Omni-Channel Intensity and Shopping Value as Key Drivers of Customer Satisfaction and Loyalty

Abstract

1. Introduction

2. Review of the Literature

2.1. Omni-Channel Retailing

2.2. Omni-Channel Intensity

2.3. Shopping Value (SV)

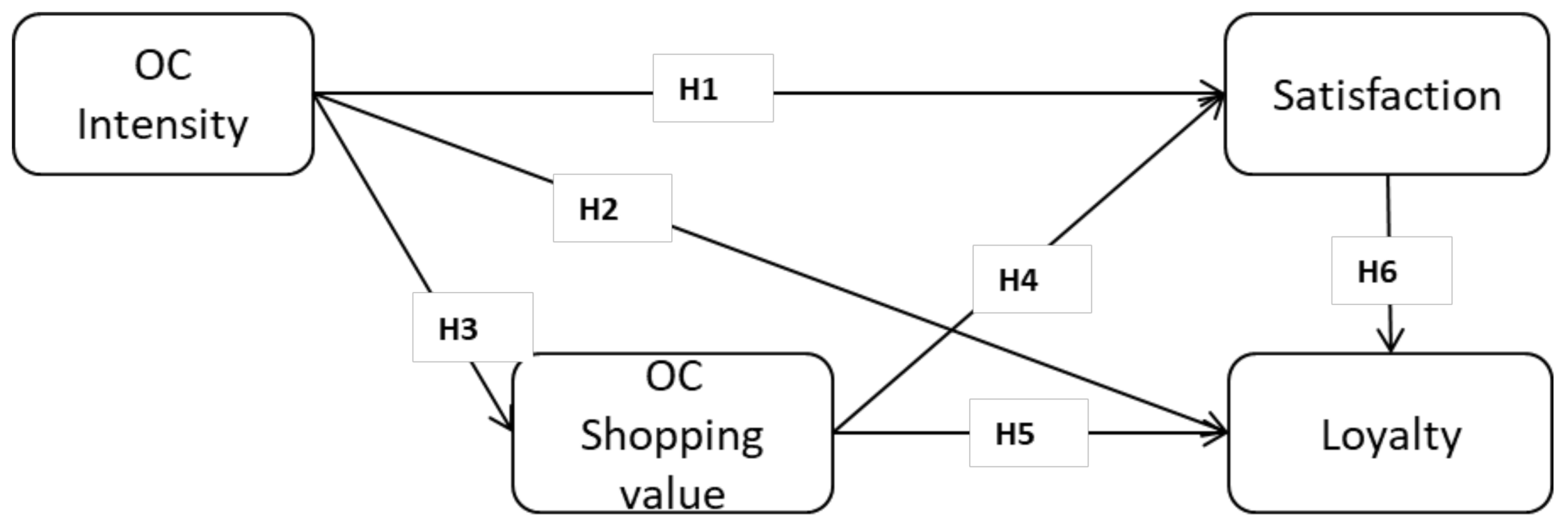

3. Hypothesis and Model Development

4. Methodology

4.1. Measurement Scales

4.2. Method

5. Results

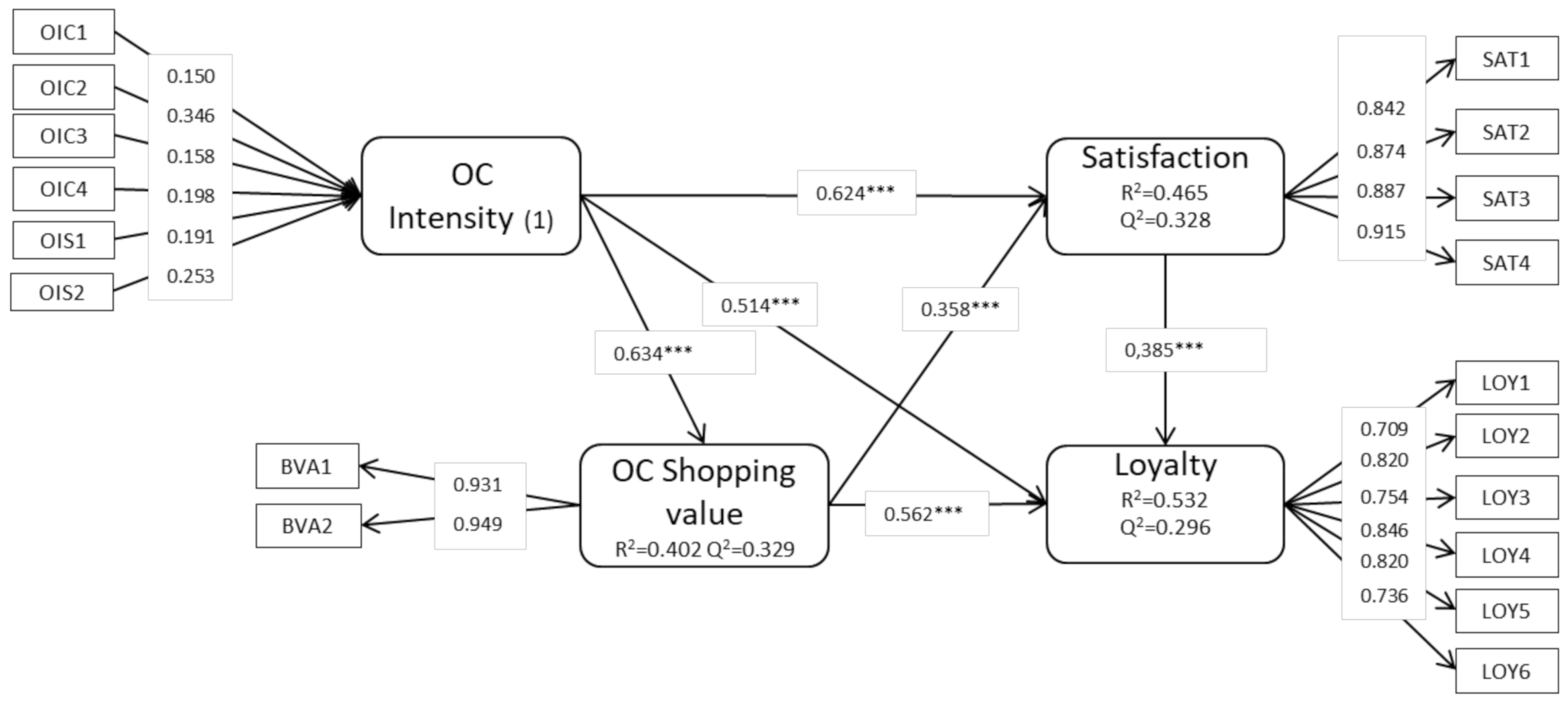

5.1. Descriptive Analysis of the Measurement Model

5.2. Analysis of the Structural Model and Hypothesis Testing

6. Discussion, Conclusions and Limitations

6.1. Discussion and Conclusions

6.2. Limitations and Future Lines of Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Baird, N.; Kilcourse, B. Omni-Channel Fulfillment and the Future of the Retail Supply Chain. 2011. Available online: http://www.scdigest.com/assets/reps/Omni_Channel_Fulfillment.pdf (accessed on 8 March 2021).

- Saghiri, S.S.; Bernon, M.; Bourlakis, M.; Wilding, R. Omni-Channel Logistics Special Issue. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 362–364. [Google Scholar] [CrossRef]

- Lemon, K.N.; Verhoef, P.C. Understanding Customer Experience throughout the Customer Journey. J. Mark. 2016, 80, 69–96. [Google Scholar] [CrossRef]

- Ailawadi, K.L.; Farris, P.W. Managing Multi- and Omni-Channel Distribution: Metrics and Research Directions. J. Retail. 2017, 93, 120–135. [Google Scholar] [CrossRef]

- Mishra, R.; Singh, R.K.; Koles, B. Consumer Decision-Making in Omnichannel Retailing: Literature Review and Future Research Agenda. Int. J. Consum. Stud. 2021, 45, 147–174. [Google Scholar] [CrossRef]

- Hickman, E.; Kharouf, H.; Sekhon, H. An Omnichannel Approach to Retailing: Demystifying and Identifying the Factors Influencing an Omnichannel Experience. Int. Rev. Retail. Distrib. Consum. Res. 2020, 30, 266–288. [Google Scholar] [CrossRef]

- Xu, X.; Jackson, J.E. Investigating the Influential Factors of Return Channel Loyalty in Omni-Channel Retailing. Int. J. Prod. Econ. 2019, 216, 118–132. [Google Scholar] [CrossRef]

- Melero, I.; Sese, F.; Verhoef, P.C. Recasting the Customer Experience in Today’s Omni-Channel Environment. 2016. Available online: https://www.redalyc.org/pdf/433/43345993001.pdf (accessed on 12 June 2020).

- Huré, E.; Picot-Coupey, K.; Ackermann, C.L. Understanding Omni-Channel Shopping Value: A Mixed-Method Study. J. Retail. Consum. Serv. 2017, 39, 314–330. [Google Scholar] [CrossRef]

- Cook, G. Customer Experience in the Omni-Channel World and the Challenges and Opportunities This Presents. J. Direct Data Digit. Mark. Pract. 2014, 15, 262–266. [Google Scholar] [CrossRef]

- Picot-Coupey, K.; Krey, N.; Huré, E.; Ackermann, C.L. Still Work and/or Fun? Corroboration of the Hedonic and Utilitarian Shopping Value Scale. J. Bus. Res. 2021, 126, 578–590. [Google Scholar] [CrossRef]

- Murfield, M.; Boone, C.A.; Rutner, P.; Thomas, R. Investigating Logistics Service Quality in Omni-Channel Retailing. Int. J. Phys. Distrib. Logist. Manag. 2017, 47, 263–296. [Google Scholar] [CrossRef]

- Hiraishi, K.; Ito, H.; Inoue, Y.; Eto, K.; Katashio, N.; Takashashi, I. The Effect of Omni Channel Retailer’s Strategy on Store Loyalty. In SMA Proceedings; SMA: Westerville, OH, USA, 2016; p. 443. [Google Scholar]

- Haile, E.; Bjork, M. Integrate…then They Might Be All Yours A Research on How Omnichannel Retailing Could Affect Customers Brand Loyalty. Master’s Thesis, Department of Business Studies, Uppsala University, Uppsala, Sweden, 2019. [Google Scholar]

- Mainardes, E.W.; Rosa, C.A.M.; Nossa, S.N. Omnichannel Strategy and Customer Loyalty in Banking. Int. J. Bank Mark. 2020, 38, 799–822. [Google Scholar] [CrossRef]

- Lee, W.-J. Unravelling Consumer Responses to Omni-Channel Approach. J. Appl. Electron. Commer. Res. 2020, 15, 37–49. [Google Scholar] [CrossRef]

- Hamouda, M. Omni-Channel Banking Integration Quality and Perceived Value as Drivers of Consumers’ Satisfaction and Loyalty. J. Enterp. Inf. Manag. 2019, 32, 608–625. [Google Scholar] [CrossRef]

- Beck, N.; Rygl, D. Categorization of Multiple Channel Retailing in Multi-, Cross-, and Omni-Channel Retailing for Retailers and Retailing. J. Retail. Consum. Serv. 2015, 27, 170–178. [Google Scholar] [CrossRef]

- Jara, M.; Vyt, D.; Mevel, O.; Morvan, T.; Morvan, N. Measuring Customers Benefits of Click and Collect. J. Serv. Mark. 2018, 32, 430–442. [Google Scholar] [CrossRef]

- Davies, A.; Dolega, L.; Arribas-Bel, D. Buy Online Collect In-Store: Exploring Grocery Click&collect Using a National Case Study. Int. J. Retail. Distrib. Manag. 2019, 47, 278–291. [Google Scholar] [CrossRef]

- Pan, S.; Giannikas, V.; Han, Y.; Grover-Silva, E.; Qiao, B. Using Customer-Related Data to Enhance e-Grocery Home Delivery. Ind. Manag. Data Syst. 2017, 117, 1917–1933. [Google Scholar] [CrossRef]

- Cortiñas, M.; Chocarro, R.; Elorz, M. Omni-Channel Users and Omni-Channel Customers: A Segmentation Analysis Using Distribution Services. Span. J. Mark. Esic 2019, 23, 415–436. [Google Scholar] [CrossRef]

- Frazer, M.; Stiehler, B.E. Omnichannel Retailing: The Merging of the Online and off-Line Environment. Glob. Conf. Bus. Financ. Proc. 2014, 9. [Google Scholar]

- Brynjolfsson, E.; Hu, Y.J.; Rahman, M.S. Competing in the Age of Omnichannel Retailing Brought to You By; MIT: Cambridge, MA, USA, 2013. [Google Scholar]

- Verhoef, P.C.; Kannan, P.K.; Inman, J.J. From Multi-Channel Retailing to Omni-Channel Retailing. Introduction to the Special Issue on Multi-Channel Retailing. J. Retail. 2015, 91, 174–181. [Google Scholar] [CrossRef]

- Bell, D.R.; Gallino, S.; Moreno, A. How to Win in an Omnichannel World. MIT Sloan Manag. Rev. 2014, 53, 45. [Google Scholar]

- Harrington, L. Fashion in Flux: Mastering the Omnichannel Supply Chain. 2014. Available online: https://www.cadenadesuministro.es/wp-content/uploads/2015/01/Fashion-in-Flux-mastering-the-omni-channel-Suplly-Chain.pdf (accessed on 28 March 2021).

- Herhausen, D.; Binder, J.; Schoegel, M.; Herrmann, A. Integrating Bricks with Clicks: Retailer-Level and Channel-Level Outcomes of Online-Offline Channel Integration. J. Retail. 2015, 91, 309–325. [Google Scholar] [CrossRef]

- Gallino, S.; Moreno, A.; Stamatopoulos, I. Channel Integration, Sales Dispersion, and Inventory Management. Manag. Sci. 2017, 63, 2813–2831. [Google Scholar] [CrossRef]

- Shen, X.L.; Li, Y.J.; Sun, Y.; Wang, N. Channel Integration Quality, Perceived Fluency and Omnichannel Service Usage: The Moderating Roles of Internal and External Usage Experience. Decis. Support. Syst. 2018, 109, 61–73. [Google Scholar] [CrossRef]

- Picot-Coupey, K.; Huré, E.; Piveteau, L. Channel Design to Enrich Customers’ Shopping Experiences: Synchronizing Clicks with Bricks in an Omni-Channel Perspective–The Direct Optic Case. Int. J. Retail. Distrib. Manag. 2016, 44, 336–368. [Google Scholar] [CrossRef]

- Tyrväinen, O.; Karjaluoto, H. Omnichannel Experience: Towards Successful Channel Integration in Retail. J. Cust. Behav. 2019, 18, 17–34. [Google Scholar] [CrossRef]

- Larke, R.; Kilgour, M.; O’Connor, H. Build Touchpoints and They Will Come: Transitioning to Omnichannel Retailing. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 465–483. [Google Scholar] [CrossRef]

- Lee, Z.W.; Chan, T.K.; Chong, A.; Thadani, D.R.Y. Association for Information Systems AIS Electronic Library (AISeL) An Empirical Investigation into the Antecedents and Consequences of Customer Engagement in Omnichannel Retailing. In PACIS 2017 Proceedings; AIS: Atlanta, GA, USA, 2017; Volume 158. [Google Scholar]

- Flavián, C.; Gurrea, R.; Orús, C. Combining Channels to Make Smart Purchases: The Role of Webrooming and Showrooming. J. Retail. Consum. Serv. 2020, 52, 101923. [Google Scholar] [CrossRef]

- Kokho Sit, J.; Hoang, A.; Inversini, A. Showrooming and Retail Opportunities: A Qualitative Investigation via a Consumer-Experience Lens. J. Retail. Consum. Serv. 2018, 40, 163–174. [Google Scholar] [CrossRef]

- Cao, L. Business Model Transformation in Moving to a Cross-Channel Retail Strategy: A Case Study. Int. J. Electron. Commer. 2014, 18, 69–96. [Google Scholar] [CrossRef]

- Fulgoni, G.M. “Omni-Channel” Retail Insights and the Consumer’s Path-to-Purchase: How Digital Has Transformed the Way People Make Purchasing Decisions. J. Advert. Res. 2014, 54. [Google Scholar] [CrossRef]

- Manser Payne, E.; Peltier, J.W.; Barger, V.A. Omni-Channel Marketing, Integrated Marketing Communications and Consumer Engagement: A Research Agenda. J. Res. Interact. Mark. 2017, 11, 185–197. [Google Scholar] [CrossRef]

- Verhagen, T.; Dolen, W.; Merikivi, J. The Influence of In-store Personnel on Online Store Value: An Analogical Transfer Perspective. Psychol. Mark. 2019, 36, 161–174. [Google Scholar] [CrossRef]

- Gallarza, M.G.M.G.; Gardó, T.; García, C.H. Experiential Tourist Shopping Value: Adding Causality to Value Dimensions and Testing Their Subjectivity. J. Consum. Behav. 2017, 16, 76–92. [Google Scholar] [CrossRef]

- Lo, A.; Services, H.Q.-J. A Theoretical Model of the Impact of a Bundle of Determinants on Tourists’ Visiting and Shopping Intentions: A Case of Mainland Chinese Tourists. J. Retail. Consum. Serv. 2015, 22, 231–243. [Google Scholar] [CrossRef]

- Holbrook, M.B. Consumer Value: A Framework for Analysis and Research; Psychology Press: London, UK, 1999. [Google Scholar]

- Holbrook, M.B.; Hirschman, E.C. The Experiential Aspects of Consumption: Consumer Fantasies, Feelings, and Fun. J. Consum. Res. 1982, 9, 132. [Google Scholar] [CrossRef]

- Merle, A.; Chandon, J.-L.; Roux, E. Understanding the Perceived Value of Mass Customization: The Distinction between Product Value and Experiential Value of Co-Design. Rech. Appl. Mark. 2008, 23, 27–50. [Google Scholar] [CrossRef]

- Aurier, P.; Evrard, Y.; N’Goala, G. La Valeur Du Produit Du Point de Vue Du Consommateur. In Actes Des XIVème Journées Nationales Des IAE; Institut d’Administration des Entreprises: Nantes, France, 1998; pp. 15–26. [Google Scholar]

- Gallarza, M.G.; Arteaga, F.; Del Chiappa, G.; Gil-Saura, I.; Holbrook, M.B. A Multidimensional Service-Value Scale Based on Holbrook’s Typology of Customer Value: Bridging the Gap between the Concept and Its Measurement. J. Serv. Manag. 2017, 28, 724–762. [Google Scholar] [CrossRef]

- Moharana, T.R.; Pradhan, D. Shopping Value and Patronage: When Satisfaction and Crowding Count. Mark. Intell. Plan. 2019, 38, 137–150. [Google Scholar] [CrossRef]

- Kumar, V.; Reinartz, W. Creating Enduring Customer Value. J. Mark. 2016, 80, 36–68. [Google Scholar] [CrossRef]

- Kim, J.; Yoo, J.; Choi, J. A Study on the Impact of Shopping Value on Loyalty Due to the Activation of Omni-Channel Based on Mobile Application by Distribution Companies. In Proceedings of the 2019 5th International Conference on E-Business and Applications, Bangkok, Thailand, 25–28 February 2019; Association for Computing Machinery: New York, NY, USA; pp. 38–42. [Google Scholar] [CrossRef]

- Jaiswal, A.K. Customer Satisfaction and Service Quality Measurement in Indian Call Centres. Manag. Serv. Qual. 2008, 18, 405–416. [Google Scholar] [CrossRef]

- Kim, R.B.; Matsui, T.; Park, J.; Okutani, T. Perceived Consumer Value of Omni-Channel Service Attributes in Japan and Korea. Eng. Econ. 2019, 30, 621–630. [Google Scholar] [CrossRef]

- Ha, H.-Y.; Perks, H. Effects of Consumer Perceptions of Brand Experience on the Web: Brand Familiarity, Satisfaction and Brand Trust. J. Consum. Behav. 2005, 4, 438–452. [Google Scholar] [CrossRef]

- Simone, A.; Sabbadin, E. The New Paradigm of the Omnichannel Retailing: Key Drivers, New Challenges and Potential Outcomes Resulting from the Adoption of an Omnichannel Approach. Int. J. Bus. Manag. 2018, 13. [Google Scholar] [CrossRef]

- Ziliani, C.; Ieva, M. Loyalty Management: From Loyalty Programs to Omnichannel Customer Experiences; Routledge: London, UK, 2019. [Google Scholar]

- Swaid, S.; Wigand, R.T. The Effect of Perceived Site-to-Store Service Quality on Perceived Value and Loyalty Intentions in Multichannel Retailing. Int. J. Manag. 2012, 29, 301–313. [Google Scholar]

- Lee, Z.W.Y.; Chan, T.K.H.; Chong, A.Y.L.; Thadani, D.R. Customer Engagement through Omnichannel Retailing: The Effects of Channel Integration Quality. Ind. Mark. Manag. 2019, 77, 90–101. [Google Scholar] [CrossRef]

- Shin, J.-K.; Oh, M.-O.; Author, C. Effects of Omni-Channel Service Characteristics on Utilitarian/Hedonic Shopping Value and Reuse Intention. J. Digit. Converg. 2017, 15, 183–191. [Google Scholar] [CrossRef]

- Babin, B.J.; Darden, W.R.; Griffin, M. Work and/or Fun: Measuring Hedonic and Utilitarian Shopping Value. J. Consum. Res. 1994, 20, 644. [Google Scholar] [CrossRef]

- Carpenter, J.M. Consumer Shopping Value, Satisfaction and Loyalty in Discount Retailing. J. Retail. Consum. Serv. 2008, 15, 358–363. [Google Scholar] [CrossRef]

- Cottet, P.; Lichtlé, M.C.; Plichon, V. The Role of Value in Services: A Study in a Retail Environment. J. Consum. Mark. 2006, 23, 219–227. [Google Scholar] [CrossRef]

- Cai, Y.J.; Lo, C.K.Y. Omni-Channel Management in the New Retailing Era: A Systematic Review and Future Research Agenda. Int. J. Prod. Econ. 2020, 229, 107729. [Google Scholar] [CrossRef]

- Yoo, W.; Lee, Y.; Park, J. The Role of Interactivity in E-Tailing: Creating Value and Increasing Satisfaction. J. Retail. Consum. Serv. 2010, 17, 89–96. [Google Scholar] [CrossRef]

- Carlson, J.; O’Cass, A.; Ahrholdt, D. Assessing Customers’ Perceived Value of the Online Channel of Multichannel Retailers: A Two Country Examination. J. Retail. Consum. Serv. 2015, 27, 90–102. [Google Scholar] [CrossRef]

- Kim, C.; Galliers, R.D.; Shin, N.; Ryoo, J.H.; Kim, J. Factors Influencing Internet Shopping Value and Customer Repurchase Intention. Electron. Commer. Res. Appl. 2012, 11, 374–387. [Google Scholar] [CrossRef]

- Diallo, M.F.; Coutelle-Brillet, P.; Rivière, A.; Zielke, S. How Do Price Perceptions of Different Brand Types Affect Shopping Value and Store Loyalty? Psychol. Mark. 2015, 32, 1133–1147. [Google Scholar] [CrossRef]

- Ipek, I.; Aşkin, N.; Ilter, B. Private Label Usage and Store Loyalty: The Moderating Impact of Shopping Value. J. Retail. Consum. Serv. 2016, 31, 72–79. [Google Scholar] [CrossRef]

- Iyer, P.; Davari, A.; Mukherjee, A. Investigating the Effectiveness of Retailers’ Mobile Applications in Determining Customer Satisfaction and Repatronage Intentions? A Congruency Perspective. J. Retail. Consum. Serv. 2018, 44, 235–243. [Google Scholar] [CrossRef]

- Adapa, S.; Fazal-e-Hasan, S.M.; Makam, S.B.; Azeem, M.M.; Mortimer, G. Examining the Antecedents and Consequences of Perceived Shopping Value through Smart Retail Technology. J. Retail. Consum. Serv. 2020, 52, 101901. [Google Scholar] [CrossRef]

- Hsieh, Y.; Chiu, H.; Hsu, Y.-C. Supplier Market Orientation and Accommodation of the Customer in Different Relationship Phases. Ind. Mark. Manag. 2008, 37, 380–393. [Google Scholar] [CrossRef]

- Kibbeling, M.; van der Bij, H.; van Weele, A. Market Orientation and Innovativeness in Supply Chains: Supplier’s Impact on Customer Satisfaction. J. Prod. Innov. Manag. 2013, 30, 500–515. [Google Scholar] [CrossRef]

- Qi, Y. Empirical Study on Multi-Channel Service Quality and Customer Loyalty of Retailers. J. Electron. Commer. Organ. 2014, 12, 1–12. [Google Scholar]

- Herhausen, D.; Kleinlercher, K.; Verhoef, P.C.; Emrich, O.; Rudolph, T. Loyalty Formation for Different Customer Journey Segments. J. Retail. 2019, 95, 9–29. [Google Scholar] [CrossRef]

- Cotarelo, M.; Calderón, H.; Fayos, T. A Further Approach in Omnichannel LSQ, Satisfaction and Customer Loyalty. Int. J. Retail. Distrib. Manag. 2021. [Google Scholar] [CrossRef]

- Deloitte. Click and Collect Booms in Europe. 2015. Available online: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Technology-Media-Telecommunications/gx-tmt-pred15-click-collect-europe.pdf (accessed on 21 July 2020).

- McCarthy, D.M.; Fader, P.S.; Hardie, B.G.S. Valuing Subscription-Based Businesses Using Publicly Disclosed Customer Data. J. Mark. 2017, 81, 17–35. [Google Scholar] [CrossRef]

- Melkonyan, A.; Gruchmann, T.; Lohmar, F.; Kamath, V.; Spinler, S. Sustainability Assessment of Last-Mile Logistics and Distribution Strategies: The Case of Local Food Networks. Int. J. Prod. Econ. 2020, 228, 107746. [Google Scholar] [CrossRef]

- Aurier, P.; Evrard, Y.; N’Goala, G. Comprendre et Mesurer La Valeur Du Point de Vue Du Consommateur. Rech. Appl. En Mark. 2004, 19, 1–20. [Google Scholar] [CrossRef]

- Bodet, G. An Investigation of the Influence of Consumer Value on Service Elements Contributions to Satisfaction. J. Target. Meas. Anal. Mark. 2009, 17, 205–228. [Google Scholar] [CrossRef]

- Voropanova, E. Conceptualizing Smart Shopping with a Smartphone: Implications of the Use of Mobile Devices for Shopping Productivity and Value. Int. Rev. Retail. Distrib. Consum. Res. 2015, 25, 529–550. [Google Scholar] [CrossRef]

- Bolton, R.N.; Drew, J.H. A Multistage Model of Customers’ Assessments of Service Quality and Value. J. Consum. Res. 1991, 17, 375. [Google Scholar] [CrossRef]

- Parasuraman, A.; Zeithaml, V. SERVQUAL: A Multiple-Item Scale for Measuring Consumer Perceptions of Service Quality. J. Retail. 1988, 64, 12–40. [Google Scholar]

- Brady, M.K.; Robertson, C.J. Searching for a Consensus on the Antecedent Role of Service Quality and Satisfaction: An Exploratory Cross-National Study. J. Bus. Res. 2001, 51, 53–60. [Google Scholar] [CrossRef]

- Selnes, F.; Gønhaug, K. Effects of Supplier Reliability and Benevolence in Business Marketing. J. Bus. Res. 2000, 49, 259–271. [Google Scholar] [CrossRef]

- Davis-Sramek, B.; Droge, C.; Mentzer, J.T.; Myers, M.B. Creating Commitment and Loyalty Behavior among Retailers: What Are the Roles of Service Quality and Satisfaction? J. Acad. Mark. Sci. 2009, 37. [Google Scholar] [CrossRef]

- Mahony, D.F.; Madrigal, R.; Hovk’ard, D. Using the Psychological Commitment to Team (PCT) Scale to Segment Sport Consumers Based on Loyalty. Available online: https://business.uoregon.edu/files/media/madrigal-using-psychological-commitment_1.pdf (accessed on 28 March 2021).

- Hansen, H.; Hem, L.E. Brand Extension Evaluations: Effects of Affective Commitment, Involvement, Price Consciousness and Preference for Bundling in the Extension Category. In Advances in Consumer Research; Association for Consumer Research: Duluth, MI, USA, 2004; Volume 31, pp. 375–381. [Google Scholar]

- Davis-Sramek, B.; Mentzer, J.T.; Stank, T.P. Creating Consumer Durable Retailer Customer Loyalty through Order Fulfillment Service Operations. J. Oper. Manag. 2008, 26, 781–797. [Google Scholar] [CrossRef]

- IAB. VI Estudio Anual de ECommerce En España; IAB: Madrid, Spain, 2020. [Google Scholar]

- Da Silva, P. 3-Catalysts-for-Click-and-Collect-Retail. 2019. Available online: https://ivend.com/bopis/3-catalysts-for-click-and-collect-retail/ (accessed on 28 March 2021).

- Lipsman, A. Holiday Shopping 2019. Available online: https://www.emarketer.com/content/click-and-collect-will-surge-this-holiday-season (accessed on 28 March 2021).

- Quelle, L. Los Consumidores Aseguran Que Click Collect Haria Experiencia de Compra Mas Sastisfactoria. Ecomercenews. 2017. Available online: https://ecommerce-news.es/26-los-consumidores-aseg (accessed on 21 July 2020).

- Hüseyinoğlu, Y.I.Ö.; Sorkun, M.F.; Börühan, G. Revealing the Impact of Operational Logistics Service Quality on Omni-Channel Capability. Asia Pac. J. Mark. Logist. 2018, 30, 1200–1221. [Google Scholar] [CrossRef]

- Ramli, N.A.; Latan, H.; Nartea, G.V. Why Should PLS-SEM Be Used Rather than Regression? Evidence from the Capital Structure Perspective. In International Series in Operations Research and Management Science; Springer: New York, NY, USA, 2018; Volume 267, pp. 171–209. [Google Scholar] [CrossRef]

- Leguina, A. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Int. J. Res. Method Educ. 2015, 38, 220–221. [Google Scholar] [CrossRef]

- Hair, J.F.J.; Tomas, G.; Hult, M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 1st ed.; Sage: Los Angeles, CA, USA, 2014. [Google Scholar]

- Rajput, H. How Can One Establish the Validity and Reliability of a Formative Construct? 2015. Available online: https://www.researchgate.net/post/How_can_one_establish_the_validity_and_reliability_of_a_formative_construct/5677e9e46307d9fa048b4592/citation/download (accessed on 28 April 2021).

- Fornell, C.; Larcker, D.F. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Falk, R.; Miller, N. A Primer for Soft Modeling; University of Akron Press: Akron, OH, USA, 1992. [Google Scholar]

- Chin, W.W. The Partial Least Squares Approach to Structural Equation Modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Hansen, R.; Sia, S.K. Hummel’s Digital Transformation toward Omnichannel Retailing: Key Lessons Learned. Mis Q. Exec. 2015, 14, 51–66. [Google Scholar]

- Alexander, B.; Cano, M.B. Futurising the Physical Store in the Omnichannel Retail Environment. In Exploring Omnichannel Retailing: Common Expectations and Diverse Realities; Springer International Publishing: Berlin/Heidelberg, Germany, 2018; pp. 197–223. [Google Scholar] [CrossRef]

- Leroi-Werelds, S.; Streukens, S.; Brady, M.K.; Swinnen, G. Assessing the Value of Commonly Used Methods for Measuring Customer Value: A Multi-Setting Empirical Study. J. Acad. Mark. Sci. 2014, 42, 430–451. [Google Scholar] [CrossRef]

- Adelaar, T.; Bouwman, H.; Steinfield, C. Enhancing Customer Value through Click-and-Mortar e-Commerce: Implications for Geographical Market Reach and Customer Type. Telemat. Inform. 2004, 21, 167–182. [Google Scholar] [CrossRef]

- Wallace, D.W.; Giese, J.L.; Johnson, J.L. Customer Retailer Loyalty in the Context of Multiple Channel Strategies. J. Retail. 2004, 80, 249–263. [Google Scholar] [CrossRef]

- Gawor, T.; Hoberg, K. Customers’ Valuation of Time and Convenience in e-Fulfillment. Int. J. Phys. Distrib. Logist. Manag. 2019, 49, 75–98. [Google Scholar] [CrossRef]

- Gallarza, M.G.; Ruiz-Molina, M.E.; Gil-Saura, I. Stretching the Value-Satisfaction-Loyalty Chain by Adding Value Dimensions and Cognitive and Affective Satisfactions: A Causal Model for Retailing. Manag. Decis. 2016, 54, 981–1003. [Google Scholar] [CrossRef]

- Gallarza, M.G.; Gil-Saura, I.; Holbrook, M.B. The Value of Value: Further Excursions on the Meaning and Role of Customer Value. Wiley Online Libr. 2011, 10, 179–191. [Google Scholar] [CrossRef]

- Wollenburg, J.; Holzapfel, A.; Hübner, A.; Kuhn, H. Configuring Retail Fulfillment Processes for Omni-Channel Customer Steering. Int. J. Electron. Commer. 2018, 22, 540–575. [Google Scholar] [CrossRef]

- Adhi, P.; Davis, A.; Jayakumar, J.; Touse, S. Reimagining Stores for Retail’s next Normal. 2020. Available online: https://www.mckinsey.com/industries/retail/our-insights/reimagining-stores-for-retails-next-normal# (accessed on 9 May 2021).

| Authors | Construct | Items |

|---|---|---|

| [9] | Omni-channel Intensity | OIC1: Prices were the same in each purchase channel. OIC2: The offers were consistent and adapted to each purchase channel. OIC3: Product information was the same in each purchase channel. OIC4: The product range was coherent and adapted to each channel. OIS1: It is easy to switch from the online shop to the physical shop. OIS2: It is easy to move from the online store to the physical store. OIS3: Barriers to moving from one shopping channel to another have been perceived |

| [78,79,80,81,82,83] | Omni-channel Shopping value | BVA1: Overall, buying this brand is worth the money and time. BVA2: Overall, buying this brand is worth the sacrifice I have made. BVA3: Overall, buying this brand is worth the energy I have wasted. |

| [84,85] | Consumer Satisfaction | SAT1: In general, I am very satisfied with the service of this store. SAT2: Compared with other stores, my current shopping experience with this one has been superior. SAT3: This store is very close to offering a “perfect” service. SAT4: This store differs from others by its superior service. |

| [12,85] | Consumer Loyalty | LOY1: I am really interested in what happens to this store. LOY2: I am proud to comment to others that I have purchased from this store. LOY3: I consider this store the best shopping alternative for this type of product. LOY4: I would recommend this store to others. LOY5: I buy regularly in this store. LOY6: I bought more from this store than from others with similar products. |

| Purchase Frequency Click and Collect | n | Response Rate | Product Category | n | Response Rate |

|---|---|---|---|---|---|

| Never. | 134 | 47% | Fashion and accessories. | 89 | 59% |

| Less than 1 time a month. | 112 | 39% | Food | 5 | 3% |

| 1 time a month. | 27 | 9% | Fast food | 1 | 1% |

| 2 to 5 times a month. | 10 | 4% | Furniture and decoration. | 3 | 2% |

| 6 to 10 times a month. | 2 | 1% | Books and music | 10 | 7% |

| More than 11 times a month. | 0 | 0% | Cosmetic and beauty products | 2 | 1% |

| Answers collected | 285 | Sport products. | 4 | 3% | |

| Toys | 5 | 3% | |||

| Products for children | 1 | 1% | |||

| Automotive accessories. | 1 | 1% | |||

| Pharmaceutical products. | 2 | 1% | |||

| Electronic products. | 19 | 13% | |||

| Others. | 9 | 6% | |||

| Answers collected | 151 |

| Construct | Item | Loadings | Outer Weights | ||

|---|---|---|---|---|---|

| OC intensity ** | OIC1 | 0.683 | 0.150 | ||

| OIC2 | 0.855 | 0.346 | |||

| OIC3 | 0.764 | 0.158 | |||

| OIC4 | 0.823 | 0.198 | |||

| OIS1 | 0.691 | 0.191 | |||

| OIS2 | 0.735 | 0.253 | |||

| Cronbach’s Alpha | Composite Reliability | AVE | |||

| Shopping value | BVA1 | 0.931 | 0.868 | 0.938 | 0.883 |

| BVA2 | 0.949 | ||||

| Loyalty | LOY1 | 0.709 | 0.873 | 0.904 | 0.612 |

| LOY2 | 0.820 | ||||

| LOY3 | 0.754 | ||||

| LOY4 | 0.846 | ||||

| LOY5 | 0.820 | ||||

| LOY6 | 0.736 | ||||

| Satisfaction | SAT1 | 0.842 | 0.902 | 0.932 | 0.774 |

| SAT2 | 0.874 | ||||

| SAT3 | 0.887 | ||||

| SAT4 | 0.915 |

| Loyalty | OC Intensity | OC Shopping Value | Satisfaction | |

|---|---|---|---|---|

| Loyalty | 0.782 | |||

| OC Intensity | 0.514 | |||

| OC Shopping Value | 0.662 | 0.634 | 0.940 | |

| Satisfaction | 0.646 | 0.624 | 0.609 | 0.880 |

| Loyalty | OC Shopping Value | |

|---|---|---|

| OC Shopping Value | 0.748 | |

| Satisfaction | 0.715 | 0.683 |

| Hypothesis | Structural Relationships | Standardized β | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics |O/STDEV| | p Values | Statistical Significance |

|---|---|---|---|---|---|---|---|

| H1 | OC Intensity → Satisfaction | 0.624 | 0.634 | 0.049 | 12.672 | 0.000 | *** |

| H2 | OC Intensity → Loyalty | 0.514 | 0.530 | 0.056 | 9.098 | 0.000 | *** |

| H3 | OC Intensity → OC Shopping Value | 0.634 | 0.648 | 0.046 | 13.644 | 0.000 | *** |

| H4 | OC Shopping Value → Satisfact | 0.358 | 0.348 | 0.074 | 4.819 | 0.000 | *** |

| H5 | OC Shopping Value → Loyalty | 0.562 | 0.555 | 0.079 | 7.141 | 0.000 | *** |

| H6 | Satisfaction → Loyalty | 0.385 | 0.385 | 0.085 | 4.522 | 0.000 | *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cotarelo, M.; Fayos, T.; Calderón, H.; Mollá, A. Omni-Channel Intensity and Shopping Value as Key Drivers of Customer Satisfaction and Loyalty. Sustainability 2021, 13, 5961. https://doi.org/10.3390/su13115961

Cotarelo M, Fayos T, Calderón H, Mollá A. Omni-Channel Intensity and Shopping Value as Key Drivers of Customer Satisfaction and Loyalty. Sustainability. 2021; 13(11):5961. https://doi.org/10.3390/su13115961

Chicago/Turabian StyleCotarelo, Mitxel, Teresa Fayos, Haydeé Calderón, and Alejandro Mollá. 2021. "Omni-Channel Intensity and Shopping Value as Key Drivers of Customer Satisfaction and Loyalty" Sustainability 13, no. 11: 5961. https://doi.org/10.3390/su13115961

APA StyleCotarelo, M., Fayos, T., Calderón, H., & Mollá, A. (2021). Omni-Channel Intensity and Shopping Value as Key Drivers of Customer Satisfaction and Loyalty. Sustainability, 13(11), 5961. https://doi.org/10.3390/su13115961