1. Introduction

In the current digital transformation era, artificial intelligence (AI) is expected to assist humans with a variety of tasks at work and in their daily lives [

1,

2]. More remarkably, the outbreak of the COVID-19 pandemic has produced a paradigm shift in the ways we communicate and work, which demonstrates the importance of automated chat functions, particularly chatbots, for various companies’ activities [

3]. A chatbot, in general, could be understood as AI software that is programmed to automatically communicate with humans via text messages or chats [

4]. Currently, chatbot systems are widely used by organizations in many fields, such as customer service, marketing, B2C sales, and training [

5,

6], to provide their online customers with effective 24/7 service [

7]. In addition, digitization has also been transforming the landscapes of various industries [

8], especially those of the financial and banking sector with the appearance of the emerging Fintech trend, including various applications, such as online banking, internet cards, digital payments, and cryptocurrencies [

9,

10]. In fact, difficulties of the current pandemic with face-to-face interactions and mobility accidentally expedited these Fintech-based applications, which help customers to experience the services in a convenient way. The usage of a chatbot in banks, typical financial institutions, is equally worth discussing.

Applying a chatbot to customer service has gained in popularity, benefitting both firms and customers. On the customer side, with traditional customer service, customers usually suffer from queuing and waiting for a response to solve their issues due to a lack of service personnel, which may cause a negative service experience [

7,

11]. By contrast, virtual agents, such as chatbots, are capable of providing immediate responses and relevant information to customers’ problems [

3,

12]. Additionally, Dospinescu et al. [

13] argued that waiting times, transaction costs, and competitive services were the most important factors determining customer satisfaction in the relationship with service providers (i.e., banks). Hence, responsive chatbot-aided customer service is thereby considered the key to customer satisfaction [

14]. On the firm side, chatbot services are able to handle a large number of customers’ requirements, 24/7, with the absence of employee engagement, enabling firms to effectively reduce operating costs [

15]. From a long-term perspective, applications of chatbots, together with other technology-enabled solutions, are expected to enhance the sustainable development of businesses [

10]. For these benefits, chatbots are implemented in various industries from banking, retail, and healthcare to tourism and hospitality. According to a report of Grand View Research [

16], the chatbot market, estimated at USD 430.9 million in 2020, is expected to reach USD 2.486 million in 2028, progressing at a compound annual growth rate of 24.9% over the 2021–2028 period. The adoption of chatbots is also estimated to save the retail, banking, and healthcare sectors USD 11 billion annually by 2023 [

17].

For this study, we placed an emphasis on the chatbot services in Vietnamese banks for several reasons. First, banking is considered one of the typical industries that majorly reaps benefits from the adoption of chatbot services, together with the retail and tourism fields [

18]. Juniper Research [

19] estimated that, thanks to chatbots, the operating cost saved in banking globally will be USD 7.3 billion by 2023, approximately 35 times higher than what it was in 2019. Second, numerous banks have started their digital transformation journey [

20], and chatbots are considered to be essential and indispensable contributors to the transformation as well as sustainable strategies for banking development [

21]. Banks often use chatbots in marketing activities, sales, and customer relationship management [

22] to provide fast, cost-effective and personalized services to customers. A similar trend can be seen in Vietnamese banks, which are progressing towards the adoption of AI-enabled technology and chatbot services. The report of Austrade [

23] showed that by the end of 2019, nearly 60% of commercial banks in Vietnam already had a digital transformation initiative, and more than half of them have implemented chatbots to date. For instance, Tienphong Bank (TPBank) and National Citizen Bank (NCB) are two prominent pioneers of chatbot adoption [

24], followed by VPbank, Vietcombank, Techcombank, NamAbank, and Eximbank, whose chatbot systems have also been applied to enhance customer service.

However, although chatbots have been extensively used by many businesses in recent years, customers’ satisfaction with chatbots is still rather low. For instance, a recent survey showed that 74% of consumers expect to encounter a chatbot on a website, but only 13% of the surveyed respondents prefer using chatbots over human interactions [

25]. This may be due to several issues that arise from chatbot usage, such as uncertainty about the chatbot’s performance [

26], uncomfortable feelings [

27], or privacy concerns [

28].

While the degree of users’ satisfaction and continuance intentions towards chatbots remains relatively low, very few extant studies have been conducted to investigate why consumers are reluctant to continue using them. For a better understanding of the issue, an empirical examination of the chatbot users’ satisfaction and continuance intentions becomes more pertinent and essential, especially for chatbot services in the banking sector. The most recent attempt to investigate customers’ satisfaction regarding chatbot services in banking was made by Eren [

22]. However, the study did not answer the question of whether or not even the satisfied users will continue using the chatbots in the future. Most importantly, whether the customer is satisfied is the sole variable affecting the likelihood of continuing to use chatbot services, which has also been a fully unanswered question. Hence, drawing on the DeLone and McLean’s information systems success (D&M ISS) model, the expectation confirmation model (ECM), and the trust concept, this study aimed to investigate the key determinants influencing users’ continuance intentions towards banks’ chatbot services in Vietnam and to explore the process by which these aforementioned effects are created.

The contribution of this study, therefore, is threefold. First, the understanding of the antecedents of chatbot users’ continuance intention contributes to the growing literature on the use of chatbots in customer service. Second, by integrating the D&M ISS model and the trust concept into the ECM, this study provides a more comprehensive viewpoint to identify the factors determining the continuance usage intention of chatbot services compared to a single-model analysis, which has not yet been done. Third, the results yielded from this study will help banking service providers and chatbot programmers to better understand the users’ reactions after adopting chatbot services and to formulate effective strategies to enhance their continuance usage intention towards chatbots, which contributes to the sustainable development of banks in the long run.

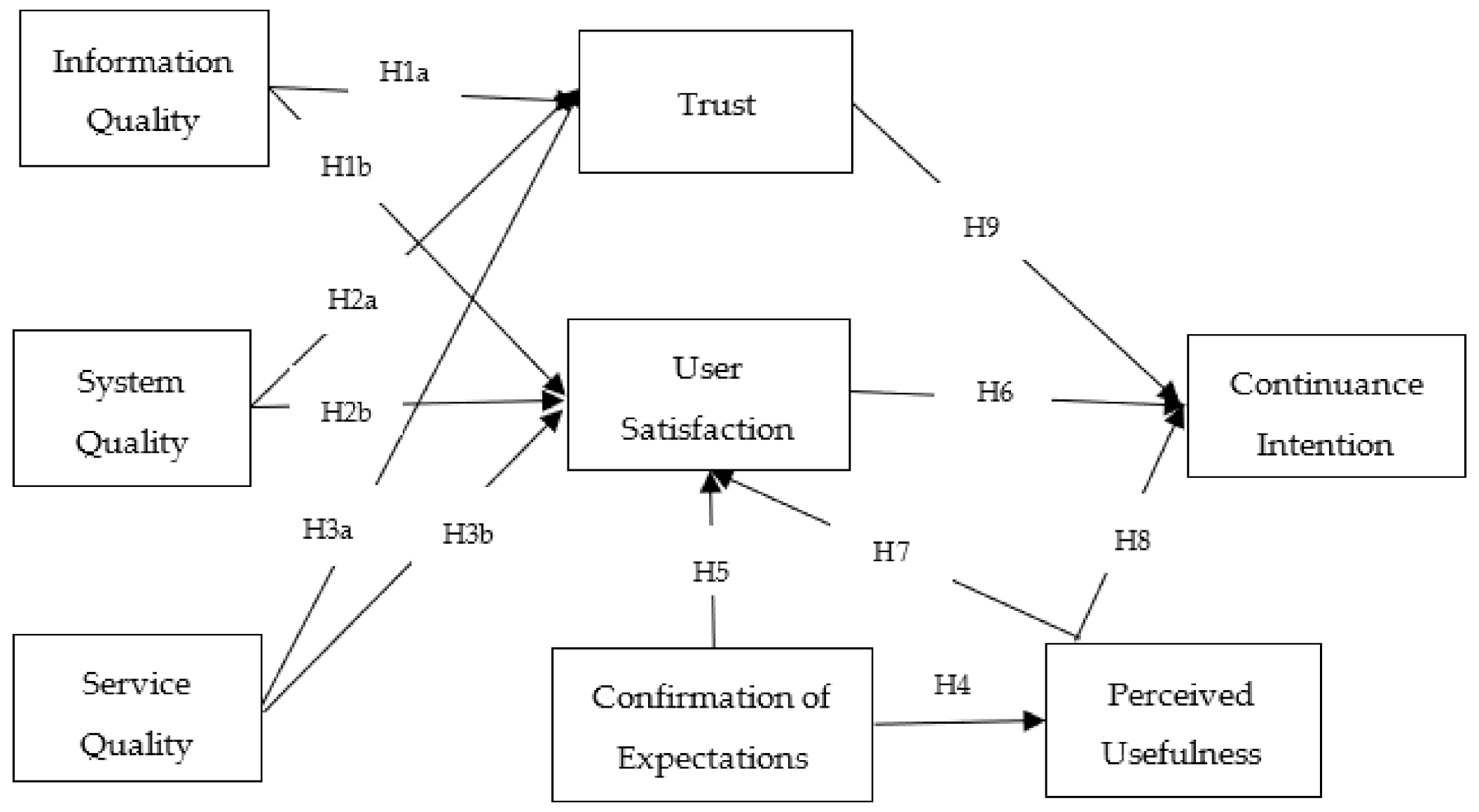

3. Research Model and Hypotheses

In this study, the authors integrated the D&M ISS model, the ECM, and the trust variable to explore the factors influencing users’ continuance intentions regarding banks’ chatbot services. In detail, hypotheses depicting the relationships among system quality, information quality, service quality, confirmation of expectations, perceived usefulness, trust, satisfaction, and continuance intention were established, in which satisfaction, trust, and perceived usefulness were three determinants of continuance intention. The research framework is shown in

Figure 1.

DeLone and McLean [

59] revealed that information quality should be reflected by several characteristics: accuracy, timeliness, integrality, and pertinence. All factors somewhat impact users’ satisfaction. Accessing reliable, precise, adequate, and updated information significantly contributes to users’ satisfaction [

57,

77]. Some existing studies also demonstrated information quality as the critical factor stimulating users’ trust (e.g., [

78,

79,

80]). Users spend much time and effort on chatbot services to seek out the information for making decisions. Hence, the information from the chatbot systems should be accurate, straightforward, personalized, and well-presented [

77]. Especially since a bank is a financial institution, the information provided by banks must be accurate due to its direct effects on customers’ transactions and financial decision-making. If chatbots provide users with irrelevant, outdated, or inaccurate information, users may no longer trust chatbot services and switch to other substitute sources of information. This situation wastes much time and effort of users [

75]. Consequently, users may end up having a poor service experience, thereby decreasing their satisfaction. Hence, we proposed that:

Hypothesis 1a (H1a). Information quality positively affects the trust of chatbot users.

Hypothesis 1b (H1b). Information quality positively affects the satisfaction of chatbot users.

In our research, system quality reflects the reliability, ease of use, response time, and availability of chatbot systems [

59,

81]. The system quality of a chatbot could be considered the technical ability of it to provide easy access and instant, reliable information to support users. Poor system quality can reduce user satisfaction since it makes chatbot usage more challenging and will not fulfill chatbot users’ needs. Numerous extant studies have demonstrated the positive impact of system quality on user satisfaction (e.g., [

59,

82,

83,

84]). Additionally, prior studies also suggested that the attributes of system quality and the trust concept had some relevance, enabling system quality to predict trust [

81,

82]. During conversations with chatbots, users are sometimes required to input their private information to serve their needs. Hence, if service providers ensure the reliability and security of chatbot systems, users may have a higher level of trust in their services. Some scholars also argued that if the information systems have a poor interface design that causes difficulties for users, they may not trust service providers’ ability in offering high-quality services [

81,

85]. Accordingly, we propose the following hypotheses:

Hypothesis 2a (H2a). System quality positively affects the trust of chatbot users.

Hypothesis 2b (H2b). System quality positively affects the satisfaction of chatbot users.

Thus far, service quality has been considered as one of the traditional determinants of satisfaction. Service quality is defined as the service capability of meeting users’ requirements and is reflected by the reliability, assurance, personalization, and service responsiveness [

81]. The relationship between service quality and satisfaction was initially explored in marketing and consumer behavior studies [

86]. Moreover, the updated D&M ISS model [

59] also postulates that good service quality will ensure users are satisfied with the information systems [

84,

87]. Thus, if chatbots are well-designed to understand users’ concerns via prompt and personalized responses, users will perceive high service quality, enhancing their satisfaction. Additionally, service quality was disclosed to affect users’ trust [

76,

81,

85]. The instant, reliable, and personalized responses from chatbots can reduce user’s time and effort spent on seeking information, positively contributing to their trust. In contrast, the poor service quality, such as interruptions and untimely responses, may cause users to doubt the efficacy of chatbots, consequently reducing user’s trust. We, therefore, hypothesize that:

Hypothesis 3a (H3a). Service quality positively affects the trust of chatbot users.

Hypothesis 3b (H3b). Service quality positively affects the satisfaction of chatbot users.

Ever since the ECM [

43] was successfully proposed to examine users’ reactions in the post-acceptance stage and IS continuance, many ECM-based studies in various contexts also found evidence of positive relationships among confirmation of expectations, perceived usefulness, satisfaction, and continuance intention (e.g., [

45,

57,

88,

89]). These studies have demonstrated that users’ satisfaction was derived from the confirmation of expectations and perceived usefulness of the information systems. In addition, satisfaction and perceived usefulness were two critical determinants of users’ continuance intentions. In line with these findings, we argue that the same logic can be applied to the context of chatbot services.

Users may expect to attain some benefits in the chatbot usages, such as time savings, accurate information, and instant support. If the performance of chatbot services meets or exceeds users’ prior expectations, users will find that the chatbots are helpful and they will satisfy users’ needs. In addition, users’ satisfaction after experiencing the chatbot services will push them to continue using chatbots in the future. Hence, the following hypotheses are proposed:

Hypothesis 4 (H4). Confirmation of expectations positively affects the perceived usefulness of chatbot users.

Hypothesis 5 (H5). Confirmation of expectations positively affects the satisfaction of chatbot users.

Hypothesis 6 (H6). Satisfaction positively affects the user’s intention to continue using chatbots.

Davis [

49] claimed in his TAM model that perceived usefulness and perceived ease of use are two vital motivational factors influencing user satisfaction and behavioral intentions. Perceived usefulness reflects the users’ belief about whether their experiences are enhanced by using a technology [

43]. Furthermore, perceived usefulness has been well-substantiated as a determinant of satisfaction and continuance intention in IS services [

54,

89,

90,

91]. Adding to the TAM, Bhattacherjee’s ECM [

43] suggested that users’ satisfaction and continuance intentions towards technological devices are primarily reliant on the extent to which users believe that technology usage can help them perform their tasks effectively. Specifically, suppose users perceive that using chatbot services is helpful for their tasks, such as seeking information or making online transactions. In that case, users’ experience with chatbots could be enhanced thanks to prompt responses and practical solutions provided by the chatbots. Consequently, users will feel more satisfied and continue using chatbot services in the future. From the above arguments, it is reasonable to propose the two following hypotheses:

Hypothesis 7 (H7). Perceived usefulness positively affects the satisfaction of chatbot users.

Hypothesis 8 (H8). Perceived usefulness positively affects the continuance intention of chatbot users.

Trust plays a crucial role in business relationships in the online environment since gaining trust could reduce risks, worries, and uncertainties [

92,

93,

94]. By reducing uncertainties, fears, and perceived risks, trust encourages people to participate in e-commerce activities. The extant literature also demonstrated how trust drives both initial behavioral intentions and continuance intentions in various contexts, such as online purchase [

92,

95], mobile payment [

96,

97], and Fintech [

8].

Based on this evidence, we also expect that trust can contribute to the user’s continuance intention towards chatbot usage. Compared to human-based services, using chatbot services is more uncertain and vulnerable, resulting in higher potential risks. For example, users’ personal information can be stolen or poorly protected systems can be easily attacked. Hence, when users trust chatbots, they expect to receive reliable services from highly qualified service providers, motivating them to continue using the chatbot. Thus, we propose that:

Hypothesis 9 (H9). Trust positively affects the continuance intention of chatbot users.

6. Discussion

This study is mainly focused on integrating DeLone and McLean’s ISS model [

59], the expectation confirmation model [

43], and trust to shed light on the issue of continuance intention regarding banks’ chatbot services. Several key findings from the analysis results are discussed as follows.

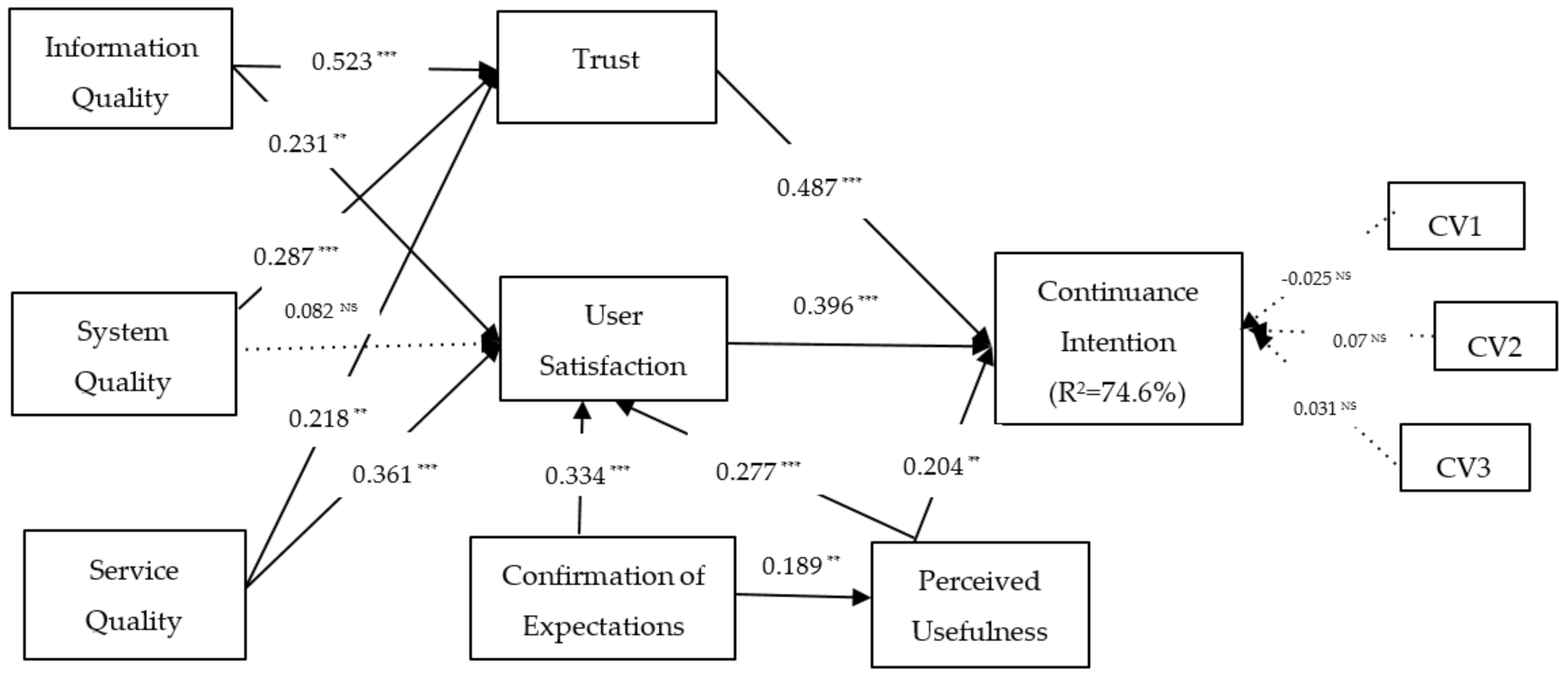

First, the relationship between information quality and trust is supported, which is similar to the findings of Lee and Chung [

85], Gao and Waechter [

81], and Ofori et al. [

111]. The satisfaction of users is also positively affected by information quality. This result is in line with the D&M ISS models [

59,

60] and several previous studies (e.g., [

42,

65,

73]). In addition, among the three dimensions of the D&M ISS model, information quality has the strongest effect on trust (β = 0.523). Our findings, thereby, emphasize the important role of information quality in enhancing users’ satisfaction and especially trust towards banks’ chatbot services. Acquiring needed information and support are the two major motivations for users to use chatbots [

112]. These are justifiable in the context of banking when interests, exchange rates, and other important indexes constantly change, and complex banking procedures often struggle with users. Hence, if the chatbots provide users with relevant, precise, and updated information, their financial decisions will be made quickly and correctly. Once users perceive chatbots as trustworthy, they will feel more satisfied [

75].

Second, the influences of service quality on both trust and satisfaction are also significantly positive. Importantly, service quality is the strongest predictor of user satisfaction (β = 0.361). These findings prove the validity of the long-established perspectives in marketing studies that service quality remains one of the key determinants of satisfaction [

113]. Similar findings can be found in the existing IS studies (e.g., [

42,

57,

81,

84,

111]). It can be inferred from these results that if the bank’s chatbots provide prompt responses, relevant suggestions, and individualized attention to users, their satisfaction and trust could be enhanced. In fact, instead of queuing and waiting for advice from staff when using human-staffed services, banks’ customers select chatbot services as a time-saving alternative. Therefore, if chatbots cannot guarantee promptness and personalization, users may suspect that banks cannot provide high-quality services, which can decrease their trust and satisfaction.

Third, the relationship between system quality and user satisfaction is not significant, which is incoherent with the D&M ISS model [

59] and findings of some existing studies in mobile payment and e-government systems (e.g., [

57,

75,

76,

84]). One possible explanation can be that using chatbot services does not require much effort from users. They can start conversations with chatbots by simply typing messages or using their voices, leading to system quality becoming less important than service quality and information quality in the relationship with satisfaction. This result also reinforces the study of Ashfaq et al. [

42], who only considered information quality and service quality within the D&M ISS model [

59] as the two predictors of satisfaction. Unlike satisfaction, the effect of system quality on trust is supported, which is in line with the findings of Zhou [

76] and Gao et al. [

75]. This reflects the fact that chatbot users are worried about information disclosure and data-stealing. Compared to some developed economies, the legal frameworks regarding consumers’ privacy protection in online environments in many developing countries and emerging markets, such as Vietnam, have not been strong enough. Banks in Vietnam hardly ensure comprehensive solutions to information disclosure. Hence, providing good system quality in terms of reliability and security has a significant role in enhancing users’ trust in chatbot services.

Fourth, confirmation of expectations is a significant driver of users’ satisfaction, perceived usefulness, and continuance intentions. These findings strongly support the postulate of the post-adoption model of IS continuance (i.e., ECM). Bhattacherjee [

43] posited that the initial expectation of IS users might change based on the post-adoption experience and the confirmation of the updated expectation should be validated as the cognitive beliefs influencing the consequent processes (i.e., perceived usefulness, satisfaction) to address the users’ continuance intentions. Our results are in line with many previous empirical studies in different contexts (e.g., [

45,

57,

89,

98]). This means that if users find the actual performance of chatbots good enough to meet their expectations, they will perceive chatbots as more valuable and be satisfied with them, which could result in continuance intentions.

Fifth, our research also pinpoints that perceived usefulness is an essential antecedent of user satisfaction and continuance intention, which validates the original findings of Bhattacherjee [

43]. This implies that if users perceive banks’ chatbots as beneficial to them, they will be more satisfied and more likely to continue using them in the future. Furthermore, the significant effect of satisfaction on continuance intentions reinforces the extant marketing literature that user satisfaction is the critical determinant of continuance intentions. This means that the more satisfied banks’ users are with the chatbot, the more likely they are to continue to use it.

Finally, trust is found to have the strongest effect (β = 0.487) on continuance intention. This finding highlights the crucial role of trust in predicting users’ intentions to continue using bank’s chatbots, which is a new finding in chatbot-related studies. Chatbots are programmed to communicate with users through online chat conversations, thereby involving potential uncertainties and risks. Trust could reduce users’ perceptions of these risks, worries, and uncertainties [

92,

94]. Thus, users who believe banks’ chatbot services to be highly trustworthy will be more willing to continue using them in the future. The strongest impact of trust on continuance intention is also reasonable for the finance-related contexts, such as banking, in which customers tend to continue using specific services only if they trust them. Our result also helps further the existing findings in other contexts, such as Fintech [

8] or mobile payment [

96,

97].

8. Conclusion and Research Limitations

While chatbot services in the financial sector have received much scholarly attention recently, a search of available databases has shown that no such research has been conducted in Vietnam so far. In the current digital transformation era, AI-enabled technologies, such as chatbots, provide a tool to maximize customer value, enhance customer loyalty, and sustain competitive advantages. With the wide usage of chatbots in delivering services, banks may decrease personnel costs, transactions costs, enhance their customer experience, and increase efficiency. The essential role of chatbots in providing personal and online services is undeniable in some external events, such as the current COVID-19 pandemic outbreak and beyond, which restricts face-to-face communications. By combining the D&M ISS model, the ECM, and the trust concept, this study investigated the determinants of users’ continuance intentions towards banks’ chatbot services in Vietnam. The findings of our study suggested that banking managers need to leverage factors influencing users’ satisfaction, trust, perceived usefulness, and continuance intentions towards banks’ chatbot services to develop action plans which contribute to sustainable developments and competitive advantages of banks.

Although the research procedure of this study was as rigorous as possible, our study still has the following limitations. First, the results of this study were analyzed based on the small sample size of the banks’ chatbot users through the convenience sampling technique; the respondents and results, therefore, are not generalized and representative of the entire banks’ chatbot users in Vietnam. Additionally, this study collected data by using the self-reported survey method. Even though common method bias was not a serious problem, as demonstrated before, it is always a concern [

109]. Thus, future studies should consider other types of approaches, such as the experimental method, to enhance the quality of respondents.

Second, our results only reflect the chatbot usage in a single context (i.e., Vietnam), an emerging market. The differences across countries, areas, cultures, or country-development levels may also influence our findings. Therefore, to strengthen the systematization of the current study, future studies can compare the current results with those from other countries with different cultural backgrounds (e.g., Western countries) and levels of development (e.g., developed markets vs. this emergent market). In addition, replicating this study in different contexts or industries and comparing the results with each other are also encouraged.

Third, the research model in the study was formulated by integrating the D&M ISS model and the trust concept into the ECM to identify the key determinants affecting chatbot users’ continuance intentions. Although the constructs included in this study are relevant to continuance intentions and fit the initial research purposes, it is worthwhile to include other essential constructs that could predict continuance intentions. We suggest that future studies could extend the current research model by including personality-related concepts, such as self-efficacy, technology readiness, and compatibility, which may further explain continuance intentions. In addition, this study omitted the effect of motivational factors on user behavioral intentions. The follow-up study should apply motivation-related theories, such as self-determination theory, a well-known theory in psychology, to explore the impact of internal motivation on chatbot users’ continuance intentions.

Finally, although our primary purpose was to focus on the intention to continue using the banks’ chatbots, the research on whether intention can serve as a proxy for behavior is ongoing [

117]. Considering that research on the IS continuance aims to boost an actual re-usage behavior, it should be more effective to measure actual re-usage behavior instead of intention [

115]. However, the link between intention to continue using chatbots and actual continuance usage has not been investigated. This remains a significant gap and opens the opportunity for future research to bridge.