Do the Green Credit Guidelines Affect Renewable Energy Investment? Empirical Research from China

Abstract

:1. Introduction

2. Literature Review

3. Methodology, Variable Selection and Data Sources

3.1. Methodology

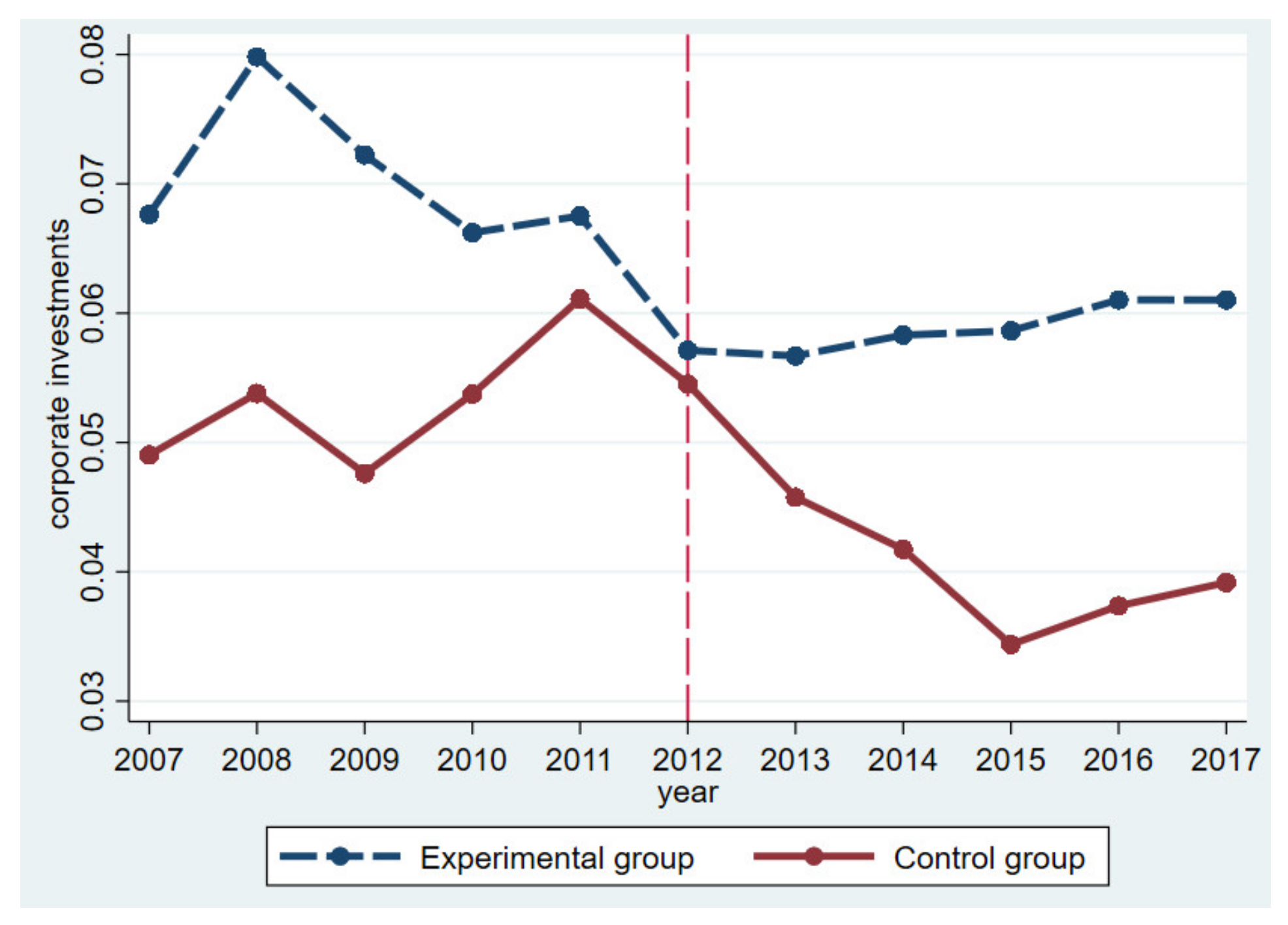

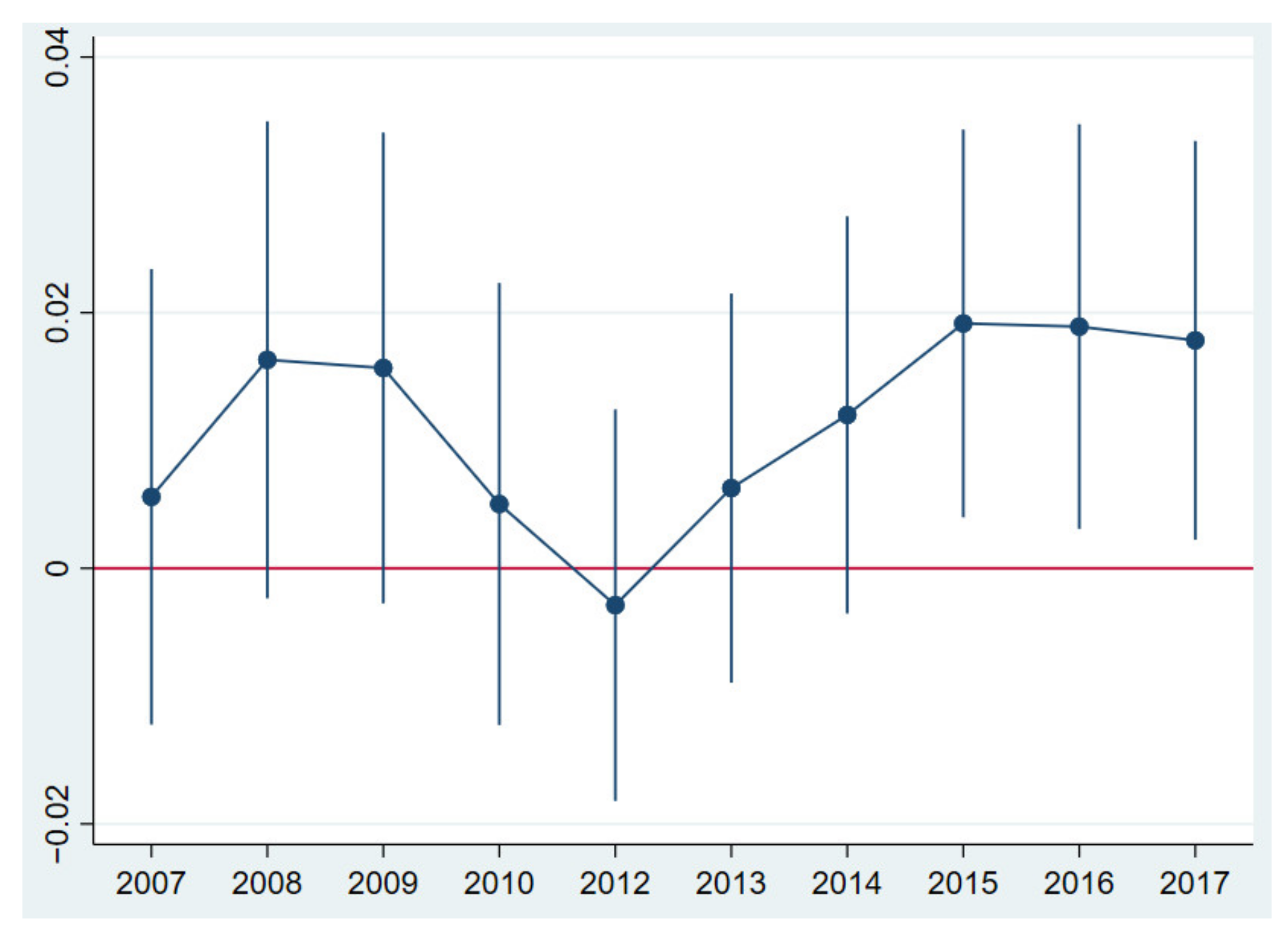

3.1.1. Difference-in-Difference Method

3.1.2. Mediating Effect Method

3.2. Variable Selection and Data Sources

4. Empirical Analysis

4.1. Unit Root Test and Correlation Coefficient Test

4.2. The Impacts of Green Credit Guidelines on Renewable Energy Investment

4.3. The Impact Mechanism of Green Credit Guidelines on Renewable Energy Investment

5. Further Discussions

5.1. Theoretical Analysis

5.2. Empirical Analysis

5.2.1. The Heterogeneous Influence Degrees

5.2.2. The Heterogeneous Influence Mechanisms

6. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Saculsan, P.; Kanamura, T. Examining risk and return profiles of renewable energy investment in developing countries: The case of the Philippines. Green Financ. 2020, 2, 135–150. [Google Scholar] [CrossRef]

- Li, T.H.; Liao, G.K. The Heterogeneous Impact of Financial Development on Green Total Factor Productivity. Front. Energy Res. 2020, 8, 9. [Google Scholar] [CrossRef] [Green Version]

- Zhong, J.H.; Li, T.H. Impact of Financial Development and Its Spatial Spillover Effect on Green Total Factor Productivity: Evidence from 30 Provinces in China. Math. Probl. Eng. 2020, 2020, 5741387. [Google Scholar] [CrossRef] [Green Version]

- Xu, S. International comparison of green credit and its enlightenment to China. Green Financ. 2020, 2, 75–99. [Google Scholar] [CrossRef]

- He, L.Y.; Liu, R.Y.; Zhong, Z.Q.; Wang, D.Q.; Xia, Y.F. Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

- Ayyagari, M.; Demirguc-Kunt, A.; Maksimovic, V. Formal versus Informal Finance: Evidence from China. Rev. Financ. Stud. 2010, 23, 3048–3097. [Google Scholar] [CrossRef] [Green Version]

- Zeng, M.; Liu, X.M.; Li, Y.L.; Peng, L.L. Review of renewable energy investment and financing in China: Status, mode, issues and countermeasures. Renew. Sustain. Energy Rev. 2014, 31, 23–37. [Google Scholar] [CrossRef]

- Richardson, B.J. The Equator Principles: The voluntary approach to environmentally sustainable finance. Eur. Energy Environ. Law Rev. 2005, 14, 280. Available online: https://kluwerlawonline.com/journalarticle/European+Energy+and+Environmental+Law+Review/14.11/EELR2005041 (accessed on 12 June 2021).

- Weber, O. Corporate sustainability and financial performance of Chinese banks. Sustain. Account. Manag. Policy J. 2017, 8, 358–385. [Google Scholar] [CrossRef] [Green Version]

- Cui, Y.J.; Geobey, S.; Weber, O.; Lin, H.Y. The Impact of Green Lending on Credit Risk in China. Sustainability 2018, 10, 2008. [Google Scholar] [CrossRef] [Green Version]

- Scholtens, B.; Dam, L. Banking on the Equator. Are banks that adopted the Equator Principles different from non-adopters? World Dev. 2007, 35, 1307–1328. [Google Scholar] [CrossRef]

- Li, Z.H.; Liao, G.K.; Albitar, K. Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 2020, 29, 1045–1055. [Google Scholar] [CrossRef]

- Xin, F.; Zhang, J.; Zheng, W.P. Does credit market impede innovation? Based on the banking structure analysis. Int. Rev. Econ. Financ. 2017, 52, 268–288. [Google Scholar] [CrossRef]

- Nanda, R.; Nicholas, T. Did bank distress stifle innovation during the Great Depression? J. Financ. Econ. 2014, 114, 273–292. [Google Scholar] [CrossRef]

- Liu, X.H.; Wang, E.X.; Cai, D.T. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Wang, E.X.; Liu, X.H.; Wu, J.P.; Cai, D.T. Green Credit, Debt Maturity, and Corporate InvestmentEvidence from China. Sustainability 2019, 11, 583. [Google Scholar] [CrossRef] [Green Version]

- Balsalobre-Lorente, D.; Leitão, N.C.; Bekun, F.V. Fresh validation of the low carbon development hypothesis under the EKC Scheme in Portugal, Italy, Greece and Spain. Energies 2021, 14, 250. [Google Scholar] [CrossRef]

- Leitão, N.C.; Lorente, D.B. The linkage between economic growth, renewable energy, tourism, CO2 emissions, and international trade: The evidence for the European Union. Energies 2020, 13, 4838. [Google Scholar] [CrossRef]

- Johnstone, N.; Hascic, I.; Popp, D. Renewable Energy Policies and Technological Innovation: Evidence Based on Patent Counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Schumacher, K. Large-scale renewable energy project barriers: Environmental impact assessment streamlining efforts in Japan and the EU. Environ. Impact Assess. Rev. 2017, 65, 100–110. [Google Scholar] [CrossRef]

- Schumacher, K. Approval procedures for large-scale renewable energy installations: Comparison of national legal frameworks in Japan, New Zealand, the EU and the US. Energy Policy 2019, 129, 139–152. [Google Scholar] [CrossRef]

- Carpenter, R.E.; Petersen, B.C. Capital market imperfections, high-tech investment, and new equity financing. Econ. J. 2002, 112, F54–F72. [Google Scholar] [CrossRef] [Green Version]

- Chen, H.F.; Chen, S.J. Investment-cash flow sensitivity cannot be a good measure of financial constraints: Evidence from the time series. J. Financ. Econ. 2012, 103, 393–410. [Google Scholar] [CrossRef]

- Zhang, D.Y.; Cao, H.; Dickinson, D.G.; Kutan, A.M. Free cash flows and overinvestment: Further evidence from Chinese energy firms. Energy Econ. 2016, 58, 116–124. [Google Scholar] [CrossRef]

- Qin, Z.; Ozturk, I. Renewable and Non-Renewable Energy Consumption in BRICS: Assessing the Dynamic Linkage between Foreign Capital Inflows and Energy Consumption. Energies 2021, 14, 2974. [Google Scholar] [CrossRef]

- Nie, P.Y.; Chen, Y.H.; Yang, Y.C.; Wang, X.H. Subsidies in carbon finance for promoting renewable energy development. J. Clean. Prod. 2016, 139, 677–684. [Google Scholar] [CrossRef]

- Krozer, Y. Financing of the global shift to renewable energy and energy efficiency. Green Financ. 2019, 1, 264–278. [Google Scholar] [CrossRef]

- Zulkhibri, M. Interest burden and external finance choices in emerging markets: Firm-level data evidence from Malaysia. Int. Econ. 2015, 141, 15–33. [Google Scholar] [CrossRef]

- Ouyang, S.; Du, Z.; Cai, M. Statistical measurement of the impact of monetary policy on price levels. Natl. Account. Rev. 2020, 2, 188–203. [Google Scholar] [CrossRef]

- Chiang, T.C. Economic policy uncertainty and stock returns-evidence from the Japanese market. Quant. Financ. Econ. 2020, 4, 430–458. [Google Scholar] [CrossRef]

- Uddin, M.A.; Hoque, M.E.; Ali, M.H. International economic policy uncertainty and stock market returns of Bangladesh: Evidence from linear and nonlinear model. Quant. Financ. Econ. 2020, 4, 236–251. [Google Scholar] [CrossRef]

- Li, Z.H.; Zhong, J.H. Impact of economic policy uncertainty shocks on China’s financial conditions. Financ. Res. Lett. 2020, 35, 7. [Google Scholar] [CrossRef]

- Wang, Y.Z.; Chen, C.R.; Huang, Y.S. Economic policy uncertainty and corporate investment: Evidence from China. Pac. -Basin Financ. J. 2014, 26, 227–243. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy Uncertainty and Corporate Investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- Liu, X.M.; Zeng, M. Renewable energy investment risk evaluation model based on system dynamics. Renew. Sustain. Energy Rev. 2017, 73, 782–788. [Google Scholar] [CrossRef]

- Zhang, D.Y.; Cao, H.; Zou, P.J. Exuberance in China’s renewable energy investment: Rationality, capital structure and implications with firm level evidence. Energy Policy 2016, 95, 468–478. [Google Scholar] [CrossRef] [Green Version]

- Yang, X.L.; He, L.Y.; Xia, Y.F.; Chen, Y.F. Effect of government subsidies on renewable energy investments: The threshold effect. Energy Policy 2019, 132, 156–166. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Bertrand, M.; Duflo, E.; Mullainathan, S. How much should we trust differences-in-differences estimates? Q. J. Econ. 2004, 119, 249–275. [Google Scholar] [CrossRef] [Green Version]

- Bertrand, M.; Mullainathan, S. Enjoying the quiet life? Corporate governance and managerial preferences. J. Political Econ. 2003, 111, 1043–1075. [Google Scholar] [CrossRef] [Green Version]

- Su, X.; Zhou, S.S.; Xue, R.; Tian, J.F. Does economic policy uncertainty raise corporate precautionary cash holdings? Evidence from China. Account. Financ. 2020, 60, 4567–4592. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Canes-Wrone, B.; Davis, S.J.; Rodden, J. Why Has US Policy Uncertainty Risen Since 1960? Am. Econ. Rev. 2014, 104, 56–60. [Google Scholar] [CrossRef] [Green Version]

| Variable | Notation | Measurement Indicators |

|---|---|---|

| Renewable energy investment | INV | The cash paid for the fixed assets, intangible assets and other long-term assets/total assets |

| Short-term debts | SD | Short-term debts/total assets |

| Long-term debts | LD | Long-term debts/total assets |

| Financial constraints | FC | SA index |

| Firm size | SIZE | Ln (total assets) |

| Tobin Q | Tobin Q | Market value/total assets |

| Profitability | ROA | ROA |

| Cash holdings | CASH | Monetary capital/total assets |

| Leverage | LEV | Liability/total assets |

| Firm age | Age | The listed years |

| Variable | N | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| INV | 9538 | 0.0496 | 0.0534 | −0.0584 | 0.2567 |

| SIZE | 9538 | 9.5285 | 0.5876 | 8.2361 | 11.3020 |

| Tobin Q | 9538 | 2.9659 | 2.1279 | 0.9322 | 11.3571 |

| CASH | 9538 | 0.1962 | 1.5001 | 0.0091 | 0.7394 |

| LEV | 9538 | 0.4777 | 0.2276 | 0.0505 | 1.2796 |

| ROA | 9538 | 0.0343 | 0.0579 | −0.2450 | 0.1953 |

| Age | 9538 | 10.3995 | 6.2537 | 0 | 27 |

| SD | 9538 | 0.1097 | 0.1130 | 0 | 0.5084 |

| LD | 9538 | 0.0566 | 0.0969 | 0 | 0.4644 |

| FC | 9538 | −3.5191 | 0.2428 | −4.0199 | −3.0434 |

| INVsoe | 7032 | 0.0525 | 0.0542 | −0.0446 | 0.2587 |

| INVnon-soe | 2506 | 0.0405 | 0.0509 | −0.1007 | 0.2481 |

| INVSME | 4769 | 0.0473 | 0.0566 | −0.1025 | 0.2610 |

| INVLarge | 4769 | 0.0511 | 0.0512 | −0.0142 | 0.2532 |

| Fisher–ADF Chi-Square | p | PP–Fisher Chi-Square | p | |

|---|---|---|---|---|

| INV | 5917.8894 | 0.0000 | 7409.0861 | 0.0000 |

| SIZE | 3870.1586 | 0.0000 | 4586.7856 | 0.0000 |

| Tobin Q | 3361.4245 | 0.0000 | 4037.4922 | 0.0000 |

| CASH | 4177.8611 | 0.0000 | 6917.0742 | 0.0000 |

| LEV | 3895.4238 | 0.0000 | 4488.5632 | 0.0000 |

| ROA | 5384.8142 | 0.0000 | 5865.4446 | 0.0000 |

| Age | 4193.0374 | 0.0000 | 4673.6678 | 0.0000 |

| SD | 4143.1468 | 0.0000 | 4617.6577 | 0.0000 |

| LD | 4207.3699 | 0.0000 | 4264.5740 | 0.0000 |

| FC | 3087.6350 | 0.0000 | 3398.1974 | 0.0000 |

| INV | SIZE | Tobin Q | CASH | LEV | ROA | Age | |

|---|---|---|---|---|---|---|---|

| INV | 1 | ||||||

| SIZE | 0.062 *** | 1 | |||||

| Tobin Q | 0.028 *** | −0.261 *** | 1 | ||||

| CASH | −0.0658 *** | −0.226 *** | 0.207 *** | 1 | |||

| LEV | −0.096 *** | 0.310 *** | −0.319 *** | −0.308 *** | 1 | ||

| ROA | 0.123 *** | 0.039 *** | 0.071 *** | 0.259 *** | −0.256 *** | 1 | |

| Age | −0.225 *** | 0.241 *** | −0.2913 *** | −0.301 *** | −0.315 *** | −0.171 *** | 1 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Post × Treat | 0.0083 *** | 0.0081 *** | 0.0095 *** |

| (0.0030) | (0.0030) | (0.0029) | |

| Post | −0.0189 *** | −0.0192 *** | −0.0792 *** |

| (0.0026) | (0.0026) | (0.0088) | |

| Treat | 0.0699 *** | 0.0677 *** | 0.0503 *** |

| (0.0208) | (0.0199) | (0.0161) | |

| Tobin Q | −0.0009* | 0.0020 *** | |

| (0.0005) | (0.0006) | ||

| CASH | −0.0447 *** | −0.0444 *** | |

| (0.0050) | (0.0049) | ||

| LEV | −0.0297 *** | −0.0372 *** | |

| (0.0046) | (0.0045) | ||

| ROA | 0.0623 *** | 0.0496 *** | |

| (0.0120) | (0.0117) | ||

| SIZE | 0.0311 *** | ||

| (0.0029) | |||

| Age | 0.0039 *** | ||

| (0.0008) | |||

| Year Dummies | Suppressed | ||

| Firm Dummies | Suppressed | ||

| N | 9538 | 9538 | 9538 |

| R2 | 0.481 | 0.471 | 0.460 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| SD | INV | LD | INV | FC | INV | |

| Post × Treat | −0.0110 ** | 0.0093 *** | −0.0099 ** | 0.0109 *** | 0.0051 *** | 0.0097 *** |

| (0.0045) | (0.0029) | (0.0051) | (0.0029) | (0.0011) | (0.0029) | |

| Post | −0.0492 *** | −0.0800 *** | −0.0703 *** | −0.0693 *** | −0.0153 *** | −0.0796 *** |

| (0.0102) | (0.0088) | (0.0113) | (0.0088) | (0.0052) | (0.0087) | |

| Treat | −0.0445 *** | 0.0496 *** | 0.2760 *** | 0.0113 | 0.1290 *** | 0.0539 *** |

| (0.0157) | (0.0162) | (0.0133) | (0.0169) | (0.0201) | (0.0165) | |

| SL | −0.0160 ** | |||||

| (0.0074) | ||||||

| LL | 0.1410 *** | |||||

| (0.0117) | ||||||

| FC | −0.0281 | |||||

| (0.0258) | ||||||

| Control Variables | Suppressed | |||||

| Year dummies | Suppressed | |||||

| Firm dummies | Suppressed | |||||

| N | 9538 | 9538 | 9538 | 9538 | 9538 | 9538 |

| R2 | 0.7260 | 0.4810 | 0.7550 | 0.4970 | 0.9960 | 0.4810 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| State-Owned Firms | Not-State-Owned Firms | Large Firms | Small Firms | |

| Post × Treat | 0.0069 ** | 0.0048 | −0.0015 | 0.0179 ** |

| (0.0041) | (0.0044) | (0.0039) | (0.0073) | |

| Post | −0.0424 *** | −0.0446 *** | −0.0370 *** | −0.0811 *** |

| (0.0059) | (0.0147) | (0.0080) | (0.0116) | |

| Treat | 0.0639 *** | −0.0886 *** | 0.0217 | 0.0924 *** |

| (0.0165) | (0.0166) | (0.0178) | (0.0151) | |

| Control Variables | Suppressed | |||

| Year dummies | Suppressed | |||

| Firm dummies | Suppressed | |||

| N | 9538 | 7032 | 2506 | 4769 |

| R2 | 0.481 | 0.489 | 0.462 | 0.599 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| SD | INV | LD | INV | FC | INV | |

| Post × Treat | −0.0157 *** | 0.00662 | −0.0238 *** | 0.0106 *** | 0.0047 *** | 0.00694 * |

| (0.00582) | (0.00405) | (0.00627) | (0.00400) | (0.00130) | (0.0041) | |

| Post | −0.0879 *** | −0.0445 *** | −0.0447 *** | −0.0357 *** | −0.00479 | −0.0424 *** |

| (0.00949) | (0.00591) | (0.00881) | (0.00591) | (0.00511) | (0.00585) | |

| Treat | −0.0379 ** | 0.0630 *** | 0.308 *** | 0.0175 | 0.141 *** | 0.0624 *** |

| (0.0175) | (0.0167) | (0.0138) | (0.0178) | (0.0157) | (0.0179) | |

| SL | −0.0239 ** | |||||

| (0.00945) | ||||||

| LL | 0.1510 *** | |||||

| (0.0145) | ||||||

| FC | 0.0103 | |||||

| (0.0287) | ||||||

| Control Variables | Suppressed | |||||

| Year dummies | Suppressed | |||||

| Firm dummies | Suppressed | |||||

| N | 7032 | 7032 | 7032 | 7032 | 7032 | 7032 |

| R2 | 0.741 | 0.490 | 0.786 | 0.504 | 0.997 | 0.489 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| SD | INV | LD | INV | FC | INV | |

| Post × Treat | −0.0033 ** | 0.0179 ** | −0.0234 *** | 0.0210 *** | −0.00146 | 0.0180 ** |

| (0.0115) | (0.0073) | (0.0090) | (0.0072) | (0.0024) | (0.0073) | |

| Post | −0.1390 *** | −0.0831 *** | −0.0421 *** | −0.0755 *** | 0.0118 | −0.0815 *** |

| (0.0179) | (0.0117) | (0.0129) | (0.0120) | (0.0078) | (0.0117) | |

| Treat | 0.1000 *** | 0.0938 *** | 0.144 *** | 0.0732 *** | −0.0044 | 0.0925 *** |

| (0.0167) | (0.0151) | (0.0181) | (0.0145) | (0.0027) | (0.0151) | |

| SL | −0.0144 ** | |||||

| (0.0111) | ||||||

| LL | 0.1330 *** | |||||

| (0.0251) | ||||||

| FC | 0.0294 | |||||

| (0.0730) | ||||||

| Control Variables | Suppressed | |||||

| Year dummies | Suppressed | |||||

| Firm dummies | Suppressed | |||||

| N | 4769 | 4769 | 4769 | 4769 | 4769 | 4769 |

| R2 | 0.7670 | 0.5170 | 0.6680 | 0.5240 | 0.9990 | 0.5160 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, K.; Wang, Y.; Huang, Z. Do the Green Credit Guidelines Affect Renewable Energy Investment? Empirical Research from China. Sustainability 2021, 13, 9331. https://doi.org/10.3390/su13169331

Zhang K, Wang Y, Huang Z. Do the Green Credit Guidelines Affect Renewable Energy Investment? Empirical Research from China. Sustainability. 2021; 13(16):9331. https://doi.org/10.3390/su13169331

Chicago/Turabian StyleZhang, Kexian, Yan Wang, and Zimei Huang. 2021. "Do the Green Credit Guidelines Affect Renewable Energy Investment? Empirical Research from China" Sustainability 13, no. 16: 9331. https://doi.org/10.3390/su13169331

APA StyleZhang, K., Wang, Y., & Huang, Z. (2021). Do the Green Credit Guidelines Affect Renewable Energy Investment? Empirical Research from China. Sustainability, 13(16), 9331. https://doi.org/10.3390/su13169331