Trends in Corporate Social Responsibility Reporting. The Case of Chinese Listed Companies

Abstract

:1. Introduction

2. Literature Review

2.1. Overview of CSR Laws, Regulations, and Guidelines in China

2.2. Characteristics of CSR Laws, Regulations and Guidelines in China

2.2.1. Coexistence of Voluntary and Mandatory Disclosure Requirements for CSR Reports

2.2.2. Emphasis on Environmental Information Disclosure

3. Methodology of Research

3.1. Research Process and Method Used

3.2. Sample of Research and Source of Data

4. Results

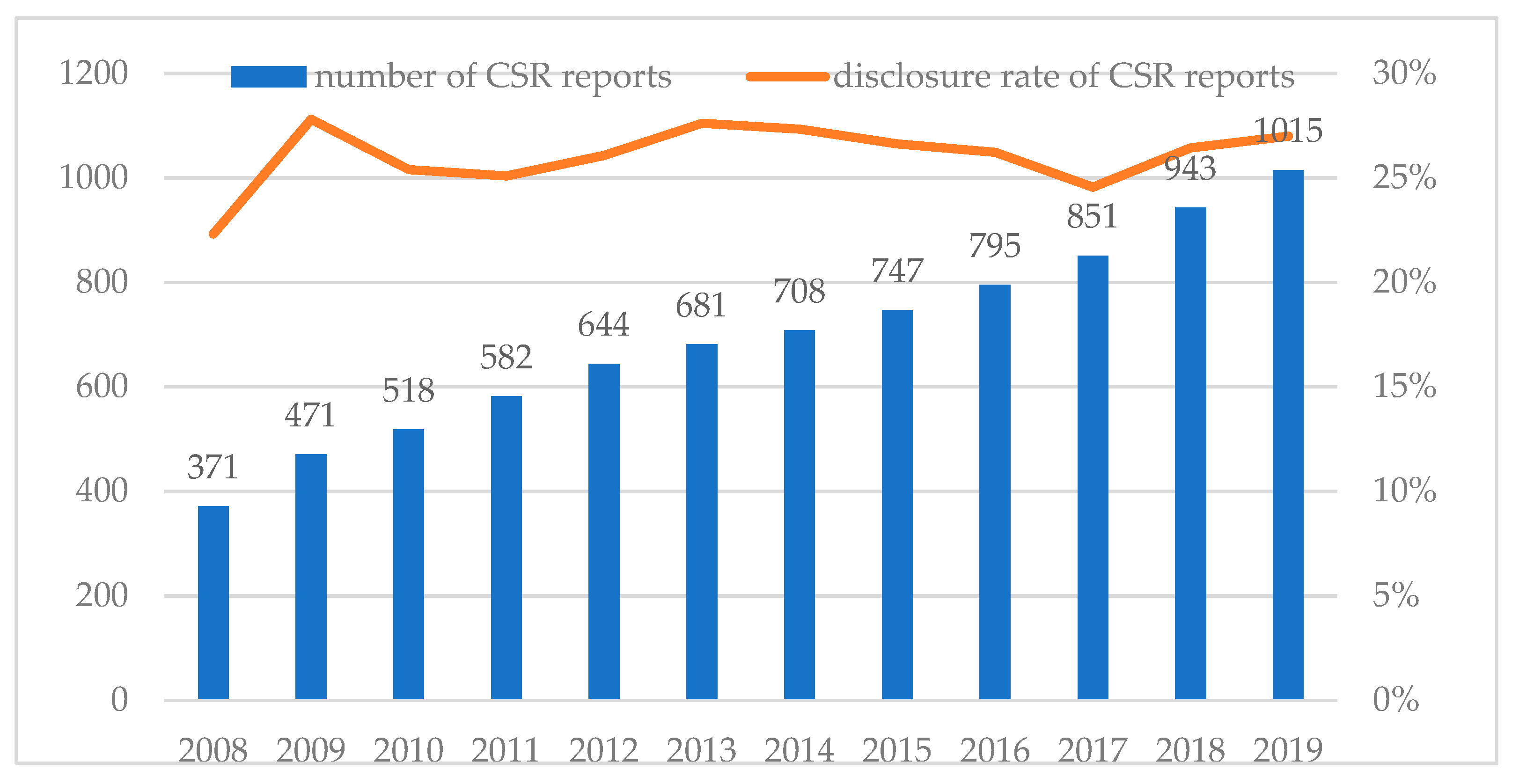

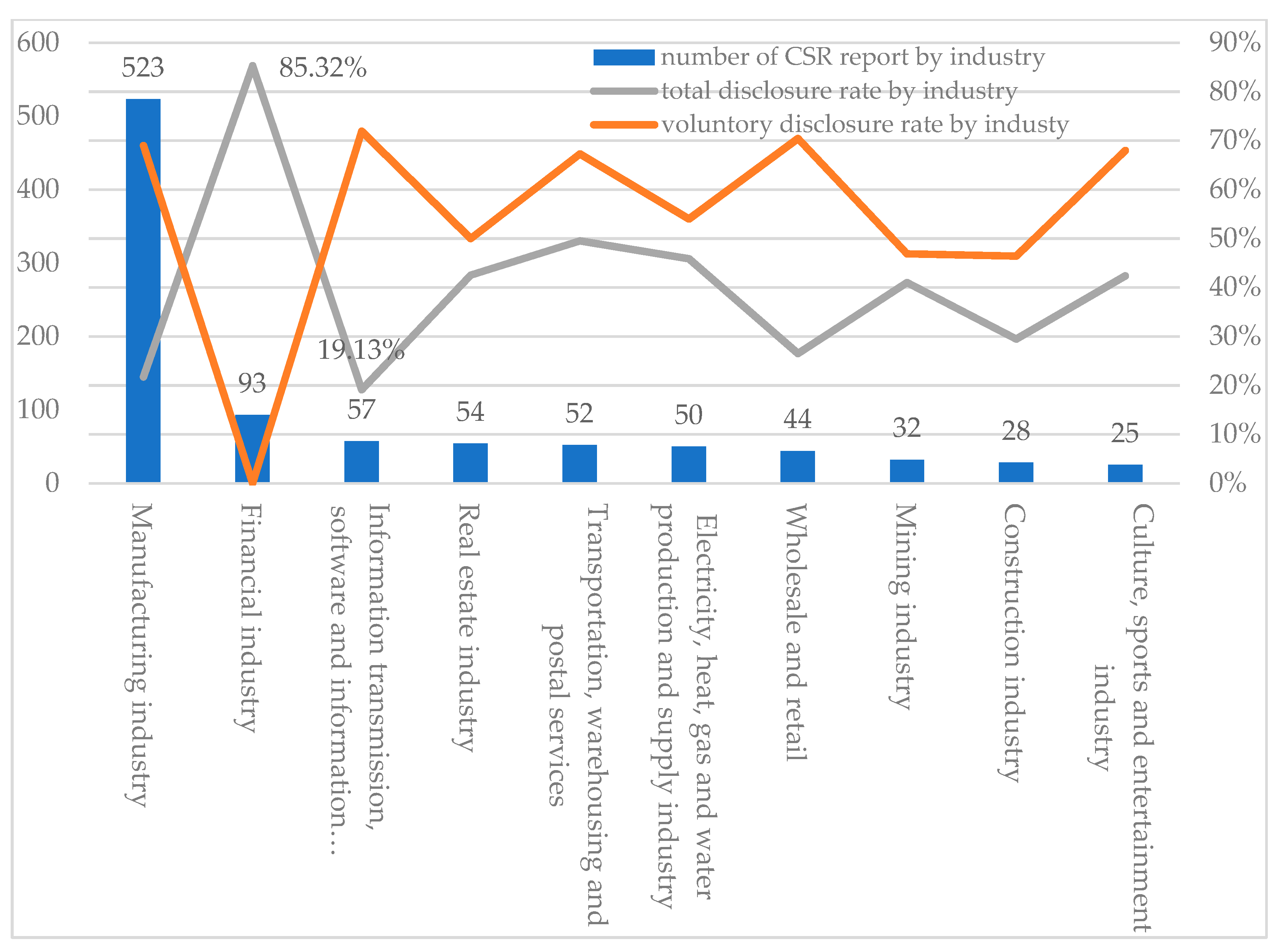

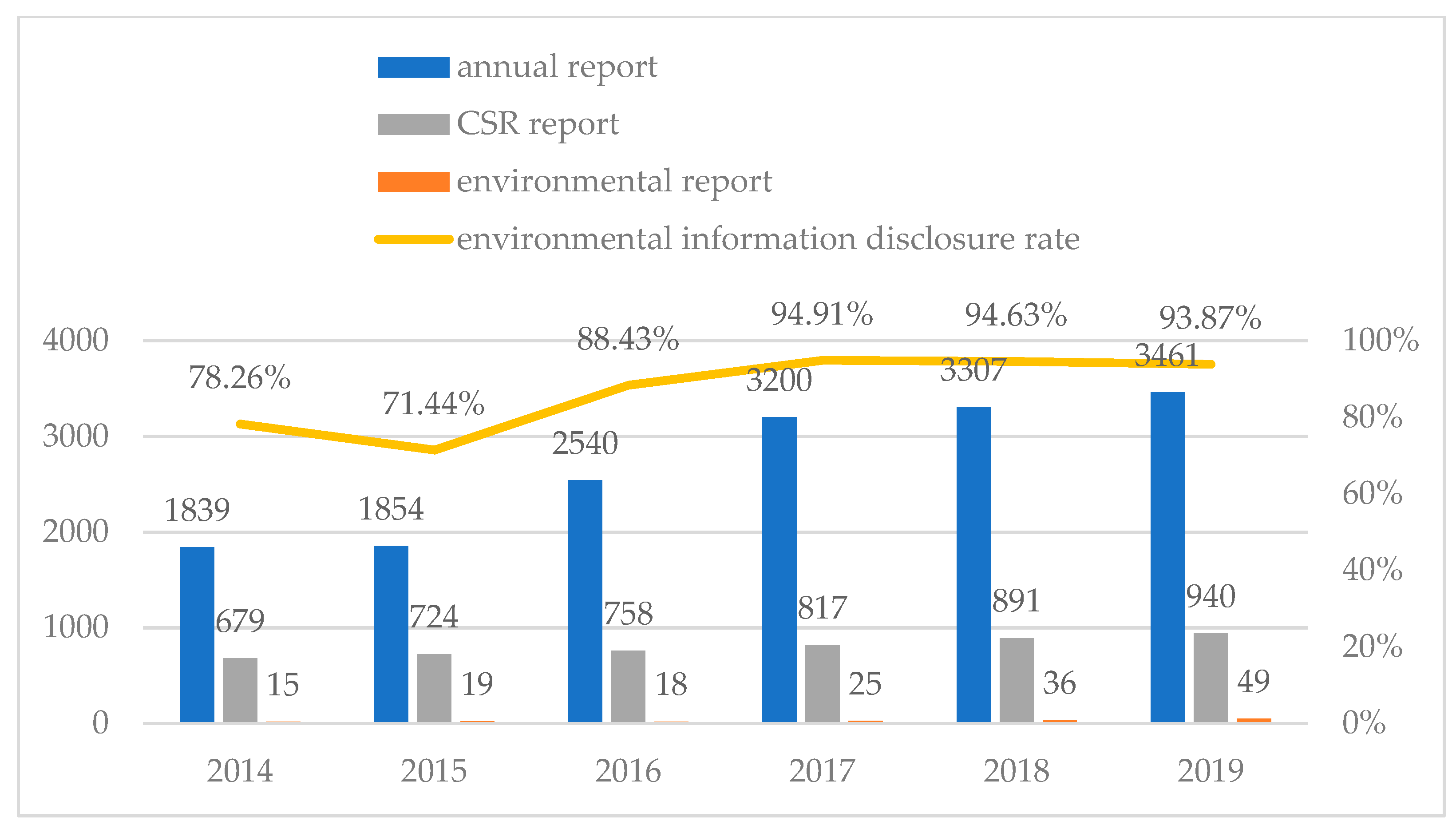

4.1. Overall Analysis of CSR Reporting of Chinese Listed Companies

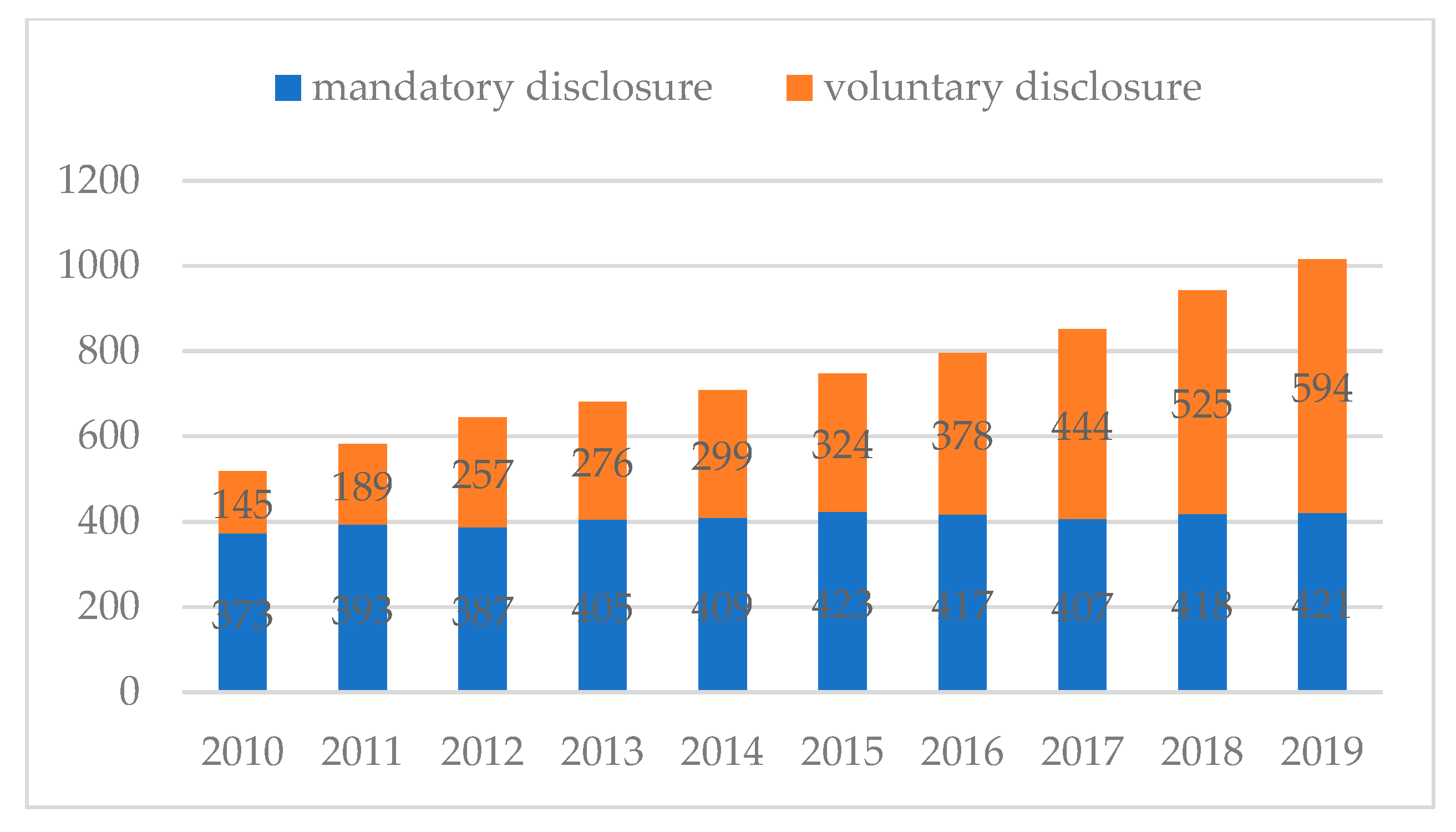

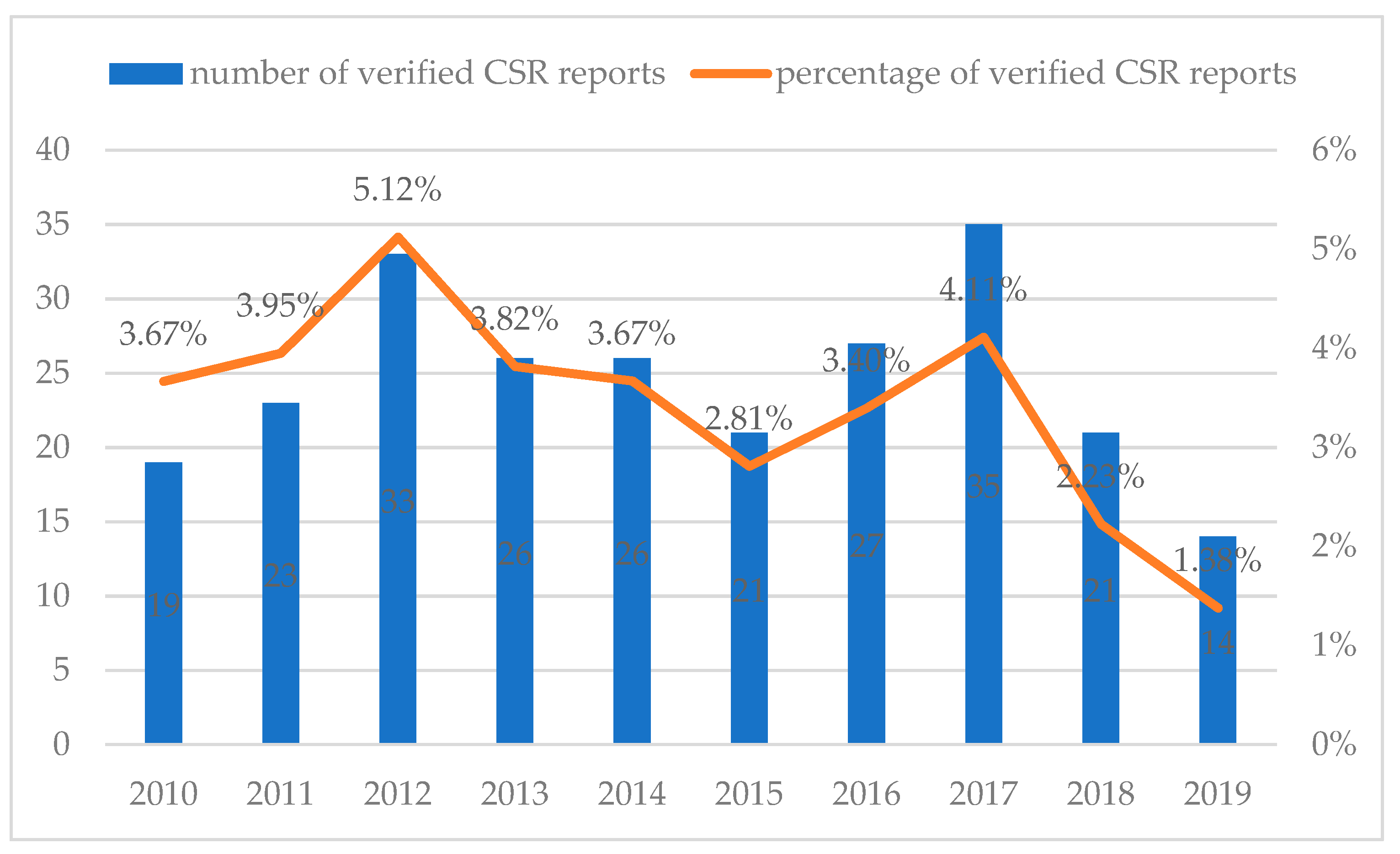

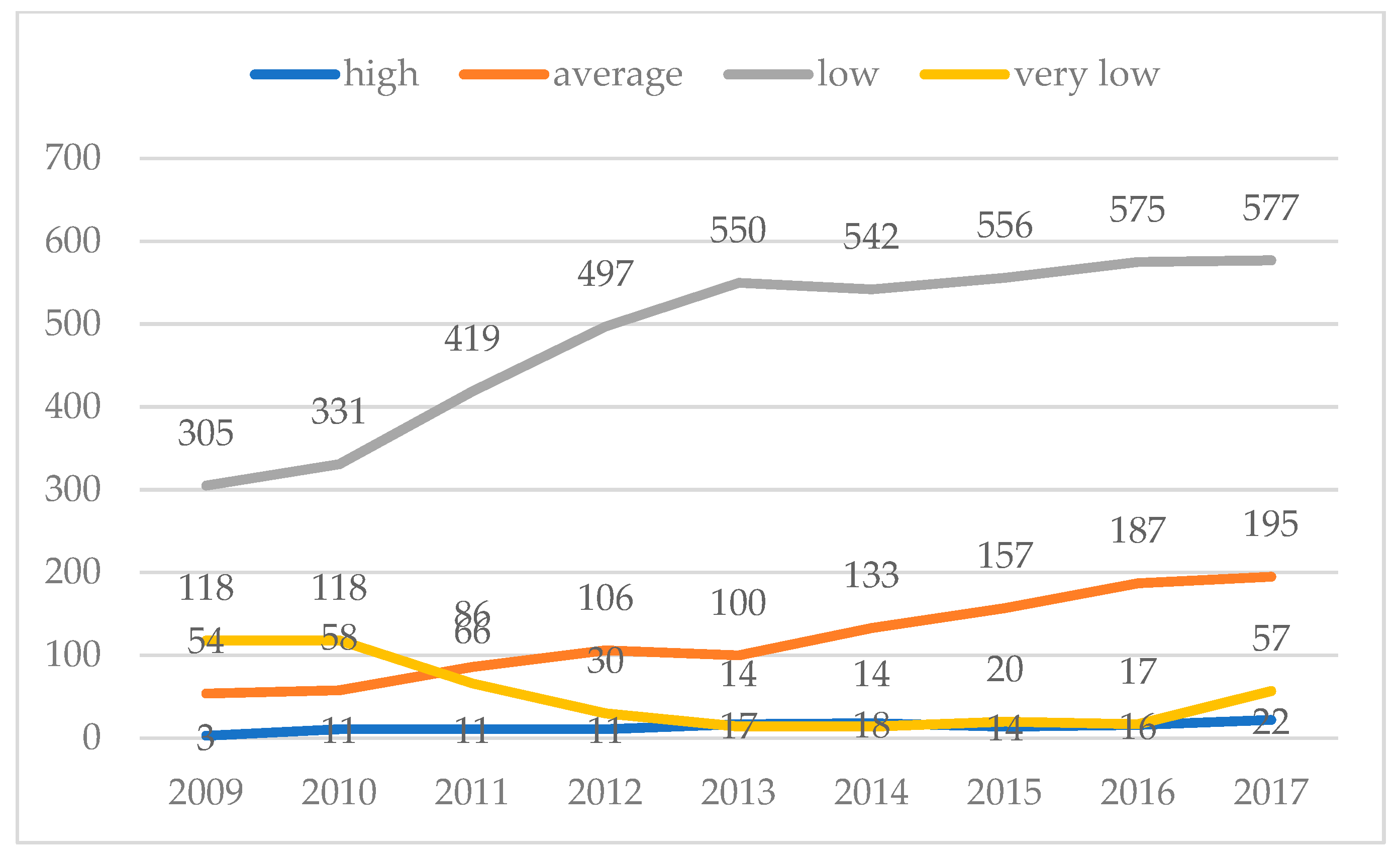

4.2. Disclosure Degree of CSR Report

4.3. Analysis of Environmental Information Disclosure

5. Discussion and Conclusions

5.1. The Strength of CSR Reporting of Chinese Listed Companies

5.2. The Weakness of CSR Reporting of Chinese Listed Companies

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Jonek-Kowalska, I.; Zielinski, M. How CSR affects polish enterprises. Eur. Res. Stud. J. 2020, XXIII, 785–803. [Google Scholar] [CrossRef]

- Cierna, H.; Sujová, E. Integrating principles of excellence and of socially responsible entrepreneurship. Manag. Syst. Prod. Eng. 2020, 28, 23–28. [Google Scholar] [CrossRef] [Green Version]

- Hąbek, P.; Wolniak, R. Relationship between management practices and quality of CSR reports. Procedia Soc. Behav. Sci. 2016, 220, 115–123. [Google Scholar] [CrossRef] [Green Version]

- Lock, I.; Seele, P. The credibility of CSR (corporate social responsibility) reports in Europe. Evidence from a quantitative content analysis in 11 countries. J. Clean. Prod. 2016, 122, 86–200. [Google Scholar] [CrossRef] [Green Version]

- Tschopp, D.; Huefner, J.R. Comparing the evolution of CSR reporting to that of financial reporting. J. Bus. Ethics 2015, 127, 565–577. [Google Scholar] [CrossRef]

- Morsing, M.; Spence, J.L. Corporate social responsibility (CSR) communication and small and medium sized enterprises: The governmentality dilemma of explicit and implicit CSR communication. Hum. Relat. 2019, 72, 1920–1947. [Google Scholar] [CrossRef] [Green Version]

- Garcia-Torea, N.; Fernandez-Feijoo, B.; De, M.; Cuesta, L. CSR reporting communication: Defective reporting models or misapplication? Corp. Soc. Responsib. Environ. Manag. 2020, 27, 952–968. [Google Scholar] [CrossRef]

- Moravcikova, K.; Stefanikova, Ľ.; Rypakova, M. CSR reporting as an important tool of CSR communication. Procedia Econ. Financ. 2015, 26, 332–338. [Google Scholar] [CrossRef] [Green Version]

- Hąbek, P.; Wolniak, R. Analysis of approaches to CSR reporting in selected European union countries. Int. J. Econ. Res. 2013, 4, 79–95. [Google Scholar]

- Visser, W.; Tolhurst, N. The World Guide to CSR. A Country-by-Country Analysis of Corporate Sustainability and Responsibility, 1st ed.; Greenleaf Publishing: Sheffield, UK, 2010. [Google Scholar]

- Steurer, R. The role of governments in corporate social responsibility: Characterising public policies on CSR in Europe. Policy Sci. 2010, 43, 49–72. [Google Scholar] [CrossRef]

- Noronha, C.; Tou, S.; Cynthia, I.M.; Guan, J.J. Corporate social responsibility reporting in China: An overview and comparison with major trends. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 29–42. [Google Scholar] [CrossRef]

- Garcia-Sanchez, I.M.; Cuadrado-Ballesteros, B.; Frias-Aceituno, V.J. Impact of the institutional macro context on the voluntary disclosure of CSR information. Long Range Plan. 2016, 49, 15–35. [Google Scholar] [CrossRef]

- Fifka, M. The development and state of research on social and environmental reporting in global comparison. J. Betr. 2012, 62, 45–84. [Google Scholar] [CrossRef]

- Chen, S.; Bouvain, P. Is corporate responsibility converging? A comparison of corporate responsibility reporting in the USA, UK, Australia, and Germany. J. Bus. Ethics 2009, 87, 299–317. [Google Scholar] [CrossRef]

- Hahn, R.; Kühnen, M. Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. J. Clean. Prod. 2013, 59, 5–21. [Google Scholar] [CrossRef]

- The KPMG Survey of Sustainability Reporting 2020-KPMG Global. Available online: https://home.kpmg/xx/en/home/insights/2020/11/the-time-has-come-survey-of-sustainability-reporting.html (accessed on 14 June 2021).

- Ali, W.; Frynas, G.J.; Mahmood, Z. Determinants of corporate social responsibility (CSR) disclosure in developed and developing countries: A literature review. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 273–294. [Google Scholar] [CrossRef]

- Bondi, M.; Yu, D. Textual voices in corporate reporting: A cross-cultural analysis of Chinese, Italian, and American CSR reports. Int. J. Bus. Commun. 2019, 56, 173–197. [Google Scholar] [CrossRef]

- Yang, L.; Ngai, B.S.C.; Lu, W. Changing trends of corporate social responsibility reporting in the world-leading airlines. PLoS ONE 2020, 15, e0234258. [Google Scholar] [CrossRef] [PubMed]

- Feng, P.; Ngai, S.C. Doing more on the corporate sustainability front: A longitudinal analysis of CSR reporting of global fashion companies. Sustainability 2020, 12, 2477. [Google Scholar] [CrossRef] [Green Version]

- Russo-Spena, T.; Tregua, M.; De Chiara, A. Trends and drivers in CSR disclosure: A focus on reporting practices in the automotive industry. J. Bus. Ethics 2018, 151, 563–578. [Google Scholar] [CrossRef]

- Weber, O. Environmental, social and governance reporting in China. Bus. Strateg. Environ. 2014, 23, 303–317. [Google Scholar] [CrossRef]

- Li, K.; Khalili, R.N.; Cheng, W. Corporate social responsibility practices in China: Trends, context, and impact on company performance. Sustainability 2019, 11, 354. [Google Scholar] [CrossRef] [Green Version]

- Carey, P.; Liu, L.; Qu, W. Voluntary corporate social responsibility reporting and financial statement auditing in China. J. Contemp. Account. Econ. 2017, 13, 244–262. [Google Scholar] [CrossRef]

- Naveed, K.; Voinea, L.C.; Ali, Z.; Rauf, F.; Fratostiteanu, C. Board gender diversity and corporate social performance in different industry groups: Evidence from China. Sustainability 2021, 13, 3142. [Google Scholar] [CrossRef]

- Isabel Sánchez-Hernández, M.; Gallardo-Vázquez, D.; Barcik, A.; Dziwiński, P. The effect of the internal side of social responsibility on firm competitive success in the business services industry. Sustainability 2016, 8, 179. [Google Scholar] [CrossRef] [Green Version]

- Miralles-Quirós, M.M.; Miralles-Quirós, L.J.; Daza-Izquierdo, J. The assurance of sustainability reports and their impact on stock market prices. Cuad. Gest. 2021, 21, 47–60. [Google Scholar] [CrossRef]

- Huang, T.; Wang, A. Sustainability reports in China: Content analysis. In 2010 International Conference on Future Information Technology and Management Engineering, Changzhou, China, 9 October 2010; IEEE: New York, NY, USA, 2010; Volume 2, pp. 154–158. [Google Scholar] [CrossRef]

- Marquis, C.; Qian, C. Corporate social responsibility reporting in China: Symbol or substance? Organ. Sci. 2014, 25, 127–148. [Google Scholar] [CrossRef] [Green Version]

- Parsa, S.; Dai, N.; Belal, A.; Li, T.; TANG, G. Corporate social responsibility reporting in China: Political, social and corporate influences. Account. Bus. Res. 2021, 51, 36–64. [Google Scholar] [CrossRef]

- Ervits, I. CSR reporting by Chinese and Western MNEs: Patterns combining formal homogenization and substantive differences. Int. J. Corp. Soc. Responsib. 2021, 6. [Google Scholar] [CrossRef]

- Qiu, J. Quality of CSR Reporting in China: A Comparative Analysis between State- and Privately-Owned Real Estate Companies. Bachlor’s Thesis, University of Pennsylvania, Philadelphia, PA, USA, 2017. [Google Scholar]

- Luo, X.R.; Wang, D.; Zhang, J. Whose call to answer: Institutional complexity and firms’ csr reporting. Acad. Manag. J. 2017, 60, 321–344. [Google Scholar] [CrossRef] [Green Version]

- The Reporting Exchange: An Overview of Sustainability and Corporate Reporting in China. World Business Council for Sustainable Development. 2018. Available online: http://docs.wbcsd.org/2018/02/CDSB_Case_Study_China.pdf (accessed on 13 June 2021).

- Company Law of the People’s Republic of China, Standing Committee of the National People’s Congress. 2013. Available online: http://www.mofcom.gov.cn/aarticle/swfg/swfgbl/201101/20110107349089.html (accessed on 13 June 2021).

- Shenzhen Stock Exchange Social Responsibility Instructions to Listed Companies. 2006. Available online: http://www.csrc.gov.cn/pub/shenzhen/xxfw/tzzsyd/ssgs/sszl/ssgsfz/200902/t20090226_95495.htm (accessed on 13 June 2021).

- Guidelines for Environmental Information Disclosure of Companies Listed on the Shanghai Stock Exchange. 2008. Available online: http://www.sse.com.cn/lawandrules/sserules/listing/stock/c/c_20150912_3985851.shtml (accessed on 13 June 2021).

- Notification on Issuance of the Guideline on Fulfilling Social Responsibility by Central Enterprises. 2008. Available online: http://www.sasac.gov.cn/n2588030/n2588939/c4297490/content.html (accessed on 13 June 2021).

- Notice on Better Preparing for 2008 Annual Reports of Listed Companies. 2008 (SSE). Available online: http://www.csrc.gov.cn/pub/shenzhen/xxfw/tzzsyd/ssgs/ssxxpl/ssplfz/200902/t20090226_95559.htm (accessed on 13 June 2021).

- Notice on Better Preparing for 2008 Annual Reports of Listed Companies. 2008 (SZSE). Available online: http://www.csrc.gov.cn/pub/shenzhen/xxfw/tzzsyd/ssgs/ssxxpl/ssplfz/200902/t20090226_95560.htm (accessed on 13 June 2021).

- Zhong, H.; Sun, X.; Zhang, E.; Zhang, T. China CSR Reporting Guidelines (CASS-CSR 1.0); Economic Management Press: Beijing, China, 2009. [Google Scholar]

- Zhong, H.; Wang, J.; Zhang, E.; Lei, S. China CSR Reporting Guidelines (CASS-CSR 4.0); Economic Management Press: Beijing, China, 2017. [Google Scholar]

- Environmental Protection Law. 2015. Available online: http://www.gov.cn/zhengce/2014-04/25/content_2666434.htm (accessed on 14 June 2021).

- The Standards Concerning the Contents and Formats of Information Disclosure by Companies Offering Securities to the Public No.2—Contents and Formats of Annual Reports. 2016. Available online: http://www.csrc.gov.cn/pub/zjhpublic/G00306201/201612/P020161216527602709328.pdf (accessed on 14 June 2021).

- Guidelines for Establishing the Green Financial System. 2016. Available online: http://www.scio.gov.cn/32344/32345/35889/36819/xgzc36825/Document/1555348/1555348.htm (accessed on 14 June 2021).

- Provisions on the Management of the List of Organizations Discharging Key Pollutants. 2017. Available online: https://www.mee.gov.cn/gkml/hbb/bgt/201712/W020171201468746002498.pdf (accessed on 14 June 2021).

- Code of Corporate Governance for Listed Companies. Beijing, China. 2018. Available online: http://www.gov.cn/gongbao/content/2019/content_5363087.htm (accessed on 14 June 2021).

- Petkoski, D.; Twose, N. Public policy for corporate social responsibility. In Proceedings of the WBI Series on Corporate Responsibility Accountability, and Sustainability Competitiveness (E-conference), Washington, DC, USA, 17–25 July 2003; Available online: http://info.worldbank.org/etools/docs/library/57434/publicpolicy_econference.pdf (accessed on 14 June 2021).

- China Security Market and Accounting Research (CSMAR). Available online: https://cn.gtadata.com/ (accessed on 14 June 2021).

- Rankins CSR Ratings. Available online: http://www.rksratings.cn/ (accessed on 14 June 2021).

- Zhong, M.; Xu, R.; Liao, X.; Zhang, S. Do CSR ratings converge in China? A comparison between RKS and Hexun scores. Sustainability 2019, 11, 3921. [Google Scholar] [CrossRef] [Green Version]

- Liu, K.; Lin, B. Research on influencing factors of environmental pollution in China: A spatial econometric analysis. J. Clean. Prod. 2019, 206, 356–364. [Google Scholar] [CrossRef]

- Hao, Y.; Zheng, S.; Zhao, M.; Wu, H.; Guo, Y.; Li, Y. Reexamining the relationships among urbanization, industrial structure, and environmental pollution in China—New evidence using the dynamic threshold panel model. Energy Rep. 2020, 6, 28–39. [Google Scholar] [CrossRef]

- Suchman, M.C. Approaches and Strategic Managing Legitimacy. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef] [Green Version]

- Gray, R.; Owen, D.; Adams, C.A. Accounting & Accountability: Changes and Challenges in Corporate Social and Environmental Reporting; Prentice-Hall: London, UK, 1996. [Google Scholar]

- Nikolaeva, R.; Bicho, M. The role of institutional and reputational factors in the voluntary adoption of corporate social responsibility reporting standards. J. Acad. Mark. Sci. 2011, 39, 136–157. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, M.D. The role of environmental disclosures as tools of legitimacy: A research note. Account. Organ. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Cambell, L.J. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Aaronson, S.A.; Reeves, J. The European Response to Public Demands for Global Corporate Responsibility; National Policy Association: Washington, DC, USA, 2002. [Google Scholar]

- Gürtürk, A.; Hahn, R. An empirical assessment of assurance statements in sustainability reports: Smoke screens or enlightening information? J. Clean. Prod. 2016, 136, 30–41. [Google Scholar] [CrossRef]

- Kolk, A. Sustainability, Accountability and corporate governance: Exploring multinationals’ reporting practices. Bus. Strateg. Environ. 2008, 17, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Hąbek, P. Corporate Social Responsibility Reporting. Practices of Visegrad Group Countries; PA NOVA SA: Gliwice, Poland, 2017. [Google Scholar]

- Michelon, G.; Pilonato, S.; Ricceri, F. CSR reporting practices and the quality of disclosure: An empirical analysis. Crit. Perspect. Account. 2015, 33, 59–78. [Google Scholar] [CrossRef] [Green Version]

- Utama, S. An evaluation of support infrastructures for corporate responsibility reporting in Indonesia. Asian Bus. Manag. 2011, 10, 405–424. [Google Scholar] [CrossRef]

| Year | Name | Issuer | Content Description | M/V 1 |

|---|---|---|---|---|

| 2006 | Company Law of the People’s Republic of China [36] | Chinese government | Article 5—requires companies to comply with social morality and bear social responsibilities Article 17—requires companies to protect the lawful rights and interests of its employees | M |

| 2006 | Shenzhen Stock Exchange Social Responsibility Instructions to Listed Companies [37] | Shenzhen Stock Exchange (SZSE) | Encourage listed companies to establish social responsibility mechanism and prepare social responsibility reports on a regular basis | V |

| 2008 | Guidelines for Environmental Information Disclosure of Companies Listed on the Shanghai Stock Exchange [38] | Shanghai Stock Exchange (SSE) | Require companies to disclose environmental information and CSR strategy in format either part of CSR report or separate report (For companies that value social responsibility and can actively disclose social responsibility reports, the Exchange will give priority to their selection in the corporate governance section of the SSE and simplify the review of their temporary announcements accordingly) | M |

| 2008 | Notification on the Issuance of the Guideline on Fulfilling Social Responsibility by Central Enterprises [39] | The State-owned Assets Supervision and Administration Commission of the State Council | Require companies to establish CSR fulfillment mechanisms and CSR information reporting systems for central state-owned enterprises | M |

| 2008 | Notice for better preparing the 2008 Annual Reports of Listed Companies [40] | SSE | Companies belonging to any of these three types must prepare CSR report: listed on the SSE Corporate Governance Section; issue foreign capital stocks listed abroad; listed companies in financial sectors. | M |

| 2008 | Notice for better preparing the 2008 Annual Reports of Listed Companies [41] | SZSE | The companies belonging to SZSE 100 index constituent stocks should prepare CSR report along with annual report; encourage other listed companies voluntarily disclose CSR report. (later, the main board and Small and Medium Enterprise (SME) Board in 2015 and Growth Enterprises Market (GEM) Board in 2016 incorporated this notice into the “Information Disclosure Business Memorandum” for the disclosure of related matters in regular reports) | M and V |

| 2009 | China CSR Reporting Guidelines (CASS-CSR1.0) [42] | The CSR Research Center of the Chinese Academy of Social Sciences (CASS)) | Provide instructions and performance indicators to guide different industries to report CSR issues in China. (In 2017, the fourth edition of the guidelines CASS-CSR 4.0 [43] was released) | V |

| 2015 | Environmental Protection Law [44] | Chinese government—Standing Committee of the National People’s Congress | Article 55—requires organizations that discharge key pollutants should truthfully disclose the following information to the public: the name of the main pollutant; the method of discharge; the concentration and total amount of discharge, the situation of excessive discharge, the construction and operation of pollution prevention facilities | M |

| 2016 | The Standards Concerning the Contents and Formats of Information Disclosure by Companies Offering Securities to the Public No.2—Contents and Formats of Annual Reports [45] | China Securities Regulatory Commission | Require companies and their subsidiaries that are key pollutant discharge organizations announced by the environmental protection department to disclose relevant environmental information. (In the 2017 revision, require companies other than key pollutant discharge organizations to disclose their environmental information according to the requirements. If they do not disclose, explain the reasons appropriately; encourage companies to voluntarily disclose relevant information that is conducive to protecting the ecology, preventing pollution, and fulfilling environmental responsibilities) | M and V |

| 2016 | Guidelines for Establishing the Green Financial System [46] | The People’s Bank of China, The Ministry of Finance, National Development and Reform Commission, The Ministry of Environment Protection, China Banking Regulatory Commission, China Securities Regulatory Commission, China Insurance Regulatory Commission | Vigorously develop green lending, e.g., establish a policy framework to support green lending, and promote securitization of green loans, etc.; enhance the role of the Securities Market in supporting green investment, e.g., actively support the qualified green enterprises to obtain financing via initial public offerings and secondary offerings, and gradually establish and improve the mandatory environmental information disclosure system for listed enterprises and bond issuers, etc. Since 2017, listed companies listed on the list of key emission companies by the Ministry of Environmental Protection have mandatory disclosure of environmental information; in 2018, if companies do not disclose environmental information, they must explain why; by 2020, all listed companies are required to compulsorily disclose environmental information. | M |

| 2017 | Provisions on the Management of the List of Organizations Discharging Key Pollutants [47] | Ministry of Ecology and Environment | According to environmental factors such as water, atmosphere, soil, sound, etc., implement classified management on the list of organizations discharging key pollutants. (The local government determines the list of organizations discharging key pollutants in the administrative region) | M |

| 2018 | Code of Corporate Governance for Listed Companies [48] | China Securities Regulatory Commission | Article 86—A listed company should actively implement the concept of green development, integrate ecological and environmental protection requirements into the development strategy and corporate governance process, actively participate in the construction of ecological civilization, and play an exemplary role in pollution prevention, resource conservation, and ecological protection. | V |

| Disclosure Degree | Evaluation Score |

|---|---|

| High | 75–100 |

| Average | 50–75 |

| Low | 25–50 |

| Very low | 0–25 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, X.; Hąbek, P. Trends in Corporate Social Responsibility Reporting. The Case of Chinese Listed Companies. Sustainability 2021, 13, 8640. https://doi.org/10.3390/su13158640

Wu X, Hąbek P. Trends in Corporate Social Responsibility Reporting. The Case of Chinese Listed Companies. Sustainability. 2021; 13(15):8640. https://doi.org/10.3390/su13158640

Chicago/Turabian StyleWu, Xiaojuan, and Patrycja Hąbek. 2021. "Trends in Corporate Social Responsibility Reporting. The Case of Chinese Listed Companies" Sustainability 13, no. 15: 8640. https://doi.org/10.3390/su13158640

APA StyleWu, X., & Hąbek, P. (2021). Trends in Corporate Social Responsibility Reporting. The Case of Chinese Listed Companies. Sustainability, 13(15), 8640. https://doi.org/10.3390/su13158640