Abstract

In this paper, the combined transactions for emission rights of international carbon sequestration and other pollutants in forestry have been taken as the research object, and the Simultaneous Multiple Round Auction (SMRA) theory has been used to design a new model for the current auction transactions. In this paper, the feasibility and application of the SMRA model of reach object are studied by the methods of simulation experiment, model analysis, and analogical analysis, and the promotion of this model is discussed. The results show that the new auction model designed in this paper fills in the blank of the combined auction of international forestry carbon sequestration and other pollutant emission rights. It successfully eliminates the winners’ curse and the losses of the sellers. Meanwhile, it provides a new way of resolving ecological deficits problems, achieving the ultimate goal of an overall reduction in carbon and pollution emission. Moreover, it’s beneficial in resolving the structural contradictions between ecological purification and pollutants discharge, hence maximizing the benefits for all the stakeholders. Finally, it is suggested that the SMRA should be adopted in the international trading of emission rights of international carbon sequestration and other pollutants to promote the emission reduction of greenhouse gases and pollutants.

1. Background

1.1. Background of Carbon Sequestrations Trading

1.1.1. Status

In recent years, the climate problem has been widely concerned by countries all over the world. Most scientists around the world believe that climate change is mainly caused by man-made factors (the use of fossil fuels and the resulting greenhouse gas emissions) [1]. In December 2015, 195 countries signed the Paris Agreement to strengthen the global response to the threat of climate change. Article 6 describes the cooperative approaches that countries can take to achieve their carbon reduction targets, including direct bilateral cooperation and new sustainable development.

International forestry carbon sequestration trading is not only a hot spot of international carbon emission reduction but also an important part of solving the global climate crisis, because forests can absorb carbon dioxide from the atmosphere. It is also because of the contribution of carbon dioxide produced by deforestation and forest degradation to global emissions [2]. Now that the carbon trading market has been established, the number of emissions trading systems around the world is increasing. In addition to the EU emissions trading system, Canada, China, Japan, New Zealand, South Korea, Switzerland, and the United States are already in operation or under development [3]. The British trading system was established in 2002, becoming the first carbon dioxide emissions trading market in the world. Founded in 2003, the Chicago Climate Exchange is the first trading platform in the world to voluntarily participate in greenhouse gas emission reduction. In 2005, the EU carbon emissions trading mechanism was established and became the largest greenhouse gas trading market in the world [4].

1.1.2. Target

Carbon trading takes into account economic development goals. If the fluctuation of carbon trading prices affects the output and economic growth of enterprises, it is unreasonable to achieve the goal of energy conservation and emission reduction. Carbon sequestration trading parties should establish a global carbon pricing mechanism to change countries’ overly optimistic attitudes towards achievable emission reduction targets. In addition, the improvement of the global climate policy framework can reduce the risk of some countries exceeding their global emissions targets and carbon leakage. Countries tailoring border taxes, departmental emissions trading, or carbon taxes according to their conditions will also be helpful to international carbon sequestration trading [5].

1.2. Background of Pollutant Emission Rights

1.2.1. Status

At the global level, emissions trading mechanisms are mainly used for carbon emissions trading. The United States was the first to prepare for emissions trading, and in 1979 it tried out a “bubble” policy to trade permits for air pollution, lead content in gasoline, and water pollution. The paid use price, transaction benchmark price, and government repurchase price in the initial distribution basically constitute the current situation of the paid use and transaction price system of the main pollutant emission rights in our country. Although the use of emission permit trading systems continues to grow, this trading system is only suitable for uniformly mixed pollutants, so its application potential is still limited. The economic efficiency of emission permits for traditional non-uniformly mixed pollutants is low because of the high variation of emission concentrations at different receptor locations [6].

At present, the emissions trading mechanism is not perfect, the initial emission approval is too loose, and the role of emission reduction has not been brought into full play. Compared with the current situation of carbon sequestration trading, the global pollutant emissions trading is more from lack of a sound system.

1.2.2. Target

With the trading of pollutant emission rights, the task of pollutant control is handed over to enterprises. Enterprises can choose pollutant discharge methods that are suitable for their development. Prophase trading can not only openly enter the pollutant emission rights trading between enterprises, but also better reflect the pollutant emission cost and the value of polymer emission rights. Enterprises can trade works of art, which can avoid the illegal transfer of pollutant emission rights and reduce the cost of pollutant emissions [7].

1.3. Question

At present, the emission rights of international forestry carbon sequestration and other pollutants have not established a realistic and feasible combinatorial auction trading system. If it is constructed according to the traditional auction model, it is difficult to apply to the current characteristics of forestry international carbon sequestration and other pollutant emissions trading, so it is necessary to establish a new combinatorial auction system. This paper will use the SMRA model to explore it.

2. Literature Review

2.1. Change of the Basic Theory

As early as 1961, according to the private value model, Vickery [8] summarized and put forward four types of auctions: English auction, Dutch auction, sealed first-price auction, and sealed second-price auction. Among them, the British Auction mentioned in this study refers to the auction of a single subject. Bidders bid from the lowest to the highest and the higher bidder gets. The basis of William’s classification is the private value model, which means that the value of each subject to the bidder is different. Each person only knows the value of the subject in his mind, but not in the mind of other competitors such as luxury goods and antiques. Based on the above assumptions, he further proposed the income equivalence theorem. The four auction methods will produce essentially the same expected income.

Myerson [9] proposed the common value model that the value of the subject matter is the same for each bidder. However, the value is unknowable due to incomplete information and other factors. At the same time, he extended William’s four auction models to other auctions. Since then, Milgrom [10] has developed a two-stage model based on common value where bidders could obtain information at cost prior to bidding.

In response to existing auction theories, Wilson found the existence of a “winner’s curse” in the British Auction. Bidders won at a price far higher than they thought. Thus, he came up with a theoretical model of sealed first-price auctions to avoid the winner’s curse [11,12].

Based on the above research, Milgrom [13] put forward the analytical framework of added value model in 1982 and proposed the correlation of auction in a pioneering way, that is, the high or low appraisal behavior of bidders on the target will affect the bidding decision of other bidders. He argued that of the four types of auctions, British Auctions bring in the most revenue.

2.2. Theoretical Study of SMRA

In the design of spectrum auctions in the United States in the 1990s, McMillan [14] raised several questions: Should an open auction or a sealed auction be used? In order or at the same time? Will a combination of licenses be submitted or will a single license bid be accepted? In the end, the Federal Communications Commission chose to combine Milgrom and Wilson’s theories and conduct an auction through the SMRA model.

After the great success of this auction, Milgrom [15] made a detailed analysis of its theory in 2000 which explained the function and limitation of SMRA auction. He explained the function of detailed rules, the possibility of introducing combination bidding and emphatically explained that the theoretical premise of SMRA is that the subject matter can be replaced with each other.

In a follow-up study, Ausubel [16,17] suggested that the application of SMRA might lead to reduced demand in auctions. The research team went on to improve on the SMRA by proposing a combined clock auction, but there are still some drawbacks. Currently, CCA and SMRA are widely used in some countries. Bichler analyzed the auction revenue and efficiency of SMRA and similar CCA models and found that SMRA is more efficient than CCA [18]. In our research on forestry carbon sequestration and other pollutants trading, there are no cases and theoretical studies on the application of the SMRA auction model.

2.3. Research on International Forestry Carbon Sequestration and Trade of Other Pollutants

At present, the European carbon market is the main object of the international forestry carbon sequestration trade. Most scholars agree on the social and economic benefits of carbon sequestration [19,20]. A few studies suggest that ordinary carbon trading may have unfair social consequences [21]. Other scholars have studied the design of the carbon market trading mechanism [22,23,24]. For example, Zhang [25] thought that regions or countries must develop according to local conditions. There are many theoretical pieces of research on carbon market trading mechanisms, but few of them can be applied to actual carbon trading.

Many countries recognized the importance of pollutant trading early and put it into practice. Some scholars believe that auction trading has played a part in the early emissions trading market [26]. The early research provided the design scheme for the best trading plan and laid a good theoretical and practical foundation for the later research. [27,28] There is no international trading system for pollutants. Chaabane [29] and Haita [30] discuss and construct the model for the emission trading scheme. Dickson [31] established a two-stage framework for emissions trading. Carmona [32] designed the market for emission trading. Different scholars have different research designs on pollutant trading mechanisms due to their different positions, perspectives, and research focus.

In the late 20th century, the pollutant auction mechanism mainly focused on the SO2 auction [26,33]. But with the development of industry, SO2 based pollutant auction has been unable to meet the needs of most enterprises for pollutant emission rights. Since the 21st century, the research has shifted to the auction mechanism of CO2 as the main pollutant. Most scholars agree with the comprehensive auction transaction for pollutants [34,35]. But Huebler [36] argued that a full auction of carbon allowances would be difficult to implement because of the macroeconomic effects. More scholars design pollutant auction mechanisms such as the ETS simulation model based on multi-agent and dynamic double-effect adjusted auction [37,38]. In the following study, Cong [39] finds that when there are many bidders and no obvious collusion, it is more efficient to use a British watch auction. Conversely, it is more efficient to use discriminatory price auctions. Jiang [40] believed that the effectiveness of auctions depends on whether the market is fully competitive. Some studies also discuss the application of consignment auctions in pollutant trading [41,42]. Wang creatively proposed a multi-round auction model for carbon emissions, with a floating cap on carbon emissions, believing that dynamic auction is conducive to price stability [43]. Sun proposed the RAEP dual auction model for Beijing’s emission rights auction, believing that it can effectively improve the auction efficiency [44].

The current research mainly aims at improving social benefits and improving the efficiency of an auction, but the design of a unified pollutant auction standard and supervision mechanism is not perfect.

2.4. Summarize

The development of SMRA has also played a key role in the practice of auction, and the design of simultaneous multiple rounds of increasing price auction has been successfully applied in the auction of many radio spectrum licenses. At present, the characteristics of forestry carbon sequestration and other pollutant emission right trading are as follows:

- Studies on trading mechanisms are abundant, but they lack universality;

- The main goal of the study is to improve the efficiency of an auction, and the design of the unified standard of pollutant auction and the supervision mechanism is not perfect;

- Most importantly, there are relatively few studies on forestry carbon sequestration and pollutant combination trade. With the increase of pollutant emission reduction target and carbon quota trading price, more and more attention will be paid to the study of forestry carbon sequestration and pollutant trading [45].

At present, the traditional auction trading method cannot meet the needs of international forestry carbon sequestration and other pollutant emission right combination trading. In order to realize the overall operation of the international pollutant emission right market, it needs a complete trading mode as the support, so it is necessary to study the SMRA based international pollutant emission right trading mode.

3. Feasibility Study

3.1. Characteristics of Buyers and Sellers under the Combined Trading of Forestry Carbon Sequestration and Other Pollutant Emission Rights

For carbon sequestration and the purification of pollutants, the ecological value of a specific ecological forest is unique and it varies a lot from one to another. For air purification, trees release oxygen through photosynthesis, absorbing many toxic gases in addition to carbon dioxide at the same time. For example, sulfur dioxide is a common toxic gas in cities and forests are good at purifying sulfur dioxide. For example, Cryptomeria Cedar (Latin name: Cryptomeria fortune) can absorb 48 kg of sulfur dioxide per acre per year and Winter Plum (Latin name: Chimonanthus praecox), Juniper (Latin name: Juniperus chinensis), Sweetgum (Latin name: Liquidambar formosana Hance), Phoenix tree (Latin name: Firmiana simplex), Albizia (Latin name: Albizia julibrissin) and Oil Tea (Latin name: Camellia oleifera) are species that are resistant to sulfur dioxide. Some other species such as Citrus (Latin name: Citrus reticulata) and Ligustrum (Latin name: Ligustrum lucidum) can absorb hydrogen chloride while Cypress (Latin name: Sabina chinensis), Metasequoia (Latin name: Metasequoia glyptostroboides), Ginkgo (Latin name: Ginkgo biloba), Podocarpus (Latin name: Podocarpus macrophyllus) and Palm (Latin name: Trachycarpus fortune) can resist oxygen pollution. Cinnamon Willow (Latin name: Elaeagnus angustifolia) and Canadian Poplar (Latin name: Populus canadensis) can absorb aldehydes, ketones, ether, and carcinogens benzoin in the air. Research data shows that 4046 square meters of forest belt can absorb and assimilate 100 tons of pollutants from the atmosphere per year. In addition, the branches and leaves of the trees are also capable of absorbing dust in the air and filtering the air. For example, 667 square meters of spruce can hold 22 tons of dust every year and 667 square meters of green forest can hold 68 tons of dust. Green trees and mulberries also could absorb lead dust [46].

For the buyer, it is practical to recognize that there is not the same combination of pollutants and emissions of each substance from each production unit. They tend to emit one or more carbon dioxide, sulfur dioxide, nitrogen, dust, and so on. For example, if a quarry is a major source of carbon and dust pollution, the owner of the plant should only consider participating in a combined auction of these two pollutants.

According to the characteristics of the double end of trading, we can see that both buyers and sellers have different quality commodity combination transaction needs, if according to the traditional auction transaction, each commodity needs to be auctioned separately, which is bound to make the transaction process complex, transaction costs are too high. Therefore, we need a new auction model to better solve this problem.

3.2. Theoretical Exploration on the Trading Model of Forestry Carbon Sequestration and Pollutant Emission Rights

3.2.1. Government Overall Allocation Model

For this kind of problem, the most direct and traditional approach to it is to issue permits and levy taxes (sometimes fines) on emitters, followed by financial support for the construction of ecological forest farms. This model can be summarized as the “Emitting Enterprise-Government-Forest farm (E-G-F) model”. However, this model is mainly faced with two problems: one is that the process is complex, and the meaningless cost is too high. For example, the various expenses and expenses required by the government for this operation cannot directly make the forest farm or emission enterprises benefit. Moreover, due to the varying degrees of the integrity of governments, it is easy to breed the problem of corruption. Second, adopting the traditional indirect transaction mode of E-G-F often produces a large amount of information gap and is difficult to optimize the allocation of resources. This planned economy transaction mode is difficult to make the direct exchange of information between supply and demand, at the same time, it is also easy to produce structural asymmetry. This approach has been difficult to adapt to emissions trading in the modern economic system.

3.2.2. Traditional English and Dutch Auctions

In order to better determine the price and realize the economic benefits of ecological forest farms, an auction is undoubtedly one of the best trading methods. Then, we mainly explore which of the current auction models is more suitable for international forestry carbon sequestration and pollutant emission rights combination trading.

Among all kinds of auction modes, British Auction and Dutch Auction are widely used in the auction mode of a single item and have a long history, but their application in a multi-item combinatorial auction has great limitations. If a variety of different quality items are auctioned in British or Dutch auction respectively, then the mutual influence and combination benefit of different items are ignored, that is, under substitution effect and under synergistic effect. We are well aware that the winner’s curse and seller’s losses in British and Dutch auctions are often unavoidable. at the same time, the adoption of this auction method will also increase the cost of the auction process and the complexity of the auction. it is not suitable for the combined auction of forestry carbon sequestration and other pollutants.

3.2.3. VCG Combinatorial Auction Mode

Since the effectiveness of auction results is the primary policy objective, a natural selection mechanism for auctions of multiple items is the Vickrey-Clarke-Groves (VCG) auction.

- Each bidder can offer for any combination of multiple items, whether it is a separate offer or a combination offer;

- After the quotation information is summarized, the quotation is combined to achieve the maximum amount of the quotation, and then the goods are allocated to the corresponding bidders according to the combination of the maximum amount of the quotation;

- The amount paid by each winning bidder is the difference between (a) the total amount offered by the corresponding winning combination assuming that the bidder did not bid and (b) the total amount offered by the other winning bidders in the actual allocation scheme. For example, in an auction of a single indivisible item, item (a) is the second-highest bid, item (b) is zero, and the winning bidder pays the second price.

However, the effectiveness of the configuration results of this combination auction is usually only used for private value auctions, and it is difficult to play an effective role in related value auctions. In the auction of pollutant emission rights, the VCG mechanism is no longer applicable due to the strong complementarity between different pollutant emission rights because the emission enterprises will have various combinations of pollutants to discharge in the production process. Therefore, finding a new auction mechanism to achieve the effective allocation of pollutant emission rights has become the focus of auction theory research.

Overview of SMRA Model and Application Case

For the design of SMRA, it can effectively solve the multi-item combinatorial auction mode when there is a related value. The most successful application of SMRA auction mode is the auction of radio spectra. In the process of auction, the auctioneer auctions all the licenses available for auction at the same time. The auction is held in multiple rounds. In each round of auctions, buyers can offer sealed bids for one or more licenses. After each round of auction, the auctioneer announces the highest auction price for each license of the round, while the starting price of the next round of auction will be increased by 5% to 15% on the basis of the highest auction price of the previous round. Buyers are required to quote at least a certain proportion of the license for each round, otherwise, they will lose their qualification for bidding in the future round, and the quotations submitted by the buyers are higher than the starting price of the round. Simultaneous price increases multiple rounds of auctions must end when there is no higher bid for all licenses. In other words, even if the buyer is only bidding for one license, there are no new bids for all other licenses, and the auction of other licenses cannot be concluded at this time.

The characteristics of SMRA are as follows:

- It is suitable for combinatorial auctions of many different quality items, that is, buyers choose their combination mode according to their own needs.

- All items are auctioned separately by British Auctions, starting and ending at the same time.

- Auctions are forced to stay active and set minimum markups.

- Auction price sealing, only the highest bid announced, until there is no new higher bid.

Applicability of SMRA to international forestry carbon sequestration and other pollutant emission rights combination trading

Suppose a forest farm has pollutants purification, t is the amount of purification (unit: ton), there are several different combinations of bidders . They have their own combination pricing and unit pricing for each pollutant, and they indicate how much they need. The auction is divided into several sessions according to the situation, and each session has several rounds. The closing condition of each session is that the highest bid in the two rounds is the same, and the total closing condition is that the carbon sequestration or pollutant emission rights are completely auctioned off. In each round of a session, set the unit price and quantity demanded by each bidder for the pollutant code 1 as (r = 1, 2, 3... Represents the number of fields). After several rounds, no one offers a higher price. At this time, the person who offers the pollutant emission right with the highest unit bid at the price of can bid tons ( ≤ = ) of the pollutant. If = , the auction of pollutant emission right with the code of 1 is completed and the auction is pulled out. If < , the next session of the pollutant takes ( − ) as the total amount, and the above process is repeated. Due to the use of sealed bids and the implementation of the mandatory active system, it is difficult for bidders to conspire to win the auction opportunistically. For the seller, the revenue of a single pollutant discharge right is the sum of the revenue of each session:

The total revenue of forest farms is the sum of all emission rights revenue

SMRA uses the way of the simultaneous auction to solve the problem of substitution and complementarity between different pollutant emission rights. For the combined auction of pollutant emission rights of different qualities, this model has very unique advantages.

- Buyers can choose the combination of pollutant emission rights they want to buy in each round according to the optimal price. Any change in the price of pollutant emission permits may lead to a change in the purchase mix of buyers, resulting in new bidding for emission permits.

- The design of multi-round auctions can fully reveal information, ensure more effective auction results, and avoid the “winner’s curse” problem.

- A bid in an auction in this mode represents a real commitment to resources, rather than a preliminary proposed transaction. As a result, bidders are reluctant to commit to goods that may become unattractive if the price of the relevant goods changes.

- At an auction, the price never goes down. This is an important limitation because the ability to adjust prices up and down is a fundamental requirement of theoretical analysis of prices. The rules of activity and closing in the auction model eliminate both the “last moment” that bidders use in silent auctions and the ability of bidders to wait until later in the auction before making any serious bids [15].

3.3. Simulation Experiment on Forestry Carbon Sequestration and Pollutant Emission Right Trading Mode

3.3.1. Research Questions

The question explored in this experiment is: if the synchronous multi-round auction mode is adopted to trade international forestry carbon sequestration and other pollutant emission rights, whether the transaction quantity, transaction amount, and intermediate cost will be more optimized than other transaction modes.

3.3.2. Research Thought

The thought of this experiment is to simulate three auction processes, namely direct transaction, British Auction transaction, and synchronous multi-round auction transaction, and compare and analyze the transaction results of the simulated experiment.

3.3.3. Experiment Preparation

Personnel Selection

One person was selected as the auction transaction officer and the other was selected as the experimental recorder, who were members of the research group, respectively. There were six bidders from different polluters. The bidders all had a certain economic knowledge base and were able to understand the rules and requirements of the experiment, make the selection of bidding strategies. We tried to avoid the students who were inarticulate to avoid affecting the experimental results.

Environment Preparation

Select a classroom as the experiment site, the classroom is equipped with computers, blackboard, chalk, desks, and chairs, multimedia projectors, several pieces of white paper, pre-printed tables, bidding signs, and experiment instructions.

The experimental designer should prepare the information and data of the goods to be traded in advance, including the geographical location of several forest enterprises, the types of pollutant emission rights provided, the quantity in terms of the unit of the year, and the maximum price and minimum price.

3.3.4. Experimental Hypothesis

There is a budget constraint assumption in all three types of transactions. Although Milgrom believed that budget does not have an absolute binding force in the actual transaction process [15], we used a budget to limit bidders’ purchasing power to promote bidders to make reasonable offers in this experiment.

Assumptions of Direct Trading

- Geographical location restrictions. The buyer has a preference in negotiating with a vendor whose location is close to it.

- Independent transaction process. Each separate transaction between the buyer and the seller does not affect the transaction process between the buyer and the other sellers, and the success of the transaction depends on the wishes of the parties.

- Risk aversion hypothesis. Both sellers and buyers are biased towards the emergence of risk aversion.

- Both the seller and the buyer are rational economic men who seek to maximize their interests.

British Auction Assumptions

- The assumption of the independent private value of the auction item. The bidder knows exactly what the utility of each item is to him and can make an independent valuation based on the utility, but does not know the utility of each item to other bidders.

- Risk neutrality assumption. Bidders are neither risk-averse nor risk-averse.

- Bidders are rational economic men.

- Non-cooperative game. The bidders’ goal is to maximize their interests, and there is no cooperation or collusion with other bidders.

- Increased auction. Auction is a necessity for bidders, and the seller’s government or enterprise has a better advantage because it holds relatively scarce resources, so it can better protect the seller’s income by choosing the auction with increased price.

Assumption of Synchronous Auctions

- Correlation value hypothesis of the auction items. Bidders’ demand for different items is related to each other, which affects bidders’ appraisals; A bidder’s higher or lower estimate affects the estimates of other bidders.

- Risk neutrality assumption. Bidders are neither risk-averse nor risk-averse.

- Bidders are rational economic men.

- Non-cooperative game. The bidders’ goal is to maximize their interests, and there is no cooperation or collusion with other bidders.

- Increased auction. The auction aims at a fair and reasonable transaction price, and the seller’s loss caused by price reduction can be effectively avoided by increasing the price. Meanwhile, the “winner curse” of increasing the price auction can be effectively alleviated by the mechanism of simultaneous multiple rounds of auction.

3.3.5. Experiment Rules and Procedures

There were four simulated emission rights , and six simulated bidders Ln has a private valuation of for each emission right. The same products to be traded are divided into three transactions. Only the trading rules are changed, and other conditions such as quantity and type of emission rights and bidders remain unchanged. The three transactions are independent of each other. In order to eliminate the influence of auction and trading experience on the experimental results, the combination requirements of bidders were required to be consistent. In the bidding process, bidders are forbidden to communicate and conspire, exchange quotations and information about the intended bidding items. The three transactions shall be conducted according to the following rules.

Direct Transactions

In this experiment, we selected three forest zone as the trading object including Lesser Xinganling forest region in China (forest area is about 5 million hectares and the main tree species are Korean pine and larch), Subalpine forest region of Canada (forest area is about 15.3 million hectares and the main tree species are Engels spruce, fir, pine) and forest region of southwest France (forest area is about 10 million hectares and the main tree species are spruce and oak) The following two trading methods are also based on this. As the person in charge of forest enterprises, the trading officer controls the quantity, type, and price of emission permits held by each forest enterprise. Suppose that the emission permit index starts to be sold at the same time, and the emission enterprises go to the enterprises with a close geographical location in order to buy the emission permit respectively. The transaction is one-to-one, and the transaction price is decided by the two parties through negotiation, or they can choose to abandon the transaction because the price is not in line with the budget. If the enterprise fails to meet all the demand for emission rights in a transaction, it can continue to the next enterprise for transaction and purchase.

British Auction Transactions

The emission rights of all enterprises are auctioned together, and the same pollutants from different forest enterprises are auctioned as a whole. The auctioneer bids a minimum price for each pollutant and asks the bidders if any of them are willing to raise the price to compete for the item. The minimum amount or proportion of the increase is not specified, and the participants raise the price until no further increase is made, and the current highest bidder wins the auction.

Synchronous Multiple Rounds of Auction Transactions

The emission right indicators of all enterprises shall be auctioned and traded in a centralized manner, and all indicators shall be classified in the manner of pollutants, regardless of factors such as enterprises and geographical location. Set for each indicator a share of the lowest price (carbon dioxide, a share of 100 tons, sulfur dioxide, nitrogen, ammonia nitrogen a share for a ton of) as a starting price, the lowest price setting is relatively low, makes the index demand greater than supply, all index of emission rights to a share at the same time for the unit start rounds of the auction. In each round, bidders can make sealed bids for one or more of the desired indicators, and the staff counts and publishes the highest bidding price and the bidder for each share. Emphasize in particular the rules for keeping bidders clearly active: the highest bidder from each previous round or the person willing to raise the price.

The next round will start with the price after the current highest price is increased by 5%, and so on, until all bidders do not increase their prices for all items, the current highest price of each indicator will become the winning bidder of the first round, the winning bidder can choose the number of shares to bid, the end of the bureau. In the next game, the remaining pollutant shares will be auctioned again in the same way, with the original starting price as the starting price of the new game, and so on, until no one continues to bid or all indicators are sold, and the auction ends.

3.3.6. Experimental Results

After the experiment, the staff sorted out the experimental data. We choose transaction volume, transaction price (the average price of each share), seller’s income, buyer’s income four data to analyze and evaluate different transaction patterns.

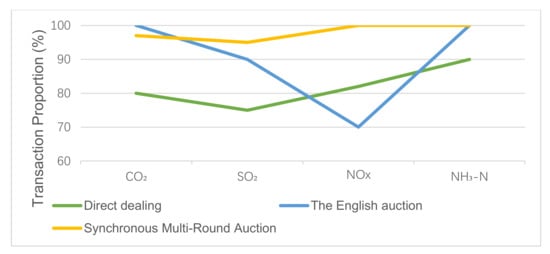

Figure 1 is the comparison of transaction volume, reflecting the proportion of the number of each auction item in each transaction to the total amount to be traded. As can be seen from Figure 1, the transaction ratio of a synchronous multi-round auction is the highest; In the process of a direct transaction, both parties give up the transaction due to price changes. In The British Auction, there are some cases such as the overall auction quantity is not appropriate, resulting in some indicators not clinked.

Figure 1.

Trading volume comparison (From left to right are carbon dioxide, sulfur dioxide, nitrogen oxide, and ammonia nitrogen, as shown in the image below).

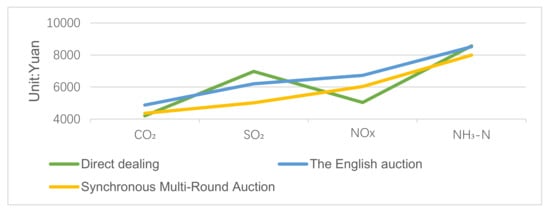

Figure 2 is the transaction price comparison, reflecting the transaction price of each auction. As can be seen from Figure 2, the price fluctuation of a direct transaction is large; British Auction prices are higher; The price of the simultaneous multi-round auction is lower than that of the British Auction and relatively reasonable. Since both parties are profit-oriented enterprises, it is better to move towards the reasonable price that both parties benefit from.

Figure 2.

Comparison of transaction prices (1 USD = 6.44 CNY, the same goes for the following).

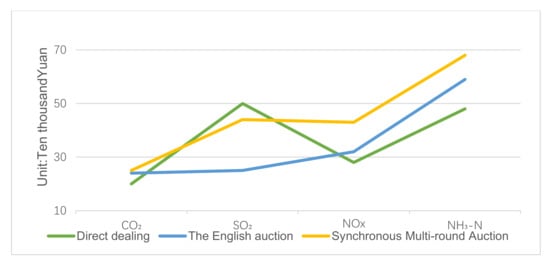

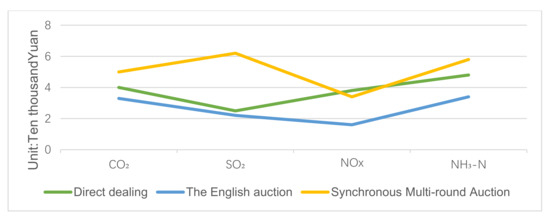

Figure 3 is the seller’s gain calculated based on the total amount of each transaction compared to the estimated seller’s cost. Figure 4 is the buyer’s gain calculated based on the total amount of each transaction compared to the highest price the buyer could trade at. As can be seen from Figure 3 and Figure 4, for both the seller and the buyer, the synchronous multi-round auction mode has relatively high earnings, which is due to the reduction of intermediate costs on the one hand, and enables each share of emission right index to be traded at a reasonable price, which can achieve mutual benefit and win-win results for both sides.

Figure 3.

Seller’s earnings.

Figure 4.

Buyer’s income.

Our experiment analyzes four indexes: trading volume, trading price, seller’s income, and buyer’s income. We find that under the condition that the trading conditions such as commodities remain unchanged and the trading results are only affected by rule changes, SMRA auction results in a higher proportion of transactions, a more stable price, and the corresponding buyers and sellers gain the most. Compared with a direct transaction, SMRA transaction relies on a specific organization, which is more efficient, buyers and sellers can obtain more comprehensive information, and it is conducive to a reasonable and stable transaction price. In contrast to traditional British auctions, SMRA takes into account the homogenous and complementary nature of forest carbon sequestrations and emission rights, overcoming the winner’s curse and seller’s loss. Therefore, this experiment believes that the homogeneity and complementarity of pollutant emission rights and radio spectrum auction, as well as the advantages of SMRA itself, make it possible to apply SMRA to the pollutant auction market.

4. Design of Auction Process

4.1. Overview of Mode Design

This section assumes that the synchronous multiple round auction mode will be applied to the auction of pollutant emission rights indexes. Different pollutants and indicators of various quantities will be combined and auctioned as a whole. An auction is a form of extension of the market mechanisms and this process is to optimally allocate existing resources. Therefore, it’s necessary that the model is established on a relatively comprehensive indicator system for pollutants. Another pre-requisite is that the existing allocation of indicators cannot meet the emission requirements of some enterprises.

The goal of the auction is to let the seller obtain the expected benefits through the emission rights index held by forest planting and to let the buyer pays the lowest possible price to obtain the index. Synchronous multiple round auctions can maintain the final transaction price higher than the specified floor price and the buyer can avoid the winner curse without excessive costs.

4.2. Auction Process

4.2.1. Preparation

Emissions trading is a civil contract. Under the supervision and guidance of the competent forestry authorities, enterprises from developed and developing countries that undertake emission reduction obligations negotiate on specific contents such as the price, target, and quantity of emission trading, reach an agreement, and sign a written contract.

- Trading entities. The subjects of emission rights include national governments and the carbon fund under the World Bank. The sellers are mainly developing countries and the buyers are mainly enterprises in developed countries.

- Object of transaction. The trading object of emission rights is forestry carbon sequestration and emission right of other pollutants.

- Effective requirements. Emission trading contracts require the parties to have appropriate capacity.

- Transaction price and method of performance. There are three ways of emission trading: ex-ante trading, annual trading, and ex post-trading.

4.2.2. Auction Stage

Auctions are divided into lots, each of which consists of three stages and rounds. In the first phase of the first auction, all emission targets of different qualities are auctioned simultaneously. Bidders will be according to their own needs, to a certain proportion, or a certain amount of emissions targets for sealing, quote, quote requests have certain mark-up is not lower than the starting price and requirements, the scene reported each index of the highest bidding price, each index of the peak holder become the indicator of “temporary” the winner of each round, the round ends. In the next round, the starting price of each indicator is increased by 5% to 15% from the previous round’s highest bid, and the process is repeated. For bidders to remain eligible to bid means to remain active. Bidders must bid on one or more indicators per round or lose all eligibility to bid. The administrator moves the auction to the second stage.

In the second stage, bidders can obtain the information of hot auction items and the tendency and attitude of other bidders based on the comprehensive analysis of the bidding situation, and then choose whether to change the bidding target or the bidding combination. When there are two or more rounds without new bids, the auction moves to a third stage.

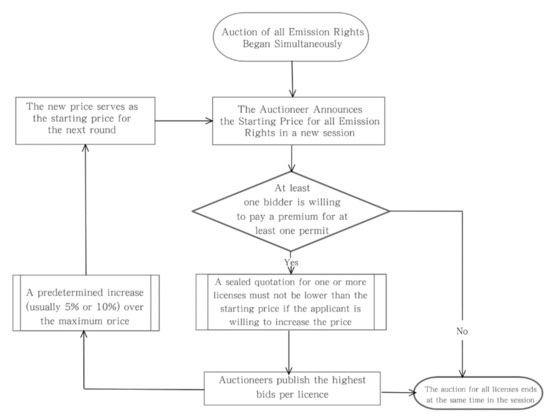

In the third stage, when all bidders are not willing to continue to carry out new bidding, that is, to increase the price, the auction of all items will end at the same time. The “temporary winner” of each emission indicator becomes the winner of the bureau, which can choose the number of transactions according to its own needs, and the Bureau ends. By the remaining indicators as the next round of bidding, the next round of bidding starts again, until no bidders continue to bid, the auction ends. The specific auction process is shown in Figure 5.

Figure 5.

SMRA based pollutant emission right combination auction flow chart.

4.2.3. Auction Transaction

After the auction is completed, the winning bidder will sign the transaction confirmation and the trading platform will charge a certain percentage normally not more than 5% of the transaction price from both sides as commission. The winning bidder pays for the goods in the current period. If the transaction amount is huge, the winning bidder can apply for late payment within a mutually agreed timeframe. If the indicators provided by the seller are found to be forged or untrue after the transaction, the trading platform shall bear the liability of insurance. If the winning bidder abandons his bid after the transaction, the winning bidder shall be solely responsible for his actions and the related consequences.

4.3. Realistic Application Conditions of the Model

In the above paper, we conducted an applied study on the SMRA-based international pollutant emission trading process in reality, and these conclusions need to be realized under certain conditions. Emission rights are often transferred from countries with excess ecological resources to those with rapid industrial development. In order to establish a unified auction mechanism among these countries, it first needs the support of unified policies, universal laws and regulations, and a perfect trading market. In practice, it needs a unified and perfect accounting mechanism and a third-party supervision organization as a guarantee; Finally, how to ensure the long-term activity of the auction market and both parties will be a problem worth considering.

4.4. The Expected Effect of Applying SMRA to Emission Rights of International Carbon Sequestration and Other Pollutants in Forestry

Through this auction model, the shortcomings of the traditional trading of carbon sequestration can be overcome and the missing part in international trading of emission rights of other pollutants can be filled.

4.4.1. Maximize Comprehensive Economic Benefits of Forestry Purification

This model expands the scope of the auction so that the ecological value of the forest can be fully realized, instead of only being limited to carbon neutrality. The comprehensive purification effect is fully utilized to maximize its economic benefits.

4.4.2. Refinement of the Purification Effect of the Forest Farm

This model subdivides the comprehensive functions of the forest farm, which is good for professional management and dedicated cultivation of the forest. The type and quantity of purified forest can be selected according to the market situation and the field environment.

4.4.3. Better Adoption of Market Mechanisms for Ecological Governance

This auction model provides a novel idea for using market mechanisms to solve the problems of ecological deficits. For those pollutants with higher discharge than purification effects, the price of getting discharge rights for such pollutants will rise. Forest owners can choose to plant more specific species that can purify such pollutants. At the same time, if the purification of a certain kind of pollutant is too difficult, the price of the rights to discharge this kind of pollutant will be higher and the company will try to reduce the discharge of such pollutant. Through this intuitive way, the structural contradiction between pollutants and purification objects is resolved and the cost of manpower allocation is reduced with improved social benefits.

4.4.4. The Problem of Complicated Process with High Cost in Combinatorial Auction Is Solved

Serving the needs of both buyers and sellers for combined transactions of various commodities (i.e. Combined transactions of carbon sequestration and other pollutants), the SMRA model can make a combination of multiple emission rights including carbon sequestration and other pollutants in forestry. The increased efficiency in auctions can reduce the total auction cost, simplifying the auction process.

4.4.5. While Reducing Excessive Environmental Protection Expenditures, Companies Are Forced to Reduce Emissions

For the pollutant emitters (the auction buyers)—the factories, this auction model makes the combined emission rights purchased and the actual pollutants discharged to a perfect match, hence the factories don’t need to pay additional emission fines and purchase excessive emission rights. At the same time, it also uses the market mechanism to effectively force enterprises to accelerate the upgrade of environmental protection technology and to minimize the emission of pollutants.

5. Discussion

5.1. The Novelty and Originality of the Research

First of all, this paper first proposed the application of the SMRA model to the auction and trading of international emission rights and carried out theoretical analysis and simulation experiment research. Secondly, this paper for the first time explores and designs a combined auction model of international forest carbon sequestrations and other pollutants. The results show that this combined auction model can integrate multiple emission trading markets, reduce transaction costs and improve transaction efficiency. Finally, the theoretical analysis method, simulation experiment method, and model analysis method adopted in this paper have obtained mutually verified consistent and original results to prove our assumption.

5.2. Comparative Discussion on the Application of SMRA Model in Other Fields

The SMRA model was proposed by Nobel laureates Paul R. Milgrom and Robert B. Wilson. This model is first applied to the auction of the radio spectrum and solves the problem of substitution and complementarity between different licenses. At the same time, it can fully reveal the information, ensure that the auction results are more effective, and avoid the problem of the “winner curse” [15]. After the application of this model, in 1994 alone, the FCC spectrum license auction generated $20 billion in revenue for the U.S. federal government, attracted a large number of media and public attention, and was called “the greatest auction in history” by the New York Times. Similarly, forestry carbon sequestration and emission rights are public goods like radio spectrum, and there are many kinds that need to be auctioned. The research results of this paper not only confirm the advantages of SMRA itself, but also improve its application. For example, the seller of radio spectrum auction is a single government, and the seller of this model is each major ecological forest farm.

5.3. Problems That May Be Encountered in Model Promotion

5.3.1. Improvement Needed in Laws and Regulations

The current law and regulations on international trading of carbon sequestration in forestry are relatively lacking and the “Kyoto Protocol” and the "Paris Agreement" for the promotion and application of related carbon sequestration trading have more flexibility. The combined transactions for emission rights of international carbon sequestration and other pollutants in forestry based on the SMRA model will bring in more interested parties, more complicated auction procedures, and more diverse auction content. Therefore, additional laws and regulations must be in place in order to enforce and regulate the mentioned mechanisms.

5.3.2. Lack of Support for Financial Services

Although the financing of international carbon sequestration projects in forestry has developed in diversified directions, the supporting funds for international carbon sequestration projects in forestry have shifted from mainly relying on investors’ purchases to multiple channels such as project loans or public sector grants, non-profit grants, supporting financial sectors and private sectors investment, etc. However, various types of financial products including carbon retail, carbon options, and carbon futures are currently still unknown to the majority in the world. Other financial products related to pollutant emission rights have not been launched on a large scale. Many developing countries are unable to obtain sufficient support from relevant financial services due to their immature financial systems.

5.3.3. Disagreements between Countries of Different Development Levels

Due to different development levels, countries will experience greater differences and contradictions in emission rights quota, quantification, and fairness in transactions in carbon sequestration and pollutants in forestry. For the setting of initial quota and auction price limits, the organizational commissioners of relevant countries need to send professionals to conduct large-scale, meticulous, and precise investigations which is a huge and very arduous task.

5.3.4. Relevant Supervision and Inspection Institutions Are Not Perfect

To ensure the fairness and stability of trading of emission rights of international carbon sequestration and pollutants, it is necessary to establish a dedicated supervision and inspection agency. However, current international data on emissions and emission reductions of various countries are mostly self-monitoring and self-auditing and there are no corresponding worldwide unified agencies for supervision, inspection, and audit.

5.4. Solutions to Problems That May Occur in the Process of Model Promotion

First, major countries in the world need to closely rely on the United Nations and other international organizations to formulate relevant and complete laws and regulations.

Second, we need to rely on the exclusive services of international financial institutions. For example, the International Monetary Fund, the World Bank, and other existing institutions should be used to expand relevant international financing channels. Third, the positioning of countries at different levels of development should be clearly defined. The implementation of the model should focus on the development rights and interests of developing countries. International dialogue and consultation mechanisms should be established to resolve problems among countries at different levels of development. Finally, in addition to the management agencies established in international organizations, each participating country should also set up dedicated regulatory agencies. We can refer to the International Atomic Energy Agency’s regulatory methods for the use of nuclear energy in various countries. Information technology should be used to establish detection and measurement systems, verify trading identities and check the emissions of trading entities. In short, as long as countries around the world actively cooperate and work together towards the same goal, the problems that arise in the process of model promotion will eventually be solved.

6. Conclusions

According to the current frontier academic research results and the feasibility research, application research, discussion, and prediction of this paper, this new combined auction model based on SMRA is suitable for the new environmental protection requirements of the world today. First, it can effectively overcome the shortcomings of the traditional carbon trading transactions such as reducing the winner’s curse and seller’s loss and can help increase overall volume. Second, it pioneered a new mechanism whereby forest carbon sequestration and pollutant emission rights can be auctioned and traded simultaneously, which can not only simplify the transaction process but also reduce the management cost and increase the comprehensive social benefits. Third, through the market pricing mechanism, it is conducive to solving the structural contradictions between ecological purification and pollutant emissions. In addition, we realize that the research in this paper focuses more on the feasibility of the model and process design. However, there are few studies on the specific safeguards implemented by the model as well as cultural, legal, human rights, and political aspects, which are also the direction of our further research.

Author Contributions

Conceptualization, H.G. and Z.L.; methodology, Z.L.; software, J.H.; validation, H.G. and Z.L.; formal analysis, H.G.; investigation, Z.L.; resources, H.Y.; data curation, Z.L. and J.H.; writing—original draft preparation, Z.L., J.H., and H.Y.; writing—review and editing, H.G. and Q.Y.; visualization, J.H.; supervision, Q.Y.; project administration, H.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by 13th Five-year Plan Social Science Project of Jilin Provincial Department of Education (JJKH20190243SK); Jilin Province Science and Technology Development Plan Project (20200101130FG); Innovation and Entrepreneurship Training Program for College Students of Jilin University(202110183X263).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Publicly available data sets were referenced in this study. These data can be found in the following places: United Nations Environment Programme (http://www.unep.org/) (accessed on 1 April 2021), Food and Agriculture Organization of the United Nations (http://www.fao.org/) (accessed on 1 April 2021).

Acknowledgments

Thanks to Jilin University for the laboratory and laboratory supplies.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Glasnovic, Z.; Margeta, K.; Logar, N.Z. Humanity Can Still Stop Climate Change by Implementing a New International Climate Agreement and Applying Radical New Technology. Energies 2020, 13, 6703. [Google Scholar] [CrossRef]

- Espejo, A.B.; Becerra-Leal, M.C.; Aguilar-Amuchastegui, N. Comparing the Environmental Integrity of Emission Reductions from REDD Programs with Renewable Energy Projects. Forests 2020, 11, 1360. [Google Scholar] [CrossRef]

- Tsai, W.-H. Carbon Emission Reduction-Carbon Tax, Carbon Trading, and Carbon Offset. Energies 2020, 13, 6128. [Google Scholar] [CrossRef]

- Zhu, J.; Fan, Y.; Deng, X.; Xue, L. Low-carbon innovation induced by emissions trading in China. Nat. Commun. 2019, 10, 4088. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Denis-Ryan, A.; Bataille, C.; Jotzo, F. Managing carbon-intensive materials in a decarbonizing world without a global price on carbon. Clim. Policy 2016, 16, 110–128. [Google Scholar] [CrossRef]

- Antweiler, W. Emission trading for air pollution hot spots: Getting the permit market right. Environ. Econ. Policy Stud. 2017, 19, 35–58. [Google Scholar] [CrossRef]

- Houyun, Z.; Xiaojun, G. Registrations for chemicals exported to China. China Chem. Rep. 2008, 19, 13. [Google Scholar]

- Vickrey, W. Counterspeculation, auctions, and competitive sealed tenders. J. Financ. 1961, 16, 8–37. [Google Scholar]

- Myerson, R.B. Incentive compatibility and the bargaining problem. Econometrica 1979, 47, 61–73. [Google Scholar] [CrossRef] [Green Version]

- Milgrom, P.R. Rational-Expectations, Information acquisition, and competitive Bidding. Econometrica 1981, 49, 921–943. [Google Scholar] [CrossRef] [Green Version]

- Wilson, R.B. Competitive Bidding with Asymmetric Information. Manag. Sci. 1967, 13, 816–820. [Google Scholar] [CrossRef]

- Wilson, R.B. Competitive Bidding with disparate information. Management Science Series a-Theory 1969, 15, 446–448. [Google Scholar]

- Milgrom, P.R.; Weber, R.J. A theory of auctions and competitive bidding. Econometrica 1982, 50, 1089–1122. [Google Scholar] [CrossRef]

- McMillan, J. Selling spectrum rights. J. Econ. Perspect. 1994, 8, 145–162. [Google Scholar] [CrossRef] [Green Version]

- Milgrom, P. Putting auction theory to work: The simultaneous ascending auction. J. Political Econ. 2000, 108, 245–272. [Google Scholar] [CrossRef] [Green Version]

- Ausubel, L.M.; Cramton, P.; Milgrom, P.R. The Clock-Proxy Auction: A Practical Combinatorial Auction Design. In Handbook of Spectrum Auction Design; Cambridge University Press: Cambridge, UK, 2017; pp. 120–140. [Google Scholar]

- Ausubel, L.M.; Cramton, P.; Pycia, M.; Rostek, M.; Weretka, M. Demand Reduction and Inefficiency in Multi-Unit Auctions. Rev. Econ. Stud. 2014, 81, 1366–1400. [Google Scholar] [CrossRef] [Green Version]

- Bichler, M.; Shabalin, P.; Wolf, J. Do core-selecting Combinatorial Clock Auctions always lead to high efficiency? An experimental analysis of spectrum auction designs. Exp. Econ. 2013, 16, 511–545. [Google Scholar] [CrossRef] [Green Version]

- Zakeri, A.; Dehghanian, F.; Fahimnia, B.; Sarkis, J. Carbon pricing versus emissions trading: A supply chain planning perspective. Int. J. Prod. Econ. 2015, 164, 197–205. [Google Scholar] [CrossRef] [Green Version]

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total. Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef]

- Lejano, R.P.; Kan, W.S.; Chau, C.C. The Hidden Disequities of Carbon Trading: Carbon Emissions, Air Toxics, and Environmental Justice. Front. Environ. Sci. 2020. [Google Scholar] [CrossRef]

- Kronenberg, J.; Orligora-Sankowska, E.; Czembrowski, P. REDD plus and Institutions. Sustainability 2015, 7, 10250–10263. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.-P.; Yang, L.; Li, S.-R.; Yuan, X. The Long-Term Trend Analysis and Scenario Simulation of the Carbon Price Based on the Energy-Economic Regulation. Int. J. Clim. Chang. Strateg. Manag. 2020, 12, 653–668. [Google Scholar] [CrossRef]

- Wang, M.; Zhou, P. Does emission permit allocation affect CO2 cost pass-through? A theoretical analysis. Energy Econ. 2017, 66, 140–146. [Google Scholar] [CrossRef]

- Zhang, M.; Liu, Y.; Su, Y. Comparison of Carbon Emission Trading Schemes in the European Union and China. Climate 2017, 5, 70. [Google Scholar] [CrossRef]

- Joskow, P.L.; Schmalensee, R.; Bailey, E.M. The market for sulfur dioxide emissions. Am. Econ. Rev. 1998, 88, 669–685. [Google Scholar]

- Sandor, R.; Walsh, M.; Marques, R. Greenhouse-gas-trading markets. Philos. Trans. R. Soc. Lond. Ser. a-Math. Phys. Eng. Sci. 2002, 360, 1889–1900. [Google Scholar] [CrossRef]

- Convery, F.J. Reflections-The Emerging Literature on Emissions Trading in Europe. Rev. Environ. Econ. Policy 2009, 3, 121–137. [Google Scholar] [CrossRef] [Green Version]

- Chaabane, A.; Ramudhin, A.; Paquet, M. Design of sustainable supply chains under the emission trading scheme. Int. J. Prod. Econ. 2012, 135, 37–49. [Google Scholar] [CrossRef]

- Haita, C. Endogenous market power in an emissions trading scheme with auctioning. Resour. Energy Econ. 2014, 37, 253–278. [Google Scholar] [CrossRef] [Green Version]

- Dickson, A.; MacKenzie, I.A. Strategic trade in pollution permits. J. Environ. Econ. Manag. 2018, 87, 94–113. [Google Scholar] [CrossRef] [Green Version]

- Carmona, R.; Fehr, M.; Hinz, J.; Porchet, A. Market Design for Emission Trading Schemes. Siam Rev. 2010, 52, 403–452. [Google Scholar] [CrossRef] [Green Version]

- Cason, T.N.; Plott, C.R. EPA’s new emissions trading mechanism: A laboratory evaluation. J. Environ. Econ. Manag. 1996, 30, 133–160. [Google Scholar] [CrossRef]

- Cramton, P.; Kerr, S. Tradeable carbon permit auctions—How and why to auction not grandfather. Energy Policy 2002, 30, 333–345. [Google Scholar] [CrossRef]

- Liu, Q. Equilibrium of a sequence of auctions when bidders demand multiple items. Econ. Lett. 2011, 112, 192–194. [Google Scholar] [CrossRef]

- Huebler, M.; Voigt, S.; Loeschel, A. Designing an emissions trading scheme for China An up-to-date climate policy assessment. Energy Policy 2014, 75, 57–72. [Google Scholar] [CrossRef] [Green Version]

- Tang, L.; Wu, J.; Yu, L.; Bao, Q. Carbon allowance auction design of China’s emissions trading scheme: A multi-agent-based approach. Energy Policy 2017, 102, 30–40. [Google Scholar] [CrossRef]

- Wang, M.; Wang, M.; Lang, L. Reconsidering Carbon Permits Auction Mechanism: An Efficient Dynamic Model. World Econ. 2017, 40, 1624–1645. [Google Scholar] [CrossRef]

- Cong, R.-G.; Wei, Y.-M. Experimental comparison of impact of auction format on carbon allowance market. Renew. Sustain. Energy Rev. 2012, 16, 4148–4156. [Google Scholar] [CrossRef]

- Jiang, M.X.; Yang, D.X.; Chen, Z.Y.; Nie, P.Y. Market power in auction and efficiency in emission permits allocation. J. Environ. Manag. 2016, 183, 576–584. [Google Scholar] [CrossRef]

- Burtraw, D.; McCormack, K. Consignment auctions of free emissions allowances. Energy Policy 2017, 107, 337–344. [Google Scholar] [CrossRef]

- Dormady, N.; Healy, P.J. The consignment mechanism in carbon markets: A laboratory investigation. J. Commod. Mark. 2019, 14, 51–65. [Google Scholar] [CrossRef] [Green Version]

- Wang, Q.; Cheng, C.; Zhou, D. Multi-round auctions in an emissions trading system considering firm bidding strategies and government regulations. Mitig. Adapt. Strateg. Glob. Chang. 2020, 25, 1403–1421. [Google Scholar] [CrossRef]

- Sun, J.; Li, G. Designing a double auction mechanism for the re-allocation of emission permits. Ann. Oper. Res. 2020, 291, 847–874. [Google Scholar] [CrossRef]

- Duan, Y.; Han, Z.; Mu, H.; Yang, J.; Li, Y. Research on the Impact of Various Emission Reduction Policies on China’s Iron and Steel Industry Production and Economic Level under the Carbon Trading Mechanism. Energies 2019, 12, 1624. [Google Scholar] [CrossRef] [Green Version]

- Yuze, X. Study on Forest Ecological Value. Beijing Agriculture 2014, 2014, 242–243. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).