Green Premium in the Tokyo Office Rent Market

Abstract

:1. Introduction

2. Data and Methods

2.1. Data

2.2. Base Model

2.3. Expanded Models: Repeat Sales and Propensity Score Analysis

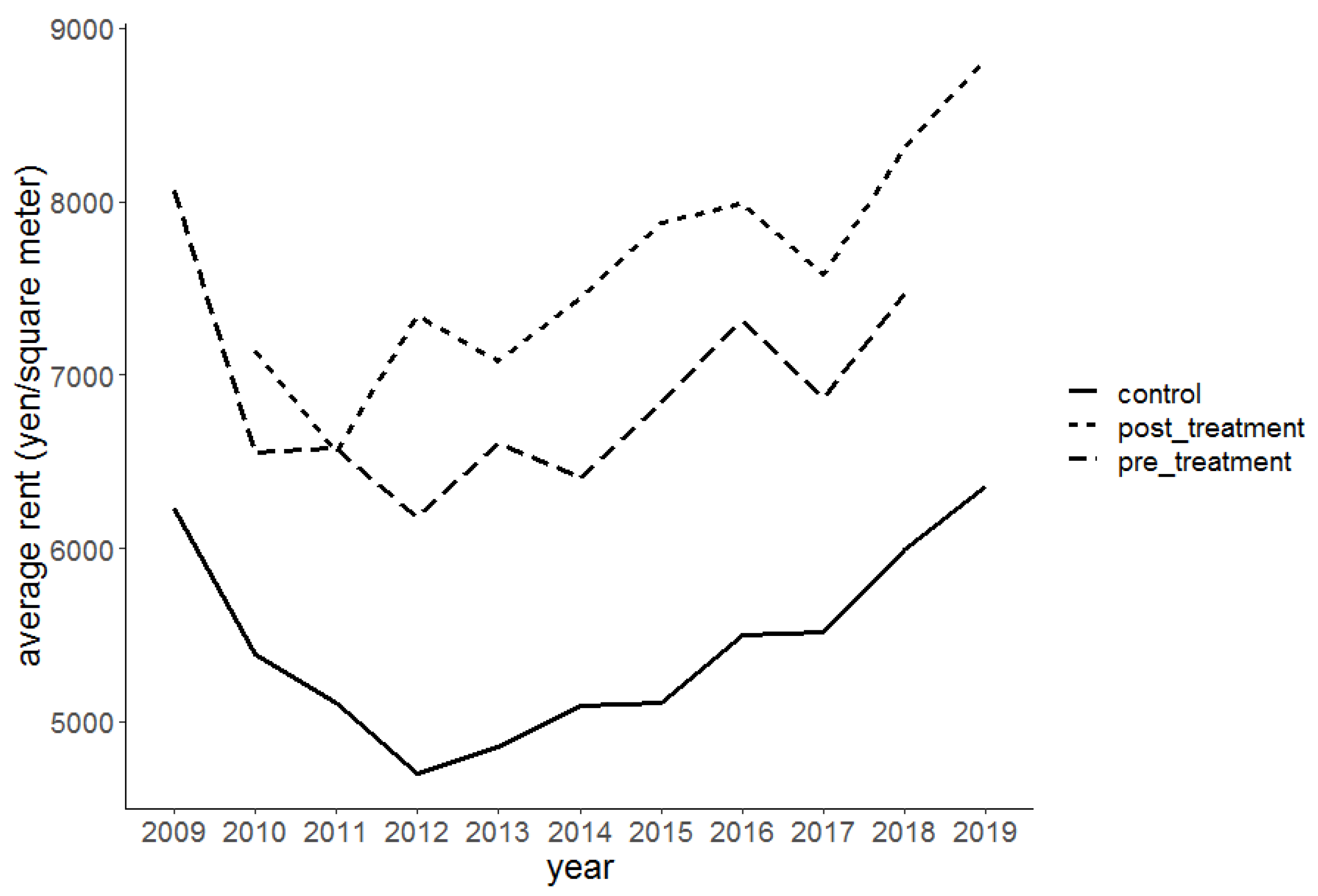

3. Results and Discussion

3.1. Base Model, Repeat Sales, and Propensity Score Matching

3.2. Results of Propensity Score Clustering

4. Conclusions

- Green labels showed a significant effect of 6.5% on new contract rents in our OLS regression. However, as the covariates differed greatly depending on green label presence or absence, estimates of a green premium included endogenous bias and were overestimated.

- When divided by propensity score clustering to address endogeneity, two homogeneous subsamples could be constructed.

- The estimated green premium for homogeneous subsamples was +5.4% for medium-sized old buildings and +2.6% for large-sized new buildings (both significant).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| LEED | Energy Star | BREEAM | EPCs | HQE | GRESB | ||

| Used in this study | - | - | - | - | - | - | |

| Development | U.S. Green Building Council (US) | U.S. Environmental Protection Agency (US) | Building Reserch Establishment (UK) | UK Government (UK) | HQE Association (France) | GRESB (The Netherlands) | |

| Since | 1998 | 1995 | 1990 | 2006 | 1996 | 2010 | |

| Target | Buildings | Buildings | Buildings | Buildings | Buildings | Firm | |

| Focus | Comprehensive | Energy Efficiency | Comprehensive | Energy Efficiency | Comprehensive | Comprehensive | |

| Output | 4 ranks | Energy Star ≥75 | 5 ranks | 8 ranks | 4 ranks | 4 quadrants | |

| Assessment items | Equipment | Yes | - | Yes | Yes | Yes | - |

| Operation | Yes | Yes | Yes | - | - | Yes | |

| Water | Yes | - | Yes | - | Yes | Yes | |

| Material | Yes | - | Yes | - | Yes | - | |

| Interior | Yes | - | Yes | - | Yes | Yes | |

| Site | Yes | - | Yes | - | Yes | - | |

| Transport | Yes | - | Yes | - | - | - | |

| Waste | Yes | - | Yes | - | Yes | - | |

| Containment | Yes | - | Yes | - | Yes | - | |

| Other | - | - | Management, performance verification | - | - | Organization, disclosure, risk assessment, green lease | |

| Source | [29] | [30] | [31] | [32] | [33] | [34] | |

| Greenstar | NABERS | CASBEE | CASBEE for Real Estate | DBJ Green Building Certificate | BELS | ||

| Used in this study | - | - | Yes | Yes | Yes | - | |

| Development | Green Building Council of Australia (Australia) | Australian Government (Australia) | MLIT (Japan) | MLIT (Japan) | Development Bank of Japan (Japan) | MLIT (Japan) | |

| Since | 2003 | 1990 | 2004 | 2012 | 2011 | 2014 | |

| Target | Buildings | Buildings | Buildings | Buildings | Buildings | Buildings | |

| Focus | Comprehensive | Energy Efficiency | Comprehensive | Comprehensive | Comprehensive | Energy Efficiency | |

| Output | 6 ranks | 5 ranks | 5 ranks | 4 ranks | 5 ranks | 5 ranks | |

| Assessment items | Equipment | Yes | - | Yes | Yes | Yes | Yes |

| Operation | Yes | Yes | - | Yes | - | - | |

| Water | Yes | Yes | Yes | Yes | Yes | - | |

| Material | Yes | - | Yes | Yes | - | - | |

| Interior | Yes | Yes | Yes | Yes | Yes | - | |

| Site | Yes | - | Yes | Yes | Yes | - | |

| Transport | Yes | - | Yes | Yes | Yes | - | |

| Waste | Yes | Yes | - | - | Yes | - | |

| Containment | Yes | - | Yes | - | - | - | |

| Other | Management, Innovation | - | Earthquake resistance, handicapped accessible | Earthquake resistance, useful life, disaster risk | Environment risk, crime prevention, tenant relation | - | |

| Source | [35] | [36] | [37] | [37] | [38] | [39] | |

Appendix B

References

- Eichholtz, P.M.A.; Kok, N.; Quigley, J.M. Why Do Companies Rent Green? Real Property and Corporate Social Responsibility. Program on Housing and Urban Policy Working Paper W09-004. 2009. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1521702 (accessed on 13 October 2021). [CrossRef] [Green Version]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Doing well by doing good? Green office buildings. Am. Econ. Rev. 2010, 100, 2492–2509. [Google Scholar] [CrossRef] [Green Version]

- Eichholtz, P.; Quigley, J.M. Green building finance and investments: Practice, policy and research. Eur. Econ. Rev. 2012, 56, 903–904. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. Eco-labelling in commercial office markets: Do LEED and Energy Star offices obtain multiple premiums? Ecol. Econ. 2011, 70, 1220–1230. [Google Scholar] [CrossRef]

- Miller, N.; Spivey, J.; Florance, A. Does green pay off? J. Real Estate Portfol. Manag. 2008, 14, 385–400. [Google Scholar] [CrossRef]

- Reichardt, A.; Fuerst, F.; Rottke, N.; Zietz, J. The business case of sustainable building certification: A panel data approach. J. Real Estate Res. 2012, 34, 99–126. [Google Scholar] [CrossRef]

- Holtermans, R.; Kok, N. On the Value of Environmental Certification in the Commercial Real Estate Market. Real Estate Econ. 2019, 47. [Google Scholar] [CrossRef]

- Szumilo, N.; Fuerst, F. Income Risk in Energy Efficient Office Buildings. Sustain. Cities Soc. 2017, 34, 309–320. [Google Scholar] [CrossRef]

- Ott, C.; Hahn, J. Green Pay off in Commercial Real Estate in Germany: Assessing the Role of Super Trophy Status. J. Prop. Invest. Financ. 2018, 36. [Google Scholar] [CrossRef]

- Robinson, S.; Simons, R.; Lee, E.; Kern, A. Demand for Green Buildings: Office Tenants’ Stated Willingness-to-Pay for Green Features. J. Real Estate Res. 2016, 38. [Google Scholar] [CrossRef]

- Shimizu, C. Will Green Buildings Be Appropriately Valued by the Market? Keizai shakai Sougou Kenkyu Cent. Work. Pap. 2010, 40, 1–28. [Google Scholar]

- Shimizu, C. Sustainable Measures and Economic Value in Green Housing. Open House Int. 2013, 38, 57–63. [Google Scholar] [CrossRef]

- Yoshida, J.; Sugiura, A. The effects of multiple green factors on condominium prices. J. Real Estate Finan. Econ. 2015, 50, 412–437. [Google Scholar] [CrossRef]

- Fuerst, F.; Shimizu, C. The rise of eco-labels in the Japanese housing market. J. Jpn. Int. Econ. 2016, 39, 108–122. [Google Scholar] [CrossRef]

- Banfi, S.; Farsi, M.; Filippini, M.; Jakob, M. Willingness to pay for energy-saving measures in residential buildings. Energy Econ. 2008, 30, 503–516. [Google Scholar] [CrossRef] [Green Version]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Does energy efficiency matter to home-buyers? An investigation of EPC ratings and transaction prices in England. Energy Econ. 2015, 48, 145–156. [Google Scholar] [CrossRef] [Green Version]

- Brounen, D.; Kok, N. On the economics of energy labels in the housing market. J. Environ. Econ. Manag. 2011, 62, 166–179. [Google Scholar] [CrossRef] [Green Version]

- Zheng, S.; Wu, J.; Kahn, M.E.; Deng, Y. The nascent market for “green” real estate in Beijing. Eur. Econ. Rev. 2012, 56, 974–984. [Google Scholar] [CrossRef]

- Deng, Y.; Li, Z.; Quigley, J.M. Economic returns to energy-efficient investments in the housing market: Evidence from Singapore. Reg. Sci. Urban Econ. 2012, 42, 506–515. [Google Scholar] [CrossRef] [Green Version]

- Deng, Y.; Wu, J. Economic Returns to Residential Green Building Investment: The Developers’ Perspective. Reg. Sci. Urban Econ. 2014, 47, 35–44. [Google Scholar] [CrossRef]

- Kahn, M.E.; Kok, N. The capitalisation of green labels in the California housing market. Reg. Sci. Urban Econ. 2014, 47, 25–34. [Google Scholar] [CrossRef]

- Hyland, M.; Lyons, R.C.; Lyons, S. The Value of Domestic Building Energy Efficiency—Evidence from Ireland. Energy Econ. 2013, 40, 943–952. [Google Scholar] [CrossRef] [Green Version]

- Yoshida, J.; Onishi, J.; Shimizu, C. Energy Efficiency and Green Building Markets in Japan. Energy Effic. Future Real Estate. 2017, 139–159. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. The Economics of Green Building. Rev. Econ. Stat. 2013, 95, 50–63. [Google Scholar] [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. The Bias Due to Incomplete Matching. Biometrics 1985, 41, 103. [Google Scholar] [CrossRef]

- Clapp, J.M.; Giaccotto, C. Estimating price indices for residential property: A comparison of repeat sales and assessed value methods. J. Am. Stat. Assoc. 1992, 87, 300–306. [Google Scholar] [CrossRef]

- Nishi, H.; Asami, Y.; Shimizu, C. The Illusion of a Hedonic Price Function: Nonparametric Interpretable Segmentation for Hedonic Inference. J. Hous. Econ. 2021, 52, 101764. [Google Scholar] [CrossRef]

- CBRE. Japan Office MarketView Provides a Quarterly Survey of Commercial Real Estate Trends Across The Nation, Providing Local Market Views of 13 Cities. Available online: https://www.cbre.co.jp/th-th/research-reports/office-marketview (accessed on 13 October 2021).

- U.S. Green Building Council. Available online: https://www.usgbc.org/resources/leed-v4-building-design-and-construction-current-version (accessed on 13 October 2021).

- ENERGY STAR. Commercial Real Estate: An Overview of Energy Use and Energy Efficiency Opportunities. Available online: https://www.energystar.gov/sites/default/files/buildings/tools/CommercialRealEstate.pdf (accessed on 13 October 2021).

- Building Research Establishment Ltd. Available online: https://www.breeam.com/discover/how-breeam-certification-works/ (accessed on 13 October 2021).

- Energy Saving Trust. Guide to Energy Performance Certificates. Available online: https://energysavingtrust.org.uk/advice/guide-to-energy-performance-certificates-epcs/ (accessed on 13 October 2021).

- Behqe. HQE CERTIFICATION. Available online: https://www.behqe.com/hqecertification (accessed on 13 October 2021).

- GRESB. GRESB Real Estate Assessment. Available online: https://gresb.com/nl-en/real-estate-assessment/ (accessed on 13 October 2021).

- Green Building Counsil Australia. Introducing Green Star. Available online: https://gbca-web.s3.amazonaws.com/media/documents/introducing-green-star.pdf (accessed on 13 October 2021).

- NABERS. What is NABERS? Available online: https://www.nabers.gov.au/about/what-nabers (accessed on 13 October 2021).

- Institute for Building Environment and Energy Conservation (IBEC). Built Environment Efficiency (BEE). Available online: https://www.ibec.or.jp/CASBEE/english/beeE.htm (accessed on 13 October 2021).

- Development Bank of Japan. DBJ Green Building. Available online: https://www.dbj.jp/en/pdf/service/finance/g_building/gb_presentation.pdf (accessed on 13 October 2021).

- Housing Performance Evaluation and Display Association. Available online: https://www.hyoukakyoukai.or.jp/bels/bels.html (accessed on 13 October 2021).

- Tokyo Building Environmental Plan System. Bureau of Environment, Tokyo Metropolitan Government. Available online: https://www7.kankyo.metro.tokyo.lg.jp/building/outline_2020.html (accessed on 29 August 2021).

| Variable | Content | Unit |

|---|---|---|

| Contract rent | Monthly rents for new lease contracts | Yen/square meter |

| Green label dummy | =1 if a building has a green label | (0,1) |

| Gross building area | Gross building area of the building | Square meter |

| Building age | Number of years since construction | Years |

| Number of stories above ground | Number of stories above ground | Stories |

| Standard story area | Standard story area of the building | Square meter |

| Five city-center wards dummy | =1 if a building is located in one of the five city-center wards (Chiyoda Ward, Chuo Ward, Minato Ward, Shinjuku Ward, and Shibuya Ward) | (0,1) |

| Time to the nearest station | Time to walk to the building from the nearest station | Minutes |

| Raised floor dummy | =1 if a building used a raised floor | (0,1) |

| Zone air conditioning dummy | =1 if a building used a zone air conditioning system | (0,1) |

| Card-key system dummy | =1 if a building used a card-key security system | (0,1) |

| Renovation dummy | =1 if a building was renovated | (0,1) |

| Time dummy | A set of dummy variables for the quarter of the contract | (0,1) |

| Area dummy | =A set of dummy variables for Tokyo 23 wards | (0,1) |

| Variable | Full Sample | Green Building | Non-Green Building | Bias | |||

|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | (%) | |

| Contract rent (yen/sq m) | 5625 | 2071 | 8309 | 2474 | 5475 | 1939 | 127.5 |

| Building age (year) | 23.098 | 11.535 | 11.829 | 10.117 | 23.729 | 11.281 | −111.1 |

| Five city-center wards dummy | 0.781 | 0.413 | 0.831 | 0.375 | 0.778 | 0.415 | 13.3 |

| Gross building area (sq m) | 19,779 | 39,755 | 63,746 | 68,490 | 17,317 | 35,945 | 84.9 |

| Zone air conditioning dummy | 0.820 | 0.384 | 0.686 | 0.464 | 0.828 | 0.378 | −33.5 |

| Card-key system dummy | 0.957 | 0203 | 1.000 | 0.000 | 0.954 | 0.208 | 30.9 |

| Raised floor dummy | 0.825 | 0.380 | 0.995 | 0.071 | 0.815 | 0.388 | 64.4 |

| Renovation dummy | 0.217 | 0.412 | 0.172 | 0.377 | 0.219 | 0.414 | −12.0 |

| Standard story area (sq m) | 767 | 806 | 1605 | 1135 | 720 | 756 | 91.7 |

| Number of stories above ground | 11.949 | 8.141 | 21.835 | 12.334 | 11.395 | 7.462 | 102.4 |

| Number of observations | 37,346 | 1981 | 35,365 | - | |||

| Ratio of green buildings | 5.3% | 100.0% | 0.0% | - | |||

| Variable | (1) Repeat Sales | (2) PS Matching | ||||

|---|---|---|---|---|---|---|

| Mean | Std. Dev | Bias (%) | Mean | Std. Dev | Bias (%) | |

| Contract rent (yen/sq m) | 6959 | 2538 | 8.0 | 8192 | 2539 | 9.3 |

| Building age (year) | 12.683 | 11.210 | 15.3 | 12.084 | 9.778 | −5.2 |

| Five city-center wards dummy | 0.786 | 0.411 | 0.0 | 0.829 | 0.376 | 0.8 |

| Gross building area (sq m) | 37,431 | 54,354 | 0.0 | 63,424 | 68,016 | 0.9 |

| Zone air conditioning dummy | 0.779 | 0.416 | 0.0 | 0.683 | 0.465 | 1.1 |

| Card-key system dummy | 1.000 | 0.000 | - | 1.000 | 0.000 | - |

| Raised floor dummy | 0.985 | 0.123 | 0.0 | 0.995 | 0.071 | 0 |

| Renovation dummy | 0.176 | 0.381 | 8.0 | 0.178 | 0.383 | −3.6 |

| Standard story area (sq m) | 1168 | 943 | 0.0 | 1587 | 1134 | 3.13 |

| Number of stories above ground | 16.282 | 10.481 | 0.0 | 21.414 | 12.049 | 7.0 |

| Number of observations | 262 | 3962 | ||||

| Ratio of green buildings | 50.0% | 50.0% | ||||

| Full Sample | Repeat Sales | PS Matching | |

|---|---|---|---|

| (1) | (2) | (3) | |

| Green label dummy | 0.065 *** | 0.061 * | 0.032 *** |

| (0.005) | (0.034) | (0.006) | |

| Gross building area (logarithm) | 0.130 *** | 0.115 *** | 0.121 *** |

| (0.001) | (0.014) | (0.002) | |

| Building age | −0.009 *** | −0.012 *** | −0.012 *** |

| (0.000) | (0.002) | (0.000) | |

| Time to the nearest station | −0.031 *** | −0.015 ** | −0.034 *** |

| (0.001) | (0.008) | (0.001) | |

| Raised floor dummy | 0.021 *** | −0.010 | −0.091 ** |

| (0.003) | (0.135) | (0.041) | |

| Zone air conditioning dummy | 0.018 *** | −0.003 | 0.042 *** |

| (0.003) | (0.041) | (0.007) | |

| Card-key system dummy | −0.031 *** | - | - |

| (0.006) | (-) | (-) | |

| Renovation dummy | 0.057 *** | 0.017 | 0.033 *** |

| (0.003) | (0.046) | (0.009) | |

| (Intercept) | 7.915 *** | 8.530 *** | 7.948 *** |

| (0.016) | (0.260) | (0.102) | |

| Location dummy | Yes | Yes | Yes |

| Time dummy | Yes | Yes | Yes |

| Adjusted R-squared | 0.611 | 0.583 | 0.707 |

| Green ratio | 5.3% | 50.0% | 50.0% |

| Number of observations | 37,346 | 262 | 3962 |

| Full Sample | Medium-Sized Old Buildings | Large-Sized New Buildings | |

|---|---|---|---|

| (1) | (2) | (3) | |

| Green label dummy | 0.065 *** | 0.054 *** | 0.026 *** |

| (0.005) | (0.016) | (0.005) | |

| Gross building area (logarithm) | 0.130 *** | 0.141 *** | 0.116 *** |

| (0.004) | (0.004) | (0.002) | |

| Building age | −0.009 *** | −0.013 *** | −0.013 *** |

| (0.000) | (0.001) | (0.000) | |

| Time to the nearest station | −0.031 *** | −0.038 *** | −0.034 *** |

| (0.001) | (0.001) | (0.001) | |

| Raised floor dummy | 0.021 *** | 0.096 *** | 0.127 *** |

| (0.003) | (0.018) | (0.030) | |

| Zone air conditioning dummy | 0.018 *** | 0.037 *** | 0.022 *** |

| (0.003) | (0.007) | (0.005) | |

| Card-key system dummy | −0.031 *** | - | - |

| (0.006) | (-) | (-) | |

| Renovation dummy | 0.057 *** | 0.090 *** | 0.059 *** |

| (0.003) | (0.008) | (0.007) | |

| (Intercept) | 7.915 *** | 7.715 *** | 7.745 *** |

| (0.016) | (0.063) | (0.139) | |

| Location dummy | Yes | Yes | Yes |

| Time dummy | Yes | Yes | Yes |

| Adjusted R-squared | 0.611 | 0.515 | 0.657 |

| Green ratio | 5.3% | 2.7% | 23.4% |

| Number of observations | 37,346 | 7469 | 7469 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Onishi, J.; Deng, Y.; Shimizu, C. Green Premium in the Tokyo Office Rent Market. Sustainability 2021, 13, 12227. https://doi.org/10.3390/su132112227

Onishi J, Deng Y, Shimizu C. Green Premium in the Tokyo Office Rent Market. Sustainability. 2021; 13(21):12227. https://doi.org/10.3390/su132112227

Chicago/Turabian StyleOnishi, Junichiro, Yongheng Deng, and Chihiro Shimizu. 2021. "Green Premium in the Tokyo Office Rent Market" Sustainability 13, no. 21: 12227. https://doi.org/10.3390/su132112227

APA StyleOnishi, J., Deng, Y., & Shimizu, C. (2021). Green Premium in the Tokyo Office Rent Market. Sustainability, 13(21), 12227. https://doi.org/10.3390/su132112227