The Inclusion of Intellectual Capital into the Green Board Committee to Enhance Firm Performance

Abstract

:1. Introduction

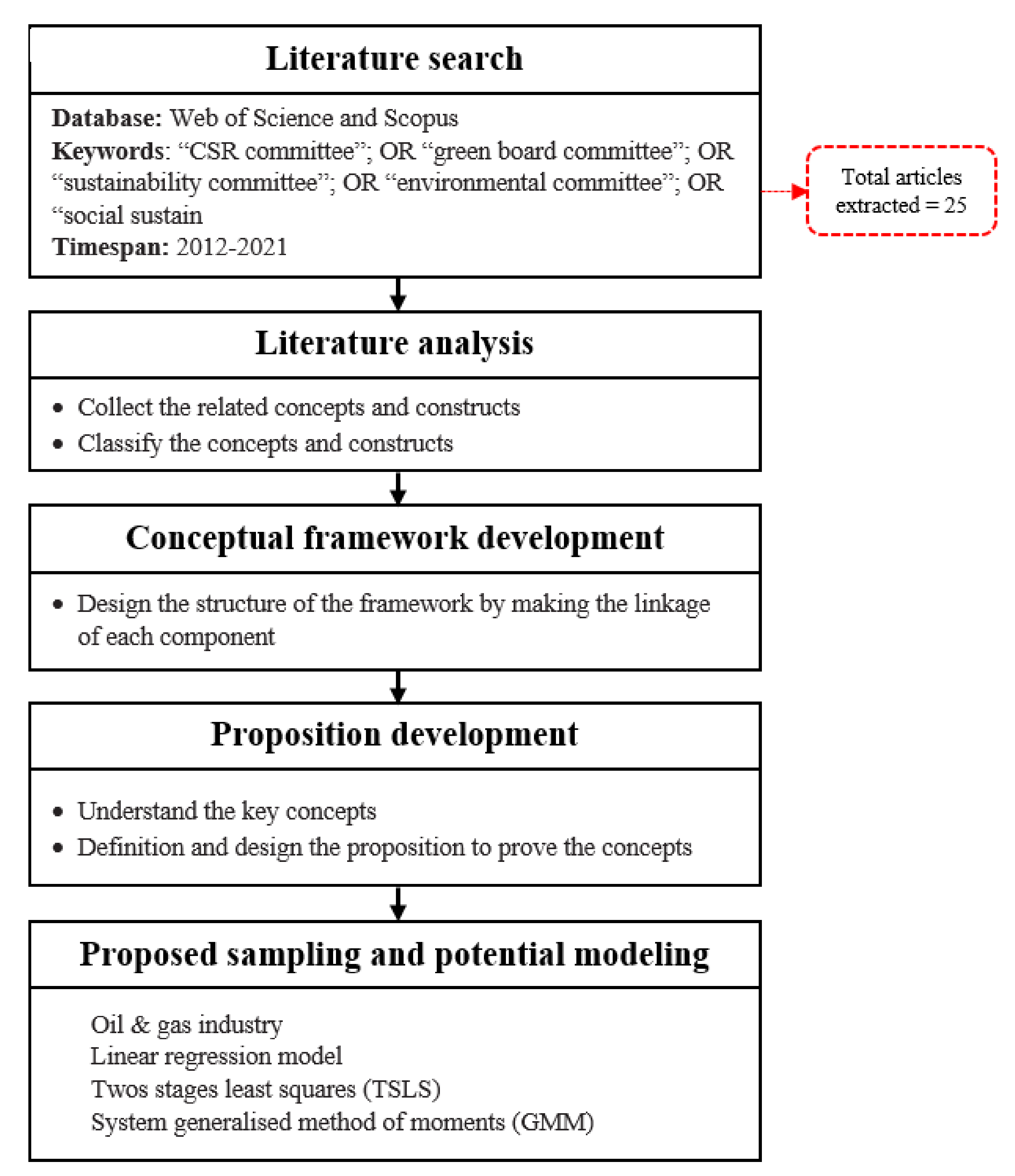

2. Literature Review

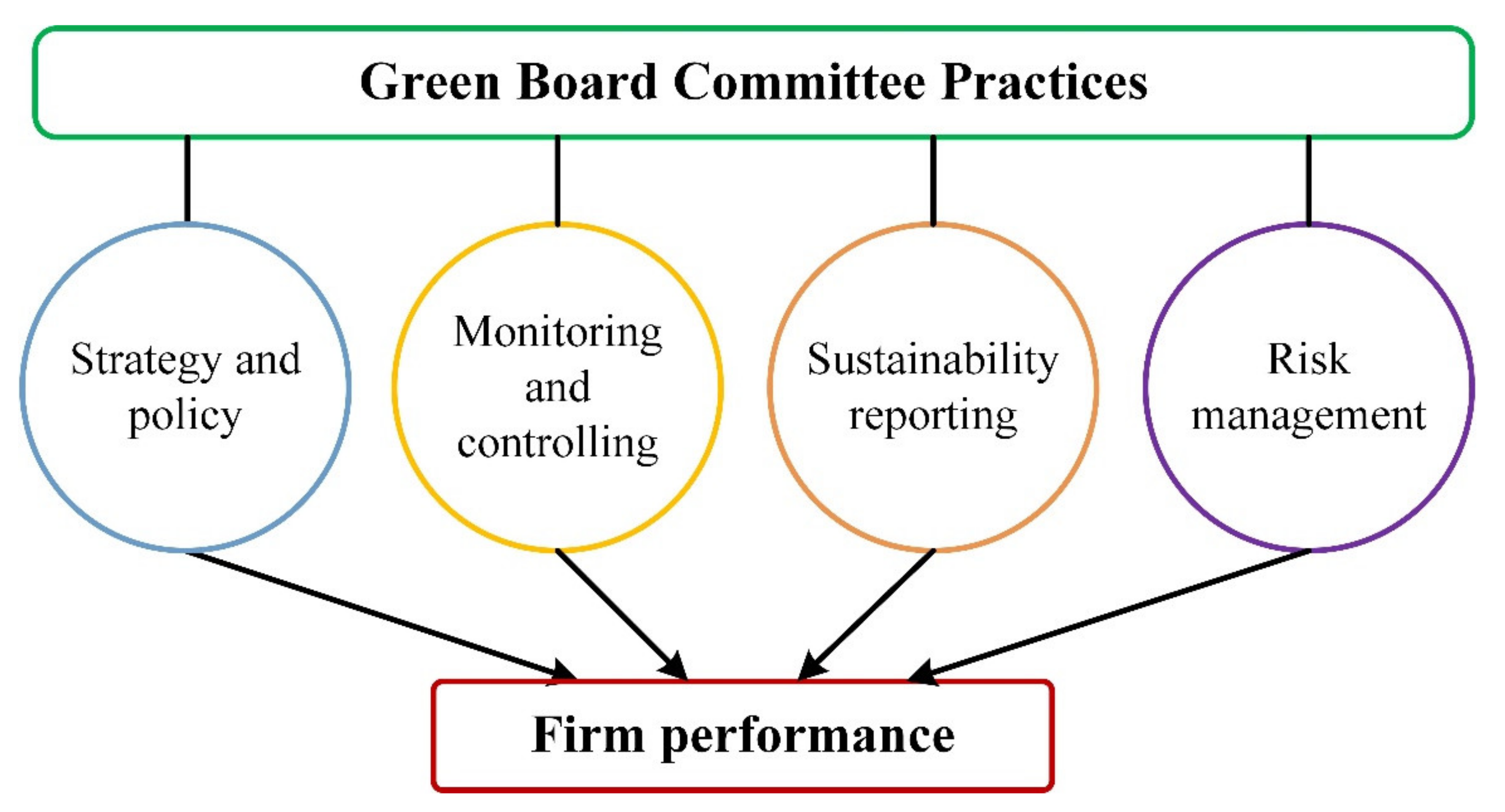

2.1. Green Board Committees

2.2. Firm Performance

2.3. Related Theories

2.3.1. Agency Theory

2.3.2. Stakeholder Theory

2.3.3. Resource-Based View Theory

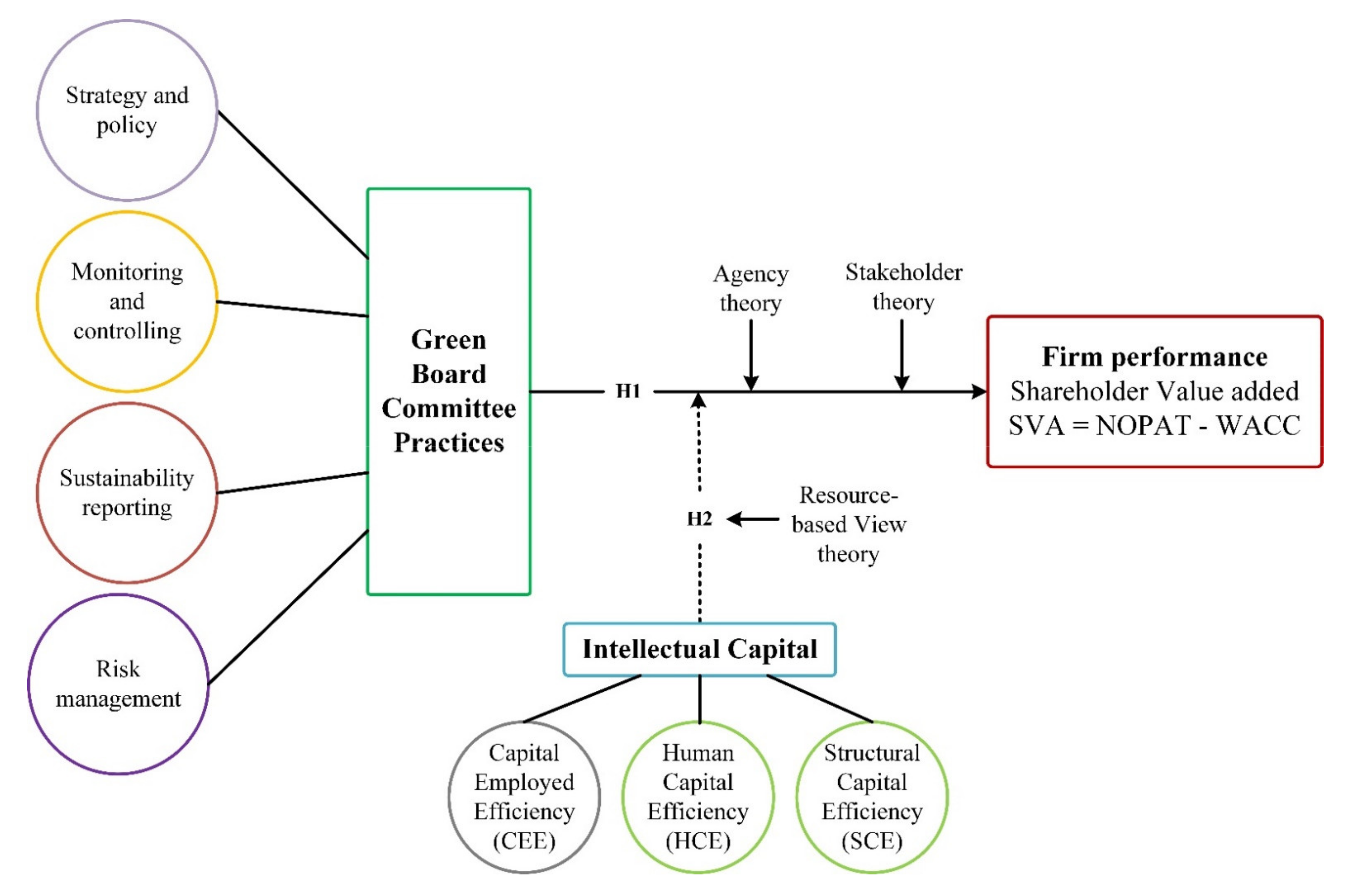

2.4. Development of Hypothesis

2.4.1. Green Board Committees and Firm Performance

2.4.2. Moderating Role of Intellectual Capital

2.5. Conceptual Framework

3. Methodology

4. Measurement of Variables

4.1. Development of the Green Board Committee Measurement Index

4.1.1. Strategy and Policy

- (a)

- Information on a green board committee’s engagement in the strategy and policymaking of the firm.

4.1.2. Monitoring and Control

- (b)

- Information on the green board committees’ engagement in the monitoring and control of the firm.

4.1.3. Sustainability Reporting

- (c)

- Information on the green board committees’ engagement in the sustainability reporting of the firm.

4.1.4. Risk Management

- (d)

- Information on the green board committees’ engagement in the risk management of the firm.

4.2. Dependent Variable

4.3. Moderating Variable

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Jan, A.A.; Lai, F.W.; Tahir, M. Developing an Islamic Corporate Governance framework to examine sustainability performance in Islamic Banks and Financial Institutions. J. Clean. Prod. 2021, 315, 128099. [Google Scholar] [CrossRef]

- Tang, M.; Walsh, G.; Lerner, D.; Fitza, M.A.; Li, Q. Green innovation, managerial concern and firm performance: An empirical study. Bus. Strateg. Environ. 2018, 27, 39–51. [Google Scholar] [CrossRef]

- Liao, L.; Luo, L.; Tang, Q. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Kilic, M.; Uyar, A.; Kuzey, C.; Karaman, A.S. Drivers and consequences of sustainability committee existence? Evidence from the hospitality and tourism industry. Int. J. Hosp. Manag. 2021, 92, 102753. [Google Scholar] [CrossRef]

- Huang, H.; Lobo, G.J.; Zhou, J. Determinants and accounting consequences of forming a governance committee: Evidence from the United States. Corp. Gov. Int. Rev. 2009, 17, 710–727. [Google Scholar] [CrossRef]

- Harrison, J.R. The strategic use of corporate board committees. Calif. Manag. Rev. 1987, 30, 109–125. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Gomez-Miranda, M.E.; David, F.; Rodríguez-Ariza, L. The explanatory effect of CSR committee and assurance services on the adoption of the IFC performance standards, as a means of enhancing corporate transparency. Sustain. Account. Manag. Policy J. 2019, 10, 773–797. [Google Scholar] [CrossRef]

- Eberhardt-Toth, E. Who should be on a board corporate social responsibility committee? J. Clean. Prod. 2017, 140, 1926–1935. [Google Scholar] [CrossRef]

- Gennari, F.; Salvioni, D.M. CSR committees on boards: The impact of the external country level factors. J. Manag. Gov. 2019, 23, 759–785. [Google Scholar] [CrossRef]

- Burke, J.J.; Hoitash, R.; Hoitash, U. The Heterogeneity of Board-Level Sustainability Committees and Corporate Social Performance. J. Bus. Ethics 2019, 154, 1161–1186. [Google Scholar] [CrossRef]

- Mahmood, M.; Orazalin, N. Green governance and sustainability reporting in Kazakhstan’s oil, gas, and mining sector: Evidence from a former USSR emerging economy. J. Clean. Prod. 2017, 164, 389–397. [Google Scholar] [CrossRef]

- Antounian, C.; Dah, M.A.; Harakeh, M. Excessive managerial entrenchment, corporate governance, and firm performance. Res. Int. Bus. Financ. 2021, 56, 101392. [Google Scholar] [CrossRef]

- Biswas, P.K.; Mansi, M.; Pandey, R. Board composition, sustainability committee and corporate social and environmental performance in Australia. Pac. Account. Rev. 2018, 30, 517–540. [Google Scholar] [CrossRef]

- Salin, A.S.; Rahman, R.A. Disclosure of board committees by Malaysian public listed companies. In Proceedings of the International Conference on Economics, Business and Management, Manila, Philippines, 14–15 June 2010. [Google Scholar]

- Saeidi, P.; Saeidi, S.P.; Gutierrez, L.; Streimikiene, D.; Alrasheedi, M.; Saeidi, S.P.; Mardani, A. The influence of enterprise risk management on firm performance with the moderating effect of intellectual capital dimensions. Econ. Res.-Ekon. Istraz. 2020, 34, 122–151. [Google Scholar] [CrossRef]

- Bontis, N.; Ciambotti, M.; Palazzi, F.; Sgro, F. Intellectual capital and financial performance in social cooperative enterprises. J. Intellect. Cap. 2018, 19, 712–731. [Google Scholar] [CrossRef]

- Ozkan, N.; Cakan, S.; Kayacan, M. Intellectual capital and financial performance: A study of the Turkish Banking Sector. Borsa Istanb. Rev. 2017, 17, 190–198. [Google Scholar] [CrossRef] [Green Version]

- Dal Mas, F. The relationship between intellectual capital and sustainability: An analysis of practitioner’s thought. In Intellectual Capital Management as a Driver of Sustainability: Perspectives for Organisations and Society; Matos, F., Vairinhos, V., Maurício Selig, P., Edvinsson, L., Eds.; Springer: Cham, Switzerland, 2019; pp. 11–24. [Google Scholar]

- Shad, M.K.; Lai, F.W.; Shamim, A.; McShane, M. The efficacy of sustainability reporting towards cost of debt and equity reduction. Environ. Sci. Pollut. Res. Int. 2020, 27, 22511–22522. [Google Scholar] [CrossRef]

- Elsayed, N.; Ammar, S. Sustainability governance and legitimisation processes: Gulf of Mexico oil spill. Sustain. Account. Manag. Policy J. 2020, 11, 253–278. [Google Scholar] [CrossRef] [Green Version]

- Baalouch, F.; Ayadi, S.D.; Hussainey, K. A study of the determinants of environmental disclosure quality: Evidence from French listed companies. J. Manag. Gov. 2019, 23, 939–971. [Google Scholar] [CrossRef] [Green Version]

- Chen, F.; Ngniatedema, T.; Li, S. A cross-country comparison of green initiatives, green performance and financial performance. Manag. Decis. 2018, 56, 1008–1032. [Google Scholar] [CrossRef]

- Dangelico, R.M. Improving firm environmental performance and reputation: The role of employee green teams. Bus Strateg. Environ. 2015, 24, 735–749. [Google Scholar] [CrossRef]

- Uyar, A.; Kilic, M.; Koseoglu, M.A.; Kuzey, C.; Karaman, A.S. The link among board characteristics, corporate social responsibility performance, and financial performance: Evidence from the hospitality and tourism industry. Tour. Manag. Perspect. 2020, 35, 100714. [Google Scholar] [CrossRef]

- Li, S.; Ngniatedema, T.; Chen, F. Understanding the impact of green initiatives and green performance on financial performance in the US. Bus. Strateg. Environ. 2017, 26, 776–790. [Google Scholar] [CrossRef]

- Li, W.; Xu, J.; Zheng, M. Green governance: New perspective from open innovation. Sustainability 2018, 10, 3845. [Google Scholar] [CrossRef] [Green Version]

- Ienciu, I.-A.; Popa, I.E.; Ienciu, N.M. Environmental reporting and good practice of corporate governance: Petroleum industry case study. Procedia Econ. Financ. 2012, 3, 961–967. [Google Scholar] [CrossRef] [Green Version]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Michelon, G.; Parbonetti, A. The effect of corporate governance on sustainability disclosure. J. Manag. Gov. 2012, 16, 477–509. [Google Scholar] [CrossRef]

- Rupley, K.H.; Brown, D.; Marshall, R.S. Governance, media and the quality of environmental disclosure. J. Account. Public Policy 2012, 31, 610–640. [Google Scholar] [CrossRef]

- Rodrigue, M.; Magnan, M.; Cho, C.H. Is environmental governance substantive or symbolic? An empirical investigation. J. Bus. Ethics 2013, 114, 107–129. [Google Scholar] [CrossRef]

- Vigneau, L.; Humphreys, M.; Moon, J. How Do Firms Comply with International Sustainability Standards? Processes and Consequences of Adopting the Global Reporting Initiative. J. Bus. Ethics 2015, 131, 469–486. [Google Scholar] [CrossRef] [Green Version]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate governance and sustainability performance: Analysis of triple bottom line performance. J. Bus. Ethics 2018, 149, 411–432. [Google Scholar] [CrossRef]

- Mahmood, Z.; Kouser, R.; Ali, W.; Ahmad, Z.; Salman, T. Does corporate governance affect sustainability disclosure? A mixed methods study. Sustainability 2018, 10, 207. [Google Scholar] [CrossRef] [Green Version]

- Adel, C.; Hussain, M.M.; Mohamed, E.K.; Basuony, M.A. Is corporate governance relevant to the quality of corporate social responsibility disclosure in large European companies? Int. J. Account. Inf. Manag. 2019, 27, 301–332. [Google Scholar] [CrossRef]

- Cancela, B.L.; Neves, M.E.D.; Rodrigues, L.L.; Dias, A.C.G. The influence of corporate governance on corporate sustainability: New evidence using panel data in the Iberian macroeconomic environment. Int. J. Account. Inf. Manag. 2020, 28, 785–806. [Google Scholar] [CrossRef]

- Orazalin, N. Do board sustainability committees contribute to corporate environmental and social performance? The mediating role of corporate social responsibility strategy. Bus. Strategy Environ. 2020, 29, 140–153. [Google Scholar] [CrossRef]

- Noja, G.G.; Cristea, M.; Jurcut, C.N.; Buglea, A.; Lala Popa, I. Management financial incentives and firm performance in a sustainable development framework: Empirical evidence from European companies. Sustainability 2020, 12, 7247. [Google Scholar] [CrossRef]

- Shahbaz, M.; Karaman, A.S.; Kilic, M.; Uyar, A. Board attributes, CSR engagement, and corporate performance: What is the nexus in the energy sector? Energy Policy 2020, 143, 111582. [Google Scholar] [CrossRef]

- Elmaghrabi, M.E. CSR committee attributes and CSR performance: UK evidence. Corp. Gov. 2021, 21, 892–919. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organisational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef] [Green Version]

- Calvert Asset Management and the Corporate Library. Board Oversight of Environmental and Social Issues: An Analysis of Current North American Practice. 2010. Available online: http://plusweb.org/Portals/0/DandO%20Material%202011/Board%20Oversight%20of%20Env%20&%20Social%20Issues.pdf (accessed on 28 June 2021).

- Institute of Business Ethics. Culture by Committee: The Pros and Cons; Institute of Business Ethics Pub: London, UK, 2016. [Google Scholar]

- Cucari, N.; De Falco, E.S.; Orlando, B. Diversity of board of directors and environmental social governance: Evidence from Italian listed companies. Corp. Soc. Responsib. Environ. Manag. 2017, 25, 250–266. [Google Scholar] [CrossRef]

- Richard, P.J.; Devinney, T.M.; Yip, G.S.; Johnson, G. Measuring organisational performance: Towards methodological best practice. J. Manag. 2009, 35, 718–804. [Google Scholar]

- Chakravarthy, B.S. Measuring strategic performance. Strateg. Manag. J. 1986, 7, 437–458. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard: Translating Strategy into Action; Harvard Business School Press: Boston, MA, USA, 1996. [Google Scholar]

- Shad, M.K.; Lai, F.W.; Fatt, C.L.; Klemeš, J.J.; Bokhari, A. Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. J. Clean. Prod. 2019, 208, 415–425. [Google Scholar] [CrossRef]

- Fernandez, P. EVA, economic profit and cash value added do not measure shareholder value creation. Fecha De Publicación 2001, 22, 1–18. [Google Scholar]

- Fernández, P. A Definition of Shareholder Value Creation. Master’s Thesis, IESE Business School, University of Navarra, Pamplona, Spain, 2002. [Google Scholar]

- Largani, M.S.; Kaviani, M.; Abdollahpour, A. A review of the application of the concept of Shareholder Value Added (SVA) in financial decisions. Procedia Soc. Behav. Sci. 2012, 40, 490–497. [Google Scholar] [CrossRef] [Green Version]

- Rappaport, A. Creating Shareholder Value: The New Standard for Business Performance; Free Press: New York, NY, USA, 1986. [Google Scholar]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Laplume, A.O.; Sonpar, K.; Litz, R.A. Stakeholder theory: Reviewing a theory that moves us. J. Manag. 2008, 34, 1152–1189. [Google Scholar] [CrossRef]

- Aras, G.; Tezcan, N.; Kutlu Furtuna, O. Multidimensional comprehensive corporate sustainability performance evaluation model: Evidence from an emerging market banking sector. J. Clean. Prod. 2018, 185, 600–609. [Google Scholar] [CrossRef]

- Khan, P.A.; Johl, S.K.; Johl, S.K. Does adoption of ISO 56002-2019 and green innovation reporting enhance the firm sustainable development goal performance? An emerging paradigm. Bus. Strateg. Environ. 2021, 1–15. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef] [Green Version]

- Peteraf, M.A. The cornerstones of competitive advantage: A resource-based view. Strateg. Manag. J. 1993, 14, 179–191. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Chofreh, A.G.; Goni, F.A.; Shaharoun, A.M.; Ismail, S. Review on enterprise resource planning implementation roadmap: Project management perspective. Sains Hum. 2014, 2, 135–138. [Google Scholar]

- Nadeem, M.; Gan, C.; Nguyen, C. The importance of intellectual capital for firm performance: Evidence from Australia. Aust. Account. Rev. 2018, 28, 334–344. [Google Scholar] [CrossRef]

- Camilleri, M. Valuing Stakeholder Engagement and Sustainability Reporting. Corp. Reput. Rev. 2015, 18, 210–222. [Google Scholar] [CrossRef]

- Pranugrahaning, A.; Donovan, J.D.; Topple, C.; Masli, E.K. Corporate Sustainability Assessments: A systematic literature review and conceptual framework. J. Clean. Prod. 2021, 295, 126385. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 9. [Google Scholar] [CrossRef]

- Chofreh, A.G.; Goni, F.A.; Klemeš, J.J.; Moosavi, S.M.S.; Davoudi, M.; Zeinalnezhad, M. COVID-19 shock: Development of strategic management framework for global energy. Renew. Sustain. Energy Rev. 2020, 139, 110643. [Google Scholar] [CrossRef]

- Ali, M.; de Azevedo, A.R.; Marvila, M.T.; Khan, M.I.; Memon, A.M.; Masood, F.; Almahbashi, N.M.; Shad, M.K.; Khan, M.A.; Fediuk, R.; et al. The Influence of COVID-19-Induced Daily Activities on Health Parameters—A Case Study in Malaysia. Sustainability 2021, 13, 7465. [Google Scholar] [CrossRef]

- Izzo, F.; Tomnyuk, V.; Varavallo, G. Intellectual capital and company performance: Evidence from European FinTech companies. Int. Bus. Res. 2020, 13, 1–34. [Google Scholar] [CrossRef]

- Tahir, M.; Shah, S.Q.A.; Khan, M.M.; Afridi, M.A. Intellectual Capital and Financial Performance of Banks in Pakistan. Dialogue 2018, 13, 105–117. [Google Scholar]

- Gangi, F.; Salerno, D.; Meles, A.; Daniele, L.M. Do corporate social responsibility and corporate governance influence intellectual capital efficiency? Sustainability 2019, 11, 1899. [Google Scholar] [CrossRef] [Green Version]

- Frederickson, J.R.; Webster, E.; Williamson, I.O. Is the current accounting treatment of education and training costs appropriate? Aust. Account. Rev. 2010, 20, 265–273. [Google Scholar] [CrossRef]

- Massaro, M.; Dumay, J.; Garlatti, A.; Dal Mas, F. Practitioners’ views on intellectual capital and sustainability. J. Intellect. Cap. 2018, 19, 367–386. [Google Scholar] [CrossRef]

- Vaio, A.D.; Palladino, R.; Hassan, R.; Escobar, O. Artificial intelligence and business models in the sustainable development goals perspective: A systematic literature review. J. Bus. Res. 2020, 121, 283–314. [Google Scholar] [CrossRef]

- Ali, S.E.A.; Lai, F.W.; Dominic, P.D.D.; Brown, N.J.; Lowry, P.B.B.; Ali, R.F. Stock Market Reactions to Favorable and Unfavorable Information Security Events: A Systematic Literature Review. Comput. Secur. 2021, 110, 102451. [Google Scholar] [CrossRef]

- Jan, A.; Marimuthu, M.; bin Mohd, M.P.; Isa, M.; Shad, M.K. Bankruptcy forecasting and economic sustainability profile of the market leading islamic banking countries. Int. J. Asian Bus. Inf. Manag. 2019, 10, 73–90. [Google Scholar] [CrossRef]

- Hamad, S.; Draz, M.U.; Lai, F.W. The Impact of Corporate Governance and Sustainability Reporting on Integrated Reporting: A Conceptual Framework. SAGE Open. 2020, 10, 2158244020927431. [Google Scholar] [CrossRef]

- Tahir, M.; Jan, A.A.; Shah, S.Q.A.; Alam, M.B.; Afridi, M.A.; Tariq, Y.B.; Bashir, M.F. Foreign inflows and economic growth in Pakistan: Some new insights. J. Chin. Econ. Foreign Trade Stud. 2020, 13, 97–113. [Google Scholar] [CrossRef]

- Jabbour, C.J.C.; Santos, F.C.A.; Fonseca, S.A.; Nagano, M.S. Green teams: Understanding their roles in the environmental management of companies located in Brazil. J. Clean. Prod. 2013, 46, 58–66. [Google Scholar] [CrossRef]

- Lun, Y.H.V. Green management practices and firm performance: A case of container terminal operations. Resour. Conserv. Recycl. 2011, 55, 559–566. [Google Scholar] [CrossRef]

- Al-Shaer, H.; Zaman, M. Credibility of sustainability reports: The contribution of audit committees. Bus. Strateg. Environ. 2018, 27, 973–986. [Google Scholar] [CrossRef]

- Marlow, D.; Beale, D.; Burn, S. Linking asset management with sustainability: Views from the Australian sector. J. Am. Water Work. Ass. 2010, 102, 56–67. [Google Scholar] [CrossRef]

- Jorge, I.C. The Influence of the CSR Committee in Firms’ Financial and Non-Financial Performance: Evidence from France, Germany, and the U.K. Master’s Thesis, ISCTE-Lisbon University Institute, Lisbon, Portugal, 2020. [Google Scholar]

- Klettner, A.; Clarke, T.; Boersma, M. The governance of corporate sustainability: Empirical insights into the development, leadership and implementation of responsible business strategy. J. Bus. Ethics 2014, 122, 145–165. [Google Scholar] [CrossRef]

- Spitzeck, H. The development of governance structures for corporate responsibility. Corp. Gov. Int. J. Bus. Soc. 2009, 9, 495–505. [Google Scholar] [CrossRef]

- COSO; WBCSD. Enterprise Risk Management: Applying Enterprise Risk Management to Environmental, Social and Governance-Related Risks. Available online: https://www.coso.org/Documents/COSO-WBCSD-ESGERM-Guidance-Full.pdf (accessed on 21 January 2021).

- Cordeiro, J.J.; Profumo, G.; Tutore, I. Board gender diversity and corporate environmental performance: The moderating role of family and dual-class majority ownership structures. Bus. Strategy Environ. 2020, 29, 1127–1144. [Google Scholar] [CrossRef]

- Dumay, J. A critical reflection on the future of intellectual capital: From reporting to disclosure. J. Intellect. Cap. 2016, 17, 168–184. [Google Scholar] [CrossRef]

- Pulic, A. Measuring the performance of intellectual potential in knowledge economy. In 2nd McMaster Word Congress on Measuring and Managing Intellectual Capital by the Austrian Team for Intellectual Potential; McMaster University: Hamilton, ON, Canada, 1998. [Google Scholar]

- Singla, H.K. Does VAIC affect the profitability and value of real estate and infrastructure firms in India? A panel data investigation. J. Intellect. Cap. 2020, 21, 309–331. [Google Scholar] [CrossRef]

- Pulic, A. Intellectual capital—Does it create or destroy value? Meas. Bus. Excell. 2004, 8, 62–68. [Google Scholar] [CrossRef] [Green Version]

| Reference | Indexing | Governance Variable | Dependent Variable | Theory Applied | Results Summary | Finding |

|---|---|---|---|---|---|---|

| [27] | Scopus | Environmental responsibility committee | Environmental reporting | Agency theory | Firms with the environmental committee present a more credible disclosure. | Positive |

| [28] | Web of Science | Environmental committee | Environmental strengths and concerns | Agency and stakeholder theory | Such a committee increases environmental strengths and mitigates environmental problems. | Positive |

| [29] | Web of Science | Socially responsible committee | Sustainability disclosure | Stakeholder theory | The existence of a sustainability committee does not improve overall sustainability disclosure. | Positive insignificant |

| [30] | Web of Science | CSR committee | Environmental performance | Legitimacy theory | Insignificant association between CSR committee and environmental disclosure. | Negative insignificant |

| [31] | Web of Science | Environmental committee | Green performance | Stakeholder and legitimacy theory | The environmental committee, as a symbolic approach, only manages stakeholder perceptions. | Negative insignificant |

| [23] | Web of Science | Green teams | Environmental performance and reputation | - | Green teams significantly improve firm environmental performance and reputation | Positive |

| [3] | Scopus | Environmental committee | Carbon disclosure | Legitimacy and stakeholder theory | Significant nexus between the committee and carbon disclosure. | Positive |

| [32] | Web of Science | CSR committee | CSR performance | Institutional theory | Such a committee is an influencer of CSR performance | positive |

| [25] | Web of Science | Sustainability-themed committee | Green and financial performance | Stakeholder theory | The committee reflects negative nexus with green performance, but green performance assists in financial performance | Negative |

| [13] | Web of Science | Sustainability committee | Social and environmental performance | Stakeholder theory | This committee improves non-financial performance | Positive |

| [22] | Web of Science | Sustainability-themed committee | Green performance | Stakeholder theory | The adoption of a sustainability-themed committee significantly improves green performance | Positive |

| [33] | Web of Science | CSR committee | Sustainability performance | Agency and stakeholder theory | The presence of a CSR committee positively influences environmental and social performance. | Positive |

| [34] | Web of Science | CSR committee | Economic, social, and environmental performance | Stakeholder theory | CSR committee brings significant enhancement in economic, social, and environmental performance | Positive |

| [35] | Web of Science | CSR committee | Sustainability disclosure | Agency and stakeholder theory | Shows significant association between CSR committee and sustainability disclosure. | Positive |

| [21] | Web of Science | Environmental committee | Environmental quality | Stakeholder and resource dependency theory | Insignificant association between the environmental committee and quality. | Negative |

| [10] | Web of Science | Sustainability committee | Corporate social performance (CSP) | Accountability theory | The effect of sustainability is economically significant. | Positive |

| [7] | Web of Science | CSR committee | GRI-IFC performance | Agency-stakeholder theory | Significant positive nexus between CSR committee and GRI-IFC performance. | Positive |

| [9] | Web of Science | CSR committee | Non-financial disclosure | Institutional theory | CSR committee has an impact on non-financial disclosure. | Negative |

| [36] | Web of Science | CSR committee | Sustainability performance | - | Significant positive association of CSR committee with social and environmental performances. | Positive |

| [37] | Web of Science | Sustainability committee | Financial performance | Agency theory | Significant nexus between sustainability and financial performance. | Positive |

| [38] | Web of Science | Sustainability committee | Social performance, environmental performance | Stakeholder and upper echelons theories | Positive association of sustainability committees with social and environmental performance. | Positive |

| [39] | Web of Science | CSR committee | ESG performance | Agency and stakeholder theory | CSR committee has a positive effect on ESG performance. | Positive |

| [24] | Web of Science | CSR committee | ESG performance | Resource dependency theory | Positive nexus between CSR committee and ESG performance. | Positive |

| [40] | Web of Science | CSR committee | CSR performance | Stakeholder-agency theory | CSR committee improves CSR performance. | Positive |

| [4] | Web of Science | Sustainability committee | CSR reporting | Stakeholder and resource dependency theory | Significant nexus between sustainability committee and CSR reporting. | Positive |

| Variables | Dimensions | Elements |

|---|---|---|

| Green board committee index | Strategy and policy | (a) Information on green board committees’ engagement in strategy and policymaking of the firm |

| Risk management | (b) Information on the green board committees’ engagement in monitoring and control of the firm | |

| Monitoring and controlling | (c) Information on green board committees’ engagement in the sustainability reporting of the firm | |

| Sustainability reporting | (d) Information on the green board committees’ engagement in the risk management of the firm | |

| Intellectual capital | VAIC model | Equation (3) |

| Firm performance | Shareholder value-added | Equation (2) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shah, S.Q.A.; Lai, F.-W.; Shad, M.K.; Konečná, Z.; Goni, F.A.; Chofreh, A.G.; Klemeš, J.J. The Inclusion of Intellectual Capital into the Green Board Committee to Enhance Firm Performance. Sustainability 2021, 13, 10849. https://doi.org/10.3390/su131910849

Shah SQA, Lai F-W, Shad MK, Konečná Z, Goni FA, Chofreh AG, Klemeš JJ. The Inclusion of Intellectual Capital into the Green Board Committee to Enhance Firm Performance. Sustainability. 2021; 13(19):10849. https://doi.org/10.3390/su131910849

Chicago/Turabian StyleShah, Syed Quaid Ali, Fong-Woon Lai, Muhammad Kashif Shad, Zdeňka Konečná, Feybi Ariani Goni, Abdoulmohammad Gholamzadeh Chofreh, and Jiří Jaromír Klemeš. 2021. "The Inclusion of Intellectual Capital into the Green Board Committee to Enhance Firm Performance" Sustainability 13, no. 19: 10849. https://doi.org/10.3390/su131910849

APA StyleShah, S. Q. A., Lai, F.-W., Shad, M. K., Konečná, Z., Goni, F. A., Chofreh, A. G., & Klemeš, J. J. (2021). The Inclusion of Intellectual Capital into the Green Board Committee to Enhance Firm Performance. Sustainability, 13(19), 10849. https://doi.org/10.3390/su131910849