Identifying and Predicting the Credit Risk of Small and Medium-Sized Enterprises in Sustainable Supply Chain Finance: Evidence from China

Abstract

1. Introduction

2. Literature Review

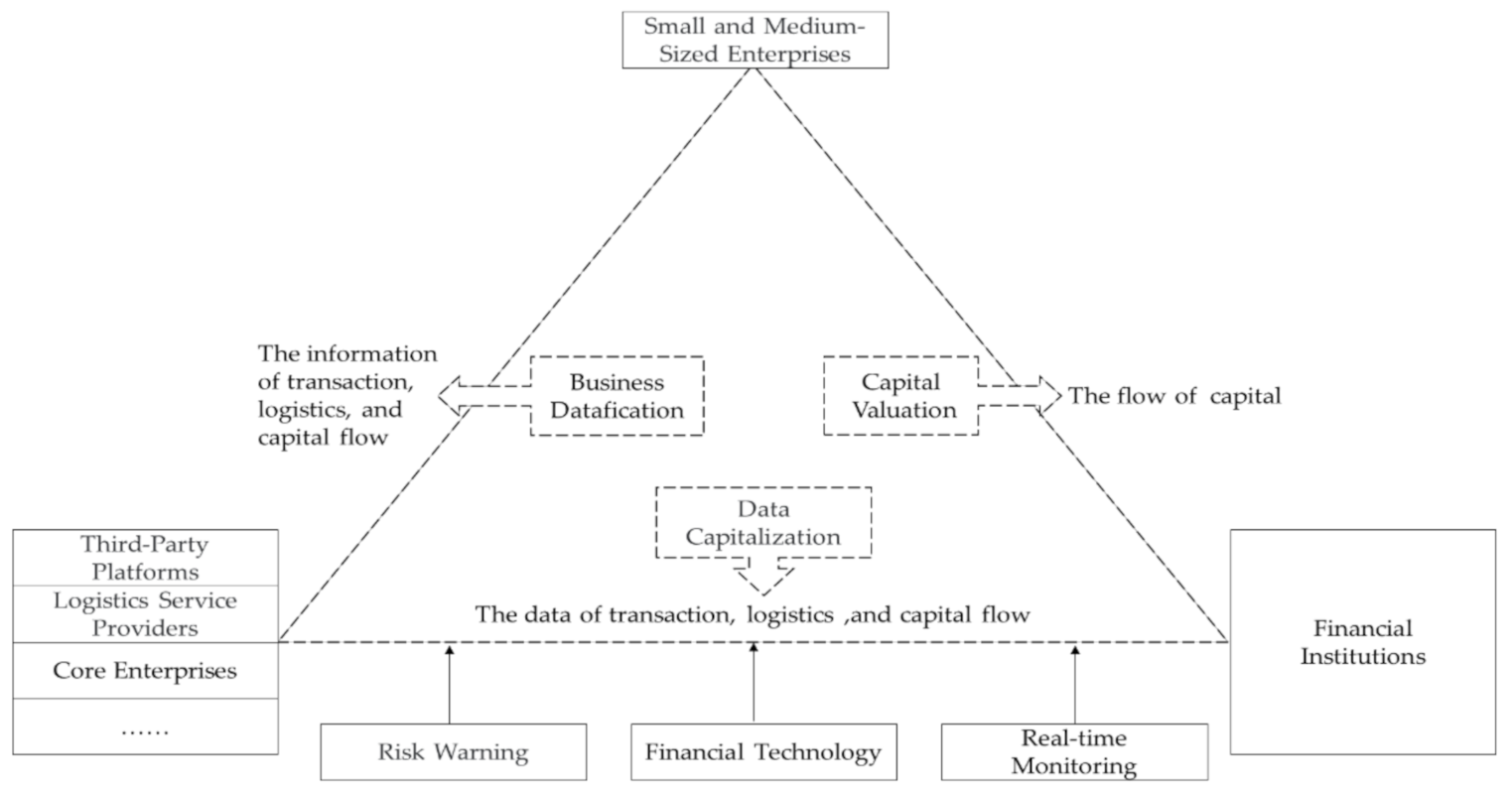

2.1. Sustainable Supply Chain Finance

2.2. Influencing Factors and Prediction Models of Credit Risk in SCF

3. Research Methodology

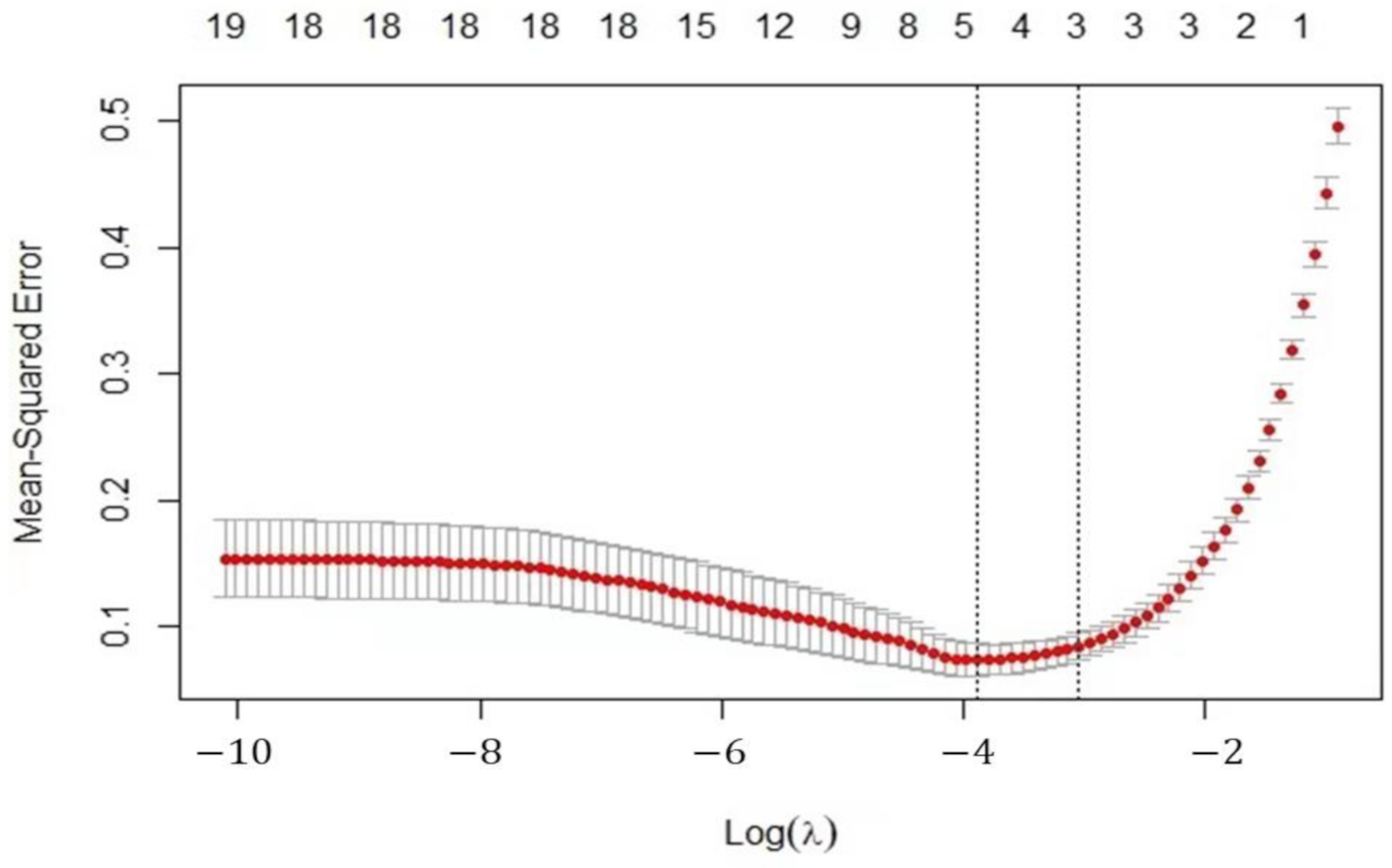

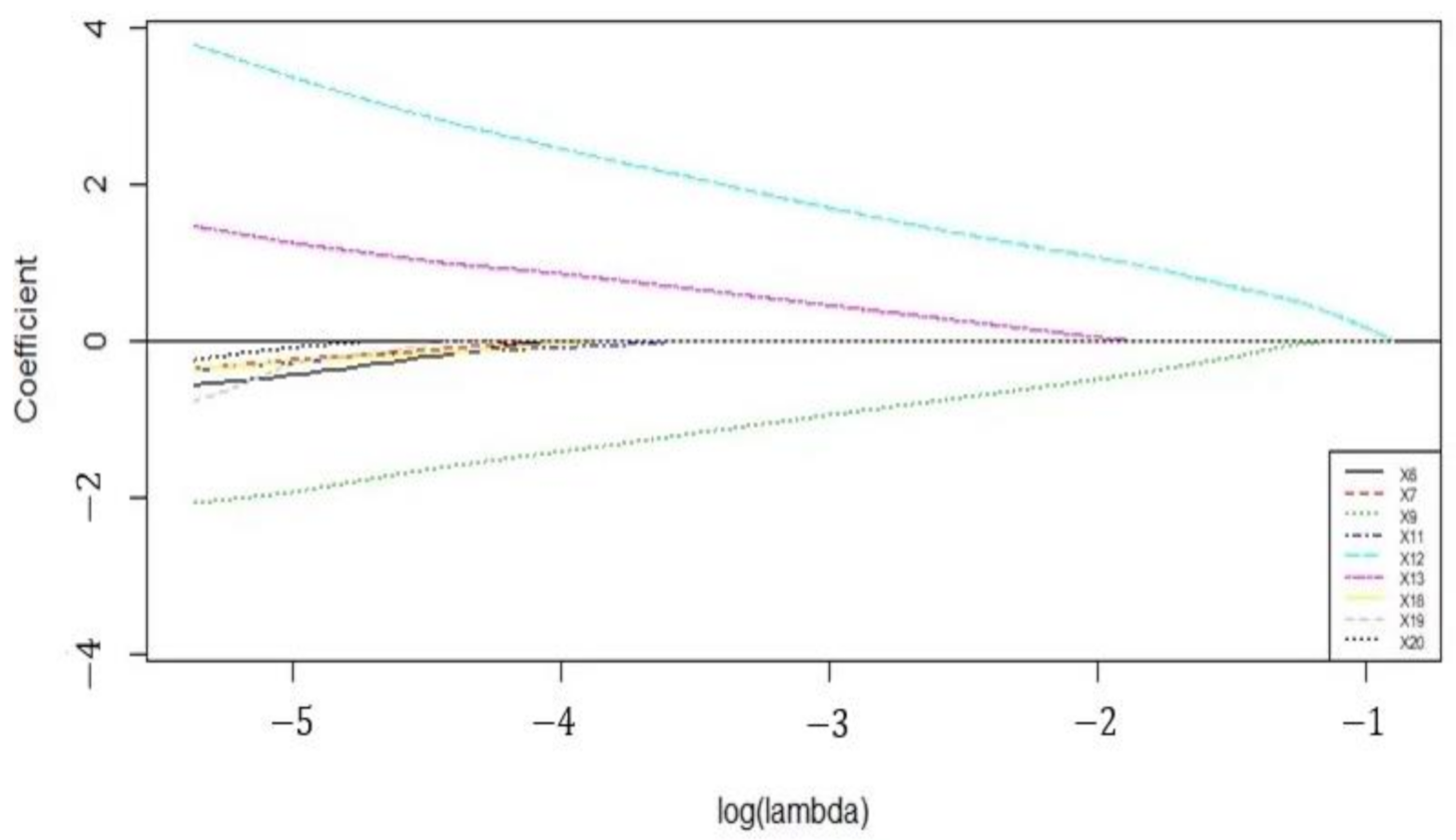

3.1. Lasso Model

3.2. Lasso-Logistic Model

3.3. Model Evaluation

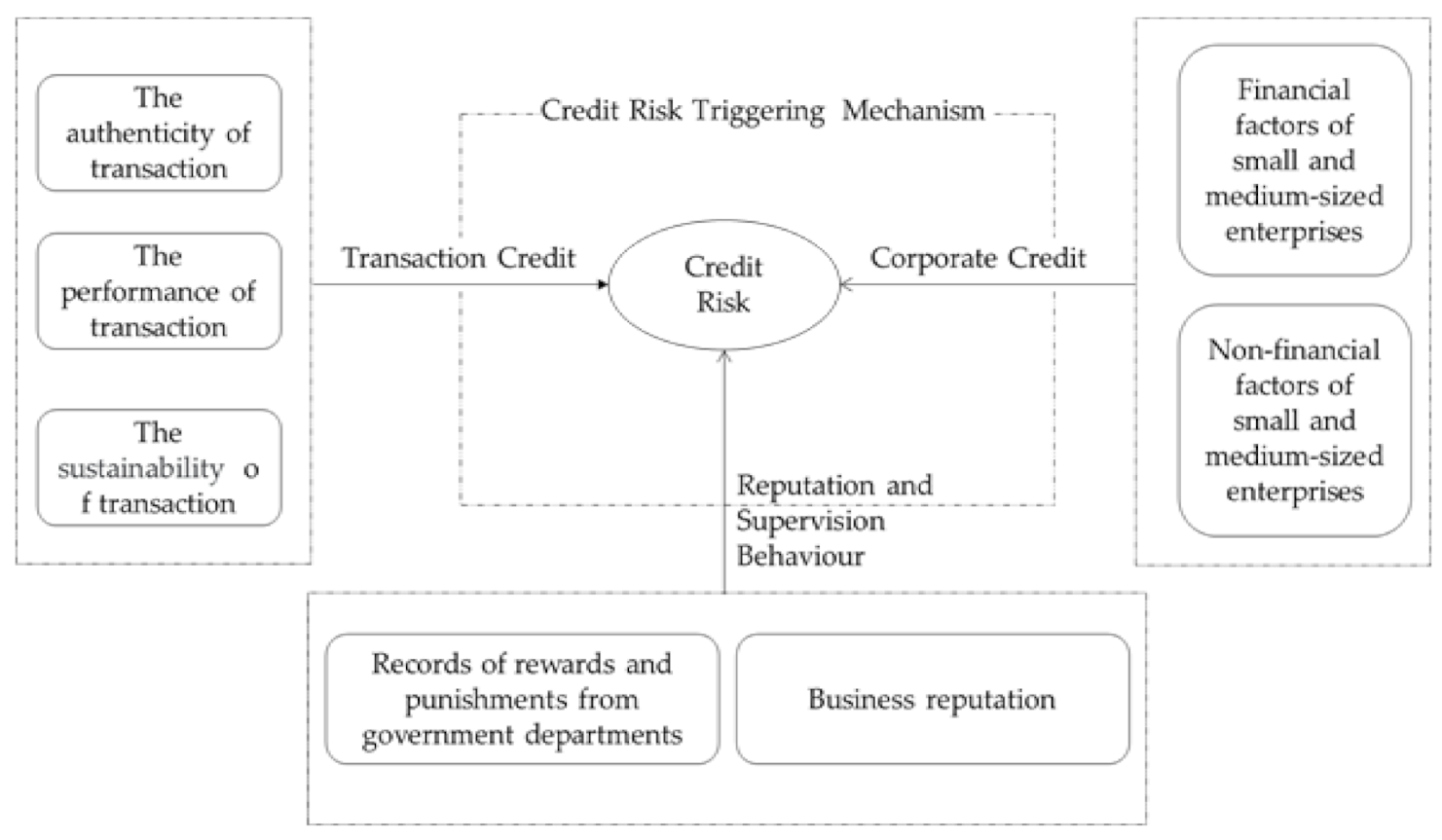

4. Credit Risk Triggering Mechanism and Variable Definition

4.1. Credit Risk Triggering Mechanism

4.2. Variable Definitions

4.3. Data Sources and Pre-Processing

5. Simulations

6. Experimental Results and Analysis

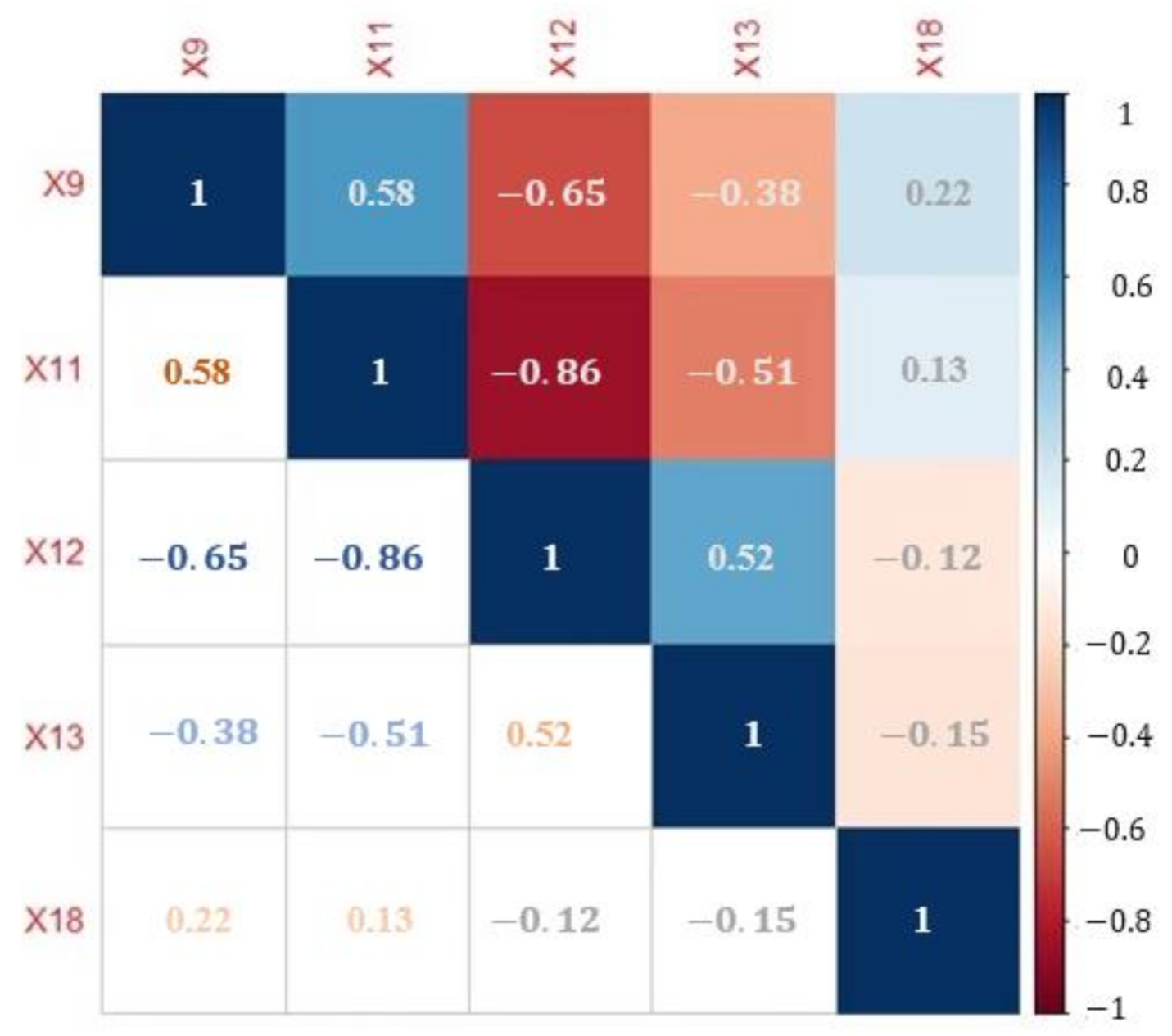

6.1. Identification of the Factors Influencing the Credit Risk of SMEs

6.2. Evaluation of the Lasso-Logistic Model

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhan, J.; Li, S.; Chen, X. The impact of financing mechanism on supply chain sustainability and efficiency. J. Clean Prod. 2018, 205, 407–418. [Google Scholar] [CrossRef]

- Zhou, Q.; Chen, X.; Li, S. Innovative financial approach for agricultural sustainability: A case study of Alibaba. Sustainability 2018, 10, 891. [Google Scholar] [CrossRef]

- Rajeev, A.; Pati, R.K.; Padhi, S.S.; Govindan, K. Evolution of sustainability in supply chain management: A literature review. J. Clean Prod. 2017, 162, 299–314. [Google Scholar] [CrossRef]

- Abe, M.; Troilo, M.; Batsaikhan, O. Financing small and medium enterprises in Asia and the Pacific. J. Entrep. Public Pol. 2016, 4, 2–32. [Google Scholar] [CrossRef]

- Harish, A.R.; Liu, X.L.; Zhong, R.Y.; Huang, Q.G. Log-flock: A blockchain-enabled platform for digital asset valuation and risk assessment in E-commerce logistics financing. Comput. Ind. Eng. 2021, 151, 107001. [Google Scholar] [CrossRef]

- Yan, N.; Sun, B.; Zhang, H.; Liu, C. A partial credit guarantee contract in a capital-constrained supply chain: Financing equilibrium and coordinating strategy. Int. J. Prod. Econ. 2016, 173, 122–133. [Google Scholar] [CrossRef]

- Wuttke, D.A.; Blome, C.; Heese, H.S.; Protopappa-Sieke, M. Supply chain finance: Optimal introduction and adoption decisions. Int. J. Prod. Econ. 2016, 178, 72–81. [Google Scholar] [CrossRef]

- Tseng, M.L.; Wu, K.J.; Hu, J.; Wang, C.H. Decision-making model for sustainable supply chain finance under uncertainties. Int. J. Prod. Econ. 2018, 205, 30–36. [Google Scholar] [CrossRef]

- Li, J.; Wang, Y.J.; Feng, G.Z.; Wang, S.Y.; Song, Y.G. Supply chain finance review: Current situation and future trend. Syst. Eng. Theory Pract. 2020, 40, 1977–1995. [Google Scholar]

- Mou, W.; Wong, W.K.; McAleer, M. Financial credit risk evaluation based on core enterprise supply chains. Sustainability 2018, 10, 3699–3715. [Google Scholar] [CrossRef]

- Tao, Z.; Li, X.; Liu, X.; Feng, N. Analysis of signal game for supply chain finance (SCF) of MSEs and banks based on incomplete information model. Discret. Dyn. Nat. Soc. 2019, 2019, 1–6. [Google Scholar] [CrossRef]

- Chen, X.; Liu, C.; Shuting, L. The role of supply chain finance in improving the competitive advantage of online retailing enterprises. Electron. Commer. Res. Appl. 2019, 33, 100821. [Google Scholar] [CrossRef]

- Yao, Z.; Hu, M.; Ye, M. Research on the mechanism of social network promoting financing availability of small and micro enterprises. Manag. World. 2013, 4, 135–147. [Google Scholar]

- Glover, J.L.; Champion, D.; Daniels, K.J.; Dainty, A.J.D. An institutional theory perspective on sustainable practices across the dairy supply chain. Int. J. Prod. Econ. 2014, 152, 102–111. [Google Scholar] [CrossRef]

- Zhao, Z.; Chen, D.; Wang, L.; Han, C. Credit risk diffusion in supply chain finance: A complex networks perspective. Sustainability 2018, 10, 4608. [Google Scholar] [CrossRef]

- Zhu, Y.; Xie, C.; Sun, B.; Wang, G.; Yan, X. Predicting China’s SME credit risk in supply chain financing by logistic regression. Artificial neural network and hybrid models. Sustainability 2016, 8, 433. [Google Scholar] [CrossRef]

- Song, H. The development trend of China’s supply chain finance. China Bus. Mark. 2020, 33, 3–9. [Google Scholar]

- Wu, X.; Liao, H. Utility-based hybrid fuzzy axiomatic design and its application in supply chain finance decision making with credit risk assessments. Comput. Ind. 2020, 114, 103144. [Google Scholar]

- Gelsomino, L.M.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply chain finance: A literature review. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 348–366. [Google Scholar] [CrossRef]

- Camerinelli, E. Supply chain finance. J. Paym. Str. Syst. 2009, 3, 114–128. [Google Scholar]

- Hofmann, E. Supply chain finance: Some conceptual insights. Logist. Manag. 2005, 1, 203–214. [Google Scholar]

- Pfohl, H.C.; Gomm, M. Supply chain finance: Optimizing financial flows in supply chains. Logist. Res. 2009, 1, 149–161. [Google Scholar] [CrossRef]

- Lu, Q.; Liu, B.; Song, H. The impact of SME’s capability on its supply chain financing performance: A study based on information perspective. Nankai. Bus. Rev. 2019, 22, 122–136. [Google Scholar]

- Liu, X.; Zhou, L.; Wu, Y. Supply chain finance in China: Business innovation and theory development. Sustainability 2015, 7, 14689–14709. [Google Scholar] [CrossRef]

- Caniato, F.; Gelsomino, L.M.; Perego, A.; Ronchi, S. Does finance solve the supply chain financing problem? Supply Chain Manag. 2016, 21, 534–549. [Google Scholar] [CrossRef]

- Song, H.; Yu, K.; Ganguly, A.; Turson, R. Supply chain network, information sharing and SME credit quality. Ind. Manag. Data Syst. 2016, 116, 740–758. [Google Scholar] [CrossRef]

- Zhu, Y.; Zhou, L.; Xie, C.; Wang, G.V.; Nguyen, T. Forecasting SMEs’ credit risk in supply chain finance with an enhanced hybrid ensemble machine learning approach. Int. J. Prod. Econ. 2019, 211, 22–33. [Google Scholar] [CrossRef]

- Su, Y.; Lu, N. Simulation of game model for supply chain finance credit risk based on multi-agent. Open J. Soc. Sci. 2015, 3, 31–36. [Google Scholar] [CrossRef]

- Abdel-Basset, M.; Mohamed, R.; Sallam, K.; Elhoseny, M. A novel decision-making model for sustainable supply chain finance under uncertainty environment. J. Clean Prod. 2020, 269, 122324. [Google Scholar] [CrossRef]

- Bruntland, G. Our common future: UN world commission on environment and development. Environment 1987, 29, 25–29. [Google Scholar]

- Feng, J.; Yuan, B.; Li, X.; Tian, D.; Mu, W. Evaluation on risks of sustainable supply chain based on optimized BP neural networks in fresh grape industry. Comput. Electron. Agric. 2021, 183, 105988. [Google Scholar]

- Barbier, E.B. The concept of sustainable economic development. Environ. Conserv. 1987, 14, 101–110. [Google Scholar] [CrossRef]

- Liang, X.; Zhao, X.; Wang, M.; Li, Z. Small and medium-sized enterprises sustainable supply chain financing decision based on triple bottom line theory. Sustainability 2018, 10, 4242. [Google Scholar] [CrossRef]

- Tseng, M.L.; Lim, M.K.; Wu, K.J. Improving the benefits and costs on sustainable supply chain finance under uncertainty. Int. J. Prod. Econ. 2019, 218, 308–321. [Google Scholar] [CrossRef]

- Sung, H.C.; Ho, S.J. Supply chain finance and impacts of consumers’ sustainability awareness. N. Am. Econ. Financ. 2020, 54, 100962. [Google Scholar] [CrossRef]

- Li, X.; Zheng, X.; Liu, J. How sustainable supply chain finance affects the financing performance of SMEs—An environmental regulation perspective. Financ. Regul. Res. 2020, 3, 70–85. [Google Scholar]

- Jia, F.; Zhang, T.; Chen, L. Sustainable supply chain finance: Towards a research agenda. J. Clean Prod. 2020, 243, 118680. [Google Scholar] [CrossRef]

- Mcdermott, T.; Stainer, A.; Stainer, L. Contaminated land: Bank credit risk for small and medium size UK enterprises. Int. J. Environ. Technol. Manag. 2015, 5. [Google Scholar] [CrossRef]

- Fantazzini, D.; Figini, S. Random survival forests models for SME credit risk measurement. Methodol. Comput. Appl. Probab. 2009, 11, 29–45. [Google Scholar] [CrossRef]

- Zhang, M.; He, Y.; Zhou, Z. Study on the influence factors of high-tech enterprise credit risk: Empirical evidence from China’s listed companies. Proc. Comput. Sci. 2013, 17, 901–910. [Google Scholar] [CrossRef]

- Angilella, S.; Mazzù, S. The financing of innovative SMEs: A multicriteria credit rating model. Eur. J. Oper. Res. 2015, 244, 540–554. [Google Scholar] [CrossRef]

- Cao, Y.; Xiong, S. A sustainable financing credit rating model for China’s small- and medium-sized enterprises. Math. Probl. Eng. 2014, 2014, 1–5. [Google Scholar] [CrossRef]

- Xiong, X.; Ma, J.; Zhao, W.; Wang, X.; Zhang, J. Credit risk analysis of supply chain finance. Nankai Bus. Rev. 2009, 12, 92–98. [Google Scholar]

- Zhang, L.; Hu, H.; Zhang, D. A credit risk assessment model based on SVM for small and medium enterprises in supply chain finance. Financ. Innov. 2015, 1, 1–21. [Google Scholar] [CrossRef]

- Tang, L.; Cai, F.; Ouyang, Y. Applying a nonparametric random forest algorithm to assess the credit risk of the energy industry in China. Technol. Forecast. Soc. Chang. 2019, 144, 563–572. [Google Scholar] [CrossRef]

- Zhang, W.; Wang, C.; Zhang, Y.; Wang, J. Credit risk evaluation model with textual features from loan descriptions for P2P lending. Electron. Commer. Res. Appl. 2020, 42, 100989. [Google Scholar] [CrossRef]

- Kuang, N.; Zhang, G.; Zhang, H. Individual credit risk prediction method: Application of a lasso-logistic mode. J. Quant. Tech. Econ. 2014, 31, 125–136. [Google Scholar]

- Jiang, C.; Huang, Y.; Xu, Q. Credit evaluation of listed companies via Lasso binary quantile regression approach. Syst. Eng. 2017, 35, 16–24. [Google Scholar]

- Wang, Y.; Nie, G.; Shi, Y. Research on customers default rate of commercial banks in China based on credit scoring models. Manag. Rev. 2012, 24, 78–87. [Google Scholar]

- Lahkani, M.J.; Wang, S.; Urbański, M.; Egorova, M. Sustainable B2B E-commerce and blockchain-based supply chain finance. Sustainability 2020, 12, 3968. [Google Scholar] [CrossRef]

- Tibshirani, R. Regression shrinkage and selection via the Lasso. J. R. Stat. Soc. Ser. B. 1996, 58, 267–288. [Google Scholar] [CrossRef]

- Efron, B.; Hastie, T.; Johnstone, I.; Tibshirani, R. Least angle regression. Ann. Stat. 2004, 32, 407–499. [Google Scholar] [CrossRef]

- Fawcett, T. An introduction to ROC analysis. Pattern Recognit. Lett. 2006, 27, 861–874. [Google Scholar] [CrossRef]

- He, X.; Tang, L. Exploration on building of visualization platform to innovate business operation pattern of supply chain finance. Phys. Procedia 2012, 33, 1886–1893. [Google Scholar] [CrossRef]

- Raub, W.; Weesie, R.J. Reputation and efficiency in social interactions: An example of network effects. Am. J. Sociol. 1990, 96, 626–654. [Google Scholar] [CrossRef]

- Granovetter, M. The impact of social structure on economic outcomes. J. Econ. Perspect. 2005, 19, 33–50. [Google Scholar] [CrossRef]

- Hermes, N.; Lensink, R.; Mehrteab, H.T. Peer monitoring, social ties and moral hazard in group lending programs: Evidence from Eritrea. World Dev. 2005, 33, 149–169. [Google Scholar] [CrossRef]

- Chu, X.; Qin, X.; Liu, F. Research on credit risk assessment of transport supply chain based on entropy-TOPSIS model. Financ. Theory Pract. 2018, 1, 57–62. [Google Scholar]

- Chi, G.; Li, H.; Pan, M. Small enterprises credit rating based on default identification ability of combination weighting: Based on an empirical analysis of small industrial enterprises. Chin. J. Manag. Sci. 2018, 21, 105–126. [Google Scholar]

- Lee, H.L.; Shen, Z. Supply chain and logistics innovations with the belt and road initiative. J. Manag. Sci. Eng. 2020, 5, 77–86. [Google Scholar] [CrossRef]

- Chen, Y.; Yang, D.; Lian, P.; Wan, Z.; Yang, Y. Will structure-environment-fit result in better port performance?—An empirical test on the validity of Matching Framework Theory. Transp. Policy 2020, 86, 23–33. [Google Scholar] [CrossRef]

- Li, C. Research on the financial credit risk of online supply chain based on system dynamics. Popul. Sci. Tech. 2016, 8, 125–128. [Google Scholar]

- Li, Z.; Huang, J. A dynamic game analysis on financing difficulties of small and micro businesses in China. East. China. Econ. Manag. 2016, 30, 1–8. [Google Scholar]

- Li, H.; Li, D.; Wang, D. Reputation effects of big customers on debt financing: Evidence from supplier-customer relationships in China. J. Financ. Res. 2018, 6, 138–154. [Google Scholar]

- Luo, W.; Fang, M.; Liu, Z.; Pan, Q. Research on cooperation evolution of E-commerce logistics platform from the perspective of business ecology—A case of Cainiao logistics platform. China Bus. Mark. 2016, 21, 534–549. [Google Scholar]

- Wang, S.; Ji, B.; Zhao, J.; Liu, W.; Xu, T. Predicting ship fuel consumption based on LASSO regression. Transport. Res. Part. D Transport. Environ. 2018, 65, 817–824. [Google Scholar] [CrossRef]

- Meng, B.; Niu, E.; Kuang, H.; Luo, J. An evaluation model and empirical research on CSR based on cloud model. Sci. Res. Manag. 2018, 39, 139–150. [Google Scholar]

- Zheng, Z.; Bao, X. A research on check rate and punishment mechanism of accounts receivable mode in supply chain finance. Econ. Rev. 2014, 6, 149–158. [Google Scholar]

- Jiang, W.; Yao, W. The enforcement of the property law and supply chain finance: Empirical evidence from bank loans pledged by accounts receivable. Econ. Res. J. 2016, 51, 141–154. [Google Scholar]

- Altman, E.I. Commercial bank lending: Process, credit scoring and costs of errors in lending. J. Financ. Quant. Anal. 1980, 15, 813–832. [Google Scholar] [CrossRef]

- Hu, H.; Lang, Z.; Zhang, D. Research on SMEs credit risk assessment from the perspective of supply chain finance–A comparative study on the SVM model and BP model. Manag. Rev. 2012, 24, 70–80. [Google Scholar]

| Actual Value | Predicted Value | Total | |

|---|---|---|---|

| 0 (Non-Default) | 1 (Default) | ||

| 0 (Non-default) | a | b | a + b |

| 1 (Default) | c | d | c + d |

| Total | a + c | b + d | a + b + c + d |

| First Level Variables | Second Level Variables | Third Level Variables | Indexes | Variables Description |

|---|---|---|---|---|

| Corporate Credit | Non-financial factors of SMEs | Registered capital | X1 | Registered capital of SME |

| Number of employees | X2 | Number of employees | ||

| Time of establishment | X3 | Time of establishment | ||

| Financial factors of SMEs | Return on equity | X4 | Net margin divided by total net assets | |

| Operating profit ratio | X5 | Operating profit divided by sales revenue | ||

| Current assets turnover ratio | X6 | Net income from main business divided by average total current assets | ||

| Operating growth rate | X7 | Growth of current operating income divided by operating income of last year | ||

| Debt asset ratio | X8 | Total l debt divided by total assets | ||

| Transaction Credit | The authenticity of transaction | Matching degree of order data | X9 | Matching degree of order flow, tax flow and capital flow for cross validation, which is divided into 5 grades |

| The performance of transaction | Ratio of on-time delivery | X10 | Ratio of on-time delivery according to the contract | |

| Ratio of contract enforcement | X11 | Actual delivery divided by contractual delivery | ||

| Number of contract defaults | X12 | Number of contract defaults | ||

| The sustainability of transaction | Degree of business concentration | X13 | Degree of business concentration, which is divided into 5 grades. | |

| The social relations of SMEs | X14 | Number of managers holding positions in other enterprises | ||

| Reputation and Supervision Behavior | Records of rewards and punishments from government departments | History of litigation | X15 | The value of 1 indicates that there is a history of litigation; The value of 0 means no litigation history |

| Number of being listed on credit blacklists | X16 | Number of being listed on credit blacklists | ||

| Tax incentive record | X17 | Number of tax rating as A | ||

| Number of administrative penalties | X18 | Number of administrative penalties | ||

| Number of abnormal operations | X19 | Number of abnormal operations | ||

| Business reputation | Industry recognition | X20 | Dynamic evaluation from the relevant website, which is divided into five grades. |

| Model | Sample Size | The Number of Non-Zero Coefficients Estimated | The Number of Correctly Estimated Zero Coefficients | The Number of Correctly Estimated Non-Zero Coefficients | Prediction Accuracy | AUC | ||

|---|---|---|---|---|---|---|---|---|

| The Training Set | The Test Set | The Training Set | The Test Set | |||||

| Lasso- logistic model | 100 | 4.050 | 3.950 | 3.000 | 0.996 | 0.978 | 0.999 | 0.998 |

| 200 | 4.250 | 3.700 | 3.000 | 0.989 | 0.979 | 0.999 | 0.999 | |

| 500 | 4.800 | 3.200 | 3.000 | 0.994 | 0.982 | 0.999 | 0.999 | |

| Ridge regression model | 100 | 3.800 | 4.200 | 3.000 | 0.964 | 0.930 | 0.996 | 0.989 |

| 200 | 4.150 | 3.850 | 3.000 | 0.980 | 0.961 | 0.998 | 0.995 | |

| 500 | 3.750 | 4.150 | 3.000 | 0.968 | 0.952 | 0.997 | 0.993 | |

| Logistic regression model | 100 | 2.000 | 5.000 | 2.000 | 0.936 | 0.925 | 0.983 | 0.973 |

| 200 | 2.000 | 5.000 | 2.000 | 0.920 | 0.892 | 0.977 | 0.960 | |

| 500 | 2.000 | 5.000 | 2.000 | 0.901 | 0.900 | 0.973 | 0.974 | |

| Explanatory Variables | βj | VIF | Explanatory Variables | βj | VIF |

|---|---|---|---|---|---|

| X9 | −1.355 | 1.805 | X13 | 0.809 | 1.416 |

| X11 | −0.063 | 3.865 | X18 | −0.018 | 1.060 |

| X12 | 2.351 | 4.556 | / | / | / |

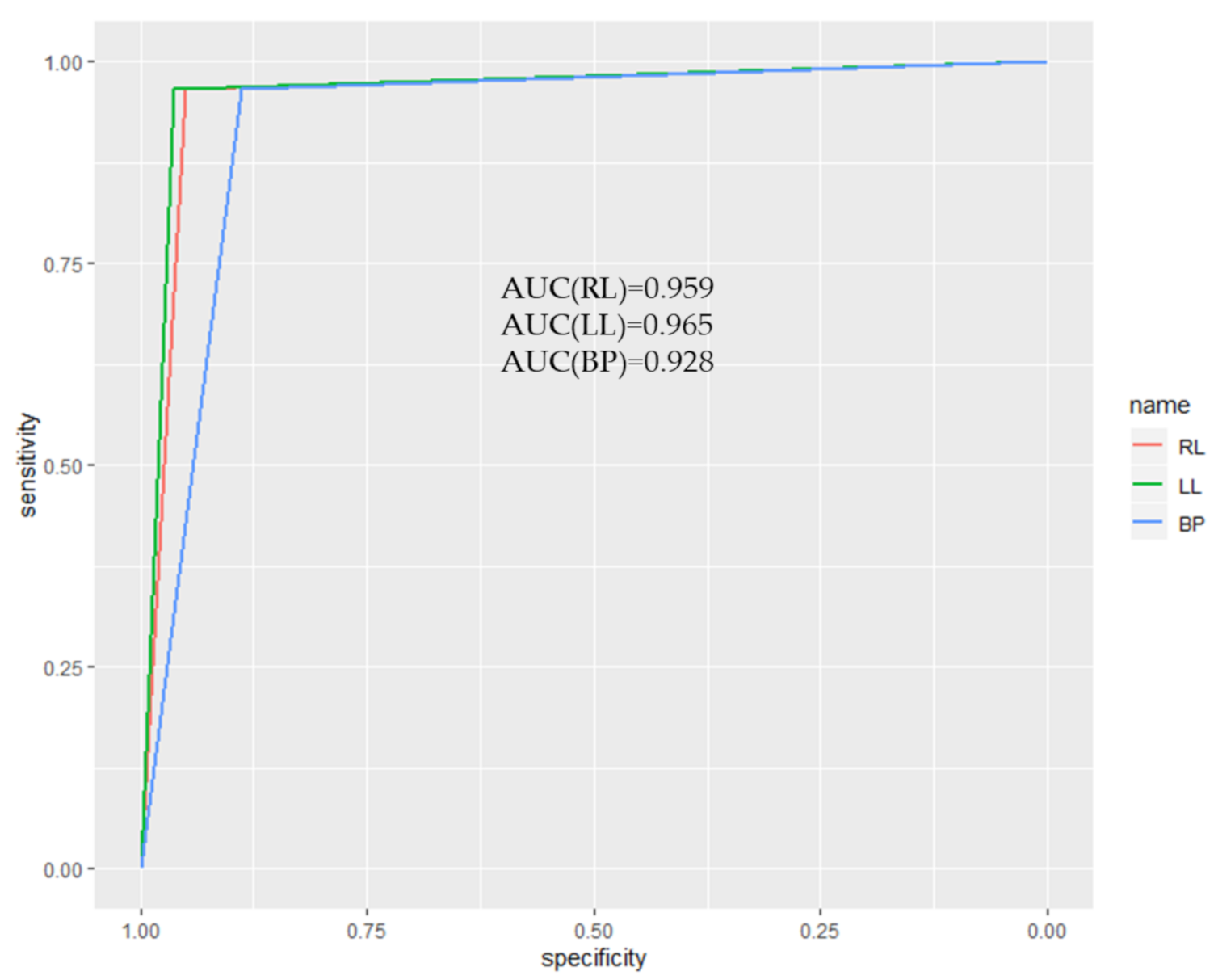

| Models | Prediction Accuracy | Type I Error | Type II Error | AUC | |

|---|---|---|---|---|---|

| Ridge regression model | 0.958 | 0.033 | 0.049 | 0.959 | |

| The train set | Lasso-logistic model | 0.965 | 0.033 | 0.037 | 0.965 |

| BP neural network | 0.923 | 0.033 | 0.111 | 0.928 | |

| Ridge regression model | 0.934 | 0.048 | 0.084 | 0.934 | |

| The test set | Lasso-logistic model | 0.964 | 0.044 | 0.032 | 0.962 |

| BP neural network | 0.903 | 0.049 | 0.148 | 0.903 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, Y.; Chu, X.; Pang, R.; Liu, F.; Yang, P. Identifying and Predicting the Credit Risk of Small and Medium-Sized Enterprises in Sustainable Supply Chain Finance: Evidence from China. Sustainability 2021, 13, 5714. https://doi.org/10.3390/su13105714

Yang Y, Chu X, Pang R, Liu F, Yang P. Identifying and Predicting the Credit Risk of Small and Medium-Sized Enterprises in Sustainable Supply Chain Finance: Evidence from China. Sustainability. 2021; 13(10):5714. https://doi.org/10.3390/su13105714

Chicago/Turabian StyleYang, Yubin, Xuejian Chu, Ruiqi Pang, Feng Liu, and Peifang Yang. 2021. "Identifying and Predicting the Credit Risk of Small and Medium-Sized Enterprises in Sustainable Supply Chain Finance: Evidence from China" Sustainability 13, no. 10: 5714. https://doi.org/10.3390/su13105714

APA StyleYang, Y., Chu, X., Pang, R., Liu, F., & Yang, P. (2021). Identifying and Predicting the Credit Risk of Small and Medium-Sized Enterprises in Sustainable Supply Chain Finance: Evidence from China. Sustainability, 13(10), 5714. https://doi.org/10.3390/su13105714