Abstract

In 2014, a European Union (EU) Directive required certain large undertakings and groups to disclose non-financial information from 2017 onwards. In 2017, the EU guidelines on non-financial reporting established that reporting climate-related information is part of the non-financial information. Later, in 2019, the guidelines were reinforced to include a supplement that envisages improving climate-related information reporting. Banks can contribute to reducing climate-related risks by supporting investments in economic activities that aim to mitigate the risk of climate change. Capital needs should be reoriented towards sustainable investment. Banks shall manage financial risks arising from climate change; therefore, they must integrate climate change into their policies and procedures, assessing the potential impact of projects and financing on climate change. This study aimed to evaluate how banks in Portugal have been reporting climate-related information and whether the level of information has increased since 2017. Using content analysis, findings indicated that banks are already including climate-related information; however, they are still far from approaching what the new guidelines require. Results suggested that there is still a long way to go in this area concerning banks and regulators.

1. Introduction

Climate change is a long-term change in weather patterns. It has consequences to the planet, society, and economy [1]. Ultimately, there is a broad agreement that climate change is the greatest economic and moral challenge [2]. The demanding challenge should be unquestionable. All sectors of society need to find, together, strategies to avert a cataclysm [2].

The banks’ perspective on climate-related information should include the double-materiality concept: the inside-out (how the bank impacts people and the environment) and the outside-in approach (how people and the environment impact the bank). Banks should play a key role in the new conjecture providing capital for innovation, infrastructure, job creation, and overall prosperity [3]. Under the increasing effects of global warming, banks have never been more important to draw the future; thus, companies that banks decide to finance will be the linchpin in slowing Earth’s warming and moving the world economy into cleaner technologies [3].

Aware of banks prominence in the global economy, regulators have been establishing guidelines that will permit banks to have a fundamental and active role in solving climate problems. Regulations have required the need for banks to disclose climate-related information, such as the Directive 2014/95/EU [4] and, more recently, guidelines on non-financial reporting [5], in 2017, as well a supplement on reporting climate-related information, in 2019 [6].

The study aimed to evaluate whether banks in Portugal are already disclosing climate-related information and if that disclosed information varies among Portuguese banks. Additionally, the study aimed to assess the disclosure degree of climate-related information.

The study starts by addressing the current climate crisis and the importance of banks as an active part in problem-solving. Additionally, the paper identifies the main guidelines on climate-related information to understand the trend of its content. Data on climate-related information disclosed by banks in Portugal are evaluated and discussed. This study focused on three research questions: (i) whether Portuguese banks disclose climate-related information and how disclosure has evolved; (ii) the limitations and restrictions found in terms of climate-related information disclosure; and (iii) what can be improved. The paper consists of a literature review, analysis of climate-related information by Portuguese banks, discussion, conclusion, limitations, and further research.

2. Literature Review

2.1. The Growing Importance of Banks in Climate Change

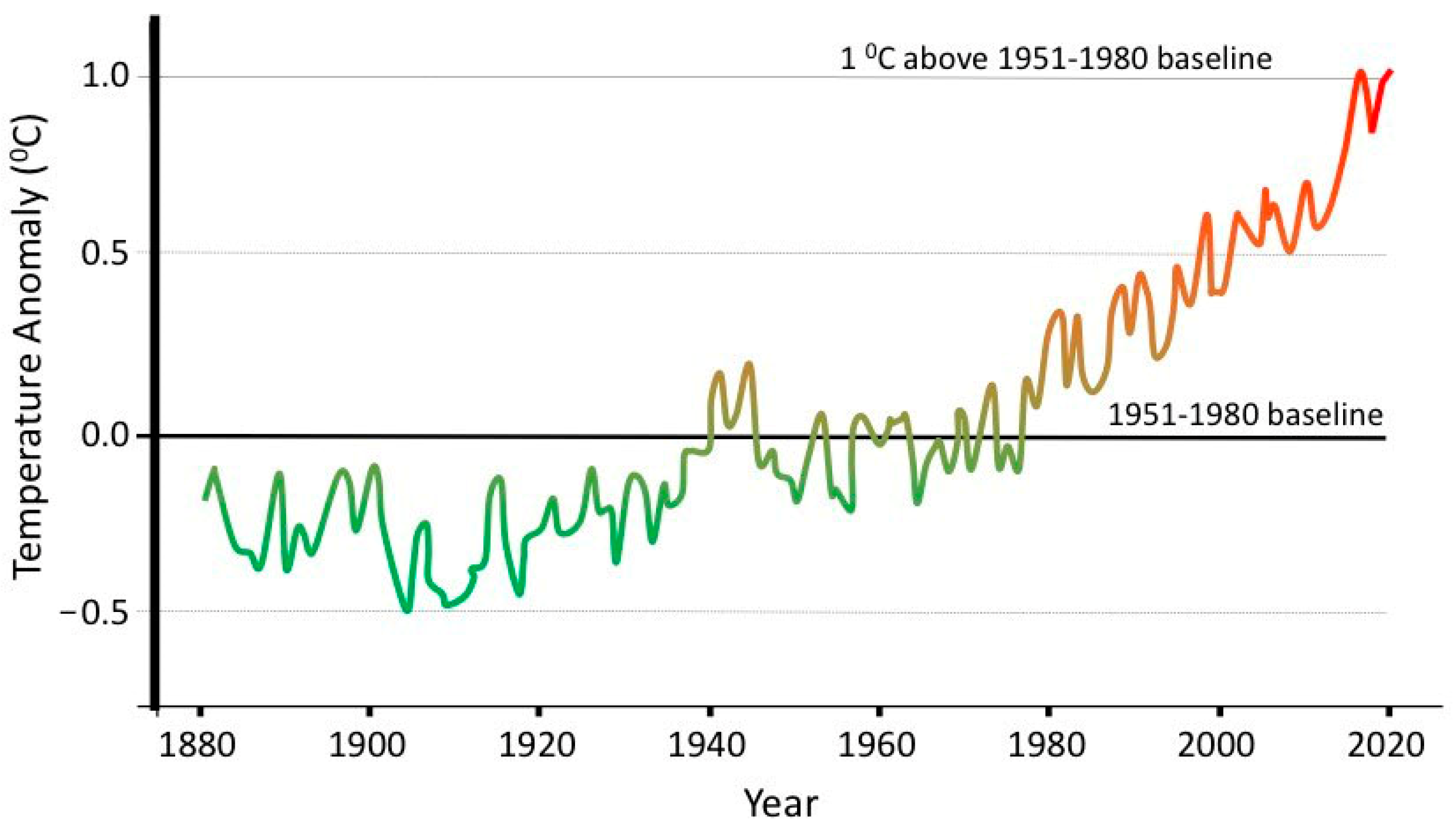

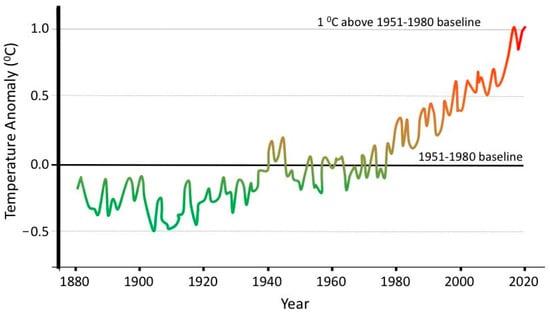

Climate change has been noticed since the early 20th century. It is primarily driven by human activities, such as fossil fuel burning. Consequently, increasing heat-trapping greenhouse gas levels in the atmosphere are observed, raising Earth’s average surface temperature (Figure 1) in a process commonly referred to as global warming [1].

Figure 1.

Change in global surface temperature (from 1880 until 2020) in relation to the temperature baseline (average temperatures measured between 1951 and 1980); adapted from National Aeronautics and Space Administration (NASA) [1].

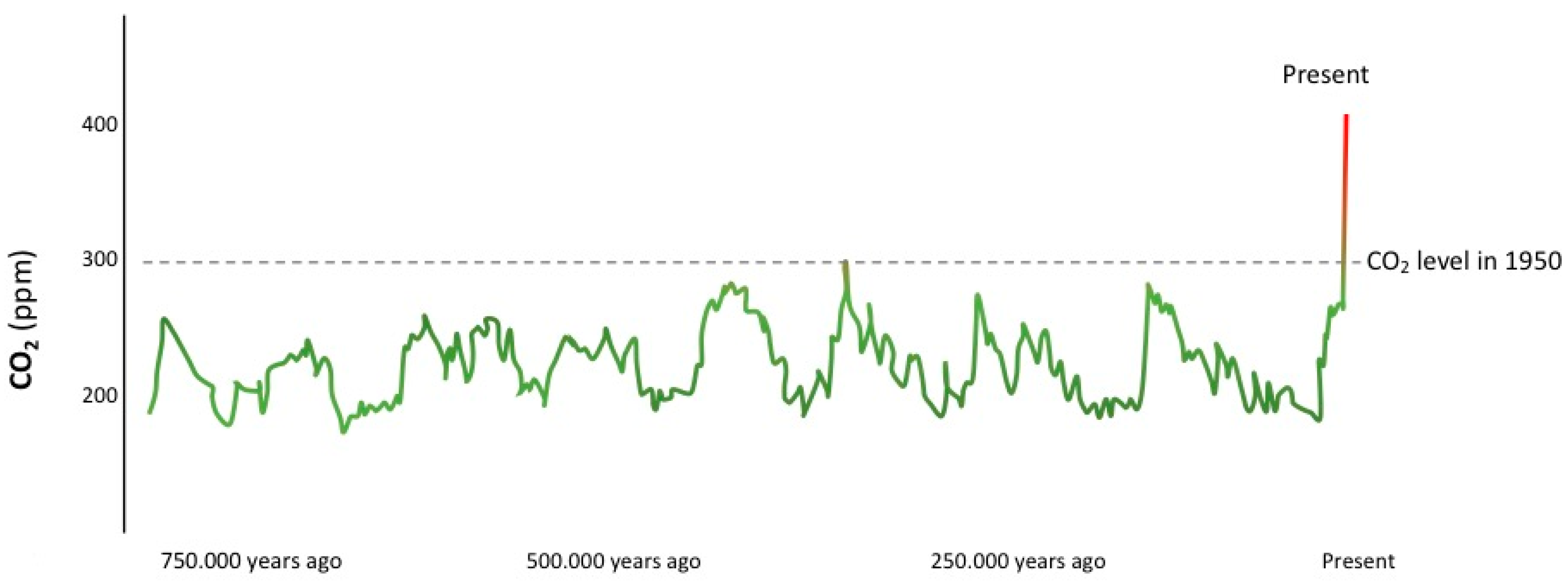

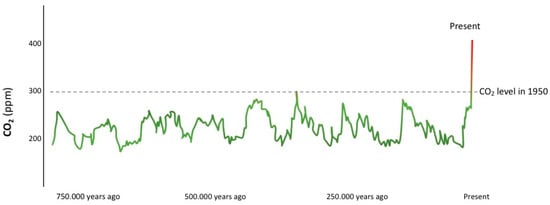

Carbon dioxide (CO2) is an important greenhouse gas, which is released through human activities (e.g., deforestation and burning fossil fuels) and from natural processes (e.g., respiration and volcanic eruptions) [7]. Figure 2 shows increasing levels of atmospheric CO2 in recent years [8].

Figure 2.

Variation of CO2 concentration (ppm) in the atmosphere during the last 750,000 years, based on the comparison of atmospheric samples contained in ice cores and more recent direct measurements. This analysis provides evidence that atmospheric CO2 has increased since the Industrial Revolution (adapted from NASA) [8].

Climate change has been detected in different aspects: in the warming of both the atmosphere and ocean environments; in perturbing the global water cycle; in reductions in snow and ice; and in mean sea level rise. Indeed, human activities have been the prevailing cause of the observed warming since the mid-20th century, as referred to by the Intergovernmental Panel on Climate Change (IPCC) [9]. Climate change has caused impacts on natural and human systems on a global scale, on all continents, and across the oceans, irrespective of its cause, indicating the sensitivity of both natural and human systems to a changing climate [9].

Recently, António Guterres, United Nations (UN) Secretary, argued: “(…) the world is facing a grave climate emergency. Climate disruption is happening now, and it is happening to all of us. (…) We are in a battle for our lives. But it is a battle we can win” [10]!

Banks could be engaged in radical changes [11], which would help the current unsustainable use of our environment [12]. There is no time for delays; it is necessary to act on behalf of the planet. According to Stephens and Skinner [11], we need to act urgently to protect the planet, people, and environment.

In this context, banks will play a fundamental role, beginning to turn down financing opportunities, such as those representative of business-as-usual and carbon-intensive development strategies [3]. This way, financial supervisors and risk managers will have to be aware of the ecological dimension [12].

According to Stephens and Skinner [11], the present international economic crisis derives from three main reasons: (i) a lending and investment culture in the context of widespread speculation and under-regulation at national and international levels; (ii) bank investment in mining and arms industries lobby, and other industries linked to climate change and environmental damage, which have also come under criticism; and (iii) the banking and financial sectors have become the object of widespread public distrust.

Climate change will be a paramount aspect. It will have a profound effect on the asset values and credit ratings of corporations and in the form of how banks sustain companies through financing [3]. It appears that the banking sector is beginning to respond to the climate challenge. However, the “decarbonization” will require banks not only to manage their greenhouse gas (GHG) emissions, but also to consider how climate change affects the competitive marketplace, lending and investment strategies, and, ultimately, their financial bottom lines [3]. In the same study, it is also stated that banks have divergent interests, programs, and priorities about climate change; they observed European banks are at the forefront of integrating climate change into environmental policies, risk management, and product development. Many leading banks in the USA are also working towards better disclosures of climate risks as an essential first step towards embracing a changing regulatory and economic environment. However, banks based in emerging markets have done the least to embrace climate change in their business practices. Banks should [3]: (i) increase climate-related information disclosure in their annual reports; (ii) report their GHG emissions from operations and define reduction targets, setting specific targets to reduce GHG emissions associated with lending portfolios; (iii) increase the demand for “climate-friendly” financial products and services (e.g., renewable energy); and (iv) take a leading role in supporting emissions-trading mechanisms and introducing new risk-management products.

Therefore, sustainability and climate concerns are changing the role and function of banks (especially their products and services concerning stakeholders) towards a sustainable economy [13].

2.2. Regulations, Banks and Climate Change

In 2014, a European Union (EU) regulation was the starting point to boost the dissemination of climate-related information: Directive 2014/95/EU (European Parliament, Council of 22 October 2014, amending Directive 2013/34/EU). This directive advocates that, to enhance the consistency and comparability of non-financial information disclosed throughout the Union, certain large undertakings should prepare a non-financial statement containing information relating to at least environmental matters, social and employee-related matters, respect for human rights, and anti-corruption and bribery matters [4]. A non-financial statement should apply only to those large undertakings which are public-interest entities (PIE) and to those PIE which are parent undertakings of a large group, in each case having an average number of employees above 500 [4].

In 2017, a complement to this Directive appeared presenting the guidelines on non-financial reporting (methodology for reporting non-financial information). These guidelines aim to lead companies to disclose high quality, relevant, useful, consistent, and more comparable non-financial information (environmental, social and governance-related), which can foster resilient and sustainable growth and employment, and provide transparency to stakeholders [5]. This way, these non-binding guidelines are intended to help companies draw up relevant, useful, and concise non-financial statements.

Concerning the overall guidelines on environmental issues, including those associated with climate change, the EU—European Commission [5] advises companies to disclose:

- information about the expected impact of climate change on its strategies and activities;

- relevant governance aspects, including board oversight on matters related to climate change;

- information on who is responsible for setting, implementing, and monitoring a specific policy on climate-related matters. They may also describe the role and responsibility of the board/supervisory board regarding environmental, social, and human rights policies;

- material information on climate-related impacts on their operations and strategy, including appropriate assessments of likelihood and use of scenario analyses; and

- the appropriate disclosures on metrics and targets that are used to assess and manage relevant environmental and climate-related matters.

Before these Directive and guidelines, despite demands for sustainability and responsibility, banks were responding slowly [13].

The mandatory requirements have been implemented in Portugal with Legislative Decree no. 89/2017 [14]. This decree requires companies to submit a non-financial statement annually, included in the management report or presented in a stand-alone report. The company’s management bodies should prepare sufficient non-financial information for an understanding of the evolution, performance, position, and impact of its activities, at least on environmental, social, and environmental issues, equality between women and men, non-discrimination, respect for human rights, and the fight against corruption and bribery attempts [14]. Law no. 148/2015 had already defined banks and credit institutions as PIE [15].

The Technical Expert Group on Sustainable Finance (TEG) was presented (June 2018) by the European Commission to promote four key areas of the Action Plan for the development of [16]:

- unified classification system for sustainable economic activities (taxonomy);

- EU green bond standard;

- benchmarks for low-carbon investment strategies;

- new guidelines on the reporting of climate-related information.

The European Commission [17] stated that it urges making the financial sector a crucial actor in the climate change fight. With the new orientations, it is expected that more investments will be directed to sustainable activities. These rules define the criteria to determine whether an economic activity is environmentally sustainable [17].

The potential benefits for banks derived from their climate-related information disclosure are: (i) improved knowledge of loan portfolios’ exposure to climate-related risks; (ii) a correct risk evaluation for the calculation of capital charges; (iii) more grounded investment and lending decisions (including asset management); (iv) improved attractiveness to climate-aware clients; (v) evidence of knowledge and experience in climate-related transactions, leading to further climate-related business opportunities; (vi) demonstration of risk control for financial regulators (stress testing) [18].

TEG published a report on climate-related disclosures (January 2019) and invited feedback by 1 February 2019 [19]. Approximately 70 organizations and individuals submitted comment letters [20]. Later, in June 2019, the European Commission used that TEG report to reinforce the guidelines on non-financial reporting by including a supplement on reporting climate-related information and an annex that provide “further guidance for banks and insurance companies”. TEG states that banks must look at the “recommend disclosures and further guidance” under its particular perspective of business activities, including lending and investing [6].

The guidelines emerged because of (i) the 2015 Paris Agreement on Climate Change; (ii) the United Nations’ Sustainable Development Goals; and (iii) the Special Report of the IPCC, from October 2018. These three initiatives envisage accelerating decisive action to reduce GHG emissions and to create a low-carbon and climate-resilient economy [6]. The EU has agreed on ambitious targets for 2030, intending to reduce GHG emissions and increase renewable energy and energy efficiency. The EU defined rules on GHG emissions, namely targets for cars and vans. These rules accord with the long-term strategic vision (published by the EU in 2018) for a prosperous, modern, competitive, and climate-neutral economy by 2050 [6].

Banks, risk assessors, lenders, and financiers can influence the business practices and the GHG emissions behaviors of other corporate actors [2]. They play a crucial role in the emerging global market for GHG emission reductions by providing specific financial services such as project finance and equity evaluation of GHG-emitting companies, which urge to be re-optimized [21]. In doing so, banks can influence corporate actors (clients and suppliers) to reduce GHG emissions by applying climate-related decision-making processes and product/market innovations [2].

Non-financial reporting harmonization will help investors to better understand what is considered “green”. Financial entities now have to inform clients about their impact on the planet or local environment. They should provide more choices to investors who wish to invest in the future of our planet [17].

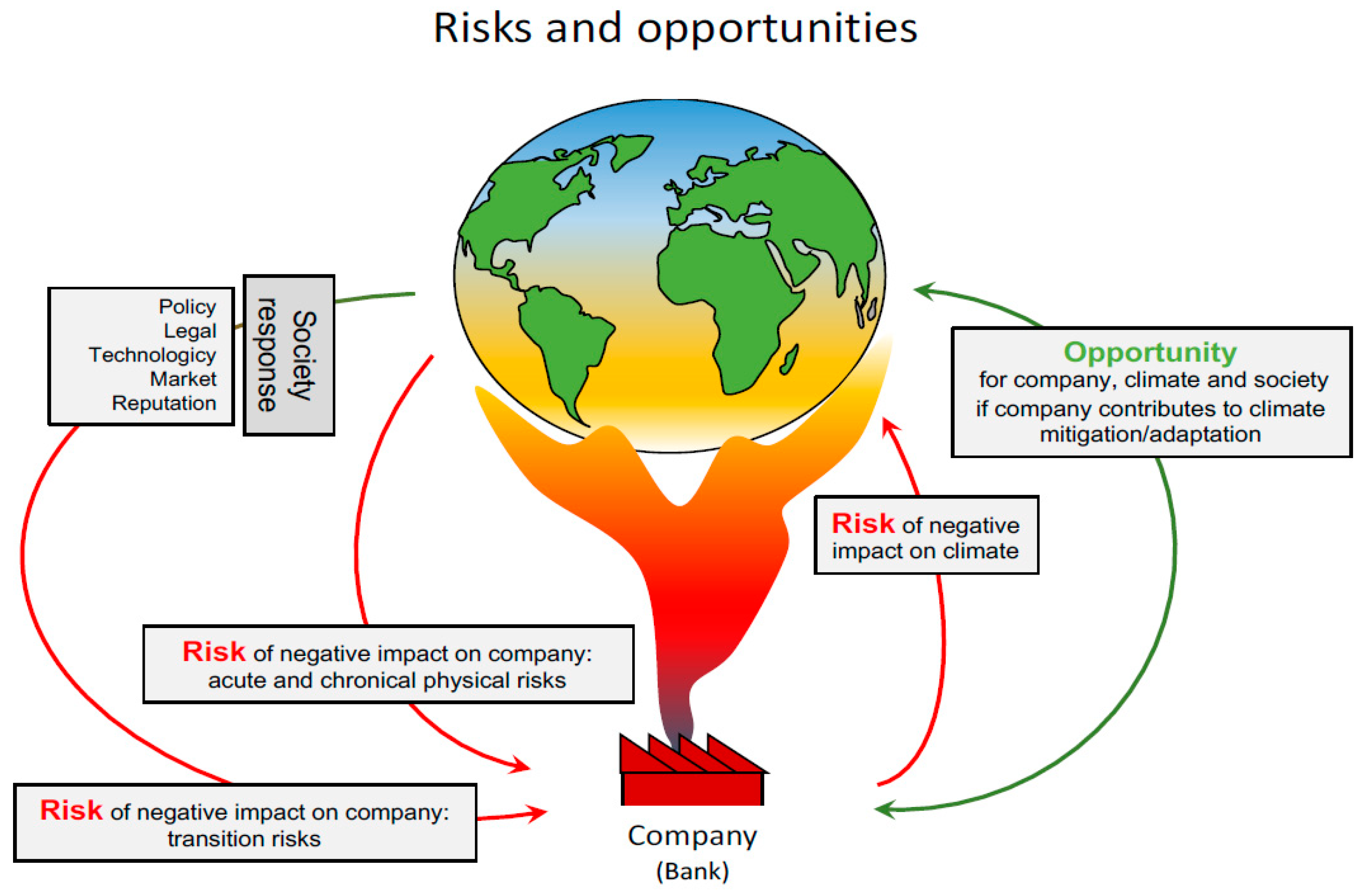

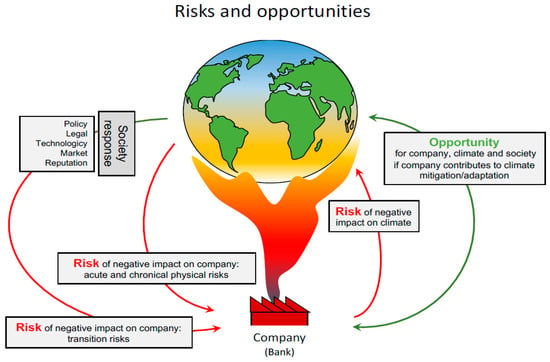

The European Commission believes that increased confidence in climate-related disclosures could promote green financial products and innovation in sustainable investment strategies under a financial eco-system [22]. Climate-related disclosure could lead to a smoother transition to a low-carbon economy, aiding a high number of investors to better assess their financial risk exposures [23]. Climate-related risks can be converted into opportunities if companies contribute to climate change mitigation or adaptation [6].

Banks and companies can be visualized, as shown in Figure 3. Unexpected carbon emission policies can lead to a disorderly re-pricing of carbon-intensive assets and generate a negative supply shock (transition risks), which can cause losses and financial instability; thus, “climate-related disclosure by industries could encourage this re-direction if it enables a wide range of investors to better assess their financial risk exposures”, helping to understand how a given change in carbon price will affect the value of the firm [23] (p. 28). Central banks can assess financial stability risks that may arise from the transition to a low-carbon economy (for example, via a stress test). A late or sudden transition to a low-carbon economy can put the banks in high exposure to environmental risks [12].

Figure 3.

Climate-related risks and opportunities (adapted from EU—European Commission [6]).

The EU Non-Financial Reporting Directive 2014/95/EU (Directive) has been implemented since 2017 at a European level. The Directive only indicates that member states are responsible for implementing procedures to ensure compliance [24]. Being that it is not completely clear, the Directive leads to a variety of approaches. Some companies disclose a few topics just to meet compliance requirements, while others do disclose detailed non-financial information, including useful climate-related information [24]. However, Matuszak and Rózańska [25] stated that the new reporting obligation should increase the extent and quality of non-financial disclosure.

Information flows between banks and borrowers should be improved mainly concerning physical climate-risk assessments and adaptation investments. Companies in climate-sensitive sectors are performing climate-change-risk assessments, developing adaptation plans, and investing in adaptation measures. Disclosure of these data will help banks evaluate the risks in their loan portfolios and identify opportunities to support clients making these investments [26].

Further progress is still needed to develop robust methodologies that permit the collection of comprehensive data for evaluating the climate-related risks that companies and investors are exposed to [27]. It is crucial to give incentives for risk disclosure, the development of asset-level databases, and the refinement of climate stress-test techniques.

Recently, the European Banking Authority (EBA) defined the guidelines for granting and monitoring loans, to be applied from June 2021 onwards. Those guidelines help banks assessing risks associated with Environmental, Social, and Governance (ESG) factors in the financial conditions of borrowers and, in particular, the potential impact of environmental factors and climate change on their appetite, policies, and procedures regarding credit risk [28]. The guidelines highlight the issue of climate change risks concerning the financial performance of borrowers, which can materialize as [28]:

- physical risks (arising from the physical effects of climate change, including liability risks for contributing to it);

- transition risks (arising from the transition to a low-carbon and climate-resistant economy);

- other risks (for example, changes in the market and consumer preferences and legal risks that may affect the performance of the underlying assets).

Banks are exposed to environmental risks. Thus, it is necessary to develop methodologies to measure the carbon intensity of investments [12]. Banks are expected to address climate risk in the same way as they address any other financial risk, ensuring that they manage their relevant exposures prudently. Thus, banks need to think in an integrated way about how climate-related risks should be identified and managed in terms of: credit risk, operational risk, market risk, reputation risk, and others. This will help to understand whether climate risks can have an impact on their balance sheets, strategies, and profits [29].

3. Methodology

3.1. Sample

According to Banco de Portugal (Portuguese Central Bank), in the first year of mandatory application of the Directive, there were thirty banks and two saving banks in Portugal [30]. Despite that, due to the size, only nine entities (eight banks and one saving bank) were required to comply with the Directive 2014/95/EU. Thus, the study sample includes the entire universe, in the Portuguese banking system, that were (in 2017) required to disclose non-financial information, being this way composed of nine entities.

3.2. Content Analysis and Evaluation Methodology

In this study, a detailed content analysis was performed using information obtained from the annual reports, and from sustainability reports (stand alone or integrated in the annual report). The paper presented the analysis of climate-related information disclosed by the nine selected entities in order to evaluate the quality and quantity of reported information about climate-related information in the period 2016–2019. It focused on climate-related information for 2016, 2017 (first year of Directive implementation), and the subsequent two years 2018 and 2019. The study enables a better understanding of how banks’ climate-related information has been presented (following the Directive 2014/95/EU and subsequent guidelines); and how disclosure can contribute to climate change evolution. Terms such as policies, objectives, emissions, or energy consumption were used to search for climate-related information. The information was classified and categorized under the identified addressed topics and indicators.

To perform the study, climate-related information was looked up in the available disclosed information, and then transcribed and entered into the computer; subsequently, the obtained data were analyzed in terms of absolute or relative numbers; finally, data were interpreted and discussed in qualitative terms to evaluate how Portuguese banks have been disclosing climate-related information.

This research has limitations associated with the sample size. However, it accounted for all the Portuguese banks that are required to comply with the Directive in the first year of application (2017).

4. Results

4.1. Evolution of Climate-Related Information

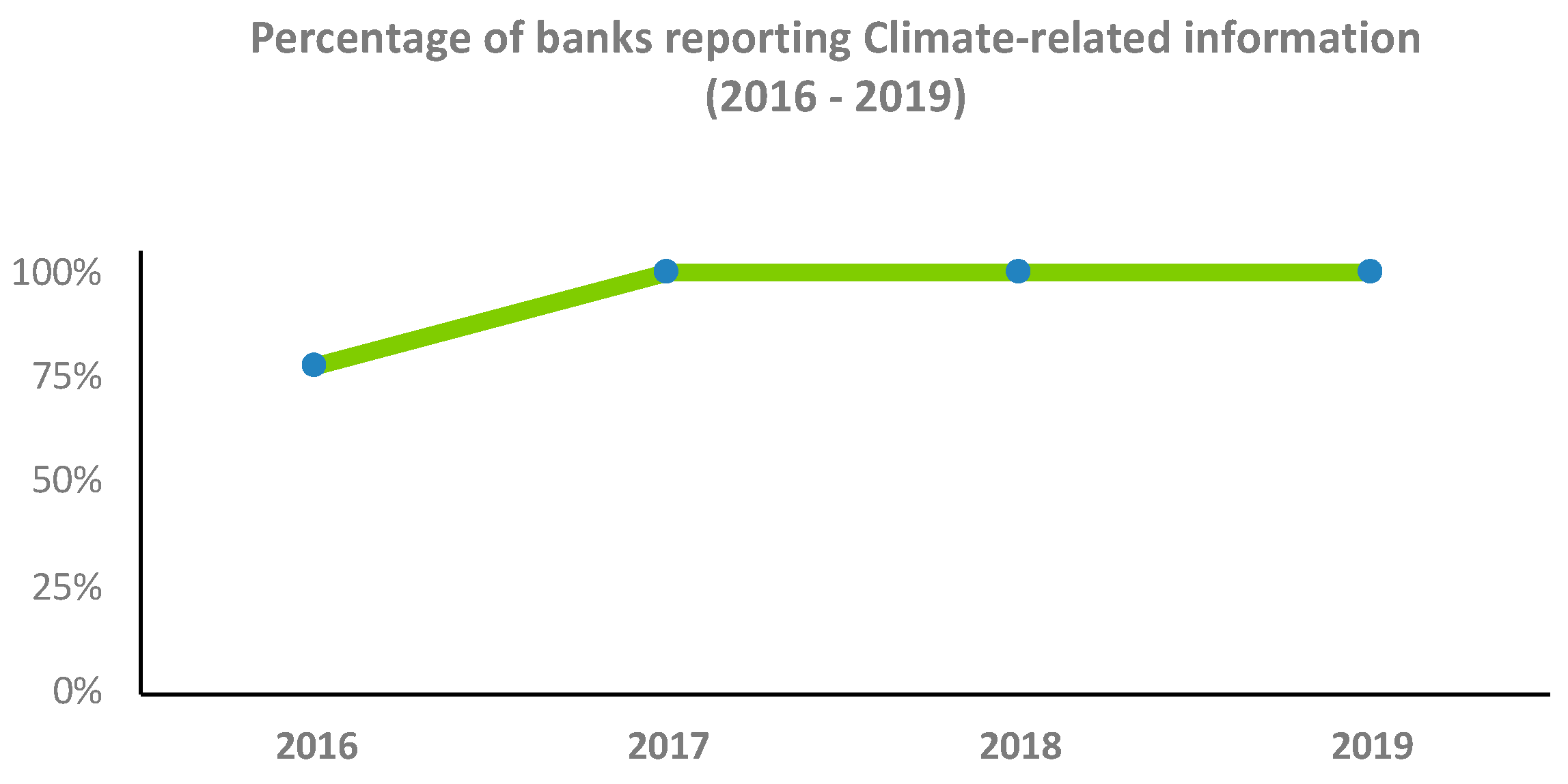

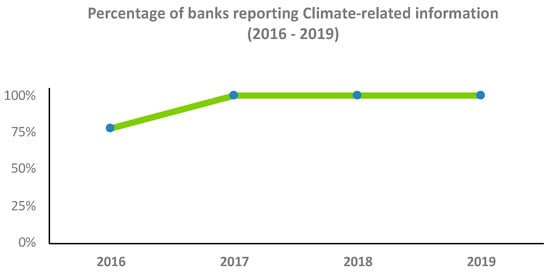

A first approach was performed to see whether banks reported climate-related information for the period 2016–2019.

Figure 4 presents a relevant evolution in the percentage of banks that disclosed climate-related information since 2016. In 2016, only 78% of banks disclosed topics about climate-related information. From 2017 onwards, all banks presented some information on this topic. Climate-related information is disclosed in the annual report and the stand-alone sustainability report, when available. One-hundred percent of banks (in 2017, 2018 and 2019) reported climate-related information in the “non-financial statement”. However, some banks designated the “non-financial statement” differently and other banks reported that the “non-financial” information was found in a stand-alone sustainability report. Sometimes, an overlap between the information included in the annual report and the stand-alone sustainability report occurred, similarly to what had also been reported in another study [31]. One bank (in 2017 and 2018) and two banks (in 2019) suggested that they used the stand-alone sustainability report to comply with the requirement to present the “non-financial statement”, which includes climate-related information.

Figure 4.

Evolution in the percentage of Portuguese banks observed presenting climate-related information.

Two banks only presented information on energy efficiency or CO2 reduction in the period of 2017–2019. Banks should highlight the importance of this climate-related information, like environmental reports, since it is considered as a reputational capital that can improve their financial performance [32,33]. Demaria et al. [34], in a study performed in 2017 (France), also revealed a disclosure increment with the EU Directive. They concluded that companies near consumers tend to disclose additional environmental information to show their ethical practices. This is consistent with legitimacy theory, which argues that the level of disclosure answers questions of legitimacy related to environmental pressures [34].

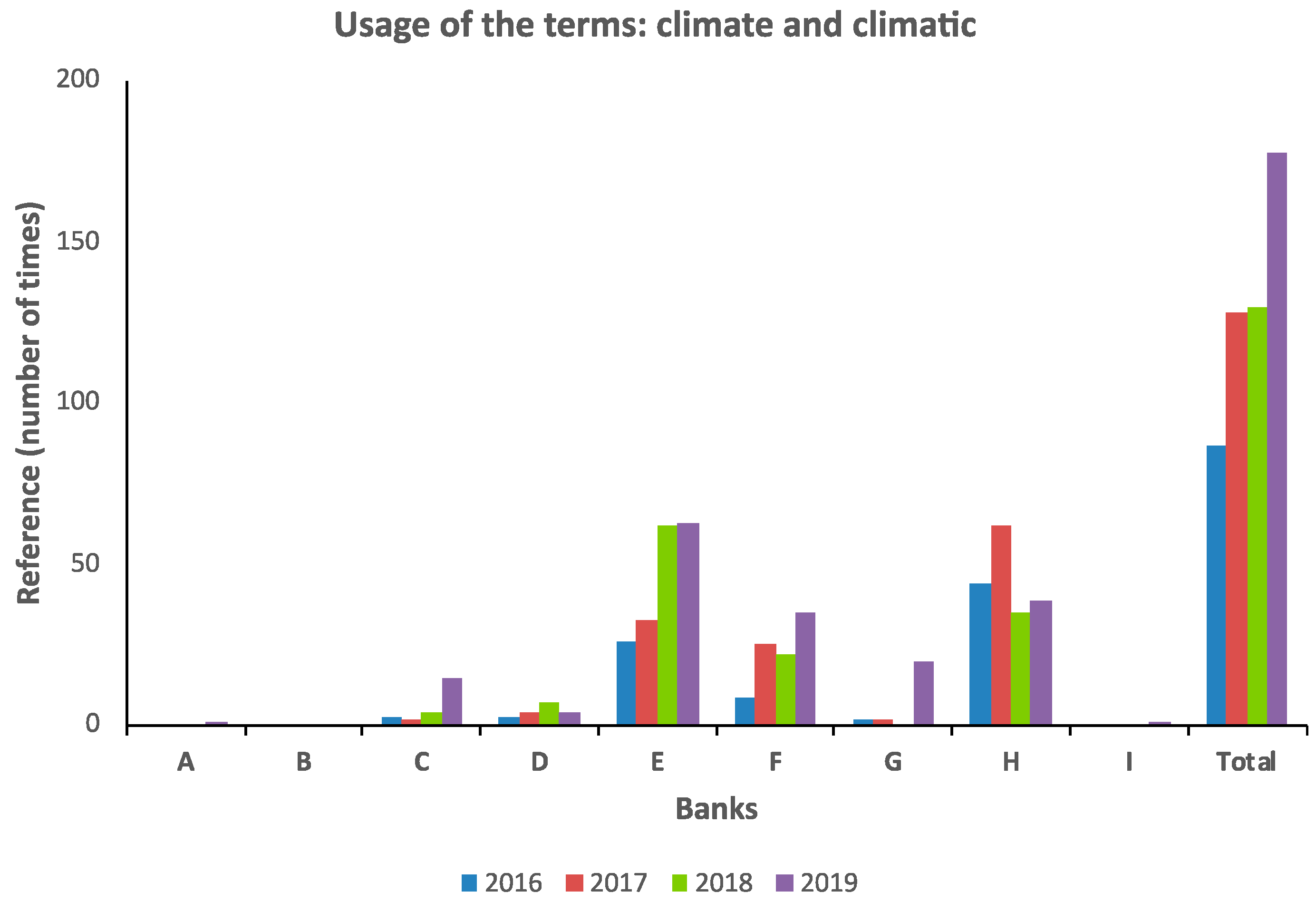

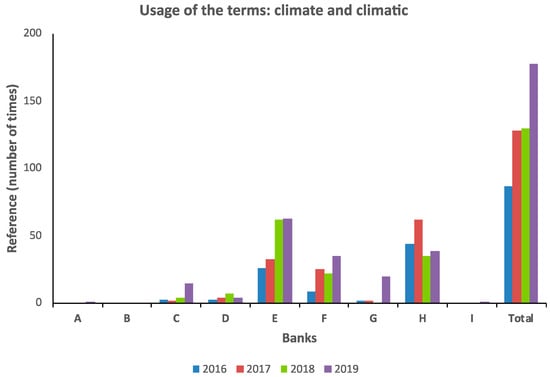

To understand the evolution of the theme over time, in the content analysis, the number of times that the terms “climate” (including “climate change”) or “climatic” were mentioned in the annual reports and standalone sustainability reports, during the analyzed period, was searched (Figure 5).

Figure 5.

Dispersion of the use of the terms: “climate” and “climatic” in the annual reports and stand-alone sustainability reports between 2016 and 2019.

Figure 5 indicates that the word “climate” and “climatic” present an evolutionary pattern of repetition in annual reports and stand-alone sustainability reports. Considering Figure 5’s overall data (see “Total”), increase of 47% in the year of the Directive implementation (2017) was observed, followed by near-maintenance in next year (2018), and an increase again in 2019 (see “Total”). This increase coincides with the year of the publication: “Guidelines on non-financial reporting: Supplement on reporting climate-related information”. It is also probably associated with the global increment of studies about the climate change and the news in the media. In 2016, only 67% of banks mentioned these terms, while in 2019 it already increased to 89%, although a diversity among banks was observed: some hardly used those terms, and others used them quite often.

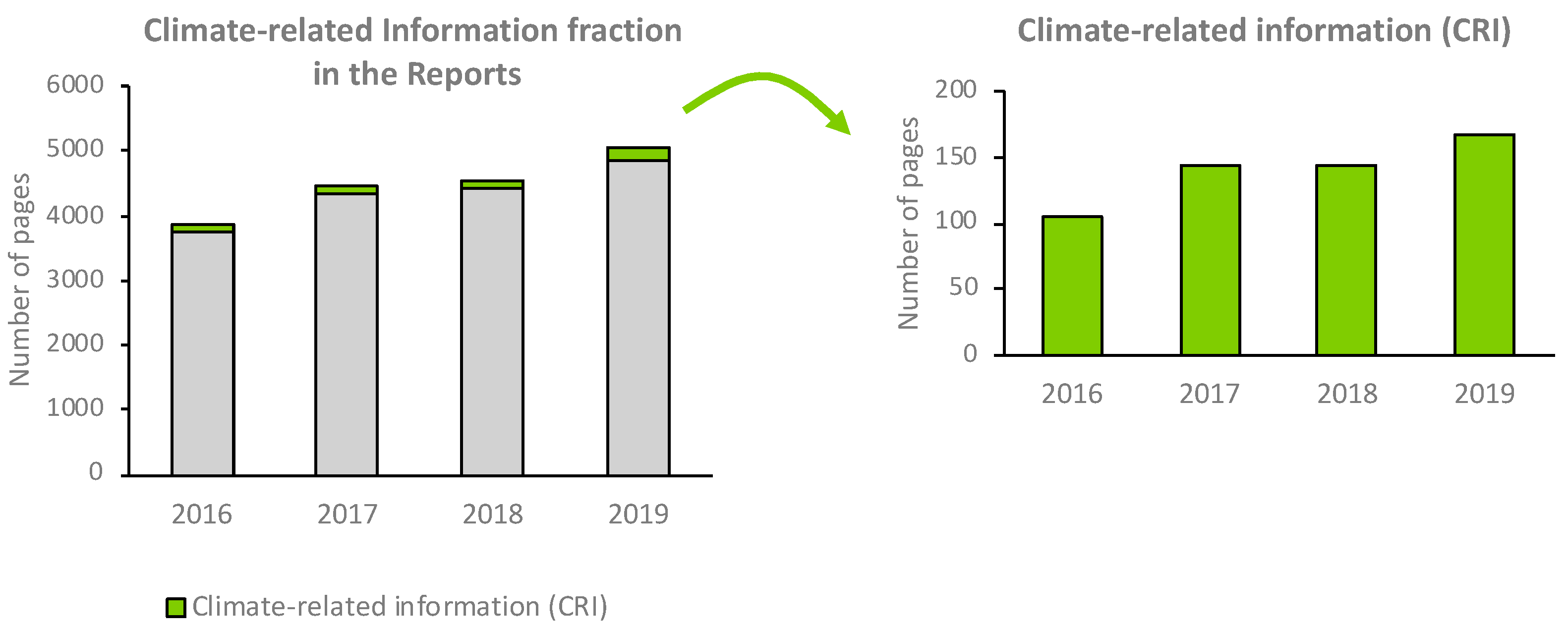

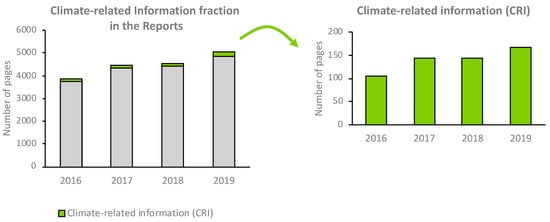

The volume of pages with climate-related information (number of pages) (Figure 6) has increased since 2016. However, the number of pages still accounts for only around 3% of the total reported pages (annual report and/or stand-alone sustainability report). Dissimilarity among banks in terms of the number of pages reporting climate-related information was also observed. The number of reporting pages by each bank, in the same evaluated year, was very different. For example, in 2019, while one bank reported only in two pages, another bank reported in about fifty pages.

Figure 6.

Climate-related information observed (green fraction) in the Reports (Annual Report and Separate Sustainability Report) from 2016 to 2019 in Portuguese banks.

Overall data reveal that banks disclosed climate-related information in the first triennium of the Directive, and there has been a positive evolution since 2016. This means that Portuguese banks have enhanced the disclosure of information on climate-related issues. This evolution agrees with Demaria and Rigot’s study [35], where it was stated that more companies are disclosing information about climate risk. In turn, Manes-Rossi et al. [36] stated that companies (including banks) demonstrated a collective awareness about the need to provide a comprehensive volume of socio-environmental disclosure to maintain legitimacy.

However, although some companies may disclose ample environmental information, it should not be ignored that this non-financial information is not currently audited. Auditors only verify whether the non-financial statement is published or not [14]. The rhetoric of companies may not be following their behavior, reflecting a gap between words and deeds [35].

4.2. Approach Adopted by Banks on Climate-Related Information for 2017–2019

After reading the annual reports and the sustainability reports for 2017, 2018, and 2019, five headings were considered and subdivided into more specific topics.

The five headings evaluated in this study, somehow following the “recommended disclosures and further guidance” in the guidelines [6], were: (a) Disclosure on the business model; (b) Disclosure on policies and due diligence processes; (c) Disclosure on outcomes; (d) Disclosure on principal risks and their management; and (e) Key performance indicators (KPI’s).

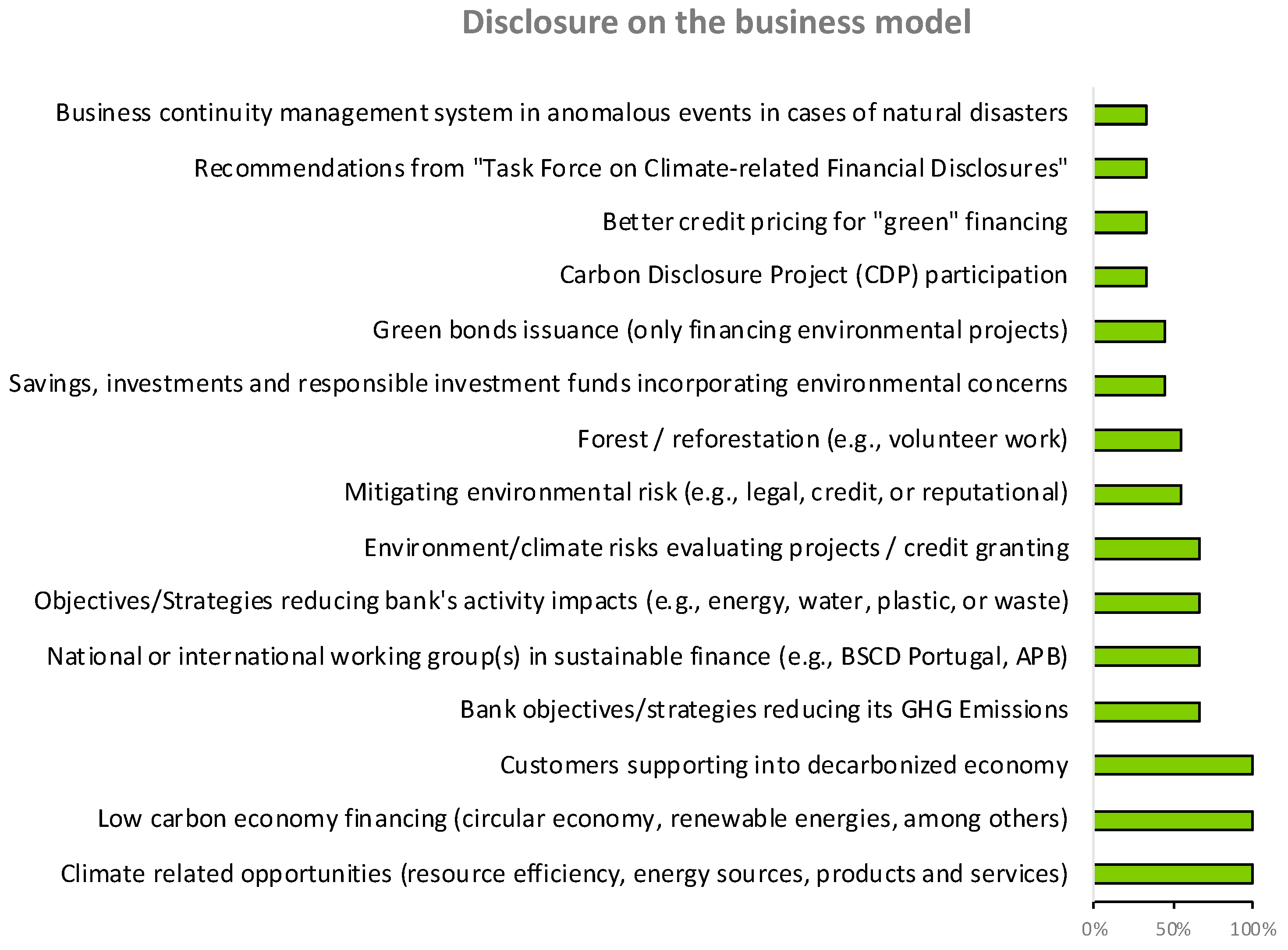

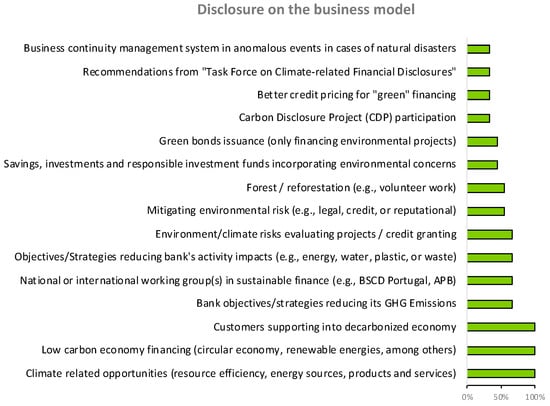

4.2.1. Disclosure on Business Model

The business model aims to describe how a bank generates and preserves value, through its products and services, in the long term [5]. In the analysis, the following information was found (Figure 7):

Figure 7.

Disclosure on the business model.

The information covered by all banks (100%) includes: opportunities related to the climate, such as seeking efficiency in the use of resources, energy sources used, and products and/or services in this area; promoting the financing of the low carbon economy with solutions for this purpose, for example, financing the circular economy, renewable energies, among others; and directly or indirectly, banks refer to support their customers for a decarbonized economy. It is not by chance that “green bonds” were mentioned by 44% of the banks.

The results showed that 67% of the banks have objectives/strategies for reducing GHG and objectives/strategies for reducing the impact of bank’s activities (for example, reducing energy consumption, water, plastic, mitigating waste, using renewable energies), while also 67% of the banks participate in national or international working groups, to be aware of the main trends and future factors on sustainable finance, such as the Business Council for Sustainable Development (BCSD) Portugal, which is part of the Global Network of the World Business Council for Sustainable Development (WBCSD), Portuguese Banking Association (APB), or European Banking Federation.

To mitigate climate-related risk, 67% of banks consider the environment/climate risks in the assessment of projects and granting of credit. The study found that 33% of banks stated they had participated in the Carbon Disclosure Project, which identifies climate change risks and opportunities. Two banks reported that they disclose climate-related issues following the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), and another bank suggested that it will implement these recommendations in the future. In fact, these three banks are the ones that most referred to climate/climatic expressions and also dedicated more pages to climate-related information.

Banks are beginning to consider opportunities and risks of climate-related action, such as: in their internal performance in terms of consumption and use of resources; and in the financing of clients (e.g., supporting energy efficiency improvement and renewable energy). This means that banks are approaching the Directive guidelines.

Despite that, the following were not observed: a clear description of climate-related risks in the existing risk categories; nor the impacts on strategy and mitigation measures to be implemented. This also agrees with the European Central Bank (ECB) [37] study, which concluded only a limited number of institutions disclosed that information.

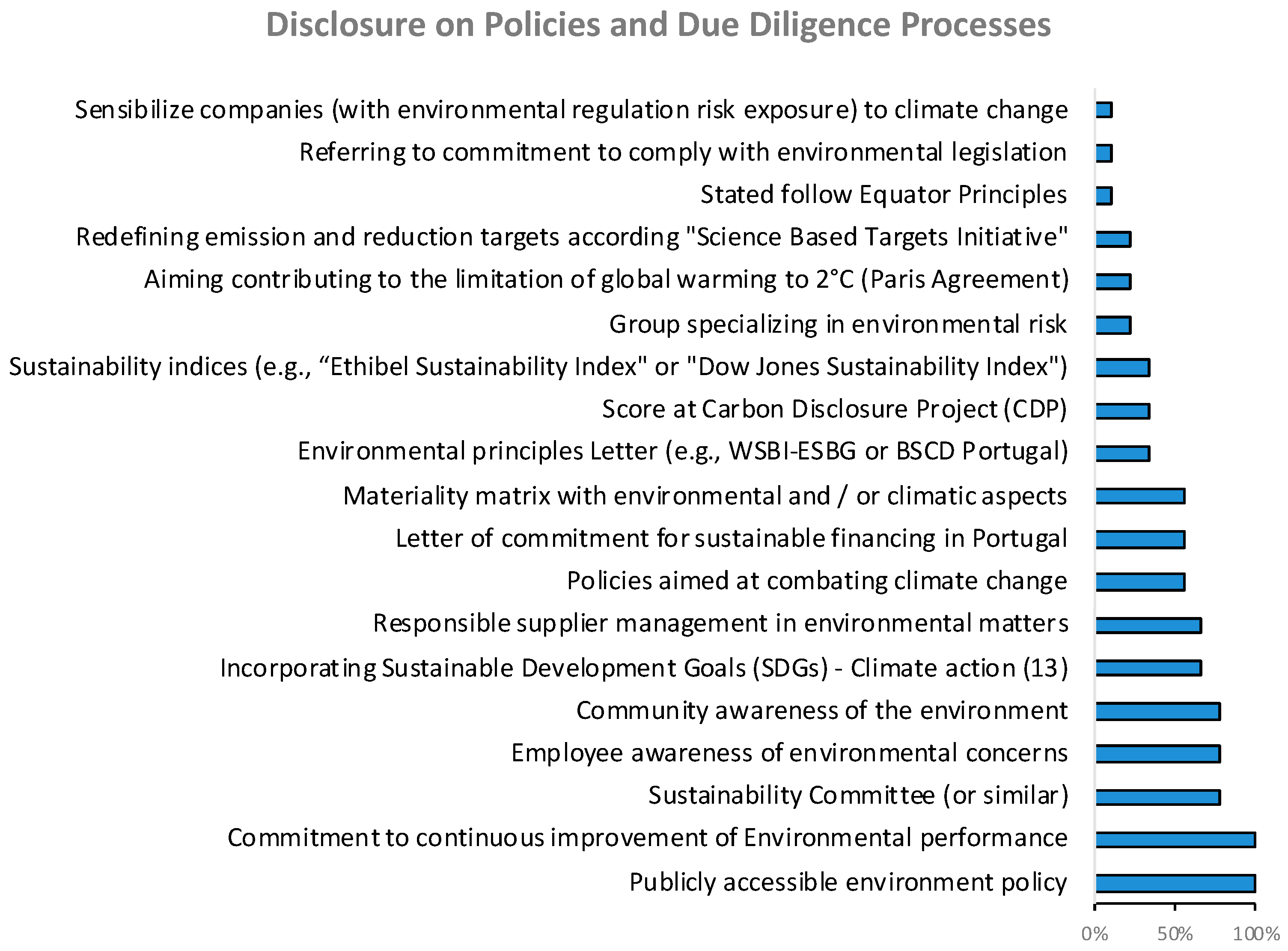

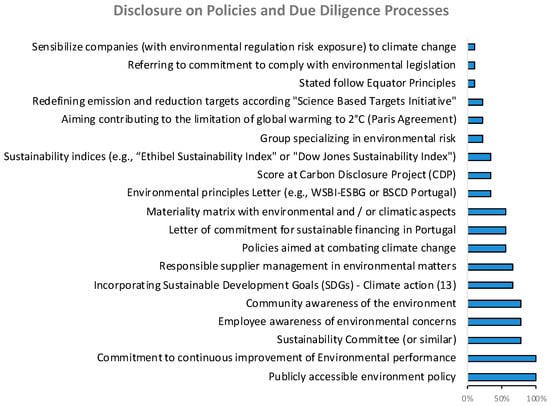

4.2.2. Disclosure on Policies and Due Diligence Processes

Considering the disclosure on policies and due diligence processes (Figure 8), all banks, either in a more summarized version or in a detailed way, presented their environmental policy, including issues related to the environment, even sometimes only referring to management consumption of materials. These findings corroborate the ECB [37] conclusions, wherein most of the assessed institutions referred to climate-related policies in their public disclosures in some form, predominantly in their annual report. In this study, all banks demonstrated commitment to the continuous improvement of their performance. However, only 56% of the banks specifically aimed at fighting climate change.

Figure 8.

Disclosures on policies and due diligence processes.

The majority (78%) of the banks identified the governance bodies in charge of environmental issues, for example, the Sustainability Committee. They also reported how banks promote employees and community awareness through events, volunteering, and awards, among others. In Turkey, Kılıç and Kuzey [33] found few banks that implemented a board committee responsible for environmental issues, climate change, or GHG emissions. Banks should begin to implement a broader governance structure, ensuring that their boards have the appropriate level of oversight with clear reporting lines related to the climate and responsibilities [29]. According to Furrer et al. [38], banks with the most advanced climate strategies appear to have top management that addresses climate change consciously and systematically.

Only 22% of banks have a group specialized in environmental risk, but only one specified an internal group on climate finance. On the other hand, 67% of the banks incorporate sustainable development objectives (13—climate action) from the United Nations Global Compact (UNGC), while the other 67% indicated having responsible supplier management in environmental matters. In 2019, 56% of banks indicated having signed a letter of voluntary commitment for sustainable financing in Portugal, having climate change as its core [39]. Besides, 56% of banks also presented a materiality matrix including environmental and/or climatic aspects.

The set of least disclosed information (by only 11% of banks) relates: to the specific reference to compliance with environmental legislation; to sensibilize companies with greater exposure to environmental risks regarding climate change; and to having stated to follow the Equator Principles. These Equator Principles point to risk management structures to be adopted by banks to determine, assess, and manage environmental and social risk when financing projects [40].

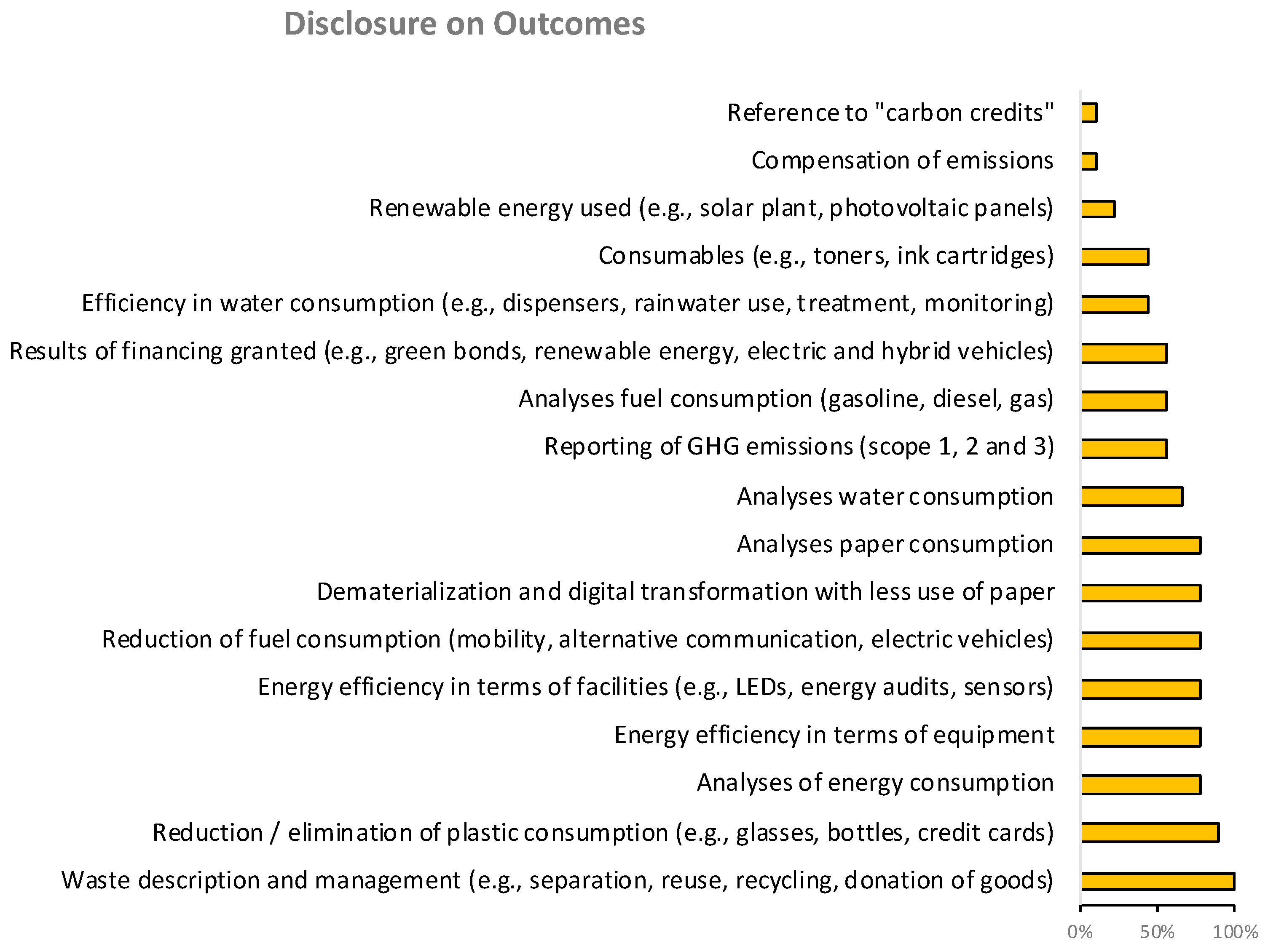

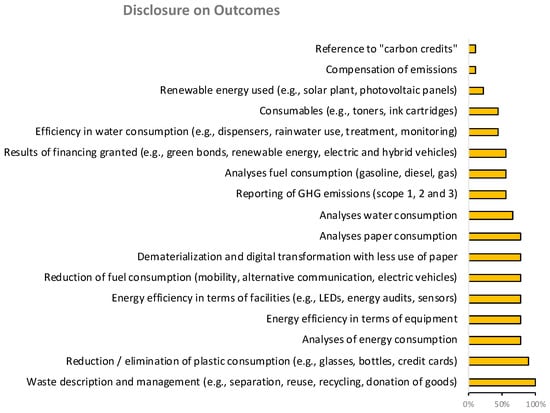

4.2.3. Disclosure on Outcomes

The outcomes are the actions taken by banks that support the achievement of the goals they define as climate-related (Figure 9).

Figure 9.

Disclosure on outcomes.

All the banks (100%) provided information on waste description and management, for example, the separation, recycling, or donation of goods. It was noted positively that 89% of the banks reported concerns about reducing/eliminating plastic consumption. Additionally, 78% of banks disclosed information about: control in energy consumption, energy efficiency in facilities and equipment, reducing fuel, dematerialization (digital transformation) in services and customers, and paper consumption. However, only 56% reported the evolution of GHG emissions.

The least-disclosed information (11%) was the offsetting of carbon emissions and the reference to carbon credits. This corroborates Cogan [3], who argued that few banks calculate the carbon risk in their loan portfolios and set specific targets to reduce GHG emissions associated with a part of their loan portfolio. The emissions trading market is growing at a fast pace. There is a lack of credit registers as tools to perform carbon stress-testing [41].

However, no disclosure of information following specific Directive guidelines for banks [6], such as the trend in carbon intensity concerning the various portfolios in the light of any relevant established goals and the risks over time, was identified.

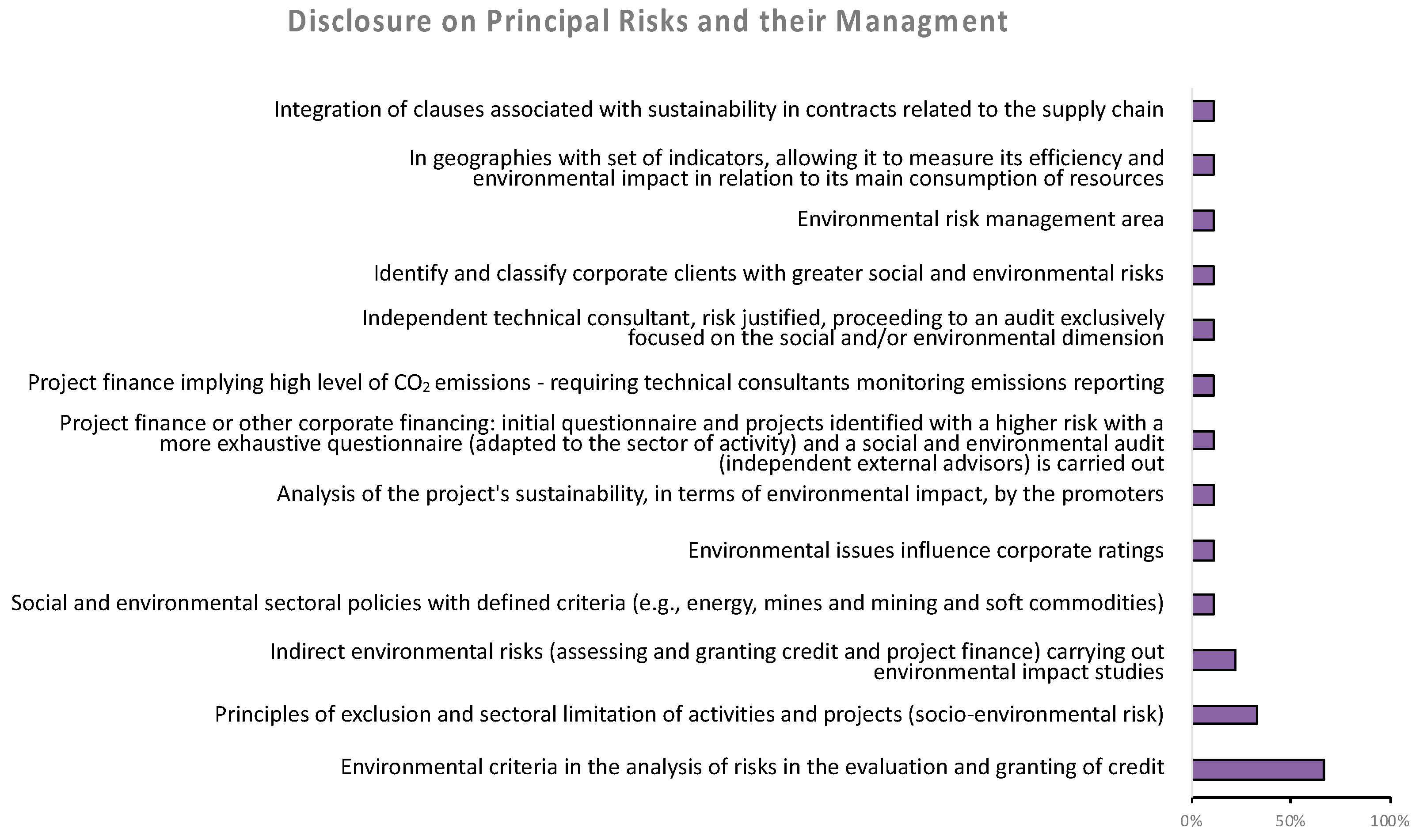

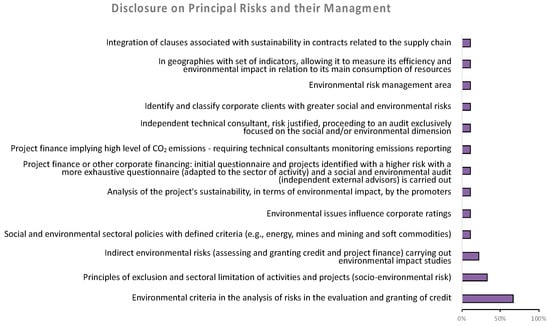

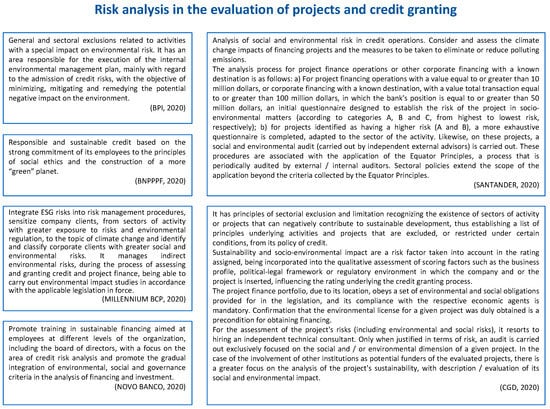

4.2.4. Disclosure on Principal Risks and Their Management

In this section, the main risks and respective management are presented. Figure 10 presents the following results:

Figure 10.

Disclosure of information on principal risks and their management.

It was observed that 67% of the banks referred to taking environmental criteria into account when evaluating risks and credit granting, reveling a similar percentage to what had been observed in the ECB study [37]. However, only 33% stated the principles of exclusion and sectoral limitation of activities and projects, considering the potential for socio-environmental risk. Additionally, only 22% evaluated the indirect environmental risks in the process of assessing and granting credit and project finance, thus, carrying out environmental impact studies following the applicable legislation. Some banks also provided a variety of other disclosures: for example, only 11% identified monitoring projects with a high level of CO2 emissions and hiring independent technical consultants to audit the environmental area of a given project. No bank disclosed climate-related scenarios. In the ECB [37] study, there were also few entities to do so.

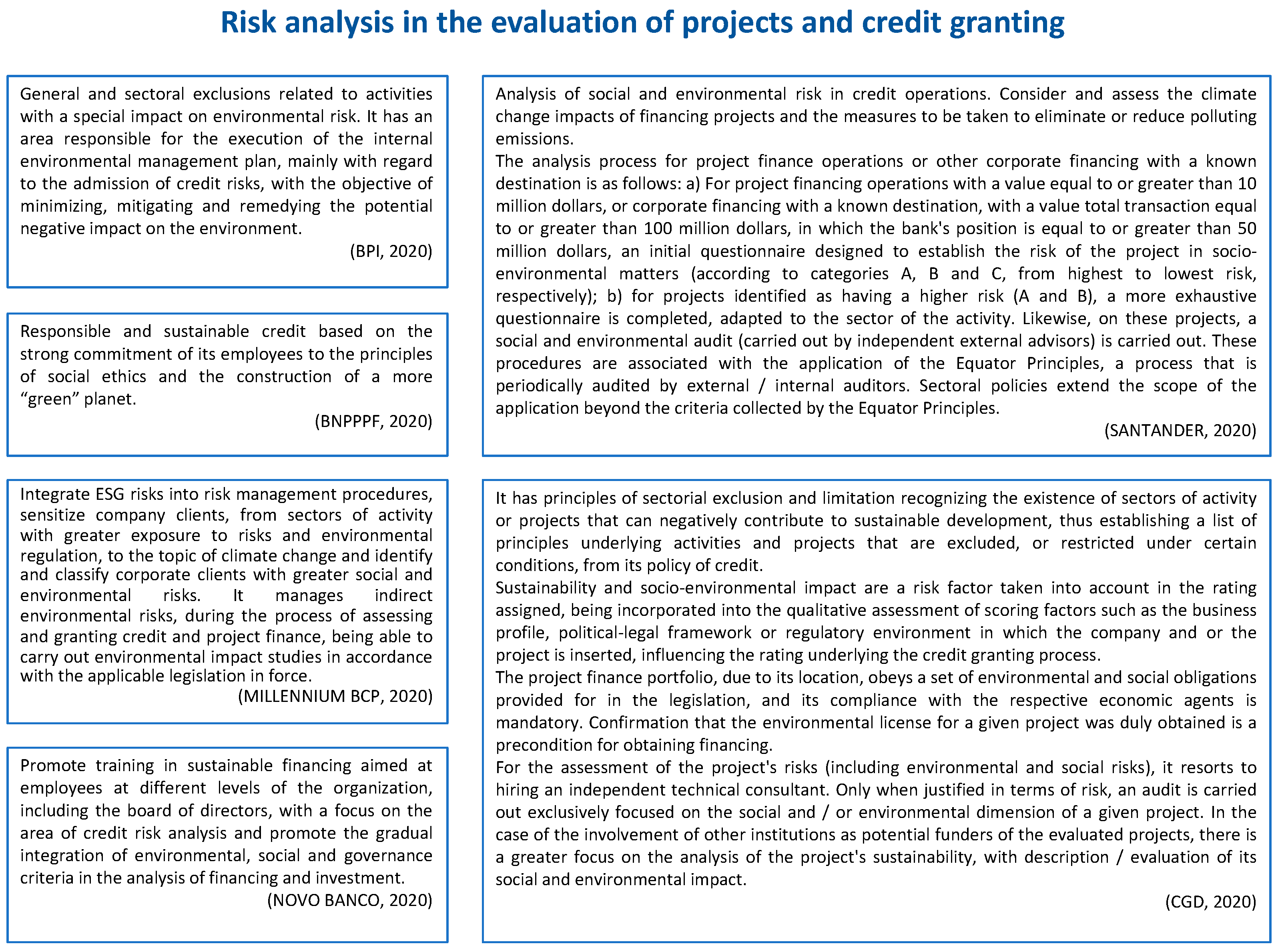

The risks associated with climate change are considerable for banks. Thus, decision-makers need to estimate their importance and consider them in credit management and environmental planning [42]. Climate-related scenarios provide meaningful insights for bank decision-makers to reduce bank risks in the future. They help credit analysts to inform customers about potential actions to adapt to climate change [42]. Still, concerning the risk analysis in the evaluation of projects and credit granting, it is crucial to highlight that several ways of approaching this situation by banks were found, such as for 2019.

Considering examples of information provided by banks on risk analysis in project appraisal and credit-granting (Figure 11), it can be observed that climate issues are just starting to be included, therefore being the first step towards being aligned with ECB guidelines. The study highlighted this issue due to its importance and influence in the respective bank area.

Figure 11.

Examples on “risk analysis in project appraisal and credit granting” reporting information from 2019 provided by banks—summarized and adapted from [43,44,45,46,47,48].

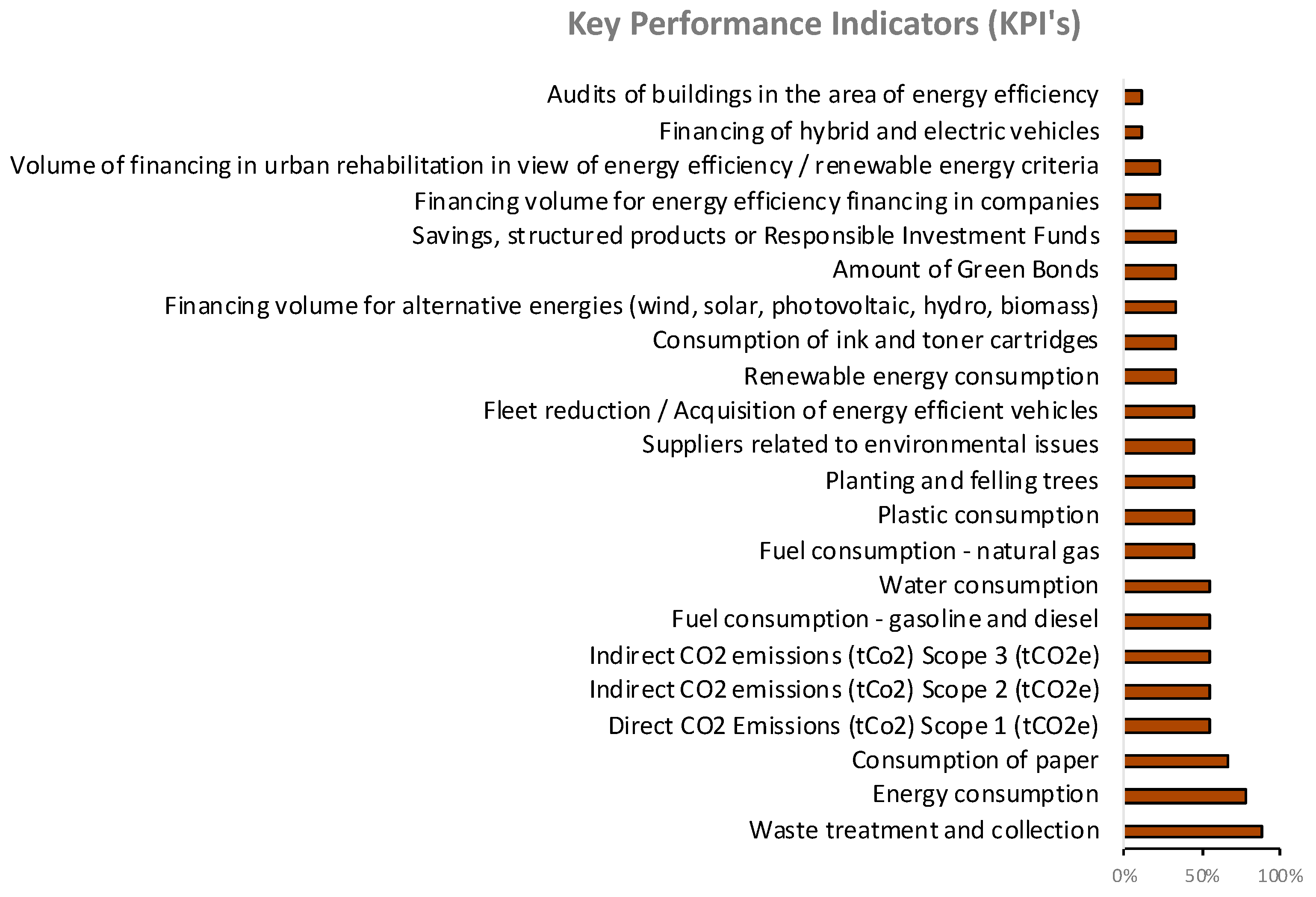

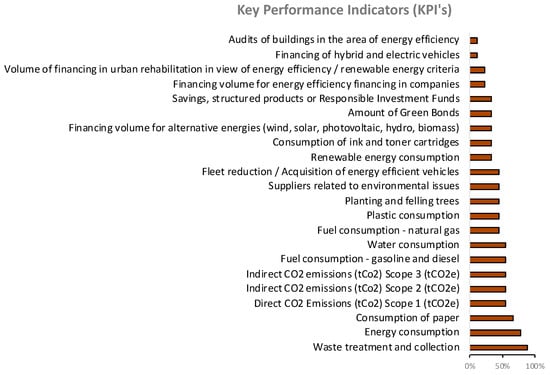

4.2.5. Key Performance Indicators (KPI’s)

The study illustrated that 89% of banks publish indicators on the treatment and collection of waste, 78% on energy consumption, and 67% on paper consumption. On the other hand, 56% of banks already have indicators on their CO2 emissions (scopes 1, 2, and 3). Only 11% of banks reported on the number of building audits about energy efficiency and financing value for hybrid and electric vehicles. The disclosures on energy efficiency financing volume in companies and financing volume for urban rehabilitation because of energy efficiency/renewable energy criteria represent only 22% (Figure 12).

Figure 12.

Illustration of the Key performance indicators (KPI’s).

These key performance indicators begin to follow the EU guidelines. However, in Portuguese banks, there is no information about the exposure of the portfolio to sectors affected by climate-related risk and opportunities (quantity or percentage of assets) or, for example, the volume of collaterals related to assets or activities in climate change mitigation sectors.

5. Discussion

Companies and banks “must increasingly demonstrate that they are future proof” [49] (p. 2). Banks, as financial intermediaries, can take exposure to relevant climate-related risks through their borrowers, customers, or counterparties when they grant loans or when trading securities of companies with direct exposure to climate-related risks [50]. In addition, markets for low-carbon and energy-efficient alternatives are growing. Banks can take material exposures in their lending and investment businesses. Additionally, they are subject to litigation related to their financing activities or through parties seeking compensation or other legal remedies [50].

The first question of this paper aimed to understand whether Portuguese banks disclose climate-related information and how disclosure has evolved. The study concluded that banks have reported climate-related information. Additionally, the level of disclosure has increased since 2017 with the implementation of the Directive. This conclusion is in agreement with ECB [37], where a clear and positive trend in the level of climate-related disclosures was also observed. Achenbach [49] identified the principal factors that positively influence disclosing information: policy and legal reforms, the aim for strategy adaption, the availability of data, and the alignment of other sustainability initiatives with the recommendations of TCFD.

This study found differences in disclosures between banks, some being more advanced compared with others. A similar situation was found by Eccles and Krzus’s [51] study, in 2017, concerning 15 oil and gas companies. They found variations among companies, with the majority making very modest disclosures, but some were more advanced concerning the application of the TCFD recommendations.

Regarding the second research question on the limitations and restrictions found in terms of climate-related information disclosure, it was observed that the main limitation found in this study was the dispersion of that information. There is no specific place to disclose the “non-financial statement” and the climate-related information. The main limitation is that environmental and climate-related information is spread over several sections of the report [35]. There is a need for a more harmonized presentation to improve environmental disclosures such as gathering all required climate-related information in a single section [35]. The climate-related information appears mainly in the non-financial statement. However, this statement sometimes appears under different names. Banks include climate-related information in the sustainability report, or present the information in disparate parts of the annual report. Thus, regulations should be more specific about “where” to publish this information to achieve European comparability. This also would reduce the amount of the same information in different documents. These findings were also reported by Carini et al. [31].

Additionally, the lack of comparability regarding climate-related information occurs mainly because each bank discloses what they consider relevant. Some banks detail the information, while others refer to it only superficially. The guidelines intend to address gaps in current reporting practice. It was supposed that the guidelines would help to increase comparability across jurisdictions [22]. However, the EU could not reach this objective. As a consequence, the European Financial Reporting Advisory Group (EFRAG) received the mission to prepare sustainability standards that promote the EU’s comparability objective [52].

Relevant information on climate-related information will give investors data for the best portfolio decisions [53]. In recent years, climate change has been identified as a risk. Managers need to measure and communicate climate risks. However, currently, disclosure is still highly fragmented and lacks the necessary oversight to adequately measure and communicate the impacts of climate change on financial markets [54].

Another limitation is that most banks are very focused on their direct impact on the environment, climate change, and other related topics. Only a few are concerned with how financing can impact the environment, clearly minimizing (or not considering) the indirect impact caused by the bank’s activities. Furrer et al. [38] also stated that banks often implement a climate strategy disengaged from their main value-creation processes, such as loans and investments.

Therefore, banks in Portugal are beginning to show signs of wanting to disclose information related to the climate. One of the banks is closer to the guidelines, another is following in its footsteps, another seeks to approach the guidelines, and the rest are even further away. There is a lack of articulation between climate-related topics. Statements are rarely supported by quantitative information. These findings were also reported in the ECB [37] study. Another study carried out in Italy [55] also identified quite large and evident gaps in the information disclosed by the non-financial companies. The provided information was limited and, in some cases, had been reported superficially and distant from the TCFD recommendations.

Research question number three explores what can be improved in this trade-off involving regulators, banks, and climate change. The results suggested that there is still a long way to go in this area of reporting climate-related information.

To allow comparability between banks, a higher standardization on specific topics and their contents is desired and needed. Regulators and the EU play a key role. Guidelines or sustainability standards should become mandatory. According to Strano and Kabli [56], mandatory corporate reporting improves the quality and comparability of the disclosure of non-financial information. Voluntary disclosure may lack integrity, accuracy, and neutrality. Johnston [57] argued that the TCFD recommendations only are likely to lead to changes in investor behavior and, in turn, in business models if national and supranational regulators require them. In 2021, the New Zealand government was the first country to introduce legislation to make climate-related disclosures mandatory for some organizations (publicly listed companies, large insurers, banks, non-bank deposit takers, and investment managers) [58].

CSR practices and their measurement, reporting, and auditing should be as clear and understandable as possible [59]. A monitoring system also seems to be necessary. According to Krasodomska et al. [60], the external guarantee would add credibility to non-financial disclosures, this way improving reporting quality [61].

It is crucial to properly assess prospective climate risks for loan and investment decisions [53]. Investors are actively considering certain types of climate-related information in their decision making. They want to know how companies are delineating the future costs of climate policies, how climate change projections impact corporate project planning, and how prepared are companies to adjust to the physical impacts of climate change [62]. UNEP FI [63] outlines a vision for the future generation of transition risk analysis using four ideas:

- building models of climate scenarios to support financial risk analysis;

- developing data and analysis for climate risk analysis at the level of borrowers;

- improving the methodology for the impact assessment of the portfolio; and

- integrating transition risk assessment in the organization.

Thus, the development of robust methodologies, the collection of comprehensive data to assess climate-related risks, the development of asset databases, and the refinement of climate stress testing techniques are necessary [27]. This will support companies to disclose climate-related risks comparably and central banks and financial regulators to assess in a better fashion the exposure of banks, individually, and of the financial system as a whole [27]. According to Weber and Kholodova [64], in Canada, to assess risks related to climate change is complex since the information needed for these assessments is also fragmented, incomplete, or not yet available, requiring strategies and tools which do not yet exist. Besides, they also concluded that there is uncertainty about how well-prepared banks are for disclosure requirements related to climate change.

As stated in the TCFD [65], the success of the recommendations about climate-related information disclosure will depend on the continuous and widespread implementation by the companies in both financial and non-financial sectors.

6. Conclusions, Limitations and Further Research

Directive 2014/95/EU is a milestone in the social and environmental area. It requires non-financial information that was often missing in corporate reporting. It aims to improve disclosure on social and environmental responsibility to make the information presented in the non-financial statements comparable and useful. These guidelines came to help the implementation of non-financial information disclosure. The guidelines highlight that banks have a fundamental role in the climate area, either by not supporting projects or industries that contribute unfavorably to climate change, or by directing support to sustainable investments.

In this sense, this study revealed an increase in climate-related information disclosure. However, that disclosure varies inter banks. It is not yet uniform. This makes the comparison of climate-related information difficult. Additionally, the level of disclosure is still far from the indicated in the guidelines.

The Directive has awakened disclosure to new paths. However, it will be necessary to have guidelines that allow increasing the comparability of climate-related information. This will only be possible if the information were mandatory for all banks. This study aimed to be a contribution to a better knowledge and understanding of Portuguese banks’ disclosure of climate-related information. The study’s conclusions have practical implications, providing data and documented information to help European and national regulators understand the shortcomings of the present sustainability reporting on climate-related information.

The major limitation of this study could be related to the small size of the sample. However, as it was explained, in Portugal, only the nine analyzed banks were required (in 2017) to adopt the EU non-financial Directive and had to follow the guidelines. Furthermore, since the non-financial reporting is not audited in Portugal, the integrity of the non-financial information cannot be guaranteed.

The paper comprises the evaluation of disclosure climate-related information for the period 2016–2019. Future research should continue to analyze subsequent periods to understand whether non-financial reporting is improving over the years. It is crucial to continue following the information released by Europe’s largest banks. Future research could also assist in developing global indicators that would promote comparability among banks. Additionally, climate-related information disclosed by companies should be studied to understand whether that information is helpful for banks concerning credit risk analysis. The development of a common taxonomy that sets minimum standards for accurately classifying climate-related activities also can be researched. Another interesting topic is the new developments that sustainability reporting is causing in Europe. EFRAG received support from the EU to prepare sustainability standards. Additionally, the International Financial Reporting (IFRS) Foundation will also be involved in the preparation of the global sustainability standards. Finally, future research should also analyze the comments letters and the support related to sustainability standards that the IFRS Foundation has been receiving.

Author Contributions

Conceptualization, A.L.S. and L.L.R.; data curation, A.L.S.; formal analysis, A.L.S. and L.L.R.; investigation, A.L.S.; methodology, A.L.S. and L.L.R.; project administration, L.L.R. and A.L.S.; resources, A.L.S. and L.L.R.; supervision, L.L.R.; validation, A.L.S. and L.L.R.; writing—original draft, A.L.S. and L.L.R.; and writing—review and editing, A.L.S. and L.L.R. All authors have read and agreed to the published version of the manuscript.

Funding

This paper was financed by National Funds of the FCT—Portuguese Foundation for Science and Technology within the project “UIDB/03182/2020”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data supporting the reported results and the dada generated for the analysis can be found with the authors. This can be made available upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- NASA (National Aeronautics and Space Administration). Overview: Weather, Global Warming and Climate Change. California, USA, 2021. Available online: https://climate.nasa.gov/resources/global-warming-vs-climate-change/ (accessed on 15 October 2021).

- Bowman, M. The Role of the Banking Industry in Facilitating Climate Change Mitigation and the Transition to a Low-Carbon Global Economy. SSRN Electron. J. 2010, 27, 448–468. [Google Scholar] [CrossRef]

- Cogan, D.G. Corporate Governance and Climate Change: The Banking Sector; Ceres: Boston, MA, USA, 2008. [Google Scholar] [CrossRef]

- EU—European Parliament and the Council. Directive 2014/95/EU of the European Parliament and of the Council—of 22 October 2014—Amending Directive 2013/34/EU as Regards Disclosure of Non-Financial and Diversity Information by Certain Large Undertakings and Groups. Off. J. Eur. Union 2014, L330, 1–9. [Google Scholar]

- EU—European Commission. Guidelines on Non-Financial Reporting (Methodology for Reporting Non-Financial Information). Off. J. Eur. Union 2017, C215, 1–68. [Google Scholar]

- EU—European Commission. Communication from the Commission Guidelines on Non-Financial Reporting: Supplement on Reporting Climate-Related Information. Off. J. Eur. Union 2019, C209, 1–30. [Google Scholar]

- NASA (National Aeronautics and Space Administration). Carbon Dioxide. California, USA, 2019. Available online: https://climate.nasa.gov/vital-signs/carbon-dioxide/ (accessed on 2 December 2019).

- NASA (National Aeronautics and Space Administration). Climate Change: How Do We Know? California, USA, 2019. Available online: https://climate.nasa.gov/evidence/ (accessed on 2 December 2019).

- IPCC (Intergovernmental Panel on Climate Change). Climate Change 2014 Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Pachauri, R.K., Meyer, L.A., Eds.; IPCC: Geneva, Switzerland, 2014; pp. 1–151. [Google Scholar]

- UN (United Nations—Climate Change). Guterres: Climate Action Is a “Battle for Our Lives”. Bonn, Germany, 2019. Available online: https://unfccc.int/news/guterres-climate-action-is-a-battle-for-our-lives (accessed on 21 December 2019).

- Stephens, C.; Skinner, C. Banks for a better planet? The challenge of sustainable social and environmental development and the emerging response of the banking sector. Environ. Dev. 2013, 5, 175–179. [Google Scholar] [CrossRef]

- Schoenmaker, D.; Tilburg, R.V. Financial Risks and Opportunities in the Time of Climate Change. Bruegel Policy Brief 2016, 2, 1–8. [Google Scholar]

- Ryszawska, B.; Zabawa, J. The Environmental Responsibility of the World’s Largest Banks. Econ. Bus. 2018, 32, 51–64. [Google Scholar] [CrossRef] [Green Version]

- RP (República Portuguesa). Decreto-Lei n.º 89/2017 de 28 de Julho. Diário da República 2017, 1.ª Série—N.º 145 de 28 de Julho de, 2017. pp. 4267–4271. Available online: https://dre.pt/home/-/dre/107773645/details/maximized (accessed on 22 December 2019).

- RP (República Portuguesa). Lei n.º 148/2015 de 9 de Setembro. Diário da República 2015, 1.ª Série—N.º 176 de 9 de Setembro de, 2015. pp. 7501–7516. Available online: https://dre.pt/home/-/dre/70237676/details/maximized (accessed on 22 December 2019).

- EU—European Commission. Consultation Document on the Update of the Non-Binding Guidelines on Non-Financial Reporting. Brussels, Belgium, 2019. Available online: https://ec.europa.eu/info/consultations/finance-2019-non-financial-reporting-guidelines_en (accessed on 23 December 2019).

- EU—European Commission. Sustainable Finance: Making the Financial Sector a Powerful Actor in Fighting Climate Change. Brussels, Belgium, 2018. Available online: http://europa.eu/rapid/press-release_IP-18-3729_en.htm?locale=en (accessed on 6 December 2019).

- TEG (Technical Expert Group on Sustainable Finance). Financing a Sustainable European Economy—Report on Climate-Related Disclosures; EU Technical Expert Group on Sustainable Finance: Brussels, Belgium, 2019; 50p. [Google Scholar]

- EU—European Commission (Banking and Finance). Targeted Consultation on the Update of the Non-Binding Guidelines on Non-Financial Reporting. Brussels, Belgium, 2019. Available online: https://www.eciia.eu/wp-content/uploads/2019/03/ECIIA-reaction-Targeted-consultation-on-the-update-of-the-non-binding-guidelines-on-non-financial-reporting-.pdf (accessed on 23 December 2019).

- EU—European Commission. Summary Report of the Targeted Consultation on the Update of the Non-Binding Guidelines on Non-Financial Reporting (20 February–20 March 2019); European Commission: Brussels, Belgium, 2019; pp. 1–9. [Google Scholar]

- Janssen, J. Implementing the Kyoto Mechanisms: Potential Contributions by Banks and Insurance Companies. Geneva Pap. Risk Insur.—Issues Pract. 2000, 25, 602–618. [Google Scholar] [CrossRef]

- Basaglia, P. Transforming the EU Financial Sector into a Powerful Actor in Promoting Sustainability. Fond. Eni Enrico Mattei FEEM 2019, 1, 1–9. [Google Scholar]

- Batten, S.; Sowerbutts, R.; Tanaka, M. Let’s Talk about the Weather: The Impact of Climate Change on Central Banks; Bank of England Working Paper N.º603; Bank of England: London, UK, 2016; 38p. [Google Scholar] [CrossRef] [Green Version]

- Jeffery, C.; Tenwick, J.; Bicciolo, G. Comparing the Implementation of the EU Non-Financial Reporting Directive in the UK, Germany, France and Italy; Frank Bold: Brno, Czech Republic, 2017; pp. 1–51. [Google Scholar]

- Matuszak, Ł.; Różańska, E. CSR Disclosure in Polish-Listed Companies in the Light of Directive 2014/95/EU Requirements: Empirical Evidence. Sustainability 2017, 9, 2304. [Google Scholar] [CrossRef] [Green Version]

- UNEP FI (Finance Initiative). Navigating a New Climate; UNEP Finance Initiative—Acclimatise: Genève, Switzerland, 2018; pp. 1–75. [Google Scholar]

- Campiglio, E.; Dafermos, Y.; Monnin, P.; Ryan-Collins, J.; Schotten, G.; Tanaka, M. Climate change challenges for central banks and financial regulators. Nat. Clim. Chang. 2018, 8, 462–468. [Google Scholar] [CrossRef]

- EBA (European Banking Authority). Final Report—Guidelines on Loan Origination and Monitoring; EBA/GL/2020/06; European Banking Authority: Paris, France, 2020; pp. 1–89. [Google Scholar]

- Feridun, M.; Güngör, H. Climate-Related Prudential Risks in the Banking Sector: A Review of the Emerging Regulatory and Supervisory Practices. Sustainability 2020, 12, 5325. [Google Scholar] [CrossRef]

- Banco de Portugal. Banco de Portugal—Instituições Autorizadas. Lisboa, Portugal, 2018. Available online: https://www.bportugal.pt/entidades-autorizadas/67/all (accessed on 21 December 2019).

- Carini, C.; Rocca, L.; Veneziani, M.; Teodori, C. Ex-Ante Impact Assessment of Sustainability Information–The Directive 2014/95. Sustainability 2018, 10, 560. [Google Scholar] [CrossRef] [Green Version]

- Branco, M.C.; Rodrigues, L. Corporate Social Responsibility and Resource-Based Perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Kılıç, M.; Kuzey, C. Determinants of climate change disclosures in the Turkish banking industry. Int. J. Bank Mark. 2019, 37, 901–926. [Google Scholar] [CrossRef]

- Demaria, S.; Rigot, S.; Borie, S. A New Measure of Environmental Reporting Practice Based on the Recommendations of the Task Force on Climate-Related Financial Disclosures. In Proceedings of the AFC 2019, Paris, France, 9–17 May 2019; pp. 1–31. [Google Scholar]

- Demaria, S.; Rigot, S. Corporate environmental reporting: Are French firms compliant with the Task Force on Climate Financial Disclosures’ recommendations? Bus. Strat. Environ. 2020, 30, 721–738. [Google Scholar] [CrossRef]

- Manes-Rossi, F.; Tiron-Tudor, A.; Nicolò, G.; Zanellato, G. Ensuring More Sustainable Reporting in Europe Using Non-Financial Disclosure—De Facto and De Jure Evidence. Sustainability 2018, 10, 1162. [Google Scholar] [CrossRef] [Green Version]

- ECB (European Central Bank). ECB Report on Institutions’ Climate-Related and Environmental Risk Disclosures (November 2020); ECB: Frankfurt, Germany, 2020; pp. 1–32. [Google Scholar]

- Furrer, B.; Hamprecht, J.; Hoffmann, V.H. Much Ado About Nothing? How Banks Respond to Climate Change. Bus. Soc. 2012, 51, 62–88. [Google Scholar] [CrossRef]

- GRIS (Grupo de Reflexão para o Desenvolvimento Sustentável). Carta de Compromisso para o Financiamento Sustentável em Portugal. Lisboa, 2019. Available online: https://www.fundoambiental.pt/ficheiros/b-carta_compromissos_web_final-pdf.aspx (accessed on 2 April 2021).

- EPs (Equator Principles). The Equator Principles EP4: July 2020; The Equator Principles Association: Eastbourne, UK, 2020; pp. 1–37. [Google Scholar]

- Nieto, M.J. Banks, climate risk and financial stability. J. Financ. Regul. Compliance 2019, 27, 243–262. [Google Scholar] [CrossRef]

- Georgopoulou, E.; Mirasgedis, S.; Sarafidis, Y.; Hontou, V.; Gakis, N.; Lalas, D.; Xenoyianni, F.; Kakavoulis, N.; Dimopoulos, D.; Zavras, V. A methodological framework and tool for assessing the climate change related risks in the banking sector. J. Environ. Plan. Manag. 2015, 58, 874–897. [Google Scholar] [CrossRef]

- BPI (Banco Português de Investimento, SA). Relatório e Contas—Banco BPI 2019; Banco Português de Investimento: Porto, Portugal, 2020; pp. 1–510. [Google Scholar]

- BNPPPF (Banco BNP Paribas Personal Finance, SA). Demonstrações Financeiras e Notas às Contas a 31 de Dezembro de 2019 Do Banco BNP Paribas Personal Finance, SA; Banco BNP Paribas Personal Finance: Lisbon, Portugal, 2020; pp. 1–116. [Google Scholar]

- MILLENNIUM BCP (Banco Comercial Português, SA). Relatório de Sustentabilidade 2019; Banco Comercial Português: Porto, Portugal, 2020; pp. 1–108. [Google Scholar]

- CGD (Caixa Geral de Depósitos, SA). 2019 Relatório de Gestão e Contas; Caixa Geral de Depósitos: Lisbon, Portugal, 2020; pp. 1–793. [Google Scholar]

- NOVO BANCO (Novo Banco, SA). Relatório de Sustentabilidades 2019; Novo Banco: Lisbon, Portugal, 2020; pp. 1–109. [Google Scholar]

- SANTANDER (Banco Santander Totta, SA). Relatório de Banca Responsável 2019; Banco Santander Totta: Lisbon, Portugal, 2020; pp. 1–108. [Google Scholar]

- Achenbach, M. Transparency of Climate-Related Risks and Opportunities: Determinants Influencing the Disclosure in Line with the Task Force on Climate-Related Financial Disclosures. Glocality 2021, 4, 1–20. [Google Scholar] [CrossRef]

- TCFD (Task Force on Climate-Related Financial Disclosures). Implementing the Recommendations of the Task Force on Climated-Related Financial Disclosures; Task Force on Climate-Related Financial Disclosures: Basel, Switzerland, 2017; pp. 1–82. [Google Scholar]

- Eccles, R.G.; Krzus, M.P. Implementing the Task Force on Climate-related Financial Disclosures Recommendations: An Assessment of Corporate Readiness. Schmalenbach Bus. Rev. 2019, 71, 287–293. [Google Scholar] [CrossRef] [Green Version]

- EU—European Commission. Proposal for a Directive of the European Parliament and of the Council Amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC and Regulation (EU) No 537/2014, as Regards Corporate Sustainability Reporting; European Commission: Brussels, Belgium, 2021; Volume 104, pp. 1–65. [Google Scholar]

- Monasterolo, I.; Ulrich, V. Addressing Climate-Related Financial Risks and Overcoming Barriers to Scaling-up Sustainable Investment. In Proceedings of the G20 Insights 2020, Riyadh, Saudi Arabia, 31 October–1 November 2020; pp. 1–4. [Google Scholar]

- Thistlethwaite, J. The Challenges of Counting Climate Change Risks in Financial Markets; Centre for International Governance Innovation: Waterloo, ON, Canada, 2015; Volume 62, pp. 1–6. [Google Scholar]

- De Bernardi, P.; Venuti, F.; Bertello, A. The Relevance of Climate Change Related Risks on Corporate Financial and Non-Financial Disclosure in Italian Listed Companies. In The Future of Risk Management Palgrave Macmillan; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 77–107. [Google Scholar] [CrossRef]

- Strano, E.; Kabli, A. Non-Financial Reporting in Banks: Emerging Trends in Italy. In Proceedings of the 15th International Conference on Social Sciences, Rome, Italy, 18–19 June 2018; Volume 2, pp. 301–307. [Google Scholar]

- Johnston, A. Climate-Related Financial Disclosures: What Next for Environmental Sustainability? Univ. Oslo Fac. Law Leg. Stud. Res. Pap. Ser. 2018, 120, 1–32. [Google Scholar]

- MBIE (Ministry of Business, Innovation & Employment). Mandatory Climate-Related Disclosures. Ministry of Business, Innovation & Employment. Wellington, New Zealand. 2021. Available online: https://www.mbie.govt.nz/business-and-employment/business/regulating-entities/mandatory-climate-related-disclosures/ (accessed on 18 April 2021).

- Camilleri, M. Environmental, social and governance disclosures in Europe. Sustain. Account. Manag. Policy J. 2015, 6, 224–242. [Google Scholar] [CrossRef]

- Krasodomska, J.; Michalak, J.; Świetla, K. Directive 2014/95/EU: Accountants’ Understanding and Attitude towards Manda-tory Non-Financial Disclosures in Corporate Reporting. Meditari Account. Res. 2020, 28, 751–779. [Google Scholar] [CrossRef]

- Jackson, G.; Bartosch, J.; Avetisyan, E.; Kinderman, D.; Knudsen, J.S. Mandatory Non-financial Disclosure and Its Influence on CSR: An International Comparison. J. Bus. Ethics 2020, 162, 323–342. [Google Scholar] [CrossRef]

- Vizcarra, H.V. The Reasonable Investor and Climate-Related Information: Changing Expectations for Financial Disclosures. Environ. Law Rep. 2020, 50, 10106–10114. [Google Scholar]

- UNEP FI (Finance Initiative). Extending Our Horizons; UNEP Finance Initiative: Genève, Switzerland, 2018; pp. 1–74. [Google Scholar]

- Weber, O.; Kholodova, O. Climate Change and the Canadian Financial Sector; Center for International Governance Innovation Papers: Waterloo, ON, Canada, 2017; Volume 134, pp. 1–8. [Google Scholar]

- TCFD (Task Force on Climate-Related Financial Disclosures). Task Force on Climate-Related Financial Disclosures—2020 Status Report; TCFD: Basel, Switzerland, 2020; pp. 1–112. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).