A Text-Mining Analysis on the Review of the Non-Financial Reporting Directive: Bringing Value Creation for Stakeholders into Accounting

Abstract

1. Introduction

2. Developmental Pathways of Sustainability Accounting

2.1. The Flourishing of Sustainability Reporting under a Mandatory Regime

2.2. The Challenges Ahead for the Review of the Non-Financial Reporting Directive (NFRD)

3. Research Method

- (1)

- Which topics have been discussed in the annexed documents to the contribution on the Review of the NFRD?

- (2)

- How prevalent is each topic and how do the topics relate to each other?

3.1. Textual Analysis with Topic Modeling

3.2. Sample Selection

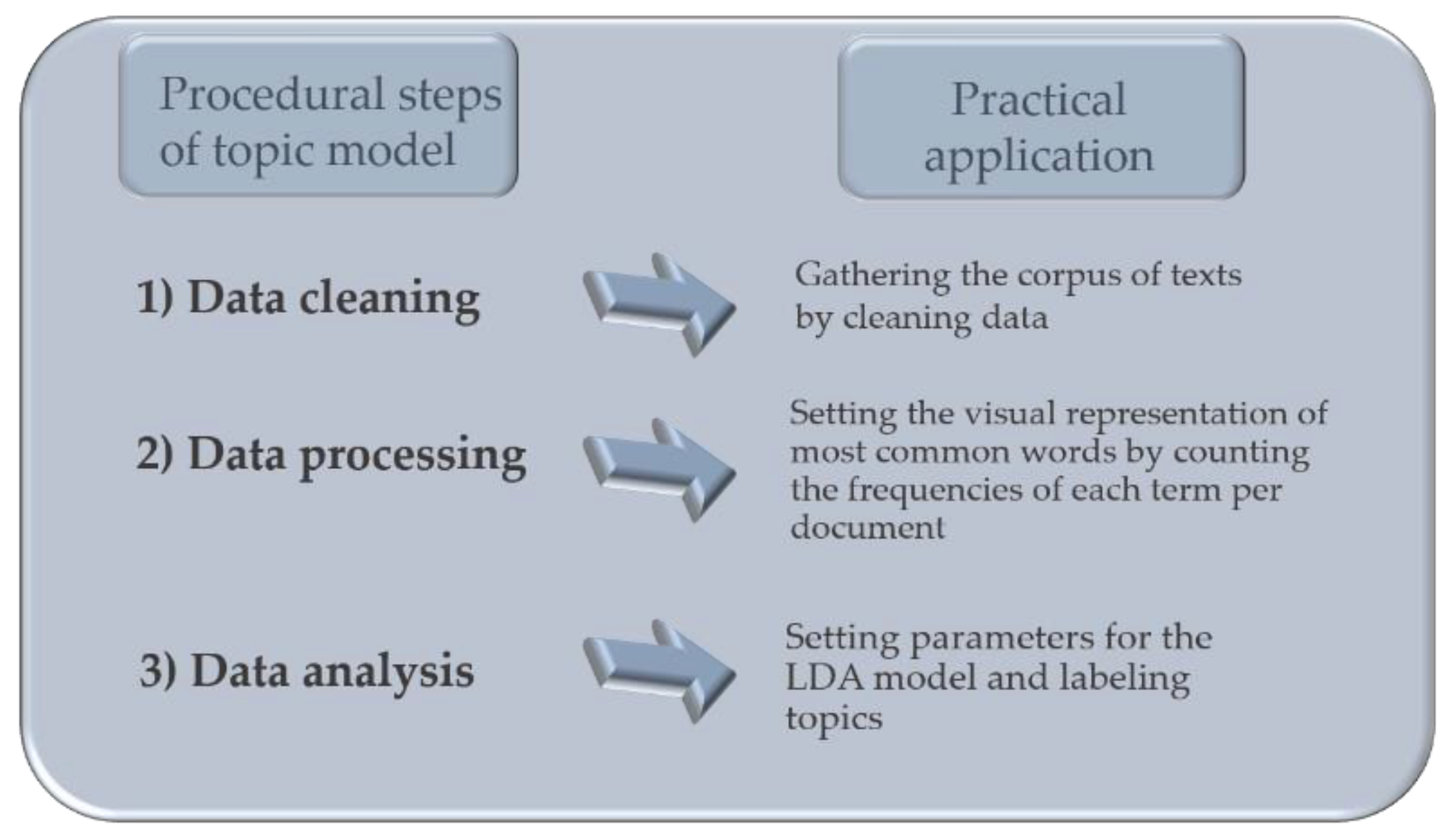

3.3. Data Cleaning, Processing, and Analysis with Topic Model

4. Results

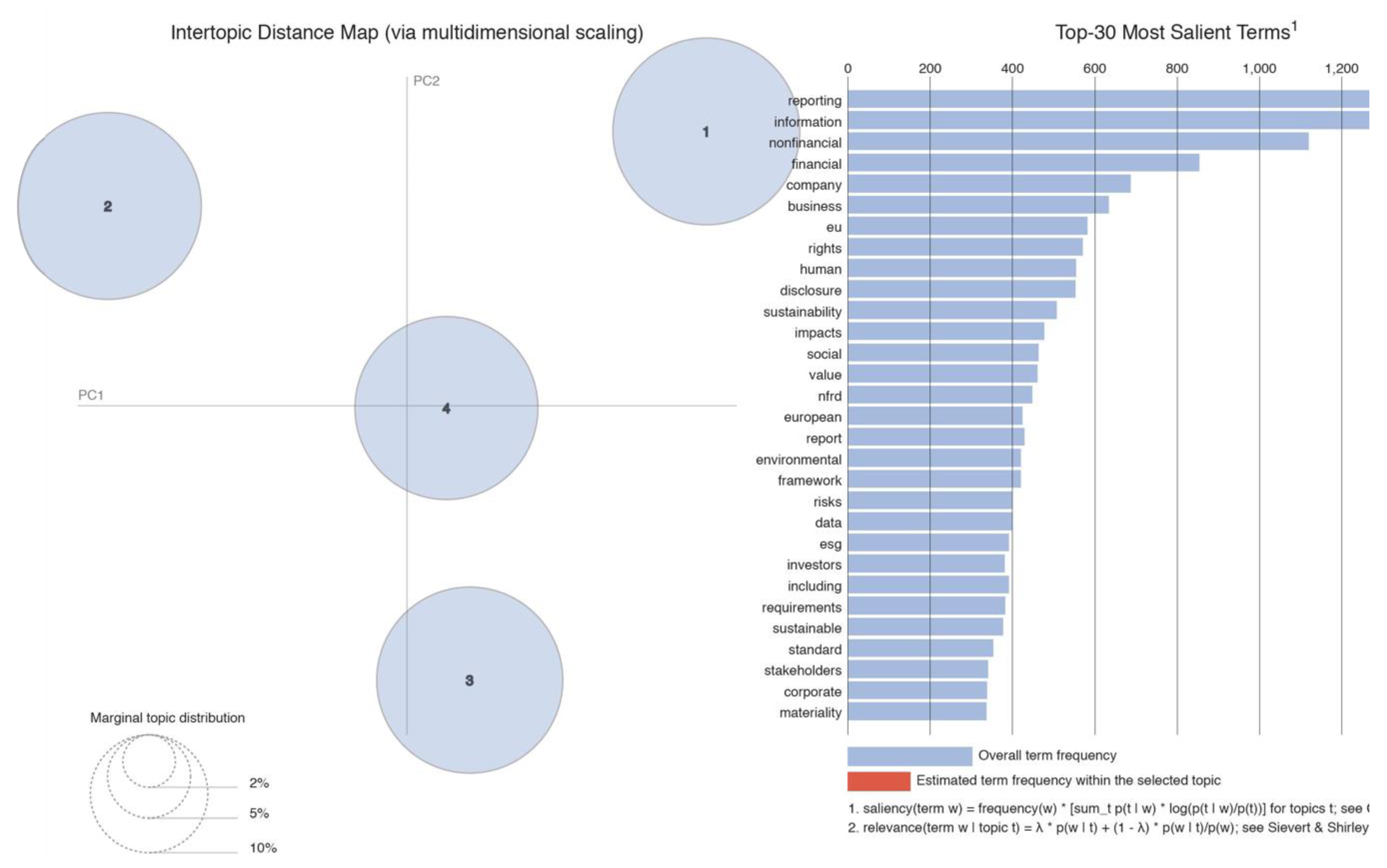

4.1. Visual Representations of the Most Common Words

4.2. Inductive Discovery of the Main Topics

5. Discussion

6. Conclusions

Limitations and Avenues for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kinderman, D. The challenges of upward regulatory harmonization: The case of sustainability reporting in the European Union. Regul. Gov. 2020, 14, 674–697. [Google Scholar] [CrossRef]

- Howitt, R. The EU law on non-financial reporting-how we got there. Guardian 2014, 16. Available online: https://www.theguardian.com/sustainable-business/eu-non-financial-reporting-how-richard-howitt (accessed on 13 January 2021).

- European Parliament. Directive 2014/95/EU of the European Parliament and of the Council—Of 22 October 2014—Amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups. Off. J. Eur. Union 2014, 2014, 1–9. [Google Scholar]

- Fiandrino, S. Disclosure of Non-Financial Information Disclosure. Evolutionary Paths and Harmonisation to Mandatory Requirements; G. Giappichelli Editore: Turin, Italy, 2019; ISBN 9788892183414. [Google Scholar]

- Schneider, T.; Michelon, G.; Paananen, M. Environmental and Social Matters in Mandatory Corporate Reporting: An Academic Note. Account. Perspect. 2018, 17, 275–305. [Google Scholar] [CrossRef]

- Venturelli, A.; Caputo, F.; Cosma, S.; Leopizzi, R.; Pizzi, S. Directive 2014/95/EU: Are Italian companies already compliant? Sustainability 2017, 9, 1385. [Google Scholar] [CrossRef]

- European Commission. The European Green Deal; European Commission: Brussels, Belgium, 2019. [Google Scholar] [CrossRef]

- Miles, D.A. A taxonomy of research gaps: Identifying and defining the seven research gaps. J. Res. Methods Strateg. 2017, 1–15. Available online: https://www.academia.edu/35505149/ARTICLE_RESEARCH_A_Taxonomy_of_Research_Gaps_Identifying_and_Defining_the_Seven_Research_Gaps (accessed on 13 January 2021).

- Matuszak, Ł.; Rózańska, E. CSR disclosure in Polish-listed companies in the light of directive 2014/95/EU requirements: Empirical evidence. Sustainability 2017, 9, 2304. [Google Scholar] [CrossRef]

- Cantino, V.; Devalle, A.; Fiandrino, S.; Busso, D. The level of compliance with the Italian Legislative Decree No. 254/2016 and its determinants: Insights from Italy. Financ. Rep. 2019. [Google Scholar] [CrossRef]

- Jonida, C.; Roberto, D.P.; Matteo, M. Mandatory vs voluntary exercise on non-financial reporting: Does a normative/coercive isomorphism facilitate an increase in quality? Meditari Account. Res. 2020. [Google Scholar] [CrossRef]

- Pizzi, S.; Venturelli, A.; Caputo, F. The “comply-or-explain” principle in directive 95/2014/EU. A rhetorical analysis of Italian PIEs. Sustain. Account. Manag. Policy J. 2020. [Google Scholar] [CrossRef]

- Caputo, F.; Leopizzi, R.; Pizzi, S.; Milone, V. The Non-Financial Reporting Harmonization in Europe: Evolutionary Pathways Related to the Transposition of the Directive 95/2014/EU within the Italian Context. Sustainability 2020, 12, 92. [Google Scholar] [CrossRef]

- Hörisch, J.; Schaltegger, S.; Freeman, R.E. Integrating stakeholder theory and sustainability accounting: A conceptual synthesis. J. Clean. Prod. 2020, 275. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Van Buren, H.J., III; Greenwood, M.; Freeman, R.E. Stakeholder Inclusion and Accounting for Stakeholders. J. Manag. Stud. 2015, 52, 851–877. [Google Scholar] [CrossRef]

- Gray, R.; Adams, C.A.; Owen, D. Accountability, Social Responsibility and Sustainability. Accounting for Society and the Environment; Pearson: New York, NY, USA, 2014; ISBN 9780273681380. [Google Scholar]

- Venturelli, A.; Pizzi, S.; Caputo, F.; Principale, S. The revision of nonfinancial reporting directive: A critical lens on the comparability principle. Bus. Strateg. Environ. 2020, 29, 3584–3597. [Google Scholar] [CrossRef]

- Liu, Y.; Mai, F.; MacDonald, C. A Big-Data Approach to Understanding the Thematic Landscape of the Field of Business Ethics, 1982–2016. J. Bus. Ethics 2019, 160, 127–150. [Google Scholar] [CrossRef]

- Hannigan, T.R.; Haan, R.F.J.; Vakili, K.; Tchalian, H.; Glaser, V.L.; Wang, M.S.; Kaplan, S.; Jennings, P.D. Topic modeling in management research: Rendering new theory from textual data. Acad. Manag. Ann. 2019, 13, 586–632. [Google Scholar] [CrossRef]

- Ferri, P.; Lusiani, M.; Pareschi, L. Accounting for Accounting History: A topic modeling approach (1996–2015). Account. Hist. 2018, 23, 173–205. [Google Scholar] [CrossRef]

- Reisenbichler, M.; Reutterer, T. Topic modeling in marketing: Recent advances and research opportunities. J. Bus. Econ. 2019, 89, 327–356. [Google Scholar] [CrossRef]

- Amado, A.; Cortez, P.; Rita, P.; Moro, S. Research trends on Big Data in Marketing: A text mining and topic modeling based literature analysis. Eur. Res. Manag. Bus. Econ. 2018, 24, 1–7. [Google Scholar] [CrossRef]

- Schmiedel, T.; Müller, O.; vom Brocke, J. Topic Modeling as a Strategy of Inquiry in Organizational Research: A Tutorial With an Application Example on Organizational Culture. Organ. Res. Methods 2019, 22, 941–968. [Google Scholar] [CrossRef]

- Pröllochs, N.; Feuerriegel, S. Business analytics for strategic management: Identifying and assessing corporate challenges via topic modeling. Inf. Manag. 2020, 57, 103070. [Google Scholar] [CrossRef]

- Deegan, C. Twenty five years of social and environmental accounting research within Critical Perspectives of Accounting: Hits, misses and ways forward. Crit. Perspect. Account. 2017, 43, 65–87. [Google Scholar] [CrossRef]

- Adam, C.A.; McNicholas, P. Making a difference: Sustainability reporting, accountability and organizational change. Account. Audit. Account. J. 2007, 20, 382–402. [Google Scholar] [CrossRef]

- Hahn, R.; Kühnen, M. Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. J. Clean. Prod. 2013, 59, 5–21. [Google Scholar] [CrossRef]

- Gray, R. Thirty years of social accounting, reporting and auditing: What (if anything) have we learnt? Bus. Ethics A Eur. Rev. 2003, 10, 9–15. [Google Scholar] [CrossRef]

- Hess, D. The three pillars of corporate social reporting as new governance regulation: Disclosure, dialogue, and development. Bus. Ethics Q. 2008, 18, 447–482. [Google Scholar] [CrossRef]

- Haslam, C.; Tsitsianis, N.; Andersson, T.; Gleadle, P. Accounting for Business Models and Increasing the Visibility of Stakeholders. J. Bus. Model. 2015, 3, 62–80. [Google Scholar]

- Zadek, S. Balancing Performance, Ethics, and Accountability. J. Bus. Ethics 1998, 17, 1421–1442. [Google Scholar] [CrossRef]

- Herremans, I.M.; Nazari, J.A.; Mahmoudian, F. Stakeholder Relationships, Engagement, and Sustainability Reporting. J. Bus. Ethics 2016, 138, 417–435. [Google Scholar] [CrossRef]

- Devalle, A.; Gromis di Trana, M.; Fiandrino, S.; Vrontis, D. Integrated thinking rolls! Stakeholder engagement actions translate integrated thinking into practice. Meditari Accountancy Research 2020. [Google Scholar] [CrossRef]

- Manetti, G. The quality of stakeholder engagement in sustainability reporting: Empirical evidence and critical points. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 110–122. [Google Scholar] [CrossRef]

- Bellantuono, N.; Pontrandolfo, P.; Scozzi, B. Capturing the Stakeholders’ View in Sustainability Reporting: A Novel Approach. Sustainability 2016, 8, 379. [Google Scholar] [CrossRef]

- Polak, P.; Masquelier, F.; Michalski, G. Towards treasury 4.0/the evolving role of corporate treasury management for 2020. Management 2018, 23, 189–197. [Google Scholar] [CrossRef]

- Freeman, R.E.; Harrison, J.S.; Wicks, A.C.; de Colle, S. Stakeholder Theory. The State of the Art; Cambridge University Press: Cambridge, UK, 2010; ISBN 9780521190817. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman Publishing Inc.: San Francisco, CA, USA, 1984; Volume 1, ISBN 0-273-01913-9. [Google Scholar]

- Dallas, L.L. Short-Termism, the Financial Crisis, and Corporate Governance. J. Corp. Law 2011, 37, 264. [Google Scholar]

- Jensen, M.C. Value maximization, stakeholder theory, and the corporate objective function. J. Appl. Corp. Financ. 2001, 14, 8–21. [Google Scholar] [CrossRef]

- Stout, L.A. The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the Public; Berrett-Koehler Publishers: San Francisco, CA, USA, 2012; ISBN 1605098167. [Google Scholar]

- Gray, R. Social, environmental and sustainability reporting and organisationa value creation? Whose value? Whose creation? Account. Audit. Account. J. 2006. [Google Scholar] [CrossRef]

- Higgins, C.; Stubbs, W.; Milne, M. Is Sustainability Reporting Becoming Institutionalised? The Role of an Issues-Based Field. J. Bus. Ethics 2015, 309–326. [Google Scholar] [CrossRef]

- Adams, C.A.; Whelan, G. Conceptualising future change in corporate sustainability reporting. Account. Audit. Account. J. 2009, 22, 118–143. [Google Scholar] [CrossRef]

- Silva, S.; Nuzum, A.K.; Schaltegger, S. Stakeholder expectations on sustainability performance measurement and assessment. A systematic literature review. J. Clean. Prod. 2019, 217, 204–215. [Google Scholar] [CrossRef]

- De Villiers, C.; Alexander, D. The institutionalisation of corporate social responsibility reporting. Br. Account. Rev. 2014, 46, 198–212. [Google Scholar] [CrossRef]

- Perego, P.; Kennedy, S.; Whiteman, G. A lot of icing but little cake? Taking integrated reporting forward. J. Clean. Prod. 2016, 136, 53–64. [Google Scholar] [CrossRef]

- Buhr, N.; Gray, R.; Milne, M. Histories, rationales, voluntary standards and future prospects for sustainability reporting: CSR, GRI, IIRC and beyond. In Sustainability Accounting and Accountability; Routledge: Abingdon, UK, 2014; pp. 69–89. [Google Scholar]

- Stubbs, W.; Higgins, C. Stakeholders’ Perspectives on the Role of Regulatory Reform in Integrated Reporting. J. Bus. Ethics 2018, 147, 489–508. [Google Scholar] [CrossRef]

- Rezaee, Z.; Tuo, L. Voluntary disclosure of non-financial information and its association with sustainability performance. Adv. Account. 2017, 39, 47–59. [Google Scholar] [CrossRef]

- Qiu, Y.; Shaukat, A.; Tharyan, R. Environmental and social disclosures: Link with corporate financial performance. Br. Account. Rev. 2016, 48, 102–116. [Google Scholar] [CrossRef]

- Camilleri, M.A. Environmental, social and governance disclosures in Europe. Sustain. Account. Manag. Policy J. 2015, 6, 224–242. [Google Scholar] [CrossRef]

- Manes-Rossi, F.; Tiron-Tudor, A.; Nicolò, G.; Zanellato, G. Ensuring more sustainable reporting in europe using non-financial disclosure-de facto and de jure evidence. Sustainability 2018, 10, 1162. [Google Scholar] [CrossRef]

- European Commission. Guidelines on Non-Financial Reporting (Methodology for Reporting Non-Financial Information); EC: Brussels, Belgium, 2017. [Google Scholar]

- Jeffery, C. Comparing the Implementation of the EU Non-Financial Reporting Directive. 2017. Available online: tps://ssrn.com/abstract=3083368 (accessed on 14 December 2020).

- Doni, F.; Martini, S.B.; Corvino, A.; Mazzoni, M. Voluntary versus mandatory non-financial disclosure. Meditari Account. Res. 2019, 28, 781–802. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The Consequences of Mandatory Corporate Sustainability Reporting. 2014. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1799589 (accessed on 13 January 2021).

- La Torre, M.; Sabelfeld, S.; Blomkvist, M.; Tarquinio, L.; Dumay, J. Harmonising non-financial reporting regulation in Europe: Practical forces and projections for future research. Meditari Account. Res. 2018, 26, 598–621. [Google Scholar] [CrossRef]

- Milne, M.J.; Gray, R. W(h)ither Ecology? The Triple Bottom Line, the Global Reporting Initiative, and Corporate Sustainability Reporting. J. Bus. Ethics 2013, 118, 13–29. [Google Scholar] [CrossRef]

- Taïbi, S.; Antheaume, N.; Gibassier, D. Accounting for strong sustainability: An intervention-research based approach. Sustain. Account. Manag. Policy J. 2020. [Google Scholar] [CrossRef]

- Fuller, M. Letters from the top: A comparative control group study of CEO letters to stakeholders. Int. J. Corp. Soc. Responsib. 2018, 3, 1–14. [Google Scholar] [CrossRef]

- Greenwood, M.; Kamoche, K. Social accounting as stakeholder knowledge appropriation. J. Manag. Gov. 2013, 17, 723–743. [Google Scholar] [CrossRef]

- Harrison, J.S.; van der Laan Smith, J. Responsible Accounting for Stakeholders. J. Manag. Stud. 2015, 52, 935–960. [Google Scholar] [CrossRef]

- Freeman, R.E. Five Challenges to Stakeholder Theory: A Report on Research in Progress. In Stakeholder Management Business and Society 360; Emerald Publishing Limited: Bentley, UK, 2017; Volume 1, pp. 1–20. ISBN 2514-1759. [Google Scholar]

- Puroila, J.; Mäkelä, H. Matter of opinion: Exploring the socio-political nature of materiality disclosures in sustainability reporting. Account. Audit. Account. J. 2019. [Google Scholar] [CrossRef]

- European Commission. Inception Impact Assessment; EC: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. Summary Report of the Public Consultation on the Review of the Non-Financial Reporting Directive; EC: Brussels, Belgium, 2020. [Google Scholar]

- Valdez, D.; Pickett, A.C.; Goodson, P. Topic Modeling: Latent Semantic Analysis for the Social Sciences. Soc. Sci. Q. 2018, 99, 1665–1679. [Google Scholar] [CrossRef]

- Pang, B.; Lee, L. Opinion mining and sentiment analysis. Found. Trends Inf. Retr. 2008, 2, 1–135. [Google Scholar] [CrossRef]

- Blei, D.M. Probabilistic topic models. Commun. ACM 2012, 55, 77–84. [Google Scholar] [CrossRef]

- Blei, D.M.; Ng, A.Y.; Jordan, M.I. Latent dirichlet allocation. J. Mach. Learn. Res. 2003, 3, 993–1022. [Google Scholar]

- Huang, A.H.; Lehavy, R.; Zang, A.Y.; Zheng, R. Analyst Information Discovery and Interpretation Roles: A Topic Modeling Approach. Manag. Sci. 2018, 64, 2833–2855. [Google Scholar] [CrossRef]

- Turney, P.D.; Pantel, P. From Frequency to Meaning: Vector Space Models of Semantics. J. Artifical Intell. Res. 2010, 37, 141–188. [Google Scholar] [CrossRef]

- DiMaggio, P.; Nag, M.; Blei, D. Exploiting affinities between topic modeling and the sociological perspective on culture: Application to newspaper coverage of US government arts funding. Poetics 2013, 41, 570–606. [Google Scholar] [CrossRef]

- Debortoli, S.; Müller, O.; Junglas, I.; vom Brocke, J. Text mining for information systems researchers: An annotated topic modeling tutorial. Commun. Assoc. Inf. Syst. 2016, 39, 110–135. [Google Scholar] [CrossRef]

- Sievert, C.; Shirley, K. LDAvis: A method for visualizing and interpreting topics. In Proceedings of the Workshop Oninteractive Language Learning, Visualization, and Interfaces, Baltimore, MD, USA, 27 June 2014; pp. 63–70. [Google Scholar]

- Röder, M.; Both, A.; Hinneburg, A. Exploring the space of topic coherence measures. In Proceedings of the Eighth ACM International Conference on Web Search and Data Mining, Shanghai, China, 2–6 February 2015; pp. 399–408. [Google Scholar] [CrossRef]

- Goloshchapova, I.; Poon, S.-H.; Pritchard, M.; Reed, P. Corporate social responsibility reports: Topic analysis and big data approach. Eur. J. Financ. 2019, 25, 1637–1654. [Google Scholar] [CrossRef]

- Helfaya, A.; Whittington, M. Does designing environmental sustainability disclosure quality measures make a difference? Bus. Strateg. Environ. 2019, 28, 525–541. [Google Scholar] [CrossRef]

- Melloni, G.; Caglio, A.; Perego, P. Saying more with less? Disclosure conciseness, completeness and balance in Integrated Reports. J. Account. Public Policy 2017, 36, 220–238. [Google Scholar] [CrossRef]

- van Steenis, H. Defective data is a big problem for sustainable investing. Financial Times, 21 January 2019; 7–9. [Google Scholar]

- Loughran, T.I.M.; Mcdonald, B. When is a Liability not a Liability? Textual Analysis, Dictionaries, and 10-Ks Journal of Finance, forthcoming. J. Financ. 2011, 66, 35–65. [Google Scholar] [CrossRef]

- Melloni, G.; Stacchezzini, R.; Lai, A. The tone of business model disclosure: An impression management analysis of the integrated reports. J. Manag. Gov. 2016, 20, 295–320. [Google Scholar] [CrossRef]

| Description | Number of Documents |

|---|---|

| Total number of documents to the contribution on the Revision of the Non-Financial Reporting Directive (NFRD) | 128 |

| • Screening of non-English written documents | 12 |

| • Screening of duplicates | 6 |

| • Screening of documents with one-written page or that have figures and tables only | 9 |

| Final sample of investigation | 101 |

| Topic Name | 10 Words Extracted by the Algorithm |

|---|---|

| Quality of NFI | Information, company, eu, rights, human, disclosure, management, need, scope, environmental |

| Standardization | Nonfinancial, financial, framework, business, European, risks, global, investors, standard, public |

| Materiality | Reporting, sustainability, social, report, relevant, including, sustainable, corporate, materiality, stakeholders |

| Assurance | Impact, value, assurance, nfrd, reliability, data, esg, requirements, society, process |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fiandrino, S.; Tonelli, A. A Text-Mining Analysis on the Review of the Non-Financial Reporting Directive: Bringing Value Creation for Stakeholders into Accounting. Sustainability 2021, 13, 763. https://doi.org/10.3390/su13020763

Fiandrino S, Tonelli A. A Text-Mining Analysis on the Review of the Non-Financial Reporting Directive: Bringing Value Creation for Stakeholders into Accounting. Sustainability. 2021; 13(2):763. https://doi.org/10.3390/su13020763

Chicago/Turabian StyleFiandrino, Simona, and Alberto Tonelli. 2021. "A Text-Mining Analysis on the Review of the Non-Financial Reporting Directive: Bringing Value Creation for Stakeholders into Accounting" Sustainability 13, no. 2: 763. https://doi.org/10.3390/su13020763

APA StyleFiandrino, S., & Tonelli, A. (2021). A Text-Mining Analysis on the Review of the Non-Financial Reporting Directive: Bringing Value Creation for Stakeholders into Accounting. Sustainability, 13(2), 763. https://doi.org/10.3390/su13020763