1. Introduction

Migration, demographic change, globalization, and digitalization continue to make a significant impact on the economy and society. In addition, environmental pollution, over urbanization, ecosystem degradation, and severe climate change pose risks to financial systems and the economy, which require global coordination and harmonized long-term strategies.

In the context of increased digitalization, social networks and the multitude of data available on them have become important factors in daily activities [

1,

2], including economic activity. The use of the internet can have advantages such as online marketing, reduction of bureaucracy, but, at the same time, it can also have disadvantages such as false news that could change consumer behavior and preferences.

The coronavirus pandemic is an example of how external factors of the financial sector can trigger a financial crisis [

3], and in order to ensure long-term global financial stability and sustainable development, both national and international public and private sectors are needed to collaborate permanently. The health crisis has triggered an economic crisis, characterized by low interest rates, rising inflation, and high investment needs [

3].

For the banking sector, as a financial intermediary and the main channel for financing the economy, environmental, social, and governance (ESG) risks are of significant importance, and their efficient management through sustainable business strategies increases financial performance.

The research proposes a selection of indicators and the study of the correlation between them. The paper analyzes the impact of social and governance factors and macroeconomic factors on the banking system of the European Union and, implicitly, the synergies between the banking system, economy, and society, in the context of the growing interest that countries show for sustainability/sustainable development. The correlation between macro and micro reflects a strategic benchmark that is part of the mix of policies and instruments developed in the context of the post-financial crisis of 2008, which is being tested, adjusted, and enriched in the pandemic context. The authors proposed a new approach and viewed the “health” of the banking system from two perspectives: (1) as being reflected by domestic credit to the private sector relative to GDP (the higher the share of credit in GDP, the more involved the banking system is in the economy) and (2) as being reflected by the level of nonperforming loans in total loans (the higher the nonperforming loans rate, the less healthy the banking system is).

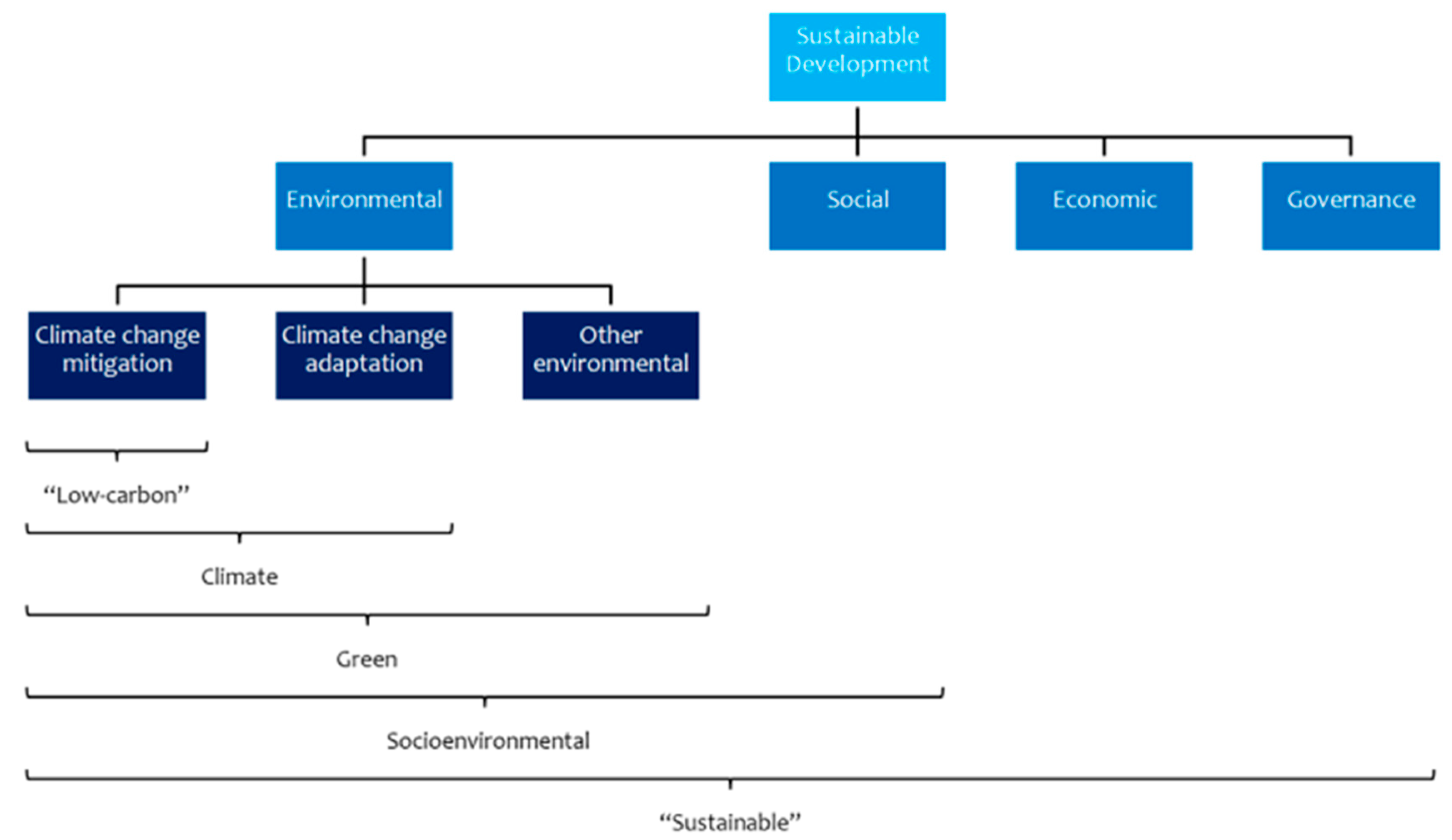

The paper addresses a topical issue of strategic importance for the European economy and society. The focus of the paper is also reflected in

Figure 1 [

4,

5], by addressing macroeconomic, social, and governance factors, both from a qualitative and quantitative perspectives.

The analysis of the issue of this paper begins with the literature review, which presents research and specialized studies relevant to the theme of this article, followed by the section that presents aspects of the research methodology. The next section of this paper reflects the results of the research, based on the two models created, which show to what extent macroeconomic, social, and governance factors influence the level of domestic credit to the private sector and the rate of nonperforming loans. In the Discussion Section, the authors also included other considerations that can add value to current and future research. The paper ends with the Conclusions Section.

2. Literature Review

Numerous research reports and specialized studies deal with the issue of sustainable development. The notion of sustainability is a complex one, and its creation requires multisectoral cooperation, the involvement of both governmental and nongovernmental sectors, citizens, companies, and, implicitly, the financial sector [

6].

Sustainability integrates issues specific to the use of ESG criteria and risks; therefore, it encompasses three pillars: environment (E), social environment (S), and governance (G) [

7]. In his paper, Danciu [

8] states that sustainability as a whole is composed of three dimensions in permanent interaction: environmental sustainability, social sustainability, and governance/economic sustainability.

The concept of sustainable development is much more comprehensive than the concept of green financing—sustainable development includes environmental, social, economic, and governance, while green financing includes climate and other environmental funding but excludes social, economic, and governance aspects. Thus, ecological financing is correlated mainly with environmental factors [

4,

5].

Figure 1 [

4,

5] reflects and clarifies certain concepts that have a broader understanding. The transition to the green economy and ensuring financial stability in this context of transition are significantly influenced by the role of regulations and regulators in the financial field, from the perspective of green, sustainable banking, and from the perspective of developed financing mechanisms and the impact on the real economy. The complexity and specificity of this strategic approach are reflected in

Figure 1.

For 2020, Global Risk Profile (GRP) published a ranking of the ESG index (calculated on the basis of 44 variables) for 176 countries and territories (

Table 1) [

9]. At the level of the European Union, the best ESG score is attributed to Finland, the assigned risk being very low, while Romania occupies 26th place, with an assigned score of 29.51. Worldwide, the ranking indicates Switzerland in the first place (9.85), and the last place is occupied by Chad (80.63).

The transmission of climate risk to the financial sector can be achieved in two ways: (i) climate change can directly affect financial stability through the impact of natural disasters and (ii) uncertainties regarding the speed of implementation processes of sustainability strategies can negatively affect financial stability [

10].

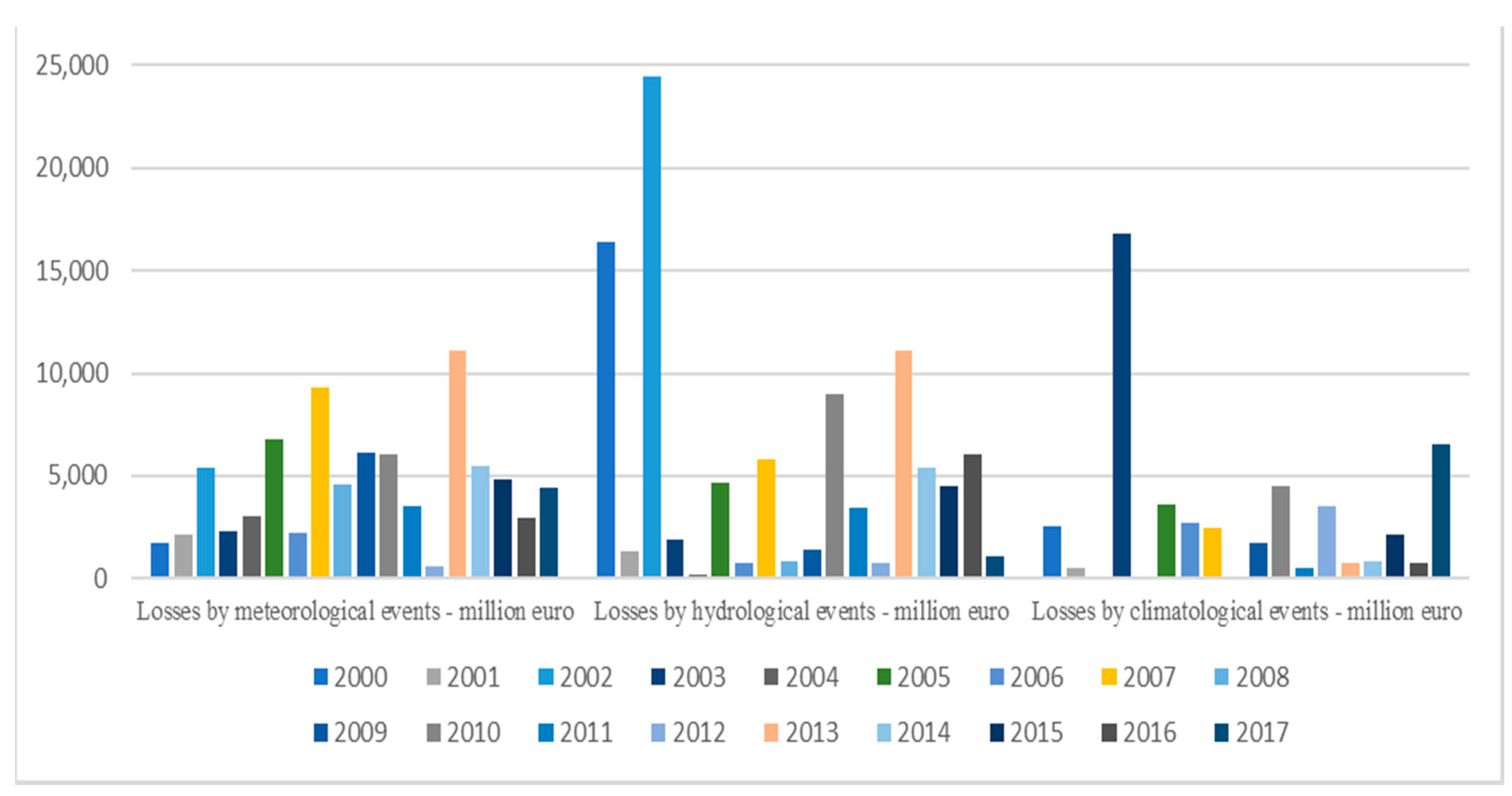

According to data published by Eurostat [

11], meteorological events caused significant losses, especially in 2007, while in 2002, there were the largest losses caused by hydrological events. Of the entire analyzed period (2000–2017), the year 2003 brought the largest losses caused by climatic events (

Figure 2).

The concept of sustainability represents a great interest from a global perspective. In 2015, the United Nations presented the 17 Sustainable Development Goals (SDGs) [

12]; each goal is associated with a set of relevant indicators. The objectives for sustainable development are presented in

Table 2.

The European economy is based mainly on bank financing, banks having a determining role in financing European economies and the European economy as a whole, while the US economy is based mainly on financing through capital markets, i.e., financial markets. From this perspective, the banking sector has a strategic role in adequately accommodating and supporting the European economy and development prospects.

The financial crisis of 2008 has paradoxically represented an opportunity for banking institutions around the world to calibrate risk and performance better. Stephens and Skinner note that this crisis has been partly linked to international investment and lending culture characterized, in particular, by speculation and deregulation [

13], in which profit maximization is more important than risk assessment and risk management. In this context, banks must contribute and add value to the process of sustainable development.

In the same context, Jeucken and Bouma [

14] state that sustainable banking is a global movement to transform the banking sector and develop new sustainable business models and strategies. The role of central banks in this transition process is significant, given their mandates, including financial stability, and their functions in managing the dynamics of the financial sector [

5].

The close link between banks and the economy has been the subject of many studies. Barattieri et al. [

15] have shown that the GDP growth rate follows an upward trend when banks are more involved in the real economy, and Monnin and Jokipii note that the stability of the banking sector is positively correlated with the growth rate of gross domestic product [

16].

Lorenc and Zhang also conclude that a country’s poor economic performance causes stress in the banking system, but moreover, they point out that the stress of the banking system leads to the poor economic performance of the country [

17]. At the European level, Balcerzak et al. show that banking systems in countries that have adopted the euro are more efficient than banking systems in countries that have not yet adopted the single currency [

18].

The systemic importance of banks is another significant factor in terms of the sustainability and well-being of an economy. In 1983, Bernanke pointed out that stress among larger banks has a greater negative impact on the economy than stress among smaller banks [

19]. In more developed financial systems, a banking crisis causes more contraction in sectors highly dependent on external financing [

20]. In developed countries, banking crises significantly affect output, while in developing countries, the output is affected by currency crises [

21]. Musa et al. [

22] show that a bank’s efficiency is also affected by its profile.

In a macroeconomic context, the study of Nizam et al. demonstrates that the inflation rate and the growth rate of gross domestic product positively influence the bank’s return on equity [

23].

In the context of the coronavirus pandemic, the measures taken by the states of the world in order to limit the transmission of the virus have caused fear among the population, with psychological, social, and economic effects [

24]. Limiting the activity of certain sectors of activity, along with limiting the mobility of the population, has led to increases in the unemployment rate and a decrease in the wage level.

In their study, Suciu et al. reinforce the idea that human capital is crucial for any company. Thus, both the improvement of a company’s financial performance and the reduction of risks depend on the professional development of employees, inclusion, and diversity [

25]. The importance of investments in labor is even higher in the context generated by the COVID-19 pandemic (working overtime, teleworking, restructuring, new working conditions), as noted by Tecău et al. [

26].

Employee satisfaction, cultural and gender diversity, flexible work schedules, and wage benefits are important variables for increasing financial performance. Adesina (2020) demonstrates that there is a close link between the development of human capital and the diversification of banking activities, along with the creation of sustainable and efficient banking systems, concluding that human capital efficiency has a positive impact on financial performance [

27]. Additionally, the process of digitalization of a company leads to increased productivity and higher wage benefits [

3].

Gender diversity must be taken into account throughout the hierarchy of a company —from executive positions to senior management. Owen and Temesvary show in their study that with increasing gender diversity, the CEO’s salary decreases, which indicates that there is no linear relationship between them [

28].

In order to implement sustainable policies and strategies, governments must adjust fiscal policies and legal regulations, recognize the need for green funding, and attract social resources. The process of transition to a sustainable economy can only be completed through permanent collaboration between governments, commercial banks, companies, and the population, and not only at the European Union level but globally [

3].

3. Materials and Methods

The study aims to contribute to the future formulation of an answer to a complex question: Do social factors, governance factors, and macroeconomic factors in a specific country, influence that country’s banking system?

In order to provide a framework for an answer and to highlight the relationships between the selected indicators at the EU level, the robustness of a financial system was considered to be reflected by domestic credit to the private sector (positive correlation) and by the rate of nonperforming loans in total loans (negative correlation). The study proposed the following hypotheses:

Hypothesis 1 (H1). The degree of the banking development of a country positively influences domestic credit to the private sector in that country and negatively influences the rate of nonperforming loans.

Hypothesis 2 (H2). Social factors (life expectancy, social inequality, the strength of legal rights, and bureaucracy) impact the robustness of the financial system.

Hypothesis 3 (H3). There is a correlation between governance factors (quality of the regulatory system and efficiency of governance) and the robustness of the banking system.

Hypothesis 4 (H4). Macroeconomic indicators (gross domestic product per capita, unemployment rate among the population with advanced education, annual growth rate of gross domestic product, inflation) are correlated with the robustness of the banking system.

The case study reflected the impact of macroeconomic, social, and governance variables on the robustness of the banking system and, implicitly, the close links between the well-being of society, the banking system, regulators, and policymakers.

The methodology used to verify the established hypotheses includes the collection of annual data series for the 27 states of the European Union, for the period 2005–2018, the data source being the World Bank. In the context of sustainability and well-being, the indicators considered relevant for the research are the following:

macroeconomic indicators—gross domestic product per capita, the unemployment rate among the population with higher education, the annual growth rate of gross domestic product, inflation;

relevant indicators for the banking system—domestic credit to the private sector, the banking development degree of a country;

social factors—life expectancy at birth, social inequality, the power of legal rights, bureaucracy;

governance factors—the quality of the regulatory system, the efficiency of governance.

The robustness of the banking system, estimated by the level of domestic credit to the private sector and by the rate of nonperforming loans in total loans, was considered a dependent variable.

To evaluate the impact of each variable on the robustness of the banking system, authors started from the following regression equation:

The advantages of using the multiple linear regression are the ability to determine the relative influence of one or more independent variables on the dependent variable (in this case study, the impact of macroeconomic, social, and governance factors on the banking system of the European Union) and the ability to identify which of the considered independent variables does not impact the dependent variable. This method also has some disadvantages—linear regression is prone to underfitting, and it is sensitive to outliers.

Equation (1) is estimated by the least squares method, and all variables used in the model are presented in

Table 3.

The variables described above will be replaced in Equation (1) to estimate their impact on the domestic credit to the private sector and on the rate of nonperforming loans in total loans granted.

4. Results

4.1. The Robustness of the Banking System Reflected by the Share of Domestic Credit to the Private Sector in Gross Domestic Product

A higher share of private-sector lending in GDP reflects a robust banking system. By substituting the coefficients in Equation (1), the regression equation will have the following form:

From the data of

Table 4, an R-Squared value of 0.6392 means that the independent variables explain about 64% of the variation of the dependent variable. It is also observed that all the independent variables are statistically significant, in all cases, the probability registering values below the 5% threshold, and the result Durbin Watson stat <2 (0.19) shows a positive serial correlation.

From the regression output, all four hypotheses are validated, considering that all the independent variables are statistically significant. However, in what direction do these variables influence the robustness of the banking system?

According to Hypothesis 1, the banking development degree positively influences domestic credit to the private sector, and to test this hypothesis, the number of commercial bank branches per 100,000 adults in the 27 countries of the European Union was used. The coefficient of this variable is positive, which means that a higher banking development degree leads to greater robustness of the banking system by increasing the lending of the private sector as a percentage of gross domestic product. Thus, Hypothesis 1 is validated.

The coefficients of the variables that define life expectancy and the strength of legal rights are positive, and therefore, there is a positive relationship between them and the robustness of the banking system—both an increase in life expectancy at birth and an increase in the strength of legal rights lead to an increase in lending to the private sector. At the same time, the coefficients of the variables that define social inequality and bureaucracy are negative—an increase in social inequality and bureaucracy decreases the robustness of the banking system, which validates Hypothesis 2.

For Hypothesis 3, the authors assumed that the factors associated with governance are correlated with the robustness of the banking system. This hypothesis is validated because the coefficients of the variables that define the quality of the regulatory system and the efficiency of governance are positive; hence, there is a positive correlation between them and the robustness of the banking system—the more the government has the capacity to formulate and implement solid policies and regulations to promote the development of the private sector, and the higher the efficiency of governance, the higher the share of domestic credit to the private sector in the gross domestic product.

The robustness of the banking system, reflected in the share of domestic credit to the private sector in GDP, is also influenced by macroeconomic indicators. From the regression output, the variables that define the unemployment rate among the population with advanced education and inflation have positive coefficients (positive correlation), while the variables that define the gross domestic product per capita and the annual growth rate of the gross domestic product have negative coefficients (negative correlation). Hypothesis 4 is thus validated.

4.2. The Robustness of the Banking System Reflected by the Share of Nonperforming Loans in the Total Loans Granted

The robustness of a banking system can also be perceived by the share of nonperforming loans in the total loans granted—the lower the share of nonperforming loans, the more robust the financial system is. To observe the impact of the same macroeconomic, governance, and social factors described above on this variable, Equation (1) will be used, in which the coefficients will be replaced as follows:

From the data of

Table 5, an R-Squared value of 0.5792 means that the independent variables explain about 58% of the variation of the dependent variable, and the result Durbin Watson stat <2 (0.25) shows a positive serial correlation.

From the regression output, it is noticed that the four hypotheses considered can be partially validated, given that not all independent variables are statistically significant.

According to Hypothesis 1, the banking development degree negatively influences the rate of nonperforming loans, and to test this hypothesis, the number of branches of commercial banks per 100,000 adults in the 27 countries of the European Union was used. The coefficient of this variable is negative, which means that a higher banking development degree leads to greater robustness of the banking system by decreasing the share of nonperforming loans in total loans. Thus, Hypothesis 1 is validated.

The probability associated with the variables that define life expectancy and the strength of legal rights is higher than 5%, and therefore, these variables are not statistically significant. At the same time, the coefficients of the variables that define social inequality and bureaucracy are negative—an increase in social inequality and bureaucracy decreases the rate of nonperforming loans, which partially validates Hypothesis 2.

For Hypothesis 3, it is assumed that the factors associated with governance are correlated with the robustness of the banking system. This hypothesis is partially validated because the probability associated with the variable that defines the quality of the regulatory system is higher than 5%, which is not statistically significant. The coefficient of the variable that defines the efficiency of government is negative; therefore, there is a negative correlation between it and the rate of nonperforming loans—a decrease in the government’s ability to formulate and implement solid policies and regulations to enable and promote private sector development and lower government efficiency result in higher nonperforming loans rate in the total loans granted. Hypothesis 3 is partially validated.

The robustness of the banking system, reflected here by the nonperforming loans rate, is also influenced by macroeconomic indicators. From the regression output, it is noticeable that the variable that defines the unemployment rate among the population with advanced education has a positive coefficient (positive correlation), and the coefficient that defines inflation is negative, while the probability of variables that define gross domestic product per capita and the annual growth rate of gross domestic product is higher than 5%, these variables not being significant to explain the variation of the nonperforming loans rate. Thus, Hypothesis 4 is partially validated.

5. Discussion

After analyzing the two regressions, in the context of the hypotheses considered, it can be summarized that the banking development degree determines the increases of domestic credit to the private sector and the decrease of nonperforming loans rate. Social factors differently impact private-sector lending and nonperforming loans. The analysis shows that life expectancy, social inequality, the strength of legal rights, and bureaucracy are correlated with the level of private-sector lending, while the rate of nonperforming loans can be explained by social inequality and bureaucracy.

The quality of the regulatory system and the efficiency of governance influence the share of private-sector lending in gross domestic product, and the rate of nonperforming loans in total loans is correlated in particular with the efficiency of governance.

All macroeconomic indicators used (gross domestic product per capita, unemployment rate among the population with advanced education, annual growth rate of gross domestic product, inflation) influence the level of private-sector lending, while the rate of nonperforming loans is influenced, in particular, by the unemployment rate among the population with advanced education and inflation.

The study shows that, at the European Union level, there is a strong link between the evolution of the banking system and macroeconomic, social, and governance factors. As Barattieri et al. [

15] also demonstrate, the GDP growth rate follows an upward trend when banks are more involved in the real economy. In line with Monnin and Jokipii [

16], this paper highlights that the banking sector and its evolution must be taken into account in forecasting models developed by policymakers.

Consequently, in order to promote and adopt a culture of sustainability, as well as to ensure well-being, the banking sector must benefit from innovative resources, tools, and mechanisms, appropriate regulations. A synergistic connection between micro and macro should be ensured, from performance and risk management perspectives, in order to contribute and support financial stability.

Banking institutions need to ensure that the activities they undertake in the context of sustainability are aligned with their operational activities, as noted by Vărzaru et al. (2021) [

29].

Lending, the main revenue-generating activity for banks, is also an important channel in the context of sustainability, as shown by Nizam et al. [

23]—an increase in lending to companies and projects with a positive impact on the environment translates into better financial performance.

Several banks have also issued green bonds to support climate or environmental projects, using them to develop a market, to mobilize the private sector, and to finance climate and ecological activities [

30].

In the context of sustainability, corporate governance of financial institutions should be adjusted, mainly from the risk management perspective, to gradually adopt the ESG risks and criteria. The adoption process is of high relevance and should be implemented at both the financial organization level and the systemic level. Redefining the risk management framework and standardizing sustainable practices at the level of the European banking system are key priorities to ensure a strong funding channel for the green initiatives and programs.

6. Conclusions

The paper reflects the fact that sustainability must be achieved and supported through active, integrative participation, and through risk taking and benefit sharing to all stakeholders.

Sustainability involves, among other things, understanding, assessing, and integrating environmental, social, and governance risks and macroeconomic risks into the activities of an economy. Banking institutions, the main financing channel of the European economy, must adapt and orient their business strategies and organizational culture to support sustainable development, both in their activities and to ensure the well-being of employees, customers, and communities, in which they grow business.

The impact of macroeconomic, social, and governance factors on the sustainability and well-being of the economic environment and the robustness of the banking system are particularly relevant components, which need to be adequately monitored and reflected in the policy mix.

The empirical study provides support to formulate answers to the complex question, included in the research. Thus, it is highlighted that the degree of banking development of a country contributes to the increase of private-sector lending and to decrease of the nonperforming loans rate. Life expectancy, social inequality, the strength of legal rights, and bureaucracy are correlated with the level of private-sector lending, while the rate of nonperforming loans can be explained mainly through social inequality and bureaucracy. The quality of the regulatory system and the efficiency of governance influence the share of private-sector lending in the gross domestic product, and the rate of nonperforming loans is correlated with the efficiency of governance. Gross domestic product per capita, the unemployment rate among the population with advanced education, the annual growth rate of gross domestic product, and inflation impact the level of private-sector lending, while the rate of nonperforming loans is influenced only by the unemployment rate among the population with advanced education and inflation.

All challenges arising in the context of implementing sustainable strategies must be turned into development opportunities for all actors in the economy—banks, companies, customers, local authorities, supervisory, and regulatory authorities. The need for close collaboration between all sectors of an economy (public and private) is vital, as Monnin and Jokipii note: in forecasting models developed by policymakers, they must take into account the banking sector and its evolution [

16].

Although in the short term, the implementation of sustainable development strategies involves high costs by rethinking and reconfiguring activities, in the long run, the potential benefits are significantly higher, both at the microeconomic level (sustainable development of the company) and at macroeconomic level (well-being of society as a whole).

The paper reflects relevant results related to the need to interrelate various factors, their inclusion in a set of harmonized policies to determine sustainability and well-being for the economic environment in the long run.

From a financial sustainability perspective, it is appropriate for Europe to continue to develop an integrated banking system, alongside the other strategic pillar capital markets. Diversification of risks, diversification of financing alternatives, and diversification of profit sources are key points for sustainable European architecture, integrating the digitalization of the European economy and finances, the transition to the green economy, and ensuring the exit from the pandemic and economic crisis.

The paper represents a valuable insight for future policies as well as a starting point for new research synergies, e.g., between other relevant indicators, amplified by the current pandemic context, and by the impact of programs developed to support the European economies.

This empirical study has some limitations. First, in the second regression, independent variables were found that were not statistically significant, among others. Second, the environmental component, emphasized by the letter “E” within ESG criteria and risks, was not included in the quantitative part of this study, because of the lack of relevant data for the analyzed period. This component was approached from a qualitative perspective in this paper and will be considered in the following research work.