as a result of these factors, as well as rising global energy demand, there is now more need for cleaner surroundings and greener energy solutions. Industrialization and human activities pollute the environment today by releasing toxic gases from conventional fossil fuels, including coal, oil, and natural gas. However, nuclear power and renewable energy have received a lot of attention in the last several decades as ways to cut carbon dioxide emissions. There has been a great deal of investigation on what causes carbon dioxide emissions [89,90]. The results of Panel F show that the value of R2 and adj-R2 are 0.699 and 0.517. Similarly, the F-statistic and DW values are 3.839 and 2.097. The plotted results of the symmetric and asymmetric cumulative sum and cumulative sum of squares at the level of 5% are illustrated in Figure 2.

Figure 2.

Symmetric and asymmetric plot of CUSUM and CUSUM of squares.

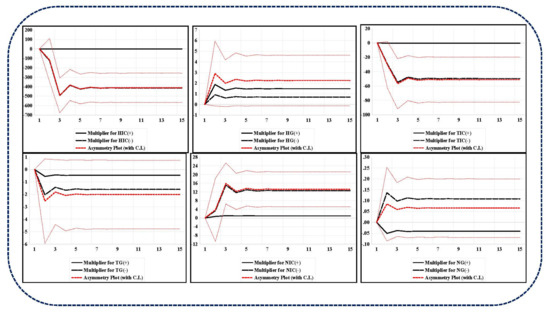

Figure 3 shows an asymmetric multiplier graph of (+ve) and (−ve) shocks caused by changes in the installed capacity of hydroelectric energy, hydroelectric energy generation, the installed capacity of thermal energy, thermal energy generation, the installed capacity of nuclear energy, and nuclear energy generation.

Figure 3.

Asymmetric multiplier graph of positive and negative shocks of variables.

5. Conclusions and Policy Directions

The major intension of this analysis was to determine the interaction of commercial energy distribution, including the installed capacity of hydroelectric energy, hydroelectric energy generation, the installed capacity of thermal energy, thermal energy generation, the installed capacity of nuclear energy, and nuclear energy generation, with the economic growth of Pakistan by taking annual data for the period 1970–2019. We have used two unit root tests to assess the stationarity of the variables. Symmetric (autoregressive distributed lag) and asymmetric (non-linear autoregressive distributed lag) methods were employed to check the interaction among the study variables. The consequences of the linear ARDL model reveal that, in the long run, hydroelectric energy generation, thermal energy from installed capacity, and nuclear energy from installed capacity had a dynamic connection with economic growth, while the installed capacity of hydroelectric energy, thermal energy generation, and nuclear energy generation had an adversative link with economic progress in Pakistan. Furthermore, the results of the nonlinear (NARDL) model show that, in the long-run, the installed capacity of hydroelectric energy, when suffering positive and negative shocks, had both an adversative and productive connection to economic growth. Positive and negative shocks to hydroelectric energy generation had both productive and adversative links to economic growth in Pakistan. Moreover, the positive and negative shocks caused by changes in the installed capacity of thermal energy had an adversative and productive association with economic growth in Pakistan. Likewise, positive and negative shocks to thermal energy generation had an adverse and productive linkage to economic growth. The positive and negative shocks caused by changes in the installed capacity of nuclear energy had a constructive and adversative relation to economic development. Lastly, the positive and negative shocks of nuclear energy generation had an adversative relative to economic growth. In addition, the symmetric and asymmetric short-run exploration also displays the constructive and adversative relationships to economic growth in Pakistan.

The Pakistani government is expected to address the energy crisis in the country which has disrupted the other performing sectors by pursuing the findings of this report. New investment schemes that deliver cheap energy, such as renewables, must be introduced. The Government of Pakistan stresses the usage of renewable energies from indigenous sources and the Pakistani ecosystem. In this respect, promoting green and alternative energy is a top priority for the government. A number of measures have been undertaken to establish a sustainable development framework for the clean energy industry of Pakistan to reap the benefits of the promise of domestic alternative energy sources. The challenge lies in the transfer of fuel to satisfy domestic energy requirements. Every new government builds new power stations and raises energy, but no one focuses on the enhancement of power transmission and distribution. The energy dilemma in Pakistan can be easily solved if specialists are empowered to develop power supply and distribution and if the government handles this question seriously and fairly. It is easier to rely on electricity transmission rather than relying on constructing further power plants. Once Pakistan becomes clearer, its economy will grow and this will attract more international investors. Furthermore, other economic sectors are affected by crises, and a certain kind of oil shortage is causing several recessions. The energy market in Pakistan has been a big economic player. Power shortages and energy subsidies’ budgetary effects hamper development. Energy subsidies are transferred from more profitable industries to more needed services.

Author Contributions

Conceptualization, A.R. and I.O.; methodology, A.R.; software, R.O.; validation, A.R. and W.B.; formal analysis, A.R.; investigation, M.R.; resources, W.B.; data curation, A.R.; writing—original draft preparation, M.R.; writing—review and editing, R.O.; visualization, W.B.; supervision, I.O.; project administration, A.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are publicly available as indicated in Section 3.

Conflicts of Interest

The authors declare no conflict of interest.

References

- GOP. Economic Survey of Pakistan 2019–2020; Finance Division, Economic Advisor’s Wing: Islamabad, Pakistan, 2020.

- Kessides, I.N. Chaos in power: Pakistan’s electricity crisis. Energy Policy 2013, 55, 271–285. [Google Scholar] [CrossRef]

- Javed, M.S.; Raza, R.; Hassan, I.; Saeed, R.; Shaheen, N.; Iqbal, J.; Shaukat, S.F. The energy crisis in Pakistan: A possible solution via biomass-based waste. J. Renew. Sustain. Energy 2016, 8, 43102. [Google Scholar] [CrossRef]

- GOP. Economic Survey of Pakistan 2017–2018; Finance Division, Economic Advisor’s Wing: Islamabad, Pakistan, 2017.

- Wang, Y. The analysis of the impacts of energy consumption on environment and public health in China. Energy 2010, 35, 4473–4479. [Google Scholar] [CrossRef]

- Liddle, B. Impact of population, age structure, and urbanization on carbon emissions/energy consumption: Evidence from macro-level, cross-country analyses. Popul. Environ. 2014, 35, 286–304. [Google Scholar] [CrossRef] [Green Version]

- Rehman, M.U.; Rashid, M. Energy consumption to environmental degradation, the growth appetite in SAARC nations. Renew. Energy 2017, 111, 284–294. [Google Scholar] [CrossRef]

- Muhammad, F.; Karim, R.; Muhammad, K.; Asghar, A. Population density, CO2 emission and energy consumption in pakistan: A multivariate analysis. Int. J. Energy Econ. Policy 2020, 10, 250–255. [Google Scholar] [CrossRef]

- Hassan, M.S.; Tahir, M.N.; Wajid, A.; Mahmood, H.; Farooq, A. Natural Gas Consumption and Economic Growth in Pakistan: Production Function Approach. Glob. Bus. Rev. 2018, 19, 297–310. [Google Scholar] [CrossRef]

- Khan, M.K.; Rehan, M. The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ. Innov. 2020, 6, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Pao, H.-T.; Tsai, C.-M. CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 2010, 38, 7850–7860. [Google Scholar] [CrossRef]

- Nawaz, S.; Iqbal, N.; Anwar, S. Electricity Demand in Pakistan: A Nonlinear Estimation. Pak. Dev. Rev. 2013, 52, 479–492. [Google Scholar] [CrossRef] [Green Version]

- Joo, Y.-J.; Kim, C.S.; Yoo, S.-H. Energy Consumption, CO2 Emission, and Economic Growth: Evidence from Chile. Int. J. Green Energy 2015, 12, 543–550. [Google Scholar] [CrossRef]

- Cho, S.; Heo, E.; Kim, J. Causal relationship between renewable energy consumption and economic growth: Comparison between developed and less-developed countries. Geosystem Eng. 2015, 18, 284–291. [Google Scholar] [CrossRef]

- Saad, W.; Taleb, A. The causal relationship between renewable energy consumption and economic growth: Evidence from Europe. Clean Technol. Environ. Policy 2018, 20, 127–136. [Google Scholar] [CrossRef]

- Can, H.; Korkmaz, Ö. The relationship between renewable energy consumption and economic growth: The case of Bulgaria. Int. J. Energy Sect. Manag. 2019, 13, 573–589. [Google Scholar] [CrossRef]

- Hwang, J.-H.; Yoo, S.-H. Energy consumption, CO2 emissions, and economic growth: Evidence from Indonesia. Qual. Quant. 2014, 48, 63–73. [Google Scholar] [CrossRef]

- Ali, H.S.; Law, S.H.; Zannah, T.I. Dynamic impact of urbanization, economic growth, energy consumption, and trade openness on CO2 emissions in Nigeria. Environ. Sci. Pollut. Res. 2016, 23, 12435–12443. [Google Scholar] [CrossRef] [PubMed]

- Song, Y.; Zhang, M. Using a new decoupling indicator (ZM decoupling indicator) to study the relationship between the economic growth and energy consumption in China. Nat. Hazards 2017, 88, 1013–1022. [Google Scholar] [CrossRef]

- Baloch, M.A.; Meng, F. Modeling the non-linear relationship between financial development and energy consumption: Statistical experience from OECD countries. Environ. Sci. Pollut. Res. 2019, 26, 8838–8846. [Google Scholar] [CrossRef] [PubMed]

- Kahia, M.; Ben Jebli, M.; Belloumi, M. Analysis of the impact of renewable energy consumption and economic growth on carbon dioxide emissions in 12 MENA countries. Clean Technol. Environ. Policy 2019, 21, 871–885. [Google Scholar] [CrossRef]

- Nathaniel, S.P. Ecological footprint, energy use, trade, and urbanization linkage in Indonesia. Geo. J. 2021, 86, 2057–2070. [Google Scholar] [CrossRef]

- Ahmad, M.; Akram, W.; Ikram, M.; Shah, A.A.; Rehman, A.; Chandio, A.A.; Jabeen, G. Estimating dynamic interactive linkages among urban agglomeration, economic performance, carbon emissions, and health expenditures across developmental disparities. Sustain. Prod. Consum. 2021, 26, 239–255. [Google Scholar] [CrossRef]

- Muhammad, B.; Khan, M.K.; Khan, S. Impact of foreign direct investment, natural resources, renewable energy consumption, and economic growth on environmental degradation: Evidence from BRICS, developing, developed and global countries. Environ. Sci. Pollut. Res. 2021, 28, 21789–21798. [Google Scholar] [CrossRef]

- Sahir, M.H.; Qureshi, A.H. Specific concerns of Pakistan in the context of energy security issues and geopolitics of the region. Energy Policy 2007, 35, 2031–2037. [Google Scholar] [CrossRef]

- Maziarz, M. A review of the Granger-causality fallacy. J. Philos. Econ. Reflect. Econ. Soc. Issues 2015, 8, 86–105. [Google Scholar]

- Saidi, K.; Hammami, S. The impact of CO2 emissions and economic growth on energy consumption in 58 countries. Energy Rep. 2015, 1, 62–70. [Google Scholar] [CrossRef] [Green Version]

- Omri, A. CO2 emissions, energy consumption and economic growth nexus in MENA countries: Evidence from simultaneous equations models. Energy Econ. 2013, 40, 657–664. [Google Scholar] [CrossRef] [Green Version]

- Sohag, K.; Begum, R.; Abdullah, S.M.S.; Jaafar, M. Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 2015, 90, 1497–1507. [Google Scholar] [CrossRef]

- Ahmed, K.; Bhattacharya, M.; Shaikh, Z.; Ramzan, M.; Ozturk, I. Emission intensive growth and trade in the era of the Association of Southeast Asian Nations (ASEAN) integration: An empirical investigation from ASEAN-8. J. Clean. Prod. 2017, 154, 530–540. [Google Scholar] [CrossRef]

- Ben Mbarek, M.; Saidi, K.; Rahman, M.M. Renewable and non-renewable energy consumption, environmental degradation and economic growth in Tunisia. Qual. Quant. 2018, 52, 1105–1119. [Google Scholar] [CrossRef]

- Shahbaz, M.; Shahzad, S.J.H.; Mahalik, M.K.; Sadorsky, P. How strong is the causal relationship between globalization and energy consumption in developed economies? A country-specific time-series and panel analysis. Appl. Econ. 2018, 50, 1479–1494. [Google Scholar] [CrossRef] [Green Version]

- Khan, M.K.; Teng, J.-Z. Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci. Total. Environ. 2019, 688, 424–436. [Google Scholar] [CrossRef]

- Saud, S.; Baloch, M.A.; Lodhi, R.N. The nexus between energy consumption and financial development: Estimating the role of globalization in Next-11 countries. Environ. Sci. Pollut. Res. 2018, 25, 18651–18661. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Mikayilov, J.I.; Mammadov, J.; Mammadov, E. The Impact of Financial Development on Energy Consumption: Evidence from an Oil-Rich Economy. Energies 2018, 11, 1536. [Google Scholar] [CrossRef] [Green Version]

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Yazdi, S.K.; Beygi, E.G. The dynamic impact of renewable energy consumption and financial development on CO2 emissions: For selected African countries. Energy Sources Part B Econ. Plan. Policy 2017, 13, 13–20. [Google Scholar] [CrossRef]

- Ma, X.; Fu, Q. The Influence of Financial Development on Energy Consumption: Worldwide Evidence. Int. J. Environ. Res. Public Health 2020, 17, 1428. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ahmed, M.M.; Shimada, K. The Effect of Renewable Energy Consumption on Sustainable Economic Development: Evidence from Emerging and Developing Economies. Energies 2019, 12, 2954. [Google Scholar] [CrossRef] [Green Version]

- Kutan, A.M.; Paramati, S.R.; Ummalla, M.; Zakari, A. Financing Renewable Energy Projects in Major Emerging Market Economies: Evidence in the Perspective of Sustainable Economic Development. Emerg. Mark. Finance Trade 2018, 54, 1761–1777. [Google Scholar] [CrossRef] [Green Version]

- Paramati, S.R.; Apergis, N.; Ummalla, M. Dynamics of renewable energy consumption and economic activities across the agriculture, industry, and service sectors: Evidence in the perspective of sustainable development. Environ. Sci. Pollut. Res. 2018, 25, 1375–1387. [Google Scholar] [CrossRef]

- Menegaki, A.N.; Tugcu, C.T. Energy consumption and Sustainable Economic Welfare in G7 countries; A comparison with the conventional nexus. Renew. Sustain. Energy Rev. 2017, 69, 892–901. [Google Scholar] [CrossRef]

- Maji, I.K.; Sulaiman, C.; Abdul-Rahim, A. Renewable energy consumption and economic growth nexus: A fresh evidence from West Africa. Energy Rep. 2019, 5, 384–392. [Google Scholar] [CrossRef]

- Li, Q.; Cherian, J.; Shabbir, M.S.; Sial, M.S.; Li, J.; Mester, I.; Badulescu, A. Exploring the Relationship between Renewable Energy Sources and Economic Growth. The Case of SAARC Countries. Energies 2021, 14, 520. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J. Economic growth, energy consumption and CO2 emissions in Gulf Cooperation Council countries. Energy 2014, 73, 44–58. [Google Scholar] [CrossRef]

- Yavuz, N.Ç. CO2 Emission, Energy Consumption, and Economic Growth for Turkey: Evidence from a Cointegration Test With a Structural Break. Energy Sources Part B Econ. Plan. Policy 2013, 9, 229–235. [Google Scholar] [CrossRef]

- Lu, W.-C. Greenhouse Gas Emissions, Energy Consumption and Economic Growth: A Panel Cointegration Analysis for 16 Asian Countries. Int. J. Environ. Res. Public Health 2017, 14, 1436. [Google Scholar] [CrossRef] [Green Version]

- Saidi, K.; Rahman, M.M.; Amamri, M. The causal nexus between economic growth and energy consumption: New evidence from global panel of 53 countries. Sustain. Cities Soc. 2017, 33, 45–56. [Google Scholar] [CrossRef]

- Shahbaz, M.; Zakaria, M.; Shahzad, S.J.H.; Mahalik, M.K. The energy consumption and economic growth nexus in top ten energy-consuming countries: Fresh evidence from using the quantile-on-quantile approach. Energy Econ. 2018, 71, 282–301. [Google Scholar] [CrossRef] [Green Version]

- Lau, E.; Tan, C.-C.; Tang, C.-F. Dynamic linkages among hydroelectricity consumption, economic growth, and carbon dioxide emission in Malaysia. Energy Sources Part B Econ. Plan. Policy 2016, 11, 1042–1049. [Google Scholar] [CrossRef]

- Ramadhana, R. Dynamic hydroelectricity consumption and economic growth in APEC countries and In-dia. Reg. Sci. Inq. 2019, 11, 111–117. [Google Scholar]

- Naz, S.; Sultan, R.; Zaman, K.; Aldakhil, A.M.; Nassani, A.A.; Abro, M.M.Q. Moderating and mediating role of renewable energy consumption, FDI inflows, and economic growth on carbon dioxide emissions: Evidence from robust least square estimator. Environ. Sci. Pollut. Res. 2019, 26, 2806–2819. [Google Scholar] [CrossRef] [PubMed]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y. An autoregressive distributed-lag modelling approach to cointegration analy-sis. Econom. Soc. Monogr. 1998, 31, 371–413. [Google Scholar]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. In The Festschrift in Honor of Peter Schmidt: Econometric Methods and Applications; Horrace, W., Sickles, R., Eds.; Springer: New York, NY, USA, 2014; pp. 281–314. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration—With appucations to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Magazzino, C. Energy consumption and GDP in Italy: Cointegration and causality analysis. Environ. Dev. Sustain. 2015, 17, 137–153. [Google Scholar] [CrossRef]

- Nain, M.Z.; Ahmad, W.; Kamaiah, B. Economic growth, energy consumption and CO2 emissions in India: A dis-aggregated causal analysis. Int. J. Sustain. Energy 2017, 36, 807–824. [Google Scholar] [CrossRef]

- Shahbaz, M.; Van Hoang, T.H.; Mahalik, M.K.; Roubaud, D. Energy consumption, financial development and economic growth in India: New evidence from a nonlinear and asymmetric analysis. Energy Econ. 2017, 63, 199–212. [Google Scholar] [CrossRef] [Green Version]

- Rodríguez-Monroy, C.; Mármol-Acitores, G.; Nilsson-Cifuentes, G. Electricity generation in Chile using non-conventional renewable energy sources—A focus on biomass. Renew. Sustain. Energy Rev. 2018, 81, 937–945. [Google Scholar] [CrossRef]

- Destek, M.A.; Aslan, A. Renewable and non-renewable energy consumption and economic growth in emerging economies: Evidence from bootstrap panel causality. Renew. Energy 2017, 111, 757–763. [Google Scholar] [CrossRef]

- Tuna, G.; Tuna, V.E. The asymmetric causal relationship between renewable and Non-Renewable energy con-sumption and economic growth in the ASEAN-5 countries. Resour. Policy 2019, 62, 114–124. [Google Scholar] [CrossRef]

- Ucan, O.; Aricioglu, E.; Yucel, F. Energy consumption and economic growth nexus: Evidence from developed countries in Europe. Int. J. Energy Econ. Policy 2014, 4, 411–419. [Google Scholar]

- Bölük, G.; Mert, M. Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: Evidence from a panel of EU (European Union) countries. Energy 2014, 74, 439–446. [Google Scholar] [CrossRef]

- Ozturk, F. Energy consumption–GDP causality in MENA countries. Energy Sources Part B Econ. Plan. Policy 2017, 12, 231–236. [Google Scholar] [CrossRef]

- Dinç, D.T.; Akdoğan, E.C. Renewable Energy Production, Energy Consumption and Sustainable Economic Growth in Turkey: A VECM Approach. Sustainability 2019, 11, 1273. [Google Scholar] [CrossRef] [Green Version]

- Rahman, M.M.; Velayutham, E. Renewable and non-renewable energy consumption-economic growth nexus: New evidence from South Asia. Renew. Energy 2020, 147, 399–408. [Google Scholar] [CrossRef]

- Destek, M.A.; Sinha, A. Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organisation for economic Co-operation and development countries. J. Clean. Prod. 2020, 242, 118537. [Google Scholar] [CrossRef]

- Chandio, A.A.; Rauf, A.; Jiang, Y.; Ozturk, I.; Ahmad, F. Cointegration and Causality Analysis of Dynamic Linkage between Industrial Energy Consumption and Economic Growth in Pakistan. Sustainability 2019, 11, 4546. [Google Scholar] [CrossRef] [Green Version]

- Akhtar, S.; Hashmi, M.K.; Ahmad, I.; Raza, R. Advances and significance of solar reflectors in solar energy tech-nology in Pakistan. Energy Environ. 2018, 29, 435–455. [Google Scholar] [CrossRef]

- Lin, B.; Benjamin, I.N. Causal relationships between energy consumption, foreign direct investment and eco-nomic growth for MINT: Evidence from panel dynamic ordinary least square models. J. Clean. Prod. 2018, 197, 708–720. [Google Scholar] [CrossRef]

- Saidi, K.; Mbarek, M.B. Nuclear energy, renewable energy, CO2 emissions, and economic growth for nine de-veloped countries: Evidence from panel Granger causality tests. Prog. Nucl. Energy 2016, 88, 364–374. [Google Scholar] [CrossRef]

- Kasman, A.; Duman, Y.S. CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: A panel data analysis. Econ. Model. 2015, 44, 97–103. [Google Scholar] [CrossRef]

- Nugraha, A.T.; Osman, N.H. CO2 emissions, economic growth, energy consumption, and household expendi-ture for Indonesia: Evidence from cointegration and vector error correction model. Int. J. Energy Eco-Nomics Policy 2019, 9, 291–298. [Google Scholar]

- Rahman, H.; Zaman, U.; Górecki, J. The Role of Energy Consumption, Economic Growth and Globalization in Environmental Degradation: Empirical Evidence from the BRICS Region. Sustainability 2021, 13, 1924. [Google Scholar] [CrossRef]

- Liu, Y.; Hao, Y. The dynamic links between CO2 emissions, energy consumption and economic development in the countries along “the Belt and Road”. Sci. Total Environ. 2018, 645, 674–683. [Google Scholar] [CrossRef] [PubMed]

- Rahman, M.M. Environmental degradation: The role of electricity consumption, economic growth and globalisation. J. Environ. Manag. 2020, 253, 109742. [Google Scholar] [CrossRef] [PubMed]

- Waheed, R.; Sarwar, S.; Wei, C. The survey of economic growth, energy consumption and carbon emis-sion. Energy Rep. 2019, 5, 1103–1115. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, H.; Yuan, J. Economic growth, energy consumption, and carbon emission nexus: Fresh evi-dence from developing countries. Environ. Sci. Pollut. Res. 2019, 26, 26367–26380. [Google Scholar] [CrossRef] [PubMed]

- Mensah, I.A.; Sun, M.; Gao, C.; Omari-Sasu, A.Y.; Zhu, D.; Ampimah, B.C.; Quarcoo, A. Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. J. Clean. Prod. 2019, 228, 161–174. [Google Scholar] [CrossRef]

- Wang, S.; Li, C.; Zhou, H. Impact of China’s economic growth and energy consumption structure on atmospheric pollutants: Based on a panel threshold model. J. Clean. Prod. 2019, 236, 117694. [Google Scholar] [CrossRef]

- Latief, R.; Lefen, L. Foreign Direct Investment in the Power and Energy Sector, Energy Consumption, and Economic Growth: Empirical Evidence from Pakistan. Sustainability 2019, 11, 192. [Google Scholar] [CrossRef] [Green Version]

- Mahmood, A.; Javaid, N.; Zafar, A.; Riaz, R.A.; Ahmed, S.; Razzaq, S. Pakistan’s overall energy potential assess-ment, comparison of LNG, TAPI and IPI gas projects. Renew. Sustain. Energy Rev. 2014, 31, 182–193. [Google Scholar] [CrossRef]

- Jaforullah, M.; King, A. Does the use of renewable energy sources mitigate CO2 emissions? A reassessment of the US evidence. Energy Econ. 2015, 49, 711–717. [Google Scholar] [CrossRef]

- Li, R.; Su, M. The Role of Natural Gas and Renewable Energy in Curbing Carbon Emission: Case Study of the United States. Sustainability 2017, 9, 600. [Google Scholar] [CrossRef] [Green Version]

- Khan, M.W.A.; Panigrahi, S.K.; Almuniri, K.S.N.; Soomro, M.I.; Mirjat, N.H.; Alqaydi, E.S. Investigating the Dynamic Impact of CO2 Emissions and Economic Growth on Renewable Energy Production: Evidence from FMOLS and DOLS Tests. Processes 2019, 7, 496. [Google Scholar] [CrossRef] [Green Version]

- Kumar, A.; Kumar, A.; Krishnan, V. Perovskite oxide based materials for energy and environment-oriented photocatalysis. ACS Catal. 2020, 10, 10253–10315. [Google Scholar] [CrossRef]

- Baek, J. Do nuclear and renewable energy improve the environment? Empirical evidence from the United States. Ecol. Indic. 2016, 66, 352–356. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).