Sustainability in the Banking Sector: A Predictive Model for the European Banking Union in the Aftermath of the Financial Crisis

Abstract

1. Introduction

2. Literature Review and Hypotheses

2.1. Banking Capital Regulation

2.2. Stress Tests

2.3. Determinants of Banking Solvency and Proposed Hypotheses

3. Materials and Methods

3.1. Dependent Variable and Sample Selection

3.2. Independent Variables

3.3. Statistic Models

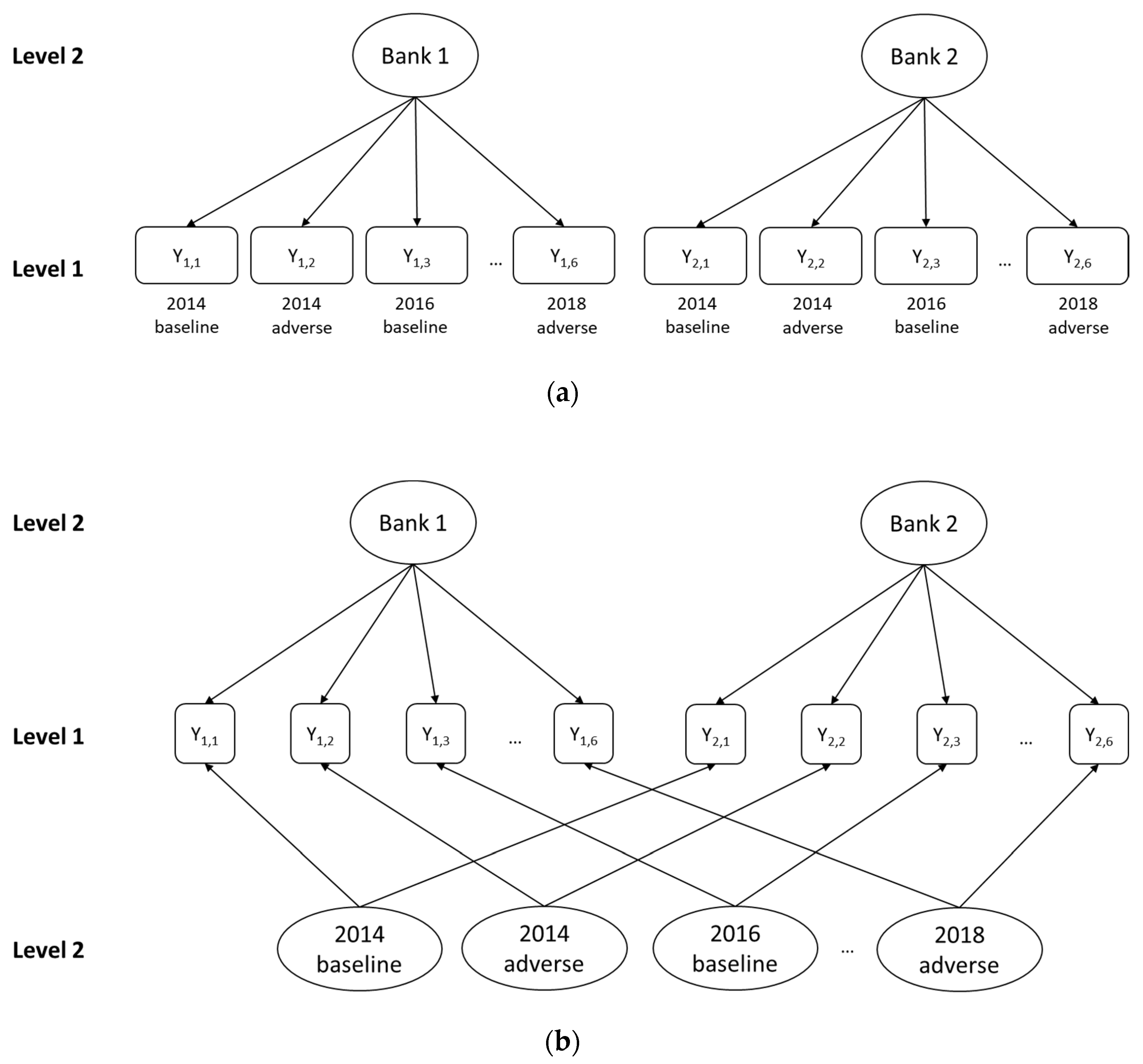

- 1.

- A two-level random intercept model with covariates according to the following specification:where Ratiokj comprises the 13 financial ratios aforementioned, Scenario_Yearki encompasses five dummies indicating the combinations between years and scenarios (being the baseline scenario in 2014 the reference category), uj is the level-2 (bank) random intercept and eij the level-1 residual error term. This model can be thought as a “mixed-effects two-way ANOVA model” since a random effect is specified for banks and the interaction between scenario and year is included as a fixed effect [62] (p. 98).

- 2.

- A crossed random effects model with covariates, according to the following specification:where the interaction between scenario and year is included as the random effect ζi instead of as a fixed effect. This model is usually called a two-way error-components model [62] (p. 433), since the two crossed factors are included in the model as random intercepts.

4. Results

5. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A

| Country | Bank |

|---|---|

| Germany | Deutsche Bank AG |

| Commerzbank AG | |

| Bayerische Landesbank | |

| Landesbank Baden-Wüttemberg | |

| Landesbank Hessen-Thüringen Girozentrale | |

| NRW.BANK | |

| Austria | Erste Bank Group |

| Raiffeisen Bank International | |

| Belfius Banque | |

| Belgium | KBCBank |

| Spain | Banco Santander |

| BBVA | |

| La Caixa | |

| Banco Sabadell | |

| Denmark | Danske Bank |

| Jyske Bank | |

| Nykredit | |

| Finland | Op-pohjola Group |

| France | BNP Paribas |

| Credit Agricole | |

| BPCE | |

| Societe Generale | |

| Group Crédit Mutuel | |

| La Banque Postal | |

| The Netherlands | ING Bank |

| ABN Amor | |

| NV Bank Nederlandse Gemeenten | |

| Coöperatieve Rabobank | |

| Hungary | OTP Bank Nyrt |

| Ireland | Allied Irish banks |

| Bank of Ireland | |

| Italy | Intesa Sanpaolo |

| Unicredit | |

| Banco Popolare | |

| Ubi Banca | |

| Poland | PKO Bank Polski |

| The UK | Royal bank of Scotland |

| HSBC Holdings | |

| Barclays | |

| Lloyds banking group | |

| Sweden | Nordea Bank |

| SEB | |

| Svenska Handelsbanken AB | |

| Swedbank AB |

| Variable | Year | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| Y (baseline scenario) | 2014 | 45 | 13.587 | 4.539 | 6.7 | 33.8 |

| 2016 | 45 | 16.118 | 5.328 | 10.97 | 39.44 | |

| 2018 | 45 | 17.415 | 5.328 | 11.83 | 39.92 | |

| Y (adverse scenario) | 2014 | 45 | 10.198 | 4.315 | 4.7 | 31.5 |

| 2016 | 45 | 10.985 | 5.226 | 4.31 | 35.4 | |

| 2018 | 45 | 12.300 | 4.937 | 7.28 | 33.96 | |

| Eq/Assets | 2013 | 45 | 6.150 | 2.505 | 2.61 | 14.54 |

| 2015 | 45 | 6.480 | 2.232 | 2.5 | 13.27 | |

| 2017 | 45 | 6.813 | 2.447 | 3.01 | 15.11 | |

| Tier1 | 2013 | 41 | 14.473 | 5.815 | 8.6 | 44.04 |

| 2015 | 45 | 15.839 | 5.682 | 9.8 | 42.82 | |

| 2017 | 45 | 17.425 | 5.875 | 10.3 | 41.34 | |

| LLR/Loans | 2013 | 44 | 3.883 | 4.157 | 0.05 | 20.63 |

| 2015 | 45 | 3.126 | 3.221 | 0.05 | 15.78 | |

| 2017 | 44 | 2.274 | 2.203 | 0.04 | 9.56 | |

| NPL/Loans | 2013 | 44 | 7.223 | 6.885 | 0.09 | 34.92 |

| 2015 | 45 | 5.680 | 5.599 | 0.14 | 24.02 | |

| 2017 | 44 | 4.197 | 4.089 | 0.03 | 19.52 | |

| Ineff | 2013 | 45 | 63.808 | 14.632 | 17.57 | 98 |

| 2015 | 45 | 62.256 | 15.022 | 22.65 | 112.52 | |

| 2017 | 45 | 60.284 | 17.245 | -3.29 | 93.29 | |

| AssetGrw | 2013 | 45 | −0.018 | 0.072 | −0.183 | 0.225 |

| 2015 | 45 | −0.114 | 0.072 | −0.263 | 0.145 | |

| 2017 | 45 | 0.142 | 0.116 | −0.217 | 0.562 | |

| OpIncome | 2013 | 45 | 0.955 | 0.572 | 0.02 | 2.54 |

| 2015 | 45 | 0.927 | 0.569 | 0.03 | 3.4 | |

| 2017 | 45 | 0.938 | 0.497 | 0.11 | 2.96 | |

| ROE | 2013 | 45 | 3.341 | 7.930 | −27.07 | 12.84 |

| 2015 | 45 | 6.366 | 4.463 | −10.01 | 16.69 | |

| 2017 | 45 | 8.073 | 4.393 | −1.35 | 21.79 | |

| ROA | 2013 | 45 | 0.183 | 0.537 | −1.61 | 1.62 |

| 2015 | 45 | 0.408 | 0.313 | −0.42 | 1.34 | |

| 2017 | 45 | 0.556 | 0.408 | −0.08 | 2.13 | |

| Loan/Dep | 2013 | 45 | 96.949 | 47.705 | 32.41 | 280.98 |

| 2015 | 45 | 99.967 | 50.978 | 37.6 | 325.64 | |

| 2017 | 45 | 98.287 | 56.427 | 43.66 | 352.51 | |

| Loan/TDep | 2013 | 45 | 61.441 | 16.988 | 26.41 | 89.91 |

| 2015 | 45 | 62.663 | 15.908 | 29.42 | 90.31 | |

| 2017 | 45 | 64.495 | 15.782 | 31.75 | 92.19 | |

| LiqAssets/Dep | 2013 | 45 | 40.807 | 22.732 | 5.39 | 100.99 |

| 2015 | 45 | 38.562 | 20.904 | 2.22 | 100.11 | |

| 2017 | 45 | 39.552 | 20.822 | 6.07 | 100.31 | |

| Interbank | 2013 | 45 | 99.389 | 86.915 | 7.65 | 443.6 |

| 2015 | 45 | 106.770 | 94.855 | 16.87 | 449.34 | |

| 2017 | 45 | 97.245 | 105.634 | 9.77 | 571.77 | |

| SIFI | 2013 | 45 | 0.411 | 0.705 | 0 | 2.5 |

| 2015 | 45 | 0.367 | 0.674 | 0 | 2.5 | |

| 2017 | 45 | 0.311 | 0.583 | 0 | 2 | |

| SCR | 2013 | 45 | 0.689 | 0.468 | 0 | 1 |

| 2015 | 45 | 0.800 | 0.405 | 0 | 1 | |

| 2017 | 45 | 0.933 | 0.252 | 0 | 1 | |

| Euro | 2013–2017 | 45 | 0.689 | 0.466 | 0 | 1 |

References

- Ballate, A. Shaping Our World for a Better Tomorrow: Sustainable Investing, ESG, and Industry Insight. In Independent Study Project Collection, 2805. 2018. Available online: https://digitalcollections.sit.edu/isp_collection/2805 (accessed on 18 October 2019).

- Jeucken, M.; Bouma, J. The changing environment of banks. In Sustainable Banking; Bouma, J., Jeucken, M., Klinkers, L., Eds.; Routledge: London, UK, 2017. [Google Scholar]

- Rebai, S. New Banking Performance Evaluation Approach: Sustainable Finance and Sustainable Banking. Ph.D. Thesis, Higher Institute of Management, University of Tunis, Tunis, Tunisia, 2014. [Google Scholar]

- European Banking Authority (EBA). Joint Committee Report on Risks and Vulnerabilities in the EU Financial System; EBA: London, UK, April 2018. [Google Scholar]

- Raut, R.; Cheikhrouhou, N.; Kharat, M. Sustainability in the banking industry: A strategic multi-criterion analysis. Bus. Strategy Environ. 2017, 26, 550–568. [Google Scholar] [CrossRef]

- Sofian, I.; Dumitru, M. The compliance of the integrated reports issued by European financial companies with the international integrated reporting framework. Sustainability 2017, 9, 1319. [Google Scholar] [CrossRef]

- Fijałkowska, J.; Zyznarska-Dworczak, B.; Garsztka, P. Corporate social-environmental performance versus financial performance of banks in Central and Eastern European countries. Sustainability 2018, 10, 772. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E. European banks’ reputation for corporate social responsibility. Corp. Soc.-Responsib. Environ. Manag. 2017, 24, 1–14. [Google Scholar] [CrossRef]

- Rebai, S.; Azaiez, M.N.; Saidane, D. A multi-attribute utility model for generating a sustainability index in the banking sector. J. Clean. Prod. 2016, 113, 835–849. [Google Scholar] [CrossRef]

- Jan, A.; Marimuthu, M. Bankruptcy and Sustainability: A Conceptual Review on Islamic Banking Industry. Glob. Bus. Manag. Res. 2015, 7, 109–138. [Google Scholar]

- European Banking Authority (EBA). 2014 EU-Wide Stress Test Results. 2014. Available online: https://eba.europa.eu/risk-analysis-and-data/eu-wide-stress-testing/2014 (accessed on 2 November 2019).

- European Banking Authority (EBA). 2016 EU-Wide Stress Test Results. 2016. Available online: https://eba.europa.eu/risk-analysis-and-data/eu-wide-stress-testing/2016 (accessed on 2 November 2019).

- European Banking Authority (EBA). 2018 EU-Wide Stress Test Results. Available online: https://eba.europa.eu/risk-analysis-and-data/eu-wide-stress-testing/2018 (accessed on 2 November 2019).

- Basel Committee on Banking Supervision. Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems; Bank for International Settlements: Basel, Switzerland, 2010; Available online: https://www.bis.org/publ/bcbs189_dec2010.htm (accessed on 16 October 2019).

- Basel Committee on Banking Supervision. Basel III: Finalizing Post-crisis Reforms; Bank for International Settlements: Basel, Switzerland, 2017; Available online: https://www.bis.org/bcbs/publ/d424.htm (accessed on 24 February 2020).

- International Monetary Fund; Bank for International Settlements; Financial Stability Board. Guidance to Assess the Systemic Importance of Financial Institutions, Markets and Instruments: Initial Considerations. 2009. Available online: https://www.imf.org/external/np/g20/pdf/100109.pdf (accessed on 27 October 2019).

- Pongini, P.; Nieri, L.; Pelagatti, M. The importance of being systemically important financial institutions. J. Bank. Financ. 2015, 50, 562–574. [Google Scholar] [CrossRef]

- Baker, C.; Cummings, C.; Jagtiani, J. The impacts of financial regulations: Solvency and liquidity in the post-crisis period. J. Financ. Regul. Compliance 2017, 25, 253–270. [Google Scholar] [CrossRef]

- Dewatripont, M. European banking: Bailout, bail-in and state aid control. Int. J. Ind. Organ. 2014, 34, 37–43. [Google Scholar] [CrossRef]

- Boccuzzi, G.; De Lisa, R. Does bail-in definitely rule out bailout? J. Financ. Manag. Mark. Inst. 2017, 1, 93–110. [Google Scholar]

- Čihák, M. Introduction to Applied Stress Testing; IMF Working Paper; Monetary and Capital Markets Department: Washington, DC, USA, 2007. [Google Scholar]

- Petrella, G.; Resti, A. Supervisors as information producers: Do stress test reduce bank opaqueness? J. Bank. Financ. 2013, 37, 5406–5420. [Google Scholar] [CrossRef]

- Nieto, M. Banks and Environmental Sustainability: Some Reflections from the Perspective of Financial Stability; CEPS: Brussels, Belgium, 2017. [Google Scholar]

- Henry, P.B. Capital account liberalization, the cost of capital, and economic growth. Am. Econ. Rev. 2003, 93, 91–96. [Google Scholar] [CrossRef]

- Beck, T.; Demirguc-Kunt, A.; Laeven, L.; Levine, R. Finance, firm size, and growth. J. Money Credit Bank. 2008, 40, 1379–1405. [Google Scholar] [CrossRef]

- Aghion, P.; Angeletos, G.M.; Banerjee, A.; Manova, K. Volatility and growth: Credit constraints and the composition of investment. J. Monet. Econ. 2010, 57, 246–265. [Google Scholar] [CrossRef]

- Laeven, L.; Valencia, F. Systemic Banking Crises: A New Database; Working Papers 08/224; International Monetary Fund: Washington, DC, USA, 2008. [Google Scholar]

- Gick, W.; Pausch, T. Optimal disclosure of supervisory information in the banking sector. SSRN Electron. J. 2016. [Google Scholar] [CrossRef]

- Goldstein, I.; Sapra, H. Should banks’ stress test results be disclosed? An analysis of the costs and benefits. Found. Trends® Financ. 2014, 8, 1–54. [Google Scholar] [CrossRef]

- Alfaro, R.A.; Drehmann, M. Macro stress tests and crises: What can we learn? BIS Q. Rev. 2009, 29–41. Available online: https://www.bis.org/publ/qtrpdf/r_qt0912e.htm (accessed on 16 October 2019).

- Acharya, V.; Engle, R.; Pierret, D. Testing macroprudential stress tests: The risk of regulatory risk weights. J. Monet. Econ. 2014, 65, 36–53. [Google Scholar] [CrossRef]

- Kolari, J.W.; López-Iturriaga, F.J.; Pastor Sanz, I. Predicting European bank stress tests: Survival of the fittest. Glob. Financ. J. 2019, 39, 44–57. [Google Scholar] [CrossRef]

- Dabos, M.; Sosa Escudero, W. Explaining and predicting bank failure using duration models: The case of Argentina after the Mexican crisis. Rev. Anal. Econ. 2004, 19, 31–49. [Google Scholar]

- Avkiran, N.K.; Cai, L. Predicting Bank Financial Distress Prior to Crises; New Zealand Finance Colloquium: Brisbane, Australia, 2012. [Google Scholar]

- Wanke, P.; Barros, C.P.; Faria, J.R. Financial distress drivers in Brazilian banks: A dynamic slacks approach. Eur. J. Oper. Res. 2015, 240, 258–268. [Google Scholar] [CrossRef]

- Kraft, E.; Galac, T. Deposit interest rates, asset risk and bank failure in Croatia. J. Financ. Stab. 2007, 2, 312–337. [Google Scholar] [CrossRef]

- Weelock, D.C.; Wilson, P.W. Why do banks disappear? The determinants of U.S. bank failures and acquisitions. Rev. Econ. Stat. 2000, 82, 127–138. [Google Scholar] [CrossRef]

- Curry, T.J.; Fissel, G.S.; Ramirez, C.D. The impact of bank supervision on loan growth. N. Am. J. Econ. Financ. 2008, 19, 113–134. [Google Scholar] [CrossRef]

- Jin, J.Y.; Kanagaretnam, K.; Lobo, G.J. Ability of accounting and audit quality variables to predict bank failure during the financial crisis. J. Bank. Financ. 2011, 35, 2811–2819. [Google Scholar] [CrossRef]

- Daley, J.; Matthews, K.; Whitfield, K. Too-big-to-fail: Bank failure and banking policy in Jamaica. J. Int. Financ. Mark. Inst. Money 2008, 18, 290–303. [Google Scholar] [CrossRef]

- Arena, M. Bank failures and bank fundamentals: A comparative analysis of Latin America and East Asia during the nineties using bank-level data. J. Bank. Financ. 2008, 32, 299–310. [Google Scholar] [CrossRef]

- Paule-Vianez, J.; Gutiérrez-Fernández, M.; Coca-Pérez, J.L. Prediction of financial distress in the Spanish banking system. Appl. Econ. Anal. 2019, 28, 69–87. [Google Scholar] [CrossRef]

- Molina, C.A. Predicting bank failures using a hazard model: The Venezuelan banking crisis. Emerg. Mark. Rev. 2002, 3, 31–50. [Google Scholar] [CrossRef]

- Poghosyan, T.; Čihak, M. Determinants of bank distress in Europe: Evidence from a new data set. J. Financ. Serv. Res. 2011, 40, 163–184. [Google Scholar] [CrossRef]

- Schulte, M.; Winkler, A. Drivers of solvency risk–Are microfinance institutions different? J. Bank. Financ. 2019, 106, 403–426. [Google Scholar] [CrossRef]

- Gambetta, N.; García-Benau, M.A.; Zorio-Grima, A. Stress test impact and bank risk profile: Evidence from macro stress testing in Europe. Int. Rev. Econ. Financ. 2019, 61, 347–354. [Google Scholar] [CrossRef]

- Nájera-Sánchez, J.J. A Systematic Review of Sustainable Banking through a Co-Word Analysis. Sustainability 2020, 12, 278. [Google Scholar] [CrossRef]

- Berger, A.N.; DeYoung, R. Problem loans and cost efficiency in commercial banks. J. Bank. Financ. 1997, 21, 849–870. [Google Scholar] [CrossRef]

- Baselga-Pascual, L.; Trujillo-Ponce, A.; Cardone-Riportella, C. Factors influencing bank risk in Europe: Evidence from the financial crisis. N. Am. J. Econ. Financ. 2015, 34, 138–166. [Google Scholar] [CrossRef]

- Männasoo, K.; Mayes, D. Explaining bank distress in Eastern European transition economies. J. Bank. Financ. 2009, 33, 244–253. [Google Scholar] [CrossRef]

- Trujillo-Ponce, A. What determines the profitability of banks? Evidence from Spain. Account. Financ. 2013, 53, 561–586. [Google Scholar] [CrossRef]

- Louzis, D.; Vouldis, A.T.; Metaxas, V. Macroeconomic and bank-specific determinants of non-performing loans in Greece: A comparative study of mortgage, business and consumer loan portfolios. J. Bank. Financ. 2012, 36, 1012–1027. [Google Scholar] [CrossRef]

- Fiordelisi, F.; Marques-Ibanez, D.; Molyneux, P. Efficiency and risk in European banking. J. Bank. Financ. 2011, 35, 1315–1326. [Google Scholar] [CrossRef]

- Kraft, E.; Jankov, L. Does speed kill? Lending booms and their consequences in Croatia. J. Bank. Financ. 2005, 29, 105–121. [Google Scholar] [CrossRef]

- Makri, V.; Tsagkanos, A.; Bellas, A. Determinants of non-performing loans: The case of Eurozone. Panoeconomicus 2014, 61, 193–206. [Google Scholar] [CrossRef]

- Acharya, V.; Naqvi, H. The seeds of a crisis: A theory of bank liquidity and risk taking over the business cycle. J. Financ. Econ. 2012, 106, 349–366. [Google Scholar] [CrossRef]

- Wanke, P.; Azad, M.A.K.; Barros, C.P. Financial distress and the Malaysian dual baking system: A dynamic slacks approach. J. Bank. Financ. 2016, 66, 1–18. [Google Scholar] [CrossRef]

- Kerstein, J.; Kozberg, A. Using accounting proxies of proprietary FDIC ratings to predict bank failures and enforcement actions during the recent financial crisis. J. Account. Audit. Financ. 2013, 28, 128–151. [Google Scholar] [CrossRef]

- Cornet, M.M.; Erhemjamts, O.; Tehranian, H. Greed or good deeds: An examination of the relation between corporate social responsibility and the financial performance of US commercial banks around the financial crisis. J. Bank. Financ. 2016, 70, 137–159. [Google Scholar] [CrossRef]

- Laguir, I.; Marais, M.; El Baz, J.; Stekelorum, R. Reversing the business rationale for environmental commitment in banking: Does financial performance lead to higher environmental performance? Manag. Decis. 2018, 56, 358–375. [Google Scholar] [CrossRef]

- Gemar, P.; Gemar, G.; Guzman-Parra, V. Modeling the Sustainability of Bank Profitability Using Partial Least Squares. Sustainability 2019, 11, 4950. [Google Scholar] [CrossRef]

- Rabe-Hesketh, S.; Skrondal, A. Multilevel and Longitudinal Modeling Using Stata. Volume I: Continuous Responses, 3rd ed.; Stata Press: College Station, TX, USA, 2012. [Google Scholar]

- Snijders, T.A.B.; Bosker, R.J. Multilevel Analysis. An Introduction to Basic and Advanced Multilevel Modeling, 2nd ed.; Sage: London, UK, 2012. [Google Scholar]

- StataCorp. Stata Statistical Software: Release 14; StataCorp LP: College Station, TX, USA, 2015. [Google Scholar]

- Abad-González, J.; Gutiérrez-López, C.; Salvador, A. Banking solvency determinants in the EU: A model based on stress tests. Appl. Econ. Lett. 2018, 25, 1296–1300. [Google Scholar] [CrossRef]

- Raudenbush, S.W.; Bryk, A.S. Hierarchical Linear Models: Applications and Data Analysis Methods, 2nd ed.; Sage: Thousand Oaks, CA, USA, 2002. [Google Scholar]

| Year | 2014 | 2016 | 2018 |

|---|---|---|---|

| Number of banks | 123 | 51 | 48 |

| Coverage | About 70% of the EU banking sector | ||

| Individual prerequisites | Covering at least 50% of the national banking sector | To be included in the sample, banks have to have a minimum of EUR 30 bn in assets. | The euro area is considered as a single jurisdiction, and smaller banks in some countries are not included but controlled by the ECB’s stress tests |

| Number of countries | 22 | 15 | 15 |

| Threshold (core equity tier 1 ratio) | 8% Baseline scenario 5.5% Adverse scenario | Non-applicable | |

| Adverse scenario | |||

| GDP deviation from the baseline level | −2.2% (2014) −5.6% (2015) −7% (2016) | −1.2% (2016) −1.3% (2017) 0.7% (2018) | −1.2% (2018) −2.2% (2019) 0.7% (2020) |

| Other factors |

|

|

|

| Specific concerns | Capital shortfalls | Market and liquidity risks | Implementation of new accounting standards on financial instruments (IFRS 9) and their effects on credit risk |

| Year | AT | BE | DE | DK | ES | FI | FR | HU | IE | IT | NL | NO | PL | SE | UK | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2013 | 3 | 0 | 6 | 3 | 3 | 1 | 6 | 1 | 1 | 4 | 2 | 1 | 0 | 4 | 4 | 39 |

| 2015 | 3 | 1 | 6 | 3 | 4 | 1 | 6 | 1 | 2 | 4 | 4 | 1 | 1 | 4 | 4 | 45 |

| 2017 | 3 | 1 | 5 | 3 | 4 | 1 | 6 | 1 | 2 | 4 | 4 | 1 | 1 | 4 | 4 | 44 |

| Group | Acronyms | Variables | Sign | References |

|---|---|---|---|---|

| C | Eq/Assets | Equity/Total assets | + | [32,42,46] |

| C | Cap/Assets | Capital Funds/Total assets | + | [49,50,61] |

| C | Tier1 | TIER 1 | + | [42,61] |

| A | LLR/Loans | Loan loss reserves/Gross loans | − | [46,61] |

| A | NPL/Loans | Non-performing or impaired loans/Gross loans | − | [32,42,61] |

| A | NCO/Loans | Net-charge offs/Gross loans | − | [42] |

| M | INEFF | Cost/Income ratio | − | [42,49,50,52] |

| M | AssetGrw | Total Assets growth% | − | [32,42] |

| E | OpIncome | Other operating income/Assets | + | [32,42] |

| E | ROE | Net Income/Equity | + | [32,42,61] |

| E | ROA | Net Income/Total assets | + | [42,44,49,61] |

| E | PayOut | Dividend Payout | + | [61] |

| L | Loan/Dep | Net Loans/(Deposits + Short term funding) | − | [32] |

| L | Loan/TDep | Net Loans/(Total Deposits + Borrowing) | − | [42] |

| L | LiqAssets/Dep | Liquid Assets/(Deposits + Short term funding) | + | [42] |

| S | InterBank | Interbank Assets/Liabilities | − | [32,42] |

| S | PER | Price-earnings ratio | − | [32,42] |

| Variable | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Y (baseline scenario) | 135 | 15.707 | 5.2871 | 6.7 | 39.92 |

| Y (adverse scenario) | 135 | 11.161 | 4.883 | 4.31 | 35.4 |

| Eq/Assets | 135 | 6.481 | 2.408 | 2.5 | 15.11 |

| Tier1 | 131 | 15.956 | 5.903 | 8.6 | 44.04 |

| LLR/Loans | 133 | 3.095 | 3.350 | 0.04 | 20.63 |

| NPL/Loans | 133 | 5.700 | 5.764 | 0.03 | 34.92 |

| Ineff | 135 | 62.116 | 15.7130 | −3.29 | 112.52 |

| AssetGrw | 135 | 0.003 | 0.1383 | −0.263 | 0.562 |

| OpIncome | 135 | 0.940 | 0.546 | 0.02 | 3.4 |

| ROE | 135 | 5.926 | 6.145 | −27.07 | 21.79 |

| ROA | 135 | 0.3823 | 0.455 | −1.61 | 2.13 |

| Loan/Dep | 135 | 98.401 | 51.746 | 32.41 | 352.51 |

| Loan/TDep | 135 | 62.866 | 16.254 | 26.41 | 92.19 |

| LiqAssets/Dep | 135 | 39.640 | 21.484 | 2.22 | 100.99 |

| Interbank | 135 | 101.135 | 96.016 | 7.65 | 571.77 |

| SIFI | 135 | 0.3630 | 0.656 | 0 | 2.5 |

| Euro | 135 | 0.6889 | 0.465 | 0 | 1 |

| CSR | 135 | 0.8074 | 0.3958 | 0 | 1 |

| Model 1 | Model 2 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Null Model | With Covariates | Null Model | With Covariates | ||||||

| Coeff. | SE | Coeff. | SE | Coeff. | SE | Coeff. | SE | ||

| N | 256 | 256 | 256 | 256 | |||||

| Log-likelihood | −723.0 | −483.9 | −591.3 | −500.4 | |||||

| Degrees of freedom | 0 | 21 | 0 | 16 | |||||

| LR test vs. linear model | 129.03*** | 32.15*** | 392.42*** | 268.71*** | |||||

| LR test vs. null model | 478.21*** | 181.92*** | |||||||

| FIXED PART | |||||||||

| Intercept | 13.492*** | 0.674 | 5.789** | 2.388 | 13.419*** | 1.293 | 4.270 | 2.612 | |

| C | Eq/Assets | 0.294** | 0.139 | 0.294** | 0.141 | ||||

| C | Tier1 | 0.585*** | 0.047 | 0.585*** | 0.047 | ||||

| A | LLR/Loans | −0.337** | 0.152 | −0.336** | 0.153 | ||||

| A | NPL/Loans | 0.028 | 0.084 | 0.027 | 0.085 | ||||

| M | Ineff | −0.044*** | 0.014 | −0.044*** | 0.014 | ||||

| M | AssetGrw | 0.106 | 1.569 | 0.0626 | 1.568 | ||||

| E | OpIncome | 0.770* | 0.459 | 0.771* | 0.464 | ||||

| E | ROE | −0.053 | 0.088 | −0.053 | 0.089 | ||||

| E | ROA | 0.588 | 1.339 | 0.594 | 1.354 | ||||

| L | Loan/Dep | 0.002 | 0.006 | 0.002 | 0.006 | ||||

| L | Loan/TDep | −0.011 | 0.024 | −0.011 | 0.024 | ||||

| L | LiqAssets/Dep | 0.025* | 0.013 | 0.025* | 0.013 | ||||

| S | Interbank | −0.001 | 0.002 | −0.001 | 0.002 | ||||

| SIFI | −1.038*** | 0.340 | −1.038*** | 0.344 | |||||

| Euro | −0.253 | 0.487 | −0.250 | 0.492 | |||||

| CSR | 1.204*** | 0.364 | 1.202*** | 0.368 | |||||

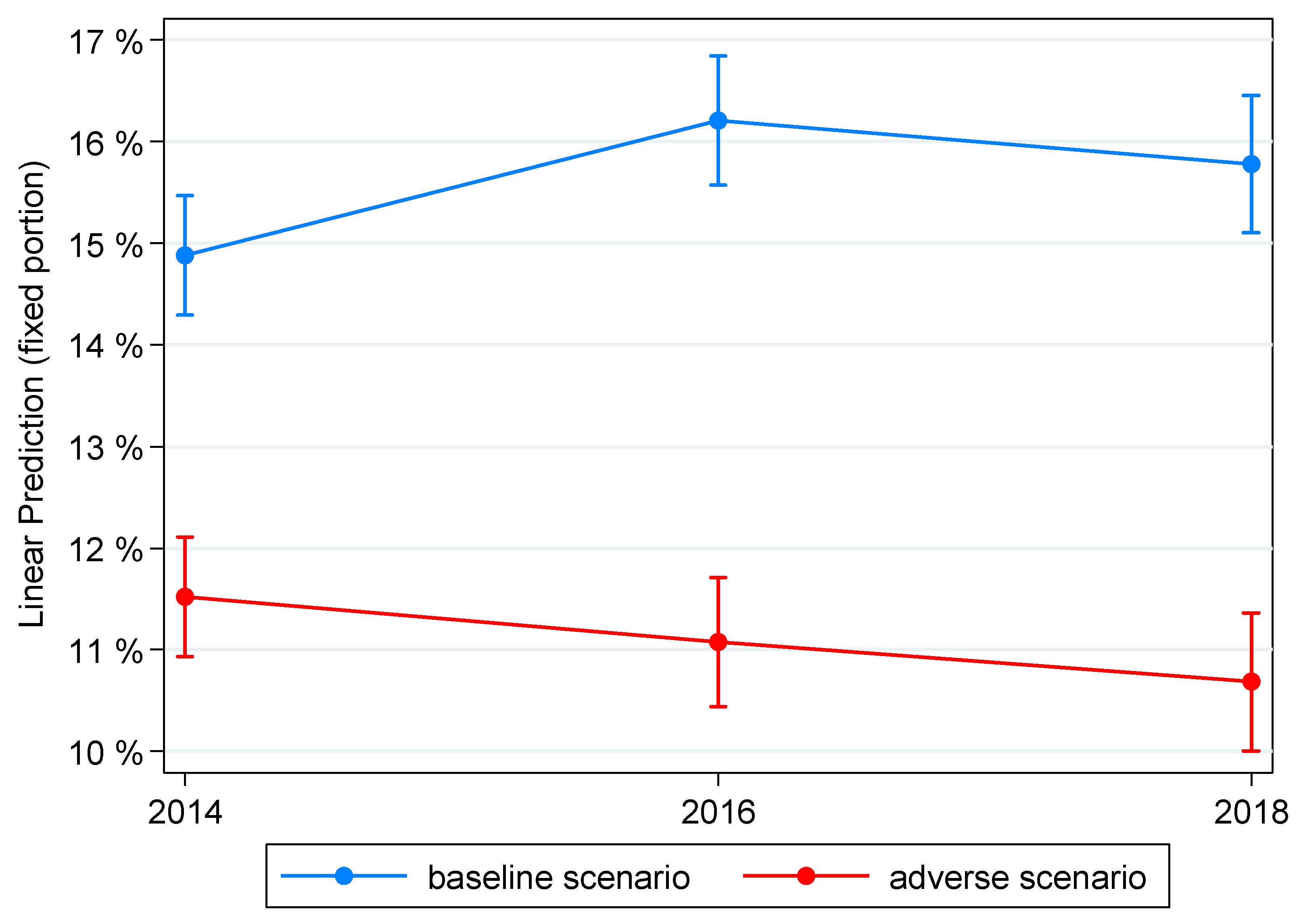

| Scenario#year | |||||||||

| Baseline-2014 | 0.000 | ||||||||

| Baseline-2016 | 1.326*** | 0.372 | |||||||

| Baseline-2018 | 0.898** | 0.425 | |||||||

| Adverse-2014 | −3.362*** | 0.319 | |||||||

| Adverse-2016 | −3.807*** | 0.372 | |||||||

| Adverse-2018 | −4.197*** | 0.425 | |||||||

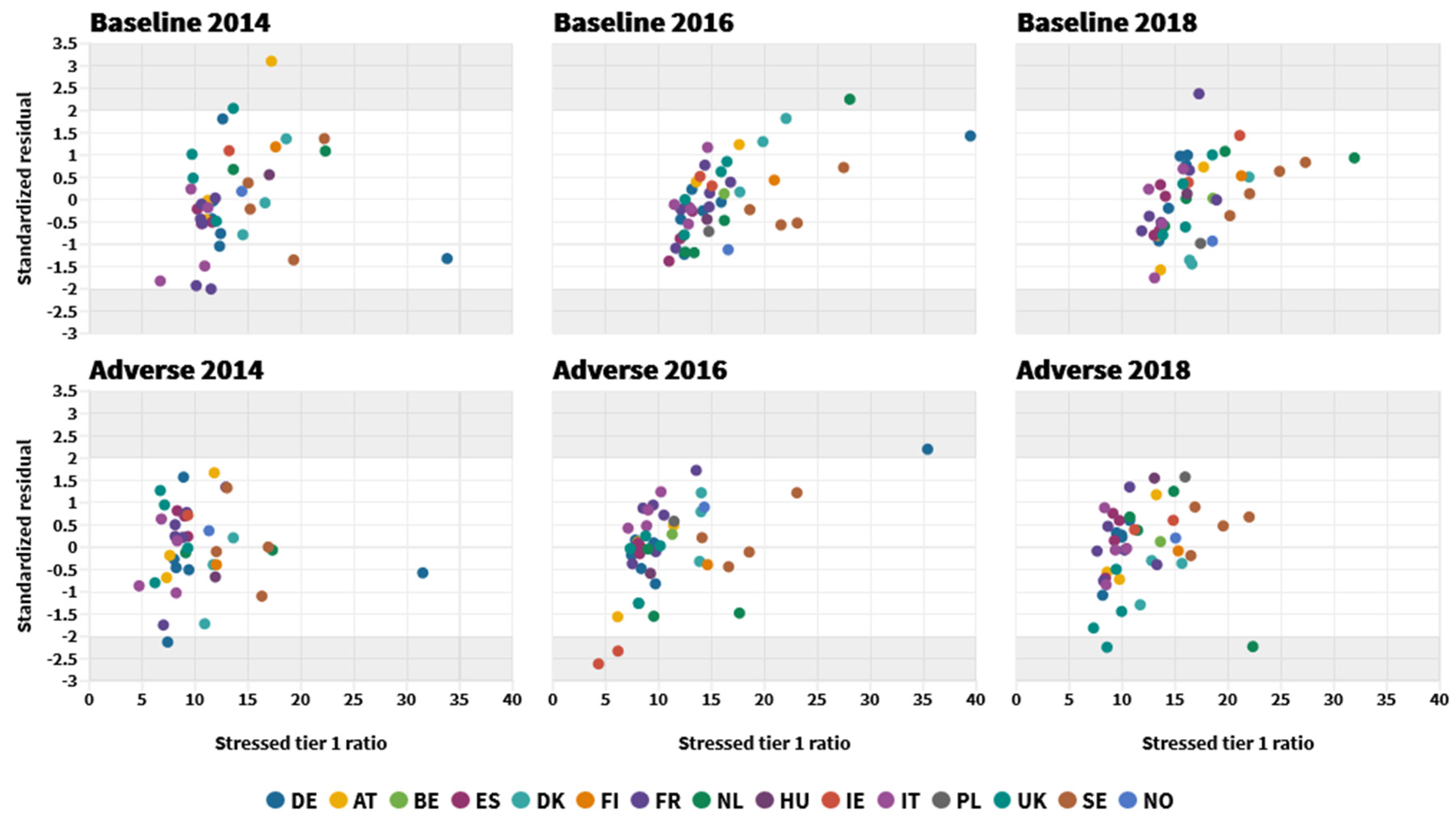

| RANDOM PART | |||||||||

| sd(ζi) | 2.661*** | 0.781 | 2.307*** | 0.672 | |||||

| sd(uj) | 4.299*** | 0.510 | 1.085 | 0.188 | 4.649*** | 0.506 | 1.096 | 0.192 | |

| sd(eij) | 3.316*** | 0.162 | 1.408*** | 0.072 | 1.662*** | 0.082 | 1.425*** | 0.074 | |

| ICC | 0.627 | 0.373 | 0.912 | 0.763 | |||||

| GOODNESS-OF-FIT | |||||||||

| Overall R2 | 0.893 | 0.728 | |||||||

| Level-2 (bank) R2 | 0.936 | 0.944 | |||||||

| Level-1 R2 | 0.820 | 0.265 | |||||||

| AIC | 1452.0 | 1015.8 | 1190.7 | 1040.7 | |||||

| BIC | 1462.7 | 1100.9 | 1204.8 | 1111.6 | |||||

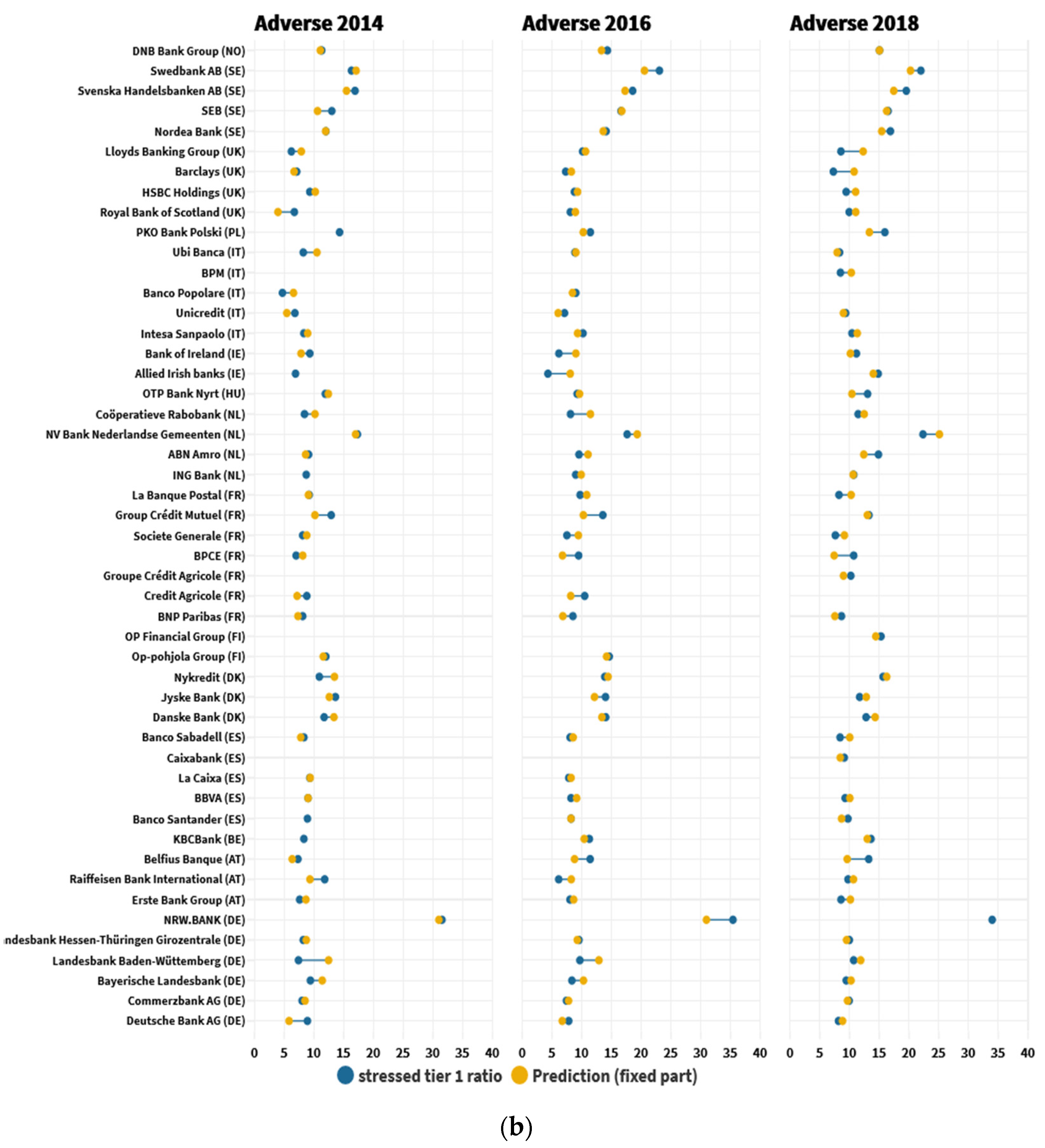

| Model 1 (Reduced) | Model 2 (Reduced) | ||||

|---|---|---|---|---|---|

| Coeff. | SE | Coeff. | SE | ||

| N | 256 | 256 | |||

| Log-likelihood | −484.6 | −501.0 | |||

| Degrees of freedom | 13 | 8 | |||

| LR test vs. linear model | 38.34*** | 270.32*** | |||

| LR test vs. null model | 476.81*** | 180.57*** | |||

| LR test vs. complete model | 1.40 | 1.36 | |||

| FIXED PART | |||||

| Intercept | 4.540*** | 1.227 | 2.983* | 1.557 | |

| C | Eq/Assets | 0.331*** | 0.097 | 0.331*** | 0.098 |

| C | Tier1 | 0.587*** | 0.039 | 0.587*** | 0.040 |

| A | LLR/Loans | −0.285*** | 0.071 | −0.285*** | 0.072 |

| M | Ineff | −0.041*** | 0.010 | −0.041*** | 0.011 |

| E | OpIncome | 0.741* | 0.430 | 0.740* | 0.434 |

| L | LiqAssets/Dep | 0.028*** | 0.010 | 0.028*** | 0.010 |

| SIFI | −0.939*** | 0.289 | −0.939*** | 0.292 | |

| SCR | 1.144*** | 0.349 | 1.143*** | 0.353 | |

| Scenario#year | |||||

| Baseline-2014 | 0.000 | ||||

| Baseline-2016 | 1.271*** | 0.321 | |||

| Baseline-2018 | 0.857** | 0.352 | |||

| Adverse-2014 | −3.362*** | 0.322 | |||

| Adverse-2016 | −3.862*** | 0.321 | |||

| Adverse-2018 | −4.328*** | 0.352 | |||

| RANDOM PART | |||||

| sd(ζi) | 2.305*** | 0.671 | |||

| sd(uj) | 1.043 | 0.166 | 1.054 | 0.170 | |

| sd(eij) | 1.421*** | 0.071 | 1.438*** | 0.073 | |

| ICC | 0.350 | 0.756 | |||

| GOODNESS-OF-FIT | |||||

| Overall R2 | 0.895 | 0.730 | |||

| Level-2 (bank) R2 | 0.941 | 0.949 | |||

| Level-1 R2 | 0.816 | 0.251 | |||

| AIC | 1001.2 | 1026.1 | |||

| BIC | 1058.0 | 1068.6 | |||

| Model 1 (Reduced) | Baseline Scenario | Adverse Scenario | |||

|---|---|---|---|---|---|

| Coeff. | SE | Coeff. | SE | ||

| N | 128 | 128 | |||

| Log-likelihood | −246.3 | −242.7 | |||

| Degrees of freedom | 10 | 10 | |||

| LR test vs. linear model | 11.11*** | 7.29*** | |||

| FIXED PART | |||||

| Intercept | 4.064*** | 1.530 | 1.035 | 1.443 | |

| C | Eq/Assets | 0.239** | 0.118 | 0.426*** | 0.109 |

| C | Tier1 | 0.636*** | 0.049 | 0.575*** | 0.046 |

| A | LLR/Loans | −0.184** | 0.089 | −0.355*** | 0.083 |

| M | Ineff | −0.037*** | 0.013 | −0.045*** | 0.013 |

| E | OpIncome | 0.402 | 0.525 | 1.046** | 0.481 |

| L | LiqAssets/Dep | 0.031*** | 0.012 | 0.031*** | 0.011 |

| SIFI | −1.133*** | 0.344 | −0.703** | 0.309 | |

| SCR | 1.122** | 0.449 | 0.752* | 0.430 | |

| Year | |||||

| 2014 | 0.000 | 0.000 | |||

| 2016 | 1.299*** | 0.317 | −0.525 | 0.322 | |

| 2018 | 0.925** | 0.361 | −0.931*** | 0.360 | |

| RANDOM PART | |||||

| sd(uj) | 1.116 | 0.204 | 0.875 | 0.204 | |

| sd(eij) | 1.378*** | 0.111 | 1.417*** | 0.113 | |

| ICC | 0.396 | 0.276 | |||

| GOODNESS-OF-FIT | |||||

| Overall R2 | 0.878 | 0.879 | |||

| Level-2 (bank) R2 | 0.935 | 0.960 | |||

| Level-1 R2 | 0.717 | 0.471 | |||

| AIC | 518.5 | 511.4 | |||

| BIC | 555.6 | 548.4 | |||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gutiérrez-López, C.; Abad-González, J. Sustainability in the Banking Sector: A Predictive Model for the European Banking Union in the Aftermath of the Financial Crisis. Sustainability 2020, 12, 2566. https://doi.org/10.3390/su12062566

Gutiérrez-López C, Abad-González J. Sustainability in the Banking Sector: A Predictive Model for the European Banking Union in the Aftermath of the Financial Crisis. Sustainability. 2020; 12(6):2566. https://doi.org/10.3390/su12062566

Chicago/Turabian StyleGutiérrez-López, Cristina, and Julio Abad-González. 2020. "Sustainability in the Banking Sector: A Predictive Model for the European Banking Union in the Aftermath of the Financial Crisis" Sustainability 12, no. 6: 2566. https://doi.org/10.3390/su12062566

APA StyleGutiérrez-López, C., & Abad-González, J. (2020). Sustainability in the Banking Sector: A Predictive Model for the European Banking Union in the Aftermath of the Financial Crisis. Sustainability, 12(6), 2566. https://doi.org/10.3390/su12062566