Abstract

Institutional environment demands from organizations to be accountable for their social and environmental actions and to provide information allowing the assessment of their long-term prospects for profitability may lead organizations to adopt Impression Management (IM) tactics to manage perceptions. Consequently, organizations may provide accounts demonstrating that they are good corporate citizens and possess the intangible assets required for future good financial performance. Although organizations have increased their corporate social reporting, the quality and reliability of those reports have been questioned. The literature suggests that these disclosures tend to be selective and biased, and do not enhance corporate accountability. This study proposes a formal conceptual framework linking IM, social and environmental accountability, financial performance, and organizational legitimacy. The arguments in this study are of economic, societal, and ethical concern, as IM behaviors may undermine the transparency of social and environmental reporting, and the decoupling between the economic and social image offered by companies through reporting and the reality. These insights also point at the complexities for organizations in dealing with accountability to all stakeholders. The conceptual framework proposed is useful for future studies aiming at understanding how organizations use IM in their corporate social reporting in the accountability process.

1. Introduction

Relevant research in the field of Impression Management (IM) in a corporate reporting context highlights the importance that this instrument often has concerning organizational image, reputation, and legitimacy [1]. It is recognized that IM behaviors are part of the process of social influence [2]. The concept of IM concerns how individuals present themselves to others in order to be perceived favorably, and has been used to explain organizational behaviors [3,4]. Thus, in the context of organizational communication, IM is considered an attempt to control and manipulate the impressions of relevant audiences [1,5].

The literature suggests that an organization can be perceived as legitimate because it acts in accordance with social expectations, or because it successfully manipulates public expectations and perceptions about the organization [6,7,8]. Organizations use IM to maintain an appearance of compliance with social values and expectations [3,9,10]. Like most cultural processes, the management of legitimacy relies heavily on communication—in this case, communication between the organization and its stakeholders [7]. IM has been adopted and applied to explain the response of organizations dealing with challenges to legitimacy [1,9,11]. But theorists argued that “legitimacy is a continually unfolding process in which different scenarios can be identified at different points in time” [6] (p. 4). Throughout the process, organizations can develop various strategies to ensure that their behaviors are perceived as legitimate. It is recognized that IM strategies are intentionally and conscientiously exercised and have the potential to impair the quality of reporting [12].

Social situations requiring accountability from an actor foster IM [1,9,13,14]. The literature demonstrates that IM commonly occurs in corporate social reporting [15,16]. Flexibility in reporting provides an opportunity to select specific pieces of information in order to present a favorable picture of organizations and to reinforce their legitimacy with society [16]. By engaging in the presentation of information by means of bias and selectivity, organizations compromise transparency about their social and environmental impacts and perpetuate a myth of accountability [16,17]. This study aims to develop a formal conceptual framework linking IM, social and environmental accountability, financial performance, and organizational legitimacy.

Existing research focuses on the relationship between social and environmental disclosure and social legitimacy, offering few insights regarding how such disclosure may be related to financial performance and economic legitimacy. There is an assumption, in most cases implicit, that such disclosure is more related to social legitimation than with economic legitimation, and is “more closely related to public pressure variables than economic ones” [18] (p. 300). According to this perspective, one should not expect social and environmental disclosure to be related to financial performance. However, there is research suggesting that such a relation exists [19,20,21]. In addition, there is a recent uptake and diffusion of Integrated Reporting (IR), by integrating social and environmental disclosures with financial disclosures in a single report [22,23]. IR is considered a vehicle to enhance accountability, transparency, and legitimacy [24]. The subsequent inherent difficulty in disentangling both types of information creates an urgent need for a framework to address social and environmental disclosure and its relationship with financial performance in an articulated way. Our aim is to contribute to the construction of such a framework. The conceptual framework is expected to be useful in future research, helping researchers to expose how organizations manage their legitimacy, with a focus on social and environmental accountability and its relationship with financial performance, using IM tactics in a context of institutional complexity.

The paper proceeds as follows. First, in the next section, we review the wider literature on legitimacy and IM in an accountability context. While highlighting that IM enables organizations to better manage their relationships with stakeholders, the literature suggests that organizations should be cautious in using IM strategies, especially in a context of skepticism on the part of stakeholders, since IM can erode, rather than build, legitimacy. We also draw upon the relevant literature on social and environmental reporting and its relationship with financial performance, which has proven that this reporting is a tool to manage impressions. In fact, while stakeholders pay increasing attention to organizations’ social responsibility practices, sometimes it becomes difficult for stakeholders to assess whether an organization is or is not socially responsible. Next, supported by this review, we present a consolidated accountability versus IM framework by linking reporting practices to opportunistic behaviors on the part of organizations. The framework emphasizes the fact that the quality and reliability of social and environmental reporting has been questioned despite its growth. Consequently, instead of increasing corporate accountability, it can be argued that these disclosures are selective and biased, and IM may be fostered in situations requiring accountability from an organization. This is followed by the discussion and conclusions. The paper ends with the contributions, limitations, and suggestions for future research.

2. Literature Review

2.1. Impression Management under Institutional Complexity—A Tool for Organizational Legitimacy

The concept of IM has its root in the literature on social psychology [25], and more recently, in sociology [2]. IM involves shaping the impression of a person, an object, an event, or an idea on an audience [25]. Schlenker [25] (p. 6) defined IM as the “attempt to control images that are projected in real or imagined social interactions”. Using a dramaturgical metaphor, Goffman [26] explains IM as the performance of the self in relation to an audience. The author demonstrated how the process of interaction between an actor and an audience permits the actor to communicate the desired identity to obtain specific outcomes in social interactions.

IM theorists have focused on how individuals manage their personal legitimacy, taking on roles, revealing social affiliations, and providing verbal explanations of their behaviors following events that threaten their image [7]. More recently, theorists have proposed that organizations use the same strategies to manage organizational legitimacy [15,16,27,28]. Thus, although the concept originates in social psychology, it has been used more recently to explain organizational behaviors [1,3,4,10,29].

Organizations are subject to ongoing stakeholders’ demands. Organizations can passively conform to these pressures or actively shape them through IM [30]. IM arises in situations where the norms and values of organizations are inconsistent with those of society [31]. Research on this subject illustrates how organizational actors produce images based on their understanding of public needs, beliefs, and knowledge in order to achieve organizational goals [30]. For example, Im, Kim, and Miao [32] analyzed 57 CEO letters published by hospitality companies during the COVID-19 outbreak and found patterns of rhetoric appeals with IM tactics embedded in the letters in order to mitigate negative reactions from stakeholders, as well as to promote the competence of the organizations and a positive image. Furthermore, IM is described as an interactive process in which the organizational image is negotiated between the organization and the public [33]. The way the audiences react to an organization’s IM strategies can lead to further IM attempts, resulting in an action/reaction cycle [14,30,33].

The IM perspective has been adopted to explain the accounting practices observed across a full range of formats (e.g., narratives, graphics, and images). Using the dramaturgical metaphor of Goffman [26], Neu et al. [31] (p. 269) argue that narrative disclosures in corporate reports allow organizations to stage and control the “play” they want their audiences to see, to choose the “characters”, to select the “script”, and to decide which events will be highlighted and those that will be omitted. In the context of corporate communication, IM occurs when organizations select the information to be disclosed and presented in a way that distorts readers’ perceptions of corporate performance [31]. A possible result of this behavior is that the message transmitted is not neutral or bias-free [12].

In ambiguous situations, an organization may have more flexibility in its IM strategies [30]. Research has demonstrated how IM is a central part of the legitimization process [7,34,35]. According to this perspective, the management of legitimacy often involves strategies aimed at presenting specific issues in order to promote an organization’s own interests and protect the power positions of specific actors [1,7,35].

The theoretical and empirical investigations indicate that the association between organizational actions and the words used to represent them is often ambiguous [7,9,17,31]. By mediating this relationship, corporate reports provide organizations with a way to ensure organizational legitimacy, without necessarily changing their practices [31]. Organizations opportunistically exploit information asymmetries between them and stakeholders through biases in reporting [36].

Accountability and IM share common roots in symbolic interactionism [37]. Corporate accountability generally refers to the “explanations or justifications of performance and actions to stakeholders to whom organizations are deemed to be accountable” [15] (p. 752). Organizations can respond to potential legitimacy threats by discharging accountability in narrative sections of corporate reports [38]. However, actors are embedded in “webs of accountabilities” [37] (p. 210). Corporate scandals have been linked to failures in accountability. Effective accountability requires transparency through honest reporting [38]. Conversely, IM implies emphasizing the organization’s desirable aspects (namely, positive performance), or masking or concealing less desirable aspects (namely, negative outcomes) and thus attempting to manipulate the perceptions of organizational audiences [36]. Martínez-Ferrero et al. [39] (p. 470) have called the first type of strategy “enhancement disclosure strategy”, and the second “obfuscation disclosure strategy”.

However, communicating, even if it is about weak performance, permits an organization to apologize, justify, or blame others for its actions, thereby helping to maintain organizational legitimacy [30]. This means that organizations deliberately engage in IM and use the various organizational communication channels, such as annual reports or sustainability reports, to strategically manipulate perceptions, and hence, stakeholders’ decisions.

In the accounting literature, IM has been applied to explain the response of organizations dealing with the challenges of legitimacy. IM is used to gain, maintain, or repair organizational legitimacy by influencing organizational audiences’ perceptions on organizational performance or events so that they are perceived as congruent with corporate beliefs, values, and norms [4,7,28,34,36,40,41]. IM, therefore, implies creating an impression of the normative adequacy of organizational structures, processes, practices, or results [36]. Previous research has suggested that IM strategies are most effective when they emphasize organizational activity compliance with widely shared normative prescriptions [7,35].

IM enables organizations to better manage their relationships with stakeholders [30]. However, organizations may face conflicting pressures from several stakeholders on whom they depend for resources and legitimacy [42]. As put by Kaplan [43] (p. 86), “every business model and every strategic choice has stakeholder trade-offs embedded within it”. Today, more than ever, the choice between different IM strategies is a challenge for organizations facing multiple stakeholders with different interests, since strategies designed to influence a particular group of stakeholders may have a distinct effect on another group [30,33]. In this regard, Bansal and Kistruck [30] note that organizations should be cautious in using IM strategies, especially in a context of skepticism on the part of stakeholders, arguing that IM can erode, rather than build, legitimacy.

2.2. Corporate Social and Environmental Disclosure—An Impression Management Perspective

In the past decade, the importance attached to sustainable development issues has moved into the mainstream of public awareness [16,27,44]. The concept of sustainable development is currently embodied in the commitments of most major organizations around the world. Increasingly, stakeholders require organizations to demonstrate their commitment to different aspects of sustainability, such as Corporate Social Responsibility (CSR) [45]. The concept of corporate responsibility has been approaching the broader concept of sustainable development [46]. Sustainability is considered a broad “umbrella” term that encompasses different aspects, with CSR being one key element [45] (p. 504).

Many of the large corporations observed this change in public awareness and, instigated by the pressure and interest of stakeholders, took action [44,47]. Organizations need to meet the sustainability demands of a global society, with most of them engaging in some kind of sustainability activity as a way to strengthen their reputation and protect their “social license to operate” [45] (p. 493). In this vein, organizations assume an increasing body of social responsibilities, including a growing number of activities that were previously considered activities of the political system [48]. Previous research suggests that the dynamics that affect perceptions about social responsibility are significantly influenced by cultural and sociopolitical factors that operate in society [49]. For example, Kaplan [43] argues that a crisis such as the 2020 pandemic has fundamentally changed society’s expectations, making people more aware of which organizations are serving all stakeholders, not just those with the most power. In sum, the expectations of the public about organizations are not static; on the contrary, CSR is an evolving concept [50]. Pressures on organizations to demonstrate they behave as good corporate citizens have contributed to the development of a whole business around reporting and analyzing organizations’ sustainability activities [45]. The Global Reporting Initiative provides guidelines for corporate social reporting and is generally considered the most reliable and accepted reporting framework [15,51]. The use of standards, such as the ones proposed by the Global Reporting Initiative, should contribute to preventing IM strategies by standardizing the external request of the reports. However, while external standards have the effect of “disciplining” the behaviors of companies, they can also be used as tools to manage impressions [27] (p. 648). Although acknowledging the role that CSR can play in promoting the reduction of information asymmetry, García-Sánchez et al. [52] (p. 2) suggest that “managers are often engaged in the deceitful behavior of creating organizational facades for signaling purposes”; that is, they try to decouple social and environmental statements from practices [53].

The literature suggests that sustainability reports are often interpreted as tools for social legitimation and IM strategies [16,27]. For example, Talbot and Boiral [54] analyzed the quality of climate information disclosed in sustainability reports and the IM strategies developed to justify or conceal negative aspects of performance. The study exposed the high number of incidences of non-compliance in Global Reporting Initiative reporting and the use of IM strategies, showing that it would be difficult or impossible for stakeholders to reasonably assess, monitor, and compare companies’ climate performance on the basis of these reports. The most recent KPMG survey on sustainability reporting worldwide [55] analyzed 5200 of the world’s largest companies. The evolution that occurred in this type of reporting between 1993 (the year of publication of the first KPMG survey on such reporting) and 2020 leads KPMG to speak of “monumental changes” in this type of reporting and refer to it as being now “nearly universally adopted” (p. 7). Notwithstanding, other recent studies suggest that CSR reporting is not well developed qualitatively, albeit being a widespread practice. For example, the findings of the Alliance for Corporate Transparency [56] analysis of the implementation of the EU Non-Financial Reporting Directive, which covered 1000 European companies, suggest that, although CSR reporting is widespread (with 19 out of every 20 companies engaging in it), there is the problem that “companies are reporting policy, not outcomes”, which is tantamount to “a failure to address concrete issues, targets, and principal risks” (p. 4). Not defining targets and reporting on progress against them while focusing on describing policies is clearly a practice that facilitates engagement in IM practices.

Corporate social disclosures help to manage the organization’s relationship with relevant audiences, shaping external perceptions, and thus influencing the public’s image of the organization and its activities [31]. For example, an expression of commitment to the environment creates a positive impression on stakeholders [15,30], and is an effective way of managing perceptions of legitimacy [57]. Freedman and Stagliano [58] (p. 478) suggest that an organization belonging to an environmentally sensitive sector that ignores the public’s demand for a certain level of environmental management runs the risk of being labeled as a “bad corporate citizen”. Such labeling may have negative economic consequences. However, through the disclosure of environmental information that meets the expectations of society, the organization can be perceived as legitimate, and thus avoid some negative consequences, even if it has poor environmental performance [58]. In this regard, Hopwood [59] (p. 437) underlines that social and environmental reporting can be used “as a corporate veil, simultaneously providing a new face to the outside world while protecting the inner workings of the organization from external view”. Boiral [15] examined the strategies used by mining organizations in sustainability reports to demonstrate their accountability with respect to biodiversity issues and the role of IM in legitimizing their impacts in this area. The findings of the study shed light on the successful use of rhetoric in reports on non-measurable and potentially unaccountable issues, and showed that sustainability reports do not represent a reliable tool for reinforcing biodiversity accountability. Drawing on Goffman’s self-presentation theory [26] and its frontstage/backstage analogy, Cho et al. [16] further documented the misleading nature of the discourse contained in stand-alone sustainability reports of large oil and gas firms by showing the inconsistencies between publicly visible corporate reporting and their less visible political activities.

Acknowledging social and environmental disclosure as a way for a company to communicate with its manifold stakeholders, Blanc et al. [60] refer to the different ways in which the annual report and the sustainability report are used in such communications. Whereas the annual report is viewed as catering to the needs of shareholders, the sustainability report is viewed as a way to manage a broad group of stakeholders. The authors suggest that companies can assume that the audiences and audiences’ information needs are different for the annual report and the sustainability report. They suggest that annual reports predominantly target external stakeholders, such as the shareholders, financial analysts, banks, and tax authorities, but also internal stakeholders, such as employees. Sustainability reports would predominantly target external stakeholders, such as consumers and suppliers, as well as the community. In their study on how Siemens AG (Aktiengesellschaft)’s compliance and anti-corruption disclosure practices changed in response to a corruption scandal, Blanc et al. [60] found that the annual report focused more on employees, whilst the sustainability report focused more on external stakeholders.

Companies do seem to consider some stakeholders more important than others in their social and environmental reporting process. In his study focused on the Italian case, Secchi [61] suggested that, in the process of social and environmental reporting, the most important groups of stakeholders for the greatest number of organizations were the local community, shareholders, employees, and customers. Hawrysz and Maj [62] reveal that, among listed Polish companies, those that identify their stakeholders are not only more likely to disclose social and environmental information, but are also more likely to generate positive financial returns. As highlighted by Wang [63], all stakeholders are relevant and play important roles in a firm’s accomplishments in sustainable development.

The strategic perspective on CSR underscores that organizations seek to make stakeholders aware of improvements in their social performance because there are perceived benefits associated with being considered socially responsible [16,57,64]. Such benefits are greatly associated with corporate reputation, which depends, to a large extent, on the daily impressions that audiences form of organizations—the projected image—through the symbolism, communication, and behaviors of organizations [65]. A favorable reputation acts as a sedative on constituents [66]. Deephouse and Carter [67] argue that organizational legitimacy and reputation have similar antecedents, processes of social construction, and consequences. However, these authors indicate that legitimacy highlights social acceptance resulting from adherence to social norms and expectations, while reputation involves comparisons between organizations. In a way, while reputation and image are related to the assessment of organizations, legitimacy is related to their acceptability in terms of social norms and rules [6,36]. From this perspective, Doh et al. [64] suggest that legitimacy is a necessary condition, but not always sufficient to achieve a positive reputation; that is, legitimacy can be seen as a precursor or antecedent of reputation.

The literature emphasizes the importance of corporate reputation as an intangible resource, and the importance of CSR disclosure in its creation and enhancement. Pérez-Cornejo et al. [68] (p. 1252) summarize numerous benefits of a firm having a good corporate reputation: relationship with stakeholders; attraction of “loyal customers who are willing to pay premium prices”; attraction of good quality employees and reduction of turnover in the workforce; loyalty in investors and better conditions in accessing financial resources. Shen et al. [69] further argue that CSR plays an important role in how a firm creates value from its intangible assets. These authors highlight the role of CSR in the enhancement of employee loyalty (which helps in the retention of good employees) and organizational identification, as well as the promotion of collaboration across units. The intangible resources of greatest strategic importance are reputation, human capital, innovation, and culture [21]. Surroca et al. [21] argue that the development of good relationships with its stakeholders, namely via CSR, allows a firm to develop such resources, and these make it possible for the firm to use its assets in the most competitive and efficient way, and enable it to gain competitive advantage regarding its competitors.

For example, Eliwa et al. [70] present evidence suggesting that lending institutions reward companies with superior social, environmental, and governance performance and disclosure with a lower cost of debt. Another example is that of potential employees. Focusing on millennial job seekers, Klimkiewicz and Oltra [71] refer to the increasing importance of CSR in labor market communication and found that millennial job seekers do seem to be attracted by the CSR-based employer image.

Stakeholders pay increasing attention to organizations’ social responsibility practices [27]. Although some of the attributes of CSR are easily observable, sometimes it becomes difficult for stakeholders to assess whether an organization is or is not socially responsible [64]. Many organizations simultaneously engage in socially responsible and irresponsible behaviors, making the net assessment of CSR particularly difficult [64]. In this context, the role of information asymmetry between organizations and stakeholders on the performance of corporate sustainability can be critical [72]. One mechanism by which stakeholders are able to assess the corporate social performance is via the guidelines of third-party organizations promoting sustainable development and corporate citizenship rankings and evaluations conducted by magazines and financial institutions [64]. These rankings include, for example, the “Most Admired Companies” ranking (which includes a social responsibility dimension), the “Best Companies to Work for”, the “Most Ethical Companies”, and also the various sustainability indexes that provide guidance to stakeholders regarding the social performance of organizations [64,72].

If stakeholders have difficulty distinguishing between good and bad social performers due to evaluative uncertainty [73], the endorsement of a recognized social index may assist with new information on social performance [64]. The third-party assessment organizations are institutional mediators that provide a normative benchmark for organizations seeking to achieve a positive reputation [45,64,73]. The inclusion in a social index can provide external support to the organization’s legitimacy in the field of CSR [64]. Because these entities have many resources and often have access to better information, their opinions influence stakeholders’ perceptions of organizations’ social responsibility [51]. Institutional mediators provide a normative benchmark for organizations seeking to achieve a positive reputation, as well as guidance to stakeholders about organizations’ practices [64]. Inclusion in a social index can provide external support to the organization’s legitimacy in the field of CSR [64].

Within the social and environmental domain, the Dow Jones Sustainability Index is considered one of the most visible proclaimed indicators of excellence in corporate sustainability [51]. For organizations that have made the strategic decision to invest in sustainability, credibly signaling this commitment can be challenging [45]. The association with a recognized best-in-class index is intended to reflect the leadership in terms of corporate sustainability [51,72,74]. However, the Dow Jones Sustainability Index has been criticized for its overweighting of financial performance in relation to the organization’s social or environmental attributes [74]. In addition, the high reliance on internal and external communication documents provided by the organizations suggests that membership in the Dow Jones Sustainability Index may be influenced more by what the organizations say (what they disclose) than what they do (their performance) [51], which brings back the question of IM strategies in the quest for legitimacy.

One can envisage at least three different theoretical views on the relationship between CSR performance and CSR disclosure [75]. The first, an economics-based approach, leads to the expectation of a positive link between the two, given that firms with good CSR performance are likely to signal such a performance to investors. Firms presenting better CSR performance are expected to present CSR information pertaining to a wider variety of issues in a more detailed manner than their counterparts, although the lack of information may hinder these latter firms “as, in the absence of any information, stakeholders could fear the worst” [75] (p. 4). Using the distinction between enhancement versus the obfuscation IM strategies presented above, one might say that firms with poor CSR performance are more likely to adopt an obfuscation strategy, and provide information that is less balanced and precise [39]. Conversely, firms presenting good CSR performance “could improve the quality of their disclosure by providing more comparable and reliable information” [39] (p. 469). The second theoretical view, built upon a sociology-based perspective focusing on legitimacy, leads to the prediction of a negative relationship, in view of the need of firms with poor CSR performance to convince “stakeholders that their actual behavior is better than perceived” [75] (p. 3). In terms of enhancement versus obfuscation strategies, again, firms in such circumstances are more likely to adopt an obfuscation strategy [39]. The third, based on pure ethical theories, looks at firms as being motivated to present good CSR performance and offering transparent information on it just because “it is the right thing to do” [75] (p. 4). Martínez-Ferrero et al. [39] (p. 470) call this “accountability perspective”, mentioning that it appeals to full accountability by companies as an ethical obligation. These researchers suggest that, according to such a view, CSR disclosure “offers the necessary transparency for being reliable and comparable with information disclosure by other firms” [39] (p. 470).

3. Proposal of a Formal Theoretical Framework

The approaches to IM within CSR disclosure lack in providing a deeper understanding of the potential link between a firm’s financial performance and social and environmental disclosure. This is an absence that needs to be addressed when one takes into account that such a disclosure is also a way of offering information on the intangible resources required to improve their future financial performance. This is an important aspect to take into account given the recent growth in investors’ use of CSR disclosure as a way of evaluating management’s quality [76]. In particular, as suggested by Lee and Maxfield [19], CSR disclosure yields value for financial performance given that it provides information on firms’ stakeholder management’s quality.

If one considers the two first theoretical views mentioned by Brooks and Oikonomou [75] and applies them to this interaction, a much more complex picture should be offered. First, from an economics-based perspective, firms presenting poor financial performance may be motivated to engage in CSR disclosure in an attempt to show to investors that they possess the intangible resources mentioned above. Firms with poor financial performance and poor CSR performance would engage in obfuscation strategies, whereas firms with poor financial performance but good CSR performance would engage in enhancement strategies. Second, from a sociology-based perspective focusing on legitimacy, firms presenting good financial performance may be compelled to address the increased visibility that such performance gives them by engaging in CSR disclosure. Firms with good financial performance but with poor CSR performance would engage in obfuscation strategies. In turn, firms with good financial performance and good CSR performance are not likely to engage in IM strategies, rather, they are likely to provide high-quality information. It means they are likely to provide a comprehensive reporting of relevant information using sound and comparable data [39].

One could refer, in the wake of Patten [18] (p. 298), to a distinction between two types of corporate legitimacy: economic and social legitimacy. The first type is market-based, and leads to the assessment of corporate performance as being assessed by way of a firm’s profits, with the firms that are deemed as successful along these lines being able to achieve legitimacy. Patten noted that such legitimacy “was, until recently, the only constraint placed on business by society” [18] (p. 298). Social legitimacy, on the other hand, “is monitored through the public policy arena rather than the marketplace” [18] (p. 297). Patten [18] thus suggested that CSR disclosure would be more related to social legitimation than to economic legitimation, and that the extent of such disclosure would be influenced more by public scrutiny and pressure than by economic ones. Hence, according to such a perspective, there would be no reason to expect that CSR disclosure is related to financial performance. Notwithstanding, based on a perspective focusing on the relationship between CSR disclosure and social legitimacy, other researchers suggest a possible relationship between high levels of profits and CSR disclosure, with a view of the desire of more successful companies to legitimize their activities [77]. We argue that besides these two possible links between CSR disclosure and financial performance, there is a third possibility related to the links between a firm’s CSR investments and its future financial performance.

Lys et al. [20] mention several specific channels through which a firm’s engagement with CSR policies and practices may be related to its future financial performance. These range from assisting in the attraction and retainment of good employees to increased demand for its products and services. These researchers also refer to indirect channels through which CSR investments may lead to improved financial performance, including the role of such investment in the mitigation of detrimental regulatory or legislative action, and its role in reputation insurance. Be that as it may, investors increasingly include social and environmental disclosure information in their decision-making processes, and one of the important factors driving this is the consideration of aspects pertaining to risk [78].

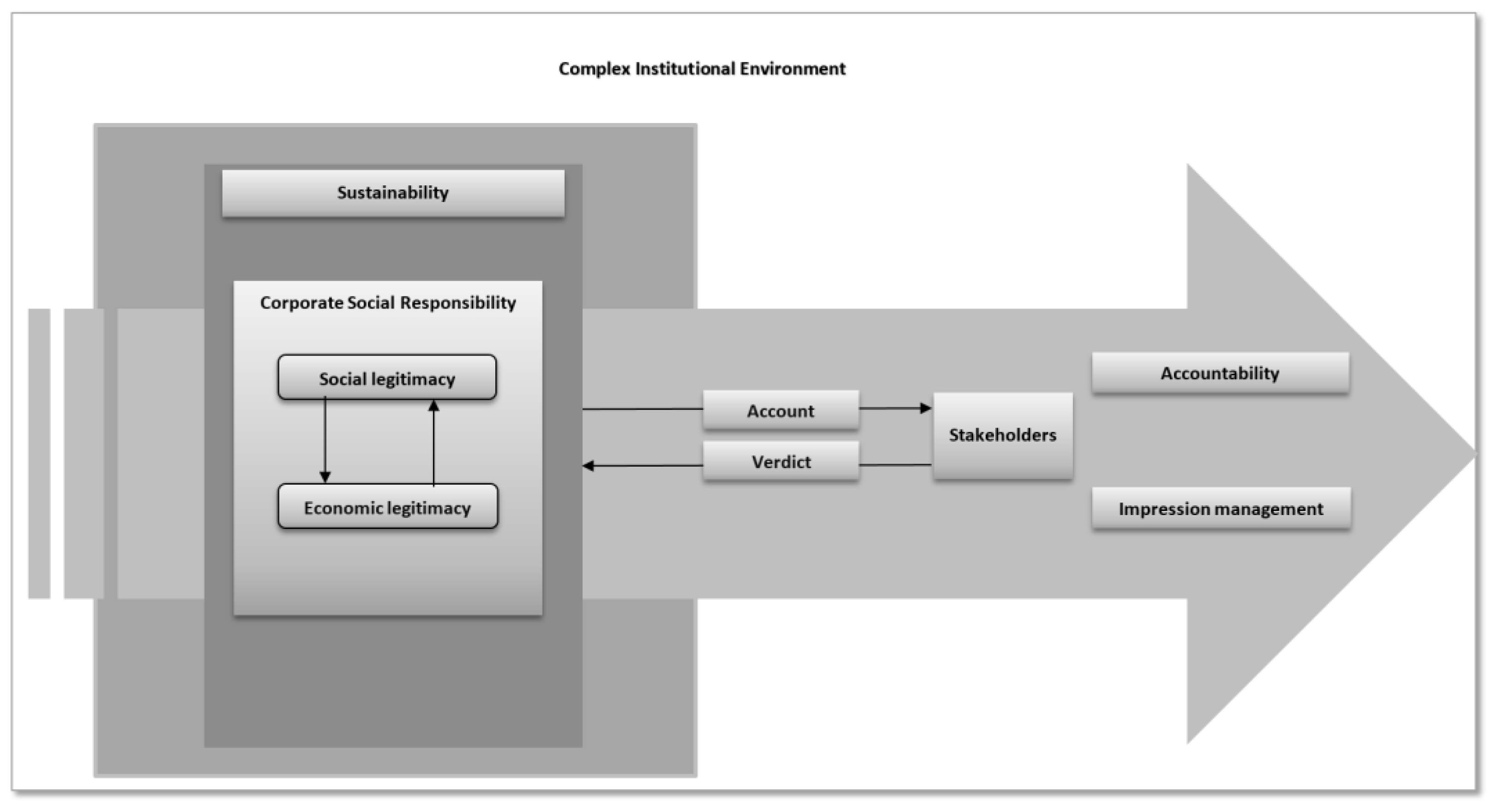

The fact is that we live in a world of perceptions, and organizations need to manage the perceptions of the different stakeholders in order to maintain/gain social, as well as economic, legitimacy. In addition, society is becoming more aware of the relevance of social and environmental issues, and investors are becoming increasingly aware of the relationship between good CSR performance and prospects for economic success. There are demands from the institutional environment both for organizations to be accountable for their social and environmental actions, and to provide information to facilitate the assessment of future financial performance. These demands may lead organizations to adopt IM tactics to manage perceptions and provide accounts demonstrating that they are good corporate citizens, and possess the intangible resources required to ensure economic success in the future, as represented in Figure 1.

Figure 1.

Framework on managing corporate social and environmental disclosure: accountability vs impression management.

With the recent emergence and rapid spread of IR, a new reporting framework that proposes the integration of social and environmental disclosures (nonfinancial information) with financial disclosures in a single report [10,22,23,24] has become even more pressing. It also adds the need to address CSR disclosure, financial performance, and social and economic legitimacy in an articulated way. IR is sometimes viewed as “the last piece of the accounting disclosure puzzle” [79] (p. 23) or as “the next step in social and environmental disclosures” [80] (p. 184). Abhayawansa et al. [81] report exponential growth in the adoption of IR. Although the existing empirical evidence of IR’s benefits to users has been described as sparse [81], some research indicates that it may be helpful in assisting the formulation of strategy, assessing the value of organizations, improving stewardship and accountability, and explaining why market values of companies exceed book values [80].

The objective of IR, of merging traditional financial information with social and environmental information and providing a single report, is to improve the quality of the information made available to investors for the purposes of their decision-making, as well as to be more transparent regarding the economic impacts of CSR activities [82]. IR is addressed at investors, whose main concern is corporate financial performance and whose analyses of CSR are inextricably linked to how it is related to corporate risks, corporate reputation, and financial performance. Hence, the social and environmental information included in IR, which is difficult to disentangle from financial information, is likely to be used as a way of assessing future financial performance. Therefore, particularly in the case of IR, social and environmental disclosure should be seen as a way of assessing both corporate social behavior and future financial performance. In such a situation, IM practices aim at achieving both social and economic legitimacy.

One should also take into account the possibility of conflict between the two types of legitimacy. This may be the case with industries or companies that present high levels of profitability when, at the same time, their activities are seen in some way as being detrimental to social welfare. One may think of the banking industry [77]. This may also be the case with companies that avoid or even evade taxes, and partly as a consequence of present high levels of profitability. One may think of the case of companies that have faced tax evasion scandals such as Starbucks, Google, or Amazon [83]. More recently, it has been reported that organizations have tried to profiteer from the Covid-19 pandemic crisis by inflating prices or making misleading claims about products [84]. The pandemic represents an unprecedented crisis with profound economic, social, political, and cultural impacts, and poses challenges to organizations with regard to CSR [84,85,86].

In the past few decades, corporate social reporting has become an important research field. Although organizations have increased their corporate social reporting, the quality and reliability of those reports have been questioned. Instead of increasing corporate accountability, it can be argued that these disclosures are selective and biased [16]. In fact, IM may be fostered in situations requiring accountability from an organization. IM will happen through the rendering of an account to an audience by the organization and the deliverance of a verdict from the audience following the account [14]. To control the verdict from the audience, organizations can use various strategies to ensure sustainability and that they engage in appropriate corporate social behavior, thus maintaining their social legitimacy. The case with economic legitimacy is similar. In certain cases, CSR will be used to signal the possibility of future superior financial performance. This will be a continuing process since the way the audiences react to an organization’s IM strategies can lead to further IM attempts. In sum, as put by Ou, Wong, and Huang [87] (p. 1), “CSR is a rather dynamic, time-variant, and highly contextualized organizational strategic response to environmental jolts”.

The framework proposed and illustrated by Figure 1, highlights the need for researchers to consider in their analyses the extent to which corporate social and environmental reporting may be more reflective of IM rather than of the discharge of functional accountability, working as a response to address legitimacy challenges, regarding both economic and social legitimacy.

4. Discussion and Conclusions

IM has been identified as occurring in any situation where an organization attempts to influence the attitudes, opinions, and behaviors of organizational audiences. From this perspective, corporate reporting on social and environmental issues might represent a tool aimed at controlling and manipulating stakeholders’ perceptions, both those pertaining to a company´s social behavior and those concerning its prospects for financial performance. Organizations use IM to maintain an appearance of compliance with social values and expectations, and to signal the existence of the intangible resources required to ensure their continued economic success.

Like most cultural processes, the management of legitimacy relies heavily on communication—in this case, communication between an organization and its multiple stakeholders [1,7]. IM has been adopted and applied to explain the response of organizations dealing with challenges to legitimacy [6]. In situations featuring complexity, where organizations are confronted with incompatible demands from stakeholders, they may be uncertain on how to respond [42].

Situations requiring accountability from an organization foster IM through the rendering of an account to an audience by the organization and the deliverance of a verdict from the audience following the account [14]. Organizations can take various strategies to ensure that their behaviors are perceived as legitimate. It is recognized that IM strategies may result in biased reporting. By reducing exposure to social and political pressures, corporate social reporting is an instrument of social legitimation [51]. By signaling the prospects of future superior financial performance, such reporting may also be an instrument of economic legitimation.

Research has discussed the role of social and environmental reporting in giving incremental information to stakeholders. Nonetheless, the quality and reliability of social and environmental reports have been largely questioned in the literature. Critics argue that these disclosures tend to be selective and biased and thus, do not enhance corporate accountability [16]. It seems that social and environmental reporting may be more reflective of IM rather than of the discharge of functional accountability, suggesting a response to the legitimacy challenge [38]. In this vein, IM can be “a tool that perpetuates a myth of accountability” [17] (p. 196).

The framework proposed in this paper underlines the need to look at the role played by CSR reporting in simultaneously addressing economic and social legitimacy. As far as we are aware, these two aspects have been predominantly addressed as separate and autonomous. The role of CSR reporting as a strategy for obtaining social legitimacy is well researched. Nowadays, the role of CSR reporting in addressing the needs of companies’ stakeholders interested in their current and future economic performance is no longer under dispute. This paper underlines the need to have a framework enabling those interested to understand and analyze the two aspects mentioned above as inextricably related. We propose such a framework. The need for it is even more pressing in light of the growth of IR reported by KPMG [55].

We argue that the decoupling of CSR statements from practices by way of IM strategies may be attempted for both social legitimacy reasons and economic legitimacy reasons. This economic legitimacy aspect is an additional one that is seldom developed when examining IM in CSR disclosure. Its usage as an instrument for providing investors (as well as other stakeholders predominantly concerned with a company’s financial performance) with information concerning the intangible resources, allowing them to ensure continued economic success, is, nowadays, an important one to which little attention is being given within the IM literature.

5. Contributions, Limitations, and Proposals for Future Research

Accountability is still in the nascent stage as a scholarly research domain and much is unknown about this construct [37]. To help with this, we developed a framework drawn from the relevant literature that sets out accountability reporting on social and environmental issues, signaling the prospects of future economic success, organizational legitimacy, and IM behavior. This paper, therefore, brings together a wide range of constructs into a single framework. In this way, we contribute to the accountability literature by highlighting the relevance of IM in compromising the quality of corporate social reporting, which can result in capital misallocation. We acknowledge that this work is of economic, societal, and ethical concern as voluntary social reporting allows organizations to project a discourse imbued by significant bias. Employing the framework developed in this research may enable further insights into whether IM behaviors in accountability reporting is reflective of the company or sector-specific circumstances within either public or private sectors. Recently, scholars have begun to acknowledge that organizations are “embedded in a web of conflicting interests” [42] (p. 86), therefore, a valuable avenue of future research is to explore how actors resolve complexity in the accountability process using the framework proposed. The COVID-19 pandemic provides immense opportunities for organizations to engage more than ever with their CSR agenda and strategies [85]. It represents a disruptive event, bringing unprecedented shocks to society and economies worldwide, which could potentially have a profound impact regarding the discharge of CSR [84,86]. This crisis has put organizations under testing for their commitments to CSR and ethical business conduct [84] and provides a unique context to test and apply the proposed conceptual framework for empirical development.

Notwithstanding, our study presents a number of limitations, which, however, also provide some additional insights for future research. One of such limitations pertains to the absence of adequate treatment in our analysis of the way different stakeholders are targeted by companies in their social and environmental disclosure. It is possible that a company uses different strategies and channels to communicate with current and potential employees. This has not been explored. Companies may use social and environmental disclosure in different documents, such as the annual report, the sustainability report, and the IR, to target different stakeholders, offering different takes on the same realities. For example, we mentioned above that one possible channel through which a firm’s CSR may be related to its future financial performance pertains to its role in the attraction and retainment of good employees. If the annual report is viewed as the main document through which the communication with current employees is achieved, and the sustainability report is viewed as the main document to present the company to potential employees, it is likely that the company uses different IM strategies in these documents while referring to the same realities. Exploration of this possibility within the model proposed is an interesting avenue for further research.

Author Contributions

All authors contributed equally to this work. All authors wrote, reviewed, and commented on the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

Delfina Gomes has conducted the study at Research Center in Political Science (UIDB/CPO/00758/2020), University of Minho/University of Évora and supported by the Portuguese Foundation for Science and Technology and the Portuguese Ministry of Education and Science through national funds. This research was also supported by the Portuguese Foundation for Science and Technology, under the project grant UIDB/05105/2020.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Acknowledgments

The authors would like to acknowledge the helpful comments of three anonymous referees of the journal, who have helped to improve this paper. An earlier draft of the paper was presented at 15th European Conference on Management, Leadership and Governance, Porto, Portugal, 14–15 November 2019, and the authors would like also to thank to the participants of the conference.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Martins, A.; Gomes, D.; Oliveira, L.; Caria, A.; Parker, L. Resistance strategies through the CEO communications in the media. Crit. Perspect. Account. 2020, 71, 1–23. [Google Scholar] [CrossRef]

- Tedeschi, J.T.; Melburg, V. Impression management and influence in organization. In Research in the Sociology of Organizations; Bacharach, S.B., Lawler, E.J., Eds.; JAI Press: Greenwich, CT, USA, 1984; Volume 3, pp. 31–58. [Google Scholar]

- Cüre, T.; Esen, E.; Çalışkan, A.Ö. Impression management in graphical representation of economic, social, and environmental issues: An empirical study. Sustainability 2020, 12, 379. [Google Scholar] [CrossRef]

- Hooghiemstra, R. Letters to the shareholders: A content analysis comparison of letters written by CEOs in the United States and Japan. Int. J. Account. 2010, 45, 275–300. [Google Scholar] [CrossRef]

- Stanton, P.; Stanton, J.; Pires, G. Impressions of an annual report: An experimental study. Corp. Commun. Int. J. 2004, 9, 57–69. [Google Scholar] [CrossRef]

- Deephouse, D.L.; Bundy, J.; Tost, L.P.; Suchman, M.C. Organizational legitimacy: Six key questions. In The Sage Handbook of Organizational Institutionalism, 2nd ed.; Greenwood, R., Oliver, C., Lawrence, T., Meyer, R., Eds.; Sage: Thousand Oaks, CA, USA, 2017; pp. 27–54. [Google Scholar]

- Elsbach, K.D. Managing organisational legitimacy in the California cattle industry: The construction and effectiveness of verbal accounts. Adm. Sci. Q. 1994, 39, 57–88. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Martins, A.; Gomes, D.; Oliveira, L.; Ribeiro, J. Telling a success story through the president’s letter. Qual. Res. Account. Manag. 2019, 16, 403–433. [Google Scholar] [CrossRef]

- Roman, A.-G.; Mocanu, M.; Hoinaru, R. Disclosure style and its determinants in integrated reports. Sustainability 2019, 11, 1960. [Google Scholar] [CrossRef]

- Hooghiemstra, R. Corporate communication and impression management—New perspectives why companies engage in social reporting. J. Bus. Ethics 2000, 27, 55–68. [Google Scholar] [CrossRef]

- Merkl-Davies, D.M.; Brennan, N.M. Discretionary disclosure strategies in corporate narratives: Incremental information or impression management? J. Account. Lit. 2007, 26, 116–194. [Google Scholar]

- Merkl-Davies, D.M.; Brennan, N.M. A conceptual framework of impression management: New insights from psychology, sociology and critical perspectives. Account. Bus. Res. 2011, 41, 415–437. [Google Scholar] [CrossRef]

- Roussy, M.; Rodrigue, M. Internal audit: Is the ‘third line of defense’ effective as a form of governance? An exploratory study of the impression management techniques chief audit executives use in their annual accountability to the audit committee. J. Bus. Ethics 2018, 151, 853–869. [Google Scholar] [CrossRef]

- Boiral, O. Accounting for the unaccountable: Biodiversity reporting and impression management. J. Bus. Ethics 2016, 135, 751–768. [Google Scholar] [CrossRef]

- Cho, C.H.; Laine, M.; Roberts, R.W.; Rodrigue, M. The frontstage and backstage of corporate sustainability reporting: Evidence from the Arctic National Wildlife Refuge Bill. J. Bus. Ethics 2018, 152, 865–886. [Google Scholar] [CrossRef]

- Solomon, J.F.; Solomon, A.; Joseph, N.L.; Norton, S.D. Impression management, myth creation and fabrication in private social and environmental reporting: Insights from Erving Goffman. Account. Organ. Soc. 2013, 38, 195–213. [Google Scholar] [CrossRef]

- Patten, D.M. Exposure, legitimacy and social disclosure. J. Account. Public Policy 1991, 10, 297–308. [Google Scholar] [CrossRef]

- Lee, J.; Maxfield, S. Doing well by reporting good: Reporting corporate responsibility and corporate performance. Bus. Soc. Rev. 2015, 120, 577–606. [Google Scholar] [CrossRef]

- Lys, T.; Naughton, J.P.; Wang, C. Signaling through corporate accountability reporting. J. Account. Econ. 2015, 60, 56–72. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- De Villiers, C.; Rinaldi, L.; Unerman, J. Integrated reporting: Insights, gaps and an agenda for future research. Account. Audit. Account. J. 2014, 27, 1042–1067. [Google Scholar] [CrossRef]

- De Villiers, C.; Venter, E.R.; Hsiao, P. Integrated reporting: Background, measurement issues, approaches and an agenda for future research. Account. Financ. 2017, 57, 937–959. [Google Scholar] [CrossRef]

- Nicolò, G.; Zanellato, G.; Tiron-Tudor, A. Integrated Reporting and European State-Owned Enterprises: A disclosure analysis pre and post 2014/95/EU. Sustainability 2020, 12, 1908. [Google Scholar] [CrossRef]

- Schlenker, B.R. Impression Management: The Self-Concept, Social Identity, and Interpersonal Relations; Brooks/Cole: Monterey, CA, USA, 1980. [Google Scholar]

- Goffman, E. The Presentation of Self in Everyday Life; Doubleday Anchor Books: New York, NY, USA, 1959. [Google Scholar]

- Diouf, D.; Boiral, O. The quality of sustainability reports and impression management: A stakeholder perspective. Account. Audit. Account. J. 2017, 30, 643–667. [Google Scholar] [CrossRef]

- Ogden, S.; Clarke, J. Customer disclosures, impression management and the construction of legitimacy. Corporate reports in the UK privatised water industry. Account. Audit. Account. J. 2005, 18, 313–345. [Google Scholar] [CrossRef]

- Bozzolan, S.; Cho, C.H.; Michelon, G. Impression management and organizational audiences: The Fiat group case. J. Bus. Ethics 2015, 126, 143–165. [Google Scholar] [CrossRef]

- Bansal, P.; Kistruck, G. Seeing is (not) believing: Managing the impressions of the firm’s commitment to the natural environment. J. Bus. Ethics 2006, 67, 165–180. [Google Scholar] [CrossRef]

- Neu, D.; Warsame, H.; Pedwell, K. Managing public impressions: Environmental disclosures in annual reports. Account. Organ. Soc. 1998, 23, 265–282. [Google Scholar] [CrossRef]

- Im, J.; Kim, H.; Miao, L. CEO letters: Hospitality corporate narratives during the COVID-19 pandemic. Int. J. Hosp. Manag. 2021, 92, 102701. [Google Scholar] [CrossRef]

- Ginzel, L.E.; Kramer, R.M.; Sutton, R.I. Organizational impression management as a reciprocal influence process: The neglected role of the organizational audience. In Organizational Identity; Hatch, M.J., Schultz, M., Eds.; Oxford University Press: Oxford, UK, 2004; pp. 223–261. [Google Scholar]

- Arndt, M.; Bigelow, B. Presenting structural innovation in an institutional environment: Hospitals’ use of impression management. Adm. Sci. Q. 2000, 45, 494–522. [Google Scholar] [CrossRef]

- Erkama, N.; Vaara, E. Struggles over legitimacy in global organizational restructuring: A rhetorical perspective on legitimation strategies and dynamics in a shutdown case. Organ. Stud. 2010, 31, 813–839. [Google Scholar] [CrossRef]

- Brennan, N.M.; Merkl-Davies, D.M. Accounting narratives and impression management. In The Routledge Companion to Accounting Communication; Jack, L., Davison, J., Craig, R., Eds.; Routledge: London, UK, 2013; pp. 109–132. [Google Scholar]

- Hall, A.T.; Frink, D.D.; Buckley, M.R. An accountability account: A review and synthesis of the theoretical and empirical research on felt accountability. J. Organ. Behav. 2017, 38, 204–224. [Google Scholar] [CrossRef]

- Conway, S.L.; O’Keefe, P.A.; Hrasky, S.L. Legitimacy, accountability and impression management in NGOs: The Indian Ocean tsunami. Account. Audit. Account. J. 2015, 28, 1075–1098. [Google Scholar] [CrossRef]

- Martínez-Ferrero, J.; Suárez-Fernández, O.; García-Sánchez, I.M. Obfuscation versus enhancement as corporate social responsibility disclosure strategies. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 468–480. [Google Scholar] [CrossRef]

- Beelitz, A.; Merkl-Davies, D.M. Using discourse to restore organizational legitimacy: “CEO-speak” after an incident in a German nuclear power plant. J. Bus. Ethics 2012, 108, 101–120. [Google Scholar] [CrossRef]

- Gendron, C.; Breton, G. Telling the privatization story: A study of the president’s letter. Bus. Soc. Rev. 2013, 8, 179–192. [Google Scholar] [CrossRef]

- Raaijmakers, A.G.; Vermeulen, P.A.; Meeus, M.T.; Zietsma, C. I need time! Exploring pathways to compliance under institutional complexity. Acad. Manag. J. 2015, 58, 85–110. [Google Scholar] [CrossRef]

- Kaplan, S. Why social responsibility produces more resilient organizations. MIT Sloan Manag. Rev. 2020, 62, 85–90. [Google Scholar]

- Pérez-Batres, L.A.; Doh, J.P.; Miller, V.V.; Pisani, M.J. Stakeholder pressures as determinants of CSR strategic choice: Why do firms choose symbolic versus substantive self-regulatory codes of conduct? J. Bus. Ethics 2012, 110, 157–172. [Google Scholar] [CrossRef]

- Robinson, M.; Kleffner, A.; Bertels, S. Signaling sustainability leadership: Empirical evidence of the value of DJSI membership. J. Bus. Ethics 2011, 101, 493–505. [Google Scholar] [CrossRef]

- Capriotti, P.; Moreno, A. Corporate citizenship and public relations: The importance and interactivity of social responsibility issues on corporate websites. Public Relat. Rev. 2007, 33, 84–91. [Google Scholar] [CrossRef]

- Fierro, J.A.M.; Sanagustín-Fons, M.V.; Álvarez Alonso, C. Accountability through environmental and social reporting by wind energy sector companies in Spain. Sustainability 2020, 12, 6375. [Google Scholar] [CrossRef]

- Palazzo, G.; Scherer, A.G. Corporate legitimacy as deliberation: A communicative framework. J. Bus. Ethics 2006, 66, 71–88. [Google Scholar] [CrossRef]

- Belal, A.R.; Roberts, R.W. Stakeholders’ perceptions of corporate social reporting in Bangladesh. J. Bus. Ethics 2010, 97, 311–324. [Google Scholar] [CrossRef]

- Lee, S.Y.; Carroll, C.E. The emergence, variation, and evolution of corporate social responsibility in the public sphere, 1980–2004: The exposure of firms to public debate. J. Bus. Ethics 2011, 104, 115–131. [Google Scholar] [CrossRef]

- Cho, C.H.; Guidry, R.P.; Hageman, A.M.; Patten, D.M. Do actions speaker louder than words? An empirical investigation of corporate environmental reputation. Account. Organ. Soc. 2012, 37, 14–25. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Hussain, N.; Khan, S.A.; Martínez-Ferrero, J. Do markets punish or reward corporate social responsibility decoupling? Bus. Soc. 2020, 1–37. [Google Scholar] [CrossRef]

- Pope, S.; Wæraas, A. CSR-washing is rare: A conceptual framework, literature review, and critique. J. Bus. Ethics 2016, 137, 173–193. [Google Scholar] [CrossRef]

- Talbot, D.; Boiral, O. GHG reporting and impression management: An assessment of sustainability reports from the energy sector. J. Bus. Ethics 2018, 147, 367–383. [Google Scholar] [CrossRef]

- KPMG International Survey of Sustainability Reporting. 2020. Available online: https://home.kpmg/xx/en/home/insights/2020/11/the-time-has-come-survey-of-sustainability-reporting.html (accessed on 18 December 2020).

- Alliance for Corporate Transparency. Research Report 2019: An Analysis of the Sustainability Reports of 1000 Companies Pursuant to the EU Non-Financial Reporting Directive. Alliance for Corporate Transparency. Available online: https://www.allianceforcorporatetransparency.org/assets/2019_Research_Report%20_Alliance_for_Corporate_Transparency-d9802a0c18c9f13017d686481bd2d6c6886fea6d9e9c7a5c3cfafea8a48b1c7.pdf (accessed on 14 December 2020).

- Bansal, P.; Clelland, I. Talking trash: Legitimacy, impression management and unsystematic risk in the context of the natural environment. Acad Manag. J. 2004, 47, 93–103. [Google Scholar] [CrossRef]

- Freedman, M.; Stagliano, A.J. Environmental disclosures: Electric utilities and phase 2 of the Clean Air Act. Crit. Perspect. Account. 2008, 19, 466–486. [Google Scholar] [CrossRef]

- Hopwood, A.G. Accounting and the environment. Account. Organ. Soc. 2009, 34, 433–439. [Google Scholar] [CrossRef]

- Blanc, R.; Cho, C.H.; Sopt, J.; Branco, M.C. Disclosure responses to a corruption scandal: The case of Siemens AG. J. Bus. Ethics 2019, 156, 545–561. [Google Scholar] [CrossRef]

- Secchi, D. The Italian experience in social reporting: An empirical analysis. Corp. Soc. Responsib. Environ. Manag. 2006, 13, 135–149. [Google Scholar] [CrossRef]

- Hawrysz, L.; Maj, J. Identification of stakeholders of public interest organisations. Sustainability 2017, 9, 1609. [Google Scholar] [CrossRef]

- Wang, M.C. The relationship between firm characteristics and the disclosure of sustainability reporting. Sustainability 2017, 9, 624. [Google Scholar] [CrossRef]

- Doh, J.P.; Howton, S.D.; Howton, S.W.; Siegel, D.S. Does the market respond to an endorsement of social responsibility? The role of institutions, information, and legitimacy. J. Manag. 2010, 36, 1461–1485. [Google Scholar] [CrossRef]

- Hrasky, S.; Smith, B. Concise corporate reporting: Communication or symbolism? Corp. Comm. Int. J. 2008, 13, 418–432. [Google Scholar] [CrossRef]

- Ashforth, B.E.; Gibbs, B.W. The double-edge of organizational legitimation. Organ. Sci. 1990, 1, 177–194. [Google Scholar] [CrossRef]

- Deephouse, D.L.; Carter, S.M. An examination of differences between organizational legitimacy and organizational reputation. J. Manag. Stud. 2005, 42, 329–360. [Google Scholar] [CrossRef]

- Pérez-Cornejo, C.; de Quevedo-Puente, E.; Delgado-García, J.B. Reporting as a booster of the corporate social performance effect on corporate reputation. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1252–1263. [Google Scholar] [CrossRef]

- Shen, N.; Au, K.; Li, W. Strategic alignment of intangible assets: The role of corporate social responsibility. Asia Pac. J. Manag. 2019, 17, 1–21. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG practices and the cost of debt: Evidence from EU countries. Crit. Perspect. Account. 2019. [Google Scholar] [CrossRef]

- Klimkiewicz, K.; Oltra, V. Does CSR enhance employer attractiveness? The role of millennial job seekers’ attitudes. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 449–463. [Google Scholar] [CrossRef]

- Lourenço, I.C.; Callen, J.L.; Branco, M.C.; Curto, J.D. The value relevance of reputation for sustainability leadership. J. Bus. Ethics 2014, 119, 17–28. [Google Scholar] [CrossRef]

- Rao, H. The social construction of reputation: Certification contests, legitimation, and the survival of organizations in the American automobile industry, 1895–1912. Strateg. Manag. J. 1994, 15, 29–44. [Google Scholar] [CrossRef]

- Fowler, S.J.; Hope, C. A critical review of sustainable business indices and their impact. J. Bus. Ethics 2007, 76, 243–252. [Google Scholar] [CrossRef]

- Brooks, C.; Oikonomou, I. The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. Br. Account. Rev. 2018, 50, 1–15. [Google Scholar] [CrossRef]

- Eccles, R.G.; Serafeim, G.; Krzus, M.P. Market interest in non-financial information. J. Appl. Corp. Financ. 2011, 23, 113–128. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Social responsibility disclosure: A study of proxies for the public visibility of Portuguese banks. Br. Account. Rev. 2008, 40, 161–181. [Google Scholar] [CrossRef]

- Reimsbach, D.; Schiemann, F.; Hahn, R.; Schmiedchen, E. In the eyes of the beholder: Experimental evidence on the contested nature of materiality in sustainability reporting. Organ. Environ. 2020, 33, 624–651. [Google Scholar] [CrossRef]

- Pavlopoulos, A.; Magnis, C.; Iatridis, G.E. Integrated reporting: Is it the last piece of the accounting disclosure puzzle? J. Multinatl. Financ. Manag. 2017, 41, 23–46. [Google Scholar] [CrossRef]

- Adhariani, D.; de Villiers, C. Integrated reporting: Perspectives of corporate report preparers and other stakeholders. Sustain. Account. Manag. Policy J. 2019, 10, 183–207. [Google Scholar] [CrossRef]

- Abhayawansa, S.; Elijido-Ten, E.; Dumay, J. A practice theoretical analysis of the irrelevance of integrated reporting to mainstream sell-side analysts. Account. Financ. 2019, 59, 1615–1647. [Google Scholar] [CrossRef]

- Mervelskemper, L.; Streit, D. Enhancing market valuation of ESG performance: Is integrated reporting keeping its promise? Bus. Strategy Environ. 2017, 26, 536–549. [Google Scholar] [CrossRef]

- Henderson, J. Tax transparency and reputation: The genie is out of the bottle. Int. Tax Rev. 2012, 23, 9. [Google Scholar]

- He, H.; Harris, L. The impact of Covid-19 pandemic on corporate social responsibility and marketing philosophy. J. Bus. Res. 2020, 116, 176–182. [Google Scholar] [CrossRef]

- Donthu, N.; Gustafsson, A. Effects of COVID-19 on business and research. J. Bus. Res. 2020, 117, 284–289. [Google Scholar] [CrossRef]

- Parker, L.D. The COVID-19 office in transition: Cost, efficiency and the social responsibility business case. Account. Audit. Account. J. 2020, 33, 1943–1967. [Google Scholar] [CrossRef]

- Ou, J.; Wong, I.A.; Huang, G.I. The coevolutionary process of restaurant CSR in the time of mega disruption. Int. J. Hosp. Manag. 2021, 92, 102684. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).