Residents’ Willingness to Pay for a Carbon Tax

Abstract

:1. Introduction

1.1. Introduction and Problem Statement

1.2. Literature Gap

2. Materials and Methods

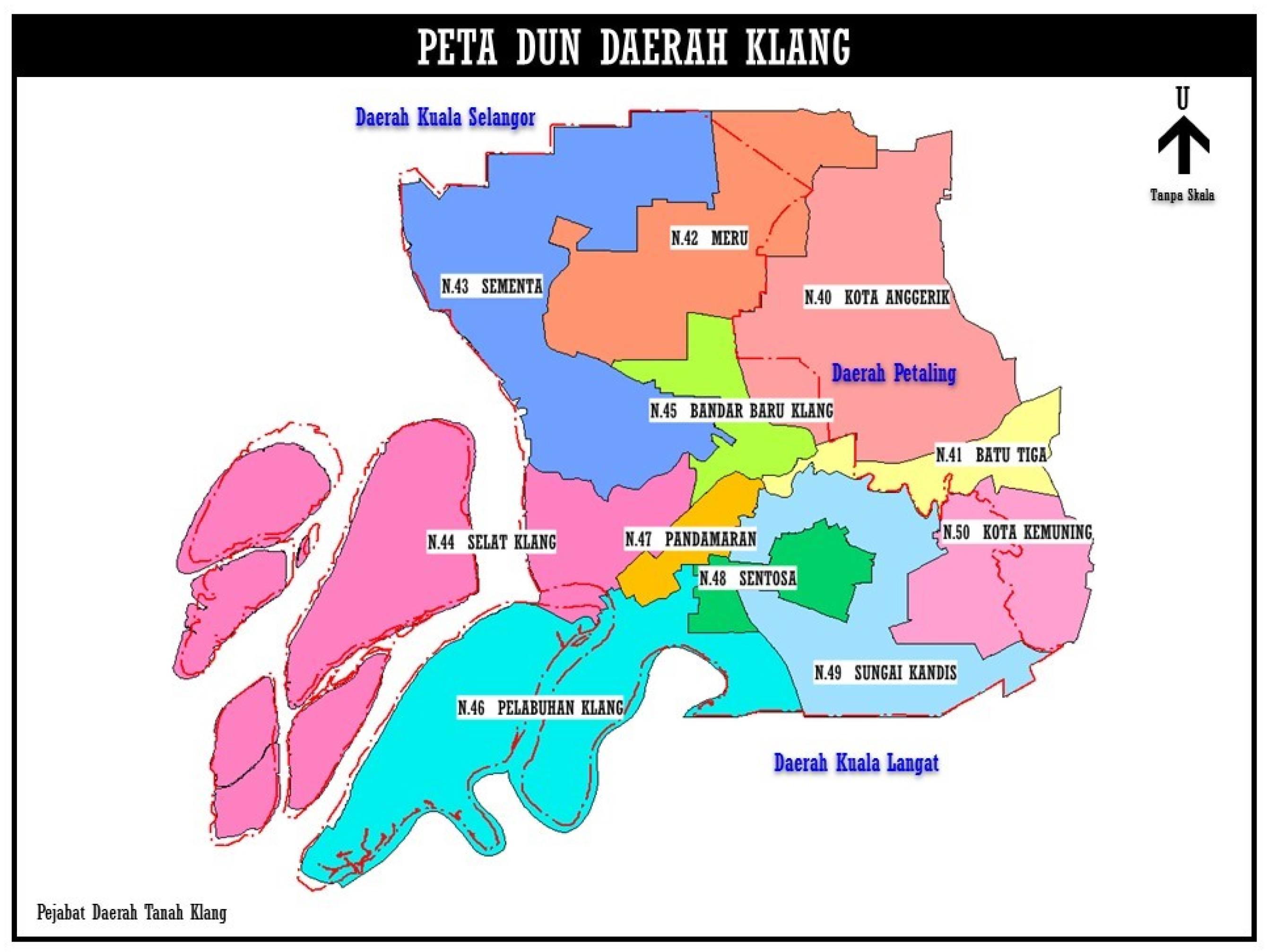

2.1. Research Location

2.2. Model Specification for Double Bound CVM and Open-Ended CVM

2.3. Research Design

2.3.1. Data Sources

2.3.2. Questionnaire Design and Structure

- The amount of willingness to pay is based on the ability to pay once every year.

2.4. Validity and Reliability Analysis

2.5. Open-Ended CVM

2.6. Sampling Technique

2.7. Data Analysis

3. Results and Discussion

3.1. General Information on Respondent Demographic

3.2. General Information on Air Quality in Klang, Selangor

3.3. General Information on Residents’ Knowledge of Greenhouse Gases Emission

3.4. General Information on Residents’ Attitude towards Greenhouse Gases Emission Reduction

3.5. General Information on the Willingness to Pay Responses

3.5.1. Single Bound CVM and Double Bound CVM

3.5.2. Estimation of WTP for Open-Ended and Double Bound CVM

3.5.3. Open-Ended CVM

3.5.4. Double Bound CVM

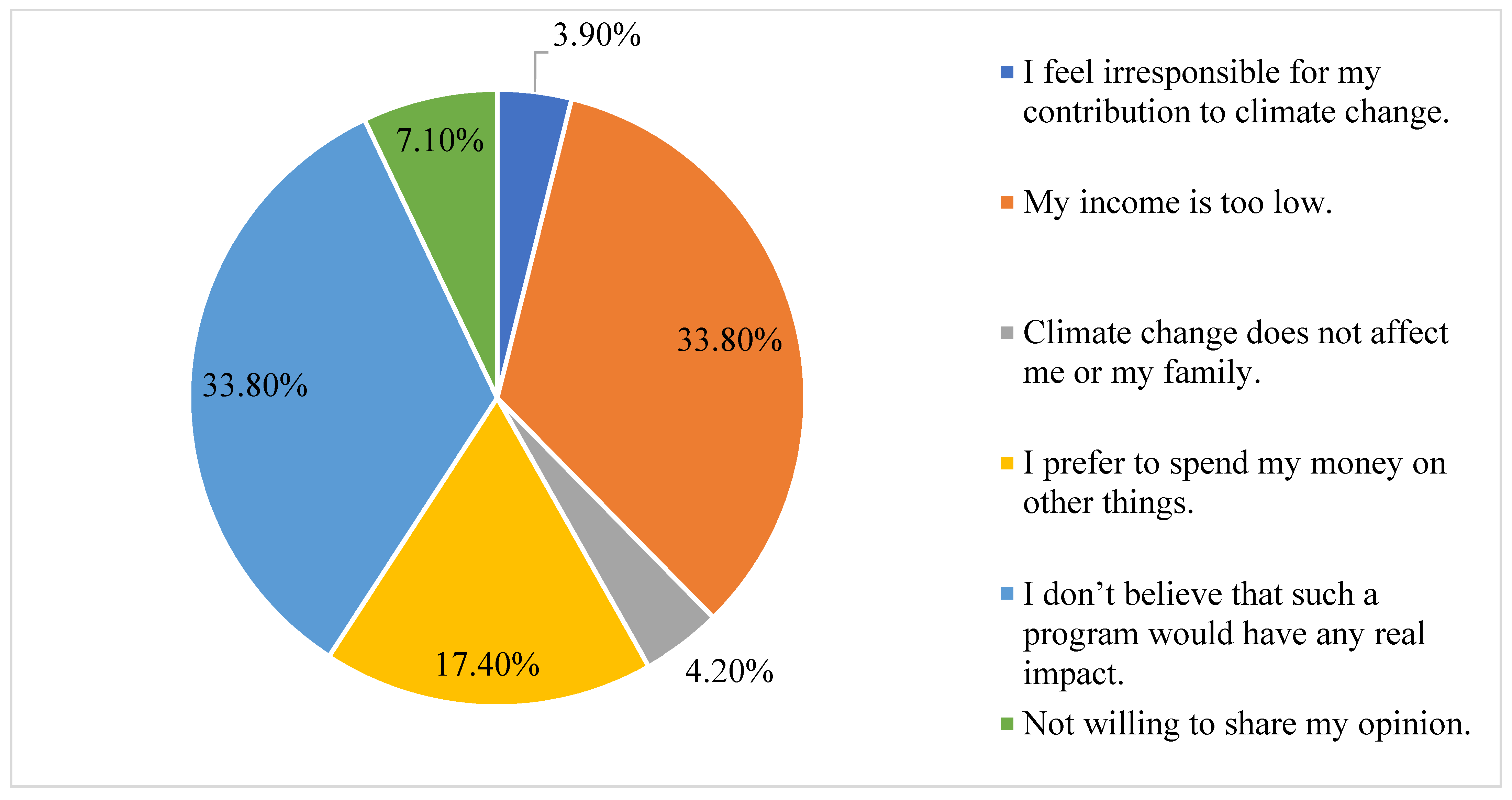

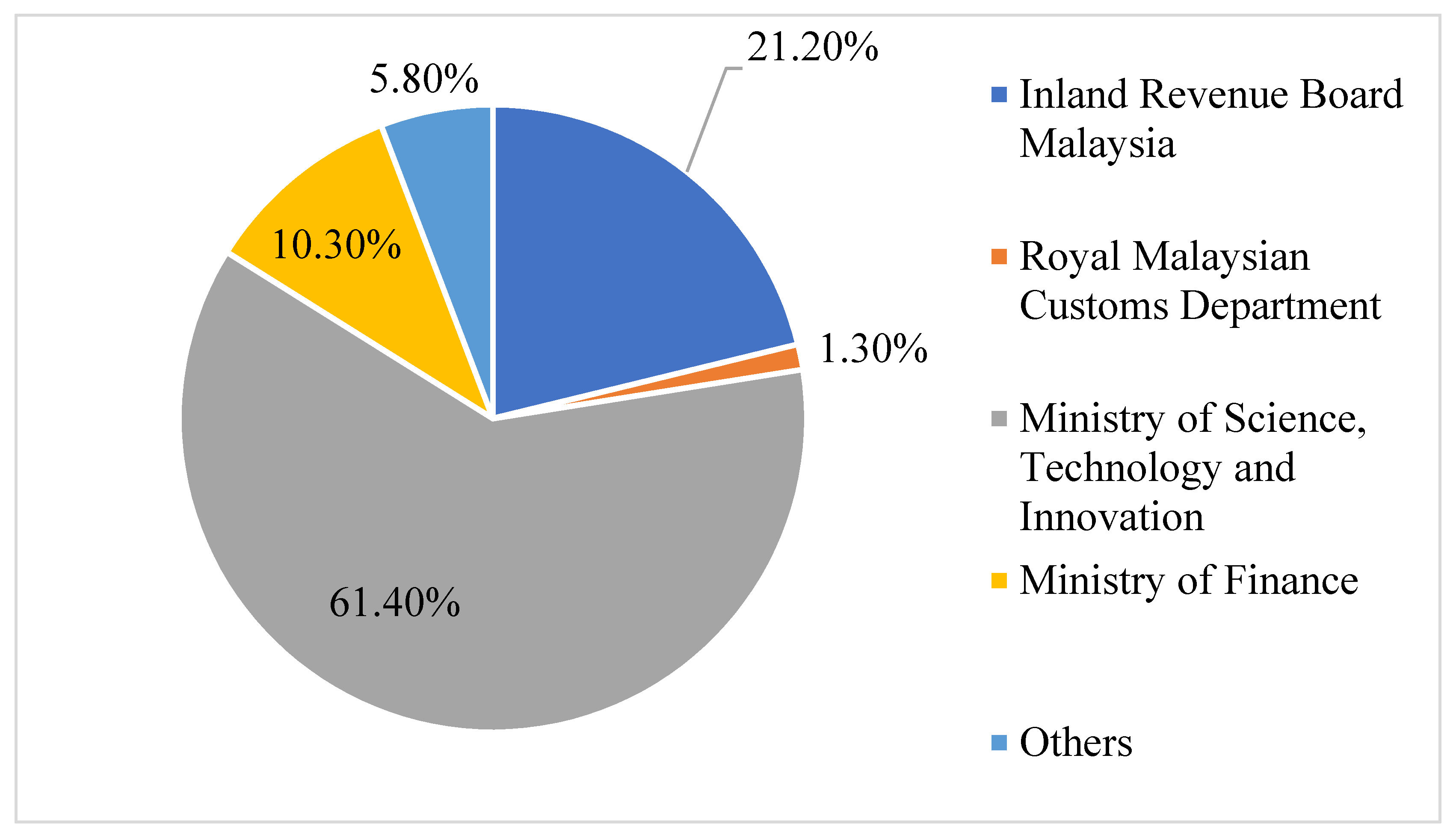

3.5.5. Reasons

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Shah, R.M.; Yunus, R.M.; Kadhum, A.A.H.; Yin, W.W. Kajian fotomangkin berasaskan grafin untuk penurunan karbon dioksida. J. Kejuruter. SI 2018, 1, 19–32. [Google Scholar]

- Centi, G.; Perathoner, S. Opportunities and prospects in the chemical recycling of carbon dioxide to fuels. Catal. Today 2009, 148, 191–205. [Google Scholar] [CrossRef]

- Jiang, Z.; Xiao, T.; Kuznetsov, V.L.; Edwards, P.P. Turning carbon dioxide into fuel. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2010, 368, 3343–3364. [Google Scholar] [CrossRef] [PubMed]

- Idris, N.; Mahmud, M. Kajian jejak karbon di Kuala Lumpur. E-Bangi J. Soc. Sci. Humanit. 2017, 12, 165–182. [Google Scholar]

- IPCC. Global Warming of 1.5 °C. 20 April 2020. Available online: https://www.ipcc.ch/sr15/ (accessed on 7 May 2020).

- Liu, W.; Liu, T.; Li, Y.; Liu, M. Recycling carbon tax under different energy efficiency improvements: A CGE analysis of China. Sustainability 2021, 13, 4804. [Google Scholar] [CrossRef]

- Fong, W.K.; Matsumoto, H.; Ho, C.S.; Lun, Y.F. Energy consumption and carbon dioxide emission considerations in the urban planning process in Malaysia. PLanning Malays. 2008, 6, 30. [Google Scholar]

- Ghazouani, A.; Xia, W.; Ben Jebli, M.; Shahzad, U. Exploring the role of carbon taxation policies on CO2 emissions: Contextual evidence from tax implementation and non-implementation European countries. Sustainability 2020, 12, 8680. [Google Scholar] [CrossRef]

- IGES. Urban Energy Use and Greenhouse Gas Emission in Asian Mega Cities: Policies for a Sustainable Future; Kanagawa; Institute of Global Environmental Strategies: Hayama, Japan, 2004. [Google Scholar]

- Chik, N.A.; Rahim, K.A.; Radam, A.; Shamsudin, M.N. CO2 emissions induced by household’s lifestyle in Malaysia. Int. J. Bus. Soc. 2013, 14, 344–357. [Google Scholar]

- Rydge, J. Implementing effective carbon pricing. New Clim. Econ. 2015, 1–24. Available online: http://2015.newclimateeconomy.report/wpcontent/uploads/2015/10/Implementing-Effective-Carbon-Pricing.pdf (accessed on 19 May 2020).

- The World Bank. State and Trends of Carbon Pricing 2015. 11 March 2015. Available online: http://data.worldbank.org/indicator (accessed on 21 May 2020).

- Council of the European Union. Energy Intensive Industries. 2017. Volume 2019. Available online: https://www.consilium.europa.eu/register/nl/content/out/?&DOC_LANCD=EN&typ=ENTRY&i=ADV&DOC_ID=ST-8263-2017-INIT (accessed on 13 May 2020).

- Awang, A.; Ali, S.S.S.; Razman, M.R. Tren penggunaan tenaga elektrik dan pembebasan gas rumah hijau di Malaysia. Asian J. Environ. Hist. Herit. 2019, 3, 39–45. [Google Scholar]

- Department of Statistic Malaysia. Air Pollutant Emission, 2011–2018. 2019. Available online: https://newss.statistics.gov.my/ (accessed on 16 May 2020).

- Knoema. Malaysia—Total CO2 Emissions from Fossil Fuels. 2020. Available online: https://knoema.com/atlas/Malaysia/topics/Environment/CO2-Emissions-from-Fossil-fuel/CO2-emissions-from-fossil-fuels (accessed on 13 May 2020).

- OECD. OECD Economic Surveys Malaysia July 2019; OECD Publications: Paris, France, 2019. [Google Scholar]

- Ling, C.C.; Leong, C.Z.; Chuen, G.P.; Vern, L.S.; Hong, L.Z. Carbon Dioxide (CO2) Emissions and GDP by Sectors: A study of Five Selected ASEAN Countries. 2017. Available online: http://eprints.utar.edu.my/2687/1/fyp-BF-1206547-CZL.pdf (accessed on 14 May 2020).

- Solarin, S.A. Tourist arrivals and macroeconomic determinants of CO2 emissions in Malaysia. Anatolia Int. J. Tour. Hosp. Res. 2014, 25, 228–241. [Google Scholar]

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- Khoo, E. Malaysia Continue Efforts to Reduce Carbon Footprint. 19 September 2019. Available online: https://www.theedgemarkets.com/article/malaysia-continues-efforts-reduce-carbon-footprint (accessed on 18 May 2020).

- Othman, J.; Yahoo, M. Reducing CO2 emissions in Malaysia: Do carbon taxes work? Pros. PERKEM 2014, 9, 17–19. [Google Scholar]

- Masahina, S.; Afroz, R.; Duasa, J.; Mohamed, N. A framework to estimate the willingness to pay of household for air quality improvement: A case study in Klang Valley, Malaysia. OIDA Int. J. Sustain. Dev. 2012, 4, 11–16. [Google Scholar]

- Department of Environment. Air Quality. 2020. Available online: https://www.doe.gov.my/portalv1/en/awam/maklumat-alam-sekitar/kualiti-udara (accessed on 20 May 2020).

- Noor, N.M.; Yahaya, A.S.; Ramli, N.A.; Luca, F.A.; Al Bakri Abdullah, M.M.; Sandu, A.V. Variation of air pollutant (particulate matter—PM10) in Peninsular Malaysia: Study in the southwest coast of Peninsular Malaysia. Rev. De Chim. 2015, 66, 1443–1447. [Google Scholar]

- MOH. Laporan. 2020. Available online: https://www2.moh.gov.my/index.php/pages/view/971?mid=55 (accessed on 22 May 2020).

- WHO. World Report on Violence and Health; World Health Organization: Geneva, Switzerland, 2002. [Google Scholar]

- Peng, X.Z.; Tian, W.H. Study on willingness to pay about air pollution on economic loss in Shanghai. World Econ. Forum 2003, 3, 32–44. [Google Scholar]

- Salcone, J.; Brander, L.; Seidl, A. Economic Valuation of Marine and Coastal Ecosystem Services in the Pacific Guidance Manual; Fernandes, L., Ed.; Report to the MACBIO Project; GIZ, IUCN, SPREP: Suva, Fiji, 2016; Available online: https://www.researchgate.net/publication/319244012_Economic_valuation_of_marine_and_coastal_ecosystem_services_in_the_Pacific_Guidance_manual (accessed on 23 May 2020).

- Rizali, R.; Sa’roni, C.; Sopiana, Y.; Muzdalifah, M. Estimasi keinginan membayar (willingness to pay) terhadap udara bersih untuk penentuan pajak emisi (survei terhadap pelanggan bengkel uji emisi di Kota Banjarmasin). At-Taradhi J. Studi Ekon. 2017, 8, 65. [Google Scholar] [CrossRef]

- Duan, H.X.; Lü, Y.L.; Li, Y. Chinese public’s willingness to pay for CO2 emissions reductions: A case study from four provinces/cities. Adv. Clim. Chang. Res. 2014, 5, 100–110. [Google Scholar] [CrossRef]

- Carlsson, F.; Kataria, M.; Krupnick, A.; Lampi, E.; Löfgren, Å.; Qin, P.; Chung, S.; Sterner, T. Paying for mitigation: A multiple country study. Land Econ. 2012, 88, 326–340. [Google Scholar] [CrossRef] [Green Version]

- Dütschke, E.; Schleich, J.; Schwirplies, C.; Ziegler, A. German Consumers’ Willingness to Pay for Carbon Emission Reductions: An Empirical Analysis of Context Dependence and Provider Participation; EEA: Mannheim, Germany, 2015. [Google Scholar]

- Schwirplies, C.; Dütschke, E.; Schleich, J.; Ziegler, A. Consumers’ Willingness to Offset Their CO2 Emissions from Traveling; Working Paper Sustainability and Innovation; EconStor: Kiel, Germany, 2017. [Google Scholar]

- Eluwa, S.E.; Siong, H.C. Willingness to engage in energy conservation and CO2 emissions reduction: An empirical investigation. IOP Conf. Ser. Earth Environ. Sci. 2014, 18. [Google Scholar] [CrossRef] [Green Version]

- Shaari, N.F.; Abdul-Rahim, A.S.; Afandi, S.H.M. Are Malaysian airline passengers willing to pay to offset carbon emissions? Environ. Sci. Pollut. Res. 2020, 27, 24242–24252. [Google Scholar] [CrossRef]

- Fatihah, S.N.; Rahim, A.A. The willingness to pay of air travel passengers to offset their carbon dioxide (CO2) emissions: A Putrajaya resident case study. J. Tour. Hosp. Environ. Manag. 2017, 2, 15. [Google Scholar]

- Bazrbachi, A.; Sidique, S.F.; Shamsudin, M.N.; Radam, A.; Kaffashi, S.; Adam, S.U. Willingness to pay to improve air quality: A study of private vehicle owners in Klang Valley, Malaysia. J. Clean. Prod. 2017, 148, 73–83. [Google Scholar] [CrossRef]

- Akhtar, S.; Saleem, W.; Nadeem, V.M.; Shahid, I.; Ikram, A. Assessment of willingness to pay for improved air quality using contingent valuation method. Glob. J. Environ. Sci. Manag. 2017, 3, 279–286. [Google Scholar] [CrossRef]

- Lu, J.L.; Shon, Z.Y. Exploring airline passengers’ willingness to pay for carbon offsets. Transp. Res. Part D Transp. Env. 2012, 17, 124–128. [Google Scholar] [CrossRef]

- Chang, G. Rural residents’ understanding and willingness to pay higher prices for mitigation against global warming in China. Int. J. Clim. Chang. Strateg. Manag. 2018, 10, 711–728. [Google Scholar] [CrossRef] [Green Version]

- APIMS. Air Pollutant Index of Malaysia. 2020. Available online: http://apims.doe.gov.my/public_v2/api_table.html (accessed on 27 May 2020).

- Department of Statistic Malaysia. Malaysia Statistical Handbook 2019; Pusat Pentadbiran Kerajaan Persekutuan; Department of Statistic Malaysia: Putrajaya, Malaysia, 2019. [Google Scholar]

- Ministry of Transport Malaysia. 2019. Available online: https://www.mot.gov.my/en/browse-by-topic/reports-and-stats (accessed on 16 May 2020).

- Tolunay, A.; Başsüllü, Ç. Willingness to pay for carbon sequestration and co-benefits of forests in Turkey. Sustainability 2015, 7, 3311–3337. [Google Scholar] [CrossRef] [Green Version]

- Nastis, S.A.; Mattas, K. Income elasticity of willingness-to-pay for a carbon tax in Greece. Int. J. Glob. Warm. 2018, 14, 510–524. [Google Scholar] [CrossRef]

- Blasch, J. Consumers’ valuation of voluntary carbon offsets—A choice experiment in Switzerland. J. Environ. Econ. Policy 2013, 1–27. Available online: https://www.unine.ch/files/live/sites/irene/files/shared/documents/SSES/Blasch.pdf (accessed on 23 June 2020).

- Tsang, F.; Burge, P. Paying for Carbon Emissions Reduction; Rand Corporation: Santa Monica, CA, USA, 2011. [Google Scholar]

- Kotchen, M.J.; Turk, Z.M.; Leiserowitz, A.A. Public willingness to pay for a US carbon tax and preferences for spending the revenue. Environ. Res. Lett. 2017, 12. [Google Scholar] [CrossRef] [Green Version]

- Jones, B.A.; Ripberger, J.; Jenkins-Smith, H.; Silva, C. Estimating willingness to pay for greenhouse gas emission reductions provided by hydropower using the contingent valuation method. Energy Policy 2017, 111, 362–370. [Google Scholar] [CrossRef]

- Diederich, J.; Goeschl, T. Willingness to pay for individual greenhouse gas emissions reductions: Evidence from a large field experiment. Environ. Resour. Econ. 2011, 57, 517. [Google Scholar]

- Brouwer, R.; Brander, L.; Van Beukering, P. “A convenient truth”: Air travel passengers’ willingness to pay to offset their CO2 emissions. Clim. Chang. 2008, 90, 299–313. [Google Scholar] [CrossRef] [Green Version]

- Gupta, M. Willingness to pay for carbon tax: A study of Indian road passenger transport. Transp. Policy 2016, 45, 46–54. [Google Scholar] [CrossRef]

- Rotaris, L.; Danielis, R. The willingness to pay for a carbon tax in Italy. Transp. Res. Part D Transp. Environ. 2019, 67, 659–673. [Google Scholar] [CrossRef]

- Jou, R.C.; Chen, T.Y. Willingness to pay of air passengers for carbon-offset. Sustainability 2015, 7, 3071–3085. [Google Scholar] [CrossRef] [Green Version]

- Zhao, Y.; Wang, C.; Sun, Y.; Liu, X. Factors influencing companies’ willingness to pay for carbon emissions: Emission trading schemes in China. Energy Econ. 2018, 75, 357–367. [Google Scholar] [CrossRef]

- Zhang, K.; Wang, Q.; Liang, Q.; Chen, H. A bibliometric analysis of research on carbon tax from 1989 to 2014. Sust. Energy Rev. 2016, 58, 297–310. [Google Scholar] [CrossRef]

- Abdullah, A.M.; Abu Samah, M.A.; Jun, T.Y. An overview of the air pollution trend in Klang Valley, Malaysia. Open Environ. Sci. 2012, 6, 13–19. [Google Scholar] [CrossRef] [Green Version]

- Department of Survey and Mapping Malaysia. Station: Pelabuhan Klang, Selangor. 2019. Available online: https://www.jupem.gov.my/page/station-pelabuhan-klang-selangor-1 (accessed on 1 July 2020).

- Klang Land and District Office Peta DUN Daerah Klang. 10 September 2019; 2021. Available online: https://www.selangor.gov.my/klang.php/pages/view/98 (accessed on 1 July 2020).

- Curry, T.E. Public Awareness of Carbon Capture and Storage: A Survey of Attitudes toward Climate Change Mitigation. 2004. Available online: http://sequestration.mit.edu/pdf/Tom_Curry_Thesis_June2004.pdf (accessed on 9 July 2020).

- Hanemann, M.; Loomis, J.; Kanninen, B. Statistical efficiency of double-bounded dichotomous choice contingent valuation. Am. J. Agric. Econ. 1991, 73, 1255–1263. [Google Scholar] [CrossRef]

- Heale, R.; Twycross, A. Validity and reliability in quantitative studies. Evid.-Based Nurs. 2015, 18, 66–67. [Google Scholar] [CrossRef] [Green Version]

- Retnawati, H. Proving content validity of self-regulated learning scale (The comparison of Aiken index and expanded Gregory index). Router A J. Cult. Stud. 2016, 22, 123–146. Available online: http://routerjcs.nctu.edu.tw/router/word/11542212017.pdf (accessed on 12 July 2020). [CrossRef] [Green Version]

- Shrotryia, V.K.; Dhanda, U. Content validity of assessment instrument for employee engagement. SAGE Open 2019, 9. [Google Scholar] [CrossRef] [Green Version]

- Rodrigues, I.B.; Adachi, J.D.; Beattie, K.A.; MacDermid, J.C. Development and validation of a new tool to measure the facilitators, barriers and preferences to exercise in people with osteoporosis. BMC Musculoskelet. Disord. 2017, 18, 1–9. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Shi, J.; Mo, X.; Sun, Z. Content validity index in scale development. J. Cent. South Univ. Med Sci. 2012, 37, 152–155. [Google Scholar] [CrossRef]

- Kuder, G.F.; Richardson, M.W. The theory of the estimation of test reliability. Psychometrika 1937, 2, 151–160. [Google Scholar] [CrossRef]

- Faizal, M.; Lee, N.; Leow, A.; Wei, T. Kesahan dan kebolehpercayaan instrumen penilaian kendiri pembelajaran geometri tingkatan satu (Learning form one geometry: Validity and reliability of a self-evaluation instrument). Malays. J. Learn. Instr. 2017, 14, 211–265. [Google Scholar]

- Pallant, J. SPSS Survival Manual: A Step by Step Guide to Data Analysis Using SPSS, 4th ed.; Open University Press: Buckingham, London, UK, 2005; Volume 181. [Google Scholar]

- Li, H.; Jenkins-Smith, H.C.; Silva, C.L.; Berrens, R.P.; Herron, K.G. Public support for reducing US reliance on fossil fuels: Investigating household willingness-to-pay for energy research and development. Ecol. Econ. 2009, 68, 731–742. [Google Scholar] [CrossRef]

- Honu, B. Contingent Valuation Method for General Practitioners: A Cookbook Approach. Inst. Dev. Stud. 2007, 11, 83–96. [Google Scholar]

- Yamane, T. Statistics, An Introductory Analysis; Harper & Row: New York, NY, USA, 1970. [Google Scholar]

- Yeo, H.Y.; Shafie, A.A. The acceptance and willingness to pay (WTP) for hypothetical dengue vaccine in Penang, Malaysia: A contingent valuation study. Cost Eff. Resour. Alloc. 2018, 16, 1–10. [Google Scholar] [CrossRef] [PubMed]

- Lendal, K. Management by Menu London; Wiley and Son Inc.: Hoboken, NJ, USA, 1997. [Google Scholar]

- Chen, S. The Urbanisation Impacts on the Policy Effects of the Carbon Tax in China. Sustainability 2021, 13, 6749. [Google Scholar] [CrossRef]

- Krupnick, A.J.; Rowe, R.D.; Lang, C.M. Transportation and air pollution: The environmental damages. In The Full Costs and Benefits of Transportation; Springer: Berlin/Heidelberg, Germany, 1997; Volume 1, pp. 337–369. [Google Scholar]

- Cropper, M.N.; Simon, N.B.; Alberini, A.; Arora, S.; Sharma, P.K. The health benefits of air pollution control in Delhi. Am. J. Agric. Econ. 1997, 79, 1625–1629. [Google Scholar] [CrossRef] [Green Version]

- Ameyaw, B.; Yao, L. Analysing the impact of GDP on CO2 emissions and forecasting Africa’s total CO2 emissions with non-assumption driven bidirectional long short-term memory. Sustainability 2018, 10, 3110. [Google Scholar] [CrossRef] [Green Version]

- Safian, S.S.S.; Hamzah, H.Z. Consumers’ willingness to pay (WTP) of special tax for non-green vehicles towards environmental performance in Malaysia. J. Tour. Hosp. Environ. Manag. 2019, 66–77. [Google Scholar] [CrossRef]

- Deutch, J.; Moniz, E.; Ansolabehere, S.; Driscoll, M.; Gray, P.E.; Holdren, J.P.; Joskow, P.L.; Lester, R.K.; Todreas, N.E. The Future of Nuclear Power: An Interdisciplinary MIT Study; MIT: Cambridge, MA, USA, 2003. [Google Scholar]

- Harris Interactive. Majorities Continue to Believe in Global Warming and Support Kyoto Treaty Harris Interactive. 2002. Available online: http://www.harrisinteractive.com/harris_poll/printerfriend/index.asp?PID=335 (accessed on 26 October 2020).

- Baranzini, A.; Goldemberg, J.; Speck, S. A future for carbon taxes. Ecol. Econ. 2000, 32, 395–412. [Google Scholar] [CrossRef]

- Khoiriyah, S.; Suam Toro, M.J. Faktor-Faktor Yang Mempengaruhi Kesediaan Membeli Produk Hijau. J. Bisnis Manaj. 2014, 1, 63–76. [Google Scholar]

- Masud, M.M.; Al-Amin, A.Q.; Akhtar, R.; Kari, F.; Afroz, R.; Rahman, M.S.; Rahman, M. Valuing climate protection by offsetting carbon emissions: Rethinking environmental governance. J. Clean. Prod. 2015, 89, 41–49. [Google Scholar] [CrossRef] [Green Version]

- Chin, Y.S.J.; De Pretto, L.; Thuppil, V.; Ashfold, M.J. Public awareness and support for environmental protection-A focus on air pollution in peninsular Malaysia. PLoS ONE 2019, 14, e0212206. [Google Scholar] [CrossRef] [PubMed]

| Author | Country | Type of Carbon Tax | Method of Study | Factors | WTP (Price per Unit) |

|---|---|---|---|---|---|

| Brouwer et al. (2008) | United Kingdom | Emission based | CVM (Open ended, Double bounded) | Nationality, Flying frequency, Awareness, Price ticket, Household income | €25 (RM122.02) per ton CO2-eq |

| Carlsson et al. (2010) | Sweden, China, United States | Emission based | CVM (Open ended, Payment card) | Gender, Age, Household size, Education, Income, Religious, Political affiliation | 2000 SEK (RM972.88) per year per household |

| Diederich and Goeschl (2011) | Germany | Emission based | CVM (Single bounded, Payment card) | Cash prize, Gender, Age, Number of children, Education, Personal benefit, Future benefit, Lifestyle, Carbon footprint | €6.30 (RM30.75) per ton of CO2 |

| Tsang and Burge (2011) | United Kingdom | Emission based | CVM (Iterative bidding) | Level of income, Social-economic background | Between £1.45 (RM7.97) and £2.97 (RM16.33) per year |

| Blasch (2013) | Switzerland | Emission based | CVM (Single bounded, Payment card) | Age, Gender, Academic level, Monthly gross income, Marital status, Knowledge of offsetting | 78 CHF (RM349.35) per tCO2 |

| Duan et al. (2014) | China | Emission based | CVM (Open ended, Iterative bidding) | Gender, Annual income, Education, Political orientation, Member of environmental organisation, House ownership, Car ownership | CNY201.86 (RM124.29) per year or CNY16.82 (RM10.36) per month for each person |

| Jou and Chen (2015) | Taiwan | Emission based | CVM (Open ended, Single bounded) | Education level, Annual number of flights, Monthly income, Age, Gender | NT$39.05 (RM5.91) per passenger |

| Tolunay and Başsüllü (2015) | Turkey | Emission based | CVM (Open ended, Payment card) | Unplanned urbanisation, Residence, Age, Gender, Marital status, Occupation, Number of household members, Income per capita | US$23.52 (RM94.61) per consumer |

| Gupta (2016) | India | Emission based | CVM (Open ended, Single bounded) | Interest, Environmental activeness, Use of public transport, Quality of public transport, Age, Education, Family size, Individual income | Rs581.5 (RM32) per people |

| Bazrbachi et al. (2017) | Malaysia | Emission based | CVM (Single bounded) | Gender, Age, Efficiency of public transport, Education level, Health index, Income, Air pollution concern | RM4.99 per trip |

| Akhtar et al. (2017) | Pakistan | Emission based | CVM (Open ended, Single bounded) | Gender, Age, Education level, Marital status, Number of children, Number of households, Monthly income, Air quality area | US$9.86 (RM39.66) per month or US$118 (RM474.65) per year |

| Jones et al. (2017) | United States | Emission based | CVM (Open ended, Single bounded) | Age, Education, Gender, Ideology, Income, Attitudinal belief | US$3.66 (RM14.72) per year per household |

| Kotchen et al. (2017) | United States | Emission based | CVM (Single bounded, Double bounded) | Education, Gender, Household size, Income, Age | US$177 (RM711.98) annually |

| Rizali et al. (2017) | Indonesia | Emission based | Open ended CVM | Car ownership, Level of education, Car insurance availability | Rp 432.182,70 (RM1225.12) average per year |

| Schwirplies et al. (2017) | Germany | Emission based | CVM (Iterative bidding) | Level of contribution, Politics, Religious, Age, Gender, Number of children, Education level, Residents, Compensation scheme | €52 (RM253.80) or €53 (RM258.68) per tCO2e |

| Nastis and Mattas (2018) | Greece | Emission based | CVM (Open ended, Single bounded) | Age, Education level, Level of income, Household size, Gender | €81 (RM395.34) per household |

| Zhao et al. (2018) | China | Emission based | CVM (Open ended, Double bounded) | Types of company, Carbon market, Potential, Sector type, Company size, Experience | 35 yuan (RM22.81) per tCO2e |

| Rotaris and Danielis (2019) | Italy | Emission based | CVM (Single bounded, Double bounded) | Attitudes and belief, Environmental awareness, Political affiliation, Place of residents, Car ownership, Gender, Age, Education, Employment status, Income level | €101 (RM492.95) to €154 (RM751.63) per litre |

| Shaari et al. (2020) | Malaysia | Emission based | CVM (Open ended, Double bounded) | Bid price, Income, Gender, Age, Education, Job, Offset information, Occupation | RM86.00 per passengers |

| Dependent Variable with 1 If a Respondent Is Willing to Pay for the Amount Asked to Them, 0 Otherwise | |

|---|---|

| Maximum (MAX) WTP | |

| Initial BID | Bid price levels set out in the CVM question (Dichotomous choice format) RM 5, RM 10, RM 15, RM 20 |

| BID2 | Follow-up the bid assigned |

| Environment attitude | Likert scale |

| Gender | 1 for male, 2 for female |

| Age | Age of the respondent (years) |

| Monthly gross income | Income of the respondents (RM/month) |

| Education | 1 for primary, 2 for secondary, 3 for diploma, 4, degree, 5 for master/PhD, 6 for others |

| Family size | Household size of the respondents (people) |

| Marital status | 1 for single, 2 for married |

| Ɛ | Random error |

| D1.Let us say a household must pay RM 5 a year for a carbon tax in Klang, Selangor. Are you willing to pay? □ Yes (please proceed to question D2) □ No (please proceed to question D3) |

| D2. Let us say a household must pay RM 10 a year for a carbon tax in Klang, Selangor. Are you willing to pay? □ Yes (please proceed to question D4) □ No (please proceed to question D4) |

| D3. Let us say a household must pay RM 2.50 a year for a carbon tax in Klang, Selangor. Are you willing to pay? □ Yes (please proceed to question D4) □ No (please proceed to question D4) |

| D4. What is the maximum amount that you are willing to pay for a carbon tax Klang, Selangor? (please state) ● Maximum payment is RM per year. |

| Reliability Coefficient | Level of Reliability |

|---|---|

| 0.81 or more | Near complete agreement |

| 0.61–0.80 | Strong |

| 0.41–0.60 | Moderate |

| 0.21–0.40 | Fair |

| 0.00–0.20 | Poor agreement |

| Reliability Coefficient | Level of Reliability |

|---|---|

| 0.90 or more | Very good |

| 0.80–0.89 | Good |

| 0.60–0.79 | Normal |

| 0.40–0.59 | Doubted |

| 0.00–0.39 | Rejected |

| Gender | Frequency (n = 311) | Percent |

|---|---|---|

| Male | 132 | 42.4 |

| Female | 179 | 57.6 |

| Age | ||

| 18–25 | 110 | 35.4 |

| 26–35 | 84 | 27 |

| 36–45 | 56 | 18 |

| 46–55 | 36 | 11.6 |

| >56 | 25 | 8 |

| Education level | ||

| Primary | 5 | 1.6 |

| Secondary | 7 | 2.3 |

| Diploma | 14 | 4.5 |

| Degree | 246 | 79.1 |

| Master and PhD | 38 | 12.2 |

| Others | 1 | 0.3 |

| Marital status | ||

| Single | 154 | 49.5 |

| Married | 157 | 50.5 |

| Number of individuals within a household (including you) | ||

| 1–3 people | 59 | 19 |

| 4–6 people | 217 | 69.8 |

| >7 people | 35 | 11.2 |

| Employment status | ||

| Student | 76 | 24.4 |

| Self-employed | 44 | 14.1 |

| Government sector | 69 | 22.2 |

| Private sector | 95 | 30.5 |

| Retired | 22 | 7.1 |

| Others | 5 | 1.6 |

| Monthly gross household income (overall) | ||

| B40 (<RM4360) | 190 | 61.1 |

| M40 (RM4361–RM9619) | 75 | 24.1 |

| T20 (>RM9619) | 46 | 14.8 |

| Monthly gross income | ||

| <RM2000 | 92 | 29.6 |

| RM2001–RM3000 | 59 | 19 |

| RM3001–RM4000 | 46 | 14.8 |

| RM4001–RM5000 | 31 | 10 |

| >RM5001 | 83 | 26.7 |

| Are you satisfied with the air quality in Klang? | Frequency (n = 311) | Percent |

| Yes | 95 | 30.5 |

| No | 216 | 69.5 |

| Are you concerned about the air pollution in the community where you live? | ||

| Yes | 253 | 81.4 |

| No | 58 | 18.6 |

| How severe would you say is the air pollution in the community where you live? | ||

| Low | 49 | 15.8 |

| Moderate | 230 | 74 |

| High | 32 | 10.3 |

| How would you feel about the quality of air pollution? | ||

| Worried | 246 | 79.1 |

| Not worried | 65 | 20.9 |

| Who do you think should be primarily responsible for the reduction of air pollution? | ||

| Government | 11 | 3.5 |

| Citizen | 13 | 4.2 |

| Industries | 41 | 13.2 |

| Non-Governmental Organisation | 9 | 2.9 |

| All the above | 237 | 76.2 |

| What is your most favourite way to obtain knowledge related to air pollution and related protective measures? | ||

| Television | 42 | 13.5 |

| Internet | 227 | 73 |

| Books | 7 | 2.3 |

| Newspaper | 9 | 2.9 |

| Lecturer | 4 | 1.3 |

| Friends | 21 | 6.8 |

| Others | 1 | 0.3 |

| Are you aware of the greenhouse gases emission reduction measure? | ||

| Yes | 236 | 75.9 |

| No | 75 | 24.1 |

| If you were responsible for designing a plan to address greenhouse gases emission reduction, which of the following technologies would you use? (Multiple responses possible) | ||

| Solar energy | 189 | 13.5 |

| Energy-efficient appliances | 120 | 73 |

| Energy-efficient cars | 123 | 2.3 |

| Wind energy | 82 | 2.9 |

| Nuclear energy | 26 | 1.3 |

| Carbon capture and storage | 53 | 6.8 |

| Item | Frequency (n = 311) | Ranking | ||

|---|---|---|---|---|

| Yes | No | Do Not Know | ||

| Knowledge 1 | 306 (98.4) | 4 (1.3) | 1 (0.3) | 1 |

| Knowledge 2 | 215 (69.1) | 17 (5.5) | 79 (25.4) | 6 |

| Knowledge 3 | 191 (61.4) | 77 (24.8) | 43 (13.8) | 12 |

| Knowledge 4 | 116 (37.3) | 104 (33.4) | 91 (29.3) | 8 |

| Knowledge 5 | 26 (8.4) | 260 (83.6) | 25 (8) | 10 |

| Knowledge 6 | 261 (83.9) | 36 (11.6) | 14 (4.5) | 5 |

| Knowledge 7 | 290 (93.2) | 4 (1.3) | 17 (5.5) | 4 |

| Knowledge 8 | 275 (88.4) | 10 (3.2) | 26 (8.4) | 11 |

| Knowledge 9 | 290 (93.2) | 16 (5.1) | 5 (1.6) | 2 |

| Knowledge 10 | 86 (27.7) | 209 (67.2) | 16 (5.1) | 7 |

| Knowledge 11 | 32 (10.3) | 263 (84.6) | 16 (5.1) | 9 |

| Knowledge 12 | 286 (92) | 18 (5.8) | 7 (2.3) | 3 |

| Item | Frequency | Mean | Ranking | Score Level | ||||

|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | ||||

| Attitude 1 | 6 (1.9) | 16 (5.1) | 74 (23.8) | 101 (32.5) | 114 (36.7) | 3.9678 | 5 | High |

| Attitude 2 | 14 (4.5) | 23 (7.4) | 91 (29.3) | 114 (36.7) | 69 (22.2) | 3.6463 | 7 | Medium |

| Attitude 3 | 1 (0.3) | 0 (0) | 8 (2.6) | 76 (24.4) | 226 (72.7) | 4.6913 | 1 | High |

| Attitude 4 | 2 (0.6) | 9 (2.9) | 77 (24.8) | 80 (25.7) | 143 (46) | 4.1350 | 4 | High |

| Attitude 5 | 25 (8) | 43 (13.8) | 128 (41.2) | 66 (21.2) | 49 (15.8) | 3.2283 | 10 | Medium |

| Attitude 6 | 9 (2.9) | 43 (13.8) | 112 (36) | 78 (25.1) | 69 (22.2) | 3.4984 | 9 | Medium |

| Attitude 7 | 11 (3.5) | 14 (4.5) | 89 (28.6) | 108 (34.7) | 89 (28.6) | 3.8039 | 6 | High |

| Attitude 8 | 6 (1.9) | 51 (16.4) | 90 (28.9) | 87 (28) | 77 (24.8) | 3.5723 | 8 | Medium |

| Attitude 9 | 0 (0) | 3 (1) | 44 (14.1) | 112 (36) | 152 (48.9) | 4.3280 | 2 | High |

| Attitude 10 | 3 (1) | 3 (1) | 44 (14.1) | 131 (42.1) | 130 (41.8) | 4.2283 | 3 | High |

| Variables | Coef. | Std. Err. | z | p > |z| | [95% Conf. Interval] | |

|---|---|---|---|---|---|---|

| Gender | −0.0991372 | 0.0191298 | −5.18 | 0.000 *** | −0.136631 | −0.0616434 |

| Age | −0.007413 | 0.0009105 | −8.14 | 0.000 *** | −0.0091975 | −0.0056285 |

| Income | 0.0000177 | 2.30 × 10−6 | 7.68 | 0.000 *** | 0.0000132 | 0.0000222 |

| Education | 0.1040986 | 0.0155919 | 6.68 | 0.000 *** | 0.0735391 | 0.1346581 |

| Number of households | −0.046041 | 0.0060985 | −7.55 | 0.000 *** | −0.0579939 | −0.0340881 |

| Attitude | −0.0141071 | 0.0199381 | −0.71 | 0.479 | −0.0531851 | 0.0249709 |

| Marital status | −0.0376537 | 0.0213806 | −1.76 | 0.078 * | −0.0795588 | 0.0042514 |

| _cons | 3.840645 | 0.1167101 | 32.91 | 0.000 *** | 3.611898 | 4.069393 |

| Coef. | Std. Err. | z | p >|z| | [95% Conf. Interval] | ||

|---|---|---|---|---|---|---|

| Beta_cons | 35.64819 | 3.2316 | 11.03 | 0.000 *** | 29.31437 | 41.98201 |

| Sigma_cons | 21.98887 | 3.072689 | 7.16 | 0.000 *** | 15.96651 | 28.01123 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Goh, I.Z.; Matthew, N.K. Residents’ Willingness to Pay for a Carbon Tax. Sustainability 2021, 13, 10118. https://doi.org/10.3390/su131810118

Goh IZ, Matthew NK. Residents’ Willingness to Pay for a Carbon Tax. Sustainability. 2021; 13(18):10118. https://doi.org/10.3390/su131810118

Chicago/Turabian StyleGoh, Ie Zheng, and Nitanan Koshy Matthew. 2021. "Residents’ Willingness to Pay for a Carbon Tax" Sustainability 13, no. 18: 10118. https://doi.org/10.3390/su131810118

APA StyleGoh, I. Z., & Matthew, N. K. (2021). Residents’ Willingness to Pay for a Carbon Tax. Sustainability, 13(18), 10118. https://doi.org/10.3390/su131810118