1. Introduction

As global air travel grew steadily in the last decade, and as policies will soon be developed to support recovery after Covid-19, it is important to balance the need for air travel to support passenger and cargo mobility with associated societal costs and benefits for airlines, airports, and the community. Although airlines and airports strive for efficiency in operations, this efficiency is not a guarantee for sustainability. Therefore, policy tools are useful to enhance the sustainability of the air transport system. The effects of these policies are a constant topic of debate for all stakeholders. The most widely accepted policy tools for policymakers concerned with sustainability in the air transport system are aviation fuel taxes. Jet fuel tax cuts are considered pro-growth by airlines and policymakers alike. These stakeholders often emphasize the potential benefits of increased airline operations and employment, while overlooking the negative environmental and airport funding ramifications. Conversely, some view a jet fuel tax increase as a detrimental policy to the air transport system and the local economy. As these policy debates continue, the need for an accurate assessment of the effects of a jet fuel tax change is apparent. This study contributes to the ongoing debate surrounding jet fuel taxes by providing an analysis of a jet fuel tax policy change, specifically the effect on key societal metrics to include air traffic, employment, and greenhouse gas emissions at a major US hub airport.

The value of assessing employment impacts is considerable, since the aviation industry directly employs 10.2 million people globally [

1] and provides more than 1.2 million jobs in the US, with a payroll of more than USD 77 billion for workers at the 493 commercial airports in the US [

2]. Moreover, airports are the largest employers in multiple states, not only at the nation’s largest airport in Georgia, where Hartsfield-Jackson Atlanta International Airport employs more than 60,000 people [

3], but also in other states, such as Colorado, where Denver International Airport employs over 35,000 employees. While airline direct employment is lower than it was before 2001, it does exceed values from before the recession in 2008 [

4]. Airline mergers, and the shift of some work to contract employees and vendors, may contribute to relatively modest growth in airline employment relative to the growth in the aviation sector. Growth in aviation has been steady, with increases in air cargo, as well as passenger enplanements. Enplanements increased steadily from 2009 through early 2020 and exceeded pre-recession levels by 2015 [

5]. Enplanements are easy to measure and are widely reported for all commercial airports in the US, and previous research has confirmed that enplanements are strongly correlated with on-airport payroll and employment [

2]. Aviation sector jobs reflect not only employees at passenger airlines, but also cargo airlines, operations, suppliers, terminal business, airport operations, and jobs associated with the construction of airport capital improvements. The inclusion of analysis encompassing the impact of a jet fuel tax on employment supports a more comprehensive analysis of aviation fuel tax policy, which is consistent with sustainability measures such as the Triple Bottom Line approach, which accounts for social, economic, and environmental impacts of policies and actions [

6].

From a global perspective, there has been significant discussion regarding aviation’s contribution to global emissions. Although aviation contributes only about 2% of CO

2 emissions [

1], the environmental impact of these emissions may be more significant than other sources, due to the chemical and physical processes associated with combustion at high altitudes [

7]. The US aviation market is a significant contributor to these emissions and contributed 23.5% of the global aviation CO

2 emissions in 2017 [

8], however, there has been less discussion and fewer incentives for US airlines to reduce their emissions.

Globally, the aviation community has taken the issue of emissions seriously, which is reflected by ambitious goals, such as carbon-neutral growth for international aviation after 2020, and net reductions for international aviation by 2050; it is expected that these goals will be met through improved technologies, increased efficiencies, modernized air traffic management, and a global market-based system to offset CO

2 emissions from international aviation activities [

9]. The future offset scheme, CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation), would stabilize emissions at 2020 levels by using an emission offset program. There are some limitations to offset schemes, for example, although CORSIA is a program of the International Civil Aviation Organization (ICAO), the proposed credits under CORSIA are not compatible with the allowances currently used by the ICAO member states in the European Union (EU) under the Emissions Trading System (ETS) [

10]. In 2012, the EU expanded the original ETS program (which began in 2005) to address CO

2 emissions for all flights within the EU for participating countries [

11]. Although previous researchers (e.g., [

12]), have noted that there are important differences between the trading systems, such as the ETS and aviation fuel taxes, the ETS is worth acknowledgement, because it presents a clear connection between financial transactions and aviation emissions, and also because it serves as evidence of greater environmental awareness in Europe. Greater environmental awareness in Europe is also evidenced by the concept of flygskam, or flight shaming, which began in Sweden in 2018 [

13]. Flygskam promotes activism to encourage travelers to use rail and modes other than air travel; flygskam was gaining traction in a number of European countries (e.g., Germany) until the Covid-19 pandemic in 2020 sidelined discussion of the topic. Another important distinction between a trading system or offset program and a fuel tax is intent. The intent of the ETS or an offset program is to reduce emissions, whereas the intent of an aviation fuel tax, such as the US fuel tax we analyze, is typically to raise revenue. There has been significantly less interest and attention to aviation emissions in the US by US air carriers, although a number of US airports have developed sustainability plans and participated in sustainability programs, such as the Airport Carbon Accreditation program by the Airports Council International (ACI).

Previous research has addressed the utility of an aviation fuel tax to monetize the negative externalities associated with aeronautical activities. Research conducted using data for Heathrow Airport in London, England, suggested that taxes of 0.5% for a short haul flight and 2% for a long-haul flight and would compensate not only for CO

2 and other air borne emissions but also noise [

14]. Other research with a more global perspective found that taxes may not have a significant impact on consumption due to low elasticity. A statistical time-series analysis of 29 years of data (reflecting world crude oil prices, bunker jet fuel, and global GDP from 1966 to 1995) suggested that, although tax on jet fuel is proposed to control emissions, the findings suggest that, since the price elasticity of demand is low, a jet fuel tax would not significantly reduce CO

2 emissions [

15]. The findings of this research (which may be somewhat limited since they are based on price data for crude oil, rather than jet fuel) suggest limitations for the usefulness of an aviation fuel tax to reduce CO

2 emissions, however, it does substantiate the value of an aviation fuel tax as a mechanism to raise revenue.

More recently, analysis of US data from 1995 to 2013 using simultaneous quantile regression suggests that jet fuel taxes would reduce fuel consumption and CO

2 emissions in the short term with elasticities of 0.14% to 0.18% in the first year, decreasing to 0.008% to 0.01% in the longer term (3 years after the tax increase) [

16]. In the first year, this suggests a 4.3 cent fuel tax would reduce fuel consumption by 698 million gallons and CO

2 emissions by 6.8 to 8.3 million metric tons for domestic flights in the US [

16]. To provide context for this reduction, a 7.5 million metric ton reduction would represent about 4% of the 184 million metric tons of CO

2 emissions contributed by the US aviation sector in 2018 [

8], although these reductions would be expected to diminish in the longer term.

These findings are consistent with the analysis of data from other countries. A 30% reduction in the Aviation Fuel Tax of Japan in 2011 provided the opportunity to evaluate the impact of the tax reduction on aviation fuel consumption and emissions using a Bayesian time series analysis of domestic flights in Japan, which utilized monthly data from January 2004 through December 2013 [

17]. The analysis results suggest that the cumulative impact of the tax cut was about 246 million gallons (converted from 930,123 Kl) and 2.4 million metric tons of CO

2 [

17]. Recognizing the complex environment that policy effects, the authors acknowledge that although there would be significant environmental benefits to an increased aviation fuel taxation, it may not be feasible, since it would result in increased costs to aviation businesses, including the regional and low-cost aviation carriers, which have experienced significant growth [

17]. Given the business implications of any tax change, often an incremental approach is recommended, a perspective which has been substantiated by previous research (e.g., [

18]). Aviation’s critical role in the local, national, and global economies is critical and uncontested. This is reflected by the exclusion of aviation emissions from the Kyoto Treaty [

19], the 2015 Paris Agreement [

20], and, historically, the prohibition on international aviation taxes per the Chicago Convention that founded ICAO [

21].

In recent years, concerns regarding aviation emissions, as well as a compelling need for a more robust understanding of the interconnectedness of aviation fuel taxes, emissions, and employment, provide a motivation for our research. This motivation has been energized by the need for public policies that will support the aviation sector as it rebounds from Covid-19, and support local employment, while minimizing the negative environmental effects due to aviation emissions. The current literature lacks research that provides analysis of the impact of aviation fuel tax on employment and emissions. This paper will fill that gap and contribute to the literature surrounding jet fuel taxes by moving beyond typical jet fuel price elasticity analyses, and investigating the effect of a jet fuel tax policy change on key societal metrics to include air traffic, employment, and greenhouse gas emissions by using quasi-experimental techniques.

The remainder of the paper is organized as follows:

Section 2 provides a description of the data used and a thorough development of the difference-in-differences model used to estimate the effects of a jet fuel tax change.

Section 3 discusses the results of the estimation of the effects of the tax cut on air traffic, employment, and emissions. Finally,

Section 4 provides a discussion of the policy implications and paths for future research.

2. Data and Methodology

The empirical analysis begins with an investigation into the effects of a jet fuel tax on airline operations into and out of the studied airport. The airlines are assumed to allocate flights to maximize profits. As states decrease the costs to airlines of conducting operations, then supply should increase ceteris paribus. Therefore, a state could incentivize an airline to increase operations at their local airport by lowering the input costs for that airline. Economic theory provides us with an expectation that there will be an increase in flight operations following a jet fuel tax cut. Georgia is a unique state with one of the busiest airports in the world, and, as previously mentioned, the airport is the largest employer in the state, with an airport-based payroll of over USD 17 billion; the total economic impact of the airport activities contributes more than USD 82 billion when the indirect and induced impacts are also considered [

3]. Another unique attribute of Georgia is that they are one of only a few states to institute a tax cut for jet fuel purchases in recent history. The passage of the tax cut provides a unique opportunity to study the effects of this policy change in relation to large hub airports not experiencing similar cuts. This study examines three of the busiest hub airports in the nation: Hartsfield-Jackson Atlanta International Airport (ATL), Dallas/Fort Worth International Airport (DFW), and Los Angeles International Airport (LAX). These airports were chosen given their comparable enplanements, geographical heterogeneity, and economic significance. These airports are large hub airports per the Federal Aviation Administration’s National Plan of Integrated Airport Systems [

22]. Based on data for 2018, ATL ranks first in the US for enplanements and 13th in cargo (with 51.9 million enplanements and 3.0 billion lbs of landed weight); LAX ranks second in enplanements and 5th in cargo (with 42.6 million enplanements and 7.3 billion lbs landed weight), and DFW ranks 4th in enplanements and 9th in cargo (32.8 million enplanements and 4.3 billion lbs landed weight) [

23]. Further, both DFW and LAX did not experience a jet fuel tax change during the periods studied. Using two geographically separated comparison airports of comparable size and traffic reduces the likelihood of biases created by selecting only one control group.

The framework for the jet fuel tax at ATL changed briefly in on July 1, 2018 [

24]. On March 1, 2018, the state legislature voted to remove the sales tax exemption on jet fuel in response to a change in Delta Airline’s policy related to a discount for members of the National Rifle Association (NRA) [

25]. The catalyst for Delta’s policy change was a shooting at a Florida high school in February 2018 [

25]. The sales tax exemption on jet fuel was reinstated in an executive order by the governor on July 31, 2018 [

26]. Although this illustrates the political environment that affects aviation tax policy, due to the brevity of the interval and fact that airline schedules are set months in advance and are relatively slow to respond to changes such as a USD 0.04/gal tax, it is assumed that this change in policy did not have a significant effect on the results of this analysis.

Data used in this analysis are monthly data for the years 2001 to 2019. Air traffic data are from the Bureau of Transportation Statistics’ T-100 database. Air traffic data include domestic and international air traffic operations categorized into major, low-cost, and regional airline operations. Airport cost data are from the Federal Aviation Administration (FAA) from 2013 to 2019, and are supplemented with Department of Transportation Form 41 airline financials provided by the vendor Cirium for the years 2001 to 2012. These figures are estimates based on average airline cost and operations data at each airport exclusive of fuel. Tax data are provided by each individual state’s Department of Revenue. The jet fuel tax is not as straightforward as other fuel related taxes. Jet fuel can be taxed by a state’s excise tax, sales tax, franchise tax, and/or local tax [

27], although there are restrictions on the use of the tax revenue per FAA Grant Assurance 25 Airport Revenues [

28]. Some states afford exemptions to airlines purchasing over certain minimum gallons of jet fuel, or if the airline has a large personnel/business presence in the state. For example, Minnesota exempts airlines from a USD 0.15/gal excise tax after purchasing 200,000 gallons. An airline operating Airbus A320 aircraft, one of the most common commercial aircraft, would need to fill fewer than 30 aircraft to reach this threshold [

29]. Therefore, we use effective tax rates which take into account sales tax, excise tax, and exemptions to determine the existence of a tax cut. Employment data are from the Bureau of Labor Statistics’ Metropolitan Statistical Area database and population data are from the Census Bureau [

30]. Air transportation related employment data are used to ascertain the direct employment effects from the policy change. Indirect effects require micro-level data and suffer from issues related to causality. Therefore, our analysis focuses on direct employment related to air transportation, but also uses total employment in the MSA for checks of robustness.

Figure 1 provides a time series of the monthly flights for the treatment (ATL) and control airports (DFW and LAX). The tax policy change is highlighted by the vertical line on the graph. The cyclical nature of flight data is apparent from visual inspection of the data. Our analysis will use a variety of techniques to account for this seasonality to include seasonally adjusting the data, using monthly dummy variables as well as a time fixed effect.

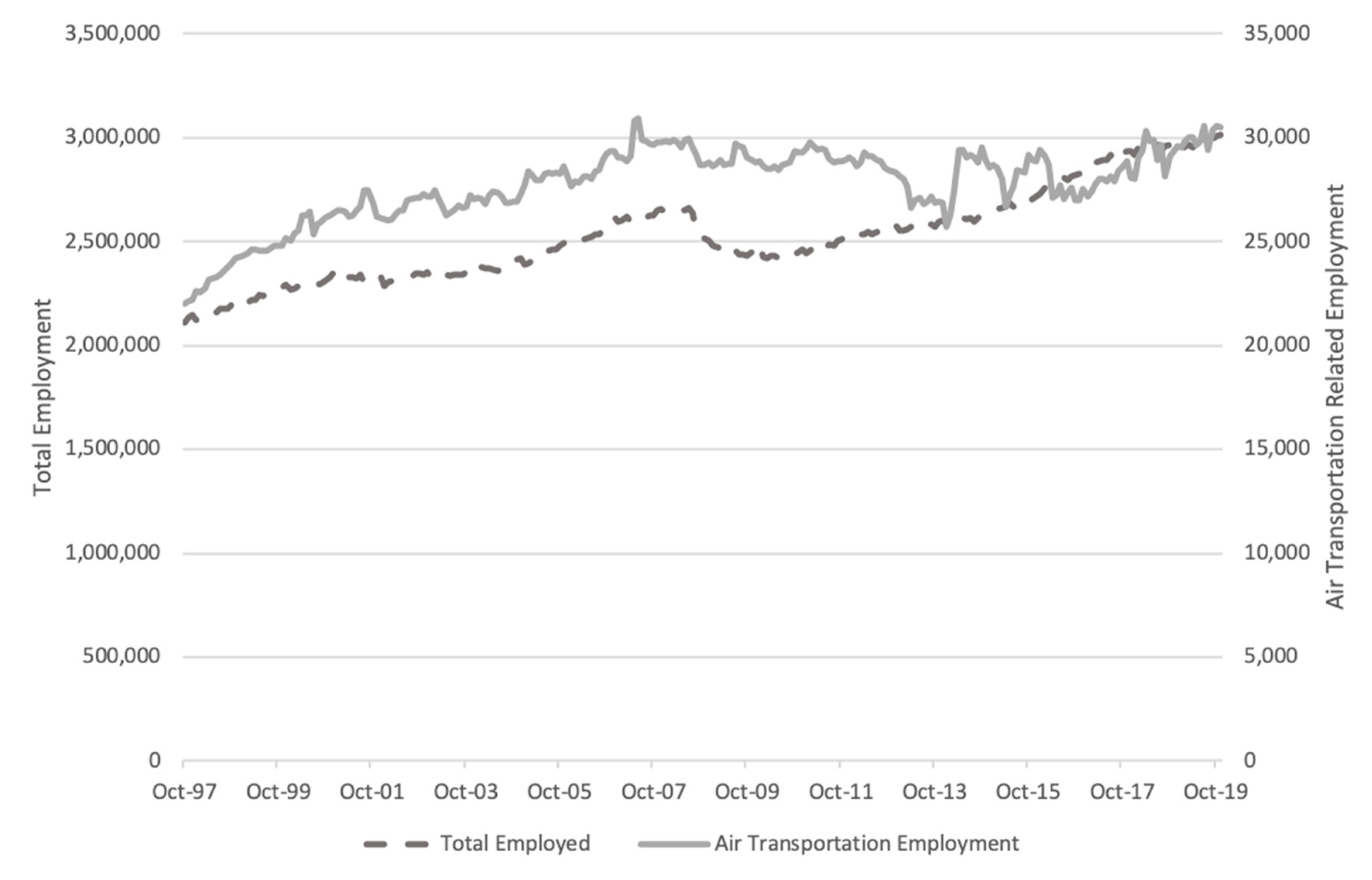

Figure 2 displays the total employment and air transportation related employment in the treatment MSA (ATL). Both variables will be used in the analysis, but the main focus will be placed on air transportation related employment to truly capture the direct effects from changes in air carrier operations. The two series appear to follow a common trend, and both experienced a downturn during the Great Recession. A recession dummy variable will be added to control for these contractionary shocks.

The main model for estimating the effect of the tax change is the difference-in-differences (DD) model. The DD model provides for a quasi-experiment, with the control group being the airport not experiencing a tax change, and the treatment group being the airport experiencing a jet fuel tax change. The DD model also provides an avenue for policy analysis, beyond models relying solely on dummy variables [

31]. One key identifying assumption of the DD model is that the trends would be the same for each individual airport without the tax change. Therefore, the treatment (tax cut) prompts the deviation from the common trend we would observe without the treatment [

32]. The common trend should be established pre-policy change with sufficient past observations to verify the assumed trend. Examining the data in

Figure 1a,b, we notice a clear trend for the pre-policy months from 2001 to 2005, which will be verified by statistical analyses. In later specifications, we control for both time and regional fixed effects. The model will be estimated with individual airline data to remove impacts related to bankruptcies, mergers, and other major events. Further, appropriate controls are added to the model to account for factors impacting the dependent variable of interest. The basic DD model is given by:

where

yirt is the endogenous variable examined (i.e., flights and employment) for airport

i in region

r at time

t.

ATr is a dummy for airports, where the tax has changed and

dt is a time dummy that indicates the periods after the policy have been changed. The effect of the tax change is captured by

ρ, which represents the difference in flights or employment due to the tax cut with seasonal effects removed (

ATr ⋅

dt). This interaction term is the policy variable and set equal to

Drt.

X is a matrix of covariates to increase the precision of our estimates and includes income per capita, population, trade in the region (exports and imports), airport facilities costs, number of runways, recession indicator, and airline market concentration in that region calculated by the Herfindahl-Hirschman Index (HHI). This model implicitly assumes that the region not observing the tax change is an appropriate control for the region that does experience the tax change. The region without a tax change should serve as an appropriate counterfactual to illustrate what would have happened to the treatment region in the absence of the tax cut.

Since the DD model is a version of the fixed effects (FE) model with aggregate data, we formulate an alternate specification using the FE and interaction term,

Drt. We control for the time and regional fixed effects in the model to exploit the regional variations in our data. This model provides an additional check for robustness and is given by:

where the region specific and time fixed effects are given by

γr and

γt, respectively. The possibility that weather data may play a role in air traffic is considered a second order concern, given the inclusion of the region and time fixed effects. We also conduct an alternative check on our identification strategy by adding a region-specific time trend. This allows for different trends for the control and treatment regions. A minimum of three periods prior to the tax change are necessary, and a greater number of periods increases the robustness of the model’s estimates [

33]. The availability of data prior to the tax change allows for a clear trend to be established and extrapolated in periods after the tax change. This time trend provides a more complete control for confounding influences on air traffic over time. This region-specific time trend DD model is given by:

where

γ1r and

γ2r are the region-specific fixed effect and region-specific trend coefficient, respectively. The time trend is given by t, and the associated coefficient provides an estimate of the region’s trajectory over the period studied due to unobserved factors. Models (2) and (3) provide tests for the robustness of our estimates of the effect of a jet fuel tax change. Another area of concern regarding the estimation and inference with respect to DD models (as well as with air travel and employment) is causality. To provide increased confidence beyond intuition of the causal relationship, we provide evidence related to the causal nature of the estimates.

Our dataset provides the opportunity to conduct further tests related to causality. A Granger-style test can be conducted on the DD model, allowing for additional confidence of the causal nature of the data as well as an examination of the pattern of lagged effects [

34]. This type of model includes both lags and leads to understand if the effects are sustained or reduced over time. We test whether past interaction terms,

Drt, predict

Yist, while future

Drt do not, conditional on time and regional effects using this Granger-style testing. This Granger test specification for the DD model is given by:

where the see the addition of the sum of the

n lags effects and

m lead effects. The lag effects are post tax change effects, and the lead effects are viewed as the anticipatory effects. Testing for causality, we would anticipate that the dummy variables related to future tax changes will have no impact on our model.

To estimate the change in emissions related to changes in air traffic, we use a procedure that examines the landing and takeoff (LTO) phases of flight. The LTO sequence is assumed to be most related to local airport operations’ emissions [

35]. This estimation technique uses the LTO cycles conducted at an airport in a given period of time to estimate the fuel burn and emissions from those operations. Data related to aircraft type and size are unavailable; however, given our data are divided into domestic and international operations as well as major, low-cost, and regional carrier operations we can assign a generic aircraft type to each category. The most ubiquitous aircraft for each type of operations are used as a guideline and fuel burn during the LTO phase for each aircraft are from derived from previous studies [

36,

37]. The aircraft used are listed in

Table 1, and the estimates of fuel burn are based on these individual aircraft operating characteristics. The emissions estimates will be based on the US Environmental Protection Agency’s Emission Factors for Greenhouse Gas Inventories database [

38].

3. Results

The descriptive statistics of the variables used are displayed in

Table 2. The average of the air traffic variable (departures) shows a pre- and post-tax cut difference in means for the treatment airport. The average employment was higher in the control airport regions, but the mean did increase for the treatment airport in the post-tax cut period. The treatment airport has a slightly higher mean level of departures pre-tax but has a fairly larger post-tax mean. The average of most the control variables are fairly similar across control and treatment airports. Trade and airport cost controls are higher on average at the control airports, but the HHI is larger at the treatment airport given the high market concentration. The summary of the controls suggests no large difference between the treatment and control airports.

The DD models were estimated using the difference-in-differences procedure in STATA.

Table 3 and

Table 4 provide the estimates of the effect of the jet fuel tax change on the dependent variables for the main model (1), both with and without covariates.

Table 3 and

Table 4 provide the estimates using DFW and LAX as the control groups, respectively. We cluster the standard errors by airport, given the possibility of group level random effects. The pre-tax trends are statistically significant for departures using either comparison group. The jet fuel tax cut is estimated to increase the level of aircraft operations when using either DFW or LAX as a comparison. The estimated effect on departures are found to be positive and statistically significant, ranging from 0.011 to 0.217. This finding aligns with economic theory, which assumes a reduction in taxes would incentivize an agent or business to increase the level of the activity being taxed. The inclusion of the covariates to increase precision also increased the effect size by over 20%. The results with respect to employment are not as promising. The pre-tax trend in employment is statistically significant in all estimations; however, post-tax differences fail to provide strong evidence of an increase (or decrease) in air transportation related employment resulting from a jet fuel tax cut (this insignificance was also found when examining all employment in the MSA). The results indicate that we have insufficient evidence to suggest that such a policy would directly benefit employment in the MSA. This conclusion is found regardless of control group used.

To test the robustness of these estimates, we conduct the additional analyses, as discussed in

Section 3 . The estimates of the alternative specifications are displayed in

Table 5 and

Table 6. The fixed effects model using both time and regional fixed effects provide estimates of the effect on departures that were comparable in magnitude to the DD estimations. The effect of a jet fuel tax cut on aircraft operations is estimated to be positive and statistically significant. The policy effects are estimated to increase aircraft operations by 1 to 12 percentage points, depending upon the specification. These estimates provide further evidence of the results in

Table 3 and

Table 4. We also estimated the effects of the jet fuel tax cut on available seat miles, which resulted in similar estimates. With respect to employment, the alternative specification estimates are unable to provide evidence of a statistically significant effect from a jet fuel tax cut. The exception are the estimation results from the fixed effects model (2), but when the time trend is added to the model the effect is no longer significant. Again, these results hold when we estimate the effect on all employment in the MSA.

The coefficients of the covariates are similar across all specifications. The income per capita coefficient is found to positively affect flights, likely due to the higher fares associated with air travel versus train or bus travel. This coefficient is surprisingly not strongly related to the air transportation employment variable. This finding could be due to the lower wages of the fixed based operations personnel of an airline versus. For flight crews, pay scales are non-location specific and therefore would not provide cost of living adjustments according to domicile. The coefficient on population is only found to be significant in one specification, while the coefficient on trade is significant in most specifications. The combination of exports and imports provide a reasonable signal of the interconnectedness of the region. As the region becomes more economically interconnected with the world, then air travel should increase in that region. The coefficients on airport costs and number of runways were both found to be insignificant. Airport costs are quite low relative to other intermediate and fixed costs of an air carrier. Furthermore, an airline ticket tax transfers some of the user fee to the flying public. The relatively few changes in number of runways or runway length during the time period studied would likely not impact capacity much. Larger expansions or closures could cause more extreme changes in air traffic, due to those capacity changes; however, this example is not the situation for the time period studied. The HHI was significant for a few of the specifications, but insignificant for most of the specifications. As air carriers increase their market share and other firms exit due to inability to compete or greener markets, then we could expect flights to decline. Conversely, air carriers may increase their frequency with increases in market share. The estimates suggest that the relationship between air traffic and HHI is much more complicated than the theoretical relationship proposes.

The estimation of the Granger-style causality model (4) resulted in insignificant estimates of the lead policy effect variables. The coefficients on the lagged policy effect variables provide some detail about the effects over time. The coefficients of the first five lagged policy variables are displayed in

Table 7. These coefficients are all positive, with the remaining coefficients being nonnegative until the tenth to twelfth lag, depending on the region. These results suggest a reduction in the positive effects on flights over time. The estimates suggest the peak effect occurs in the second period (month) with diminishing positive effects as time passes. These results align with the graphical evidence in

Figure 1, showing the eventual reduction in flights occurring after the policy generate boost in air traffic

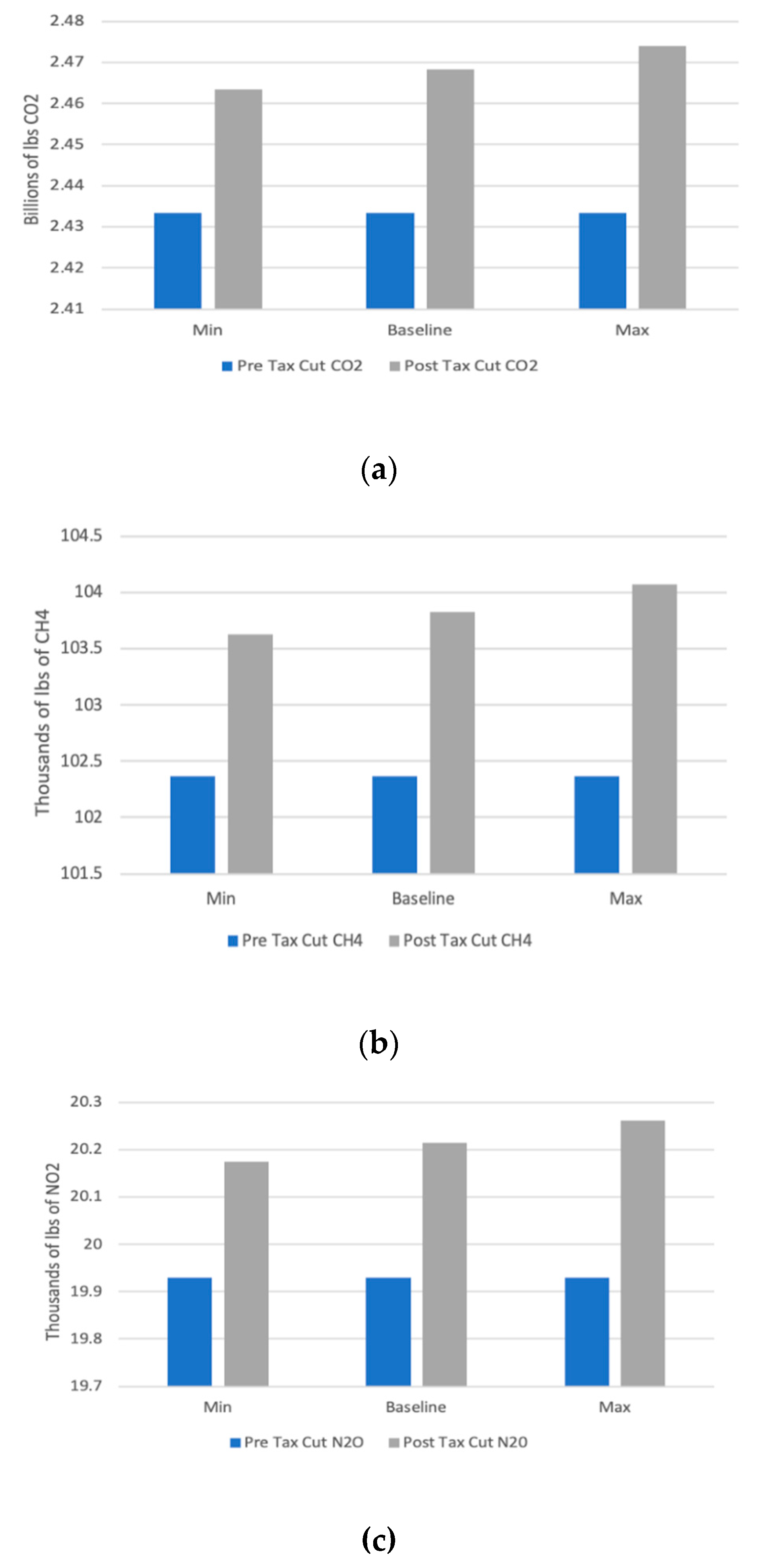

The effects of the policy on emissions are estimated by examining the flight data at ATL. The composition of the aircraft operating during the period that the tax changed is used as a baseline for measuring the change in emissions at the peak of the policy impacts. In

Figure 3, the range of estimates are provided for the additional emissions generated by the policy change. The baseline values represent an increase in emissions of approximately 1.4% from the policy change. Using the standard errors, we estimated the range of emissions around that central level. Overall, we see an increase in emissions to a level of between 1.2% to 1.7% versus pre-tax change levels. These increases were estimated for all greenhouse gas emissions related to jet fuel consumption to include CO

2 (carbon dioxide), CH

4 (methane), and N

2O (nitrous oxide).

4. Discussion

Jet fuel taxation has been a recent topic of discussion as airports and governments have adapted to changing federal regulations with respect to use of those collected funds. In the shadow of these debates are the continually touted societal benefits of reducing an air carriers’ tax burden. The pro-business policy of reducing, exempting, or eliminating a commercial carrier’s jet fuel tax has repeatedly passed through legislative wickets. These policies claim to increase air traffic and bring jobs to local communities surrounding the airport. The results of this study test those assertions with respect to three primary metrics. First, the effects on air traffic are found to be positive as airlines respond to the new costs associated with operating at that particular airport. The policy change increases traffic by over 0.2%, but the increase is not sustained and eventually fades over the period of 10–12 months. This type of fading effect is akin to an announcement effect in the economics literature [

39].

Another important metric related to these policy impacts are employment. When examining direct air transportation related employment, the results suggests an insignificant change occurs. The policy does not significantly affect air transportation employment, despite the fact that air traffic in the area increases. It appears air carriers do not increase employment significantly in coordination with increased air traffic operations. The effect on total employment in the MSA was also estimated to be insignificant. A jet fuel tax cut may increase air traffic, but it does not necessarily incentivize airlines to increase personnel in that location. These findings are counter to the narrative regarding the employment benefits associated with these policies.

The final metric examined was the change in emissions from the tax cut. As air carriers increase their operations at an airport, they perform more landing and takeoff sequences in the terminal area. These sequences are the main drivers of locally produced air transport pollution. The results suggest that the jet fuel tax cut increased greenhouse gas emissions of CO

2, CH

4, and N

2O by over 1%. The tax cut reduces the internalization of the cost of emissions for the airline. This condition leads to increased emissions and accelerated environmental degradation. Furthermore, as airports and governments collect fewer tax revenue from the airlines, then the funds available to mitigate or correct for these externalities is reduced. Additionally, these results add to the scant body of literature discussing the environmental effects from changes in jet fuel taxes, and complements the research surrounding carbon taxation [

40,

41].

The results suggest that policymakers and individuals should create a broader evaluation method to determine the efficacy and net societal benefits of policy changes related to jet fuel taxation. The pro-economy mantra of jet fuel tax cuts hinges on the status quo versus data driven evidence. Closer examination into the effects could benefit airports, local economies, the local environment, and tax coffers. These findings could be especially relevant as policy makers seek to support aviation and aviation employment without unduly impacting the environment during the recovery from Covid-19. Future work could focus on a spatial analysis of jet fuel tax effects as well as the indirect effects on air carriers and employment. Additionally, a true costing of the tax cut would greatly aid any state, local, or federal government in decision making with respect to jet fuel taxation.