Dynamic Portfolio Selection in Gas Transmission Projects Considering Sustainable Strategic Alignment and Project Interdependencies through Value Analysis

Abstract

1. Introduction

2. Literature Review

2.1. Sustainable Strategic Project Portfolio Selection

2.2. Project Interdependencies within a Portfolio

2.3. Dynamic Project Portfolio Selection

3. An Integrated Framework for Project Portfolio Selection

3.1. Preliminary Stage Phase

3.1.1. Identifying the DMs

3.1.2. Identifying Evaluation Concerns and Constraints

3.1.3. Providing a List of Potential Projects

3.1.4. Preparing the Map of Project Interdependencies

3.2. Building the Optimization Model Phase

3.3. Project Portfolio Selection Phase

4. Modeling of the Iranian Gas Engineering and Development Company (IGEDC) Gas Pipeline Project Portfolio Selection

4.1. Preliminary Stage Phase

4.1.1. Identifying the DMs

4.1.2. Identifying Evaluation Concerns and Constraints

- Economic concerns

- Environmental concerns

- -

- Avoiding/minimizing pipeline construction within or near the protected area.

- -

- Avoiding/minimizing intersection with rivers, seas, and surface water.

- -

- Minimizing land use changes and vegetation cover removal.

- Social concerns

- -

- Avoiding/minimizing routes that have not kept their standard distances from populated areas.

- -

- Maximizing the number of households of developed regions with access to natural gas.

- -

- Maximizing the number of households living in less developed regions of the country with access to natural gas.

- -

- Maximizing the number of households living in cold areas with natural gas access.

- Technical concerns

- -

- Avoiding/minimizing the routes that cross areas with steep slopes, and other unfavorable land features.

- -

- Avoiding/minimizing the routes that intersect with existing pipelines, highways, high-voltage power lines, and other existing infrastructure.

4.1.3. Providing a List of Potential Projects

4.1.4. Preparing the Map of Possible Projects Interdependencies

- -

- Actors/component dimension: identifying all the participating actors (projects) in the networks.

- -

- Relationship dimension: The projects can be linked through different types of interdependencies. This dimension focuses on determining types of interdependencies, e.g., cost, NPV, social effect, environmental effect, technical interdependency.

4.2. Building the Optimization Model Phase

4.3. Project Portfolio Selection Phase

5. Computational Results

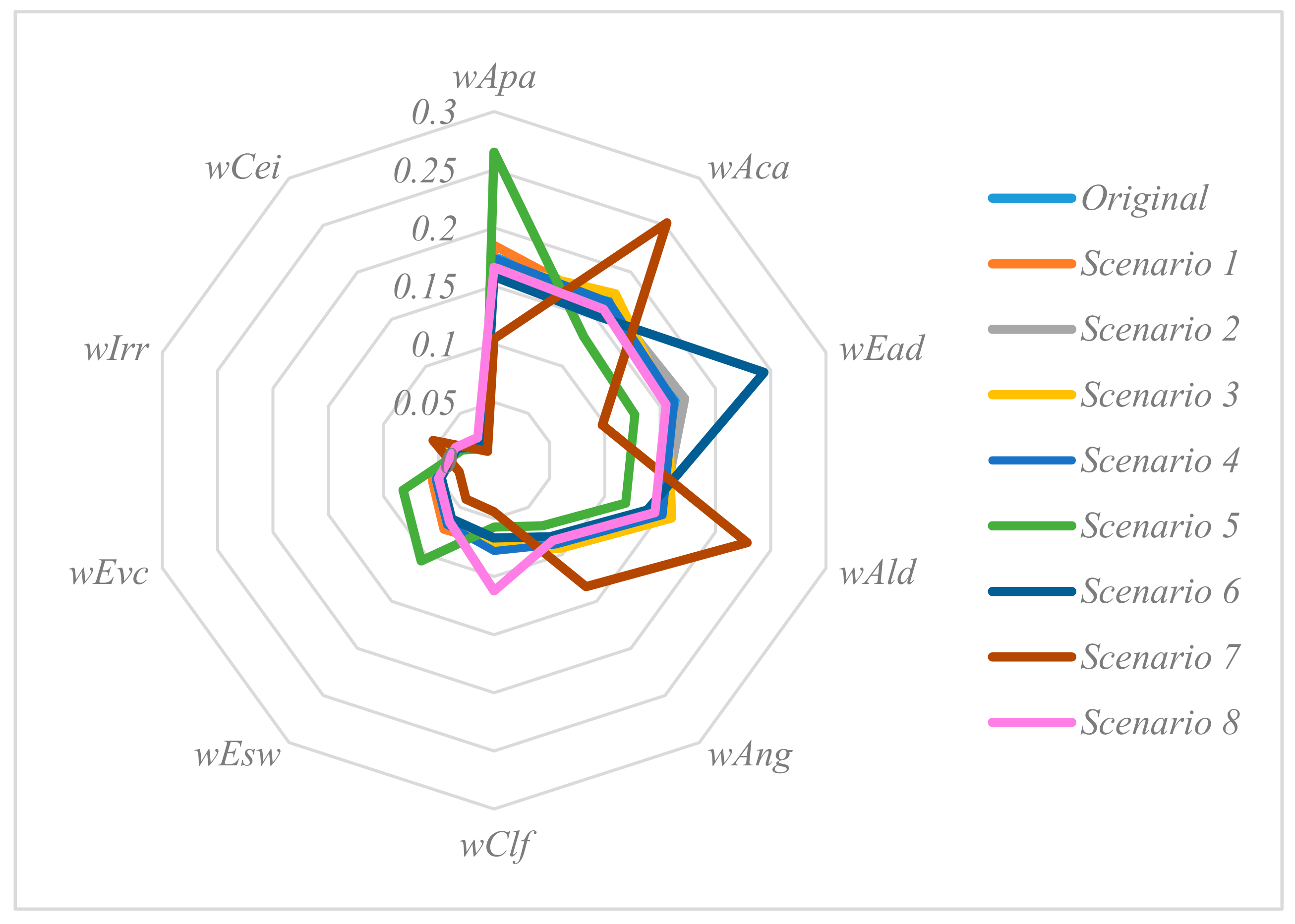

Sensitivity Analysis

6. Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- Liu, D.; Zhou, W.; Pan, X. Risk evaluation for city gas transmission and distribution system based on information revision. J. Loss Prev. Process Ind. 2016, 41, 194–201. [Google Scholar] [CrossRef]

- Guo, M.; Bu, Y.; Cheng, J.; Jiang, Z. Natural Gas Security in China: A Simulation of Evolutionary Trajectory and Obstacle Degree Analysis. Sustainability 2019, 11, 96. [Google Scholar] [CrossRef]

- Khan, M.I. Evaluating the strategies of compressed natural gas industry using an integrated SWOT and MCDM approach. J. Clean. Prod. 2018, 172, 1035–1052. [Google Scholar] [CrossRef]

- Balogun, A.; Matori, A.; Lawal, D.U.; Chandio, I. Optimal oil pipeline route selection using GIS: Community participation in weight derivation and disaster mitigation. In Proceedings of the International Conference on Future Environment and Energy, Singapore, 26–28 February 2012; Volume 28, pp. 100–104. [Google Scholar]

- Li, M.; Liu, L.; Li, Y.; Xu, Y. Evaluating the Risk of Natural Gas Pipeline Operation Management in Intuitionistic Fuzzy Linguistic Environments. Math. Probl. Eng. 2018. [Google Scholar] [CrossRef]

- Hafezi, R.; Akhavan, A.N.; Pakseresht, S. Projecting plausible futures for Iranian oil and gas industries: Analyzing of historical strategies. J. Nat. Gas Sci. Eng. 2017, 39, 15–27. [Google Scholar] [CrossRef]

- Sweis, R.; Moarefi, A.; Amiri, M.H.; Moarefi, S.; Saleh, R. Causes of delay in Iranian oil and gas projects: A root cause analysis. Int. J. Energy Sect. Manag. 2019, 13, 630–650. [Google Scholar] [CrossRef]

- Castillo, L.; Dorao, C.A. Decision-making in the oil and gas projects based on game theory: Conceptual process design. Energy Convers. Manag. 2013, 66, 48–55. [Google Scholar] [CrossRef]

- Ghasemzadeh, F.; Archer, N.P. Project portfolio selection through decision support. Decis. Support Syst. 2000, 29, 73–88. [Google Scholar] [CrossRef]

- Li, X.; Wang, Y.; Yan, Q.; Zhao, X. Uncertain mean-variance model for dynamic project portfolio selection problem with divisibility. Fuzzy Optim. Decis. Mak. 2019, 18, 37–56. [Google Scholar] [CrossRef]

- Dey, P.K. An integrated assessment model for cross-country pipelines. Environ. Impact Assess. Rev. 2002, 22, 703–721. [Google Scholar] [CrossRef]

- Valavanides, M.S. Portfolios as off-equilibrium processes: Similarities and affinities—Towards rational prioritizing and selecting portfolio components. Procedia Soc. Behav. Sci. 2014, 119, 539–548. [Google Scholar] [CrossRef]

- Kaiser, M.G.; Arbi, F.E.; Ahlemann, F. Successful project portfolio management beyond project selection techniques: Understanding the role of structural alignment. Int. J. Proj. Manag. 2015, 33, 126–139. [Google Scholar] [CrossRef]

- Rad, F.H.; Rowzan, S.M. Designing a hybrid system dynamic model for analyzing the impact of strategic alignment on project portfolio selection. Simul. Model. Pract. Theory 2018, 89, 175–194. [Google Scholar]

- Tanriverdi, H. Information technology relatedness, knowledge management capability, and performance of multibusiness firms. MIS Q. 2005, 29, 311–334. [Google Scholar] [CrossRef]

- Mild, P.; Liesiö, J.; Salo, A. Selecting infrastructure maintenance projects with Robust Portfolio Modeling. Decis. Support Syst. 2015, 77, 21–30. [Google Scholar] [CrossRef]

- Gonçalves, L.R.; Mello, A.M.D.; Nascimento, P.T.S. How different R&D project types are terminated. In Proceedings of the PICMET’14 Conference: Portland International Center for Management of Engineering and Technology, Infrastructure and Service Integration, Kanazawa, Japan, 27–31 July 2014; IEEE: Piscataway, NJ, USA; pp. 2506–2515. [Google Scholar]

- Canbaz, B.; Marle, F. Construction of project portfolio considering efficiency, strategic effectiveness, balance and project interdependencies. Int. J. Proj. Organ. Manag. 2016, 8, 103–126. [Google Scholar] [CrossRef]

- Cooper, R.G.; Edgett, S.J.; Kleinschmidt, E.J. New product portfolio management: Practices and performance. J. Prod. Innov. Manag. 1999, 16, 333–351. [Google Scholar] [CrossRef]

- Archer, N.; Ghasemzadeh, F. An integrated framework for project portfolio selection. Int. J. Proj. Manag. 1999, 17, 207–216. [Google Scholar] [CrossRef]

- Oosthuizen, C.; Grobbelaar, S.S.; Bam, W. Exploring the link between PPM implementation and company success in achieving strategic goals: An empirical framework. S. Afr. J. Ind. Eng. 2016, 27, 238–250. [Google Scholar] [CrossRef]

- Wu, Y.; Li, J.; Wang, J.; Huang, Y. Project portfolio management applied to building energy projects management system. Renew. Sustain. Energy Rev. 2012, 16, 718–724. [Google Scholar] [CrossRef]

- García-Melón, M.; Poveda-Bautista, R. Using the strategic relative alignment index for the selection of portfolio projects application to a public Venezuelan Power Corporation. Int. J. Prod. Econ. 2015, 170, 54–66. [Google Scholar] [CrossRef]

- Wu, Y.; Xu, C.; Ke, Y.; Li, X.; Li, L. Portfolio selection of distributed energy generation projects considering uncertainty and project interaction under different enterprise strategic scenarios. Appl. Energy 2019, 236, 444–464. [Google Scholar] [CrossRef]

- Debnath, A.; Roy, J.; Kar, S.; Zavadskas, E.K.; Antucheviciene, J. A hybrid MCDM approach for strategic project portfolio selection of Agro by-products. Sustainability 2017, 9, 1302. [Google Scholar] [CrossRef]

- Khalili-Damghani, K.; Tavana, M. A comprehensive framework for sustainable project portfolio selection based on structural equation modeling. Proj. Manag. J. 2014, 45, 83–97. [Google Scholar] [CrossRef]

- Tinoco, M.A.; Dutra, C.; Ribeiro, J.L.; Miorando, R.; Caten, C.S. An integrated model for evaluation and optimisation of business project portfolios. Eur. J. Ind. Eng. 2018, 12, 442–463. [Google Scholar] [CrossRef]

- Dobrovolskien˙e, N.; Tamošiuniene, R. Sustainability-Oriented Financial Resource Allocation in a Project Portfolio through Multi-Criteria Decision-Making. Sustainability 2016, 8, 485. [Google Scholar]

- Yi, P.; Li, W.; Zhang, D. Assessment of city sustainability using MCDM with interdependent criteria weight. Sustainability 2019, 11, 1632. [Google Scholar] [CrossRef]

- Xu, D.; Lv, L.; Ren, X.; Ren, J.; Dong, L. Route selection for low-carbon ammonia production: A sustainability prioritization framework based-on the combined weights and projection ranking by similarity to referencing vector method. J. Clean. Prod. 2018, 193, 263–276. [Google Scholar] [CrossRef]

- Kwast-kotlarek, U.; Hełdak, M. Evaluation of the Construction and Investment Process of a High-Pressure Gas Pipeline with Use of the Trenchless Method and Open Excavation Method. Analytic Hierarchy Process (AHP). Sustainability 2019, 11, 2438. [Google Scholar] [CrossRef]

- Lee, J.W.; Kim, S.H. An integrated approach for interdependent information system project selection. Int. J. Proj. Manag. 2001, 19, 111–118. [Google Scholar] [CrossRef]

- Bathallath, S.; Smedberg, Å.; Kjellin, H. Managing project interdependencies in IT/IS project portfolios: A review of managerial issues. Int. J. Inf. Syst. Proj. Manag. 2016, 4, 67–82. [Google Scholar]

- Thompson, J.D. Organizations in Action: Social Science Bases of Administrative Theory; Transaction Publishers: New Brunswick, NJ, USA, 2003. [Google Scholar]

- Santhanam, R.; Kyparisis, G.J. A decision model for interdependent information system project selection. Eur. J. Oper. Res. 1996, 89, 380–399. [Google Scholar] [CrossRef]

- Schmidt, R.L. A model for R&D project selection with combined benefit, outcome and resource interactions. IEEE Trans. Eng. Manag. 1993, 40, 403–410. [Google Scholar]

- Eilat, H.; Golany, B.; Shtub, A. Constructing and evaluating balanced portfolios of R&D projects with interactions: A DEA based methodology. Eur. J. Oper. Res. 2006, 172, 1018–1039. [Google Scholar]

- Ghapanchi, A.H.; Tavana, M.; Khakbaz, M.H.; Low, G. A methodology for selecting portfolios of projects with interactions and under uncertainty. Int. J. Proj. Manag. 2012, 30, 791–803. [Google Scholar] [CrossRef]

- Dickinson, M.W.; Thornton, A.C.; Graves, S. Technology portfolio management: Optimizing interdependent projects over multiple time periods. IEEE Trans. Eng. Manag. 2001, 48, 518–527. [Google Scholar] [CrossRef]

- Stummer, C.; Heidenberger, K. Interactive R&D portfolio analysis with project interdependencies and time profiles of multiple objectives. IEEE Trans. Eng. Manag. 2003, 50, 175–183. [Google Scholar]

- Liesiö, J.; Mild, P.; Salo, A. Robust portfolio modeling with incomplete cost information and project interdependencies. Eur. J. Oper. Res. 2008, 190, 679–695. [Google Scholar] [CrossRef]

- Ghasemi, F.; Sari, M.; Yousefi, V.; Falsafi, R.; Tamošaitienė, J. Project Portfolio Risk Identification and Analysis, Considering Project Risk Interactions and Using Bayesian Networks. Sustainability 2018, 10, 1609. [Google Scholar] [CrossRef]

- Killen, C.P.; Kjaer, C. Understanding project interdependencies: The role of visual representation, culture and process. Int. J. Proj. Manag. 2012, 30, 554–566. [Google Scholar] [CrossRef]

- Meyer, W.G. Early termination of failing projects: Literature review and research framework. In Proceedings of the PMI® Research and Education Conference, Limerick, Ireland, 16–18 July 2012; Project Management Institute: Limerick, Munster, Ireland; Newtown Square, PA, USA, 2012. [Google Scholar]

- Thornley, C.V.; Crowley, C.A. Developing the capability to terminate IT projects when they can no longer deliver business value: A discussion of key insights from practitioners. Int. J. Manag. Proj. Bus. 2018, 11, 406–431. [Google Scholar] [CrossRef]

- Unger, B.N.; Kock, A.; Gemünden, H.G.; Jonas, D. Enforcing strategic fit of project portfolios by project termination: An empirical study on senior management involvement. Int. J. Proj. Manag. 2012, 30, 675–685. [Google Scholar] [CrossRef]

- Cooper, R.G.; Edgett, S.J. Overcoming the crunch in resources for new product development. Res. Technol. Manag. 2003, 46, 48–58. [Google Scholar] [CrossRef]

- Belarbi, H. Improving Project Portfolio Decision Making in Theory and Practice. In Proceedings of the 24th European Conference on Information Systems (ECIS), Istanbul, Turkey, 12–15 June 2016. [Google Scholar]

- Huang, X.; Xiang, L.; Islam, S.M.N. Optimal project adjustment and selection. Econ. Model. 2014, 36, 391–397. [Google Scholar] [CrossRef]

- Huang, X.; Su, X.; Zhao, T. Optimal multinational project adjustment and selection with random parameters. Optimization 2014, 63, 1583–1594. [Google Scholar] [CrossRef]

- Ferreira, F.A.F.; Spahr, R.W.; Sunderman, M.A. Using multiple criteria decision analysis (MCDA) to assist in estimating residential housing values. Int. J. Strateg. Prop. Manag. 2016, 20, 354–370. [Google Scholar] [CrossRef]

- Marques, M.; Neves-silva, R. Decision support for energy savings and emissions trading in industry. J. Clean. Prod. 2015, 88, 105–115. [Google Scholar] [CrossRef]

- Lima, A.S.d.; Damiani, J.H.d.S. A proposed method for modeling research and development (R&D) project prioritization criteria. In Proceedings of the PICMET: Portland International Center for Management of Engineering and Technology, Portland, OR, USA, 2–6 August 2009; IEEE: Piscataway, NJ, USA, 2009; pp. 599–608. [Google Scholar]

- Bana e Costa, C.A.; Beinat, E. Model-Structuring in Public Decision-Aiding; Department of Operational Research, London School of Economic and Political Science: London, UK, 2005. [Google Scholar]

- Keeney, R.L. Value-Focused Thinking: A Path to Creative Decisionmaking; Harvard University Press: Cambridge, UK, 1992. [Google Scholar]

- Hummel, J.M.; Oliveira, M.D.; Bana e Costa, C.A.; IJzerman, M.J. Supporting the Project Portfolio Selection Decision of Research and Development Investments by Means of Multi-Criteria Resource Allocation Modelling. In Multi-Criteria Decision Analysis to Support Healthcare Decisions; Springer: Berlin/Heidelberg, Germany, 2017; pp. 89–103. [Google Scholar]

- Kumar, V.; Persaud, A.N.S.; Kumar, T. To terminate or not an ongoing R&D project: A managerial dilemma. IEEE Trans. Eng. Manag. 1996, 43, 273–284. [Google Scholar]

- Duarte, B.P.M.; Reis, A. Developing a projects evaluation system based on multiple attribute value theory. Comput. Oper. Res. 2006, 33, 1488–1504. [Google Scholar] [CrossRef]

- Keeney, R.L.; Raiffa, H.; Meyer, R.F. Decisions with Multiple Objectives: Preferences and Value Trade-Offs; Cambridge University Press: Cambridge, UK, 1993. [Google Scholar]

- Balogun, A.-L.; Matori, A.-N.; Hamid-Mosaku, A.I.; Lawal, D.U.; Chandio, I.A. Fuzzy MCDM-based GIS model for subsea oil pipeline route optimization: An integrated approach. Mar. Georesour. Geotechnol. 2017, 35, 961–969. [Google Scholar] [CrossRef]

- Antunes, C.H.; Henriques, C.O. Multi-objective optimization and multi-criteria analysis models and methods for problems in the energy sector. In Multiple Criteria Decision Analysis: State of the Art Surveys; Springer: New York, NY, USA, 2016; pp. 1067–1165. [Google Scholar]

- Bogucki, M.; Polonski, M. Risk analysis for high pressure gas pipeline construction schedule. In Proceedings of the IOP Conference Series: Materials Science and Engineering; IOP Publishing: Bristol, UK, 2019; Volume 471, p. 112042. [Google Scholar]

- Luo, H.; Xie, Y.; Lv, J. Effectiveness of soil and water conservation associated with a natural gas pipeline construction project in China. L. Degrad. Dev. 2019, 30, 768–776. [Google Scholar] [CrossRef]

- Krishna, P.; Moynihan, K.; Callon, D. Environmental Management Process for Major Projects. In Proceedings of the International Petroleum Technology Conference, Doha, Qatar, 7–9 December 2009. [Google Scholar]

- Chen, C.; Li, C.; Reniers, G.; Yang, F. Safety and security of oil and gas pipeline transportation: A systematic analysis of research trends and future needs using WoS. J. Clean. Prod. 2021, 279, 123583. [Google Scholar] [CrossRef]

- Zhang, P.; Qin, G.; Wang, Y. Optimal Maintenance Decision Method for Urban Gas Pipelines Based on as Low as Reasonably Practicable Principle. Sustainability 2019, 11, 153. [Google Scholar] [CrossRef]

- Dey, P.K. Analytic hierarchy process helps evaluate project in Indian oil pipelines industry. Int. J. Oper. Prod. Manag. 2004, 24, 588–604. [Google Scholar] [CrossRef]

- Lopes, Y.G.; de Almeida, A.T. Assessment of synergies for selecting a project portfolio in the petroleum industry based on a multi-attribute utility function. J. Pet. Sci. Eng. 2015, 126, 131–140. [Google Scholar] [CrossRef]

- Park, C.Y.; Han, S.H.; Lee, K.-W.; Lee, Y.M. Analyzing Drivers of Conflict in Energy Infrastructure Projects: Empirical Case Study of Natural Gas Pipeline Sectors. Sustainability 2017, 9, 2031. [Google Scholar] [CrossRef]

- Carazo, A.F.; Gómez, T.; Molina, J.; Hernández-Díaz, A.G.; Guerrero, F.M.; Caballero, R. Solving a comprehensive model for multiobjective project portfolio selection. Comput. Oper. Res. 2010, 37, 630–639. [Google Scholar] [CrossRef]

- Hassanzadeh, F.; Nemati, H.; Sun, M. Robust optimization for interactive multiobjective programming with imprecise information applied to R&D project portfolio selection. Eur. J. Oper. Res. 2014, 238, 41–53. [Google Scholar]

- e Costa, C.A.B.; De Corte, J.-M.; Vansnick, J.-C. MACBETH. Int. J. Inf. Technol. Decis. Mak. 2012, 11, 359–387. [Google Scholar] [CrossRef]

- Gürbüz, T.; Albayrak, Y.E. An engineering approach to human resources performance evaluation: Hybrid MCDM application with interactions. Appl. Soft Comput. J. 2014, 21, 365–375. [Google Scholar] [CrossRef]

- Carnero, M.C.; Gómez, A. A multicriteria model for optimization of maintenance in thermal energy production systems in hospitals: A case study in a Spanish hospital. Sustainability 2017, 9, 493. [Google Scholar] [CrossRef]

- Carnero, M.C.; Gómez, A. Optimization of Decision Making in the Supply of Medicinal Gases Used in Health Care. Sustainability 2019, 11, 2952. [Google Scholar] [CrossRef]

- Hurson, C.; Mastorakis, K.; Siskos, Y. Application of a synergy of MACBETH and MAUT multicriteria methods to portfolio selection in Athens stock exchange. Int. J. Multicriteria Decis. Mak. 2012, 2, 113–127. [Google Scholar] [CrossRef]

- Carnero, M.C.; Gómez, A. Maintenance strategy selection in electric power distribution systems. Energy 2017, 129, 255–272. [Google Scholar] [CrossRef]

- Costa, C.A.B.e.; Oliveira, M.D. A multicriteria decision analysis model for faculty evaluation. Omega 2012, 40, 424–436. [Google Scholar] [CrossRef]

- Komchornrit, K. The selection of dry port location by a hybrid CFA-MACBETH-PROMETHEE method: A case study of Southern Thailand. Asian J. Shipp. Logist. 2017, 33, 141–153. [Google Scholar] [CrossRef]

- Santhanam, R.; Kyparisis, J. A multiple criteria decision model for information system project selection. Comput. Oper. Res. 1995, 22, 807–818. [Google Scholar] [CrossRef]

| DMs | Expertise | Work Experience (Years) |

|---|---|---|

| Strategic planning manager | 20 | |

| Project manager | 15 | |

| Environmental expert | 12 | |

| Gas pipeline execution engineer | 10 | |

| Economic expert | 10 |

| Areas of Concern | Key Concerns | Abbreviation | Type of Descriptor | Descriptor of Performance |

|---|---|---|---|---|

| Economic | Economic advantage | Ead | Quantitative | The project’s net present value (The details of the calculation of NPV are shown in Appendix A) |

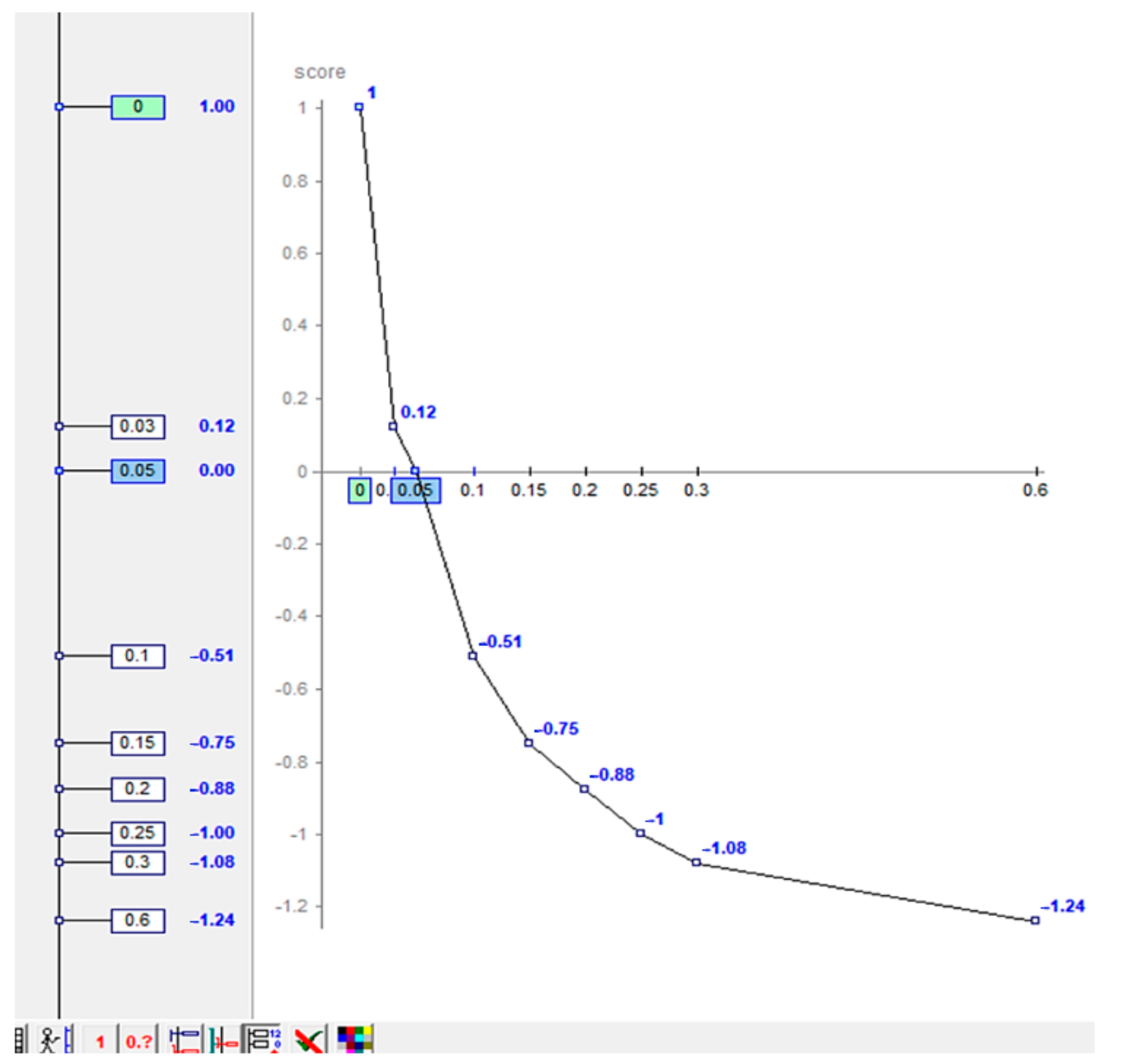

| Environmental | Effect on protected area | Epa | Quantitative/ Qualitative | Equivalent areas of the reference protected area of the project located in protected areas |

| Effect on surface water resources | Esw | Quantitative/ Qualitative | Equivalent number of intersections with reference surface water bodies | |

| Effect on vegetation cover | Evc | Quantitative/ Qualitative | Equivalent areas of the reference vegetation cover removed | |

| Social | Impact on residential areas along the route | Irr | Quantitative | Number of households affected due to short distance from the pipeline route |

| Access to natural gas | Ang | Quantitative | Number of households of developed regions which will access to natural gas | |

| Access of less developed regions of the country to natural gas | Ald | Quantitative | Number of households living in less developed regions of the country which access to natural gas | |

| Access of cold areas of the country to natural gas | Aca | Quantitative | Number of households living in cold areas which access to natural gas | |

| Technical | Constructability due to land features | Clf | Qualitative | Five qualitative performance levels |

| Constructability due to existing infrastructure | Cei | Quantitative/ Qualitative | Equivalent number of the reference type intersections with the pipeline route |

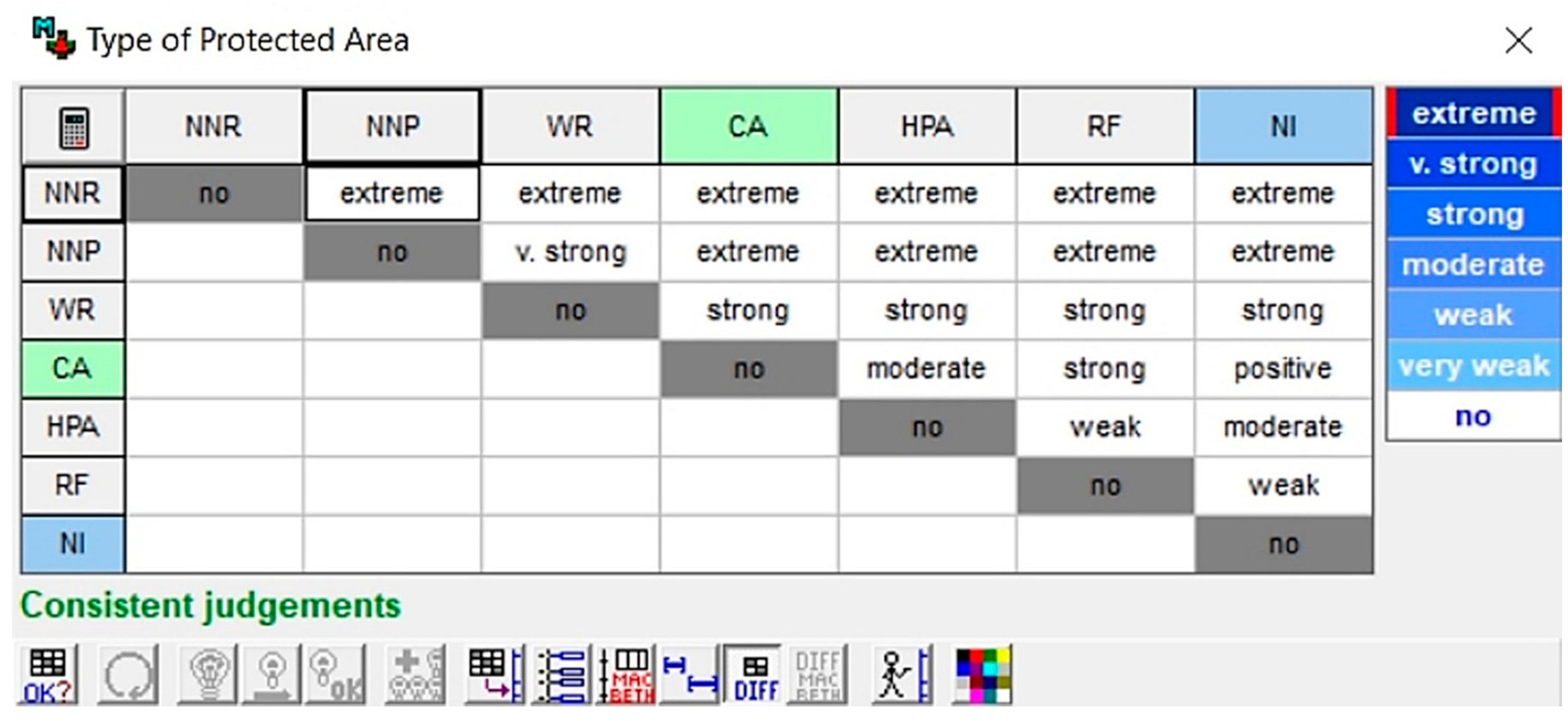

| Type of Protected Area | |

|---|---|

| National Nature Reserve | 5 |

| National Natural Park or International Lagoon | 3 |

| Wildlife Refuge | 1.99 |

| Conservation Area | 1 |

| Hunting Prohibited Area | 0.57 |

| Reserved Forest | 0.29 |

| Non-Interference | 0 |

| Project | OVS | Project | OVS | Project | OVS | Project | OVS |

|---|---|---|---|---|---|---|---|

| 0.87 | 1.45 | 0.19 | −0.04 | ||||

| 0.7 | 1.31 | 0.34 | −0.03 | ||||

| 0.72 | 1.25 | 0.24 | −0.09 | ||||

| −0.16 | 1.48 | 0.46 | −0.02 | ||||

| −0.04 | 1.28 | 0.11 | 0.46 | ||||

| 0.4 | 0.22 | 0.21 | −0.45 | ||||

| 0.68 | 0.2 | 0.83 | −0.45 | ||||

| 1.03 | 2.58 | 0.92 | 0.34 | ||||

| 1.03 | 2.79 | 0.87 | −0.54 |

| ||||||||||

| 1 | 1 | 0 | 1 | |||||||

| 1 | 0 | 0 | 0 | |||||||

| 0 | 0 | 0 | 0 | |||||||

| 0 | 1 | 1 | 1 | |||||||

| 1 | 0 | 0 | 1 | |||||||

| 0 | 0 | 1 | 0 | |||||||

| 1 | 1 | 0 | 0 | |||||||

| 0 | 0 | 0 | 0 | |||||||

| 1 | 1 | 0 | 0 | |||||||

| ||||||||||

| 1 | 1 | 0 | 1 | |||||||

| 1 | 0 | 0 | 1 | |||||||

| 0 | 0 | 0 | 1 | |||||||

| 0 | 1 | 1 | 0 | |||||||

| 1 | 0 | 0 | 0 | |||||||

| 0 | 1 | 1 | 0 | |||||||

| 1 | 0 | 0 | 0 | |||||||

| 0 | 1 | 0 | ||||||||

| 1 | 0 | 0 | ||||||||

| ||||||||||

| 1 | 1 | 0 | 1 | |||||||

| 0 | 0 | 0 | 0 | |||||||

| 1 | 0 | 0 | 0 | |||||||

| 0 | 1 | 1 | 1 | |||||||

| 1 | 0 | 0 | ||||||||

| 0 | 0 | 1 | ||||||||

| 1 | 1 | 0 | ||||||||

| 0 | 0 | 0 | ||||||||

| 1 | 1 | 0 | ||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lotfian Delouyi, F.; Ghodsypour, S.H.; Ashrafi, M. Dynamic Portfolio Selection in Gas Transmission Projects Considering Sustainable Strategic Alignment and Project Interdependencies through Value Analysis. Sustainability 2021, 13, 5584. https://doi.org/10.3390/su13105584

Lotfian Delouyi F, Ghodsypour SH, Ashrafi M. Dynamic Portfolio Selection in Gas Transmission Projects Considering Sustainable Strategic Alignment and Project Interdependencies through Value Analysis. Sustainability. 2021; 13(10):5584. https://doi.org/10.3390/su13105584

Chicago/Turabian StyleLotfian Delouyi, Fahime, Seyed Hassan Ghodsypour, and Maryam Ashrafi. 2021. "Dynamic Portfolio Selection in Gas Transmission Projects Considering Sustainable Strategic Alignment and Project Interdependencies through Value Analysis" Sustainability 13, no. 10: 5584. https://doi.org/10.3390/su13105584

APA StyleLotfian Delouyi, F., Ghodsypour, S. H., & Ashrafi, M. (2021). Dynamic Portfolio Selection in Gas Transmission Projects Considering Sustainable Strategic Alignment and Project Interdependencies through Value Analysis. Sustainability, 13(10), 5584. https://doi.org/10.3390/su13105584