1. Introduction

The bioeconomy, which encompasses the production of renewable biological resources and the conversion of these resources and waste streams into products such as food, feed, bio-based products and bioenergy [

1], is increasingly becoming a contributor to the overall European economy [

2]. In 2017, the total turnover of Europe’s bioeconomy amounted to over 2.4 trillion Euros, an increase of 25% since 2008 [

2]. The bioeconomy enables the replacement of non-renewable fossil-based materials with renewable bio-based materials, which has a beneficial effect on carbon emissions and thus on climate change [

3]. Products produced from biomass can include, for example, plastics, lubricants, solvents, surfactants and ingredients for everyday consumer products as well as packaging. Previous work from the World Economic Forum and the Ellen MacArthur Foundation (2016) demonstrates the potential climate benefits of substituting fossil-based plastics with bio-based plastics, presented in

Figure 1 [

4]. For the first time in many years, the compound annual growth rate (CAGR) for bio-based polymers is, at 8%, significantly higher than the overall market growth of polymers (3–4%), and this is expected to continue until 2025 [

5]. The continued growth of a sustainable EU bioeconomy will be essential in helping to meet very ambitious national, European and international climate and sustainability targets, including a 55% reduction in greenhouse gas emissions by 2030 [

6], and the fulfillment of key UN Sustainable Development Goals commitments including sustainable consumption, climate change, and clean and affordable energy [

7]. The bioeconomy can also contribute to Europe’s plan for a circular economy through provision of bio-based products (BBPs) delivered by circular biological value chains [

8].

As noted by Costa and Donner (2020), shifting from a fossil-based, linear economy to a sustainable, bio-based and circular economy requires a change at a system level, involving all actors of different chains and sectors [

9]. Lokesh et al. (2018) previously highlighted the different value chain actors who need to be involved and engaged from feedstock production and procurement, through pretreatment and conversion to consumption and end of life management [

10]. This includes upstream actors producing and supplying raw materials, value chain actors that convert these into bio-based intermediates and building blocks, manufacturers turning these into bio-based end products, as well as downstream actors such as retailers, consumers and other customers who will eventually purchase and use these BBPs.

According to the EU Bioeconomy Strategy update (2018), consumers and their behavior can play a major role in supporting the profound transformation required for the successful transition to a bio-based economy [

11]. Yildirim (2020) states that transforming consumption patterns, alongside sustainable production, is one of the most important change movements to achieve the broader goal of sustainable development [

12]. In this sense, consumers bear some responsibility for accepting and sharing environmental values, which they exercise in purchasing decision, while industry and business must ensure sustainable production of green products of sufficient quantity to allow consumers to meet their needs without harming the environment [

12]. Consumers can influence the types of products produced by the purchasing choices that they make [

13] and, as the final users of BBPs, can influence in a crucial way the demand for products derived from biomass [

14]. Despite this recognition of the important role of consumers in implementation of a sustainable bioeconomy, consumer awareness of the existence of BBPs only seems to lie at around 50%, while only 12% have ever consciously chosen bio-based products over conventional ones [

15].

More work is therefore required not only to improve consumer awareness of BBPs but also to understand their motivations for purchasing BBPs. The perception of a product influences consumer attitudes, and in turn, a positive attitude stimulates the decision to buy a product [

16]. A positive attitude of consumers (or at least of some consumer segments) towards BBPs, or their willingness to pay a higher price for fully or partly BBPs, could be interpreted as a positive signal towards actors of the bioeconomy and their possibilities to grow [

14]. Additionally, the level of knowledge about BBPs and the reasons why consumers buy such products can provide valuable indications and information for further marketing activities in this field [

14]. Gaining the consumer perspectives from the outset can also guide research and industry who are developing new processes and products. Sjitsema et al. (2016) notes the importance of obtaining insight of “ordinary people” about new biotechnologies from the start, as what may be accepted by the research community may be rejected by consumers [

17]. Similarly, early consumer perspectives regarding BBPs in different categories can help to guide research and investment decisions of industry, while also guiding marketing choices. The role of tools such as life cycle assessment and social life cycle assessment has been acknowledged as contributing to informing and supporting the consumer transition towards more sustainable consumption patterns, including the uptake of BBPs [

18,

19].

The purpose of the current study is to explore consumer perspectives in two EU countries, namely Ireland and the Netherlands, with regard to specific BBP categories, while gathering information on their drivers, motivations and purchasing intentions. Both Ireland and the Netherlands have dedicated bioeconomy policy documents in place. In a 2018 communication on its position of the bioeconomy, the Dutch government observed that “the bioeconomy should also help (..) develop sustainable production and consumption patterns” and “Increasing visibility for consumers and between sectors will encourage innovation and cultivate demand for new products that can help tackle the major social challenges of our era” [

20]. Ireland’s National Bioeconomy Policy Statement, published in 2018, highlighted the importance of improving public and consumer awareness of the bioeconomy and its products as a key action [

21]. Prior to this study, no detailed studies regarding Irish consumer perspectives of BBPs had been implemented; however, Dutch consumers (N = 1016) were previously included among the cohort of respondents to participate in the consumer study reviewed below [

16]. The current study goes beyond the previous studies (summarized in

Table 1) by assessing specific BBP categories for current and future consumer buying intentions and willingness to pay extra. This extra payment is referred as a “green premium”, which is defined by Carus et al. (2014) as “the additional price a market actor is willing to pay for the additional emotional performance and/or the strategic performance of the intermediate or end product the buyer expects to get when choosing the bio-based alternative compared to the price of the conventional counterpart with the same technical performance” ([

22], p. 2). The survey also gauges the importance of brands in consumer uptake of bio-based products, including familiarity of consumers with brands already producing or marketing these products. In particular, brand influence can be a major driver of the success of bio-based products, where large brands can champion a technology or product and jumpstart its expansion into vast markets [

23]. A consumer study by Chovanova et al. (2015) demonstrated that over half of consumers in Slovakia were influenced by brands when making their purchasing choices [

24]. Aside from providing regional comparisons, the current study also assesses trends and perspectives between different age and gender demographics.

Relevant Literature

A relatively small number of public studies have been conducted previously, focused specifically on the consumer perspective of BBPs, with most of these coming within the context of EU-funded research projects [

15,

16,

25,

26,

27,

28]. Most of these studies have focused on evaluating consumer knowledge, interest and motivations with regard to BBPs, without assessing the perspectives in relation to individual BBP categories. The studies show that consumers generally appear to have a quite limited understanding and knowledge about bio-based products thus far [

5,

26,

28], with the majority having positive perceptions towards BBPs, primarily associated with perceived environmental or sustainability benefits [

15,

25,

28].

A scoping of the main findings of relevant studies is provided in

Table 1, presenting the study type, region, sample size and high-level findings.

Some previous work has also been undertaken to assess consumer willingness to pay a green premium for bio-based products. Delioglamnis et al. (2018) found that 41% of consumers surveyed seemed willing to pay more for a BBP of the same functionality and properties as a fossil fuel-derived one [

25]. Similarly, through the literature survey, Pfau et al. found that a significant percentage of consumers (between 55% and 64%) would be willing to pay a little bit more for a bio-based product than for a conventional product [

15]. The willingness to pay is related to the personal interests of consumers in, e.g., health and the concern of consumers about the environment, welfare and future generations. This therefore suggests that this willingness to pay extra would be found mainly in a niche market [

15]. Consulting experts from various backgrounds to assess the degree to which experts or customers would pay a green premium for bioplastics, 85% of the experts report green premium prices for bio-based plastics. Most of the participants (60%) considered the green premium to range between 10 and 20%, while almost 20% indicated a price premium of 20% up to 40%. About 6% of the respondents perceive a willingness to pay more than 50% extra for bio-based plastics [

30].

The approach used to implement the study is described in Materials and Methods in

Section 2, with Results in

Section 3, and comparative analysis included within the Discussion in

Section 4.

2. Materials and Methods

Geels (2011) proposed creating a practical sustainability framework when studying new socio-technical innovations in any regime shift, in order to sketch the most important dimensions of the related issue, and help to specify the types of questions that should be asked of the participants in the transition area [

31]. In this context, the sustainability framework was developed for investigating customer perception on bio-based products and brands with quantitative surveys and qualitative online focus groups [

32]. The sustainability framework was explicitly built upon predefined topics that were related to consumer awareness (how consumers recognize or recall bio-based products and brands); consumption habits (expectations and habits: main incentives and key barriers for choosing the bio-based alternatives); and future concerns (willingness to adopt bio-based products and consumption in the future). This framework falls under the value sensitive design methodology, which is a theoretically grounded approach to the design of technology that accounts for human values [

33,

34].

In this study, the consumer studies were undertaken in the form of a structured quantitative survey in order to gauge their perspectives with regard to BBPs in the Netherlands (NL) and Ireland (IRL). The survey was designed to gain an understanding of consumer awareness with regard to BBPs, their consumption habits, consumers’ drivers and motivations, and paying specific attention to current and future buying intentions, including prioritization of bio-based product categories, willingness to pay, and brand preferences. Background information was integrated and translation of the questionnaire, from English to Dutch, was completed. The survey design is presented in

Figure 2.

Participants were recruited via a recruitment company, Bilendi. The target consumer group for the survey were citizens aged 18–75, and 500 respondents were collected from each country. Sampling was representative according to the national population statistics in the particular age group regarding gender, age and geography. There was a relatively even spread of respondents across age categories. For both countries, sampling included a breakdown by geographical regions (provinces), defined in

Table 2. Sampling was based on a soft-quota approach in the spread of 0.75 to 1.25. More information about the participant samples is presented in

Table 2.

The online survey was implemented during the period of 14–23 December 2020. The survey structure included some background information about terminology and different bio-based product samples to help the participants to understand the theme better. First, the term of bio-based product was defined: “Bio-based products are made—completely or partially—from biogenic material, which means they are made from renewable resources (also called “biomass”). The most frequently used types of biomass are sugar, starch, plant oils, wood and natural fibers. Partially bio-based products may also contain non-bio-based materials.” In addition, examples of categories of bio-based products in the household (fabrics, packaging and cutlery, health and beauty products, and construction and insulation materials) were shared with the participants, including some figures and text (

Figure 3). It took about 10 min for the participants to complete the survey.

First in the survey, consumer choice influence potential was assessed, regarding whether the respondent believes that their individual consumer choices can have a positive impact on the environment. This is important in order to understand the degree to which consumers feel that they can play a role in helping to solve environmental challenges through the purchases that they make. After explaining the terminology and presenting the BBP examples, consumer awareness was defined. The bio-based brands that consumers are familiar with were asked to be defined, in order to understand the degree to which consumers recognize brands who are supplying bio-based products to the market. Consumption habits were studied based on their willingness to switch from fossil-based to bio-based products. The respondents were asked if they prefer buying BBPs as opposed to fossil-based products and to identify the specific product categories that consumers may be more interested in purchasing bio-based options. Additionally, the main motivating factors to choose BBPs in the selected category were defined, and their willingness to purchase these BBPs from each category in the future. As consumers often have different positive or negative word associations, it is important to understand how various relevant sustainability terms may motivate a consumer to choose a BBP. This information can also be useful for bio-based industries, brand owners and others to understand what is important to the consumer, and to better develop their marketing, branding and messaging. In this case, consumers were presented with a range of sustainability terms and asked which of the terms would motivate them to choose a product. In addition, the importance of branding was assessed. While various other studies have looked at a generic green premium for bio-based products, in this survey the focus is to ascertain the consumer green premium perspective on many different bio-based product categories so a deeper understanding can be gained regarding which product categories consumers are most willing to pay more (and how much more) for BBPs. Finally, the factors that help consumers choose between similar products were defined, including a variety of sustainability factors, along with branding.

3. Results

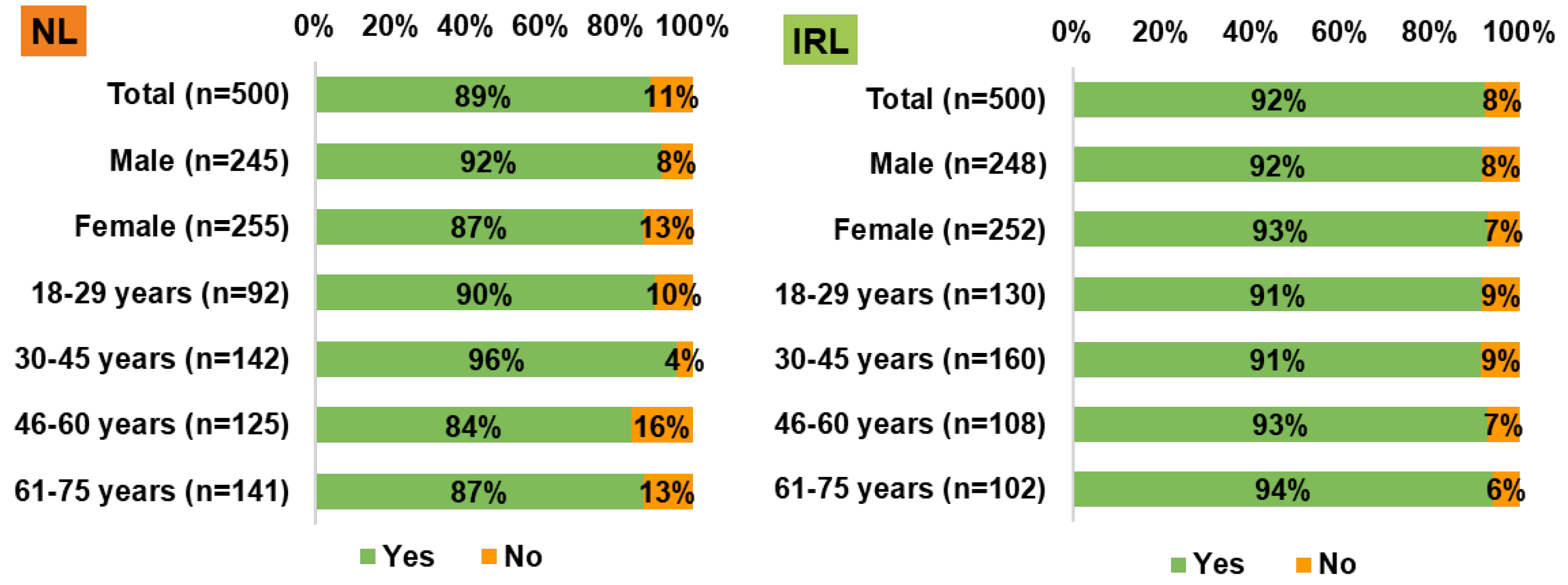

The aim of the current quantitative study is to understand consumer drivers, motivations and purchasing intentions regarding BBPs in Ireland and the Netherlands. According to the results, consumers in the Netherlands (89%) and in Ireland (92%) agree that their individual consumer choices can indeed have a positive impact on the environment. The most positive respondents are Irish females, with 93% believing that their consumer choices can have a positive impact on the environment, with 87% of Dutch females feeling the same way. The average results are quite similar throughout the gender and age groups for Irish respondents, while there is more variance among Dutch respondents. The highest overall positive response among Dutch respondents is in the 30–45-year-old age category, with 96% having the opinion that their individual consumer choices can have a positive impact on the environment, with respondents in the age category of 46–60 having the least positive response at 84%. A comprehensive overview of responses in presented in

Figure 4 for the Netherlands and Ireland.

Many respondents, 77% of Dutch and 72% of Irish respondents, are not familiar with any bio-based brands. The respondents that indicated familiarity with bio-based brands provided brand examples such as Body Shop, Alpro, Delta and Ikea in the case of Dutch consumers, and Ecover, Coillte, Airtricity, Body Shop and Johnson and Johnson in the case of Irish consumers.

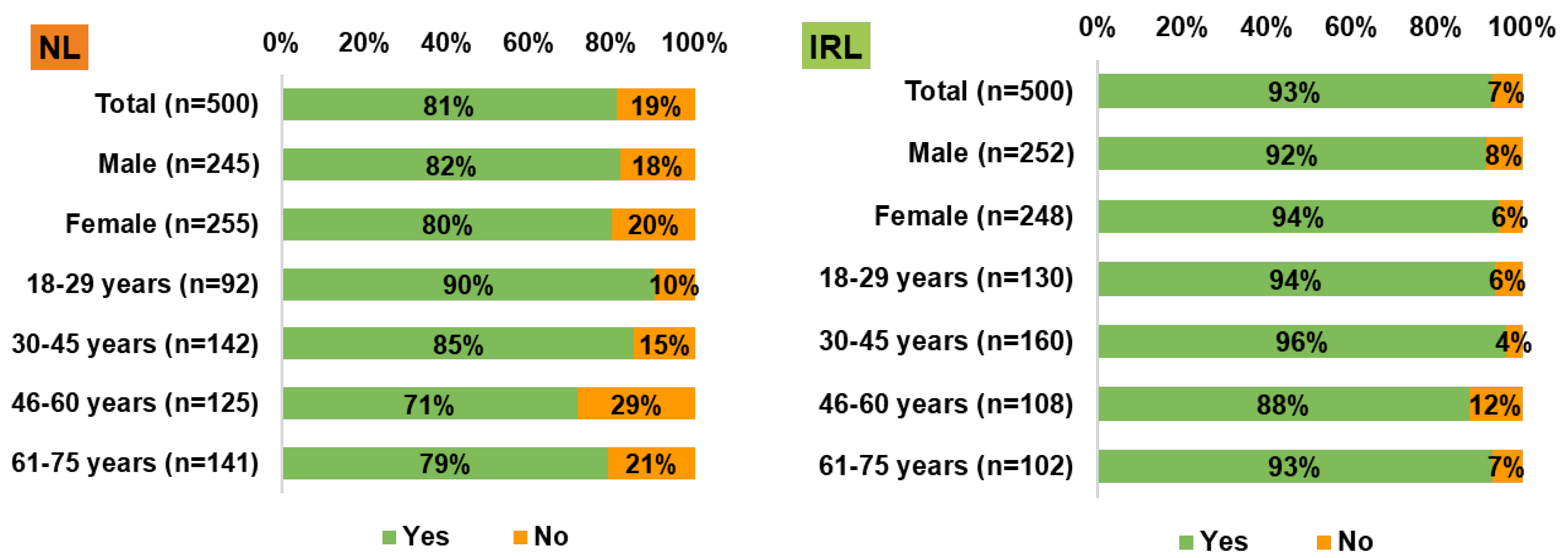

Irish consumers are much more positive about their preference for buying bio-based products as opposed to fossil-based products, with 93% of Irish respondents indicating their preference for BBPs with 81% of Dutch respondents indicating the same. The average results for both males and females are relatively similar in both counties, with small variances seen by age. Overall, Irish consumers seem to have a much greater preference for bio-based products over fossil-based products, with respondents in the 30–45-year-old age category showing the greatest preference (96%). In the Netherlands, the 18–29-year-old age group are most likely to prefer buying bio-based over fossil-based (90%), with Dutch consumers in the 46–60-year-old age group least likely to indicate that they would prefer to buy bio-based products rather than fossil-based products (71%). The results are further presented in

Figure 5.

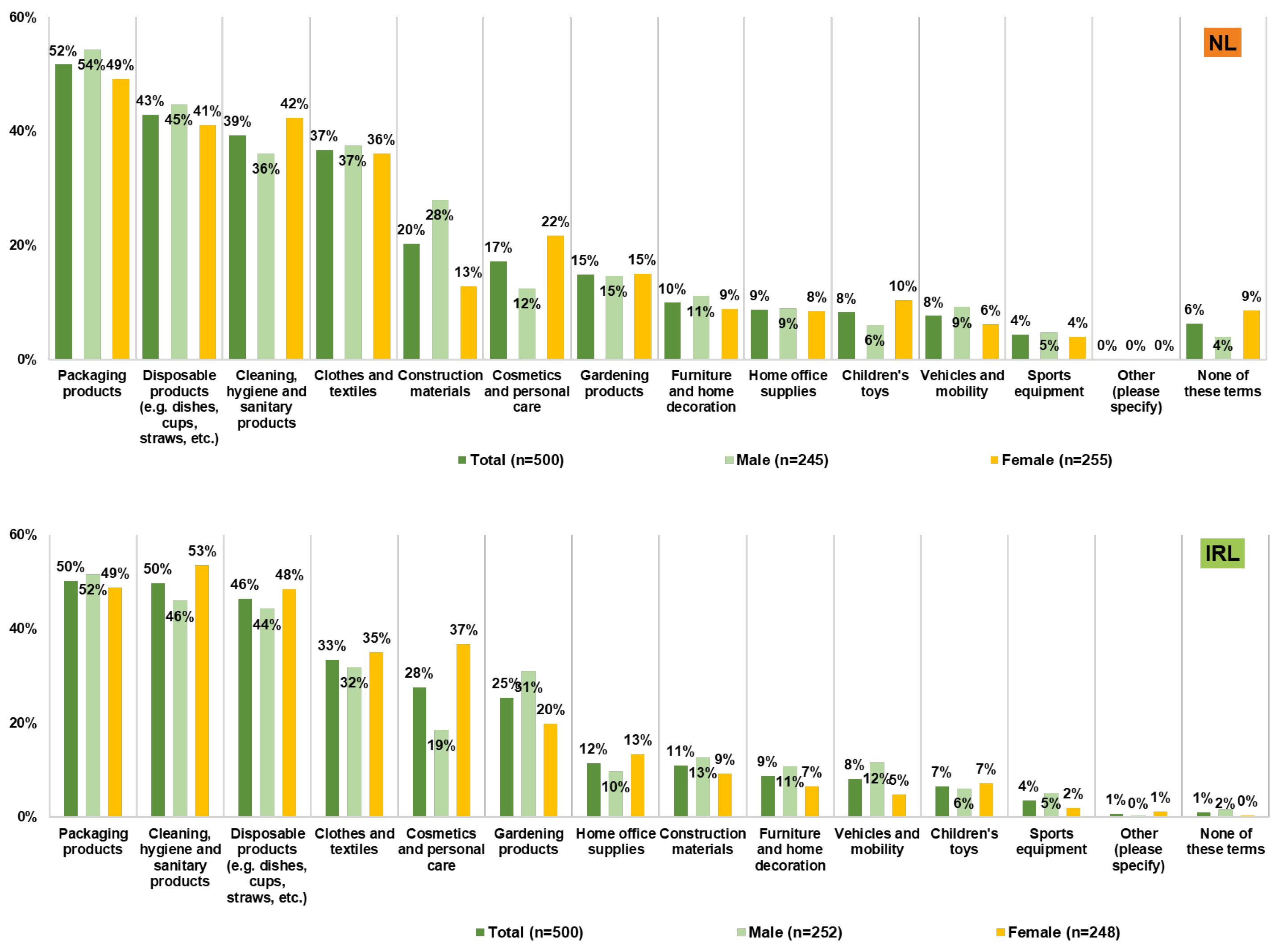

In selecting the product categories which they are most likely to buy BBPs from, the top categories for both countries are very similar. Taking the results of both countries (Ireland and the Netherlands) together (n = 1000), the top three categories are 51% packaging products (52% NL, 50% IRL), 45% disposable products such as dishes, cups, and straws (43% NL, 46% IRL), and 44% cleaning products including hygiene and sanitary products (39% NL, 50% IRL). Among other product categories of interest, Irish females are most likely of all groups surveyed to buy bio-based in the cosmetic and personal care category (37%), while Dutch men are most likely to buy bio-based construction materials (28%). Clothing and textiles is another major category for both countries (37% NL, 33% IRL). In the 61–75 age group in Ireland, 58% would purchase bio-based cleaning products while 34% of this group would purchase bio-based gardening products. In the Netherlands, the 61–75 age group also prefer certain bio-based product categories; 49% would purchase bio-based cleaning and hygiene products, 42% would buy bio-based clothes and textiles and 23% would purchase bio-based construction materials. For Dutch responses, the 18–29-year-olds are the most likely to buy bio-based cosmetic and personal care products (26%). Taking into account the results of both countries (n = 1000), sports equipment (4%), children’s toys (7%), and vehicles and mobility (8%) are the least likely categories that consumers indicate their willingness to buy bio-based products from. A full overview of responses from both countries is presented in

Figure 6.

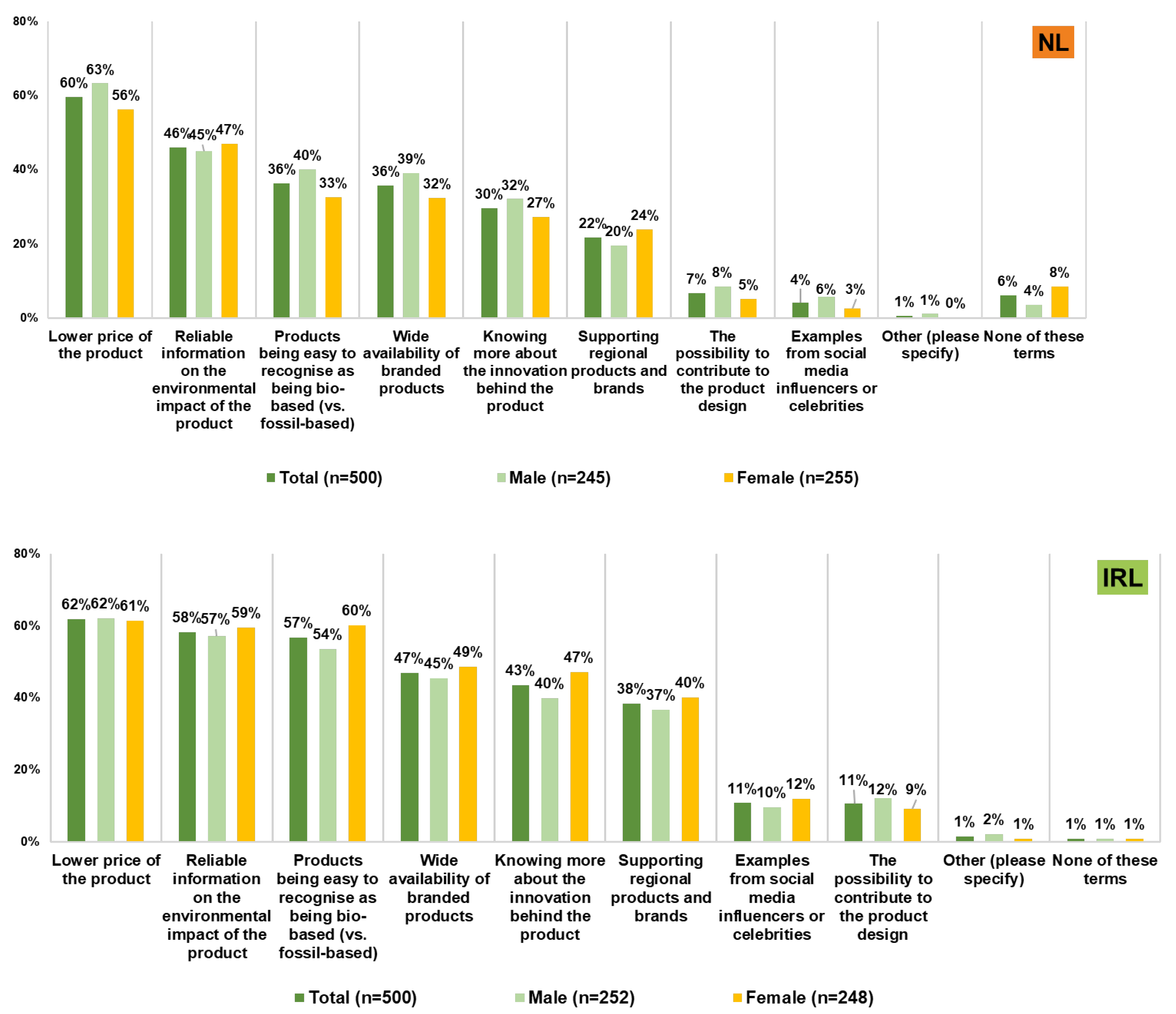

For both the Netherlands and Ireland, the consumer motivations to buy bio-based products are very similar, with the highest categories being the same for both countries. Taking into account the combined responses from both countries (n = 1000), the top five motivating categories are: lower price of the product (61%), reliable information on the environmental impact of the product (52%), products being easy to recognize as being bio-based compared to fossil-based (47%), wide availability of branded products (41%), and knowing more about the innovation behind the product (37%). While the overall order of motivating factors is largely consistent across both countries, a greater share of Irish respondents than Dutch respondents indicate positive responses to some motivating factors. These factors include reliable information on the environmental impact of the product (58% IRL compared to 46% NL), products being easy to recognize as being bio-based vs. fossil-based (57% IRL compared to 36% NL), wide availability of branded products (47% IRL compared to 36% NL), and knowing more about the innovation behind a product (43% IRL compared to 30% NL). Supporting regional and local products and brands is also a greater motivating factor for Irish consumers (38% IRL compared to 22% NL). The variance in response by gender is quite small, with a slightly higher likelihood for males in both countries to be motivated by lower price. Irish females are the most likely group to be motivated by products which are recognizable as being bio-based as opposed to fossil-based. A comprehensive overview of results is presented in

Figure 7.

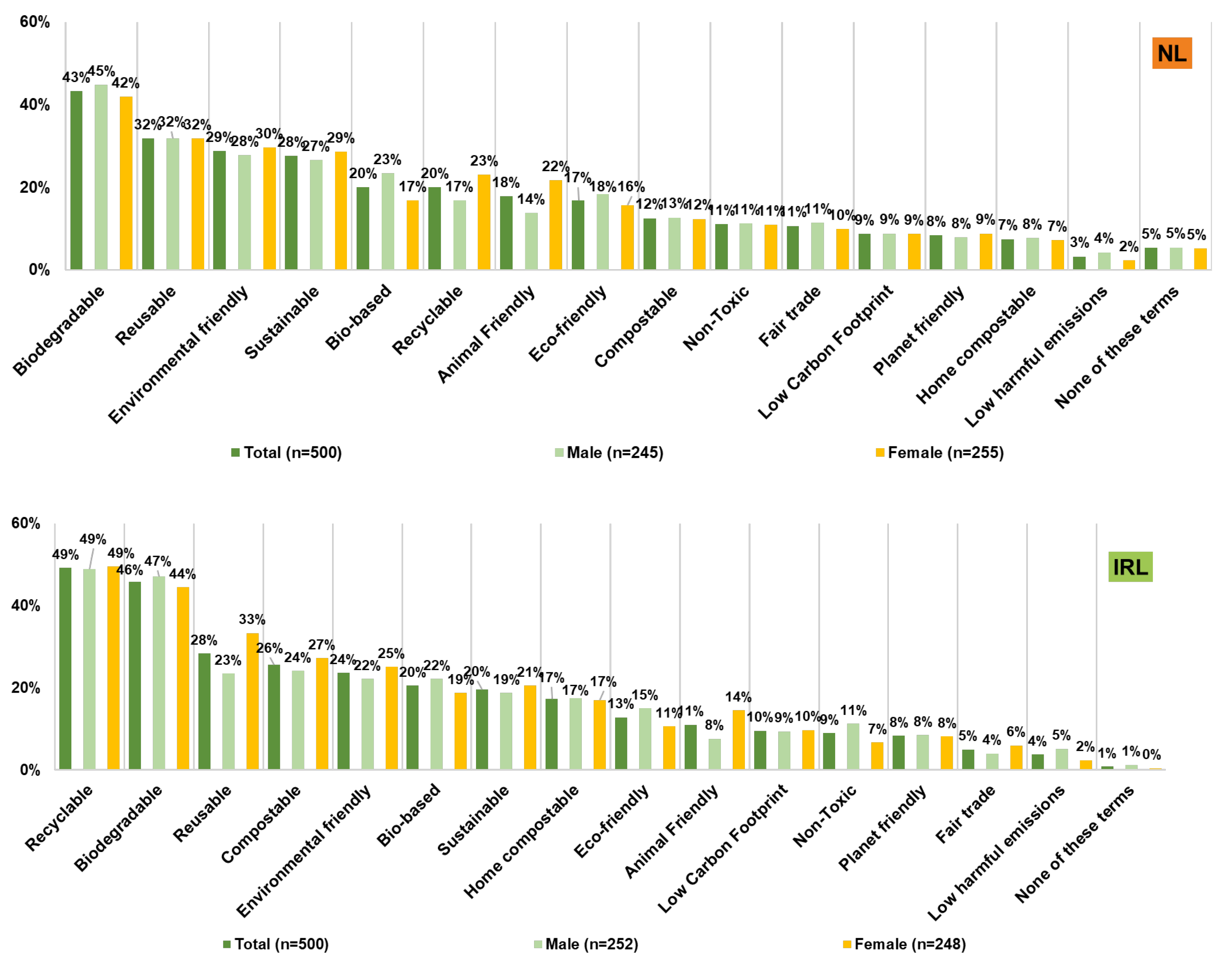

The top three motivating terms for consumers overall when choosing the product are: biodegradable (45%), recyclable (35%) and reusable (30%). There is some variability in the most popular motivating term for consumers in the Netherlands and Ireland. For Dutch consumers, 43% chose biodegradable, 32% chose reusable and 29% chose environmentally friendly as the top motivating terms. For Irish consumers, the top motivating terms are overwhelmingly recyclable (49%) and biodegradable (46%), and quite far ahead of reusable at 28%. An equal share of Dutch and Irish consumers (20%) indicate that bio-based is a term that could motivate them, while compostable fares much better among Irish consumers (26% IRL compared to 12% NL). There are only small variances in gender choices in both countries. The results for both countries are presented in

Figure 8.

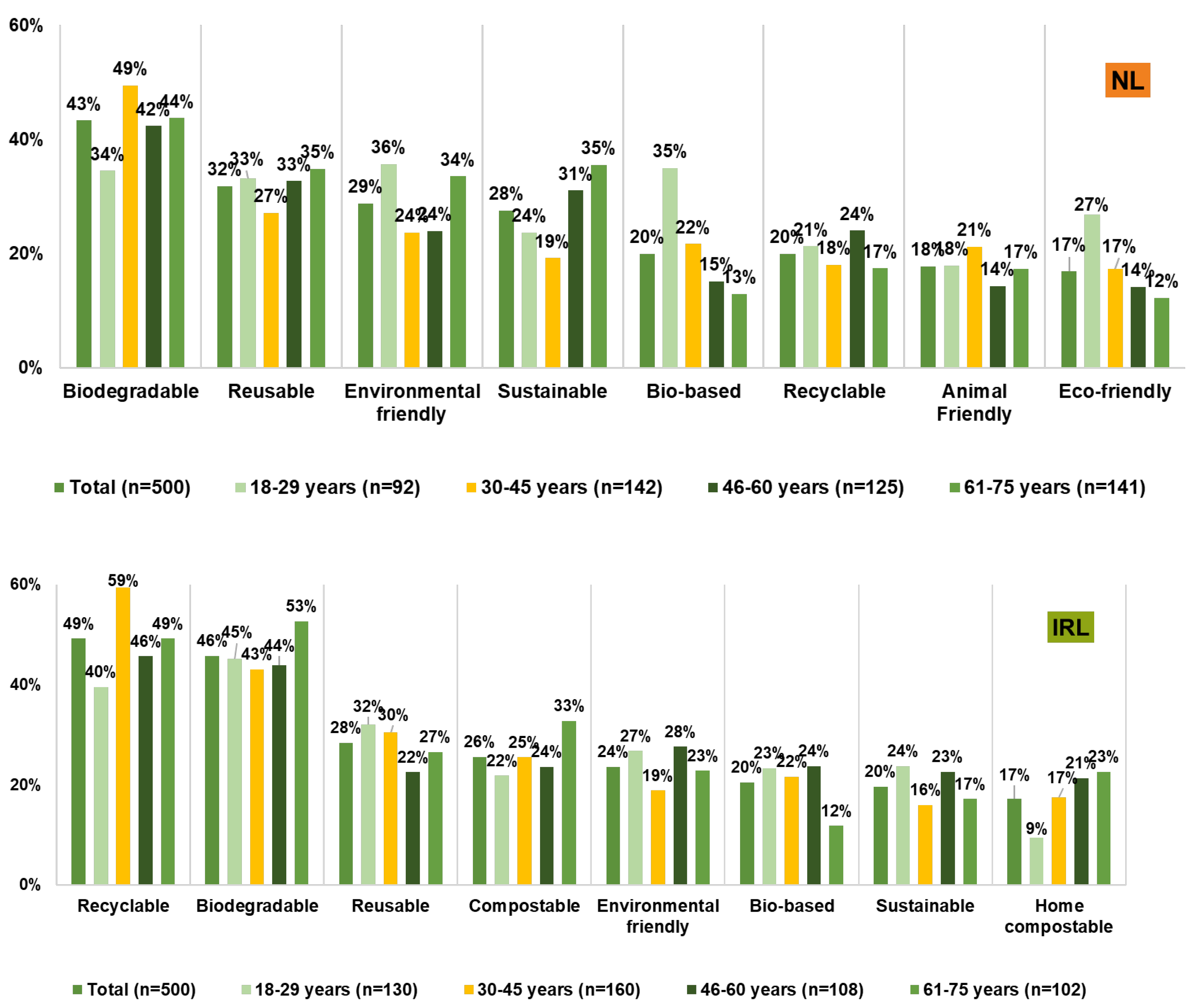

Looking at how these sustainability terms motivate consumers from different age categories, there are some variances. Notably, the term bio-based is a motivating term for a high proportion of 18–29-year-olds in the Netherlands (at 25%, significantly higher than any of the other surveyed groups), with eco-friendly performing best amongst this cohort (27%). The age group of 30–45-year-olds from the Netherlands (49%) and 61–75-year-olds from Ireland (53%) are most likely to be motivated by the term biodegradable. In Ireland, 18–29-year-olds are least likely to be motivated by the term home compostable (9%). These results are presented in more detail in

Figure 9.

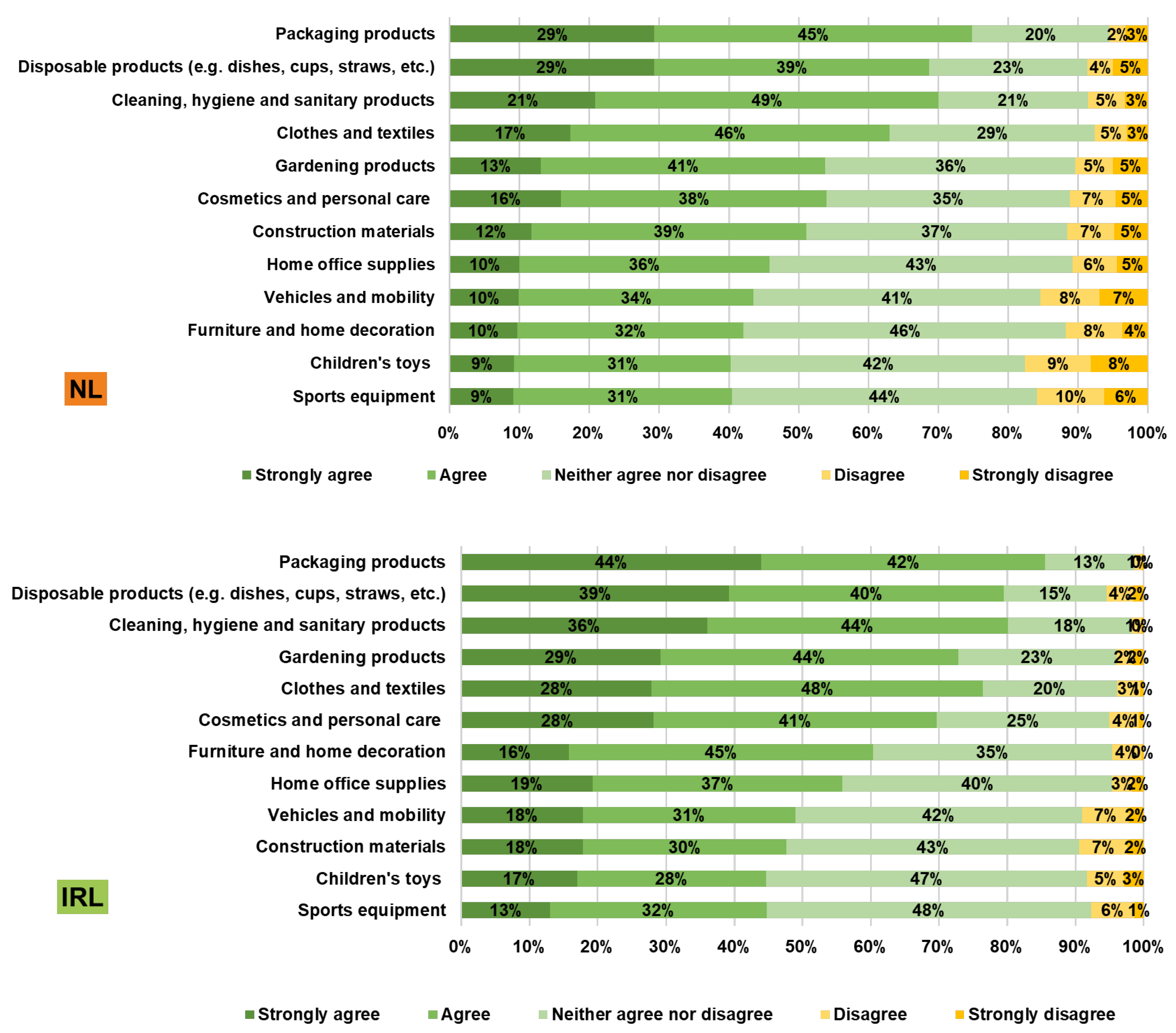

Looking at which product categories consumers expect to buy more BBPs from, overall, consumers’ trend towards the same bio-based products in both countries with a few variations. Irish consumers indicate that they expect (indicating either “strongly agree” or “agree”) to buy more bio-based products in the following categories; packaging products, disposable products, cleaning, hygiene and sanitary products, gardening products, clothes and textiles, cosmetics and personal care, furniture and home decoration and home and office supplies. For Irish consumers, packaging products is the top product category option, with 44% and 42% of consumers indicating that they “strongly agree” or “agree”, respectively, that they will buy more bio-based packaging in future. Disposable products (39% strongly agree, 40% agree) and cleaning hygiene and sanitary products (36% strongly agree, 44% agree) also perform strongly. Dutch consumers indicate that they expect to buy more bio-based products in the following categories: packaging products, disposable products, cleaning hygiene and sanitary products, clothes and textiles, gardening products, cosmetics and personal care, and construction materials. Again, packaging products are the top option for Dutch consumers (29% strongly agree, 45% agree), with disposable products (29% strongly agree, 39% agree) and cleaning, hygiene and sanitary products (21% strongly agree, 49% agree) also performing well. The results are further presented in

Figure 10.

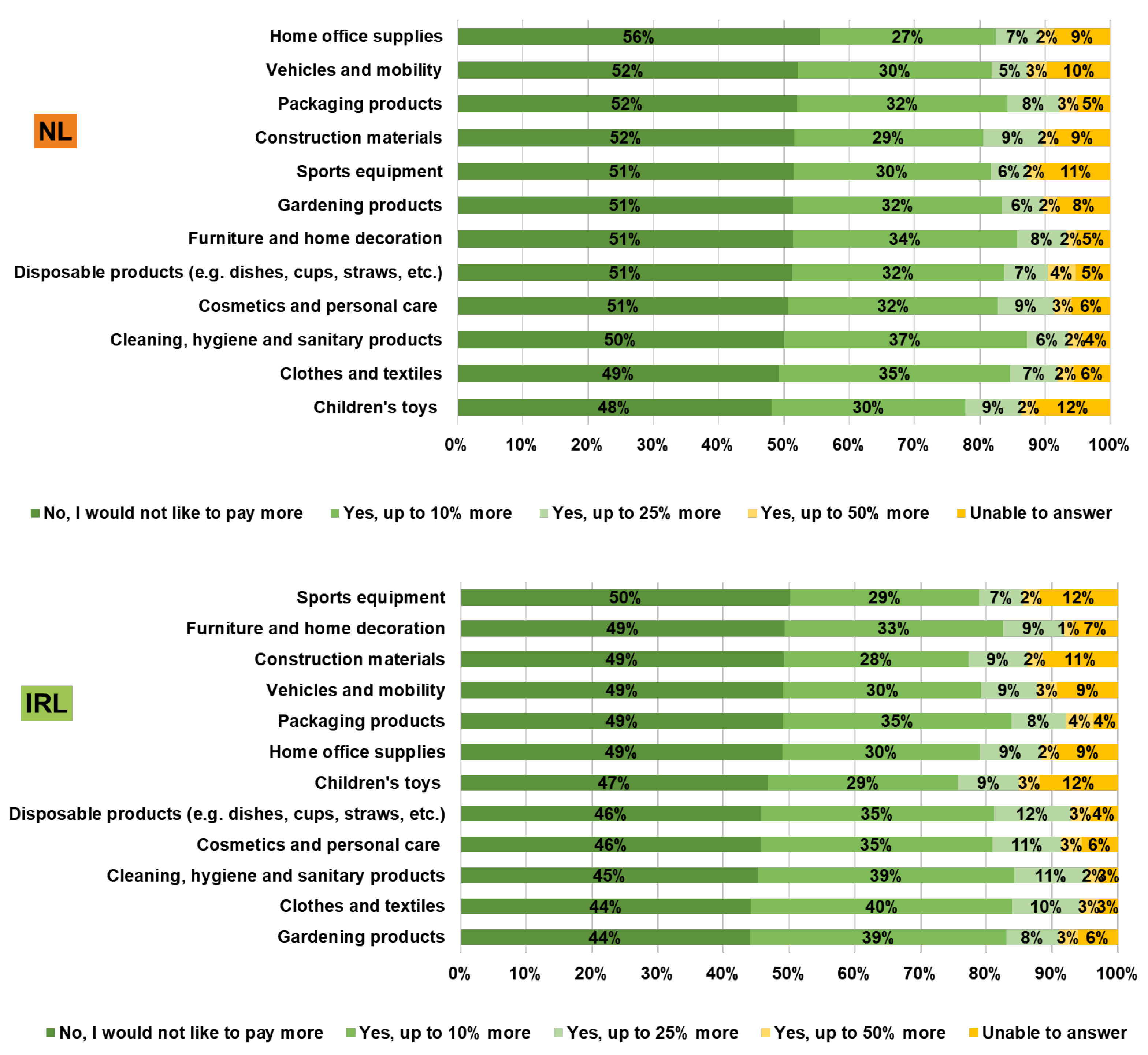

The results related to consumers’ willingness to pay a “green premium” for BBPs in different product categories are quite similar across both countries. In particular, in the product categories of disposable products (15% in IRL, and 11% in NL) and cosmetics and personal care products (14% in IRL and 12% in NL), consumers are willing to pay up to 25–50% extra. In the Netherlands, there is no product category in which over 50% of consumers indicate that they would be willing to pay extra for a bio-based product. However, the categories that Dutch consumers were most likely to pay extra include: cleaning, hygiene and sanitary products (45% would pay extra), cosmetics and personal care (44%) textiles (44%) and furniture (44%). In Ireland, there is a higher degree of willingness overall among consumers to pay extra for bio-based products. Overall, 50% or more of Irish consumers indicate that they would pay extra for bio-based products in the following categories of products: clothes and textiles (53%), cleaning, hygiene and sanitary products (52%), disposable products (50%) and gardening products (50%). The responses for both countries are presented in

Figure 11.

Consumers were asked to rank the most important criteria when deciding on a specific product brand. These criteria include product price and performance, feedstock (ingredients/materials), and branding and product labelling. From the responses, the prioritization of these criteria is the same in both countries. The product price and performance is the most important criterion (first choice among 69% in NL and 67% in IRL), followed by feedstock (first choice among 24% in NL and 22% in IRL) and branding and product labelling (first choice among 7% in NL and 10% in IRL). Overall, there is slightly more emphasis on branding and product labelling among Irish consumers (with 10% as first choice, 34% as second) than among Dutch consumers (7% as first choice, 28% as second). The results are further presented in

Figure 12.

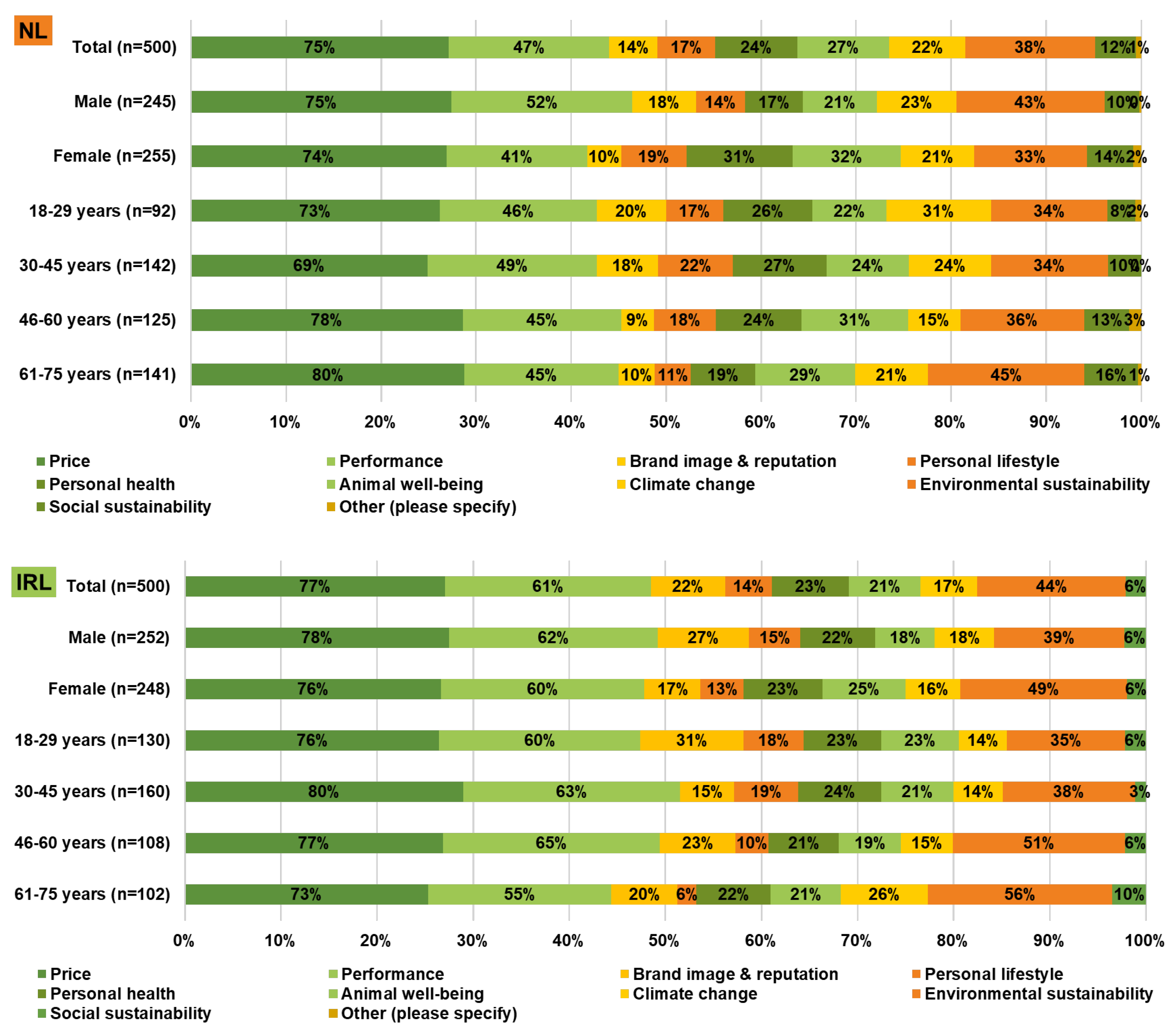

Finally, price is the most significant factor that helps the consumer to make a choice between similar products, according to 76% of all consumer respondents in both countries. When comparing similar products, performance (54%) and environmental sustainability (41%) are also important factors for consumers. While a similar percentage of Dutch and Irish consumers indicate price to be the most significant factor in both countries (75% in NL compared to 77% in IRL), Irish consumers place more value on the performance of a product (61% IRL compared to 47% NL) as well as brand image and reputation (22% IRL compared to 14% NL). Environmental sustainability is also emphasized in both countries (44% IRL compared to 38% NL). In particular, respondents in the age group of 61–75 years place a greater emphasis on environmental sustainability (56% IRL compared with 45% NL). These results are presented in more detail in

Figure 13.

4. Discussion

Overall, the results show that consumers in the Netherlands and in Ireland feel that their individual choices can have a positive impact on the environment, with most respondents preferring to buy bio-based products rather than fossil-based ones. This is a positive signal and offers possibilities for future growth [

14]. Earlier studies found that the majority of consumers have positive perceptions towards BBPs, primarily associated with perceived environmental or sustainability benefits [

15,

25,

28]. Based on our results, there is a slightly more positive response to BBPs among Irish consumers than among consumers in the Netherlands, evidenced by the greater share of Irish consumers who would prefer buying bio-based products as opposed to fossil-based products. This is a positive finding towards more sustainable development that is significantly influenced by consumption patterns [

13]. Irish consumers also have a slightly more positive impression that their consumer choice can be beneficial for the environment. However, a large share of consumers are not familiar with any bio-based brands yet, as was also concluded in earlier studies [

15,

16].

Respondents in both countries are most likely to buy BBPs in the same top selected categories of packaging products, disposable products, and cleaning, hygiene and sanitary products. However, there are variances with regard to other product categories lower on the list, with bio-based construction materials being more popular among Dutch consumers and bio-based cosmetics and personal care products, as well as bio-based gardening products, more popular among Irish consumers. The motivational criteria for buying bio-based products are almost the same in both counties, with lower price of product being the top option. Additionally, [

27] highlighted price to be one of the most critical issues affecting the purchase decision. Additionally, functionality of the product is essential. Despite the similarities, the response rate of Irish consumers to many of the motivational criteria is higher than among the Dutch respondents. Previously, it has been revealed that a lack of knowledge and misunderstandings raise mixed and negative feelings towards BBPs [

16,

28].

Biodegradable is the sustainability term most likely to motivate Dutch consumers when choosing a product, with recyclable followed by biodegradable being the most likely terms for Irish consumers. The literature review implemented by [

15] emphasized that consumers feel that bio-based corresponds to environmentally friendly. That also increases their expectations regarding bio-based products. It has also been shown that there is much misunderstanding among consumers about what is meant by different terms such as bio-based or biodegradable [

26,

28]. There is a clear need to improve consumer awareness about terminology surrounding different sustainable solutions and making them more visible for the users.

Looking at whether Irish or Dutch consumers would be willing to pay a green premium for bio-based products in different categories, around half of the respondents in both countries are not willing to pay extra for BBPs. The other half of the consumers define their interest based on the product category. Additionally, the amount of green premium varies based on the product categories. Overall, Irish consumers are slightly more willing to pay extra for BBPs. In relation to a large premium, between 25 and 50%, this is reserved for the same product categories in both regions; disposable products, and cosmetics and personal care. Additionally, [

15,

22,

25] concluded that consumers are willing to pay more for BBPs having the same functionalities and properties as fossil-based products. The pricing of the bio-based products is essential in becoming more widely used in the future. Indeed, consumer respondents in both countries indicate that product price as well as performance are the most important criteria for deciding on a specific brand, while price was also chosen by consumers in both countries as the most significant factor in helping consumers choose between products.

When identifying trends in gender-based responses, Irish females stand out as the cohort most likely to indicate that they prefer buying BBPs rather than fossil-based products and are also the most likely to believe that their individual consumer choices can have a positive impact on the environment. Dutch males are most likely to buy bio-based construction materials, with Irish females most likely to buy bio-based cosmetics and personal care products as well as cleaning, hygiene and sanitary products. In both countries, male respondents are more likely to be motivated by the lower cost of products. In Ireland, females are more likely than males to be motivated by products that are easy to recognize as being bio-based versus fossil-based, while in the Netherlands the opposite is the case. Dutch females and Irish females are more motivated than their male counterparts to support regional products and brands.

Finally, looking at trends and variances which emerge between different age categories, it is observed that Dutch respondents in the 30–45-year old age group most likely believe that their consumer choices can have a positive impact on the environment, while in Ireland the 61–75 age group are most likely to agree with this belief. Irish consumers in the 30–45 age group are most likely to prefer buying bio-based products rather than fossil-based products, followed by 18–29-year-olds and 61–75-year-olds. In the Netherlands, 18–29-year-olds are the most likely group to prefer buying BBPs rather than fossil-based, while, notably, 46–60-year-olds in both countries are the least likely to prefer buying BBPs rather than fossil-based products. When assessing the most important criteria for choosing between similar products, the largest age group to indicate price as the primary factor were 61–75-year-olds in the Netherlands, while in Ireland more 30–45-year-old respondents indicated price than any other age group. Environmental sustainability was indicated to be a significant factor among the 61–75-year-old age group in both countries. Climate change was selected as an important factor most often by Dutch consumers in the 18–29-year-old age category and Irish consumers in the 61–75-year-old age category, while social sustainability was indicated most often by the 18–29-year-old age category in both countries.

The results of this research show that while greater efforts are required to improve consumer knowledge of and familiarity with BBPs, consumers in Ireland and the Netherlands appear to be interested and willing to purchase these products. This will particularly be the case if the BBPs are able to compete in terms of cost and performance with alternative products. Falcone and Imbert (2019) identified the perceived risk and uncertainty associated with consumer acceptance and demand for bio-based products as one of the key issues surrounding a bio-based economy, and noted that understanding how consumers react to adoption may help to persuade firms to make the decision to adopt new sustainable options [

35]. The switch to bio-based products is already underway among some first mover firms and household brands, including Bewleys Coffee and Lyons Tea in Ireland and Royal DSM and Sigma Coatings in the Netherlands [

36,

37,

38,

39]. The evidence gained from our research, of consumer interest and willingness to pay for BBPs, may help to entice new firms and brands in Ireland, the Netherlands and beyond to join in taking up these sustainable alternatives by providing reassurance and market certainty.