6.2. Case Study

The aim of this case study consists of checking whether the features of the mainstream investment and the CSR policy of the company under analysis are compatible with the approach to CSR adopted in this article. Specifically, this case study aims to answer the following questions:

- (a)

Is the CSR policy of this corporation focused on mitigating the externalities generated by its mainstream activity?

- (b)

Does the corporation undertake investment projects for their mitigation?

- (c)

Does the corporation dialogue with stakeholders on sustainability issues?

- (d)

Does the corporation aim to create value for stakeholders?

- (e)

Is its CSR policy also oriented to creating value for shareholders?

A representative company in the field of CSR is the International Airlines Group (IAG). As stated in its sustainability report [

73] (p. 53), IAG performed in 2017 a materiality report following the Global Reporting Initiative Sustainability Guidelines, and in 2018 it worked with the Global Reporting Initiative and the Air Transport Association (IATA) in the GRI Sectorial Guidance Handbook for airlines. Its Sustainability Report follows the Directive 2014/95/EU on non-financial reporting and the relevant legislation in the UK and Spain.

This case study focuses on this corporation. The method of analysis consists of a detailed study of the integrated financial and sustainability report of 2018 [

73], complemented with the support of a frequency analysis through text mining techniques. Frequency analysis is a well-known technique of text analysis. Archer [

74] points out that the relevance of frequencies is due to the fact that the author’s choice of words is seldom arbitrary. Davies [

75] (p. 68) stresses that frequencies should be considered in context. Ignatow and Mihalcea [

76] (p. 84) discuss the value of word clouds for text analysis, praising their contribution to identifying keywords and comparing the word usage across documents and signalling that, when considered alone, they lead researchers to put the context aside. Popping [

77] points out the need for systematically submitting the outcomes of quantitative text analysis to qualitative interpretation. Consequently, following the arguments stated by Davies, Ignatow, Mihalcea, and Popping, text mining is used in this case study as a complementary technique for illustrating the conceptual analysis of IAG reports. A remarkable example of text mining application is the text mining handbook for central banks by Bholat et al. [

78] for the Bank of England.

Carbon emissions, not surprisingly, are the primary focus of the chairman’s letter [

73] (p. 53), as well as of the whole sustainability report. Aircrafts noises constitute another externality that receives remarkable attention concerning corporate relations with communities [

73] (p. 53) and the corporate commitment to SDGs (p. 60). Waste reduction is mentioned in a similar line [

73] (p. 68). IAG has undertaken several investment projects for mitigating carbon emissions, some of them also associated with noise reduction. Investing in the modernisation of the fleet with a 20% reduction on carbon emissions and a 50% on noise is one of the most relevant projects. New software for improving fuel efficiency, actions for reducing waste in the aeroplanes, and substituting traditional vehicles for electric ones at airports are other relevant initiatives. Supporting research for cutting down emissions—specifically research projects, as the Futures Fuel challenge, with universities and other partners [

73] (p. 55), can be interpreted as a CSR line that generates real options. The corporate dialogue with stakeholders takes place at two levels. First, shared initiatives with industry partners and associations [

73] (p. 53) for improving environmental conditions centred on airlines, mainly with fuel efficiency in mind. Second, talking with communities placed near airports with IAG hubs about noise reduction initiatives can be regarded as a way of generating valuable information for the noise reduction projects [

73] (p. 53). The former case constitutes an example of generating financial value through business partnerships on sustainability. The corporate dialogue with employees is, logically, more related to labour conditions than with new investments. The corporate interest on social capital is shown by supporting programmes for employees, gender equality actions among them, and external programmes on scholarships for STEM studies that may provide the future workforce for IAG. Finally, the link with CSR and corporate value creation is shown by the repeated statements about creating sustainable value. To sum up, the answers to questions (a) to (e) show that the CSR of IAG mainly focuses on the mitigation of corporate externalities and assumes the goals of technical efficacy, social efficiency, and financial value creation in their main courses of action.

The study of word frequencies in IAG reports corroborates these conclusions from the perspective of text mining. IAG discloses its financial and sustainability information in an integrated report. The text analysis starts by exploring the whole sustainability report and, next, it centres on the sustainability chapters. Ignatow and Mihalcea [

76] (p. 57), among others, point out that word distribution often follows Zipf’s law. However, this is not the case of the text under analysis. Through

Mathematica software, we have estimated a value of 0.72 for the coefficient of the Zipf’s distribution applied to the frequencies of the Strategy Report. For the Sustainability Report, this value becomes 0.87. However, the estimation of the distribution fit refutes the hypothesis that the samples of both reports come from a Zipf’s population. Turkel [

79] presents the complete development of the applicability of

Mathematica software to text analysis.

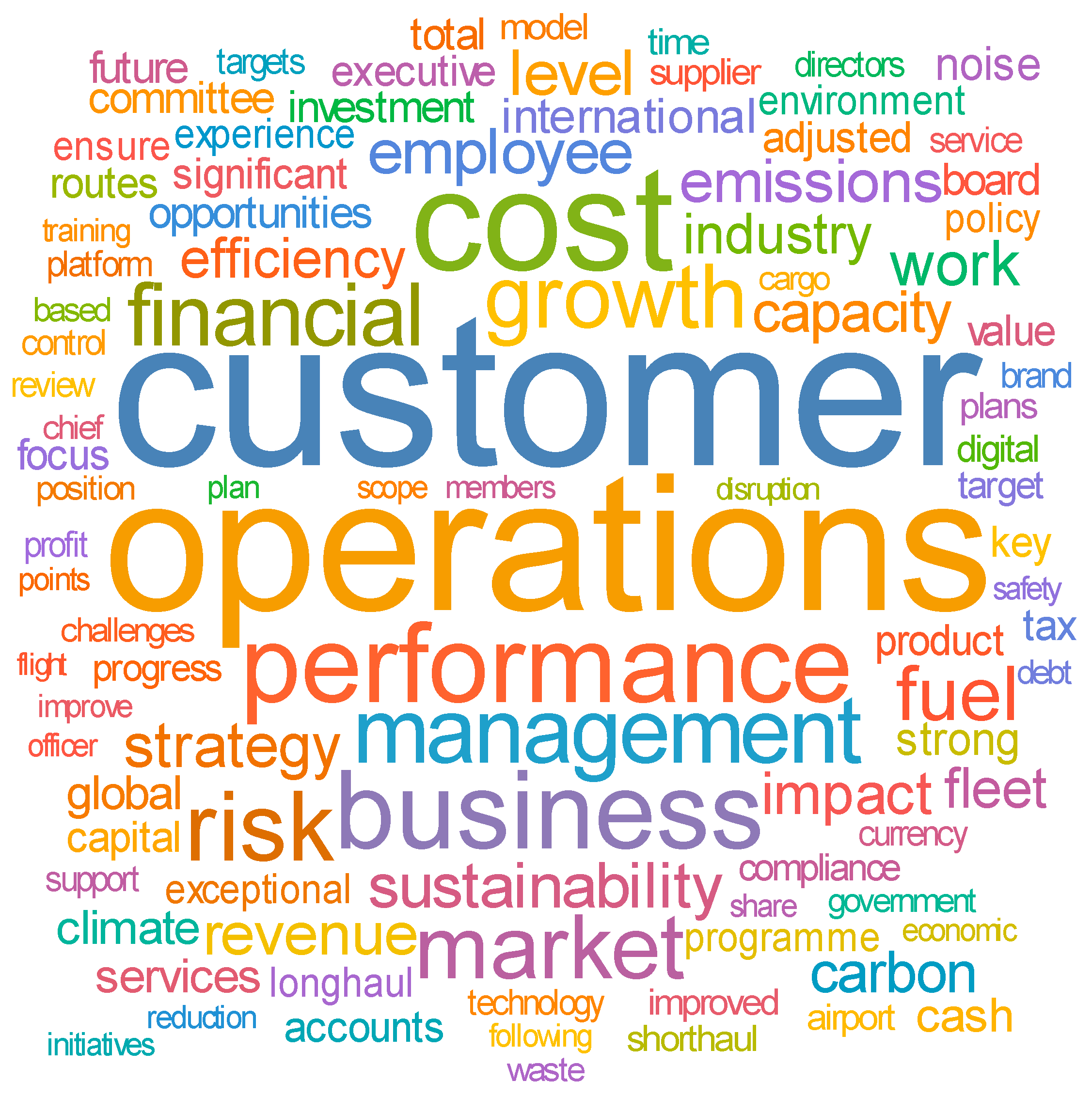

The outcome of this application of text mining consists of the statistical analysis of the list of most frequent words, together with the corresponding bigrams and trigrams. The word clouds illustrate the results. The first step of the text analysis was to eliminate stop-words and homogenising synonymous. The most frequent meaningful words in a text, i.e., excluding stop-words, can be taken as its keywords, after considering them from the perspective of the whole text. The integrated report presents a high concentration of words related to corporate strategy but also sustainability.

Table 2 shows the most frequent words, while

Table 3 and

Table 4 display the most frequent bigrams and trigrams, respectively. In the tables that report bigrams and trigrams (

Table 3 and

Table 4 for the strategic report and Table 6 for the sustainability report), we have excluded the outputs that are non-significant for the current analysis by maintaining, of course, the correct position of each bigram and trigram in the frequency ranks. The mean of the frequency is 5, with a standard deviation of 11 and a skewness coefficient of 11 as well. The frequencies of the twenty most used words range from 65 to 283. The upper quartile starts at a frequency equal to the mean, and the upper 1% starts at a frequency of 43. The word cloud in

Figure 3 shows a visual image of the word concentration.

Figure 4 displays the frequencies concerning the number of words in each position and shows the significant weight of the most frequent words. From these results, we can conclude that the analysis of the whole report shows a corporation concerned with its customers, operations, costs, and financial performance, which fits the goal of value creation for shareholders. The associations that bigrams and trigrams identify, where “chief executive officer” and “management committee” occupy paramount positions, stress the logically important role of corporate leaders in the management of the concerns and challenges reflected in word frequencies. However, words related to sustainability also appear in the most frequent words list, although in a lower position (“sustainability” in the 13th position, “emissions” in 17th, “impact” in 19th, and “carbon” in 20th). Remarkably, “fuel efficiency” turns out to be the 5th bigram, while “climate change” becomes the 22st. The 8th, 13th, and 14th trigrams show the corporate concern with the Sustainability Development Goals, where “link” becomes a keyword, showing that the IAG report relates its CSR to the SDGs.

Centring on the sustainability report, not surprisingly, the word “sustainability” turns out to be the most frequent.

Table 5 displays the frequencies of the words in this report, while

Table 6 displays its bigrams.

Figure 5 and

Figure 6 present the corresponding word cloud and frequencies table. The high positions of the words “aircraft”, “operations”, “emissions”, and “carbon” convey the corporate interest on environmental sustainability, centrally focused on carbon emissions. The analysis of the bigrams—where “fuel efficiency” appears in the 1st position, followed by “operations, company” and “sustainability fuels”, while “climate change” occupies the 5th position—confirms this view. The equally relevant positions (15th and 16th) of “CO emissions” and “low carbon” reinforce it.

The corporate capital budgeting analysis is not disclosed due to its confidentiality. However, the whole report and its text analysis present enough evidence of the existence and application of the capital budgeting circle closely connected with corporate strategic planning.

The conjoint interpretation of any text analysis lies in its capacity for identifying the keywords of the text through the frequencies of single words. The word associations in bigrams and trigrams enhances its potential. The scientific legitimacy of text analysis is justified by the methodological works on the subject; some of them have been quoted above. Interpreting the results of the text analysis in the full context of the documents under study is a central requirement. In the case of IAG’s strategic and sustainability reports, the text analysis identifies corporate externalities as relevant keywords. The term “sustainability” also has the value of a principal keyword. Terms related to corporate performance and business context are categorised as main keywords as well, especially in the strategic report. By itself, this text analysis does not show the corporate attitude towards externalities and sustainability, although, considering the general social and economic concern on sustainability, we could hardly expect keywords to be associated to a negationist attitude towards sustainability. The IAG’s sustainability strategy has been identified through the conceptual analysis of its reports presented in the first paragraphs of this case study. To sum up, the frequency analysis has confirmed that the corporate investment projects mentioned in the sustainability report as the central courses of action for dealing with corporate externalities belong to a text in which these externalities appear as keywords.

All in all, the questions asked at the beginning of this case study receive positive answers. The CSR of IAG is focused on the mitigation of its externalities, mainly carbon emissions and noise. To achieve this goal, IAG undertakes investment projects with a long-run horizon by renewing its fleet, investing in new software, and supporting innovation. The dialogue with stakeholders is also well argued for in the report as the value creation for stakeholders through specific programmes. The financial sustainability of the CSR policy—and, thus, the value creation for shareholders—is inherent to the repeatedly stated goal of creating sustainable value, namely value for the long run. The CSR investment projects of IAG confirm this statement. The compatibility between this setting and the capital budgeting model developed in this paper is justified by the mitigation of externalities as the central CSR goal, and by assuming the goals of efficacy for the natural and social capitals together with economic efficiency for stakeholders and value creation for shareholders in the CSR investment projects undertaken by IAG for mitigating its main externalities.

Table 7 summarises the questions and answers of the IAG case study.

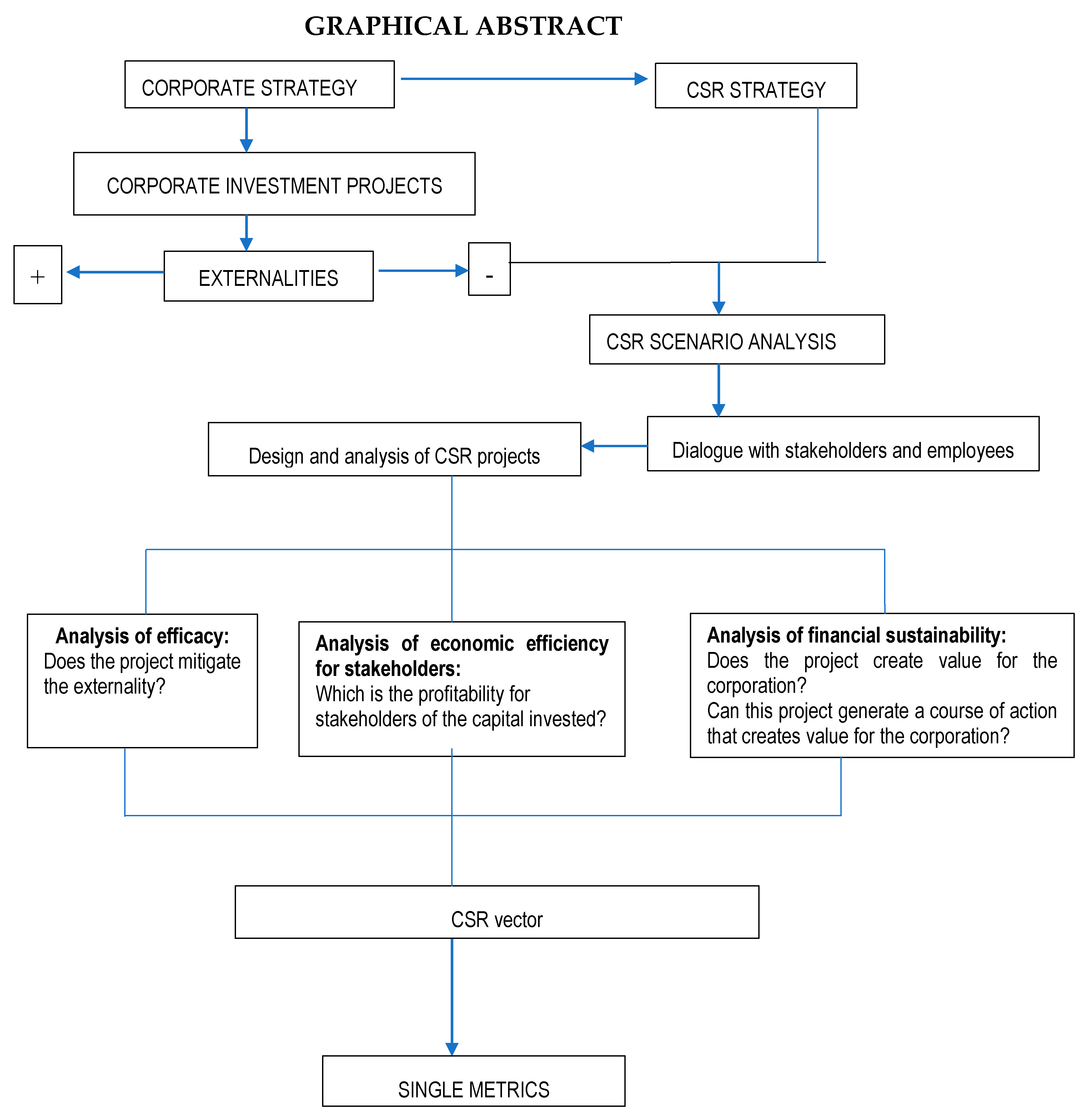

The conceptual map presented in

Figure 7 summarises the contents of this paper. It expresses the process that connects the corporate investment projects with the CSR strategy when CSR focuses on the control of the negative externalities produced by corporate investments. After a scenario analysis and a dialogue with stakeholders and employees, the corporation designs a CSR project aimed at mitigating the negative externalities. The analysis of this project consists of evaluating its capacity for controlling the externalities under consideration (efficacy), its economic efficiency for stakeholders, and its impact on corporate value, i.e., its financial sustainability for shareholders. The outcome of this analysis constitutes the CSR vector for the project under analysis. The indicators of the CSR vector can be summarised in a single metric, as shown in this paper.

The conceptual map presented in

Figure 7 summarises the contents of this paper. It expresses the process that connects the corporate investment projects with the CSR strategy when CSR focuses on the control of the negative externalities produced by corporate investments. After a scenario analysis and a dialogue with stakeholders and employees, the corporation designs a CSR project aimed at mitigating the negative externalities. The analysis of this project consists of evaluating its capacity for controlling the externalities under consideration (efficacy), its economic efficiency for stakeholders, and its impact on corporate value, i.e., its financial sustainability for shareholders. The outcome of this analysis constitutes the CSR vector for the project under analysis. The indicators of the CSR vector can be summarised in a single metrics, as shown in this paper.