The Impact of High-Speed Rail Opening on City Economics along the Silk Road Economic Belt

Abstract

1. Introduction

2. Literature Review

3. Mechanism Analysis of High-Speed Rail’s Impact on Economic Growth

3.1. High-Speed Rail Opening and Economic Growth

3.2. Impact Heterogeneity of High-Speed Rail Opening Regarding Urban Scale

3.3. Impact Heterogeneity of High-Speed Rail Opening Regarding Marketization and Government Efficiency

4. Model and Data

4.1. Model Setting

4.2. Sample and Data Selection

5. Empirical Results and Analyses

5.1. Benchmark Model

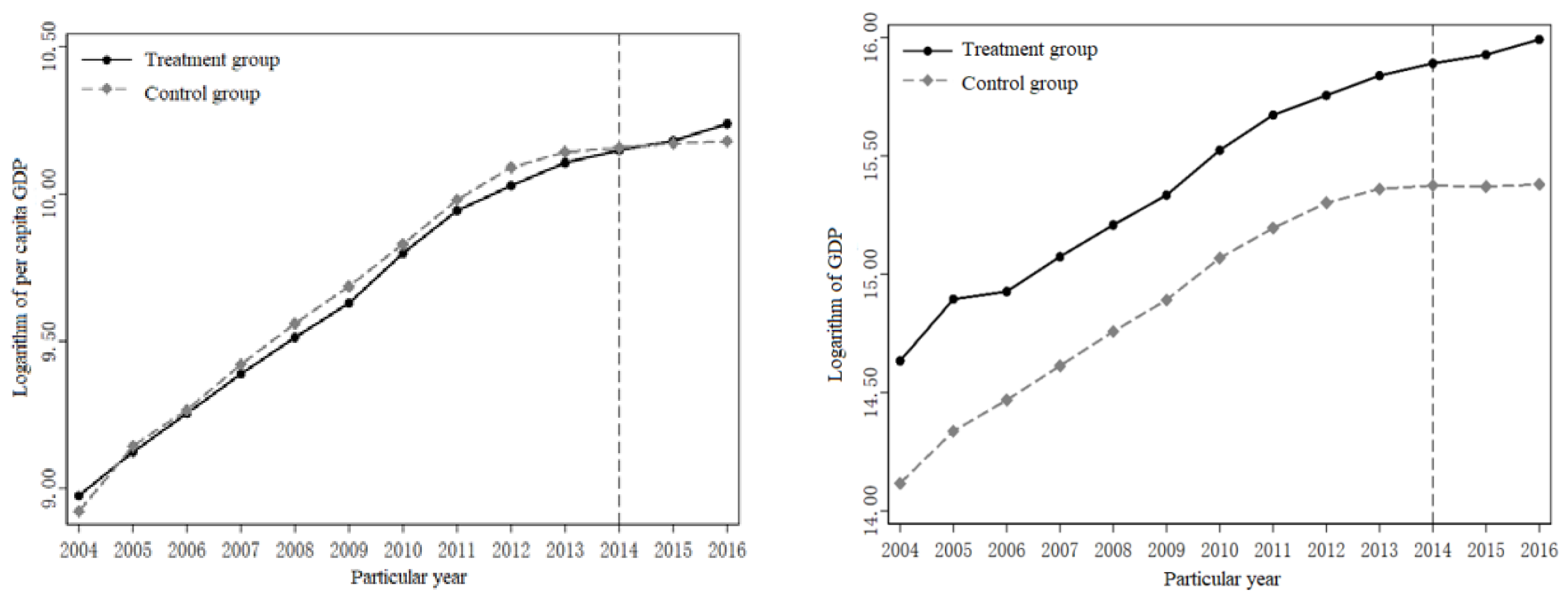

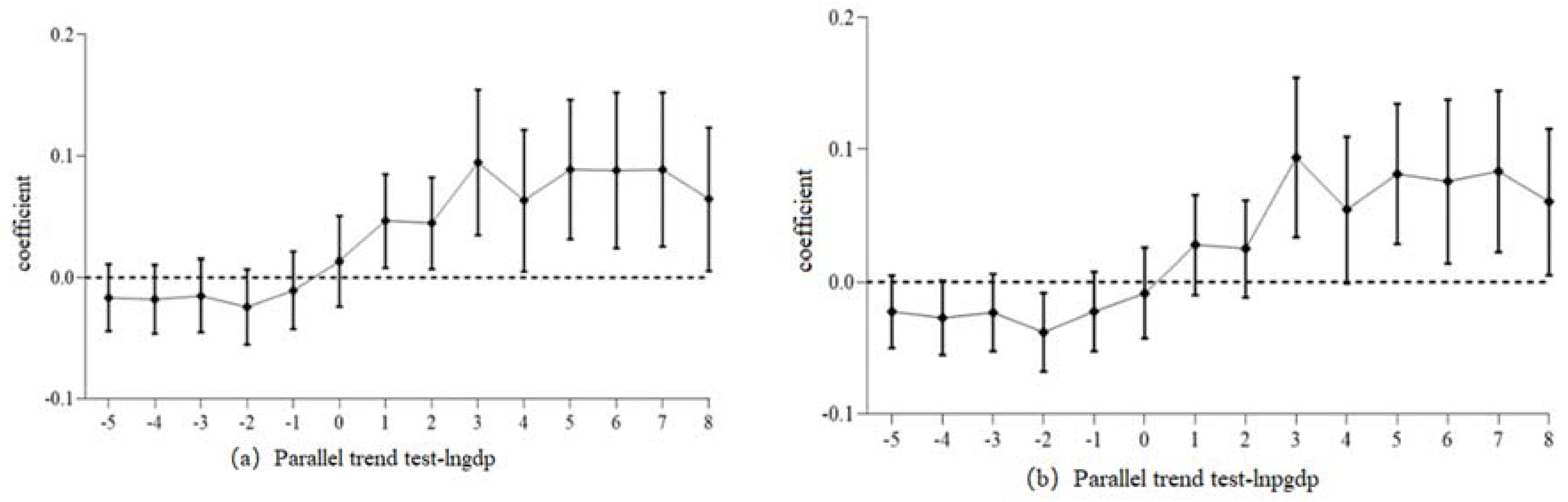

5.2. Parallel Trend Test

5.3. Robustness Test

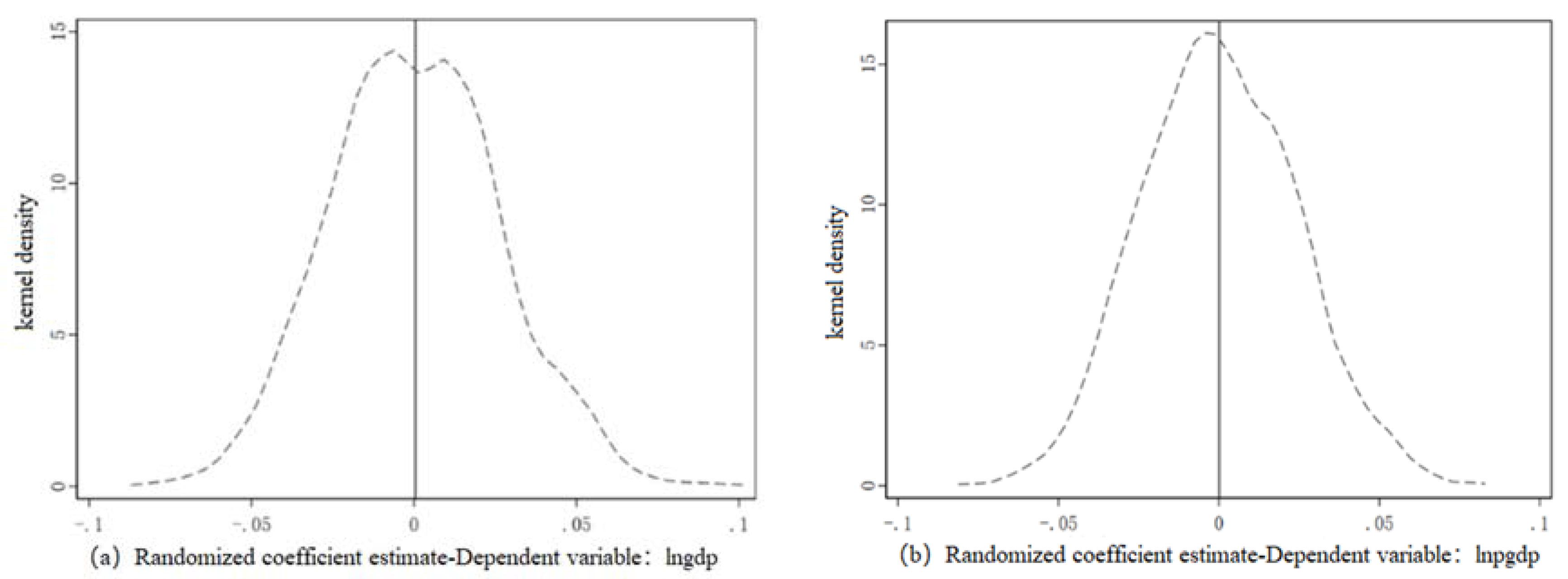

5.3.1. Placebo Test

5.3.2. Other Robustness Tests

6. Further Heterogeneity Analysis

6.1. Urban Scale Heterogeneity

6.2. Marketization Level and Government Efficiency Heterogeneity

7. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Donaldson, D. Railroads of the Raj: Estimating the Impact of Transportation Infrastructure. Am. Econ. Rev. 2010, 4–5, 899–934. [Google Scholar]

- Xueliang, Z. Does China’s Transportation Infrastructure Promote Regional Economic Growth? Concurrently on the Spatial Spillover Effect of Transportation Infrastructure. Chin. Soc. Sci. 2012, 3, 60–77. [Google Scholar]

- Rodan, P.R. Problems of Industrialization of Eastern and South-Eastern Europe. Econ. J. 1943, 53, 202–211. [Google Scholar] [CrossRef]

- Nurkse, R. The capacity of the market and the lure of investment. In Problems of Capital Formation in Underdeveloped Countries; Zhai, J., Ed.; Commercial Press: Beijing, China, 1966; pp. 6–26. [Google Scholar]

- Rostow, W. Six stages of growth. In The Stages of Economic Growth: A Non-Communist Manifesto; Cambridge University Press: Cambridge, UK, 1960; pp. 6–10. [Google Scholar]

- Kim, K.S. High-Speed Rail Developments and Spatial Restructuring: A Case Study of the Capital Region in South Korea. Cities 2000, 4, 251–262. [Google Scholar] [CrossRef]

- Albalate, D. High Speed Rail and Tourism: Empirical Evidence from Spain’s Provinces and Cities. Transp. Res. 2016, 1, 174–185. [Google Scholar]

- Jianfeng, W.; Zhigang, L. Empirical Analysis of the Impact of Shanghai-Hangzhou High-speed rail on Regional Economic Development along the Line. Explor. Econ. Issues 2014, 9, 74–77. [Google Scholar]

- Xinguang, L.; Anmin, H.; Yongqi, Z. Evaluation of the Impact of High-speed Rail on Regional Economic Development—An Empirical Analysis of Fujian Province Based on DID Model. Mod. Urban Res. 2017, 4, 125–132. [Google Scholar]

- Givoni, M. Development and impact of the modern high-speed train:a review. Transp. Rev. 2006, 5, 593–611. [Google Scholar] [CrossRef]

- Yu, F.; Lin, F.; Tang, Y.; Zhong, C. High-speed railway to success? The effects of high-speed rail connection on regional economic development in China. J. Reg. Sci. 2019, 4, 723–742. [Google Scholar] [CrossRef]

- Shi, J.; Zhou, N. How Cites Influenced by High Speed Rail Development: A Case Study in China. J. Transp. Technol. 2013, 3, 7–16. [Google Scholar] [CrossRef]

- Chen, L.; Long, C.; Wang, D.; Yang, J. Phytoremediation of cadmium (Cd) and uranium (U) contaminated soils by Brassica juncea L. enhanced with exogenous application of plant growth regulators. Chemosphere 2020, 242, 125112. [Google Scholar] [CrossRef] [PubMed]

- Chenglin, Q.; Zhaohui, Z. Development of High-speed rail and Economic Agglomeration of Cities along Railways. Explor. Econ. Issues 2014, 5, 163–169. [Google Scholar]

- Shao, S.; Tian, Z.; Yang, L. High speed rail and urban service industry agglomeration: Evidence from China’s Yangtze River Delta Region. J. Transp. Geogr. 2017, 64, 174–183. [Google Scholar] [CrossRef]

- Fucai, L.; Zhan Xianzhi, Z. Research on the Impact of High-speed rail on Industrial Agglomeration in Cities along the Line—An Empirical Analysis Based on Panel Data of Central Cities. Contemp. Financ. Econ. 2017, 11, 88–99. [Google Scholar]

- Chunfang, H.; Qing, H. Does the high-speed rail line have a “shadow of Agglomeration” on urban economic activities? —Evidence from night lights in cities around Beijing Shanghai high speed railway. Shanghai Econ. Res. 2019, 11, 46–58. [Google Scholar]

- Hall, P. Magic Carpets and Seamless Webs: Opportunities and Constraints for High-speed Trains in Europe. Built Environ. 2009, 1, 59–69. [Google Scholar] [CrossRef]

- Ke Zhong, Z.; Dongjie, T. Economic Distribution Effect of Transportation Infrastructure. Evidence from the Opening of High-speed Rail. Economics 2016, 6, 62–73. [Google Scholar]

- Chen, Z.; Haynes, K.E. Impact of high-speed rail on regional economic disparity in China. J. Transp. Geogr. 2017, 8, 80–91. [Google Scholar] [CrossRef]

- Hongchang, L.; Linda, T.; Hu, S.X. Influence of China’s High Speed Railway on Economic Agglomeration and Equalization of Cities along the Line. J. Ind. Econ. Quant. 2016, 11, 127–143. [Google Scholar]

- Xinguang, L.; Anmin, H. Research on the Impact of High-speed Rail on the Spillover Effect of County Economic Growth—Taking Fujian Province as an Example. Geogr. Sci. 2018, 2, 233–241. [Google Scholar]

- Song, W.J.; Zhu, Q.; Zhu, Y.M.; Kong, C.C.; Shi, Y.J.; Gu, Y.T. The impact of high-speed rail on the development of different scale cities. Econ. Geogr. 2015, 35, 57–63. [Google Scholar]

- Liu, L.; Zhang, M. High-speed rail impacts on travel times, accessibility, and economic productivity: A benchmarking analysis in city-cluster regions of China. J. Transp. Geogr. 2018, 73, 25–40. [Google Scholar] [CrossRef]

- Jie, X.; Ming, Z.; Xiaoling, Z.; Di, Z.; Yina, Z. How does City-cluster high-speed rail facilitate regional integration? Evidence from the Shanghai-Nanjing corridor. Cities 2019, 85, 83–97. [Google Scholar]

- Xinze, L.; Xiaole, L.; Lingling, Z. Can high-speed rail improve enterprise resource allocation? Microscopic evidence from Chinese industrial enterprise database and high-speed rail geographic data. Econ. Rev. 2017, 6, 3–21. [Google Scholar]

- Xingqiang, D.; Miaowei, P. Will the opening of the high-speed rail promote the flow of senior talents in enterprises? Econ. Manag. 2017, 12, 89–107. [Google Scholar]

- Jianhua, T.; Hongyan, D.; Zhidong, T. High-speed rail opening and enterprise innovation—based on the quasi-natural experiment of high-speed rail opening. J. Shanxi Univ. Financ. Econ. 2019, 3, 60–70. [Google Scholar]

- Yu, L.; Hailong, Z.; Xinde, Z.; Tao, L. Venture Capital under Time and Space Compression—Regional Change of High-speed Rail and Risk Investment. Econ. Res. 2017, 4, 195–208. [Google Scholar]

- Wen, W.; Yuting, H.; Jianbo, S. Does the construction of transportation infrastructure improve the efficiency of enterprise investment? Based on the quasi-natural experiment of China’s high-speed rail opening. J. Zhongnan Univ. Econ. Law 2019, 2, 42–52. [Google Scholar]

- Kainan, H.; Guangzhao, S. How does the high-speed rail opening affect the total factor productivity of enterprises? Based on the research of listed companies in China’s manufacturing industry. J. China Univ. Geosci. 2019, 1, 144–157. [Google Scholar]

- Cantos, P.; Gumbau-Albert, M.; Maudos, J. Transport Infrastructures, Spillover Effects and Regional Growth: Evidence of the Spanish Case. Transp. Rev. 2005, 1, 25–50. [Google Scholar] [CrossRef]

- Wei, W.; Jingjuan, J.; Fengjun, J. The influence of high-speed rail on the spatial interaction intensity of Chinese cities. Acta Geogr. Sin. 2014, 2, 1833–1846. [Google Scholar]

- Xiaowen, Z. The Promotion of High-speed rail to the Coordinated Development of Regional Economy. Railw. Econ. Econ. Res. 2010, 6, 19–22. [Google Scholar]

- Chenglin, Q.; Qingqing, Y. The impact of high-speed rail on the spatial pattern change of producer service industry. Econ. Geogr. 2017, 2, 90–97. [Google Scholar]

- Puga, D. European Regional Policies in Light of Recent Location Theories. Cepr Discuss. Pap. 2002, 4, 113–150. [Google Scholar] [CrossRef]

- Liwen, L.; Ming, Z. The Impact of High Speed Railway on China’s Urban Accessibility and Regional Economy. Int. Urban Plan. 2017, 4, 76–81. [Google Scholar]

- Yifu, L. New Structural Economics, Viability and New Theoretical Insights. J. Wuhan Univ. 2017, 6, 5–15. [Google Scholar]

- Zhihua, R.; Wenhua, L.; Sanggyun, N.; Xianhua, T.; Tianqiao, X. Regional Marketization, OFDI, and Sustainable Employment: Empirical Analysis in China. Sustainability. 2019, 15, 4101. [Google Scholar]

- Jie, Z. Measurement, Change Mechanism and Government Intervention Effect of China’s Manufacturing Factor Efficient Efficiency. J. Stat. Res. 2016, 3, 72–79. [Google Scholar]

- Yuanchao, B.; Lihua, W.; Junhong, B. High-speed rail opening, factor flow and regional economic disparity. Financ. Trade 2018, 6, 147–161. [Google Scholar]

- Jun, Z.; Guiying, W.; Jipeng, Z. Estimation of China’s inter provincial material capital stock: 1952–2000. Econ. Res. 2004, 10, 35–44. [Google Scholar]

- Ashenfelter O, C. Estimating the Effect of Training Programs on Earnings. Rev. Econ. Stat. 1978, 1, 47–57. [Google Scholar] [CrossRef]

- Huajun, S.; Erming, C. Double difference method of policy effect evaluation. Stat. Decis. 2017, 17, 80–83. [Google Scholar]

- State Council 2014: Notice on Adjusting the Standard of City Scale Division. Available online: http://www.gov.cn/zhengce/content/2014-11/20/content_.htm (accessed on 9 November 2019).

- Gang, F.; Xiaolu, W.; Guangrong, M. Contribution of China’s marketization process to economic growth. Econ. Res. 2011, 9, 4–16. [Google Scholar]

- Gang, F.; Xiaolu, W.; Liwen, W.; Hengpeng, Z. Report on the relative process of marketization in various regions of China. Econ. Res. 2003, 3, 9–18. [Google Scholar]

| Variable Type | Variable | Definition | Expected Impact Direction |

|---|---|---|---|

| Dependent Variables | lngdp | GDP | none |

| lnpgdp | Per capita GDP | none | |

| Policy Variable | hsr | High-speed rail opening variable | + |

| Control Variables | lnpop | Labor input, measured by population density | + |

| lnk | Capital input, measured by capital stock | + | |

| lns | Industrial structure, measured by the proportion of secondary industry | + | |

| lnwage | Wage level, measured by the average wage of employed workers | + | |

| inno | Innovation level, measured by the Urban Innovation Index | + | |

| lnfdi | Foreign investment, measured by the amount of direct foreign investment per capita | +/− | |

| lnfina | Financial development level, measured by the proportion of loan balance of financial institutions in urban GDP | +/− |

| Variable Type | Variable | Sample Size | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|

| Dependent variables | lngdp | 1157 | 15.3141 | 0.9427 | 12.7899 | 18.0145 |

| lnpgdp | 1157 | 9.8716 | 0.7977 | 7.7577 | 12.2121 | |

| Policy variables | hsr | 1157 | 0.1599 | 0.3667 | 0 | 1 |

| Control variables | lnpop | 1157 | −4.3224 | 0.9079 | −7.6629 | −2.5055 |

| lnk | 1157 | 10.2601 | 0.5270 | 8.7335 | 11.8284 | |

| lns | 1157 | 2.4793 | 9.1760 | 0.0000 | 141.4800 | |

| lnwage | 1157 | −0.8012 | 0.3037 | −2.4079 | −0.0946 | |

| inno | 1157 | 7.0286 | 1.1742 | 3.5881 | 10.2122 | |

| lnfdi | 1157 | −0.6548 | 1.4877 | −7.0007 | 2.4243 | |

| lnfina | 1157 | −0.3375 | 0.5296 | −2.5860 | 1.5489 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| lngdp | lngdp | lnpgdp | lnpgdp | |

| hsr | 0.039*(0.021) | 0.035***(0.013) | 0.030(0.020) | 0.024*(0.013) |

| lnpop | 0.146(0.140) | 0.004(0.042) | ||

| lnk | 0.110***(0.025) | 0.103***(0.024) | ||

| lns | 0.459***(0.045) | 0.414***(0.042) | ||

| lnwage | 0.122**(0.058) | 0.125**(0.058) | ||

| inno | 0.001(0.001) | 0.000(0.001) | ||

| lnfdi | −0.007(0.004) | −0.003(0.004) | ||

| lnfina | −0.275***(0.027) | −0.304***(0.026) | ||

| Constant term | 15.308***(0.006) | 14.306***(0.858) | 9.867***(0.005) | 8.108***(0.641) |

| Urban fixation | Control | Control | Control | Control |

| Fixed time | Control | Control | Control | Control |

| N | 1157 | 1157 | 1157 | 1157 |

| AR2 | 0.975 | 0.988 | 0.966 | 0.984 |

| Opening Time 2 Years Ahead | Opening Time 3 Years Ahead | Without Provincial Capital Cities | 2SLS | |||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| lngdp | lnpgdp | lngdp | lnpgdp | lngdp | lnpgdp | lngdp | lnpgdp | |

| L2_hsr | 0.010 | −0.002 | ||||||

| (0.012) | (0.012) | |||||||

| L3_hsr | 0.003 | −0.008 | ||||||

| (0.012) | (0.012) | |||||||

| hsr | 0.035** | 0.023* | 0.057*** | 0.051*** | ||||

| (0.015) | (0.014) | (0.018) | (0.017) | |||||

| F | 247.040 | 247.040 | ||||||

| Sargan | 1.282 | 2.291 | ||||||

| Control variable | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled |

| Urban fixed | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled |

| Time fixed | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled |

| N | 1157 | 1157 | 1157 | 1157 | 1053 | 1053 | 1157 | 1157 |

| AR2 | 0.988 | 0.984 | 0.988 | 0.984 | 0.985 | 0.983 | 0.513 | 0.516 |

| Variable | Medium and Small Cities | Big Cities | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| lngdp | lnpgdp | lngdp | lnpgdp | |

| hsr | 0.041** | 0.038** | 0.054*** | 0.058*** |

| (0.017) | (0.016) | (0.020) | (0.019) | |

| lnpop | 0.127 | 0.009 | 1.213*** | 0.361 |

| (0.126) | (0.041) | (0.203) | (0.225) | |

| lnk | 0.110*** | 0.099*** | 0.102*** | 0.121*** |

| (0.030) | (0.028) | (0.039) | (0.041) | |

| lns | 0.484*** | 0.439*** | 0.325*** | 0.303*** |

| (0.048) | (0.044) | (0.105) | (0.100) | |

| lnwage | 0.115** | 0.116** | 0.105 | 0.100 |

| (0.058) | (0.057) | (0.075) | (0.073) | |

| inno | −0.000 | −0.010 | 0.001** | 0.001*** |

| (0.010) | (0.008) | (0.000) | (0.000) | |

| lnfdi | −0.011* | −0.006 | 0.016** | 0.015** |

| (0.005) | (0.005) | (0.007) | (0.007) | |

| lnfina | −0.222*** | −0.253*** | −0.439*** | −0.399*** |

| (0.031) | (0.029) | (0.055) | (0.057) | |

| Constant term | 14.129*** | 8.238*** | 18.807*** | 9.559*** |

| (0.836) | (0.634) | (1.263) | (1.331) | |

| Urban fixed | Controlled | Controlled | Controlled | Controlled |

| Time fixed | Controlled | Controlled | Controlled | Controlled |

| N | 712 | 712 | 260 | 260 |

| AR2 | 0.980 | 0.981 | 0.995 | 0.993 |

| Marketization Level | Government Efficiency | |||||||

|---|---|---|---|---|---|---|---|---|

| Low | High | Low | High | |||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| lngdp | lnpgdp | lngdp | lnpgdp | lngdp | lnpgdp | lngdp | lnpgdp | |

| hsr | 0.032 | 0.048 | 0.039*** | 0.024* | −0.003 | −0.010 | 0.063*** | 0.051*** |

| (0.035) | (0.042) | (0.014) | (0.014) | (0.019) | (0.019) | (0.017) | (0.016) | |

| lnpop | 0.262 | −0.399** | 0.100 | 0.011 | 1.073*** | 0.417*** | 0.073 | −0.018 |

| (0.162) | (0.189) | (0.115) | (0.049) | (0.180) | (0.152) | (0.075) | (0.021) | |

| lnk | 0.136*** | 0.131*** | 0.101*** | 0.090*** | 0.148*** | 0.138*** | 0.059** | 0.063** |

| (0.034) | (0.033) | (0.030) | (0.027) | (0.038) | (0.037) | (0.029) | (0.027) | |

| lns | 0.229*** | 0.282*** | 0.482*** | 0.430*** | 0.441*** | 0.423*** | 0.351*** | 0.294*** |

| (0.076) | (0.091) | (0.047) | (0.045) | (0.057) | (0.056) | (0.070) | (0.062) | |

| lnwage | 0.163 | 0.216** | 0.113* | 0.106* | 0.101* | 0.103* | 0.181*** | 0.191*** |

| (0.108) | (0.105) | (0.060) | (0.057) | (0.057) | (0.057) | (0.064) | (0.059) | |

| inno | 0.007* | 0.002 | 0.001 | 0.000 | −0.001 | −0.002 | 0.000 | 0.000 |

| (0.004) | (0.005) | (0.001) | (0.001) | (0.004) | (0.005) | (0.001) | (0.001) | |

| lnfdi | −0.007 | −0.009* | -0.007 | -0.001 | −0.006 | −0.004 | 0.000 | 0.004 |

| (0.005) | (0.005) | (0.006) | (0.005) | (0.005) | (0.005) | (0.006) | (0.005) | |

| lnfina | −0.348*** | −0.340*** | −0.274*** | −0.310*** | −0.259*** | −0.265*** | −0.313*** | −0.350*** |

| (0.027) | (0.031) | (0.032) | (0.030) | (0.042) | (0.042) | (0.029) | (0.028) | |

| Constant term | 13.712*** | 4.880*** | 14.352*** | 8.467*** | 18.278*** | 9.876*** | 13.808*** | 7.621*** |

| (0.844) | (0.816) | (0.824) | (0.655) | (0.952) | (0.838) | (0.734) | (0.642) | |

| Urban fixed | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled |

| Time fixed | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled |

| N | 166 | 166 | 806 | 806 | 474 | 474 | 498 | 498 |

| AR2 | 0.995 | 0.993 | 0.986 | 0.981 | 0.982 | 0.979 | 0.993 | 0.989 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, F.; Su, Y.; Xie, J.; Zhu, W.; Wang, Y. The Impact of High-Speed Rail Opening on City Economics along the Silk Road Economic Belt. Sustainability 2020, 12, 3176. https://doi.org/10.3390/su12083176

Li F, Su Y, Xie J, Zhu W, Wang Y. The Impact of High-Speed Rail Opening on City Economics along the Silk Road Economic Belt. Sustainability. 2020; 12(8):3176. https://doi.org/10.3390/su12083176

Chicago/Turabian StyleLi, Feng, Yang Su, Jiaping Xie, Weijun Zhu, and Yahua Wang. 2020. "The Impact of High-Speed Rail Opening on City Economics along the Silk Road Economic Belt" Sustainability 12, no. 8: 3176. https://doi.org/10.3390/su12083176

APA StyleLi, F., Su, Y., Xie, J., Zhu, W., & Wang, Y. (2020). The Impact of High-Speed Rail Opening on City Economics along the Silk Road Economic Belt. Sustainability, 12(8), 3176. https://doi.org/10.3390/su12083176