2.1. Model

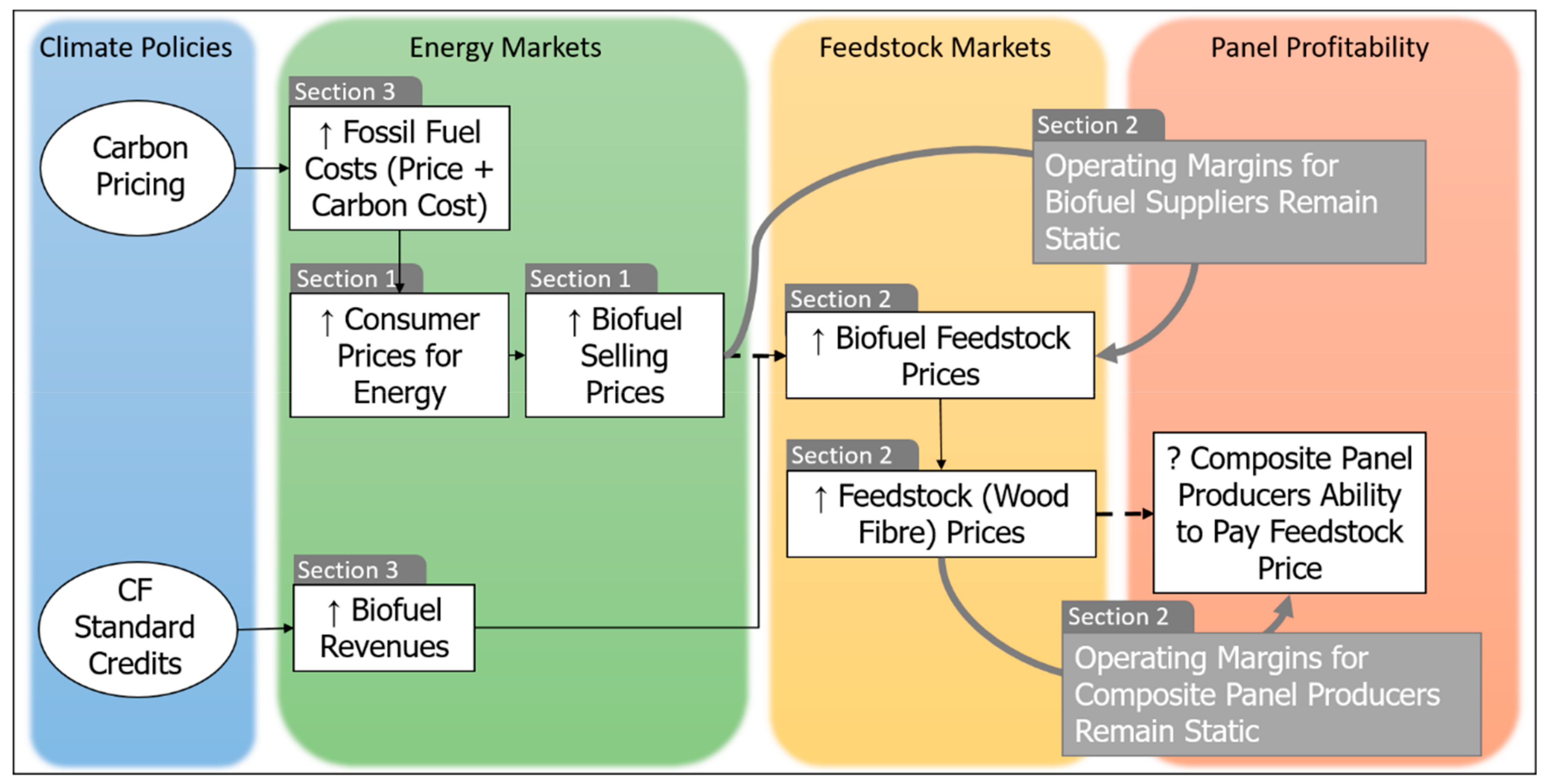

To evaluate the potential effect of carbon pricing and the CF Standard on composite panel mill feedstock prices, we modeled the impacts of both regulations on fuel consumers, pellet producers, and indirectly, on composite panel producers. The model assumes that fuel consumers will accept higher price-points for biomass energy as a heat source as fossil fuels become comparatively more expensive. Pellet producers and chip suppliers are thus theoretically able to pay higher prices for their feedstocks. The model assumes that the sawmills supplying the biomass feedstocks are profit maximizing, and will sell their by-products to the highest paying customer. Canadian composite panel mills may be unable to respond to feedstock price changes as their revenues depend on North American composite panel selling prices, subsequently impacting their access to sawmill residues.

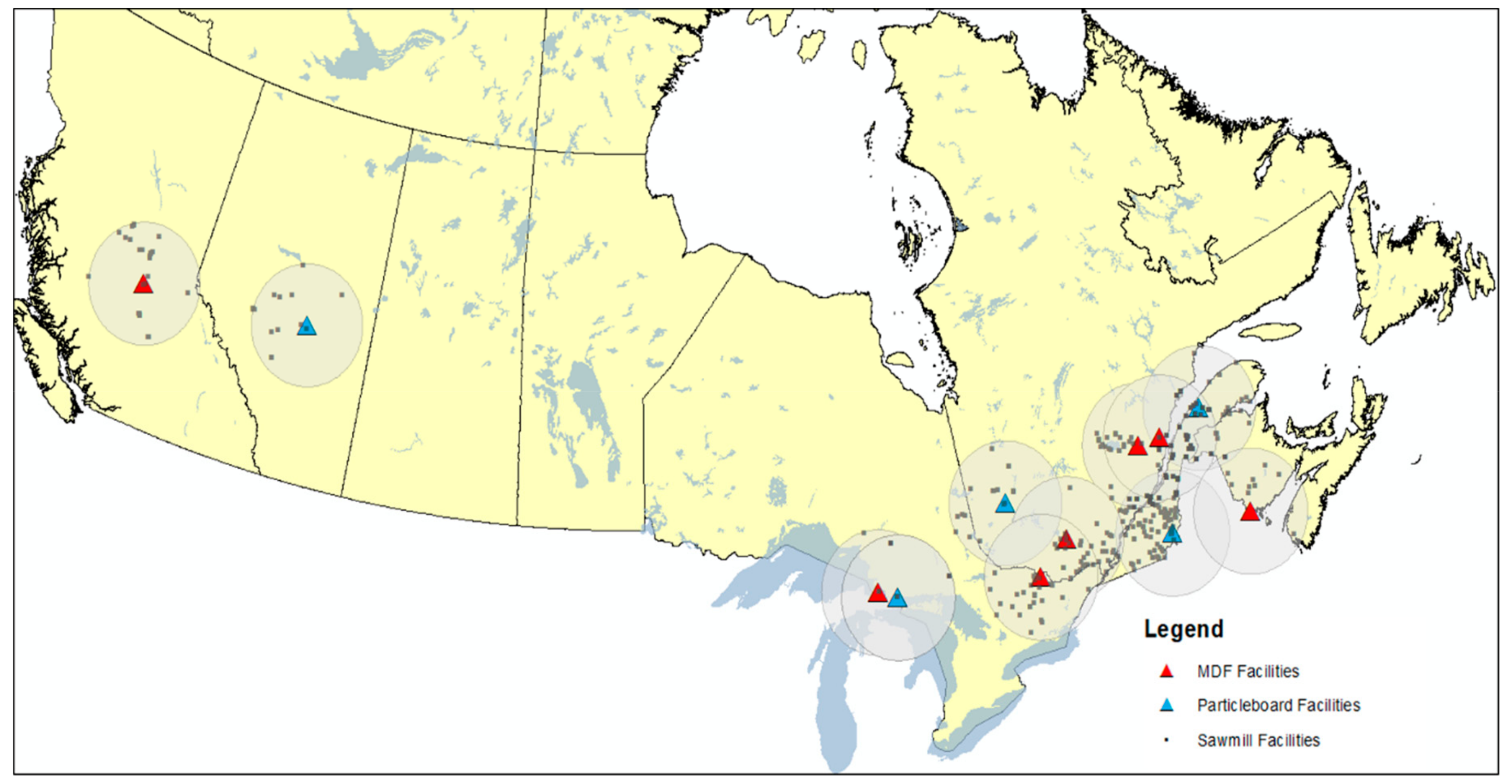

Figure 2 illustrates the key process and relationships within the model. External factors, including shifts in biomass supply, changes to fossil fuel prices, etc., may also influence changes in price-points and break-even costs, however, modeling and including these external factors was beyond the scope of this analysis, and we therefore assess the effects of carbon pricing and CF Standard credits ceteris paribus. Additionally, current demand elasticities specific to the Canadian situation for fossil fuels and bioenergy feedstock were unavailable. We examine four types of consumers (residential, commercial and institutional buildings, electric utilities and industrial), and assume that each will be selecting from a certain set of fuels for their heat energy needs (

Table 1). Fossil fuel and electricity prices vary provincially, impacting regional pellet and chip supply and local panel mills. In addition to a national analysis, the model examines five specific Canadian provinces in which panel mills are located: British Columbia (BC), Alberta (AB), Ontario (ON), Québec (QC) and New Brunswick (NB).

Our spreadsheet-based model is augmented with @Risk, a Monte Carlo simulation software (@Risk v7.5, Palisade Co., Ithaca, NY, USA, 2016). Incorporating Monte Carlo simulations allows the model to address some of the uncertainty associated with key variables, specifically fossil fuel prices and estimated price-points for energy and biomass feedstocks. These variables are assigned unique distributions representative of price estimates available from the literature and available data. The model is iterated a thousand times and produces output distributions for each variable of interest; because the inputs are stochastic in nature, the output metrics also represent a level of stochasticity.

The approach devised to assess the theoretical prices consumers would pay for biomass begins with an estimate of the cost per GJ of heat across a select set options. The model assumes rational cost minimizing consumers that are indifferent between heating systems. These consumers would be willing to switch to a bioenergy system as long as the cost per GJ was comparable to the next least cost option, accounting for the additional capital costs that may be associated with a bioenergy system.

Based on the calculated prices consumers would be willing to pay for heat output, the model derives an approximate price that bioenergy suppliers (i.e., pellet producers or chip suppliers) would be able to pay for their feedstock. We equate the price-points at which consumers would be indifferent between a biomass heating system and a fossil fuel/electricity-based system to an approximate selling price for pellets or chips. From this selling price, the model calculates the price pellet producer/chip suppliers would be able to pay for their respective biomass feedstocks, accounting for profit margins, operating costs and transportation costs associated with the production of industrial and residential pellets. We assume that pellet producers and chip suppliers maintain margins similar to those obtained prior to the implementation of carbon pricing and the CF Standard.

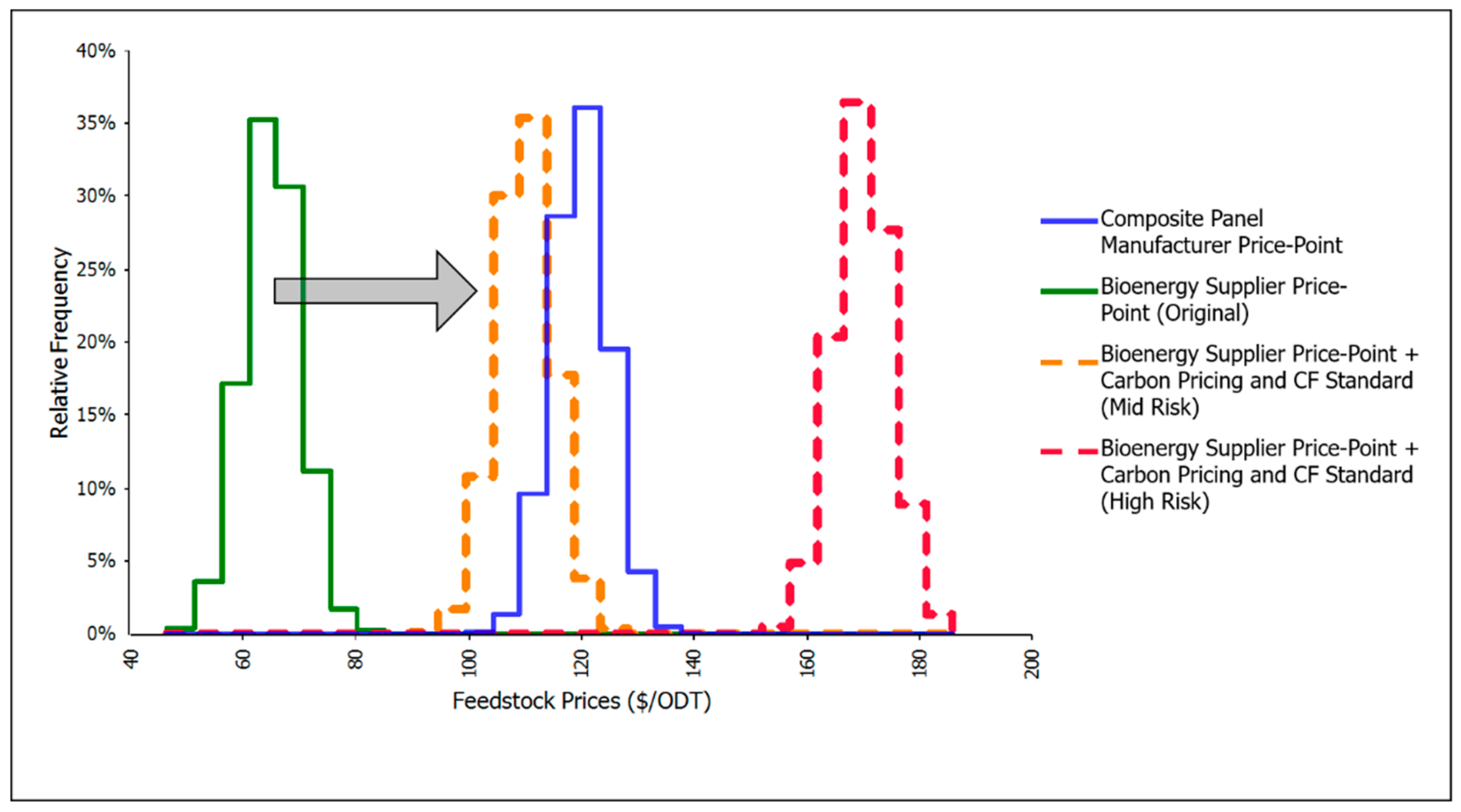

With the assumption that the feedstock will be sold to the producer offering the highest price, we then compare the calculated prices bioenergy suppliers might pay against the feedstock prices Canadian composite panel producers pay given current and projected selling prices and operating costs. The ability of panel manufacturers to secure access to feedstock and outbid other users of sawmill residues such as pellet manufacturers is assessed as follows for the different applications:

High: Panel mills can only afford to pay less for feedstock than biofuel producers or users.

Medium: Panel mills and biofuel producers or users can afford to pay a similar price for feedstock.

Low: Panel mills can afford to pay more for feedstock than biofuel producers or users.

We assess the feedstock accessibility risk for the panel industry based on the relationship between the distribution of prices that pellet producer/chip suppliers would be willing to pay, and the distribution of prices that panel producers pay. In the event that the 75th percentile of the distribution of the price values for bioenergy suppliers is less than the 25th percentile of the distribution of prices for the panel producers, we assume that there is a relatively low risk to the panel producers; they are likely able to outbid bioenergy suppliers for the feedstock. We assume a mid-level of risk under three circumstances when the distributions overlap:

first, the 75th percentile of the bioenergy supplier distribution lies between the 25th and the 75th percentiles of the panel distribution and the 25th percentile of the bioenergy supplier is less than the 25th percentile of the panel distribution;

second, the 25th and 75th percentiles of the bioenergy supplier distribution are between the 25th and 75th percentiles of the panel distribution;

third, the 25th percentile of the bioenergy supplier distribution lies between the 25th and 75th percentiles of the panel distribution, and the 75th percentile of the bioenergy supplier is greater than the 75th percentile of the panel distribution.

High risk is assumed when the 25th percentile of the bioenergy supplier distribution is greater than the 75th percentile of the panel distribution.

Figure 3 illustrates an example of all three levels of risk, as the PCF policies allow pellet producers and chip suppliers to pay higher prices for their feedstock such that the composite panel industry’s ability to access the same feedstock at historic prices is challenged.

The CF Standard and carbon pricing initiatives put forward by the GoC aim to motivate behavior change by increasing the cost of fossil fuels over time. As such, we estimated the potential impacts of the policies under three different time periods; the short-term (2018), mid-term (2023) and long term (2030). Under each time period, the carbon price increases as a result of increased stringency in environmental regulations, and the CF Standard credit price increases to encourage the supply of low carbon fuels. Note, however, that future forecasts for fossil fuel prices are not directly captured here; we account for the potential change in fossil fuel prices within the uncertainty distributions assigned to each fuel variable.

2.2. Data

To estimate prices that consumer might pay for biomass as a heat source (identified as section 1 in

Figure 2), the levelized cost of energy (LCOE) was calculated for each energy system using Equation (1) [

32] and includes the capital cost, the fuel cost and other operation and maintenance cost. The LCOE was estimated for every application within each consumer group and within each region:

where

LCOE represents the levelized cost of energy (

$/GJ),

CRF is the capital recovery factor (1/yr),

CapC is the capital cost (

$),

FC is the fuel cost in

$/GJ,

Q is the energy demand in GJ/yr,

Eff is the conversion efficiency (%) and

OMC represents operation and maintenance costs, excluding fuel (

$/yr).

The capital cost per unit of heat generated is a function of the annual heat demand, the installed capacity and the time period over which the system is financed. The relationship between heat or power generation (

Q * Eff-1) and installed capacity is a function of the capacity factor, which is equivalent to the fraction of time the system is used at full capacity over a year. The annuity associated with the capital cost was calculated using Equation (2) [

32]:

where

i is the annual interest rate (%) and

n is the number of annuities.

Parameters used to calculate the capital cost per unit of heat generated are provided in

Table 2. The number of annuities reflects the decision time frame of the investor for each application, while the assumed interest rate for the study period is 5%, based on recent interest rates posted by Canadian chartered banks for a 5-year conventional mortgage [

33].

Values for fuel cost, energy efficiency and operating and maintenance costs are provided in

Table 3. The range for natural gas prices are based on current (2019) utility rates in Canadian provinces (BC [

34], AB [

35], ON [

36,

37], QC [

38,

39], NB [

40]), for both residential and commercial applications. Given the relatively stable projected natural gas prices at the National Inventory Transfer and Henry Hubs over the 2015–2030 period [

41], real delivered natural gas prices are kept constant over the study timeline. Natural gas prices for electric utilities and industry are not publicly available but were assumed equal to the cost of natural gas supply at regional hubs, plus transmission costs. The range for fuel oil prices is based on historic prices (2010–2017) in the Canadian provinces examined [

42]. Since crude oil price variations over 2010–2017 cover the projected crude oil prices over the study period [

41], historic prices for fuel oil are assumed to reflect a reasonable range for the study period. Propane prices for residential applications were only available for parts of BC [

43], ON [

44] and NB [

45]. The range for current propane prices across provinces is considered representative of prices for the study period, based on recent projections by the Conference Board of Canada [

46] for domestic propane prices. The range for electricity prices is based on current (2019) utility rates in the Canadian provinces listed above, for both residential and commercial applications [

47]. On average, electricity prices are assumed to follow inflation over the study period, based on the trend for 2011–2019 [

47,

48]. Electricity prices are regulated in Canadian provinces and increases in rates are subject to approval by utility boards. Prices for coal and pet coke are based on historical prices (2010–2017) for the United States [

49], as no data specific to Canada is publicly available. Fuel costs for wood pellet and wood chip systems are variable in the model, as they are driven by the prices that of consumers are willing to pay for energy. Details on fuel costs by province used to conduct the regional analysis are found in the

Supplementary Materials Table S1.

For residential, commercial and institutional applications, efficiency, operations and maintenance (O&M) costs and capital costs are based on technology forecasts for residential and commercial building technologies prepared for the U.S. Energy Information Administration [

50]. Values are representative of typical equipment in 2017 and do not vary significantly over the study period. Wood pellet boilers and wood chip boilers are not covered in the cited technology forecasts, hence cost estimates are based on information provided by Canadian suppliers and project developers for recent projects. Efficiency values are available for residential wood pellet boilers [

51]. For electric utilities and industrial facilities, only the incremental cost of conversion to biomass is considered, based on the conversion of the Ontario Power Generation Atikokan coal power plant [

52]. Typical conversion efficiencies are used for electricity generation [

53] and industrial facilities [

54,

55,

56].

To derive the potential price-points for biomass feedstocks from panel manufacturers, wood pellet producers and chip suppliers (biomass feedstock consumers) (identified as section 2 in

Figure 2), we estimate product selling prices, wood costs, variable and fixed costs, distribution costs and operating profit margins for each biomass feedstock consumer. The operating profit (

OperP) for panel manufacturers, wood pellet producers and chip suppliers was calculated using Equation (3) and represents the difference between operating revenues and operating expenses:

where

OperP represents operating profits,

SelP is selling price,

WoodC is wood cost,

VarC is variable costs other than wood,

FixC is fixed costs,

TraC is transportation costs (where applicable). Values are in

$/m

3 for panel manufacturers,

$/t for wood pellets and

$/ODT (Oven Dried Tonne) for wood chips. For panel manufacturers, wood cost is equal to fiber price (

$/ODT) multiplied by fiber use (ODT/m

3). The ratio of operating profit to operating revenues (

OperP/SelP) is the operating profit margin.

Values for operating revenues and expenses for bioenergy suppliers and composite panel producers are provided in

Table 4. Selling prices and costs for particleboard and MDF are from Forest Economic Advisors (FEA) [

57]. Selling price and wood cost for wood pellets and wood chips are derived within the model via the prices consumers are willing to pay for energy. Production and transportation costs for wood pellets reflect values found in the literature [

58,

59], with higher production costs assumed for residential applications that require higher quality pellets and additional packaging. Given the lack of publicly available data on distribution costs of wood pellets for residential use, the incremental cost compared to industrial pellets (for electricity generation) was derived from the price difference between both types of pellets in several regions [

58]. For use in buildings, costs are associated with wood chip conditioning and storage at a regional supplier [

60] and transportation to user, while chips are delivered directly from the sawmill to the industrial users (no variable, fixed or distribution costs). The operating profit margin was set at 15% for all producers, which is consistent with recent values for the wood product sector in Canada [

61].

2.3. Climate Policy Impacts

Under the GoC’s carbon pricing and CF Standard policies, the price of fossil fuels will increase through time. As the model iterates over the time periods, fossil fuel prices for consumers increase, theoretically increasing prices for bioenergy, and subsequently increasing the prices bioenergy suppliers might be able to pay biomass feedstocks. This phase of the model is identified as section 3 within

Figure 2. Fuel costs in

Table 3 reflect prices prior to the application of carbon pricing. As described before, sale revenues for wood pellets and wood chips suppliers are expected to be complemented by credits generated through the production of low carbon fuels under the CF Standard. Carbon price and the value of CF Standard credits assumed over the study period are provided in

Table 5. Fuel charges for fossil fuels under the federal carbon pricing system are set out in the Greenhouse Gas Pollution Pricing Act [

62] until 2022 and reflect GHG combustion emissions for each fuel. CO

2 emissions from the combustion of biomass is not subject to carbon pricing. Because the price of carbon in 2030 under the federal system has not been set, the estimate is based on projections for the Western Climate Initiative (California–Québec carbon market) allowance price [

63].

The CF Standard is planned to come into force in 2022 for the liquid stream and in 2023 for the solid and gaseous stream. Credit prices will be set through a credit market system and will depend on multiple factors including the carbon intensity reduction requirements and low carbon fuel supply to the Canadian market. Compliance pathways (e.g., upstream GHG reductions, accumulation of early action credits) and market stability mechanisms (e.g., payment into an emissions reduction fund, market-clearing mechanisms) are expected to provide flexibility to fossil fuel suppliers. Hence, CF Standard credit prices are set at the same level as carbon pricing, which is lower than recent market pricing for North American low carbon fuel standards. Under the CF Standard, the amount of credits generated by low carbon fuel producers depend on the difference in carbon intensity (kgCO

2e/GJ) between the reference (i.e., substituted) fossil fuel and the low carbon fuel. Carbon intensities for fossil fuels and low carbon fuels are provided in

Table 6.

For fossil fuels, preliminary values for the CF Standard [

64] were available for light fuel oil and propane. For other fossil fuels, upstream emissions from GHGenius [

56] were combined with combustion emissions in GHG reporting regulations [

65]. The carbon intensity of wood pellets are highly dependent on the fuel used to dry the feedstock (natural gas or biomass) and transportation to user (mode and distance). The values used in this study reflects the range found in the literature [

66,

67,

68]. We assume the carbon intensity of wood chips to be identical to wood pellets but excludes the pelletization process. In addition to the calculation of carbon intensity for biomass, the carbon or climate neutrality of forest biomass has been the subject of much debate over the last decade [

69,

70,

71] and multiple approaches were proposed to take into account biogenic CO2e emissions and removals when quantifying GHG reductions from harvested wood products, including biofuels [

72]. However, biogenic CO

2 emissions and removals will not be included in the calculation of carbon intensities under the CF Standard and GHG reductions from the substitution of fossil fuels with solid biofuels calculated accordingly in this study.