Addressing the Impact of Fourth Industrial Revolution on South African Manufacturing Small and Medium Enterprises (SMEs)

Abstract

1. Introduction

1.1. The Use of Propositions

1.2. Manufacturing SME Readiness

1.3. Manufacturing SME Opportunities

- Locally produced, personalized and mass customized production of products.

- Processes of cluster dynamics and networked manufacturing; end-to-end digital engineering; integration of shop floors and top floors; and real-time networks.

- Business models from value chain fragmentation, service integrated offerings, and development and creation of services and products that are related to customer emotions.

- Converging globalized competition frontiers with low cost, light footprint, and frugal innovation.

- Interdisciplinary skills, being of the complexity of a higher degree.

1.4. Manufacturing SME Organizational Changes

1.5. Research Questions and Objective

- What are the components of the fourth industrial revolution technologies? (RQ1)

- What are the challenges faced by the manufacturing SMEs in South Africa in moving into the 4IR? (RQ2)

- How can 4IR technologies address the challenges of South African SMEs? (RQ3)

- Develop a conceptual framework to guide South African SMEs into 4IR to gain competitive advantage and sustainable business performance.

2. Literature Review

2.1. Role of SMEs Globally

- Are the main source of employment and value creation.

- Contribute to economic diversification and resilience.

2.2. Role of SMEs in South Africa

2.3. Manufacturing SME Sector

- To minimize downtime, a migration plan must be in place to transition smoothly to the new 4IR technologies.

2.4. Manufacturing SME Challenges

- Inequality, particularly it’s potential to disrupt labor markets, as the labor force is substituted for automation across the entire 4IR economy [10].

- Displacement of workers by machines might worsen the gap between returns to capital and returns to labor [1].

- Talents in the future will be more valued than working capital, and this will give rise to a job market where high-skilled workers are paid more compared to low-skilled workers aggravating social tension [1].

- Lack of sufficient financial means to procure the necessary 4IR technologies.

- Manufacturing SMEs have difficulty in committing resources and may lack the capabilities to transform.

- Challenges for technical skills relating to the increasing complexity of automated production systems arise, much of which has to be hidden from the end-user [38].

- Automation substitution of labor across the entire economy.

- Displacement of workers by machines worsening the unemployment gap (job insecurity).

- High-skilled employees getting high pay as opposed to low-skilled with low pay aggravating social tension.

- Lack of sufficient financial means to procure the necessary 4IR technologies (cf. interrupted supply chains—Proposition pC5).

- Technical skills’ challenges to operate automated production systems.

- New business models that enable scientific forecasts and analysis as well as disseminating traders’ and manufacturers’ information are being developed. While Artificial intelligence (AI) technologies may cause the number of workers to reduce, [39] reports there is not a sufficiently skilled number of workers to implement these 4IR technologies.

- Safety and security are increasing concerns for businesses owing to the increased complexities of production systems that are being automated [38].

- Lack of technological progress prohibits manufacturing SMEs to reduce industrial wastes by redesigning consumption and production systems to be more efficient in using resources [35].

- Fears of the poor, non-skilled, and the marginalized are feeling increasingly challenged in an ever-increasing digitalized world.

- According to the report from the Department of Economic & Social Affairs [40], many occupations and professions have been significantly transformed by the growth of the current technological revolution; yet, while some occupations are growing fast while changing the requirements in skills and competencies, some professions and occupations are already threatened by massive occupation dislocations, redundancies, and skillset disruption, as agreed by [10,39,40].

- Low-cost labor is no longer an effective strategy for attracting manufacturing investment from foreign investors. The cost of automation is expected to drop through the introduction of automation, mainly owing to the resources in developed economies. They might export their assembly operations back to developed economies, thereby creating less opportunity for employment in developing African economies [7,41].

- New business models should be developed through Artificial Intelligence (AI).

- Technological-progress programs with manufacturing SMEs reducing industrial waste need to be implemented.

- Safety and security (Information Security) challenge for manufacturing SMEs needs to be addressed.

- Increased investment in education and training to address shortages of key technical skills should be made.

- Adoption in terms of infrastructure to facilitate a competitive advantage and enable sustainable business performance through highly adaptable structures and agile manufacturing should be investigated.

2.5. The Fourth Industrial Revolution

2.5.1. The Key Technical Elements of the 4IR

2.5.2. Benefits of the 4IR

- Improved, possibly interrupted innovation capability.

- Improved monitoring and diagnosis of systems that multifunction.

- Increased self-awareness of intelligent systems and subsequent self-maintenance.

- Improved productivity with environmentally friendly and more customized products.

- Improved flexibility with decreased costs.

- Faster product development processes with new service models and business.

- More market spread and access to global through e-business.

- Improved access to public services, for example, education (training), health, local services, and personal information.

2.5.3. Challenges of the 4IR

2.5.4. The Effects of the 4IR

2.5.5. The 4IR Technology Components

2.5.6. The 4IR Technologies Useful for SMEs

- It creates a competitive advantage whereby rival companies are outperformed in new, innovative ways.

- New businesses lines can be spawned, usually from within the organization’s existing working operations.

- It creates a competitive advantage whereby rival companies may be outperformed in innovative ways.

- New business models can be spawned up, usually from within the organization’s existing working operations.

2.5.7. The 4IR Impact on Manufacturing SMEs

2.6. Manufacturing SME Product Customization

2.7. Gaps in Literature

2.8. Business Considerations

2.8.1. Business Performance

2.8.2. Competitive Advantage

2.8.3. Sources of Competitive Advantage

Tangible Assets

Intangible Assets

Capabilities

Dynamic Capabilities

- Proposition pC37b: To achieve a sustained competitive advantage, dynamic capabilities assist manufacturing SMEs to sense and take advantage of new opportunities,

- protect and reconfigure core competencies, knowledge assets, and complementary assets, and

- re-create (create and modify) its resource structure to respond to changes in the business environment.

Performance Measurement

- Organizational improved performance can be achieved from competitor advantage.

- An organization enjoys a competitive advantage without necessarily gaining improved performance.

- An organization may enjoy an improved performance with no competitor advantage.

2.8.4. Strategic Management

2.8.5. Business Relationships with the 4IR

3. Materials and Methods

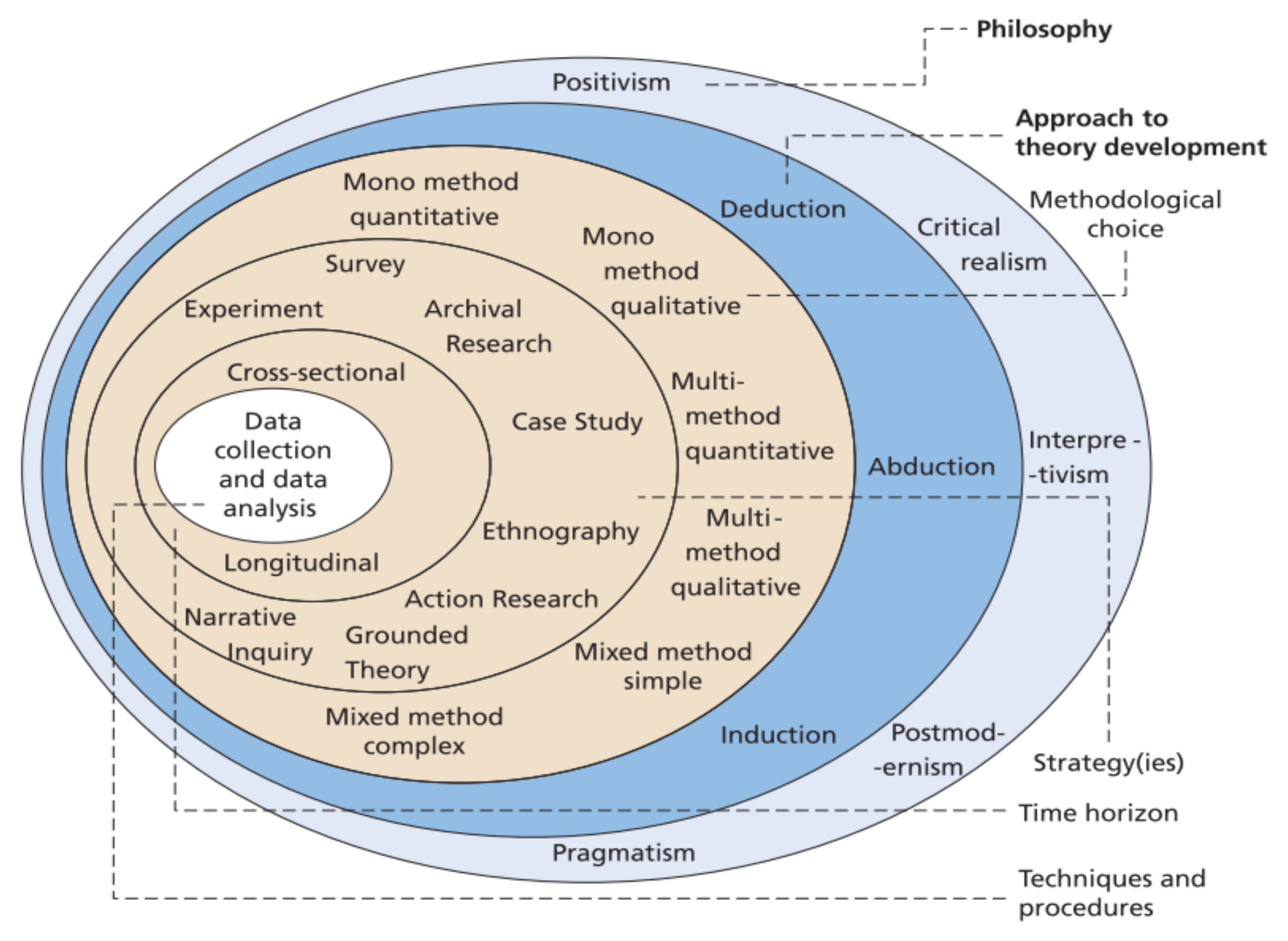

3.1. Research Methodology

3.2. Theories Considered for This Study

4. Results

5. Validation of the Framework

6. Contributions of the Research

7. Conclusions and Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Schwab, K. The Fourth Industrial Revolution: What It Means and How to Respond, World Economic Forum. 2016. Available online: https://www.weforum.org/agenda/2016/01/the-fourth-industrial-revolution-what-it-means-and-how-to-respond/ (accessed on 8 August 2020).

- Brynjolfsson, E.; McAfee, A. The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies, 1st ed.; WW Norton & Company: New York, NY, USA, 2014. [Google Scholar]

- Ford, M. Rise of the Robots: Technology and the Threat of a Jobless Future; Basic Books: New York, NY, USA, 2015. [Google Scholar]

- Arntz, M.; Gregory, T.; Zierahn, U. The Risk of Automation for Jobs in OECD Countries: A Comparative Analysis; OECD Publishing: Paris, France, 2016. [Google Scholar]

- Frey, C.B.; Osborne, M.A. The future of employment: How susceptible are jobs to computerisation? Technol. Forecast. Soc. Chang. 2017, 114, 254–280. [Google Scholar] [CrossRef]

- Department of Small Business Development. Revised Schedule 1 of the National Definition of Small Enterprise in South Africa; Pretoria, South Africa. 2019. Available online: https://www.gov.za/sites/default/files/gcis_document/201903/423041gon399.pdf (accessed on 12 October 2021).

- World Economic Forum. Africa Competitiveness Report 2017. Afr. Res. Bull. Econ. Financ. Tech. Ser. 2017, 54, 21667B–21667C. [Google Scholar] [CrossRef]

- Ayentimi, D.T.; Burgess, J. Is the fourth industrial revolution relevant to sub-Sahara Africa? Technol. Anal. Strat. Manag. 2018, 31, 641–652. [Google Scholar] [CrossRef]

- World Economic Forum. The Future of Jobs and Skills in Africa. Geneva, 2017. Available online: https://www3.weforum.org/docs/WEF_EGW_FOJ_Africa.pdf (accessed on 20 October 2020).

- Prisecaru, P. The challenges of the industry 4.0. Glob. Econ. Obs. 2017, 5, 66. [Google Scholar]

- Borg, A. How Will the Fourth Industrial Revolution Affect Economic Policy? World Economic Forum. 2016. Available online: https://www.weforum.org/agenda/2016/01/how-will-the-fourth-industrial-revolution-affect-economic-policy/ (accessed on 3 November 2020).

- Gadzala, A. 3D Printing: Shaping Africa’s Future. Atlantic Council. 2018. Available online: https://www.jstor.org/stable/resrep17104 (accessed on 3 May 2020).

- Zug, M. The influence of protected areas on military training areas in terms of sustainable development. J. Secur. Sustain. Issues 2015, 5, 129–136. [Google Scholar] [CrossRef][Green Version]

- Bayode, A.; van der Poll, J.A.; Ramphal, R.R. 4th Industrial Revolution: Challenges and Opportunities in the South African Context. In Proceedings of the 17th Johannesburg International Conference on Science, Engineering, Technology & Waste Management, Johannesburg, South Africa, 18–19 November 2019; pp. 4–10. [Google Scholar]

- Armbruster, H.; Bikfalvi, A.; Kinkel, S.; Lay, G. Organizational innovation: The challenge of measuring non-technical innovation in large-scale surveys. Technovation 2008, 28, 644–657. [Google Scholar] [CrossRef]

- Whittington, R.; Pettigrew, A.; Peck, S.; Fenton, E.; Conyon, M. Change and Complementarities in the New Competitive Landscape: A European Panel Study, 1992–1996. Organ. Sci. 1999, 10, 583–600. [Google Scholar] [CrossRef]

- Geroski, P.; Gregg, P. Corporate Restructuring in the UK during the Recession. Bus. Strat. Rev. 1994, 5, 1–19. [Google Scholar] [CrossRef]

- Devanna, M.A.; Tichy, N. Creating the competitive organization of the 21st century: The boundaryless corporation. Hum. Resour. Manag. 1990, 29, 455–471. [Google Scholar] [CrossRef]

- Zenger, T.R.; Hesterly, W.S. The Disaggregation of Corporations: Selective Intervention, High-Powered Incentives, and Molecular Units. Organ. Sci. 1997, 8, 209–222. [Google Scholar] [CrossRef]

- Whittington, R. Changing control strategies in industrial R&D. R D Manag. 1991, 21, 43–53. [Google Scholar] [CrossRef]

- Gulati, R.; Lavie, D.; Singh, H. The nature of partnering experience and the gains from alliances. Strat. Manag. J. 2009, 30, 1213–1233. [Google Scholar] [CrossRef]

- Merchant, H.; Schendel, D. How do international joint ventures create shareholder value? Strat. Manag. J. 2000, 21, 723–737. [Google Scholar] [CrossRef]

- Sharma, M. Organizational Change: Nature, Process and Types, Business Management Ideas. 2018. Available online: https://www.businessmanagementideas.com/management/organisation-management/organizational-change-nature-process-and-types-management/7876 (accessed on 5 August 2020).

- Haseeb, M.; Hussain, H.I.; Kot, S.; Androniceanu, A.; Jermsittiparsert, K. Role of Social and Technological Challenges in Achieving a Sustainable Competitive Advantage and Sustainable Business Performance. Sustainability 2019, 11, 3811. [Google Scholar] [CrossRef]

- Cioffi, R.; Travaglioni, M.; Piscitelli, G.; Petrillo, A.; Parmentola, A. Smart Manufacturing Systems and Applied Industrial Technologies for a Sustainable Industry: A Systematic Literature Review. Appl. Sci. 2020, 10, 2897. [Google Scholar] [CrossRef]

- Brozzi, R.; Forti, D.; Rauch, E.; Matt, D.T. The Advantages of Industry 4.0 Applications for Sustainability: Results from a Sample of Manufacturing Companies. Sustainability 2020, 12, 3647. [Google Scholar] [CrossRef]

- Florescu, A.; Barabas, S.A. Modeling and Simulation of a Flexible Manufacturing System—A Basic Component of Industry 4.0. Appl. Sci. 2020, 10, 8300. [Google Scholar] [CrossRef]

- WTO. World Trade Report 2016: Levelling the Trading Field for SMEs; WTO: Geneva, Switzerland, 2016. [Google Scholar] [CrossRef]

- OECD. Enhancing the Contributions of SMEs in a Global and Digitalised Economy. 2017. Available online: https://www.oecd.org/mcm/documents/C-MIN-2017-8-EN.pdf (accessed on 20 October 2020).

- Matt, D.T.; Modrák, V.; Zsifkovits, H. Industry 4.0 for SMEs; Springer: Cham, Switzerland, 2020. [Google Scholar]

- Ingaldi, M.; Ulewicz, R. Problems with the Implementation of Industry 4.0 in Enterprises from the SME Sector. Sustainability 2019, 12, 217. [Google Scholar] [CrossRef]

- Business Report, Small Businesses in SA Critical to the 4th Industrial Revolution, Technology. 2018. Available online: https://www.iol.co.za/business-report/technology/small-businesses-in-sa-critical-to-the-4th-industrial-revolution-15867017 (accessed on 4 November 2019).

- Ganzarain, J.; Errasti, N. Three stage maturity model in SME’s toward industry 4.0. J. Ind. Eng. Manag. 2016, 9, 1119. [Google Scholar] [CrossRef]

- Craven, P. The Fourth Industrial Revolution-or Socialist Revolution. Daily Maverick, 5 January 2017. [Google Scholar]

- Prisecaru, P. Challenges of the fourth industrial revolution. Knowl. Horiz. Econ. 2016, 8, 57. [Google Scholar]

- Sommer, L. Industrial revolution—Industry 4.0: Are German manufacturing SMEs the first victims of this revolution? J. Ind. Eng. Manag. 2015, 8, 1512–1532. [Google Scholar] [CrossRef]

- Kumalo, N.; van der Poll, J.A. The Role of Cloud Computing in Addressing Small, Medium Enterprise Challenges in South Africa. Ph.D. Thesis, University of South Africa, Pretoria, South Africa, 2018. [Google Scholar]

- Gidlund, M. Myths, Truth, and challenges in Industrial 4. 0 and Wireless Automation. South Africa. 2016. Available online: https://www.youtube.com/watch?v=DrdTR5Kpnl0%0A (accessed on 5 November 2020).

- Coleman, G. The Fourth Industrial Revolution Is Already Here. World Economic Forum. 2016. Available online: https://www.weforum.org/agenda/2016/01/the-fourth-industrial-revolution-is-already-here/ (accessed on 3 November 2020).

- Bruckner, M.; LaFleur, M.; Pitterle, I. The impact of the technological revolution on labour markets and income distribution. 2017. Available online: https://www.un.org/development/desa/dpad/wp-content/uploads/sites/45/publication/2017_Aug_Frontier-Issues-1.pdf (accessed on 8 August 2020).

- Naudé, W. Entrepreneurship, Education and the Fourth Industrial Revolution in Africa. IZA Discussion Paper No. 10855. 2017. Available online: https://ssrn.com/abstract=2998964 (accessed on 7 October 2021).

- Peters, M.A. Technological unemployment: Educating for the fourth industrial revolution. Educ. Philos. Theory 2016, 49, 1–6. [Google Scholar] [CrossRef]

- Ogwo, B.A. Re-Visioning Technical Vocational Education and Training (TVET) for the Youth in Sub-Saharan Africa (SSA) and the Sustainable Development Goals (SDGs): Prospects and Promises within The Framework of The Ubuntu Paradigm. In Re-Visioning Education in Africa: Ubuntu-Inspired Education for Humanity; Takyi-Amoako, E., Assié-Lumumba, N., Eds.; Palgrave Macmillan: London, UK, 2018; pp. 155–173. [Google Scholar]

- Oketch, M. Education policy, vocational training, and the youth in Sub-Saharan Africa, WIDER Working Paper, No. 2014/069, ISBN 978-92-9230-790-5, The United Nations University World Institute for Development Economics Research (UNU-WIDER), Helsinki. 2014. Available online: http://dx.doi.org/10.35188/UNU-WIDER/2014/790-5 (accessed on 12 October 2021).

- Millington, K.A. How Changes in Technology and Automation Will Affect the Labor Market in Africa. Available online: https://gsdrc.org/wp-content/uploads/2017/10/Impact-of-automation-on-jobs-in-Africa.pdf (accessed on 12 October 2021).

- Rauch, E.; Vickery, A.R.; Brown, C.A.; Matt, D.T. SME Requirements and Guidelines for the Design of Smart and Highly Adaptable Manufacturing Systems; Palgrave Macmillan: London, UK, 2020; pp. 39–72. [Google Scholar] [CrossRef]

- Kagermann, W.; Wahlster, W.; Helbig, J. Recommendations for Implementing the Strategic initiative INDUSTRIE 4.0. 2013. Available online: https://www.din.de/blob/76902/e8cac883f42bf28536e7e8165993f1fd/recommendations-for-implementing-industry-4-0-data.pdf (accessed on 12 October 2021).

- Qin, J.; Liu, Y.; Grosvenor, R. A Categorical Framework of Manufacturing for Industry 4.0 and Beyond. Procedia CIRP 2016, 52, 173–178. [Google Scholar] [CrossRef]

- Tao, F.; Cheng, Y.; Da Xu, L.; Zhang, L.; Li, B.H. CCIoT-CMfg: Cloud Computing and Internet of Things-Based Cloud Manufacturing Service System. IEEE Trans. Ind. Inform. 2014, 10, 1435–1442. [Google Scholar] [CrossRef]

- Adebayo, A.O.; Chaubey, M.S.; Numbu, L.P. Industry 4.0: The Fourth Industrial Revolution and How It Relates to the Application of Internet of Things (IoT). J. Multidiscip. Eng. Sci. Stud. 2019, 5, 2478. [Google Scholar]

- Oztemel, E.; Gursev, S. Literature review of Industry 4.0 and related technologies. J. Intell. Manuf. 2020, 31, 127–182. [Google Scholar] [CrossRef]

- Almada-Lobo, F. The Industry 4.0 revolution and the future of Manufacturing Execution Systems (MES). J. Innov. Manag. 2016, 3, 16–21. [Google Scholar] [CrossRef]

- Zhong, R.Y.; Xu, X.; Klotz, E.; Newman, S.T. Intelligent Manufacturing in the Context of Industry 4.0: A Review. Engineering 2017, 3, 616–630. [Google Scholar] [CrossRef]

- Yoon, D. What We Need to Prepare for the Fourth Industrial Revolution. Healthc. Inform. Res. 2017, 23, 75–76. [Google Scholar] [CrossRef]

- Davies, R. Industry 4.0. Digitalisation for productivity and growth. 2015. Available online: https://www.europarl.europa.eu/RegData/etudes/BRIE/2015/568337/EPRS_BRI(2015)568337_EN.pdf (accessed on 12 October 2021).

- Porter, M.; Millar, V. How information gives you competitive advantage. Harv. Bus. Rev. 2011, 36, 152–171. [Google Scholar]

- Akanle, O.; Adésìnà, J.O. The Development of Africa: Issues, Diagnoses and Prognoses; Social Indicators Research Series; Springer: Cham, Switzerland, 2018; Volume 71, pp. 1–8. [Google Scholar]

- Ogundari, K.; Awokuse, T. Human capital contribution to economic growth in Sub-Saharan Africa: Does health status matter more than education? Econ. Anal. Policy 2018, 58, 131–140. [Google Scholar] [CrossRef]

- Jensen, M. ICT in Africa: A Status Report, in The Global Competitiveness Report 2002–2003; Oxford University Press: New York, NY, USA, 2003. [Google Scholar]

- Ponelis, S.R.; Holmner, M. ICT in Africa: Building a Better Life for All. Inf. Technol. Dev. 2015, 21, 163–177. [Google Scholar] [CrossRef]

- Asongu, S.A.; Nwachukwu, J.C. Openness, ICT and entrepreneurship in sub-Saharan Africa. Inf. Technol. People 2018, 31, 278–303. [Google Scholar] [CrossRef]

- Xin, C. China-EU Trade and Economic Relations (2003–2013). Glob. Econ. Obs. 2014, 2, 41–55. [Google Scholar]

- Li, G.; Hou, Y.; Wu, A. Fourth Industrial Revolution: Technological drivers, impacts and coping methods. Chin. Geogr. Sci. 2017, 27, 626–637. [Google Scholar] [CrossRef]

- Liao, Y.; Deschamps, F.; Loures, E.D.F.R.; Ramos, L.F.P. Past, present and future of Industry 4.0—A systematic literature review and research agenda proposal. Int. J. Prod. Res. 2017, 55, 3609–3629. [Google Scholar] [CrossRef]

- Olanders, D.; Rosenvinge, M. Industry 4.0 How Can Industry 4.0 Create Value in Manufacturing Companies? 2018. Available online: http://urn.kb.se/resolve?urn=urn:nbn:se:kth:diva-233809 (accessed on 7 October 2021).

- Müller, J.M.; Kiel, D.; Voigt, K.-I. What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability 2018, 10, 247. [Google Scholar] [CrossRef]

- Liao, Y.; Loures, E.R.; Deschamps, F.; Brezinski, G.; Venâncio, A. The impact of the fourth industrial revolution: A cross-country/region comparison. Production 2018, 28, 1–18. [Google Scholar] [CrossRef]

- Maisiri, W.; Van Dyk, L. Industry 4.0 readiness assessment for south african industries. S. Afr. J. Ind. Eng. 2019, 30, 134–148. [Google Scholar] [CrossRef]

- Haseeb, M.; Hussain, H.I.; Ślusarczyk, B.; Jermsittiparsert, K. Industry 4.0: A Solution towards Technology Challenges of Sustainable Business Performance. Soc. Sci. 2019, 8, 154. [Google Scholar] [CrossRef]

- Gross, A. Sub-Saharan Africa and the 4 th Industrial Revolution Technological Leapfrogging as a Strategy to Enhance Economic by. Master’s Thesis, Lund University, Lund, Sweden, 2019. [Google Scholar]

- Ghobakhloo, M. Industry 4.0, digitization, and opportunities for sustainability. J. Clean. Prod. 2020, 252, 119869. [Google Scholar] [CrossRef]

- Bai, C.; Dallasega, P.; Orzes, G.; Sarkis, J. Industry 4.0 technologies assessment: A sustainability perspective. Int. J. Prod. Econ. 2020, 229, 107776. [Google Scholar] [CrossRef]

- Da Silva, V.L.; Kovaleski, J.L.; Pagani, R.N.; Silva, J.D.M.; Corsi, A. Implementation of Industry 4.0 concept in companies: Empirical evidences. Int. J. Comput. Integr. Manuf. 2020, 33, 325–342. [Google Scholar] [CrossRef]

- Müller, J.M.; Buliga, O.; Voigt, K.-I. Fortune favors the prepared: How SMEs approach business model innovations in Industry 4.0. Technol. Forecast. Soc. Chang. 2018, 132, 2–17. [Google Scholar] [CrossRef]

- Lee, A.H.; Wang, W.-M.; Lin, T.-Y. An evaluation framework for technology transfer of new equipment in high technology industry. Technol. Forecast. Soc. Chang. 2010, 77, 135–150. [Google Scholar] [CrossRef]

- Marnewick, C.; Marnewick, A. Technology readiness: A precursor for Industry 4.0. J. Contemp. Manag. 2020, 17, 129–149. [Google Scholar] [CrossRef]

- Lebas, M.; Euske, K. A Conceptual and Operational Delineation of Performance; Cambridge University Press: New York, NY, USA, 2007. [Google Scholar]

- Spanos, Y.E.; Lioukas, S. An examination into the causal logic of rent generation: Contrasting Porter’s competitive strategy framework and the resource-based perspective. Strat. Manag. J. 2001, 22, 907–934. [Google Scholar] [CrossRef]

- Strandskov, J. Sources of competitive advantages and business performance. J. Bus. Econ. Manag. 2006, 7, 119–129. [Google Scholar] [CrossRef][Green Version]

- Newbert, S.L. Assessing performance measurement in RBV research. J. Strat. Manag. 2014, 7, 265–283. [Google Scholar] [CrossRef]

- Barney, J.; Wright, M.; Ketchen, D.J. The resource-based view of the firm: Ten years after 1991. J. Manag. 2001, 27, 625–641. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Hunt, S.D.; Morgan, R.M. The Resource-Advantage Theory of Competition: Dynamics, Path Dependencies, and Evolutionary Dimensions. J. Mark. 1996, 60, 107. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage, Creating and Sustaining Superior Performance; The Free Press: New York, NY, USA, 1985; Volume 25. [Google Scholar]

- Barney, J.B.; Hesterly, W. Strategic Management and Competitive Advantages: Concepts and Cases, 3rd ed.; Pearson Education Inc.: Hoboken, NJ, USA, 2010. [Google Scholar]

- Analoui, F.; Karami, A. Strategic Management in Small and Medium Enterprises; University of Bradford: Bradford, UK, 2003. [Google Scholar]

- Magretta, J. Understanding Michael Porter: The Essential Guide to Competition and Strategy; Harvard Business School Publishing: Boston, MA, USA, 2012. [Google Scholar]

- Lynch, R. Corporate Strategy, 4th ed.; Pearson Education: London, UK, 2006. [Google Scholar]

- Andrews, K.R. The Concept of Corporate Strategy, 7th ed.; Dow Jones-Irwin: Homewood, IL, USA, 1971. [Google Scholar]

- Johnson, R.E.; Chang, C.-H.; Yang, L.-Q. Commitment and motivation at work: The relevance of employee identity and regulatory focus. Acad. Manag. Rev. 2010, 35, 226–245. [Google Scholar] [CrossRef]

- Zaridis, A.D. Competitive Advantage and its Sources in an Evolving Market. AIP Conf. Proc. 2009, 1148, 917–921. [Google Scholar] [CrossRef]

- Winter, S.G. Knowledge and Competence as Strategic Assets. In The Competitive Challenge: Strategies for Industrial Innovation and Renewal; Teece, D., Ed.; Harper & Row: New York, NY, USA, 1987. [Google Scholar]

- Ainuddin, R.A.; Beamish, P.W.; Hulland, J.S.; Rouse, M.J. Resource attributes and firm performance in international joint ventures. J. World Bus. 2007, 42, 47–60. [Google Scholar] [CrossRef]

- Lynch, R. Corporate Strategy, 2nd ed.; Prentice Hall: London, UK, 2000. [Google Scholar]

- Bamiatzi, V.; Bozos, K.; Cavusgil, S.T.; Hult, G.T.M. Revisiting the firm, industry, and country effects on profitability under recessionary and expansion periods: A multilevel analysis. Strat. Manag. J. 2016, 37, 1448–1471. [Google Scholar] [CrossRef]

- Bridoux, F. A Resource-based Approach to Performance and Competition: An Overview of the Connections between Resources and Competition. In Luvain; Belgium Institut et de Gestion, Universite Catholique de Louvain: Ottignies-Louvain-la-Neuve, Belgium, 2004; pp. 1–21. Available online: http://www.uclouvain.be/cps/ucl/doc/iag/documents/WP_110_Bridoux.pdf (accessed on 6 October 2020).

- Caloghirou, Y.; Protogerou, A.; Spanos, Y.; Papagiannakis, L. Industry-Versus Firm-specific Effects on Performance: Contrasting SMEs and Large-sized Firms. Eur. Manag. J. 2004, 22, 231–243. [Google Scholar] [CrossRef]

- Barney, J.B.; Clark, D.N. Resource-Based Theory: Creating and Sustaining Competitive Advantage; Oxford University Press: New York, NY, USA, 2007. [Google Scholar]

- Grant, R.M. Contemporary Strategy Analysis, 7th ed.; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Galbreath, J.; Galvin, P. Firm factors, industry structure and performance variation: New empirical evidence to a classic debate. J. Bus. Res. 2008, 61, 109–117. [Google Scholar] [CrossRef]

- Pearce, J.A.; Robinson, R.B. Formulation, Implementation, and Control of Competitive Strategy, 11th ed.; McGraw-Hill: Boston, MA, USA, 2009. [Google Scholar]

- Thompson, A.; Janes, A.; Peteraf, M.; Sutton, C.; Gamble, J.; Strickland, A. Strickland, Crafting and Executing Strategy: The Quest for Competitive Advantage: Concepts and Cases, 8th ed.; McGraw Hill: New York, NY, USA, 2012. [Google Scholar]

- Wernerfelt, B. From Critical Resources to Corporate Strategy. J. Gen. Manag. 1989, 14, 4–12. [Google Scholar] [CrossRef]

- Andersen, O.; Kheam, L.S. Resource-based theory and international growth strategies: An exploratory study. Int. Bus. Rev. 1998, 7, 163–184. [Google Scholar] [CrossRef]

- Galbreath, J. Which resources matter the most to firm success? An exploratory study of resource-based theory. Technovation 2005, 25, 979–987. [Google Scholar] [CrossRef]

- Fahy, J. The resource-based view of the firm: Some stumbling-blocks on the road to understanding sustainable competitive advantage. J. Eur. Ind. Train. 2000, 24, 94–104. [Google Scholar] [CrossRef]

- Fernández, E.; Montes, J.M.; Vázquez, C.J. Typology and strategic analysis of intangible resources: A resource-based approach. Technovation 2000, 20, 81–92. [Google Scholar] [CrossRef]

- Ray, G.; Barney, J.B.; Muhanna, W.A. Capabilities, business processes, and competitive advantage: Choosing the dependent variable in empirical tests of the resource-based view. Strat. Manag. J. 2004, 25, 23–37. [Google Scholar] [CrossRef]

- Arrighetti, A.; Landini, F.; Lasagni, A. Intangible assets and firm heterogeneity: Evidence from Italy. Res. Policy 2014, 43, 202–213. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Villalonga, B. Intangible resources, Tobin’s q, and sustainability of performance differences. J. Econ. Behav. Organ. 2004, 54, 205–230. [Google Scholar] [CrossRef]

- Hall, R. The strategic analysis of intangible resources. Strat. Manag. J. 1992, 13, 135–144. [Google Scholar] [CrossRef]

- Hall, R. A framework linking intangible resources and capabiliites to sustainable competitive advantage. Strat. Manag. J. 1993, 14, 607–618. [Google Scholar] [CrossRef]

- Carpenter, M.A.; Sanders, W.G. Strategic Management: A Dynamic Perspective; Concepts and Cases, 2nd ed.; Pearson Prentice Hall: Hoboken, NJ, USA, 2009. [Google Scholar]

- Barney, J.B. Looking inside for competitive advantage. Acad. Manag. Perspect. 1995, 9, 49–61. [Google Scholar] [CrossRef]

- Grant, R.M. Contemporary Strategy Analysis, 6th ed.; John Wiley & Sons: West Sussex, UK, 2008. [Google Scholar]

- Ehlers, T.; Lazenby, K. Strategic Management: Southern African Concepts and Cases, 2nd ed.; Van Schaik: Pretoria, South Africa, 2010. [Google Scholar]

- Grant, R.M. The resource-based theory of competitive advantage: Implications for strategy formulation. Calif. Manag. Rev. 1991, 33, 114–135. [Google Scholar] [CrossRef]

- Amit, R.; Schoemaker, P.J.H. Strategic assets and organizational rent. Strat. Manag. J. 1993, 14, 33–46. [Google Scholar] [CrossRef]

- Day, G.S. The Capabilities of Market-driven Organizations. J. Mark. 1994, 58, 37. [Google Scholar] [CrossRef]

- Winter, S.G. Understanding dynamic capabilities. Strat. Manag. J. 2003, 24, 991–995. [Google Scholar] [CrossRef]

- Ambrosini, V.; Bowman, C. What are dynamic capabilities and are they a useful construct in strategic management? Int. J. Manag. Rev. 2009, 11, 29–49. [Google Scholar] [CrossRef]

- Augier, M.; Teece, D.J. Dynamic capabilities and multinational enterprise: Penrosean insights and omissions. Manag. Int. Rev. 2009, 47, 175–192. [Google Scholar] [CrossRef]

- Easterby-Smith, M.P.V.; Lyles, M.A.; Peteraf, M.A. Dynamic Capabilities: Current Debates and Future Directions. Br. J. Manag. 2009, 20 (Suppl. S1), S1–S8. [Google Scholar] [CrossRef]

- Galunic, D.C.; Eisenhardt, K.M. Architectural innovation and modular corporate forms. Acad. Manag. J. 2001, 44, 1229–1249. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Helfat, C.E.; Finkelstein, S.; Mitchell, W.; Peteraf, M.; Singh, H.; Teece, D.; Winter, S.G. Dynamic Capabilities: Understanding Strategic Change in Organizations; Blackwell: Malden, MA, USA, 2007. [Google Scholar]

- Zollo, M.; Winter, S.G. Deliberate Learning and the Evolution of Dynamic Capabilities. Organ. Sci. 2002, 13, 339–351. [Google Scholar] [CrossRef]

- Parnell, J.A. Strategic clarity, business strategy and performance. J. Strat. Manag. 2010, 3, 304–324. [Google Scholar] [CrossRef]

- Venkatraman, N.; Ramanujam, V. Measurement of Business Performance in Strategy Research: A Comparison of Approaches. Acad. Manag. Rev. 1986, 11, 801–814. [Google Scholar] [CrossRef]

- Venkatraman, N.; Ramanujam, V. Measurement of Business Economic Performance: An Examination of Method Convergence. J. Manag. 1987, 13, 109–122. [Google Scholar] [CrossRef]

- Yamin, S.; Gunasekaran, A.; Mavondo, F.T. Relationship between generic strategies, competitive advantage and organizational performance: An empirical analysis. Technovation 1999, 19, 507–518. [Google Scholar] [CrossRef]

- Parnell, J.A.; O’Regan, N.; Ghobadian, A. Measuring performance in competitive strategy research. Int. J. Manag. Decis. Mak. 2006, 7, 408. [Google Scholar] [CrossRef]

- Allen, R.S.; Helms, M.M. Linking strategic practices and organizational performance to Porter’s generic strategies. Bus. Process. Manag. J. 2006, 12, 433–454. [Google Scholar] [CrossRef]

- Yeniyurt, S. A literature review and integrative performance measurement framework for multinational companies. Mark. Intell. Plan. 2003, 21, 134–142. [Google Scholar] [CrossRef]

- Hoque, Z. 20 years of studies on the balanced scorecard: Trends, accomplishments, gaps and opportunities for future research. Br. Account. Rev. 2014, 46, 33–59. [Google Scholar] [CrossRef]

- Norreklit, H. The balance on the balanced scorecard a critical analysis of some of its assumptions. Manag. Account. Res. 2000, 11, 65–88. [Google Scholar] [CrossRef]

- Nørreklit, H. The Balanced Scorecard: What is the score? A rhetorical analysis of the Balanced Scorecard. Account. Organ. Soc. 2003, 28, 591–619. [Google Scholar] [CrossRef]

- Carmeli, A.; Tishler, A. Resources, capabilities, and the performance of industrial firms: A multivariate analysis. Manag. Decis. Econ. 2004, 25, 299–315. [Google Scholar] [CrossRef]

- Morgan, N.A.; Vorhies, D.W.; Mason, C. Market orientation, marketing capabilities, and firm performance. Strateg. Manag. J. 2009, 30, 909–920. [Google Scholar] [CrossRef]

- Powell, T.C. Competitive advantage: Logical and philosophical considerations. Strat. Manag. J. 2001, 22, 875–888. [Google Scholar] [CrossRef]

- Newbert, S.L. Value, rareness, competitive advantage, and performance: A conceptual-level empirical investigation of the resource-based view of the firm. Strat. Manag. J. 2008, 29, 745–768. [Google Scholar] [CrossRef]

- O’Shannassy, T. Sustainable competitive advantage or temporary competitive advantage: Improving understanding of an important strategy construct. J. Strat. Manag. 2008, 1, 168–180. [Google Scholar] [CrossRef]

- Sigalas, C.; Economou, V.P. Revisiting the concept of competitive advantage: Problems and fallacies arising from its conceptualization. J. Strat. Manag. 2013, 6, 61–80. [Google Scholar] [CrossRef]

- Ma, H. Toward an Advantage-Based View of the Firm. Adv. Compet. Res. 2000, 8, 34. [Google Scholar]

- Ma, H. Competitive advantage and firm performance. Compet. Rev. 2000, 10, 15–32. [Google Scholar] [CrossRef]

- Peteraf, M.A.; Barney, J.B. Unraveling the resource-based tangle. Manag. Decis. Econ. 2003, 24, 309–323. [Google Scholar] [CrossRef]

- Porter, M.E. Towards a dynamic theory of strategy. Strat. Manag. J. 1991, 12, 95–117. [Google Scholar] [CrossRef]

- Makadok, R. Invited Editorial: The Four Theories of Profit and Their Joint Effects. J. Manag. 2011, 37, 1316–1334. [Google Scholar] [CrossRef]

- Bharadwaj, S.G.; Varadarajan, P.R.; Fahy, J. Sustainable Competitive Advantage in Service Industries: A Conceptual Model and Research Propositions. J. Mark. 1993, 57, 83. [Google Scholar] [CrossRef]

- Foss, N.J. The resource-based tangle: Towards a sustainable explanation of competitive advantage. Manag. Decis. Econ. 2003, 24, 291–307. [Google Scholar] [CrossRef]

- Flint, G.D. What is the meaning of competitive advantage? Adv. Compet. Res. 2000, 8, 121–129. [Google Scholar]

- Conner, K.R. A Historical Comparison of Resource-Based Theory and Five Schools of Thought within Industrial Organization Economics: Do We Have a New Theory of the Firm? J. Manag. 1991, 17, 121–154. [Google Scholar] [CrossRef]

- Ghobadian, A.; O’Regan, N. Where do we fit in the swings and roundabouts of strategy? J. Strat. Manag. 2008, 1, 5–14. [Google Scholar] [CrossRef]

- Nothnagel, K. Empirical Research within Resource-Based Theory: A Meta-Analysis of the Central Propositions; Gabler: Wiesbaden, Germany, 2008. [Google Scholar]

- Nham, P.T.; Hoang, V.H. Building an integrated framework of strategic management theories to explain performance of firm in one industry. J. Glob. Manag. Res. 2011, 1, 29–42. [Google Scholar]

- David, F.R. Strategic Management: Concepts and Cases, 13th ed.; Prentice Hall: Hoboken, NJ, USA, 2011. [Google Scholar]

- Saunders, M.N.K.; Lewis, P.; Thornhill, A. Research Methods for Business Students, 8th ed.; Pearson: London, UK; Harlow, UK, 2019. [Google Scholar]

- Panda, B.; Leepsa, N.M. Agency theory: Review of Theory and Evidence on Problems and Perspectives. Indian J. Corp. Gov. 2017, 10, 74–95. [Google Scholar] [CrossRef]

- Madhani, P.M. The resource-based view (RBV): Issues and perspectives. PACE J. Res. Prestig. Inst. 2010, 1, 43–55. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1579837 (accessed on 8 August 2020).

| Business Size | Number of Full-Time Employees |

|---|---|

| Micro | 1–9 |

| Small | 10–49 |

| Medium | 50–249 |

| Aspect | Percentages | Sector and Company Classification |

|---|---|---|

| Direct exports | 7.6% of total sales | Manufacturing SMEs |

| 14.1% | Large manufacturing | |

| Export share | 3% | African developing economies |

| 8.7 | Developing economies of Asia | |

| SME participation in export share | 0.9 of total sales | Developing countries |

| 31.9% | Large enterprises | |

| OECD group | 99% of all companies | SMEs |

| 70% of employment | ||

| 50%–60% of the value created | ||

| Developing economies | 45% of employment | SMEs |

| 3% of the GDP |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Serumaga-Zake, J.M.; van der Poll, J.A. Addressing the Impact of Fourth Industrial Revolution on South African Manufacturing Small and Medium Enterprises (SMEs). Sustainability 2021, 13, 11703. https://doi.org/10.3390/su132111703

Serumaga-Zake JM, van der Poll JA. Addressing the Impact of Fourth Industrial Revolution on South African Manufacturing Small and Medium Enterprises (SMEs). Sustainability. 2021; 13(21):11703. https://doi.org/10.3390/su132111703

Chicago/Turabian StyleSerumaga-Zake, John Mugambwa, and John Andrew van der Poll. 2021. "Addressing the Impact of Fourth Industrial Revolution on South African Manufacturing Small and Medium Enterprises (SMEs)" Sustainability 13, no. 21: 11703. https://doi.org/10.3390/su132111703

APA StyleSerumaga-Zake, J. M., & van der Poll, J. A. (2021). Addressing the Impact of Fourth Industrial Revolution on South African Manufacturing Small and Medium Enterprises (SMEs). Sustainability, 13(21), 11703. https://doi.org/10.3390/su132111703