Modeling Formation and Operation of Collaborative Green Innovation between Manufacturer and Supplier: A Game Theory Approach

Abstract

1. Introduction

2. Theoretical Foundation and Factor Selection

2.1. Green Innovation and CGI

2.2. Motivation Factors for Suppliers to Participate in Green Innovation Cooperation

2.3. Determinants for Suppliers Involvement into CGI

- (1)

- Partnership of mutual trust.

- (2)

- Knowledge complementarity and mutual learning.

- (3)

- Level of collaboration.

- (4)

- Green added value and innovation efficacy.

- (5)

- Green revenue distribution strategy.

3. Modelling Green Innovation Collaboration Formation

3.1. Background of the Model and Assumptions

- (1)

- The green innovation revenue generated from the collaboration is calculated by the added income from the collaborative innovation minus the innovation cost, and the added value is incurred from coordinated efforts and knowledge spill-overs.

- (2)

- The two partners obtain the green knowledge stock based on the initial cost input of green knowledge, and they determine the level of knowledge sharing according to the level of trust granted to each other.

- (3)

- CGI could reduce the overall cost of green innovation, but collaboration still incurs a cost for the involved partners. CGI incurs costs, which include the knowledge input cost, green innovation development cost, and collaboration cost. As two partners need to invest in green development, we assume that collaboration can improve innovation efficiency and reduce overall green development costs compared with independent green innovation. Here, the collaborative cost refers to the capital investment cost for information technology capability enhancement and the additional integration cost for the division of the development [53], which needs to be shared by the two partners.

3.2. Description of the Model

- (1)

- Definition of absorptive capacity function , mutual learning level function and knowledge stock function .

- (2)

- Definition of green innovation development cost function .

- (3)

- Definition of cooperative cost function and cost-sharing ratio .

- (4)

- Definition of green innovation value , innovation conversion efficiency , and profit distribution coefficient .

3.3. Mathematical Model

3.4. Model Solution by Using Nash Bargaining Equilibrium

- (1)

- Based on the revenue function, the manufacturer calculates the optimal CGI level , which maximize the value in the formula (8).

- (2)

- Based on the CGI level proposed by the manufacturer, the supplier calculates the optimal cost-sharing rate through formula (9).

- (3)

- Based on the Nash bargaining game, the two partners determine the profit distribution ratio . As the collaboration aim is to maximize the anticipative total green revenue we obtain the objective function in function (11). That is, for any ω, ,

4. Simulation in Different Scenarios

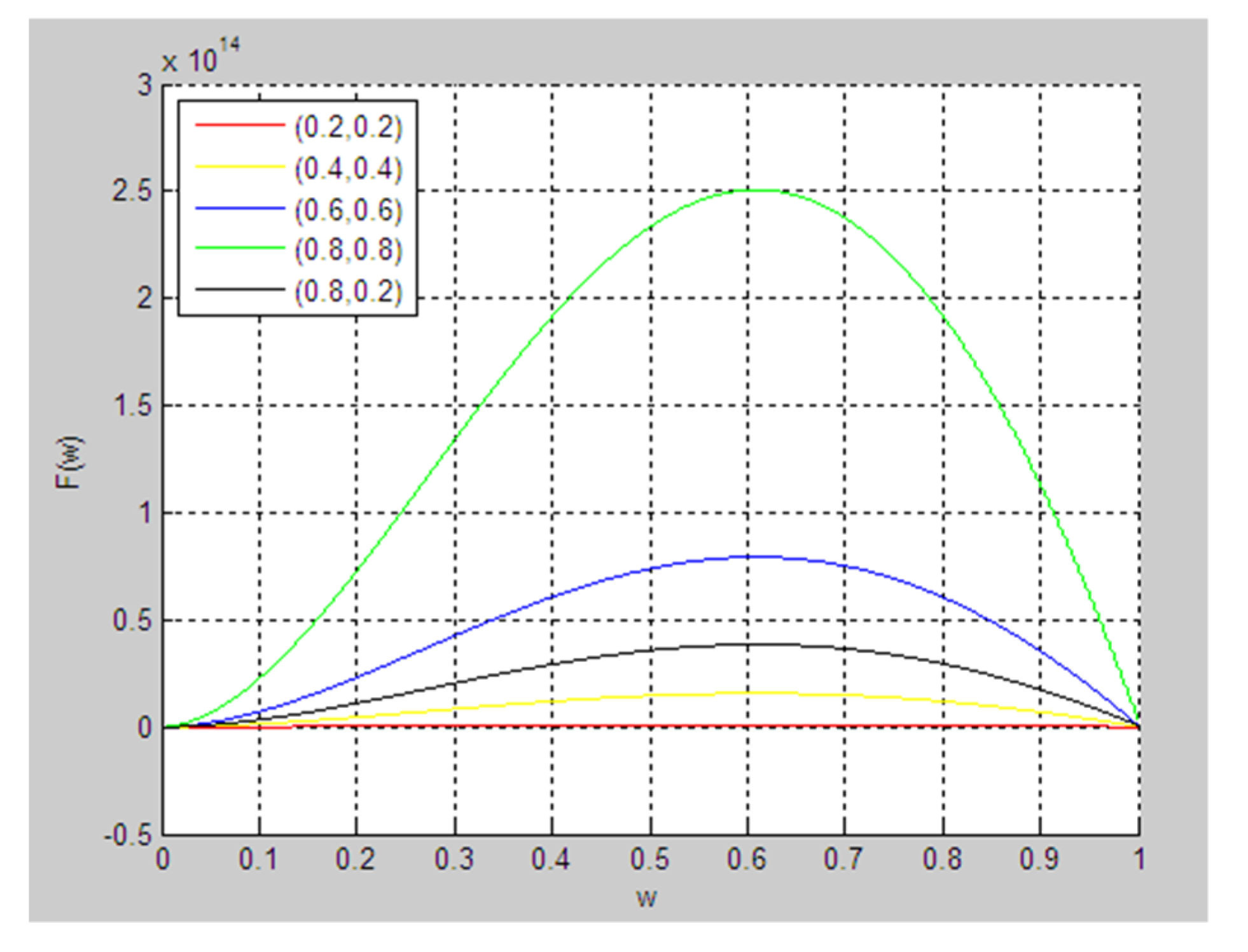

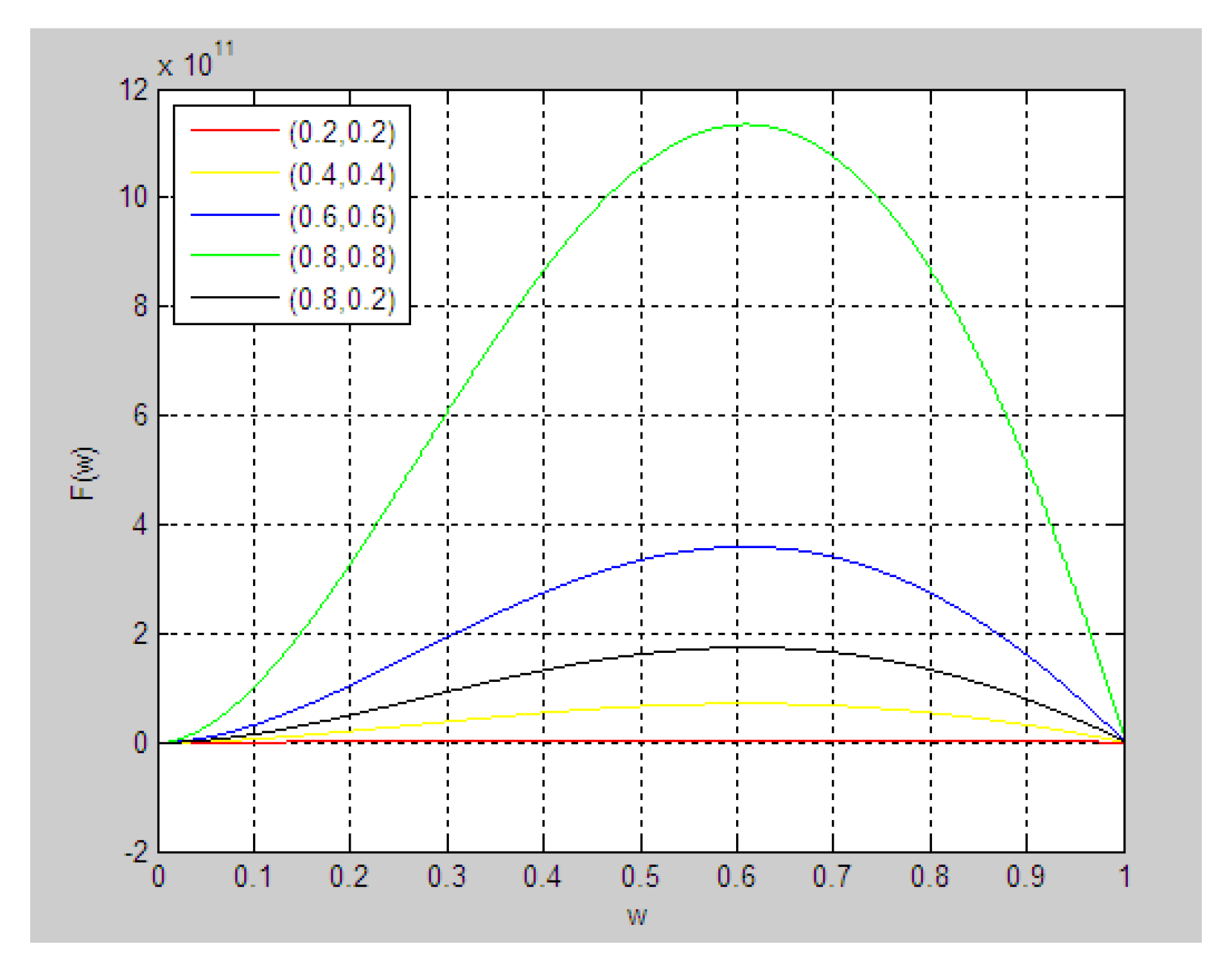

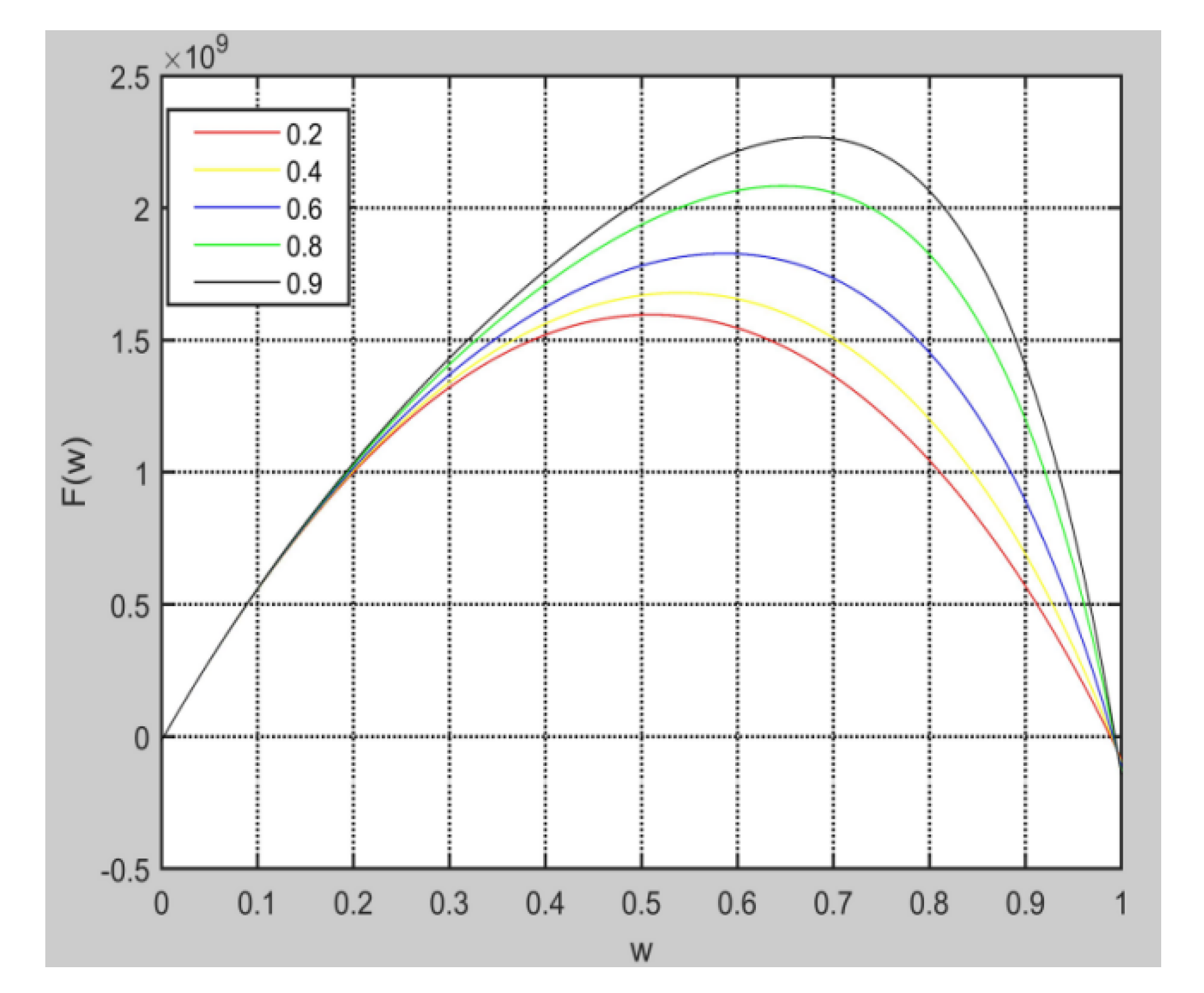

4.1. The effect of trust on total CGI revenue

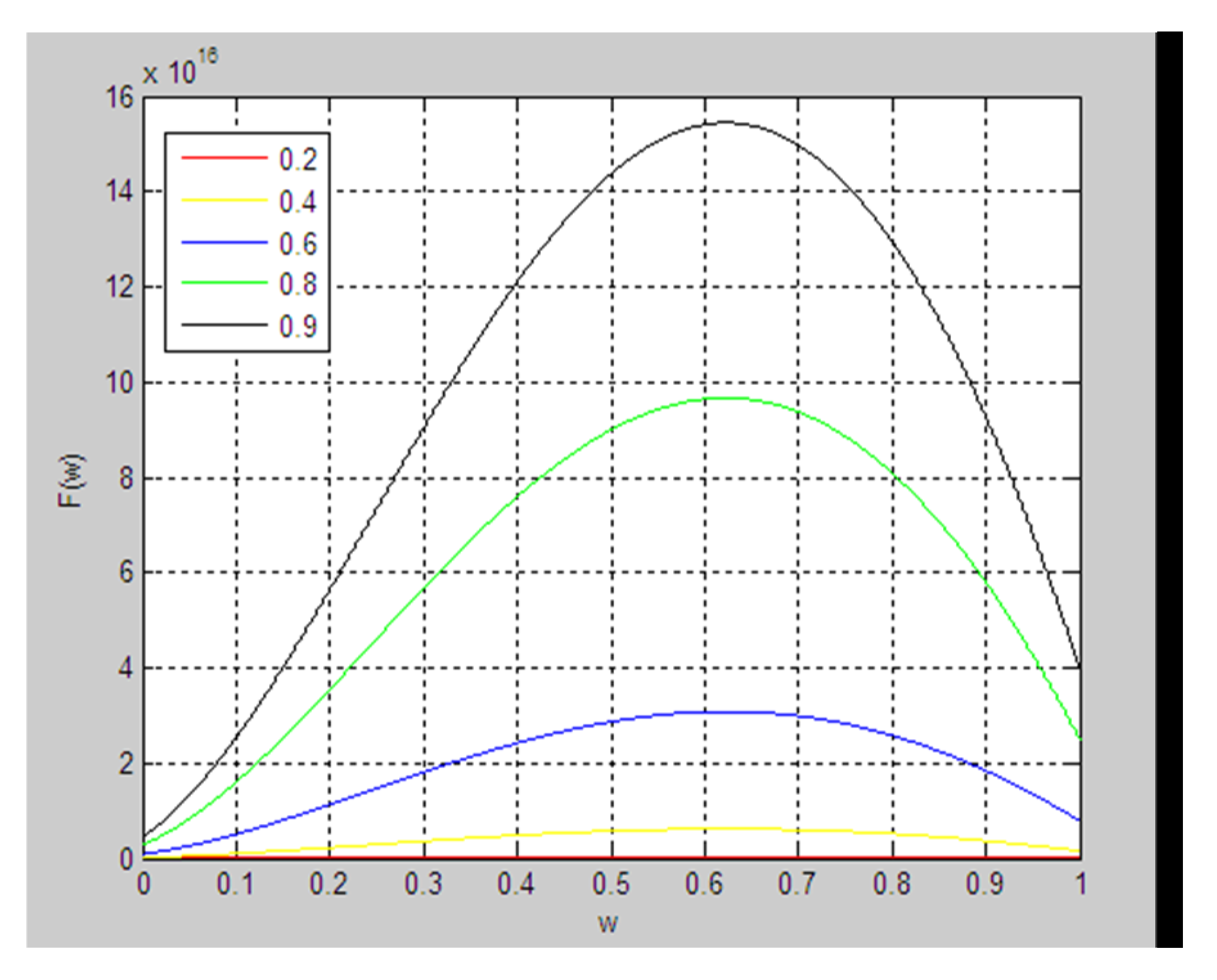

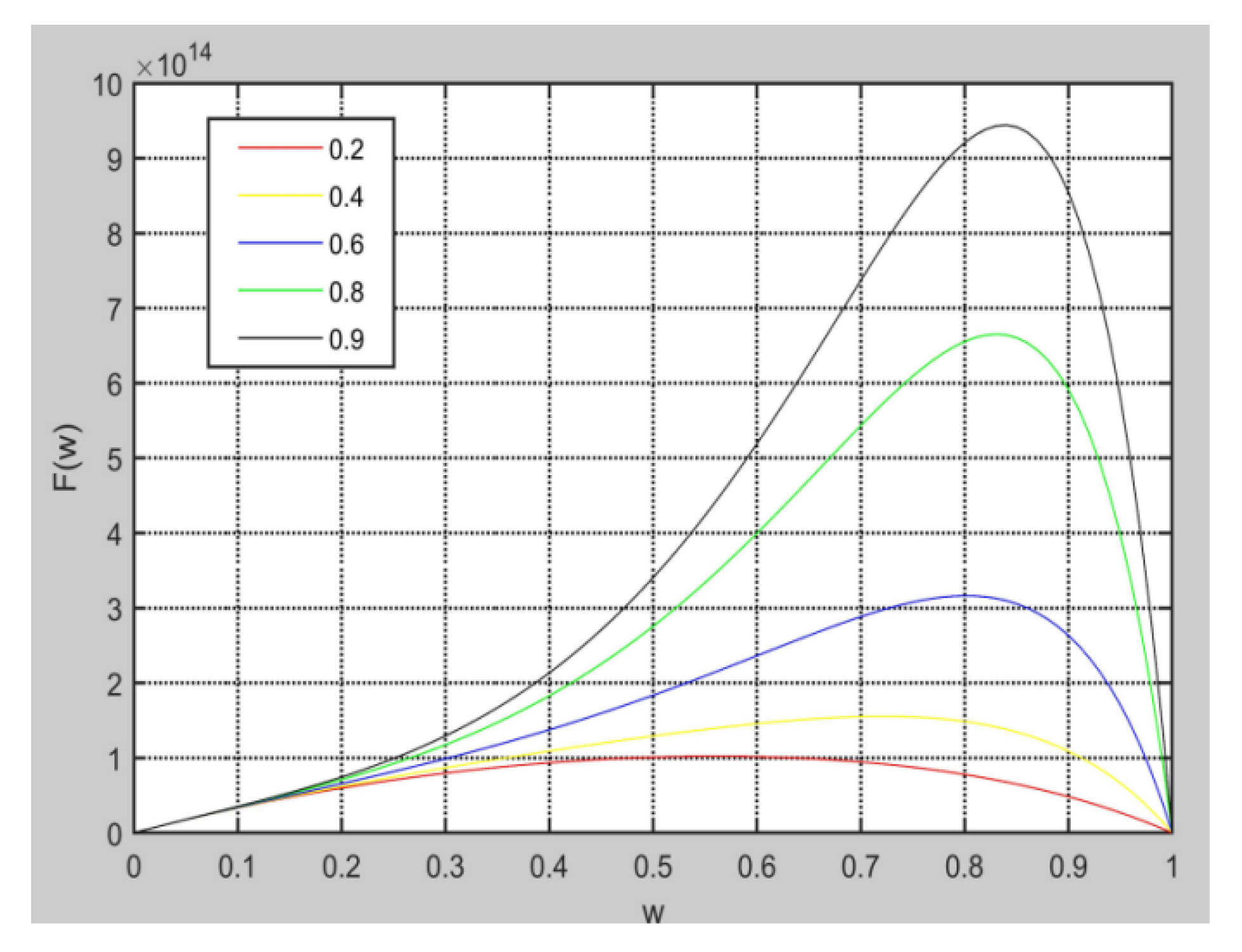

4.2. The Effect of Knowledge Complementarity on Total CGI Revenue

4.3. The Effect of Product Type and Innovation Efficiency on Total CGI Revenue

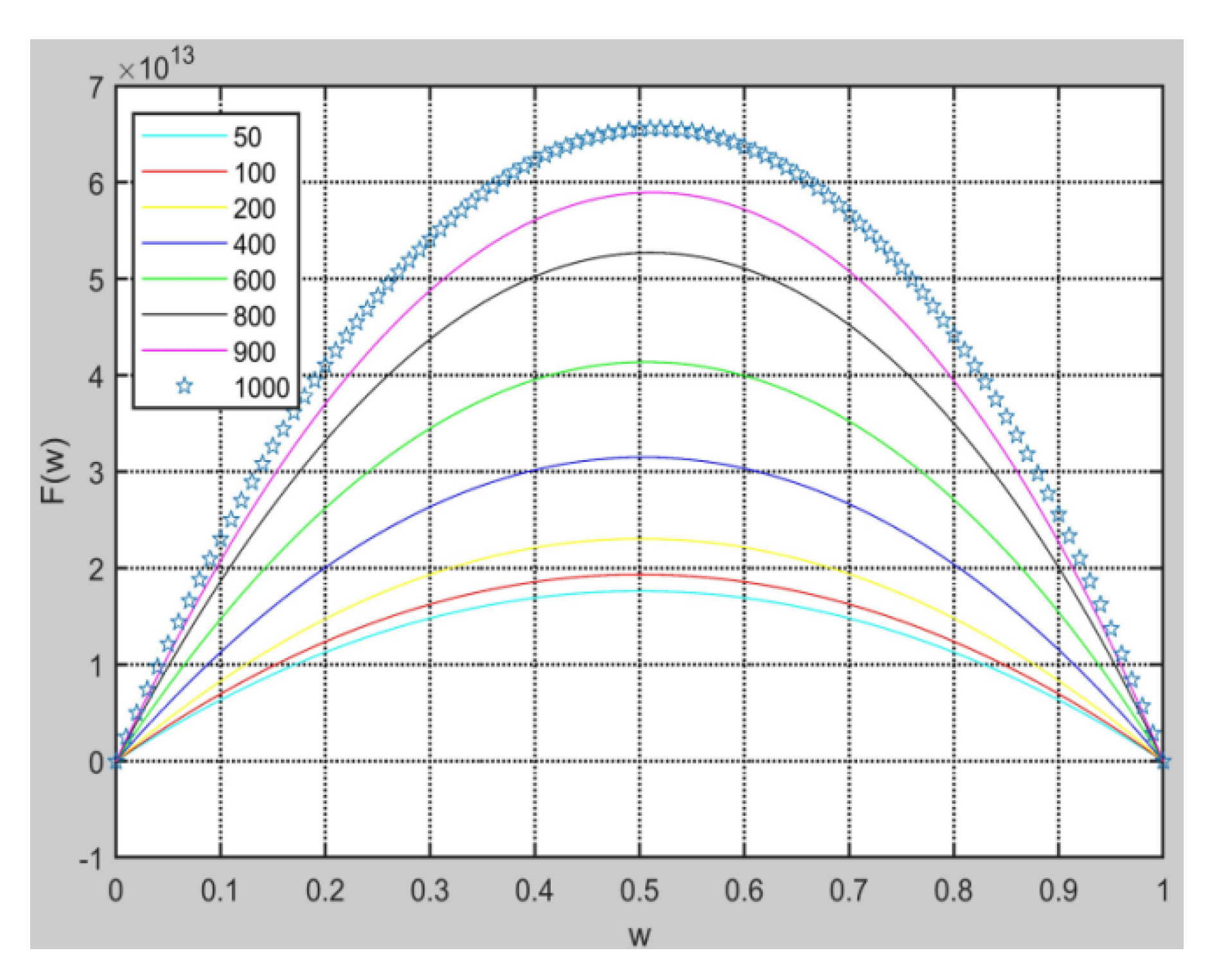

4.4. The Effect of Green Knowledge Input on Total CGI Revenue

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Zhu, Q.H.; Sarkis, J.; Geng, Y. Green supply chain management in china: Pressures, practices and performance. Int. J. Oper. Prod. Manag. 2005, 5, 449–468. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pujari, D.; Pontrandolfo, P. Green product innovation in manufacturing firms: A sustainability-oriented dynamic capability perspective. Bus. Strategy Environ. 2017, 4, 490–506. [Google Scholar] [CrossRef]

- Wu, C.; Barnes, D. Partner selection for reverse logistics centres in green supply chains: A fuzzy artificial immune optimisation approach. Prod. Plan. Control 2016, 16, 1356–1372. [Google Scholar] [CrossRef]

- Lee, K.H.; Kim, J.W. Integrating suppliers into green product innovation development: An empirical case study in the semiconductor industry. Bus. Strategy Environ. 2011, 8, 527–538. [Google Scholar] [CrossRef]

- Chiou, T.Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 6, 822–836. [Google Scholar] [CrossRef]

- Kim, M.G.; Woo, C.; Rho, J.J.; Chung, Y. Environmental capabilities of suppliers for green supply chain management in construction projects: A case study in Korea. Sustainability 2016, 8, 82. [Google Scholar] [CrossRef]

- Chen, P.C.; Hung, S.W. Collaborative green innovation in emerging countries: A social capital perspective. Int. J. Oper. Prod. Manag. 2014, 3, 347–363. [Google Scholar] [CrossRef]

- Lee, S.Y. Drivers for the participation of small and medium-sized suppliers in green supply chain initiatives. Supply Chain Manag. 2008, 3, 185–198. [Google Scholar] [CrossRef]

- Dey, K.; Roy, S.; Saha, S. The impact of strategic inventory and procurement strategies on green product design in a two-period supply chain. Int. J. Prod. Res. 2018, 7, 1915–1948. [Google Scholar] [CrossRef]

- Saha, S.; Majumder, S.; Nielsen, I.E. Is It a Strategic Move to Subsidized Consumers Instead of the Manufacturer? IEEE Access 2019, 7, 169807–169824. [Google Scholar] [CrossRef]

- Nielsen, I.E.; Majumder, S.; Sana, S.S.; Saha, S. Comparative analysis of government incentives and game structures on single and two-period green supply chain. J. Clean. Prod. 2019, 6, 1371–1398. [Google Scholar] [CrossRef]

- Rezaei, J. A two-way approach to supply chain partner selection. Int. J. Prod. Res. 2015, 16, 4888–4902. [Google Scholar] [CrossRef]

- Song, H.; Gao, X. Green supply chain game model and analysis under revenue-sharing contract. J. Clean. Prod. 2018, 170, 183–192. [Google Scholar] [CrossRef]

- Awasthi, A.; Adetiloye, T.; lCraini, T.G. Collaboration partner selection for city logistics planning under municipal freight regulations. Appl. Math. Model. 2016, 1, 510–525. [Google Scholar] [CrossRef]

- Fahimullah, M.; Faheem, Y.; Ahmad, N. Collaboration formation and profit sharing between software development firms: A shapley value based cooperative game. IEEE Access 2019, 7, 42859–42873. [Google Scholar] [CrossRef]

- Gattringer, R.; Wiener, M.; Strehl, F. The challenge of partner selection in collaborative foresight projects. Technol. Forecast. Soc. Chang. 2017, 120, 298–310. [Google Scholar] [CrossRef]

- Mafakheri, F.; Nasiri, F. Revenue sharing coordination in reverse logistics. J. Clean. Prod. 2013, 59, 185–196. [Google Scholar] [CrossRef]

- Gan, Q.M.; Zhao, D.Z. Research on emission reduction r&d cooperation between supplier and manufacturer based on carbon tax. J. Northwest. Polytech. Univ. 2015, 4, 57–63. [Google Scholar]

- Erkal, N.; Minehart, D. Optimal technology sharing strategies in dynamic games of r&d. J. Econ. Manag. Strategy 2014, 1, 149–177. [Google Scholar]

- Liu, L.; Chen, G.; Niu, X. Game analysis of the knowledge sharing mechanism for the supply chain collaborative innovation. J. Ind. Eng. Manag. 2015, 1, 152–169. [Google Scholar] [CrossRef]

- Arsenyan, J.; Büyüközkan, G.; Feyzioglu, O. Modeling collaboration formation with a game theory approach. Expert Syst. Appl. 2015, 42, 2073–2085. [Google Scholar] [CrossRef]

- Guertler, M.R.; Lindemann, U. Identifying open innovation partners: A methodology for strategic partner selection. Int. J. Innov. Manag. 2016, 5, 1640011. [Google Scholar] [CrossRef]

- Gunasekaran, A.; Subramanian, N.; Rahman, S. Green supply chain collaboration and incentives: Current trends and future directions. Transp. Res. Part E Logist. Transp. Rev. 2015, 74, 1–10. [Google Scholar] [CrossRef]

- Sari, K. Modeling of a fuzzy expert system for choosing an appropriate supply chain collaboration strategy. Intell. Autom. Soft Comput. 2017, 1–8. [Google Scholar] [CrossRef]

- Wang, C.N.; Nguyen, X.T.; Wang, Y.H. Automobile industry strategic alliance partner selection: The application of a hybrid dea and grey theory model. Sustainability 2016, 2, 173. [Google Scholar] [CrossRef]

- Gema, A.M.; Jörg, H.; Antonio, L.M.; Gabriel, C.C. Mapping the field: A bibliometric analysis of green innovation. Sustainability 2017, 9, 1011. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 1, 99–120. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 4, 331–339. [Google Scholar] [CrossRef]

- Chang, C.H. The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. J. Bus. Ethics 2011, 3, 361–370. [Google Scholar] [CrossRef]

- Zhu, Q.H.; Sarkis, J. Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. J. Oper. Manag. 2004, 3, 265–289. [Google Scholar] [CrossRef]

- Oliveira, M.L.d.; Santos, J.L.S.; Becker, G.V.; Hansen, P.B. A bibliometric analysis of international literature on collaboration in supply chains. BASE 2016, 1, 32–52. [Google Scholar]

- Handfield, R.; Sroufe, R.; Walton, S. Integrating environmental management and supply chain strategies. Bus. Strategy Environ. 2005, 1, 1–19. [Google Scholar] [CrossRef]

- Wynstra, F.; Pierick, E.T. Managing supplier involvement in new product development: A portfolio approach. Eur. J. Purch. Supply Manag. 2000, 6, 49–57. [Google Scholar] [CrossRef]

- Venegas, B.B.; Ventura, J.A. A two-stage supply chain coordination mechanism considering price sensitive demand and quantity discounts. Eur. J. Oper. Res. 2018, 2, 524–533. [Google Scholar] [CrossRef]

- Carayol, N.; Roux, P. ‘Collective innovation’ in a model of network formation with preferential meeting. In Nonlinear Dynamics and Heterogeneous Interacting Agents; Springer: Berlin/Heidelberg, Germany, 2005; pp. 139–153. [Google Scholar]

- Büyüközkan, G.; Arsenyan, J. Collaborative product development: A literature overview. Prod. Plan. Control 2011, 1, 47–66. [Google Scholar] [CrossRef]

- Panteli, N.; Sockalingam, S. Trust and conflict within virtual inter-organizational alliances: A framework for facilitating knowledge sharing. Decis. Support Syst. 2005, 4, 599–617. [Google Scholar] [CrossRef]

- Cheng, J.H.; Yeh, C.H.; Tu, C.W. Trust and knowledge sharing in green supply chains. Supply Chain Manag. 2008, 4, 283–295. [Google Scholar] [CrossRef]

- Hou, Y.; Xiong, Y.; Wang, X.; Liang, X. The effects of a trust mechanism on a dynamic supply chain network. Expert Syst. Appl. 2014, 6, 3060–3068. [Google Scholar] [CrossRef]

- Zhang, M.; Huo, B. The impact of dependence and trust on supply chain integration. Int. J. Phys. Distrib. Logist. Manag. 2013, 7, 544–563. [Google Scholar] [CrossRef]

- Trim, P.R.; Lee, Y.I. A strategic approach to sustainable partnership development. Eur. Bus. Rev. 2008, 3, 222–239. [Google Scholar] [CrossRef]

- Kwon, I.W.G.; Suh, T. Factors Affecting the Level of Trust and Commitment in Supply Chain Relationships. J. Supply Chain Manag. 2004, 40, 4–14. [Google Scholar] [CrossRef]

- Capaldo, A.; Petruzzelli, A.M. Origins of knowledge and innovation in r&d alliances: A contingency approach. Technol. Anal. Strateg. Manag. 2015, 4, 461–483. [Google Scholar]

- Cummings, J.L.; Holmberg, S.R. Best-fit alliance partners: The use of critical success factors in a comprehensive partner selection process. Long Range Plan. 2012, 2–3, 136–159. [Google Scholar] [CrossRef]

- Dushnitsky, G.; Shaver, J.M. Limitations to interorganizational knowledge acquisition: The paradox of corporate venture capital. Strateg. Manag. J. 2009, 10, 1045–1064. [Google Scholar] [CrossRef]

- Tsai, W. Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Acad. Manag. J. 2001, 5, 996–1004. [Google Scholar]

- Berchicci, L.; Bodewes, W. Bridging environmental issues with new product development. Bus. Strategy Environ. 2005, 5, 272–285. [Google Scholar] [CrossRef]

- Kenneth, W.; Green, J.; Zelbst, P.J.; Bhadauria, V.S.; Meacham, J. Do environmental collaboration and monitoring enhance organizational performance. Ind. Manag. Data Syst. 2012, 2, 186–205. [Google Scholar]

- Peng, J.P.; Quan, J.; Zhang, G.Y.; Dubinsky, A.J. Knowledge sharing, social relationships, and contextual performance: The moderating influence of information technology competence. J. Organ. End User Comput. 2015, 2, 58–73. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pontrandolfo, P.; Pujari, D. Developing sustainable new products in the textile and upholstered furniture industries: Role of external integrative capabilities. J. Prod. Innov. Manag. 2013, 4, 642–658. [Google Scholar] [CrossRef]

- Bhaskaran, S.R.; Krishnan, V. Effort, revenue, and cost sharing mechanisms for collaborative new product development. Manag. Sci. 2009, 7, 1152–1169. [Google Scholar] [CrossRef]

- Parkhe, A. Strategic alliance structuring: A game theoretic and transaction cost examination of interfirm cooperation. Acad. Manag. J. 1993, 4, 794–829. [Google Scholar]

- Giovanni, P.D. Environmental collaboration in a closed-loop supply chain with a reverse revenue sharing contract. Ann. Oper. Res. 2011, 1, 135–157. [Google Scholar] [CrossRef]

- Nash, J.J.F. The bargaining problem. Econometrica 1950, 2, 155–162. [Google Scholar] [CrossRef]

| Notations/Variables | Description | |

|---|---|---|

| status symbols | F refers to the leading manufacturer, and S refers to the supplier. | |

| a | Initial value of the product (a > 0). | |

| b | The added green value generated by CGI, defined as the marginal benefit of each unit of sales of green innovative products. | |

| status variables | β | The complementarity of green knowledge between the two firms. |

| tFS | The manufacturer’s trust level towards the supplier. | |

| tSF | The supplier’s trust level towards the manufacturer. | |

| zF | The stock of the manufacturer’s green innovation knowledge. | |

| zs | The stock of the supplier’s green innovation knowledge. | |

| qF | The manufacturer’s knowledge input of green innovation (efforts). | |

| qS | The supplier’s knowledge input of green innovation (efforts). | |

| control variable | θ | Green collaboration level. |

| Distribution ratio of collaboration costs. | ||

| independent varible | Green profit distribution ratio for manufacturer F. | |

| function notations | Knowledge absorptive capacity of manufacturer F and supplier S. | |

| Learning level of Manufacturer F and supplier S. | ||

| Total knowledge storage owned the two firms for green innovation. | ||

| Green development costs of manufacturer F and supplier S. | ||

| Cooperative cost function for CGI. | ||

| The efficiency of successful green innovation development | ||

| Green innovation revenue for manufacturer F and supplier S. |

| Scenarios | ||||||

|---|---|---|---|---|---|---|

| Figure 1 | 0.2, 0.2 0.4, 0.4 0.6, 0.6 0.8, 0.8 0.8, 0.2 | 1100, 1000 | 3000, 3000 | 0.05, 0.05 | 0.8 | 0, 0.6 |

| Figure 2 | 1100, 1000 | 3000, 3000 | 0.05, 0.05 | 0.2 | 0, 0.6 | |

| Figure 3 | 1000, 100 | 3000, 3000 | 0.05, 0.05 | 0.8 | 0, 0.6 | |

| Figure 4 | 1000, 100 | 3000, 3000 | 0.05, 0.05 | 0.2 | 0, 0.6 | |

| Figure 5 | 0.8, 0.8 | 1100,1000 | 3000, 3000 | 2, 2 | 0.2 0.4 0.6 0.8 0.9 | 0, 0.6 |

| Figure 6 | 0.8, 0.8 | 1000, 200 | 3000, 3000 | 2, 2 | 0, 0.6 | |

| Figure 7 | 0.8, 0.8 | 200, 200 | 300, 3000 | 2, 2 | 0, 0.6 | |

| Figure 8 | 0.8, 0.8 | 1000, 1000 | 3000, 3000 | 0.05, 0.05 | 0.6 | 0, 0.2 0, 0.8 |

| Figure 9 | 0.8, 0.8 | (50, 100, 200, 400, 600, 800, 900, 1000), 1000 | 3000, 3000 | 0.05, 0.05 | 0.6 | 0, 0.6 |

| Figure 10 | 0.8, 0.8 | (50, 100, 200, 400, 600, 800, 900, 1000), 1000 | 3000, 3000 | 2, 0.05 | 0.6 | 0, 0.6 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Q.; Kang, Y.; Tan, L.; Chen, B. Modeling Formation and Operation of Collaborative Green Innovation between Manufacturer and Supplier: A Game Theory Approach. Sustainability 2020, 12, 2209. https://doi.org/10.3390/su12062209

Li Q, Kang Y, Tan L, Chen B. Modeling Formation and Operation of Collaborative Green Innovation between Manufacturer and Supplier: A Game Theory Approach. Sustainability. 2020; 12(6):2209. https://doi.org/10.3390/su12062209

Chicago/Turabian StyleLi, Qian, Yuanfei Kang, Lingling Tan, and Bo Chen. 2020. "Modeling Formation and Operation of Collaborative Green Innovation between Manufacturer and Supplier: A Game Theory Approach" Sustainability 12, no. 6: 2209. https://doi.org/10.3390/su12062209

APA StyleLi, Q., Kang, Y., Tan, L., & Chen, B. (2020). Modeling Formation and Operation of Collaborative Green Innovation between Manufacturer and Supplier: A Game Theory Approach. Sustainability, 12(6), 2209. https://doi.org/10.3390/su12062209