Gender Diversity in Spanish Banks: Trickle-Down and Productivity Effects

Abstract

1. Introduction

2. Theoretical Framework

2.1. Current Studies on the Theme

2.2. Theoretical Approaches

2.2.1. The Linear Relation between Diversity and Performance

2.2.2. The Curvilinear Relationship between Gender Diversity and Performance

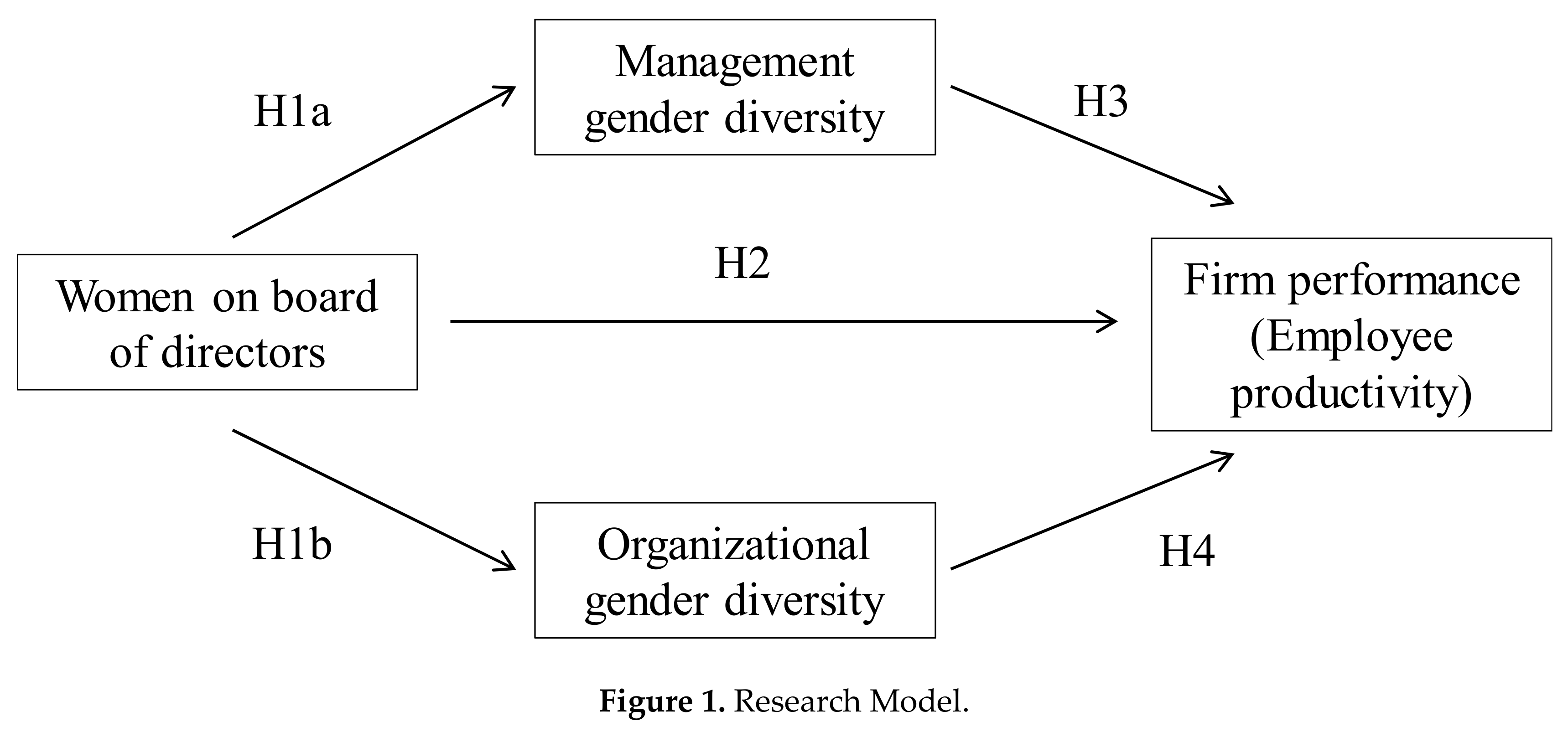

3. Hypotheses

4. Method

4.1. Research Setting

4.2. Design and Procedure

4.3. Measures

4.3.1. Dependent Measures

4.3.2. Independent Variables

4.3.3. Other Measures

5. Results

5.1. Descriptive Analyses

5.2. Test of Hypotheses

6. Discussion

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Eagly, A.H. When passionate advocates meet research on diversity, does the honest broker stand a chance? J. Soc. Issues 2016, 72, 199–222. [Google Scholar] [CrossRef]

- Torchia, M.; Calabró, A.; Huse, M. Women Directors on Corporate Boards: From Tokenism to Critical Mass. J. Bus. Ethics 2011, 102, 299–317. [Google Scholar] [CrossRef]

- Schwab, A.; Werbel, J.D.; Hofmann, H.; Henriques, P.L. Managerial gender diversity and firm performance: An integration of different theoretical perspectives. Group Organ. Manag. 2016, 41, 5–31. [Google Scholar] [CrossRef]

- Elvira, M.M.; Cohen, L. Location matters: A cross-level analysis of the effects of organizational sex composition on turnover. Acad. Manag. J. 2001, 44, 591–605. [Google Scholar]

- Nielsen, S. Top Management Team Diversity: A Review of Theories and Methodologies. Int. J. Manag. Rev. 2010, 12, 301–316. [Google Scholar] [CrossRef]

- Gould, J.A.; Kulik, C.T.; Sardeshmukh, S.R. Trickle-down effect: The impact of female board members on executive gender diversity. Hum. Resour. Manag. 2018, 57, 931–945. [Google Scholar] [CrossRef]

- Richard, O.C.; Kirby, S.L.; Chadwick, K. The impact of racial and gender diversity in management on financial performance: How participative strategy making features can unleash a diversity advantage. Int. J. Hum. Resour. Manag. 2013, 24, 2571–2582. [Google Scholar] [CrossRef]

- Frink, D.D.; Robinson, R.K.; Reithel, B.; Arthur, M.M.; Ammeter, A.P.; Ferris, G.R.; Kaplan, D.M.; Morrisette, H.S. Gender demography and organization performance. A two-study investigation with convergence. Group Organ. Manag. 2003, 28, 127–147. [Google Scholar] [CrossRef]

- Richard, O.C.; Ford, D.; Ismail, K. Exploring the performance effects of visible attribute diversity: The moderating role of span of control and organizational life cycle. Int. J. Hum. Resour. Manag. 2006, 17, 2091–2109. [Google Scholar] [CrossRef]

- Reguera-Alvarado, N.; Fuentes, P.; Laffarga, J. Does Board Gender Diversity Influence Financial Performance? Evidence from Spain. J. Bus. Ethics 2017, 141, 337–350. [Google Scholar] [CrossRef]

- INE. Encuesta de Población Activa. Cuarto Trimestre 2019. Available online: https://www.ine.es/dyngs/INEbase/es/operacion.htm?c=Estadistica_C&cid=1254736176918&menu=ultiDatos&idp=1254735976595# (accessed on 6 February 2020).

- The Women Institute. Estadísticas: Mujeres en Cifras. Poder y Toma de Decisiones. Poder Económico. Available online: http://www.inmujer.gob.es/MujerCifras/PoderDecisiones/PoderEconomico.htm (accessed on 5 February 2020).

- European Institute for Gender Equality. Gender Statistics Database (2019, Second Semester). Available online: https://eige.europa.eu/gender-statistics/dgs/indicator/wmidm_bus_bus__wmid_comp_compbm/bar/year:2019-B2/geo:EU28,ES/EGROUP:COMP/sex:M,W/UNIT:PC/POSITION:MEMB_BRD/NACE:TOT (accessed on 6 February 2020).

- European Banking Authority. EBA Report on the Benchmarking of Diversity Practices at the European Union Level under Article 91(11) of Directive 2013/36/EU (2018 Data). Available online: https://eba.europa.eu/eba-calls-measures-ensure-more-balanced-composition-management-bodies-institutions (accessed on 6 February 2020).

- Herring, C. Does Diversity Pay? Race, Gender, and the Business Case for Diversity. Am. Sociol. Rev. 2009, 74, 208–224. [Google Scholar] [CrossRef]

- González, J.A.; Denisi, A.S. Cross-level effects of demography and diversity climate on organizational attachment and firm effectiveness. J. Organ. Behav. 2009, 30, 21–40. [Google Scholar] [CrossRef]

- Luanglath, N.; Ali, M.; Mohannak, K. Top management team gender diversity and productivity: The role of board gender diversity. Equal. Divers. Incl. Int. J. 2019, 39, 71–86. [Google Scholar] [CrossRef]

- Kanter, R.M. Some effects of proportions on group life: Skewed sex ratios and responses to token women. Am. J. Sociol. 1977, 82, 965–990. [Google Scholar] [CrossRef]

- Post, C.; Byron, K. Women on boards and firm financial performance: A meta-analysis. Acad. Manag. J. 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Cohen, L.E.; Broschak, J.P.; Haveman, H.A. And Then There Were More? The Effect of Organizational Sex Composition on Hiring and Promotion of Managers. Am. Sociol. Rev. 1998, 63, 711–727. [Google Scholar] [CrossRef]

- Bilimoria, D. The Relationship between Women Corporate Directors and Women Corporate Officers. J. Manag. Issues 2006, 18, 47–61. [Google Scholar]

- Huffman, M.L.; Cohen, P.N.; Pearlman, J. Engendering change: Organizational dynamics and workplace gender segregation. Adm. Sci. Q. 2010, 55, 255–277. [Google Scholar] [CrossRef]

- Matsa, D.A.; Miller, A.R. Chipping Away at the Glass Ceiling: Gender Spillovers in Corporate Leadership. Am. Econ. Rev. 2011, 101, 635–639. [Google Scholar] [CrossRef]

- Cohen, L.E.; Broschak, J.P. “Whose Jobs Are These? The Impact of the Proportion of Female Managers on the Number of New Management Jobs Filled by Women versus Men”. Adm. Sci. Q. 2013, 58, 509–541. [Google Scholar] [CrossRef]

- Ali, M.; Ng, Y.L.; Kulik, C.T. Board Age and Gender Diversity: A Test of Competing Linear and Curvilinear Predictions. J. Bus. Ethics 2014, 125, 497–512. [Google Scholar] [CrossRef]

- Joecks, J.; Pull, K.; Vetter, K. Gender Diversity in the Boardroom and Firm Performance: What Exactly Constitutes a “Critical Mass”? J. Bus. Ethics 2013, 118, 61–72. [Google Scholar] [CrossRef]

- Pathan, S.; Faff, R. Does board structure in banks really affect their performance? J. Bank. Financ. 2013, 37, 1573–1589. [Google Scholar] [CrossRef]

- Smith, N.; Smith, V.; Verner, M. Do women in top management affect firm performance? A panel study of 2,500 Danish firms. Int. J. Perform. Manag. 2006, 55, 569–593. [Google Scholar] [CrossRef]

- Ali, M.; Metz, I.; Kulik, C.T. The Impact of Work–Family Programs on the Relationship between Gender Diversity and Performance. Hum. Resour. Manag. 2014, 54, 553–576. [Google Scholar] [CrossRef]

- Mínguez-Vera, A.; López-Martinez, R. Female directors and SMEs: An empirical analysis. J. Glob. Strateg. Manag. 2010, 4, 30–46. [Google Scholar] [CrossRef]

- Rodríguez-Domínguez, L.; García-Sánchez, I.M.; Gallego-Álvarez, I. Explanatory factors of the relationship between gender diversity and corporate performance. Eur. J. Law Econ. 2012, 33, 603–620. [Google Scholar] [CrossRef]

- McMillan-Capehart, A.; Simerly, R.L. Effects of Managerial Racial and Gender Diversity on Organizational Performance: An Empirical Study. Int. J. Manag. 2008, 25, 446–592. [Google Scholar]

- Shrader, C.B.; Blackburn, V.B.; Iles, P. Women in management and firm financial performance: An exploratory study. J. Manag. Issues 1997, 9, 355–372. [Google Scholar]

- Dwyer, S.; Richard, O.C.; Chadwick, K. Gender diversity in management and firm performance: The influence of growth orientation and organizational culture. J. Bus. Res. 2003, 56, 1009–1019. [Google Scholar] [CrossRef]

- Joshi, A.; Liao, H.; Roh, H. Bridging domains in workplace demography research: A review and reconceptualization. J. Manag. 2011, 37, 521–552. [Google Scholar] [CrossRef]

- Sacco, J.M.; Schmitt, N. A dynamic multilevel model of demographic diversity and misfit effects. J. Appl. Psychol. 2005, 90, 203–231. [Google Scholar] [CrossRef] [PubMed]

- Ali, M.; Kulik, C.T.; Metz, I. The gender-diversity performance relationship in services and manufacturing organizations. Int. J. Hum. Resour. Manag. 2011, 2, 1464–1485. [Google Scholar] [CrossRef]

- Gould, J.A.; Kulik, C.T.; Sardeshmukh, S.R. Gender diversity, time to take it from the top? An integration of competing theories. Acad. Manag. Annu. Meet. Proc. 2014, 2014, 13194. [Google Scholar] [CrossRef]

- Byrne, D. The Attraction Paradigm; Academic Press: New York, NY, USA, 1971. [Google Scholar]

- Williams, K.Y.; O’Reilly, C.A. Demography and diversity in organizations: A review of 40 years of research. In Research in Organizational Behaviour, 20; Staw, B.M., Sutton, R., Eds.; JAI Press: Greenwich, UK, 1998; pp. 77–140. [Google Scholar]

- Tajfel, H. Social Psychology of Intergroup Relations. Annu. Rev. Psychol. 1982, 33, 1–39. [Google Scholar] [CrossRef]

- Kravitz, D.A. More Women in the Workplace: Is There a Payoff in Firm Performance? Acad. Manag. Exec. 2003, 17, 148–149. [Google Scholar] [CrossRef]

- Pelled, L.H. Relational demography and perceptions of group conflict and performance: A field investigation. Int. J. Confl. Manag. 1996, 7, 230–246. [Google Scholar] [CrossRef]

- Harrison, D.A.; Klein, K.J. What’s the difference? Diversity constructs as separation, variety or disparity in organizations. Acad. Manag. Rev. 2007, 32, 1199–1228. [Google Scholar] [CrossRef]

- Prieto, L.C.; Phipps, S.T.A.; Osiri, J.K. Linking Workplace Diversity to Organizational Performance: A Conceptual Framework. J. Divers. Manag. 2009, 4, 13–21. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Byron, K.; Post, C. Women on boards of directors and corporate social performance: A meta-analysis. Corp. Gov. An. Int. Rev. 2016, 24, 428–442. [Google Scholar] [CrossRef]

- Blau, P.M. Inequality and Heterogeneity; Free Press: New York, NY, USA, 1977. [Google Scholar]

- Richard, O.C.; Barnett, T.; Dwyer, S.; Chadwick, K. Cultural diversity in management, firm performance, and the moderating role of entrepreneurial orientation dimensions. Acad. Manag. J. 2004, 47, 255–266. [Google Scholar]

- Richard, O.C.; Murthi, B.P.S.; Ismail, K. The impact of racial diversity on intermediate and long-term performance: The moderating role of environmental context. Strateg. Manag. J. 2007, 28, 1213–1233. [Google Scholar] [CrossRef]

- Nishii, L.; Gotte, A.; Raver, J. Upper Echelon Theory Revisited: The Relationship Between Upper Echelon Diversity, The Adoption of Diversity Practices, and Organizational Performance; CAHRS Working Paper #07–04; Cornell University, School of Industrial and Labor Relations, Center for Advanced Human Resource Studies: Ithaca, NY, USA, 2007; Available online: http://digitalcommons.ilr.cornell.edu/cahrswp/461 (accessed on 6 February 2020).

- Kurtulus, F.A.; Tomaskovic-Devey, D. Do Female Top Managers Help Women to Advance? A Panel Study Using EEO-1 Records. Ann. Am. Acad. Polit. Soc. Sci. 2012, 639, 173–198. [Google Scholar] [CrossRef]

- Cohen, J.R.; Dalton, D.W.; Holder-Webb, L.L.; McMillan, J.J. An Analysis of Glass Ceiling Perceptions in the Accounting Profession. J. Bus. Ethics 2018, 1–22. [Google Scholar] [CrossRef]

- Skaggs, S.; Stainback, K.; Duncan, P. Shaking things up or business as usual? The influence of female corporate executives and board of directors on women's managerial representation. Soc. Sci. Res. 2012, 41, 936–948. [Google Scholar] [CrossRef]

- Carter, D.A.; Simkins, B.J.; Simpson, W.G. Corporate governance, board diversity, and firm value. Financ. Rev. 2003, 38, 33–53. [Google Scholar] [CrossRef]

- Fray, D.; Guillaume, Y. Team Diversity. In International Encyclopedia Of Organization Studies; Clegg, S., Bailey, J.R., Eds.; Sage: Thousand Oaks, CA, USA, 2007; pp. 1510–1513. [Google Scholar]

- Krishnan, H.A.; Park, D. A Few Good Women-On Top Management Teams. J. Bus. Res. 2005, 58, 1712–1720. [Google Scholar] [CrossRef]

- Bonn, I.; Toru, Y.; Phillip, H.P. Effects of board structure on firm performance: A comparison between Japan and Australia. Asian Bus. Manag. 2004, 3, 105–125. [Google Scholar] [CrossRef]

- Rosener, J.B. America´s Competitive Secret: Utilizing Women as a Management Strategy; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Richard, O.; Kochan, T.; McMillan-Capehart, A. The impact of visible diversity on organizational effectiveness: Disclosing the contents in Pandora’s black box. J. Bus. Manag. 2002, 8, 1–26. [Google Scholar]

- Birindelli, G.; Dell’Atti, S.; Iannuzzi, A.P.; Savioli, M. Composition and Activity of the Board of Directors. Impact on ESG Performance in the Banking System. Sustainability 2018, 10, 4699. [Google Scholar] [CrossRef]

- Leonard, J.S.; Levine, D.I. Diversity, Discrimination, and Performance; IIRUPS Working Paper 091–03; University of California Berkeley: Berkeley, CA, USA, 2003. [Google Scholar]

- Martín, E.; Bachiller, A.; Bachiller, P. The restructuring of the Spanish banking system: Analysis of the efficiency of financial entities. Manag. Decis. 2018, 56, 474–487. [Google Scholar] [CrossRef]

- Serrano, S.C. La reestructuración del Sistema bancario español tras la crisis y la solvencia de las entidades financieras. Consecuencias para las cajas de ahorro. Span. Account. Rev. 2013, 16, 136–146. [Google Scholar]

- Richard, O. Racial diversity, business strategy, and firm performance: A resource-based view. Acad. Manag. J. 2000, 43, 164–177. [Google Scholar]

- Becker, B.; Gerhart, B. The impact of Human Resource Management on organizational performance: Progress and prospects. Acad. Manag. J. 1996, 39, 779–801. [Google Scholar]

- Hausman, J. Specification tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Certo, S.T.; Semadeni, M. Strategy research and panel data: Evidence and implications. J. Manag. 2006, 32, 449–471. [Google Scholar] [CrossRef]

- Campbell, K.; Mínguez-Vera, A. Gender Diversity in the Boardroom and Firm Financial Performance. J. Bus. Ethics 2008, 83, 435–451. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Bartels, L.M. Panel Effects in the American National Election Studies. Polit. Anal. 1999, 8, 1–20. [Google Scholar] [CrossRef]

- Huselid, M.A.; Jackson, S.E.; Schuler, R.S. Technical and strategic human resource management effectiveness as determinants of firm performance. Acad. Manag. J. 1997, 40, 171–188. [Google Scholar]

- Konrad, A.; Kramer, V.; Erkut, S. Critical Mass: The Impact of Three or More Women on Corporate Boards. Organ. Dyn. 2008, 37, 145–164. [Google Scholar] [CrossRef]

- Zimmerman, G.C. Factors Influencing Community Bank Performance in California. Econ. Rev. Fed. Reserve Bank San Franc. 1996, 1, 26–42. [Google Scholar]

- Gospel, H.; Pendleton, A. Financial markets, corporate governance and the management of labour: A conceptual and comparative analysis. Br. J. Ind. Relat. 2003, 41, 557–582. [Google Scholar] [CrossRef]

- Harrison, D.A.; Sin, H.P. What is Diversity and How Should it be Measured? In Handbook of Workplace Diversity; Konrad, A.M., Prasad, P., Pringle, J.K., Eds.; Sage: London, UK, 2006; pp. 191–216. [Google Scholar]

| Abbreviation | Variable | Description | Sources |

|---|---|---|---|

| B_WOMAN_1 | Presence of women at board level 1 | One female director on board of directors | [2,26,62,74] |

| B_WOMAN_2 | Presence of women at board level 2 | Two female directors on board of directors | [2,26,62,74] |

| B_WOMAN_3 | Presence of women at board level 3 | At least three women on board of directors | [2,18,26,62,74] |

| EQUITY | Composition of the bank liabilities | Logarithm of the equity in millions of euros for each year | [27,76] |

| ASSETS | Organizational size 1 | Logarithm of average total assets in millions of euros for each year | [10,15,51,62] |

| OFFICES | Organizational size 2 | Number of branches of each bank | [75] |

| SUBSIDIARY | The bank is a subsidiary of a holding company | Dummy variable: 1 the bank is a subsidiary; 0 the bank is not a subsidiary. | [7,66] |

| PRODUCTIV | Firm performance, measured as employee productivity | Logarithm of the average turnover divided by the average personnel expenses. Turnover: sum of client’ s deposits plus client’ s credits in millions of euros for each year | [3,8,16,29,34] |

| F_WOMAN | Gender diversity at the firm level | Percentage of women in the workforce of each bank for each year. | [55,77] |

| M_WOMAN | Gender diversity at the management level | Percentage of women in technical staff of each bank for each year. | [55,77] |

| Mean | S. D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. B_WOMAN_1 | 0.412 | 0.493 | 1 | |||||||||

| 2. B_WOMAN_2 | 0.256 | 0.437 | 0.514 | 1 | ||||||||

| 3. B_WOMAN_3 | 0.156 | 0.363 | 0.271 | 0.526 | 1 | |||||||

| 4. EQUITY (× 103 mill. €) | 94.89 | 36.58 | −0.157 | −0.146 | −0.098 | 1 | ||||||

| 5. ASSETS (× 103 mill. €) | 183.46 | 58.019 | 0.247 | 0.119 | −0.006 | −0.137 | 1 | |||||

| 6. OFFICES | 282.58 | 682.61 | 0.229 | 0.108 | 0.007 | −0.187 | 0.897 | 1 | ||||

| 7. SUBSIDIARY | 0.339 | 0.474 | −0.056 | −0.101 | −0.131 | −0.056 | −0.135 | −0.144 | 1 | |||

| 8. PRODUCTIV | 168.98 | 332.18 | 0.052 | −0.009 | 0.019 | −0.222 | 0.029 | −0.016 | 0.228 | 1 | ||

| 9. F_WOMAN | 0.365 | 0.109 | 0.101 | 0.028 | −0.019 | −0.093 | −0.023 | −0.139 | 0.090 | 0.217 | 1 | |

| 10. M_WOMAN | 0.289 | 0.126 | 0.252 | 0.101 | 0.005 | −0.160 | 0.958 | 0.936 | −0.161 | −0.004 | −0.025 | 1 |

| Model 1 Dependent Variable M_WOMANt + 1 | Model 2 Dependent Variable F_WOMANt + 1 | |||

|---|---|---|---|---|

| Coeff. (Std. Error) | VIF | Coeff. (Std. Error) | VIF | |

| C | 0.452 (0.375) | 0.201 (0.344) | ||

| B_WOMAN_1t | 0.135 *** (0.040) | 1.397 | −0.003 (0.004) | 1.403 |

| B_WOMAN_2t | 0.181 *** (0.057) | 1.780 | 0.015 (0.012) | 1.780 |

| B_WOMAN_3t | −0.015 (0.076) | 1.448 | −0.009 (0.025) | 1.443 |

| LOG(EQUITYt) | 0.051 (0.139) | 2.148 | 0.033 *** (0.009) | 2.136 |

| SUBSIDIARYt | −0.094 (0.144) | 3.337 | 0.045 (0.075) | 3.349 |

| LOG(ASSETSt) | 0.058 ** (0.027) | 2.671 | 0.008 (0.019) | 2.689 |

| LOG(OFFICESt) | 0.050 ** (0.021) | 1.111 | 0.003 (0.006) | 1.112 |

| LOG(PRODUCTIVt) | −0.203 (0.187) | 1.906 | 0.022 (0.134) | 1.906 |

| Adjusted R2 | 0.952 | 0.901 | ||

| Number of cross-sections | 59 | 59 | ||

| Total observations | 558 | 481 | ||

| Model 3 | Model 4 | Model 5 | Model 6 | |||||

|---|---|---|---|---|---|---|---|---|

| Coeff. (Std. Error) | VIF | Coeff. (Std. Error) | VIF | Coeff. (Std. Error) | VIF | Coeff. (Std. Error) | VIF | |

| C | 2.002 *** (0.681) | 0.537 (0.790) | −0.700 (1.016) | 1.893 *** (0.621) | ||||

| B_WOMAN_1t | −0.031 (0.036) | 1.396 | ||||||

| B_WOMAN_2t | 0.116 * (0.066) | 1.768 | ||||||

| B_WOMAN_3t | 0.109 ** (0.055) | 1.439 | ||||||

| M_WOMANt | 6.254 ** (2.521) | 2.077 | ||||||

| F_WOMANt | 8.194 *** (2.739) | 1.286 | ||||||

| LOG(EQUITYt) | −0.311 *** (0.111) | 1.801 | −0.322 *** (0.118) | 2.029 | −0.389 *** (0.118) | 1.790 | −0.321 *** (0.058) | 1.762 |

| SUBSIDIARYt | −0.326 * (0.167) | 1.096 | −0.411 ** (0.179) | 1.109 | −0.366 ** (0.164) | 1.106 | −0.210 * (0.114) | 1.105 |

| LOG(ASSETSt) | 0.166 ** (0.064) | 3.436 | 0.145 ** (0.069) | 4.472 | 0.102 (0.067) | 3.437 | 0.144 *** (0.051) | 3.233 |

| LOG(OFFICESt) | −0.155 (0.104) | 2.516 | −0.169 (0.106) | 2.419 | −0.016 (0.125) | 2.903 | −0.052 (0.065) | 2.386 |

| Adjusted R2 | 0.890 | 0.829 | 0.867 | 0.791 | ||||

| Number of cross-sections | 59 | 59 | 59 | 59 | ||||

| Total observations | 555 | 583 | 583 | 583 | ||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Delgado-Piña, M.I.; Rodríguez-Ruiz, Ó.; Rodríguez-Duarte, A.; Sastre-Castillo, M.Á. Gender Diversity in Spanish Banks: Trickle-Down and Productivity Effects. Sustainability 2020, 12, 2113. https://doi.org/10.3390/su12052113

Delgado-Piña MI, Rodríguez-Ruiz Ó, Rodríguez-Duarte A, Sastre-Castillo MÁ. Gender Diversity in Spanish Banks: Trickle-Down and Productivity Effects. Sustainability. 2020; 12(5):2113. https://doi.org/10.3390/su12052113

Chicago/Turabian StyleDelgado-Piña, María Isabel, Óscar Rodríguez-Ruiz, Antonio Rodríguez-Duarte, and Miguel Ángel Sastre-Castillo. 2020. "Gender Diversity in Spanish Banks: Trickle-Down and Productivity Effects" Sustainability 12, no. 5: 2113. https://doi.org/10.3390/su12052113

APA StyleDelgado-Piña, M. I., Rodríguez-Ruiz, Ó., Rodríguez-Duarte, A., & Sastre-Castillo, M. Á. (2020). Gender Diversity in Spanish Banks: Trickle-Down and Productivity Effects. Sustainability, 12(5), 2113. https://doi.org/10.3390/su12052113