2.1. Key M-Commerce Business Features

According to Michael Rappa [

30], merchant models vary from traditional wholesalers (B2B) and retailers of goods and services (B2C) to virtual merchants (or “e-tailers”) that are operating solely on the web. Between those two opposites, there are also catalogue merchants (that are operating based on a web-based catalogue, with customers placing their orders via mail, telephone or online), “click and mortar” merchants (that are traditional vendors that developed their webstore) and bitvendors (that are selling and distributing only digital products and services strictly online).

Currently, two major e-commerce business models are the most developed so far, according to Turban et al. [

31]: internet malls (e-malls) and webstores (also known as storefronts).

The internet mall (e-mall) is offering multiple companies the possibility to sell their goods online, in a similar manner to a physical mall, but using software tools. The main difference between the e-mall and webstore business models are in the revenue streams (e-mall revenues come mainly from commission fees from online sellers, based on their sales volumes).

The webstore business model is heavily similar in some features with traditional retail model—a company that is selling goods to individuals [

32] but has some particularities given by specific use of Information and Communication Technology (ICT) tools, i.e., the existence of a merchant software (that includes an electronic catalogue, a search engine, an electronic shopping cart and a link to an electronic payment system), plus an (possibly) automated customer relationship centre and certain shipment facilities. In addition, it is addressed to customers equipped with smart mobile devices and who know how to use applications developed especially for them.

Therefore, the development of an m-commerce business starts from the premises of the pre-existence of a relatively sophisticated infrastructure of networks, servers and mobile devices capable of interconnecting (e.g., the hardware architecture) databases, security applications, search engines, electronic catalogues, electronic shopping carts and applications for electronic payment processing (e.g., the software architecture). It also presupposes the existence of efficient shipping and Customer Relationship Management (CRM) systems, which are in some cases automated (see

Figure 1), because “for online retailing operations, shipping costs are also an important determinant of a consumer’s purchase decision” [

33].

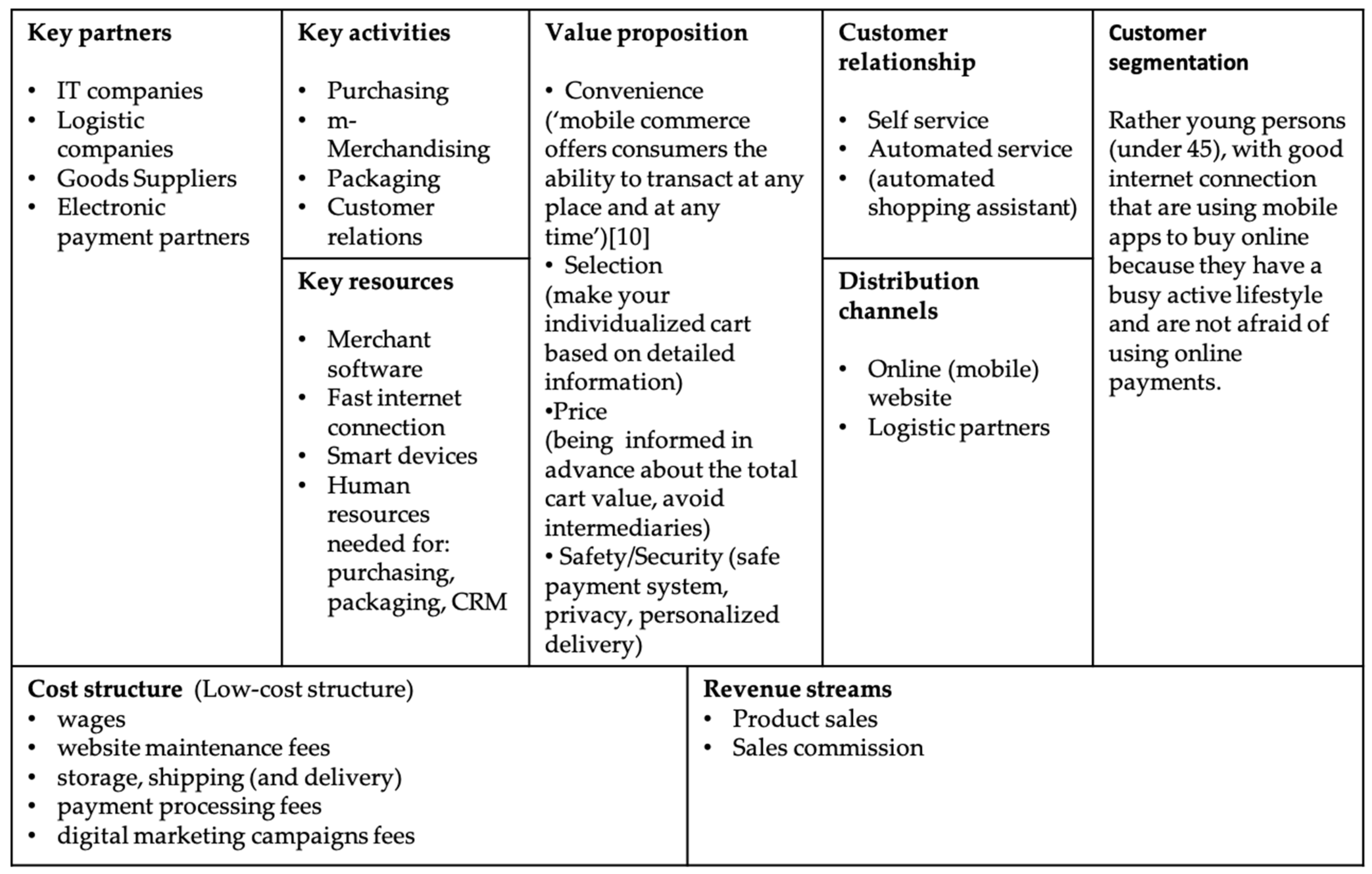

For a better understanding of this type of business, we present a possible business model in the m-commerce field for webstores, developed by us based on the Canvas Business Model (

Figure 2) [

34].

We can see that the development of such new businesses depends on the degree of development of other industries such as mobile telecommunications and smartphone apps, but also on the degree of customer sophistication (or “customer readiness”), i.e., living and education standards, lifestyle, skills in using phones and mobile apps.

Ijaz and Rhee [

35] concluded that the factors influencing online consumer behaviour are perceived value, perceived risk, social factors, ease of use of the site, perceived usefulness, purchase intention, previous online experience, current desire to purchase, entertainment gratification, website irritation, information design, visual design, and navigation design. Technological developments have led to changes in consumer behaviour concerning online purchases, from computers/laptops to mobile phones/tablets [

36]. This influenced the emergence of more and more applications for smartphones; the ease and convenience of using them can make the difference between them from the consumer’s point of view [

36].

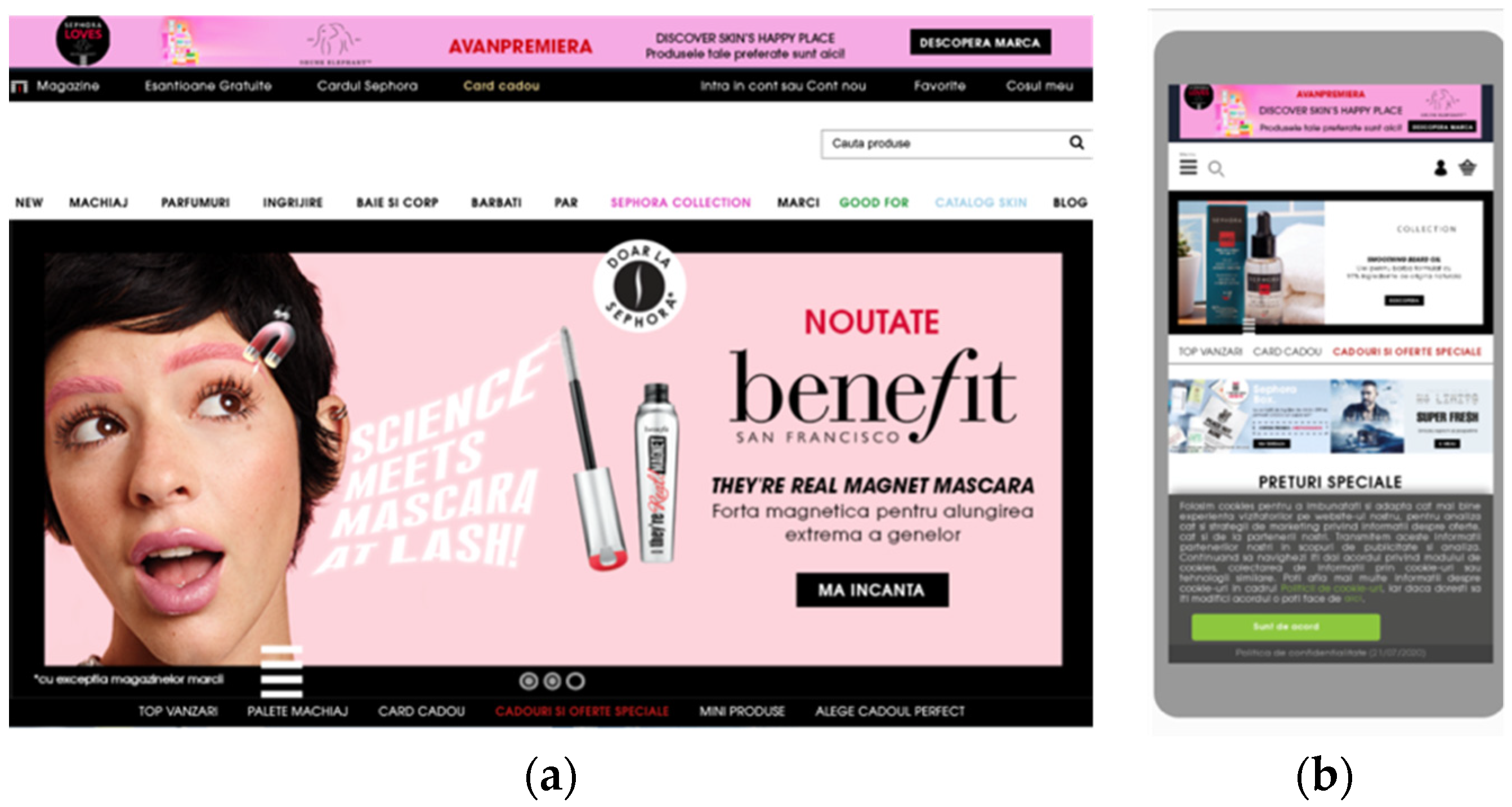

Retailers in m-commerce are interested in providing visitors with a pleasant experience through applications with the most appropriate design, friendly and easy to use [

37]. An SME related study from the European Union revealed that companies that have an optimised site have more visitors, more chances to receive orders (even if some of these orders are made from the computer), and as the number of mobile visitors increases, companies are tempted to invest more in optimising the site [

38]. Optimising mobile applications can provide the opportunity to collect information about consumers to better manage the relationship with them [

39].

2.2. Free Shipping Threshold

The competitiveness of m-commerce retailers also depends on the delivery policy (how the buyer receives the products) and any failure related to this is leading to the emergence of problems related to the long-term relationship with the consumer [

40]. The most important issues related to the delivery policy are the delivery time, the delivery fees and the ease of changing and returning the products [

41]. From the consumer’s point of view, the delivery fee has the greatest significance, followed by the delivery speed, the time interval, and the delivery date (day/evening) [

42].

Free delivery (or at least free delivery for minimum order) is considered one of the success keys in m-commerce [

43,

44] and one of the most used methods implemented by online retailers to attract consumers’ attention [

45] along with issuing cards that offer lower prices to consumers [

46,

47]. Providing free transportation of a value higher than the average value of orders placed can stimulate consumers to buy more [

48].

Free or reduced shipping costs can be achieved in several ways by online retailers: free shipping despite the shopping cart’s value, contingent free shipping (CFS) for a certain value, and/or lower shipping charges as the shopping cart value increases [

33].

A popular strategy among online retailers is the contingent free-shipping strategy (CFS), which provides free shipping for a certain value of the shopping cart, which determines buyers to add so-called “fillers” (products) to the cart to achieve the value [

49]. The results of a study related to Free Shipping Policy show that the distance for home delivery does not significantly influence the costs of providing free shipping, and setting a reasonable minimum threshold for free shipping can increase the shopping cart’s value, increasing the long-term profitability of retailers [

50]. However, some studies show that this method can lead to lower profits for online retailers and unsatisfactory quality of logistics services [

45]. Researchers consider that in making decisions about the transport price, the fact that the consumer’s sensitivity to this price is different when buying expensive or cheap products must also be taken into consideration. Respectively, the action to offer free transport creates an advantage for the sellers of cheap products, while the transport fees are advantageous those who sell expensive products [

51].

2.3. Evolution of the M-Commerce

Under the pressure of the development of information technology and the Internet, not only the companies’ business models have transformed [

52,

53], but also the markets in which these competitors operate. According to Laudon and Traver [

54], price rivalry between existing competitors has now increased with the expansion of the market, due to the reduction in entry barriers in the field of online commerce. In addition, in some market segments, the bargaining power of some suppliers has decreased (especially in the field of automobiles with online procurement systems) and of some buyers has increased (especially of retail consumers). Companies are thus forced to increase their operational efficiency and apply more sophisticated differentiation strategies if they want to be successful in business in the m-commerce market.

According to Statista [

55], in 2018, the percentage of consumers who made at least one purchase online in the previous 12 months grew to 93% of internet users in the U.S., 97% in the UK, and 92% in China. The market of developed countries is in its maturity phase, and the competition among e-commerce players is extremely high and cost-intensive. Marketplaces such as Amazon and AliExpress are flourishing, while many stand-alone retailers struggle to find their unique selling proposition as brand and store loyalty are decreasing and the cart bounce rate in the industry is currently at 75%. Increasing brand engagement can be achieved through community building (e.g., ASOS Marketplace), loyalty programs, and a seamless mobile and desktop user experience.

In 2020, the e-commerce retail sales saw a spectacular increase of over 27% worldwide, with countries in Latin America, North America and central and eastern Europe (Romania included) being among the most visible in this respect. A clear trend becomes more obvious: the e-commerce is moving beyond the Western world [

56].

According to Statista [

57], the retail e-commerce sales are forecasted to grow with a compounded annual growth rate (CAGR) of 6.29% worldwide. While developed markets (US, Australia, UK, France, Italy) will encounter a lower CAGR, the emerging markets (such as Turkey, Argentina, Indonesia and South Africa) will have a CAGR of over 10%. The information provided by datareportal.com for the year of 2019 [

58] stated that for a population of 7.676 billion, the internet penetration rate was at 54%, while the mobile subscription rate was over 115%. In 2021 “6 in 10 people around the world is using the internet” [

59]. Out of all internet users, 91.5% are smartphone internet users, and 46.4% are using them for researching products and brands.

Therefore, m-commerce is a market with huge world business opportunities, and for a better understanding of its dynamics and characteristics, a series of ranking indices have been developed based on criteria related to the availability of high-speed mobile internet networks (

infrastructure), mobile internet services’ ease of access and smartphone price accessibility (

affordability), the degree of sophistication of consumers regarding their ability to understand and use applications on mobile phones (

consumer readiness), the degree of availability, security, and accessibility of the relevant online content for the local population (

content and services). According to Global System for Mobile Communications Association (GSMA) [

60], the most used indices worldwide are: the ICT Development Index (International Telecommunication Union); Mobile Connectivity Index (GSMA); Affordability Index (Alliance for Affordable Internet); Digital Economy and Society Index (European Union); Global Connectivity Index (Huawei); Inclusive Internet Index (The Economist Intelligent Unit). The main characteristics of the mobile e-commerce market in Romania are presented in

Table 1 [

61,

62,

63,

64,

65,

66].

Based on its yearly index (calculated for 100 economies of the world), The Intelligent Economist Unit [

67] states that “Romania merits its place in the top quintile of index countries (20 out of 100) on the back of comparatively high scores in Availability (particularly fixed broadband quality) and Affordability (costs of fixed broadband as well as smartphones). Readiness, meanwhile, leaves much room for improvement, particularly in the area of policy”. The Huawei Global Connectivity Index ranks the economies based on four technologies enablers (broadband, cloud, AI, IoT) and four pillars (supply, demand, experience and potential), offering 40 indicators for a broad comparison among countries. Romania’s rank reflects its strengths and also its business opportunities: increased connectivity due to high smartphone penetration rates and mobile broadband subscription and an incipient e-commerce market, with ICT having a growing role in influencing new business models [

66]. According to ecommercedb.com [

68], “Romania is the 50th largest market for e-Commerce with revenue of US

$2 billion in 2020, placing it ahead of Bangladesh and behind Singapore”. The GPeC Report (2020) [

69] estimates that the e-commerce sector was EUR 5.6 bil. in 2020 compared to only EUR 4.3 bil. in 2019 (a 30% increase). The Romanian market is fragmented between several large traders and many small traders, some of which are in the first attempt of doing businesses of this type, and others belonging to mature companies that either initiated this type of sales in Romania or diversified their selling processes, setting up their own online sales site. The eMAG.ro platform is among the pioneers of the online commerce market in Romania, currently being the largest player in the Romanian e-commerce market, with a revenue of USD 653 mill. in 2020 and in the process of a full transformation into an e-mall. “It is followed by fashiondays.ro with USD 103 million revenue, altex.ro and dedeman.ro with USD 94 million each.” The profile of e-commerce websites can be a general one, such as e-mag.ro and fashiondays.ro platforms, or specialised in a certain field (construction materials, interior design, fashion, food, personal care, sports and outdoor, events, furniture and appliances, DIY, Garden and Pets, etc.). “Five categories are considered by

ecommercedb.com [

68]. Fashion is the largest segment in Romania and accounts for 40% of the e-commerce revenue in Romania. This is followed by electronics and media with 26%, food and personal care with 14%, Toys, hobby and DIY with 11% and furniture and appliances with the remaining 9%.” Some of these companies are part of large international groups, which operate in multiple markets (such as Prosum NV—ultimate parent of Dante International SA, which operates e-mag.ro and fashiondays.ro—and which in turn is owned by the Southern African company Naspers), while others are focused almost exclusively nationally, both as a market and as a shareholder. The e-commerce platforms with the fastest growth rate in 2020 on the Romanian market were those that belong to the large retail chains operated by Ahold Delhaize (mega-image.ro) and Auchan (auchan.ro), but also a company that sells consumables, disinfectants and medical instruments (mkd-medicale.ro). According to Statista [

70], the CAGR for 2020–2024 for Romania was estimated at 13%, while for 2021–2025, it was at 9.5%, one of the fastest in the Eastern European Region (after Ukraine), due to the main drivers of the market expansion presented above (see

Table 1).

A 2018 report provided by Nielsen Co. (New York, NY, USA) [

71] emphasised that the online customers were buying mostly fashion items (61%), travel related items (59%), books and music (49%), but also IT and mobile (47%), and event tickets (45%). Women were more interested than men in this activity (72% versus 68%); female online shoppers were buying clothes, while male shoppers were more interested in acquiring computers and travel related items (tickets and accommodation) [

72].

Their online shopping behaviour is displayed more and more on mobile phones rather than on desktops, according to bigcommerce.com, with mobile commerce becoming dominant in online sales in 2021 [

73]. This trend is also influenced by the COVID-19 pandemic, as a 2021 United Nations Conference on Trade and Development (UNCTAD) online purchasing behaviour study revealed. Among the people that were questioned, 52% agreed that since the outbreak of COVID-19 they shopped online more often than before, with women, highly educated consumers and the 25–45-year-olds being the most prominent online shoppers worldwide [

74].

According to Eurostat [

75], the profile of the Romanian customer who uses online shopping has also evolved rapidly in the last 10 years, from a modest 2% of the total population who made such purchases at least once every 3 months in 2010, to 22% in 2020 (see

Figure 3); in 2021, the profile will already be much changed after a whole year of pandemic and lockdown periods.

Not only have the devices used changed radically in the last 5 years (from laptops to smartphones), but the frequency of purchases has also changed, as has the structure of the shopping cart. Thus, according to Kemp [

61], the profile of the Romanian customer owning mobile devices is the following: not only have the devices used changed radically in the last 5 years (from laptop to smartphones), but the frequency of purchases has also changed, as well as the structure of the shopping cart. Moreover, according to datareportal.com, the profile of the Romanian customer who owns mobile devices at the beginning of 2021 is the following: is part of a group of 55.5% of internet users who use shopping apps on mobile devices every month and who has made at least one purchase online via mobile phones in the last month (41.7% of the total population), most of them being between 35 and 44 years old and being female (19.6% women compared to 18.8% men) and whose pandemic has radically changed their online shopping habits (see

Table 2).

Given the recent history (sprinkled with many payment incidents, especially in 1990–2000), the Romanian consumer is rather cautious and conservative, attached to his favourite brands and sites [

61,

76] and not very willing to use online card payments, even if in 2020 there were several cards in circulation almost equal to that of the country’s population (

Table 3) [

77,

78].

“Romanians preferred online card payments especially when they paid for services and less when they paid for e-tail” [

79]. According to Romania Journal.ro [

80], “e-commerce will continue its evolution and will register an increase of at least 15% in 2021”, with two of the major trends being “increased card payments and mobile shopping” and “better online experience due to digitisation”. In 2021, customers will perceive card payments as increasingly secure, due to Romania’s implementation of the European PSD2 directive. In addition, in the medium term, the clients will tend to use the shopping cart in one online place, preferably a marketplace, with the main domains being home and decoration, pharm and fashion [

81].