Energy Network Embodied in Trade along the Belt and Road: Spatiotemporal Evolution and Influencing Factors

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data Sources

2.2. Multi-Regional Input-Output (MRIO) Model

2.3. Complex Network Analysis

2.4. QAP Analysis

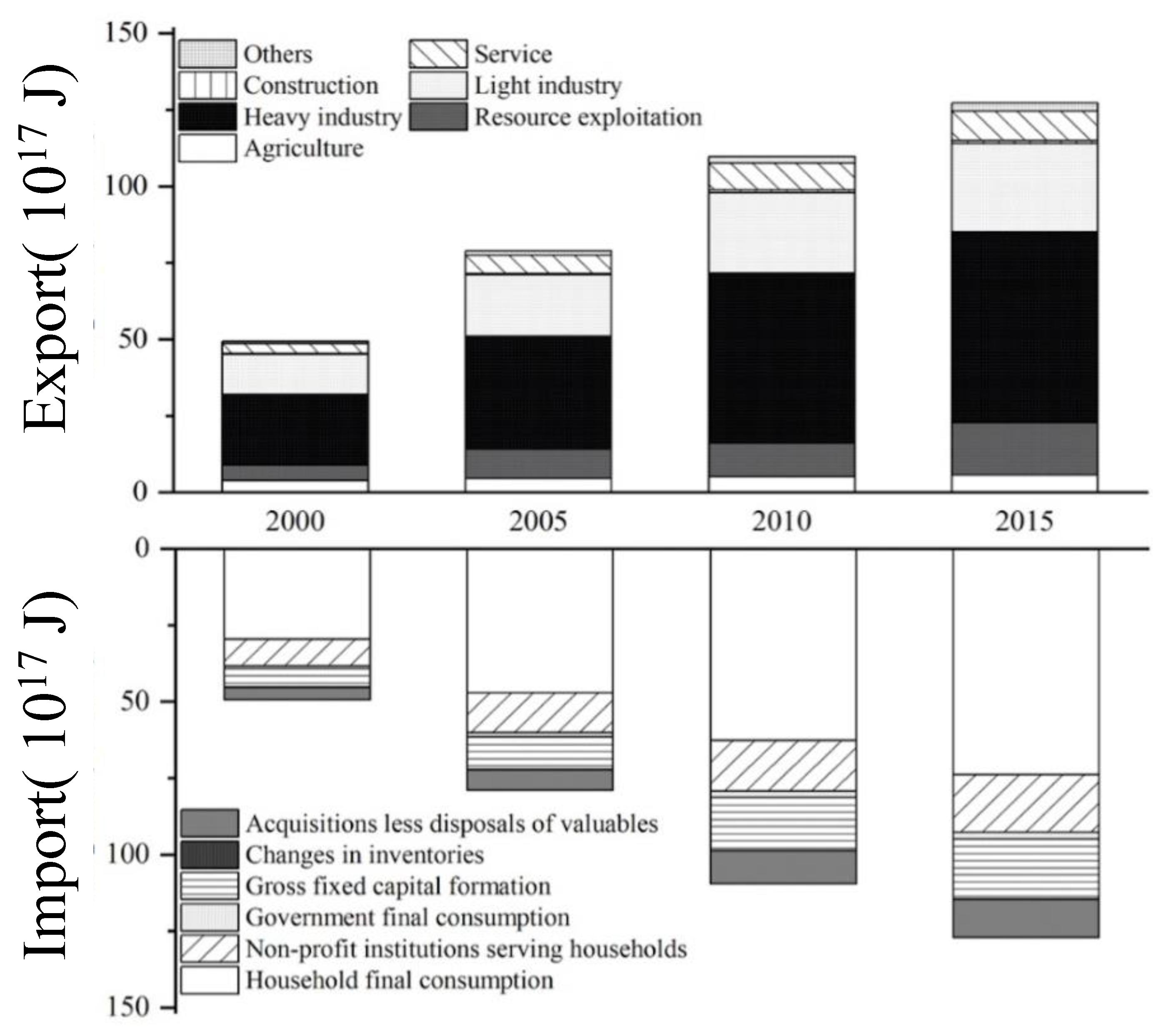

3. Energy Embodied in Intermediate and Final Trade along the BRI

4. Intermediate and Final Energy Trade Networks along the BRI

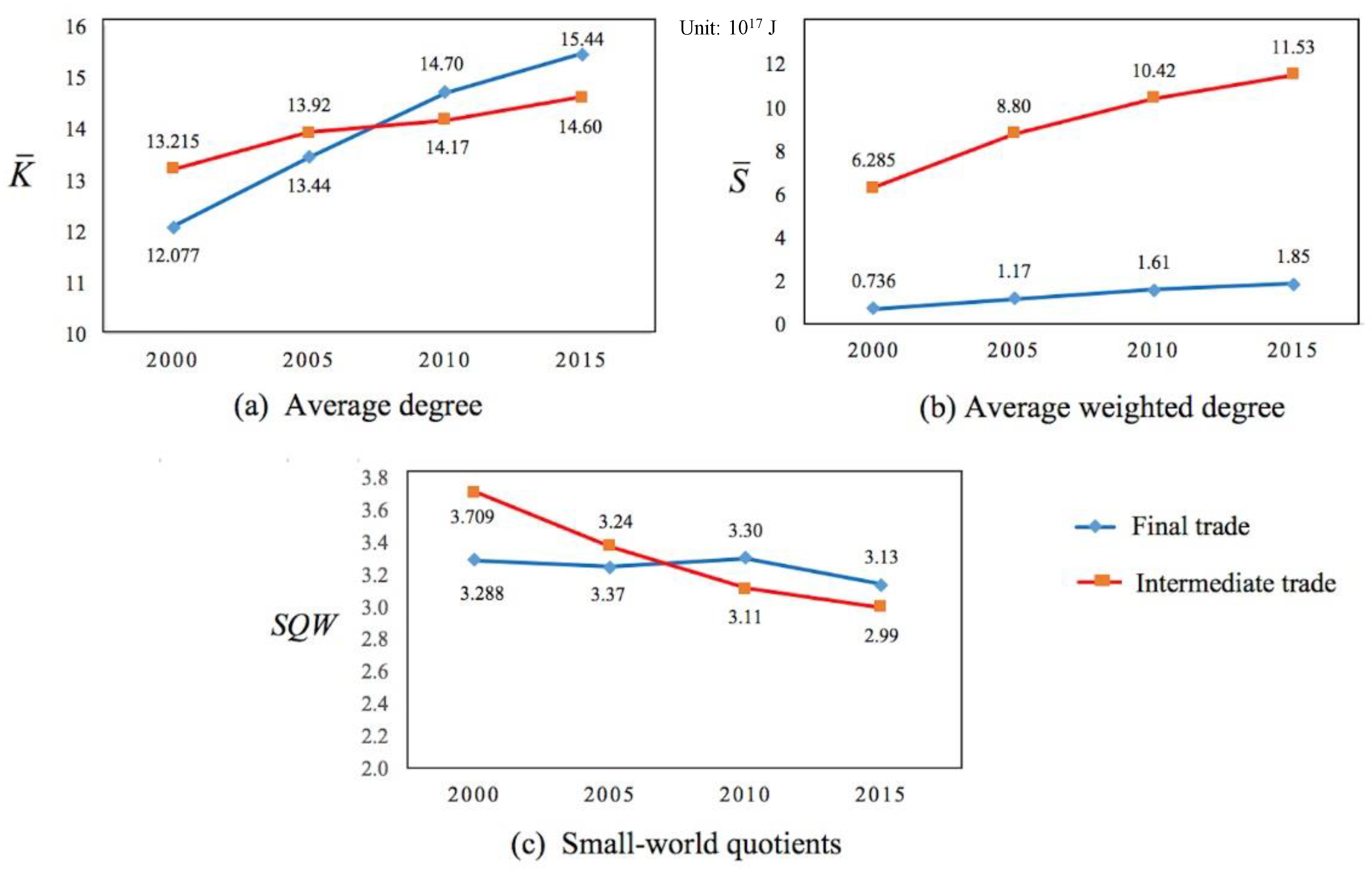

4.1. Macro-Level Analysis

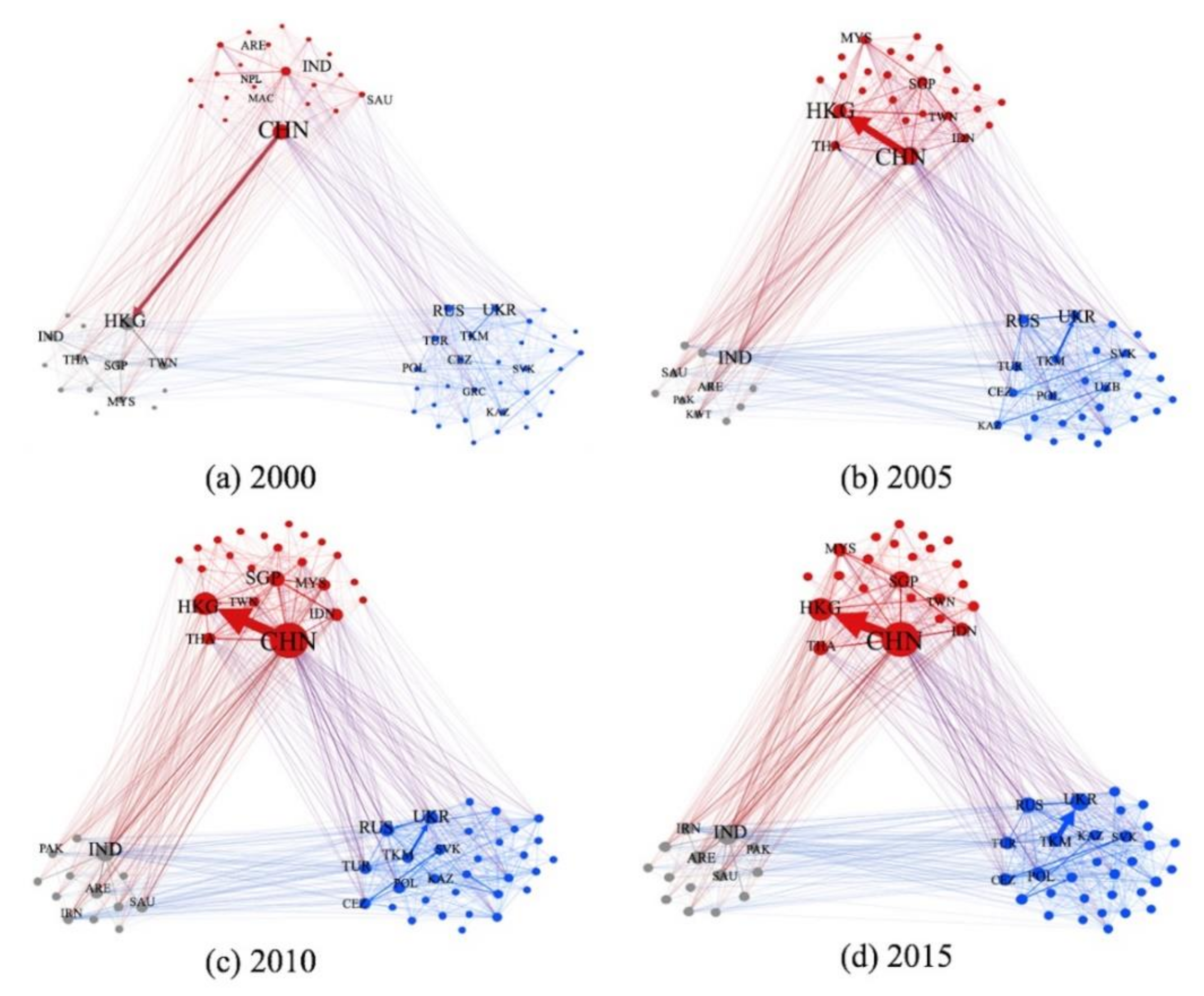

4.2. Meso-Level Analysis

4.3. Micro-Level Analysis

5. Influencing Factors on Energy Trade Network of the BRI

5.1. QAP Correlation Analysis

5.2. QAP Regression Analysis

6. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Information on the Method

Appendix B. Data Description and Data Source

| Country | Abbreviation | Country | Abbreviation | Country | Abbreviation | |||

|---|---|---|---|---|---|---|---|---|

| 1 | Afghanistan | AFG | 24 | Indonesia | IDN | 47 | Poland | POL |

| 2 | Albania | ALB | 25 | Iran | IRN | 48 | Qatar | QAT |

| 3 | Armenia | ARM | 26 | Iraq | IRQ | 49 | Moldova | MDA |

| 4 | Azerbaijan | AZE | 27 | Israel | ISR | 50 | Romania | ROU |

| 5 | Bahrain | BHR | 28 | Jordan | JOR | 51 | Russia | RUS |

| 6 | Bangladesh | BGD | 29 | Kazakhstan | KAZ | 52 | Saudi Arabia | SAU |

| 7 | Belarus | BLR | 30 | Kuwait | KWT | 53 | Serbia | SRB |

| 8 | Bhutan | BTN | 31 | Kyrgyzstan | KGZ | 54 | Singapore | SGP |

| 9 | Bosnia and Herzegovina | BIH | 32 | Laos | LAO | 55 | Slovakia | SVK |

| 10 | Brunei | BRN | 33 | Latvia | LVA | 56 | Slovenia | SVN |

| 11 | Bulgaria | BGR | 34 | Lebanon | LBN | 57 | Sri Lanka | LKA |

| 12 | Cambodia | KHM | 35 | Lithuania | LTU | 58 | Syria | SYR |

| 13 | Mainland China | CHN | 36 | Macao SAR | MAC | 59 | Taiwan | TWN |

| 14 | Croatia | HRV | 37 | Malaysia | MYS | 60 | Tajikistan | TJK |

| 15 | Cyprus | CYP | 38 | Maldives | MDV | 61 | Thailand | THA |

| 16 | Czech Republic | CZE | 39 | Mongolia | MNG | 62 | Macedonia | MKD |

| 17 | Egypt | EGY | 40 | Montenegro | MNE | 63 | Turkey | TUR |

| 18 | Estonia | EST | 41 | Myanmar | MMR | 64 | Turkmenistan | TKM |

| 19 | Georgia | GEO | 42 | Nepal | NPL | 65 | Ukraine | UKR |

| 20 | Greece | GRC | 43 | Gaza Strip | PSE | 66 | UAE | ARE |

| 21 | Hong Kong | HKG | 44 | Oman | OMN | 67 | Uzbekistan | UZB |

| 22 | Hungary | HUN | 45 | Pakistan | PAK | 68 | Viet Nam | VNM |

| 23 | India | IND | 46 | Philippines | PHL | 69 | Yemen | YEM |

| Sector Content | Sector Grouping | |

|---|---|---|

| 1 | Agriculture | Agriculture |

| 2 | Fishing | Agriculture |

| 3 | Mining and quarrying | Resource exploitation |

| 4 | Food and beverages | Light industry |

| 5 | Textiles and wearing apparel | Light industry |

| 6 | Wood and paper | Light industry |

| 7 | Petroleum, chemical and non-metallic mineral products | Heavy industry |

| 8 | Metal products | Heavy industry |

| 9 | Electrical and machinery | Heavy industry |

| 10 | Transport equipment | Heavy industry |

| 11 | Other manufacturing | Light industry |

| 12 | Recycling | Light industry |

| 13 | Electricity, gas and water | Heavy industry |

| 14 | Construction | Construction |

| 15 | Maintenance and repair | Service |

| 16 | Wholesale trade | Service |

| 17 | Retail trade | Service |

| 18 | Hotels and restaurants | Service |

| 19 | Transport | Service |

| 20 | Post and telecommunications | Service |

| 21 | Financial intermediation and business activities | Service |

| 22 | Public administration | Service |

| 23 | Education, health and other services | Service |

| 24 | Private households | Service |

| 25 | Others | Other industries |

| 26 | Re-export and re-import | Other industries |

| Influencing Factor | Explanation | Variables | Data Sources |

|---|---|---|---|

| Geographic distance | The geographic distance between the capitals of two countries | Diff_distance (Geographic distance difference matrix) | CEPII database http://www.cepii.fr/CEPII/en/bdd_modele/presentation.asp?id=6 (accessed on 8 June 2021) |

| Land adjacency | Whether two countries are adjacent to each other by land | Binary_land (Land adjacency binary matrix) | CEPII database http://www.cepii.fr/CEPII/en/bdd_modele/presentation.asp?id=6 (accessed on 8 June 2021) |

| Culture and language | Whether countries share the same language or culture | Binary_culture (Culture and language binary matrix) | CEPII database http://www.cepii.fr/CEPII/en/bdd_modele/presentation.asp?id=19 (accessed on 8 June 2021) |

| Level of economic development | The GDP disparity between countries | Diff_GDP (Economic scale difference matrix) | World Bank database https://data.worldbank.org/indicator/NY.GDP.MKTP.CD (accessed on 8 June 2021) |

| Industrial structure | The difference of the proportion of the secondary industry in GDP between two countries | Diff_industry (Industrial structure difference matrix) | World Bank database https://data.worldbank.org/indicator/NV.IND.TOTL.ZS?view=chart (accessed on 8 June 2021) |

| Energy intensity | The disparity of the proportion of energy consumption to output between two countries | Diff_energy (Energy intensity difference matrix) | This study |

| Population | The population difference between two countries | Diff_population (Population difference matrix) | World Bank database https://data.worldbank.org/indicator/SP.POP.TOTL (accessed on 8 June 2021) |

Appendix C. Data for Network Indexes

| Network Category | Year | Average Degree | Average Weighted Degree | Small-World Quotients |

|---|---|---|---|---|

| Intermediate trade network | 2000 | 13.22 | 6.29 × 1017 J | 3.71 |

| 2005 | 13.92 | 8.80 × 1017 J | 3.38 | |

| 2010 | 14.17 | 1.04 × 1018 J | 3.11 | |

| 2015 | 14.60 | 1.15 × 1018 J | 2.99 | |

| Final trade network | 2000 | 12.08 | 7.36 × 1016 J | 3.29 |

| 2005 | 13.44 | 1.17 × 1017 J | 3.24 | |

| 2010 | 14.70 | 1.61 × 1017 J | 3.30 | |

| 2015 | 15.44 | 1.85 × 1017 J | 3.13 |

| Ranking | 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|---|

| Intermediate | 2000 | Mainland China | Russia | Turkey | Thailand | India |

| 43 | 35 | 35 | 34 | 33 | ||

| 2005 | Mainland China | India | Thailand | Russia | Turkey | |

| 45 | 38 | 36 | 34 | 34 | ||

| 2010 | Mainland China | India | Russia | Saudi Arabia | Thailand | |

| 48 | 39 | 37 | 35 | 35 | ||

| 2015 | Mainland China | India | Russia | Saudi Arabia | Turkey | |

| 49 | 39 | 37 | 35 | 35 | ||

| Final | 2000 | Russia | Mainland China | Turkey | Saudi Arabia | Greece |

| 37 | 33 | 32 | 27 | 27 | ||

| 2005 | Russia | Mainland China | India | Turkey | Saudi Arabia | |

| 39 | 38 | 32 | 31 | 30 | ||

| 2010 | Mainland China | Russia | India | Saudi Arabia | Turkey | |

| 43 | 39 | 35 | 35 | 32 | ||

| 2015 | Mainland China | Russia | Turkey | Saudi Arabia | India | |

| 43 | 39 | 36 | 36 | 35 | ||

| Ranking | 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|---|

| Intermediate | 2000 | Mainland China | India | Russia | Turkey | Ukraine |

| 46 | 42 | 41 | 37 | 36 | ||

| 2005 | Mainland China | India | Russia | Turkey | Ukraine | |

| 51 | 44 | 42 | 38 | 37 | ||

| 2010 | Mainland China | India | Russia | Turkey | Ukraine | |

| 56 | 47 | 45 | 41 | 37 | ||

| 2015 | Mainland China | India | Russia | Turkey | Greece | |

| 58 | 47 | 45 | 41 | 36 | ||

| Final | 2000 | Mainland China | India | Turkey | Thailand | Taiwan |

| 51 | 42 | 40 | 35 | 32 | ||

| 2005 | Mainland China | India | Thailand | Turkey | Greece | |

| 55 | 45 | 43 | 40 | 32 | ||

| 2010 | Mainland China | India | Turkey | Thailand | Indonesia | |

| 59 | 48 | 47 | 45 | 37 | ||

| 2015 | Mainland China | India | Turkey | Thailand | Czech Republic | |

| 59 | 49 | 49 | 47 | 39 | ||

| Ranking | 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|---|

| Intermediate | 2000 | Mainland China | Turkey | Greece | Slovakia | Czech Republic |

| 38.38 | 37.61 | 32.91 | 28.62 | 24.82 | ||

| 2005 | Mainland China | Turkey | Slovakia | Greece | Czech Republic | |

| 70.44 | 49.45 | 47.65 | 40.13 | 38.51 | ||

| 2010 | Mainland China | Turkey | Slovakia | Czech Republic | Greece | |

| 130.50 | 60.31 | 58.06 | 46.40 | 36.92 | ||

| 2015 | Mainland China | Turkey | Slovakia | Czech Republic | Thailand | |

| 147.75 | 67.85 | 60.51 | 48.90 | 41.70 | ||

| Final | 2000 | Hong Kong | Russia | India | Singapore | Malaysia |

| 10.11 | 2.90 | 2.82 | 2.54 | 2.09 | ||

| 2005 | Hong Kong | Russia | India | Ukraine | Singapore | |

| 15.45 | 4.90 | 4.74 | 4.36 | 3.60 | ||

| 2010 | Hong Kong | Mainland China | India | Russia | Ukraine | |

| 20.04 | 6.83 | 6.72 | 6.54 | 5.93 | ||

| 2015 | Hong Kong | Ukraine | Mainland China | Russia | India | |

| 20.19 | 10.92 | 8.94 | 7.60 | 7.24 | ||

| Ranking | 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|---|

| Intermediate | 2000 | Russia | Mainland China | Iran | Saudi Arabia | Ukraine |

| 123.68 | 28.77 | 24.07 | 22.27 | 18.63 | ||

| 2005 | Russia | Mainland China | Iran | Saudi Arabia | India | |

| 192.55 | 51.48 | 29.79 | 28.6 | 20.86 | ||

| 2010 | Russia | Mainland China | Iran | Saudi Arabia | India | |

| 227.50 | 71.92 | 37.74 | 34.00 | 30.06 | ||

| 2015 | Russia | Mainland China | Saudi Arabia | Iran | India | |

| 244.75 | 74.19 | 41.75 | 39.23 | 36.29 | ||

| Final | 2000 | Mainland China | Singapore | Taiwan | India | Thailand |

| 11.75 | 3.29 | 2.96 | 2.79 | 2.31 | ||

| 2005 | Mainland China | India | Singapore | Turkmenistan | Thailand | |

| 22.50 | 4.44 | 4.36 | 3.99 | 3.50 | ||

| 2010 | Mainland China | India | Singapore | Thailand | Turkmenistan | |

| 34.02 | 6.84 | 6.76 | 4.64 | 4.30 | ||

| 2015 | Mainland China | Turkmenistan | India | Singapore | Thailand | |

| 34.60 | 8.83 | 8.83 | 7.80 | 5.60 | ||

| Ranking | 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|---|

| Intermediate | 2000 | Mainland China | Russia | Turkey | India | Greece |

| 0.15 | 0.14 | 0.08 | 0.074 | 0.052 | ||

| 2005 | Mainland China | Russia | India | Turkey | Greece | |

| 0.16 | 0.11 | 0.09 | 0.08 | 0.061 | ||

| 2010 | Mainland China | Russia | India | Turkey | Greece | |

| 0.17 | 0.10 | 0.09 | 0.05 | 0.048 | ||

| 2015 | Mainland China | Russia | India | Thailand | Turkey | |

| 0.19 | 0.09 | 0.08 | 0.06 | 0.056 | ||

| Final | 2000 | Mainland China | Russia | Turkey | India | Greece |

| 0.15 | 0.13 | 0.10 | 0.06 | 0.05 | ||

| 2005 | Mainland China | Russia | India | Turkey | Greece | |

| 0.17 | 0.11 | 0.07 | 0.06 | 0.06 | ||

| 2010 | Mainland China | Russia | India | Turkey | Greece | |

| 0.18 | 0.09 | 0.07 | 0.06 | 0.05 | ||

| 2015 | Mainland China | Russia | Turkey | India | Thailand | |

| 0.16 | 0.08 | 0.07 | 0.06 | 0.04 | ||

References

- Tian, X.; Hu, Y.; Yin, H.; Geng, Y.; Bleischwitz, R. Trade impacts of China’s Belt and Road Initiative: From resource and environmental perspectives. Resour. Conserv. Recycl. 2019, 150, 104430. [Google Scholar] [CrossRef]

- Zhao, L.; Li, D.; Guo, X.; Xue, J.; Wang, C.; Sun, W. Cooperation risk of oil and gas resources between China and the countries along the Belt and Road. Energy 2021, 227, 120445. [Google Scholar] [CrossRef]

- Jackson, K.; Shepotylo, O. Belt and road: The China dream? China Econ. Rev. 2021, 67, 101604. [Google Scholar] [CrossRef]

- World Trade Organization Data. 2020. Available online: https://data.wto.org/ (accessed on 1 June 2021).

- Zhang, J. Oil and gas trade between China and countries and regions along the ‘Belt and Road’: A panoramic perspective. Energy Policy 2019, 129, 1111–1120. [Google Scholar] [CrossRef]

- Zhao, Y.; Liu, X.; Wang, S.; Ge, Y. Energy relations between China and the countries along the Belt and Road: An analysis of the distribution of energy resources and interdependence relationships. Renew. Sustain. Energy Rev. 2019, 107, 133–144. [Google Scholar] [CrossRef]

- Wu, X.F.; Chen, G.Q. Global overview of crude oil use: From source to sink through inter-regional trade. Energy Policy 2019, 128, 476–486. [Google Scholar] [CrossRef]

- Li, J.S.; Chen, G.Q.; Hayat, T.; Alsaedi, A. Mercury emissions by Beijing׳s fossil energy consumption: Based on environmentally extended input—Output analysis. Renew. Sustain. Energy Rev. 2015, 41, 1167–1175. [Google Scholar] [CrossRef]

- Chen, S.; Liu, Z.; Chen, B.; Zhu, F.; Fath, B.D.; Liang, S.; Su, M.; Yang, J. Dynamic Carbon Emission Linkages Across Boundaries. Earth’s Future 2019, 7, 197–209. [Google Scholar] [CrossRef] [Green Version]

- Costanza, R. Embodied Energy and Economic Valuation. Science 1980, 210, 1219–1224. [Google Scholar] [CrossRef] [PubMed]

- Liu, B.; Wang, D.; Xu, Y.; Liu, C.; Luther, M. Embodied energy consumption of the construction industry and its international trade using multi-regional input—Output analysis. Energy Build. 2018, 173, 489–501. [Google Scholar] [CrossRef]

- Chen, B.; Li, J.S.; Wu, X.F.; Han, M.Y.; Zeng, L.; Li, Z.; Chen, G.Q. Global energy flows embodied in international trade: A combination of environmentally extended input–output analysis and complex network analysis. Appl. Energy 2018, 210, 98–107. [Google Scholar] [CrossRef]

- Hong, J.; Tang, M.; Wu, Z.; Miao, Z.; Shen, G.Q. The evolution of patterns within embodied energy flows in the Chinese economy: A multi-regional-based complex network approach. Sustain. Cities Soc. 2019, 47, 101500. [Google Scholar] [CrossRef]

- Zhang, B.; Qiao, H.; Chen, Z.M.; Chen, B. Growth in embodied energy transfers via China’s domestic trade: Evidence from multi-regional input—Output analysis. Appl. Energy 2016, 184, 1093–1105. [Google Scholar] [CrossRef]

- Guo, S.; Zheng, S.; Hu, Y.; Hong, J.; Wu, X.; Tang, M. Embodied energy use in the global construction industry. Appl. Energy 2019, 256, 113838. [Google Scholar] [CrossRef]

- Tang, M.; Hong, J.; Liu, G.; Shen, G.Q. Exploring energy flows embodied in China’s economy from the regional and sectoral perspectives via combination of multi-regional input–output analysis and a complex network approach. Energy 2019, 170, 1191–1201. [Google Scholar] [CrossRef]

- Sun, X.; Li, J.; Qiao, H.; Zhang, B. Energy implications of China’s regional development: New insights from multi-regional input-output analysis. Appl. Energy 2017, 196, 118–131. [Google Scholar] [CrossRef]

- Zhang, L.; Hu, Q.; Fan, Z.; Ben, B.L. Input-Output Modeling for Urban Energy Consumption in Beijing: Dynamics and Comparison. PLoS ONE 2014, 9, e89850. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Guo, S.; Li, Y.; He, P.; Chen, H.; Meng, J. Embodied energy use of China’s megacities: A comparative study of Beijing and Shanghai. Energy Policy 2021, 155, 112243. [Google Scholar] [CrossRef]

- Han, Y.M.; Xiong, J.; Liu, W.D. China’s cross-border energy relations between direct trade and embodied transfers: Based on “the Belt and Road” energy cooperation. J. Nat. Resour. 2020, 35, 2674–2686. [Google Scholar]

- Zhang, Y.; Zhang, J.-H.; Tian, Q.; Liu, Z.-H.; Zhang, H.-L. Virtual water trade of agricultural products: A new perspective to explore the Belt and Road. Sci. Total Environ. 2018, 622, 988–996. [Google Scholar] [CrossRef]

- Lu, Q.L.; Fang, K.; Heijungs, R.; Feng, K.S.; Li, J.S.; Wen, Q.; Li, Y.M.; Huang, X.J. Imbalance and drivers of carbon emissions embodied in trade along the Belt and Road Initiative. Appl. Energy 2020, 280, 12. [Google Scholar] [CrossRef]

- Han, M.; Lao, J.; Yao, Q.; Zhang, B.; Meng, J. Carbon inequality and economic development across the Belt and Road regions. J. Environ. Manag. 2020, 262, 110250. [Google Scholar] [CrossRef]

- Cuiyun, C.; Chazhong, G. Green development assessment for countries along the belt and road. J. Environ. Manag. 2020, 263, 110344. [Google Scholar] [CrossRef] [PubMed]

- Wu, X.F.; Chen, G.Q. Global primary energy use associated with production, consumption and international trade. Energy Policy 2017, 111, 85–94. [Google Scholar] [CrossRef]

- Wu, X.D.; Guo, J.L.; Li, C.; Chen, G.Q.; Ji, X. Carbon emissions embodied in the global supply chain: Intermediate and final trade imbalances. Sci. Total Environ. 2020, 707, 134670. [Google Scholar] [CrossRef] [PubMed]

- Wu, X.D.; Guo, J.L.; Li, C.H.; Shao, L.; Han, M.Y.; Chen, G.Q. Global socio-hydrology: An overview of virtual water use by the world economy from source of exploitation to sink of final consumption. J. Hydrol. 2019, 573, 794–810. [Google Scholar] [CrossRef]

- Fang, K.; Wang, S.; He, J.; Song, J.; Fang, C.; Jia, X. Mapping the environmental footprints of nations partnering the Belt and Road Initiative. Resour. Conserv. Recycl. 2021, 164, 105068. [Google Scholar] [CrossRef]

- Johnson, R.C.; Noguera, G. Accounting for intermediates: Production sharing and trade in value added. J. Int. Econ. 2012, 86, 224–236. [Google Scholar] [CrossRef] [Green Version]

- Zhao, Y.; Liu, Y.; Qiao, X.; Wang, S.; Zhang, Z.; Zhang, Y.; Li, H. Tracing value added in gross exports of China: Comparison with the USA, Japan, Korea, and India based on generalized LMDI. China Econ. Rev. 2018, 49, 24–44. [Google Scholar] [CrossRef]

- Dai, F.; Yang, J.; Guo, H.; Sun, H. Tracing CO2 emissions in China-US trade: A global value chain perspective. Sci. Total Environ. 2021, 775, 145701. [Google Scholar] [CrossRef]

- Wei, W.; Hao, S.; Yao, M.; Chen, W.; Wang, S.; Wang, Z.; Wang, Y.; Zhang, P. Unbalanced economic benefits and the electricity-related carbon emissions embodied in China’s interprovincial trade. J. Environ. Manag. 2020, 263, 110390. [Google Scholar] [CrossRef]

- Cassi, L.; Morrison, A.; Ter Wal, A.L.J. The Evolution of Trade and Scientific Collaboration Networks in the Global Wine Sector: A Longitudinal Study Using Network Analysis. Econ. Geogr. 2012, 88, 311–334. [Google Scholar] [CrossRef]

- Ermann, L.; Shepelyansky, D.L. Google matrix analysis of the multiproduct world trade network. Eur. Phys. J. B 2015, 88, 84. [Google Scholar] [CrossRef] [Green Version]

- Chong, Z.; Qin, C.; Pan, S. The Evolution of the Belt and Road Trade Network and Its Determinant Factors. Emerg. Mark. Financ. Trade 2019, 55, 3166–3177. [Google Scholar] [CrossRef]

- Li, Y.; Li, Y.; Pan, A.; Pan, X.; Veglianti, E. The Network Structure Characteristics and Determinants of the Belt & Road Industrial Robot Trade. Emerg. Mark. Financ. Trade 2021, 57, 1–11. [Google Scholar]

- Li, Y.L.; Chen, B.; Chen, G.Q. Carbon network embodied in international trade: Global structural evolution and its policy implications. Energy Policy 2020, 139, 111316. [Google Scholar] [CrossRef]

- Li, J.; Dong, X.; Jiang, Q.; Dong, K.; Liu, G. Natural gas trade network of countries and regions along the belt and road: Where to go in the future? Resour. Policy 2021, 71, 101981. [Google Scholar] [CrossRef]

- Feng, L.; Xu, H.; Wu, G.; Zhao, Y.; Xu, J. Exploring the structure and influence factors of trade competitive advantage network along the Belt and Road. Phys. A Stat. Mech. Appl. 2020, 559, 125057. [Google Scholar] [CrossRef]

- Zhang, C.; Fu, J.; Pu, Z. A study of the petroleum trade network of countries along “The Belt and Road Initiative”. J. Clean. Prod. 2019, 222, 593–605. [Google Scholar] [CrossRef]

- Wu, G.; Pu, Y.; Shu, T. Features and Evolution of Global Energy Trade Network Based on Domestic Value-Added Decomposition of Export. Energy 2021, 228, 120486. [Google Scholar] [CrossRef]

- Lv, K.; Feng, X.; Kelly, S.; Zhu, L.; Deng, M. A study on embodied carbon transfer at the provincial level of China from a social network perspective. J. Clean. Prod. 2019, 225, 1089–1104. [Google Scholar] [CrossRef]

- Fair, C.O.I. List and Overview of 65 Countries and Regions Along the Belt and Road. 2017. Available online: http://www.codafair.org/index.php?m=content&c=index&a=show&catid=113&id=1203 (accessed on 1 June 2021). (In Chinese).

- Chen, G.Q.; Wu, X.D.; Guo, J.; Meng, J.; Li, C. Global overview for energy use of the world economy: Household-consumption-based accounting based on the world input-output database (WIOD). Energy Econ. 2019, 81, 835–847. [Google Scholar] [CrossRef]

- Lenzen, M.; Moran, D.; Kanemoto, K.; Geschke, A. Building eora: A global multi-region input–output database at high country and sector resolution. Econ. Syst. Res. 2013, 25, 20–49. [Google Scholar] [CrossRef]

- International Monetary Fund (IMF). Available online: http://data.imf.org/?sk=29e74e46-0824-427f-bbde-af108686157f&sId=1390030109571 (accessed on 2 June 2021).

- International Energy Agency (IEA). Available online: https://www.iea.org/ (accessed on 1 May 2021).

- Cui, L.-B.; Peng, P.; Zhu, L. Embodied energy, export policy adjustment and China’s sustainable development: A multi-regional input-output analysis. Energy 2015, 82, 457–467. [Google Scholar] [CrossRef]

- Bullard, C.W.; Herendeen, R.A. The energy cost of goods and services. Energy Policy 1975, 3, 268–278. [Google Scholar] [CrossRef]

- Chen, Z.-M.; Chen, G.Q. Demand-driven energy requirement of world economy 2007: A multi-region input–output network simulation. Commun. Nonlinear Sci. Numer. Simul. 2013, 18, 1757–1774. [Google Scholar] [CrossRef]

- Watts, D.J.; Strogatz, S.H. Collective dynamics of ‘small-world’ networks. Nature 1998, 393, 440–442. [Google Scholar] [CrossRef]

- Newman, M.E.J. Scientific collaboration networks. II. Shortest paths, weighted networks, and centrality. Phys. Rev. E Statal Nonlinear Soft Matter Phys. 2001, 64, 016132. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Newman, M.E.J. Analysis of weighted networks. Phys. Rev. E 2004, 70, 056131. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Freeman, L.C. Centrality in social networks conceptual clarification. Soc. Netw. 1978, 1, 215–239. [Google Scholar] [CrossRef] [Green Version]

- Cranmer, S.J.; Leifeld, P.; McClurg, S.D.; Rolfe, M. Navigating the Range of Statistical Tools for Inferential Network Analysis. Am. J. Political Sci. 2017, 61, 237–251. [Google Scholar] [CrossRef] [Green Version]

- Xu, H.; Cheng, L. The QAP weighted network analysis method and its application in international services trade. Phys. A Stat. Mech. Appl. 2016, 448, 91–101. [Google Scholar] [CrossRef]

- Bergstrand, J.H. The Gravity Equation in International Trade: Some Microeconomic Foundations and Empirical Evidence. Rev. Econ. Stat. 1985, 67, 474–481. [Google Scholar] [CrossRef]

- Chaney, T. The Network Structure of International Trade. Am. Econ. Rev. 2014, 104, 3600–3634. [Google Scholar] [CrossRef] [Green Version]

- Borchert, I.; Yotov, Y.V. Distance, globalization, and international trade. Econ. Lett. 2017, 153, 32–38. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Sheng, D. Social trust and export comparative advantage: An empirical investigation based on IVTSLS and PSM method. J. Int. Trade 2010, 10, 64–71. [Google Scholar]

- Jing, S.; Zhihui, L.; Jinhua, C.; Zhiyao, S. China’s renewable energy trade potential in the “Belt-and-Road” countries: A gravity model analysis. Renew. Energy 2020, 161, 1025–1035. [Google Scholar] [CrossRef]

- Deeparghya, M. Services traded for intermediate and final usage: An analysis of the role of services FTAs and restrictions. J. Econ. Stud. 2018, 45, 459–497. [Google Scholar]

- Joyeux, R.; Ripple, R.D. Household energy consumption versus income and relative standard of living: A panel approach. Energy Policy 2007, 35, 50–60. [Google Scholar] [CrossRef]

- Liu, W.; Dunford, M. Inclusive Globalization: Unpacking China’s Belt and Road Initiative. Area Dev. Policy 2016, 1, 323–340. [Google Scholar] [CrossRef]

- Meo, P.D.; Ferrara, E.; Fiumara, G.; Provetti, A.; Flickr, O.C.; Zhang, Y.; Wang, J.; Wang, Y.; Zhou, L.; Kaza, S. Fast unfolding of communities in large networks. J. Stat. Mech. Theory Exp. 2008, 2008, 10008. [Google Scholar]

- Yang, Y.; Poon, J.P.H.; Liu, Y.; Bagchi-Sen, S. Small and flat worlds: A complex network analysis of international trade in crude oil. Energy 2015, 93, 534–543. [Google Scholar] [CrossRef]

- Zhang, H.; Wang, Y.; Yang, C.; Guo, Y. The impact of country risk on energy trade patterns based on complex network and panel regression analyses. Energy 2021, 222, 119979. [Google Scholar] [CrossRef]

- Guo, S.; Shen, G.; Yang, J.; Sun, B.; Xue, F. Embodied energy of service trading in Hong Kong. Smart Sustain. Built Environ. 2015, 4, 234–248. [Google Scholar] [CrossRef] [Green Version]

- Liu, A.; Lu, C.; Wang, Z. The roles of cultural and institutional distance in international trade: Evidence from China’s trade with the Belt and Road countries. China Econ. Rev. 2020, 61, 101234. [Google Scholar] [CrossRef]

- Qi, S.-Z.; Peng, H.-R.; Zhang, Y.-J. Energy intensity convergence in Belt and Road Initiative (BRI) countries: What role does China-BRI trade play? J. Clean. Prod. 2019, 239, 118022. [Google Scholar] [CrossRef]

- Moran, D.; Wood, R. Convergence between the EORA, WIOD, EXIOBASE, and Openeu’s consumption-based carbon accounts. Econ. Syst. Res. 2014, 26, 245–261. [Google Scholar] [CrossRef]

- Li, X.; Zhou, W.; Hou, J. Research on the impact of OFDI on the home country’s global value chain upgrading. Int. Rev. Financ. Anal. 2021, 77, 101862. [Google Scholar] [CrossRef]

- Grodzicki, M.J.; Skrzypek, J. Cost-competitiveness and structural change in value chains—Vertically-integrated analysis of the European automotive sector. Struct. Chang. Econ. Dyn. 2020, 55, 276–287. [Google Scholar] [CrossRef]

- Koopman, R.; Wang, Z.; Wei, S.-J. Tracing Value-Added and Double Counting in Gross Exports. Am. Econ. Rev. 2014, 104, 459–494. [Google Scholar] [CrossRef] [Green Version]

- Usubiaga-Liaño, A.; Arto, I.; Acosta-Fernández, J. Double accounting in energy footprint and related assessments: How common is it and what are the consequences? Energy 2021, 222, 119891. [Google Scholar] [CrossRef]

- Kim, T.-J.; Tromp, N. Analysis of carbon emissions embodied in South Korea’s international trade: Production-based and consumption-based perspectives. J. Clean. Prod. 2021, 320, 128839. [Google Scholar] [CrossRef]

- Wu, X.; Guo, J.; Chen, G.; Wu, X.; Meng, J.; Alhodaly, M.; Wakeel, M. Energy use flows in the supply chains of the world economy: A full account of both primary and intermediate inputs. J. Clean. Prod. 2021, 320, 128621. [Google Scholar] [CrossRef]

| Indexes | Formula | Specifications | |

|---|---|---|---|

| Macro-level indexes | Average degree | It indicates the average amount of trade relations each country has. n is the number of countries in the BRI trade network of embodied energy, is the degree of country i, and is the number of trade links between country i and j. | |

| Average weighted degree | It indicates the country’s average trade relations by trade volume. is the weighted degree of country i, and is the weight of edge between country i and j, representing their trade relations weighted by embodied energy trade volume. | ||

| Clustering coefficient | It represents the average clustering coefficient of the countries, denoting the probability that any two neighbors of a country are also connected with each other [51]. is the actual number of connections among the neighbors of country i. | ||

| Characteristic path length | It describes the average topological distance for any two countries to trade with energy [52]. , reflecting the minimum number of edges in all paths from country i to j. | ||

| Small-world quotient | It measures the network’s small-world nature, in which most countries have no direct trade relationship with each other, but they can establish trade links through a small number of steps. A network presents a small-world nature when its SWQ is greater than 1. and are the clustering coefficient and characteristic path length in random network, respectively. | ||

| Meso-level indexes | Newman’s modularity | It measures the quality of community partitions, by comparing the density of trade links inside communities with links between communities [53]. is the community to which country i is assigned, and . | |

| Micro-level indexes | Degree (In- and Out degree) | ; | It is the number of direct linkages that country i has with other countries. In a directed network, node degree can be further divided into in-degree and out-degree, which indicates the number of countries that a country imports from and exports to in this network. |

| Strength (In- and Out-strength) | ; | It is the weighted version of node degree. In a directed network, in-strength and out-strength represent the total volume of embodied energy a country importing from and exporting to in the energy trade network, respectively. | |

| Betweenness centrality | It is the degree to which a country is located in the “center” of other countries to reflect the ability of one country to control embodied energy trade relationships. The larger value indicates country i leverages a greater impact on the network. is the number of shortcuts between country j and k, and is the number of shortest paths between country j and country k through country i [54]. |

| Year | 2000 | 2005 | 2010 | 2015 |

|---|---|---|---|---|

| Diff_distance | −0.203 *** | −0.190 *** | −0.180 *** | −0.178 *** |

| Binary_land | 0.336 *** | 0.333 *** | 0.338 *** | 0.335 *** |

| Binary_culture | 0.132 *** | 0.122 *** | 0.120 *** | 0.115 *** |

| Diff_GDP | 0.195 *** | 0.293 *** | 0.324 *** | 0.314 *** |

| Diff_industry structure | −0.009 | 0.024 | 0.032 | −0.001 |

| Diff_energy intensity | 0.077 * | 0.087 * | 0.004 | −0.001 |

| Diff_population | 0.207 *** | 0.257 *** | 0.280 *** | 0.296 *** |

| Year | 2000 | 2005 | 2010 | 2015 |

|---|---|---|---|---|

| Diff_distance | −0.190 *** | −0.173 *** | −0.161 *** | −0.170 *** |

| Binary_land | 0.353 *** | 0.340 *** | 0.334 *** | 0.339 *** |

| Binary_culture | 0.107 *** | 0.101 *** | 0.097 *** | 0.097 *** |

| Diff_GDP | 0.352 *** | 0.422 *** | 0.442 *** | 0.444 *** |

| Diff_industry structure | 0.044 | 0.071 * | 0.091 * | 0.030 |

| Diff_energy intensity | 0.024 | 0.045 | −0.035 | −0.033 |

| Diff_population | 0.348 *** | 0.390 *** | 0.404 *** | 0.407 *** |

| Year | 2000 | 2005 | 2010 | 2015 |

|---|---|---|---|---|

| Diff_distance | −0.112 *** | −0.106 *** | −0.108 *** | −0.105 *** |

| Binary_land | 0.277 *** | 0.264 *** | 0.265 *** | 0.267 *** |

| Binary_culture | 0.056 *** | 0.049 *** | 0.044 *** | 0.038 ** |

| Diff_GDP | 0.048 | 0.212 *** | 0.257 *** | 0.189 ** |

| Diff_industry structure | −0.021 | −0.010 | −0.018 | −0.029 |

| Diff_energy intensity | 0.082 ** | 0.094 ** | 0.017 | 0.013 |

| Diff_population | 0.157 ** | 0.074 * | 0.059 | 0.137 ** |

| Adj-R2 | 0.170 | 0.202 | 0.213 | 0.212 |

| Year | 2000 | 2005 | 2010 | 2015 |

|---|---|---|---|---|

| Diff_distance | −0.121 *** | −0.110 *** | −0.113 *** | −0.117 *** |

| Binary_land | 0.281 *** | 0.262 *** | 0.254 *** | 0.256 *** |

| Binary_culture | 0.026 * | 0.025 * | 0.020 | 0.016 |

| Diff_GDP | 0.168 *** | 0.264 *** | 0.296 *** | 0.305 *** |

| Diff_industry structure | 0.005 | 0.016 | 0.012 | −0.025 |

| Diff_energy intensity | 0.034 | 0.056 * | −0.013 | −0.014 |

| Diff_population | 0.192 *** | 0.159 ** | 0.145 ** | 0.156 ** |

| Adj-R2 | 0.251 | 0.287 | 0.295 | 0.306 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fu, Y.; Xue, L.; Yan, Y.; Pan, Y.; Wu, X.; Shao, Y. Energy Network Embodied in Trade along the Belt and Road: Spatiotemporal Evolution and Influencing Factors. Sustainability 2021, 13, 10530. https://doi.org/10.3390/su131910530

Fu Y, Xue L, Yan Y, Pan Y, Wu X, Shao Y. Energy Network Embodied in Trade along the Belt and Road: Spatiotemporal Evolution and Influencing Factors. Sustainability. 2021; 13(19):10530. https://doi.org/10.3390/su131910530

Chicago/Turabian StyleFu, Yue, Long Xue, Yixin Yan, Yao Pan, Xiaofang Wu, and Ying Shao. 2021. "Energy Network Embodied in Trade along the Belt and Road: Spatiotemporal Evolution and Influencing Factors" Sustainability 13, no. 19: 10530. https://doi.org/10.3390/su131910530

APA StyleFu, Y., Xue, L., Yan, Y., Pan, Y., Wu, X., & Shao, Y. (2021). Energy Network Embodied in Trade along the Belt and Road: Spatiotemporal Evolution and Influencing Factors. Sustainability, 13(19), 10530. https://doi.org/10.3390/su131910530