Panel Econometric Analysis on Mobile Payment Transactions and Traditional Banks Effort toward Financial Accessibility in Sub-Sahara Africa

Abstract

1. Introduction

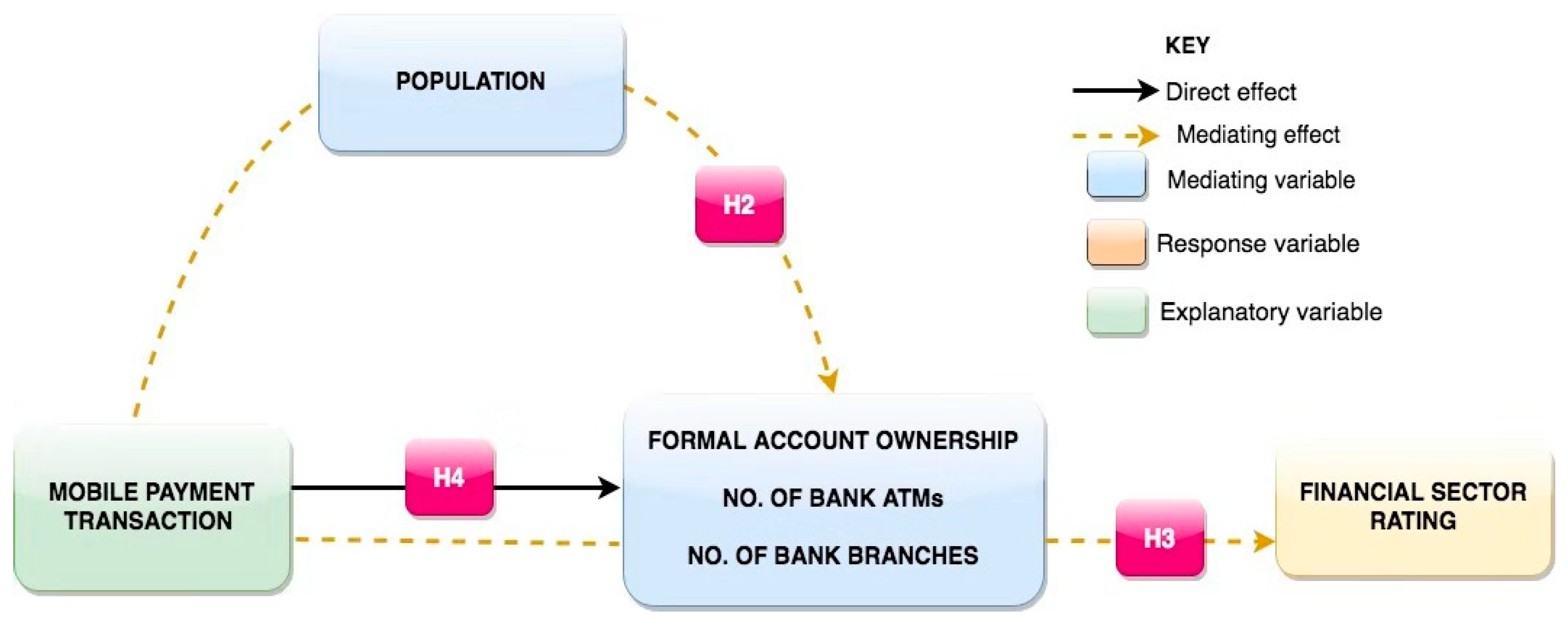

2. Literature Review and Hypotheses

2.1. Financial Accessibility

2.2. Mobility Payment, Traditional Banks, and Financial Accessibility

3. Research Method

3.1. Description of Data and Variables

3.2. Model Specification

4. Theoretical Framework

4.1. Cross-Sectional Dependence Test

4.2. Panel Unit Root Test (PURT)

4.3. Panel Co-Integration Test

4.4. Panel Model Estimation

4.5. Heteroskedasticity and Serial Correlation Tests

5. Results and Discussion

5.1. Summary of Descriptive Statistics and Multicolinearity Test

5.1.1. Cross-Sectional Residual Dependence Test

5.1.2. Panel Unit Root Test

5.1.3. Panel Cointegration Test

5.2. Estimation of Panel Models

5.2.1. Diagnostic Tests

Tests of Serial Correlations and Heteroskedasticity

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Claessens, S.; Glaessner, T.; Klingebiel, D. Electronic finance: Reshaping the financial landscape around the world. J. Financ. Serv. Res. 2002, 22, 29–61. [Google Scholar] [CrossRef]

- Yermack, D. FinTech in Sub-Saharan Africa: What Has Worked Well, and What Hasn’t; New York University (NYU)-Stern School of Business: New York, NY, USA, 2018. [Google Scholar]

- Aggarwal, S.; Klapper, L.; Singer, D.; Demirgüc-Kant, A.; Klapper, L.; Merritt, C.; Demirgüç-Kunt, A.; Klapper, L.; Singer, D.; Limited, M.G.; et al. Mobile Money for Financial Inclusion. Enterp. Dev. Microfinance 2016, 22, 134–146. [Google Scholar]

- Jagtiani, J.; Lemieux, C. Do fintech lenders penetrate areas that are underserved by traditional banks? J. Econ. Bus. 2018, 100, 43–54. [Google Scholar] [CrossRef]

- Sy, A.N.R.; Maino, R.; Massara, A.; Perez-saiz, H.; Sharma, P. FinTech in Sub-Saharan African Countries: A Game Changer? International Monetary Fund: Washington, DC, USA; ISBN 9781484385661-5333.

- Bömer, M.; Maxin, H. Why fintechs cooperate with banks—Evidence from germany. Z. für die gesamte Versicher. 2018, 107, 359–386. [Google Scholar] [CrossRef]

- Arner, D.W.; America, D.A.; Law, T. 150 YEARS OF FINTECH: An evolutionary analysis. JASSA 2016, 3, 22–29. [Google Scholar]

- Drasch, B.J.; Schweizer, A.; Urbach, N. Integrating the ‘Troublemakers’: A taxonomy for cooperation between banks and fintechs. J. Econ. Bus. 2018, 100, 26–42. [Google Scholar] [CrossRef]

- Barczak, G. From the Editor JPIM 2015: The Year in Review. J. Prod. Innov. Manag. 2016, 33, 238. [Google Scholar]

- Catalini, C.; Gans, J.S. Some Simple Economics of the Blockchain. SSRN Electron. J. 2016. [Google Scholar] [CrossRef]

- Zhu, H.; Zhou, Z.Z. Analysis and outlook of applications of blockchain technology to equity crowdfunding in China. Financ. Innov. 2016, 2, 29. [Google Scholar] [CrossRef]

- Fichman, R.G.; Dos Santos, B.L.; Zheng, Z.E. Digital innovation as a fundamental and powerful concept in the information systems curriculum. MIS Q. 2014, 38, 329–353. [Google Scholar] [CrossRef]

- Ondiege, P.O. Regulatory Impact on Mobile Money and Financial Inclusion in African countries-Kenya, Nigeria, Tanzania and Uganda; Center for Global Development: Washington, DC, USA, 2015; pp. 1–49. [Google Scholar]

- Jack, W.; Suri, T. Mobile money: The economics ofM-PESA. Camb. MA Natl. Bur. Econ. Res. 2011. [Google Scholar] [CrossRef]

- Kirui, O.K.; Okello, J.J.; Nyikal, R.A.; Njiraini, G.W. Impact of mobile phone-based money transfer services in agriculture: Evidence from Kenya. Q. J. Int. Agric. 2013, 52, 141–162. [Google Scholar]

- Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. Antecedents of the adoption of the new mobile payment systems: The moderating effect of age. Comput. Hum. Behav. 2014, 35, 464–478. [Google Scholar] [CrossRef]

- Ghezzi, A.; Renga, F.; Balocco, R.; Pescetto, P. Mobile payment applications: Offer state of the art in the Italian market. Info 2010, 12, 3–22. [Google Scholar] [CrossRef]

- Dahlberg, T.; Guo, J.; Ondrus, J. A critical review of mobile payment research. Electron. Commer. Res. Appl. 2015, 14, 265–284. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Capgemini, E. World Retail Banking Report; Capgemini: Paris, France, 2015. [Google Scholar]

- Hung, J. FinTech in Taiwan: A case study of a Bank’ s strategic planning for an investment in a FinTech company. Financ. Innov. 2016, 15. [Google Scholar] [CrossRef]

- Skan, J.; Dickerson, J.; Masood, S. The Future of Fintech and Banking: Digitally disrupted or reimagined? Accenture: Dublin, Ireland, 2015. [Google Scholar]

- Yao, M.; Di, H.; Zheng, X.; Xu, X. Impact of payment technology innovations on the traditional financial industry: A focus on China. Technol. Forecast. Soc. Chang. 2018, 135, 199–207. [Google Scholar] [CrossRef]

- Arner, D.W.; Barberis, J.; Buckley, R.P. The Evolution of FinTech: A New Post-Crisis Paradigm. Georg. J. Int. Law 2015, 47, 1271–1319. [Google Scholar] [CrossRef]

- Yoo, Y.; Boland, R.J.; Lyytinen, K.; Majchrzak, A. Organizing for innovation in the digitized world. Organ. Sci. 2012, 23, 1398–1408. [Google Scholar] [CrossRef]

- Anagnostopoulos, I. Fintech and regtech: Impact on regulators and banks. J. Econ. Bus. 2018, 100, 7–25. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Klapper, L. Measuring financial inclusion: Explaining variation in use of financial services across and within countries. Brook. Pap. Econ. Act. 2013, 44, 279–321. [Google Scholar] [CrossRef]

- Ahamed, M.M.; Mallick, S.K. Is financial inclusion good for bank stability? International evidence. J. Econ. Behav. Organ. 2019, 157, 403–427. [Google Scholar] [CrossRef]

- Westerlund, J. Testing for Error Correction in Panel Data. Oxf. Bull. Econ. Stat. 2007, 69, 709–748. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Robinson Building, A. General Diagnostic Tests for Cross Section Dependence in Panels; Institute of Labor Economics: Bonn, Germany, 2004. [Google Scholar]

- Breusch, T.S.; Pagan, A.R. The Lagrange Multiplier Test and its Applications to Model Specification in Econometrics. Rev. Econ. Stud. 1980, 47, 239. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Pedroni, P. Social capital, barriers to production and capital shares: Implications for the importance of parameter heterogeneity from a nonstationary panel approach. J. Appl. Econom. 2007, 22, 429–451. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Pedroni, P. Purchasing power parity tests in cointegrated panels. Rev. Econ. Stat. 2001, 83, 727–731. [Google Scholar] [CrossRef]

- Gujarati, D.; Porter, D. Basic Econometrics; McGraw-Hill International Edition: New York, NY, USA, 2009. [Google Scholar]

- Breusch, T.S.; Pagan, A.R. A Simple Test for Heteroscedasticity and Random Coefficient Variation. Econometrica 1979, 47, 1287. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Control function methods in applied econometrics. J. Hum. Resour. 2015, 50, 420–445. [Google Scholar] [CrossRef]

- Bansal, S. Perspective of Technology in Achieving Financial Inclusion in Rural India. Procedia Econ. Financ. 2014, 11, 472–480. [Google Scholar] [CrossRef]

- Chen, Z.; Li, Y.; Wu, Y.; Luo, J. The transition from traditional banking to mobile internet finance: An organizational innovation perspective-a comparative study of Citibank and ICBC. Open Access 2017, 3, 12. [Google Scholar] [CrossRef]

- Economides, N.; Jeziorski, P. Mobile Money in Tanzania. Mark. Sci. 2017, 36, 815–837. [Google Scholar] [CrossRef]

- Das Gupta, A. Recent Developments in Africa. Afr. Q. 1967, 7, 4–11. [Google Scholar]

- Donovan, K.; Martin, A. The Rise of African SIM Registration: The Emerging Dynamics of Regulatory Change. 2012. Available online: https://ssrn.com/abstract=2172283 (accessed on 17 November 2019).

- Fowowe, B. Access to finance and firm performance: Evidence from African countries. Rev. Dev. Financ. 2017, 7, 6–17. [Google Scholar] [CrossRef]

- Quartey, P.; Turkson, E.; Abor, J.Y.; Iddrisu, A.M. Financing the growth of SMEs in Africa: What are the contraints to SME financing within ECOWAS? Rev. Dev. Financ. 2017, 7, 18–28. [Google Scholar] [CrossRef]

- Douglas, J.L.; Grinberg, R. Old Wine in New Bottles: Bank Investments in Fintech Companies. Rev. Bank. Fin. L 2016, 36, 667–684. [Google Scholar]

- Tchamyou, V.S.; Erreygers, G.; Cassimon, D. Inequality, ICT and financial access in Africa. Technol. Forecast. Soc. Chang. 2019, 139, 169–184. [Google Scholar] [CrossRef]

- Yakubu, I.; Dinye, R.; Buor, D.; Iddrisu, W.A. Determining and Forecasting Financial Inclusion in Northern Ghana Using Discriminant Analysis. Int. Res. J. Financ. Econ. 2017, 163, 60–72. [Google Scholar]

- Anarfo, E.B.; Abor, J.Y.; Osei, K.A. Financial regulation and financial inclusion in Sub-Saharan Africa: Does financial stability play a moderating role? Res. Int. Bus. Financ. 2020, 51, 101070. [Google Scholar] [CrossRef]

- Munyegera, G.K.; Matsumoto, T. Mobile Money, Remittances, and Household Welfare: Panel Evidence from Rural Uganda. World Dev. 2016, 79, 127–137. [Google Scholar] [CrossRef]

- Zins, A.; Weill, L. The determinants of financial inclusion in Africa. Rev. Dev. Financ. 2016, 6, 46–57. [Google Scholar] [CrossRef]

- Oluniyi, D.A. MTN Ghana launches MTN Mobile Money; TECH dot AFRICA: Randburg, South Africa, 2009. [Google Scholar]

| Variable | Definition | Units of Measurement | Source |

|---|---|---|---|

| MPT | Mobile payment transactions | Total number of mobile payment transactions in a year. | WDI, 2017 |

| POP | Population | Total population of a country aged 15 years and above on yearly basis. | WDI, 2017 |

| FAO | Formal account ownership | Individuals aged 15 years and above having account with a formal financial institution within the past 12 months. | WDI, 2017 |

| NATM | Number of ATMs | Total number of ATMs within a country per 100,000 adults. | WDI, 2017 |

| NBB | Number of bank branches | Number of bank branches within a county per 100,000 adults. | WDI, 2017 |

| FSR | Financial sector rating | Overall financial sector of a country on a scale of 1–5. | WDI, 2017 |

| Variable | Mean | Std. Dev. | Skewness | Kurtosis | Jarque-Bera Test |

|---|---|---|---|---|---|

| Mobile payment transaction | 5.84 | 0.21 | 0.75 | 1.64 | 19.83 a |

| Population | 9.56 | 2.39 | −0.49 | 2.46 | 55.32 a |

| Formal account ownership | 6.34 | 1.59 | −1.32 | 2.38 | 30.64 a |

| Number of ATMs | 6.19 | 1.55 | −1.63 | 2.53 | 45.20 a |

| Number of bank branches | 5.12 | 1.28 | 1.25 | 2.64 | 26.58 a |

| Financial sector rating | 7.52 | 1.88 | −1.83 | 2.20 | 58.98 a |

| Model | Independent Variables | VIF | Tolerance |

|---|---|---|---|

| Model 2 | MPT | 8.250 | 0.472 |

| POP | 5.216 | 0.761 | |

| Model 3 | MPT | 1.773 | 0.833 |

| FAO | 1.892 | 0.885 | |

| NATM | 4.281 | 0.820 | |

| NBB | 9.175 | 0.757 |

| Panel | CD-Test Statistic | CD-Test Value | Probability Value |

|---|---|---|---|

| Africa | Breusch and Pagan LM test | 21.399 | 0.559 |

| Pesaran scaled LM | −0.427 | 0.636 | |

| Pesaran CD | −0.318 | 0.830 |

| Form | Variable | LL&C | IPS | ADF-Fisher | PP-Fisher | Decision |

|---|---|---|---|---|---|---|

| Level | MPT | 3.397 | 0.343 | 5.855 | 2.356 | Not stationary |

| POP | 3.780 | 0.302 | 10.780 | 3.932 | Not stationary | |

| FAO | 1.522 | 4.367 | 0.695 | 0.543 | Not stationary | |

| NATM | 5.577 | 8.708 | 0.070 | 0.084 | Not stationary | |

| NBB | −0.422 | 1.092 | 4.408 | 11.423 | Not stationary | |

| FSR | 5.167 | 1.799 | 7.581 | 6.198 | Not stationary | |

| First Difference | MPT | −5.205 a | −4.723 a | 34.767 a | 45.612 a | Stationary |

| POP | −2.652 a | −2.224 b | 22.078 b | 27.608 a | Stationary | |

| FAO | −4.412 a | −4.380 a | 41.043 a | 35.086 a | Stationary | |

| NATM | −2.854 a | −2.146 b | 24.368 b | 29.846 a | Stationary | |

| NBB | −5.330 a | −1.681 b | 23.587 b | 29.816 a | Stationary | |

| FSR | −2.273 b | −1.629 b | 23.104 b | 57.915 a | Stationary |

| Model 1 | Model 2 | Model 3 | |||||

|---|---|---|---|---|---|---|---|

| Alternative Hypothesis: Common AR Coefficients (within Dimension) | |||||||

| Panel v-statistic | −3.927 | −1.515 | −3.308 | 0.330 | 1.709 | −0.938 | −3.504 |

| Panel rho-statistic | −33.684 a | −29.789 a | −18.554 a | −17.785 a | −16.809 a | −14.508 a | −13.263 a |

| Panel PP-statistic | −181.553 a | −209.863 a | −125.819 a | −85.611 a | −100.129 a | −70.941 a | −75.525 a |

| Panel ADF-statistic | −79.535 a | −58.669 a | −43.661 a | −30.905 a | −31.246 a | −35.815 a | −28.507 a |

| Weight Statistics | |||||||

| Panel v-statistic | −6.710 | −7.766 | −2.708 | −2.980 | −3.703 | −2.549 | −4.407 |

| Panel rho-statistic | −24.352 a | −24.512 a | −17.683 a | −17.614 a | −19.765 a | −17.468 a | −14.033 a |

| Panel PP-statistic | −168.746 a | −177.961 a | −83.418 a | −84.007 a | −101.225 a | −77.050 a | −90.550 a |

| Panel ADF-statistic | −60.700 a | −60.176 a | −42.915 a | −37.993 a | −25.385 a | −35.066 a | −27.257 a |

| Alternative Hypothesis: Individual AR Coefficients (between Dimension) | |||||||

| Group rho-statistic | −22.087 a | −22.625 a | −15.419 a | −18.546 a | −16.405 a | −16.938 a | −11.816 a |

| Group PP-statistic | −139.279 a | −156.963 a | −122.402 a | −102.209 a | −133.050 a | −106.065 a | −130.006 a |

| Group ADF-statistic | −79.719 a | −78.917 a | −50.771 a | −35.615 a | −35.211 a | −45.203 a | −43.996 a |

| Model | Predictors | Criterion | Coef. | Std. Error | t-Statistic | p-Value | R-Square | R-Square Adj. |

|---|---|---|---|---|---|---|---|---|

| 1 | MPT | FOA | 0.582 a | 0.212 | 9.131a | 0.000 | 0.338 | 0.334 |

| NATM | 0.552 a | 0.220 | 8.461 a | 0.000 | 0.305 | 0.301 | ||

| NBB | 0.533 a | 0.007 | 8.051 a | 0.000 | 0.285 | 0.280 | ||

| 2 | MPT POP | FOA | 0.323 a | 0.255 | 4.200 a | 0.000 | 0.435 | 0.428 |

| 0.405 a | 0.378 | 5.272 a | 0.000 | |||||

| NATM | 0.282 a | 0.264 | 3.595 a | 0.000 | 0.411 | 0.403 | ||

| 0.422 a | 0.392 | 5.383 a | 0.000 | |||||

| NBB | 0.167 b | 0.008 | 2.258 b | 0.025 | 0.479 | 0.472 | ||

| 0.573 a | 0.011 | 7.766 a | 0.000 | |||||

| 3 | MPT FOA NATM NBB | FSR | 0.199 b | 0.006 | 2.402 b | 0.017 | 0.871 | 0.864 |

| −0.008 | 0.003 | −1.118 | 0.265 | |||||

| −0.001 | 0.003 | −0.184 | 0.854 | |||||

| 0.755 a | 0.057 | 9.578 a | 0.000 |

| Model 1 | |

| Diagnostic Tests | Test Statistic |

| Serial correlation | F = 0.429 (0.838) |

| Normality test | 2 (Chi-square) = 3.372 (0.185) |

| Heteroskedasticity | F = 0.962 (0.531) |

| Model 2 | |

| Serial correlation | F = 0.619 (0.415) |

| Normality test | 2 (Chi-square) = 5.087 (0.335) |

| Heteroskedasticity | F = 0.931 (0.510) |

| Model 3 | |

| Serial correlation | F = 0.715 (0.110) |

| Normality test | 2 (Chi-square) = 6.651 (0.136) |

| Heteroskedasticity | F = 0.650 (0.264) |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Coffie, C.P.K.; Zhao, H.; Adjei Mensah, I. Panel Econometric Analysis on Mobile Payment Transactions and Traditional Banks Effort toward Financial Accessibility in Sub-Sahara Africa. Sustainability 2020, 12, 895. https://doi.org/10.3390/su12030895

Coffie CPK, Zhao H, Adjei Mensah I. Panel Econometric Analysis on Mobile Payment Transactions and Traditional Banks Effort toward Financial Accessibility in Sub-Sahara Africa. Sustainability. 2020; 12(3):895. https://doi.org/10.3390/su12030895

Chicago/Turabian StyleCoffie, Cephas Paa Kwasi, Hongjiang Zhao, and Isaac Adjei Mensah. 2020. "Panel Econometric Analysis on Mobile Payment Transactions and Traditional Banks Effort toward Financial Accessibility in Sub-Sahara Africa" Sustainability 12, no. 3: 895. https://doi.org/10.3390/su12030895

APA StyleCoffie, C. P. K., Zhao, H., & Adjei Mensah, I. (2020). Panel Econometric Analysis on Mobile Payment Transactions and Traditional Banks Effort toward Financial Accessibility in Sub-Sahara Africa. Sustainability, 12(3), 895. https://doi.org/10.3390/su12030895