The Impact of Corporate Governance Mechanism over Financial Performance: Evidence from Romania

Abstract

1. Introduction

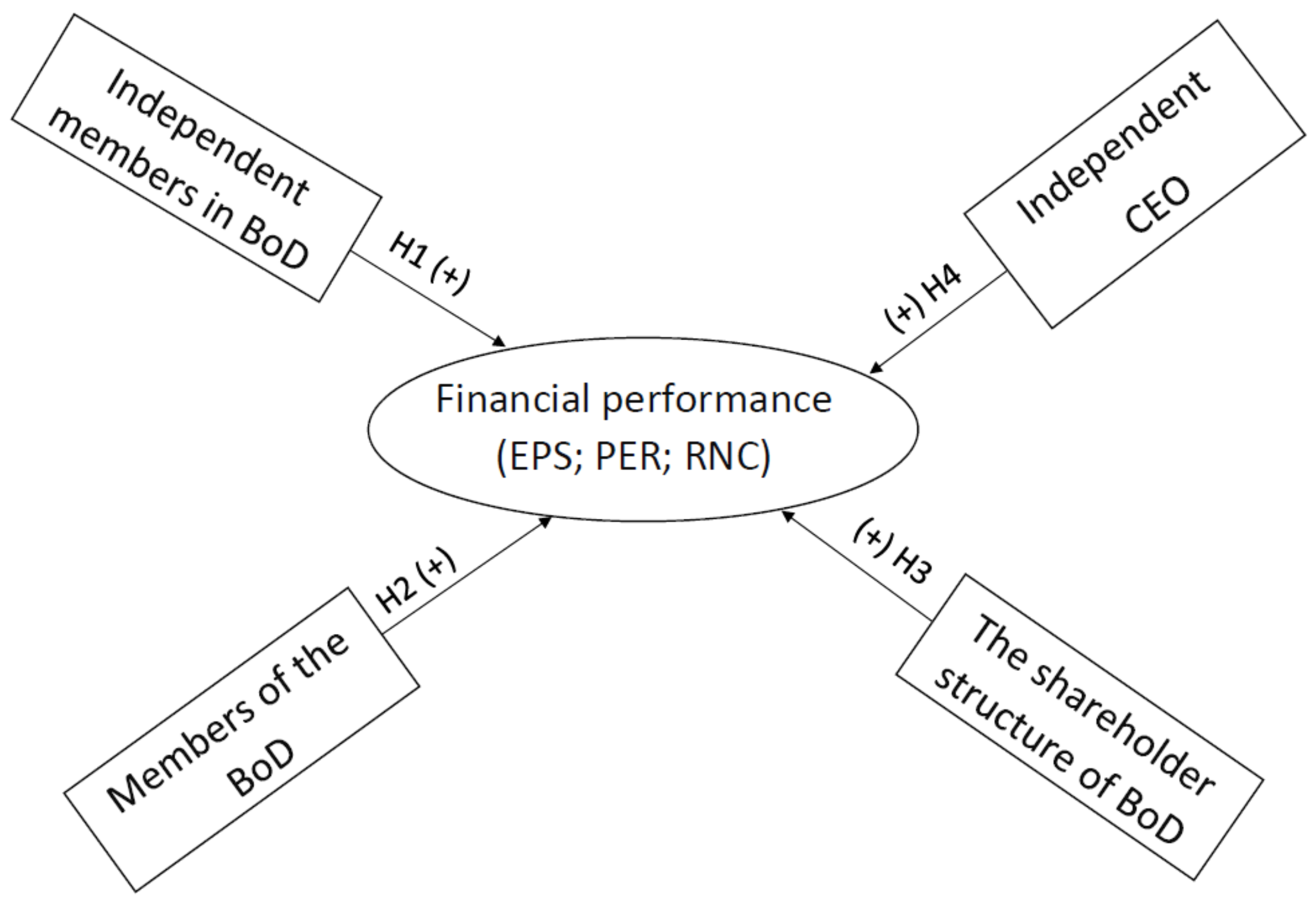

2. Literature Review and Hypothesis Development

3. Research Methodology

4. Results and Discussions

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ashkanasy, N.M.; Windsor, C.A. Personal and Organisational Factors Affecting Auditor Independence: Empirical Evidence and Directions for Future Research. Res. Account. Ethics 1997, 3, 35–48. [Google Scholar]

- Black, B.; Jang, H.; Kim, W. Does corporate governance predict firms’ market values? Evidence from the Korean market. J. Law Econ. Organ. 2016, 22, 366–413. [Google Scholar] [CrossRef]

- Herdjiono, I.; Sari, I.M. The Effect of Corporate Governance on the Performance of a Company. Some Empirical Findings from Indonesia. J. Manag. Bus. Adm. 2017, 25, 33–52. [Google Scholar] [CrossRef]

- Oncioiu, I.; Căpuşneanu, S.; Türkeș, M.C.; Topor, D.I.; Constantin, D.-M.O.; Marin-Pantelescu, A.; Hint, M.S. The Sustainability of Romanian SMEs and Their Involvement in the Circular Economy. Sustainability 2018, 10, 2761. [Google Scholar] [CrossRef]

- Ponemon, L.A. The Objectivity of Accountants’ Litigation Support Judgements. Account. Rev. 1995, 70, 467–488. [Google Scholar]

- Bertschinger, P.; Schaad, M. Der amerikanische Sabanes-Oxley Act of 2002-Mögliche Auswirkungen auf die amerikanische und international Wirtschaftsprüfung und Corporate Governance. Der. Schweiz. Treuhänder. 2003, 10, 883–888. [Google Scholar]

- Zakaria, A. The Influence of the Audit Committee and the Remuneration Committee on Company Performance. In Proceedings of the International Conference on Islamic Finance, Economics and Business (ICIFEB), Tangerang, Indonesia, 11–12 October 2017; Supriyono, M.M., Ed.; KnE Social Sciences: Dubai, United Arab Emirates, 2018; pp. 18–32. [Google Scholar]

- Choi, K.S.; Cho, W.H.; Lee, S.H.; Lee, H.J.; Kim, C.K. The Relationships among Quality, Value, Satisfaction and Behavioral Intention in Health Care Provider Choice: A South Korean Study. J. Bus. Res. 2004, 57, 913–921. [Google Scholar] [CrossRef]

- Carcello, J.V.; Neal, T.L.; Zoe-Vonna, P.; Scholz, S. CEO Involvement in Selecting Board Members and Audit Committee Effectiveness. 2008. Available online: http://www.ssrn.com/abstract=887512 (accessed on 22 October 2018).

- Fülöp, M.T. Audit in Corporate Governance; Alma Mater Publishing House: Cluj-Napoca, Romania, 2012. [Google Scholar]

- Dănescu, T.; Popa, M.A. Public health and corporate social responsibility: Exploratory study on pharmaceutical companies in an emerging market. Glob. Health 2020, 16, 117. [Google Scholar] [CrossRef] [PubMed]

- Collier, P.; Zaman, M. Convergence in European corporate governance: The audit committee concept. Corp. Gov. 2005, 13, 753–768. [Google Scholar] [CrossRef]

- Dănescu, T.; Prozan, M.; Prozan, R.D. Perspectives regarding accounting—corporate governance—Internal control. Proc. Econ. Financ. 2015, 32, 588–594. [Google Scholar] [CrossRef][Green Version]

- Anderson, R.C.; Mansi, S.A.; Reeb, D.M. Board characteristics, accounting report integrity and the cost of debt. J. Account. Econ. 2004, 37, 315–342. [Google Scholar] [CrossRef]

- Beiner, S.; Schmid, M.M.; Drobetz, W.; Zimmermann, H. An Integrated Framework of Corporate Governance and Firm Valuation. Eur. Financ. Manag. 2006, 12, 249–283. [Google Scholar] [CrossRef]

- Sewell, M. Behavioral Finance; University of Cambridge: Cambridge, UK, 2010. [Google Scholar]

- Vafeas, N. Board meeting and firm performance. J. Financ. Econ. 1999, 53, 113–142. [Google Scholar] [CrossRef]

- Song, J.; Windram, B. Benchmarking audit committee effectiveness in financial reporting. Int. J. Audit. 2004, 8, 195–205. [Google Scholar] [CrossRef]

- Danquah, B.S.; Gyimah, P.; Afriyie, R.O.; Asiamah, A. Corporate Governance and Firm Performance: An Empirical Analysis of Manufacturing Listed Firms in Ghana. Account. Financ. Res. 2017, 7, 111–118. [Google Scholar] [CrossRef]

- Fernandes, D.; Lynch, J.G.; Netemeyer, R.G. Financial Literacy, Financial Education, and Downstream Financial Behaviors. Manag. Sci. 2014, 60, 1861–1883. [Google Scholar] [CrossRef]

- Salahuddin, M.; Islam, M.R. Factors Affecting Investment in Developing Countries: A Panel Data Study. J. Dev. Areas 2008, 42, 21–37. [Google Scholar] [CrossRef]

- Bolgorian, M. Corruption and stock market development: A quantitative approach. Phys. A Stat. Mech. Appl. 2011, 390, 4514–4521. [Google Scholar] [CrossRef]

- Black, B.S.; Khanna, V.S. Can corporate governance reforms increase firm market values? event study evidence from india. J. Empir. Leg. Stud. 2007, 4, 749–796. [Google Scholar] [CrossRef]

- Claessens, S. Corporate Governance and Development. World Bank Res. Obs. 2006, 21, 91–122. [Google Scholar] [CrossRef]

- Allen, F. Corporate Governance in Emerging Economies. Oxf. Rev. Econ. Policy 2005, 21, 164–177. [Google Scholar] [CrossRef]

- Clarke, T. International Corporate Governance: A Comparative Approach, 2nd ed.; Routledge: Oxfordshire, UK, 2017. [Google Scholar] [CrossRef]

- Claessens, S.; Yurtoglu, B.B. Corporate Governance and Development: An Update; Global Corporate Governance Network, IFC.: London, UK, 2012; Available online: https://ssrn.com/abstract=2061562 (accessed on 23 August 2021).

- Burlea, A.S.; Popa, I. Legitimacy Theory. Encycl. Corp. Soc. Responsib. 2013, 20, 1579–1584. [Google Scholar] [CrossRef]

- Shi, H.; Zhang, X.; Zhou, J. Cross-listing and CSR performance: Evidence from AH shares. Front. Bus. Res. China 2018, 12, 11. [Google Scholar] [CrossRef]

- Ball, R.; Kothari, S.; Robin, A. The effect of international institutional factors on properties of accounting earnings. J. Account. Econ. 2000, 29, 1–51. [Google Scholar] [CrossRef]

- Chang, C.-S.; Yu, S.-W.; Hung, C.-H. Firm risk and performance: The role of corporate governance. Rev. Manag. Sci. 2014, 9, 141–173. [Google Scholar] [CrossRef]

- Bushman, R.M.; Smith, A.J. Financial accounting information and corporate governance. J. Account. Econ. 2001, 32, 237–333. [Google Scholar] [CrossRef]

- Crişan-Mitra, C.; Borza, A. Approaching CSR in Romania: An Empirical Analysis. Procedia Soc. Behav. Sci. 2015, 207, 546–552. [Google Scholar] [CrossRef][Green Version]

- Klapper, L.F.; Love, I. Corporate Guvernance Investor Protection, and Performance in Emerging Markets. J. Corp. Financ. 2004, 10, 287–322. [Google Scholar] [CrossRef]

- Black, B.S.; Love, I.; Rachinsky, A. Corporate governance indices and firms’ market values: Time series evidence from Russia. Emerg. Mark. Rev. 2006, 7, 361–379. [Google Scholar] [CrossRef]

- Ullah, W. Evolving corporate governance and firms performance: Evidence from Japanese firms. Econ. Gov. 2016, 18, 1–33. [Google Scholar] [CrossRef]

- Mishra, A.K.; Jain, S.; Manogna, R.L. Does corporate governance characteristics influence firm performance in India? Empirical evidence using dynamic panel data analysis. Int. J. Discl. Gov. 2020, 18, 71–82. [Google Scholar] [CrossRef]

- Rehman, M.A.; Shah, S.G.M.; Cioca, L.-I.; Artene, A. Accentuating the Impacts of Political News on the Stock Price, Working Capital and Performance: An Empirical Review of Emerging Economy. J. Econ. Forecast. 2021, 24, 55. [Google Scholar]

- Abidin, Z.Z.; Kamal, N.M.; Jusoff, K. Board Structure and Corporate Performance in Malaysia. Int. J. Econ. Financ. 2009, 1, 150–164. [Google Scholar] [CrossRef]

- Pucheta-Martínez, M.C.; Fuentes, C. The impact of audit committee characteristics on the enhancement of the quality of financial reporting: An empirical study in the Spanish context. Corp. Gov. 2007, 15, 1394–1412. [Google Scholar] [CrossRef]

- Drobetz, W.; Schillhofer, A.; Zimmermann, H. Corporate Governance and Firm Performance: Evidence from Germany; Working Paper. 2004. Available online: http://pages.unibas.ch/wwz/finanz/publications/researchpapers/10-03%20CorpGov.pdf (accessed on 24 October 2018).

- Hategan, C.-D.; Sirghi, N.; Curea-Pitorac, R.-I.; Hategan, V.-P. Doing Well or Doing Good: The Relationship between Corporate Social Responsibility and Profit in Romanian Companies. Sustainability 2018, 10, 1041. [Google Scholar] [CrossRef]

- Grove, H.; Basilico, E. Major Financial Reporting Frauds of the 21st Century: Corporate Governance and Risk Lessons Learned. J. Forensic Investig. Account. 2011, 3, 36. Available online: https://ssrn.com/abstract=2277524 (accessed on 23 August 2021).

- Vintila, G.; Paunescu, R.A. Empirical Analysis of the Connection between Financial Performance and Corporate Governance within Technology Companies Listed on NASDAQ Stock Exchange. J. Financ. Stud. Res. 2016, 2016, 1–20. [Google Scholar] [CrossRef]

- Finegold, D.; Benson, G.S.; Hecht, D. Corporate Boards and Company Performance: Review of research in light of recent reforms. Corp. Gov. Int. Rev. 2007, 15, 865–878. [Google Scholar] [CrossRef]

- Parmar, B.L.; Freeman, R.E.; Harrison, J.S.; Wicks, A.C.; Purnell, L.; de Colle, S. Stakeholder Theory:The State of the Art. Acad. Manag. Ann. 2010, 4, 403–445. [Google Scholar] [CrossRef]

- Gușe, R.G.; Almășan, A.; Circa, C.; Dumitru, M. The role of the stakeholders in the institutionalization of the CSR reporting in Romania. Account. Manag. Inf. Syst. 2016, 15, 304. [Google Scholar]

- Armstrong, C.S.; Guay, W.R.; Weber, J.P. The role of information and financial reporting in corporate governance and debt contracting. J. Account. Econ. 2010, 50, 179–234. [Google Scholar] [CrossRef]

- Ahmad, I.; Sadiqa, B.A.; Khan, R. The Impact of Corporate Governance Practices on the Firm Financial Performance of the Non-Financial Firms. Glob. Econ. Rev. 2021, 6, 53–70. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Paniagua, J.; Rivelles, R.; Sapena, J. Corporate governance and financial performance: The role of ownership and board structure. J. Bus. Res. 2018, 89, 229–234. [Google Scholar] [CrossRef]

- Kao, M.-F.; Hodgkinson, L.; Jaafar, A. Ownership structure, board of directors and firm performance: Evidence from Taiwan. Corp. Gov. Int. J. Bus. Soc. 2019, 19, 189–216. [Google Scholar] [CrossRef]

- Alahdal, W.; Alsamhi, M.H.; Tabash, M.I.; Farhan, N.H. The impact of corporate governance on financial performance of Indian and GCC listed firms: An empirical investigation. Res. Int. Bus. Financ. 2019, 51, 101083. [Google Scholar] [CrossRef]

- Peizhi, W.; Ramzan, M. Do corporate governance structure and capital structure matter for the performance of the firms? An empirical testing with the contemplation of outliers. PLoS ONE 2020, 15, e0229157. [Google Scholar] [CrossRef]

- Albu, C.N.; Girbina, M.M. Compliance with corporate governance codes in emerging economies. How do Romanian listed companies “comply-or-explain”? Corp. Gov. Int. J. Bus. Soc. 2015, 15, 85–107. [Google Scholar] [CrossRef]

- Rose, C. Firm performance and comply or explain disclosure in corporate governance. Eur. Manag. J. 2016, 34, 202–222. [Google Scholar] [CrossRef]

- Aluchna, M.; Kuszewski, T. Does Corporate Governance Compliance Increase Company Value? Evidence from the Best Practice of the Board. J. Risk Financ. Manag. 2020, 13, 242. [Google Scholar] [CrossRef]

- Siminica, M.; Cristea, M.; Sichigea, M.; Noja, G.G.; Anghel, I. Well-Governed Sustainability and Financial Performance: A New Integrative Approach. Sustainability 2019, 11, 4562. [Google Scholar] [CrossRef]

- Mwambuli, E.L. The Effects of Board Structure Characteristics on Corporate Financial Performance in Developing Economies: Evidence from East African Stock Markets. Eur. J. Bus. Manag. 2016, 8, 126–138. [Google Scholar]

- Villarón-Peramato, O.; Martinez-Ferrero, J.; Garcia-Sanchez, I.-M. CSR as entrenchment strategy and capital structure: Corporate governance and investor protection as complementary and substitutive factors. Rev. Manag. Sci. 2016, 12, 27–64. [Google Scholar] [CrossRef]

- Chiang, H.T.; He, L.J. Board supervision capability and information transparency. Corp. Gov. 2010, 18, 18–31. [Google Scholar] [CrossRef]

- Kouaib, A.; Mhiri, S.; Jarboui, A. Board of directors’ effectiveness and sustainable performance: The triple bottom line. J. High. Technol. Manag. Res. 2020, 31, 100390. [Google Scholar] [CrossRef]

- Chams, N.; García-Blandón, J. Sustainable or not sustainable? The role of the board of directors. J. Clean. Prod. 2019, 226, 1067–1081. [Google Scholar] [CrossRef]

- Martínez, M.D.C.V.; Rambaud, S.C.; Oller, I.M.P. Gender policies on board of directors and sustainable development. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 1539–1553. [Google Scholar] [CrossRef]

- Nicolo’, G.; Zanellato, G.; Manes-Rossi, F.; Tiron-Tudor, A. Beyond Financial Reporting. Integrated Reporting and its determinants: Evidence from the context of European state-owned enterprises. Financ. Rep. 2019, 72, 43–72. [Google Scholar] [CrossRef]

- Rathnayake, D.N.; Sun, G. Corporate Ownership, Governance and Performance: Evidence form Asian Countries. Res. J. Financ. Account. 2017, 8, 28–36. [Google Scholar]

- Uadiale, O. Impact of Board Structure on Performance in Nigeria. Int. J. Bus. Manag. 2010, 5, 155–166. [Google Scholar]

- An, Z.; Li, D.; Yu, J. Earnings management, capital structure, and the role of institutional environments. J. Bank. Financ. 2016, 68, 131–152. [Google Scholar] [CrossRef]

- Beasley, M.; Carcello, J.; Hermanson, D.; Lapides, P.D. Fraudulent Financial Reporting: Consideration of Industry Traits and Corporate Governance Mechanisms. Account. Horiz. 2000, 14, 441–454. [Google Scholar] [CrossRef]

- O’Sullivan, N. The impact of board composition and ownership on audit quality: Evidence from large UK companies. Br. Account. Rev. 2000, 32, 397–414. [Google Scholar] [CrossRef]

- Fabrizi, M.; Mallin, C.; Michelon, G. The Role of CEO’s Personal Incentives in Driving Corporate Social Responsibility. J. Bus. Ethic. 2013, 124, 311–326. [Google Scholar] [CrossRef]

- Weir, C.; Laing, D. The Performance-Governance Relationship: The Effects of Cadbury Compliance on UK Quoted Companies. J. Manag. Gov. 2000, 4, 265–281. [Google Scholar] [CrossRef]

- Lloret, A. Modeling corporate sustainability strategy. J. Bus. Res. 2016, 69, 418–425. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Weisbach, M.S. The State of Corporate Governance Research. Rev. Financ. Stud. 2010, 23, 939–961. [Google Scholar] [CrossRef]

- Lozano, M.B.; Martínez, B.; Pindado, J. Corporate governance, ownership and firm value: Drivers of ownership as a good corporate governance mechanism. Int. Bus. Rev. 2016, 25, 1333–1343. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Hurghis, R.; Lacurezeanu, R.; Podoaba, L. The Level of European Companies’ Integrated Reports Alignment to the Framework: The Role of Boards’ Characteristics. Sustainability 2020, 12, 8777. [Google Scholar] [CrossRef]

- Claessens, S.; Yurtoglu, B.B. Corporate governance in emerging markets: A survey. Emerg. Mark. Rev. 2013, 15, 1–33. [Google Scholar] [CrossRef]

- Akbar, A. The Role of Corporate Governance Mechanism in Optimizing Firm Performance: A Conceptual Model for Corporate Sector of Pakistan. J. Asian Bus. Strategy 2015, 5, 109–115. [Google Scholar]

- Chen, C.-C.; Chen, C.-D.; Lien, D. Financial Distress Prediction Model: The Effects of Corporate Governance Indicators. J. Forecast. 2020, 39, 1238–1252. [Google Scholar] [CrossRef]

- Bucharest Stock Exchange. Corporate Governance Code. 2015. Available online: https://www.bvb.ro/info/Rapoarte/Diverse/RO_Cod%20Guvernanta%20Corporativa_WEB_revised.pdf. (accessed on 16 September 2021).

- Baltes-Götz, B. Lineare Regressions Analyse Mit SPSS. Available online: http://www.uni-trier.de/urt/user/baltes/docs/linreg/linreg.pdf. (accessed on 27 October 2020).

- Lozano, R. A Holistic Perspective on Corporate Sustainability Drivers. Corp. Soc. Responsib. Environ. Manag. 2013, 22, 32–44. [Google Scholar] [CrossRef]

- Bucharest Stock Exchange. 2018. Available online: http://bvb.ro/TradingAndStatistics/Publications/DailyReport# (accessed on 2 August 2021).

- Gino, F. Understanding ordinary unethical behavior: Why people who value morality act immorally. Curr. Opin. Behav. Sci. 2015, 3, 107–111. [Google Scholar] [CrossRef]

- Uddin, M.N.; Hosen, M.; Chowdhury, S.A.; Chowdhury, M.M.; Alam Mazumder, M. Does Corporate Governance Influence the Firm Value in Bangladesh? A Panel Data Analysis. EM Econ. Manag. 2021, 24, 84–100. [Google Scholar] [CrossRef]

| Variable | Test Results 1 | SCA | MCA | ACA | CEO | RNC |

|---|---|---|---|---|---|---|

| RNC | Pearson Correlation | 0.09 | 0.305 ** | −0.069 | 0.189 * | 1 |

| Sig. (2-tailed) | 0.227 | 0 | 0.358 | 0.011 | ||

| N | 50 | 50 | 50 | 50 | ||

| PER | Pearson Correlation | 0.017 | −0.198 ** | −0.104 | −0.107 | 1 |

| Sig. (2-tailed) | 0.835 | 0.015 | 0.203 | 0.192 | ||

| N | 50 | 50 | 50 | 50 | ||

| EPS | Pearson Correlation | −0.114 | −0.057 | 0.014 | 0.119 | 1 |

| Sig. (2-tailed) | 0.211 | 0.328 | 0.879 | 0.19 | ||

| N | 50 | 50 | 50 | 50 |

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|

| RNC | 0.344a | 0.118 | 0.098 | 94.25689684 |

| PER | 0.244a | 0.059 | 0.034 | 51.85434575 |

| EPS | 0.264a | 0.070 | 0.030 | 1.66697448 |

| Model 1 | RNC | PER | EPS |

|---|---|---|---|

| Intercept | −73.241 | 45.9808 | 0.391 |

| SCA | 0.091 | 0.030 | −0.225 * |

| MCA | 0.297 ** | −0.178 * | 0.132 |

| ACA | −0.047 | −0.102 | 0.032 |

| CEO | 0.087 | −0.122 | 0.216 * |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dănescu, T.; Spătăcean, I.-O.; Popa, M.-A.; Sîrbu, C.-G. The Impact of Corporate Governance Mechanism over Financial Performance: Evidence from Romania. Sustainability 2021, 13, 10494. https://doi.org/10.3390/su131910494

Dănescu T, Spătăcean I-O, Popa M-A, Sîrbu C-G. The Impact of Corporate Governance Mechanism over Financial Performance: Evidence from Romania. Sustainability. 2021; 13(19):10494. https://doi.org/10.3390/su131910494

Chicago/Turabian StyleDănescu, Tatiana, Ioan-Ovidiu Spătăcean, Maria-Alexandra Popa, and Carmen-Gabriela Sîrbu. 2021. "The Impact of Corporate Governance Mechanism over Financial Performance: Evidence from Romania" Sustainability 13, no. 19: 10494. https://doi.org/10.3390/su131910494

APA StyleDănescu, T., Spătăcean, I.-O., Popa, M.-A., & Sîrbu, C.-G. (2021). The Impact of Corporate Governance Mechanism over Financial Performance: Evidence from Romania. Sustainability, 13(19), 10494. https://doi.org/10.3390/su131910494