Governance of the Risks of Ridesharing in Southeast Asia: An In-Depth Analysis

Abstract

1. Introduction

2. Background

2.1. Ridesharing in SEA

2.2. Governance Strategies

3. Method and Case Description

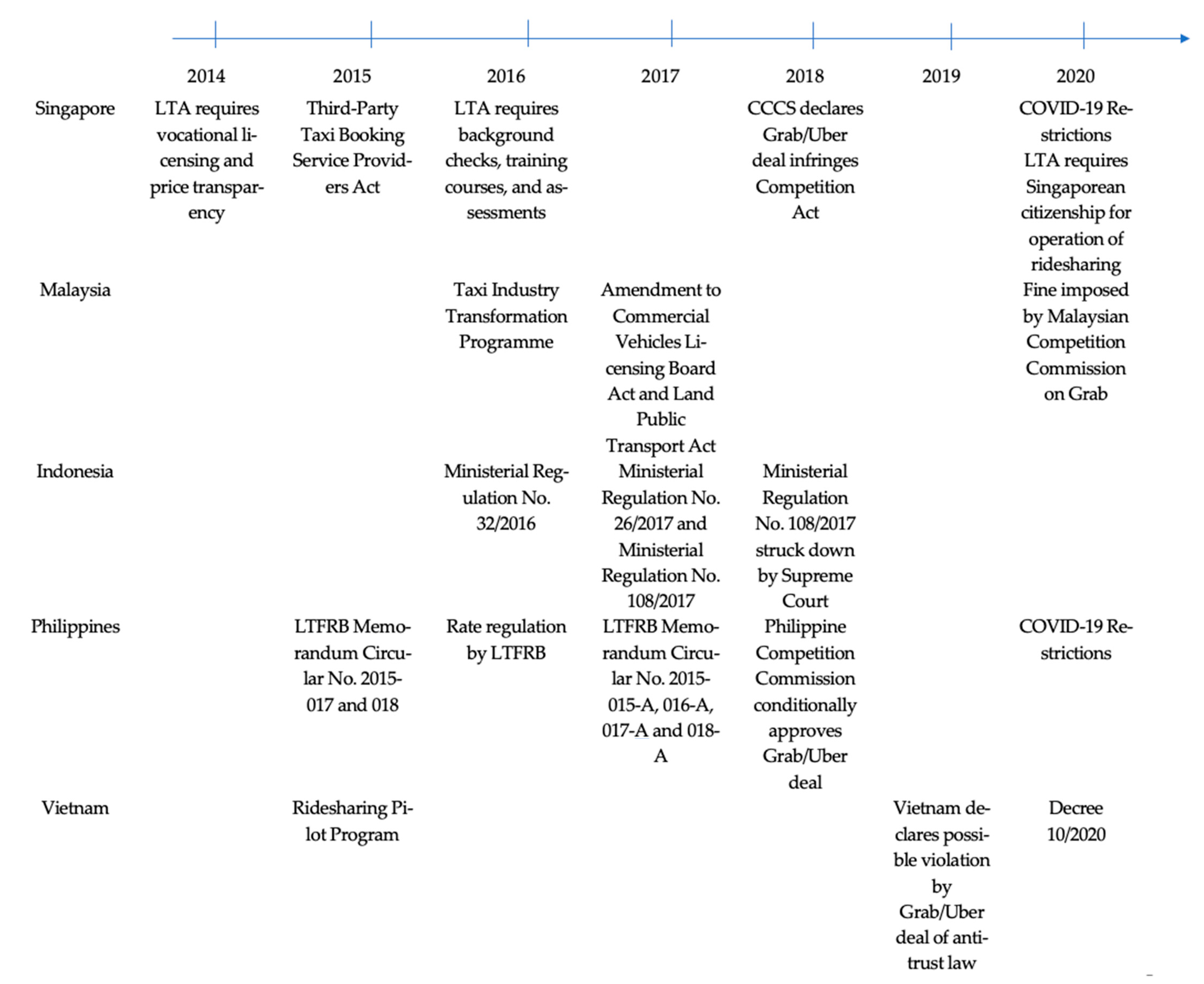

3.1. Philippines

3.2. Singapore

3.3. Indonesia

3.4. Malaysia

3.5. Vietnam

3.6. COVID-19 and Ridesharing in SEA

4. Results: Case Analysis

4.1. Issue in Ridesharing in SEA

4.1.1. Influence on Incumbent Industries

4.1.2. Privacy

4.1.3. Liability and Insurance

4.1.4. Safety

4.1.5. Competition and Network Effects

4.1.6. Congestion

4.1.7. Employment

4.1.8. Government Revenue Collection

4.1.9. Risks in Ridesharing during the COVID-19 Pandemic

4.2. The Governance of Ridesharing in SEA

5. Discussion

5.1. Discussion of Strategies across the SEA Countries

5.2. Policy Recommendations

5.2.1. Unified Regulatory Approach

5.2.2. Cross-Jurisdictional Cooperation

5.2.3. Stakeholder Involvement in the Regulatory Process

5.2.4. Regulatory Sandboxes

5.2.5. Proactive Governance

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Gopalakrishnan, K.; Chitturi, M.V.; Prentkovskis, O. Smart and Sustainable Transport: Short Review of the Special Issue. Transport 2015, 30, 243–246. [Google Scholar] [CrossRef]

- Tan, S.Y.; Taeihagh, A. Smart City Governance in Developing Countries: A Systematic Literature Review. Sustainability 2020, 12, 899. [Google Scholar] [CrossRef]

- Yu, B.; Ma, Y.; Xue, M.; Tang, B.; Wang, B.; Yan, J.; Wei, Y.-M. Environmental Benefits from Ridesharing: A Case of Beijing. Appl. Energy 2017, 191, 141–152. [Google Scholar] [CrossRef]

- Li, Y.; Taeihagh, A.; De Jong, M. The Governance of Risks in Ridesharing: A Revelatory Case from Singapore. Energies 2018, 11, 1277. [Google Scholar] [CrossRef]

- Meurer, J.; Stein, M.; Randall, D.; Rohde, M.; Wulf, V. Social Dependency and Mobile Autonomy: Supporting Older Adults’ Mobility with Ridesharing Ict. In Proceedings of the SIGCHI Conference on Human Factors in Computing Systems, Toronto, ON, Canada, 26 April 2014; ACM: New York, NY, USA, 2014; pp. 1923–1932. [Google Scholar]

- D’Orey, P.M.; Ferreira, M. Can Ride-Sharing Become Attractive? A Case Study of Taxi-Sharing Employing a Simulation Modelling Approach. IET Intell. Transp. Syst. 2015, 9, 210–220. [Google Scholar] [CrossRef]

- Hang, C.; Liu, Z.; Wang, Y.; Hu, C.; Su, Y.; Dong, Z. Sharing Diseconomy: Impact of the Subsidy War of Ride-Sharing Companies on Urban Congestion. Int. J. Logist. Res. Appl. 2019, 22, 491–500. [Google Scholar] [CrossRef]

- Wang, M.; Mu, L. Spatial Disparities of Uber Accessibility: An Exploratory Analysis in Atlanta, USA. Comput. Environ. Urban Syst. 2018, 67, 169–175. [Google Scholar] [CrossRef]

- Lee, C. Dynamics of Ride Sharing Competition; ISEAS Yusof Ishak Institute: Singapore, 2017. [Google Scholar]

- Google; Temasek; Bain & Company. E-Conomy SEA—Swipe up and to the Right: Southeast Asia’s $100 Billion Internet Economy. 2019. Available online: https://www.blog.google/documents/47/SEA_Internet_Economy_Report_2019.pdf (accessed on 12 April 2021).

- Yunus, E.; Susilo, D.; Riyadi, S.; Indrasari, M.; Putranto, T.D. The Effectiveness Marketing Strategy for Ride-Sharing Transportation: Intersecting Social Media, Technology, and Innovation. JESI 2019, 7, 1424–1434. [Google Scholar] [CrossRef]

- Wang, Y.; Zheng, B.; Lim, E.-P. Understanding the Effects of Taxi Ride-Sharing—A Case Study of Singapore. Comput. Environ. Urban Syst. 2018, 69, 124–132. [Google Scholar] [CrossRef]

- Aw, E.C.-X.; Basha, N.K.; Ng, S.I.; Sambasivan, M. To Grab or Not to Grab? The Role of Trust and Perceived Value in on-Demand Ridesharing Services. APJML 2019, 31, 1442–1465. [Google Scholar] [CrossRef]

- Limpin, L. Investigating the Factors Influencing the Participation in Ride-Sharing: The Case of the Philippines. In Proceedings of the 8th International Workshop on Computer Science and Engineering (WSCE 2018), Bangkok, Thailand, 28–30 June 2018. [Google Scholar]

- Asirin, A.; Azhari, D. Ride-Sharing Business Model for Sustainability in Developing Country: Case Study Nebengers, Indonesia. IOP Conf. Ser. Earth Environ. Sci. 2018, 158, 012053. [Google Scholar] [CrossRef]

- Li, Y.; Taeihagh, A.; Jong, M.; Klinke, A. Toward a Commonly Shared Public Policy Perspective for Analyzing Risk Coping Strategies. Risk Anal. 2021, 41, 519–532. [Google Scholar] [CrossRef] [PubMed]

- Taeihagh, A.; Lim, H.S.M. Governing Autonomous Vehicles: Emerging Responses for Safety, Liability, Privacy, Cybersecurity, and Industry Risks. Transp. Rev. 2019, 39, 103–128. [Google Scholar] [CrossRef]

- Rosique, F.; Navarro, P.J.; Fernández, C.; Padilla, A. A Systematic Review of Perception System and Simulators for Autonomous Vehicles Research. Sensors 2019, 19, 648. [Google Scholar] [CrossRef] [PubMed]

- Walker, W.E.; Marchau, V.A.W.J.; Swanson, D. Addressing Deep Uncertainty Using Adaptive Policies: Introduction to Section 2. Technol. Forecast. Soc. Chang. 2010, 77, 917–923. [Google Scholar] [CrossRef]

- ASEAN Secretariat. ASEAN Statistical Yearbook 2020; ASEAN: Jakarta, Indonesia, 2020. [Google Scholar]

- Cupin, B. Philippine Congressmen Want Uber to Stop Operations ASAP. Available online: https://r3.rappler.com/nation/75284-philippines-uber-taxi-regulation (accessed on 11 April 2021).

- Basa, M. Uber Offers PH Gov’t Information Access to Drivers. Available online: http://r3.rappler.com/business/industries/208-infrastructure/82697-uber-driver-information-ph-government (accessed on 11 April 2021).

- Land Transportation Franchising and Regulatory Board. LTFRB Memorandum Circular No. 2015-018 s. 1; The Government of the Philippines: Manila, Philippines, 2015.

- Grab. GrabCar First and Only Transport Network Company Legalized by the Philippine Government. Available online: https://www.grab.com/ph/blog/grabcar-first-and-only-transport-network-company-legalized-by-the-philippine-government/ (accessed on 5 April 2021).

- Francisco, K. LTFRB to Grab: Remove Feature Showing Passengers’ Destination. Available online: https://www.rappler.com/nation/ltfrb-grabcar-drivers-passenger-destination-feature (accessed on 11 April 2021).

- Dela Paz, C. GrabTaxi Rebrands as Grab, Eyes Further Expansion. Available online: https://www.rappler.com/business/grabtaxi-rebranding-grab-regional-app (accessed on 11 April 2021).

- Elemia, C. Senate Panel to Probe “Unreasonable” Surge Pricing of Grab, Uber. Available online: https://www.rappler.com/nation/senate-investigate-surge-pricing-uber-grab (accessed on 11 April 2021).

- ABS-CBN News. Uber Suspension Lifted after Paying P489-M. Available online: https://news.abs-cbn.com/business/08/29/17/uber-suspension-lifted-after-paying-p489-m (accessed on 11 April 2021).

- Marcelo, P. LTFRB Resumes Application Processing for Ride-Share Drivers. Available online: https://www.bworldonline.com/ltfrb-resumes-application-processing-ride-share-drivers/ (accessed on 9 February 2019).

- ABS-CBN News. LTFRB Tells Uber to “Cease and Desist” Operations on April 16|ABS-CBN News. Available online: https://news.abs-cbn.com/business/04/11/18/ltfrb-tells-uber-to-cease-and-desist-operations-on-april-16 (accessed on 10 April 2021).

- Philippine Competitition Commission. Acquisition by Grab Holdings, Inc. and MyTaxi.PH, Inc. of Assets of Uber B.V. and Uber Systems, Inc. (PCC Case No. M-2018-001). Available online: https://www.phcc.gov.ph/commission-decision-no-26-m-12-2018-acquisition-by-grab-holdings-inc-and-mytaxi-ph-inc-of-assets-of-uber-b-v-and-uber-systems-inc/ (accessed on 5 April 2021).

- ABS-CBN News. Grab-Uber Gets Antitrust Watchdog’s Approval with Conditions|ABS-CBN News. Available online: https://news.abs-cbn.com/business/08/10/18/grab-uber-gets-antitrust-watchdogs-approval-with-conditions (accessed on 5 April 2021).

- Cheng, W. Grab Fined P6.5 Million for Failure to Provide Price Data|ABS-CBN News. Available online: https://news.abs-cbn.com/business/01/25/19/grab-fined-p65-million-for-failure-to-provide-price-data (accessed on 11 April 2021).

- Subingsubing, K. 2 New Ride-Hailing Firms Get LTFRB Accreditation|Inquirer News. Available online: https://newsinfo.inquirer.net/1061236/2-new-ride-hailing-firms-get-ltfrb-accreditation (accessed on 11 April 2021).

- Channel News Asia. Regulations for Private-Hire Car Industry under Review. Available online: https://www.channelnewsasia.com/news/singapore/private-hire-cars-grab-uber-regulations-under-review-10020098 (accessed on 19 February 2019).

- The Business Times. Uber to Appeal Singapore’s Competition Watchdog Decision on Grab Deal, Transport—The Business Times. Available online: https://www.businesstimes.com.sg/transport/uber-to-appeal-singapores-competition-watchdog-decision-on-grab-deal (accessed on 11 April 2021).

- Tan, C. Indonesian Ride-Hailing App Go-Jek Launches Portal for Drivers to Pre-Register. Available online: https://www.straitstimes.com/singapore/transport/indonesian-ride-hailing-app-go-jek-launches-portal-for-drivers-to-pre-register (accessed on 11 April 2021).

- Wei, A.C. Grab Launches Free Medical Leave Insurance for Drivers. Available online: https://www.straitstimes.com/business/grab-launches-free-medical-leave-insurance-for-drivers (accessed on 11 April 2021).

- Tan, C. Private-Hire Demand Pushes up Car COE Premiums, Transport News & Top Stories—The Straits Times. Available online: https://www.straitstimes.com/singapore/transport/private-hire-demand-pushes-up-car-coe-premiums (accessed on 11 April 2021).

- Poh, O. Grab to Add Platform Fee after Singapore Competition Watchdog Drops Restrictions, Garage—The Business Times. Available online: https://www.businesstimes.com.sg/garage/grab-to-add-platform-fee-after-singapore-competition-watchdog-drops-restrictions (accessed on 12 April 2021).

- OECD. Taxi Ride-Sourcing and Ride-Sharing Services—Note by Indonesia. 2018. Available online: https://www.oecd.org/daf/competition/taxis-and-ride-sharing-services.htm (accessed on 11 April 2021).

- Susanty, F.; Boediwardhana, W. Ride-Hailing Apps to Soon See Curbs to Business. Available online: https://www.thejakartapost.com/news/2017/03/22/ride-hailing-apps-to-soon-see-curbs-to-business.html (accessed on 11 April 2021).

- The Jakarta Post. Uber, Grab to Adjust with New Decree. Available online: https://www.thejakartapost.com/news/2018/01/21/uber-grab-to-adjust-with-new-decree.html (accessed on 11 April 2021).

- KPPU. The Acquisition of Uber Assets in Indonesia. Available online: https://eng.kppu.go.id/the-acquisition-of-uber-assets-in-indonesia/ (accessed on 11 April 2021).

- Tang, W. Go-Jek Strengthens Grip on Local Ride-Hailing Market as Fresh Funds Pour in. Available online: https://www.thejakartapost.com/news/2019/02/07/go-jek-strengthens-grip-on-local-ride-hailing-market-as-fresh-funds-pour-in.html (accessed on 11 April 2021).

- The Star. Online Taxi! Temasek Firm Backs South-East Asia Cab Booking App|The Star. Available online: https://www.thestar.com.my/tech/tech-news/2014/04/09/taxi-temasek-firm-backs-south-east-asia-cab-booking-app (accessed on 10 April 2021).

- Bavani, M. Break the Law, Lose Your Vehicle|The Star. Available online: https://www.thestar.com.my/metro/community/2015/10/02/break-the-law-lose-your-vehicle (accessed on 11 April 2021).

- Randhawa, S.S. MyTeksi Ready to Discuss Ride-Sharing Laws|The Star. Available online: https://www.thestar.com.my/news/nation/2015/07/14/myteksi-ready-to-discuss-ridesharing-laws (accessed on 11 April 2021).

- Yuen, M. Law to Regulate Mobile Apps Offering Public Transport Soon|The Star. Available online: https://www.thestar.com.my/news/nation/2015/09/20/law-to-regulate-mobile-apps-offering-public-transport-soon/ (accessed on 11 April 2021).

- The Star. Online SPAD Still Mulling Whether to Ban or Regulate Ride-Sharing Services|The Star. Available online: https://www.thestar.com.my/news/nation/2015/10/07/spad-still-mulling-whether-to-ban-or-regulate-ridesharing-services (accessed on 10 April 2021).

- Lee, P. Cabbies Want to Cut off Main Roads If Uber and GrabCar Not Banned|The Star. Available online: https://www.thestar.com.my/news/nation/2015/11/19/threat-to-block-city-roads-cabbies-want-to-cut-off-main-roads-if-uber-and-grabcar-not-banned (accessed on 11 April 2021).

- Premananthini, C. A Staggering 80 per Cent of the Public Prefer Using Uber, GrabCar than Cabs, Says SPAD. Available online: https://www.nst.com.my/news/2016/04/141740/staggering-80-cent-public-prefer-using-uber-grabcar-cabs-says-spad (accessed on 11 April 2021).

- Lee, P.; Sivanandam, H.; Beh, Y.H.; Brown, V. Traffic Comes to a Standstill as Cabbies Mount Protest|The Star. Available online: https://www.thestar.com.my/news/nation/2016/03/30/chaos-in-kls-city-centre-traffic-comes-to-a-standstill-as-cabbies-mount-protest/ (accessed on 11 April 2021).

- The Star. Online Cabbies Stage ‘Mobile’ Protest in a Convoy. Available online: https://www.thestar.com.my/news/nation/2016/04/09/cabbies-stage-mobile-protest-in-a-convoy/ (accessed on 25 March 2019).

- Bavani, M.; Ravindran, S. KL’s Uber, GrabCar Drivers Face Increasing Harassment from Cabbies|The Star. Available online: https://www.thestar.com.my/metro/community/2016/04/14/hailed-down-to-be-verbally-abused-ridehailing-drivers-face-increasing-harassment-from-cabbies/ (accessed on 11 April 2021).

- Karim, K. Court Strikes out Taxi Drivers’ Lawsuit Seeking Ban on Uber, GrabCar. Available online: https://www.nst.com.my/news/2016/09/176177/court-strikes-out-taxi-drivers-lawsuit-seeking-ban-uber-grabcar (accessed on 11 April 2021).

- Bernama up to 60,000 Msians Are Uber, Grab Drivers. Available online: https://www.nst.com.my/news/2016/11/190916/60000-msians-are-uber-grab-drivers%3E (accessed on 11 April 2021).

- Kaur, B. Penang Cabbies Want State Government to Come up with Taxi Hailing Application. Available online: https://www.nst.com.my/news/nation/2017/10/288061/penang-cabbies-want-state-government-come-taxi-hailing-application (accessed on 11 April 2021).

- Yusof, A. Drivers’ Mixed Feelings over Grab Merger with Uber Southeast Asia. Available online: https://www.nst.com.my/business/2018/03/349977/drivers-mixed-feelings-over-grab-merger-uber-southeast-asia (accessed on 11 April 2021).

- Lim, J. Grab Confirms Going to Court over MyCC’s Proposed Fine|The Edge Markets. Available online: https://www.theedgemarkets.com/article/grab-confirms-going-court-over-myccs-proposed-fine (accessed on 11 April 2021).

- Yatim, H.; Loh, M. High Court Dismisses Grab’s Legal Challenge, Company to Appeal Decision|The Edge Markets. Available online: https://www.theedgemarkets.com/article/high-court-dismisses-grabs-legal-challenge-company-appeal-decision (accessed on 11 April 2021).

- Lam, T. Uber, GrabTaxi Heading towards de-Facto Recognition. Available online: https://vneconomictimes.com/article/business/uber-grabtaxi-heading-towards-de-facto-recognition (accessed on 19 April 2021).

- Le, D. Grab, Uber Carpool Services Banned in Hanoi. Available online: https://vneconomictimes.com/article/business/grab-uber-carpool-services-banned-in-hanoi (accessed on 19 April 2021).

- Freischlad, N. Three Major Taxi Firms in Vietnam Unites under Single Brand against Grab. Available online: https://kr-asia.com/three-major-taxi-firms-in-vietnam-unites-under-single-brand-against-grab (accessed on 19 April 2021).

- Thong, V. Ride-Hailing Market Quintuples in Last 4 Years—VnExpress International. Available online: https://e.vnexpress.net/news/business/companies/ride-hailing-market-quintuples-in-last-4-years-3993887.html (accessed on 19 April 2021).

- Phong, H. Vietnam Ride-Hailing Market Sees New Entrant—VnExpress International. Available online: https://e.vnexpress.net/news/business/companies/vietnam-ride-hailing-market-sees-new-entrant-4123794.html (accessed on 11 April 2021).

- Occenola, P. Need a Cab? There’s an App for That! Available online: https://r3.rappler.com/life-and-style/technology/34811-grab-taxi-app (accessed on 11 April 2021).

- Villanueva, M.J. What’s a Trip like on Uber’s Pay-per-Ride Chauffeur Service? Available online: https://www.rappler.com/technology/features/uber-app-pay-per-ride-chauffeur-service (accessed on 11 April 2021).

- Rappler. No Franchise: Uber Falls in LTFRB Sting Operation. Available online: https://r3.rappler.com/business/industries/215-tech-biz/72898-ltfrb-uber-sting-operation (accessed on 7 February 2019).

- Basa, M. Abaya to Uber, LTFRB: Let’s Work Together. Available online: https://r3.rappler.com/business/industries/215-tech-biz/73526-abaya-uber-ltfrb-work-together (accessed on 11 April 2021).

- Rappler. Uber Partner Cars to Be Placed under LTFRB Regulation. Available online: https://www.rappler.com/business/industries/tech-biz-uber-franchise-regulation-ltfrb (accessed on 7 February 2019).

- Cupin, B. Should the PH Government Regulate Uber? Available online: https://r3.rappler.com/nation/75900-ltfrb-hearing-uber (accessed on 11 April 2021).

- Schnabel, C.; Schnabel, S. GrabCar PH Relaunches. Available online: https://www.rappler.com/business/industries/grabcar-ph-relaunches (accessed on 11 April 2021).

- Corrales, N. DOTC Now Regulates App-Based Transport Services like Uber, GrabTaxi. Available online: https://newsinfo.inquirer.net/690850/dotc-now-regulates-app-based-transport-services-like-uber-grabtaxi (accessed on 18 April 2021).

- Rappler. In PH, Uber, GrabTaxi Get License to Work Nationwide. Available online: https://www.rappler.com/business/industries/208-infrastructure/92762-dotc-new-classification-app-based-transportation-services (accessed on 8 February 2019).

- Francisco, K. What’s Needed by Uber, Other App-Based PUVs to Operate Legally. Available online: https://r3.rappler.com/business/industries/208-infrastructure/95230-uber-transport-network-company-requirements (accessed on 11 April 2021).

- Land Transportation Franchising and Regulatory Board. LTFRB Memorandum Circular No. 2015-017; Republic of the Philippines, Department of Transportation: Quezon City, Philippines, 2015.

- De la Paz, C. PH Taxi Industry Protests New Rules. Available online: https://www.rappler.com/business/philippine-taxi-industry-dotc-uber (accessed on 11 April 2021).

- Department of Transportation and Communication. Further Amending Department Order No. 97-1097 to Promote Mobility; Department Order No. 2015-011, S.4; Republic of the Philippines, Department of Transportation: Quezon City, Philippines, 2015.

- De la Paz, C. LTFRB to Start Unregistered Uber, GrabCar Clampdown. Available online: https://r3.rappler.com/business/industries/208-infrastructure/102278-ltfrb-uber-grabcar-crackdown (accessed on 11 April 2021).

- Reuters Staff. Philippines Suspends New Uber, Grab Vehicle Registrations as Backlog Mounts. Available online: https://www.reuters.com/article/us-philippines-uber-grab/philippines-suspends-new-uber-grab-vehicle-registrations-as-backlog-mounts-idUKKCN1020AS (accessed on 2 June 2021).

- Cabuenas, J.V. Times Two on Top of Base Fare: LTFRB Puts Cap on Grab, Uber’s Surge Rates. Available online: https://www.gmanetwork.com/news/story/593817/money/companies/ltfrb-puts-cap-on-grab-uber-s-surge-prices/ (accessed on 11 April 2021).

- Bondoc, M.R. Over 120,000 Signatures: Grab, Uber Drivers File Petition to Lift Moratorium on Franchise Applications. Available online: https://www.gmanetwork.com/news/money/motoring/618914/grab-uber-drivers-file-petition-to-lift-moratorium-on-franchise-applications/story/ (accessed on 11 April 2021).

- Terrazola, V. Transpo Execs to Fix Uber, Grabissues. Available online: https://www.tempo.com.ph/2017/07/22/transpo-execs-to-fix-uber-grab-issues/ (accessed on 2 June 2021).

- Francisco, K. Timeline: Why Only Uber Is Suspended. Available online: https://www.rappler.com/newsbreak/iq/grab-uber-ltfrb-suspension (accessed on 11 April 2021).

- Land Transportation Franchising and Regulatory Board. LTFRB Memorandum Circular No. 2015-016-A; Republic of the Philippines, Department of Transportation: Quezon City, Philippines, 2017.

- Land Transportation Franchising and Regulatory Board. LTFRB Memorandum Circular No. 2015-018-A; Republic of the Philippines, Department of Transportation: Quezon City, Philippines, 2017.

- Rey, A. LTFRB Raises Ride-Hailing Vehicle Cap to 66,750. Available online: https://www.rappler.com/nation/ltfrb-raises-ride-hailing-vehicle-cap (accessed on 11 April 2021).

- Ong, M. PCC Says It Can Block Grab-Uber Deal. ABS-CBN News. Available online: https://news.abs-cbn.com/business/03/27/18/pcc-says-it-can-block-grab-uber-deal (accessed on 11 April 2021).

- Rafales, A. PCC Wants Uber, Grab to Operate Separately amid Deal Review. ABS-CBN News. Available online: https://news.abs-cbn.com/business/04/05/18/pcc-wants-uber-grab-to-operate-separately-amid-deal-review (accessed on 11 April 2021).

- Rey, A. LTFRB Again Rejects Go-Jek Entry into Philippine Market. Available online: https://www.rappler.com/nation/ltfrb-again-rejects-go-jek-entry-philippine-market (accessed on 11 April 2021).

- National Privacy Commission. NPC Suspends GRAB PH’S Selfie Verification, Audio, Video Recording Systems. Available online: https://www.privacy.gov.ph/2020/02/npc-suspends-grab-phs-selfie-verification-audio-video-recording-systems/ (accessed on 18 April 2021).

- Cheok, J. Market Players. Welcome LTA Regulation of Third-Party Taxi Apps (Amended). Available online: https://www.businesstimes.com.sg/transport/market-players-welcome-lta-regulation-of-third-party-taxi-apps-amended (accessed on 18 April 2021).

- Lim, Y.L. Law to Regulate Taxi Booking Services. Available online: https://www.straitstimes.com/singapore/transport/law-to-regulate-taxi-booking-services (accessed on 18 April 2021).

- Lee, T. It Turns out Grab’s Service between Johor and Singapore Was Illegal. Available online: https://www.techinasia.com/turns-grabs-service-johor-singapore-illegal (accessed on 20 May 2021).

- Lee, T. Grab-Uber Merger May Have Infringed Competition Laws, Says Singapore Watchdog. Available online: https://www.techinasia.com/grabuber-merger-infringed-competition-laws-singapore-watchdog (accessed on 2 June 2021).

- Channel News Asia. Ride-Hailing Firm Go-Jek to Enter Singapore, Other Southeast Asian Markets in Next Few Months—CNA. Available online: https://www.channelnewsasia.com/news/singapore/go-jek-to-enter-singapore-philippines-thailand-vietnam-10273010 (accessed on 10 April 2021).

- Channel News Asia. Grab-Uber Merger Has Reduced Competition and Increased Prices, Says Watchdog. Available online: https://www.channelnewsasia.com/news/singapore/grab-uber-merger-competition-financial-penalties-10501708 (accessed on 5 April 2021).

- Jagdish, B. Commentary: Grab-Uber Saga Shows Even with Disruption, Comes Great Responsibility—CNA. Available online: https://www.channelnewsasia.com/news/commentary/grab-uber-merger-cccs-competition-consumer-watchdog-ruling-10764108 (accessed on 11 April 2021).

- Channel News Asia. Allow Taxis, Private-Hire Drivers to Use Bus Stops and Lanes: Industry Associations. Available online: https://www.channelnewsasia.com/news/singapore/taxis-private-hire-vehicles-lta-2040-master-plan-transport-11046378 (accessed on 19 February 2019).

- Abdullah, Z. Mediation a Way of Protecting Private-Hire Car Drivers. The Straits Times. Available online: https://www.straitstimes.com/singapore/transport/mediation-a-way-of-protecting-private-hire-car-drivers (accessed on 10 April 2021).

- Channel News Asia. Go-Jek Opens up Service to All Singapore Consumers—CNA. Available online: https://www.channelnewsasia.com/news/singapore/go-jek-ride-hailing-app-opens-up-service-singapore-11104854 (accessed on 5 April 2021).

- Iwamoto, K.; Tani, S. Ride-Hailers Grab and Go-Jek Wage First Full-On War in 2019—Nikkei Asia. Available online: https://asia.nikkei.com/Spotlight/Sharing-Economy/Ride-hailers-Grab-and-Go-Jek-wage-first-full-on-war-in-2019 (accessed on 11 April 2021).

- Cheng, K. Commuters Surprised by Grab’s Recent U-Turn in Offering Fare Promotions. Available online: https://www.todayonline.com/singapore/commuters-surprised-grabs-recent-u-turn-offering-fare-promotions (accessed on 11 April 2021).

- Tan, C. LTA to Streamline Rules Governing Taxis, Private-Hire Cars, Transport News & Top Stories—The Straits Times. Available online: https://www.straitstimes.com/singapore/transport/lta-to-streamline-rules-governing-taxis-private-hire-cars (accessed on 11 April 2021).

- Yong, C. New Private-Hire Drivers Must Be Singaporean, Aged 30 and Above, Singapore News & Top Stories—The Straits Times. Available online: https://www.straitstimes.com/singapore/new-private-hire-drivers-must-be-singaporean-aged-30-and-above (accessed on 11 April 2021).

- Wong, L. Grab Fined $10k over Fourth Data Privacy Breach in Two Years. Available online: https://www.straitstimes.com/tech/grab-fined-10k-over-fourth-data-privacy-breach-in-two-years (accessed on 11 April 2021).

- Noviandari, L. Cab Booking App GrabTaxi Now Available in Indonesia. Available online: https://www.techinasia.com/taxi-booking-app-grabtaxi-indonesia (accessed on 11 April 2021).

- Kevin, J. Why Uber Will Fail in Jakarta, and Why It Won’t. Available online: https://www.techinasia.com/uber-fail-jakarta-wont (accessed on 11 April 2021).

- Cosseboom, L. This Guy Turned Go-Jek from a Zombie into Indonesia’s Hottest Startup. Available online: https://www.techinasia.com/indonesia-go-jek-nadiem-makarim-profile (accessed on 11 April 2021).

- Chilkoti, A. Go-Jek: Opening the Throttle in Indonesia. Available online: https://www.ft.com/content/d774419c-8a0f-11e5-9f8c-a8d619fa707c (accessed on 11 April 2021).

- Amin, K. GrabTaxi to Launch Services in Jakarta. Available online: https://www.thejakartapost.com/news/2015/08/10/grabtaxi-launch-services-jakarta.html (accessed on 11 April 2021).

- The Jakarta Post. Transport Ministry Bans Ride-Hailing Apps. Available online: https://www.thejakartapost.com/news/2015/12/18/transport-ministry-bans-ride-hailing-apps.html (accessed on 11 April 2021).

- The Jakarta Post. Go-Jek Praises Jokowi for Withdrawing Ban. Available online: https://www.thejakartapost.com/news/2015/12/18/go-jek-praises-jokowi-withdrawing-ban.html (accessed on 5 April 2021).

- Budiari, I.; Amirio, D. Transport Conflict Widens. Available online: https://www.thejakartapost.com/news/2016/03/16/transport-conflict-widens.html (accessed on 11 April 2021).

- Primanita, A. Transportation Ministry Requests Uber, Grab Taxi Ban. Available online: https://www.thejakartapost.com/news/2016/03/14/transportation-ministry-requests-uber-grab-taxi-ban.html (accessed on 11 April 2021).

- Cabinet Secretariat of the Republic of Indonesia. Transportation Minister: App-Based Taxi Must Be Registered and Has KIR. Available online: https://setkab.go.id/en/transportation-minister-app-based-taxi-must-be-registered-and-has-kir/ (accessed on 11 April 2021).

- Pasya, H. Go-Jek to Launch Go-Car Service. Available online: https://jakartaglobe.id/business/go-jek-launch-go-car-service (accessed on 11 April 2021).

- Wijaya, C.A. Blue Bird Teams up with Go-Jek. Available online: https://www.thejakartapost.com/news/2016/05/10/blue-bird-teams-up-with-gojek.html (accessed on 11 April 2021).

- Indonesian Ministry of Transportation. Ministerial Regulation No. 32/2016; Indonesian Ministry of Transportation: Jakarta, Indonesia, 2016.

- Assegaf Hamzah & Partners. Amid Continuing Controversy, Minister Revisits Online Taxi Issue with New Regulation; Rajah & Tan Asia: Singapore, 2017. [Google Scholar]

- Desfika, T.S. Ride-Hailing Drivers Call on Govt Not to Implement New Regulation. Available online: https://jakartaglobe.id/context/association-wants-government-to-rethink-online-ride-hailing-policy (accessed on 11 April 2021).

- Yuniarni, S.; Diela, T. Uber, Grabcar Hit the Road After Ministry Updates Regulation. Available online: https://jakartaglobe.id/context/govt-offers-a-win-win-solution-for-uber-grab-car-drivers (accessed on 11 April 2021).

- Dipa, A. Quiet Streets in Bandung as Drivers Stage Strike. Available online: https://www.thejakartapost.com/news/2017/03/09/quiet-streets-in-bandung-as-drivers-stage-strike.html (accessed on 11 April 2021).

- Susanty, F. Government Designs Bumper Sticker for Ride-Hailing Cars. Available online: https://www.thejakartapost.com/news/2017/03/15/govt-designs-bumper-sticker-for-ride-hailing-cars.html (accessed on 11 April 2021).

- The Jakarta Post. Government Sets Price Range for Car-Hailing Services. Available online: https://www.thejakartapost.com/news/2017/07/02/indonesia-sets-price-caps-on-car-hailing-services.html (accessed on 5 April 2021).

- The Straits Times. Safety Is Top Priority in New Ride-Hailing Regulations in Indonesia. Available online: https://www.straitstimes.com/asia/se-asia/safety-is-top-priority-in-new-ride-hailing-regulations-in-indonesia (accessed on 10 April 2021).

- Savitri, Y. Ministry to Issue Revised “Online Taxi” Regulation in December. Available online: https://www.thejakartapost.com/news/2018/11/19/ministry-to-issue-revised-online-taxi-regulation-in-december.html (accessed on 11 April 2021).

- Maulia, E. Indonesia Revising Regulation on Ride-Hailing Apps. Available online: https://asia.nikkei.com/Economy/Indonesia-revising-regulation-on-ride-hailing-apps2 (accessed on 11 April 2021).

- Almanar, A. Revised Regulation on App-Based Taxi Services to Come into Effect in November. Available online: https://jakartaglobe.id/business/revised-regulation-app-based-taxi-services-come-effect-november (accessed on 11 April 2021).

- The Jakarta Post. Go-Jek, Grab Welcome Government Plan to Introduce State-Owned Ride-Hailing App. Available online: https://www.thejakartapost.com/news/2018/09/19/go-jek-grab-welcome-government-plan-to-introduce-state-owned-ride-hailing-app.html (accessed on 5 April 2021).

- Shofa, J.N. Grab Seeks an Appeal against Indonesia’s Antitrust Decision. Available online: https://jakartaglobe.id/business/grab-seeks-an-appeal-against-indonesias-antitrust-decision (accessed on 11 April 2021).

- The Star Online. MyTeksi Service Launched. Available online: https://www.thestar.com.my/news/nation/2012/06/05/myteksi-service-launched/ (accessed on 10 April 2021).

- Lee, J. Revving up the Limos. The Star. Available online: https://www.thestar.com.my/business/sme/2014/06/12/revving-up-the-limos-company-provides-another-way-to-ease-kls-transport-problems (accessed on 11 April 2021).

- The Star Online. Uber-Heated Battle as Mobile Apps Rattle Asia’s Taxis. Available online: https://www.thestar.com.my/tech/tech-news/2014/10/14/uber-heated-battle-as-mobile-apps-rattle-asias-taxis (accessed on 11 April 2021).

- Lee, P. SPAD Seizes Nine Uber, GrabCar Vehicles. The Star. Available online: https://www.thestar.com.my/news/nation/2015/09/30/spad-seize-rideshare-cars (accessed on 11 April 2021).

- The Star Online. Drivers Protest New Chauffeured Service by MyTeksi. Available online: https://www.thestar.com.my/news/nation/2015/06/30/cabbies-against-grabcar-drivers-protest-new-chauffeured-service-by-myteksi/ (accessed on 24 March 2019).

- Sukumaran, T. SPAD Will Clamp Down on Private Vehicles Used as Taxis. The Star. Available online: https://www.thestar.com.my/news/nation/2015/06/30/spad-to-clamp-down-uber-grabcar (accessed on 11 April 2021).

- The Star Online. Uber and Grabcar Drivers Face Harassment. Available online: https://www.thestar.com.my/metro/community/2015/10/02/uber-and-grabcar-drivers-face-harassment/ (accessed on 11 April 2021).

- Lee, P. Taxi Drivers Arresting Uber and Grabcar Drivers around KLCC. The Star. Available online: https://www.thestar.com.my/news/nation/2015/10/09/taxi-drivers-operations-uber-grabcar (accessed on 11 April 2021).

- Lee, P. Cabbies Protest Uber and GrabCar in KL City. The Star. Available online: https://www.thestar.com.my/news/nation/2015/11/18/taxi-protests-spad-uber-grabcar/ (accessed on 11 April 2021).

- Lee, P. SPAD Says Regulating Uber, GrabCar Takes Time. The Star. Available online: https://www.thestar.com.my/news/nation/2016/03/29/spad-says-regulating-uber-grabcar-takes-time (accessed on 11 April 2021).

- The Star Online. Protesting Cabbies Getting No Sympathy from Netizens. Available online: https://www.thestar.com.my/news/nation/2016/03/30/protesting-cabbies-getting-no-sympathy-from-netizens (accessed on 10 April 2021).

- The Star Online. SPAD Wants E-Hailing Services to Be Legalised. Available online: https://www.thestar.com.my/news/nation/2016/06/19/spad-wants-ehailing-services-to-be-legalised/ (accessed on 10 April 2021).

- The Star Online. Decision to Regulate E-Hailing Services Lauded. Available online: https://www.thestar.com.my/news/nation/2016/08/11/decision-to-regulate-ehailing-services-lauded (accessed on 24 March 2019).

- The Star Online. Conventional Cabbies Unhappy with Decision. Available online: https://www.thestar.com.my/news/nation/2016/08/12/conventional-cabbies-unhappy-with-decision (accessed on 25 March 2019).

- Chan, Y. TITP Puts More Bite into Taxi Industry. Available online: https://www.nst.com.my/news/2016/08/167313/titp-puts-more-bite-taxi-industry (accessed on 11 April 2021).

- The Star Online. Uber, Grabcar Must Follow Taxi Rules. Available online: https://www.thestar.com.my/news/nation/2016/10/14/uber-grabcar-must-follow-taxi-rules-cabinet-decision-is-to-even-out-playing-field-says-nazri/ (accessed on 11 April 2021).

- The Star Online. Malaysians Hail Move to Legalise Grab, Uber. Available online: https://www.thestar.com.my/news/nation/2017/07/29/msians-hail-move-to-legalise-grab-uber/ (accessed on 10 April 2021).

- The Star Online. E-Hailing Services Law to Be Gazetted. Available online: https://www.thestar.com.my/news/nation/2018/03/21/ehailing-services-law-to-be-gazetted/ (accessed on 26 March 2019).

- Malaysia. Commercial Vehicles Licensing Board (Amendment) Act 2017; Government of Malaysia: Putrajaya, Malaysia, 2017.

- De Silva, J.E. Taxi Drivers Lament Drop in Income. The Star. Available online: https://www.thestar.com.my/metro/community/2017/08/17/taxi-drivers-lament-drop-in-income-they-attribute-situation-to-introduction-of-ehailing-services (accessed on 11 April 2021).

- Muhamading, M. Taxis Can Excel If They Are with Uber, Grab or Other e-Hailing Services. Available online: https://www.nst.com.my/news/nation/2017/12/313288/taxis-can-excel-if-they-are-uber-grab-or-other-e-hailing-services (accessed on 11 April 2021).

- Azman, S. MyCC to Probe Grab-Uber Merger. The Edge Markets. Available online: https://www.theedgemarkets.com/article/mycc-probe-grabuber-merger (accessed on 11 April 2021).

- Malek, N.H. Grab-Uber Merger Probe to Conclude Soon. Available online: https://themalaysianreserve.com/2018/11/28/grab-uber-merger-probe-to-conclude-soon/ (accessed on 11 April 2021).

- Parzi, M.N.; Yunus, A. 67,000 Cabbies Nationwide to Get 1Malaysia Taxi Assistance Card Aid. Available online: https://www.nst.com.my/news/nation/2018/04/356859/67000-cabbies-nationwide-get-1malaysia-taxi-assistance-card-aid (accessed on 11 April 2021).

- Landau, E.; Amran, S.N.M.E. Traditional Taxi Drivers Encouraged to Adopt E-Hailing Service. Available online: https://www.nst.com.my/news/nation/2018/08/403728/traditional-taxi-drivers-encouraged-adopt-e-hailing-service (accessed on 11 April 2021).

- Do, A.-M. GrabTaxi Enters Vietnam, Intensifying the Battle for Mobile Taxi Booking Apps. Available online: https://www.techinasia.com/grabtaxi-enters-vietnam (accessed on 18 April 2021).

- Do, A.-M. Uber Finally Arrives in Vietnam, a Country That Needs a Major Logistics Overhaul. Available online: https://www.techinasia.com/uber-in-vietnam (accessed on 18 April 2021).

- Saigoneer. HCMC Begins to Crack Down On “Illegal” Uber Taxis. Saigoneer. Available online: https://saigoneer.com/saigon-news/3287-hcmc-begins-to-crack-down-on-illegal-uber-taxis (accessed on 18 April 2021).

- Tuyet, M. Calls for Uber to Be Banned. Available online: https://vneconomictimes.com/article/vietnam-today/calls-for-uber-to-be-banned (accessed on 18 April 2021).

- Tuyet, M. MoT: Uber Not Our Responsibility. Available online: https://vneconomictimes.com/article/vietnam-today/mot-uber-not-our-responsibility (accessed on 18 April 2021).

- Tuoi Tre News. GrabCar Licensed to Operate Legally in Vietnam. Available online: http://b1.tuoitrenews.vn/news/business/20160401/grabcar-licensed-to-operate-legally-in-vietnam/12673.html (accessed on 19 April 2021).

- Tuoi Tre News. Ho Chi Minh City to Force Cash-Rich Uber to Pay Tax: Official. Available online: http://b1.tuoitrenews.vn/news/business/20160109/ho-chi-minh-city-to-force-cash-rich-uber-to-pay-tax-official/39147.html (accessed on 19 April 2021).

- Tuoi Tre News. Low Tax on Uber, Grab “Unfair” for Traditional Cabs: Taxi Chairman. Available online: http://b1.tuoitrenews.vn/news/business/20170224/low-tax-on-uber-grab-unfair-for-traditional-cabs-taxi-chairman/20360.html (accessed on 19 April 2021).

- Duy, A. Uber’s Ride Hailing Service Is Finally Legal in Vietnam? VnExpress International. Available online: https://e.vnexpress.net/news/business/uber-s-ride-hailing-service-is-finally-legal-in-vietnam-3568563.html (accessed on 19 April 2021).

- DTi News. Authorities Blame Uber and Grab for Congestion. DTiNews—Dan Tri International. Available online: http://dtinews.vn/en/news/024/50419/authorities-blame-uber-and-grab-for-congestion.html (accessed on 19 April 2021).

- Van, M. Grab & Uber Drivers Protest Fare Share Structure. Available online: https://vneconomictimes.com/article/business/grab-uber-drivers-protest-fare-share-structure (accessed on 19 April 2021).

- Reuters. Vietnam Launches In-Depth Probe into Grab-Uber Deal in SE Asia. Available online: https://www.thestar.com.my/tech/tech-news/2018/05/21/vietnam-launches-indepth-probe-into-grabuber-deal-in-se-asia (accessed on 19 April 2021).

- Bao, A. Grab Hit by Complaints after Dominating Ride-Hailing Industry in Vietnam. Available online: http://b1.tuoitrenews.vn/news/business/20180605/grab-hit-by-complaints-after-dominating-ridehailing-industry-in-vietnam/45946.html (accessed on 19 April 2021).

- Singh, N. Go-Jek Drives Expansion in Vietnam with Launch in Hanoi. Available online: https://www.entrepreneur.com/article/320087 (accessed on 19 April 2021).

- Duyen, H.; Hoa, K. Vietnam Court Orders Grab to Pay Vinasun $208,000—VnExpress International. Available online: https://e.vnexpress.net/news/business/companies/vietnam-court-orders-grab-to-pay-vinasun-208-000-3861066.html (accessed on 19 April 2021).

- Vietnam News. Grab’s Acquisition of Uber Scrutinised-Economy—Vietnam News. Available online: https://vietnamnews.vn/economy/483140/grabs-acquisition-of-uber-scrutinised.html (accessed on 19 April 2021).

- Nguyen, Q. GrabTaxi, Uber Must Display Taxi Signage. Available online: https://vneconomictimes.com/article/business/grabtaxi-uber-must-display-taxi-signage (accessed on 19 April 2021).

- DTi News. Ministry Caves into Uber and Grab Taxi Business Model. Available online: http://dtinews.vn/en/news/018/50200/ministry-caves-in-to-uber-and-grab-taxi-business-model.html (accessed on 19 April 2021).

- VietNamNet. Uber, Grab under Tighter Supervision. Available online: https://english.vietnamnet.vn/fms/business/193432/uber--grab-under-tighter-supervision.html (accessed on 19 April 2021).

- Vietnam Investment Review. Vietnam Formalises Legal Framework for Grab and Other Ride-Hailing Platforms. Available online: https://www.vir.com.vn/vietnam-formalises-legal-framework-for-grab-and-other-ride-hailing-platforms-75312.html (accessed on 20 April 2021).

- Socialist Republic of Vietnam. Decree on Auto Transport Business and Conditions for Auto Transport Business; Decree No. 10/2020/ND-CP; The Government of Vietnam: Hanoi, Vietnam, 2020.

- Liu, Y.-C.; Kuo, R.-L.; Shih, S.-R. COVID-19: The First Documented Coronavirus Pandemic in History. Biomed. J. 2020, 43, 328–333. [Google Scholar] [CrossRef] [PubMed]

- Grab. Grab Announces Additional COVID-19 Support Measures. Available online: https://www.grab.com/sg/press/social-impact-safety/grab-announces-additional-covid-19-support-measures/ (accessed on 20 April 2021).

- Samboh, E. Gojek Bosses Give up 25% of Annual Salary for Drivers, Partners as COVID-19 Deals Blow. Available online: https://www.thejakartapost.com/news/2020/03/24/gojek-bosses-give-up-25-of-annual-salary-for-drivers-partners-as-covid-19-deals-blow.html (accessed on 20 April 2021).

- Land Transport Authority Singapore (LTA). LTA’s Measures for COVID-19. Available online: https://www.lta.gov.sg/content/ltagov/en/industry_innovations/industry_matters/LTA’s%20Measures%20for%20COVID-19.html (accessed on 12 April 2021).

- Wei, T.T. Carpooling Now Illegal after Transport Ministry Waives Exemption. Largest Telegram Group Halts Operations. Available online: https://www.straitstimes.com/singapore/transport/carpooling-now-illegal-after-transport-ministry-waives-exemption-but-largest (accessed on 12 April 2021).

- Tan, C. Cabbies, Private-Hire Drivers and Operators to Get Additional $112m in Aid; New Private-Hire Drivers Must Be Citizens, at Least 30 Years Old. Available online: https://www.straitstimes.com/singapore/transport/private-hire-drivers-must-be-citizens-at-least-30-years-old-lta (accessed on 20 April 2021).

- Wei, T.T. Coronavirus: Passengers to Be Banned from Front Seat of Grab Car—Have to Declare Health and Hygiene Status. Available online: https://www.straitstimes.com/singapore/transport/coronavirus-passengers-to-be-banned-from-front-seat-of-grab-car-have-to-declare (accessed on 19 April 2021).

- Galvez, D. “New Normal” Ushers in Grab’s “No-Touch Policy” in Car Services. Available online: https://newsinfo.inquirer.net/1282346/grab-to-implement-addtl-safety-measures-in-car-services-vs-covid-19-spread (accessed on 12 April 2021).

- Caña, P.J.C. Grab Drivers Can Cancel Your Ride If You’re Not Wearing a Mask-And Other Things You Need to Know. Available online: https://www.esquiremag.ph/wheels/drive/grab-new-safety-protocols-a00289-20200528-lfrm (accessed on 19 April 2021).

- Nurbaiti, A. COVID-19: Jakarta’s Partial Lockdown Deals a Heavy Blow to “Ojek” Drivers. Available online: https://www.thejakartapost.com/news/2020/04/12/covid-19-jakartas-partial-lockdown-deals-a-heavy-blow-to-ojek-drivers.html (accessed on 19 April 2021).

- Shofa, J.N. Safe Travels: GrabCar Protect Now Available in Jayapura. Available online: https://jakartaglobe.id/lifestyle/safe-travels-grabcar-protect-now-available-in-jayapura (accessed on 19 April 2021).

- BOTS Team. #TECH: Grab Introduces New Safety Measures. Available online: https://www.nst.com.my/lifestyle/bots/2020/06/598181/tech-grab-introduces-new-safety-measures (accessed on 19 April 2021).

- Karim, K.N. E-Hailing Drivers Thankful for RM500 One-Off Payment. Available online: https://www.nst.com.my/news/nation/2020/03/578815/e-hailing-drivers-thankful-rm500-one-payment (accessed on 19 April 2021).

- The Star Online. Vietnamese Motorbike Ride-Hailing Service Suspended as Total Covid-19 Cases Rise to 237. Available online: https://www.thestar.com.my/news/regional/2020/04/03/vietnamese-motorbike-ride-hailing-service-suspended-as-total-covid-19-cases-rise-to-237 (accessed on 20 April 2021).

- Reuters Indonesia. Plans to Standardise Rates for Grab and Go-Jek, Curtailing Their Bold Expansion Plans. Available online: https://www.scmp.com/news/asia/southeast-asia/article/2181918/indonesia-plans-standardise-rates-grab-and-go-jek (accessed on 5 April 2021).

- The Jakarta Post. Grab Agrees to Increase Drivers’ Income. Available online: https://www.thejakartapost.com/news/2018/03/29/grab-agrees-to-increase-drivers-income.html (accessed on 5 April 2021).

- Canivel, R.S. Uber PH Confirms Data of Filipino Users among Those Hacked—NPC. Available online: https://technology.inquirer.net/69763/breaking-internet-hacking-uber-national-privacy-commission-breach-personal-information (accessed on 11 April 2021).

- Rey, A. No Migration of Personal Data to Grab in Uber App Shutdown—Privacy Commission. Available online: https://www.rappler.com/nation/personal-data-national-privacy-comission-ltfrb-uber (accessed on 11 April 2021).

- Tung, Y.H. Grab Ordered to Pay US $208K to Vietnamese Taxi Firm Vinasun in Lawsuit. Available online: https://e27.co/grab-ordered-to-pay-us208k-vinasun-lawsuit-20181228/ (accessed on 27 April 2021).

- Talabong, R. Grieving Lawmaker Demands Grab, Uber Legal Accountability. Available online: https://www.rappler.com/nation/grieving-lawmaker-demands-grab-uber-legal-accountability-ltfrb (accessed on 11 April 2021).

- Land Transportation Franchising and Regulatory Board. LTFRB Memorandum Circular No. 2015-015-A; Republic of the Philippines, Department of Transportation: Quezon City, Philippines, 2017.

- Land Transportation Franchising and Regulatory Board. LTFRB Memorandum Circular No. 2015-028; Republic of the Philippines, Department of Transportation: Quezon City, Philippines, 2015.

- Olano, G. Grab Laments Insufficient Insurance Options in Malaysia. Available online: https://www.insurancebusinessmag.com/asia/news/breaking-news/grab-laments-insufficient-insurance-options-in-malaysia-159403.aspx (accessed on 11 April 2021).

- Prabowo, Y. Uber, Go-Jek, Grab: What Do People in Indonesia Actually Want from Ride-Hailing Apps? Available online: https://ecommerceiq.asia/cp-ride-hailing-apps-in-indonesia/ (accessed on 27 April 2021).

- Susanty, F. As Deadline Nears, GrabCar and Uber Still Face Hurdles. Available online: https://www.thejakartapost.com/news/2016/08/19/as-deadline-nears-grabcar-and-uber-still-face-hurdles.html (accessed on 11 April 2021).

- The Jakarta Post. Sandiaga to Meet Go-Jek, Grab CEOs to Discuss Congestion around Palmerah Station. Available online: https://www.thejakartapost.com/news/2017/09/27/sandiaga-to-meet-go-jek-grab-ceos-to-discuss-congestion-around-palmerah-station.html (accessed on 10 April 2021).

- Elemia, C. Grab: Only 35,000 Drivers Serve 600,000 Bookings per Day. Available online: https://www.rappler.com/business/grab-philippines-drivers-not-enough-passenger-bookings (accessed on 11 April 2021).

- Li, C. Uber Dispute Ends as Firm Pays Back Taxes, Fines. Available online: https://e.vnexpress.net/news/business/companies/uber-dispute-ends-as-firm-pays-back-taxes-fines-3806680.html (accessed on 11 April 2021).

- Jun, S.W. Grab, Uber Now Regulated after Public Transport Bills Passed in Dewan Negara. Available online: https://www.nst.com.my/news/government-public-policy/2017/08/268231/grab-uber-now-regulated-after-public-transport-bills (accessed on 11 April 2021).

- De la Paz, C. LTFRB Approves Uber as Transport Network Company. Available online: https://www.rappler.com/business/ltfrb-approves-uber-accreditation (accessed on 11 April 2021).

- Thuy, N. Vietnam Transport Ministry Ends Ride-Hailing Services Pilot Program. Available online: http://hanoitimes.vn/vietnam-transport-ministry-ends-ride-hailing-services-pilot-program-301071.html (accessed on 25 April 2021).

- Muhamading, M. Income of Taxi Drivers Increase after Registering with E-Hailing Service Providers. Available online: https://www.nst.com.my/news/nation/2017/12/313345/income-taxi-drivers-increase-after-registering-e-hailing-service (accessed on 11 April 2021).

- Ministry of Transport Malaysia. National Transport Policy 2019–2030. Available online: https://www.pmo.gov.my/2019/10/national-transport-policy-2019-2030/ (accessed on 11 April 2021).

- Valdez, D. LTFRB given Power to Set Ride-Sharing Fares. Available online: https://www.bworldonline.com/ltfrb-given-power-to-set-ride-sharing-fares/ (accessed on 25 April 2021).

- Lee, L. Malaysia Proposes $20 Million Fine on Grab for Abusive Practices. Reuters, 2 October 2019. [Google Scholar]

- Elemia, C. Public to “Suffer” from “Cruel” Suspension of Uber. Available online: https://www.rappler.com/nation/senators-ltfrb-suspension-uber (accessed on 11 April 2021).

- Tan, S.Y.; Taeihagh, A. Adaptive Governance of Autonomous Vehicles: Accelerating the Adoption of Disruptive Technologies in Singapore. Gov. Inf. Q. 2021, 38, 101546. [Google Scholar] [CrossRef]

- Taeihagh, A.; Ramesh, M.; Howlett, M. Assessing the Regulatory Challenges of Emerging Disruptive Technologies. Regul. Gov. 2021, rego.12392. [Google Scholar] [CrossRef]

- Tan, S.Y.; Taeihagh, A. Governing the Adoption of Robotics and Autonomous Systems in Long-Term Care in Singapore. Policy Soc. 2020, 1–21. [Google Scholar] [CrossRef]

| Strategy | Definition and Ridesharing Examples |

|---|---|

| No-response | Decision makers refrain from taking action on new risks. This inaction could be the result of the lack of information or inability to predict consequences of new technologies [4]. There might also be a rational argument for this strategy, if it is understood that waiting reduces costs, because by not investing in ineffective measures and waiting for more clarity, a better response can be given [11]. In SEA, there was a lack of enforcement action taken at the launch of ridesharing firms due to the lack of clear regulatory guidelines. |

| Prevention-oriented | Prevention-oriented strategies involve policymakers prohibiting new technologies, such as ridesharing, in order to avoid any of the risks associated with them [4]. In SEA, several countries prohibited the vehicles operating under ridesharing applications due to the absence of regulations governing them. |

| Precaution-oriented | Precaution-oriented strategies involve “a risk analysis framework consisting of risk assessment, risk management, and risk communication” [16] (p. 8). Due to the risk management involved in precaution-oriented strategies, it emphasizes transparency as well as the selection of a proportionate policy to address the risk involved [16]. |

| Control-oriented | A control-oriented strategy involves the assessment of risk to reduce uncertainties, allowing them to exist but controlling them with regulation [17]). An example for ridesharing is the imposition of licensing and inspection requirements for motor vehicles to be used in ridesharing. |

| Toleration-oriented | This strategy involves increasing the ability of the systems or organisations to perform well in an uncertain and constantly changing environment and corresponds with the system or organisation surviving and managing a wide range of circumstances [4]. It also means that policy changes or reforms in various situations are prepared in advance [4,19]. |

| Adaptation-oriented | This strategy involves improving the capability of a system or organization to adapt. Several methods are used in this strategy including “learning by doing, public participation, forward-looking planning, co-deciding, and negotiation” [4] (p. 4). In ridesharing, this strategy involves the solicitation of comments and engagement of the stakeholders by regulators or legislators on ways to regulate ridesharing. |

| Malaysia | Indonesia | Philippines | Vietnam | Singapore |

|---|---|---|---|---|

| Influence on incumbent industries | Influence on incumbent industries | Influence on incumbent industries | Influence on incumbent industries | Influence on incumbent industries |

| Privacy | Privacy | Privacy | Privacy | |

| Liability and Insurance | Liability and Insurance | Liability and Insurance | Liability and Insurance | |

| Safety | Safety | Safety | ||

| Competition and network effects | Competition and network effects | |||

| Congestion | Congestion | |||

| Employment | ||||

| Government revenue collection |

| Strategy | Malaysia | Indonesia | Philippines | Vietnam | Singapore |

|---|---|---|---|---|---|

| No-response | When ridesharing entered the market in Malaysia, Indonesia, Philippines, and Vietnam, their respective governments initially took no action on ridesharing. No regulatory framework was in place to specifically govern ridesharing at this time in these various countries. | No framework established, but Singapore was more willing to promote ridesharing as a transport alternative compared to other countries [4]. | |||

| Prevention-oriented | Following a period of no enforcement action being taken, the Philippines, Indonesia, Malaysia, Vietnam all took action, either prohibiting ridesharing or apprehending drivers operating under the ridesharing applications on the ground that they failed to get proper government authorizations to operate as taxis or public service vehicles [69,113,136,160]. | Singapore prohibited the establishment by Grab of a carpooling service between Singapore and Malaysia on the basis that the proposed arrangement was not permitted by Singaporean regulations [4]. | |||

| Control-oriented | In Malaysia, amendments to the Land Public Transport Act required that ridesharing applications to provide the transport regulator the identification of their drivers and to allow criminal checks of potential drivers. The amendments also required health check-ups for drivers, vehicle roadworthiness inspections, and insurance coverage. Professional licenses were also required for drivers of ridesharing vehicles, similar to taxis [207]. | In Indonesia, the transport ministry required roadworthiness tests to ensure that vehicles operating under ridesharing platforms were safe (respondents 1, 5, and 6). Floor and ceiling prices were also imposed to prevent predatory pricing that would harm the incumbent taxi industry and excessive prices that would harm consumers [193]. | In the Philippines, its land transport regulatory body issued regulations that required the procurement of insurance for ridesharing vehicles, professional driving licenses for operators of ridesharing vehicles, andpolice background checks for drivers in order to regulate quality of the services provided by ridesharing platforms. Subsequently, fares of ridesharing services were subject to regulation by the land transport authority; further, ridesharing applications were required to have a minimum amount of Philippine equity to begin or continue operations in the country [74,200,208] | In Vietnam, ridesharing applications were allowed provisional licenses to operate on a trial scheme, with a view towards amending existing regulations that would allow ridesharing applications to operate in the country. This eventually resulted in regulations that provided that vehicles on ridesharing applications would have to be appropriately badged and labelled. There were also confidentiality obligations for passenger and driver data [180,209]. | In Singapore, the parliament approved the Third-party Taxi Booking Service Providers Act that required registration of ridesharing providers with the Land Transport Authority. Further regulation came in the form of a required licensing framework for drivers of ridesharing vehicles [4]. New regulations announced in September 2020 required that drivers of ridesharing vehicles be Singaporean citizens and be 30 years old and above [106]. |

| Toleration-oriented | In Malaysia, taxis were encouraged to adopt ridesharing applications in order to compete, with drivers finding increased income after using these applications. The transport ministry also relaxed taxi regulations in order to allow taxis to better compete with ridesharing services [153,210]. | In Singapore, taxi industry regulations were revised to level the playing field with ridesharing services, removing regulations that required minimum distance travelled for taxis [4]. | |||

| Adaptation-oriented | In Malaysia, the Ministry of Transport released a transport policy master plan from 2019 to 2030, providing for a comprehensive review of transport regulation, and to strengthen coordination between the transport sector and the various regulators involved in transport policy. The transport policy also provides for a regularly updated database to aid transport agencies in decision making [211]. | In the Philippines, consultations are mandated to be held by the transport regulator in the event of an application for a price increase by ridesharing applications [212]. | In Singapore, its government conducted consultations with various actors for the governance of ridesharing in Singapore. A committee was also established to review risks in ridesharing [4]. | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Icasiano, C.D.A.; Taeihagh, A. Governance of the Risks of Ridesharing in Southeast Asia: An In-Depth Analysis. Sustainability 2021, 13, 6474. https://doi.org/10.3390/su13116474

Icasiano CDA, Taeihagh A. Governance of the Risks of Ridesharing in Southeast Asia: An In-Depth Analysis. Sustainability. 2021; 13(11):6474. https://doi.org/10.3390/su13116474

Chicago/Turabian StyleIcasiano, Charles David A., and Araz Taeihagh. 2021. "Governance of the Risks of Ridesharing in Southeast Asia: An In-Depth Analysis" Sustainability 13, no. 11: 6474. https://doi.org/10.3390/su13116474

APA StyleIcasiano, C. D. A., & Taeihagh, A. (2021). Governance of the Risks of Ridesharing in Southeast Asia: An In-Depth Analysis. Sustainability, 13(11), 6474. https://doi.org/10.3390/su13116474