1. Introduction

For a long period of time, China’s technological innovation activities have been dominated by public enterprises and research institutions. The R&D activities of public enterprises are often equipped with a large amount of R&D funds, thus attracting a large number of high-tech talents. However, in the poor R&D environment that lacks the support of physical and human capital, the rise of a large number of private high-tech enterprises, such as Lenovo and Huawei, also reflects the huge technological potential of private enterprises in China. Since China’s patent system was formally established in 1985, the proportion of patent applications of domestic enterprises significantly increased. To gain the competitiveness and increase the innovation capability, public enterprises were mostly restructured in the 1990s. On the other hand, the private enterprises that have sprung up after the reform and opening-up since the 1980s also contribute to the patenting.

There is no consensus reached by the existing literature that compares the technological innovation capability between public and private enterprises. Researchers tend to compare the technological innovation level of public and private enterprises from the perspective of productivity, and it is generally believed that the productivity of the latter is higher than that of the former [

1,

2]. The dependence, learning closeness, and innovation capability viciously interact with each other within public enterprises [

1,

2]. By comparison, because of a high reliance upon indigenous innovation capability, private enterprises have overcome this vicious circle embedded in public enterprises, which leads to the significant difference in their innovation capability [

3,

4,

5,

6,

7]. However, other literature holds the opposite attitude. Although most studies emphasized the solution of industrialization in China through privatization, public enterprises have gained more opportunities brought by the restructuring under the current policy preference. The rapid growth of upstream product demand driven by domestic demand and the integration of the world economy, as well as the preferential policies of the state for large state-owned enterprises, have brought tremendous changes to them [

1]. State-owned enterprises whose capital source depends on state-owned banks have significantly higher efficiency growth rate than that of other enterprises [

7,

8,

9], whereas enterprises without governmental financial support do not have enough space for development and innovation, and the productivity growth of these enterprises tends to slow down [

4].

By studying the existing literature, we find the following deficiencies: First, the different conclusions by existing research studies may be caused by data differences, that is, the data from either macro or micro dimension. Macro statistical data remove individual differences by summing up the data, while micro survey data generally select samples from the whole, and are usually unrepresentative of the whole data. Secondly, the current research lacks the evaluation of innovation quality. The evaluation of innovation capability should not only examine the quantity of innovation achievements, but also consider the “quality” of innovation [

10,

11]. [

10] originally proposed the concept of “innovation quality”. Although an enterprise may have developed many scientific and technological achievements, not every scientific and technological achievement can produce economic value. This means that in addition to the number of patent applications, we should also examine the technical connotation of the patent right. As one of the most important forms of scientific research achievements in R&D activities, patent value to a large extent represents the quality level of innovation activities [

12,

13,

14,

15], which should be considered as one of the important indicators. Although, [

14,

15] estimated the patent value, but insufficiently discussed the significance of innovation quality, which leads to one-sided research.

China is now in a transitional period from catching up to leaping over, and the enterprises’ innovation capability characterized by "high quantity and low quality" patent output needs to be reversed [

16]. Based on the above fact, this paper attempts to attach the following issues: what is the difference between the contribution of private enterprises and state-owned enterprises in patent application under the current policy preference for public enterprises? Which performs better? More specifically, on the macro level, do enterprises with more R&D resources produce higher innovation quality? Does a concentration of R&D resources for cross-enterprise significantly improve the quality of innovation? At the micro level, can R&D investment of a single patent impact the level of patent quality? That is, can the enterprise significantly improve the quality level of the patent right by increasing the R&D investment? The answer to the above questions will be conducive to promoting the in-depth implementation of an innovation driven strategy in China, which has strong theoretical and practical significance.

Therefore, this study attempts to investigate Chinese enterprises’ innovation quality measured by the patent value, which provides knowledge about the enterprises’ innovation quality and how it is determined by the enterprise ownership. This study contributes to existing literature from the following aspects: First, we employ all the patent data by Chinese domestic enterprises to make up for the sample deviation in the existing literature. Different from the macro statistical data, these data are composed of micro individual patent data, while our data are also different from the micro survey data by including the overall rather than the samples. A huge dataset is more representative of the real innovation capability of enterprises. Second, by estimating the patent value, this paper explores the quality differences of technological innovation between public and private enterprises. This study not only provides a dynamic and intuitive method for the relevant departments to monitor technological innovation of enterprises, but also comprehensively investigates the innovation input and output of enterprises with different ownership in China under the current policy preferences. We have also provided theoretical reference for the rational allocation of R&D resources in China at this stage.

3. Empirical Results

3.1. The Data

We employ all the invention patents applied by Chinese enterprises (including public and private enterprises) because we relate our study to the patent duration (i.e., the time length between the phase when the patent is granted and the expiration phase of the patent right). However, since most patents granted in recent years do not expire, we do not account for the patents that were currently granted. We select the patents applied during 1985–2011 as our research object. Through a careful screening, we retained 73,800 invention patents applied by about 14,000 public and private enterprises in China (excluding collectively owned enterprises). Since the public enterprises in China experienced deep reorganization in the 1990s and their operating mechanism has changed significantly before and after the reorganization, it is necessary to discuss the quality of technological innovation before and after the reorganization, respectively. This undoubtedly involves the time that the enterprise reorganization occurs, which is not easy to determine. We adopt the method of the telephone interview and Internet search to survey the year when the enterprise begins to reorganize, and separate the patent applied by the enterprise before and after that reorganization occurs.

According to the government’s reform principle of “focusing on the big and liberating the small”, most small and medium-sized public enterprises have been transformed into private enterprises, while the large-scale public enterprises remain public after the reform. Therefore, without considering the participation of foreign capital and collective enterprises, the property of Chinese enterprises before and after the reorganization can be roughly classified into the following cohorts: the public enterprises before reorganization, the public enterprises that transformed into private enterprises after reorganization, the enterprises that maintain public, as well as the enterprises that were founded privately (hereinafter referred to as “pure private enterprises”).

In addition to the restructuring, we also account for the competitiveness of the industry in which the enterprises belong to. The public enterprises in the competitive industry are often directly impacted by competitors in the same industry, while those in the monopoly industry have little competition pressure. The operating environments faced by the two types of public enterprises are significantly different. In view of this, we make an independent analysis of the public enterprises in the monopoly industry and competitive industry. As the private enterprises are mostly private through the whole period of our study, this paper does not account for the restructuring of pure private enterprises. The number of patents applied by enterprises with various properties are shown in

Table 1.

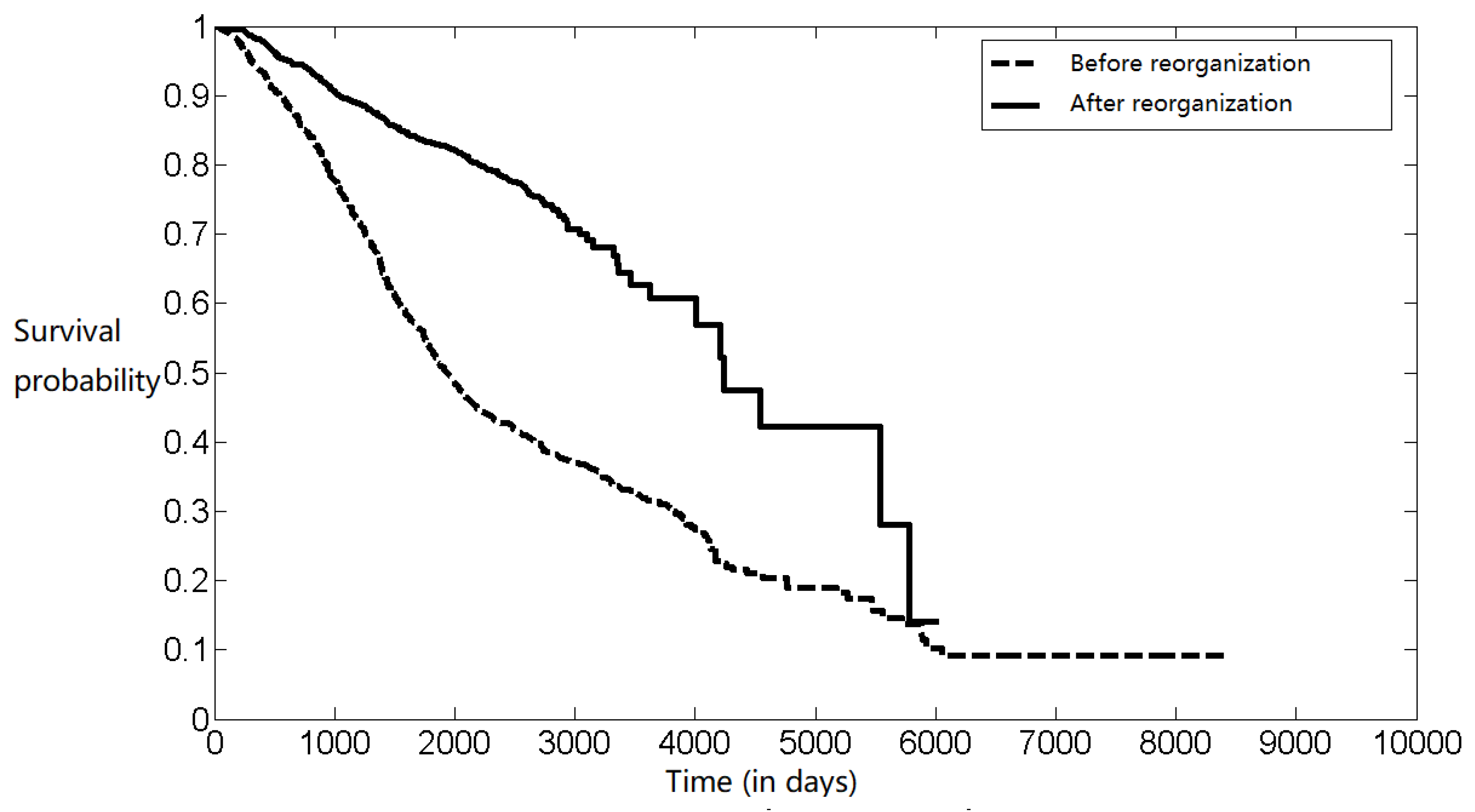

Using the patent data applied by public enterprises before and after reorganization, we draw the patent survival curve, where the x-axis represents the duration of the patent right, and the y-axis represents the proportion of the patents that do not expire, which also corresponds with the patent survival probability. As shown in

Figure 1, when the value of the x-axis, which corresponds with the time, is low, the accuracy of the estimated value of the patent survival probability is high, because a large number of patents survive and thus present a large sample size. As the value of the x-axis increases, the sample size gradually decreases, then the accuracy of the estimated value of the patent survival probability will decrease.

It can be seen from

Figure 1 that the patents’ survival curve of the public enterprises after the reorganization is located in a higher position than that before the reorganization, which suggests that the patent duration after the reorganization of enterprises has been significantly extended. However, there are a number of patents held by public enterprises in the pre-reorganization stage that survives 16 years (about 6000 days). Due to the great changes of the enterprises’ ownership after the reorganization, it is more meaningful to study the qualitative difference of technological innovation between the public enterprises in the post-reorganization stage and the pure private enterprises whose production and operation are relatively more stable.

We plot the survival curve of patents held by different types of enterprises, as shown in

Figure 2.

Figure 2 shows that the positions of the survival curves of various types of enterprises are not too far from each other, but the differences are relatively clearer. In

Figure 2, the patent survival curve of the public enterprises in the monopoly industry is basically in the highest position throughout the whole time axis, which is followed by the pure private enterprises, and the public enterprises in the competitive industry are in the lowest position. It can be seen that the patent survival curve differences of these three types of enterprises are relatively obvious, which further indicates the differences of innovation quality between the public and private enterprises. We additionally find that although the patent survival curve of the public enterprises that transformed into private after reorganization is higher than that of the public enterprises in the competitive industry, no patent filed by these two types of enterprises can last for more than 12 years (about 4500 days).

Although the patent survival curve is representative of the difference of innovation quality, it is still difficult to reflect to what extent the enterprises’ innovation quality is different from each other. In order to further quantify the difference of innovation quality between the two types of enterprises, we calculate and compare the patent value of different types of enterprises.

3.2. Estimating and Comparing the Patent Value

We use all the patent duration data to maximize the likelihood function (9) and then we obtain the estimated values of

and

, as shown in

Table 2.

After obtaining the parameter estimates, we use (13) to calculate the patent value, and then classify the patents into cohorts according to the application time and enterprise type. The results are shown in

Table 3. It can be seen from

Table 3 that of all the three types of public enterprises in the post-reorganization stage, only the average value of patents held by public enterprises in monopoly industries is higher than that of pure private enterprises, while the value of public enterprises in competitive industries is lower than that of pure private enterprises, which is basically consistent with the trend reflected in

Figure 2.

In terms of the absolute difference of patent value, the difference between E3 and E4 is about 2000 yuan (7545–5327 yuan), the difference between E2 and E4 is about 3000 yuan (7545–4402 yuan). Compared with the public enterprises before the reorganization (E2 and E3), the innovation quality of the public enterprises in the competitive industry in the post-reorganization stage was greatly improved. Its patent value increased from 2100 yuan to 4400 yuan. However, it is still lower than that of the pure private enterprises (E4). In contrast, the innovation quality of the public enterprises in the monopoly industry after the reorganization has not improved, and its patent value has only increased by 500 yuan compared with that before the reorganization. However, its patent value is always the highest, and the average patent value is about 4000 yuan higher than that of the pure private enterprise.

The above analysis shows that although the government has significantly improved the innovation quality of public enterprises by initiating a restructure, which makes the innovation output of public enterprises more suitable to the needs of the market, there is still a big gap compared to private enterprises. The government’s monopoly of industry resources through administrative means, which provides protection for public enterprises, has significantly improved their innovation quality. Although monopoly can improve the innovation quality of public enterprises, it is questionable whether it is effective. Because of a low constraint of factor endowments, public enterprises in monopoly industries often lack motivation to efficiently allocate R&D resources in R&D activities. Therefore, although the innovation quality of public enterprises in monopoly industries is high, it may be the result of using more R&D resources. In order to illustrate this issue, we introduce the method of regression analysis to investigate how the allocation of R&D resources affects the quality of technological innovation.

3.3. Independent and Dependent Variables

After calculating the patent value, we use it to measure the innovation quality of enterprises. We take the logarithm of patent value, that is, as the dependent variable and run the regression. We attempt to analyze how the influencing factors impact the enterprises’ innovation quality from the macro and micro perspectives: the former focuses on the impact of R&D resources held by enterprises on innovation quality, that is, whether enterprises holding more R&D resources have higher innovation quality? In addition, can multiple enterprises concentrate the R&D resources for joint R&D significantly improve the innovation quality? The latter focuses on the influence of the R&D investment of a single patent on the patent quality, that is, can an enterprise significantly improve the quality of the patent by increasing their R&D investment?

In the macro level, we choose enterprise scale () as the variable representing the amount of R&D resources. Since enterprises may apply for more patents in some industries (such as the information technology field) than that in other industries (such as the biotechnology field), the impact of industry should be accounted. We introduce the percentage of patent applications an enterprise takes in the technology field to indicate the enterprise scale. This implies that an enterprise may have different scales in different technology fields, which may be more realistic. For example, Lenovo has a larger scale in the field of personal computers, but a smaller scale in the field of mobile phones.

When a patent is invented through a joint R&D activity carried out by more than two applicants, the patent may have a higher technical connotation, because the R&D process uses the R&D resources of multiple enterprises, universities, and research institutes, as well as the professional skills and knowledge of R&D personnel with different backgrounds. For example, the patents jointly applied by enterprises and universities may generate higher economic value, because the enterprise holds the knowledge of the market demand, while the university often has stronger scientific research strength. The patents jointly invented by them may not only account for the customers’ requirements, but also have considerable technical content. Accordingly, we introduce a dummy variable () to represent the joint R&D behavior of the patent. When the patent is jointly applied by two or more applicants, takes 1, and 0 otherwise.

When we construct the R&D resource input indicators in the micro level, we account for the fact that when an enterprise invests more physical capital in a R&D activity, it will generally be supplemented by a corresponding amount of human capital. Therefore, the number of personnel participating in the R&D activity is employed to represent the R&D resources. We use the number of inventors () involved in a patent document to represent the amount of R&D resources.

In addition to the above variables representing R&D resources, we need to control the patent value differences in different technical fields in the regression. To achieve this, we introduce the dummy variable

to represent the technical field of the patent. According to the ISI OST INPI classification method [

24], the patents are classified into six technical fields.

Due to the short time span of patent data in China, patents filed in earlier dates tend to have a longer renewal period. Accordingly, the patent application period () is introduced into our regression model. We classified the patents into five time periods according to their application year: 1985–1988, 1989–1992, 1993–1996, 1997–2000, 2001–2004.

The regression model in this study can be expressed as follows:

where

i is the subscript of the patent,

j and t represent the patent’s technological field and its application, respectively. Because patents’ revenue produced in different stages are assumed to be independent, there is no sequence related problem in this model. Since the generation of the patent revenue sequence occurs after the patent R&D activity, it will not affect the early R&D activity, and other independent variables in this model are used to describe the early R&D activity, so there is no endogeneity problem. Our model uses the patent data, which may cause heterogeneity. We thus use weighted least square (WLS) in regression. Enterprises with greater parameter estimates of

, and

correspond with higher allocation efficiency of R&D resources, which suggests that enterprises could achieve higher innovation quality with the same R&D activity and the same R&D input level.

By running the above regression, we compare and analyze how R&D resources impact the innovation quality under different ownership of the enterprises, and attempt to find the causes of the innovation quality difference between public and private enterprises.

3.4. Regression Results

We classify the observations into 6 cohorts according to their ownership and reorganization experience. Then, we run 6 regressions with these observations. The results are shown in

Table 4. As shown in

Table 4, the parameter estimates of

,

and

are all significantly positive in model 1, which indicates that the R&D resource allocation of pure private enterprises is very efficient, that is, enterprises occupying more R&D resources can achieve a higher level of innovation quality.

Like Model 1, the parameter estimates of , and in Models 2 and 3 are both significantly positive, which shows that the R&D resource allocations of public enterprises, which are transformed into private enterprises after the reorganization, and those that remain public enterprises in competitive industries after reorganization, are also efficient.

However, further comparison shows that the parameter estimate of in Model 1 is significantly greater than that in Models 2 and 3. The patent value would increase by 74.15 yuan (Exp [4.3061]) for every 1% increase in in pure private enterprises, which is significantly greater than that of public enterprises in the competitive industry (2.92 yuan, exp [1.0718]) and public enterprises that were transformed into private enterprises after the reorganization (5.35 yuan, exp [1.6774]). Therefore, the R&D resources play a more significant role in improving the innovation quality in pure private enterprises than that in public enterprises. According to the parameter estimates of , in Model 1, the joint R&D activity carried out by pure private enterprises is 7.38 yuan (Exp [1.9985]), which is more than that of independent R&D activity. This is also higher than that in Models 2 and 3. However, the parameter estimate of is the highest in Model 2, which suggests that for every R&D personnel increase, the patent value would increase by 2.44 yuan (Exp [0.8936]) in the public enterprises that were transformed into private enterprises after the reorganization, which is greater than that in Models 1 and 3. In addition, the parameter estimates of , and in Model 2 are all significantly higher than those in Model 3, which indicates that the R&D resource allocation efficiency in the public enterprises that were transformed into private enterprises after the reorganization is higher than that in the public enterprises that remains public after the reorganization. Therefore, the efficiency of R&D resource allocation in pure private enterprises is the highest, which is followed by the public enterprises that were transformed into private enterprises after the reorganization, while the efficiency of R&D resource allocation in the public enterprises that remains public after the reorganization is the lowest.

Model 4 uses the observation of the public enterprises in the monopoly industry. As shown in

Table 4, The parameter estimate of

is not significant, suggesting that the R&D resource does not significantly improve the innovation quality for the public enterprises in the monopoly industry before the reorganization. The parameter estimate of

is significantly positive, which indicates that joint R&D activity can effectively increase the innovation quality, but it is only significant at 10% level. In comparison,

is not as significant as that in Model 1, which further suggests the inefficient allocation of internal R&D resources in public enterprises in monopoly industries. Based on the above results, we may find that the efficiency of R&D resource allocation in public enterprises in the monopoly industry is both lower than that in public enterprises in the competitive industry, and lower than public enterprises that were transformed into private enterprises. In addition, compared with Models 4 and 6, the parameter estimates of

and

are both insignificant, indicating that the allocation efficiency of R&D resources in public enterprises in monopoly industries is not significantly improved before and after the reorganization.

In contrast, the allocation efficiency of R&D resource in public enterprises in competitive industries is significantly improved after the reorganization, which can be proved through a comparison between Models 3 and 5. In Model 5, only the parameter estimate of is significantly positive, while in Model 3, the parameter estimates of , and are all significantly positive. Therefore, the allocation efficiency of R&D resource was significantly improved after the reorganization of public enterprises in competitive industries.

3.5. Robustness Check

The different model settings provide an opportunity for us to test the robustness of the regression results. The robustness test in this section is based on the fact that the intrinsic value of a patent is consistent with the market revenue it generates. If a certain factor helps improve the patent revenue, it generates the same effect on the patent value. Therefore, we test the robustness of the regression results by examining the impact factors of the patent revenue. The above calculation process is based on the traditional patent value model, that is:

While [

12] accounted for the impact of patent heterogeneity on patent revenue:

We expand Bessen’s model by expressing the regression model as follows:

After replacing

with

, we repeat the regression presented in

Section 2 and re-estimate the likelihood function (9). The estimation results of

are shown in

Table 5. By comparing the results in

Table 4 and

Table 5, we see that the main parameter estimates and their significance level are relatively correspondent, which proves the robustness of our empirical results.

4. Conclusions and Implications

Based on the data of invention patent filed during 1985 to 2011 in China, this paper compares the quality of technological innovation between public and private enterprises by calculating the difference of their patent value, and obtains the following important findings:

First, in the competitive industry, the patent value of public enterprises is significantly lower than that of the pure private enterprises, which shows that the overall innovation quality level of public enterprises is lower than that of the pure private enterprises. However, the innovation quality of public enterprises in the monopoly industry is significantly higher than that of private enterprises, which shows that R&D resource monopoly can improve the innovation capability of enterprises, but it also leads to the inefficient allocation of R&D resources.

Second, for the public enterprises in the competitive industry, the efficiency of R&D resource allocation is not high before the reorganization. While after the reorganization, the quality of technological innovation was significantly improved. The patents filed after the reorganization of public enterprises has generated a higher level of revenue, which suggests that the efficiency of R&D resource allocation is significantly improved by the reorganization. However, the effect of reorganization on the quality of technological innovation of public enterprises in monopoly industries was not significant, and the patent income was not significantly improved before and after the reorganization. Although the high patent revenue by public enterprises in the monopoly industry indicates that they have a high quality of technological innovation, the efficiency of allocation of R&D resources is not high. No matter how much R&D resources the public enterprises in the monopoly industry own, their roles in improving the technology innovation quality is not significant. In contrast, the R&D resource allocation of reorganized public enterprises in competitive industries is proved to be efficient.

Third, the innovation quality and the R&D resource allocation efficiency of public enterprises that were transformed into private enterprises after the reorganization are close to but are still lower than that of the pure private enterprises. This may be because there still exists bureaucracy in public enterprises after the reorganization.

The above conclusion is an important supplement to the existing literatures, and has important implications for the next step to improve the innovation quality: First, there is a huge potential for technological innovation in private enterprises in China. In general, the lower the degree of nationalization of enterprises, the higher the efficiency of R&D resource allocation. Governmental intervention destroys the market fairness, which cultivates state-owned enterprises and prevents the private R&D sector. This is because government could initiate the control of state-owned enterprises, which is proved to be inefficient in R&D activity. Therefore, if more R&D resources are distributed to the private enterprises, the R&D output with higher quality will be produced. It may be key to fundamentally improve China’s overall innovation capability. Secondly, almost all of China’s R&D resources are held by public enterprises, universities, and research institutions. Unrestricted use of R&D resources is bound to cause inefficiency, which is clearly reflected by the ineffective allocation of R&D resources in public enterprises in monopoly industries. Therefore, breaking the monopoly of some public enterprises, carrying out the reorganization of public enterprises, and liberalizing the monopoly industry may be important ways to improve the overall innovation capability of China. To achieve this, more nuanced perspectives on the design of policies mixes should be developed [

25]. Thirdly, government usually initiates a preferential policy to support patent activity in state-owned enterprises. For example, State Grid, one of the largest state-owned enterprises, provides financial award for inventors who successfully apply patents. Obviously, to gain the award, inventors may improvise innovation to apply for patents, which will weaken the effects of R&D and increase the technological and organizational distance of the Chinese economy.

We extend the significance of patent value by correlating it with the innovation quality, which extends existing studies like [

12,

17,

19] who insufficiently analyzed the implication of patent value. We further extended [

14,

15], who estimated the value of Chinese patents without classifying the type of applicants. Instead, we focus on the patents filed by enterprises and have some new findings, that is, the innovation quality embedded in the patent value correlates with the enterprise ownership, which is rarely discussed by existing studies.

The limitations of this paper are as follows: first, there are some limitations in using patent value to measure the quality of technological innovation. The patent value we calculate is based on the differences between revenue and cost. Therefore, the patent value reflects the extent to which the patent technology is accepted and popularized by the market. In this case, the innovation quality is represented by its market value. Although the market value created by a technology is an important measurement of its indigenous quality, the innovation quality is also closely related to other aspects, such as the technical complexity, academic value, etc. Therefore, future research needs to account for the technological value of the patents. Secondly, our research employs only Chinese patent data. To increase the representativeness of the data, future studies should expand the coverage of patents to the United States, Europe, and Japan, and compare and analyze innovation quality in a broader range.