Abstract

In the current dynamic and competitive environment, the sustainable competitive advantage of firms has flowed to the development of innovative knowledge assets. Drawing on resource dependence theory, this paper develops a contingency research model to explore how technology-independent directors affect innovative knowledge assets. A sample of Chinese manufacturing firms listed on Shanghai and Shenzhen Stock Exchanges between 2010 and 2019 was used for the regression analysis. By employing the fixed effect model, the results show that technology-independent directors have a significant positive impact on innovative knowledge assets. Furthermore, the impact of technology-independent directors on innovative knowledge assets is strengthened in the firms that are state-owned, larger, and older. These results provide important insights related to innovation research.

1. Introduction

With the rise in environmental problems, more and more firms are obliged to achieve sustainable development. The sustainable development requires firms to transform their business logics from short-term, focusing on economic performance, to long-term, including the concern of environmental responsibility [1]. It is argued that the innovative knowledge assets, a particular kind of organizational knowledge, which are characterized as firm-specific and difficult-to-imitate [2], is a strategic tool for firms to nurture the transformations of business logics because they are the foundations of strategy development [3]. Therefore, it is important for firms to understand how to develop innovative knowledge assets in order to achieve sustainable development.

Prior research on innovative knowledge assets has paid much attention to its role of contributing to firm performance, particularly economic performance [4,5]. Meanwhile, the research on the development of innovative knowledge assets always falls into organisational and managerial practices [6]. For instance, Rai (2011) argues that organizational culture is a critical factor in building knowledge creation [7]. Von Krogh et al. (2012) proposes that leadership plays an important role in the knowledge creation process [8]. However, the research of the antecedent of the innovative knowledge assets have not been extended to the board of directors. Investigating the role of the board of directors is important because they are the decision-making groups [9], having significant influence on the organisational and managerial practices of a firm [10]. Specifically, this paper is interested in a special kind of directors, which are technology-independent directors. Technology-independent directors are the outside directors with backgrounds in technology [11]. There is some research that focuses on the effects of director backgrounds. For instance, Dass et al. (2014) find that directors with industry expertise can help firms increase their R&D investment [12]. Balsmeier et al. (2014) find that independent directors with management experience have a positive effect on innovation performance [13]. However, less focus has paid on technology-independent directors. The independent directors with technology backgrounds are critical for firms because they not only have more in-depth understandings of specific technologies relevant to the firm, but also have more connections with external stakeholders to gain special technology information and knowledge. Thus, they may have a closer relationship with the development of innovative knowledge assets. In this paper, we provide two underlying mechanisms to explain how technology-independent directors affect innovative knowledge assets.

Beyond the direct relationship, this paper next explores whether the effect of technology-independent directors on innovative knowledge assets may be enhanced or restricted by three fundamental firm characteristics, which are firm ownership, firm size, and firm age [14,15]. Previous research on the board of directors has paid some attention to whether the functions of boards of directors are equally important in all firms. For instance, O’connell and Cramer (2010) investigate the moderating role of firm size on the relationship between board characteristics and firm performance [16]. Desender et al. (2013) find that a firm’s ownership structure shapes the abilities of board members to monitor top management [17]. Although the previous research has provided some insights regarding the contingency effects of firm characteristics on their board of directors, they always focus on single characteristic. Actually, a firm has more than one characteristic, and these characteristics may have different effects. Firm size and firm age are two of the most critical firm-level factors that influence innovation activities [18]. Firm ownership signals a firm’s superior access to resources that are unavailable from market channels [19]. The ownership is particularly important in the Chinese context in which state-owned firms are significantly different from non-state-owned firms. In this paper, we argue that firm ownership, firm size, and firm age may positively moderate the relationship between technology-independent directors and innovative knowledge assets. The arguments are based on the assumption that state-owned firms, larger firms, and older firms can better access resources than non-state-owned firms, smaller firms, and younger firms [15], which enables the technology-independent directors accelerate the innovative knowledge assets more easily. The revelation of the moderating effects of firm ownership, firm size, and firm age will provide us with a deeper understanding of the relationship between technology-independent directors and innovative knowledge assets.

Using a panel data of Chinese manufacturing firms from 2010 to 2019, this paper examines the relationship between independent directors with technology backgrounds and innovative knowledge assets. Specifically, we address two research questions: Do technology-independent directors positively affect innovative knowledge assets? If so, do firm ownership, firm size, and firm age moderate that relationship? The remainder of the paper is organized as follows. Section 2 develops the research hypotheses of this paper. Section 3 and Section 4 present the method issues and the analysis results, respectively. The research results are discussed in Section 5, and the final section concludes with implications and limitations.

2. Research Hypotheses

2.1. Technology-Independent Directors and Innovative Knowledge Assets

This paper focuses on the independent directors with technology backgrounds, a kind of board of directors that are less explored, and examines their effects on innovative knowledge assets. This paper develops its theoretical arguments based on resource dependence theory. Resource dependence theory is premised on the notion that the existence of all firms critically depends on the provision of vital resources [20], and this is especially true in firm innovation. According to the resource dependence theory, one of the most important function of board of directors is the resource provision because they do not only have essential skills and expertise themselves, but they can also link firms to external stakeholders through their networks to help firms acquire external resources [21]. The resource provision function of the board of directors has been proven by several studies, and this is particularly important for the development of innovative knowledge assets because it involves a huge amount of resources input. The nature of the innovative knowledge assets is that they cannot be readily bought and sold, and thus they must be built in-house by firms [5]. However, if a firm has a lack of resources, the development of innovative knowledge assets could not be achieved successfully. Therefore, technology-independent directors may have a positive impact on innovative knowledge assets.

Firstly, technology-independent directors could affect innovative knowledge assets by providing firms with advanced knowledge and diversified opinions regarding specific technologies, and thus help firms to produce more innovative output. Researchers have argued that the homogeneous groups are more likely to mire in myopic and faulty decision making [22]. Accordingly, boards with more inside directors who have relatively homogeneous backgrounds may lack a clear understanding of the external environment and thus be less likely to support the development of innovative knowledge assets [23]. Conversely, boards with a greater proportion of technology-independent directors are more likely to be heterogeneous in terms of the backgrounds of their members [24]. The technology-independent directors may provide an in-depth understanding of specific technologies relevant to the firm and to the corresponding industry. This provides firms with more knowledge about external environments, which enables firms to become more engaged in the innovative knowledge assets development. Moreover, the development of innovative knowledge assets is a complex activity with high risk [25]. A board consisting of more technology-independent directors is likely to be vigorous and vigilant in making the strategic decisions related to innovative knowledge assets [26]. Independent directors with technology backgrounds may not only have an appreciation of current technology dynamics, but also be skilled in identifying and exploiting new technology opportunities [27]. Accordingly, the incorporation of more technology-independent directors to the board may ensure the success probability of the development of innovative knowledge assets.

Secondly, via positions in the industry, technology-independent directors could maintain good connections with external stakeholders, which enable them to help firms acquire critical resources [28]. All of these resources can consequently contribute to the development of innovative knowledge assets. Given that the innovative knowledge assets development is a costly process, a lack of external information and knowledge may be a major obstacle to success. Owing to their reputations, technology-independent directors always can build relationships with other firms’ directors, which may facilitate the communication with high-quality information and knowledge enabling firms to be well-informed of environmental events and trends [29]. This will allow firms to identify and assess new opportunities for the development of innovative knowledge assets [30]. In addition, the complexity of innovative knowledge assets also requires the execution of multiple practices [5]. The social ties of technology-independent directors may be helpful in providing an important source of information and knowledge about how other firms develop innovative knowledge assets [31]. This information and knowledge can provide firms with potential solutions when encountering difficulties in their innovation activities, which is beneficial for the development of innovative knowledge assets. Lastly, the development of innovative knowledge assets requires high-quality human resources [5]. The social ties of technology-independent directors also allow firms to build valuable connections with other stakeholders in acquiring human resources [23]. Therefore, firms with technology-independent directors may recruit more qualified human resources to implement innovation activities, which contribute to the development of innovative knowledge assets. Based on the above arguments, the following hypothesis is proposed:

Hypothesis 1.

Technology-independent directors are positively associated with the innovative knowledge assets of the firm.

2.2. Moderating Role of Firm Ownership

State-owned firms are the firms that are controlled by the government as the dominant shareholder, while non-state-owned firms are those with different degrees of privatization. The main difference between state-owned firms and non-state-owned firms is the government involvement. From a resource dependence perspective, the ownership ties with government could bring firms with resource advantages [14], which will create a favorable climate for technology-independent directors to develop innovative knowledge assets. Firstly, from the perspective of financial resources, state-owned firms have advantages over non-state-owned to access [32]. State-owned firms are more likely to obtain subsidies, tax rebates, and research funding from government and are also more likely to obtain loans from banks or other institutions [33]. Therefore, technology-independent directors in state-owned firms could stimulate the development of innovative knowledge assets more easily. In contrast, non-state-owned firms are typically faced with financial resource poverty when engaging in innovation activities [34], which limits the role of technology-independent directors in the development of innovative knowledge assets. Secondly, from the perspective of information resources, state-owned firms may have less policy uncertainty surrounding innovation activities [35]. It is argued that being state-owned can help a firm gain more information on government regulations and emerging policies [36]. With the access to such kinds of information, a firm could better evaluate innovation projects according to the government’s potentially requirements or preferences [37]. In such circumstances, the technology-independent directors will have more confidence on their innovation investments, and thus are more likely to develop innovative knowledge assets. On the contrary, the technology-independent directors in non-state-owned firms find it harder to make decisions in innovation investments, which weakens their role in enhancing innovative knowledge assets. Thirdly, state-owned firms also enjoy other resource advantages, such as have greater access to up-to-date technology and technical human resources [38]. These superiorities also place technology-independent directors of state-owned firms in an advantageous position to engage in the development of innovative knowledge assets. Based on the above arguments, the following hypothesis is proposed:

Hypothesis 2.

The relationship between technology-independent directors and innovative knowledge assets is bounded by the firm’s ownership in such a way that the relationship would be stronger for state-owned firms than non-state-owned firms.

2.3. Moderating Role of Firm Size

Firm size and firm age could be considered as two of the important contingency organizational factors [39]. In the literature, firm size and firm age have been identified as two of the key variables that may facilitate or constrain a firm’s innovation activities [40]. From resource dependence perspective, larger firms and older firms are in better positions in resource accumulation as well as resource acquisition, which may influence the effect of technology-independent directors. However, most of the previous research only includes them as control variables in analyzing the relationship between boards of directors and innovation. In this paper, we further investigate whether firm size and firm age play the moderating role in the relationship between technology-independent directors and innovative knowledge assets.

There are at least three potential reasons why the impact of technology-independent directors on innovative knowledge assets is connected to firm size. Firstly, larger firms tend to have more financial resources than smaller firms [41]. Therefore, they can invest more in innovation projects, which can effectively motivate technology-independent directors to make more decisions that are conducive to innovation, and hence produce more innovative knowledge assets. In contrast, smaller firms, usually financially constrained firms, always use their financial resources in operation rather than innovation, which could not motivate technology-independent directors to support innovation. Secondly, larger firms are better able to tolerate potential losses stemming from innovation [40]. Therefore, larger firms provide technology-independent directors with more support in innovation decision-making, which contributes to the development of innovative knowledge assets. In contrast, smaller firms are less able to tolerate the potential losses associated with innovation initiatives. Therefore, technology-independent directors in smaller firms will find it more difficult to reach a consensus about innovation decisions, making them particularly detrimental to innovative knowledge assets. Thirdly, larger firms generally have a better opportunity to successfully realize innovation projects because they have well-defined procedures to carry out innovation activities [42]. It has been acknowledged that larger firms have established structures and processes [43]. In this case, the technology-independent directors in larger firms probably face relatively few problems, and they could foster innovative knowledge assets more easily. However, smaller firms always have less formalized structures and processes, in which technology-independent directors have more difficult tasks to develop innovative knowledge assets. Based on the above arguments, the following hypothesis is proposed:

Hypothesis 3.

The relationship between technology-independent directors and innovative knowledge assets is bounded by the firm size in such a way that the relationship would be stronger for larger firms than smaller firms.

2.4. Moderating Role of Firm Age

Firm age is also a demographic characteristic of a firm that may affect the relationship between technology-independent directors and innovative knowledge assets. The theoretical basis for treating firm age as a moderator is the notion of liability of newness [44]. The liability of newness posits that younger firms are disadvantaged vis-à-vis older firms because younger firms are always lacking resources, and there is much empirical support for the liability of newness [45].

Liability of newness as a theoretical basis provides several predictions for the moderating role of firm age on the effect of technology-independent directors on innovative knowledge assets. Firstly, older firms tend to have more slack resources, while younger firms have inadequate or constrained resources [40]. Moreover, the external actors, such as creditors and suppliers, may also be reluctant to interact with younger firms, making it more difficult for younger firms to acquire resources [46]. Therefore, the efforts of technology-independent directors will not as readily translate into innovative knowledge assets in younger firms because of a lack of resources. This logic is similar to that for firm size. Secondly, older firms have more experience with innovation activities. Older firms could be able to apply their experience to identify which innovation projects are more likely to fail and terminate them earlier, reducing the risks and minimizing the costs of innovation investments [47]. Furthermore, older firms may also have a more diversified portfolio of innovation projects, which would reduce the overall uncertainty of their innovation activities [48]. On this occasion, the technology-independent directors in older firms may have more return on innovative knowledge assets because the probability of innovation success is higher. Thirdly, technology-independent directors in older firms could launch innovation projects on the high-quality human resource [49]. In contrast, the human resources in younger firms are less likely to have the experience to implement complex innovation activities [50], which is likely to impede the effect of technology-independent directors. Based on the above arguments, the following hypothesis is proposed:

Hypothesis 4.

The relationship between technology-independent directors and innovative knowledge assets is bounded by the firm age in such a way that the relationship would be stronger for older firms than younger firms.

3. Method

3.1. Samples

This paper integrated the China Stock Market and Accounting Research (CSMAR) database, Wind database, and Chinese Research Data Services (CNRDS) database to obtain research data. Specifically, this paper derived innovative knowledge assets data from CSMAR and CNRDS database. The data on technology-independent directors and the control variables data were obtained from the CSMAR database. We used Wind database to supplement missing data. We included all manufacturing firms listed on Shanghai and Shenzhen Stock Exchanges between 2010 and 2019 in our initial sample. Following previous research, we then excluded the firms with ST and ST *, firms with abnormal data, as well as those firms that did not disclose complete information. The final panel dataset to be used for analysis included 734 firms and 5270 firm-observations.

3.2. Measurement

3.2.1. Dependent Variable

Usually, firms invest in R&D and then produce patent applications, which further give rise to innovative knowledge assets [51]. Therefore, patent applications can represent the latest innovative knowledge assets most directly [5]. Moreover, patent applications indicate more managerial activities while patents granted can be the result of managerial efforts, and it can also result from governmental regulations [52]. Since our focus in this paper is the outcomes of technology-independent directors, patent applications are deemed to be more proper than patents granted [53].

There are three sub-categories of patents in China, namely invention patents, utility model patents, and design patents. Among these three kinds of patents, the invention patents are the most original. Therefore, in line with previous research [54], we use the number of invention patent applications in the firm plus one and then take the natural logarithm to measure innovative knowledge assets. In the robustness tests, we also include utility model patents and design patents to measure innovative knowledge assets.

In this paper, the dependent variable (innovative knowledge assets) is modeled one year after the independent variables. This one-year lag allows time for technology-independent directors to develop innovative knowledge assets.

3.2.2. Independent Variable

Following previous research, independent directors with working experience in production, R&D, and design are considered as technology-independent directors [11]. Following this operating definition, we first reviewed the vitae of each independent director obtained from CSMAR to determine whether a director is a technology-independent director or not. We then used the number of technology-independent director divided by the total number of independent directors as the proxy in the regression analysis.

3.2.3. Moderating Variables

Following previous research, firm ownership is measured by the ultimate controller of the firm. If a firm was state-owned, it was assigned a value of 1. If a firm was non-state-owned, it was assigned a value of 0 [36]. Firm size is measured as the natural log of the total assets [55], while firm age is computed by the number of years since the firm was established [56]. Furthermore, as part of our research design, the variables of firm ownership, firm size, and firm age are used as independent and moderating variables as well as control variables.

3.2.4. Control Variables

Control variables were included to improve the reliability of our analysis. Leverage, measured by the book value of debt divided by total assets, was chosen because a high debt to equity ratio may affect investment decisions on innovation [57]. Firm growth, measured by the annual growth rate of sales revenue, was chosen because firms with high growth may have more flexibility in innovation investments [58]. To account for the effect of firm performance on innovative knowledge assets, we included return on assets (ROA) as a control variable [59]. To account for the effect of board on innovative knowledge assets, we included board size as a control variable [60]. To capture the effect of a firm’s competitive environment, we included Herfindahl–Hirschman Index (HHI) as a control variable [61]. Finally, the year dummies were included to control for any potential patenting trends over time.

3.3. Model Specification

To test our hypotheses, we use the following regression models:

Innovative knowledge assetsi,t+1 = β1Technology-independent directorsi,t + γ1Leveragei,t + γ2Firm growthi,t + γ3ROAi,t + γ4Board sizei,t + γ5HIHIi,t + μi,t

Innovative knowledge assetsi,t+1 = β1Technology-independent directorsi,t + β2Firm ownershipi,t + β3Technology-independent directorsi,t×Firm ownershipi,t + γ1Leveragei,t + γ2Firm growthi,t + γ3ROAi,t + γ4Board sizei,t + γ5HIHIi,t + μi,t

Innovative knowledge assetsi,t+1 = β1Technology-independent directorsi,t + β2Firm sizei,t + β3Technology-independent directorsi,t×Firm sizei,t + γ1Leveragei,t + γ2Firm growthi,t + γ3ROAi,t + γ4Board sizei,t + γ5HIHIi,t + μi,t

Innovative knowledge assetsi,t+1 = β1Technology-independent directorsi,t + β2Firm agei,t + β3Technology-independent directorsi,t×Firm agei,t + γ1Leveragei,t + γ2Firm growthi,t + γ3ROAi,t + γ4Board sizei,t + γ5HIHIi,t + μi,t

Innovative knowledge assetsi,t+1 = β1Technology-independent directorsi,t + β2Firm ownershipi,t + β3Technology-independent directorsi,t×Firm ownershipi,t + β4Firm sizei,t + β5Technology-independent directorsi,t×Firm sizei,t + β6Firm agei,t + β7Technology-independent directorsi,t×Firm agei,t + γ1Leveragei,t + γ2Firm growthi,t + γ3ROAi,t + γ4Board sizei,t + γ5HIHIi,t + μi,t

Model 1 introduces technology-independent directors and control variables to explain the impact of technology-independent directors on innovation knowledge assets. Models 2 to 4 introduce the moderating variables and their interactions with technology-independent directors to explain the moderating effects of firm ownership, firm size, and firm age on the relationship between technology-independent directors and innovation knowledge assets. Model 5 is the full model.

4. Results

4.1. Descriptive Statistics

Table 1 reports the descriptive statistics of the regression variables. From Table 1, it can be seen that the minimum value and the maximum value of innovation knowledge assets are 0 and 8.8346, respectively, which indicates that there exist significant variations in the innovative knowledge assets of the sample firms. The mean value of technology-independent directors is 0.8222. The average value of firm ownership is 0.2606, indicating that the proportion of state-owned firms in the sample was 26.06%. The standard deviations of firm size and firm age are 1.2101 and 5.7249, respectively, indicating that there are certain differences in the selected firms in terms of firm size and firm age.

Table 1.

Descriptive statistics.

Table 2 reports the correlation coefficients between the regression variables. The correlation coefficient between innovative knowledge assets and technology-independent directors is 0.049 (p < 0.01). This result shows that without considering the influence of other variables, the more technology-independent directors, the more innovative knowledge assets. This result essentially meets the expectations of Hypothesis 1. To prevent serious multicollinearity among explanatory variables, we also calculated the variance inflation factor (VIF value) of each variable. The calculation results show the VIF value of each explanatory variable.

Table 2.

Correlations results.

4.2. Regression Analysis

To reduce the potential problem of multicollinearity, the predictor and moderator variables were mean-centered prior to the creation of the interaction terms. Before the regression analysis, the Hausman test was run, which specifies that the fixed effect model is better than random effect model (p < 0.001). As a result, this paper employs the fixed effect model to explain the regression results. The results are shown in Table 3. Model 1 tests the main effect of technology-independent directors on innovative knowledge assets. The coefficient of technology-independent directors is positive and significant (β = 0.1960, p < 0.01). Thus, Hypothesis 1 is supported. We entered the three moderators into Models 2, Model 3, and Model 4, to test Hypothesis 2, Hypothesis 3, and Hypothesis 4, respectively. Model 2 examines the effect of the interaction between technology-independent directors and firm ownership. The coefficient of the interaction term is found to be positive and significant (β = 0.0541, p < 0.01). Hence, Hypothesis 2 is supported. Model 3 shows the coefficient of the interactive term between technology-independent directors and firm size to be positive and significant (β = 0.0073, p < 0.05). Therefore, Hypothesis 3 receives supports. Model 4 examines the effect of the interaction between technology-independent directors and firm age. The coefficient of the interaction term is found to be positive and significant (β = 0.1102, p < 0.05). Hence, Hypothesis 4 is supported. The results show consistent findings with those presented in Model 2 to Model 4.

Table 3.

Regression results.

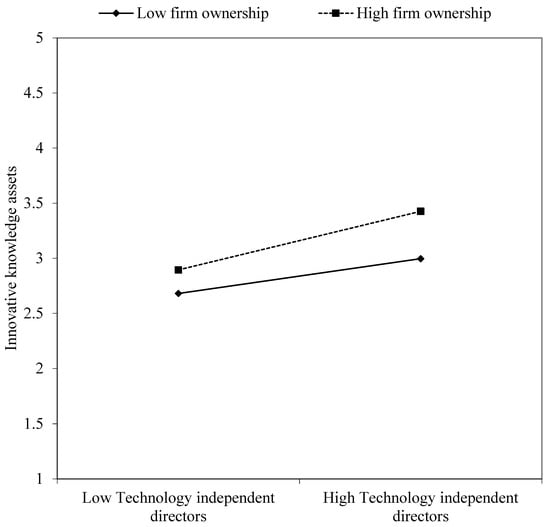

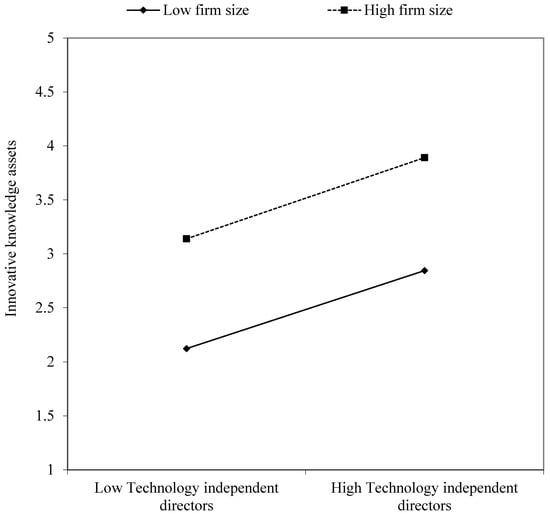

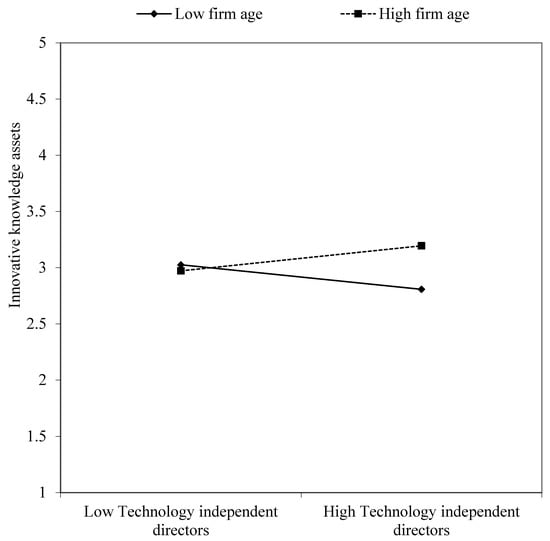

To visualize the significant interaction effects, we plotted three figures to show the moderating effects of firm ownership, firm size, and firm age. Figure 1 shows that the slope is much steeper when the firm is state-owned. In other words, the innovative knowledge assets will increase significantly faster when the technology-independent directors are in state-owned firms. Figure 2 and Figure 3 depict the moderating effects of firm size and firm age, respectively. From the figure, we can know that the innovative knowledge assets will increases significantly faster when the technology-independent directors are in larger firms and older firms.

Figure 1.

The moderating effect of firm ownership.

Figure 2.

The moderating effect of firm size.

Figure 3.

The moderating effect of firm age.

4.3. Robustness Tests

This paper ran two robustness tests to verify whether the results were robust. Firstly, we included all three sub-categories of patents, namely, invention patents, utility model patents, and design patents, to measure innovative knowledge assets. In order to reflect the innovative differences of different kinds of patents, this paper assigned different weights to different kinds of patents. To be specific, the weight of invention patents, utility model patents, and design patents was 3:2:1. Then, we re-ran the regression analysis. As reported in Table 4, the robustness regression results had no substantial differences with the previous findings, which showed that the research results were robust.

Table 4.

Robustness test of alternative measure of the innovative knowledge assets.

Furthermore, according to the research of Tabesh et al. (2019) [62], this paper included other control variables to determine whether the results were robust. We included two control variables, which were the R&D investment and the board shareholding ratio. A higher R&D investment allows firms to stimulate more innovative output [63] while board shareholding has a direct relationship with how boards engage in innovation [64]. After adding two control variables, we re-ran the regression analysis. The results are shown in Table 5. The results are in line with the previous findings, which showed that the research results were robust.

Table 5.

Robustness test of inclusion of other control variables.

4.4. Endogeneity

This paper takes several measures to avoid endogeneity. For instance, we set the value for all of the independent variables and control variables with a one-year lag to avoid the potential endogeneity caused by correlations among independent variables. Moreover, we also employed the fixed effect model to avoid time-invariant heterogeneities.

In order to further address the concern of endogeneity, we used the system GMM method to re-run the main model of regression analysis as well as the robustness test. The GMM method has several advantages, such as tackling the endogeneity based on internal instruments instead of relying on external instruments and explicitly modeling the dynamic nature of the relationship by including past performance as one of the variables. The results of the system GMM regression are shown in Table 6, having no substantial differences with the previous findings.

Table 6.

System GMM regression results.

5. Discussions

The literature has long recognized the importance of the board of directors to a firm’s innovation [65], and it has been argued that the resource provision of the board of directors is an important function for firm innovation [66]. The development of innovative knowledge assets is a complex innovation issue, and thus the board of directors is particularly important [67]. Our results prove that technology-independent directors have positive and significant effect on innovative knowledge assets (β = 0.1960, p < 0.01), which is in line with the broad arguments of the effect of board of directors [68]. This paper provides two underlying mechanisms for the effects of technology-independent directors based on the resource dependence theory. On one hand, it is widely accepted that independent directors have accumulated varied human capital during their professional careers. This allows them to learn how to engage in innovation decisions and further to acquire better decisions’ consequences [69]. Therefore, the technology background of independent directors could assist firms by enhancing positive value from investments in innovation, which brings benefit to the development of innovative knowledge assets. On the other hand, firms with more independent directors could access to more innovation related resources because they provide a firm with connections with external stakeholders [70]. Therefore, technology-independent directors can exert a significant positive impact on innovative knowledge assets since they can be regarded as a means for facilitating the acquisition of external resources, especially the resources related to firm innovation. As a result, the technology-independent directors have closely positive relationship with innovative knowledge assets.

On the basis of the direct effect, this paper also explored the boundary conditions of the relationship between technology-independent directors and innovative knowledge assets. It has been found that the firm ownership (β = 0.0541, p < 0.01), firm size (β = 0.0073, p < 0.05), and firm age (β = 0.1102, p < 0.05) all exerted important impacts on that relationship, which is also consistent with the arguments of the resource dependence theory. One of the basic arguments of the resource dependence theory is that firms are not autonomous, but rather are constrained by a network of interdependencies with other stakeholders [21]. It is argued that being connected with the government will strongly influences business operations through resource allocation [36]. Therefore, as government-owned entities, state-owned firms enjoy privileges granted by the government and related agencies. For instance, state-owned banks, which control most of the lending capital, prioritize state-owned firms as their top clients. State ownership thus helps a firm to access such capital [71], which then enable the technology-independent directors obtain more finical support to develop innovative knowledge assets. In addition, the firm size and firm age also affect a firm’s ability to acquire and retain resources. Over time, firms make strategic commitments that embed them within a value network of suppliers, customers, communities, etc. [18]. Consequently, larger firms and older firms have better access to external resources for firm innovation. Following this logic, compared to smaller firms and younger firms, the technology-independent directors in larger firms and older firms have more chances to develop valuable innovations.

6. Conclusions

This paper was motivated by the desire to better understand the role of technology-independent directors in the development of innovative knowledge assets. Using data on Chinese manufacturing firms from 2010 to 2019, this paper found that the technology-independent directors have a significant positive impact on innovative knowledge assets (β = 0.1960, p < 0.01), and that impact was stronger for state-owned firms (β = 0.0541, p < 0.01), larger firms (β = 0.0073, p < 0.05), and older firms (β = 0.1102, p < 0.05) than non-state-owned firms, smaller firms, and younger firms. Based on these research results, this paper advances the literature in several ways.

Firstly, this paper extends the resource dependence theory by showing how technology-independent directors apply their human capital and relation capital to develop innovative knowledge assets. Previous studies of innovative knowledge assets mainly focus on its consequence [4,5], while the research on the board of directors mainly focuses on the effect of independent directors [31,72]. This paper transferred these streams of literature by revealing that technology-independent directors can exert influences on innovative knowledge assets. Hence, this paper, on the one hand, extends the implications of technology-independent directors and sheds light on the exploration of further consequences of technology-independent directors. On the other hand, this paper also identifies a new antecedent of innovative knowledge assets and thus offers important new directions on how firms can stimulate innovative knowledge assets.

Secondly, this paper contributes the interpretation of the conditions under which the relationship between technology-independent directors and innovative knowledge assets can be intensified or weakened. Although there are several studies that have investigated the impact of firm characteristics on boards of directors [42,50], there are few studies that explore the effects of firm ownership, firm size, and firm age on the relationship between independent directors and firm innovation simultaneously. The results of this paper confirmed that firm ownership, firm size, and firm age all positively moderate the relationship between technology-independent directors and innovative knowledge assets. This paper thus provides a more detailed elaboration of the mechanisms that enable independent directors to apply and leverage their human capital to govern firm innovation. The results of this paper can also open a research field for other moderating effects concerning the effect of technology-independent directors.

Thirdly, this paper also contributes to innovation research by providing fresh insights into how resources provision affects firm innovation and further presents a more nuanced and comprehensive account of which kind of firms could benefit more from the resources provision. Thus, this paper demonstrates that the development of innovative knowledge assets is more multifaceted than previously assumed.

This paper also has some practical implications. Firstly, the technology-independent directors have a significant and positive effect on innovative knowledge assets. This result indicates that firms attempting to gain a competitive advantage through innovative knowledge assets should increase the weight of technology-independent directors in their boards. Secondly, by confirming the moderating roles of firm ownership, firm size, and firm age on the relationship between technology-independent directors and innovative knowledge assets, we emphasize that the increasing of technology-independent directors should depend on each firm’s ownership, size, and age. To be specific, firms that are state-owned, larger, and older could employ more technology-independent directors because these firms could benefit more from the employment.

Although this paper provides some relevant contributions to the existing literature, it also presents some limitations, which leave room for future research. Firstly, this paper relies on patent applications to measure innovative knowledge assets. Despite their extensive use, patent applications can only capture a subset of a firm’s innovative knowledge assets. Therefore, further research might create a more comprehensive measurement to measure innovative knowledge assets.

Secondly, although this paper provided some insights into the effect of technology-independent directors on innovative knowledge assets, the internal mediating mechanism of this connection was not examined. For the sake of obtaining greater benefits from technology-independent directors, future research is needed to examine the internal mediating mechanisms in detail.

Thirdly, in addition to firm ownership, firm size, and firm age, other firm characteristics may be considered such as organizational structure, which might also influence the relationship between technology-independent directors and innovative knowledge assets. Moreover, future research may also extend our line of inquiry by investigating the moderating effect of the external environment, such as competitive intensity and environmental dynamism.

Lastly, another opportunity for future research derives from the research sample. The sample in this paper was limited to the Chinese manufacturing listed firms. In order to verify the generalizability of our findings, other industries and countries may be analyzed.

Limitations notwithstanding, this paper has found support for the positive effect of technology-independent directors on innovative knowledge assets. It also systematically examined how firms’ fundamental attributes may differentially affect the effect of technology-independent directors on innovative knowledge assets. Our findings could enhance the understanding of how boards of directors affect innovation, which may stimulate more future research in this important research area.

Author Contributions

Conceptualization, Y.L.; methodology, R.H.; original draft preparation, Y.L. and R.H.; review and editing, W.W. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Humanities and Social Sciences Project of MOE (20YJC630090), National Natural Science Foundation of China (72072047), Heilongjiang Philosophy and Social Science Research Project (19GLB087), the Fundamental Research Funds for the Central Universities (HIT.HSS.202102), and the Science and Technology Program of Hebei Province, China (20557688D).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The study did not report any data.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Xing, X.; Liu, T.; Wang, J.; Shen, L.; Zhu, Y. Environmental Regulation, Environmental Commitment, Sustainability Exploration/Exploitation Innovation, and Firm Sustainable Development. Sustain. 2019, 11, 6001. [Google Scholar] [CrossRef] [Green Version]

- Ferraresi, A.A.; Quandt, C.O.; dos Santos, S.A.; Frega, J.R. Knowledge management and strategic orientation: Leveraging innovative-ness and performance. J. Knowl. Manag. 2012, 16, 688–701. [Google Scholar] [CrossRef] [Green Version]

- Mills, A.M.; Smith, T.A. Knowledge management and organizational performance: A decomposed view. J. Knowl. Manag. 2011, 15, 156–171. [Google Scholar] [CrossRef]

- Díaz-Díaz, N.L.; Aguiar-Díaz, I.; De Saá-Pérez, P. The effect of technological knowledge assets on performance: The innovative choice in Spanish firms. Res. Policy 2008, 37, 1515–1529. [Google Scholar] [CrossRef]

- He, J.; Wang, H.C. Innovative knowledge assets and economic performance: The asymmetric roles of incentives and monitoring. Acad. Manag. J. 2009, 52, 919–938. [Google Scholar] [CrossRef]

- Natalicchio, A.; Ardito, L.; Savino, T.; Albino, V. Managing knowledge assets for open innovation: A systematic literature review. J. Knowl. Manag. 2017, 21, 1362–1383. [Google Scholar] [CrossRef]

- Rai, R.K. Knowledge management and organizational culture: A theoretical integrative framework. J. Knowl. Manag. 2011, 15, 779–801. [Google Scholar] [CrossRef]

- Von Krogh, G.; Nonaka, I.; Rechsteiner, L. Leadership in organizational knowledge creation: A review and framework. J. Manag. Stud. 2012, 49, 240–277. [Google Scholar] [CrossRef]

- Wu, J.; Wu, Z. Integrated risk management and product innovation in China: The moderating role of board of directors. Technovation 2014, 34, 466–476. [Google Scholar] [CrossRef]

- Arzubiaga, U.; Kotlar, J.; De Massis, A.; Maseda, A.; Iturralde, T. Entrepreneurial orientation and innovation in family SMEs: Unveiling the (actual) impact of the Board of Directors. J. Bus. Ventur. 2018, 33, 455–469. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.; Liu, Y.; Xie, F. Technology directors and firm innovation. J. Multinatl. Financ. Manag. 2019, 50, 76–88. [Google Scholar] [CrossRef]

- Dass, N.; Kini, O.; Nanda, V.; Onal, B.; Wang, J. Board expertise: Do directors from related industries help bridge the information gap? Rev. Financ. Stud. 2014, 27, 1533–1592. [Google Scholar] [CrossRef]

- Balsmeier, B.; Buchwald, A.; Stiebale, J. Outside directors on the board and innovative firm performance. Res. Policy 2014, 43, 1800–1815. [Google Scholar] [CrossRef]

- Chen, C.; Zhan, Y.; Yi, C.; Li, X.; Wu, Y.J. Psychic distance and outward foreign direct investment: The moderating effect of firm hetero-geneity. Manag. Decis. 2020, 58, 1497–1515. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Y.A.; Shi, W. Navigating geographic and cultural distances in international expansion: The paradoxical roles of firm size, age, and ownership. Strat. Manag. J. 2019, 41, 921–949. [Google Scholar] [CrossRef]

- O’connell, V.; Cramer, N. The relationship between firm performance and board characteristics in Ireland. Eur. Manag. J. 2010, 28, 387–399. [Google Scholar] [CrossRef]

- Desender, K.A.; Aguilera, R.V.; Crespi, R.; GarcÍa-cestona, M. When does ownership matter? Board characteristics and behavior. Strat. Manag. J. 2013, 34, 823–842. [Google Scholar] [CrossRef]

- Petruzzelli, A.M.; Ardito, L.; Savino, T. Maturity of knowledge inputs and innovation value: The moderating effect of firm age and size. J. Bus. Res. 2018, 86, 190–201. [Google Scholar] [CrossRef]

- Yi, J.; Hong, J.; Hsu, W.; Wang, C. The role of state ownership and institutions in the innovation performance of emerging market enterprises: Evidence from China. Technovation 2017, 62, 4–13. [Google Scholar] [CrossRef]

- Drees, J.M.; Heugens, P.P. Synthesizing and extending resource dependence theory: A meta-analysis. J. Manag. 2013, 39, 1666–1698. [Google Scholar] [CrossRef] [Green Version]

- Hillman, A.J.; Withers, M.C.; Collins, B.J. Resource dependence theory: A review. J. Manag. 2009, 35, 1404–1427. [Google Scholar] [CrossRef] [Green Version]

- Kim, B.; Burns, M.L.; Prescott, J.E. The strategic role of the board: The impact of board structure on top management team strategic action capability. Corp. Gov. Int. Rev. 2009, 17, 728–743. [Google Scholar] [CrossRef]

- Chen, H.L. Does board independence influence the top management team? Evidence from strategic decisions toward internationalization. Corp. Gov. Int. Rev. 2011, 19, 334–350. [Google Scholar] [CrossRef]

- Boivie, S.; Bednar, M.K.; Aguilera, R.V.; Andrus, J.L. Are boards designed to fail? The implausibility of effective board monitoring. Acad. Manag. Ann. 2016, 10, 319–407. [Google Scholar] [CrossRef]

- Freeze, R.D.; Kulkarni, U. Knowledge management capability: Defining knowledge assets. J. Knowl. Manag. 2007, 11, 94–109. [Google Scholar] [CrossRef]

- Chen, H.L.; Hsu, W.T.; Chang, C.Y. Independent directors’ human and social capital, firm internationalization and performance implications: An integrated agency-resource dependence view. Int. Bus. Rev. 2016, 25, 859–871. [Google Scholar] [CrossRef]

- Le, S.A.; Kroll, M.J.; Walters, B.A. Outside directors’ experience, TMT firm-specific human capital, and firm performance in entrepreneurial IPO firms. J. Bus. Res. 2013, 66, 533–539. [Google Scholar] [CrossRef]

- Wei, W.; Tang, R.W.; Yang, J.Y. Independent directors in Asian firms: An integrative review and future directions. Asia Pac. J. Manag. 2018, 35, 671–696. [Google Scholar] [CrossRef]

- Kweh, Q.L.; Lu, W.M.; Ting, I.W.K.; Le, H.T.M. The cubic S-curve relationship between board independence and intellectual capital efficiency: Does firm size matter? J. Intellect. Cap. 2021, 23, 40–66. [Google Scholar]

- Rejeb, W.B.; Berraies, S.; Talbi, D. The contribution of board of directors’ roles to ambidextrous innovation. Eur. J. Innov. Manag. 2019, 23, 40–66. [Google Scholar] [CrossRef]

- Lu, J.; Wang, W. Managerial conservatism, board independence and corporate innovation. J. Corp. Financ. 2018, 48, 1–16. [Google Scholar] [CrossRef]

- Liu, D.; Gong, Y.; Zhou, J.; Huang, J.-C. Human resource systems, employee creativity, and firm innovation: The moderating role of firm ownership. Acad. Manag. J. 2017, 60, 1164–1188. [Google Scholar] [CrossRef]

- Rong, Z.; Wu, X.; Boeing, P. The effect of institutional ownership on firm innovation: Evidence from Chinese listed firms. Res. Policy 2017, 46, 1533–1551. [Google Scholar] [CrossRef] [Green Version]

- Zhu, K.; Kraemer, K.L.; Xu, S. The process of innovation assimilation by firms in different countries: A technology diffusion perspective on e-business. Manag. Sci. 2006, 52, 1557–1576. [Google Scholar] [CrossRef] [Green Version]

- Ju, M.; Zhao, H. Behind organizational slack and firm performance in China: The moderating roles of ownership and competitive intensity. Asia Pac. J. Manag. 2009, 26, 701–717. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H. State ownership and firm innovation in China: An integrated view of institutional and efficiency logics. Adm. Sci. Q. 2017, 62, 375–404. [Google Scholar] [CrossRef]

- Wu, J. Asymmetric roles of business ties and political ties in product innovation. J. Bus. Res. 2011, 64, 1151–1156. [Google Scholar] [CrossRef]

- Shailer, G.; Wang, K. Government ownership and the cost of debt for Chinese listed corporations. Emerg. Mark. Rev. 2015, 22, 1–17. [Google Scholar] [CrossRef]

- D’Angelo, A.; Buck, T. The earliness of exporting and creeping sclerosis? The moderating effects of firm age, size and centralization. Int. Bus. Rev. 2018, 28, 428–437. [Google Scholar] [CrossRef]

- Yu, G.J.; Lee, J. When should a firm collaborate with research organizations for innovation performance? The moderating role of innovation orientation, size, and age. J. Technol. Transf. 2017, 42, 1451–1465. [Google Scholar] [CrossRef]

- D’Amato, A.; Falivena, C. Corporate social responsibility and firm value: Do firm size and age matter? Empirical evidence from European listed companies. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 909–924. [Google Scholar] [CrossRef]

- Zona, F.; Zattoni, A.; Minichilli, A. A contingency model of boards of directors and firm innovation: The moderating role of firm size. Br. J. Manag. 2013, 24, 299–315. [Google Scholar] [CrossRef]

- Leal-Rodríguez, A.L.; Eldridge, S.; Roldán, J.L.; Leal-Millán, A.G.; Ortega-Gutiérrez, J. Organizational unlearning, innovation outcomes, and performance: The moderating effect of firm size. J. Bus. Res. 2015, 68, 803–809. [Google Scholar] [CrossRef]

- Rafiq, S.; Salim, R.; Smyth, R. The moderating role of firm age in the relationship between R&D expenditure and financial per-formance: Evidence from Chinese and US mining firms. Econ. Model. 2016, 56, 122–132. [Google Scholar]

- Segarra-Blasco, A.; Teruel, M. Application and success of R&D subsidies: What is the role of firm age? Ind. Innov. 2016, 23, 713–733. [Google Scholar]

- BarNir, A.; Gallaugher, J.M. Auger, P. Business process digitization, strategy, and the impact of firm age and size: The case of the magazine publishing industry. J. Bus. Ventur. 2003, 18, 789–814. [Google Scholar] [CrossRef]

- Coad, A.; Segarra, A.; Teruel, M. Innovation and firm growth: Does firm age play a role? Res. Policy 2016, 45, 387–400. [Google Scholar] [CrossRef] [Green Version]

- Naldi, L.; Davidsson, P. Entrepreneurial growth: The role of international knowledge acquisition as moderated by firm age. J. Bus. Ventur. 2014, 29, 687–703. [Google Scholar] [CrossRef] [Green Version]

- Kotha, R.; Zheng, Y.; George, G. Entry into new niches: The effects of firm age and the expansion of technological capabilities on innovative output and impact. Strateg. Manag. J. 2011, 32, 1011–1024. [Google Scholar] [CrossRef]

- Bianchini, S.; Krafft, J.; Quatraro, F.; Ravix, J.-L. Corporate governance and innovation: Does firm age matter? Ind. Corp. Chang. 2018, 27, 349–370. [Google Scholar] [CrossRef]

- Qian, C.; Wang, H.; Geng, X.; Yu, Y. Rent appropriation of knowledge-based assets and firm performance when institutions are weak: A study of Chinese publicly listed firms. Strateg. Manag. J. 2017, 38, 892–911. [Google Scholar] [CrossRef]

- Wu, S.; Levitas, E.; Priem, R.L. CEO tenure and company invention under differing levels of technological dynamism. Acad. Manag. J. 2005, 48, 859–873. [Google Scholar] [CrossRef]

- Wang, H.; Zhao, S.; He, J. Increase in takeover protection and firm knowledge accumulation strategy. Strateg. Manag. J. 2016, 37, 2393–2412. [Google Scholar] [CrossRef]

- Yuan, R.; Wen, W. Managerial foreign experience and corporate innovation. J. Corp. Financ. 2018, 48, 752–770. [Google Scholar] [CrossRef]

- Munjal, S.; Requejo, I.; Kundu, S.K. Offshore outsourcing and firm performance: Moderating effects of size, growth and slack resources. J. Bus. Res. 2019, 103, 484–494. [Google Scholar] [CrossRef]

- Carr, J.C.; Haggard, K.S.; Hmieleski, K.M.; Zahra, S.A. A study of the moderating effects of firm age at internationalization on firm survival and short-term growth. Strateg. Entrep. J. 2010, 4, 183–192. [Google Scholar] [CrossRef] [Green Version]

- Jiang, W.; Wang, A.X.; Zhou, K.Z.; Zhang, C. Stakeholder relationship capability and firm innovation: A contingent analysis. J. Bus. Ethics 2020, 167, 111–125. [Google Scholar] [CrossRef]

- Guney, Y.; Li, L.; Fairchild, R. The relationship between product market competition and capital structure in Chinese listed firms. Int. Rev. Financ. Anal. 2011, 20, 41–51. [Google Scholar] [CrossRef]

- Li, J.; Xia, J.; Zajac, E.J. On the duality of political and economic stakeholder influence on firm innovation performance: Theory and evidence from Chinese firms. Strateg. Manag. J. 2018, 39, 193–216. [Google Scholar] [CrossRef]

- Chen, S.; Bu, M.; Wu, S.; Liang, X. How does TMT attention to innovation of Chinese firms influence firm innovation activities? A study on the moderating role of corporate governance. J. Bus. Res. 2015, 68, 1127–1135. [Google Scholar] [CrossRef]

- Lui, A.K.H.; Ngai, E.W.T.; Lo, C.K.Y. Disruptive information technology innovations and the cost of equity capital: The moderating effect of CEO incentives and institutional pressures. Inf. Manag. 2016, 53, 345–354. [Google Scholar] [CrossRef]

- Tabesh, P.; Vera, D.; Keller, R.T. Unabsorbed slack resource deployment and exploratory and exploitative innovation: How much does CEO expertise matter? J. Bus. Res. 2019, 94, 65–80. [Google Scholar] [CrossRef]

- Berchicci, L. Towards an open R&D system: Internal R&D investment, external knowledge acquisition and innovative performance. Res. Policy 2013, 42, 117–127. [Google Scholar]

- Klarner, P.; Probst, G.; Useem, M. Opening the black box: Unpacking board involvement in innovation. Strateg. Organ. 2020, 18, 487–519. [Google Scholar] [CrossRef]

- Robeson, D.; O’Connor, G.C. Boards of directors, innovation, and performance: An exploration at multiple levels. J. Prod. Innov. Manag. 2013, 30, 608–625. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Misangyi, V.F.; Park, C.A. The quad model for identifying a corporate director’s potential for effective moni-toring: Toward a new theory of board sufficiency. Acad. Manag. Rev. 2015, 40, 323–344. [Google Scholar] [CrossRef] [Green Version]

- Wang, C.; Xie, F.; Zhu, M. Industry expertise of independent directors and board monitoring. J. Financ. Quant. Anal. 2015, 50, 929–962. [Google Scholar] [CrossRef] [Green Version]

- Balsmeier, B.; Fleming, L.; Manso, G. Independent boards and innovation. J. Financ. Econ. 2017, 123, 536–557. [Google Scholar] [CrossRef]

- McDonald, M.L.; Westphal, J.D.; Graebner, M.E. What do they know? The effects of outside director acquisition experience on firm acquisition performance. Strateg. Manag. J. 2008, 29, 1155–1177. [Google Scholar] [CrossRef]

- Chuluun, T.; Prevost, A.; Upadhyay, A. Firm network structure and innovation. J. Corp. Financ. 2017, 44, 193–214. [Google Scholar] [CrossRef]

- Chen, V.Z.; Li, J.; Shapiro, D.M.; Zhang, X. Ownership structure and innovation: An emerging market perspective. Asia Pac. J. Manag. 2014, 31, 1–24. [Google Scholar] [CrossRef]

- Sena, V.; Duygun, M.; Lubrano, G.; Marra, M.; Shaban, M. Board independence, corruption and innovation. Some evidence on UK subsidiaries. J. Corp. Financ. 2018, 50, 22–43. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).