Profitability Assessment of Residential Photovoltaic Battery Systems in Japan Using Electric Power Big Data

Abstract

1. Introduction

2. Materials and Methods

2.1. The Period for Scenario Analyses

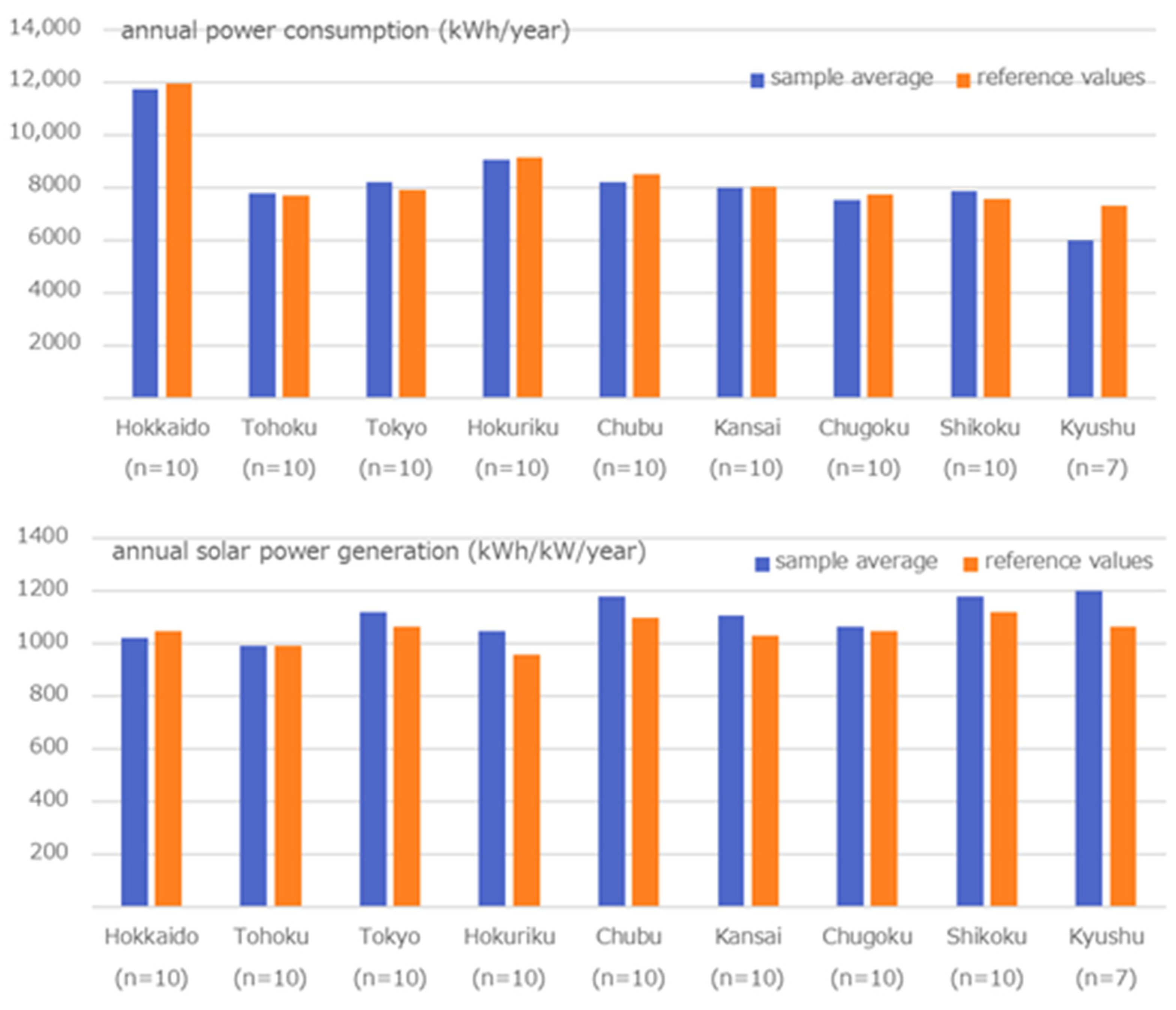

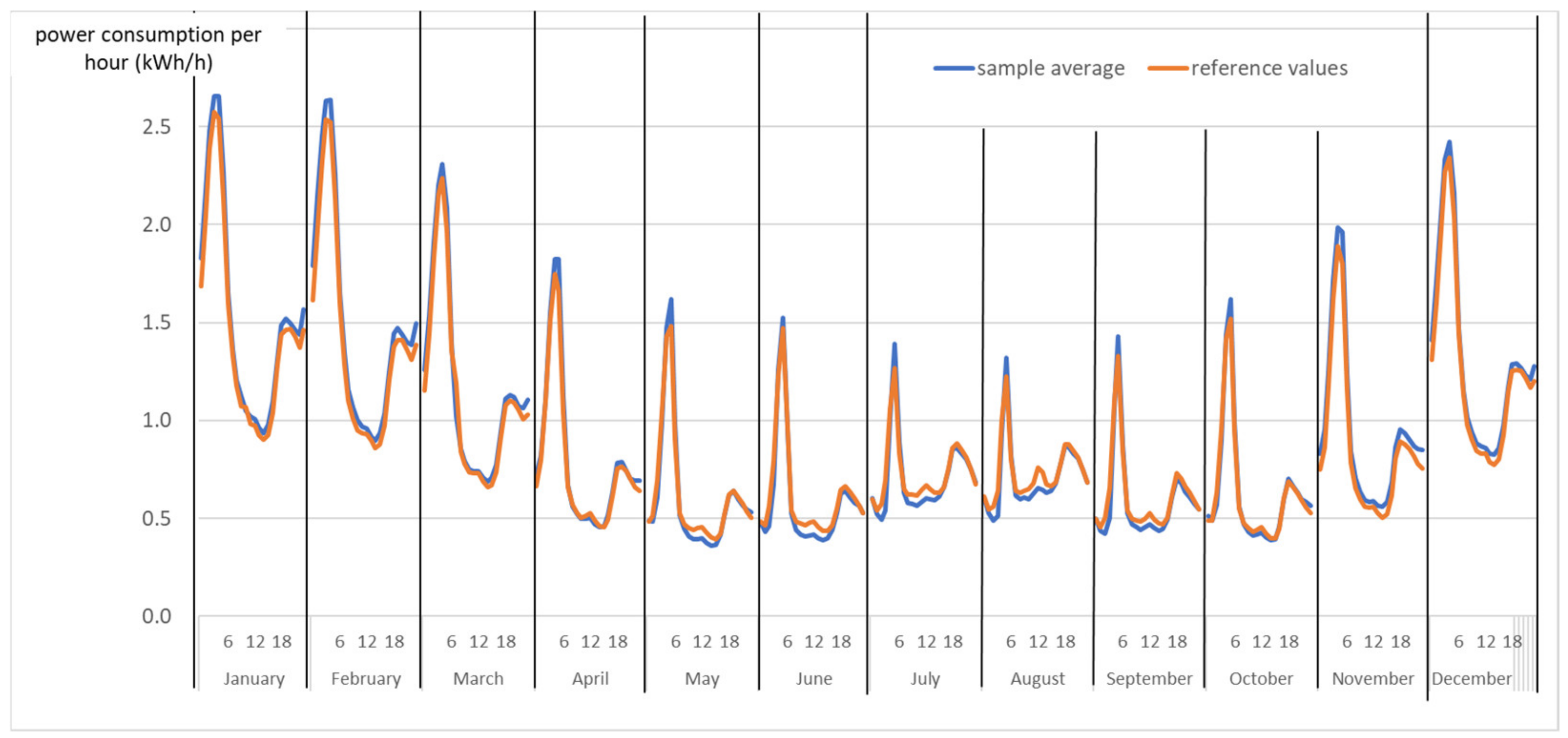

2.2. Electricity Consumption and Solar Power Generation

- Houses that had joined renewed rate plans for all-electric houses offered by major electric power companies in 2017 were extracted from the all-electric houses. This allowed us to predict the electricity consumption pattern of the households closer to the pattern found after the deregulation of electricity rates;

- We identified houses that had a one-year period without data loss (i.e., 8760 h), and extracted the data of the houses for this period;

- The houses included in the extracted data were classified according to where they were located. Then, a maximum of 10 houses from each of the nine power jurisdiction districts (all districts except Okinawa) were chosen. These houses were randomly selected on the condition that their average annual power consumption and that of standard deviation were the same as those of each region. The data obtained from these houses were used for the analysis.

2.3. Electricity Rates

2.4. Sale of Surplus Solar Power

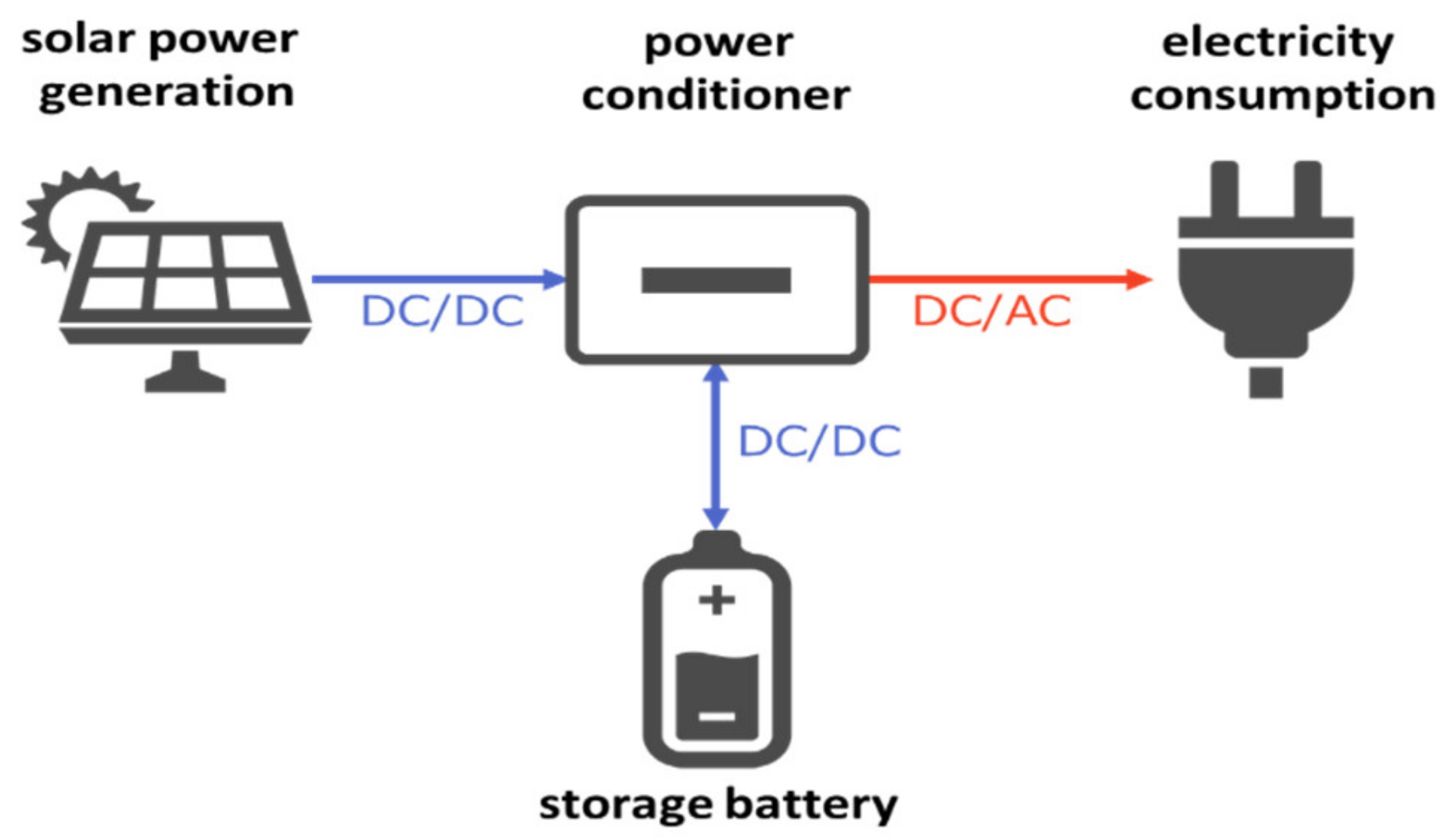

2.5. Residential PV Battery Systems

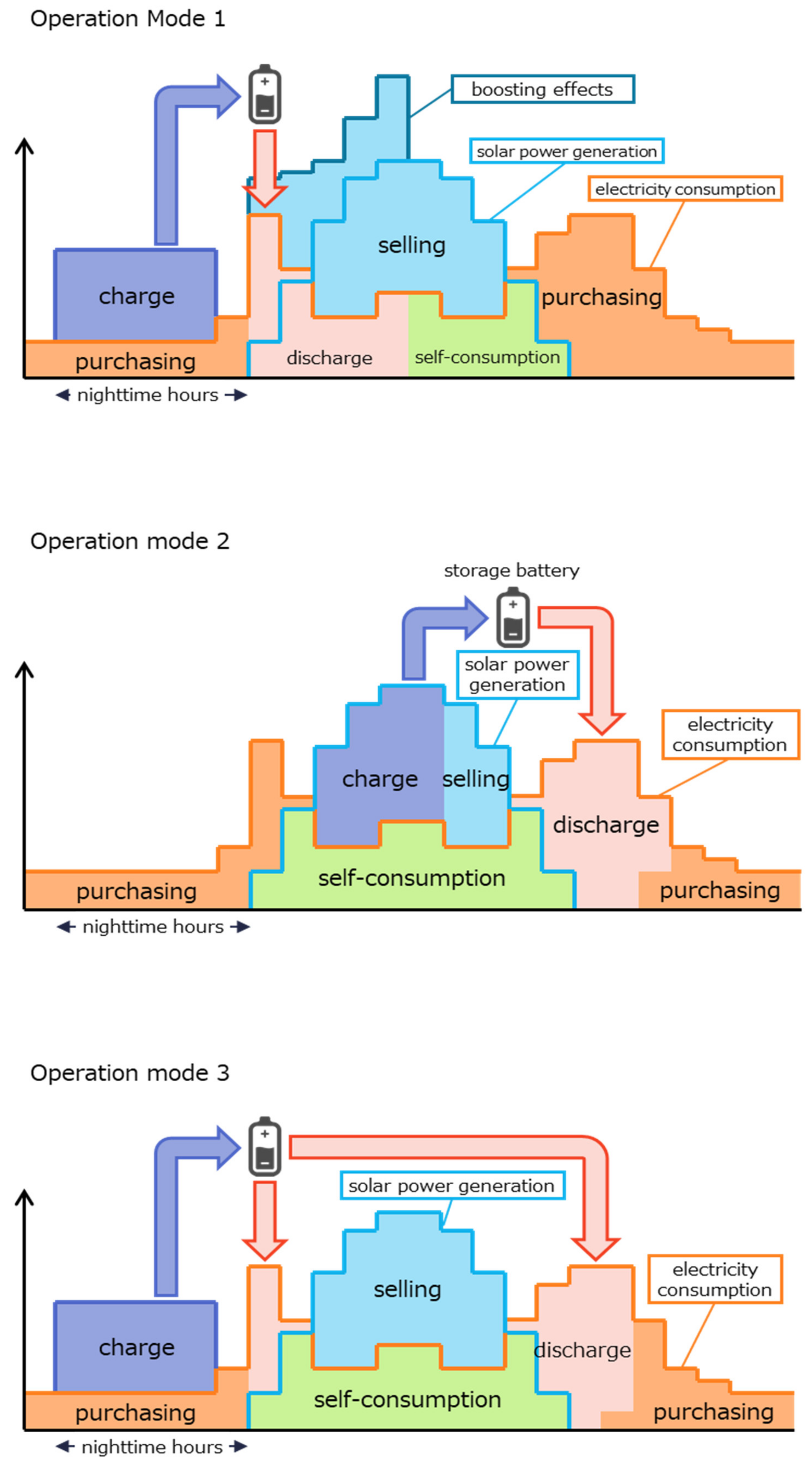

2.6. An Energy Supply–Demand Simulation

2.7. Scenarios and Assessments

2.8. Factor Analysis Using Multiple Regression Analysis

2.9. Sensitivity Analysis

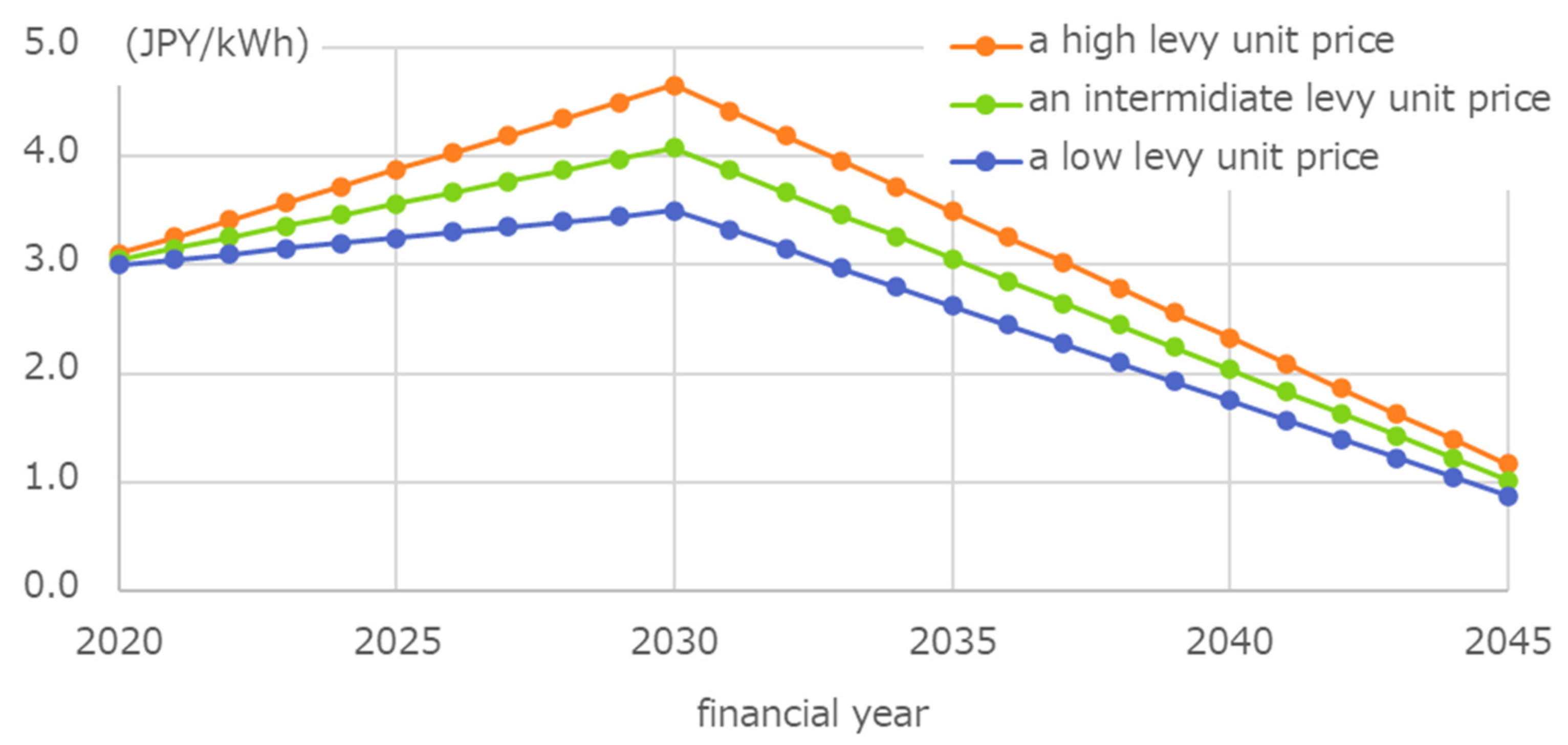

2.9.1. Uncertainty Analysis of Parameters

2.9.2. Impact Analysis of Aging Deterioration in Effective Capacity of Storage Batteries

3. Results

3.1. Profitability

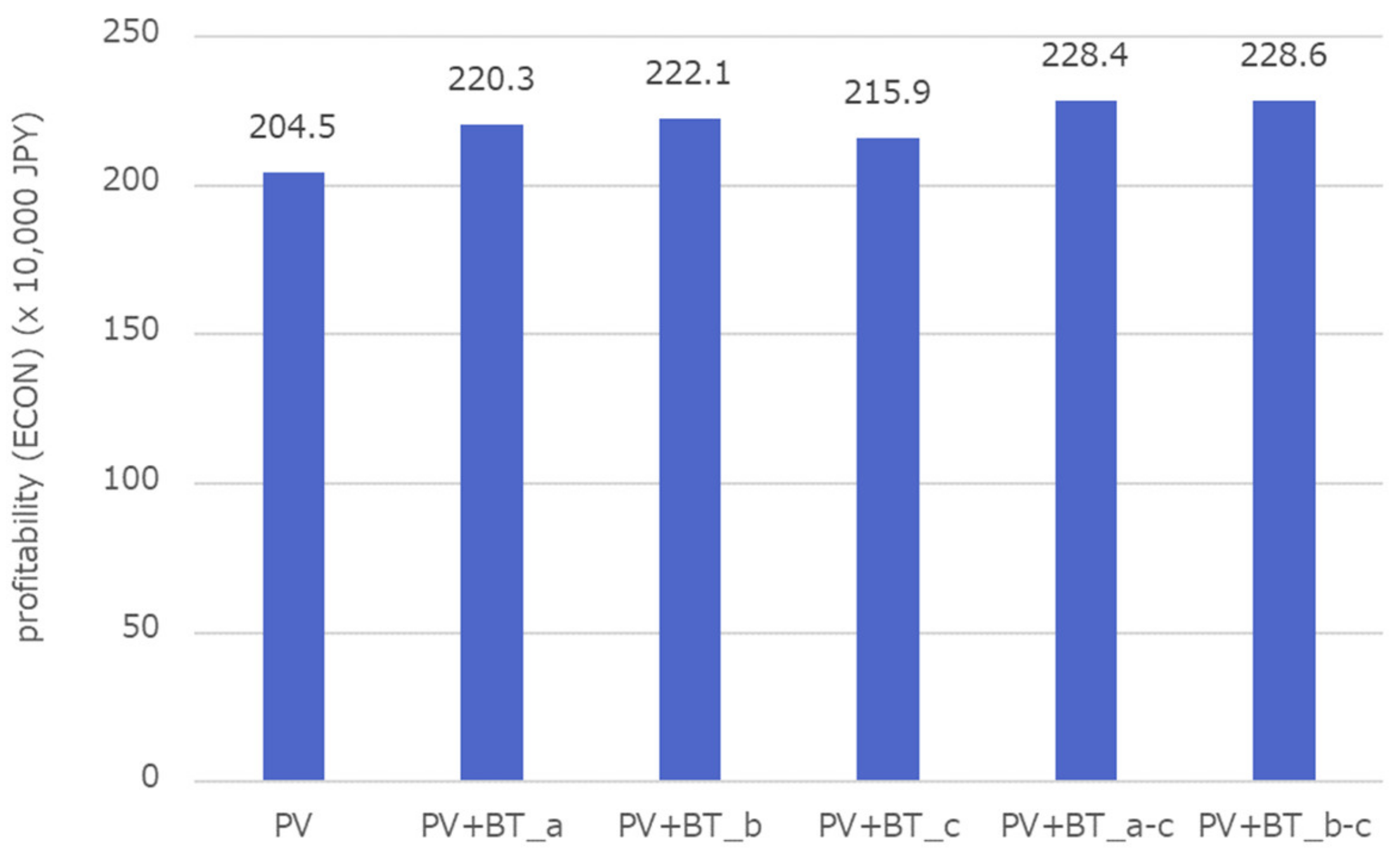

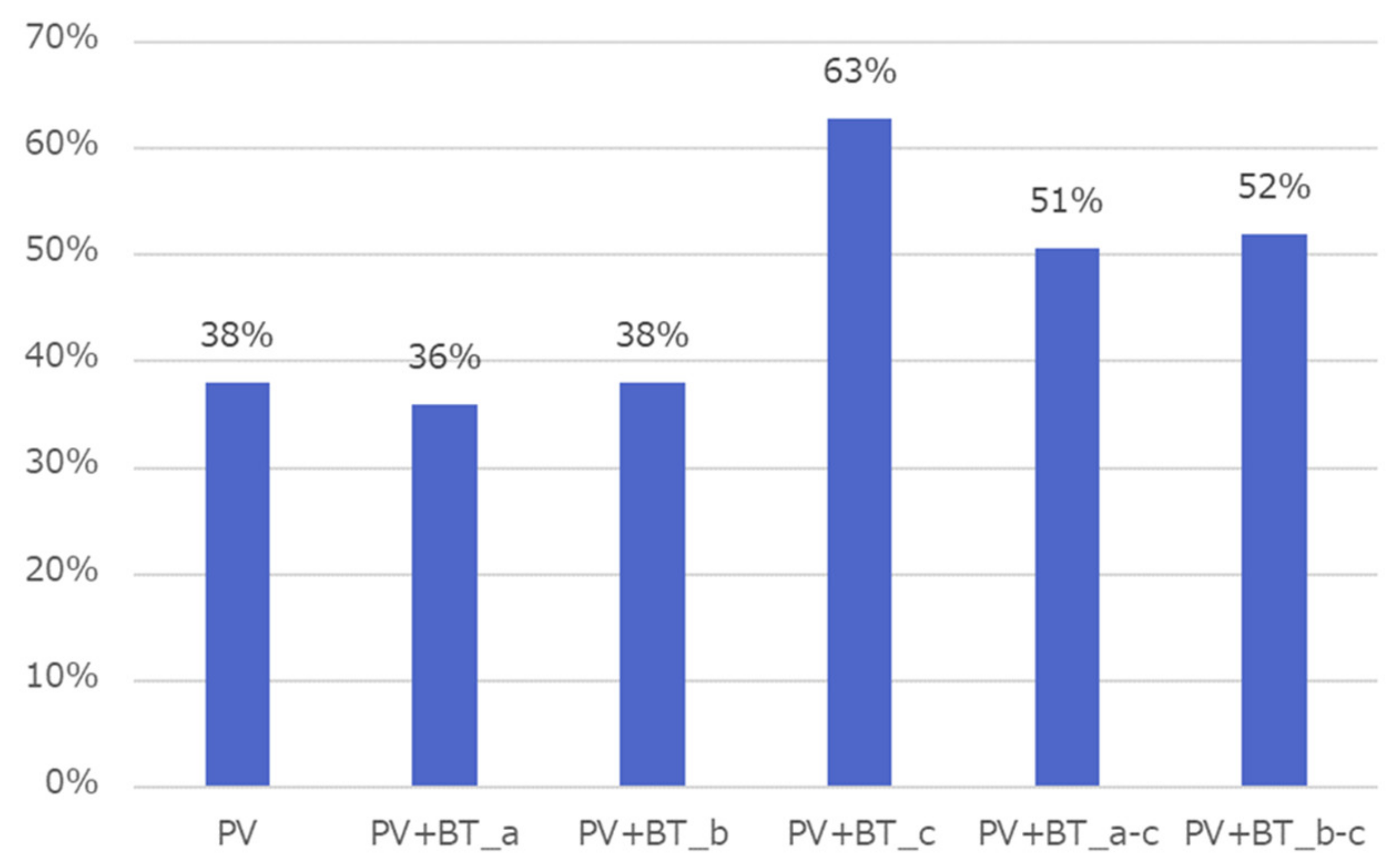

3.1.1. Comparing Scenarios

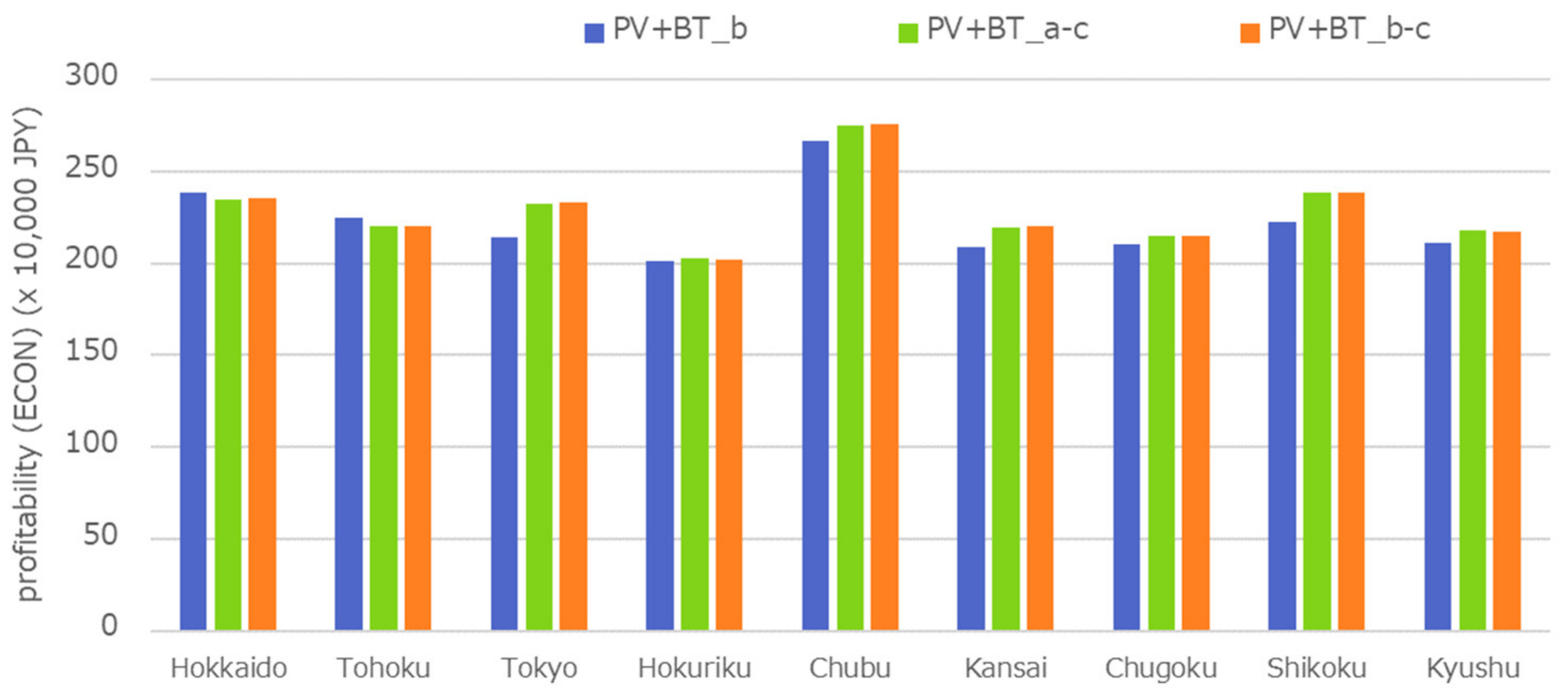

3.1.2. Comparison among Regional Areas

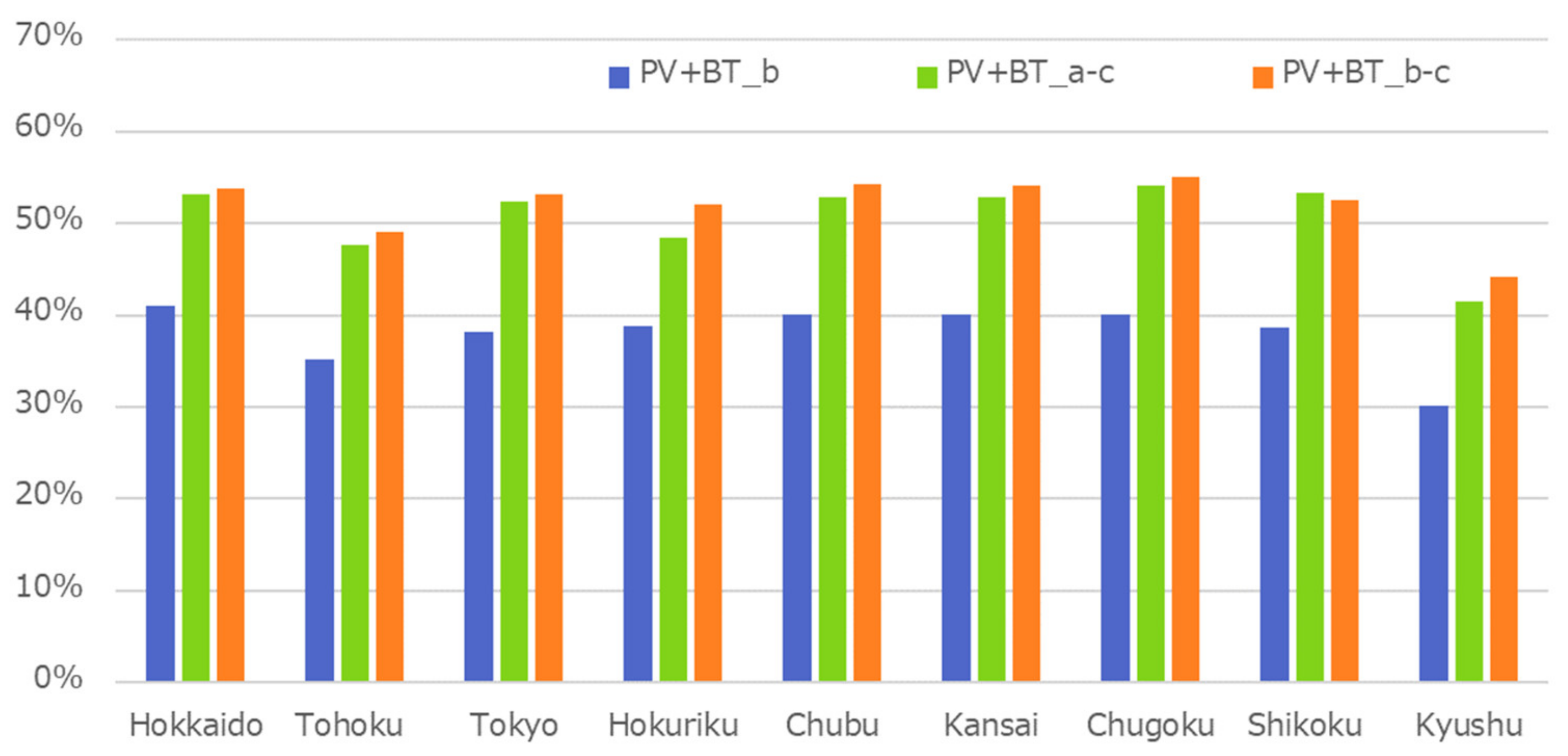

3.1.3. Results of Multiple Regression Analysis

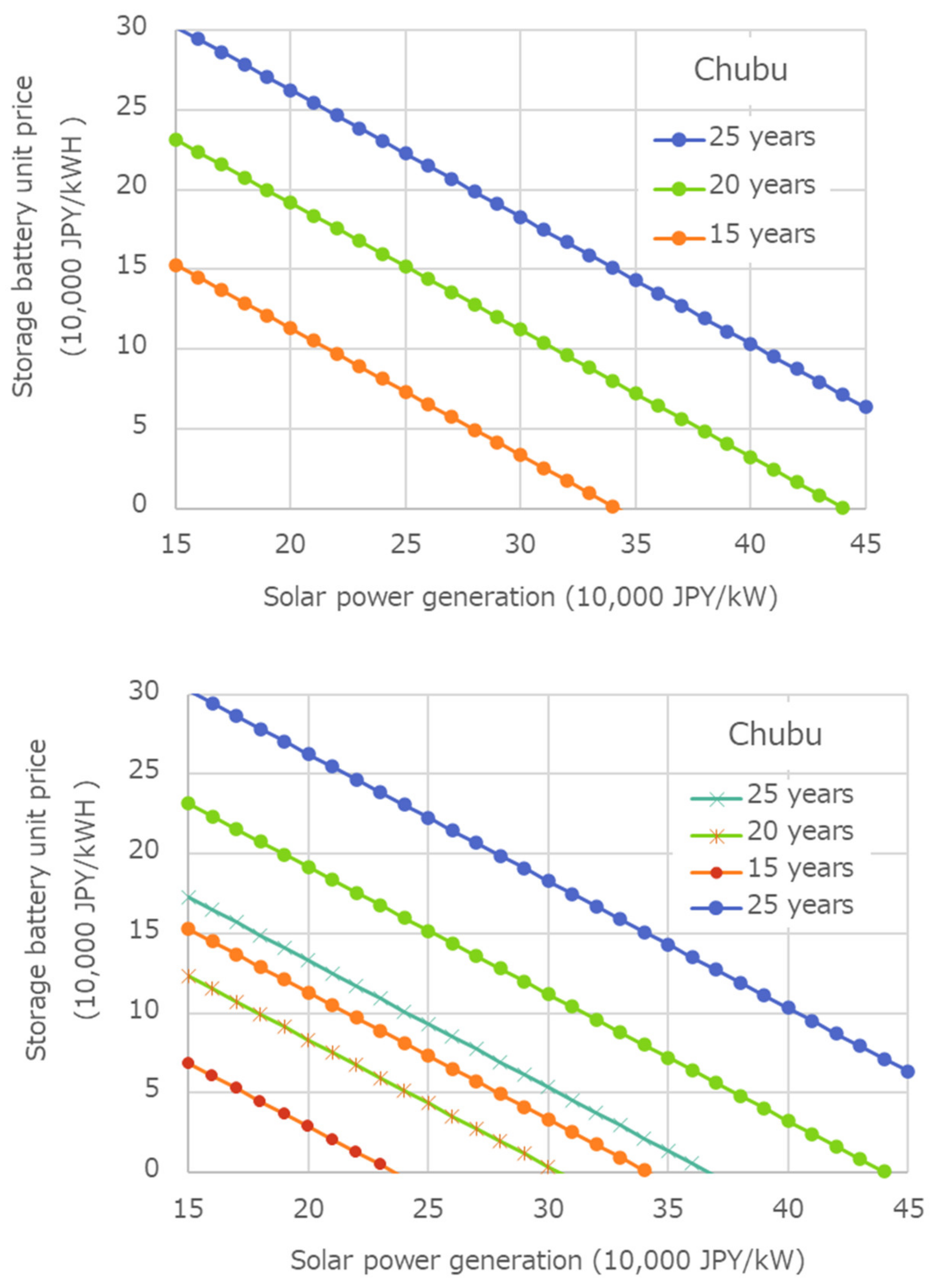

3.1.4. Analyzing the Unit Price of PV Power Generation and Storage Batteries in View of Investment Recoverability

3.2. Self-Consumption Rates of Solar Power Generation

3.2.1. Comparing Scenarios

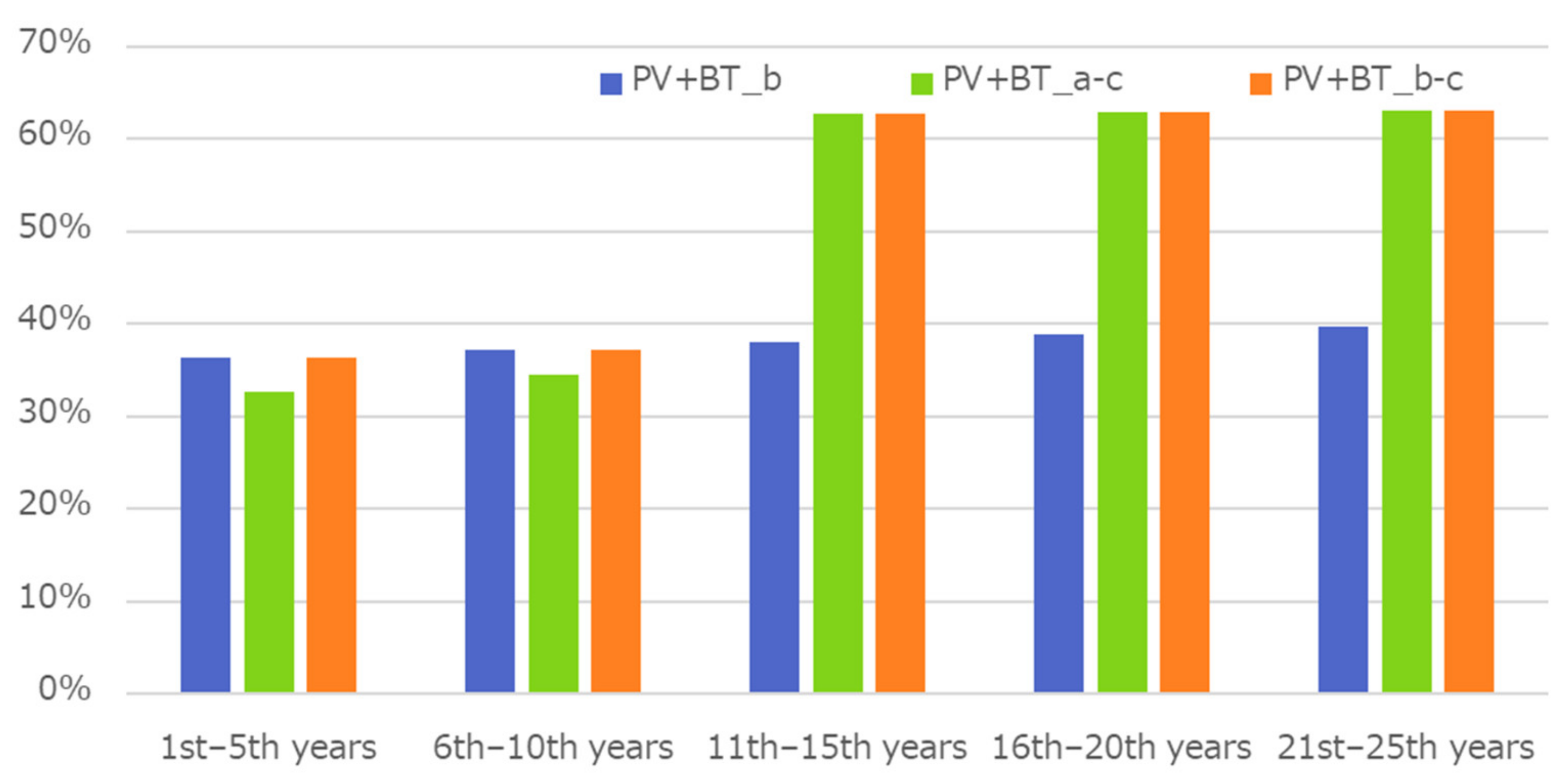

3.2.2. Comparing Regions

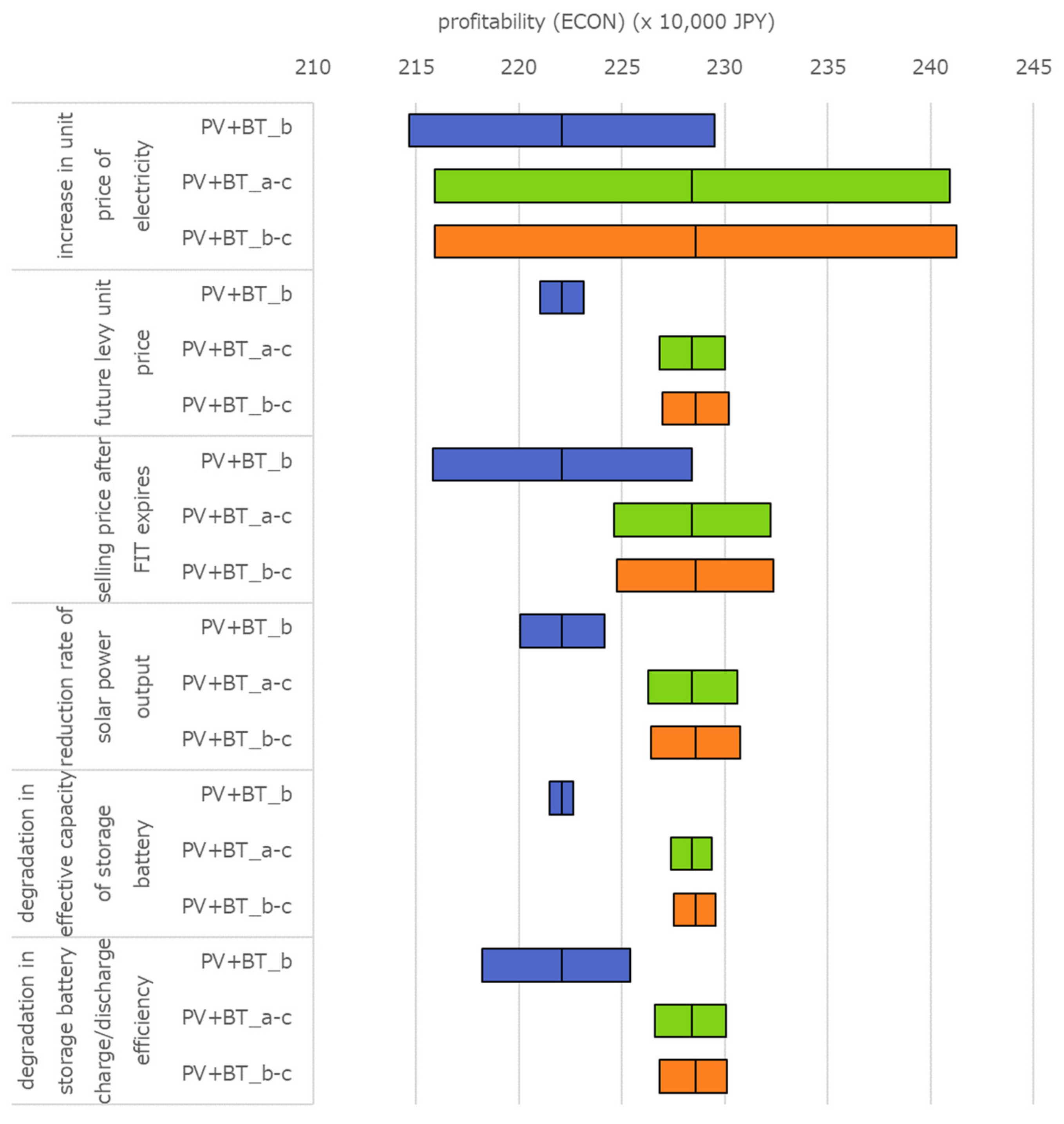

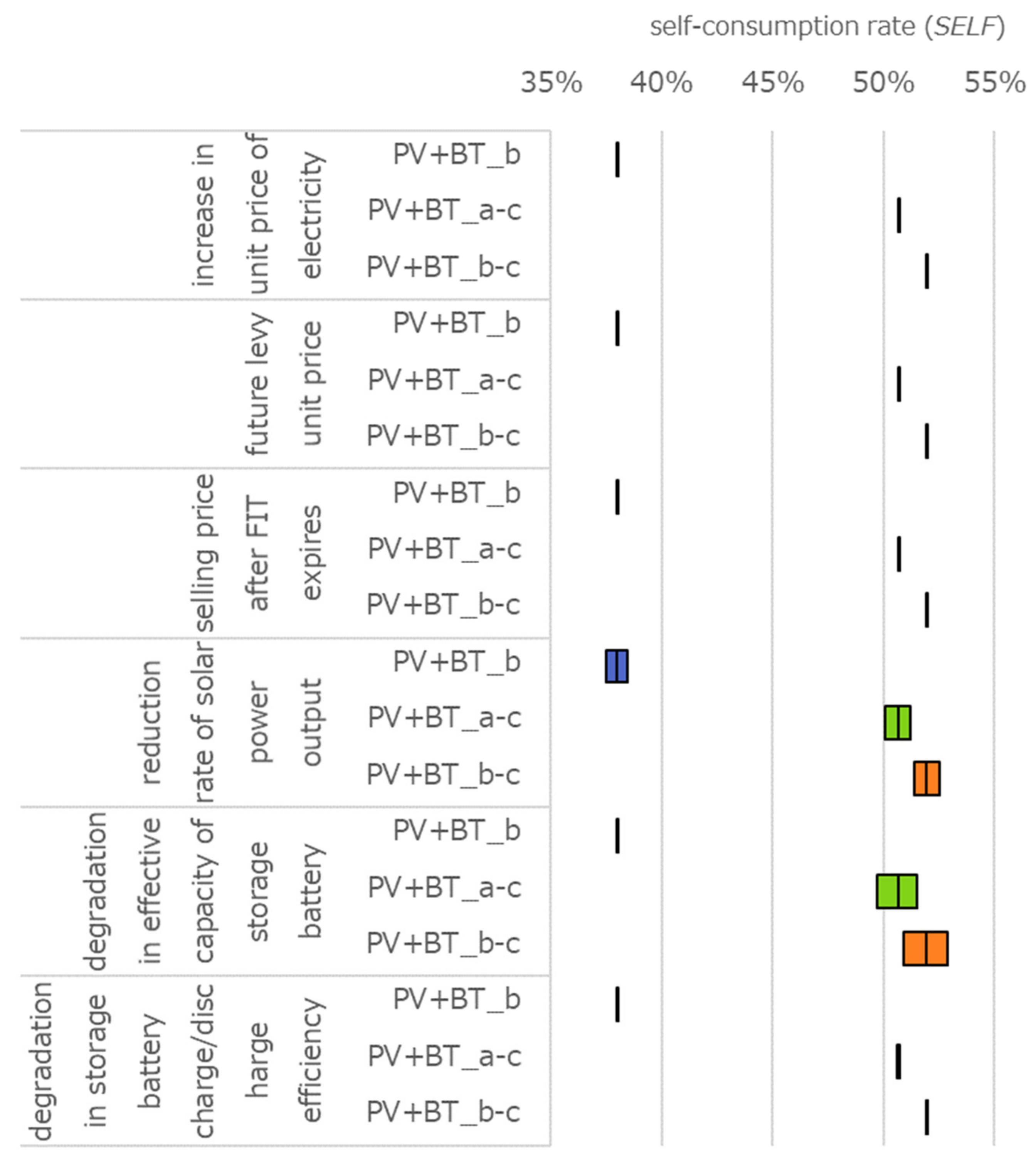

3.3. A Sensitivity Analysis

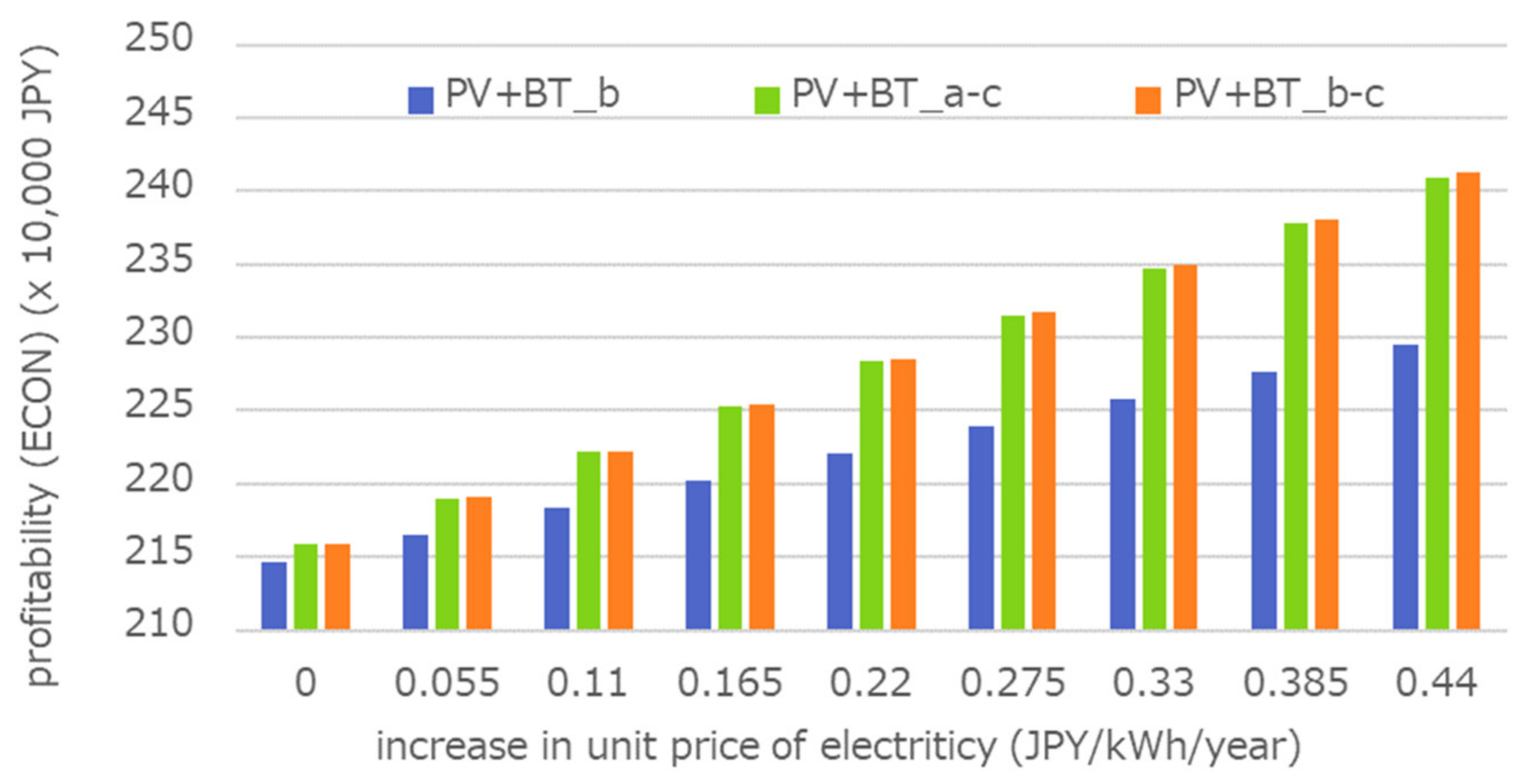

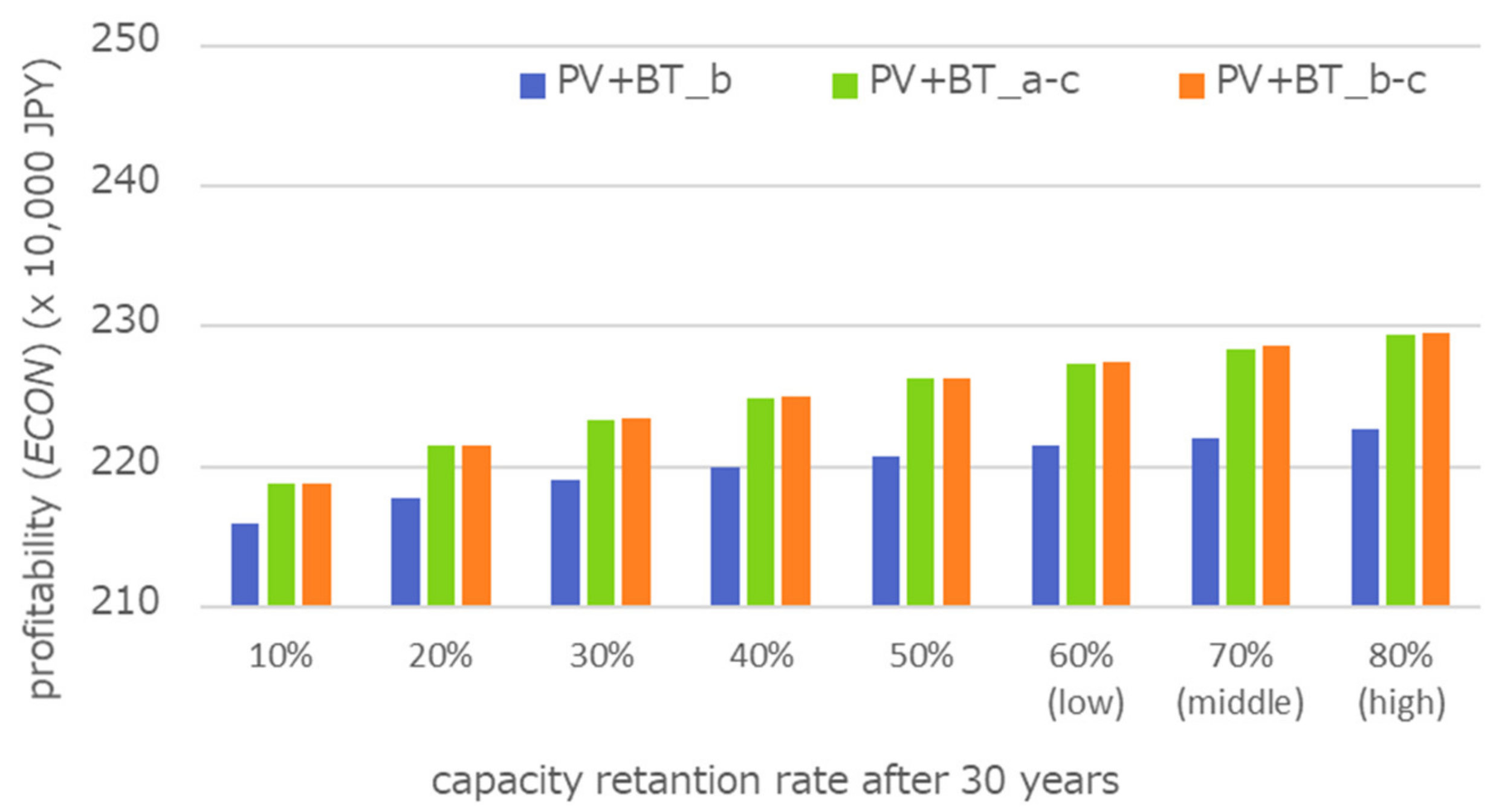

3.3.1. Impacts on Profitability

3.3.2. Effect of Time-Related Deterioration of Effective Capacity of The Storage Battery

3.3.3. Impact on Self-Consumption Rate

4. Conclusions

- The profitability of residential PV battery systems can be increased by charging the surplus PV power generated with a shift in the battery operation mode of the storage battery when the purchase contract period of FIT is over. Profitable battery operation modes and investment recovery conditions differ by regions.

- By selecting the operation mode to charge the surplus power, more than half of the generated power can be consumed at home.

- The results of the sensitivity analysis showed that an increase in the unit price of electricity, the selling price after the expiration of the FIT period, and significant decrease in battery capacity retention rate greatly affect the economic efficiency of the system. However, the economic efficiency of the system is not impaired when the future levy unit price decreases due to an increase in private consumption.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- IRENA. Electricity Storage and Renewables: Costs and Markets to 2030. 2017. Available online: https://www.irena.org/publications/2017/Oct/Electricity-storage-and-renewables-costs-and-markets (accessed on 23 March 2021).

- Weniger, J.; Bergner, J.; Tjaden, T.; Quaschning, V. Economics of Residential PV Battery Systems in the Self-Consumption Age. In Proceedings of the 29th European PV Solar Energy Conference and Exhibition, Amsterdam, The Netherlands, 22–26 September 2014; pp. 3871–3877. [Google Scholar]

- Naumann, M.; Karl, R.C.; Truong, C.N.; Jossen, A.; Hesse, H.C. Lithium-ion Battery Cost Analysis in PV-household Application. Energy Procedia 2015, 73, 37–47. [Google Scholar] [CrossRef]

- Truong, C.N.; Naumann, M.; Karl, R.C.; Müller, M.; Jossen, A.; Hesse, H.C. Economics of Residential Photovoltaic Battery Systems in Germany: The Case of Tesla’s Powerwall. Batteries 2016, 2, 14. [Google Scholar] [CrossRef]

- Kaschub, T.; Jochem, P.; Fichtner, W. Solar Energy Storage in German Households: Profitability, Load Changes and Flexibility. Energy Policy 2016, 98, 520–532. [Google Scholar] [CrossRef]

- Japan Electrical Manufacturers’ Association. JEMA Chikuden Shisutemu Bijon Ver.5, 2020 [Prospects for Power Storage System Ver.5, 2020]. Available online: https://www.jema-net.or.jp/jema/data/S7216(20200313).pdf (accessed on 23 March 2021).

- Tabuchi Electrics Press Release, 26 September 2019. Available online: http://www.zbr.co.jp/news/docs/%E4%BD%8F%E5%AE%85%E7%94%A8%E8%93%84%E9%9B%BB%E3%83%8F%E3%82%A4%E3%83%96%E3%83%AA%E3%83%83%E3%83%89%E3%82%B7%E3%82%B9%E3%83%86%E3%83%A0%E2%80%9CEIBS7%E2%80%9D%E6%96%B0%E7%99%BA%E5%A3%B2.pdf (accessed on 23 March 2021).

- Tabuchi Electrics Storage Hybrid System. Available online: http://www.enetelus.jp/products/post_eibs2.html (accessed on 23 March 2021).

- Sharp. Cloud Battery System. Available online: https://jp.sharp/e_solution/battery/products/wb1821_spec.html (accessed on 23 March 2021).

- Sharp. Cloud Battery System. Available online: https://jp.sharp/e_solution/battery/products/wb1621_spec.html (accessed on 23 March 2021).

- Eliiy Power. Power iE6 Hybrid. Available online: https://www.eliiypower.co.jp/products/general/pi6h.html (accessed on 23 March 2021).

- Eliiy Power. Power iE5 Link. Available online: https://www.eliiypower.co.jp/products/general/pi5l.html (accessed on 23 March 2021).

- Panasonic. Energy Bill Simulation—ENEPITA. Available online: https://sumai.panasonic.jp/solar_battery/simulation/ (accessed on 23 March 2021).

- Kyocera. Residential Solar Power Generation Simulation. Available online: http://solarsystem.kyocera.co.jp/solar/app/simu/bp/step1.html (accessed on 23 March 2021).

- Omine, E.; Kobayashi, H.; Asari, M.; Ueno, T. PV Setchi Juyoka Niokeru Chikudenchi No Keizaiseihyoka—Chikudenchi Setchi Niyori Keizai Meritto Gashojiru Joken no Kento, [Economical Evaluation of Battery Energy Storage System for PV Installing Customer -Evaluation of Condition to Obtain Economic Benefit by Installing Battery-]. CRIEPI Res. Rep. 2013, R122018. Available online: https://criepi.denken.or.jp/jp/kenkikaku/report/detail/R12018.html (accessed on 23 March 2021).

- Yabe, K.; Hayahsi, Y. An Evaluation of Economical Capacity of Storage Battery Equipped with Residential PV System and Reverse Power Flow Pattern. IEEJ Trans. Power Energy 2018, 138, 175–182. [Google Scholar] [CrossRef]

- Yabe, K.; Hayahsi, Y. Economic Evaluation of Increased Self-Use of PV Output Driven by Storage Battery System. IEEJ Trans. Power Energy 2019, 139, 363–371. [Google Scholar] [CrossRef]

- Power Generation Cost Verification Working Group. Report on Verification of Power Generation Costs, etc. to the Long-Term Energy Supply and Demand Outlook Subcommittee (Reference Material 2) List of Specifications for Each Power Source. Available online: https://www.enecho.meti.go.jp/committee/council/basic_policy_subcommittee/mitoshi/cost_wg/pdf/cost_wg_03.pdf (accessed on 23 March 2021).

- Hokkaido Electric Power Company. Government Approval of Rise in Electricity Charge Rise. Available online: https://wwwc.hepco.co.jp/hepcowwwsite/info/2014/__icsFiles/afieldfile/2014/10/15/authoriz_previse_1.pdf (accessed on 23 March 2021).

- Tohoku Electric Power Company. Government Approval of Rise in Electricity Charge Rise. Available online: https://www.tohoku-epco.co.jp/ryokin_app/reason/pdf/summary_ninka.pdf (accessed on 23 March 2021).

- Tokyo Electric Power Company. Approved Electricity Charge Rates. Available online: https://www.tepco.co.jp/cc/press/betu12_j/images/120725j0201.pdf (accessed on 23 March 2021).

- Hokuriku Electric Power Company. Revision of Electricity Charge Rates. Available online: http://www.rikuden.co.jp/press/attach/17112901.pdf (accessed on 23 March 2021).

- Chubu Electric Power Company. Government Approval of Rise in Electricity Charge Rise. Available online: https://www.chuden.co.jp/publicity/press/__icsFiles/afieldfile/2020/02/12/20140418_pre.pdf (accessed on 23 March 2021).

- Kansai Electric Power Company. Price Cut in Electricity Charge. Available online: https://www.kepco.co.jp/corporate/pr/2018/pdf/0528_1j_01.pdf (accessed on 23 March 2021).

- Chugoku Electric Power Company. Revision of Electricity Rates. Available online: https://www.energia.co.jp/press/2019/12018.html (accessed on 23 March 2021).

- Shikoku Electric Power Company. Government Approval of Rise in Electricity Charge Rise. Available online: https://www.yonden.co.jp/press/re1308/data/pr001-01.pdf (accessed on 23 March 2021).

- Kyushu Electric Power Company. Price Cut in Electricity Charge. Available online: http://www.kyuden.co.jp/var/rev0/0186/0444/ku54dd14.pdf (accessed on 23 March 2021).

- Japan Photovoltaic Energy Association. 3.1 Calculation of Expected Annual Power Generation. Available online: http://www.jpea.gr.jp/pdf/011.pdf (accessed on 23 March 2021).

- Agency for Natural Resources and Energy. Response to Reconstruction of Renewable Energy Policy. 2019. Available online: https://www.meti.go.jp/shingikai/enecho/denryoku_gas/saisei_kano/pdf/014_08_00.pdf (accessed on 23 March 2021).

- Calculation Committee for Procurement Price. Opinions on Procurement Prices for 2020. Available online: https://www.meti.go.jp/shingikai/santeii/pdf/20200204001_1.pdf (accessed on 23 March 2021).

- Choi, S.; Sato, R.; Ishii, T.; Chiba, Y.; Masuda, J. Tasunen No Okugai Bakuro Niyoru Kakushu Taiyo Denchi Mojuru No Keijihenka Tokusei [Temporal Variation Properties of Various Solar Cell Modules due to Long-Term Outdoor Exposure]. Available online: https://unit.aist.go.jp/rpd-envene/PV/ja/results/2017/poster/P37_.pdf (accessed on 23 March 2021).

- Japan Housing Finance Agency. Flat 35. Available online: https://www.flat35.com/loan/flat35/ (accessed on 23 March 2021).

- Agency for Natural Resources and Energy. Price Reduction Scheme for Stationary Storage Batteries. Available online: https://www.meti.go.jp/committee/kenkyukai/energy_environment/energy_resource/pdf/005_08_00.pdf (accessed on 23 March 2021).

| Geographical Factors | Power Consumption/Solar Power Generation |

|---|---|

| Technical factors |

|

| Socio-economic factors |

|

| Electric Power Company | Time Zones and Corresponding Electricity Unit Prices | ||

|---|---|---|---|

| Daytime Hours | Morning Hours and Evening Hours | Nighttime Hours | |

| Hokkaido Electric Power Company | 40.68 JPY (April–October: 13:00–18:00) 36.61 JPY (November–March: 13:00–18:00) | 30.91 JPY (April–October: 8:00–13:00, 18:00–22:00) 27.82 JPY (November–March: 8:00–13:00, 18:00–22:00) | 14.64 JPY (April–October: 22:00–08:00) 13.18 JPY (November–March: 22:00–08:00) |

| Tohoku Electric Power Company | 43.14 JPY (July–September: 10:00–17:00, December–February: 16:00–18:00) 39.22 JPY (March–June, October–November: 10:00–17:00) | 26.73 JPY (March–November 8:00–10:00, 17:00–22:00, December–February: 8:00–16:00, 18:00–22:00) | 11.43 JPY (year-round: 22:00–08:00) |

| Tokyo Electric Power Company | 25.80 JPY (year-round: 6:00–01:00) | 17.78 JPY (year-round: 01:00–6:00) | |

| Hokuriku Electric Power Company | 34.95 JPY (July–September, weekdays: 8:00–20:00) 25.07 JPY (October–June, weekdays: 8:00–20:00) 19.64 JPY (holidays: 8:00–20:00) | 12.51 JPY (year-round: 20:00–08:00) | |

| Chubu Electric Power Company | 38.71 JPY (weekdays: 10:00–17:00) | 28.52 JPY (weekdays: 8:00–10:00, 17:00–22:00, holidays: 8:00–22:00) | 16.30 JPY (year-round: 22:00–08:00) |

| Kansai Electric Power Company | 27.51 JPY (July–September, weekdays: 10:00–17:00) 25.01 JPY (October–June, weekdays: 10:00–17:00) | 21.75 JPY (weekdays: 7:00–10:00, 17:00–23:00, holidays: 7:00–23:00) | 14.44 JPY (year-round: 23:00–07:00) |

| Chugoku Electric Power Company | 32.68 JPY (July–September, weekdays: 9:00–21:00) 30.62 JPY (October–June, weekdays: 09:00–21:00) 14.87 JPY (holidays: 9:00–21:00) | 14.87 JPY (year-round: 21:00–09:00) | |

| Shikoku Electric Power Company | 29.24 JPY (weekdays: 9:00–23:00) 19.48 JPY (holidays: 9:00–23:00) | 19.48 JPY (year-round: 23:00–09:00) | |

| Kyushu Electric Power Company | 26.84 JPY (July–September, December–February, weekdays: 8:00–22:00) 23.95 JPY (March–June, October–November, weekdays: 8:00–22:00) 21.22 JPY (July–September, December–February, holidays: 8:00–22:00) 17.82 JPY (March–June, October–November, holidays: 8:00–22:00) | 13.21 JPY (year-round: 22:00–08:00) | |

| Parameter (Unit) | Set Value |

|---|---|

| PV capacity (kW) | 4.5 |

| rated capacity of storage battery (kWh) | 5.65 |

| effective capacity of storage battery (kWh) | 4.80 |

| battery charge capacity (kWh/h) | 2.20 |

| battery discharge capacity (kWh/h) | 3.00 |

| storage battery charge/discharge efficiency | 0.95 |

| Parameter (Unit) | Low | Intermediate | High |

|---|---|---|---|

| reduction rate of solar power output (%/year) | 0.47 | 0.61 | 0.75 |

| effective capacity of storage battery, 12,000 cycles (kWh) | 2.88 | 3.36 | 3.84 |

| storage battery charge/discharge efficiency, 12,000 cycles | 0.570 | 0.665 | 0.760 |

| Scenario | Solar Power Generation | Storage Battery | Battery Operation Mode |

|---|---|---|---|

| Ref | no | no | - |

| PV | yes | no | - |

| PV+BT_a | yes | yes | With boosting effects |

| PV+BT_b | yes | yes | Without boosting effects (nighttime charge) |

| PV+BT_c | yes | yes | Without boosting effects (PV charge) |

| PV+BT_a-c | yes | yes | First 10 years: with boosting effects 11th years and afterword: without boosting effects (PV charge) |

| PV+BT_b-c | yes | yes | First 10 years: without boosting effects (nighttime charge) 11th years and afterword: without boosting effects (PV charge) |

| Daily Average of The Power Unit Price (JPY/kWh) | Day/Night Price Difference (JPY/kWh) | |

|---|---|---|

| Hokkaido | 25.08 | 18.93 |

| Tohoku | 23.71 | 21.06 |

| Tokyo | 24.13 | 8.02 |

| Hokuriku | 18.65 | 12.28 |

| Chubu | 25.37 | 15.54 |

| Kansai | 20.05 | 8.42 |

| Chugoku | 20.17 | 10.61 |

| Shikoku | 23.19 | 6.36 |

| Kyushu | 19.13 | 10.14 |

| Annual Power Consumption | The Amount of Annual Solar Power Generation | All-Day Average Unit Price | Day/Night Price Difference of Unit Price | |

|---|---|---|---|---|

| The amount of annual power consumption | 1.00 | |||

| The amount of annual solar power generation | −0.24 | 1.00 | ||

| All-day average unit price | 0.31 | 0.00 | 1.00 | |

| Day/night price difference of unit price | 0.33 | −0.49 | 0.43 | 1.00 |

| Parameter | Low | Intermediate | High |

|---|---|---|---|

| increase in unit price of electricity (JPY/kWh/year) | 0.00 | 0.22 | 0.44 |

| future levy unit price (JPY/kWh) | See Figure 3 | ||

| selling price after the FIT expires (JPY/kWh) | 7.3 | 9.3 | 11.3 |

| reduction rate of solar power output (%/year) | 0.47 | 0.61 | 0.75 |

| effective capacity of storage battery, 12,000 cycles (kWh) | 2.88 | 3.36 | 3.84 |

| storage battery charge/discharge efficiency, 12,000 cycles | 0.570 | 0.665 | 0.760 |

| R2 | Adjusted R2 | F | Sig. | ||

|---|---|---|---|---|---|

| Regression model | 0.708 | 0.694 | ANOVA | 49.751 | 0.000 |

| Partial regression coefficient | SD | Standard partial regression coefficient | t | Sig. | |

| (constant) | −1,319,090.6 | 264,595.7 | −4.985 | 0.000 | |

| Amount of annual power consumption | 48.1 | 9.2 | 0.344 | 5.251 | 0.000 |

| Annual amount of solar power generation | 1926.4 | 208.1 | 0.668 | 9.257 | 0.000 |

| Daily average of electricity charge unit price | 29,181.2 | 7572.4 | 0.272 | 3.854 | 0.000 |

| Day/night price difference of electricity charge unit price | 25,369.8 | 4326.5 | 0.465 | 5.864 | 0.000 |

| R2 | Adjusted R2 | F | Sig. | ||

|---|---|---|---|---|---|

| Regression model | 0.718 | 0.705 | ANOVA | 44.401 | 0.000 |

| Partial regression coefficient | SD | Standard partial regression coefficient | t | Sig. | |

| (constant) | −1,372,748.5 | 259,448.7 | −5.291 | 0.000 | |

| Amount of annual power consumption | 40.6 | 9.0 | 0.291 | 4.525 | 0.000 |

| Annual amount of solar power generation | 1970.2 | 204.1 | 0.685 | 9.655 | 0.000 |

| Daily average of electricity charge unit price | 45,195.8 | 7425.1 | 0.422 | 6.087 | 0.000 |

| Day/night price difference of electricity charge unit price | 9231.6 | 4242.3 | 0.170 | 2.176 | 0.032 |

| R2 | Adjusted R2 | F | Sig. | ||

|---|---|---|---|---|---|

| Regression model | 0.791 | 0.617 | ANOVA | 52.133 | 0.000 |

| Partial regression coefficient | SD | Standard partial regression coefficient | t | Sig. | |

| (constant) | −1,384,576.7 | 261,127.7 | −5.302 | 0.000 | |

| Amount of annual power consumption | 40.2 | 9.0 | 0.287 | 4.454 | 0.000 |

| Annual amount of solar power generation | 1967.3 | 205.4 | 0.680 | 9.579 | 0.000 |

| Daily average of electricity charge unit price | 46,177.0 | 7473.1 | 0.429 | 6.179 | 0.000 |

| Day/night price difference of electricity charge unit price | 9055.8 | 4269.8 | 0.165 | 2.121 | 0.037 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Honda, T.; Ozawa, A.; Wakamatsu, H. Profitability Assessment of Residential Photovoltaic Battery Systems in Japan Using Electric Power Big Data. Sustainability 2021, 13, 5370. https://doi.org/10.3390/su13105370

Honda T, Ozawa A, Wakamatsu H. Profitability Assessment of Residential Photovoltaic Battery Systems in Japan Using Electric Power Big Data. Sustainability. 2021; 13(10):5370. https://doi.org/10.3390/su13105370

Chicago/Turabian StyleHonda, Tomonori, Akito Ozawa, and Hiroko Wakamatsu. 2021. "Profitability Assessment of Residential Photovoltaic Battery Systems in Japan Using Electric Power Big Data" Sustainability 13, no. 10: 5370. https://doi.org/10.3390/su13105370

APA StyleHonda, T., Ozawa, A., & Wakamatsu, H. (2021). Profitability Assessment of Residential Photovoltaic Battery Systems in Japan Using Electric Power Big Data. Sustainability, 13(10), 5370. https://doi.org/10.3390/su13105370