Abstract

This paper explores the impact of investor sentiment on financial markets in China by taking the quantile causality test. We find that government bond markets, gold markets, and foreign exchange markets are affected by stock investor sentiment, except for in the corporate bond market. In extreme situations, such as excessively optimistic or pessimistic sentiment, these markets will become more vulnerable to suffering from drastic fluctuations. On the contrary, the market return in government bonds, corporate bonds, and foreign exchange also has an influence on stock investor sentiment. Moreover, these links show various asymmetry due to the heterogeneity of different financial markets. Our results are consistent with the noise trader model, which shows the impact of investor sentiment on market returns. Hence, the authorities can sustain the stabilization of financial markets by reducing information asymmetry, guiding the rational sentiment of investors, and increasing effective regulations.

1. Introduction

This paper aims to examine the relationship between stock investor sentiment and the return of other financial markets in China. From the efficient market hypothesis, rational investors will reasonably allocate their portfolios to achieve optimization [1]. Investors will compete, and then asset prices will reach rational equilibrium [2]. However, there are numerous counterexamples that eclipse the traditional perspectives. The U.S. financial markets, as the representative of the most developed markets, often experience extreme situations. The subprime crisis in 2008 caused investor panic and, thus, resulted in the dramatic fluctuation of asset price [3]. This evidence highlights that asset prices are influenced, not only by fundamentals, but also by investor sentiment [4]. Due to the influence of non-market interaction (or social interaction) mechanisms, asset prices often deviate from fundamental levels [5,6]. Investors do not make investment decisions completely based on the fundamental information of assets, but more on intuition and other irrational sentiments [7]. This mechanism makes even developed financial markets more uncertain and unpredictable [8]. Previous studies confirm that investor sentiment in the stock market has strong infectivity and sociality so that the value of other assets, such as bonds [9], gold [10], and foreign exchange markets, may be misjudged [11]. In social interactions, communication and emulation among investors can intensify the contagion of market sentiment. This community behavior results in price distortion under existing information asymmetry [12]. Although many organizations and individuals operate at the level of social responsibility, recognizing the importance and advantages of social responsibility and of sustaining market efficiency in increasing profits, productivity, and performance [13], these tend to be sustainable by maintaining financial security or minimizing negative environmental impacts [14]. Especially in certain extreme pessimistic situations, sentiment in the stock market can lead to drastic fluctuations in other financial markets [15,16], and the authorities cannot maintain market stability and continuity of development. In turn, the performance of these markets is also a remarkable barometer that leads stock investor sentiment to change [17]. Through information in different market environments, external shocks, not only make asset price fluctuate, but also result in stock investors overreacting, and this affects their investment expectations [18]. This bidirectional transmission is regarded as an important factor for the linkage among major financial markets [19]. Hence, investor sentiment plays an important role in the formation of financial market effectiveness. If investor sentiment cannot be reasonably guided, it will be difficult to suppress irrational trading and speculative bubbles and improve market efficiency.

Compared with stock markets in developed countries, individual investors account for a large proportion of Chinese stock investors, which makes the whole market more emotional [20]. With a lack of social responsibility and an awareness of sustaining market efficiency, the individual Chinese investor has an underdeveloped investment education and, thus, they often show irrational investment behavior [21]. Hence, market fluctuation frequently happens, and it is difficult for investor sentiment to be properly guided. Not only do investors make irrational trades in the stock market, but they are also more likely to carry their emotions to other markets [22]. If investor sentiment in the stock market spreads to other markets and causes unexpected fluctuations in China, the pricing and operating efficiency of many financial markets will be damaged. As well as the stock market, the gold, bond, and foreign exchange markets are all financial markets with a large scale in China. If such emotional contagion exists in China, investors who excessively ignore the fundamentals will find it difficult to form the ideal of value investment [23]. Further, Chinese investor sentiment is more sensitive to different financial information, such as the wax and wane of other financial markets. Cao et al. [24] indicate that stock, bond, and foreign exchange markets show a strong correlation in China because investors deal with frequent noise trading based on their intuition rather than reasonable estimation [25]. Regulators will confront more difficulties in sustaining market efficiency and stability. Combining the aforementioned factors, we attempt to study the relationship between investor sentiment in the stock market and other financial markets, including bond, gold, and foreign exchange markets, in order to provide helpful analysis for the authorities to maintain the efficiency and stability of markets.

The contributions of this paper to the existing literature are as follows. To begin with, although previous studies provide comprehensive explanations about the relationship between investor sentiment and financial markets [26,27], these mechanisms cannot fully explain the realities of China. China’s financial market is still in a stage of development and has many distinctions compared with developed markets. It is proposed that the relationship between stock investor sentiment and Chinese financial markets is sensitive to the level investor sentiment [28]. We cannot capture the comprehensive results if we ignore this characteristic [29]. Hence, we analyze the asymmetric relationship between them based on different sentiment levels. Second, we fully consider the heterogeneity of different financial markets. Longstaff [30] points out that the impact of stock investor sentiment on different markets shows discrepancy. Hence, we examine government bonds, corporate bonds, and gold and foreign exchange markets and, thus, give an interpretation for this inconsistency in China. We point out that, except for the corporate bond market, investor sentiment has an impact on the other three markets, and these impacts show different asymmetries. This result is generally consistent with the noise trader model [31], which highlights the positive impact of investor sentiment on market return. Finally, we provide a special perspective for studying the nonlinear relationship between investor sentiment and financial market returns through the quantile causality test.

The remainder of this paper is arranged as follows: The literature review is presented in Section 2. Section 3 shows the theoretical basis. The quantile causality test and data are shown in Section 4 and 5, respectively. Section 6 describes our empirical results. Section 7 summarizes and proposes policy suggestions.

2. Literature Review

The bond, gold, and foreign exchange markets provide channels of asset allocation for investors to meet their sentiment levels. Investors’ judgment is contingent on the future cash flow and potential risks of the company [32], but investors may also overvalue bonds when stock investors are in high spirits, leading to the increasing demand for bonds, thus reducing credit spread [33]. Nayak [9] proves that, given the change of investor sentiment relating to the stock market, the trend of the corporate bond market shows similarity to that of the stock market. Compared with low-yield bonds, high-yield bonds are more likely to be mispriced due to investor sentiment [34]. Furthermore, as Longstaff et al. [35] proposed, government bonds, serving as a safe haven asset, are closely tied to stock market sentiment. Especially when the market sentiment is extremely low, the safety offered by U.S. government bonds has triggered a flight to high-quality bonds [36]. Conversely, the performance of the government bonds of developing countries is relatively sluggish in periods of pessimism [37], but the rising cross-country correlation of interest rate spread means that the government bonds of developed countries cannot fully decouple from the other developing countries during periods of gloomy sentiment [38].

Gold is generally regarded as a hedge or a safe haven [39]. Balcilar et al. [40] hold the results that investor sentiment in the stock market cannot predict the gold return, showing the imperviousness of gold to stock investor sentiment. Piñeiro-Chousa et al. [41] hold that there is no evidence manifesting that causality exists between stock investor sentiment and gold returns. However, Garcia [10] argues that, because investors are susceptible to pessimism in times of economic crisis, they are disheartened by the stock market and turn to hold a higher weighting of gold in their portfolios. Baur and Lucey [42] also suggest that, when investor sentiment in the stock market becomes depressed, gold return has a significant increase, but this correlation will be ephemeral. Souček [43] indicates that the feeble negative correlation between stock and gold returns leads to periods of sentiment uncertainty in the stock market.

The stock and foreign exchange markets are systems that are interactively related [44]. Investor sentiment in the stock market can be contagious and affect expectations in the foreign exchange market and thus change the exchange rate through investment decisions [11,45]. In the process of affecting the stock price, investor sentiment will also change the allocation of investors’ domestic and foreign assets, thus influencing the exchange rate [46]. Moreover, Ozturk and Ciftci [47] prove that Twitter content categorized as stock market sentiment has a time-varying influence on foreign exchange returns. Feuerriegel et al. [48] likewise propose that news sentiment in stock has a certain explanatory power on exchange rate fluctuations. Heiden et al. [49] find that institutional investor sentiment in the stock market can significantly affect foreign exchange returns, but the ability to affect individual investor sentiment is highly volatile. On the contrary, Menkhoff and Rebitzky [50] mention that, in the long run, exchange rates move in a fundamental direction while investor sentiment continues to build unreasonable currency rate expectations. It is also indicated that investor sentiment in the stock market only has a short-lived effect on the exchange rate, while in the long term, investor sentiment is cointegrated with fundamental factors such as interest rate and inflation [51]. Furthermore, Uhl [52] insists that news sentiment in the stock market has nothing to do with exchange rate return.

Most studies propose that, serving as a certain motivation of noise trading, the fluctuation of these financial markets can also influence investor sentiment. Bethke et al. [34] hold that the bad performance of corporate bonds can drive a deterioration in investor sentiment. Balcilar et al. [40] indicate that there is bidirectional causality between gold and investor sentiment. Hau and Rey [44] agree that foreign exchange fluctuation can reflect investor sentiment changes. However, Canbaş and Kandır [53] argue that the causality between asset price and investor sentiment is unidirectional. Qadan and Yagil [54] observe that changes in investor sentiment drive the gold returns, but not vice versa. Caporale et al. [55] further point out that, during non-crisis periods, there is no significant causality between bond price and investor sentiment.

The link between investor sentiment and Chinese government bonds is regarded by Gao and Lin [22] as a predictive factor of the risk premium. Excess optimism in the stock market will spill over into the bond market, where rational investors will hedge against the risk of a bubble, both of which drive up demand for bonds [56]. Zhou et al. [57] indicate that government intervention plays an important role in the relationship between investor sentiment and bond markets in China. When government intervention is implemented, the relationship between them becomes insignificant. Wang et al. [58] hold that, with investor sentiment intervening, stock and corporate bond markets in China move in the same direction. As for the Chinese gold market, Jiang et al. [59] indicate that, in different market conditions, heterogeneous investor sentiments have different effects on gold prices, sometimes completely contradictory. However, gold price increases irrationally, which may generate bubbles when investor confidence falls and apprehension abounds [28]. Gold is still deemed as a reliable hedge or safe-haven asset in China, especially at a time of extreme pessimism [60,61]. Eventually, with regard to the exchange rate market in China, the results also evidence inconsistency. Zhao [62] proposes that investor sentiment in the stock market has no explanatory power for foreign exchange market fluctuation. Liu and Wan [63] argue that there is no causality between investor sentiment and exchange rates in non-crisis periods, while there is a unidirectional causality between them during a financial crisis. When investors are pessimistic about domestic stock markets, large capital outflows lead to strong foreign currencies [64,65]. Chen et al. [66] prove that a nonlinear effect between them exists in the long term, and this link is also affected by foreign exchange intervention. Moreover, some evidence is also provided supporting the idea that market return can also influence investor sentiment in China. Kling and Gao [67] hold that negative market returns are more likely to cause investor sentiment to fall in the relative short-term. Chu et al. [68] indicate that, though there is no linear causality from market returns to investor sentiment, a strong bidirectional nonlinear causality between them exists. Zhang et al. [69] argue that, in non-crisis periods, market returns do not drive investor sentiment changes.

Although previous studies have taken the nonlinear relationship between investor sentiment and market returns into account, few studies pay attention to the influence of investor sentiment on market returns under different sentiment levels or extreme conditions. If the relationship is sensitive to sentiment levels, we cannot capture the comprehensive results without examining different quantile intervals [70]. Moreover, even at the same quantile level, the impact of investor sentiment on market return may be different for different financial markets. In order to cover this deficiency, this paper focuses on the asymmetric effect of investor sentiment on market return at different sentiment levels, and thus examines various market situations based on the heterogeneity of different financial markets.

3. The Interaction Mechanism

According to the noise trader model [31], both rational arbitragers and noise traders exist in the market. Noise traders, driven by irrational emotions, tend to make noise tradings, which results in abnormal changes in the stock price that deviate from the fundamentals. For rational arbitrageurs, the optimal investment strategy is to take advantage of the noise traders’ mistakes and push the price back to the fundamental. However, it does not mean that rational arbitrageurs can achieve their strategy in practice. We assume that there are two kinds of assets in the market, named risk-free assets, s, and risk assets, u, respectively. Both types of asset have a fixed dividend payment, r. Given the normal distribution of the return of risk-free assets, investors choose portfolios to maximize their utility function:

where is the expected return of the portfolio, and the variance is denoted by . represents the absolute risk aversion of investors. Noise traders’ deviation from the expected price of risk assets due to irrational emotions is an independent normally distributed random variable, . Rational arbitragers, i, maximize their utility function by holding the amount, , of risk assets:

Similarly, the utility function of noise traders can be denoted as follows:

Taking the first derivative of and , we have:

The equilibrium price of risk assets can be derived from Equations (4) and (5):

where is the proportion of noise traders in the market. Using recursion, we obtain the formula of pricing risk assets as follows:

When the noise trader faces the market with optimism, the price of the risky asset will rise, and pessimism leads the price to fall. On the other hand, reflects the average expected valuation of all noise traders in the market. With the irrational sentiment of noise traders becoming more extreme, turns out to be larger, which results in a greater deviation between the stock price and its fundamental value. Further, in this paper, if stock investor sentiment can spread to government bond, corporate bond, gold, and foreign exchange markets, it will result in market returns changing in these markets.

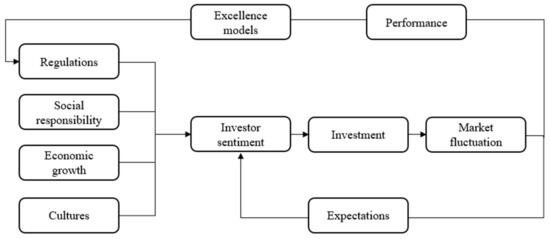

In addition, we also summarize the roles of some external factors in the interaction mechanism between stock investor sentiment and market returns. Changes in policies and regulations alter investors’ perspectives of market trends along with their investment behavior [4]. The authorities assess the efficiency of regulations and make adjustments according to market performance and the criterion of some excellence models [71]. Recognizing the importance and advantages of social responsibility and of sustaining market efficiency in increasing profits, productivity, and performance, many organizations and individuals make their investments at the level of social responsibility. This reduces the emergence of extreme investment sentiments and decreases market fluctuations [21,72]. A slowdown in economic growth can lead to pessimistic expectations of investors about the future and overreaction to their investment behavior, which can cause market fluctuations [73]. Moreover, the cultural traits of different regions potentially have an influence on investor sentiment and lead to market changes. A conservative personality and investment style may be more prone to pessimism [74]. Figure 1 shows these external factors in the interaction mechanism between stock investor sentiment and market returns.

Figure 1.

External factors in the interaction mechanism between stock investor sentiment and market returns.

4. Quantile Granger Causality Test

Defining as the - the quantile of the conditional distribution function , we examine the causal relationship of the distribution according to the conditional quantile:

We assume that , , and . Then the linear conditional quantile model can be expressed as:

Based on the conclusion of Koenker and Bassett [75], under appropriate assumptions, asymptotically follows a normal distribution. Therefore, when testing the null hypothesis that random variable, x, does not Granger cause y, only the significance of the parameter vector as the zero vector needs to be tested:

With the given value of , the Wald statistic of , for is:

where indicates a selection matrix. However, the Wald test is not reliable because the fixed τ is required. Hence, a sup-Wald test is proposed by Koenker and Machado [70] to solve this problem. Resorting to denote a vector of q-independent Brownian bridges, , we can estimate:

In order to test the null hypothesis, Koenker and Machado [70] suggest that the significance of the coefficient should be tested by calculating the maximum Wald statistic at different quantile levels, namely sup-Wald statistic. The Wald statistic shows uniformity in compact set :

where is the Euclidean norm and represents weakly convergence. Hence, we can estimate the limitation properties of sup-Wald statistic:

When τ is close to 0 or 1, the value of approaches infinity. Hence we should denote as a close set of . Taking different intervals to conduct the sup-Wald statistic test, we capture the causal links derived from various quantile ranges. De Long [76] and Andrews [77] propose that the critical values of a sup-Wald statistic can be estimated through standard Brownian motion.

Compared to the traditional Granger causality test (GC), the Quantile Granger causality test (QGC) provides advanced insights to delineate the causality. The disadvantage of GC is that, without carrying over to other distribution characteristics, the empirical results are unreliable due to the sensitivity to data sets and variable selection [78,79]. The properties rely very much on the assumption of normal distribution, which makes the conclusions of the test more questionable [80]. For QGC, the test is not only permitted to examine the causality on the mean of conditional distribution but is also extended to test the causality of variables on different conditional quantiles. The results are more robust for outliers and more effective for non-normal distributions [81]. Moreover, based on the excellent features of QGC, we indicate that QGC is suitable to describe more accurately the relationship between investor sentiment in the stock market and returns in other financial markets. In particular, we aim to explore whether market returns will be affected when investor sentiment is at different levels.

5. Data

We conduct the study using monthly data from July 2005 to April 2019. Since July 2005, China began to implement a managed floating exchange rate system, which is based on the supply and demand of the foreign exchange market [62]. Meanwhile, the emergence of commercial paper in 2005 became the prelude to the explosion of the corporate bond market. The People’s Bank of China (PBOC) allowed all institutional investor, including commercial banks, to invest corporate bonds, laying a foundation for the development of the bond market [82]. Moreover, the Amendment to Securities Law of the PBOC in 2005 strengthened the protection of individual investors, which led to investor sentiment being in tune with market trends. We resort to government bond index [83], corporate bond index [84], gold price [85], and the basic rate of the Renminbi (RMB) against the U.S. dollar (USD) [86] to represent the government bond price (GB), corporate bond price (CB), gold price (GT), and exchange rate (ER), respectively. According to Table 1, these four series are transformed by taking the first logarithmic difference and can then be regarded as the return of the market. The investor sentiment index is constructed based on the proposed method of Baker and Wurgler [19], and we use this index with the aim of representing Chinese stock investor sentiment (IS) [87]. These comprehensively consider the discount of closed-end fund, turnover rate, and other key factors to delineate the measurement, and all components data are captured from the A-share market of China. It is also indicated that the trend of IS is generally consistent with that of the Chinese stock market. During the bull market in 2006 and 2014, IS remained at a high level. Accordingly, it stayed at a low level in the bear market in 2008 and 2015. All data come from the Shanghai Stock Exchange and the Shanghai Gold Exchange.

Table 1.

Unit Root Test Results.

6. Empirical Analysis

We tested the Granger causality between IS and each market return based on the bivariate VAR model, and the results are showed in Table 2. The listed p-values illustrate that IS does not cause any market returns, except in CB. These conclusions are generally inconsistent with the noise trader model [29] and other previous studies [10,11,35], which hold that IS can influence GB, GT, and ER.

Table 2.

Granger Causality Test.

However, such results are hardly convincing because the traditional assumption in previous studies holds that there is only simple linear causality in the series [67]. Actually, the relationship between the series may be affected by various external factors, thus presenting nonlinear characteristics [88]. Hence, we further examine whether a nonlinear relationship exists by taking the Brock, Dechert, and Scheinkman (BDS) test [89]. The results of the BDS test are shown in Table 3. We find that all the null hypotheses that the residual series is an independent identical distribution are rejected, which means that there is a nonlinear relationship between two sequences.

Table 3.

Brock, Dechert, and Scheinkman (BDS) Test.

Through the above analysis, the results of the traditional Granger causality test are unreliable, thus we consider resorting to the quantile causality test to explore the further relationship in this series. IS is rearranged from the minimum to the maximum and divided into eight quantile intervals [0.05, 0.95], [0.05, 0.5], [0.5, 0.95], [0.05, 0.2], [0.2, 0.4], [0.4, 0.6], [0.6, 0.8], and [0.8, 0.95]. The intervals of low quartile, such as [0.05, 0.2], represent a period with a low IS level (pessimistic). Accordingly, [0.8, 0.95] includes a high level of IS (optimistic). Before the quantile causality test, the optimal lag, , of each interval should be determined. Taking the IS and GB, for example, if the null hypothesis, , is rejected when is an interval specified above, we will conclude that has an impact on . Hence, the optimal lag, , will be defined as q. The sup-Wald test is applied to test the joint significance for all coefficients of lagged IS for each interval. The null hypothesis becomes for after the optimal lag is confirmed. According to Table 4, we obtain the test results by conducting 20,000 bootstrap replications to enhance the precision.

Table 4.

Quantiles Causality Results.

Through the quantile causality test, we find that when IS is within the intervals of [0.05, 0.5], [0.05, 0.2], and [0.8, 0.95], the null hypothesis that IS does not Granger cause GB can be rejected. That is, IS has an impact on GB when IS is at the extremes. This phenomenon can be explained by the evidence of short-term capital flow and expectation of future interest rate orientation. First, as a safe haven asset, Chinese government bonds show a robust capability to avoid risk for investors [90]. Due to the high credit level and low volatility of government bonds, investors choose government bonds rather than stocks in periods of pessimism, which increases the relative demand for government bonds. Similarly, attracted by the high returns of the stock market, the capital from the government bond market flows into the stock market when investor sentiment is at a high level [91]. This mechanism contributes to the short-term negative correlation between stock investor sentiment and government bond price. On the other hand, the sentiment of stock investors affects their judgment of future interest rates. Pessimism predicts the contraction of the real economy and shapes expectations of interest rate increases, leading to the depression of the price of long-term government bonds [36]. Especially in recent years, monetary policy of China begins to shift from loose to prudent, leading to a moderate rise in the interest rate of social financing and a gradual tightening of social liquidity. Such expectations of interest rate are more susceptible to macro factors [92]. Moreover, there is an obvious information asymmetry between the stock investors and the government bond market in China. The investors are more likely to be affected by their own emotions when they make investment decisions that often ignore the fundamentals. Frequent irrational trading also leads to the fluctuation of the government bond market [73]. However, with regards to the corporate bond market, our empirical results show inconsistency against the government bond market. The null hypothesis that IS does not Granger cause CB cannot be rejected in all quantile intervals, which means stock investor sentiment does not have any influence on the corporate bond market. Compared to the safe-haven characteristics of government bonds, investors’ judgment on future risks of corporate bonds is based on future cash flow and the potential risks of enterprises. In China, however, this similarity does not cause a capital interaction effect between stock and corporate bonds through investor sentiment. To begin with, Chinese enterprises and individual investors are keen on equity investment [93]. When investor sentiment is relatively high, investors are more likely to be overly optimistic in judging the stock price. In contrast, other relatively rational investors with higher risk aversion prefer the corporate bond market, where returns are guaranteed and risks are relatively low [82]. In periods of pessimism, safe-haven government bonds tend to be a better choice than corporate bonds, which have semblable risk exposure with stocks [94].

As for the gold market, the quantile intervals of IS are [0.05, 0.5] and [0.05, 0.2] when the null hypothesis that IS does not Granger cause GT is rejected. It means that only when IS is at a relatively low level can GT be influenced. The sentiment effect is channeled particularly at extreme low quantiles, implying that investor depression contributes to changes in gold trading. It is widely confirmed that an increase in gold trading usually results from a rise in investor risk aversion, which generally appears in the capital market turmoil and the downturn trend of the economy [56,95]. When stock market investors are depressed, they tend to lose confidence in future capital markets. Instead, as a result of the countercyclical nature of gold, they tend to add gold to their portfolios in order to hedge risks [42]. Unlike large scale international gold markets, China’s gold market is still dominated by spot trading rather than futures trading. This leads the gold price to move towards investor sentiment more conspicuously [96]. In addition, we also conclude that the impact of investor sentiment on the gold market in China has a typical characteristic of asymmetry. Positive sentiment has an insignificant effect on the gold market compared with negative sentiment. Some evidence shows that participants in the gold market initially overreact to negative stock market information but this is reversed in subsequent periods, manifesting as a contemporaneous effect of negative sentiment [97]. For positive sentiment, stock investors tending to add weights of risk assets weakens the role of gold as a safe haven [98].

We also examine the relationship between IS and ER. According to our results, there are significant effects of IS on ER when IS is in the intervals of [0.05, 0.95], [0.05, 0.5], [0.5, 0.95], [0.05, 0.2], and [0.8, 0.95]. It is illustrated that ER can be influenced when IS is extremely optimistic or pessimistic. Since the reform of the exchange rate in 2005, the effectiveness of China’s monetary authorities to ensure the relative stability of the exchange rate through foreign exchange market intervention has gradually declined [62]. Although the authorities step up intervention in some extreme situations, such as the subprime crisis in 2008 when the Renminbi was forced to be pegged to the US dollar, the trend of liberalization of the foreign exchange market is inevitable, which provides the institutional basis for the contagion of stock investor sentiment [99]. From the perspective of capital flow, high stock investor sentiment may stimulate capital inflows to the stock market, including international capital, which increases the demand for the Renminbi in the foreign exchange market. Depressed sentiment leads to capital escape, which means depreciation pressure on the Renminbi [92]. Sentiment in the stock market will change the allocation in domestic and foreign assets, which also affects demand for the Renminbi [46]. On the other hand, according to the theory of investor heterogeneity [100], when extreme sentiments appear in the domestic stock market, the proportion of noise traders increases, thus more irrational trading aggravates the degree of stock price mismatch. Some international investors will be attracted by this phenomenon and then enter into the domestic stock market to arbitrage [101]. Hence, the foreign exchange market will be affected. In addition, because investor sentiment in the Chinese stock market is vulnerable to bombshells and unexpected shocks, stock prices often deviate from the fundamentals [102]. This mechanism exists in the long term, which also shows the close links between these two markets [44,65].

As a byproduct of our analysis, the effects of GB, CB, GT, and ER on IS are also explored. Our results point out that when GB, CB, and ER become extremely optimistic or pessimistic, IS will be influenced. Given that government bonds are the main tool of asset allocation in different periods of the economic cycle, changes in stock investor sentiment can be reflected through fluctuations of the government bond market [89]. For example, with the depression of the macroeconomy in China, the "flight-to-quality" phenomenon results in stock market capital leaking into the government bond market, exacerbating the pessimistic sentiment in the stock market [103]. This can be supported by evidence that indicates the negative correlation between government bonds and stock in China [90]. Taking corporate bonds into account, the performance of CB represents a reflection of the overall listed companies’ operating conditions. If a company suffers from deteriorating operation and declining solvency, investors’ expectations for its stock will also be pessimistic [104]. This mechanism makes a short-term linkage manifest between the stock market and the corporate bond market in China [105]. As for ER, IS is driven by the strength of the Renminbi. With the appreciation of the Renminbi, international capital flows into the domestic stock market. This positive stimulation leads stock investor to generate more optimistic sentiment [106]. In addition, there is no significant impact of GT on IS. It is indicated that market returns of gold are driven by investor sentiment, and the effect is unidirectional rather than a feedback mechanism [97]. To sum up, the wax and wane of major financial markets can affect stock market investors’ expectations and thus affect their investment behaviors [107]. From this perspective, we have reasonable evidence to support the idea that stock investor sentiment can be regarded as a systematic factor that influences the financial system [108]. Because of the aforementioned links between stock market investor sentiment and different financial markets, sustainable market efficiency in some excellence models cannot be realized simply by implementation of management systems. In order to ensure the favorable investment environment and avoid the drastic fluctuations of markets, all segments of society (regulators, corporates, individuals, etc.) should make efforts to achieve their own patterns of excellence.

Through the quantile Granger causality test, we provide a perspicacious insight into the relationship between IS and other major financial markets. We find that the other three markets, including GB, GT, and ER, are influenced by IS, except for CB. The results of these three markets are consistent with the noise trader model, which emphasizes the influence of investor sentiment on market return [31]. This effect shows heterogeneity in different markets, which can be explained by whether the characteristics of safe-haven or the similar risk exposure with the stock market exists in this market. There is an asymmetric impact on market returns for different levels of investor sentiment. Moreover, we emphasize that IS will also be influenced by GB, C, and ER, indicating that investors in China are vulnerable to market information. This phenomenon is attributed to stock investors’ overreaction to other market information.

7. Conclusions

We examined the causality between stock investor sentiment and another four major financial markets in China. We found that, though the traditional Granger causality test shows there is no relationship between them, the BDS and quantile causality tests provide a novel perspective, indicating that IS can influence the other three markets that include GB, GT, and ER. Due to investor heterogeneity and similar risk exposure with stock, CB manifests no significant link with IS. The relationship with IS also shows multiformity among the other three markets. The asymmetry effect of IS on GT can be attributed to gold’s counter-cyclical nature and weakened its role as a safe haven in optimistic periods. IS has an impact on GB when IS is at the extremes. This phenomenon can be explained by the evidence of short-term capital flow and expectation of future interest rate orientation. ER can be influenced when IS is both extremely optimistic and pessimistic. This result is ascribed to the trend of the liberalization of the foreign exchange market, the international capital flow, and arbitrageurs. We conclude that stock market sentiment, as an insidious factor, impacts the stability and efficiency of other financial markets. Conversely, GB, CB, and ER also have an influence on IS when these markets face extreme optimistic or pessimistic situations. The information from these markets might be over-interpreted by fickle investors. The wax and wane of major financial markets can affect stock market investors’ expectations and thus affect their investment behaviors. Our results are generally confirmed with the noise trader model [31], which shows the positive impact of investor sentiment on market returns. Hence, guiding the rational sentiment of stock investors on other markets can be conducive to sustaining the effectiveness of the financial markets in China. The authorities should take appropriate measures in response to market forces to avoid sharp fluctuations in stock investor sentiment. An effective and mature stock market should be established by reducing information asymmetry and guiding the rational sentiment of investors in order to maintain the stability of the other financial markets. To summarize, to explore whether different levels of stock investor sentiment have an impact on other markets (e.g.; stock investor sentiment and cryptocurrency market), not necessarily in the case of China, serves as a continuous stimulus for future studies. Moreover, we should consider whether the time-varying effects of stock investor sentiment exist in these markets, which this paper does not examine. These further works can help comprehensively capture the relationship between stock investor sentiment and different markets.

Author Contributions

C.-W.S. and X.-Y.C. provided conceptualization, formal analysis, data curation, writing—original draft preparation, writing—review and editing; R.T. provided visualization, supervision, and project administration. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Malkiel, B.G. The efficient market hypothesis and its critics. J. Econ. Perspect. 2003, 17, 59–82. [Google Scholar] [CrossRef]

- Shleifer, A.; Summers, L.H. The noise trader approach to finance. J. Econ. Perspect. 1990, 4, 19–33. [Google Scholar] [CrossRef]

- Yuan, Y.; Zhuang, X.T.; Jin, X. Measuring multifractality of stock price fluctuation using multifractal detrended fluctuation analysis. Phys. A Stat. Mech. Appl. 2009, 388, 2189–2197. [Google Scholar] [CrossRef]

- Hirshleifer, D. Behavioral finance. Annu. Rev. Financ. Econ. 2015, 7, 133–159. [Google Scholar] [CrossRef]

- Aissia, D.B. Home and foreign investor sentiment and the stock returns. Q. Rev. Econ. Financ. 2016, 59, 71–77. [Google Scholar] [CrossRef]

- Sayim, M.; Rahman, H. The relationship between individual investor sentiment, stock return and volatility: Evidence from the Turkish market. Int. J. Emerg. Mark. 2015, 10, 504–520. [Google Scholar] [CrossRef]

- Dimic, N.; Neudl, M.; Orlov, V.; Äijö, J. Investor sentiment, soccer games and stock returns. Res. Int. Bus. Financ. 2018, 43, 90–98. [Google Scholar] [CrossRef]

- Lamont, O.A.; Stein, J.C. Investor sentiment and corporate finance: Micro and macro. Am. Econ. Rev. 2006, 96, 147–151. [Google Scholar] [CrossRef]

- Nayak, S. Investor sentiment and corporate bond yield spreads. Rev. Behav. Financ. 2010, 2, 59–80. [Google Scholar] [CrossRef]

- Garcia, D. Sentiment during recessions. J. Financ. 2013, 68, 1267–1300. [Google Scholar] [CrossRef]

- Dieci, R.; Westerhoff, F. Heterogeneous speculators, endogenous fluctuations and interacting markets: A model of stock prices and exchange rates. J. Econ. Dyn. Control 2010, 34, 743–764. [Google Scholar] [CrossRef]

- Talbi, M.; Halima, A.B. Global Contagion of Investor Sentiment during the US Subprime Crisis: The Case of the USA and the Region of Latin America. Int. J. Econ. Financ. Issues 2019, 9, 163–174. [Google Scholar] [CrossRef]

- Popescu, C.R.G.; Popescu, G.N. An exploratory study based on a questionnaire concerning green and sustainable finance, corporate social responsibility, and performance: Evidence from the Romanian business environment. J. Risk Financ. Manag. 2019, 12, 162. [Google Scholar] [CrossRef]

- Lagoarde-Segot, T. Sustainable finance. A critical realist perspective. Res. Int. Bus. Financ. 2019, 47, 1–9. [Google Scholar] [CrossRef]

- Jouini, E.; Napp, C. Unbiased disagreement in financial markets, waves of pessimism and the risk-return trade-off. Rev. Financ. 2010, 15, 575–601. [Google Scholar] [CrossRef]

- Su, C.W.; Li, Z.Z.; Chang, H.L.; Lobonţ, O.R. When will occur the crude oil bubbles? Energy Policy 2017, 102, 1–6. [Google Scholar] [CrossRef]

- Blasco, N.; Corredor, P.; Ferreruela, S. Market sentiment: A key factor of investors’ imitative behaviour. Account. Financ. 2012, 52, 663–689. [Google Scholar] [CrossRef]

- Li, Q.; Wang, T.; Li, P.; Liu, L.; Gong, Q.; Chen, Y. The effect of news and public mood on stock movements. Inf. Sci. 2014, 278, 826–840. [Google Scholar] [CrossRef]

- Baker, M.; Wurgler, J. Investor sentiment and the cross-section of stock returns. J. Financ. 2006, 61, 1645–1680. [Google Scholar] [CrossRef]

- Bailey, W.; Cai, J.; Cheung, Y.L.; Wang, F. Stock returns, order imbalances, and commonality: Evidence on individual, institutional, and proprietary investors in China. J. Bank. Financ. 2009, 33, 9–19. [Google Scholar] [CrossRef]

- Wang, M.; Qiu, C.; Kong, D. Corporate social responsibility, investor behaviors, and stock market returns: Evidence from a natural experiment in China. J. Bus. Ethics 2011, 101, 127–141. [Google Scholar] [CrossRef]

- Gao, K.; Lin, W. Margin trading, short selling, and bond yield spread. China J. Account. Res. 2018, 11, 51–70. [Google Scholar] [CrossRef]

- Shi, Y.; Tang, Y.R.; Long, W. Sentiment contagion analysis of interacting investors: Evidence from China’s stock forum. Phys. A Stat. Mech. Appl. 2019, 523, 246–259. [Google Scholar] [CrossRef]

- Cao, G.; Cao, J.; Xu, L.; He, L. Detrended cross-correlation analysis approach for assessing asymmetric multifractal detrended cross-correlations and their application to the Chinese financial market. Phys. A Stat. Mech. Appl. 2014, 393, 460–469. [Google Scholar] [CrossRef]

- Hu, C.; Wang, Y. Noise trading and stock returns: Evidence from China. China Financ. Rev. Int. 2013, 3, 301–315. [Google Scholar] [CrossRef]

- Barberis, N.; Shleifer, A.; Vishny, R. A model of investor sentiment. J. Financ. Econ. 1998, 49, 307–343. [Google Scholar] [CrossRef]

- Brown, G.W.; Cliff, M.T. Investor sentiment and the near-term stock market. J. Empir. Financ. 2004, 11, 1–27. [Google Scholar] [CrossRef]

- Pan, W.F. Sentiment and asset price bubble in the precious metals markets. Financ. Res. Lett. 2018, 26, 106–111. [Google Scholar] [CrossRef]

- Su, C.W.; Khan, K.; Tao, R.; Nicoleta-Claudia, M. Does geopolitical risk strengthen or depress oil prices and financial liquidity? Evidence from Saudi Arabia. Energy 2019, 187, 116003. [Google Scholar] [CrossRef]

- Longstaff, F.A. The subprime credit crisis and contagion in financial markets. J. Financ. Econ. 2010, 97, 436–450. [Google Scholar] [CrossRef]

- De Long, J.B.; Shleifer, A.; Summers, L.H.; Waldmann, R.J. Noise trader risk in financial markets. J. Political Econ. 1990, 98, 703–738. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Common risk factors in the returns on stocks and bonds. J. Financ. Econ. 1993, 33, 3–56. [Google Scholar] [CrossRef]

- Downing, C.; Underwood, S.; Xing, Y. The relative informational efficiency of stocks and bonds: An intraday analysis. J. Financ. Quant. Anal. 2009, 44, 1081–1102. [Google Scholar] [CrossRef]

- Bethke, S.; Gehde-Trapp, M.; Kempf, A. Investor sentiment, flight-to-quality, and corporate bond comovement. J. Bank. Financ. 2017, 82, 112–132. [Google Scholar] [CrossRef]

- Longstaff, F.A.; Pan, J.; Pedersen, L.H.; Singleton, K.J. How sovereign is sovereign credit risk? Am. Econ. J. Macroecon. 2011, 3, 75–103. [Google Scholar] [CrossRef]

- Laborda, R.; Olmo, J. Investor sentiment and bond risk premia. J. Financ. Mark. 2014, 18, 206–233. [Google Scholar] [CrossRef]

- Miyajima, K.; Mohanty, M.S.; Chan, T. Emerging market local currency bonds: Diversification and stability. Emerg. Mark. Rev. 2015, 22, 126–139. [Google Scholar] [CrossRef]

- Csontó, B. Emerging market sovereign bond spreads and shifts in global market sentiment. Emerg. Mark. Rev. 2014, 20, 58–74. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is gold a safe haven? International evidence. J. Bank. Financ. 2010, 34, 1886–1898. [Google Scholar] [CrossRef]

- Balcilar, M.; Bonato, M.; Demirer, R.; Gupta, R. The effect of investor sentiment on gold market return dynamics: Evidence from a nonparametric causality-in-quantiles approach. Resour. Policy 2017, 51, 77–84. [Google Scholar] [CrossRef]

- Piñeiro-Chousa, J.; López-Cabarcos, M.Á.; Pérez-Pico, A.M.; Ribeiro-Navarrete, B. Does social network sentiment influence the relationship between the S&P 500 and gold returns? Int. Rev. Financ. Anal. 2018, 57, 57–64. [Google Scholar]

- Baur, D.G.; Lucey, B.M. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financ. Rev. 2010, 45, 217–229. [Google Scholar] [CrossRef]

- Souček, M. Crude oil, equity and gold futures open interest co-movements. Energy Econ. 2013, 40, 306–315. [Google Scholar] [CrossRef]

- Hau, H.; Rey, H. Exchange rates, equity prices, and capital flows. Rev. Financ. Stud. 2005, 19, 273–317. [Google Scholar] [CrossRef]

- He, X.Z.; Westerhoff, F.H. Commodity markets, price limiters and speculative price dynamics. J. Econ. Dyn. Control 2005, 29, 1577–1596. [Google Scholar] [CrossRef]

- French, J. Asset pricing with investor sentiment: On the use of investor group behavior to forecast ASEAN markets. Res. Int. Bus. Financ. 2017, 42, 124–148. [Google Scholar] [CrossRef]

- Ozturk, S.S.; Ciftci, K. A sentiment analysis of twitter content as a predictor of exchange rate movements. Rev. Econ. Anal. 2014, 6, 132–140. [Google Scholar]

- Feuerriegel, S.; Wolff, G.; Neumann, D. News sentiment and overshooting of exchange rates. Appl. Econ. 2016, 48, 4238–4250. [Google Scholar] [CrossRef]

- Heiden, S.; Klein, C.; Zwergel, B. Beyond fundamentals: Investor sentiment and exchange rate forecasting. Eur. Financ. Manag. 2013, 19, 558–578. [Google Scholar] [CrossRef]

- Menkhoff, L.; Rebitzky, R.R. Investor sentiment in the US-dollar: Longer-term, non-linear orientation on PPP. J. Empir. Financ. 2008, 15, 455–467. [Google Scholar] [CrossRef]

- Papapostolou, N.C.; Pouliasis, P.K.; Nomikos, N.K.; Kyriakou, I. Shipping investor sentiment and international stock return predictability. Transp. Res. Part E: Logist. Transp. Rev. 2016, 96, 81–94. [Google Scholar] [CrossRef]

- Uhl, M.W. Emotions matter: Sentiment and momentum in foreign exchange. J. Behav. Financ. 2017, 18, 249–257. [Google Scholar] [CrossRef]

- Canbaş, S.; Kandır, S.Y. Investor sentiment and stock returns: Evidence from Turkey. Emerg. Mark. Financ. Trade 2009, 45, 36–52. [Google Scholar] [CrossRef]

- Qadan, M.; Yagil, J. Fear sentiments and gold price: Testing causality in-mean and in-variance. Appl. Econ. Lett. 2012, 19, 363–366. [Google Scholar] [CrossRef]

- Caporale, G.M.; Spagnolo, F.; Spagnolo, N. Macro news and bond yield spreads in the euro area. Eur. J. Financ. 2018, 24, 114–134. [Google Scholar] [CrossRef]

- Lee, K.; Kim, M. Investor sentiment and bond risk premia: Evidence from China. Emerg. Mark. Financ. Trade 2019, 55, 915–933. [Google Scholar] [CrossRef]

- Zhou, Y.; Han, L.; Yin, L. Is the relationship between gold and the US dollar always negative? The role of macroeconomic uncertainty. Appl. Econ. 2018, 50, 354–370. [Google Scholar] [CrossRef]

- Wang, L.; Nie, C.; Wang, S. A new credit spread to predict economic activities in China. J. Syst. Sci. Complex. 2019, 32, 1140–1166. [Google Scholar] [CrossRef]

- Jiang, W.; Luan, P.; Yang, C. The study of the price of gold futures based on heterogeneous investors’ overconfidence. China Financ. Rev. Int. 2014, 4, 24–41. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Lahiani, A.; Nguyen, D.K. World gold prices and stock returns in China: Insights for hedging and diversification strategies. Econ. Model. 2015, 44, 273–282. [Google Scholar] [CrossRef]

- Dee, J.; Li, L.; Zheng, Z. Is gold a hedge or a safe haven? Evidence from inflation and stock market. Int. J. Dev. Sustain. 2013, 2, 1–16. [Google Scholar]

- Zhao, H. Dynamic relationship between exchange rate and stock price: Evidence from China. Res. Int. Bus. Financ. 2010, 24, 103–112. [Google Scholar] [CrossRef]

- Liu, L.; Wan, J. The relationships between Shanghai stock market and CNY/USD exchange rate: New evidence based on cross-correlation analysis, structural cointegration and nonlinear causality test. Phys. A Stat. Mech. Appl. 2012, 391, 6051–6059. [Google Scholar] [CrossRef]

- Han, L.; Wu, Y.; Yin, L. Investor attention and currency performance: International evidence. Appl. Econ. 2018, 50, 2525–2551. [Google Scholar] [CrossRef]

- Sui, L.; Sun, L. Spillover effects between exchange rates and stock prices: Evidence from BRICS around the recent global financial crisis. Res. Int. Bus. Financ. 2016, 36, 459–471. [Google Scholar] [CrossRef]

- Chen, H.; Chong, T.T.L.; She, Y. A principal component approach to measuring investor sentiment in China. Quant. Financ. 2014, 14, 573–579. [Google Scholar] [CrossRef]

- Kling, G.; Gao, L. Chinese institutional investors’ sentiment. J. Int. Financ. Mark. Inst. Money 2008, 18, 374–387. [Google Scholar] [CrossRef]

- Chu, X.; Wu, C.; Qiu, J. A nonlinear Granger causality test between stock returns and investor sentiment for Chinese stock market: A wavelet-based approach. Appl. Econ. 2016, 48, 1915–1924. [Google Scholar] [CrossRef]

- Zhang, Q.; Deng, M.; Yang, S. Does investor sentiment and stock return affect each other: (S) VAR model approach. Int. J. Manag. Sci. Eng. Manag. 2010, 5, 334–340. [Google Scholar] [CrossRef]

- Koenker, R.; Machado, J.A. Goodness of fit and related inference processes for quantile regression. J. Am. Stat. Assoc. 1999, 94, 1296–1310. [Google Scholar] [CrossRef]

- Popescu, C.R.; Popescu, G.N.; Popescu, V.A. Assessment of the State of Implementation of Excellence Model Common Assessment Framework (CAF) 2013 by the National Institutes of Research–Development–Innovation in Romania. Amfiteatru Econ. 2017, 19, 41–60. [Google Scholar]

- Popescu, C.R. The Role of Total Quality Management in Developing the Concept of Social Responsibility to Protect Public Interest in Associations of Liberal Professions. Amfiteatru Econ. 2017, 19, 1091–1106. [Google Scholar]

- Dimson, E.; Marsh, P.; Staunton, M. Irrational optimism. Financ. Anal. J. 2004, 60, 15–25. [Google Scholar] [CrossRef]

- Aggarwal, R.; Kearney, C.; Lucey, B. Gravity and culture in foreign portfolio investment. J. Bank. Financ. 2012, 36, 525–538. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G., Jr. Regression quantiles. Econometrica 1978, 46, 33–50. [Google Scholar] [CrossRef]

- De Long, D.M. Crossing probabilities for a square root boundary by a Bessel process. Commun. Stat. Theory Methods 1981, 10, 2197–2213. [Google Scholar] [CrossRef]

- Andrews, D.W. Tests for parameter instability and structural change with unknown change point. Econom. J. Econom. Soc. 1993, 61, 821–856. [Google Scholar] [CrossRef]

- Su, C.W.; Wang, X.Q.; Tao, R.; Oana-Ramona, L. Do oil prices drive agricultural commodity prices? Further evidence in a global bio-energy context. Energy 2019, 172, 691–701. [Google Scholar] [CrossRef]

- Tsai, I.C. The relationship between stock price index and exchange rate in Asian markets: A quantile regression approach. J. Int. Financ. Mark. Inst. Money 2012, 22, 609–621. [Google Scholar] [CrossRef]

- Gebka, B.; Wohar, M.E. Causality between trading volume and returns: Evidence from quantile regressions. Int. Rev. Econ. Financ. 2013, 27, 144–159. [Google Scholar] [CrossRef]

- Troster, V. Testing for Granger-causality in quantiles. Econom. Rev. 2018, 37, 850–866. [Google Scholar] [CrossRef]

- Dhawan, R.; Yu, F. Are credit ratings relevant in China’s corporate bond market? Chin. Econ. 2015, 48, 235–250. [Google Scholar] [CrossRef]

- Lucey, B.M.; Li, S. What precious metals act as safe havens, and when? Some US evidence. Appl. Econ. Lett. 2015, 22, 35–45. [Google Scholar] [CrossRef]

- Xu, S.; Gong, G.; Gong, X. Accruals quality, underwriter reputation, and corporate bond underpricing: Evidence from China. China J. Account. Res. 2017, 10, 317–339. [Google Scholar] [CrossRef]

- Bedoui, R.; Braeik, S.; Goutte, S.; Guesmi, K. On the study of conditional dependence structure between oil, gold and USD exchange rates. Int. Rev. Financ. Anal. 2018, 59, 134–146. [Google Scholar] [CrossRef]

- Cao, G.; Xu, L.; Cao, J. Multifractal detrended cross-correlations between the Chinese exchange market and stock market. Phys. A Stat. Mech. Appl. 2012, 391, 4855–4866. [Google Scholar] [CrossRef]

- Zhu, B.; Niu, F. Investor sentiment, accounting information and stock price: Evidence from China. Pac. Basin Financ. J. 2016, 38, 125–134. [Google Scholar] [CrossRef]

- Bekiros, S.; Gupta, R.; Kyei, C. A non-linear approach for predicting stock returns and volatility with the use of investor sentiment indices. Appl. Econ. 2016, 48, 2895–2898. [Google Scholar] [CrossRef]

- Brock, W.A.; Scheinkman, J.A.; Dechert, W.D.; LeBaron, B. A test for independence based on the correlation dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- Lee, H.; Lee, K.; Zhang, X. Time-varying comovement of Chinese stock and gvernment bond markets: Flight to safe haven. Emerg. Mark. Financ. Trade 2019, 55, 3058–3068. [Google Scholar] [CrossRef]

- Kolluri, B.; Wahab, S.; Wahab, M. An examination of co-movements of India’s stock and government bond markets. J. Asian Econ. 2015, 41, 39–56. [Google Scholar] [CrossRef]

- Chang, C.; Liu, Z.; Spiegel, M.M. Capital controls and optimal Chinese monetary policy. J. Monet. Econ. 2015, 74, 1–15. [Google Scholar] [CrossRef]

- Lin, J.; An, Y.; Yang, J.; Liang, Y. Price inversion and post lock-up period returns on private investments in public equity in China: An interest transfer perspective. J. Corp. Financ. 2019, 54, 47–84. [Google Scholar] [CrossRef]

- Chen, A.H.; Mazumdar, S.C.; Surana, R. China’s corporate bond market development: Security design implications of information asymmetry. Chin. Econ. 2011, 44, 6–33. [Google Scholar] [CrossRef]

- Parisi, A.; Parisi, F.; Díaz, D. Forecasting gold price changes: Rolling and recursive neural network models. J. Multinatl. Financ. Manag. 2008, 18, 477–487. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C.; Jiang, Z.Q.; Stanley, H.E. Extreme risk spillover effects in world gold markets and the global financial crisis. Int. Rev. Econ. Financ. 2016, 46, 55–77. [Google Scholar] [CrossRef]

- Smales, L.A. Asymmetric volatility response to news sentiment in gold futures. J. Int. Financ. Mark. Inst. Money 2015, 34, 161–172. [Google Scholar] [CrossRef]

- Chen, K.; Wang, M. Does gold act as a hedge and a safe haven for China’s stock market? Int. J. Financ. Stud. 2017, 5, 18. [Google Scholar] [CrossRef]

- Tang, B. Real exchange rate and economic growth in China: A cointegrated VAR approach. China Econ. Rev. 2015, 34, 293–310. [Google Scholar] [CrossRef]

- Opie, W.; Zhang, H.F. Investor heterogeneity and the cross-sectional stock returns in China. Pac. -Basin Financ. J. 2013, 25, 1–20. [Google Scholar] [CrossRef]

- Ho, K.Y.; Shi, Y.; Zhang, Z. Does news matter in China’s foreign exchange market? Chinese RMB volatility and public information arrivals. Int. Rev. Econ. Financ. 2017, 52, 302–321. [Google Scholar] [CrossRef]

- Li, X.; Xie, H.; Chen, L.; Wang, J.; Deng, X. News impact on stock price return via sentiment analysis. Knowl. -Based Syst. 2014, 69, 14–23. [Google Scholar] [CrossRef]

- Qian, Z.; Luo, Q. Regime-dependent determinants of China’s sovereign credit default swap spread. Emerg. Mark. Financ. Trade 2016, 52, 10–21. [Google Scholar] [CrossRef]

- Geng, R.; Bose, I.; Chen, X. Prediction of financial distress: An empirical study of listed Chinese companies using data mining. Eur. J. Oper. Res. 2015, 241, 236–247. [Google Scholar] [CrossRef]

- Yang, J.; Zhou, Y.; Wang, Z. The stock–bond correlation and macroeconomic conditions: One and a half centuries of evidence. J. Bank. Financ. 2009, 33, 670–680. [Google Scholar] [CrossRef]

- He, D.; Cheung, L.; Zhang, W.; Wu, T. How would capital account liberalization affect China’s capital flows and the renminbi real exchange rates? China World Econ. 2012, 20, 29–54. [Google Scholar] [CrossRef]

- Rao, Y.; Mei, L.; Zhu, R. Happiness and stock-market participation: Empirical evidence from China. J. Happiness Stud. 2016, 17, 271–293. [Google Scholar] [CrossRef]

- De Long, J.B.; Shleifer, A. The stock market bubble of 1929: Evidence from clsoed-end mutual funds. J. Econ. Hist. 1991, 51, 675–700. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).