Abstract

Blockchain implications within the sustainability domain are rapidly arousing the interest of researchers and institutions. However, despite the avalanche of articles, papers, and recently published books, innovation in the blockchain domain is still heavily influenced by light literature, such as news, articles, opinion posts, and white papers. Lacking a homogeneous literature background, case studies often fall into storytelling, providing mere descriptions of the facts according to the writers’ impressions and opinions. We therefore investigate blockchain adoption for sustainable purposes through a case study while remaining firmly grounded in three main theoretical literature streams: knowledge management, knowledge infrastructure, and trust. Since blockchain interaction with the real world is managed by oracles, addressing the oracle problem is essential in order to evaluate the effectiveness of blockchain for sustainability issues. However, to the best of the authors’ knowledge, no other paper has efficiently addressed this subject or even mentioned it. Recognizing its scarce consideration in the literature, the oracle problem will be analyzed in both theoretical and practical terms, thereby providing a way to solve the issues related to non-fungible products in the supply chain. Choice over the selected case study was made in light of the divergence in motives for the adoption of blockchain (economic over social), which makes the results more inferable at a broader scale and offers an insight into how sustainable innovations can also be economically viable.

1. Introduction

As recently shown by the Politecnico di Milano Observatory [1], at an international level, more than 580 projects involving blockchain as the main subject can be observed, with an increment of 76% since 2017, although the number of real applications barely exceeds 10%. Many blockchain applications involve financial technology, whereas we are assisting with a slight but progressive increase in non-financial projects such as logistics, production, and traceability [2,3]. Recent literature has shown that blockchain is being tested [4,5,6], mainly in the Chinese and US markets, to track product information and to improve product traceability. In 2011, China experienced a massive mislabeling of pork meat, together with a contamination problem where donkey meat was secretly mixed with fox meat [7,8]. In 2017, Papayas in the US were linked with a multi-state outbreak of salmonella, leading to 173 cases of salmonellosis, 53 hospitalizations, and one death across 21 states [9]. Traceability improves food safety and public confidence, pinpointing the exact product to be discarded without compromising the entire supply line [10]. Kamath [11], Mearian [12], and Corkery and Popper [13], extensively described Walmart’s efforts involving the adoption of blockchain and cryptography to trace the products sold in their stores. Supported by government entities, cooperating with IBM and utilizing Linux Hyperledger [14], they managed to improve the time taken to trace a product from one week to a few seconds, in addition to providing updated information, such as temperature, humidity, and a roadmap. Their pilot project concerning mangos aimed to demonstrate transferability and accountability across borders; while successful, the maintenance costs for the whole system were quite high [15]. Blockchain for a sustainable agri-food market is mostly intended to solve social problems rather than technical or economic problems [16]. In contrast, in Italian markets, non-financial blockchain applications are considered a valuable resource for the protection of the “Made-in-Italy” brand. Federalimentare’s (2018) data show that the capitalization of agri-food products utilizing the “Made-in-Italy” brand is around 135 billion euros [17], with an added value of more than 61 billion euros. Italian agri-food products are protected by the “Designation of Origin” (DOP, DOCG), which reached the value of 15 billion euros in early 2017, representing nearly 18% of the entire agri-food sector and comprising 822 products subject to regulations and checks.

However, the same protection system limits the growth of production, exponentially enlarging the gap between demand and offer. As the solution cannot involve production adjustments, as a result of DOP constraints, Italian small to medium enterprises (SMEs) are fighting the phenomenon, incentivizing client awareness of product provenance and transportation, lately also considering blockchain. As sustainable innovation should also be economically viable, we build on this divergence of aims for blockchain’s adoption to effectively address our research questions. Sustainability driven blockchain adoption involves a very narrow but important aspect of the economy, making models and inference less applicable on a broader scale [18,19]. In contrast, a value-driven approach to blockchain adoption undertaken by Italian SMEs could be easier to replicate for companies entering the market or simply changing their business model to a blockchain orientation. Further, for managers trying to replicate a sustainable supply chain, being aware of how it can also promote financial sustainability could represent the right incentive for the investment to be promoted. Further, food-safety designed blockchain models are more expensive than value-driven blockchains, which, designed for value creation, are by definition “cost effective”. Early evidence supports the usefulness of blockchain in the financial sector to lower costs and facilitate faster transactions [20,21]. Non-financial applications are still in the pilot/early stages, and no robust findings have been produced so far. What the literature neglects about blockchain implication for traceability and sustainability is the so-called oracle problem, and the trustworthiness of information written in smart contracts [22,23]. Few have made attempt to address the problem, and those who have work mainly in the light literature of the insurance/finance sector [24,25]. Although the problem is less worrying for fungible products [26], in non-fungible products it can undermine the worthiness of entire projects. Seeking to make a solid contribution to the literature addressing blockchain social and economic implications, this paper focuses on two main research questions. First, how does blockchain technology adoption affect organizational effectiveness and, second, how can the oracle problem be effectively overcome for sustainable supply chains?

Undoubtedly, addressing the critical gap in the literature that neglects the oracle problem is mandatory when developing further empirical/theoretical papers on traceability and smart-contract-driven blockchain. Above all, the concept is critical when smart contracts are used for sustainability purposes where information reliability and transparency constitute essential aspects. To answer our two research questions, we will take a knowledge-based view of a modified Gold et al. model to analyze a single case study of an Italian agri-food company undertaking a blockchain-based traceability project [27]. The paper proceeds as follows. Section 2 provides a background on the literature on blockchain technology and the oracle problem, addressing streams of literature by Gold et al. [27], and on the implications of knowledge process capabilities [28]. In Section 3, the methodology of this research is explained, along with a detailed illustration of the data gathered. In Section 4, an in-depth analysis of the research questions is provided, along with the most significative data. Section 5 provides the concluding remarks, limitations, implications for academics and practitioners, and hints for further research.

2. Theoretical Background

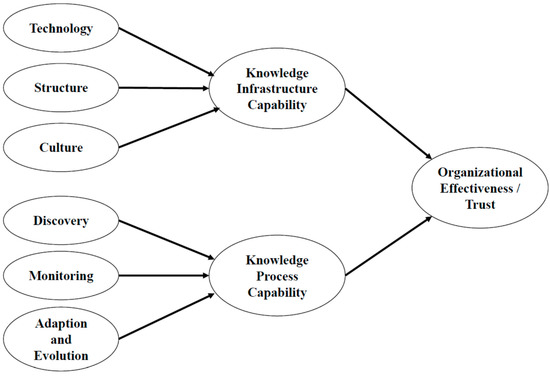

The concept of blockchain was introduced by Haber and Stornetta’s [29] paper that promoted the idea of the digital stamping of documents “in a sequence” (one at a time) to authenticate Intellectual Property Rights. In a subsequent work, they, along with other authors, proposed bundling large volumes of transactions together into blocks and arranging them in a chronological sequence according to a hash code. The first to refer to this particular “chain of block” appears to be Nakamoto in 2008 [30], who connected the concept of blockchain to a public ledger, constantly updated by multiple users. Motivated by distrust in financial establishments, Nakamoto [30] introduced a blockchain framework for his cryptocurrency (Bitcoin) with no central organization to supervise the creation of blocks [30,31]. Blockchain technology is defined as a distributed ledger [32,33], able to record transactions (of any kind) in a secure, transparent, efficient, decentralized, and low-cost way [34]. There are several types of blockchain (public, private, hybrid) that vary according to the degree of freedom to access information [35,36]. Swan presents a list of potential blockchain applications [37], divided into three categories: The first area is related to currencies, payments, and invoices; the second regards smart contracts in financial and non-financial markets; and the third pertains to social applications, such as voting and healthcare identification. Regarding the second type of application, smart contracts are defined by Morkunas et al. as a self-executing code on a blockchain that automatically implements the terms of an agreement between parties [2]. When operating with smart contracts, a problem related to the insertion of data on the blockchain arises. Smart contracts for non-financial/real-world applications involve the role of an oracle (human or artificial intelligence) to actually insert critical data drawn from an external environment into the blockchain. As the role of oracles is critical when evaluating smart contracts for sustainable supply chains, further explanations and examples of financial and non-financial smart contracts involving the oracle are provided. When dealing with cryptocurrencies, the provenance of a bitcoin, or another token on a smart-contract platform, is certain because the token itself is in the blockchain and, therefore, all of its information is available to the smart-contract. For example, if the smart-contract pertains to a swap between two different cryptocurrencies, all the requisite information will be drawn from the two respective blockchains, which are “true and immutable”. For non-financial applications, such as food traceability, the tracking of information about things that are not part of the “locked chain” but happen outside (such as weather effects, temperature, or product provenance) constitutes an externality to the blockchain. In the case of, for example, a pack of cheese sitting on a store shelf, the information about that product is not present in any of the available blockchains, and so it has to be inserted by an oracle. An oracle is essentially a gateway between a smart-contract environment and the external world [22,23]. It obtains information about something that has occurred outside the blockchain and then provides that information to the smart contract through a specific communication channel (e.g., platforms, probes). The main difference between financial and non-financial/real-world smart-contract applications is that, for financial applications, the information is true and immutable (if the system has not been compromised) because it is drawn from other blockchain environments, while, for non-financial/real-world applications, the information is immutable because it is protected by the blockchain (Experts [22] consider immutable, Proof-of-Work based blockchains like Bitcoin or Ethereum), but its truth or trustworthiness is dependent on the trustworthiness of the oracle that inserted it. Many blockchain communities are skeptical about non-financial applications, especially for sustainable domains, because of the problem of the oracle’s credibility, also pointing out the following arguments. If the oracle is trusted, then it becomes a single trusted party, which produces a “counterparty risk” because if lies can be fed to the oracle, or if it is compromised, then the smart contract will work on data that is “untrue”. There are significant financial incentives to compromise such systems because they are perceived to be safer and more trustworthy than the legacy ones. The implementation of the Internet of Things (IoT) is considered to have solved the problem using sensors to track various physical objects as they move through the supply chain. However, the problem of trust still applies to the sensor, as well as its placement, its scanning ability, and its communication channels with the oracle, returning us again to the problem of the oracle. For fungible goods, such as crude oil, this problem can be efficiently addressed because the product is easier to track [26]. Think of a certain amount of crude oil loaded onto a tanker and then tracked on the other side as it is unloaded from a ship—all of which information is recorded to the blockchain. Since crude oil is fungible, it does not matter whether the same molecules of oil are tracked or not. Unfortunately, to date, there is still not an efficient way to address the problem of non-fungible products, and, to the best of our knowledge, many of the current applications in the supply chain suffer from the oracle problem, leading to the risk of creating a false trustworthy environment in which the consumer is not sufficiently safeguarded, further mining sustainability. To address this problem, and more broadly, the two research questions of this paper, we decided to utilize the knowledge-based view and, in particular, a modified Gold et al. model (see Figure 1), as knowledge management and information sharing are the main aspects affected by the oracle problem [27]. A further explanation of the theoretical construct is provided below.

Figure 1.

Blockchained Gold et al. model [3].

The construct of knowledge management (KM), as Gao declares [28], embodies a higher value than the separate concepts of knowledge and management alone. It is defined as a formal and well-defined way to shape information that will advantage companies over others while, at the same time, crafting information to be freely available for those who require it [38,39,40,41,42,43]. Confirming the importance of KM, Gharakhani and Mousakhani suggested that knowledge management creates new capabilities for organizations, enables superior performance, encourages innovation, and enhances customer value [44]. Cho added that an effective KM helps organizations to become flexible, respond quickly to changing conditions, become innovative, and improve decision-making capacities and productivity [45]. Denford [46], in his dissertation on KM capabilities, distinguished resource-based capability as comprising a technological structure and a culture of knowledge-based capabilities, including expertise, learning, and information, that are needed for organizations to efficiently manage knowledge. Resource-based capabilities were renamed by Gold et al. as “knowledge infrastructure,” and will constitute a central part of this article’s analysis [27] because we are investigating how they are affected by the adoption of blockchain. As Smith stated [47], the concept of KM infrastructure is mostly associated with modular products that support KM actions in organizations. KM infrastructure analysis is divided into two main capabilities: technical and social. The technical capabilities comprise IT infrastructure, physical devices, and components, whereas social capacity comprises cultural, human, and governance resources [48]. We then analyze the technical and social capabilities separately according to their blockchain implications, finding that organizations should make every effort to expand their infrastructure capabilities, not only in terms of hardware and software, but also in terms of technology, structure, people, and culture. Regarding the concept of culture, Masa’deh [49] stated that “Organizational culture not only defines the value and advantage of knowledge for organizations, it also influences the ability of employees to share knowledge” [50]. Organizational culture is necessary for encouraging interaction and collaboration between individuals to facilitate the flow of knowledge. It also provides individuals with the ability to self-organize their personal knowledge and to facilitate problem solving and the sharing of knowledge [51]. We contribute to the literature by showing how blockchain adoption affects a firm’s culture and also how that culture determines successful blockchain implementation. As extensively underlined by researchers, one of the most important elements of culture for knowledge sharing is trust [52]. Kushwaha and Rao stated that high levels of trust reduce the reluctance of individuals to share knowledge and decrease the associated risk of losing competitiveness [48]. Further, organizational culture influences the way strategic decisions are implemented in firms [53]. Barney and Hansen have asserted that trust is beneficial to interfirm exchanges and can be a source of competitive advantage [54]. However, the literature reveals ambiguity in the nature of trust, as transaction cost theory, for example, implies that firms tend to behave opportunistically [55,56]. A fundamental challenge in conceptualizing the role of trust lies in extending the micro-foundational phenomenon to the organizational level. Many authors have agreed that viewing opportunism and trust as characteristics of firms anthropomorphizes organizations [57,58]. With the advent of blockchain, the element of trust has been digitalized and separated by the idiosyncratic human correlation. Trust in blockchain is no longer an exclusive outcome of a micro level; it can be generated directly at the macro level. A recent study by Zaheer et al. showed a direct link between interorganizational trust and performance [52], but not between interpersonal trust and performance, whereby even if interpersonal trust is low, interorganizational trust remains high. This perfectly supports the modifications that we are applying to Gold et al.’s model [27], in which trust is included in organizational effectiveness and seen as one of the major drivers of firm performance.

3. Methodology

To answer our research questions, we decided to build on Gold et al.’s model to conduct our case study [27], as a quantitative data analysis still did not constitute a valid alternative. The first part of the research involved a thorough investigation of the existing literature to locate the keywords needed to build the model. As demonstrated by Lin et al. [59], the literature lacks seminal papers associating blockchain technology with sustainable agri-food or agribusiness. Switching from a broad analysis to a more in-depth investigation, segmenting “management” and “business” keywords, Lin et al. identified only ten papers [59]. The same results were obtained by Bermeo-Almeida et al. [6], who added that most of the papers (seven out of ten) were written by Asiatic authors. Aware of the limited background, we decided to address the situation using the Scopus platform. We used a specific string—“blockchain” AND “food” (OR “agriculture” OR “agricultural delivery” OR “agricultural supply chain”)—obtaining more than 130 potential results. Controlling for knowledge management, we arrived at slightly more than 20 papers (22), of which 14 were published in peer-reviewed journals and eight had been presented at international conferences. From the most influential and available literature, we were able to identify the following keywords: blockchain technology [60], information structure [61], and firm culture [62]. In our knowledge process capability model, we included products and production processes [63], along with their management insertion rules [64]. Finally, to the “organizational effectiveness” construct, we added the value of trust [65], as well as transparency, auditability, and immutability characteristics—these latter constructs bearing a dual interpretation. We considered trust as a higher grade of consumer faith when evaluating product acquisition and consumption. Further, with blockchain, companies benefit from increased levels of trust among their supply-chain partners, as even the smallest non-compliance episode can be tracked and registered [59]. Because Gold et al.’s sample was quite extensive and mainly involved large companies [27], some modifications were required. First, as stated above, large companies are not the main sources of KM activity, and drivers for knowledge management innovation are also less evident in large organizations. Second, items generating knowledge are reduced according to the sample because of developments in the literature over recent years [66,67,68]. However, since the most intriguing part of the paper is the model (as also stated by the same authors), we gave high priority to the drawing process. The model was slightly adapted, although the scope of its application remained the same in focusing on the relation between knowledge infrastructure capabilities, knowledge process capabilities, and organizational effectiveness/trust. The major changes regarding knowledge infrastructure capability were implemented according to Mendling et al. [28], who introduced, in theoretical terms, the possible impacts of blockchain technology adoption on business process management (BPM). Further developing Mendling et al. [28], we inserted into the model the parts that, according to our case study, seemed most affected by the application of blockchain technology, specifically, discovery, monitoring, adaptation, and evolution. Guided by Pettigrew [69], our approach to the case study involved team visits to the site. We managed three visits to the case study site and conducted a total of nineteen interviews. Our team comprised two professors from the organization department of Business Administration who led and conducted the face to face interviews, one PhD student from the same department who submitted the research questionnaires, and two master’s degree students who transcribed the notes and interviews. The registered interviews were conducted in a semi-structured form. According to prior studies [70,71,72,73], our dataset retained a certain degree of flexibility, along with our research questions, which were often updated according to ongoing feedback and unexpected events. The semi-structured interviews lasted 50 min on average and were conducted with directors involved with the blockchain project, entrepreneurs associated with the cooperative, and service providers. The data and results were presented to the main actors in the organization and to its directors. The analysis of the case study commenced in June 2018 and finished in November 2019. This research was undertaken without preconceptions and without the need to prove anything in advance; we were solely moved by the disinterested aim of contributing to the agri-food sector and the academic literature.

3.1. Data Collection

For our case study, we decided to analyze the “San Rocco Dairy” cooperative in Tezze sul Brenta (VI). The company was founded on August 25, 1966, from a congregation of breeders with the aim of producing homogeneous local food, while maintaining excellence (mainly in cheese). At the time of the study, the cooperative counted 19 associates across three different districts of the Veneto region. Its main aggregations were in Vicenza, Treviso, and Padova. The size of the companies was, on average, quite small, and their most common structure was that of a family business that occasionally employed external staff, but rarely more than two. All the companies shared the same structure, except for two that were more prominent. Trusting the quality of their products, the employees suggested competing at national and international levels to increase awareness of the food’s excellence. Since then, the cooperative has received countless prizes, including the Caseus Veneti and the World Cheese Award; it has also been included in the Super Gold Ranking of “Asiago DOP (Fresh and Aged),” and is thus listed among the best cheeses in the world. To defend its strong brand, strengthened through many years of hard work, the cooperative agreed to test the potential of blockchain (public/ETH), and the IoT technology, utilizing a specific quick response (QR) code to guarantee its certification information and to be directly validated by institutions, company partners, and final consumers. In Table 1, it is highlighted the main data used in the analysis of this article.

Table 1.

Data collection.

The underlying strategy adopted by the consortium was to redefine the information systems to create a completely tracked supply chain. Data were monitored from the production of milk to the finished products (blocks of cheese), guaranteeing a secure and certified product provenance to consumers. Improvements involved, not only monitoring the safety and quality of products, but also information awareness and procedure compliance, so that well-informed consumers, aware of the supply chain, had become the best contributors to the processes of optimization and engagement. As studies on traceability are few but increasing, our research contributes to the literature as its motivations and the products being analyzed differ slightly from those of other studies.

3.2. Data Analysis

The examined consortium began blockchain integration in September 2018, introducing the first blocks of Asiago DOP cheese to the market by January 2019. The consortium also implemented an IoT system based on a QR code to facilitate interaction with its main stakeholders. Data were collected from the beginning of April 2019 (see Table 2). The main data stored in the blockchain and retrievable through the QR code comprised the company ID code (for General Data Protection Regulation (GDPR) compliance), the liters of milk provided, data about milk entry, and milk analysis. Regarding the specific activities for transformation and storage, the cooperative decided to include in the blockchain temporal identification data about the entry and exit of every semi-finished product according to the different phases that characterized the critical activities. All information relative to a specific process was stored in a single block to ensure easier trackability of the entire supply-chain process.

Table 2.

Data analysis.

The QR code was utilized, both by clients and intermediaries, returning precious information to San Rocco’s Dairy. When a user scans the QR code, that user releases critical data to the network, such as their gender, their job, the device used, their location, the time, and the number of times the specific QR has been scanned. Extracted data from the 100 blocks for Asiago cheese show that almost 87% of the products scanned were consumed by Italian clients. Around 10% were French users and the remaining 3% were north-European consumers. The product was most often scanned on Fridays during the daytime (10.00–13.00 h), and the most frequently requested information was from the timeline in reference to the production, the history of the firm, and the prizes awarded. In relation to customer retention, it was discovered that nearly 10% of clients observed the same type of product once a week for at least four weeks. Aware that the value of the data on the blockchain was quite low for consumers, we focused on the changes that this implementation made to organizational effectiveness and whether its application violated the insidious oracle problem. In the first round of informal interviews, we concentrated on company availability to cooperate with our department and on business acquaintance with this new technology, to be sure that the decision for undertaking the project was not merely based on marketing benefits, driven by the hype that blockchain has lately experienced. To clarify the intentions, the first official round of semi-structured interviews had the goal of understanding why the cooperative had chosen to undertake a blockchain-based project and whether they had evaluated it in relation to other alternatives. We asked participants about their plans for the future, and of course, whether they were experiencing any unpredicted issues. After exactly one year, we started a second round of semi-structured interviews, with the aim of understanding what had changed in the organization after the project had been executed and whether the cooperative was planning to improve or abandon it. Considering it necessary to double-check the information provided by the firms, we also contacted the technology provider via phone-call interviews to understand whether there was an alignment between what the firms aimed to obtain through the technology and the exact potential of the implemented service. Further information was taken from the company website and social media, as well as from newspapers, in which San Rocco’s project is often described. The authors transcribed all the interviews and details from direct observations, writing nearly 50 pages of notes that were used to link the data gathered with the Gold et al. model and to understand its implications for the oracle problem [6].

4. Discussions

To better clarify how the company addressed the insidious oracle problem in a sustainable supply chain context, details on the blockchain’s impact on organizational effectiveness must first be provided. Drawing from the informal interviews with the consortium directors, problems linked to the valorization of the brand and to the internalization of products emerged. As underlined by one participant: The “dairy market bears some difficulties generated by the presence of small wholesalers, and the large-scale retail trade”. The constant presence of intermediaries with high commercial competence was helpful in compensating for the low levels of territorial and market control because San Rocco only has two registered shops. Dealers help consumers to receive the product, but the issue of ensuring that the quality is linked with the San Rocco brand has not been solved. One common vision of the consortium’s top management involved the need to more directly reach final consumers and to reduce the information bias generated by intermediaries. Further, one interviewed executive extensively underlined the issues related to the internationalization and safety of the products/brand as a result of the massive presence of counterfeiters: “Asiago is very famous in California … but only a few wheels of cheese are genuine Asiago”. A massive presence of counterfeit products not only undermines company trustworthiness but can also have negative social implications. As a matter of fact, counterfeit products do not differ from the original in terms of just taste and shape. Not subject to strict regulation and checks, they constitute a threat for consumer health. The outcome of blockchain application in terms of value creation cannot be detected at present because the data is insufficient; however, extensive results were already visible in the effects of the blockchain’s application at the organizational level. To obtain these results, many areas were addressed according to the Gold et al. model [27]. The blockchain impacts on organizational effectiveness are summarized in Table 3.

Table 3.

Blockchain effects on organizational effectiveness.

The appeal of blockchain technology arises from its distinctive characteristics, which make it a valuable implementation for sustainability purposes [18,19], such as the immutability of its data, the availability of the information, and its transparence, as well as its distributed certification and reliability. During the first official round of interviews, the quality manager stated, “we are a peculiar dairy company, since every employee has the passion for information technology”. Although able to create its own blockchain, the company decided to outsource the technical aspects to limit the chances of failure. As the project grows, they plan to fully automate it with probes and microchips. One of the associates that operates the blockchain remarked, “we need to automatize the system as soon as possible, since if we produce milk today, the data needs to be immediately inserted on the blockchain. Delays of any sort can affect the reliability of data”. Of course, the company also utilized Enterprise Resource Planning (ERP), but they preferred to invest in local software houses rather than using the best-known alternatives. As one of the directors declared: “We always tried to cooperate with the local companies … even for services not directly related to our production”. Further, the cooperative installed a remote-control system for the “CASARO” (Mainly used in northern Italy, it describes highly specialized cheesemakers, in charge of guarding high-quality cheeses’ secret recipes), which allowing for the checking of every production site in real time to quickly adjust production gaps. According to the participants, the limitations of the cloud with respect to blockchain involved the “malleability” of the data, and having a very delicate raw material, the date of production of which should be immediately known and certain. The firm’s structure was quite controversial. As one of the directors indicated: “Our cooperative has a pretty controversial governance structure, since the board of the director’s members are also the shareholders”. Every member had to choose whether to defend the cooperative’s interests, his company’s interests, or his own. This could easily create conflicts of interests and difficulties in making decisions; it could also lead to associates’ withdrawal. Despite this, the director had managed to govern the cooperative for more than 40 years without any major issues and, as he stated, the hardest problem to solve consisted of finding a successor. In San Rocco’s Dairy, employees were considered part of the decision-making team, and they also introduced valuable innovations such as blockchain technology, because their mean age was very low. The blockchain adoption was actually promoted by one of the youngest associates, who had studied its application during his master’s degree and had proposed the innovation to the directors. He stated: “The cooperative is always open for innovation … although not aware of the technology, they understood its potential!” The blockchain adoption required no considerable changes to the company structure, as all those interviewed agreed during the second round. However, some changes were made in task distribution after the blockchain’s adoption. As well as contracting a consultant for the implementation, management also awarded employees specific roles and responsibilities related to the blockchain. Further, they planned to hire highly qualified professionals when the project reached a significant level of growth. Nonetheless, changes were not always welcomed, as one of the associates remarked: “It was not easy to present the new technology to the employees, since it means more work for people already overburdened”. The culture of the consortium was stable and strong, and it aimed to strengthen coordination between producers and processers, exploiting the firm’s core sustainability values (economic, social, environmental, cultural, and ethical). Identifying these common values, the cooperative invested in the project of defining a common information structure, transferring to its clients and associates the positive elements that the company pursued, such as the absence of chemical agents, environmental protection, and employee protection. Blockchain implementation, as agreed by almost all those interviewed, brought no changes to the company culture, but the participants also stressed that one of the main motives to undertake this adventure was to better reach the customers and make them aware of the consortium’s core values. One of the associates stated: “Blockchain will help us promote our company values directly to the client and deliver product information at 360 degrees”. Further, the company culture fostered the adoption of the blockchain as its type of innovation was technologically driven. The company’s will to reach clients did not just have a promotional role; it also served as a canvas to build and strengthen trust. Trust was a critical value for San Rocco’s Dairy that participants were eagerly trying to defend. The threats to this trust were multiple. At an international level, Asiago cheese appeared to be a highly requested product, but the narrowed site of production (DOP protection) did not allow for the complete satisfaction of the constantly increasing demand, leaving promising opportunities for counterfeiters. The role of the blockchain for the consortium is not to “create” trust but to maintain the high level of trust built over many years of hard work. This aim is quite controversial because, in the early literature, the blockchain was viewed as a means for creating trust, while it is now widely held that blockchain provides a way to transact in a trustless environment [74,75]. For the consortium, the technology should work in an environment where trust is at a maximum, defending it from external threats. When prompted about this issue, the quality manager affirmed: “We firmly believe in the quality of our products … blockchain ensures that third parties will not alter client awareness”. From the data gathered, there was not strong evidence of the blockchain’s capability of defending trust in those environments; however, theoretically, this remains quite a robust conjecture. Regarding the intra/interorganizational environment, by definition, it acts more as a monitoring authority than a trust enhancer, as assumed in Mendling et al. [28]. The associates and the quality manager stressed that they were surprised about the high level of blockchain involvement in business processes. As a consequence of its structure and functionality, the adoption of blockchain required the company to clearly map and divide all their business processes for information to be uploaded to the ledger. One of those interviewed stated: “Yes, blockchain requires mapping for all business processes. It clearly helps to define the supply chain”. The quality manager stressed that, although the technology was helpful for that task, its compliance with the “disciplinare” (policy document) already required a high level of understanding and control of company processes. Conversely, applying the technology, the consortium realized that some of its processes needed to be changed to remain consistent with blockchain’s potential. The participants noticed that blockchain’s adoption required the packaging process to be internalized. Outsourcing the packaging process created some doubts about the last “steps” of the supply chain’s traceability. Since the tracking devices are on the packaging, the outsourcing of this last step is perceived as a threat to the whole traceability process. One of the associates who interacts with large-scale retailers stated: “Retailers strongly believe in the potential of the technology, but they offer only standardized packaging … we must focus on products that we can pack ourselves”. To ensure the trustworthiness of the process, the packaging step cannot be outsourced. Further, in opposition to the expectations of previous literature [28,76], the business process (at least for this case study) was not automated through blockchain smart contracts but remained a function of human action; while the immutability of the ledger created the “trigger” for an ease in monitoring activity. The blockchain manager proudly stated: “We can enjoy a double outcome for [the] blockchain application, first to reach our clients and also to detect potential malfunctions and loss of efficiency”. However, the adaptation of processes constitutes a limitation for this technology. While BPM is aimed at the continuous improvement of processes [74], blockchain technology, as a result of its very origin and purpose, offers fewer degrees of freedom in the field, since, when a process changes it may be detected by the blockchain as invalid. A private blockchain would probably prove to be more efficient, as the quality manager declared: “For now, it works … but sooner or later we may have to build our own system” [23].

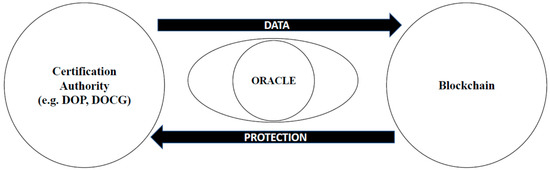

One critical further contribution to the literature is to analyze how and whether the organization was able to effectively address the oracle problem, which greatly affects the meaning of non-financial smart contract based blockchain projects. As specified in Section 2, the oracle problem arises when connecting a physical asset or commodity to a virtual token that tracks it on a blockchain [77,78,79]. Although other papers/articles describe practical cases of blockchain technology for product traceability, none are robust in relation to the oracle problem, keeping the blockchain community firmly skeptical about the reliability of non-financial applications. When blockchain is implemented for sustainability reasons, trustworthiness and transparency are often pointed to as being the core characteristics that makes it suitable for purpose [3,80,81]. However, since information on smart contract based blockchain comes from oracles [22,23], trustworthiness and transparency should be no longer given nor guaranteed. As a matter of fact, studies on sustainability driven blockchain should focus on oracles and not only on the mere technology. Conversely, whether the company operates directly on the blockchain or with an external consultant, whether the blockchain is proprietary or public, or whether a Bitcoin or Ethereum blockchain is utilized, the oracle problem remains unmentioned in the literature because it has clearly still not been sufficiently addressed. In our case study, we noticed an important implication for trust involving a specific type of product, which may greatly affect the extent of the oracle problem. For high-quality products, and precisely, for products with a certified provenance (especially DOP or DOCG), trustworthiness has rarely been questioned. The Italian Government, for instance, imposes strict laws on food producers that are among the most severe in the world. Companies producing DOP products, for example, must precisely track all production phases to ensure the correct provenance of all raw materials used in the production. Utilizing blockchain in these supply chains requires the oracle to upload only information that has been strictly verified by the certification authority. Consequently, there are no apparent incentives for the oracle to alter data. Oracles should be extra cautious when inserting information into the blockchain, as they are definitely under the “eyes” of the authority. From those interviewed, it emerged that the choice of the Asiago as a pilot for the blockchain project arose from the policy surrounding DOP products, which requires information to be already tracked and secure. One of the executives declared: “The choice of tracing our Asiago DOP on the blockchain derives also from the large availability of data on the supply chain that it is strictly supervised by the authority and has to comply with the “disciplinare” [policy document]”. The aim of the blockchain utilization was not to guarantee the safety of the product, which was already supervised by the authorities, but to fight counterfeiters operating outside the domain of the authorities. The trust involving information uploaded to the blockchain is then shifted from the firm to the certification authority. Basically, in that “protected environment,” the information on products’ traceability uploaded to the blockchain falls under the supervision of the certification authority. Being on the blockchain, information can hardly be altered by counterfeiters even outside the authority’s domain. This dualistic protection system created by the blockchain is explained in Figure 2.

Figure 2.

Relationships between the oracle, the blockchain, and the certification authority.

Any other addition, such as implementing the IoT in the blockchain (sensors or probes), requested by the “disciplinare”, will be verified by the authority, ensuring that only trustworthy information is uploaded to the blockchain. The quality manager further explained: “Once the Asiago DOP project reaches an appropriate speed, we will then start with the Grana Padano DOP, which is another product with a strong ‘disciplinare’”. It is quite clear that, for the consortium, the blockchain does not represent a certification authority by itself, but a means to defend the integrity of information gathered and supervised in compliance with the “disciplinare”. Implementing blockchain with this aim clearly reduces the impact of the oracle problem, as the need for trusted, third-party input is fulfilled by the certification authority (especially the DOP or DOCG). Without a trusted third-party, external to the firm, the information uploaded to the blockchain is no more trustworthy that that written by the company itself on the labels of its products and does not really improve quality or consumer protection.

5. Conclusions

This paper sought to address the oracle problem for a smart contract based blockchain implemented in the traceability of specific non-fungible products. To do so, we first contextualized the issue through a case study of a dairy company in northeastern Italy, whose interest in blockchain was mainly related to marketing. As the literature lacks empirical studies involving blockchain technology’s adoption, our first research question addressed its impact on organizational effectiveness, building on three precise literature streams: KM [38], knowledge infrastructure [27], and trust [52]. Data show that successful technological implementation is strictly connected to a firm’s attitude to innovation and to employee involvement in the innovation process. However, highly specialized consultants are probably required for the process to be undertaken smoothly and in a reasonable time frame. Company culture does not seem to be affected by blockchain’s adoption. However, reaching clients and spreading firm culture is one of the main reasons for firms to undertake blockchain projects. From the interviews, it emerged that blockchain does not really affect governance structures, but requires the introduction of new professional figures, or role extensions for existing employees, creating conditions for job enrichment and promotions. Processes are also affected by the implementation of the technology in three different ways. First, the blockchain’s structure helps the quality managers to better rationalize processes and the supply chain. Second, consensus mechanisms can create a “trigger” for faulty processes to be promptly located and addressed. Third, blockchain may constitute an obstacle to process innovation, as updates are by nature more difficult on (public) blockchains. Regarding the concept of trust, we may say that, from this research, no clear evidence emerges on trust improvement. On the contrary, blockchain seems to be useful only in environments where trust is already established, enabling defense mechanisms against external threats such as counterfeiters. With a clear vision of how blockchain affected organizational effectiveness, we were able to narrow our second research question as to how the oracle problem could be overcome in sustainable supply chain environments. As already stated by blockchain experts [22], the oracle problem has the lowest impact in cases with trusted, third-party mechanisms that supervise and certify in a coercive manner information uploaded to and stored on the blockchain (although it may lead to counterparty risk). As information on the blockchain is immutable but not necessarily true, without a trusted third party to verify the data to be inserted, the details provided should not be considered any more trustworthy that those contained in a legacy database. Furthermore, even though in such environments the impact of the oracle problem is low, doubts arise as to the need for a blockchain to be implemented at all. To enlighten possible solutions to this dilemma, the case study analyzed in this paper, by way of example, involved a blockchain project undertaken by San Rocco’s Dairy for the traceability of the Asiago DOP (non-fungible product). In this specific case, the certification authority (DOP) constituted a strong third party whose verified data, when inserted into the blockchain, became public and highly secure. The presence of a highly trusted third-party reduced the impact of the oracle problem. Nonetheless, blockchain technology proved to be more effective than legacy technologies, since it guaranteed the protection of products outside the domain of the authority. The results provided in this research should be useful for academics to build on, allowing further studies on non-financial blockchains and the oracle problem. Managers can also exploit these results to decide whether their company might benefit from blockchain’s application and how to implement it in the most profitable way. When addressing sustainable development, it may be useful to consider this case study so as to understand how blockchain implementation can also be economically viable. Conversely, limitations regarding the qualitative approach and the single case study need to be taken into consideration when making inferences at a broader scale. Further studies may try to replicate the results of this paper, addressing a different sector and market, or perhaps comparing countries where authorities have multiple degrees of enforcement or different certifications. Samples could also include more structured companies as results on processes are highly influenced by company size, which, in this paper, is small to medium. As soon as there are enough data to undertake a quantitative study, it would be interesting to compare companies utilizing blockchain to see which sector benefits more from the adoption of the technology.

Author Contributions

Conceptualization, G.C.; methodology, software, validation, formal analysis G.C., and A.Z.; investigation, resources, data curation, G.C., and C.R.; writing—original draft preparation, G.C., A.Z. and C.R.; supervision, C.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

The authors thank the peer reviewers for their valuable comments on ways to improve this paper. We would also to thank Caseificio San Rocco, and EZ Lab srl for the data, and their contribution to this research.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Perego, A.; Sciuto, D.; Portale, V.; Bruschi, F. Blockchain & Distributed Ledger 2019. Available online: https://www.osservatori.net/it_it/osservatori/blockchain-distributed-ledger (accessed on 13 December 2019).

- Morkunas, J.V.; Paschen, J.; Boon, E. How Blockchain Technologies Impact Your Business Model. Bus. Horiz. 2018, 62, 295–306. [Google Scholar] [CrossRef]

- Fosso Wamba, S.; Kala Kamdjoug, J.R.; Epie Bawack, R.; Keogh, J.G. Bitcoin, Blockchain and Fintech: A systematic review and case studies in the supply chain. Prod. Plan. Control 2020, 31, 115–142. [Google Scholar] [CrossRef]

- Tse, D.; Zhang, B.; Yang, Y.; Cheng, C.; Mu, H. Blockchain Application in Food Supply Information Security. In Proceedings of the 2017 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Singapore, 10–13 December 2017; pp. 1357–1361. [Google Scholar]

- Xie, C.; Sun, Y.; Luo, H. Secured Data Storage Scheme Based on Block Chain for Agricultural Products Tracking. In Proceedings of the 2017 Third International Conference on Big Data Computing and Communications (BIGCOM), Yonago, Japan, 10–12 July 2017; pp. 45–50. [Google Scholar]

- Bermeo-Almeida, O.; Cardenas-Rodriguez, M.; Samaniego-Cobo, T.; Ferruzola-Gómez, E.; Cabezas-Cabezas, R.; Bazán-Vera, W. Blockchain in Agriculture: A Systematic Literature Review. In International Conference on Technologies and Innovation; Springer: Cham, Switzerland, 2018; pp. 44–56. [Google Scholar]

- Bradsher, K. Chinese City Shuts down 13 Walmarts. New York Times. 11 October 2011. Available online: www.nytimes.com/2011/10/11/business/global/wal-marts-in-china-city-closed-for-pork-mislabeling.html (accessed on 17 February 2020).

- Clemons, S. China’s Latest Food Scandal: Fox-Tainted Donkey Meat. The Atlantic. 2 January 2014. Available online: www.theatlantic.com/international/archive/2014/01/chinas-latest-food-scandal-fox-tainted-donkey-meat/282776 (accessed on 17 February 2020).

- Yiannas, F.; Liu, R. E-mail to R. Kamath, 6 September 2017. [Google Scholar]

- Bottemelier, H. IBM and China Team up to Build Pork Traceability System. Food Safety News. 19 December 2011. Available online: www.foodsafetynews.com/2011/12/ibm-and-china-team-up-to-build-pork-traceability-system/#.WZjWBCiGPIU (accessed on 17 February 2020).

- Kamath, R. Food Traceability on Blockchain: Walmart’s Pork and Mango Pilots with IBM. JBBA 2018, 1, 2516–3949. [Google Scholar] [CrossRef]

- Mearian, L. Q&A: Walmart’s Frank Yiannas on the Use of Blockchain for Food Safety. Computerworld. 1 October 2018. Available online: https://www.computerworld.com/article/3309656/emerging-technology/qa-walmarts-frank-yiannas-on-the-use-of-blockchain-for-food-safety.html (accessed on 17 February 2020).

- Corkery, M.; Popper, N. From Farm to Blockchain: Walmart Tracks its Lettuce. The New York Times. 24 September 2018. Available online: https://www.nytimes.com/2018/09/24/business/walmart-blockchain-lettuce.html (accessed on 17 February 2020).

- Tiwari, T. Profit Alert: Walmart is Adopting the Blockchain Right Now. Palm Beach Research Group. 6 December 2016. Available online: https://www.palmbeachgroup.com/palm-beach-daily/profit-alert-walmart-is-adopting-the-blockchain-right-now/ (accessed on 11 December 2019).

- Burkitt, L. Walmart to Triple Spending on Food Safety in China. Wall Street Journal. 17 June 2014. Available online: www.wsj.com/articles/Walmart-to-triple-spending-on-food-safety-in-china-1402991720 (accessed on 17 February 2020).

- McDermott, B. IBM’s Vice President of Blockchain Business Development, interviewed by R. Kamath, June 23 2017; edited by B. McDermott, 12 September 2017. Available online: https://www.fool.com/investing/2018/01/07/my-interview-ibms-vice-president-of-blockchain.aspx (accessed on 11 December 2019).

- Federalimentare, 2018. Report conclusivo Federalimentare 2018. Available online: http://www.federalimentare.it/new2016/Comunicazione/ComunicatiStampa.asp?Anno=2018 (accessed on 13 December 2019).

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef]

- Venkatesh, V.G.; Kang, K.; Wang, B.; Zhong, R.Y.; Zhang, A. System architecture for blockchain based transparency of supply chain social sustainability. Robot. Comput. Integr. Manuf. 2020, 63, 101896. [Google Scholar] [CrossRef]

- Zharova, A.; Lloyd, I. An Examination of the Experience of Cryptocurrency Use in Russia. In Search of Better Practice. Comp. Law Sec. Rev. 2018, 34, 1300–1313. [Google Scholar] [CrossRef]

- Fisch, C. Initial Coin Offerings (ICOs) to Finance New Ventures. J. Bus. Ventur. 2019, 34, 1–22. [Google Scholar] [CrossRef]

- Davis, J. A Discussion of the Oracle Problem. 2019. Available online: https://hackernoon.com/a-discussion-of-the-oracle-problem-6cbec7872c10 (accessed on 11 December 2019).

- Khan, F. What is the “Oracle Problem” and How Does Chainlink Solve It? Available online: www.datadriveninvestor.com/2019/06/15/what-is-the-oracle-problem-how-does-chainlink-solve-it/ (accessed on 11 December 2019).

- Antonopoulos, M.A.; Wood, G. Mastering Ethereum: Implementing Digital Contracts; O’Reilly Media: Sebastopol, CA, USA, 2018. [Google Scholar]

- Schaad, A.; Reski, T.; Winzenried, O. Integration of a Secure Physical Element as a Trusted Oracle in a Hyperledger Blockchain. In Proceedings of the SECRYPT 2019, the Sixteenth International Conference on Security and Cryptography, Prague, Czech Republic, 26–28 July 2019. [Google Scholar]

- Antonopoulos, M.A. The Killer App: Bananas on the Blockchain? Coinscrum Meetup on 13 June 2019 at Monzo Bank HQ, London, UK, 2019. Available online: https://aantonop.com/the-killer-app-bananas-on-the-blockchain/ (accessed on 11 December 2019).

- Gold, A.H.; Malhotra, A.; Segars, A.H. Knowledge Management: An Organizational Capabilities Perspective. J. Manag. Inf. Syst. 2001, 18, 185–214. [Google Scholar] [CrossRef]

- Mendling, J.; Dustdar, S.; Gal, A.; García-Bañuelos, L.; Governatori, G.; Hull, R.; La Rosa, M.; Ciccio, C.D.; Dumas, M.; Debois, S.; et al. Blockchains for Business Process Management—Challenges and Opportunities. ACM Trans. Manag. Inf. Syst. 2018, 9, 1–16. [Google Scholar] [CrossRef]

- Haber, S.; Stornetta, S. How to Time Stamp a Digital Document. Lect. Notes Comp. Sci. 1991, 537, 437–455. [Google Scholar]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008; (Unpublished Manuscript). [Google Scholar]

- Antonopoulos, M.A. Mastering Bitcoin: Programming the Open Blockchain, 2nd ed.; O’Reilly Media: Sebastopol, CA, USA, 2017. [Google Scholar]

- Walport, N. Distributed Ledger Technology: Beyond Blockchain. Technical Report by the Government Office for Science, UK. 2016. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/492972/gs-16-1-distributed-ledger-technology.pdf (accessed on 11 December 2019).

- Schatsky, D.; Muraskin, C. Beyond Bitcoin. Blockchain is Coming to Disrupt Your Industry; Deloitte University Press: New York, NY, USA, 2015. [Google Scholar]

- Zavolokina, L.; Schwabe, G.; Bauer, I. To Token or Not to Token: Tools for Understanding Blockchain Tokens. In Proceedings of the Thirty Ninth International Conference on Information Systems, San Francisco, CA, USA, 13–16 December 2018. [Google Scholar]

- He, D.; Habermeier, K.; Leckow, R.; Haksar, V.; Almeida, Y.; Kashima, M.; Kyriakos-Saad, N.; Oura, H.; Sedik, T.S.; Stetsenko, N.; et al. Virtual Currencies and Beyond: Initial Considerations; No. 16/3; International Monetary Fund: Washington, DC, USA, 2016. [Google Scholar]

- Buterin, V. On Public and Private Blockchains. Ethereum Blog. 6 August 2015. Available online: https://blog.ethereum.org/2015/08/07/on-public-and-private-blockchains/ (accessed on 11 December 2019).

- Swan, M. Blockchain Blueprint for a New Economy; O’Reilly Media: Sebastopol, CA, USA, 2005. [Google Scholar]

- AL-Lozi, M. Total Quality Management in the Civil Service Institutions in Jordan. Mu’tah Humanit. Soc. Sci. Ser. 2002, 18, 151–185. [Google Scholar]

- Gao, F.; Li, M.; Clarke, S. Knowledge, Management, and Knowledge Management in Business Operations. J. Knowl. Manag. 2008, 12, 3–17. [Google Scholar] [CrossRef]

- Singh, S.K. Role of Leadership in Knowledge Management: A Study. J. Knowl. Manag. 2008, 12, 3–15. [Google Scholar] [CrossRef]

- AL-Syaidh, N.; Masa’deh, R.; Al-Zu’bi, Z. Transformational Leadership and its Impact on the Effectiveness of Employees’ Behavior in the Public and Private Jordanian Hospitals. Jordan J. Bus. Adm. 2014, 11, 23–57. [Google Scholar]

- AL-Syaidh, N.; Al- Lozi, M.; AlHarrasi, J. Transformational Leadership and its Role on the Effectiveness of Employees’ Behavior: A Theoretical Study. J. Bus. Manag. (COES&RJ-JBM) 2016, 4, 14–35. [Google Scholar]

- Darawsheh, S.; ALshaar, A.; AL-Lozi, M. The Degree of Heads of Departments at the University of Dammam to Practice Transformational Leadership Style from the Point of View of the Faculty Members. J. Soc. Sci. (COES&RJ-JSS) 2016, 5, 56–79. [Google Scholar]

- Gharakhani, D.; Mousakhani, M. Knowledge Management Capabilities and SMEs’ Organizational Performance. J. Chin. Entrep. 2012, 4, 35–49. [Google Scholar] [CrossRef]

- Cho, T. Knowledge Management Capabilities and Organizational Performance: An Investigation into the Effects of Knowledge Infrastructure and Processes on Organizational Performance. Ph.D. Thesis, University of Illinois, Champaign, IL, USA, 2011. Available online: http://hdl.handle.net/2142/24182 (accessed on 17 February 2020).

- Denford, J.S. Building Knowledge: Developing a Knowledge-based Dynamic Capabilities Typology. J. Knowl. Manag. 2013, 17, 175–194. [Google Scholar] [CrossRef]

- Smith, T.A. Knowledge Management and its Capabilities Linked to the Business Strategy for Organizational Effectiveness. Ph.D. Thesis, Nova Southeastern University, Fort Lauderdale, FL, USA, 2006. Unpublished. [Google Scholar]

- Kushwaha, P.; Rao, M.K. Integrative Role of KM Infrastructure and KM Strategy to Enhance Individual Competence: Conceptualizing Knowledge Process Enablement. VINE 2015, 45, 376–396. [Google Scholar] [CrossRef]

- Masa’deh, R. The Role of Knowledge Management Infrastructure in Enhancing Job Satisfaction at Aqaba Five Star Hotels in Jordan. Commun. Netw. 2016, 8, 219–240. [Google Scholar] [CrossRef]

- Yeh, Y.-J.; Lai, S.-Q.; Ho, C.-T. Knowledge Management Enablers: A Case Study. Ind. Manag. Data Syst. 2006, 106, 793–810. [Google Scholar] [CrossRef]

- Sandhawalia, B.S.; Dalcher, D. Developing Knowledge Management Capabilities: A Structured Approach. J. Knowl. Manag. 2011, 15, 313–328. [Google Scholar] [CrossRef]

- Shannak, R.; Obeidat, B. Culture and the Implementation Process of Strategic Decisions in Jordan. J. Manag. Res. 2012, 4, 257–281. [Google Scholar] [CrossRef][Green Version]

- Zaheer, A.; Venkatraman, N. Relational Governance as an Interorganizational Strategy: An Empirical Test of the Role Trust in Economic Exchange. Strateg. Manag. J. 1995, 19, 373–392. [Google Scholar] [CrossRef]

- Barney, J.B.; Hansen, M.H. Trustworthiness as a Source of Competitive Advantage. Strateg. Manag. J. 1995, 15, 175–190. [Google Scholar] [CrossRef]

- Williamson, O.E. Markets and Hierarchies; The Free Press: New York, NY, USA, 1975. [Google Scholar]

- Williamson, O.E. The Economic Institutions of Capitalism; The Free Press: New York, NY, USA, 1985. [Google Scholar]

- Dore, R. Goodwill and the Spirit of Market Capitalism. Br. J. Sociol. 1983, 34, 459–482. [Google Scholar] [CrossRef]

- Macneil, I.R. The New Social Contract; Yale University Press: New Haven, CT, USA, 1980. [Google Scholar]

- Lin, Y.P.; Petway, J.; Anthony, J.; Mukhtar, H.; Liao, S.W.; Chou, C.F.; Ho, Y.F. Blockchain: The Evolutionary Next Step for ICT E-Agriculture. Environments 2017, 4, 50. [Google Scholar] [CrossRef]

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where is Current Research on Blockchain Technology?—A Systematic Review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef]

- Biswas, K.; Muthukkumarasamy, V.; Tan, W.L. Blockchain-based Wine Supply Chain Traceability System. In Proceedings of the Future Technologies Conference, Vancouver, BC, Canada, 29–30 November 2017. [Google Scholar]

- Du, W.D.; Pan, S.L.; Leidner, D.E.; Ying, W. Affordances, Experimentation and Actualization of Fintech: A Blockchain Implementation Study. J. Strateg. Inf. Syst. 2019, 28, 50–65. [Google Scholar] [CrossRef]

- Tian, F. An Agri-food Supply Chain Traceability System for China Based on RFID and Blockchain Technology. In Proceedings of the 2016 Thirteenth International Conference on Service Systems and Service Management (ICSSSM), Shenzhen, China, 13–15 July 2016; pp. 1–6. [Google Scholar]

- Abeyratne, S.A.; Monfared, R.P. Blockchain-ready Manufacturing Supply Chain Using Distributed Ledger. Int. J. Res. Eng. Technol. 2016, 5, 1–10. [Google Scholar]

- Caro, M.P.; Ali, M.S.; Vecchio, M.; Giaffreda, R. Blockchain-based Traceability in Agri-food Supply Chain Management: A Practical Implementation. In Proceedings of the 2018 IoT Vertical and Topical Summit on Agriculture-Tuscany, Tuscany, Italy, 8–9 May 2018; pp. 1–4. [Google Scholar]

- Almajali, D.; AL-Lozi, M. Reviewing the Literature of The Associations among Knowledge Management, Knowledge Management Infrastructure, and Job Satisfaction. J. Bus. Manag. 2019, 7, 1–15. [Google Scholar]

- Zhao, G.; Liu, S.; Lopez, C.; Lu, H.; Elgueta, S.; Chen, H.; Boshkoska, B.M. Blockchain Technology in Agri-food Value Chain Management: A Synthesis of Applications, Challenges and Future Research Directions. Comp. Ind. 2019, 109, 83–99. [Google Scholar] [CrossRef]

- Zhao, Z.; Meng, F.; He, Y.; Gu, Z. The Influence of Corporate Social Responsibility on Competitive Advantage with Multiple Mediations from Social Capital and Dynamic Capabilities. Sustainability 2019, 11, 218. [Google Scholar] [CrossRef]

- Pettigrew, A.M. Longitudinal Field Research on Change: Theory and Practice. Organ. Sci. 1990, 1, 267–292. [Google Scholar] [CrossRef]

- Burgelman, R. A Process Model of Internal Corporate Venturing in a Major Diversified Firm. Adm. Sci. Q. 1983, 28, 223–244. [Google Scholar] [CrossRef]

- Harris, S.; Sutton, R. Functions of Parting Ceremonies in Dying Organizations. Acad. Manag. J. 1986, 29, 5–30. [Google Scholar]

- Sutton, R.; Callahan, A. The Stigma of Bankruptcy: Spoiled Organizational Image and Its Management. Acad. Manag. J. 1987, 30, 405–436. [Google Scholar]

- Leonard-Barton, D. A Dual Methodology for Case Studies: Synergistic Use of a Longitudinal Single Site with Replicated Multiple Sites. Organ. Sci. 1990, 1, 248–266. [Google Scholar] [CrossRef]

- Beck, R.; Stenum Czepluch, J.; Lollike, N.; Malone, S. Blockchain—The Gateway to Trust-free Cryptographic Transactions. Res. Pap. 2016, 153. Available online: https://aisel.aisnet.org/ecis2016_rp/153 (accessed on 17 February 2020).

- Hawlitschek, F.; Notheisen, B.; Teubner, T. The Limits of Trust-Free Systems: A Literature Review on Blockchain Technology and Trust in the Sharing Economy. Electron. Commer. Res. Appl. 2018, 29, 50–63. [Google Scholar] [CrossRef]

- Weber, I.; Xu, X.; Riveret, R.; Governatori, G.; Ponomarev, A.; Mendling, J. Untrusted Business Process Monitoring and Execution Using Blockchain. In International Conference on Business Process Management; Springer: Cham, Switzerland, 2016; pp. 329–347. [Google Scholar]

- Dumas, M.; La Rosa, M.; Mendling, J.; Reijers, H.A. Fundamentals of Business Process Management, 2nd ed.; Springer: Cham, Switzerland, 2018. [Google Scholar]

- Buck, J. Blockchain Oracles, Explained. Cointelegraph. 2017. Available online: https://cointelegraph.com/explained/blockchain-oracles-explained (accessed on 11 December 2019).

- Apla. What is a Blockchain Oracle? 2019. Available online: https://blog.apla.io/what-is-a-blockchain-oracle-2ccca433c026 (accessed on 11 December 2019).

- Treiblmaier, H. The impact of the blockchain on the supply chain: A theory-based research framework and a call for action. Supply Chain Manag. 2018, 23, 545–559. [Google Scholar] [CrossRef]

- Ramachandran, A.; Kantarcioglu, D.M. Using Blockchain and smart contracts for secure data provenance management. arXiv 2017, arXiv:1709.10000. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).