Factors Affecting the Organizational Adoption of Blockchain Technology: Extending the Technology–Organization–Environment (TOE) Framework in the Australian Context

Abstract

1. Introduction

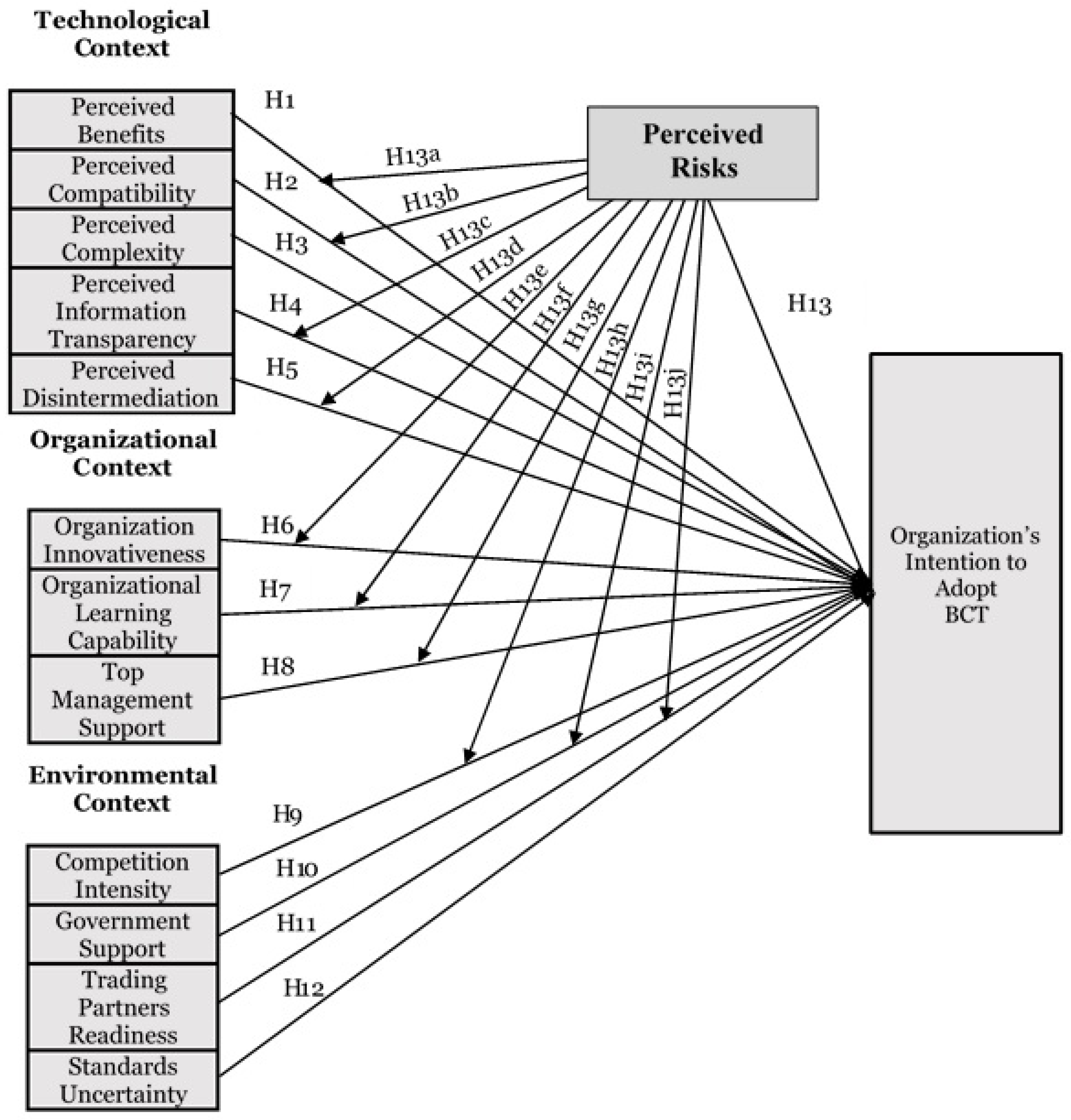

What are the key factors influencing the adoption intention of BCT among Australian organizations?

- (i)

- Technological factors: information transparency and disintermediation;

- (ii)

- Organizational factors: organization innovativeness, organizational learning capability;

- (iii)

- Environmental factors: standards uncertainty, and

- (iv)

- Moderating factor: perceived risks.

2. Literature Review

2.1. Adoption of Blockchain Technology

2.2. Research Gaps Found in the Published Literature

- (i)

- Most of the research on BCT adoption has been conducted in non-Oceania countries and there is little research in the context of the Oceania region, particularly in Australia. Since the countries differ from each other in terms of their contextual and demographic characteristics such as GDP, union density, trade laws, and gender, therefore the findings of studies conducted in other countries cannot be applied in the Australian context.

- (ii)

- There is an identified inconsistency in the results of the past studies. The studies report a linear relationship between the influencing factors and BCT adoption and ignore the impact of any intervening factor causing that inconsistency in findings.

2.3. Blockchain Technology in Australia

3. Research Model and Hypotheses

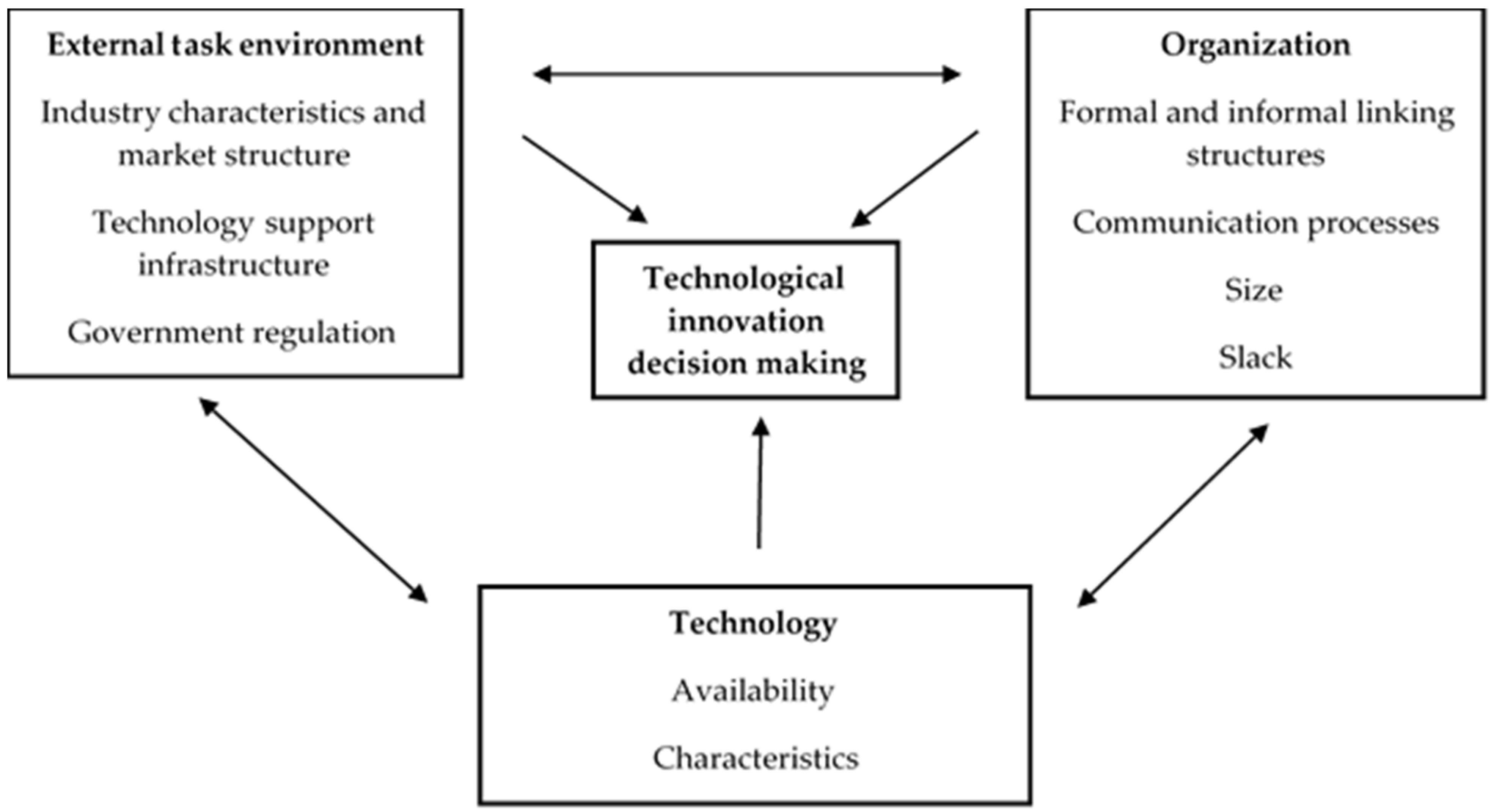

3.1. TOE Framework

Rationale for Choosing the TOE Framework

- Most of the available IT adoption theories at the organizational level are variants of the TOE framework that either divide or extend its dimensions. For example, the Institutional Theory [61] describes the influence of the environmental perspective on technology adoption that is already part of the TOE framework. Similarly, the DoI theory [60] contains technology and organizational aspects, which are also part of the TOE framework.

- Since the context is an important aspect of technology adoption, the TOE provides a useful starting point to examine the adoption process where it takes place [62].

- The TOE is the most validated theory to examine the adoption of new technologies at the organization level [59].

3.2. Technology Context

3.2.1. Perceived Benefits (PB)

3.2.2. Perceived Compatibility (PC)

3.2.3. Perceived Complexity (PCM)

3.2.4. Perceived Information Transparency (PIT)

3.2.5. Perceived Disintermediation (PD)

3.3. Organizational Context

3.3.1. Organization Innovativeness (OI)

3.3.2. Organizational Learning Capability (OLC)

3.3.3. Top Management Support (TMS)

3.4. Environment Context

3.4.1. Competition Intensity (CI)

3.4.2. Government Support (GS)

3.4.3. Trading Partner Readiness (TPR)

3.4.4. Standards Uncertainty (SU)

3.5. Direct and Moderating Effect of Perceived Risks

- (i)

- As previously mentioned in Section 1 of this paper, semi-structured interviews with the BCT experts were conducted to identify the factors influencing BCT adoption in Australia. The experts highlighted the moderating role of perceived risks in BCT adoption.

- (ii)

- The past literature reports the moderating role of perceived risks in the adoption of different technological innovations. For example, Shen and Chiou [88] found that the perceived risks moderates the relationship between perceived ease of use and intention towards using internet services. Similarly, Khaksar, Khosla, Singaraju and Slade [84] reported the moderating role of perceived risks in the adoption of social assistive technology.

- (iii)

- Given the higher value of the “uncertainty avoidance index” for Australia in Table 1, anecdotally it can be assumed that the perceived risks would moderate the relationship between the influential factors and organizations’ intention to adopt new technology such as BCT.

4. Research Methodology

4.1. Research Method

4.2. Unit of Analysis and Unit of Observation

4.3. Target Population and Sampling

4.4. Questionnaire Designing

- We used validated measuring items for the perceived compatibility, perceived complexity, perceived information transparency, top management support, organization innovativeness, organizational learning capability, government support, trading partner readiness, competition intensity, standards uncertainty, and perceived risks from the existing peer-reviewed literature on information systems research. The items were adapted and modified to meet the requirement of this study. Table 4 provides detail about the measuring items for each factor and their sources. Measuring items for perceived disintermediation were not found in the existing literature, hence we developed it for this study by following the guidelines of MacKenzie, et al. [96].

- Use of duplicate and long questions, technical and specialized terms were avoided.

- Feedback from the senior academic and researchers working in the information system domain was sought to evaluate instrument relevance and content clarity in order to avoid any difficulty or non-response that the respondents might have faced while completing the survey.

- The questionnaire was sent to language experts for proofreading including review of grammatical errors and wording.

4.5. Measurement Scale

4.6. Pilot Testing

4.7. Data Collection Process

4.8. Data Analysis Technique

5. Data Analysis and Results

5.1. Preliminary Data Analysis

5.2. Demographic

5.3. Measurement Model

5.4. Structural Model

5.5. Measuring the Moderating Effects

6. Discussion

6.1. Technology Context

6.2. Organizational Context

6.3. Environmental Context

6.4. Direct Effect of Perceived Risks

6.5. Moderating Effect of Perceived Risks

6.6. Implications

6.6.1. Theoretical Implications

6.6.2. Practical Implications

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Factor | Questions |

| Perceived benefits (PB) | In my opinion, organizations adopt blockchain when they perceive that: |

| Blockchain reduces overhead expenses | |

| Blockchain reduces data error rates | |

| Blockchain reduces transaction costs while transferring funds | |

| Blockchain saves time while accomplishing business tasks | |

| Blockchain increases the organization’s overall productivity | |

| Perceived compatibility (PC) | In my opinion, organizations adopt blockchain when they perceive that: |

| Blockchain fits well with their business processes | |

| Blockchain is compatible with their technological infrastructure | |

| Blockchain fits well with their technological skills | |

| Perceived complexity (PCM) | In my opinion, organizations do not adopt blockchain when they perceive that it: |

| Blockchain requires extra technical skills to use | |

| Blockchain is difficult to understand from a business perspective | |

| Blockchain is conceptually difficult to understand from a technical perspective | |

| Perceived information transparency (PIT) | In my opinion, organizations adopt blockchain when they perceive that: |

| Blockchain enables them to have transparent access to information across the network | |

| Blockchain enables them to have a transparent view of any activity in the data | |

| Blockchain enables them to have a transparent flow of the entire data | |

| Perceived disintermediation (PD) | In my opinion, organizations adopt blockchain when they perceive that: |

| Blockchain enables them to store their data without the involvement of any intermediary | |

| Blockchain enables them to access their data without the involvement of any intermediary | |

| Blockchain enables them to share their data without the involvement of any intermediary | |

| Blockchain enables them to audit without the involvement of any intermediary | |

| Top management support (TMS) | In my opinion, organizations adopt blockchain when: |

| Their top management provides the necessary resources for blockchain | |

| Their top management considers blockchain as strategically important | |

| Their top management is actively involved in IT-related decisions | |

| Organizational innovativeness (OI) | In my opinion, organizations adopt blockchain when: |

| They actively seek new ideas | |

| They like to do things in new ways | |

| They are open to taking risks | |

| Organizational learning capability (OLC) | In my opinion, organizations adopt blockchain when: |

| They have a mechanism to store new knowledge | |

| They encourage their employees to acquire new knowledge and skills | |

| Their employees share their work experiences, ideas, or learning with each other | |

| They have practices to utilize new knowledge in their IT-related decisions | |

| Government support (GS) | In my opinion, organizations adopt blockchain when: |

| The Australian government supports the adoption of blockchain | |

| The Australian government introduces economic incentives for blockchain adoption | |

| The Australian government is active in setting up facilities to promote blockchain | |

| Trading partner readiness (TPR) | In my opinion, organizations adopt blockchain when: |

| Their trading partners are also willing to adopt blockchain | |

| Their trading partners are also technologically ready to adopt blockchain | |

| Their trading partners are also financially ready to adopt blockchain | |

| Competitive intensity (CI) | In my opinion, organizations adopt blockchain when: |

| They feel pressure when their competitors have adopted it | |

| They feel the fear of losing a competitive advantage if they do not adopt it | |

| They see their competitors benefiting from adopting it | |

| Standards uncertainty (SU) | In my opinion, organizations do not adopt blockchain when: |

| They see blockchain has not reached its maturity | |

| They see blockchain still requires changes to become more efficient compared with existing technologies | |

| They cannot predict that blockchain would become an industry standard in the near future | |

| Perceived risks (PR) | In my opinion, organizations do not adopt blockchain when they perceive that: |

| Blockchain is not secured | |

| Their transactions’ information will be compromised while using blockchain | |

| Blockchain will not provide its expected benefits | |

| Intention to adopt blockchain (INT) | In my opinion: |

| Organizations would adopt blockchain whenever they will have access to it in the future | |

| Organizations would adopt blockchain in the future | |

| Organizations would adopt blockchain frequently in the future |

Appendix B

- ▪

- B2B-Commerce

- ▪

- Blockchain Technology

- ▪

- Electronic Data Interchange (EDI)

- ▪

- Distributed DBMS

- ▪

- Other (please type)

- ▪

- B2B-Commerce

- ▪

- Cloud Computing

- ▪

- RFID

- ▪

- Robotics

- ▪

- Internet of Things (IoT)

- ▪

- Blockchain Technology

- ▪

- Electronic Data Interchange (EDI)

- ▪

- Artificial Intelligence

- ▪

- Distributed DBMS

- ▪

- Social Media Technologies

- ▪

- Gaming

- ▪

- Other

- ▪

- Chief Executive Officer President Chairperson

- ▪

- Chief Technology Officer Chief Information Officer Chief Digital Officer

- ▪

- IT Manager

- ▪

- Business Development Manager

- ▪

- Other

- ▪

- IT Director

- ▪

- Technology Strategy Manager

- ▪

- Finance Director Finance Manager

- ▪

- Customer Service Manager

- ▪

- Database Administrator

- ▪

- Supply Chain Manager

- ▪

- Store Manager

- ▪

- Sales Manager

- ▪

- Other

- ▪

- Less than 3 years

- ▪

- 3–4 years

- ▪

- 5–7 years

- ▪

- 8–10 years

- ▪

- Above 10 years

- ▪

- Little knowledge of blockchain technology

- ▪

- Good knowledge of blockchain technology

- ▪

- Excellent knowledge of blockchain technology

- ▪

- Currently interested in blockchain technology and actively seeking related information

- ▪

- Currently in the process of deciding adoption of blockchain technology

- ▪

- Currently implemented blockchain technology

- ▪

- Previously implemented blockchain technology, but currently not using

- ▪

- Having employees between 1 and 4

- ▪

- Having employees between 5 and 19

- ▪

- Having employees between 20 and 199

- ▪

- Having employees more than 200

- ▪

- Less than $1 million

- ▪

- Between $1–5 million

- ▪

- Between $5–50 million

- ▪

- Above $50 million

- ▪

- Automotive

- ▪

- Electronics

- ▪

- Services

- ▪

- Chemical

- ▪

- Finance/Banking

- ▪

- Insurance

- ▪

- Construction

- ▪

- Manufacturing

- ▪

- Education

- ▪

- Consultancy

- ▪

- Pharmaceutical

- ▪

- Information Technology

- ▪

- Supply Chain

- ▪

- Real Estate

- ▪

- Government

- ▪

- Telecommunication

- ▪

- Retail

- ▪

- Transport

- ▪

- Legal

- ▪

- Other

- ▪

- Public

- ▪

- Private

- ▪

- Hybrid

- ▪

- Other (please type)

- ▪

- College Certificate

- ▪

- Undergraduate Degree

- ▪

- Postgraduate Degree or Higher

- ▪

- Professional Certificate/Diploma

- ▪

- Other (please type)

- ▪

- Male

- ▪

- Female

- ▪

- Not Specified

References

- Nakamoto, S. Bitcoin: A peer-to-peer electronic cash system. Decentralized Bus. Rev. 2008. [Google Scholar] [CrossRef]

- Gorkhali, A.; Li, L.; Shrestha, A. Blockchain: A literature review. J. Manag. Anal. 2020, 7, 321–343. [Google Scholar] [CrossRef]

- Casino, F.; Dasaklis, T.K.; Patsakis, C. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telemat. Inform. 2019, 36, 55–81. [Google Scholar] [CrossRef]

- Alketbi, A.; Nasir, Q.; Talib, M.A. Blockchain for government services—Use cases, security benefits and challenges. In Proceedings of the 15th Learning and Technology Conference (L&T), Jeddah, Saudi Arabia, 25–26 February 2018; pp. 112–119. [Google Scholar]

- Ganne, E. Can Blockchain Revolutionize International Trade? World Trade Organization: Geneva, Switzerland, 2018. [Google Scholar]

- La Cava, A.; Naatus, M.K. Disrupting business as usual: Blockchain startups in the international remittance market. Int. J. Innov. Digit. Econ. 2020, 11, 47–54. [Google Scholar] [CrossRef][Green Version]

- Mohammed, A.; Potdar, V.; Yang, L. Key factors affecting blockchain adoption in organizations. In Proceedings of the International Conference on Big Data and Security, Nanjing, China, 20–22 December 2019; pp. 455–467. [Google Scholar]

- Underwood, S. Blockchain beyond bitcoin. Commun. ACM 2016, 59, 15–17. [Google Scholar] [CrossRef]

- Tapscott, D.; Tapscott, A. How blockchain will change organizations. MIT Sloan Manag. Rev. 2017, 58, 10. [Google Scholar]

- Alzahrani, S.; Daim, T.U. Analysis of the cryptocurrency adoption decision: Literature review. In Proceedings of the Portland International Conference on Management of Engineering and Technology (PICMET), Portland, OR, USA, 25–29 August 2019; pp. 1–11. [Google Scholar]

- Chen, S.; Yan, J.; Tan, B.; Liu, X.; Li, Y. Processes and challenges for the adoption of blockchain technology in food supply chains: A thematic analysis. In Proceedings of the iConference, Washington, DC, USA, 31 March–3 April 2019. [Google Scholar]

- Xu, M.; Chen, X.; Kou, G. A systematic review of blockchain. Financ. Innov. 2019, 5, 27. [Google Scholar] [CrossRef]

- Lakhani, K.; Iansiti, M. The truth about blockchain. Harv. Bus. Rev. 2017, 95, 119–127. [Google Scholar]

- PwC. Global Blockchain Survey. Available online: https://www.pwccn.com/en/research-and-insights/publications/global-blockchain-survey-2018/global-blockchain-survey-2018-report.pdf (accessed on 23 July 2021).

- Deloitte. Global Blockchain Survey. Available online: https://www2.deloitte.com/content/dam/Deloitte/cz/Documents/financial-services/cz-2018-deloitte-global-blockchain-survey.pdf (accessed on 23 July 2021).

- Woodside, J.M.; Augustine, F.K., Jr.; Giberson, W. Blockchain technology adoption status and strategies. J. Int. Technol. Inf. Manag. 2017, 26, 65–93. [Google Scholar]

- ACS. Blockchain Challenges for Australia. Available online: https://www.acs.org.au/content/dam/acs/acs-publications/ACS-Blockchain-Technical-Whitepaper-2019.pdf (accessed on 23 July 2021).

- Gunasekera, D.; Valenzuela, E. Adoption of blockchain technology in the australian grains trade: An assessment of potential economic effects. Econ. Pap. 2020. [Google Scholar] [CrossRef]

- Maroun, E.; Daniel, J. Opportunities for use of blockchain technology in supply chains: Australian manufacturer case study. In Proceedings of the International Conference on Industrial Engineering and Operations Management (IEOM), Bangkok, Thailand, 5–7 March 2019. [Google Scholar]

- Holotiuk, F.; Moormann, J. Organizational adoption of digital innovation: The case of blockchain technology. In Proceedings of the European Conference on Information Systems (ECIS), Portsmouth, UK, 23–28 June 2018. [Google Scholar]

- Wong, L.-W.; Leong, L.-Y.; Hew, J.-J.; Tan, G.W.-H.; Ooi, K.-B. Time to seize the digital evolution: Adoption of blockchain in operations and supply chain management among Malaysian SMEs. Int. J. Inf. Manag. 2019, 52, 101997. [Google Scholar] [CrossRef]

- Clohessy, T.; Acton, T. Investigating the influence of organizational factors on blockchain adoption. Ind. Manag. Data Syst. 2019, 119, 1457–1491. [Google Scholar] [CrossRef]

- Hong, W.; Chan, F.K.; Thong, J.Y.; Chasalow, L.C.; Dhillon, G. A framework and guidelines for context-specific theorizing in information systems research. Inf. Syst. Res. 2013, 25, 111–136. [Google Scholar] [CrossRef]

- Chandra, S.; Kumar, K.N. Exploring factors influencing organisational adoption of augmented reality in e-commerce: Empirical analysis using Technology-Organisation-Environment model. J. Electron. Commer. Res. 2018, 19, 237–265. [Google Scholar]

- Orji, I.J.; Kusi-Sarpong, S.; Huang, S.; Vazquez-Brust, D. Evaluating the factors that influence blockchain adoption in the freight logistics industry. Transp. Res. Part E 2020, 141, 102025. [Google Scholar] [CrossRef]

- De Castro, P.; Tanner, M.; Johnston, K. Perceived factors influencing blockchain adoption in the asset and wealth management industry in the Western Cape, South Africa. In Proceedings of the International Development Informatics Association Conference, Macau, China, 25–27 March 2020; pp. 48–62. [Google Scholar]

- Albrecht, S.; Reichert, S.; Schmid, J.; Strüker, J.; Neumann, D.; Fridgen, G. Dynamics of blockchain implementation-a case study from the energy sector. In Proceedings of the 51st Hawaii International Conference on System Sciences, Waikoloa Village, HI, USA, 2–6 January 2018. [Google Scholar]

- Umrani, W.A.; Kura, K.M.; Ahmed, U. Corporate entrepreneurship and business performance. PSU Res. Rev. 2018. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Dobrovnik, M.; Herold, D.M.; Fürst, E.; Kummer, S. Blockchain for and in logistics: What to adopt and where to start. Logistics 2018, 2, 18. [Google Scholar] [CrossRef]

- Barnes, B.W., III; Xiao, B. Organizational adoption of blockchain technology: An ecosystem perspective. In Proceedings of the Diffusion Interest Group In Information Technology, Munich, Germany, 15 December 2019. [Google Scholar]

- Kühn, O.; Jacob, A.; Schüller, M. Blockchain adoption at German logistics service providers. In Proceedings of the Artificial Intelligence and Digital Transformation in Supply Chain Management: Innovative Approaches for Supply Chains—Hamburg International Conference of Logistics (HICL), Hamburg, Germany, 25–27 September 2019; Volume 27, pp. 387–411. [Google Scholar]

- Wong, L.-W.; Tan, G.W.-H.; Lee, V.-H.; Ooi, K.-B.; Sohal, A. Unearthing the determinants of Blockchain adoption in supply chain management. Int. J. Prod. Res. 2020, 58, 2100–2123. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. A supply chain transparency and sustainability technology appraisal model for blockchain technology. Int. J. Prod. Res. 2020, 58, 2142–2162. [Google Scholar] [CrossRef]

- Kouhizadeh, M.; Saberi, S.; Sarkis, J. Blockchain technology and the sustainable supply chain: Theoretically exploring adoption barriers. Int. J. Prod. Econ. 2020, 231, 107831. [Google Scholar] [CrossRef]

- Ghode, D.; Yadav, V.; Jain, R.; Soni, G. Adoption of blockchain in supply chain: An analysis of influencing factors. J. Enterp. Inf. Manag. 2020, 33, 437–456. [Google Scholar] [CrossRef]

- Kalaitzi, D.; Jesus, V.; Campelos, I. Determinants of blockchain adoption and perceived benefits in food supply chain. In Proceedings of the Logistics Research Network (LRN), Northampton, UK, 4–6 September 2019. [Google Scholar]

- Loklindt, C.; Moeller, M.-P.; Kinra, A. How blockchain could be implemented for exchanging documentation in the shipping industry. In Proceedings of the International Conference on Dynamics in Logistics, Bremen, Germany, 20–22 February 2018; pp. 194–198. [Google Scholar]

- Post, R.; Smit, K.; Zoet, M. Identifying factors affecting blockchain technology diffusion. In Proceedings of the Americas Conference on Information Systems (AMCIS), New Orleans, LA, USA, 16–18 August 2018. [Google Scholar]

- Hoxha, V.; Sadiku, S. Study of factors influencing the decision to adopt the blockchain technology in real estate transactions in Kosovo. Prop. Manag. 2019, 37, 684–700. [Google Scholar] [CrossRef]

- Kulkarni, M.; Patil, K. Block chain technology adoption for banking services-model based on technology-organization-environment theory. SSRN 2020. [Google Scholar] [CrossRef]

- Koster, F.; Borgman, H. New kid on the block! Understanding blockchain adoption in the public sector. In Proceedings of the 53rd Hawaii International Conference on System Sciences, Maui, HI, USA, 7–10 January 2020. [Google Scholar]

- Choi, D.; Chung, C.Y.; Seyha, T.; Young, J. Factors affecting organizations’ resistance to the adoption of blockchain technology in supply networks. Sustainability 2020, 12, 8882. [Google Scholar] [CrossRef]

- Malik, S.; Chadhar, M.; Chetty, M.; Vatanasakdakul, S. An exploratory study of the adoption of blockchain technology among australian organizations: A theoretical model. In Proceedings of the European, Mediterranean, and Middle Eastern Conference on Information Systems, Dubai, United Arab Emirates, 25–26 November 2020; pp. 205–220. [Google Scholar]

- Yadav, V.S.; Singh, A.; Raut, R.D.; Govindarajan, U.H. Blockchain technology adoption barriers in the Indian agricultural supply chain: An integrated approach. Resour. Conserv. Recycl. 2020, 161, 104877. [Google Scholar] [CrossRef]

- Malik, M.S.; Chadhar, M.; Chetty, M. Factors Affecting the Organizational Adoption of Blockchain Technology: An Australian Perspective. In Proceedings of the 54th Hawaii International Conference on System Sciences, Kauai, HI, USA, 5–8 January 2021. [Google Scholar]

- Zhou, Y.; Soh, Y.S.; Loh, H.S.; Yuen, K.F. The key challenges and critical success factors of blockchain implementation: Policy implications for Singapore’s maritime industry. Mar. Policy 2020, 122, 104265. [Google Scholar] [CrossRef]

- Novak, M. Crypto-friendliness: Understanding blockchain public policy. J. Entrep. Public Policy 2019, 9, 165–184. [Google Scholar] [CrossRef]

- Australia, S. Roadmap for Blockchain Standards. Available online: https://www.standards.org.au/getmedia/ad5d74db-8da9-4685-b171-90142ee0a2e1/Roadmap_for_Blockchain_Standards_report.pdf.aspx (accessed on 24 July 2021).

- DISER. The National Blockchain Roadmap. Available online: https://www.industry.gov.au/sites/default/files/2020-02/national-blockchain-roadmap.pdf (accessed on 24 July 2021).

- Garrard, R.; Fielke, S. Blockchain for trustworthy provenances: A case study in the Australian aquaculture industry. Technol. Soc. 2020, 62, 101298. [Google Scholar] [CrossRef]

- Cao, S.; Powell, W.; Foth, M.; Natanelov, V.; Miller, T.; Dulleck, U. Strengthening consumer trust in beef supply chain traceability with a blockchain-based human-machine reconcile mechanism. Comput. Electron. Agric. 2020, 180, 105886. [Google Scholar] [CrossRef]

- Monroe, J.G.; Hansen, P.; Sorell, M.; Berglund, E.Z. Agent-based model of a blockchain enabled peer-to-peer energy market: Application for a neighborhood trial in Perth, Australia. Smart Cities 2020, 3, 53. [Google Scholar] [CrossRef]

- Foth, M.; McQueenie, J. Creatives in the country? Blockchain and agtech can create unexpected jobs in regional Australia. The Conversation, 12 June 2019. [Google Scholar]

- AUSTRADE. Australian Digital Innovation on the Rise. Available online: https://www.austrade.gov.au/international/invest/resources/publications (accessed on 5 June 2021).

- ACS. Blockchain 2030, A Look at the Future of Blockchain in Australia. Available online: https://www.acs.org.au/content/dam/acs/acs-publications/ACS-Data61-Blockchain-2030-Report.pdf (accessed on 5 August 2020).

- Ward, O.; Rochemont, S. Understanding Central Bank Digital Currencies. Available online: https://www.actuaries.org.uk/system/files/field/document/Understanding%20CBDCs%20Final%20-%20disc.pdf (accessed on 2 February 2021).

- Tornatsky, L.; Fleischer, M. The Process of Technology Innovation; Lexington Books: Lexington, MA, USA, 1990. [Google Scholar]

- Rogers, E.M. Diffusion of Innovations; Simon and Schuster: New York, NY, USA, 2003. [Google Scholar]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Oliveira, T.; Martins, M.F. Literature review of information technology adoption models at firm level. Electron. J. Inf. Syst. Eval. 2011, 14, 110. [Google Scholar]

- Baker, J. The technology–organization–environment framework. In Information Systems Theory; Springer: Berlin/Heidelberg, Germany, 2012; pp. 231–245. [Google Scholar]

- Sadhya, V.; Sadhya, H. Barriers to adoption of blockchain technology. In Proceedings of the Americas Conference on Information Systems, New Orleans, LA, USA, 16–18 August 2018. [Google Scholar]

- Al-Jabri, I.M.; Roztocki, N. Adoption of ERP systems: Does information transparency matter? Telemat. Inform. 2015, 32, 300–310. [Google Scholar] [CrossRef]

- Rizal Batubara, F.; Ubacht, J.; Janssen, M. Unraveling transparency and accountability in blockchain. In Proceedings of the 20th Annual International Conference on Digital Government Research, Dubai, United Arab Emirates, 18–20 June 2019; pp. 204–213. [Google Scholar]

- Wamba, S.F.; Queiroz, M.M.; Trinchera, L. Dynamics between blockchain adoption determinants and supply chain performance: An empirical investigation. Int. J. Prod. Econ. 2020, 229, 107791. [Google Scholar] [CrossRef]

- Quiniou, M. Blockchain: The Advent of Disintermediation; Wiley Online Library: Hoboken, NJ, USA, 2019. [Google Scholar]

- Parekh, J.; Jaffer, A.; Bhanushali, U.; Shukla, S. Disintermediation in medical tourism through blockchain technology: An analysis using value-focused thinking approach. Inf. Technol. Tour. 2020, 23, 1–28. [Google Scholar] [CrossRef]

- O’Dair, M. The networked record industry: How blockchain technology could transform the consumption and monetisation of recorded music. Strateg. Chang. 2017, 26, 471–480. [Google Scholar] [CrossRef]

- Newby, M.; Nguyen, T.H.; Waring, T.S. Understanding customer relationship management technology adoption in small and medium-sized enterprises. J. Enterp. Inf. Manag. 2014, 27, 541–560. [Google Scholar] [CrossRef]

- Thong, J.Y.; Yap, C.-S. CEO characteristics, organizational characteristics and information technology adoption in small businesses. Omega 1995, 23, 429–442. [Google Scholar] [CrossRef]

- Lin, J.; Luo, Z.; Luo, X. Understanding the roles of institutional pressures and organizational innovativeness in contextualized transformation toward e-business: Evidence from agricultural firms. Int. J. Inf. Manag. 2020, 51, 102025. [Google Scholar] [CrossRef]

- Nuryyev, G.; Wang, Y.-P.; Achyldurdyyeva, J.; Jaw, B.-S.; Yeh, Y.-S.; Lin, H.-T.; Wu, L.-F. Blockchain technology adoption behavior and sustainability of the business in tourism and hospitality SMEs: An empirical study. Sustainability 2020, 12, 1256. [Google Scholar] [CrossRef]

- Argyris, C.; Schon, D.A. Organizational Learning: A Theory of Action Perspective; Addison-Wesley: New York, NY, USA, 1978. [Google Scholar]

- Woiceshyn, J. Technology adoption: Organizational learning in oil firms Jaana Woiceshyn. Organ. Stud. 2000, 21, 1095–1118. [Google Scholar] [CrossRef]

- Werner, F.; Basalla, M.; Schneider, J.; Hayes, D.; Vom Brocke, J. Blockchain adoption from an interorganizational systems perspective–a mixed-methods approach. Inf. Syst. Manag. 2020, 38, 1–16. [Google Scholar]

- Blind, K.; Petersen, S.S.; Riillo, C.A. The impact of standards and regulation on innovation in uncertain markets. Res. Policy 2017, 46, 249–264. [Google Scholar] [CrossRef]

- Cumming, D.J.; Johan, S.; Pant, A. Regulation of the crypto-economy: Managing risks, challenges, and regulatory uncertainty. J. Risk Financ. Manag. 2019, 12, 126. [Google Scholar] [CrossRef]

- Shanaev, S.; Sharma, S.; Ghimire, B.; Shuraeva, A. Taming the blockchain beast? Regulatory implications for the cryptocurrency Market. Res. Int. Bus. Financ. 2020, 51, 101080. [Google Scholar] [CrossRef]

- Peter, J.P.; Ryan, M.J. An investigation of perceived risk at the brand level. J. Mark. Res. 1976, 13, 184–188. [Google Scholar] [CrossRef]

- Luo, X.; Li, H.; Zhang, J.; Shim, J.P. Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services. Decis. Support Syst. 2010, 49, 222–234. [Google Scholar] [CrossRef]

- Tseng, S.-Y.; Wang, C.-N. Perceived risk influence on dual-route information adoption processes on travel websites. J. Bus. Res. 2016, 69, 2289–2296. [Google Scholar] [CrossRef]

- Kesharwani, A.; Bisht, S.S. The impact of trust and perceived risk on internet banking adoption in India: An extension of technology acceptance model. Int. J. Bank Mark. 2012, 30, 303–322. [Google Scholar] [CrossRef]

- Khaksar, S.M.S.; Khosla, R.; Singaraju, S.; Slade, B. Carer’s perception on social assistive technology acceptance and adoption: Moderating effects of perceived risks. Behav. Inf. Technol. 2019, 40, 1–24. [Google Scholar] [CrossRef]

- Yoo, K.; Bae, K.; Park, E.; Yang, T. Understanding the diffusion and adoption of Bitcoin transaction services: The integrated approach. Telemat. Inform. 2019, 53, 101302. [Google Scholar] [CrossRef]

- Erturk, E.; Lopez, D.; Yu, W.Y. Benefits and risks of using blockchain in smart energy: A literature review. Contemp. Manag. Res. 2019, 15, 205–225. [Google Scholar] [CrossRef]

- Abramova, S.; Böhme, R. Perceived benefit and risk as multidimensional determinants of bitcoin use: A quantitative exploratory study. In Proceedings of the International Conference on Information Systems, Dublin, Ireland, 11–14 December 2016. [Google Scholar]

- Shen, C.-C.; Chiou, J.-S. The impact of perceived ease of use on Internet service adoption: The moderating effects of temporal distance and perceived risk. Comput. Hum. Behav. 2010, 26, 42–50. [Google Scholar] [CrossRef]

- Sekaran, U.; Bougie, R. Research Methods for Business: A Skill Building Approach; John Wiley and Sons: Hoboken, NJ, USA, 2016. [Google Scholar]

- Hair, J.F. Multivariate Data Analysis; Pearson: London, UK, 2009. [Google Scholar]

- Iacobucci, D. Structural equations modeling: Fit indices, sample size, and advanced topics. J. Consum. Psychol. 2010, 20, 90–98. [Google Scholar] [CrossRef]

- Yurdusev, A.N. ‘Level of analysis’ and ‘unit of analysis’: A case for distinction. Millennium 1993, 22, 77–88. [Google Scholar] [CrossRef]

- DeCarlo, M. Scientific Inquiry in Social Work; Open Social Work Education: Roanoke, VA, USA, 2018. [Google Scholar]

- Schonlau, M.; Ronald, D., Jr.; Elliott, M.N. Conducting Research Surveys Via E-Mail and the Web; Rand Corporation: Santa Monica, CA, USA, 2002. [Google Scholar]

- Schmidt, W.C. World-Wide Web survey research: Benefits, potential problems, and solutions. Behav. Res. Methods Instrum. Comput. 1997, 29, 274–279. [Google Scholar] [CrossRef]

- MacKenzie, S.B.; Podsakoff, P.M.; Podsakoff, N.P. Construct measurement and validation procedures in MIS and behavioral research: Integrating new and existing techniques. MIS Q. 2011, 35, 293–334. [Google Scholar] [CrossRef]

- Chwelos, P.; Benbasat, I.; Dexter, A.S. Empirical test of an EDI adoption model. Inf. Syst. Res. 2001, 12, 304–321. [Google Scholar] [CrossRef]

- Rawashdeh, A.; Al-namlah, L. Factors influencing electronic data interchange adoption among small and medium enterprises in Saudi Arabia. AJBA 2017, 10, 253–280. [Google Scholar]

- Moore, G.C.; Benbasat, I. Development of an instrument to measure the perceptions of adopting an information technology innovation. Inf. Syst. Res. 1991, 2, 192–222. [Google Scholar] [CrossRef]

- Atkinson, N.L. Developing a questionnaire to measure perceived attributes of eHealth innovations. Am. J. Health Behav. 2007, 31, 612–621. [Google Scholar] [CrossRef] [PubMed]

- Teo, H.-H.; Wei, K.K.; Benbasat, I. Predicting intention to adopt interorganizational linkages: An institutional perspective. MIS Q. 2003, 27, 19–49. [Google Scholar] [CrossRef]

- Terry Anthony Byrd, D.E.T. Measuring the flexibility of information technology infrastructure: Exploratory analysis of a construct. J. Manag. Inf. Syst. 2000, 17, 167–208. [Google Scholar]

- Soliman, K.S.; Janz, B.D. An exploratory study to identify the critical factors affecting the decision to establish Internet-based interorganizational information systems. Inf. Manag. 2004, 41, 697–706. [Google Scholar] [CrossRef]

- Igbaria, M.; Zinatelli, N.; Cragg, P.; Cavaye, A.L. Personal computing acceptance factors in small firms: A structural equation model. MIS Q. 1997, 21, 279–305. [Google Scholar] [CrossRef]

- Venkatesh, V.; Bala, H. Adoption and impacts of interorganizational business process standards: Role of partnering synergy. Inf. Syst. Res. 2012, 23, 1131–1157. [Google Scholar] [CrossRef]

- Muñoz-Pascual, L.; Curado, C.; Galende, J. How does the use of information technologies affect the adoption of environmental practices in SMEs? A mixed-methods approach. Rev. Manag. Sci. 2019, 15, 1–28. [Google Scholar] [CrossRef]

- Tan, M.; Teo, T.S. Factors influencing the adoption of Internet banking. J. Assoc. Inf. Syst. 2000, 1, 5. [Google Scholar] [CrossRef]

- Zhu, K.; Dong, S.; Xu, S.X.; Kraemer, K.L. Innovation diffusion in global contexts: Determinants of post-adoption digital transformation of European companies. Eur. J. Inf. Syst. 2006, 15, 601–616. [Google Scholar] [CrossRef]

- Zhu, K.; Kraemer, K.L.; Dedrick, J. Information technology payoff in e-business environments: An international perspective on value creation of e-business in the financial services industry. J. Manag. Inf. Syst. 2004, 21, 17–54. [Google Scholar] [CrossRef]

- Featherman, M.S.; Pavlou, P.A. Predicting e-services adoption: A perceived risk facets perspective. Int. J. Hum. Comput. Stud. 2003, 59, 451–474. [Google Scholar] [CrossRef]

- Kim, D.; Ammeter, T. Predicting personal information system adoption using an integrated diffusion model. Inf. Manag. 2014, 51, 451–464. [Google Scholar] [CrossRef]

- Lewis, J.R. Multipoint scales: Mean and median differences and observed significance levels. Int. J. Hum. Comput. Interact. 1993, 5, 383–392. [Google Scholar] [CrossRef]

- Cox, E.P., III. The optimal number of response alternatives for a scale: A review. J. Mark. Res. 1980, 17, 407–422. [Google Scholar] [CrossRef]

- Cavana, R.; Delahaye, B.; Sekeran, U. Applied Business Research: Qualitative and Quantitative Methods; John Wiley and Sons: Hoboken, NJ, USA, 2001. [Google Scholar]

- Urbach, N.; Ahlemann, F. Structural equation modeling in information systems research using partial least squares. J. Inf. Technol. Theory Appl. 2010, 11, 5–40. [Google Scholar]

- Ramli, N.A.; Latan, H.; Nartea, G.V. Why should PLS-SEM be used rather than regression? Evidence from the capital structure perspective. In Partial Least Squares Structural Equation Modeling; Springer: Berlin/Heidelberg, Germany, 2018; pp. 171–209. [Google Scholar]

- Cuddeback, G.; Wilson, E.; Orme, J.G.; Combs-Orme, T. Detecting and statistically correcting sample selection bias. J. Soc. Serv. Res. 2004, 30, 19–33. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Thousand Oaks, CA, USA, 2016. [Google Scholar]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Podsakoff, N.P. Sources of method bias in social science research and recommendations on how to control it. Annu. Rev. Psychol. 2012, 63, 539–569. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Vatanasakdakul, S.; Aoun, C.; Putra, Y.H.S. Social media in micro-enterprises: Exploring adoption in the indonesian retail sector. J. Glob. Inf. Manag. (JGIM) 2020, 28, 184–203. [Google Scholar] [CrossRef]

- Chin, W.W. The partial least squares approach to structural equation modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Academic Press: Cambridge, MA, USA, 2013. [Google Scholar]

- Cohen, J.; Cohen, P.; West, S.G.; Aiken, L.S. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences; Routledge: Abingdon-on-Thames, UK, 2013. [Google Scholar]

- Chin, W.W.; Marcolin, B.L.; Newsted, P.R. A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Inf. Syst. Res. 2003, 14, 189–217. [Google Scholar] [CrossRef]

- Gastwirth, J.L.; Gel, Y.R.; Miao, W. The impact of Levene’s test of equality of variances on statistical theory and practice. Stat. Sci. 2009, 24, 343–360. [Google Scholar] [CrossRef]

- Stone, M. Cross-validatory choice and assessment of statistical predictions. J. R. Stat. Soc. Ser. B 1974, 36, 111–133. [Google Scholar] [CrossRef]

- Geisser, S. The predictive sample reuse method with applications. J. Am. Stat. Assoc. 1975, 70, 320–328. [Google Scholar] [CrossRef]

- Chin, W.W. How to write up and report PLS analyses. In Handbook of Partial Least Squares; Springer: Berlin/Heidelberg, Germany, 2010; pp. 655–690. [Google Scholar]

- Henseler, J.; Chin, W.W. A comparison of approaches for the analysis of interaction effects between latent variables using partial least squares path modeling. Struct. Equ. Modeling 2010, 17, 82–109. [Google Scholar] [CrossRef]

- Chin, W.W. Bootstrap cross-validation indices for PLS path model assessment. In Handbook of Partial Least Squares; Springer: Berlin/Heidelberg, Germany, 2010; pp. 83–97. [Google Scholar]

- Adams, R.; Parry, G.; Godsiff, P.; Ward, P. The future of money and further applications of the blockchain. Strateg. Chang. 2017, 26, 417–422. [Google Scholar] [CrossRef]

- Kim, S.H. A study on blockchain technology adoption and intention of logistics firms in Korea. J. Korea Soc. Comput. Inf. 2020, 25, 231–239. [Google Scholar]

- Johnson, V. Organizational Learning through Disruptive Digital Innovation. A Blockchain Implementation. Available online: https://scholarworks.gsu.edu/bus_admin_diss/118/ (accessed on 23 July 2021).

- Stratopoulos, T.C.; Wang, V.X.; Ye, J. Blockchain technology adoption. SSRN 2020. [Google Scholar] [CrossRef]

- Chalmers, D.; Matthews, R.; Hyslop, A. Blockchain as an external enabler of new venture ideas: Digital entrepreneurs and the disintermediation of the global music industry. J. Bus. Res. 2019, 125, 577–591. [Google Scholar] [CrossRef]

- Guo, Y.; Liang, C. Blockchain application and outlook in the banking industry. Financ. Innov. 2016, 2, 24. [Google Scholar] [CrossRef]

| Country | Characteristics | ||

|---|---|---|---|

| Technology Readiness Index | Networked Readiness Index | Uncertainty Avoidance Index | |

| Germany | 9.15625 | 77.48 | 65 |

| Ireland | 8.03125 | 72.13 | 35 |

| Malaysia | 7.46875 | 61.43 | 36 |

| Australia | 9.71875 | 75.09 | 51 |

| TOE Contexts | Factors | Sources |

|---|---|---|

| Technological factors | Complexity, compatibility, cost, relative advantages, security, privacy, scalability, availability of specific BCT tools, trialability, observability, immutability, transactions speed, perceived novelty, disintermediation, perceived benefits, computability, infrastructural facility, increase in data availability, reduction of information asymmetry, easy verification of transactions, comprehensibility of the transactions, data accuracy and reliability, exclusion of false information from contractual information, hacking attempts system denials, high-security encryption, contract conclusion with a reasonable fee, transparency, integrity, confidentiality, interoperability, perceived challenges, hype, trust, storage capacity, decentralization, inclusiveness, territoriality, maturity | [7,18,21,25,26,27,30,37,38,40,41,42,43,44,45] |

| Organizational factors | Top management support, top management knowledge/awareness, firm size, capability of human resources, financial resources, presence of training facilities, organizational culture, supportive technological environment, perceived risk of vendor lock-in, perceived efforts in collaboration, organization learning capability, organization innovativeness, IT governance, huge resources (energy, infrastructure), high need for process harmonization, firm scope, existing infrastructure, learning culture | [22,25,26,32,37,41,42,43,44,46] |

| Environmental factors | Regulations, competitive pressure, government policy/support, stakeholder pressure, customer pressure, trading partner readiness, legal/standards uncertainties, institutional-based trust, technology progress in the industry, support from the community, professional consultation and assistance, perceived constraint of infrastructure, market turbulence, market power, market dynamics, customer readiness, consensus among trading partners, characteristics of industry | [21,25,26,27,32,37,41,42,43,44,46,47] |

| Type of Industry | Total Population | Sample | Percentage (Out of 917) | Response | Percentage (Out of 500) |

|---|---|---|---|---|---|

| Automotive | 17 | 11 | 1.2 | 7 | 1.4 |

| Construction | 11 | 8 | 0.87 | 3 | 0.6 |

| Consultancy | 56 | 30 | 3.27 | 14 | 2.8 |

| Education | 117 | 61 | 6.65 | 21 | 4.2 |

| Electronics | 28 | 16 | 1.74 | 7 | 1.4 |

| Finance | 80 | 44 | 4.8 | 13 | 2.6 |

| Government | 3 | 2 | 0.22 | 1 | 0.2 |

| IT | 219 | 112 | 12.21 | 43 | 8.6 |

| Insurance | 56 | 30 | 3.27 | 12 | 2.4 |

| Manufacturing | 38 | 23 | 2.51 | 11 | 2.2 |

| Pharmaceutical | 46 | 26 | 2.84 | 9 | 1.8 |

| Retail | 29 | 17 | 1.85 | 8 | 1.6 |

| Supply chain | 145 | 75 | 8.18 | 29 | 5.8 |

| Telecommunication | 24 | 15 | 1.64 | 7 | 1.4 |

| Transport | 33 | 20 | 2.18 | 8 | 1.6 |

| Legal | 15 | 10 | 1.09 | 3 | 0.6 |

| Total | 917 | 500 | 54.53 | 196 | 39.2 |

| Factor | Measuring Items | Source |

|---|---|---|

| Perceived benefits (PB) | Blockchain reduces overhead expenses | [97,98] |

| Blockchain reduces data error rates | ||

| Blockchain reduces transaction costs while transferring funds | ||

| Blockchain saves time while accomplishing business tasks | ||

| Blockchain increases the organization’s overall productivity | ||

| Perceived compatibility (PC) | Blockchain fits well with business processes | [99,100] |

| Blockchain is compatible with technological infrastructure | ||

| Blockchain fits well with technological skills | ||

| Perceived complexity (PCM) | Blockchain requires extra technical skills to use | [99] |

| Blockchain is difficult to understand from a business perspective | ||

| Blockchain is conceptually difficult to understand from a technical perspective | ||

| Perceived information transparency (PIT) | Access to information across the blockchain | [101] |

| View of any activity with the data in the blockchain | ||

| See the flow of the entire data in the blockchain | ||

| Perceived disintermediation (PD) | Store data without the involvement of any intermediary | Authors |

| Access data without the involvement of any intermediary | ||

| Share data without the involvement of any intermediary | ||

| Audit without the involvement of any intermediary | ||

| Top management support (TMS) | Provides the necessary resources for blockchain | [102,103] |

| Considers blockchain as strategically important | ||

| Actively involved in IT-related decisions | ||

| Organizational innovativeness (OI) | Actively seek new ideas | [104] |

| Like to do things in new ways | ||

| Are open to taking risks | ||

| Organizational learning capability (OLC) | Have a mechanism to store new knowledge | [105] |

| Encourage their employees to acquire new knowledge and skills | ||

| Employees share their work experiences, ideas, or learning with each other | ||

| Have practices to utilize new knowledge in their IT-related decisions | ||

| Government support (GS) | Policies support the adoption of blockchain | [98] |

| Introduces economic incentives for blockchain adoption | ||

| Is active in setting up the facilities to promote blockchain | ||

| Trading partner readiness (TPR) | Willing to adopt blockchain | [97] |

| Technologically ready to adopt blockchain | ||

| Financially ready to adopt blockchain | ||

| Competitive intensity (CI) | Feel pressure when competitors have adopted blockchain | [106] |

| Feel the fear of losing a competitive advantage if they do not adopt it | ||

| See competitors benefiting from adopting blockchain | ||

| Standards uncertainty (SU) | See blockchain has not reached its maturity | [104] |

| See blockchain still requires changes to become more efficient compared with existing technologies | ||

| Cannot predict that blockchain would become an industry standard in the near future | ||

| Perceived risks (PR) | It is not secured | [107] |

| Transactions’ information will be compromised while using it | ||

| It will not provide its expected benefits | ||

| Intention to adopt blockchain (INT) | Adopt blockchain whenever they will have access to it in the future | [108] |

| Adopt blockchain in the future | ||

| Adopt blockchain frequently in the future |

| Construct with Measuring Items | Outer Loadings | CR | AVE | Cronbach’s Alpha |

|---|---|---|---|---|

| Competitive Intensity (CI) | 0.863 | 0.678 | 0.761 | |

| CI1 | 0.754 | |||

| CI2 | 0.879 | |||

| CI3 | 0.831 | |||

| Perceived Complexity (PCM) | 0.894 | 0.738 | 0.823 | |

| CMP1 | 0.829 | |||

| CMP2 | 0.869 | |||

| CMP3 | 0.878 | |||

| Government Support (GS) | 0.900 | 0.749 | 0.833 | |

| GS1 | 0.863 | |||

| GS2 | 0.846 | |||

| GS3 | 0.887 | |||

| Intention to adopt BCT (INT) | 0.881 | 0.711 | 0.796 | |

| INT1 | 0.786 | |||

| INT2 | 0.858 | |||

| INT3 | 0.883 | |||

| Organization Innovativeness (OI) | 0.887 | 0.724 | 0.810 | |

| OI1 | 0.829 | |||

| OI2 | 0.856 | |||

| OI3 | 0.868 | |||

| Organization Learning Capability (OLC) | 0.887 | 0.663 | 0.831 | |

| OLC1 | 0.778 | |||

| OLC2 | 0.860 | |||

| OLC3 | 0.782 | |||

| OLC4 | 0.834 | |||

| Perceived Benefits (PB) | 0.905 | 0.704 | 0.859 | |

| PB1 | 0.776 | |||

| PB2 | 0.871 | |||

| PB3 | 0.851 | |||

| PB4 | 0.856 | |||

| Perceived Compatibility (PC) | 0.899 | 0.749 | 0.833 | |

| PC1 | 0.866 | |||

| PC2 | 0.847 | |||

| PC3 | 0.883 | |||

| Perceived Disintermediation (PD) | 0.879 | 0.645 | 0.816 | |

| PD1 | 0.744 | |||

| PD2 | 0.847 | |||

| PD3 | 0.814 | |||

| PD4 | 0.804 | |||

| Perceived Information Transparency (PIT) | 0.929 | 0.814 | 0.887 | |

| PIT1 | 0.889 | |||

| PIT2 | 0.903 | |||

| PIT3 | 0.914 | |||

| Perceived Risks (PR) | 0.880 | 0.711 | 0.797 | |

| PR1 | 0.834 | |||

| PR2 | 0.806 | |||

| PR3 | 0.887 | |||

| Standards Uncertainty (SU) | 0.879 | 0.708 | 0.793 | |

| SU1 | 0.777 | |||

| SU2 | 0.876 | |||

| SU3 | 0.867 | |||

| Top Management Support (TMS) | 0.886 | 0.722 | 0.807 | |

| TMS1 | 0.827 | |||

| TMS2 | 0.875 | |||

| TMS3 | 0.846 | |||

| Trading Partner Readiness (TPR) | 0.886 | 0.722 | 0.805 | |

| TPR1 | 0.773 | |||

| TPR2 | 0.914 | |||

| TPR3 | 0.857 |

| Constructs | CI | PCM | GS | INT | OI | OLC | PB | PC | PD | PIT | PR | SU | TMS | TPR |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CI | 0.823 * | |||||||||||||

| PCM | 0.682 | 0.859 * | ||||||||||||

| GS | 0.043 | 0.411 | 0.866 * | |||||||||||

| INT | 0.327 | 0.581 | 0.588 | 0.843 * | ||||||||||

| OI | 0.159 | 0.382 | 0.505 | 0.223 | 0.851 * | |||||||||

| OLC | 0.204 | 0.222 | 0.110 | 0.195 | 0.638 | 0.814 * | ||||||||

| PB | 0.410 | 0.500 | 0.225 | 0.589 | 0.435 | 0.270 | 0.839 * | |||||||

| PC | 0.290 | 0.041 | 0.481 | 0.502 | 0.577 | 0.588 | 0.163 | 0.865 * | ||||||

| PD | 0.565 | 0.490 | 0.195 | 0.323 | 0.067 | 0.484 | 0.244 | 0.568 | 0.803 * | |||||

| PIT | 0.500 | 0.603 | 0.365 | 0.063 | 0.217 | 0.166 | 0.457 | 0.485 | 0.348 | 0.902 * | ||||

| PR | 0.235 | 0.111 | 0.402 | 0.684 | 0.359 | 0.405 | 0.326 | 0.215 | 0.667 | 0.518 | 0.843 * | |||

| SU | 0.175 | 0.299 | 0.025 | 0.270 | 0.168 | 0.383 | 0.038 | 0.130 | 0.514 | 0.463 | 0.651 | 0.841 * | ||

| TMS | 0.288 | 0.620 | 0.319 | 0.601 | 0.500 | 0.147 | 0.530 | 0.501 | 0.073 | 0.219 | 0.120 | 0.598 | 0.850 * | |

| TPR | 0.304 | 0.321 | 0.540 | 0.301 | 0.101 | 0.073 | 0.631 | 0.090 | 0.297 | 0.336 | 0.475 | 0.208 | 0.533 | 0.850 * |

| Hypothesis | Relationship | Path Coefficient | t-Value | Decision |

|---|---|---|---|---|

| H1 | PB→INT | 0.259 | 3.947 * | Supported |

| H2 | PC→INT | 0.178 | 3.158 ** | Supported |

| H3 | CMP→INT | −0.165 | 3.859 ** | Supported |

| H4 | PIT→INT | 0.163 | 3.713 * | Supported |

| H5 | PD→INT | 0.357 | 6.341 * | Supported |

| H6 | OI→INT | 0.273 | 4.770 * | Supported |

| H7 | OLC→INT | 0.056 | 2.371 ** | Supported |

| H8 | TMS→INT | 0.124 | 3.102 * | Supported |

| H9 | CI→INT | 0.265 | 4.538 * | Supported |

| H10 | GS→INT | 0.041 | 2.337 * | Supported |

| H11 | TPR→INT | 0.210 | 3.950 * | Supported |

| H12 | SU→INT | −0.170 | 3.185 * | Supported |

| H13 | PR→INT | −0.146 | 2.506 * | Supported |

| H13a | PB→PR→INT | −0.104 | 0.951 ** | Not Supported |

| H13b | PC→PR→INT | −0.163 | 2.204 * | Supported |

| H13c | PIT→PR→INT | 0.087 | 1.995 * | Supported |

| H13d | PD→PR→INT | 0.175 | 2.583 * | Supported |

| H13e | OI→PR→INT | −0.209 | 2.925 * | Supported |

| H13f | OLC→PR→INT | −0.102 | 1.252 ** | Not Supported |

| H13g | TMS→PR→INT | 0.026 | 0.458 ** | Not Supported |

| H13h | CI→PR→INT | 0.380 | 3.561 * | Supported |

| H13i | GS→PR→INT | 0.008 | 0.265 ** | Not Supported |

| H13j | TPR→PR→INT | −0.013 | 0.190 ** | Not Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Malik, S.; Chadhar, M.; Vatanasakdakul, S.; Chetty, M. Factors Affecting the Organizational Adoption of Blockchain Technology: Extending the Technology–Organization–Environment (TOE) Framework in the Australian Context. Sustainability 2021, 13, 9404. https://doi.org/10.3390/su13169404

Malik S, Chadhar M, Vatanasakdakul S, Chetty M. Factors Affecting the Organizational Adoption of Blockchain Technology: Extending the Technology–Organization–Environment (TOE) Framework in the Australian Context. Sustainability. 2021; 13(16):9404. https://doi.org/10.3390/su13169404

Chicago/Turabian StyleMalik, Saleem, Mehmood Chadhar, Savanid Vatanasakdakul, and Madhu Chetty. 2021. "Factors Affecting the Organizational Adoption of Blockchain Technology: Extending the Technology–Organization–Environment (TOE) Framework in the Australian Context" Sustainability 13, no. 16: 9404. https://doi.org/10.3390/su13169404

APA StyleMalik, S., Chadhar, M., Vatanasakdakul, S., & Chetty, M. (2021). Factors Affecting the Organizational Adoption of Blockchain Technology: Extending the Technology–Organization–Environment (TOE) Framework in the Australian Context. Sustainability, 13(16), 9404. https://doi.org/10.3390/su13169404