Investigating the Ripple Effect through the Relationship between Housing Markets and Residential Migration in Seoul, South Korea

Abstract

1. Introduction

2. Research Background

3. Housing Market and Residential Migration Trends in the Seoul Metropolitan Area

4. Analytical Framework

4.1. Analysis Methods and Approaches

- SSR = the sums of the squared residuals from the restricted(r) and unrestricted(ur) models

- = number of restrictions

- O = number of usable observations

- = number of parameters estimated in the unrestricted model.

4.2. Data and Variables

5. Descriptive Statistics and Unit Root Test

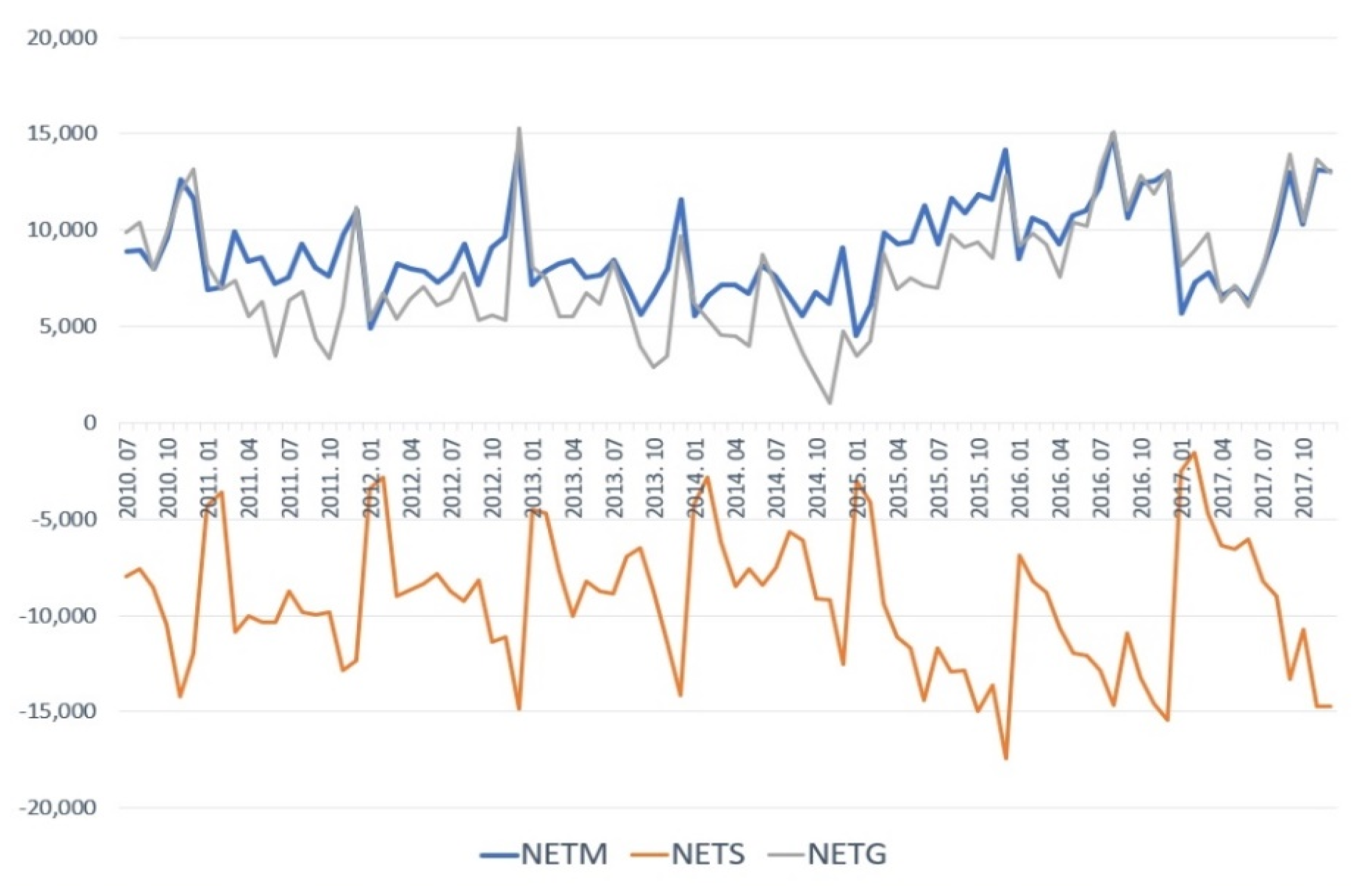

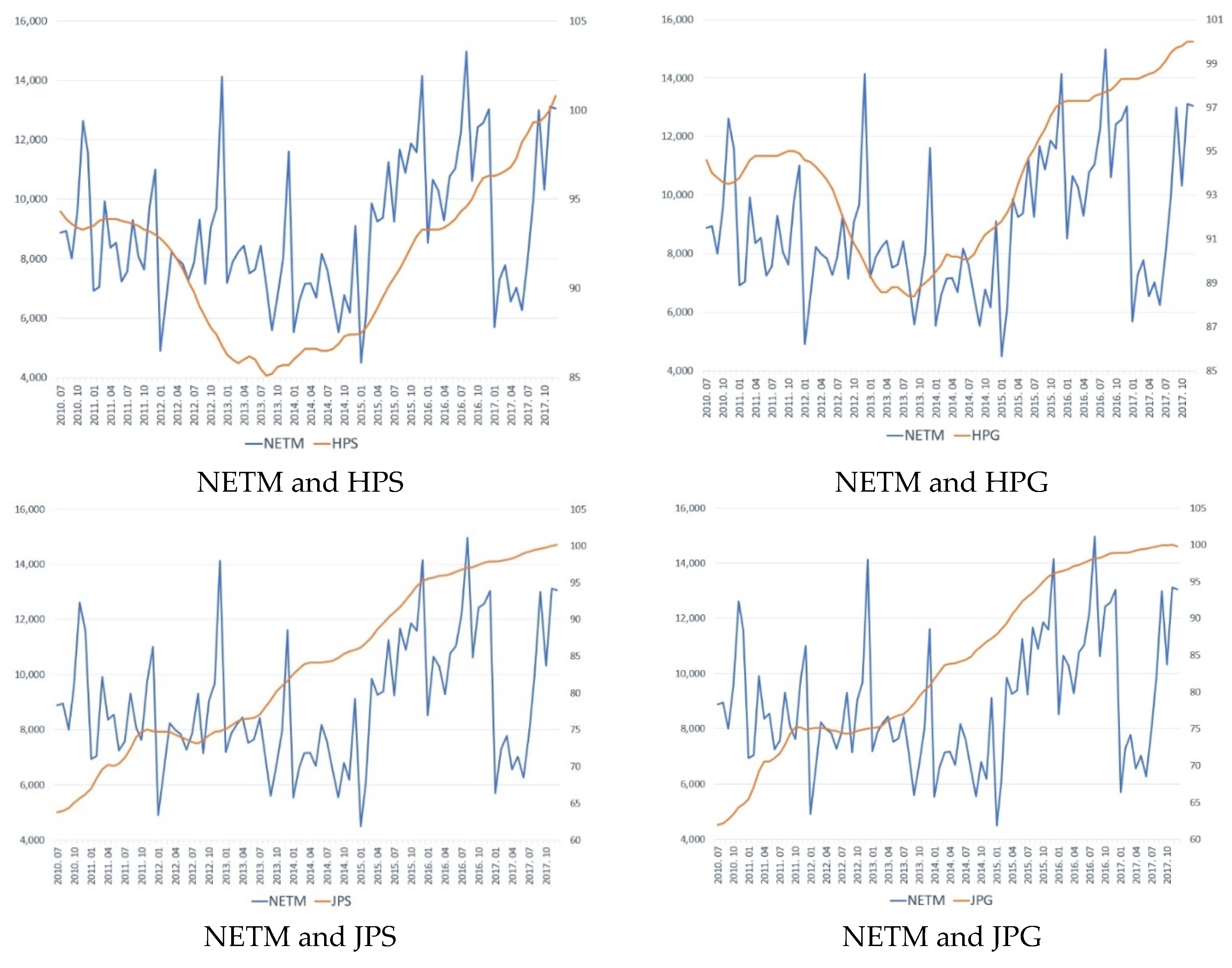

5.1. Descriptive Results

5.2. Unit Root Test

6. Empirical Results

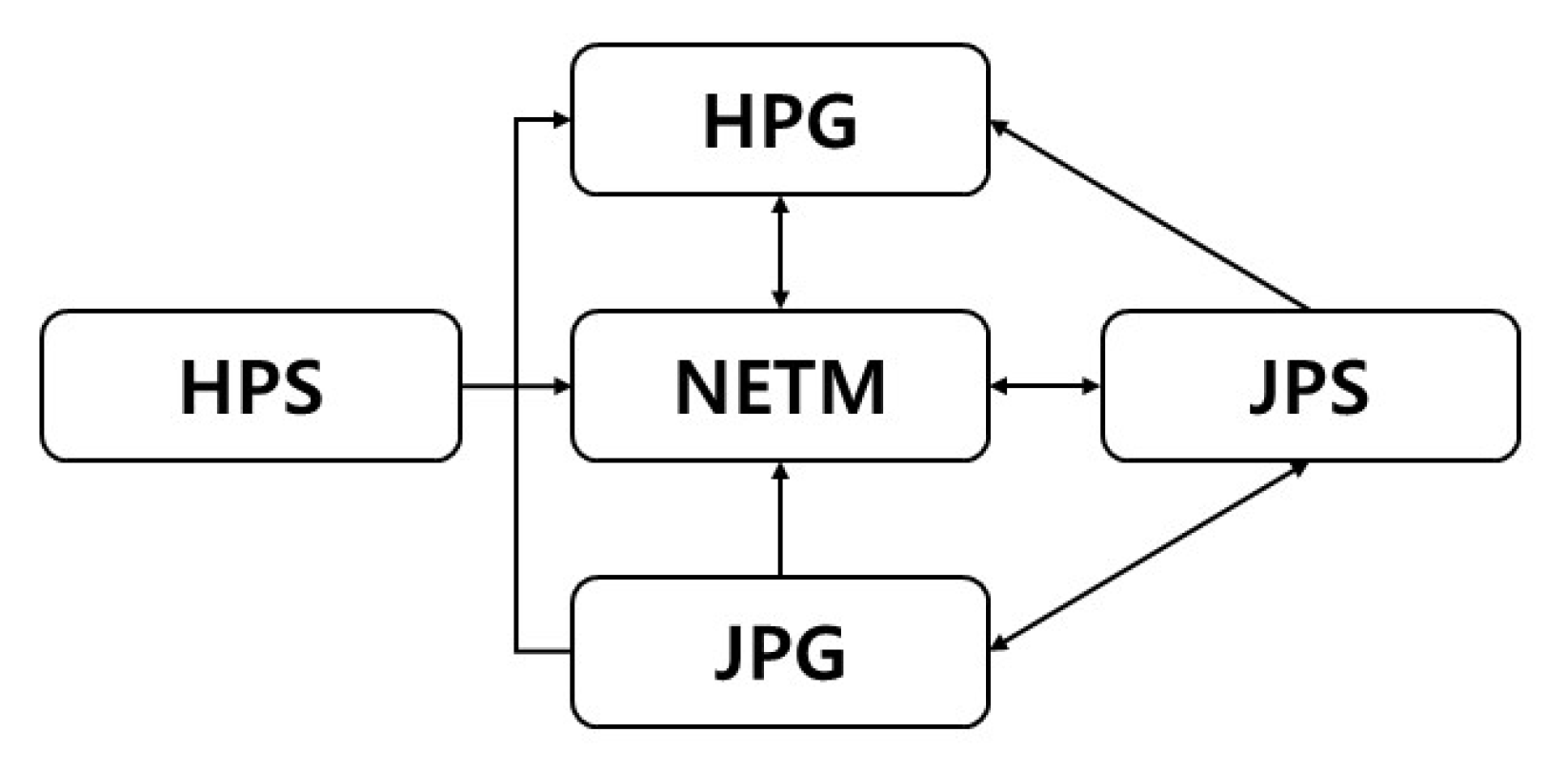

6.1. Relationship between Housing Markets and Residential Migration

6.2. Factors Affecting Intra-metropolitan Migration and Housing Markets

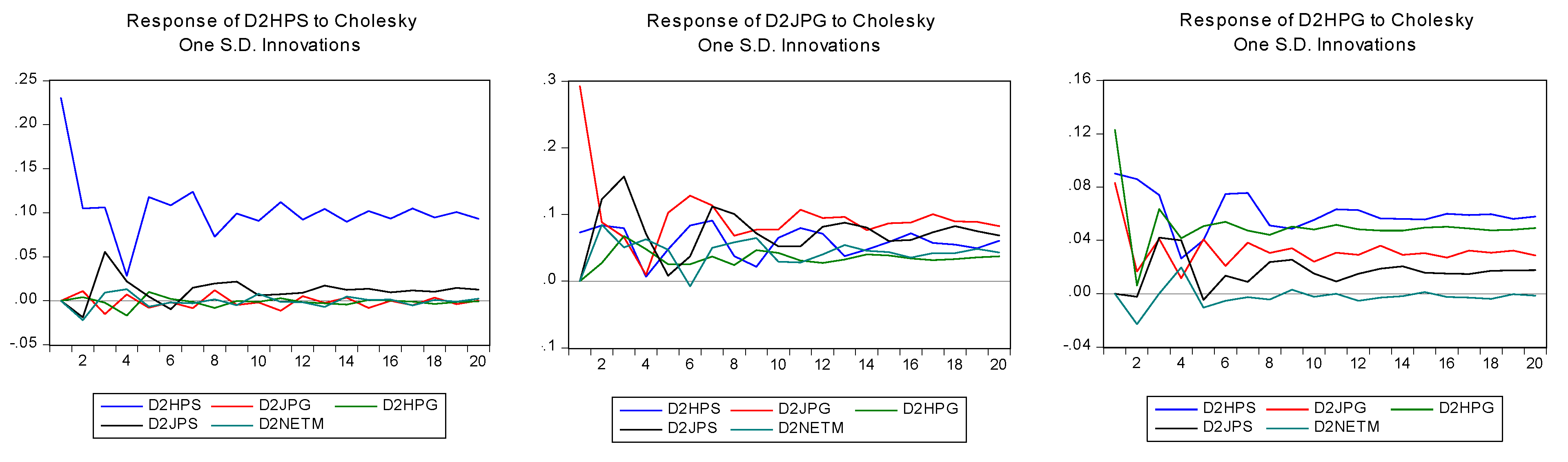

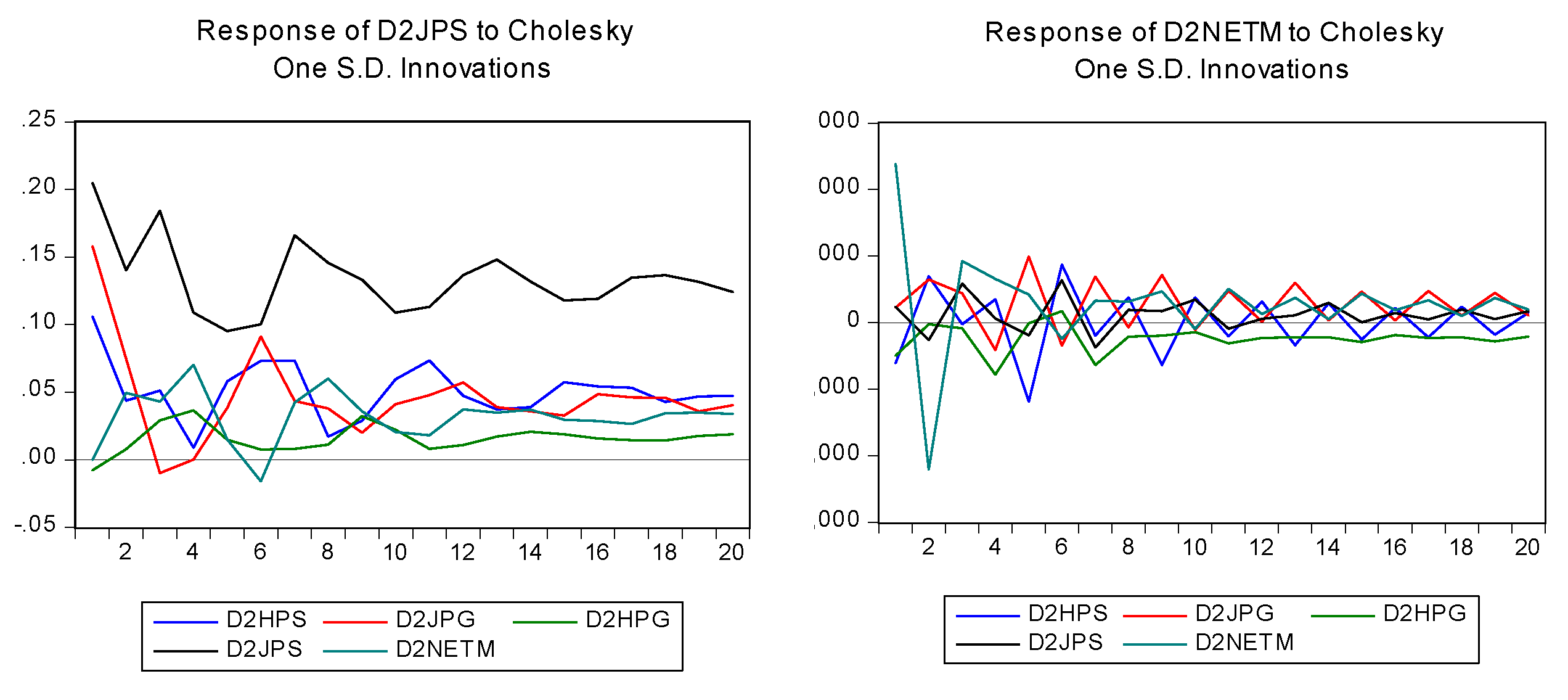

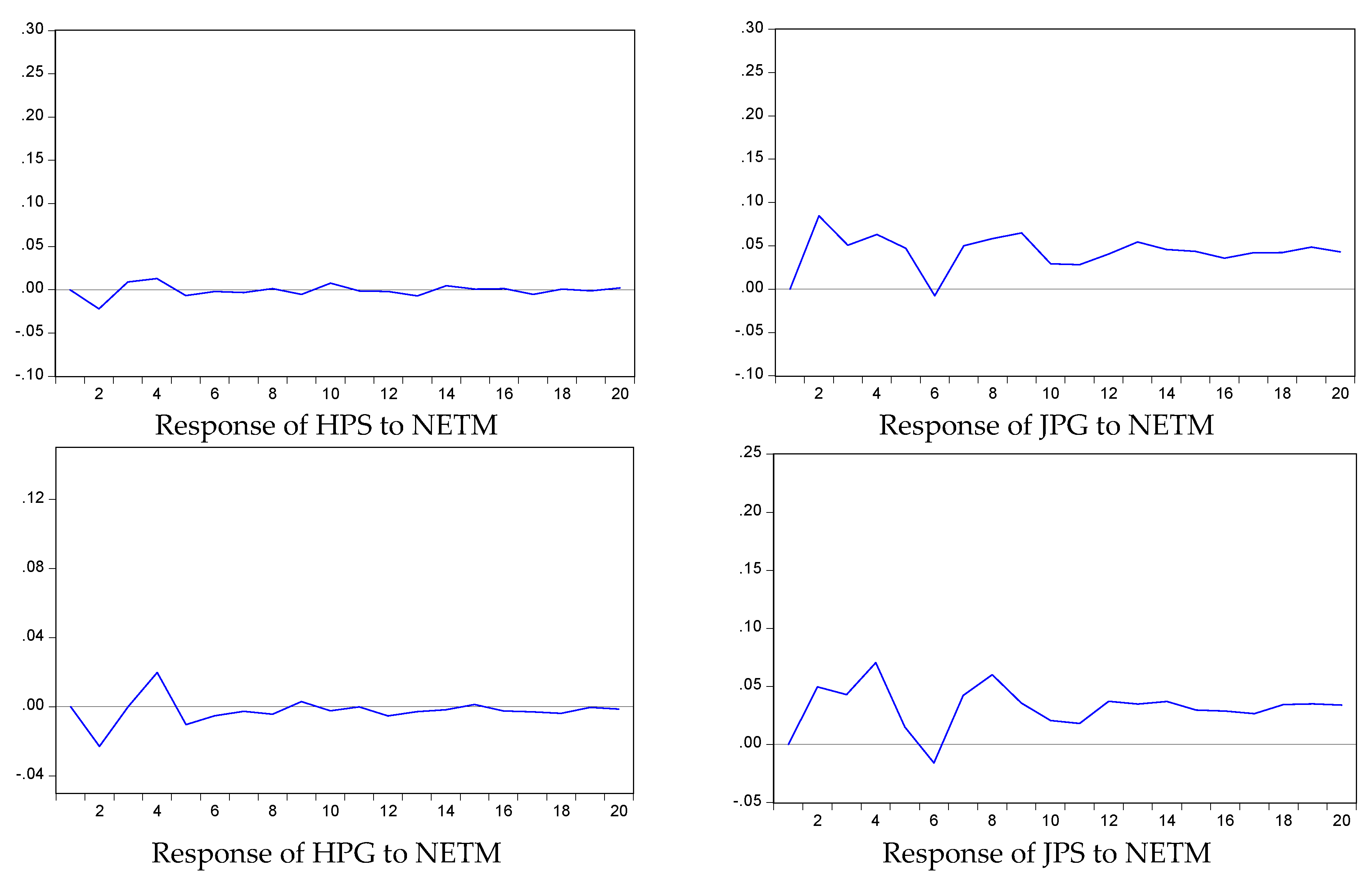

6.3. Impulse Response Analysis

6.4. Forecast Error Variance Decomposition Analysis

7. Conclusion and Findings

Author Contributions

Funding

Conflicts of Interest

References

- Ryu, K.; Kim, J. Jeonse, will it be extinguished? Differentiation of Korean rental housing market. J. Hous. Built Environ. 2018, 33, 409–427. [Google Scholar] [CrossRef]

- Yoon, J. Structural changes in South Korea’s rental housing market: The rise and fall of the Jeonse system. J. Comp. Asian Dev. 2003, 2, 151–168. [Google Scholar] [CrossRef]

- Ambrose, B.; Kim, S. Modeling the Korean chonsei lease contract. Real Estate Econ. 2003, 31, 53–74. [Google Scholar] [CrossRef]

- Kim, S.; Kim, J.; Kim, J. Structural changes in the Korean housing market before and after macroeconomic fluctuations. Sustainability 2016, 8, 415. [Google Scholar] [CrossRef]

- Jones, C.; Leishman, C. Spatial dynamics of the housing market: An interurban perspective. Urban Stud. 2006, 43, 1041–1059. [Google Scholar] [CrossRef]

- Seo, W. Dynamic relationship between housing consumer sentiment in Seoul and metropolitan housing market. SH Urban Res. Insight 2019, 9, 31–47. [Google Scholar] [CrossRef]

- Jeong, Y.; Kim, K.; Kim, H.; Yang, D.; Kang, E. A Diagnosis of Bubble Risk in the Global Real Estate Sector and Prospective Impacts on Financial Crises; Policy Analysis 18-01; Korea Institute for International Economic Policy: Seoul, Kerea, 2018. [Google Scholar]

- Ashworth, J.; Parker, S. Modeling regional house prices in the UK. Scott. J. Political Econ. 1997, 44, 225–246. [Google Scholar] [CrossRef]

- Cook, S.; Thomas, C. An alternative approach to examining the ripple effect in UK house prices. Appl. Econ. Lett. 2003, 10, 749–851. [Google Scholar] [CrossRef]

- Cook, S.; Watson, D. A new perspective on the ripple effect in the UK housing market: Comovement, cyclical subsamples and alternative indices. Urban Stud. 2016, 53, 3048–3062. [Google Scholar] [CrossRef]

- Giussani, B.; Hadjimatheou, G. Modeling regional house prices in the United Kingdom. Pap. Reg. Sci. 1991, 70, 201–219. [Google Scholar] [CrossRef]

- Meen, G. Spatial aggregation, spatial dependence and predictability in the UK housing market. Hous. Stud. 1996, 11, 345–372. [Google Scholar] [CrossRef]

- Meen, G. Regional house prices and the ripple effect: A new interpretation. Hous. Stud. 1999, 14, 733–753. [Google Scholar] [CrossRef]

- Tsai, I. Ripple effect in house prices and trading volume in the UK housing market: New viewpoint and evidence. Econ. Model. 2014, 40, 68–75. [Google Scholar] [CrossRef]

- Blake, J.; Gharleghi, B. The ripple effect at an inter-suburban level in the Sydney metropolitan area. Int. J. Hous. Mark. Anal. 2018, 11, 2–33. [Google Scholar] [CrossRef]

- Ma, L.; Liu, C. Ripple effects of house prices: Considering spatial correlations in geography and demography. Int. J. Hous. Mark. Anal. 2013, 6, 284–299. [Google Scholar] [CrossRef]

- Shi, S.; Young, M.; Hargreaves, B. The ripple effect of local housing price movements in New Zealand. J. Prop. Res. 2009, 26, 1–24. [Google Scholar] [CrossRef]

- Pollakowski, H.O.; Ray, T.S. Housing price diffusion patterns at different aggregation level: An examination of housing market efficiency. J. Hous. Res. 1997, 8, 107–124. [Google Scholar]

- Chiang, S. Housing markets in China and policy implications: Comovement or ripple effect. China World Econ. 2014, 22, 103–120. [Google Scholar] [CrossRef]

- Huang, F.; Li, C.; Li, Y. Ripple effect of housing prices among Chinese deputy provincial cities based on an alternative approach. Int. J. Bus. Adm. 2010, 1, 19–24. [Google Scholar] [CrossRef]

- Zhang, L.; Hui, E.C.; Wen, H. The regional house prices in China: Ripple effect or differentiation. Habitat Int. 2017, 67, 118–128. [Google Scholar] [CrossRef]

- Suh, S. An empirical study on the existence and the cause of ripple effect: The case of Kangnam-gu. Seoul Study 2007, 8, 1–13. [Google Scholar]

- Choi, K.; Hyung, N.; Jeon, H.; Kim, J. Analyzing the spillover effect of housing prices. In Proceedings of the 3rd International Conference on Humanities, Geography and Economics, Bali, Indonesia, 4–5 January 2013; pp. 138–142. [Google Scholar]

- Jeon, H.; Hyung, N. Spillover effects in the housing market: Shocks originating from gangnam. Hous. Stud. Rev. 2018, 26, 63–88. [Google Scholar] [CrossRef]

- Jin, C.; Lee, G. Analysis of the spatio-temporal interaction patterns of the house sales and rent price using SpVAR model: Focus on the Seoul metropolitan area. J. Real Estate Anal. 2016, 2, 23–42. [Google Scholar] [CrossRef]

- Lee, H.; Lee, J. Spillover effects of apartment housing prices across cities: A generalized forecast error variance decomposition for seven large cities. Korea Spat. Plan. Rev. 2014, 82, 3–15. [Google Scholar]

- Munro, M.; Mclennan, D. Intra-urban changes in house prices: Glasgow 1972–83. Hous. Stud. 1987, 2, 65–81. [Google Scholar] [CrossRef]

- Wilson, P.; White, M.; Dunse, N.; Cheong, C.; Zurbruegg, R. Modelling price movements in housing micro market: Identifying long-term components in local housing market dynamics. Urban Stud. 2011, 48, 1853–1874. [Google Scholar] [CrossRef]

- Macdonald, R. Regional house prices in Britain: Long-run relationships and short-run dynamics. Scott. J. Political Econ. 1993, 40, 43–55. [Google Scholar] [CrossRef]

- Cook, S. Detecting long-run relationship in regional house prices in the UK. Int. Rev. Appl. Econ. 2005, 19, 107–118. [Google Scholar] [CrossRef]

- Lee, C.; Chien, M. Empirical modeling of regional house prices and the ripple effect. Urban Stud. 2011, 48, 2029–2047. [Google Scholar] [CrossRef]

- Chang, B. Spillover effect and its time-varying characteristics in the Korean housing market. Hous. Stud. Rev. 2014, 22, 5–30. [Google Scholar]

- Kim, H. Spatio-temporal analysis of house price diffusion of Korea. J. Korean Econ. Anal. 2017, 23, 89–135. [Google Scholar]

- Dickey, D.; Fuller, W. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Harris, R.I.D. Testing for unit roots using the augmented dickey-fuller test. Econ. Lett. 1992, 38, 381–386. [Google Scholar] [CrossRef]

- Granger, C. Investigating causal relations by econometric model and cross-spectral methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Han, Y.; Han, K.; Lee, J. A study on the causality of housing price variations. J. Korean Urban Manag. Assoc. 2010, 23, 199–219. [Google Scholar]

- Schelter, B.; Winterhalder, M.; Timmer, J. Handbook of Time Series Analysis: Recent Theoretical Developments and Applications; Wiley-VCH: Weinheim, Germany, 2006. [Google Scholar]

- Enders, W. Applied Econometric Time Series; Willey: Hobken, NJ, USA, 2014. [Google Scholar]

- Sims, C. Macroeconomics and reality. Ecoometrica 1980, 48, 1–48. [Google Scholar] [CrossRef]

- Engle, R.; Granger, C. Co-integration and error correction: Representation, estimation and testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Maysami, R.; Koh, T. A vector error correction model of the Singapore stock market. Int. Rev. Econ. Financ. 2000, 9, 79–96. [Google Scholar] [CrossRef]

- Asghar, Z.; Abid, I. Performance of Lag Length Selection Criteria in Three Different Situations; MPRA Paper No. 40042; University Library of Munich: Munich, Germany, 2007; Available online: https://EconPapers.repec.org/RePEc:pra:mprapa:40042 (accessed on 13 July 2012).

- Gallet, C. Housing market segmentation: An application of convergence tests to Los Angeles housing. Ann. Reg. Sci. 2002, 38, 551–561. [Google Scholar] [CrossRef]

- Islam, K.; Asami, Y. Housing market segmentation: A review. Rev. Urban Reg. Dev. Stud. 2009, 21, 93–109. [Google Scholar] [CrossRef]

- Liew, V. Which lag length selection criteria should be employ? Econ. Bull. 2004, 3, 1–9. [Google Scholar]

| GRDP/Capita | Population | # of Housing | Mean Sales Price | Mean Jeonse Price | |

|---|---|---|---|---|---|

| Unit | KRW 1000 | Person | Unit | KRW 1000 | KRW 1000 |

| Seoul | 38,062 (113%) | 9,776,305 (19%) | 2,866,845 (17%) | 659,905 (210%) | 437,365 (192%) |

| Gyeonggi | 32,347 (96%) | 12,809,379 (25%) | 3,949,829 (23%) | 320,920 (102%) | 249,726 (110%) |

| Nationwide | 33,657 (100%) | 51,446,201 (100%) | 17,122,573 (100%) | 313,552 (100%) | 227,506 (100%) |

| Category | Variable | Description | Unit | Source | Variable Use | |

|---|---|---|---|---|---|---|

| Granger | VAR | |||||

| Housing Price Factors | HPS | Housing Price Index in Seoul | 2017.11 = 100 | South Korea Appraisal Board. | 0 | 0 |

| JPS | Jeonse Price Index in Seoul | 2017.11 = 100 | 0 | 0 | ||

| HPS | Housing Price Index in Gyeonggi | 2017.11 = 100 | 0 | 0 | ||

| JPG | Jeonse Price Index in Gyeonggi | 2017.11 = 100 | 0 | 0 | ||

| Demand Factors | IND | Index of All Industry Production | 2015 = 100 | Bank of Korea. Statistics Korea. | 0 | |

| RATE | Mortgage Rate | % | 0 | |||

| NETM | Net Migration from Seoul to Gyeonggi | person | 0 | 0 | ||

| Supply Factors | CONS | The Number of Housing Supply Units in Seoul | unit | Ministry of Land, Infrastructure and Transport. | 0 | |

| CONG | The Number of Housing Supply Units in Gyeonggi | unit | 0 | |||

| Factor | Variable | Mean | Min | Max | Standard Deviation |

|---|---|---|---|---|---|

| Housing Price Factors | HPS | 91.45 | 85.1 | 100.8 | 4.218 |

| JPS | 83.53 | 63.8 | 100.2 | 11.176 | |

| HPG | 93.99 | 88.4 | 100.0 | 3.459 | |

| JPG | 83.90 | 62.0 | 100.0 | 11.732 | |

| Demand Factors | IND | 98.57 | 82.8 | 116.5 | 6.165 |

| RATE | 3.80 | 2.7 | 5.1 | 0.764 | |

| NETM | 8917 | 4512 | 14,963 | 2317.348 | |

| Supply Factors | CONS | 5762 | 1458 | 14,696.0 | 2065.654 |

| CONG | 10,219 | 3551 | 23,391.0 | 4567.261 |

| Variable | Lag Order | t-Statistics | ||

|---|---|---|---|---|

| Original Data | 1st Order Difference | 2nd Order Difference | ||

| HPS | 2nd | −0.448 | −1.514 | −8.076 *** |

| HPG | 2nd | −0.948 | −3.061 | −9.507 *** |

| JPS | 2nd | −1.105 | −4.723 *** | −8.297 *** |

| JPG | 2nd | −1.451 | −1.991 | −9.860 *** |

| IND | 1st | 1.535 | −7.915 *** | −6.750 *** |

| RATE | 2nd | −1.370 | −6.237 *** | −10.235 *** |

| NETM | 2nd | −5.240 *** | −3.333 | −6.658 *** |

| CONS | 1st | −7.213 *** | −9.538 *** | −6.773 *** |

| CONG | 1st | −1.001 | −8.052 *** | −7.598 *** |

| Null Hypothesis | lag 1 | lag 2 | lag 4 | lag 6 | ||||

|---|---|---|---|---|---|---|---|---|

| F | Prob. | F | Prob. | F | Prob. | F | Prob. | |

| HPS ↛ NETM | 8.999 | 0.004 | 3.817 | 0.026 | 3.374 | 0.014 | 2.280 | 0.018 |

| NETM ↛ HPS | 0.266 | 0.608 | 1.189 | 0.310 | 1.188 | 0.323 | 1.021 | 0.419 |

| HPG ↛ NETM | 3.434 | 0.067 | 3.563 | 0.0329 | 2.465 | 0.052 | 2.070 | 0.068 |

| NETM ↛ HPG | 0.420 | 0.519 | 2.837 | 0.065 | 1.965 | 0.109 | 1.098 | 0.373 |

| JPS ↛ NETM | 4.460 | 0.038 | 3.117 | 0.049 | 2.002 | 0.103 | 1.083 | 0.382 |

| NETM ↛ JPS | 0.006 | 0.937 | 2.511 | 0.088 | 2.553 | 0.046 | 2.330 | 0.042 |

| JPG ↛ NETM | 3.141 | 0.080 | 3.130 | 0.049 | 1.448 | 0.227 | 1.079 | 0.384 |

| NETM ↛ JPG | 0.037 | 0.848 | 1.322 | 0.272 | 0.919 | 0.458 | 1.323 | 0.259 |

| HPS ↛ JPG | 0.666 | 0.417 | 0.701 | 0.499 | 1.167 | 0.332 | 0.829 | 0.551 |

| JPG ↛ HPS | 1.529 | 0.220 | 0.897 | 0.412 | 0.612 | 0.655 | 0.743 | 0.617 |

| HPG ↛ JPS | 0.997 | 0.321 | 1.369 | 0.260 | 0.326 | 0.860 | 0.568 | 0.755 |

| JPS ↛ HPG | 5.199 | 0.025 | 3.525 | 0.034 | 0.954 | 0.438 | 0.785 | 0.585 |

| HPS ↛ HPG | 15.605 | 0.000 | 7.992 | 0.001 | 3.289 | 0.015 | 2.756 | 0.019 |

| HPG ↛ HPS | 0.000 | 0.988 | 0.633 | 0.534 | 0.085 | 0.987 | 0.865 | 0.525 |

| JPS ↛ JPG | 15.389 | 0.000 | 11.343 | 0.000 | 4.717 | 0.002 | 3.097 | 0.009 |

| JPG ↛ JPS | 0.345 | 0.559 | 6.700 | 0.002 | 2.554 | 0.046 | 1.800 | 0.112 |

| HPS ↛ JPS | 1.516 | 0.222 | 0.793 | 0.456 | 0.196 | 0.940 | 0.534 | 0.781 |

| JPS ↛ HPS | 0.523 | 0.471 | 1.568 | 0.215 | 0.626 | 0.645 | 1.234 | 0.300 |

| HPG ↛ JPG | 0.195 | 0.660 | 0.199 | 0.820 | 0.775 | 0.545 | 0.322 | 0.923 |

| JPG ↛ HPG | 3.199 | 0.077 | 1.663 | 0.196 | 0.903 | 0.467 | 0.862 | 0.527 |

| NETM ↛ IND | 27.197 | 0.000 | 5.993 | 0.004 | 4.389 | 0.003 | 5.982 | 0.000 |

| IND ↛ NETM | 57.574 | 0.000 | 20.959 | 0.000 | 16.171 | 0.000 | 15.121 | 0.000 |

| NETM ↛ RATE | 0.016 | 0.901 | 0.152 | 0.859 | 1.933 | 0.114 | 1.774 | 0.117 |

| RATE ↛ NETM | 0.018 | 0.892 | 1.200 | 0.306 | 1.199 | 0.318 | 2.390 | 0.037 |

| NETM ↛ CONS | 1.735 | 0.191 | 4.818 | 0.011 | 2.056 | 0.095 | 1.452 | 0.208 |

| CONS ↛ NETM | 10.191 | 0.002 | 4.351 | 0.016 | 1.147 | 0.341 | 1.214 | 0.310 |

| NETM ↛ CONG | 0.630 | 0.430 | 1.908 | 0.155 | 1.811 | 0.136 | 1.255 | 0.290 |

| CONG ↛ NETM | 0.113 | 0.738 | 0.685 | 0.507 | 1.712 | 0.156 | 1.352 | 0.246 |

| Hypothesized No. of CE(s) | Eigenvalue | Trace Statistic | Critical Value (0.05) | Prob.** |

|---|---|---|---|---|

| None * | 0.727279 | 304.7564 | 69.81889 | 0.0001 |

| At most 1 * | 0.585915 | 194.3153 | 47.85613 | 0.0000 |

| At most 2 * | 0.469870 | 119.3720 | 29.79707 | 0.0000 |

| At most 3 * | 0.357945 | 65.42827 | 15.49471 | 0.0000 |

| At most 4 * | 0.278673 | 27.76635 | 3.841466 | 0.0000 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −740.8541 | NA | 28.79291 | 17.54951 | 17.69319* | 17.60730 |

| 1 | −695.8371 | 83.67873 | 17.99890 | 17.07852 | 17.94063 | 17.42529 |

| 2 | −659.4946 | 63.27867 | 13.86754 | 16.81164 | 18.39218 | 17.44738 |

| 3 | −619.4859 | 64.95536* | 9.892959* | 16.45849* | 18.75746 | 17.38320* |

| Error Correction: | HPS | JPG | HPG | JPS | NETM |

|---|---|---|---|---|---|

| CointEq1 | 0.010707 | −0.474237 | 0.017300 | −0.338478 | 6074.437 |

| (0.08417) | (0.11045) | (0.06353) | (0.10226) | (925.085) | |

| [0.12720] | [−4.29377] | [0.27232] | [−3.30982] | [6.56635] | |

| HPS(−3) | −0.444233 | 0.050715 | −0.037044 | 0.083502 | 1011.284 |

| (0.17219) | (0.22595) | (0.12996) | (0.20921) | (1892.48) | |

| [−2.57988] | [0.22445] | [−0.28504] | [0.39913] | [0.53437] | |

| JPG(−3) | −0.065100 | −0.323307 | −0.152422 | 0.054855 | −6363.858 |

| (0.12702) | (0.16668) | (0.09587) | (0.15433) | (1396.07) | |

| [−0.51250] | [−1.93970] | [−1.58987] | [0.35544] | [−4.55842] | |

| HPG(−3) | −0.120422 | −0.239624 | −0.142759 | −0.294372 | 6726.647 |

| (0.21717) | (0.28497) | (0.16391) | (0.26386) | (2386.87) | |

| [−0.55450] | [−0.84087] | [−0.87096] | [−1.11564] | [2.81819] | |

| JPS(−3) | 0.172822 | 0.283449 | 0.205396 | −0.142802 | 2944.945 |

| (0.13419) | (0.17608) | (0.10128) | (0.16304) | (1474.84) | |

| [1.28788] | [1.60974] | [2.02800] | [−0.87588] | [1.99679] | |

| NETM(−3) | 4.42E−07 | −5.20E−05 | −4.60E−06 | −3.96E−05 | −0.160789 |

| (9.4E−06) | (1.2E−05) | (7.1E−06) | (1.1E−05) | (0.10339) | |

| [0.04697] | [−4.20985] | [−0.64769] | [−3.46915] | [−1.55519] | |

| C | −0.000960 | −0.001988 | −0.007500 | −0.001923 | 20.31237 |

| (0.02514) | (0.03299) | (0.01897) | (0.03054) | (276.282) | |

| [−0.03818] | [−0.06026] | [−0.39529] | [−0.06297] | [0.07352] | |

| Adj. R-squared | 0.306560 | 0.507830 | 0.438286 | 0.340487 | 0.870657 |

| F-statistic | 3.293317 | 6.352552 | 5.047625 | 3.678153 | 35.91918 |

| Log likelihood | 13.70771 | −9.114787 | 37.34339 | −2.648768 | −767.8951 |

| Akaike AIC | 0.078388 | 0.621781 | −0.484366 | 0.467828 | 18.68798 |

| Period | HPS | JPS | HPG | ||||||||||||

| HPS | JPG | HPG | JPS | NETM | HPS | JPG | HPG | JPS | NETM | HPS | JPG | HPG | JPS | NETM | |

| 1 | 100.00 | 0.00 | 0.00 | 0.00 | 0.00 | 14.40 | 31.87 | 0.08 | 53.66 | 0.00 | 26.98 | 22.94 | 50.08 | 0.00 | 0.00 |

| 2 | 98.49 | 0.18 | 0.03 | 0.55 | 0.75 | 12.20 | 28.29 | 0.11 | 57.12 | 2.28 | 40.47 | 18.74 | 39.42 | 0.01 | 1.37 |

| 3 | 94.52 | 0.44 | 0.03 | 4.30 | 0.72 | 10.72 | 20.80 | 0.66 | 64.91 | 2.92 | 40.91 | 17.31 | 37.31 | 3.45 | 1.02 |

| 4 | 93.43 | 0.50 | 0.38 | 4.79 | 0.91 | 9.59 | 18.50 | 1.39 | 64.92 | 5.59 | 38.83 | 16.14 | 37.36 | 6.03 | 1.64 |

| 5 | 94.16 | 0.49 | 0.43 | 4.11 | 0.82 | 10.70 | 17.85 | 1.40 | 64.77 | 5.27 | 37.68 | 17.27 | 37.91 | 5.48 | 1.65 |

| 6 | 94.70 | 0.44 | 0.38 | 3.74 | 0.74 | 12.07 | 19.81 | 1.27 | 62.08 | 4.77 | 40.71 | 15.66 | 37.12 | 5.04 | 1.48 |

| 7 | 95.13 | 0.44 | 0.34 | 3.44 | 0.65 | 12.46 | 17.58 | 1.10 | 64.07 | 4.79 | 43.00 | 15.63 | 35.52 | 4.54 | 1.31 |

| 8 | 94.89 | 0.53 | 0.37 | 3.58 | 0.62 | 11.32 | 16.36 | 1.04 | 65.62 | 5.66 | 43.00 | 15.61 | 35.28 | 4.87 | 1.24 |

| 9 | 94.90 | 0.51 | 0.34 | 3.65 | 0.60 | 10.78 | 15.29 | 1.32 | 66.93 | 5.68 | 42.44 | 15.73 | 35.46 | 5.22 | 1.16 |

| 10 | 95.11 | 0.48 | 0.33 | 3.47 | 0.60 | 11.30 | 14.94 | 1.41 | 66.87 | 5.49 | 42.87 | 15.33 | 35.58 | 5.12 | 1.09 |

| 11 | 95.38 | 0.52 | 0.31 | 3.23 | 0.56 | 12.23 | 14.68 | 1.34 | 66.51 | 5.24 | 43.52 | 15.11 | 35.51 | 4.83 | 1.02 |

| 12 | 95.55 | 0.51 | 0.29 | 3.12 | 0.53 | 11.98 | 14.54 | 1.27 | 66.96 | 5.25 | 44.15 | 14.88 | 35.27 | 4.72 | 0.97 |

| 13 | 95.63 | 0.49 | 0.28 | 3.08 | 0.52 | 11.51 | 13.93 | 1.26 | 68.09 | 5.21 | 44.20 | 15.08 | 35.06 | 4.74 | 0.92 |

| 14 | 95.71 | 0.47 | 0.28 | 3.03 | 0.51 | 11.26 | 13.48 | 1.30 | 68.69 | 5.26 | 44.36 | 14.96 | 34.99 | 4.82 | 0.88 |

| 15 | 95.81 | 0.48 | 0.26 | 2.96 | 0.49 | 11.52 | 13.12 | 1.32 | 68.81 | 5.23 | 44.44 | 14.90 | 35.06 | 4.76 | 0.84 |

| 16 | 95.94 | 0.46 | 0.25 | 2.88 | 0.47 | 11.65 | 13.04 | 1.32 | 68.82 | 5.17 | 44.75 | 14.67 | 35.09 | 4.69 | 0.80 |

| 17 | 96.06 | 0.45 | 0.24 | 2.80 | 0.46 | 11.66 | 12.82 | 1.29 | 69.17 | 5.06 | 44.94 | 14.67 | 35.01 | 4.61 | 0.77 |

| 18 | 96.16 | 0.44 | 0.24 | 2.73 | 0.44 | 11.46 | 12.63 | 1.27 | 69.59 | 5.05 | 45.18 | 14.62 | 34.88 | 4.59 | 0.74 |

| 19 | 96.23 | 0.42 | 0.23 | 2.70 | 0.42 | 11.39 | 12.33 | 1.28 | 69.94 | 5.07 | 45.22 | 14.65 | 34.83 | 4.59 | 0.71 |

| 20 | 96.30 | 0.41 | 0.22 | 2.67 | 0.41 | 11.37 | 12.15 | 1.30 | 70.10 | 5.08 | 45.35 | 14.54 | 34.84 | 4.59 | 0.68 |

| Period | JPG | NETM | |||||||||||||

| HPS | JPG | HPG | JPS | NETM | HPS | JPG | HPG | JPS | NETM | ||||||

| 1 | 5.90 | 94.10 | 0.00 | 0.00 | 0.00 | 5.75 | 0.79 | 3.86 | 0.84 | 88.76 | |||||

| 2 | 9.60 | 72.53 | 0.59 | 11.73 | 5.55 | 6.93 | 3.82 | 2.02 | 1.02 | 86.21 | |||||

| 3 | 10.90 | 57.11 | 3.12 | 23.19 | 5.67 | 6.23 | 4.84 | 1.87 | 3.41 | 83.65 | |||||

| 4 | 10.24 | 53.57 | 4.20 | 24.50 | 7.49 | 6.48 | 5.53 | 5.79 | 3.13 | 79.07 | |||||

| 5 | 10.59 | 54.63 | 4.19 | 22.58 | 8.01 | 13.54 | 10.29 | 4.93 | 2.87 | 68.36 | |||||

| 6 | 12.50 | 55.75 | 4.01 | 20.63 | 7.12 | 16.55 | 10.17 | 4.73 | 4.82 | 63.72 | |||||

| 7 | 13.87 | 52.65 | 3.95 | 22.47 | 7.06 | 15.78 | 11.96 | 6.47 | 5.23 | 60.56 | |||||

| 8 | 13.38 | 50.52 | 3.88 | 24.46 | 7.76 | 16.23 | 11.79 | 6.58 | 5.33 | 60.07 | |||||

| 9 | 12.74 | 49.48 | 4.37 | 24.71 | 8.69 | 17.21 | 13.48 | 6.40 | 5.17 | 57.74 | |||||

| 10 | 13.45 | 48.93 | 4.73 | 24.36 | 8.53 | 17.62 | 13.35 | 6.40 | 5.64 | 56.99 | |||||

| 11 | 14.45 | 49.09 | 4.70 | 23.56 | 8.21 | 17.31 | 13.99 | 6.65 | 5.52 | 56.53 | |||||

| 12 | 14.92 | 48.43 | 4.61 | 23.90 | 8.13 | 17.61 | 13.88 | 6.83 | 5.49 | 56.18 | |||||

| 13 | 14.42 | 48.02 | 4.61 | 24.51 | 8.43 | 17.61 | 15.01 | 6.84 | 5.38 | 55.16 | |||||

| 14 | 14.33 | 47.30 | 4.81 | 25.00 | 8.57 | 17.80 | 14.87 | 6.98 | 5.70 | 54.65 | |||||

| 15 | 14.54 | 47.07 | 4.96 | 24.79 | 8.65 | 17.66 | 15.42 | 7.18 | 5.57 | 54.18 | |||||

| 16 | 15.08 | 46.78 | 5.01 | 24.57 | 8.56 | 17.75 | 15.33 | 7.28 | 5.62 | 54.01 | |||||

| 17 | 15.09 | 46.78 | 4.99 | 24.59 | 8.55 | 17.63 | 15.97 | 7.37 | 5.53 | 53.50 | |||||

| 18 | 15.07 | 46.43 | 5.00 | 24.95 | 8.55 | 17.74 | 15.91 | 7.52 | 5.64 | 53.19 | |||||

| 19 | 14.96 | 46.20 | 5.06 | 25.10 | 8.68 | 17.56 | 16.40 | 7.70 | 5.56 | 52.78 | |||||

| 20 | 15.14 | 45.87 | 5.15 | 25.11 | 8.73 | 17.55 | 16.36 | 7.83 | 5.64 | 52.63 | |||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Seo, W.; Kim, L. Investigating the Ripple Effect through the Relationship between Housing Markets and Residential Migration in Seoul, South Korea. Sustainability 2020, 12, 1225. https://doi.org/10.3390/su12031225

Seo W, Kim L. Investigating the Ripple Effect through the Relationship between Housing Markets and Residential Migration in Seoul, South Korea. Sustainability. 2020; 12(3):1225. https://doi.org/10.3390/su12031225

Chicago/Turabian StyleSeo, Wonseok, and LeeYoung Kim. 2020. "Investigating the Ripple Effect through the Relationship between Housing Markets and Residential Migration in Seoul, South Korea" Sustainability 12, no. 3: 1225. https://doi.org/10.3390/su12031225

APA StyleSeo, W., & Kim, L. (2020). Investigating the Ripple Effect through the Relationship between Housing Markets and Residential Migration in Seoul, South Korea. Sustainability, 12(3), 1225. https://doi.org/10.3390/su12031225