Does More Mean Better? Exploring the Relationship between Report Completeness and Environmental Sustainability

Abstract

1. Introduction

2. Background Literature

2.1. Sustainability Reporting and Credibility Gap

2.2. Environmental Sustainability and Verified Emissions

3. Research Design

3.1. Sample

3.2. Variables

- (1)

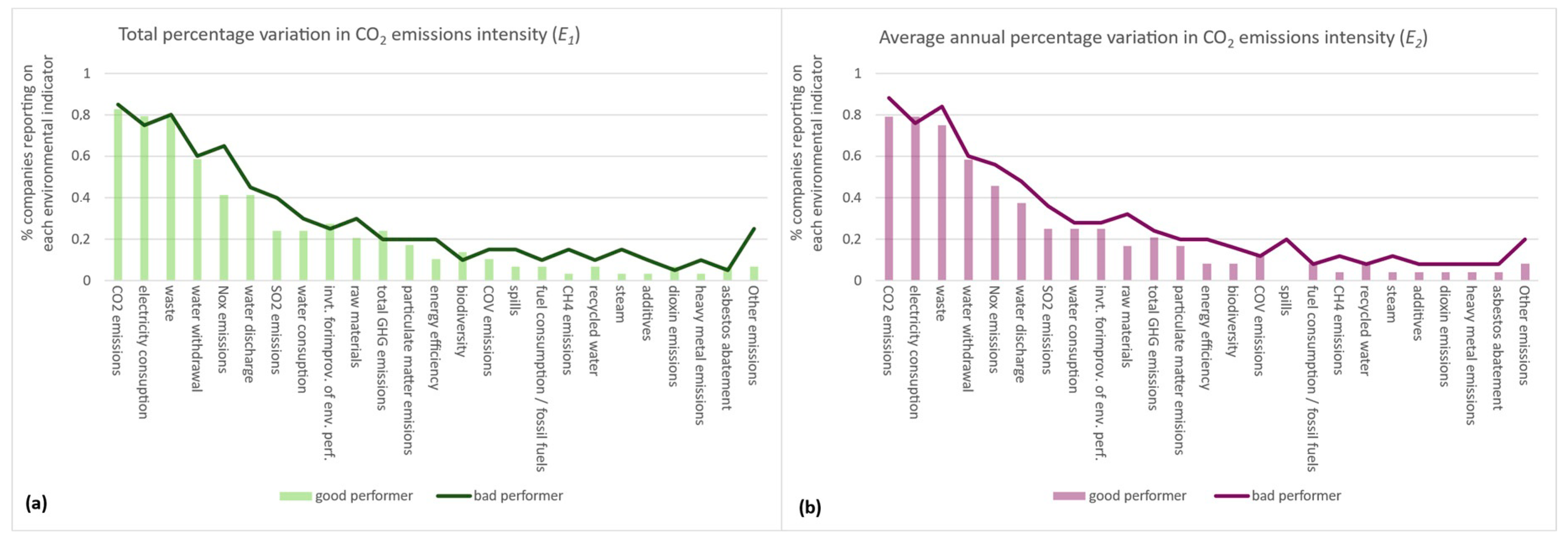

- E1 is the “total percentage variation in CO2 emissions intensity” during 2008–2013 determined as:where corresponds to the normalized CO2 emissions in kg/€ of company “i” in the year “t”.

- (2)

- E2 is the “average annual percentage variation in CO2 emissions intensity” calculated during 2008–2013 and defined as:where corresponds to the normalized CO2 emissions in kg/€ of company “i” in the year “t”.

- (3)

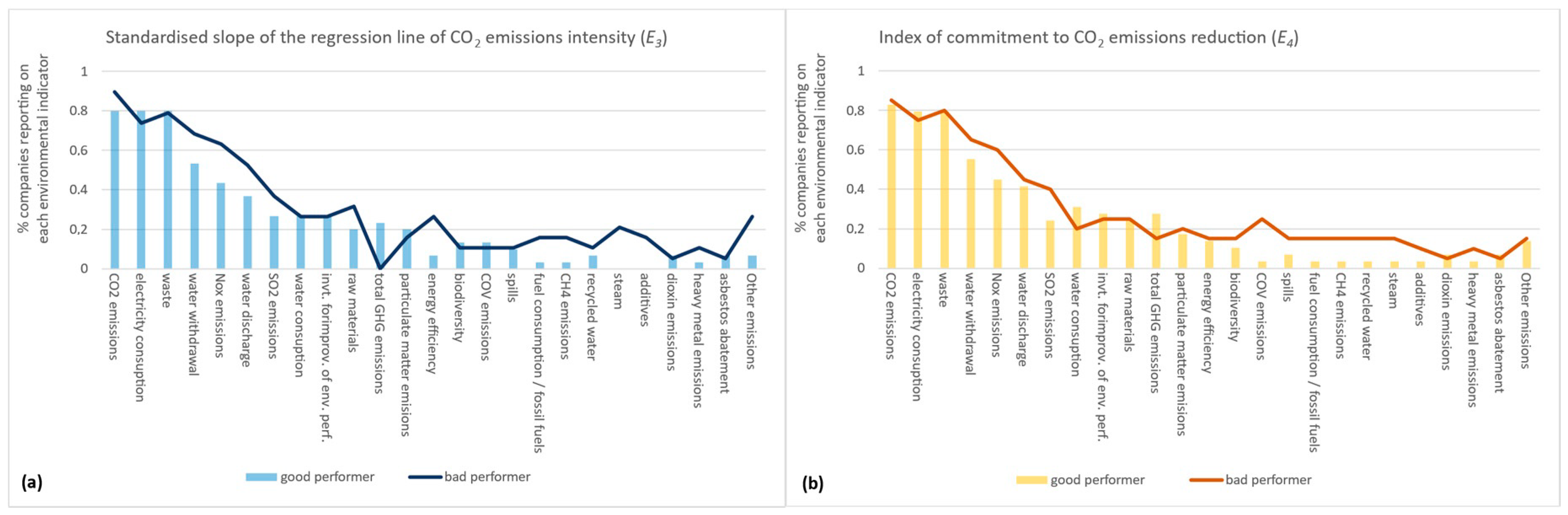

- E3 is the “standardized slope of the regression line of CO2 emissions intensity” during 2008–2013, calculated for each company, using the normalized and standardized values of CO2 emission intensity .

- (4)

- E4 is the “index of commitment to CO2 emissions reduction” calculated as:

4. Results

- -

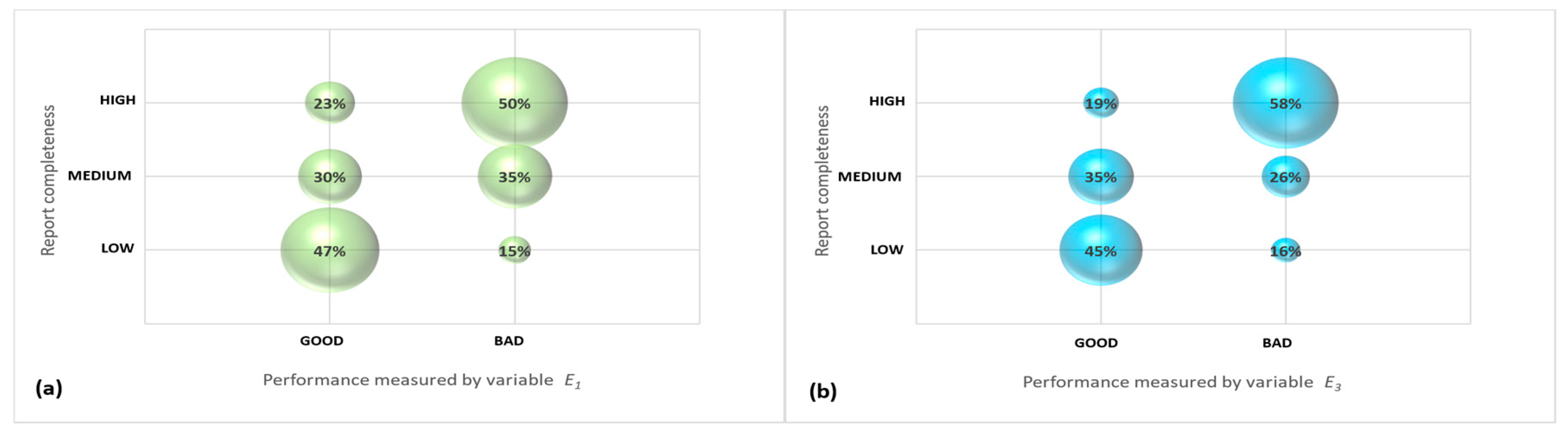

- “Good performers” are companies that achieved negative values for the variables E1, E2, and E3 in the period under analysis, demonstrating reduction in CO2 emissions and so a positive environmental performance.

- -

- “Bad performers” are companies that achieved positive (or null) values for the variables E1, E2, and E3 in the period under analysis, demonstrating increase in CO2 emissions and so a negative environmental performance.

- -

- “Good performers” are companies that achieved the reduction of CO2 emissions in at least three of the five two-year periods (E4 ≥ 0.6).

- -

- “Bad performers” are companies that achieved the reduction of CO2 emissions in less than three two-year periods (E4 ≤ 0.4).

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Performance Measured by E1 | ||||

|---|---|---|---|---|

| Bad | Good | Total | ||

| Report completeness | High | 10 | 7 | 17 |

| Medium | 7 | 9 | 16 | |

| Low | 3 | 14 | 17 | |

| Total | 20 | 30 | 50 | |

| Performance Measured by E3 | ||||

|---|---|---|---|---|

| Bad | Good | Total | ||

| Report completeness | High | 11 | 6 | 17 |

| Medium | 5 | 11 | 16 | |

| Low | 3 | 14 | 17 | |

| Total | 19 | 31 | 50 | |

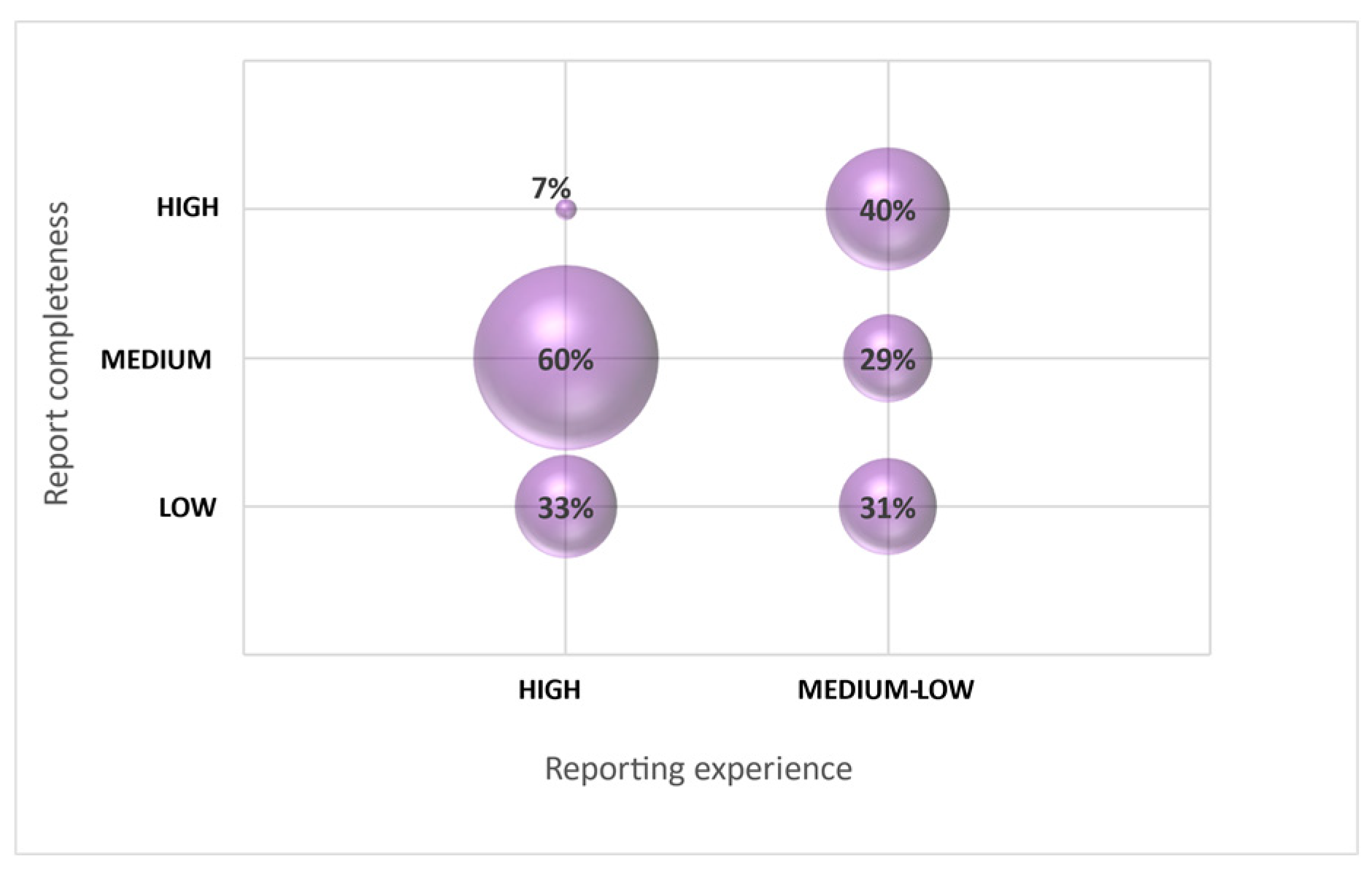

| Reporting Experience | ||||

|---|---|---|---|---|

| High | Medium-Low | Total | ||

| Report completeness | High | 1 | 14 | 15 |

| Medium | 9 | 10 | 19 | |

| Low | 5 | 11 | 16 | |

| Total | 15 | 35 | 50 | |

References

- Falkenberg, J.; Brunsæl, P. Corporate social responsibility: A strategic advantage or a strategic necessity? J. Bus. Ethics 2011, 99, 9–16. [Google Scholar] [CrossRef]

- Gerstlberger, W.; Præst, M.; Knudsen; Stampe, I. Sustainable development strategies for product innovation and energy efficiency. Bus. Strategy Environ. 2014, 23, 131–144. [Google Scholar] [CrossRef]

- Walsh, P.R.; Dodds, R. Measuring the Choice of Environmental Sustainability Strategies in Creating a Competitive Advantage. Bus. Strategy Environ. 2017, 26, 672–687. [Google Scholar] [CrossRef]

- Burritt, R.L.; Schaltegger, S. Sustainability accounting and reporting: Fad or trend? Account. Audit. Account. J. 2010, 23, 829–846. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Radhakrishnan, S.; Tsang, A.; Yang, Y.G. Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Zhao, C.; Song, H.; Chen, W. Can social responsibility reduce operational risk: Empirical analysis of Chinese listed companies. Technol. Forecast. Soc. Chang. 2016, 112, 145–154. [Google Scholar] [CrossRef]

- Romero, S.; Ruiz, S.; Feijoo, B.F. Sustainability reporting and stakeholder engagement in Spain: Different instruments, different quality. Bus. Strategy Environ. 2019, 28, 221–232. [Google Scholar] [CrossRef]

- Bernard, S.; Abdelgadir, S.; Belkhir, F. Does GRI reporting impact environmental sustainability? An industry-specific analysis of CO2 emissions performance between reporting and non-reporting companies. J. Sustain. Dev. 2015, 8, 190–205. [Google Scholar] [CrossRef][Green Version]

- Birkey, R.N.; Michelon, G.; Patten, D.M.; Sankara, J. Does assurance on CSR reporting enhance environmental reputation? An examination in the US context. Account. Forum 2016, 40, 143–152. [Google Scholar] [CrossRef]

- Bouten, L.; Everaert, P.; van Liedekerke, L.; de Moor, L.; Christiaens, J. Corporate social responsibility reporting: A comprehensive picture? Account. Forum 2011, 35, 187–204. [Google Scholar] [CrossRef]

- Bouten, L.; Everaert, P.; Roberts, R.W. How a two-step approach discloses different determinants of voluntary social and environmental reporting. J. Bus. Financ. Account. 2012, 39, 567–605. [Google Scholar] [CrossRef]

- Cho, C.H.; Michelon, G.; Patten, D.M. Impression management in sustainability reports: An empirical investigation of the use of graphs. Account. Public Interest 2012, 12, 16–37. [Google Scholar] [CrossRef]

- Higgins, C.; Tang, S.; Stubbs, W. On managing hypocrisy: The transparency of sustainability reports. J. Bus. Res. 2020, 114, 395–407. [Google Scholar] [CrossRef]

- Husillos, J.; Larrinaga, C.; Alvarez, M.J. The emergence of triple bottom line reporting in Spain. Rev. Esp. Financ. Contab. 2011, 60, 195–219. [Google Scholar] [CrossRef]

- Gray, R. Is accounting for sustainability actually accounting for sustainability and how would we know? An exploration of narratives of organisations and the planet. Account. Organ. Soc. 2010, 35, 47–62. [Google Scholar] [CrossRef]

- Montiel, I.; Ceballos, J.D. Defining and measuring corporate sustainability: Are we there yet? Organ. Environ. 2014, 27, 113–139. [Google Scholar] [CrossRef]

- Helfaya, A.; Whittington, M.; Alawattage, C. Exploring the quality of corporate environmental reporting: Surveying preparers’ and users’ perceptions. Account. Audit. Account. J. 2018, 32, 163–193. [Google Scholar] [CrossRef]

- Ching, H.Y.; Gerab, F. Sustainability reports in Brazil through the lens of signaling, legitimacy and stakeholder theories. Soc. Responsib. J. 2017, 13, 95–110. [Google Scholar] [CrossRef]

- Helfaya, A.; Whittington, M. Does designing environmental sustainability disclosure quality measures make a difference? Bus. Strategy Environ. 2019, 28, 525–541. [Google Scholar] [CrossRef]

- Michelon, G.; Pilonato, S.; Ricceri, F. CSR reporting practices and the quality of disclosure: An empirical analysis. Crit. Perspect. Account. 2015, 33, 59–78. [Google Scholar] [CrossRef]

- Tang, S.; Demeritt, D. Climate change and mandatory carbon reporting: Impacts on business process and performance. Bus. Strategy Environ. 2018, 27, 437–455. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- O’Donovan, G. Environmental disclosures in the annual report: Extending the applicability and predictive power of legitimacy theory. Account. Audit. Account. J. 2002, 15, 344–371. [Google Scholar] [CrossRef]

- Nikolaeva, R.; Bicho, M. The role of institutional and reputational factors in the voluntary adoption of corporate social responsibility reporting standards. J. Acad. Mark. Sci. 2011, 39, 136–157. [Google Scholar] [CrossRef]

- Marquis, C.; Qian, C. Corporate social responsibility reporting in China: Symbol or substance? Organ. Sci. 2014, 25, 127–148. [Google Scholar] [CrossRef]

- Wei, Z.; Shen, H.; Zhou, K.Z.; Li, J.J. How does environmental corporate social responsibility matter in a dysfunctional institutional environment? Evidence from China. J. Bus. Ethics 2017, 140, 209–223. [Google Scholar] [CrossRef]

- Hahn, R.; Kühnen, M. Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. J. Clean. Prod. 2013, 59, 5–21. [Google Scholar] [CrossRef]

- Kolk, A. The social responsibility of international business: From ethics and the environment to CSR and sustainable development. J. World Bus. 2016, 51, 23–34. [Google Scholar] [CrossRef]

- Schneider, A. Reflexivity in sustainability accounting and management: Transcending the economic focus of corporate sustainability. J. Bus. Ethics 2015, 127, 525–536. [Google Scholar] [CrossRef]

- Skouloudis, A.; Evangelinos, K.; Kourmousis, F. Assessing non-financial reports according to the global reporting initiative guidelines: Evidence from Greece. J. Clean. Prod. 2009, 18, 426–438. [Google Scholar] [CrossRef]

- Lopes, P.; Rodrigues, L. Accounting for financial instruments: An analysis of the determinants of disclosure in the Portuguese stock exchange. Int. J. Account. 2007, 42, 25–56. [Google Scholar] [CrossRef]

- Laufer, W. Social accountability and corporate greenwashing. J. Bus. Ethics 2003, 43, 253–261. [Google Scholar] [CrossRef]

- Milne, M.J.; Patten, D.M. Securing organizational legitimacy: An experimental decision case examining the impact of environmental disclosures. Account. Audit. Account. J. 2002, 5, 372–405. [Google Scholar] [CrossRef]

- Badia, F.; Bracci, E.; Tallaki, M. Quality and diffusion of social and sustainability reporting in Italian public utility companies. Sustainability 2020, 12, 4525. [Google Scholar] [CrossRef]

- Lock, I.; Seele, P. The credibility of CSR (corporate social responsibility) reports in Europe. Evidence from a quantitative content analysis in 11 countries. J. Clean. Prod. 2016, 122, 186–200. [Google Scholar]

- Mazzotta, R.; Bronzetti, G.; Veltri, S. Are mandatory non-financial disclosures credible? Evidence from Italian listed companies. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1900–1913. [Google Scholar] [CrossRef]

- Hsueh, J.W.J. Governance structure and the credibility gap: Experimental evidence on family businesses’ sustainability reporting. J. Bus. Ethics 2018, 153, 547–568. [Google Scholar]

- Davies, D.M.M.; Brennan, N. Discretionary disclosure strategies in corporate narratives: Incremental information or impression management? J. Account. Lit. 2007, 26, 116–196. [Google Scholar]

- Davies, D.M.M.; Brennan, N. A conceptual framework of impression management: New insights from psychology, sociology and critical perspectives. Account. Bus. Res. 2011, 41, 415–437. [Google Scholar] [CrossRef]

- Diouf, D.; Boiral, O. The quality of sustainability reports and impression management: A stakeholder perspective. Account. Audit. Account. J. 2017, 30, 643–667. [Google Scholar]

- Courtis, J.K. Corporate report obfuscation: Artefact or phenomenon? Br. Account. 2004, 36, 291–312. [Google Scholar] [CrossRef]

- Dienes, D.; Sassen, R.; Fischer, J. What are the drivers of sustainability reporting? A systematic review. Sustain. Account. Manag. Policy J. 2016, 7, 154–189. [Google Scholar] [CrossRef]

- Adams, C.; Evans, R. Accountability, completeness, credibility and the audit expectations gap. J. Corp. Citizsh. 2004, 14, 97–115. [Google Scholar] [CrossRef]

- Beck, A.C.; Campbell, D.; Shrives, P.J. Content analysis in environmental reporting research: Enrichment and rehearsal of the method in a British-German context. Br. Account. Rev. 2010, 42, 207–222. [Google Scholar] [CrossRef]

- Guthrie, J.; Cuganesan, S.; Ward, L. Industry specific social and environmental reporting: The Australian food and beverage industry. Account. Forum 2008, 32, 1–15. [Google Scholar] [CrossRef]

- Mahoney, L.; Thorne, L.; Cecil, L.; LaGore, W. A research note on standalone corporate social responsibility reports: Signaling or greenwashing? Crit. Perspect. Account. 2013, 24, 350–359. [Google Scholar] [CrossRef]

- Belkhir, L.; Bernard, S.; Abdelgadir, S. Does GRI reporting impact environmental sustainability? A cross-industry analysis of CO2 emissions performance between GRI-reporting and non-reporting companies. Manag. Environ. Qual. Int. J. 2017, 28, 138–155. [Google Scholar] [CrossRef]

- Siano, A.; Vollero, A.; Conte, F.; Amabile, S. “More than words”: Expanding the taxonomy of greenwashing after the Volkswagen scandal. J. Bus. Res. 2017, 71, 27–37. [Google Scholar] [CrossRef]

- LeBlanc, D. Towards integration at last? The sustainable development goals as a network of targets. Sustain. Dev. 2015, 23, 176–187. [Google Scholar] [CrossRef]

- Schönherr, N.; Findler, F.; Martinuzzi, A. Exploring the interface of CSR and the sustainable development goals. Transnatl. Corp. 2017, 24, 33–47. [Google Scholar] [CrossRef]

- Meng, X.H.; Zeng, S.X.; Shi, J.J.; Qi, G.Y.; Zhang, Z. The relationship between corporate environmental performance and environmental disclosure: An empirical study in China. J. Environ. Manag. 2014, 145, 357–367. [Google Scholar] [CrossRef] [PubMed]

- Font, X.; Walmsley, A.; Cogotti, S.; McCombes, L.; Häusler, N. Corporate social responsibility: The disclosure of performance gap. Tour. Manag. 2012, 33, 1544–1553. [Google Scholar] [CrossRef]

- Testa, F.; Miroshnychenko, I.; Barontini, R.; Frey, M. Does it pay to be a greenwasher or a brownwasher? Bus. Strategy Environ. 2018, 27, 1104–1116. [Google Scholar] [CrossRef]

- Brundtland, G. Our Common Future: Report of the World Commission on Environment and Development. 1987. Available online: http://www.un-documents.net/our-common-future.pdf (accessed on 18 December 2020).

- Dias, V.; Villazon Montalvan, R.A. Perspectivas sustentáveis da implantação de um forno alternativo de carvoejamento no município de Biguaçu/SC e suas implicações legais. Rev. Int. Direito Ambient. 2013, 2, 317–332. [Google Scholar]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone: Oxford, UK, 1997. [Google Scholar]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development A/RES/70/1; de Resolution Adopted by the General Assembly on 25 September 2015; Available online: https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_70_1_E.pdf (accessed on 18 December 2020).

- Sánchez, L. Avaliação de Impacto Ambiental: Conceitos e Métodos; Oficina de Textos: São Paulo, Brazil, 2013. [Google Scholar]

- Sánchez, L.; Hacking, T. An approach to linking environmental impact assessment and environmental management systems. Impact Assess. Proj. Apprais. 2002, 20, 25–38. [Google Scholar] [CrossRef]

- Kemerich, P.D.; Ritter, L.G.; Borba, W.F. Indicadores de sustentabilidade ambiental: Métodos e aplicações. Rev. Monogr. Ambient. REMOA 2014, 13, 3723–3736. [Google Scholar] [CrossRef]

- Rahdari, A.; Rostamy, A. Designing a General Set of Sustainability Indicators at the Corporate Level. J. Clean. Prod. 2015, 108, 757–771. [Google Scholar] [CrossRef]

- Marzall, K.; Almeida, J. Indicadores De Sustentabilidade Para Agroecossistemas: Estado da arte, limites e potencialidades de uma nova ferramenta para avaliar o desenvolvimento sustentável. Cad. Ciênc. Tecnol. 2000, 7, 41–59. [Google Scholar]

- UNFCC (United Nations Framework Convention on Climate Change). Kyoto Protocol to the United Nations Framework Convention on Climate Change. In Proceedings of the COP3, Kyoto, Japan, 11 December 1997; Available online: https://www.eea.europa.eu/policy-documents/kyoto-protocol-to-the-un (accessed on 18 December 2020).

- Council of the EU. Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 Establishing a Scheme for Greenhouse Gas Emission Allowance Trading within the Community and Amending Council Directive 96/61/EC; 25 October 2003. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2003:275:0032:0046:en:PDF (accessed on 18 December 2020).

- di Pillo, F.; Gastaldi, M.; Levialdi, N.; Miliacca, M. Environmental Performance Versus Economic-financial Performance: Evidence from Italian Firms. Int. J. Energy Econ. Policy 2017, 7, 98–108. [Google Scholar]

- Fezzigna, P.; Borghesi, S.; Caro, D. Revising emission responsibilities through consumption-based accounting: A European and post-Brexit perspective. Sustainability 2019, 11, 488. [Google Scholar] [CrossRef]

- Ren, S.; Hu, Y.; Zheng, J.; Wang, Y. Emissions trading and firm innovation: Evidence from a natural experiment in China. Technol. Forecast. Soc. Chang. 2020, 155, 119989. [Google Scholar] [CrossRef]

- Sariannidis, N.; Zafeiriou, E.; Giannarakis, G.; Arabatzis, G. CO2 emissions and financial performance of socially responsible firms: An empirical survey. Bus. Strategy Environ. 2013, 22, 109–120. [Google Scholar] [CrossRef]

- Brzobohatý, T.; Janský, P. Impact of CO2 Emissions Reductions on Firms’ Finance in an Emerging Economy: The Case of the Czech Republic. Transit. Stud. Rev. 2010, 17, 725–736. [Google Scholar] [CrossRef]

- Wiedmann, T.; Barrett, J. A greenhouse gas footprint analysis of UK Central Government, 1990–2008. Environ. Sci. Policy 2011, 14, 1041–1051. [Google Scholar] [CrossRef]

- Global Carbon Project. Supplemental Data of Global Carbon Budget 2019 (Version 1.0). Global Carbon Project, ICOS. 2019. Available online: https://doi.org/10.18160/gcp-2019 (accessed on 18 December 2020).

- Albertini, E. A descriptive analysis of environmental disclosure: A longitudinal study of French companies. J. Bus. Ethics 2014, 121, 233–254. [Google Scholar] [CrossRef]

- Capece, G.; di Pillo, F.; Gastaldi, M.; Levialdi, N.; Miliaca, M. Examining the effect of managing GHG emissions on business performance. Bus. Strategy Environ. 2017, 26, 1041–1060. [Google Scholar] [CrossRef]

- Scott, P.; Williams, R.; Ho, K. Forming Categories in Exploratory Data Analysis and Data Mining. In International Symposium on Intelligent Data Analysis; Springer: Berlin/Heidelberg, Germany, 1997; pp. 235–246. [Google Scholar] [CrossRef]

- Liu, Z.; Liu, T.; McConkey, B.; Li, X. Empirical analysis on environmental disclosure and environmental performance level of listed steel companies. Energy Procedia 2011, 5, 2211–2218. [Google Scholar] [CrossRef][Green Version]

- Hummel, K.; Schlick, C. The relationship between sustainability performance and sustainability disclosure–Reconciling voluntary disclosure theory and legitimacy theory. J. Account. Public Policy 2016, 35, 455–476. [Google Scholar] [CrossRef]

- Cohen, E. The A+ Myth of Sustainability Reporting: Stop the Hype. 2012. Available online: http://csr-reporting.blogspot.com/2012/06/a-myth-of-sustainability-reporting-stop.html (accessed on 18 December 2020).

- Fortanier, F.; Kolk, A.; Pinkse, J. Harmonization in CSR reporting. Manag. Int. Rev. 2011, 51, 665–696. [Google Scholar] [CrossRef]

| Reporting Experience | Completeness | E1 | E2 | E3 | E4 | |

|---|---|---|---|---|---|---|

| Mean | 6.22 | 6.86 | 0.1086 | 0.0272 | −0.1280 | 0.5760 |

| Median | 6.00 | 6.00 | −0.1565 | −0.0032 | −0.3069 | 0.6000 |

| Std. Deviation | 3.86 | 2.86 | 0.8996 | 0.1608 | 0.3857 | 0.2378 |

| Minimum | 1.00 | 1.00 | −0.9812 | −0.3176 | −0.5693 | 0.2000 |

| Maximum | 19.00 | 15.00 | 3.8803 | 0.4865 | 0.5621 | 1.0000 |

| Reporting Experience | Completeness | E1 | E2 | E3 | E4 | |

|---|---|---|---|---|---|---|

| Reporting Experience | 1 | |||||

| Completeness | −0.140 | 1 | ||||

| E1 | −0.030 | 0.243 * | 1 | |||

| E2 | −0.035 | 0.242 * | 0.886 ** | 1 | ||

| E3 | −0.047 | 0.246 * | 0.769 ** | 0.765 ** | 1 | |

| E4 | 0.090 | −0.143 | −0.662 ** | −0.647 ** | −0.730 ** | 1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Calabrese, A.; Costa, R.; Levialdi, N.; Menichini, T.; Villazon Montalvan, R.A. Does More Mean Better? Exploring the Relationship between Report Completeness and Environmental Sustainability. Sustainability 2020, 12, 10635. https://doi.org/10.3390/su122410635

Calabrese A, Costa R, Levialdi N, Menichini T, Villazon Montalvan RA. Does More Mean Better? Exploring the Relationship between Report Completeness and Environmental Sustainability. Sustainability. 2020; 12(24):10635. https://doi.org/10.3390/su122410635

Chicago/Turabian StyleCalabrese, Armando, Roberta Costa, Nathan Levialdi, Tamara Menichini, and Roberth Andres Villazon Montalvan. 2020. "Does More Mean Better? Exploring the Relationship between Report Completeness and Environmental Sustainability" Sustainability 12, no. 24: 10635. https://doi.org/10.3390/su122410635

APA StyleCalabrese, A., Costa, R., Levialdi, N., Menichini, T., & Villazon Montalvan, R. A. (2020). Does More Mean Better? Exploring the Relationship between Report Completeness and Environmental Sustainability. Sustainability, 12(24), 10635. https://doi.org/10.3390/su122410635