1. Introduction

Improving energy efficiency is an effective way to mitigate the climate crisis. To develop an impactful energy policy for energy efficiency, assessing the drivers of energy consumption changes, especially the intensity effect of the changes, is essential. Thus, it is quite natural that there have been continuous efforts to analyze the drivers of energy use through a decomposition analysis covering various countries, including Europe [

1,

2]. Korea is also one of the most energy-consuming countries and ranked ninth in global primary energy supply as of 2019 [

3]. Most Korean energy consumption is concentrated in the manufacturing industry [

4], and it is a country with a high proportion of energy-intensive industries. In Korea, for example, the proportion of GDP of the petrochemical and basic metal industries, which are energy-intensive industries [

5], is 23% of the total GDP of manufacturing [

6]. However, as with other countries, it is very important to improve energy efficiency to cope with climate change as agreed in the Paris Agreement [

7]. Therefore, it is essential to examine the energy efficiency of the manufacturing industry in Korea. In this study, energy intensity effect is used to examine energy efficiency. The intensity effect in the decomposition analysis of energy consumption indicates that energy consumption changes with the change in energy intensity. It is commonly used as an energy efficiency indicator [

8].

There are various methods to measure energy intensity, such as index decomposition analysis (IDA), data envelopment analysis (DEA), and structural decomposition analysis (SDA) [

9]. Among these methodologies, IDA is a widely used method in studies, focusing primarily on quantifying drivers of changes in energy consumption or the aggregate energy intensity of a particular sector [

10]. There are several relevant studies [

11,

12,

13,

14]. To effectively measure the energy intensity effect, this study uses the IDA method. In the IDA method, changes in energy consumption are often decomposed into three parts: activity effect, structure effect, and intensity effect. The activity effect indicates changes in overall activity level. The structure effect represents changes in energy consumption resulting from structure change, and intensity effect represents changes in energy intensity. It is a common practice that has been widely used in previous studies to decompose energy consumption and identify the intensity effect in energy efficiency analysis [

8].

Until now, monetary output indicators have been used in many studies to measure energy intensity [

11,

15,

16,

17]; monetary output measures for all sectors are easy to obtain and activity effects and structure changes are easy to compute. Besides, monetary output indicator data, such as value-added, are generally provided in a country’s national accounts and are easily accessible [

8]. In fact, more than 90% of the empirical studies on energy consumption in industries generally use monetary output measures in the IDA [

18]. In this study, we refer to the energy intensity given by IDA as “monetary energy intensity”; this is the energy consumption divided by the monetary output indicator (GDP) [

16]. Please note that the result of analysis obtained using only monetary output indicator and without considering actual production activity indicator cannot, however, reflect the impact of physical output. For instance, even if energy efficiency in actual production deteriorates, the result of monetary intensity may appear to be opposite due to an increase in commodity value.

When energy intensity is measured using physical output indicators, it has the advantage of reducing the impact of price shocks, such as price fluctuation and inflation. It is hard to understand energy efficiency in actual production using only monetary output indicators as price is determined by supply and demand. When measuring energy efficiency using physical output indicators, “physical energy intensity” is often used as an indicator of energy efficiency, which is given as the amount of energy required per unit of physical output. In this study, physical energy intensity measurements are made using the activity revaluation (AR) approach [

8]. The AR approach measures energy efficiency using both monetary output and physical output indicators; this helps reduce the impact of price fluctuation.

Several studies have analyzed the Korean manufacturing industry using an index decomposition method based on an indicator of monetary output. Kim [

19] conducted a decomposition analysis of energy consumption in the Korean manufacturing sector using the logarithmic mean Divisia index (LMDI) method. In addition, this paper used the additive LMDI method as well as the multiplication method to decompose energy consumption. Choi and Oh [

20] applied an extended Divisia index decomposition to the energy intensity of the Korean manufacturing industry. Using the extended Divisia index decomposition, this paper decomposed the aggregate energy intensity into real energy intensity and structural change. Jeong and Kim [

21] decomposed the greenhouse gas emissions in the Korean manufacturing sector using the LMDI method. This paper contributed to providing an insight into building a long-term low carbon economy using the LMDI method. Furthermore, Oh et al. [

22] conducted an LMDI analysis to decompose the carbon emission of the Korean manufacturing industry. This paper investigated sectoral trends of carbon emissions, the effects of the main factors of carbon emissions in each sector and the main drivers of the changes in terms of energy policy and socio-economic characteristics.

In previous literature, energy consumption was decomposed based on monetary outputs, such as GDP, and consequently, the results could be affected by price fluctuations. Thus, it is necessary to assess the activity effect in a decomposition analysis without the price impacts. To fill this gap, we applied a physical output indicator instead of GDP. The AR approach is utilized to incorporate physical output for the decomposition. The AR approach combines monetary output and physical output to improve decomposition analysis results [

23]. Through the combination, the AR approach can effectively control the price impact on a decomposition analysis. We can also observe the energy intensity at the level of physical production. Comparing the AR approach results with the conventional, economic-based method, we could find methodological implications.

In this study, energy intensity was measured based on the primary energy supply as well as the final energy consumption. In many studies so far, energy decomposition analysis has been attempted on the basis of final energy consumption. However, as the conversion efficiency of power is as low as 34%, there is a problem in that the energy intensity is measured higher in the industry that uses a lot of electricity than the industry that uses less [

15]. Moreover, in the Korean manufacturing industry, as electricity consumption continues to increase year on year, a more thorough analysis is required in terms of energy intensity measurement based on primary energy supply.

This study contributes to gaining new insights by comparing the results using monetary output and physical output indicators, while also comparing the results based on final energy consumption and primary energy supply. Considering the physical output indicator and primary energy supply, we believe that the impact of the monetary output fluctuation can be eliminated. In addition, through our analysis, we would like to clarify how the results of the analysis using monetary output indicator and those of energy analysis using physical output indicators are different and what they mean.

Section 2 describes the data and methodology. The techniques applied for calculation purposes are presented as well as the data collection process. We then describe the LMDI and AR approaches used in this study.

Section 3 presents the results from this study in detail. In

Section 4, we discuss what these findings suggest. Finally, in

Section 5, based on our results and implications, guidelines on the future direction for the Korean manufacturing industry as well as the policies the government should implement to deal with climate change are presented.

3. Results

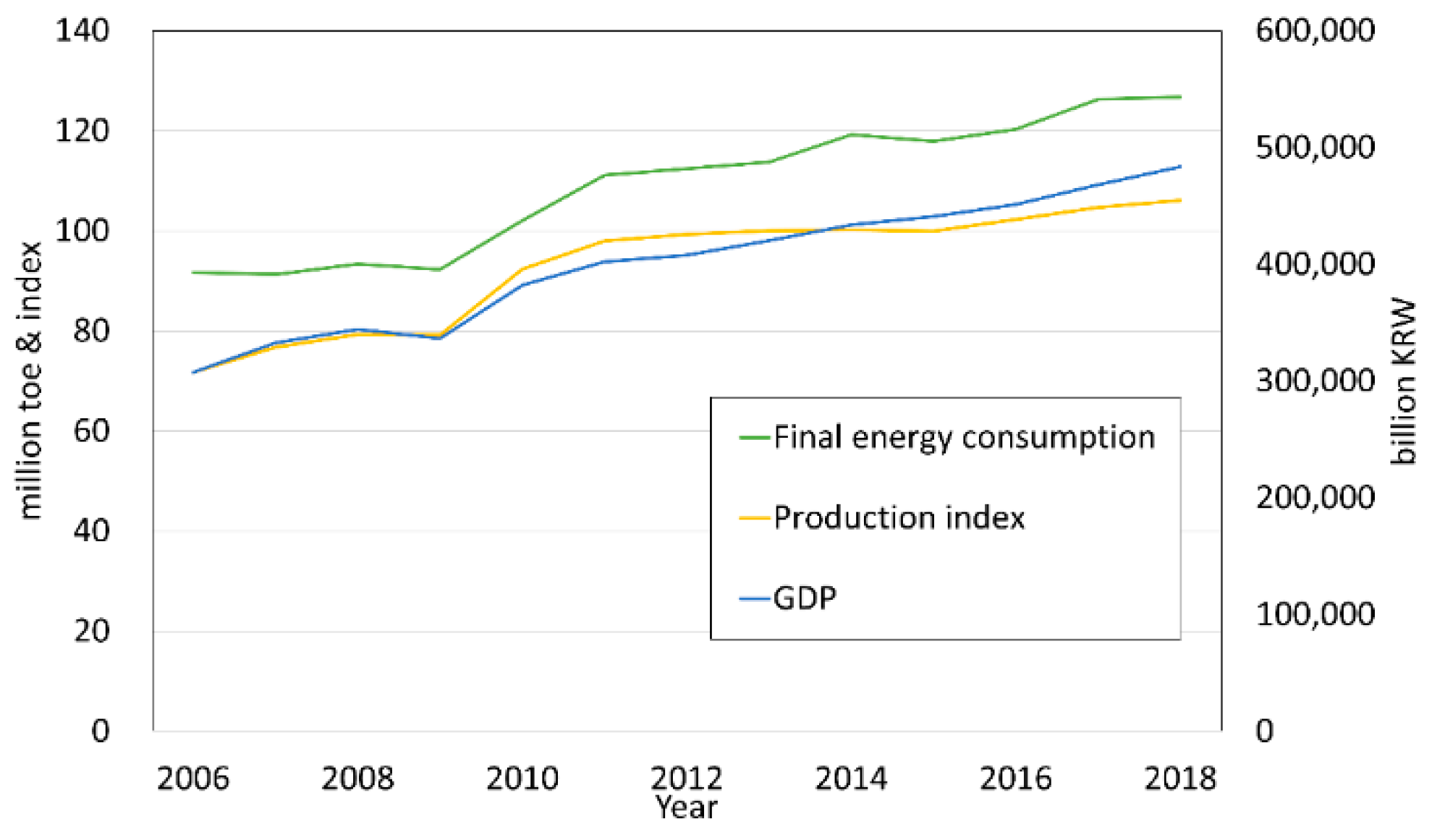

Table 2 and

Table 3 depict the yearly decomposition results for final energy consumption and primary energy supply, respectively, in the Korean manufacturing sector for the period 2006–2018. When analyzing energy consumption, we have two methods of selecting a base year: the rolling base year method and the fixed base year method. The rolling base year method involves comparison with the previous year, whereas the fixed base year method involves comparison with a fixed base year. This study uses the rolling base year method to capture the driving forces behind changes in energy consumption from 2006 to 2018 over time or how energy consumption has evolved over time [

32]. Looking at the total effect for 2006–2018, it can be seen that the change in final energy consumption is much higher than the change in primary energy supply. The values of the intensity effect based on final energy consumption also seem much higher than the results based on primary energy supply. We can guess that it is because the final energy consumption cannot reflect the losses due to electricity conversion. By comparing the energy consumption in

Table 2 and

Table 3, it can be seen that the largest contributing periods are 2009–2010, 2010–2011, and 2016–2017. In this way, an analysis based on the primary energy supply as compared to the final energy consumption can adjust the distortion caused by energy conversion.

Table 2 shows that final energy consumption in 2017–2018 increased to 35,031 ktoe, as compared to 2006–2007, where it was −422. The activity effect appears to play an important role in increasing energy consumption in both the approaches. Meanwhile, the structure effect and the intensity effect seem to contribute to reducing the energy consumption.

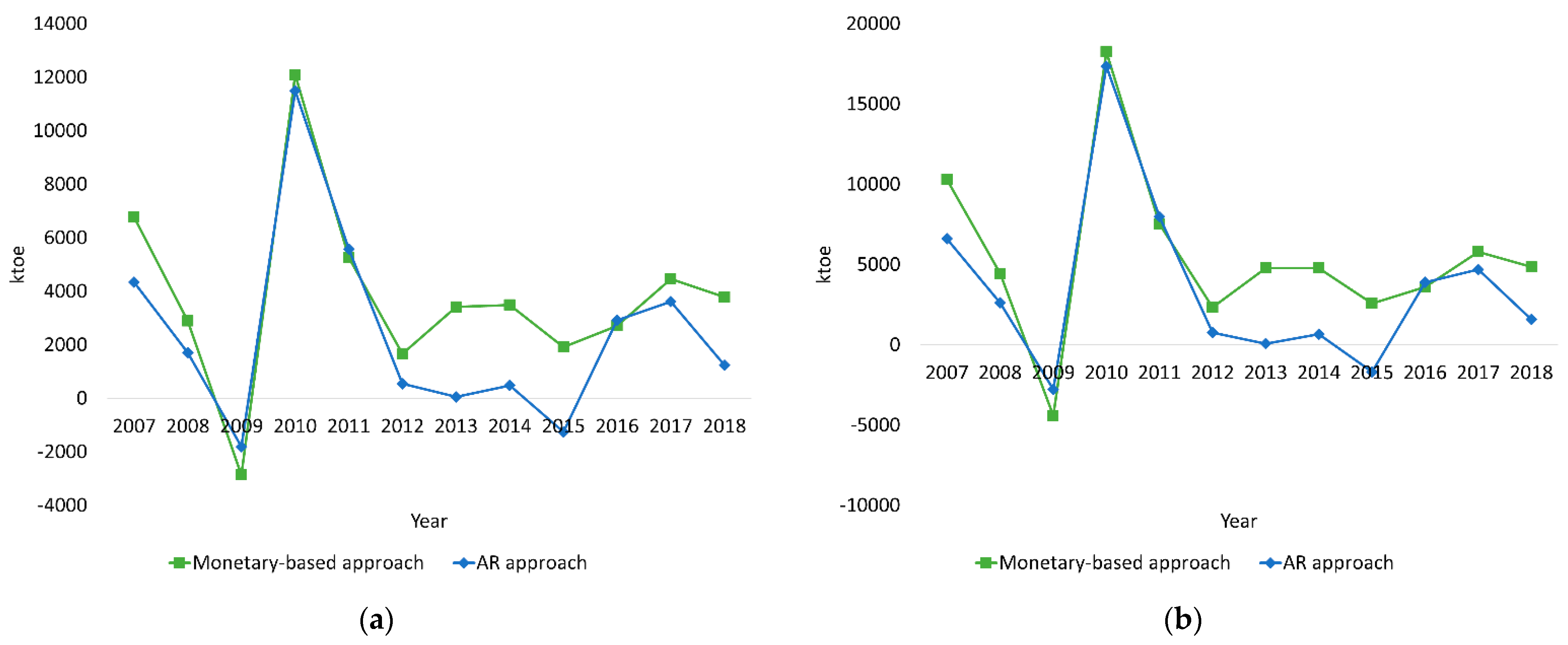

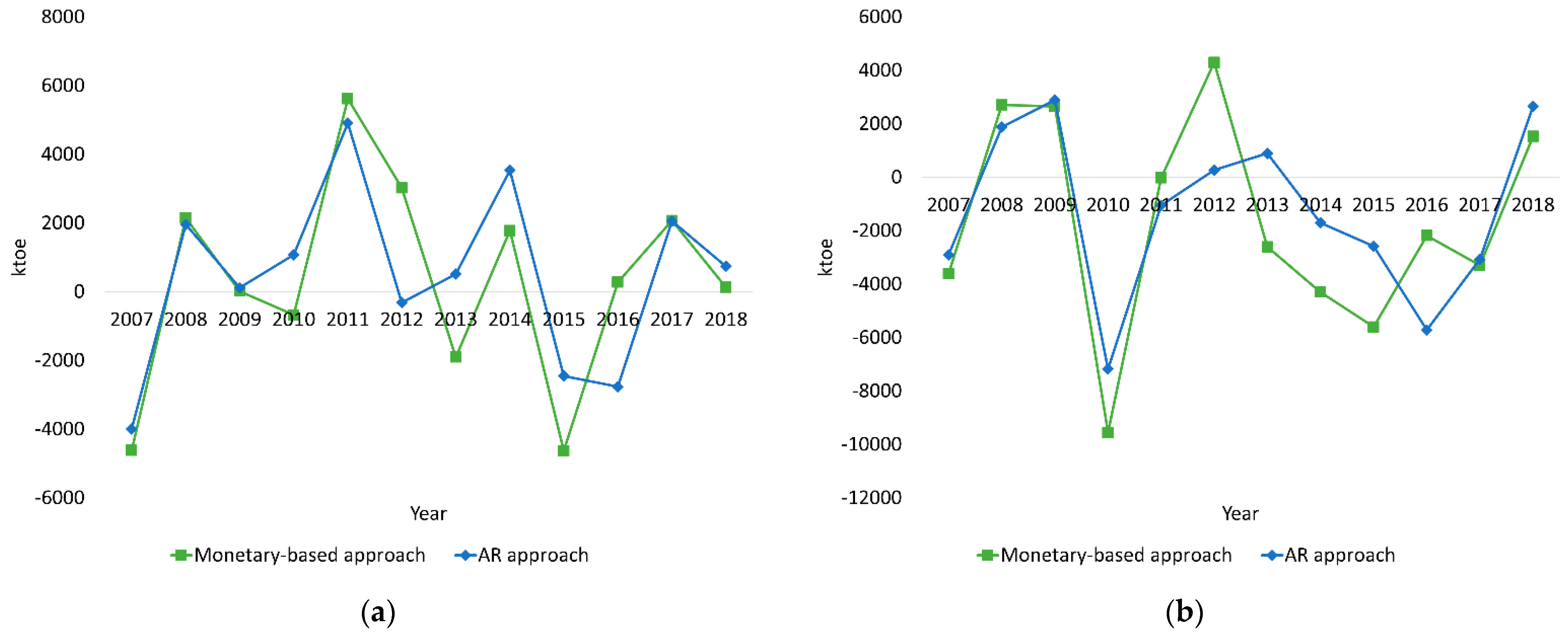

Figure 2,

Figure 3 and

Figure 4 show the activity effect, structure effect, and intensity effect, respectively. The results are based on both final energy consumption and primary energy supply. The overall activity effect in the AR approach seems less than that in monetary-based approach as illustrated in

Figure 2. In 2015, the activity effect in the monetary-based approach is positive but it is opposite in the case of the AR approach. This shows that the activity effect can be overestimated unless the impact of price increase is eliminated. In 2009, the activity effect declined significantly due to the US financial crisis caused by the real estate bubble [

21]. The structure effect analyzed using only monetary output indicator is lower than that obtained using AR approach (see

Figure 3). The structure effect seems to increase when the impact of price is eliminated.

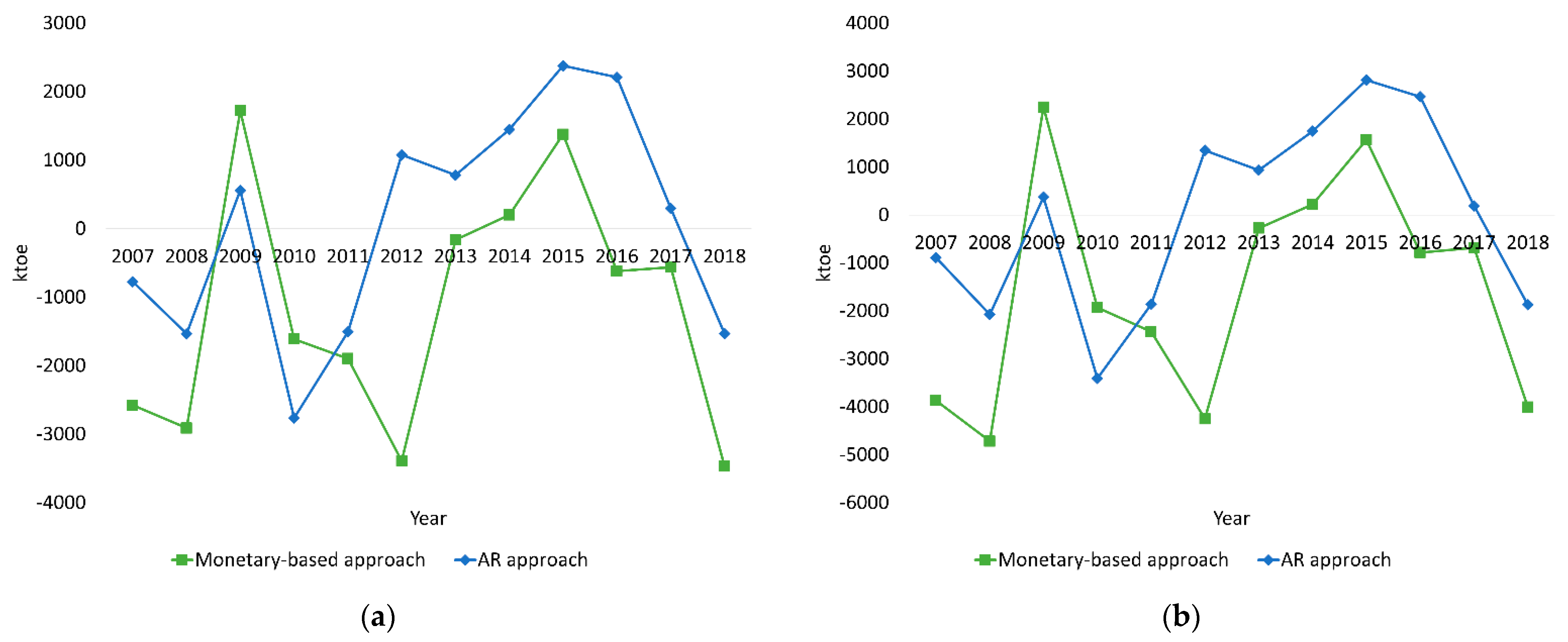

In the analysis using the monetary output indicator, the intensity effect indicates the monetary energy intensity, which is given by energy consumption per unit monetary output indicator (GDP), whereas in the analysis using the physical output indicator, it is the energy consumption per unit physical output indicator. As shown in

Figure 4, the intensity effect in the AR approach is generally higher than that in the monetary-based approach, especially over the period after 2013. It indicates that even if there is no improvement in energy efficiency in physical production, an increase in price can reduce the intensity effect.

Comparing the results based on final energy consumption and primary energy supply (see

Figure 4), the differences in intensity effects in 2010 and 2014 are noticeable. In the AR approach, the energy efficiency seems to be bad when analyzed based on the final energy consumption but seems to improve when analyzed based on the primary energy supply.

4. Discussion

This study analyzes the energy intensity using the AR approach to reflect physical output and compares the results from the monetary-based approach and the AR approach. Besides, it compares the results between the final energy consumption and the primary energy supply. We discuss the overestimation in the activity effect of the monetary-based approach as compared to that of the AR approach. We address different directions of the structure effects in the two approaches. We discuss different perspectives when examining the monetary intensity effect and the physical intensity effect. We discuss why the results differ based on the final energy consumption and the primary energy supply. We gain new insights through these comparisons.

In the results based on monetary indicators from 2013 to 2018, the activity effect continues to be positive. Conversely, when analyzed using physical output indicator, the activity effect in 2013 and 2014 are marginal, whereas in 2015, it is negative. This indicates that product prices have risen or that the proportion of high value-added industries has risen, rather than the actual production output has increased considerably. In fact, if we look at the macro data, the average annual GDP growth rate of 3.91% is higher than the production index of 3.41% in the manufacturing sector from 2006 to 2018. These findings would not have been observed had they been analyzed using only the monetary output indicator. When decomposition analysis is performed using only monetary output indicator, it is not possible to determine whether a change in activity effect is due to a change in product price or a change in actual production activity. Therefore, there is a limitation in that it is difficult to reflect energy efficiency technologies related to actual production in an analysis that does not use physical output indicator. However, in the analysis using physical output indicator, it is possible to interpret whether only a change in product’s price has occurred or whether physical output has also changed. This suggests that analysis using physical output indicator is necessary to compensate for the shortcomings of the decomposition analysis method that is based on monetary output indicator.

Looking at the change in the structure effect, the result given by the monetary output indicator show negative values, excluding three years (2009, 2014, 2015), which can be considered as a structural shift toward a low energy consumption industry. However, the results of the analysis using physical output indicators show that the structural effects continued to be positive from 2012 to 2017. In the results of the AR approach, the share of energy-intensive industries appeared to increase from 2012 to 2017. It can be interpreted that the share of the energy-intensive industries’ production did not increase significantly, rather, the product prices or the share of the high value-added industries has increased more. It is necessary to increase the share of high value-added industries. However, we know that transition to low energy consumption is also necessary in terms of physical production.

Looking at the overall intensity effect from 2006 to 2018, it seems that the value of the monetary-based approach is generally greater than the value of the AR approach. It means that energy efficiency is overestimated if measured using only monetary output. It can be expected that the intensity effect based on the monetary output indicator is greater due to an increase in product prices or an increase in the share of high value-added industries. In 2013, the intensity effect given by monetary analysis is negative, but the intensity effect given by the physical output indicator is positive. This result shows that energy efficiency has not been improved in terms of physical efficiency, and it would not have been observed had it been analyzed using only monetary output indicator. From the results, it can be argued that the energy-efficient technology was inefficient in actual production. Companies need to improve energy efficiency by using energy-efficient technologies to reduce energy consumption per physical output as well as energy consumption per value-added. Transition to high value-added manufacturing and improvement of energy efficiency in actual production technology are both important tasks for the government and should not be neglected in the future.

Until now, in research on energy decomposition analysis, final energy consumption has been widely used to decompose energy consumption. When other energy sources are converted to electric power, the conversion efficiency of electric power exceeds 30%; therefore, it should be noted that it is more accurate to analyze based on primary energy supply rather than final energy consumption. Therefore, this study analyzes and compares the results using both final energy consumption and primary energy supply. When comparing the final energy consumption and the primary energy supply, the difference in intensity effect is more notable than that in the other effects. In particular, the primary energy-based intensity effects in 2010 and 2014 are much lower than the results analyzed based on the final energy consumption. It means that the primary energy supply did not increase significantly as compared to the corresponding increase in the final energy consumption. It seems to be largely influenced by the petrochemical sector and the basic metal sector. It can be speculated that this is due to the impact of fuel mix changes in the petrochemical and basic metal sectors. Although the final energy consumption has increased, energy efficiency has improved significantly in terms of primary energy supply. For the analysis based on only final energy consumption, energy efficiency does not appear to have improved, although energy efficiency seems to have improved when analyzed based on actual primary energy supply, as the analysis cannot be performed to reflect the loss of energy conversion. Therefore, for a more accurate analysis, it is advisable that energy efficiency be measured based on primary energy supply.

Comparing our results with the previous decomposition studies on Korean manufacturing can give us additional insights. For the same study period from 2006 to 2010, Kim [

19] and Choi and Oh [

20] show the negative values for the structure effect and intensity effect. In our results, structure effect and intensity effect values are also negatively signed. However, comparing the results between the monetary-based approach and the AR approach, we show that the absolute values of structure effect and intensity effect using the AR approach are smaller than those of the monetary-based approach. The difference between the monetary output and physical output, and this influence on the results given by the AR approach indicates that it may be valuable to use physical output indicator for the energy decomposition analysis in the future [

23]. We can measure the energy efficiency with reduced price impact using the physical output indicator. This was not possible in previous literature [

19,

33], which used only monetary output indicator for decomposition analysis.

From the perspective of international comparison, Ang and Xu [

8] and Norman [

23] used the AR approach to perform decomposition analysis and compared the results of the AR approach to the monetary-based approach. The results given by the monetary-based and the AR approaches showed negative values for structure effect and intensity effect. However, the absolute values of the results given by monetary output and physical output were different. The absolute values of the structure effect using the AR approach were higher than those of the monetary-based approach, but the absolute values of the intensity effect using the AR approach were smaller than those of the monetary-based approach. It shows that analysis using physical output indicator can produce different results and provide more information.

5. Conclusions

We incorporate physical output data to adjust the effect of monetary output indicator and compare the results given by the monetary-based approach and the AR approach. We also compare the results based on final energy consumption and primary energy supply. The analysis results indicate that the overall activity effect is reduced when the impact of the price is eliminated by using a physical output indicator. The structure effects are higher when analyzed in the AR approach than in the monetary-based approach. It can be noted that the Korean manufacturing industry continues to transition toward an energy-intensive industry. The energy efficiency seems to be overestimated when analyzed without physical output indicators. The analysis results support that investigating the driving forces of energy consumption via the AR approach and primary energy base could give us a more accurate result.

We also compare the impact of replacing final energy consumption with primary energy supply. The intensity effects in the two periods (2010, 2014) are much lower when using the primary energy supply. We now know that we need to consider primary energy supply in energy consumption analysis to reflect the energy conversion loss. Consequently, a monetary- and final energy-based approach cannot appropriately reflect energy efficiency in the manufacturing sector. Physical output data should be used to eliminate the impact of price in the analysis. Therefore, we suggest measuring energy efficiency using physical output indicator. If the government collects physical output data separated into categories, which is the same as the energy consumption classification, it can be helpful in measuring physical energy intensity.

This study has a limitation in that the production indices were aggregated using averaging. This aggregation could make a biased index, but the averaging is the only way to apply if there is no useful information on sector production. Further studies using a bottom-up approach and field data could support our findings. Additionally, since the AR approach can capture the impact of physical production changes without price effects, applying it for the decomposition analysis of the other industries would be an excellent future research direction—agriculture, fishing, mining, and transport sectors could be promising.